VOLUME 2 NO. 2 | APRIL–MAY 2025

A COPPER ISLAND

Discovering the mines of Bougainville A-OK

One of PNG’s most iconic miners has a bright future KEEPING HEALTHY

How workers can keep physically and mentally safe

VOLUME 2 NO. 2 | APRIL–MAY 2025

A COPPER ISLAND

Discovering the mines of Bougainville A-OK

One of PNG’s most iconic miners has a bright future KEEPING HEALTHY

How workers can keep physically and mentally safe

How PNG is capitalising on new advances in technology

Conservation

The environmental responsibility of mining in PNG

OFFICIAL MEDIA PARTNER

With over 67 years of proud service to Papua New Guinea, the Brian Bell Group operates seven diverse divisions, delivering tailored solutions for large-scale projects.

Proven expertise and capabilities

Wide product range

Dedicated specialist support

COO

Christine Clancy

EDITOR

Alexandra Eastwood

T: +61 3 9690 8766

E: alexandra.eastwood@primecreative.com.au

GROUP MANAGING EDITOR

Paul Hayes

T: +61 3 9690 8766

E: paul.hayes@primecreative.com.a

CLIENT SUCCESS MANAGER

Janine Clements

T: +61 2 9439 7227

E: janine.clements@primecreative.com.au

RESOURCES GROUP LEAD

Jonathan Duckett

M: +61 498 091 027

the industry in 2025.

E: jonathan.duckett@primecreative.com.au

BUSINESS DEVELOPMENT MANAGER

Ezra Wolde

M: +61 411 188 322

E: ezra.wolde@primecreative.com.au

ART DIRECTOR

Michelle Weston

SUBSCRIPTION RATES

Australia (surface mail) $140.00 (incl GST)

New Zealand A$148.00

Overseas A$156.00

For subscriptions enquiries please call +61 3 9690 8766

COVER IMAGE: Crusher Screen Sales & Hire

PRIME CREATIVE MEDIA

379 Docklands Drive

Docklands, VIC 3008 Australia www.primecreative.com.au

© Copyright Prime Creative Media, 2016

WITH DIGITISATION rapidly advancing, new and improved technology is revolutionising how mining operations are conducted across Papua New Guinea (PNG). From automation to artificial intelligence (AI)-driven analytics, digital tools are enhancing efficiency, safety and sustainability in ways never before seen.

In the April–May issue of PNG Mining, we examine how local and international companies are integrating these innovations to stay ahead of the curve.

As new technologies take off, so too do advancements in sustainability and conservation. With environmental responsibility becoming more and more important, mining companies are investing in sustainable practices that balance economic growth with ecological stewardship.

In this issue, we spotlight initiatives that are making a difference, whether through riverine conservation projects or innovation tailings and waste disposal systems.

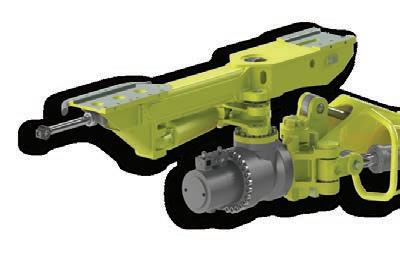

Crusher Screen Sales & Hire (CSSH) graces the front cover of our April–May issue with its PM1200-48TB blender. Powered by a Cat C7 generator, the blender has four 5m-long feed hoppers all holding 12m3 each that can operate in conjunction with the pugmills.

“These machines also offer great serviceability, and the improved PLC control and recording system that can be monitored from an office and our service department increases both safety and ease of use,” CSSH manager John Andersen told PNG Mining in our interview.

In this issue we also shine a much deserved spotlight on a true pioneer of the PNG mining and business scene: Brian Bell. The group’s head managers talk us through the founding of the company, the development of the Sir Brian Bell Foundation, and the future projects that are in the works.

Meanwhile, the highly anticipated WafiGolpu project continues to be a major talking point both in PNG and overseas. As stakeholders navigate regulatory hurdles and community concerns, the project’s progress will be pivotal for PNG’s mining landscape.

As always, PNG Mining remains committed to bringing our readers the latest insights, expert opinions and indepth analyses on the forces helping to grow the local sector.

The road ahead presents both challenges and opportunities, and we look forward to exploring them with you. Happy reading.

Alexandra Eastwood Editor

14 Cover story

Ushering in the next generation Crusher Screen Sales & Hire is making waves in the mining, transport and quarrying industries with its range of innovations and equipment.

18 Digital mining

Flicking the digital switch

Digital mining is becoming a mainstay in the broader resources industry, as PNG looks to capitalise on new advancements.

22 Mine spotlight

PNG’s next mining giant The Wafi-Golpu mine is on the cusp of greatness.

28 Company profile

From the ground up Mayur Resources’ two flagship projects are progressing on schedule.

34 Company spotlight

Much more than a store

A figurehead of PNG business, the Brian Bell Group is only expected to grow as the year goes on.

40 Safety

Staying mentally healthy Employers have a duty to ensure their workforces are kept safe from physical and psychological harm.

48 PNG Expo

On the global s The 2025 PNG Expo is set to connect industry leaders, investors and policymakers to explore more opportunities and innovations.

52 Regional spo

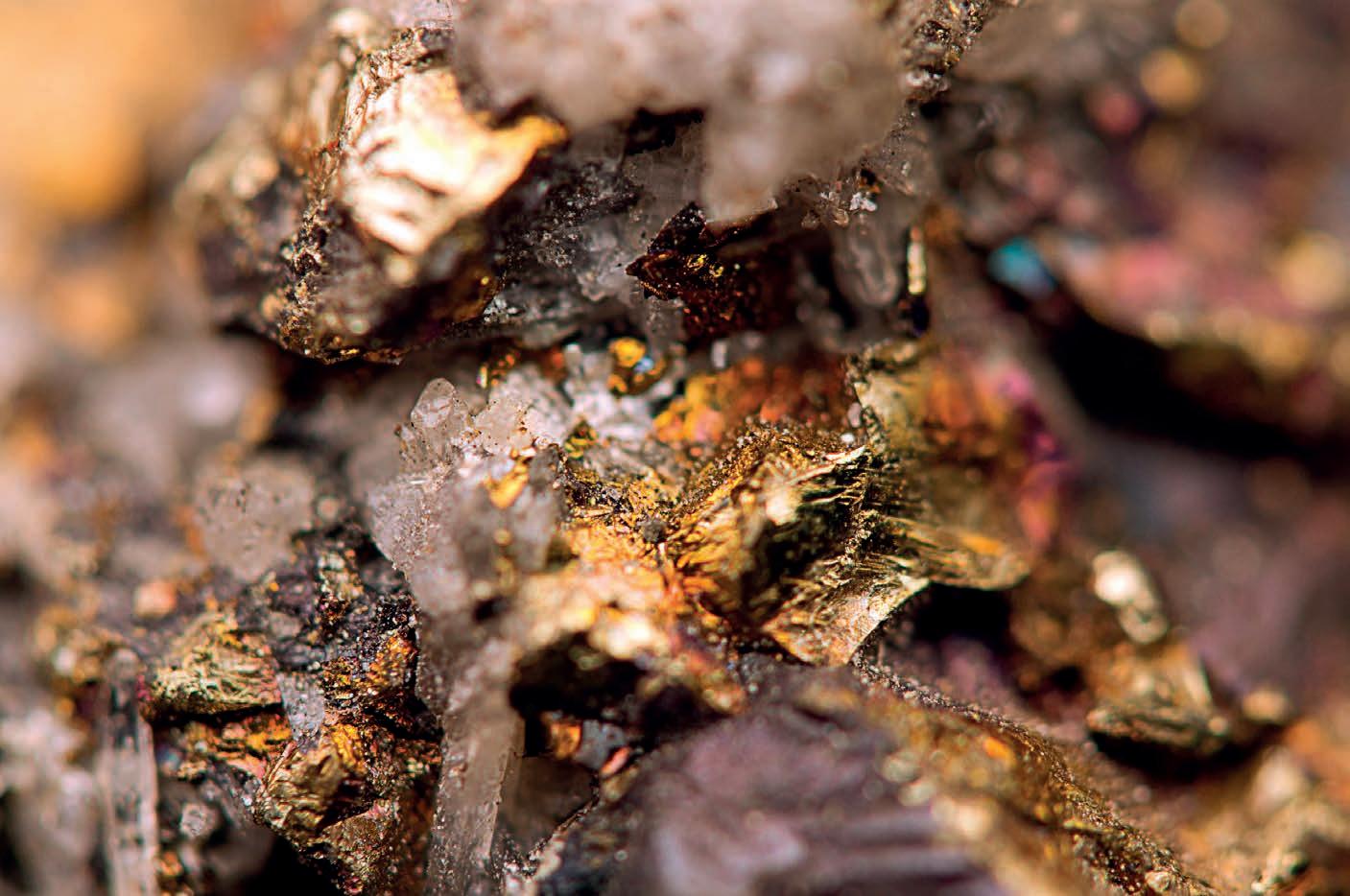

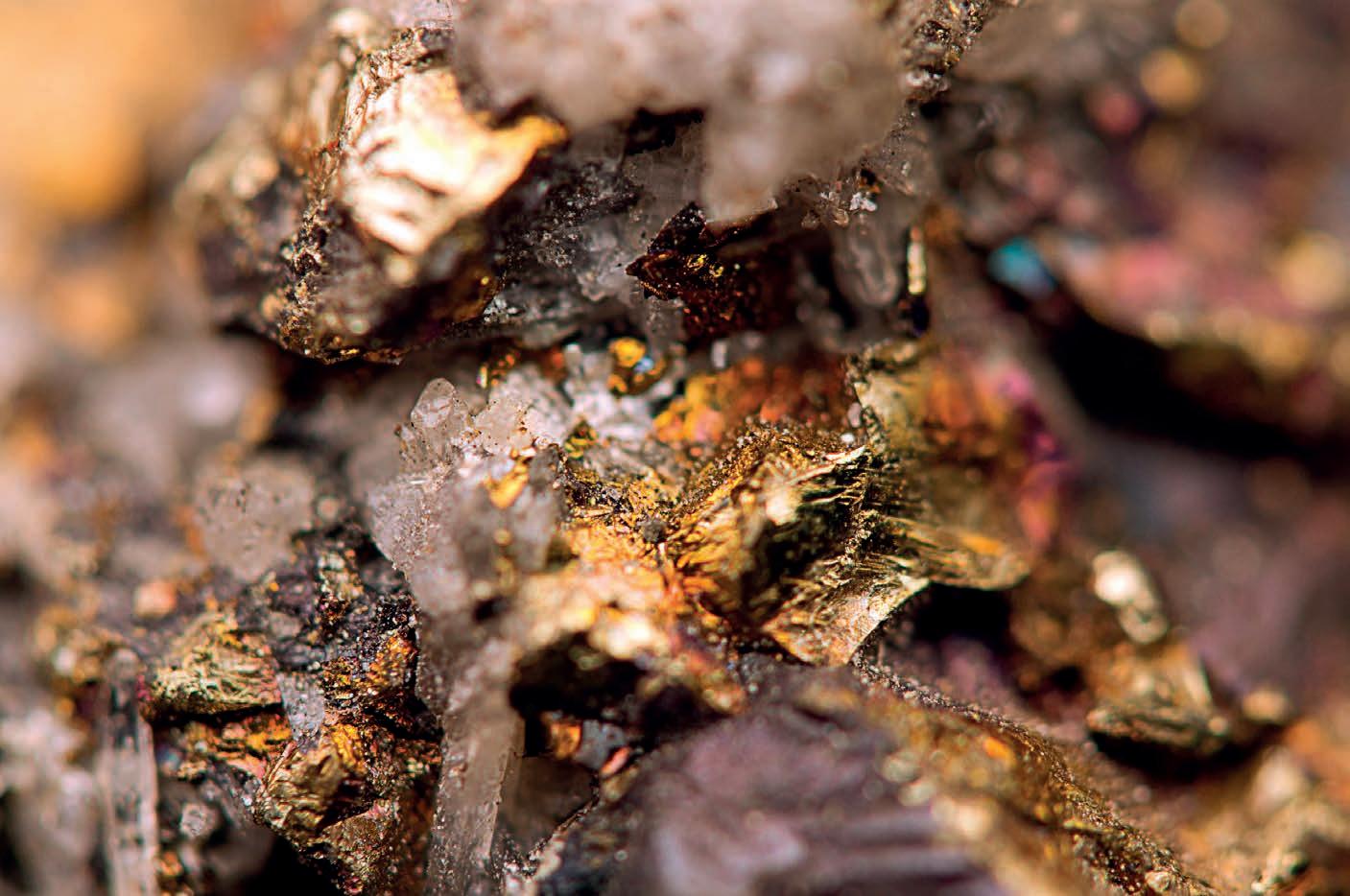

Mapping a copper island Bougainville Island is home to what was once one of the world’s largest copper mines.

56 Sustainability

Digging deep, keeping green PNG-based mining companies don’t take the responsibility of conservation lightly.

Email:

LCL Resources has announced its Ono gold project has an inferred mineral resource of 18.3 million tonnes (Mt).

LCL owns 100 per cent of the Ono project, located 150km from the Port of Lae, and has recently adopted a new strategy aimed at streamlining the business and reducing overheads.

New and existing shareholders have strongly endorsed this strategy, and with Ono’s mineral resource estimate, it isn’t hard to see why.

“The geology supports the existence of further shallow pods of mineralisation around the central Kusi intrusive centre as well as the possibility for deeper mineralisation within the Lower Limestone,” LCL executive chairman Chris van Wijk said.

“Further exploration is warranted to investigate the tenor and scale of mineralisation in the Lower Limestone unit as well as to test the obvious targets outlined by the soil geochemistry results.”

Independent mining consultancy WSP has been commissioned to estimate an inferred mineral resource incorporating all the drilling completed by LCL.

“[LCL] is investing in the use of 3D induced polarity to target mineralisation at depth in the Lower Limestone unit and to define the margins of the Kusi intrusive body,” van Wijk said.

“These results reflect the focus on the copper-gold assets within the portfolio. There remain a number of other coppergold opportunities to follow up on in PNG which we are excited to continue exploring.” PNG

St Barbara is intending to focus more on its Simberi gold mine in PNG as it plans to separate its Atlantic gold operations from the company.

The Atlantic gold operations consist of the 15-Mile, Beaver Dam and Cochrane Hill projects in Nova Scotia, Canada. Managing director and chief executive officer Andrew Strelein said the separation would allow the company to dedicate its resources to PNG.

“The decision to separate Atlantic from St Barbara is underpinned by

the opportunity to unlock the full value potential of the Atlantic projects under a Canadian listed company with a local leadership team, to focus on delivering upcoming project milestones and benefit from being closer to regulators and key stakeholders,” he said.

Strelein said the company is still considering its options for how the separation of Atlantic will play out, including by way of sale, vend-in or demerger.

“Atlantic is a highly attractive and financially robust project and has the potential to be in production within 12 months from permitting approval,” he said. “The separation of Atlantic enables St Barbara to focus solely on the Simberi sulphide expansion project.”

The Atlantic operations have 1.4 million ounces (Moz) of gold in ore reserves and 2Moz in mineral resources, with significant potential due to production-ready infrastructure and exploration opportunities. PNG

The future of the Simberi gold mine mining lease will be discussed at the Warden Court from April 8–9.

The hearings are the next step in St Barbara’s bid to have the Simberi mining lease renewed in accordance with the Papua New Guinea (PNG) Mining Act 1992 It follows the acceptance and registration of Simberi’s application for early lease renewal by the Mineral Resources Authority of PNG (MRA) in December 2024.

Once the Warden Court hearings have been conducted, the Mining

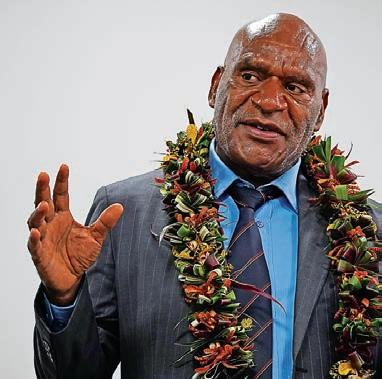

Advisory Council will make a final recommendation to Minister for Mining Wake Goi.

“The announcement of the Warden Court hearing dates is an important next step in application for early renewal of Simberi’s mining lease,” St Barbara managing director and chief executive officer Andrew Strelein said.

“We are very grateful for the support of our renewal submission from all directors of the Simberi Landowner Association, the New Ireland Provincial Government, the Local Member of

Tolu Minerals installed the modular gravity recovery plant at its Tolukuma gold mine in March, paving the way for final commissioning and testing.

The plant is an integral part of the phased restart at Tolukuma, contributing to revenue by producing a gold/silver doré for sale.

It will also allow for advanced testwork on comminution performance and gold and silver gravity recovery.

Tolu is on the path to initial production from Tolukuma, targeting a production rate of 2000 ounces of gold per month by the end of the year.

“The commencement of final hot commissioning of the modular gravity gold plant is a major milestone in the

development of Tolu and the return of [the] Tolukuma mine to high-grade gold and silver production with commencement of revenue generation,” Tolu managing director and chief executive officer Iain Macpherson said.

“Industry-leading geotube technology is being deployed to temporarily store tailings to facilitate efficient and safe decanting of water and provide insight into the use of the technology as a potential long-term aide to tailings storage.”

The plant has been designed in partnership with South Africa based

Parliament and from the Namatanai District Development Authority.”

The announcement of the court dates follow St Barbara’s extensive discussions with stakeholders of Simberi in relation to the company’s proposal for an enhanced net profits-based royalty.

St Barbara is currently completing its 2024–25 financial year drilling program at Simberi, with “significant” intercepts found, including:

• 31m at 6.1 grams per tonne (g/t) gold from 35m,

• 25m at 1.9 g/t gold from 17m. PNG

Appropriate Process Technologies based on historical testwork and operating parameters from the 20-year period that Tolukuma was operational.

Tolu is currently undertaking training of management, operating and maintenance staff while the commissioning engineers and inspectors are on-site.

“The plant throughput and modular expansion capability is designed to match the mine’s production ramp-up schedule while enabling lower operating costs,” Macpherson said.

“Not only will it generate revenue, but it will also enable testing of more effective processing, including enhanced silver recovery.” PNG

The recently completed $40 million entitlement offer at Geopacific’s Woodlark gold project will be put to use advancing and unlocking the site’s potential.

Geopacific has planned for 30,000m of RC and diamond drilling to extend Woodlark’s known gold mineralisation and test new targets.

PNG-based drilling company Quest Exploration Drilling has been selected as the preferred drill contractor.

“Significant underlying value and upside potential exists at Woodlark,” Geopacific chief executive officer James Fox said.

“With funding for an extensive exploration and project development work program now in place, the team is working hard to deliver on a series of key objectives, including commencing a 30,000m drill program and the completion of a project definitive feasibility study by the end of the calendar year.”

Drilling is set to commence in May, with earthmoving equipment and fuel supplies locked in for shipping to Woodlark during March. High-priority zones, including Little Mackenzie, Wayai Creek and Boscalo North, will also be advanced.

“We are keen to assess the impact of the materially higher gold price and ensure the engineering design appropriately considers throughput flexibility to maximise project returns,” Fox said.

“We look forward to updating the market as the project activities progress.” PNG

Landowners of the Frieda River coppergold project are looking forward to the operation moving beyond the exploration stage.

The Frieda River orebody has changed hands multiple times since its discovery in the 1960s. PanAust took over the exploration licence in 2014 and has since moved the project into the permitting stage.

“Frieda River Limited (FRL) and its parent company PanAust are the only companies that have progressed Frieda River to the permitting

phase,” FRL project director Phil McCormack said.

“We are proud development partners for the East and West Sepik provinces and PNG. We are committed to PNG.”

Armaromin village community leader Afasep Tiptop said the community was thankful that PanAust had stayed with the project for the past 11 years.

“You have our consent, and we want to see Frieda River progress because it will mean much needed infrastructure and services for us like roads, airstrips, health and education,” Tiptop said.

Sokamin village resident Titus Sikitmap voiced similar sentiments.

“Many of our people and leaders have passed on while waiting for the Frieda River project to be developed,” Sikitmap said.

The Frieda River copper-gold project is just one of four multibillion-kina projects that FRL is hoping to develop in the Sepik region. The others are the Frieda River Hydroelectric project, the Sepik power grid project, and the Sepik infrastructure project. PNG

The first roundtable to address the findings from the ‘Panguna Mine Legacy Impact Assessment’ (PMLIA) report was held in Port Moresby in March.

The joint undertaking follows the November 2024 agreement between the Autonomous Bougainville Government (ABG), Bougainville Copper Limited (BCL) and Rio Tinto to address environmental issues at the site.

The roundtable aims to develop a process for collectively remedying impacts identified in the report and is an important first step toward finding ways to address the legacy concerns of the mine.

“Throughout the meeting, the parties deliberated and reached consensus on the scope of additional investigations needed to address the most critical impacts identified in the PMLIA,” Rio Tinto said. “This will be submitted for consultation with and formal endorsement by the PMLIA Oversight Committee, which includes diverse stakeholders representing local communities, the Government of PNG, the ABG, BCL, Rio Tinto, and the Human Rights Law Centre.”

The parties will continue to address ageing infrastructure and other priority issues at the site.

“The PMLIA has been an important initiative for the ABG and for impacted communities,” Bougainville President Ishamel Toroama said in November 2024.

“Rio Tinto and BCL should be commended for stepping up and supporting the assessment, as well as the clan representatives on the Oversight Committee who have been a vital bridge in their communities throughout the process.

“We are now looking beyond these results to working in concert with the [agreement] partners to address the legacy environmental impacts.” PNG

Prime Minister James Marape met with US Ambassador to PNG Ann

Both countries are preparing to celebrate 50 years of bilateral

an environment that attracts international investors.”

deepening the US–PNG relationship and

Some of Papua New Guinea’s most remote villages have been registered by the National Identity Project (NID) thanks to Frieda River Limited (FRL).

The NID is a registry office that records births, deaths, marriages, divorces and adoptions in PNG.

The goal of the department is to have every PNG citizen accounted for, recognised and given mandatory individual identity to contribute to the country’s national building and citizenship.

In early January, FRL arranged for NID officers to visit its Frieda River mine site and then onto the remote villages of Sokamin, Wameimin 1 and 2, Amaromin, Ok Isai, and Wabia.

The drive saw over 2300 people registered, with those over 18 undercoming biometric testing and receiving NID cards.

The registration will allow these individuals to participate in state-led processes like the creation of landowner associations near mine sites.

“Accessing the seven villages in our project footprint is no easy feat,” FRL country manager Joel Hamago said.

“The only way to reach them is by helicopter, canoe or on foot, with days of trekking between each location.”

Hamago said FRL is proud to support the NID process, something that is vital for the next stage of Frieda River’s

Ok Tedi Mining Limited (OTML) is backing higher education in PNG with the launch of a new scheme.

Dubbed the University Talent Management (UTM) application, the program has been designed to streamline the process for students who want to participate in OTML’s University Internship Program, aligning OTML’s training programs with the needs of both the company and the students.

Now managed by OTML’s training and capability development department, students in the program will be supported with placements at the mid- and endyear intervals.

The program primarily focuses on thirdyear students who maintain a grade point

average (GPA) of 3.5 or higher. Students from Western Province with a GPA of 3.0 or over are also encouraged to apply.

“We are excited to roll out the UTM application, which will significantly enhance how we connect the requirements for the University Internship Program from OTML departments to eligible students,” OTML manager training and capability development Ian Strachan said.

In other higher education news from OTML, the company’s senior aquatic ecologist Gilton Alimaka participated in an intensive 24-day training course in Perth, Western Australia during March.

Conducted by Sustainable Leaders in Resources (SLR) Consulting, Alimaka’s training focused on laboratory processing,

development, and that despite the challenging terrain and weather, the registration was completed in less than two weeks.

Residents of the villages expressed their gratitude for the scheme and said they are eagerly awaiting the arrival of the NID cards now that registration is complete. PNG

taxonomic identification and statistical methods for assessing aquatic organisms. This knowledge will be crucial for monitoring water quality and ecosystem health in areas affected by mining.

“Aquatic macroinvertebrates, such as mayflies and snails, are vital indicators of water quality,” OTML manager environment department Erizo Kepe said.

“The ability to identify these species accurately helps in assessing environmental health, especially in ecosystems impacted by mining.”

The training is part of OTML’s ongoing efforts to upskill its environmental team in their scientific fields to operate more efficiently and promoting reliance on internal expertise. PNG

Frieda River Limited (FRL) is committed to enhancing the lives of Papua New Guineans as it works to finalise its Frieda River copper-gold project.

The miner has been a steadfast supporter of promoting health in PNG, recently sponsoring a suite of specialised plastic surgery equipment to enhance the country’s 2025 plastic and reconstructive surgery program.

The equipment includes nerve and cleft palate trays which comprise of microsurgical instruments used in the delicate repair of cleft lips and palates. These repair procedures can help to improve an individual’s speech, feeding and mobility.

“The specialised equipment is difficult to procure, therefore we are very grateful for the assistance of Frieda River Limited and PanAust [FRL’s parent company],” Port Moresby General Hospital head of plastic and reconstructive surgery Dr Jackson Nuli said.

“Many children, men, and women will benefit from this important surgical equipment.”

Nuli will join a team of Australian surgical volunteers from Interplast this month, heading to Wewark to conduct free consultations, perform surgeries and train new PNG-based surgeons, nurses and anaesthetic staff.

Papua New Guinea’s (PNG) mineral exploration and mining sectors were on display at the Prospectors and Developers’ Association of Canada (PDAC) in early March.

Held in Toronto from March 2–5, PDAC is one of the world’s premier mineral exploration and mining convention, attracting over 30,000 global attendees annually.

A team made up of members from the Mineral Resources Authority (MRA) and the Minister of Mining attended the convention, including MRA managing director Jerry Garry and PNG Mining for Mining Wake Goi.

The purpose of their attendance was to promote mineral exploration in PNG which has seen a decline since 2019.

“Between 2012-2018, most of the country was taken up by companies exploring for mineral resources,” the MRA said. “However, since 2019, PNG has seen a decline in mineral exploration interest due to lack of geoscience data amongst other issues.

“Another major concern for the government has been the depletion of

mineral resources, and the fact that most of the major operating mines will have closed down by 2060.”

As over 60 per cent of PNG’s revenue is driven by the mining sector, increasing exploration in the country has long been a primary focus of the MRA.

“As a country, without exploration, there will be no mining,” Garry said

“We at Frieda River Limited and PanAust are humbled to contribute to making a difference in someone’s life,” FRL country manager Joel Hamago said.

“Seeing children, men and women live enhanced lives because of reconstructive surgery is the kind of humanitarian benefit our proposed Sepik development project is keen to bring to the Sepik provinces and PNG.

“The Sepik development project will be developed with the utmost respect and care for the ecosystem of the remote Sepik. That’s our commitment to the people and governments of the two Sepik provinces and PNG.” PNG

“It is therefore important to start looking for new mines now, because the lead time from discovery to commissioning of projects is between 11–50 years, as in the case of the Frieda River project.”

The Frieda River gold project was discovered in 1967 but is yet to be commissioned. PNG

PNG Mining takes a look at the leadership changes from resources companies across the country.

SOME OF PAPUA NEW GUINEA’S (PNG) most well-known resources companies have recently undergone significant leadership changes.

In a bid to strengthen its leadership team, K92 Mining issued a slew of new appointments in January.

These included Heidi Grobler, who took on the position of vice president – human resources; Stanley Komunt in the general manager, external affairs role; and Andrew Kohler, who was promoted to interim vice-president – exploration.

Kohler took over the role from Chris Muller, who departed the company after more than eight years of service.

K92 chief executive officer and director John Lewins welcomed the changes.

“As K92 Mining continues to grow and evolve, the leadership changes reflect our firm commitment to building a strong, dynamic team capable of driving our success well into the future,” he said.

Of the leaders, only Komunt is a new recruit for K92. Grobler joined the company in 2021 as head of human resources, while Kohler took on the position of mine geology and exploration manager in 2016.

“Over the past three years, Heidi Grobler has consistently demonstrated exceptional dedication, resourcefulness and the ability to excel in many roles, making her a natural fit for this promotion,” Lewins said.

“We are also pleased to welcome Stanley Komunt … who brings a wealth of community and government relations expertise in PNG, most recently with Newcrest and Newmont.

“I would also like to recognise Andrew Kohler. With over eight years of significant contributions to K92 and a wealth of industry expertise, Andrew is well-positioned to ensure continuity and leadership during this transitional period.”

Harmony appointed its own hat-trick of industry leaders to its board in January and February.

Mametja Moshe, Zanele Matlala and Mangisi Gule were all appointed to the company’s board of directors in early 2025, with Moshe and Matlala serving as members of the audit and risk committee and Gule taking a role on the remuneration committee.

“We are pleased to welcome our new independent non-executive directors,” Harmony chairman Patrice Motsepe said.

“Each of them have got expertise and experience that will contribute to Harmony continuing to being a globally competitive company that create attractive returns for its shareholders and benefits all of its various stakeholders.”

There has also been some internal movement on the Harmony board, with Martin Prinsloo taking the role of audit and risk committee chairman and Given Sibiya serving as chairman of the remuneration committee.

Tolu Minerals

Tolu’s 2025 will be marked by a targeted exploration program at its Tolukuma gold mine, a plan that needs a strong leader to head the program up. Enter Chris Muller.

Muller joined Tolu as its executive group geologist after almost nine years leading K92’s exploration team.

Tolu managing director and chief executive officer Iain Macpherson said hiring PNG’s “foremost geologist and explorer of recent years” was a boon for the company.

“Chris joins Tolu at a key stage in the company’s exciting growth trajectory and brings unparalleled experience, success and no small dose of enthusiasm to Tolu’s very large and prospective exploration profile,” Macpherson said.

Muller has more than 25 years of experience in underground and surface mining and has been committed to PNG for the past 20 years.

“The timely arrival of Chris brings unparalleled capability to Tolu’s already first-rate team and is further demonstration of Tolu’s commitment

to deliver another world-class gold-silver and potentially copper producer in what is rapidly becoming one of the leading global gold-copper provinces,” Macpherson said.

As K92 Mining continues to grow and evolve, the leadership changes reflect our firm commitment to building a strong, dynamic team capable of driving our success well into the future.

K92 chief executive officer and director John Lewins

Barbara

February saw St Barbara announce it would be selling its Atlantic operations to focus on becoming a PNGdedicated miner.

The company wasted no time in taking delivery of an MMD sizer crusher at its Simberi gold mine and welcoming Phil Stephenson into its fold as consultant operations advisor in that same month.

Stephenson, reporting directly to chief executive officer Andrew Strelein, will monitor the company’s operating performance and provide recommendations on strategic and tactical actions that will help achieve Simberi’s operating objectives. He will also provide advice on the Simberi sulphides feasibility study outputs and guide operational readiness decisions.

Phil has extensive and very relevant mining experience, particularly in PNG, and he will provide invaluable input and advice for both the current oxide operation and as we move towards a final investment decision on the sulphide expansion.

St Barbara managing director and chief executive officer Andrew Strelein

Strelein is excited to have Stephenson join the St Barbara team.

“Phil has extensive and very relevant mining experience, particularly in PNG, and he will provide invaluable input and advice for both the current oxide operation and as we move towards a final investment decision on the sulphide expansion,” Strelein said.

Stephenson was most recently Newcrest Mining chief operating officer, a role that included responsibility for the Lihir gold mine in PNG. He has also held several other executive and senior management roles within Newcrest, Newmont, Barrick Gold and Placer Dome, including the role of general manager at the Porgera gold mine. PNG

Crusher Screen Sales & Hire is making waves in the mining, transport and quarrying industries with its range of innovative equipment.

SOME OF THE BIGGEST challenges for the mining industry of Papua New Guinea (PNG) involve the access roads to and from the mines.

Located in hard-to-reach places, PNG’s mine access roads are often unpaved, leading to increased wear and tear on the tyres that drive across them.

Luckily, Crusher Screen Sales & Hire (CSSH) has a portfolio of equipment to help change the game.

As the Irish Manufacturers (IMS) distributors for Australia, CSSH has already caught the eye of many in the roads and transport sectors, and the company is keen to turn its attention to PNG.

“Both CSSH and IMS have worked together to create pugmills and blenders suitable for Australian conditions, as well as the changing requirements for blended material in the quarry, construction and mining industry,” CSSH manager John Andersen said.

“Some quarries or mines have difficulty meeting road base standards without blending fines into the product.

“There is also increased use in the industry of blending recycled products into virgin quarry products in order to reduce the amount of raw material being used, reduce the amount of waste

20TB. And while much has changed since CSSH introduced its first IMS-PM1050-16TB track pugmill in 2014, Andersen said the improvements in the portfolio have been a natural progression.

“The new IMS PM1200-20TB track pugmill has two 5m-long feed hoppers holding 10m3 each, with separate hopper conveyors fitted with belt scales enabling the blending of two products with accuracy,” he said.

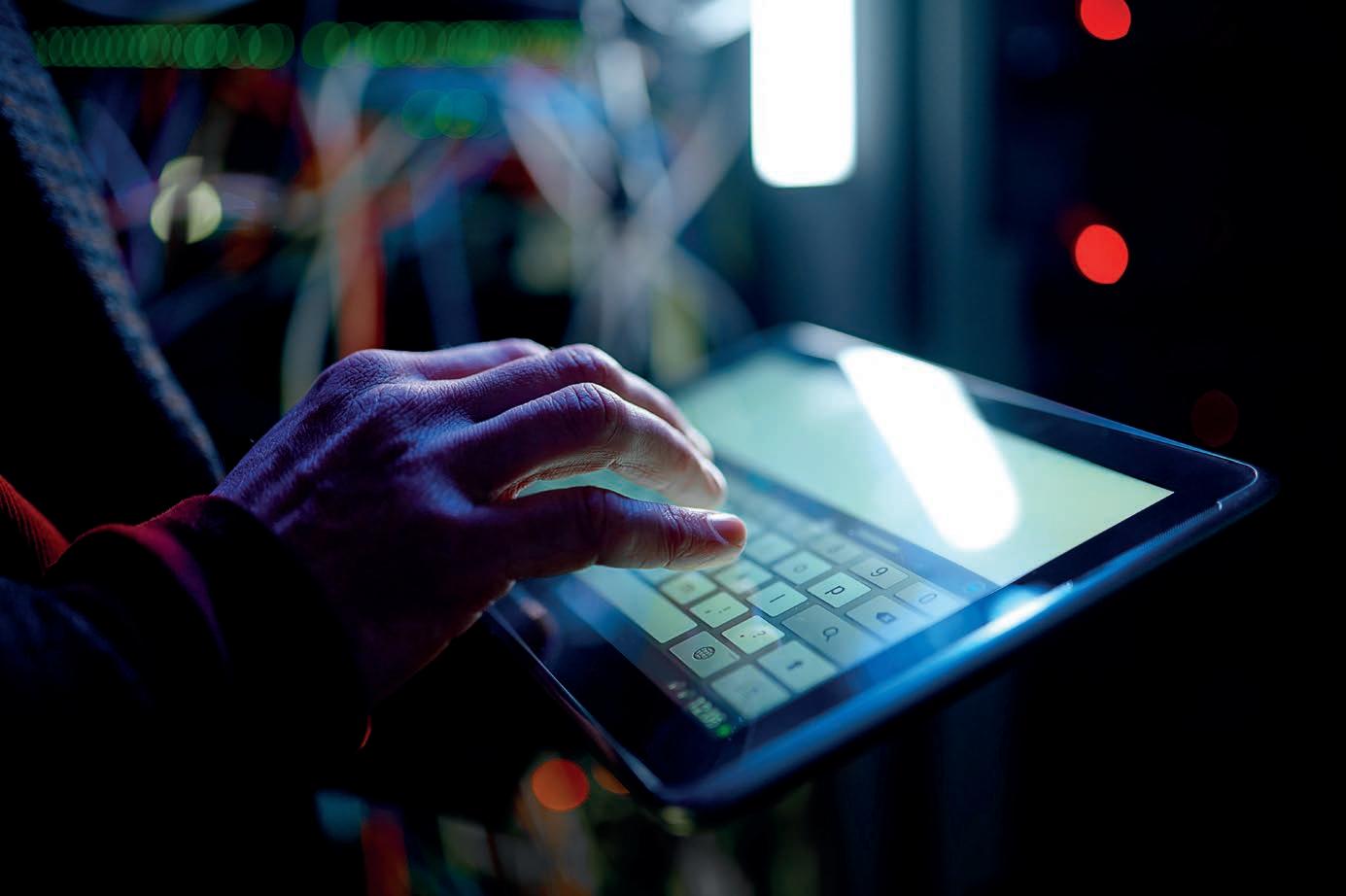

“The pugmill has the option of one or two powder hoppers and the ability to add two liquids. This is fully automated with a PLC [programmable logic controller] and recording system that can be operated with an iPad in a loader or site office.”

The pugmill’s ability to blend two raw materials with the option of adding two powders and two liquids has made it an instant hit with the market.

The PM1200-20TB also has the option of hydraulic vibrating tipping grids on the feed hoppers and can be adapted to produce a slurry for mines remediation projects.

The Australian designed PLC – with a full reporting program – shows the percentages of each product used, along with a supporting graph for each batch. It will auto stop if the blend is not making the programmed percentages and will also give daily totals of all the different products used for the day, aiding in the management and ordering of materials.

5m-long feed hoppers all holding 12m3 each that can operate in conjunction with the pugmills.

There is also the BP1200-914S twin feed hopper blender, which stands on six jacking legs that a 2.5m-wide drop deck can back under for transporting. The electric gear drive motors ensure constant flow, with variable speed invertors and a front-of-hopper adjustable flow gate that can be altered depending on product parameters.

The unit also comes with a remote stop and start, and feed hopper sensors can be fitted to stop and start the conveyors. Additionally, both feed hopper conveyors can be fitted with belt scales and PLC control and recording systems.

The BP1200-914S can also operate with an IMS electric modular pugmill and radial stacker that offers four feed hoppers.

Andersen said innovation from both IMS and CSSH has resulted in a product range that’s interconnected and constantly reviewable.

“These machines also offer great serviceability, and the improved PLC control and recording system that can be monitored from an office and our service department increases both safety and ease of use,” he said.

“These are just some of the options developed and maintained in Australia, offering the ability to change the functions for whatever the industry throws at our customers.”

Exploration wins and production records in 2024 have set K92 up for a bumper 2025.

will continue its focus on exploration in 2025.

PAPUA NEW GUINEA (PNG)-based miner K92 went from strength to strength in 2024, and the company has no plans to start slowing down in 2025.

In the fourth quarter of 2024, K92 achieved a record quarterly production of 53,401 ounces (oz) of gold equivalent, comprising 51,371oz of gold, 958,312 pounds of copper, and 41,992oz of silver.

This marked a 37 per cent increase from the fourth quarter of 2023 and a 21 per cent rise from a previous record set in the third quarter of 2024.

K92’s metallurgical performance also reached new heights, with fourth-quarter gold recoveries averaging 96.4 per cent and 94.7 per cent for copper.

“The fourth quarter of 2024 marked a significant milestone for K92, with record production and recoveries,” K92 chief executive officer and managing director John Lewins said.

“This performance not only reflects the dedication of our team but also positions us strongly as we move forward with our expansion plans.”

And these expansion plans are well on their way.

The PNG major is currently commissioning its stage three expansion of its processing plant, scheduled to be completed late in the second quarter of the year. The expansion should double the plant’s throughout capacity from 600,000 tonnes per annum (tpa) to 1.2 million tpa.

Once stage three is complete, K92 will turn its attention to the stage four preliminary economic

assessment to further expand the throughput to 1.7 million tpa.

“The advancements in our stage three and stage four expansions are pivotal for K92’s growth strategy,” Lewins said. “Doubling our throughput capacity and enhancing production efficiency will significantly bolster our position in the global gold mining sector.”

Beyond its record production results and expansion plans, K92’s exploration endeavours have also yielded promising results.

The company’s maiden drill program at the Arakompa prospect, located approximately 405km from the Kainantu process plant, has led to the discovery of two significant high-grade veins: AR1 and AR2.

Both veins have been defined to depths in excess of 500m, with strike lengths of approximately 675m for AR1 and 775m for AR2.

“The discoveries at Arakompa are a testament to the untapped potential within our exploration portfolio,” K92 vice-president for exploration Chris Muller said. “The identification of high-grade veins and bulk tonnage zones presents exciting opportunities for resource growth.”

K92 is planning a large exploration program in 2025, projecting $17–20 million for the year.

Growth capital is forecast to hit $110 million.

“We enter 2025 in a position of strength, with 70 per cent of our stage three and four expansion growth capital spent or committed at 2024 year end, plus a notable strengthening of our cash position to a record high,” Lewins said.

“During this major production growth period, we plan to continue to invest heavily in exploration and significantly ramp up our exploration activities. We believe we control a significant and well-endowed mineral district that we are just scratching the surface of. We look forward to providing updates in due course.”

K92 has also extended the interpreted bulk tonnage zone at Arakompa by approximately 150m

to the south and is now defined over a 900m strike length and to a vertical depth of 650m.

With drill results recording an average true thickness of 48m, K92 is seeing strong bulk mining potential at Arakompa, as well as Kainantu.

“Importantly, both AR1 and AR2 are high-grade and have recorded considerable thickness and strong observed continuity, demonstrating high potential for underground mining,” Lewins said.

“With just over half of the 1.7km-strike-length mineralised corridor drill tested to date, alongside the significant potential at depth, we believe that we are only beginning to unlock Arakompa’s full potential.

The identification of high-grade veins presents exciting opportunities for resource growth.

K92 vice-president for exploration

Chris Muller

“Notably, a new compact heli-portable rig is scheduled to arrive at site in mid-2025, significantly enhancing our ability to efficiently target the northern extension of Arakompa, effectively opening up a new front for exploration.”

Looking ahead, K92 remains in a robust financial position and Lewins is excited about the year ahead and the exploration opportunities it will bring.

“There is tremendous enthusiasm internally among our various stakeholders including in Papua New Guinea for the year ahead as K92 transforms into a Tier 1 producer with the delivery of the stage three expansion,” Lewins said.

“In the second half of the second quarter, the stage three expansion process plant is scheduled to commence commissioning, marking the beginning of a step-change in our throughput and production capabilities.” PNG

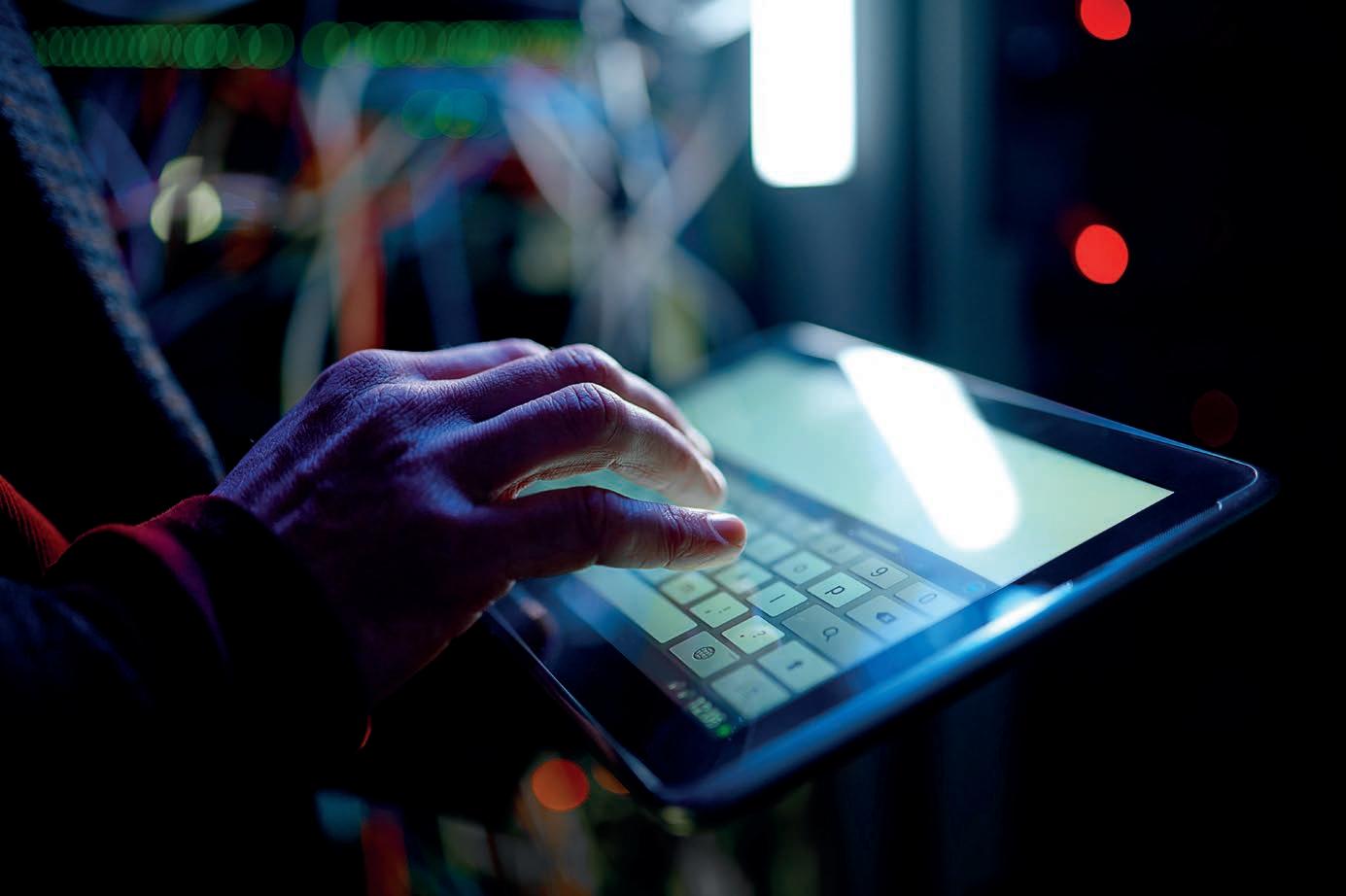

Digital mining is becoming a mainstay in the broader mining industry, as PNG looks to capitalise on new advancements.

AT THE END of the first quarter of the 21st century, technological advancements in the mining sector are more prominent than ever before.

But while mining jurisdictions like Australia and the US seem to implement new technology with ease, it can be a different road in less developed places like Papua New Guinea (PNG), where terrain is more rugged and infrastructure less built-up.

But that doesn’t mean taking advantage of the latest digital mining methods is impossible – it just means that mines must sometimes rely on partnerships to get the job done.

OTML and Accruent

Ok Tedi Mining Limited (OTML) is the owner of the longest-running open-pit copper-gold-silver operation in PNG: the Ok Tedi mine.

As the country’s only 100-per-cent PNG-owned mining company, OTML has gone from strength to strength in recent years, investing in more technology and infrastructure to produce over 250,000 ounces of gold in 2024.

However, operating the Ok Tedi mine in a rainforest 2000m above sea level can be a challenging venture, especially when it comes to connection and bandwidth.

Recognising this situation, OTML turned to Accruent for a drawing management solution that would perform reliably in the often-harsh conditions of Western Province. The team wanted legacy digital files from its drawing library and data assets from future projects and upgrades to be managed safely and securely.

“It became clear that we needed to get the foundations of our engineering business processes right,” OTML engineering manager Brendan Gowdie said.

“That meant getting our drawing management right and regaining control of the documentation.”

OTML chose Accruent’s cloud-based solution RedEye to solve its problem.

RedEye allows teams to manage documents online, eliminating disorganised engineering information that can slow projects, increase risks and cause compliance issues.

Using RedEye, the OTML team is able to access documents from any device while automating key processes like document review and approval to speed up tasks and minimise errors.

It’s also ideally suited to mines in remote areas, like Ok Tedi.

“Ok Tedi’s crews were able to operate and work without interruption by using the low-bandwidth and offline features of RedEye,” Accruent said.

“These features allow an operator to download relevant drawings from RedEye to a mobile device

when they are connected to the internet. They can then move to a low or zero-bandwidth area and mark up changes on the digital image.”

Once an operator is re-connected to the internet, RedEye will automatically synchronise the updated drawing into the wider system.

“The cloud-based platform performs as well in the remote mountains of PNG as it does from our Brisbane office,” Gowdie said.

The benefits were far-reaching. RedEye was able to remove document duplicates to reduce the number of files by 82 per cent – from 900,000 to 165,000.

OTML was also able to increase the speed of data management activities from 50 to 800 artifacts a week.

“It’s been important for us that Accruent realised this was a journey of improvement,” former OTML senior draftsman Mark Kelly said. “After initial processing and upload, we have continued to reduce our file count by folding in and ordering revisions. When we look back and see how far we’ve come, the benefits of RedEye are clear.”

Before Newmont took over the Lihir gold mine on Niolam Island, former owner Newcrest Mining had turned to Rockwell Automation to help the mine meet the demand for quality products and yield. Optimising the flotation process at Lihir was

new technology.

of particular concern to stakeholders, since poor flotation can result in reduced recovery efficiency, low-grade product, high input disturbances, and increased use and cost of reagents.

Technology has allowed companies to mine more productively.

co-design this MPC solution, building core capability to support our future expanded MPC program.”

Stakeholders turned to Kalypso, a subsidiary of Rockwell Automation, to solve the problem.

Working with the Newcrest team, Kalypso developed a solution for multi-variable optimisation of the flotation circuit, targeting a measurable increase in recovery as an indicator of success.

“The flotation circuit solution development began with monitoring and controlling process parameters to reduce variability and achieve optimisation targets,” Rockwell Automation said.

“The application provides real-time visibility into process management and controls multiple process parameters simultaneously. Control actions are updated continuously based on actual process observations and virtual online analysers, while adhering to plant process constraints to meet recovery and grade requirements.”

The new MPC flotation circuit was designed, implemented and validated over a period of 12 months before it was transitioned to Lihir for ongoing operation.

Former Newcrest process plant operations manager Robert Gordon said the MPC delivered well above the challenge of increasing gold recovery.

“The implementation of MPC on the Lihir flotation circuit has delivered significant performance improvement and downstream flowsheet stability,” Gordon said.

“The Lihir operations, process control and metallurgical teams have worked collaboratively to

Lihir senior process engineering specialist Gareth Peachey said it was rewarding to see the technology go above and beyond.

“It was a new technology for Lihir designed to improve on existing regulatory controls and was implemented during COVID-19 restrictions with limited access to resources,” he said.

“Our close collaboration with the Kalypso team enabled us to navigate through these challenges to deliver a successful project that exceeded the challenging performance goals we set.”

The flotation circuit solution provides real-time visibility into process management. Control actions are updated continuously based on actual process observations and virtual online analysers, while adhering to plant process constraints to meet recovery and grade requirements.

Rockwell Automation

When Newmont took over Lihir’s operations following the acquisition in November 2023, the team was able to hit the ground running thanks to the forward-thinking of the Newcrest and Rockwell Automation teams.

Digital mining advancements continue to transform PNG’s mining sector, offering safer and more productive ways to mine.

The benefits are clear: miners are seeing a reduction in operating costs, a boost in production and an improvement in process and decision making.

As the industry continues its march into the future, PNG is well-placed to capitalise off the successful implementation of digital mining tools in the wider world, partnering with key players to mine better than ever before. PNG

ALLSHELTER DOMES | SPLIT SET MINE MESH | ROCK DRILLING CONSUMABLES

The Wafi-Golpu mine is on the cusp of greatness.

ALTHOUGH THE WAFI-GOLPU copper-gold mine is one of the world’s biggest, the sprawling encampment is hard to spot from the ground.

Nestled in the green hills of Morobe Province in Papua New Guinea (PNG), Wafi-Golpu has been on the radar of international miners since exploration began in the area in 1979.

Sampling of float in the Wafi River in 1977 marked the beginning of Wafi-Golpu’s story.

The sampling was undertaken by geologists from a SW Pacific island reconnaissance exploration program called CRAE Star – and what these geologists found was significant, returning samples of 22 grams per tonne (g/t) of gold and 89g/t of silver.

The geologists followed up their find by sampling surface rock-chip and soil before digging 8500m underground to identify multiple centres of gold mineralisation.

But drilling at Wafi didn’t return the results the geologists had hoped for after seeing what could be found on the surface. As a result, the project was farmed out to Elders Mining PNG – who had better luck. The company drilled to find a gold-rich core of high sulphidation.

Further drilling in 1991 revealed copper-goldstyle mineralisation in a new area that was named

The Markham River may become home to Wafi-Golpu’s infrastructure corridor.

Rafferty’s, after the captain of a WWII bomber that crashed nearby. With new findings indicating the beginnings of an extensive mine beneath the surface, CRAE was keen to reengage in the project.

Elders PNG had been acquired in the early 1990s by Carter Holt Harvey, which decided to sell its 40 per cent stake in Wafi back to CRAE. CRAE drilled the area between 1991 and 1997, defining a resource of 100 million tonnes at 1.3 per cent copper and 0.6g/t gold.

Nestled in the green hills of Morobe Province in Papua New Guinea, Wafi-Golpu has been on the radar of international miners since exploration began in the area in 1979.

Wafi remained under care and maintenance from 1997 until 2001 before it was acquired by Aurora Gold in 2002.

But the changes didn’t stop there. Aurora would later merge with Abelle, which would be acquired by Harmony Gold in 2004, marking the beginning of the Wafi-Golpu project we know today.

Wafi-Golpu joint venture

Even the largest miners need partnerships in order to get the best out of their assets.

That’s why Harmony joined forces with Newcrest Mining in 2008 to explore for and evaluate mineral deposits in Morobe Province, creating the WafiGolpu joint venture (WGJV). Newcrest was acquired by Newmont in 2023, and Newmont has since taken on Newcrest’s 50 per cent stake in the WGJV.

The WGJV brings together the combined experience and technical resources of Harmony and Newmont. Harmony has an extensive underground portfolio in South Africa, while Newmont’s experience in Australia and the Americas puts the company in prime position to expand its reach across the Pacific. The WGJV applied for a special mining lease and related tenements to the Mineral

Resources Authority PNG (MRA) in 2016 to begin the process of permitting the project. It took another four years for the Conservation and Environment Protection Agency to conclude its assessment of the project’s environment permit application, which the WGJV received in December 2020. Between 2016 and 2020, the WGJV was ramping up the process of additional

approvals throughout the project. It submitted the feasibility study update and environmental impact study in 2018, and later that same year the State of PNG signed a memorandum of understanding to further progress the permitting process.

forms part of the primary ventilation circuit and materials handling unit.

When mining begins, there will be three zones of proposed activity: the mine area, the infrastructure corridor, and the coastal area.

The WGJV is proposing to place the infrastructure

Prime Minister James Marape – are calling for mining to begin,.

“Time is ticking away,” Marape said in October 2024.

“As a nation, we have collectively agreed that the Wafi-Golpu project must move forward on terms that are in line with our laws and policies, especially those that ensure the state and Papua New Guinea secure 55 per cent of the project’s economic benefits.

“I want to make it absolutely clear: we cannot afford to lose any more time. The Wafi-Golpu project must advance without further delay.”

Current estimations have Wafi-Golpu holding approximately 12 million ounces of gold and three million ounces of copper.

“This is a project of national importance, and moving forward on key milestones is critical to the country’s economic progress,” Marape said.

Newmont chief executive Tom Palmer is similarly keen to see Wafi-Golpu get off the ground.

“Wafi-Golpu is a fantastic resource,” Palmer told Business Advantage PNG

“It’s a block-cave copper mine that will be developed.

“PNG is a country with a lot of natural resources. It’s a country that’s strategically important to Australia and the United States. As a US foreign direct investor in PNG, with Australian connections, we’re almost the perfect combination.”

As Wafi-Golpu continues to ramp up, the eyes of PNG will be on it and the WGJV to see what happens next. PNG

Investment in local talent, high safety standards, innovative training methods and the strength of a global network underpin the services of P&O Maritime Logistics.

P&O MARITIME LOGISTICS (P&OML) offers port marine services and cargo transportations across the world through its fleet of over 400 dedicated vessels.

In addition to its operations in Papua New Guinea (PNG), it has a strong presence across the Middle East, Europe, Africa and the Americas, which allows it to draw on knowledge of maritime operations from all manner of operating environments and clients.

“P&OML has the strength of operating in a global and local PNG context,” P&OML general manager Captain Isabelle Kuli told PNG Mining

“We routinely work in challenging areas which gives us an in-depth understanding of the unique PNG operating environment and how we can best support our clients, which in turn provides strength to the PNG economy.”

The P&OML ship masters and seafarers that operate in PNG are well versed with the skills required to undertake the task.

Thanks to the company’s more than 30 years of experience in PNG and the operation of 11 purposebuilt ships designed to prioritise safety and optimise cargo carrying capacity, P&OML is able to support its clients’ export and supply chain needs.

A key aspect of P&OML’s PNG operation is navigating 460 nautical miles (852km) of the Fly River. With a lack of reliable depth data combined with a quickly changing riverbed, the task brings with it many challenges. To improve reliability under these conditions, P&OML has recently introduced a

270-degrees full bridge mission simulator to train and prepare its crews for their important role on the P&OML ships. It is also applying modern equipment and data to better understand the characteristics of the Fly River so that the environment, the people and cargoes are kept safe.

With an eye to a long-term future in PNG, P&OML is also increasing its cadet onboarding through its training program, as well as increasing the career opportunities it can offer its seafarers so they can best support the future needs of PNG. P&OML is ready to support PNG industries as they grow.

A

Captain Kuli said P&OML’s parent company, DP World, has given its employees a strong foundation from which to strive for success.

DP World is a supply-chain-solutions company with more than 100,000 employees worldwide.

“‘Collaborate to win’ is one of those principles we take very seriously here at P&OML,” Captain

“When our clients succeed, the economies we operate in also win; that’s why it’s so important for us to centre their needs and offer them the best service possible.”

P&OML has embedded this philosophy in every level of the company, leading to its continued investment in its workers to help them achieve their full potential.

Captain Kuli herself has seen the benefit this outlook can bring, starting out as a ship master before coming ashore to experience new opportunities with the company.

for us and the maritime industry,” she said. “We’ve seen a major training gap over the years and we’re determined to fill it with the latest advancements in quality maritime training.” PNG

Mayur Resources’ two flagship projects in PNG are progressing on schedule.

MAYUR RESOURCES is a company dedicated to the development of natural resources and renewables in Papua New Guinea (PNG).

The company has recently made significant progress in two of its flagship projects: the Central lime project (CLP) and the Orokolo Bay industrial sands project (OBP).

These ventures underscore Mayur’s commitment to not only PNG, but the country’s growth and community engagement.

Advancements at the CLP

Situated approximately 25km north of Port Moresby, the CLP is poised to become a cornerstone of

PNG’s industrial and mining landscape. The project has been designed to produce 0.45 million tonnes per annum (Mtpa) of quick and hydrated lime, and 0.6Mtpa of raw limestone aggregate.

The granting of special economic zone (SEZ) status in 2021 was a pivotal moment for Mayur and the CLP, reflecting robust support from local authorities and providing a suite of concessions, including tax relief and duty exemptions.

October 2024 saw Mayur secure a $US50 million ($79.7 million) investment agreement with natural

resource focused partnership ACAM LP. The funds were allocated between Mayur and its wholly owned subsidiary MR Central Lime PNG.

The company also locked in a $US115 million ($183.3 million) exclusive debt term sheet with a private mining and metals fund to ensure comprehensive funding for the CLP’s development.

Mayur Resources managing director Paul Mulder said the CLP is a significant project for PNG, supported by its strong financial backing.

“The CLP is set to revolutionise PNG’s industrials sector by providing essential materials locally, reducing reliance on imports and fostering economic growth,” he said.

Construction activities at the CLP have now commenced, with early revenue expected in the first half of this year. The combination of the CLP’s coastal location, the nearby quarry, plant site and wharf is expected to facilitate low operating costs and direct access to local and international markets.

Like the CLP, the OBP represents a significant venture within Mayur’s growing PNG portfolio. Located in Gulf Province along the southern coast of PNG, the

OBP is fully permitted and ready for construction, with initial production targeted for late 2025.

Mayur announced it had secured developing funding for the OBP through Pacific Unison Holdings (PacUn) in February this year. Under the agreement, PacUn will fund the construction and commissioning of the magnetite phase of the project, aiming for initial nameplate capacity of 500,000tpa.

“Bringing the Orokolo Bay project into production alongside our flagship Central lime project will generate attractive cashflows and, importantly, compliments Mayur’s commitment to developing the building blocks within PNG,” Mulder said.

“Domestically produced and affordable downstream iron and cement are the key pillars that will build PNG and also displace imports and set up an export industry.”

Mayur’s agreement with PacUn includes an upfront commitment of $US500,000 ($796,940) and establishes a profit-sharing system that will see both companies recover their initial investments before the profits are shared equally.

PacUn isn’t the only supporter of the OBP, with Governor of Gulf Province Chris Haieveta also confirming his commitment to seeing the project thrive.

Mayur’s CLP will become a cornerstone of PNG’s mining operations.

“As Governor of Gulf Province, I am proud to reaffirm my full support for the Orokolo Bay project, a Gulf Province building initiative I have championed since taking office,” he said in February.

“It is a transformative project that will drive economic growth, create over 130 direct and 450 indirect jobs, and create province building capacity using local skills and resources.

“This marks a pivotal step for PNG having its own domestic iron ore resources for export, but to also consider development of PNG’s own small-scale iron and steel industry, being a critical ingredient to build our nation, alongside cement.”

Focused on community and sustainability

Mayur also places a strong emphasis on community engagement and sustainable development.

The company has been proactive in finalising its Community Development Agreements (CDAs) for both the CLP and the OBP to ensure local people remain integral stakeholders in the development process.

Initiatives such as CDAs are designed to deliver tangible benefits to landowners in PNG, including employment opportunities, infrastructure development and capacity-building programs.

Final meetings to progress the CDA for the CLP concluded in February, with all stakeholders agreeing to the final terms.

“We are thankful to all stakeholders present at the consultative forum representing various levels of the PNG Government, landowners, and other key stakeholders,” Mulder said.

“This is a pivotal moment for Papua New Guinea – being the first new greenfield mine to commence construction in PNG in 18 years, and a cornerstone for the first downstream manufacturing production facility of quicklime and cement.”

The CDA set out the distribution of royalties to be paid by Mayur, as well as the various community development activities the company will complete and the undertakings of the PNG Government and landowners to ensure development and operation.

Mayur is committed to delivering local employment opportunities, ongoing support for community initiatives, and the development of key community infrastructure like new road access from the Kido village to Port Moresby.

“We are well placed on the path to achieving final investment decision with a view towards full scale development [beyond wharf construction, which is already underway] commencing within months,” Mulder said.

“Seeing this project into full-scale development reflects a culmination of over 10 years of work by Mayur.

It is a pivotal moment for Mayur’s shareholders as well as the local landowner communities and the nation of Papua New Guinea.”

Mayur also employs innovative techniques to minimise its ecological footprint, ensuring the preservation of PNG’s biodiversity.

“Our success is directly connected to bringing better sustainability outcomes to PNG and the

broader Asia Pacific region by reducing the building industry’s carbon footprint,” Mayur Resources head of business affairs Darren Lockyer said.

Mayur’s strategic vision encompasses not only the development of the CLP and the OBP but also the exploration of future opportunities.

The company’s approach includes developing mineral projects that deliver high-quality, low-cost and net-zero inputs for the mining and construction industries, as well as constructing and operating a renewable energy portfolio comprising solar, wind, geothermal, carbon mitigation and battery storage.

The successful progression of the CLP and OBP signifies Mayur’s dedication to contributing to PNG’s economic growth while adhering to principles of environmental stewardship and social responsibility.

As the two flagship projects advance towards production, each is expected to play a pivotal role in transforming PNG’s industrial landscape and enhancing its position in the domestic and international markets. PNG

Mayur has some future plans already locked in.

Harmony Gold, Newmont and Mayur Resources are riding strong results into the second half of the 2024–25 financial year.

WITH THE FIRST HALF of the 2024–25 financial year (H1 FY25) now in the books, some of the most prominent miners across Papua New Guinea (PNG) are reaping the benefits of a strong local sector.

Harmony Gold chief executive Beyers Nel hailed the company’s results for H1 FY25 as “excellent”. And with a 19 per cent increase in group gold revenue to $3.12 million, up from the $2.5 million recorded in H1 FY24, it’s easy to see why.

A 33 per cent increase in net profit to $702 million was driven by a strong, flexible balance sheet and a record interim dividend payout of $123.2 million.

“The excellent H1 FY25 results are on the back of our unwavering commitment to improving our safety performance and delivering consistent, predictable production,” Nel said.

“While we have historically been a gold producer, we are on the cusp of introducing near-term copper, which will further de-risk and diversify our production profile.”

Harmony reported a two per cent increase in underground recovered grades, as well as a jump in average gold prices – up $6695 per ounce (oz) compared to $3002/oz in H1 FY24.

Harmony Gold is on the cusp of introducing copper into its portfolio.

“Harmony continues to generate stellar cash flows, and our balance sheet is robust, flexible and in a significant net cash position,” Nel said. “The gold price has continued to rally since the beginning of the 2025 calendar year, enhancing our strong financial position.

“We remain disciplined and responsible with our capital allocation, and we will not deviate from our risk-based approach to decision-making.

“Having a balanced approach to capital allocation will enable us to deliver on our growth aspirations and ensure we continue to create real long-term value for our shareholders and our stakeholders.”

Harmony’s production, grade, cost and capital guidance for FY25 remains unchanged.

Chief executive officer Tom Palmer said the company’s 2024 gold reserves have helped solidify Newmont’s position as a leading gold producer into FY25.

The major miner reported gold reserves of 134.1 million attributable ounces for H1 FY25, a slight decrease from the 135.9 million ounces recorded at the tail end of FY23. Newmont’s go-forward Tier 1 portfolio includes 125.5 million gold ounces, more

A reduction in losses and surge in revenue were the hallmarks of a successful H1 FY25 for PNG-based Mayur Resources.

The company, which owns the Central lime project (CLP) 25km north of Port Moresby, recorded revenue of $1.28 million, up from the $29,349 reported in the prior corresponding period. Mayur attributed the increase to the advancement of the CLP and generating operational income.

Basic loss per share from continuing operations sat at $0.009, an improvement on the $0.0225 in the previous year.

In regard to cash flow, Mayur reported net operating cash outflows of $4.72 million, compared to the $4.21 million recorded in H1 FY24. Net investing cash outflows were $9 million, up from $4 million to reflect increased investment in project development.

Significant developments during the half-year included having $79 million in financing conditionally committed by investors for the CLP, with $15.8 million already received via convertible notes.

A further $63.2 million is planned as equity funding subject to condition satisfaction.

“The $15.8 million in convertible notes, maturing in October 2026, provides funds for continuation of early construction works at the CLP, debt repayment and working capital,” Mayur said.

“[Our] $63.2 million conditional equity funding will fund 100 per cent of the equity requirements for the CLP through its development stages and along with debt funding is forecast to bring the project to commercial production within 18 months of the final investment decision.”

Mayur will continue its focus on the development of the CLP, remaining

than 13.5 million tonnes of copper reserves and 540 million ounces of silver reserves.

“Newmont has solidified its position as the gold industry’s leader with the highest concentration of Tier 1 assets, reserves and resources,” Palmer said.

“Supported by our industry-leading exploration program, we continue to focus on extending mine life, developing districts and discovering new opportunities in the most favourable mining jurisdictions.”

Newmont has doubled its reserve base since 2018, diversifying itself across the world’s mining jurisdictions, including at Lihir in PNG.

Lihir, along with a handful of other Newmontowned assets, has a gold reserve life of at least 10 years.

The major has also expanded its copper reach in the past year, with 14.1 million attributable tonnes in measured and indicated resources and 11 million attributional tonnes in inferred resources.

“Newmont’s extensive gold and copper reserve base represents the foundation for stable production and meaningful value creation for the next several decades,” Palmer said. PNG

Company founder, the late Sir Brian Ernest Bell CSM, KBE, CStJ.

A

figurehead of PNG business, the Brian Bell Group is only expected to grow as the year goes on.

THE BRIAN BELL STORY is one of tenaciousness, legacy and success.

Today, the Brian Bell Group comprises 17 retail stores, six trade centres, a luxury residential development and over 1300 team members scattered across Papua New Guinea (PNG) – but this wasn’t always the case.

Australian-born Sir Brian Bell CSM, KBE, CStJ opened his first retail store in Port Moresby’s thriving commercial centre in 1958. Having recently moved to PNG, Bell fell in love with the way of life, eventually becoming Port Moresby’s Deputy Lord Mayor.

With Bell’s promise that his stores would “service whatever we sell”, Brian Bell Group has become

much more than just a store since it opened its doors.

“The Brian Bell Group is a 67-year-old, 100-percent PNG-owned business that operates in seven of PNG’s largest regional centres,” Brian Bell chairman Ian Clough told PNG Mining. “We operate retail businesses, wholesale businesses, support the agriculture sector, and we are working in the health sector through our Meddent business. We also have an extensive property portfolio across the country that includes residential and commercial facilities as well as a large land bank for future growth.”

Brian Bell secured the full acquisition of the Meddent business in January 2024. Over a year on, the medical and diagnostic equipment supplier is thriving under the group’s leadership.

“Our goal is to be the supplier of choice for PNG’s medical and scientific supplies in 2025 and beyond,” Meddent general manager Todd McKenzie told PNG Mining.

“Our strengths are in our professional service and after-sales support, our readily available stock and our fast delivery for items not in stock.”

The Meddent arm of the business is now part of the 45,000 active products Brian Bell maintains at any given time.

According to Clough, it’s all part of the group’s aim to do more for the people of PNG.

“We employ 1300 team members, the majority of which are Papua New Guinean, and through our business and through the Sir Brian Bell Foundation, we are committed to doing more for our customers, our team members and our communities,” he said.

The Sir Brian Bell Foundation was established to honour Bell’s love for PNG and his drive to give back to the country and its people. One of the main aims of the foundation is to improve the quality of life in PNG, becoming a catalyst for change for future generations. The foundation has provided over K42 million ($16.15 million) to communities across PNG since 2016.

Long-term partnerships have become part of the Brian Bell Group’s DNA. The company has fostered relationships with some of the country’s biggest miners in the last decades.

“Some of these partnerships date back some 40 years and operate across our commercial service division, our chemicals teams, our trade electrical division and now with our recent acquisition, our Meddent business,” Clough said.

“We have presence across the country with many of our divisions and we support our larger clients with resources from our central team in Port Moresby. We also opened a new Trade Electrical, Chemicals and Agriculture site in Goroka late last year to support this key region.”

Siva Raman, general manager of Brian Bell Chemicals, said the company takes pride in its ability to manufacture chemicals and keep up with the nation’s demand.

“No matter the size and scope of the project, Brian Bell Chemicals can offer a solution,” Raman told PNG Mining.

“We understand the PNG market and its growing needs which enables us to evolve with new solutions. The business has doubled in size in the last decade without flattening out, a great indicator that 2025

Meddent general manager Todd McKenzie.

Brian Bell’s medical and chemicals businesses are joined by Brian Bell Homecentres, Trade Electrical, and Agriculture, Industrial and Property – all companies that have experienced rapid growth.

Brian Bell Homecentres, for example, boasts the title of the largest home furnishings retail and wholesale business in PNG, continuing to innovate, develop and source new international brands and products every year.

The group’s service to the mining industry is no different.

“We have an extensive supply chain network which allows us to move product effectively and efficiently throughout the country,” Clough said.

“We also have a team of specialists that support our mining customers with end-to-end management of their requirements. From sourcing discussions that help to crystallise their requirements to managing the logistics from source to delivery, our team can help make any project seamless for our customers.

“Most importantly, our customers have peace of mind when they work with us as we have a team of trained technicians in place to ensure customers are supported with preventive maintenance programs and warranty and repair works.”

Brian Bell’s corporate sales arm can also lend a hand in mining matters.

“Our commercial services division was established to specifically support the growing product and service needs of corporate account customers

throughout PNG,” corporate services general manager Matthew Forssman told PNG Mining.

“Our corporate services offer a wide range of procurement services catering to the needs of growing small-to-medium enterprises, right through to the largest corporate projects throughout the country.

“This includes many of the largest mining and construction project builds throughout Papua New Guinea.”

Janoah Smith, general manager of Brian Bell’s agricultural and industrial division, told PNG Mining that almost all arms of the business have strong relationships with PNG’s miners, both major and artisanal.

“We have strong partnerships with mining companies supporting their community services projects supplying seeds, fertilizers, nursery equipment, tramontina spades and bush knives for their sustainability programs within the mine impact communities,” Smith said.

“We are also a supplier of choice for artesian and small scale miners for mining equipment such as gold dredges, water pumps, panning equipment and portable gensets.”

It’s been a busy couple of years at Brian Bell, and this trajectory shows no signs of slowing.

New warehouse sites are set to launch in mid2025, along with increased investments to expand the company’s supply chain capacity.

Brian Bell corporate services general manager Matthew Forssman.

Brian Bell is particularly optimistic about the reopening of the Porgera gold mine in Enga Province, seeing it as a great opportunity to continue providing value to its mining customers.

“We can help stage projects for our customers, reducing their handling and storage costs and assisting them with any space challenges,”

Clough said.

“As many long-awaited projects come online, we look forward to these sites providing successful outcomes for investors but more importantly, providing opportunities and development for Papua New Guinea while helping its people realise the country’s potential.” PNG

Providing counselling services is one way mines can ensure their employees are staying mentally healthy.

Employers have a duty to ensure their workforces are kept safe from physical and psychological harm.

KEEPING A MINE site safe involves more than just personal protective equipment (PPE) and compliance reporting.

While all safety aspects are essential, modern mining organisations must ensure they implement measures to reduce psychosocial hazards in order to keep all parts of their workforce safe.

Psychosocial hazards are psychological and social conditions that could cause mental harm. Common examples on a mine can include job demands, traumatic events, bullying and harassment, and remote or isolated work.

Work-related stress can result in negative effects ranging from physical symptoms like headaches and

problems sleeping to emotional symptoms such as irritability and mood swings.

Work-related stress can also affect an employee’s behaviour. They could experience diminished performance, impulsive behaviour or withdrawal from work. In an industry like mining, where each step must be considered and undertaken with care, behavioural problems can lead directly to potential health and safety risks.

It can be overwhelming for mining companies to try and reduce psychosocial hazards in one fell swoop. Instead, wellbeing solutions company Healthy Business suggests taking a measured approach to reducing harm.

The company worked with a large Papua New Guinea (PNG) gold miner from 2016–22 to implement solutions to improve the health and wellbeing of employees and the wider community.

“The mining industry faces many occupational challenges when it comes to health and wellbeing,” Healthy Business said.

“Remote working environments, shift work and fly-in, fly-out [FIFO] work are all typical demands of the industry which have been identified as contributors for obesity, a key risk factor for many lifestyle-related diseases.”

The often hot and humid weather in PNG’s remote mine sites can also contribute to risk factors for illness and injury.

“To address their organisational needs, [a PNG] client partnered with Healthy Business to design and deliver a health and wellbeing program

that would engage their people and support positive health and wellbeing outcomes,” Healthy Business said.

The program featured a multifaceted approach that included:

• the development of a multidisciplinary PNG national team to ensure cultural sensitivity

• integration into existing processes, policies and procedures

• personalised one-on-one coaching

• promotion of a confidential counselling service

• physiotherapy treatment to reduce the burden of musculoskeletal injuries.

More than 11,600 employees participated in the program across 2016–22, with clear positive results.

From initial health assessment data, Healthy Business found that the program had reduced very

FIFO work can be considered a potential psychosocial hazard.

high-risk blood pressure readings by 66 per cent, high-risk cholesterol levels by 62 per cent, and high-risk blood glucose levels by 50 per cent.

“By working with these employees and providing the appropriate early intervention, we have been able to reduce their risk of developing more serious and potentially life-threatening conditions such as Tye 2 diabetes, heart attack or stroke,” Healthy Business said.

“There is a flow-on effect of less absenteeism from injury and ill health. On top of this, productivity levels increase, with staff feeling more engaged, motivated and cared for by their employer.”

Healthy Business also assisted in providing the employees and wider community access to a fully equipped gym, group exercise classes and a range of recreational activities.

Feedback from those involved at the mine was overwhelmingly positive.

“Having the Healthy Business team provide our ongoing health checks has not only given our employees education and knowledge on certain aspects of their health and wellbeing and how

to maintain or improve it, but also identified an employee who had health issues,” the Healthy Business feedback stated.

“The Healthy Business team has continued to work with this employee, helping them reduce their BMI [body mass index] and put them in a position where they no longer need continual medical monitoring and are fit to work without restrictions.

“I believe the program is a massive asset in the way we help our employees make healthy decisions.”

Psychosocial safety is a critical issue in the industry today and we should allow for the opportunity of integrating a broader and holistic risk management framework encompassing psychosocial risks.

OTML safety manager Anna Ila

Another major miner in PNG, Ok Tedi Mining Limited (OTML), has been working to bring the importance of psychosocial safety front of mind.

The gold miner recently held a safety forum at which its key theme of psychosocial safety provided a timely reminder that psychosocial safety remains a critical issue in the modern mining industry.

“Thoughtful and meaningful conversations need to occur around our current approaches on how we manage risk in our present day dynamic working environment,” OTML manager – safety Anna Ila said.