Hamilton and District Apartment Association (HDAA)

Hamilton's landlord licensing pilot project not proceeding as the city expected.

London Property Management Association (LPMA)

Small landlords are losing their livelihoods as LTB backlog grows

Eastern Ontario Landlord Organization (EOLO)

Ottawa City Council approved a new Vacant Unit Tax

The official publication of: Canada’s #1 most widely read publication for Apartment Owners, Managers and Association Executives Vol. 15 No. 5 January 2023

Keep

• Revolutionize the prospect journey by automating the entire lead-to-lease cycle

• Enrich the resident experience with a comprehensive service portal

• In crease conversions with dynamic and integrated websites and internet listings

• O ptimize your online presence and attract more prospects with SEO and PPC advertising

Learn

connected when it matters the most by safely attracting prospects, converting quality leads and supporting residents. A single

management.

business moving:

Stay

connected solution for Canadian multifamily marketing

(888) 569-2734 | Yardi.com/RentCafe ©2023 Yardi Systems, Inc All Rights Reserved. Yardi, the Yardi logo, and al Yardi product names are trademarks of Yardi Syst ems, Inc.

with us at Yardi.com/ Webinars

Project Management | Building Science | Structural Engineering | Roofing Surveys | Condition Assessments | Asbestos and Mould Surveys 1.888.348.8991 McIntoshPerry.com We’ve encountered every possible building-related issue over our five decades of history. With more than 500 engineers, project managers and technical experts across the country, we provide a full range of services to the rental housing industry.

EDITOR’S NOTES

Another year is here

The calendar has flipped to 2023. But it seems like not a lot has changed. Or perhaps we’re just exhausted by everything we’ve gone through. The constant bad news – both personal and societal – can wear you down. For many, January 1 is just another day. But the beginning of a new year is an incentive to change something and look at the situation with fresh eyes. Take this opportunity to do something different. A small change can produce significant results.

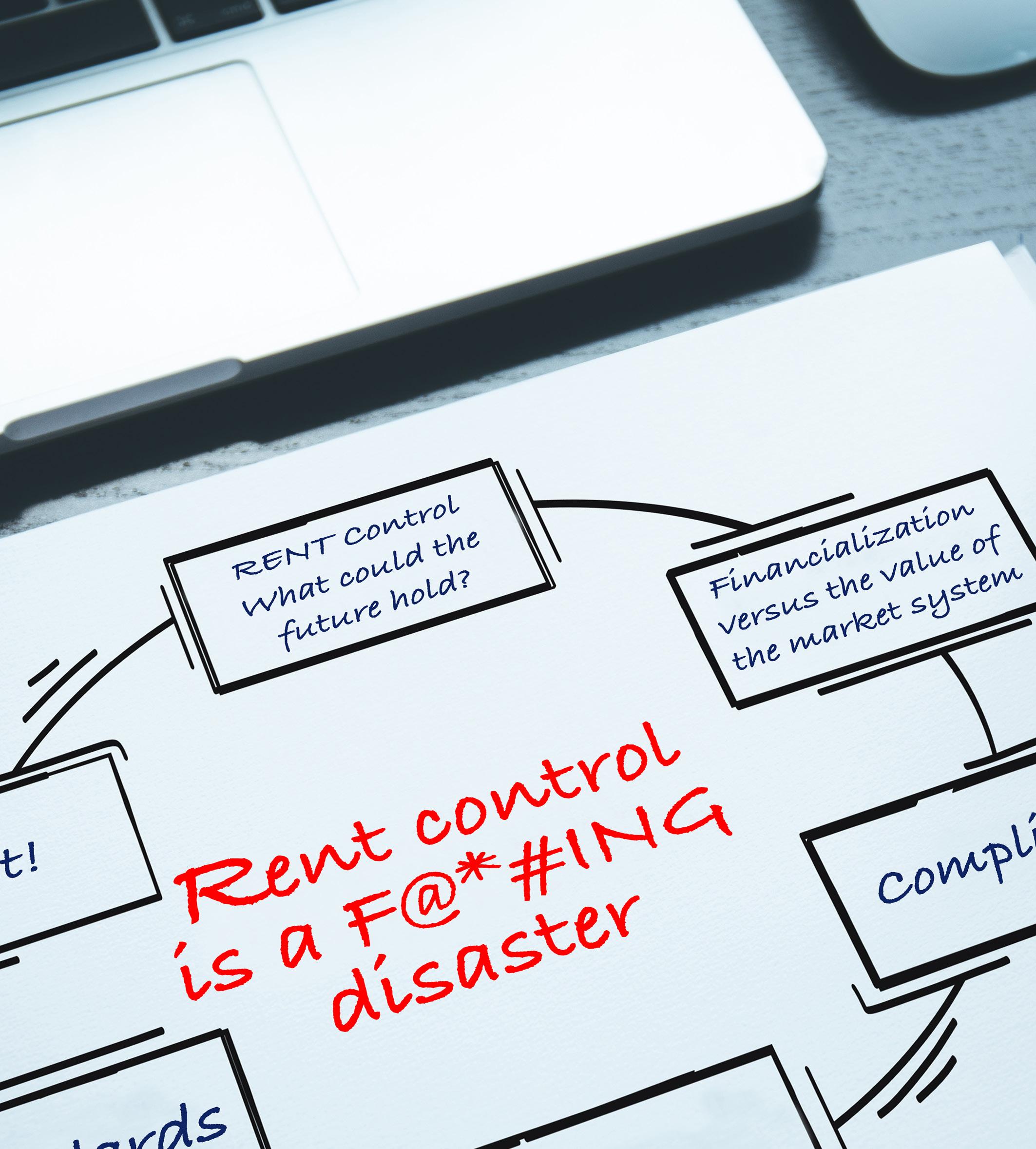

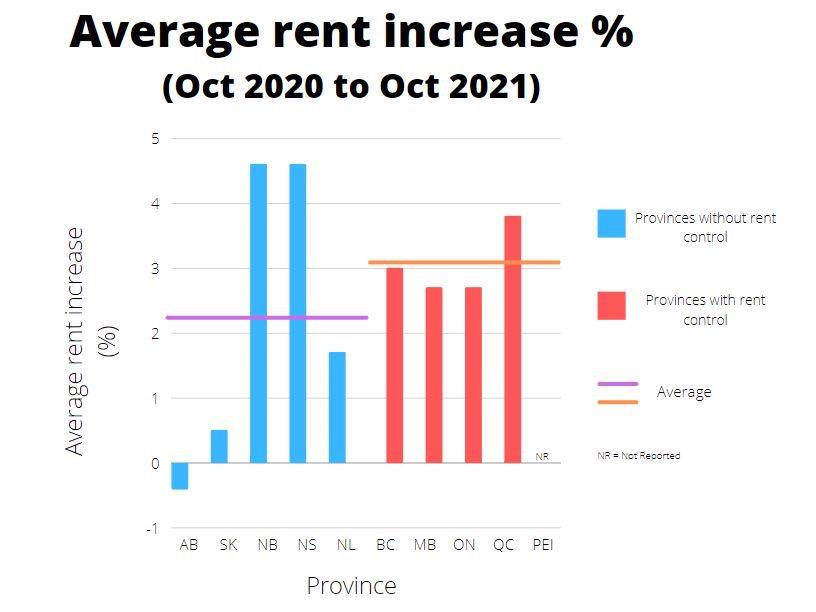

This issue of RHB Magazine features a deep dive into rent control and how it has failed everyone – tenants, rental property owners, homeowners, the government, and society. We looked at the data and analysis from a San Francisco study, summarized the results of a CMHC-funded study of Canadian markets, and discussed the negative consequences of rent control.

The second article examines the impact of rental property owners’ motives to realize profit in a larger context, disputing the claims the financialization of housing is to blame for the shortfalls in individuals’ rights to adequate housing. It also looks at the data related to Canada’s homelessness problem. The third article is an editorial on rent control, written by John Dickie of the CFAA, discussing the issues related to rent control and its potential future.

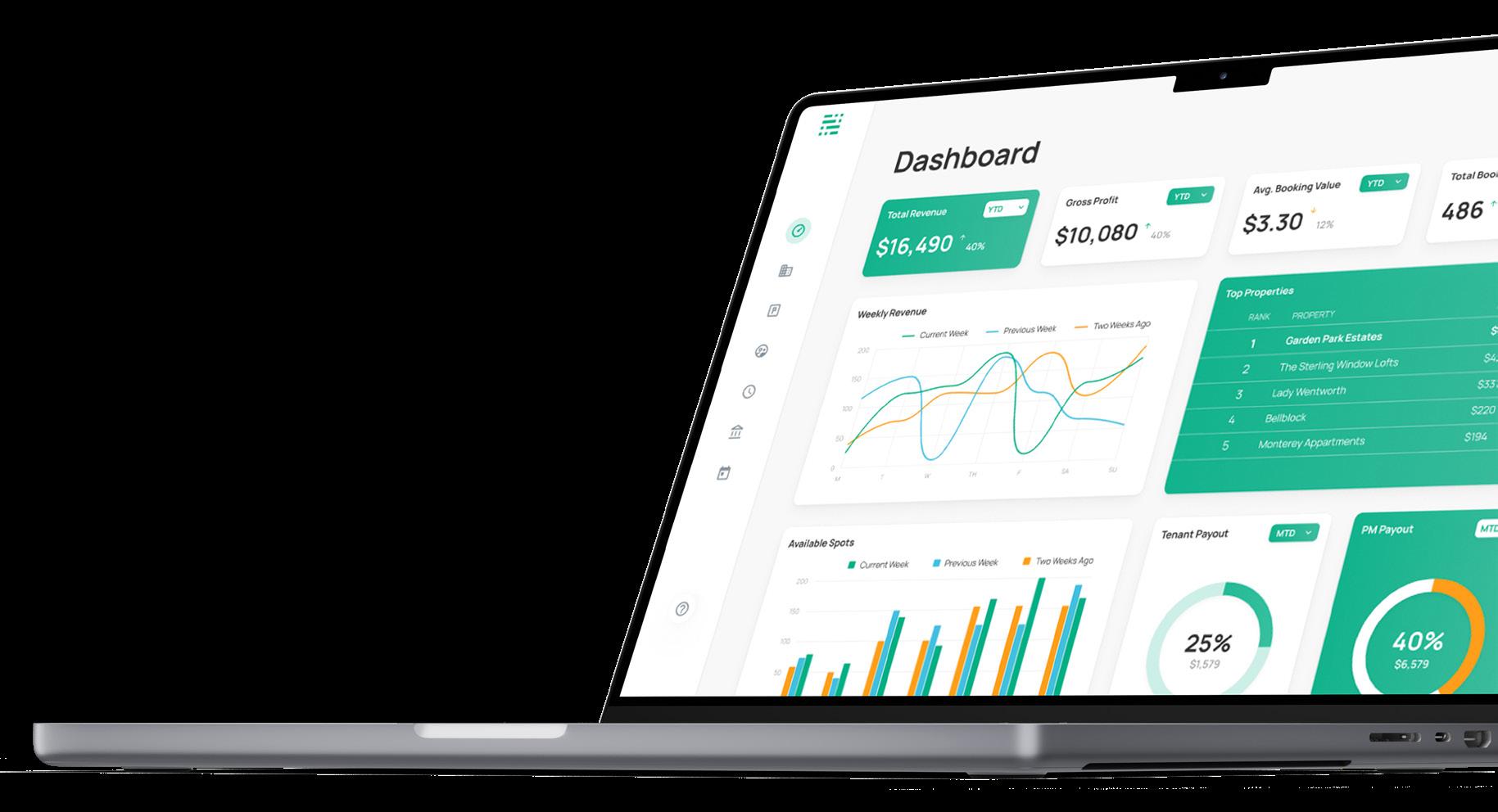

Don't forget to read CFAA’s newsletter, National Outlook, as well as the Regional Association Voice. FRPO discusses its efforts to engage with various government ministries and officials to collaborate and support the Ford government in building more housing. Yardi Canada wraps up this issue with a discussion of investment management technology.

We enjoy hearing from our readers, and we want to support two-way communication. If you have any comments or questions, send them to david@rentalhousingbusiness.ca. I look forward to your emails.

Publisher Marc Côté marc@rentalhousingbusiness.ca

Associate Publisher

Nishant Rai

Editorial David Gargaro david@rentalhousingbusiness.ca

Contributing Editor

John Dickie, President CFAA jdickie@rentalhousingbusiness.ca

Creative Director / Designer

Scott Clark

Photography

Noah Goldentuler

Sales Executive

Justin Kreslin

Office Manager

Geeta Lokhram

Subscriptions

One year $49.99 Cdn

Two years $79.99 Cdn

Single copy sales $9.99 Cdn

Opinions expressed in articles are those of the authors and do not necessarily reflect the views and opinions of the CFAA Board or management. CFAA and RHB Inc. accept no liability for information contained herein. All rights reserved. Contents may not be reproduced without the written permission from the publisher.

P.O. Box 696, Maple, ON L6A 1S7 416-236-7473

Produced in Canada

David Gargaro Senior Editor

All contents copyright © RHB Inc. Canadian Publications Mail Product Sales Agreement No. 42652516

the issue!

Enjoy

4 | January 2023

We hope to partner with you today... ...to build for a SOLID tomorrow Emergency Response | Disaster Restoration | Suite Upgrades | Capital Improvements | New Development Montreal | Ottawa | Toronto | Edmonton | Calgary | Vancouver | Victoria 66 Leek Crescent, Richmond Hill, ON, L4B 1H1 info@solidgc.ca (905) 470-0707 solidgc.ca

6 | January 2023 47 Regional Association Voice RHB’s forum for rental housing associations to share news, events and industry information The Member Associations Hot Topics: HDAA discusses the status of the licensing pilot project in Hamilton, and recalls key tips from its most recent Dinner Meeting on dealing with the LTB. pg. 49 LPMA discusses how small landlords are being negatively impacted by the LTB backlog and what the government has been doing to address the issues. pg. 53 EOLO discusses the City of Ottawa's new Vacant Unit Tax and its housing spending. pg. 57 IPOANS discusses its advocacy efforts, Nova Scotia's unsustainable growth strategy, the RTA, and the association's education efforts. pg. 61 Rent control is a F@*#ING disaster Rent control is having the opposite effect of its desired intent. Financialization versus the value of the market system There is no financial sense in removing profit from the rental housing sector. Final Take Away Investment management tech for a stronger 2023 Prepare your real estate tech stack to run it as efficiently as possible. RAV features the latest industry news from four member associations. Rent control. What could the future hold? Can changes be made so deserving tenants receive more protection but the negative consequences of rent control are minimized? CONTENTS VOL.15 NO.5 2023 64 30

Luxer One has 15+ years of experience providing industry leading Parcel Locker solutions. Coinamatic is a proud Canadian Distributor of Luxer One parcel delivery lockers. www.coinamatic.com | 1.877.755.5302 | info@coinamatic.com CONTACT US! MADE IN NORTH AMERICA USER FRIENDLY APPLE IPAD TOUCHSCREEN UL CERTIFIED 12-GAUGE STEEL The Future of Package Management! User Friendly Self Service 24/7 Package Access Eliminates constant staff disruption for deliveries Officially approved by Canadian Carriers Robust Lockers designed and built in USA 6-8 week delivery timeline Over 200,000,000 parcels delivered to Luxer One lockers

PRESIDENT’S CORNER

This issue of RHB Magazine addresses rent control. Across Canada, tenant advocates are calling for tighter rent control to apply in more situations. More extreme advocates want to drive the profit motive out of rental housing entirely. At page 24, the authors address the benefits of markets and the profit motive, and how they have enabled our current much improved economic conditions, from which everyone benefits.

At page 35, in National Outlook, CFAA addresses the right to housing: what it means, how rental housing providers support it, and ways to support the right to housing that can mesh with what the rental housing industry does, and wants to do. (The right to housing is two-edged. ACORN and other tenant advocates try to use it to attack rental housing. CFAA lays out arguments that supporting rental housing development and re-development is the only realistic way to achieve greater realization of the right to housing.)

All of this is of immediate and critical interest because rental demand is hot, and rent increases on turnover are high, especially in BC and Ontario. CFAA is working with rental marketing platforms (which provide rental data) to seek to mitigate the effects of reports of dramatic rent increases on the industry’s political situation.

CFAA-Rental Housing Conference 2023 will be held in Halifax from Wednesday, June 14 to Friday, June 16, 2023! Registration is open. Early bird rates are available until Feb 28. Please plan to attend. See page 39 for more information.

The CFAA Rental Housing Awards program should also be open for application when you read this. The deadline to apply is March 10. See page 40 for more information.

The Home Depot remains a CFAA Strategic Partner. By registering your membership

in CFAA (either directly or through one of CFAA’s 13 member associations) with Home Depot Pro, you benefit yourself and CFAA. This partnership benefits every rental housing provider reading this magazine.

Yardi Systems is another long-standing CFAA Strategic Partner. As well as receiving Yardi’s help with rent information, we look forward to working with Yardi to bring you informative panels, and the latest and best information on technology and marketing for rental housing providers, at CFAA-RHC 2023 in Halifax. If you are not already a direct member of CFAA, please consider joining CFAA as a Direct Rental Housing Provider Member, or a Suppliers Council Member. Visit www. cfaa-fcapi.org or e-mail admin@cfaafcapi.org today!

8 | January 2023

John Dickie, CFAA President

In this issue of... NATIONAL OUTLOOK

35. The National Housing Council is consulting on the impact of “financialization” on tenants’ right to housing in Canada’s private rental market. What is the right to housing? What do rental housing providers do already? How can the industry respond to this new pressure?

Corporation des Propriétaires Immobiliers du Québec (CORPIQ) www.corpiq.com

P: 514-748-1921

Eastern Ontario Landlord Organization (EOLO) www.eolo.ca

P: 613-235-9792

Federation of Rental-housing Providers of Ontario (FRPO) www.frpo.org

P: 416-385-1100, 1-877-688-1960

Greater Toronto Apartment Association (GTAA) www.gtaaonline.com

P: 416-385-3435

38. CFAA is holding Rental Housing Conference 2023 from Wednesday, June 14 to Friday, June 16. Where will CFAARHC 2023 take place? What topics will be explored? Who is to be the keynote speaker?

Hamilton & District Apartment Association (HDAA) www.hamiltonapartmentassociation.ca

P: 905-632-4435

Investment Property Owners Association of Nova Scotia (IPOANS) www.ipoans.ns.ca

P: 902-425-3572

LandlordBC www.landlordbc.ca

P: 1-604-733-9440

Vancouver Office P: 604-733-9440

Victoria Office P: 250-382-6324

41. The CFAA Rental Housing Awards for 2023 are now open What are the awards categories? Who can enter? What is the deadline for applications? When and where will the winners will be announced?

To subscribe to CFAA’s e-Newsletter, please send your email address to communication@cfaa-fcapi.org.

The Canadian Federation of Apartment Associations represents the owners and managers of close to one million residential rental suites in Canada, through 13 apartment associations and direct landlord memberships across Canada.

CFAA is the sole national organization representing the interests of Canada’s $950 billion rental housing industry.

For more information about CFAA itself, see www.cfaa-fcapi.org or telephone 613-235-0101.

London Property Management Association (LPMA) www.lpma.ca

P: 519-672-6999

New Brunswick Apartment Owners Association (NBAOA) www.nbaoa.ca

jbrealsetate@nb.aibn.com

Manufactured Home Park Owners Alliance of British Columbia (MHPOA) www.mhpo.com

P: 1-877-222-4560

Professional Property Managers’ Association (of Manitoba) (PPMA) www.ppmamanitoba.com

P: 204-957-1224

Saskatchewan Landlord Association Inc. (SKLA) www.skla.ca

P: 306-653-7149

Waterloo Regional Apartment Management Association (WRAMA)

www.wrama.com

P: 519-748-0703

10 | January 2023

CFAA Member Associations

Average rent for a 2-bedroom by province: 2 1 4 3 5 British Columbia - $1,566 Alberta - $1,254 Ontario - $1,465 Nova Scotia - $1,255 Manitoba - $1,266 Saskatchewan

$1,117 source: 2022 National Edition theAnnual 6

-

Tenant advocacy groups often claim that rent control legislation is essential for ensuring rental housing remains affordable for those who need it most. Proponents of rent control state that rental property owners should not be able to increase rents when tenants move out or to keep up with inflation. They want the government to implement rent control policies to protect financially disadvantaged groups from having to pay market rents.

However, according to research, rent control policies are disadvantageous to renters over the long run, as they lead to higher market rents and less housing supply. The legislation also negatively impacts rental property owners and the surrounding neighbourhoods. When all is said and done, rent control has the opposite effect of its designed intent.

14 | January 2023

What is rent control?

Rent control (or rent stabilization) refers to legislation that limits rental rates in a city, province or region. Although rent control legislation varies by jurisdiction, rent control generally sets a limit on the maximum rent that can be charged for a unit, as well as how much the rent can be increased per year. Rent control policies are designed to enable governments to regulate the housing market.

The most basic goal of rent control is to establish and maintain a base of affordable rental housing for lower-income tenants. The city, province or region sets guidelines that determine how much the rent can be increased at any given time. While rent control policies vary by province, they typically include three, four or five main types of rules:

• Frequency limits: How often rent can be increased (e.g., once every 12 months)

• Increase limits: The amount by which rent can be increased (e.g., 2%)

• Vacancy decontrol: The ability to re-rent a unit at the market rate once a tenant moves out

• An exemption for new rental units for a period of time after their construction

• An exemption for rental units renting for more than a certain amount (as in Manitoba)

In Canada, British Columbia, Manitoba, Ontario, and Prince Edward Island have rent control; the other provinces and territories have their own rules for how and when rent can be increased. In BC, the rent increase is tied to the inflation rate. In Manitoba and Ontario, the rent can increase according to the amount set under the annual rent increase guideline, as determined by the province’s Consumer Price Index (CPI). In PEI, the Island Regulatory and Appeals Commission sets the annual allowable percentage by which rent can be increased (although the government overrode the Commission for 2023).

The ”benefits” of rent control

Advocates often declare rent control offers three key benefits for tenants. First, rent-controlled properties have lower-than-market rents, so they are more affordable for lower-income tenants. Rent control ensures that rents do not increase faster than wages, especially in large cities.

Second, rent control prevents people from being “unfairly” displaced from their homes. The elderly and financially disadvantaged can remain in their homes, especially in areas where market

rentalhousingbusiness.ca | 15

rents are higher than they can afford. And third, rent control reduces turnover, which helps to maintain neighbourhood stability and strengthens community ties. This means people can live where they want for as long as they want.

Proponents of rent control often discuss these benefits in general terms. However, they rarely provide statistics or research to back up these claims, relying instead on specific situations that support their statements. They also look at the positives of rent control in a vacuum, ignoring issues like inflation and the overall economy’s impact on increasing rents.

Those who support rent control also ignore its drawbacks. Rent control reduces rental property owners’ financial ability to meet their maintenance expenses. This affects the quality of the building and living conditions, which has a negative impact on every tenant in the building. Rental property owners are more likely to sell their rental properties or convert them into condos, which reduces the amount of rental stock. Developers are also less likely to invest in building new rental stock, since they cannot earn sufficient income from their investment. This reduces the number of new rental properties available on the market, leading to higher rents due to lower supply.

Statistics tell a more complete story

Economists Rebecca Diamond, Timothy McQuade, and Franklin Qian conducted extensive research on the effects of rent control in San Francisco, which is well known for its high housing and rental costs. They published their results in a paper entitled “The Effects of Rent Control Expansion on Tenants, Landlords, and Inequality: Evidence from San Francisco.” The findings demonstrated that rent control is not as beneficial to tenants (or anyone else) as tenant advocates would have you believe.

San Francisco followed the example of other North American cities in the 1970s by imposing rent control in 1979 on all standing buildings that had five or more units. New construction and smaller multi-family buildings were exempt from rent control. However, the city removed the exemption in 1994. The authors used this change to compare the newly rent-controlled buildings to other buildings in San Francisco that were not affected by the change in legislation.

The report states that tenants in rent-controlled buildings stayed in their buildings longer than tenants living in non-rent-controlled buildings. Between five and ten years after the change in

legislation, tenants in rent-controlled buildings were, on average, 3.5 percentage points more likely to remain in their unit relative to other tenants. Only 18 per cent of the control group were still living in their 1994 address, which equals a 19.4 per cent increase in tenants not moving relative to the control group. Tenants in rent-controlled buildings were also 4.5 percentage points more likely to stay in San Francisco when compared to the control group.

This means a significant percentage of renters who continued to live in their 1994 address because of rent control would have left their rental properties if they were not under rent control. Advocates of rent control would likely claim this is the best outcome for tenants. However, this also reduces mobility to other housing over time and reduces apartment supply for those who most need it.

Mobility is an essential component of a healthy rental housing ecosystem. Under ideal circumstances, renters should move to different apartments when their needs change over time. In the absence of rent control, lower-priced rental units are also made available to young renters, immigrants, and retirees looking for smaller, more affordable accommodations. Rent control keeps tenants in specific rental units longer than normal, which affects those living there, and those who need the accommodations.

Rental property owners responded to rent control measures as one would expect. Over time, they shifted their resources to other real estate options, such as converting their properties to condominiums, which are exempt from rent control in San Francisco. They also sold their properties to owner-occupants. This resulted in a 15 per cent decrease in the rental housing supply. Converting rental properties to higher-end condos attracted more higher-income people to the San Francisco area, which led to more income inequality and reduced the mobility of lowerincome tenants in rent-controlled properties.

The report demonstrates that rent control forced more lower-income people to move out of their preferred neighbourhoods. Rather than staying within their established communities, tenants were left with few rental housing options, often having to move to lower-income neighbourhoods with fewer employment opportunities and lower education levels.

16 | January 2023 continued on page 20

"[Rent control] resulted in a 15 per cent decrease in the rental housing supply."

Future-proof your laundry.

Learn

more about our mobile and cashless bundles and other digital laundry room solutions.

your residents happy with Coinamatic’s digital laundry room solutions.

the Coinamatic digital laundry room mobile app + card bundle, residents get their choice of easy-to-use mobile or laundry card payment.

Keep

With

Mobile App + Laundry Card Bundle

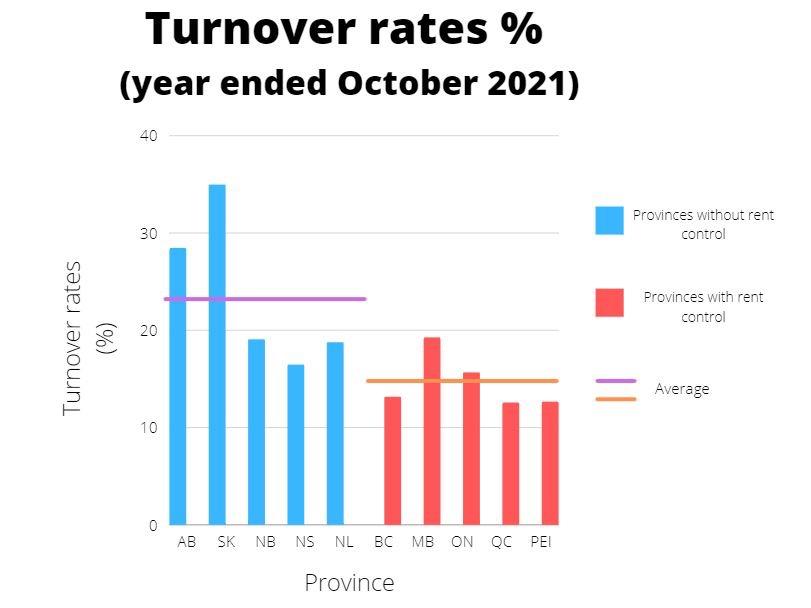

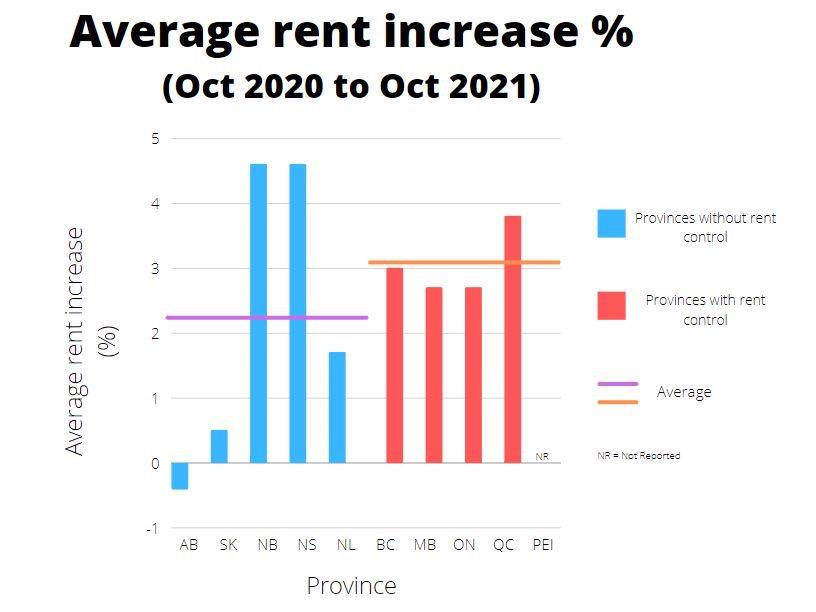

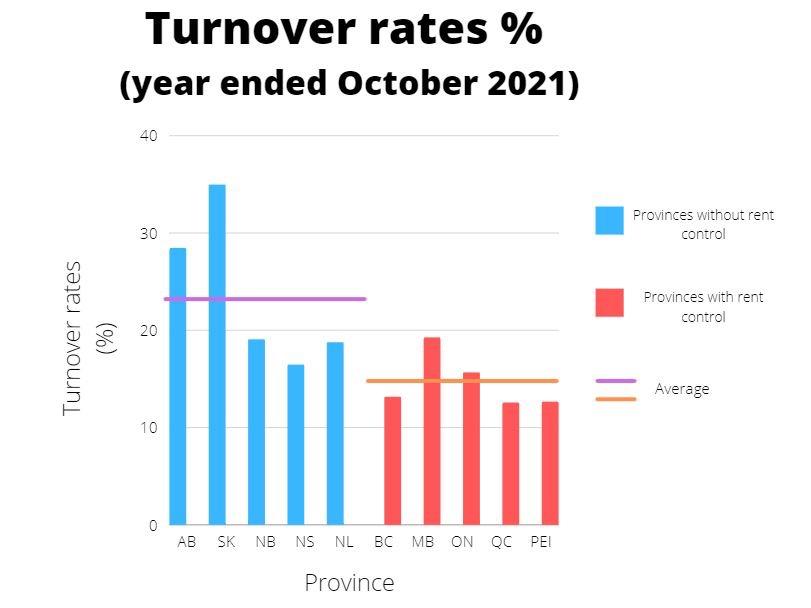

Impact of rent control on rents and turnover rates

By John Dickie, CFAA President

By John Dickie, CFAA President

Rent control imposes a long lag on rents catching up with housing costs and values. Rent control also concentrates the increases in rents on unit that turn over, which means turnover rents exceed the rents that would apply across the rental market if there were no rent control.

18 | January 2023

Increase in in-place rents for the 12

–

increase

Source: Yardi Canada 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% Halifax MontrealOttawa-Gatineau Toronto Hamilton KCW London Winnipeg Vancouver Calgary Edmonton Canada Rent and CPI Increases in Canada Rent Increase CPI increase Rent Controlled Markets No Rent Controls Delivered to you by

months to Q4

2022 compared with the

in the Consumer Price Index

CONTACT US! info@snaile.com or visit www.snailelockers.com for contactless and secure resident delivery information MULTI-RESIDENTIAL | RETAIL | OFFICE | SCHOOL CAMPUS | www.snailelockers.com MANAGING RESIDENT DELIVERIES WHY SNAILE CANADA? Scan QR Code to find out! CERTIFIED DATAHOSTED INCANADA SERVICING NAC A D AN DATA SECURITY PRIVACYLAWS PROC E D SERU C ANADIANCARRIERSDELIVE R CONTRACTS INFORCE PROTECTED BY PIPEDALAW S CANADIAN TOWNS+CITIES55 + OEM $ 9/10 SERVICING LARGEST CANADIAN BUILDING OWNERS CANADIAN CYBER INSURANCE POLICY MADE IN CANADA INTEGRATED WITHYOURBUILDING SSOFTWAR E API ISO/IEC 27001 PRICE MATCH GUARANTEED PROTECTED BY CANADIAN ELECTRICAL CODE CSA C22. 1 FIRE RATED CAN/ULCS102 ORIGINAL EQUIPMENT MANUFACTURER NOT A RESELLER ICKETIN UP TO 355x LESS ² CO EROM VNE I R ONMENTALLY FRIENDLY

Rent control prevents people from moving into the city. This is a significant issue for younger people looking to live where jobs are located. With fewer rental properties available, there was less rental housing supply. Rents also increased in San Francisco during this time. According to the report, the rent control policy increased rents in the city by 5.1 per cent over what they would have been without rent control, which is significant where housing costs are already high.

Empirical evidence from CMHC

In November 2020, KPMG conducted a study on rent control on behalf of CMHC to help provide a better understanding how it impacts housing affordability issues. It examined regulatory changes to rent controls and analyzes how the policies affected rental markets, including rental prices and the number of rental starts.

KPMG’s study analyzed Toronto, Vancouver, Montreal, and Winnipeg, using Calgary and Halifax as the control group (since Alberta does not have rent control and Nova Scotia did not at the time of the study). The study looked at the period from 1971 to 2019. The analysis focused on three key topic areas:

• The introduction to rent controls in several jurisdictions and a review of the literature on the impacts of rent controls

• A statistical analysis of rental market data, including comparisons of rent control and no rent control markets, correlation analyses, and a high-level difference-in-difference analysis

• Regression analyses to evaluate the impacts of tenancy deregulation (i.e., vacancy decontrol, or the ability of rental property owners to raise rents between tenancies) and new unit exemptions (i.e., newly built rental units are exempt from rent control for a set period of time)

According to the literature review, rent control did result in lowering prices for rent-controlled units. However, rent control also resulted in reduced rental supply due to the imposition of limits on rent prices, as well as the resulting effects on rental property valuations.

Statistical analysis of the Census Metropolitan Centres (CMCs) determined that rental prices were better able to respond to market supply and demand changes in markets without rent control. Rental prices also appeared to vary more under less strict rent control policies, specifically those that included tenancy deregulation.

Regression analysis determined that new unit exemption policies were correlated to an increase

in average rents. This is most likely because these policies typically cause an increase in the number of new, uncontrolled units in the rental price index. This means there is more rental supply available, which is a positive result. There was also a correlation between tenancy deregulation policies and a decrease in the rental supply, although that is primarily due to the presence of rent controls. Rent control policies tend to limit property developers’ return on investment, which negatively affects the supply of new rental housing stock.

Understanding the effects of rent control

Rent control effectively locks tenants into their apartments. The San Francisco report shows that tenants stay in their units longer than they would have if the units were not rent controlled. This means they don’t move out when their housing needs change (e.g., getting married, having a child, children move out). This also means people who would benefit from living in these apartments will have to live somewhere else less appropriate for their needs (e.g., too small, more expensive).

The San Francisco study showed that rent control increased income inequality in the city. Rent control prevented displacement of the original 1994 group of tenants from San Francisco in the short run, particularly among minorities. However, eight years after the law changed, only 4.5 per cent of tenants under rent control were able to remain in the city, with this percentage decreasing over time. Over the long run, rental property owners substituted housing types that were exempt from rent control price caps, which upgraded the housing stock and lowered the supply of rent-controlled housing. As a result, the average rent-controlled property has higher income residents than comparable market rate

20 | January 2023 continued from page 16

"...rent control policy increased rents in the city by 5.1 per cent over what they would have been without rent control."

properties. This offset the effect of keeping lowerincome tenants in the city as they were replaced with above-average income tenants.

Rent control also treated tenants living in the city differently than tenants who were moving into (or planning to move) to the city. Tenants who were already living in San Francisco and had access to rent control following the law change were better off due to their preference to stay in rentcontrolled units. However, this negatively affected future renters in San Francisco, who must pay higher rents due to the lack of rental supply. Rent control legislation created economic well-being inequality between current and future renters in San Francisco.

The proponents of rent control are almost always those who are currently better off because they are living in rent-controlled units. Cities like San Francisco, which have a high percentage of renters, will often vote in favour of keeping these policies. However, future renters cannot vote on the issue and end up paying the related costs of rent control.

Rent control affects the quality of the surrounding neighbourhood. Areas with many rent-controlled buildings tend to have lower house prices, lower median incomes, lower education levels, and higher unemployment rates. Houses in rentcontrolled areas tend to sell for less. Some of this is due to the fact that rent-controlled properties are not as well maintained. With prices depressed across the board, and less movement of people into and out of the area, there is greater likelihood of overall depression on home prices and rents.

Let’s take a look at what happened in Cambridge, Massachusetts, where rent control was eliminated in 1994. Prior to the removal of rent control, controlled units rented for more than 40 per cent below the price of non-rent-controlled units. When rent control was removed, the market value of the decontrolled properties increased by 45 per cent.

There was an even greater impact on Cambridge’s housing stock. From 1994 to 2004, the surrounding property values increased by $2.0 billion. However, only $300 million came as a direct effect of decontrol on the previously controlled units. There was a greater increase in the value of properties near rent-controlled buildings than properties in non-rent-controlled areas (or with fewer rent-controlled buildings). And while rents increased when rent control was removed, there was a greater increase in the value of the homes, which means the surrounding neighbourhoods were more affected by rent control than the rental properties.

Rental property owners tend to respond to rent control by converting their properties to condos or redeveloping their properties to escape rent control. This has served to reduce the amount of available affordable rental housing, as well as attracting higher income individuals to newly converted properties. The result is increasing gentrification and higher income inequality, which goes against the goal of rent control.

Other rental property owners chose to accept rent control regulation but economized on property maintenance or upgrades, allowing building quality to decline. This was a direct result of restrictions on removing units from the rental stock. In addition to keeping rents low, as well as building quality, it served to depress the values of the surrounding properties.

Take a look at Ontario, where older buildings (built pre-1991) were subject to rent control. Premier Wynne’s government repealed this exemption, then Premier Ford’s government brought in a new exemption for buildings constructed after 2018. Older properties are less likely to be upgraded at the same level as non-rent-controlled properties due to the lack of incentive to invest in repairs, as rental property owners cannot increase rents to adequately recoup their investments. Tenants are less likely to move out, as they would want to keep their below-market rents, so rental providers have less incentive to invest in the buildings to attract new tenants.

Conclusion

Rent control does make rental housing more affordable for tenants over the short run. However, over the long term, rent control decreases the amount of rental stock, which tends to makes existing rental properties less available and less affordable. Rent control promotes gentrification and negatively impacts surrounding neighbourhoods. Imposing rent control on rental property owners for the purpose of restricting increases in rent is also counterproductive. Allowing the market to determine rents, as well as implementing social assistance supports for lower-income tenants, would be more effective in keeping housing affordability in check, supporting a healthy rental stock, and ensuring more equitable treatment for all tenants.

22 | January 2023

"When rent control was removed, the market value of the decontrolled properties increased by 45 per cent."

Dynamic Visual Marketing Solutions

Maximize your leasing potential with immersive pre-development digital marketing and innovative media capture technology.

Unlock The Full Potential of Your Parking Assets

Gain control and oversight over your parking operations with GrydPark, the tech suite designed to drive efficiency, revenue + asset value.

Driving Property Tech Forward gryd.com 52% LIFT IN CASHFLOW 1.2X INCREASE IN ASSET VALUE 21% ADMIN COST SAVINGS GRYDPARK PROPERTIES HAVE SEEN UP TO

Financialization versus the value of the market system

By John Dickie and David Gargaro

The federal government established the National Housing Council (NHC) to advise the federal Minister of Housing on the effectiveness of its National Housing Strategy (NHS), specifically about whether the NHS is effectively improving housing outcomes for people who are in the greatest need.

In 2022, the NHC began consultations on one of its three main priorities: Co-Creating the Right to Adequate Housing (R2AH) in Canada. NHC employed SHS Consulting to conduct a survey on homelessness and housing service providers, which included holding focus groups involving people with real-world experience with homelessness and housing problems.

SHS Consulting’s Interim Report to the NHC cites the “financialization of housing” as the main barrier to survey respondents realizing the right to adequate housing. The Interim Report states the following:

“There is a growing understanding that a primary goal of our current [housing] system is to generate wealth by maximizing returns for both household and institutional investors in housing. …This underlying function is seen as being fundamentally at odds with the goals of housing as a human right and was identified as contributing to, or linked to, several other barriers that respondents experience, including rising house prices, reduced security of tenure, and decreased supply of affordable and belowmarket rental units.” (Interim Report, p. 18)

In effect, the report blames housing providers’ desire to earn a profit as one of the primary causes for the current shortfalls in individuals’ right to have adequate housing. The report includes suggestions that would restrict rental housing providers. ACORN and the Federal Housing Advocate also want to remove profit entirely from the rental housing sector.

24 | January 2023

PROVIDING OUR CLIENTS WITH THE HIGHEST POSSIBLE ROI

. .

THE APT PROMISE:

A larger context

This article seeks to examine the impact of rental property owners’ motives to realize profit in a larger context. Jared Diamond’s Pulitzer prize-winning book, Guns, Germs and Steel, explains human history, including outlining the stages of societal development from bands through tribes and chiefdoms to states. In his published work, Economist Kenneth Boulding describes the three main organizing principles for human societies: love, force and exchange.

Love typically drives parents to support their children and vice versa. During the Middle Ages, love drove members of religious orders to support the poor. Love was the primary motivation for Mother Theresa, although she was also encouraged to convert Hindus and Muslims to Christianity. Love and support for others thrive today in families, co-operative housing, charities, and charitable giving. Force was present in bands and tribes from the origin of early societies. Force became more prominent when chiefdoms emerged. Chiefs imposed their will on their members through force. When states and early cities formed, rulers controlled the land, often using religion to support their right and obligation to do so. Rulers also collected taxes, using the funds to organize agriculture and the production of goods and to redistribute income (mostly for their benefit and to the benefit of those close to them). These institutions relied mostly on force.

Force continued to be a key factor during Greek and Roman times, the Middle Ages, and the modern era. As of the 1800s, the use of force gradually decreased, and was replaced by voluntary exchange. Force remains today in the form of taxation on income, capital gains, the exchange of goods and services, and real estate. Politics and the judicial system also employ force, as they are charged with suppressing crime and settling disputes, respectively.

Exchange was often reciprocal between bands and tribes, mostly involving barter (e.g., fish was exchanged for cloth made from coconuts). As tribes became chiefdoms, currency emerged, starting with seashells and later becoming gold and silver coins. There was little societal advancement, as most interactions were zero-sum. The strong used force to take from the weak, and societies moved up and down in wealth, without any major advances, despite the use of some exchange.

The vast growth of total income

A significant change occurred around 1700 or 1800 AD. In his recent book, Enlightenment NOW, Steven Pinker states:

“A millennium after 1 CE, the world was a barely richer than it was at the time of Jesus. It took another half-millennium for income to double. … Starting in the 19th century, the increments turned into leaps and bounds.

Between 1820 and 1900, the world’s income tripled. It tripled again in a bit more than 50 years. It took only 25 years for it to triple again, and another 33 years to triple yet another time. The Gross World Product has grown almost a hundredfold since … 1820, and two hundredfold from the start of the Enlightenment in the 18th Century.”

Due to the vast growth in income and wealth, starvation is rarely a threat, medical care is greatly improved, and more income is directed to support the poor, elderly and vulnerable. Those changes have occurred more in developed countries than in less developed countries, but they apply almost everywhere in the world.

Pinker (and other economic historians) stated there are three main causes for the growth of income and human welfare over the last two centuries:

• The application of science and technology to improving material life

• Institutions that facilitate the exchange of goods, services, and ideas

• A change in values wherein commerce was seen as moral and uplifting

26 | January 2023

1 0 10 20 30 40 50 60 70 80 90 100 110 400 200 600 800 1000 1200 1400 1600 1800 2000

Source: Our Work in Data, Roser 2016c, based on data from World Bank and from Angus Maddison and Maiddison Project 2014.

2011 international dollars, trillions

Pinker Figure 8-1: Gross World Product, 1-2015

REDUCE YOUR

Protect

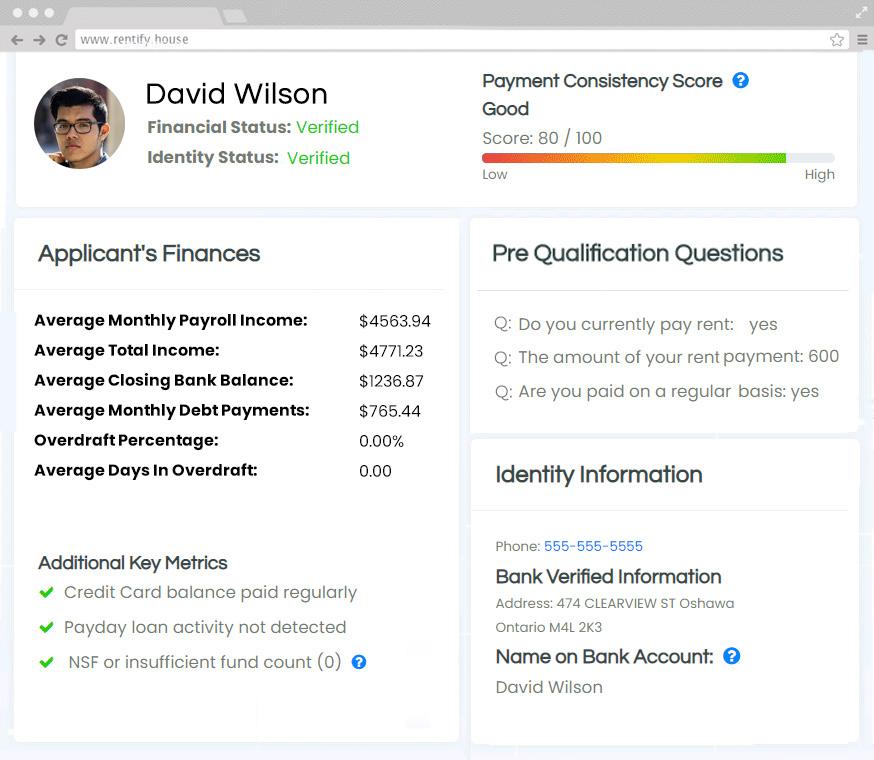

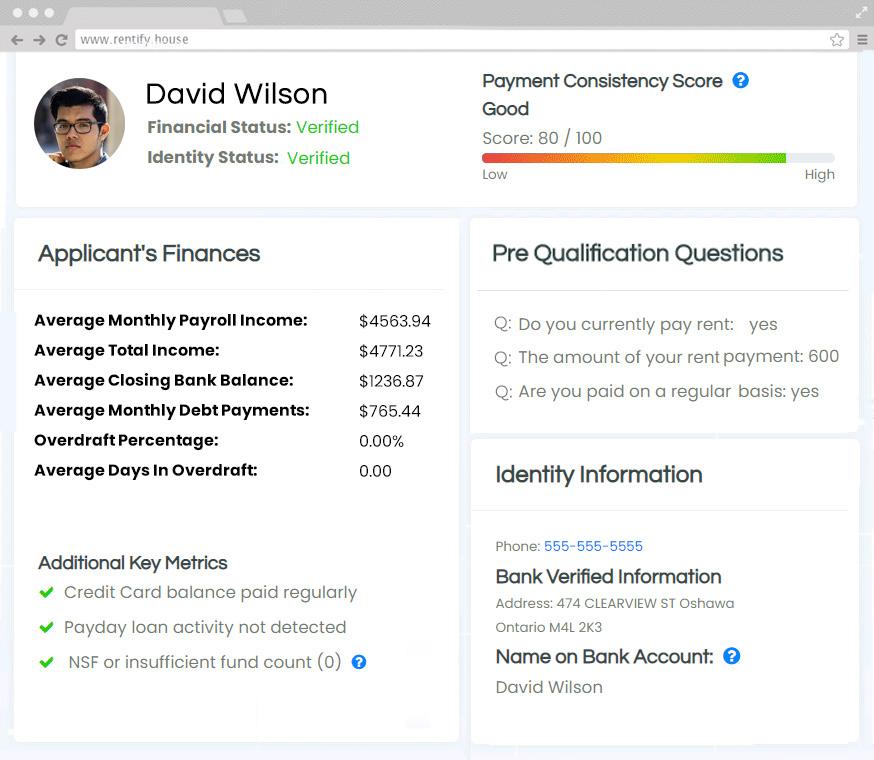

Rentify

Instantly verifies:

Employment income

Identity and address

History of NSF fees

Average closing bank balance

Average monthly debt payments

Overdraft percentage

Consistent payment of rent

Consistent payment of bills

and more

Other benefits include:

Reduced average verification time from 2 hrs to 5 mins

Cost savings up to 50% compared to a credit score

Rentify does not leave a mark on renters credit scores

Bank statements are a significantly better predictor of evictions than credit scores

Save thousands of dollars by reducing evictions

your property with the power of bank statement analysis

EVICTIONS BY UP TO 25% powered by

For more information or to book a demo visit www.rentify.house !

Canada’s banks $

This third point recognizes the benefits of exchange and the profit motive, which ACORN and the Federal Housing Advisor want to eliminate from housing.

Over the last two centuries, science and technology have been broadly and rapidly applied to human endeavours due to the institution of markets, the ability to raise and apply capital, and the freedom to identify and apply better ways to produce goods and services, which leads to discovering and applying knowledge.

Efficient exchange replaced force and love as the way to coordinate most production. The growth in income achieved through efficient exchange allowed governments to collect more tax, which supported the application of more resources in supporting lower-income people. However, exchange is not (nor can it be) based on the love principle. Instead, the exchange principle is primarily based on producers and suppliers making a profit and being rewarded by that profit. Profit enables people and companies to expand and make more profit, as well as produce more or better goods and services. People and companies that do not make profits cannot remain in business. They will leave the market, and then other people or companies will use their resources to make profit by applying those resources in better ways to produce goods and services which people want and can pay for.

How to solve Canada’s current homelessness problem

It is counter-productive to remove the profit motive from the rental housing sector. Profitmaking businesses can be regulated and channeled. The profit motive can also be

limited to a degree, or supported to create an advantage. However, attempting to eliminate the profit motive from an economic sector where it operates will limit the exchange system. It will also risk some percentage of the massive gains that the exchange system and profit motive have achieved for society within each economic sector.

According to Statistics Canada, the percentage of Canadians in core housing need in 2021 was 10.1 per cent. Many would say that that figure is too high, but it still means that 90 per cent of Canadians are NOT in core housing need. That means 90 out of every 100 households in Canada have access to housing that is well maintained, suitable for its occupants, and affordable. The 10 households out of 100 that lack access to such housing do not have the income to afford suitable housing in good repair at 30 per cent or less of their incomes. However, many of those households occupy suitable housing in good repair, but are paying more than 30 per cent of their incomes for their housing. To address this percentage difference, these households would benefit greatly from a rent subsidy to bring the rent they pay within (or closer to) the standard affordability test, but they do not need new or different housing.

Note: Two-thirds of households that have a housing need move out of housing need within two years. They are replaced by others who move into housing need. Only 4 per cent of households are consistently in core housing need.

According to the Homeless Hub of the Canadian Observatory on Homelessness, there are 13,000 to 33,000 people who are chronically or episodically homeless, which is less than one out of every 1,000 Canadians. They are in much worse condition than the bulk of the least well-off 10 per cent. However, it does not make sense to dismantle the system that functions well for 90 per cent of the population, and is close to functioning well for the remaining 10 per cent of the population.

Conclusion

The intelligent solution to homelessness is to provide additional housing supplements to the supplements that already exist to address the needs of the population whose needs are not being sufficiently served by the private housing system. The intelligent solution to chronic housing need is similar. It does not make sense to try to drive profit out of the rental housing system.

28 | January 2023

CFAA RENTAL HOUSING CONFERENCE 2023 For more information , or to receive email updates, email events@cfaa-fcapi.org CANADIAN FEDERATION OF APARTMENT ASSOCIATIONS HALIFAX CFAA invites you to join us in Halifax in 2023 WEDNESDAY, JUNE 14 to FRIDAY, JUNE 16 The Westin Nova Scotian Visit us at cfaa-rhc.ca

OPINION OPINION

Rent control.

Rent control. What

could the future hold?

What could the future hold?

By John Dickie, CFAA President

Rent control. Most rental providers hate it. Many tenants love it. Some politicians love it. What does rent control do? Can rent control be improved for everyone?

A key reason for the different views is the different interests and goals of the parties. People who are looking to rent compare available rental properties and choose the one that gives them the best value; it may not be the least expensive, although among properties with similar packages of amenities (including a suitable location), potential tenants will normally choose the least expensive.

Rental providers generally want to achieve a high net income, or to maximize the value of their rental asset. To do either, in free rental markets, most rental housing providers keep their properties clean, attractive, and in a good state of repair. They provide amenities if potential renters value those amenities more than the amenities cost to provide.

Rental adjustments in free markets

Free rental markets exist in many parts of the world, including four provinces (Alberta, Saskatchewan, New Brunswick, and Newfoundland and Labrador), and many states in the Unites States. In those markets, the desire by rental providers for higher rents and the desire of tenants for lower rents results in rent and amenity packages that are determined by supply (mostly based on rental costs) and demand mostly based on tenant incomes and preferences).

If rental supply is up or demand is down, then market rents will fall. We saw that happen for rental units in the core of cities or near postsecondary schools during the pandemic, when rental demand and rents fell sharply in those exact areas. Calgary and St. John’s see that every time the oil and gas sector goes bust.

If rental supply is short or demand is up, then market rents will rise. When rents rise, fewer young people move out of their parents’ homes, more renters double up, and other renters rent smaller apartments. In many cases, single people will rent rooms from homeowners or other

renters. That spreads the available rental supply among more people, and makes rental units available to people who must have them.

Rising market rents draw out new rental supply, provided interest rates and other conditions are favourable. Most of Canada saw that happen between 2014 and 2021. Over time, if supply catches up with demand, the new supply moderates rents. Most of Canada has not yet seen that happen because the growth in rental housing demand continues to exceed the growth in rental housing supply.

What can gum up the works is barriers to new rental supply. Barriers to supply are a very serious problem in Ontario and BC, especially in the major centres, but are a less serious problem in other provinces. The provinces seem to recognize the problem, and some are taking steps to address it, as Ontario has done through Bill 23.

Rent control

Besides all the helpful behavioural adjustments to increasing rents, there can be a political

30 | January 2023

adjustment, called rent control. Due to rising rents, tenants sometimes call on politicians to save them. Too often, laws are brought in to override the results of changes in supply and demand. Rent control rules prohibit rental providers from increasing rents on renewals or even on changes in tenancies.

However, besides limiting many rent increases, rent control laws have unintended consequences. They change the incentive to clean and maintain buildings well. They change the incentive to improve buildings and to provide amenities. Most critically, rent control laws discourage people from providing more rental housing. Rental housing shortages continue or worsen. Landlord-tenant disputes get more common and nastier. Rental quality and rental supply spiral downwards.

Rent control inevitably leads to a reduced and deteriorated rental stock, which does not serve renters well. Existing tenants gain lower rents at the cost of fewer rental options of less quality, and many people who want to move to a new location cannot find any rental housing at all. Around the world, for the last century or more, that has been the invariable result of rent control.

(The negative effects on new supply and building upgrades can be mitigated. For example, vacancy decontrol mitigates rent control in Ontario and

BC, while a 20-year exemption for new buildings makes rent control less damaging in Manitoba.)

For political reasons, the continuation of extensive rent control seems inevitable in Ontario, BC, Manitoba, and Quebec. Change may come because of federal pressure, or the demand for tighter rent control by the public in any province. Can changes be made so that deserving tenants receive more protection, but the negative consequences of rent control are minimized?

Can rent control be attached to tenants based on their incomes? Can rent control come with government subsidies for major repairs or building upgrades, such as installing heat pumps to mitigate climate change? Can vacancy decontrol be extended so that some new tenancies are not subject to rent control on a permanent basis?

Critically, can such changes be made in ways that do not bring new problems, but rather reduce existing problems, while still providing better protection to existing low-income tenants? Can rent control be made less unfair for rental housing providers?

Over the next few months, CFAA will be working with members associations and direct members to explore these and other questions. To join in the work, reach out to your regional apartment association or email president@cfaa-fcapi.org.

rentalhousingbusiness.ca | 31

Exclusive Discounts for the Rental Housing Industry Members and supplier members of apartment associations save more on home and auto insurance with Westland MyGroup. Click or call for a quote today: westlandmygroup.ca/CFAA 1-844-999-7687

Social Media Award of Excellence Best Property Management Website www.theparkerlife.ca Best Advertising Campaign Steps Away. Literally Best Suite Renovation Under $25,000 262 Jarvis Street, Toronto Best Suite Renovation Over $25,000 Tower Hill East — 330 Spadina Ave. Contractor: MultiTech Contracting 2000 Best Lobby Renovation The Torontonian 45 Duneld Ave, Toronto Congratulations to the Winners of the 2022 FRPO MAC Awards! Best Curb Appeal West Lodge — 103 & 105 West Lodge Avenue, Toronto Best Amenities Renovated or Existing Knightsbridge Kings Cross Apartments 3 Knightsbridge Road, Brampton Best Amenities New Development Novus — 11 & 25 Ordnance Street, Toronto Rental Development Over 200 Units Story of Brampton Central™ 205 Queen St. East, Brampton Rental Development 200 Units or Less The Huron — 2475 Hurontario Street, Mississauga Environmental Excellence

The MAC Awards recognizes innovation and leadership in Ontario’s vibrant rental housing industry. Each year, our members demonstrate their commitment to high levels of service and rental accommodations. We are inspired by your efforts and can’t wait to see what the industry accomplishes in 2023.

Property Manager of the Year

Michelle Twiss

Resident Manager of the Year

Andrew Scheib

Community Service Award of Excellence

- Supplier Member

Company Culture Award of Excellence

Leasing Manager of the Year

Scott McCabe

Customer Service Award of Excellence

Community Service Award of Excellence

- Rental Housing Provider

Impact Award

It’s Time to Celebrate!

Kristin Ley, Partner, Cohen Highley, has joined RHBTV News as an on air legal analyst. Kristin will be answering questions from YOU our viewers.

Send your questions to info@rhbtv.ca and Kristin will answer them on upcoming shows

The Right to Housing and what it means for rental housing providers

By John Dickie, CFAA President

Across Canada the most worrisome political issue currently facing rental housing providers is the claim by tenant advocates that the “financialization” of rental housing is interfering with tenants’ “right to housing”. “Financialization” basically means the profit motive. Some tenant advocates want to drive the profit motive out of rental housing. In that mis-guided goal, they have been backed by the Federal Housing Advocate. For more information on their specific goals, see page 24 in the November 2022 issue of RHB Magazine, which is available on-line.

The advocates argue that the profit motive results in constant pressure to raise rents. (They ignore the fact that rising rents draw out more rental supply, and help to manage excess rental demand. See page 30 for a discussion of those issues. Managing demand is a key short-term solution, and more rental supply is a key solution at all times.)

The new National Housing Council (NHC) is holding a consultation about the right to housing. SHS Consulting is supporting the NHC, and approached CFAA and GTAA to connect with private-sector rental housing providers. CFAA, FRPO, IPOANS, LandlordBC, EOLO and GTAA provided contacts who took part in the consultation. This article reports on what CFAA and rental housing providers said. For the consultation questions and more detailed answers, visit www.cfaa-fcapi.org.

The Definition of the Right to Adequate Housing (Q 1 & 2)

The NHC is using the phrase “right to adequate housing” (R2AH) rather than “right to housing” (R2H). The consultation guide says “The right to housing … should be seen as the right to live somewhere in security, peace and dignity.”

The use of the word “somewhere” is positive. It is implied that somewhere means somewhere suitable and appropriate, but that is better than a definition that seems to give everyone the right to keep living where they are living at any given time. The advocates often extend that claim to include the right to live in the present accommodation at the present rent, plus rent increases at or below the rate of inflation, regardless of increasing costs, the need for major repairs or a landlord’s rights to terminate a tenancy to renovate a building or to demolish it.

CFAA supports the right to adequate housing as defined by NHC. However, we have concerns about the details of implementation.

CFAA talked about the right to housing before and when it was enacted under the National Housing Strategy Act, several years ago. Housing rights advocates assured us that the right to housing was about requiring governments to use its resources to make housing more available to low-income people and vulnerable populations (primarily through social housing and subsidizing rents).

At CFAA Rental Housing Conference 2022, Leilani Farha, a leading tenants rights advocate, placed much more emphasis on the private sector’s obligations than anyone had expressed to CFAA before. CFAA finds a

rentalhousingbusiness.ca | 35 JANUARY 2023

Reevie Partner

Learn with us at Yardi.com/ Webinars (888) 569-2734 | Yardi.com/IMsuite ©2023 Yardi Systems, Inc. All Rights Reserved. Yardi, the Yardi logo, and all Yardi product names are trademarks of Yardi Systems Inc. Investments grow on Yardi • Provide a branded investor portal to publish property metrics and data • Automate the subscription agreement process for new investment opportunities • Track capital activity, investor commitments, contributions and distributions “Yardi Investment Manager has been a critical element of Baceline’s ability to grow our investor base and scale our investor relations department. The level of comprehensive, dynamic investment data brings confidence to our investors and credibility to our business.” BACELINE INVESTMENTS Lindsey

societal obligation to achieve the R2AH acceptable and desirable, but not an obligation imposed solely or primarily on rental housing providers.

Provincial Human Rights Codes and Acts make it clear that discrimination in rental housing is forbidden. Pursuant to the National Housing Strategy Act, there is a right to housing under federal law and regulations, but currently, there is no right to housing under provincial law.

What roles does private rental housing play in achieving R2AH? (Q 3 & 4)

CFAA plays a role through education about compliance with laws and promoting best practices. The private rental sector plays a major role because, among other activities:

a. Responsible rental housing providers respect the right of renters and potential renters not to be discriminated against on any grounds protected under Human Rights Codes

b. Private sector rental housing providers provide close to 90 per cent of all rental housing

c. Unless impeded by misguided government policy moves, the private sector is likely to build and provide close to 90% of the all new rental housing supply for the foreseeable future

d. The private rental housing sector provides housing that is safe, provides security of tenure pursuant to provincial law, and includes property management services

e. In many locations, the private sector provides rental housing at rents considerably below market levels due to the effect of rent control

f. Rental housing providers cooperate with governments and partner with social service agencies to assist tenants with special needs.

If the private rental supply disappeared, without being replaced unit for unit, low-income people would be much worse off than they are today. Each year, two-thirds of the housing occupied by renters in core housing need is provided by the private sector. (Community housing houses only one-third of needy people.) In the private sector, low-income renters may well pay more than 30 per cent of their income on their housing, but they have housing. (As reported by CMHC from longitudinal studies, often within a year or two, the household income of people in housing need rises so that their housing becomes affordable by the standard test, and the people move out of housing need.)

Provided the major changes to the economic system in housing as suggested by ACORN and the Federal Housing Advocate are not made, the private sector can mobilize and apply investment capital to increase housing supply, and to maintain and upgrade existing rental housing. The market process balances supply and demand for housing of different types, locations, and qualities.

Private market housing offers many choices and demands minimal effort from renters other than paying rent on time and not disturbing their neighbours. It offers the flexibility to move to respond to life changes.

The consultation guide asked participants to envision a world where we’ve realized the right to housing in Canada. The paper asked, what might your industry’s role look like?

The industry’s role would best be to do what we do best, namely providing rental housing in a cost-effective manner, and providing various combinations of rents and amenity packages to suit the variety of consumer preferences.

Governments have erected barriers to the development of rental housing, and inhibit the rental market from reaching a healthy equilibrium. Governments need to walk back those barriers and understand how housing policies impact housing markets.

Governments can support the growth of community housing, but they cannot realistically replace the private housing sector with the community housing sector (as the advocates want). That sector has taken 50 years to reach its current size. Even ignoring future population growth, the community housing sector would have to expand to eight times its current size to replace the private rental sector, which is utterly impractical.

rentalhousingbusiness.ca | 37

NATIONAL OUTLOOK

What commonly held views would have to change to achieve R2AH? (Q 5, 6 & 7)

One view which affects our sector is that of critics of the sector who say that the profit motive is against society’s interests. In fact, without the profit motive, the sector will not attract the investment to maintain and upgrade existing rental supply and to construct new supply, both of which are critical to achieve R2AH. (See page 24 for an article on the value of the profit motive.) Another erroneous view is that housing development is highly profitable. The development industry is highly competitive. Economic theory indicates that competition prevents high levels of profit from remaining in place, although profit can fluctuate up and down with market conditions. New housing is expensive. No one can create new affordable housing other than by building expensive housing and subsidizing its costs.

Reducing barriers to new developments would help the private sector to realize R2AH through providing more housing supply. Reducing barriers to conversions would help the private sector to realize R2AH through re-purposing existing housing supply to today’s consumer preferences and needs, and today’s environmental standards.

Absent reduced barriers, the private sector now (in early 2023) finds it difficult to justify developing rental housing even at full market rents. Such development was attractive between 2014 and 2020, but pandemic-related supply chain problems raised construction costs substantially. In 2022, interest rates and net capitalization rates increased substantially. (Both changes have hammered new development by the community housing sector as well as new development by the private rental sector.)

Developing modestly affordable housing requires subsidies. Providing deeply affordable housing requires major amounts of subsidies, possibly extending to paying for the full cost of development, by leaving the households in deep need to pay only the operating costs of their housing.

In re-developments in major centres, most large developers already assist renters who need to relocate to find replacement housing. Modifications can be made to make those systems work better, provided existing renters can be required to relocate. Otherwise, intensification will be prevented, when we critically need intensification to house the growing population.

R2AH is sometimes said to require governments to “invest a maximum of available resources”. The consultation guide asked us to comment.

Government resources are used to address many of society’s needs. The desirability of meeting R2AH more fully needs to be balanced against the desirability of meeting society’s other needs more fully, such as health care, childcare, support for seniors and transit. Within rental housing, there are numerous competing demands, including paying for the operating costs, financing costs, employee costs, repairs, major capital repairs, building life safety needs, building upgrades, and making buildings more environmentally friendly. Buildings also have to generate return on investment so that property owners will incur all the other costs and make more investments in new supply. There are tensions between all competing demands because they all need to be satisfied. An optimal result is not achieved by putting “a maximum of available resources” into any single one of them.

What attitudes need to change for diverse stakeholders to work toward R2AH? (Q 8 & 9)

R2AH is not just an issue about rental housing providers.

The perceived interests of homeowners in fighting increased intensification seems to pits them against developers, but really it pits them against the interests of future renters. Many homeowners like exclusionary zoning, which prevents the division of properties into flats or rooms. Municipalities are inclined to preserve the status quo, preventing re-developments, and developments.

When the rental market is tight, the interests of renters in stopping the demolition of their homes pits their self-interest against interests of future renters. While the fight appears to be current

38 | January 2023

JANUARY 2023

tenants against developers, the fight is really between existing renters and future renters, as well as against intensification and housing the population of the future. One critical part of the solution is there be an ample number of places for people to live. This requires building more housing faster. R2AH should NOT be implemented in ways that impede new housing supply or discourage the repair and upgrading of the existing rental supply. The consultation guide suggested that the profit-making and wealth-generating goals of our current housing system might be fundamentally at odds with the goals of housing as a human right.

CFAA answered that claim by arguments similar to those set out in the article on page 24, which addresses the benefits of markets and the profit motives. Only through the high income which the economic system allows society to achieve can there be sufficient resources set aside to look after health care, education, housing and the needs of low-income households. More and better targeted assistance for people with low-incomes needs to come from governments or charitable institutions. However, the bulk of funding would need to come from tax dollars. Tax dollars spent on housing cannot be spent on healthcare, subsidies to public transit, or education. Tax dollars which are not available cannot be spent on anything.

To shift to a proper understanding of the issues, the following would help:

a. Broader understanding of the costs of housing development

b. Broader understanding of the value of markets in meeting consumer demand and needs

c. Moving away from labels such as “financialization”, as there is no evidence housing providers labeled as “financialized” act less desirably than other housing providers

d. Broader understanding of the negative effects of rent control policies, and of barriers to development

e. Broader understanding of the benefits and efficiency of targeted rental assistance.

Conclusion

CFAA will continue to advocate for the interests of the rental housing sector. We invite you to contact us if you want to take part in the work of defending the rental housing industry. E-mail president@cfaa-fcapi.org.

CFAA-RHC 2023: Canada’s rental housing industry visits Halifax

CFAA Rental Housing Conference 2023 will take place from Wednesday, June 14, to Friday, June 16, at the Westin Nova Scotian in downtown Halifax. Register and book a hotel room now before the room block runs out! Register at www.cfaa-rhc.ca.

CFAA-RHC 2023 - Schedule in brief

CFAA and its partners are excited to visit Halifax, a city transformed in recent years by record-setting development. This year’s building tour will feature three new projects recently completed in downtown Halifax. Explore new trends and discuss new ideas with peers from leading organizations in Canada’s rental housing industry.

CFAA-RHC 2023 - Schedule in brief Wed, June 14

Building Innovations Tour

Welcome Reception

Harbour Cruise

Thu, June 15

Breakfast

Economic Update with Benjamin Tal Education Sessions

Awards Reception

Awards Dinner

Fri, June 16

Breakfast

Education Sessions

rentalhousingbusiness.ca | 39 NATIONAL OUTLOOK

JANUARY 2023

CFAA-RHC 2023 will be presenting many timely sessions on issues that matter. Sessions will cover topics in areas such as:

• Benjamin Tal (CIBC World markets), on the World economy and what it means for Canada

• Technology issues

• Marketing

• Rental Operations

• Human Resources

• Equity, diversity and inclusion

• The Halifax rental housing market

• Comparisons among development in Halifax, Ontario and other markets

• Information about the political threats to rental investments, how CFAA and our allies are defending the industry, and how you can help

• And much more!

Check future issues of RHB or cfaa-rhc.ca for more information.

Conclusion

Whether you are a rental housing executive or manager, a hands-on owner or a rental industry supplier, there will be great information, ideas and contacts for you at CFAA Rental Housing Conference 2023. Come meet with other engaged individuals in the rental housing industry, exchange ideas and see how we benefit from working together.

For more information, or to register for CFAA-RHC 2023, please visit www.CFAA-RHC.ca. Act now to ensure your registration and hotel room!

CFAA Rental Housing Awards 2023

The CFAA Rental Housing Awards Program celebrates excellence and achievements in our industry, and contributions by rental providers, rental suppliers and apartment associations. From among the finalists in each category, the awards winner will be announced at the CFAA Awards Dinner on Thursday, June 15. The Dinner is part of the CFAA Rental Housing Conference 2023 taking place in Halifax. For more information about the conference, and to book your tickets for the Awards dinner, visit www.CFAA-RHC.ca. Tickets are limited! Book yours today. In all, CFAA is now offering at least 11 awards categories. As in previous years, CFAA reserves the right to split categories in order to award more specific awards. CFAA Suppliers Council members, direct landlord members and affiliate members (rental housing provider members of one of CFAA’s member associations) are invited to apply.

• FOR APARTMENT ASSOCIATIONS

Association Achievement of the Year

• FOR RENTAL HOUSING SUPPLIERS

New Product or Service of the Year

CFAA Suppliers Council Member of the Year

• FOR RENTAL HOUSING PROVIDERS

Property Manager of the Year

On-Site Employee of the Year

40 | January 2023

Benjamin Tal, Deputy Chief Economist, CIBC World Markets

NATIONAL OUTLOOK

Off-Site Employee of the Year

Resident Manager/Superintendent of the Year

Rental Housing Provider of the Year

Marketing Program Excellence of the Year

Rental Development of the Year

Renovation of the Year

How to Apply

Visit awards.cfaa-fcapi.org for more program information, including instructions on how to apply. The deadline to apply is Friday, March 10.

Sign-up to receive updates about the awards and other CFAA programs by emailing admin@ cfaa-fcapi.org.

Call for Sponsors and attendance

CFAA’s Awards Program relies on sponsors to help keep our program open and free of application fees. Please consider sponsoring components of the awards program. Help CFAA celebrate excellence in the rental housing industry! For information about sponsor opportunities, please email events@cfaa-fcapi.org.

Attend the Awards Dinner on Thursday, June 15, 2023, and enjoy celebrating excellence in rental housing. Buy your ticket at www.CFAA-RHC.ca.

rentalhousingbusiness.ca | 41

Contact Michael Gnat 416-635-4835 mgnat@midnorthern.com 45 Red Maple Rd Richmond Hill, ON 1-844-733-1696 www.thebrick.com www.midnorthern.com Coming soon... New Luxury Appliance Showroom

President’s message

As we begin a new year, I reflect on where we were a year ago: still in lockdown and kids at home doing online learning. Fortunately, we gradually began to reopen our economy and resume in-person activities, and while COVID-19 may always be with us, we have returned to some sense of normalcy. At FRPO, we hosted our annual golf classic in support of Interval House in July complete with dinner and gathered at the Metro Toronto Convention Centre to showcase the best in our industry at the MAC Awards with a sold-out crowd in December. After all we have endured over the past three years, I am optimistic that we will have a great 2023! The focus of the Ford government continues to be on the need for more housing supply, including more purpose-built rental housing. Bill 23: More Homes Built Faster Act, which passed last December, contains several measures that support the rental housing industry, such as reducing government fees and charges, streamlining the approvals process, and cutting red tape. FRPO will continue to work with the Ministry of Municipal Affairs & Housing on the development of regulations that will support this bill, and on additional housing legislation expected in the spring with an emphasis on urgently needed RTA reform.

Your association is hard at work preparing an exciting calendar of in-person events and educational webinars, which will kick off with the return of our CHMC Rental Market Breakfast as an in-person event. I look forward to engaging with as many members as I can, so be sure to visit www.frpo.org for details on all of our events and where to sign up. And for those who haven’t heard, our Certified Rental Building Program was rebranded as the Canadian Certified Rental Building Program last year to support rental housing providers and residents all across Canada. To find out more about our quality assurance program, please visit www.crbprogram.org.

We know 2023 will present some economic challenges caused by high inflation and a sharp rise in interest rates. I continue to be amazed by the resilience of our industry and ability to go above and beyond for your residents in spite of enormous adversity. I often remind people this is not our response to a crisis; this is just who we are. FRPO will continue to ensure your voice is heard by the government, media, and the public as we ferociously educate and advocate for policies that support a vibrant rental housing industry.

Finally, I would like to thank you for your support. We are here to serve our members, so don’t hesitate to reach out with ideas, feedback or just to say hello.

- Tony Irwin, President

rentalhousingbusiness.ca | 43

Government relations update

As 2023 gets into full swing, FRPO has resumed engagement with various government ministries and officials to collaborate and support the Ford government as it continues to make progress on building 1.5 million homes over the next decade. In late November, Bill 23, More Homes Built Faster Act passed third reading and received Royal Assent. This legislation takes aim at government fees and charges by providing discounts from development charges for purpose-built rental housing, and makes a number of policy changes to streamline approvals and cut red tape. These are welcome changes that provide much needed relief to purpose-built proformas and will help to get shovels in the ground.

FRPO returned to Queen’s Park for our first in-person advocacy day since 2019. Activities included a lunch reception with MPPs and staff, and attending Question Period and in-person meetings with Minister of Municipal Affairs & Housing Steve Clark, Associate Minister of Housing Michael Parsa, and Attorney General Doug Downey. FRPO members shared their concerns and offered suggestions to improve the operating climate for rental housing providers.

Before the end of the last legislative session, the NDP also introduced two Bills that FRPO opposes: Bill 47, which would amend the RTA and Condominium Act to require rental housing providers to supply emergency generators that would be AGI ineligible, and Bill 48, which would expand rent control to all units. These are opposition Bills that are not expected to progress past the Bill introduction stage.

In November, Attorney General Downey announced $1.4 million for the LTB to hire 35 additional operational staff to enhance scheduling, issue decisions and orders faster, and help tackle the high number of cases. FRPO welcomed this announcement, but structural changes are also needed to ensure timely access to justice for rental housing providers and residents. In December, FRPO engaged Attorney General Downey, Ministers Clark and Parsa, and the Premier’s office on this urgent issue, and we are hopeful that the government will tackle this in the next Housing Bill expected in the spring.

Prior to the provincial election last June, we heard from a few members that the Condominium Management Regulatory Authority of Ontario had contacted them regarding purpose-built

rental buildings that are condominium titled to inform them that these buildings must be licensed under their authority and are subject to regulations under the Condominium Act and Condominium Management Services Act. FRPO has engaged with officials from the Ministry of Public & Business Service Delivery with proposed amendments that would exempt properties registered as condominiums but operating entirely as rentals. The government has been receptive to our position and we are advocating for inclusion in an upcoming red tape Bill.

We also plan to initiate a number of studies and reports to support our advocacy efforts, including an updated economic impact study of our industry in Ontario as well as other studies that explore the economic challenges that are unique to building purpose-built rental housing, as well as potential solutions. Government relations continues to be at the forefront of what we do to advocate for a strong rental housing industry with policymakers at Queen’s Park.

The Agenda - Discussing the housing crisis and affordability

On January 17, 2023, Tony Irwin joined Brad Bradford, Toronto City Councillor, and Carolyn Whitzman, Housing Researcher and Adjunct Geography Professor at the University of Ottawa, on The Agenda hosted by Steve Paikin. The topic of the show was whether the government should build more rental housing to make up for the shortage. The panel discussed the reasons for the shortage of rental properties, the rapid increase in housing prices, the economics of building condos vs. purpose-built rentals, potential solutions to address the issue, and other related topics.

The episode is available for viewing on YouTube: https://www.youtube.com/watch?v=CptyEITT3uY

Past events

December 6, 2022 – Dear Everybody with Holland Bloorview

As part of FRPO’s ongoing Diversity, Equity, and Inclusion series, FRPO partnered with Holland Bloorview Kids Rehabilitation Hospital for an educational webinar. Attendees learned about creating a more inclusive world for people with disabilities by keeping inclusion at the forefront of all aspects of your business. This complimentary webinar described best practices of disability inclusion in the workplace. It also discussed authentic inclusion and representation of people with disabilities in the workplace through using proper language with disability, and provided tips and tricks on being an ally and how to be an ongoing resource to your team moving forward.

Upcoming events

February 22, 2023 – CMHC Rental Market Survey

Breakfast

This breakfast event will take place from 8:00 – 10:30 am at the Parkview Manor, 55 Barber Greene Road in Toronto. CMHC will share their key findings from its October 2022 Rental Market Survey for the Greater Toronto Area. They will also discuss trends in other major Ontario centres. The presentation will conclude with an outlook of where rental markets are headed in 2023 and beyond. Registration is $80 per person plus HST, and is open to FRPO and GTAA members.

July 18, 2023 – FRPO Charity Golf Classic