ABN: 36 426 734 954

C/- The Commons, 36–38 Gipps St, Collingwood VIC 3066

P: (03) 9988 4950 monkeymedia.com.au

info@monkeymedia.com.au miningmagazine.com.au info@miningmagazine.com.au

Editor

Assistant

ABN: 36 426 734 954

C/- The Commons, 36–38 Gipps St, Collingwood VIC 3066

P: (03) 9988 4950 monkeymedia.com.au

info@monkeymedia.com.au miningmagazine.com.au info@miningmagazine.com.au

Editor

Assistant

With 2023 and the holiday festivities well and truly behind us, we’re starting this year off with a bang.

Crammed full of the latest industry news, insights and thought leadership – I’d like to warmly welcome you back to Australia’s resources sector with the first edition of Mining Magazine for 2024.

The industry is off to a rockier start than anticipated, with an influx of lower cost nickel supply from other countries causing global market disruption and resulting in six operating nickel facilities either reducing operations or going into care and maintenance.

Design

Jacqueline

National

Rima

Brett

Radhika

Marketing

Isabella

Digital

Publisher

Managing

ISSN: 2653-634X

Despite this, the adaptability and resilience of the industry has shone through, with nickel earning a spot on the Critical Minerals List and nickel companies being given the opportunity to unlock billions of dollars in Commonwealth funding.

2024 is forecast to be a significant year for the industry and in this edition of Mining, Deloitte offers insight into the key trends it expects will shape and impact the industry over the next 12 to 18 months.

We spoke to former Western Australian Mines and Petroleum Minister, Bill Johnston, about how the industry has changed throughout his decades-long career and the challenges lying on the horizon for the state's mining and resources industry.

Incorporating innovative technologies into mining operations continues to pique the interest of the industry, and this edition includes input from Sydney University’s Australian Centre for Robotics about the significant opportunities for automation and AI in mining.

Mine rehabilitation is still a prevalent topic of conversation for the industry’s key players and with a new CSIRO report estimating the closure of almost 240 Australian mines by 2040, we investigate solutions to help the industry to overcome the challenges associated with mine closure.

With additional features on mining in outer space and how virtual reality can significantly enhance worker training, safety, and operational efficiency in the mining industry, Mining Autumn is bursting with the latest topics that are rocking the mining industry.

As always, if there’s a topic, project, technology or challenge you’d like to read in future editions, please feel free to flick me an email – I’d love to hear from you.

Rebecca Todesco EditorDrop Rebecca a line at rebecca.todesco@monkeymedia.net.au

Following his November 2023 announcement to retire from Cabinet, Mining Magazine sat down with former Western Australian Mines and Petroleum Minister, Bill Johnston, to reflect on his time in the role and what’s in store for the resources sector.

Entering 2024, the mining and metals industry finds itself at the centre of a complex matrix of challenges and opportunities, expectations and demands.

It is hard to believe that less than 20 years ago there was very little automation on even the world's largest, most complex mines. The resources sector of today is a pioneer in the development and adoption of robotics, automation and artificial intelligence systems, and while much has been achieved there is still much more to be done.

Various Virtual Reality (VR) and Augmented Reality (AR) technologies have the potential to significantly enhance worker training, safety, and operational efficiency in the mining industry.

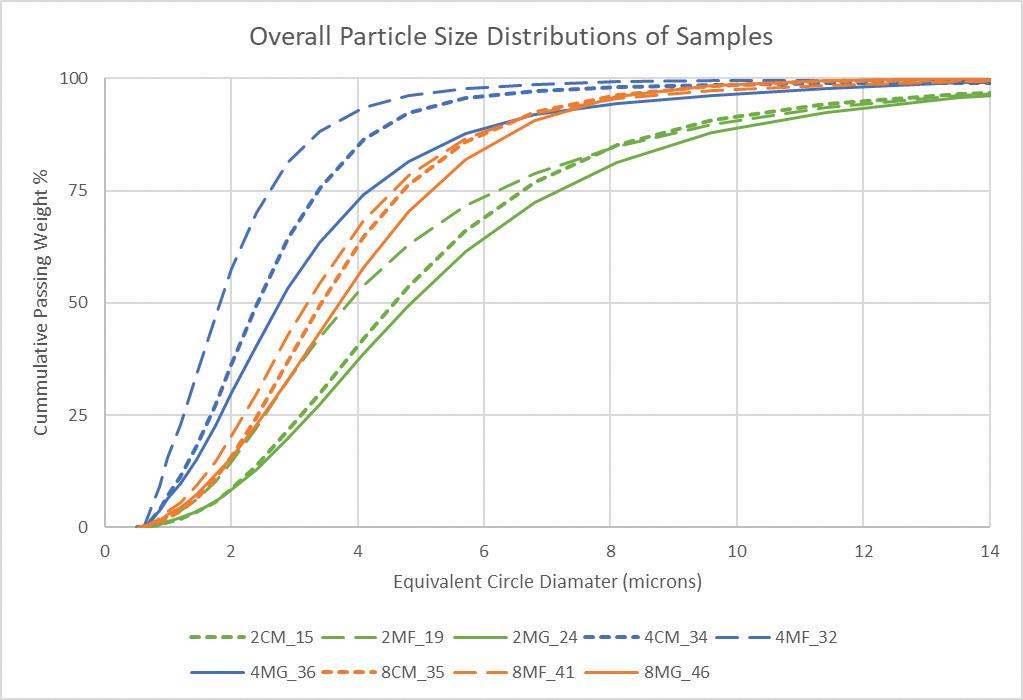

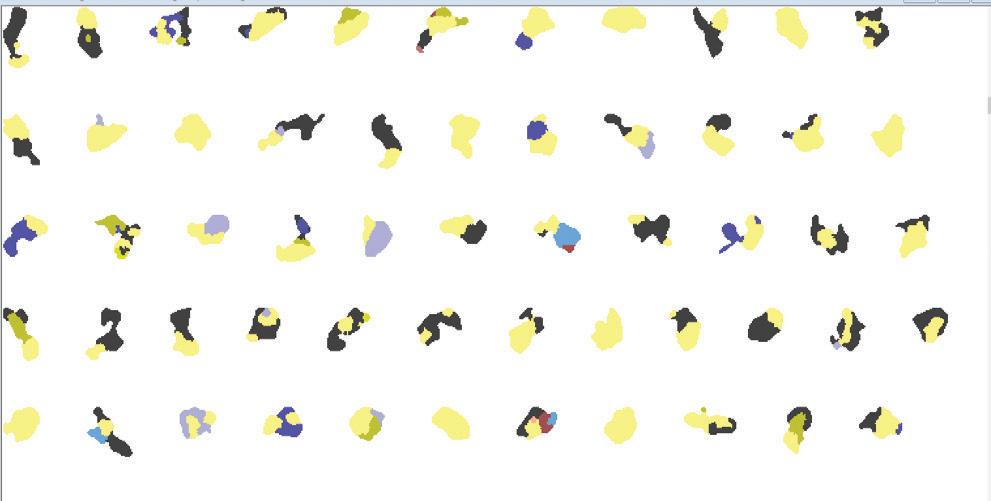

The last decade has seen an increased focus on the escalating prevalence of mine dust lung disease in both mining and the engineered stone industries. A new dust testing methodology has been developed by the Minerals Industry Safety and Health Centre (MISHC) at The University of Queensland (UQ) to provide insight into dust exposure to better protect workers from mine dust lung diseases such as black lung and silicosis.

Choosing the right pump for applications in the mining industry is essential to ensuring efficient and reliable operations, cost effectiveness and safety for the workers and environment. Knowing which type – either diesel-driven or electric-driven – is suitable for a particular application is critically important.

Aboriginal business owner Derek Flucker highlights how Traditional Owners, First Nations companies and the resource sector working together will protect Indigenous culture. This will secure a meaningful future for First Nations people and prevent the destruction of the world’s oldest living culture, so events like the eradication of Juukan Gorge are never repeated.

The night sky has long captured the fascination and imagination of countless generations but it seems that for ensuing generations it may also hold the future of the mining industry.

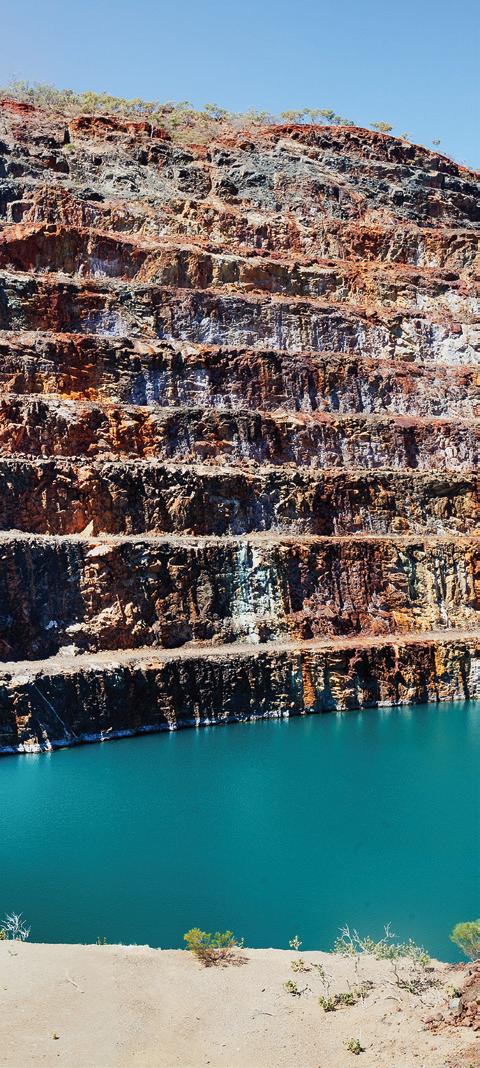

With tens of thousands of Australian mines awaiting rehabilitation and a new report estimating the closure of almost 240 Australian mines by 2040, it is more important than ever to explore innovative solutions for the mining industry to overcome closure challenges as it simultaneously leads the way in the path to net zero.

The waste generated from mining operations is one of the largest waste streams in the world, and there can be catastrophic consequences if it’s not handled properly. Knowing this, a team at Flinders University is sifting through tonnes of mining waste to address this problem head-on.

The first copper concentrate has been produced at a copper mine in Adelaide’s southeast, marking a significant milestone for the project following its successful commissioning.

The commissioning and production of copper at Hillgrove Resources’ Kanmantoo plant was achieved within the targeted time frame of Q1 2024.

Hillgrove is now positioned as one of the few pure play copper producers on the ASX, with first revenues from sales of the copper concentrate received in February.

Hillgrove said there is significant opportunity to grow the resource and therefore mine life, as evidenced by:

♦ The substantial JORC Exploration Target at the Project of 60 – 100Mt at 0.9 per cent to 1.2 per cent copper (Cu) and 0.1g/t to 0.2 g/t gold (Au)

♦ Recent drilling results, including:

» 36.6m at 3.35 per cent Cu from 43m downhole in East Kavanagh

» 45.4m at 1.19 per cent Cu and 0.12g/t Au from Spitfire from 428.5m downhole

» 40m at 1.2 per cent Cu from 43m downhole in Central Kavanagh

» 33.23m at 1.46 per cent Cu from 42m downhole in East Kavanagh

Mains power was established to the underground operation resulting in a substantial circa 65 per cent cost reduction to power use from circa $0.40 per kilowatt hour to circa $0.13 per kilowatt hour.

Furthermore, connection to the South Australian power grid, which is supplied by over 70 per cent renewable energy generation, substantially reduces Kanmantoo’s carbon footprint.

Hillgrove CEO and Managing Director, Lachlan Wallace, said, “First copper production from the Kanmantoo underground operation, and the transition to cashflow generation, is a watershed moment for the company.”

Mr Wallace said that mine output and copper production was expected to continue to ramp up as the planned additional work areas are established underground.

“Completing this transition from explorer to producer makes Hillgrove Resources one of only a few copper producers on the ASX, and doing so in eight months highlights the company’s capability to deliver on stated objectives.

“Operations will be bedded down at Kanmantoo as we ramp up to steady stage production, and our attention will turn to growing the business by converting future exploration and development opportunities.”

Mr Wallace said the project was well-positioned to take advantage of the anticipated growth in demand for copper as the world continues to decarbonise through electrification.

“To leverage our position as a copper producer into the future, we are actively seeking to grow both the mine life and the annual copper production profile through exploration, starting with our substantial 60-100 million tonne exploration target within close proximity to the underutilised processing plant, including the recently discovered Kanmantoo Deeps target.”

The FS10i is a universal flow switch and flow monitor designed for simple insertion into 13mm or larger diameter pipes and square ducts. The unit is suitable for either liquid or air/gas applications. Fast responding, the unit is highly repeatable to both increasing and decreasing flow rate changes.

The standard 1A relay trip point is easily set in the field for low or high trip points and the trip and reset points can be further tuned with hysteresis and time delay adjustments. Also included standard is a 4-20mA trending output of the flow rate for connection to ancillary controls or alarm systems.

The FS10i includes a 10-LED array which provides both an indication that the trip point has been exceeded – in which the LED flashes on and off – and of relative flow rate (ten per cent increments) across the flow range.

The FS10i provides best-in-class features for installation in rugged duty, and long-life in industrial plants, processes and large buildings. Its flow sensor’s thermowells are constructed of highly corrosion resistant Hastelloy C-22, meaning it will operate in fluid temperatures up to 121 degrees Celsius.

The FS10i boasts an IP protection rating to IP67, optional global agency approvals for installation in Division 2/Zone 2 locations and it is the only unit in its price range to carry a SIL 2 compliance rating.

The fact that it has no moving parts that can clog and requires no routine maintenance offers users time and cost savings over any mechanical-technology based flow switch on the market.

Fluid Components International (FCI) are represented in Australia by AMS Instrumentation & Calibration.

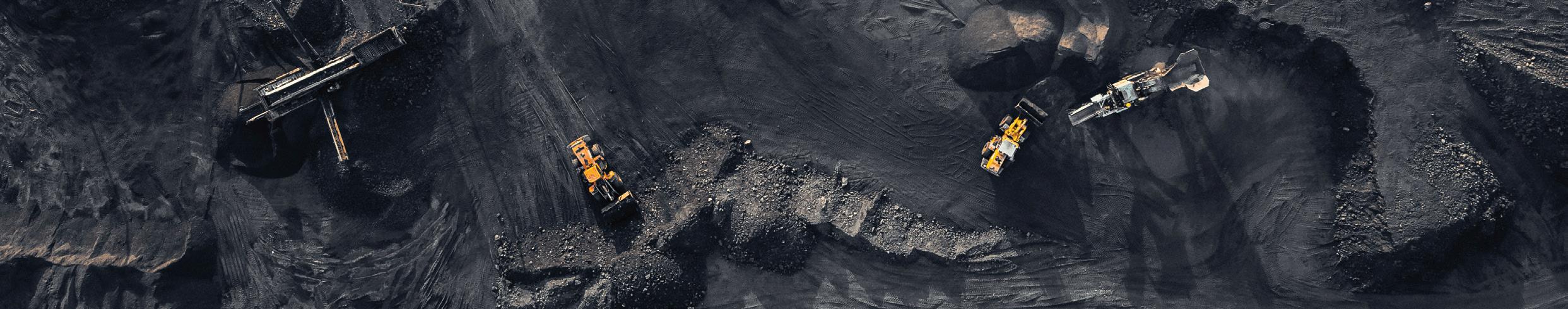

ANew South Wales coal mine was issued a prohibition notice, banning any further mining of coal onsite due to ongoing safety concerns.

The NSW Resources Regulator had been working closely with the operator of Russell Vale coal mine since an initial frictional ignition event in April 2022.

The prohibition notice was to remain in place until the Regulator was satisfied appropriate safety measures had been carried out at the site.

Following investigations into numerous incidents at the mine and the scrutiny from the Regulator, it was later announced that the Russell Vale Colliery would close, affecting approximately 145 employees.

The environmental authority (EA) application for Whitehaven Winchester South coal mine was approved by the Queensland Government’s Department of Environment, Science and Innovation.

The project was assessed through an environmental impact statement managed by the Coordinator-General, who issued an evaluation report in November 2023, recommending the project proceed subject to the stated conditions and recommendations.

The EA application was publicly notified and five submissions were received by the department – all of which were considered in the assessment process.

The department said that it would issue a notice of the decision, including reasons, to Whitehaven and the five submitters by 14 February 2024.

Whitehaven and the submitters would have the opportunity to object to the department’s decision and request that the project be referred to the Land Court.

The objection period was 20 business days from receipt of the notice of decision.

Queensland environmental groups did not welcome the approval, with the Queensland Conservation Council (QCC) saying that it was a terrible decision that would impact Queenslanders still clearing up from storms, fires and floods made worse by climate change.

The QCC also said that as the largest proposed greenfield coal mine in Australia, Winchester South had the potential to release 583 million tonnes of CO2e emissions, posing a threat to Australia’s climate, nature and the health of its communities.

QCC Director, Dave Copeman, said that the Queensland Government put Queenslanders at further risk by approving the mine.

“Despite the continuous environmental disasters we have witnessed in the past months across Queensland, the Queensland Government’s decision to greenlight this project shows that their approvals process must change.

“Instead of protecting Queenslanders from the worst impacts of climate change, they are adding fuel to the fire for short-term gains.

“The climate science is clear, we must end the use of coal urgently if we are to meet our climate targets and keep Queenslanders safe from the worsening impact of climate change. We are dangerously close to likely tipping points in our global climate systems.

“As an open cut mine, once they start extracting coal, it will be too late to reduce the methane that will be released into the atmosphere continuously for generations, turbocharging climate change.”

sharp decline in nickel prices led to closures in two key Australian nickel operations.

Wyloo Metals, owned by iron ore billionaire Andrew Forrest, announced that its Kambalda nickel operations will be put on care and maintenance from the end of May due to low nickel prices.

Following this, BHP announced that it would pause part of its Kambalda processing operations in June, cutting 20 roles in Western Australia. Wyloo Metals

supplies ore to BHP’s Kambalda nickel concentrator.

Wyloo’s CEO, Luca Giacovazzi, said in a statement to the ABC, “The decision to temporarily pause our operations in the current nickel market will allow us to develop and assess these options as we move towards our long-term strategy to mine and process nickel from our own facilities in Kambalda and Kwinana.”

BHP’s Nickel West asset president, Jessica Farrell, told the ABC that “the decision by Wyloo to suspend its operations means it will no longer be

viable to continue operating parts of the Kambalda concentrator from mid-year. BHP will transition the Kambalda concentrator’s crushing, milling and flotation circuits into care and maintenance from June 2024.”

Fortescue announced that a change of name was approved for the company after being accepted by shareholders at the Annual General Meeting of the company held on 21 November.

Formerly known as Fortescue Metals Group, the company is now called Fortescue on the ASX, with the ASX ticker code remaining unchanged as FMG.

Fortescue said that the change of name was intended to reflect the diversification of Fortescue’s operations as an integrated green technology, energy and metals company.

Construction of a vanadium electrolyte manufacturing facility in Western Australia is now complete.

Australian Vanadium Limited (AVL) announced the completion of the facility, located in the northern suburbs of Perth. The facility has been designed to produce up to 33MWh per year of high purity electrolyte for vanadium flow batteries (VFBs).

CEO of AVL, Graham Arvidson, said, “We are pleased to have been able to successfully and safely execute another segment of our ‘pit to battery’ strategy through the construction of Western Australia’s first vanadium electrolyte manufacturing facility.”

The construction of the facility was supported by a $3.6 million Modern Manufacturing Initiative grant by the Federal Government, which demonstrates the value of investing in domestic downstream processing capability, allowing more value from Western Australia’s battery mineral endowment to be captured and retained in Australia.

Construction of the facility was undertaken by Western Australian-based engineering company Primero Group

and was completed without injury. AVL issued a certificate of practical completion to Primero Group, which allowed for the formal handover of the facility from the construction team to the commissioning team.

“We are grateful to the teams at Primero and USV for their contributions in delivering a facility that is the first of its kind for Western Australia,” Mr Arvidson said.

The vanadium electrolyte manufacturing facility utilises proven electrolyte manufacturing technology licensed from US Vanadium LLC exclusively to AVL in Australia and New Zealand. Using this technology greatly reduced the development risk for the facility.

USV will assist with commissioning of the facility, which was anticipated to be completed in early 2024.

The vanadium electrolyte produced by the facility will initially be employed in the VFB projects being developed by AVL’s wholly owned subsidiary, VSUN Energy Pty Ltd, and will allow AVL to qualify its product with key global VFB manufacturers.

Demand for vanadium electrolyte within the region is expected to grow rapidly over the coming years. According to Guidehouse Insights, “Asia Pacific leads significantly, with a compound annual growth rate (CAGR) of 25.7 per cent for revenue and 37.4 per cent for energy capacity. By 2031, it is estimated that Asia Pacific will reach around 14.5GWh of annual VFB energy capacity.”

Construction and subsequent operation of the facility ensures that AVL remains engaged with downstream aspects of the vanadium and VFB markets.

Vanadium pentoxide for electrolyte manufacture will initially be sourced from USV, prior to supply being available from the AVL’s Australian Vanadium Project in Western Australia. The experience gained from the construction of the vanadium electrolyte manufacturing facility is anticipated to be of great use in the construction of the Australian Vanadium Project.

“Production of AVL’s first vanadium electrolyte will position AVL to become a trusted supplier for battery projects in Australia and the wider region,” Mr Arvidson said.

Your industry personnel roundup – here we cover who’s moved where, which boardrooms have been shaken-up and the new leaders making big decisions in organisations across the industry.

In December 2023, Pilbara Minerals announced the appointment of a new Non-Executive Chair, with Kathleen Conlon assuming the position from 1 January 2024 after retiring as Chair of Lynas Rare Earth. Ms Conlon took over from Anthony Kiernan, who retired on 31 January 2024 after seven years in the role, including seeing Pilbara Minerals through its transition from a lithium developer to a lithium producer.

For BHP, the new year came with a new executive leadership team, with the announcement of a number of updates in December 2023 to come into effect in the first quarter.

On 1 March, Vandita Pant commenced as the new Chief Financial Officer (CFO), having worked for BHP since 2016 – most recently in the capacity of Chief Commercial Officer (CCO). The previous CFO, David Lamont, will remain with BHP until February 2025 as a Senior Executive Officer in an advisory and projects capacity.

Ragnar Udd took over as CCO from 1 March 2024, departing his previous role as President Americas.

Other updates to the BHP team include the appointment of Brandon Craig as the new President Americas, commencing on 1 March, and Johan van Jaarsveld as Chief Technical Officer, who also stepped into the role on 1 March 2024.

On 11 January 2024, Dr Luke Mortimer commenced his role as the new Chief Executive Officer of Kalamazoo Resources. Dr Mortimer joined Kalamazoo in 2019 as the Exploration Manager and played a role in Kalamazoo’s acquisition and development of lithium exploration assets.

Dr Mortimer took over from Luke Reinehr, who co-founded Kalamazoo and has served as CEO since 2019. Mr Reinehr will continue as Executive Chairman of Kalamazoo.

Another company who made changes to its board and leadership team is Mineral Resources (MinRes).

In February 2024, Jacqueline McGill was appointed as an Independent Non-Executive Director to its Board, with a background as a highly credentialed mining executive and gender equity champion and a long career in the commodities sector. Another change to the MinRes Board in February was the resignation of Independent Non-Executive Director, Kelvin Flynn, who served for 14 years, including nine years as the chair of the Audit and Risk Committee.

Finally for MinRes, Jenna Mazza was appointed joint Company Secretary, having joined the company in 2014, working across a variety of senior legal roles, most recently as General Manager, Corporate Legal.

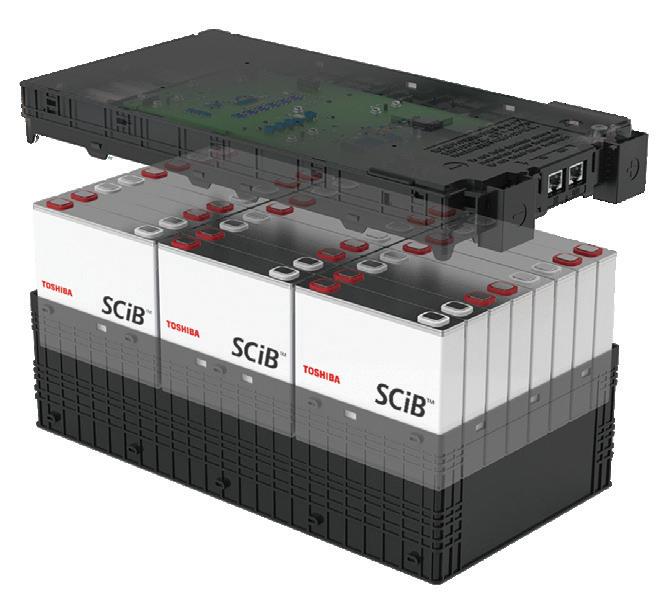

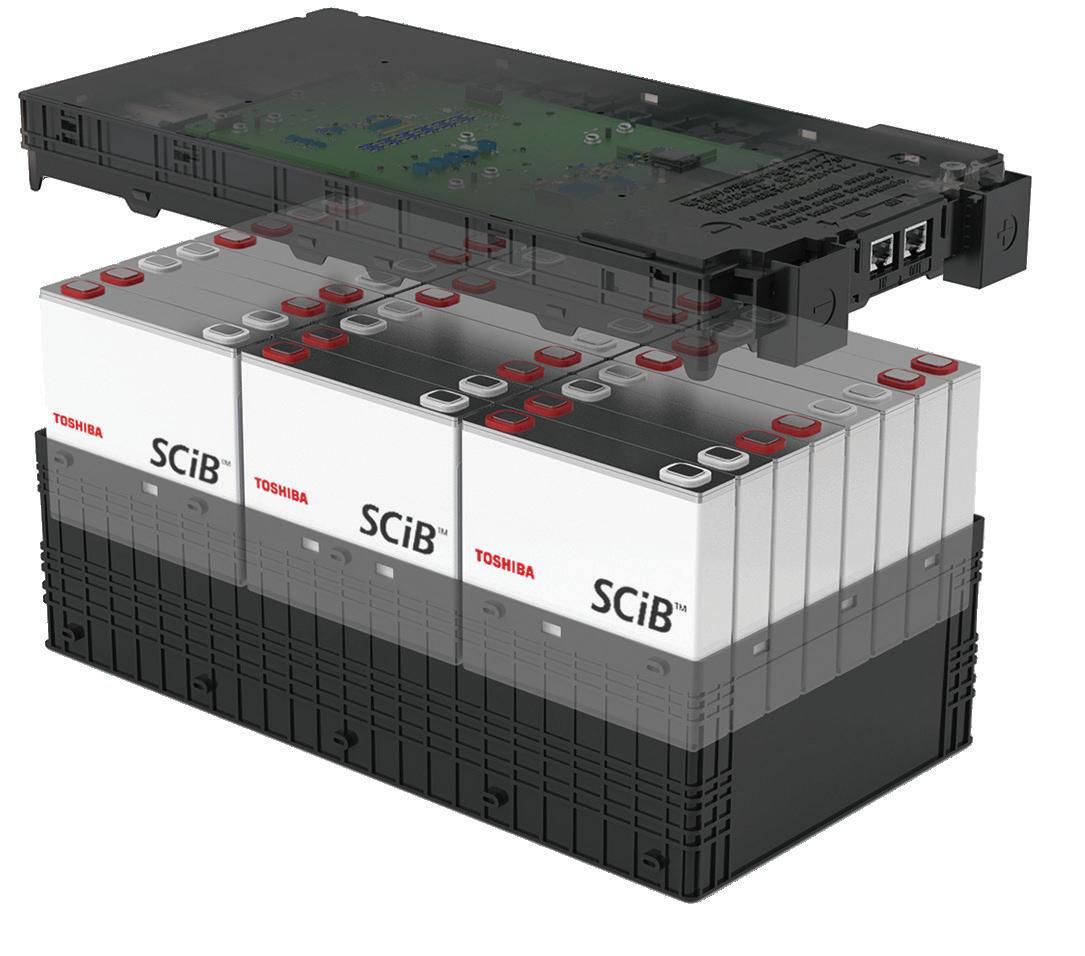

The increasing uptake of battery technology is a critical step in supporting traditionally emissionsheavy industries to decarbonise their operations, but it won’t be conventional lithium batteries driving technology for the future.

Toshiba’s SCiBTM technology is a transformative force in the battery market. Unlike conventional lithium batteries, a SCiBTM cell utilises a lithium titanium oxide (LTO) in its anode. This chemistry means that if SCiBTM cells are pierced or damaged, the anode material transitions from a conductive phase to a high-resistance phase. This is key to limiting the flow of energy and preventing thermal runaway and subsequent combustion. Essentially, SCiBTM cells are self-protecting, which is a gamechanging development.

Additionally, using an LTO anode means no possibility of lithium deposition or membrane-puncturing dendrite growth – meaning SCiBTM is exceedingly robust and far safer over time.

Toshiba have been manufacturing SCiBTM since 2010, with zero cell recalls or CPL (Contract/Product Liability) accidents – a claim that conventional lithium batteries can’t make.

Optimising the total lifespan and cost of ownership for battery technology are crucial factors in the decarbonisation process –another area where SCiBTM technology excels.

Compared to conventional lithium batteries, SCiBTM cells have a typical lifespan of more than 20,000 cycles. Even after the 20,000 cycle point they still retain 80 per cent of their original capacity. This means that after reaching the end of the first application, they can receive a second life where weight isn’t a factor, such as stationary solar support, creating a provable asset long into the future.

An exciting development for the technology is its rapid charging capabilities. With a high C-rate, charge times are measured in minutes, not hours, and an entire system can be charged to 80 per cent capacity in just six minutes and fully charged in ten minutes.

This is key for easy adoption. If a vehicle requires multi-hour charging times, workers must carefully plan their usage to ensure availability, but if their vehicle rapidly charges in the time it takes for a coffee break, this downtime disappears.

With exceptional safety, improved lifespan and rapid charging, SCiBTM technology has the capability to be the cornerstone of a business’ decarbonisation plan. The Australian mining industry has started to take notice, with SCiBTM systems already deployed in underground electric vehicles.

More than just fleet electrification, there are also flow-on effects – faster charging enables a smaller fleet, fewer charging stations and more efficient use of the vehicles on hand. It allows businesses to improve safety onsite, while vastly reducing capital costs at the same time.

Does this signal the end for conventional lithium batteries? Not yet. As decarbonisation efforts ramp up across industry, they will still be used in low-challenge applications where low charge rates or lower lifetime is required. However, for operations that require rapid charging, uncompromising safety and extreme longevity, SCiBTM technology will lead the way.

While traditional trade publications have quality audiences and high levels of trust, they can lack the full range of services to guarantee a return on your investment. And while traditional marketing agencies offer the latest marketing techniques, they don’t have the audience or the industry understanding the B2B sector needs.

Monkey Media is the missing link that brings together a trusted brand and powerful audience, with a complete agency offering.

TO FIND OUT MORE SCAN THE QR CODE NOW

Following his November 2023 announcement to retire from Cabinet, Mining Magazine sat down with former Western Australian Mines and Petroleum Minister, Bill Johnston, to reflect on his time in the role and what’s in store for the resources sector.

Mining Magazine (MM): Can you give us a bit of insight into what led to your decision to step down?

Bill Johnston (BJ): After the 2021 election, I spoke to thenPremier McGowan and explained that I thought that seven years was plenty of time to be a minister, and I wanted to step away from Cabinet before Christmas 2023 so that I could return to the back bench and see out my term in Parliament. In that role, I thought that was the best way forward for myself and for the party.

When Roger Cook took over in June of last year, I met with him and explained that was my intention. I feel that I've made a significant contribution and it was time for somebody else to have a try and for me to get ready for the next phase of my life.

MM: How have things changed over the decades your political career has spanned?

BJ: I've been thinking about that quite a lot lately. Over the last 25 years, social media has changed the landscape of politics. It encourages extremists and unfortunately, the media follows the social media line. It's harder to explain complex issues in the public arena now than it was 25 years ago and because of the reduction in the number of journalists, there's less analysis of politics and more opinion. I think that's been the biggest change.

MM: Have your expectations of politics changed over the course of your career? And if so, how?

BJ: My expectation of politics hasn't changed. I've always thought that politics is about achieving the best outcomes for the community and in particular for working people. But I do think there's less rigorous analysis of politics now than there was in the past.

MM: The mining and resources industry has played such an important role and will continue to play an important role in the state economy, and the nation's economy. With this in mind, how did it feel to take on the role of Minister for Mines and Petroleum back in 2017?

BJ: It was an extraordinary privilege to be given that responsibility and I felt the weight of needing to provide proper leadership to the industry. I know how important the industry is to all Australians, even if they don't necessarily understand it themselves.

Who wouldn't want to be the Minister for Mines and Petroleum in the world's number one mining jurisdiction? I always had the view that it was a rare privilege to have such a fabulous job, and I wanted to make the most of it each day.

MM: It has been a big year for the Western Australian resources industry, with the environmental approval system being overhauled and the Aboriginal Cultural Heritage Act being repealed. What challenges do you think lie on the horizon for the state's mining and resources industry?

BJ: When I talk to people, the number one thing that they raise at the moment, of course, is skilled labour. Making sure we've got enough people to execute all the projects that are out there is very critical. But the number one issue for the mining

sector is always exploration. That's why, as Minister, I always gave strong encouragement to the exploration sector because if you don't make new discoveries, you won't have future mining.

Along with the Government of Western Australia, we've always tried to strongly support the exploration sector. That's why we invested strongly in pre-competitive data projects and also in the exploration incentive scheme and the co-funded drilling activities. Continuing to support exploration activity is going to be the number one thing here in Western Australia.

MM: Other than exploration, what are you hoping to see more of in Western Australia and Australia's mining industry in the future?

BJ: I'm really looking forward to continued expansion of the downstream processing of battery minerals here in Western Australia and nationally. This is a real opportunity as the demand for these new materials grows. We're not competing with other existing jurisdictions. It's all about where the growth in the processing infrastructure is built.

Whilst there are many challenges here in Western Australia, I'm confident that we'll see continued success in the midstream sector of the battery and critical minerals industry.

MM: What impact are you hoping that your time as Mines and Petroleum Minister has had on the industry?

BJ: I'm not too concerned about legacy. I just hope that people respected the fact that I wanted to listen to the needs of the industry and respond to the things that are occurring.

Obviously, we had the global pandemic during my time in the role, and government and industry worked very closely together to make sure that the industry here in Western Australia was able to continue to operate. At a time when we thought that there was going to be a major economic dislocation, we were able to keep the industry strong, which kept Western Australia strong, and that supported Australia's rapid return from the impacts of COVID-19. That was a really critical element that the government and industry executed together. I think everybody in the sector can be proud of the work that was done during that time.

MM: What are some of the biggest challenges you faced throughout not only your time as Mines and Petroleum Minister, but your years in politics and Cabinet as a whole?

BJ: The COVID-19 global pandemic was extraordinary. I think when we were in opposition thinking about what it would be like to be in government, we ran a lot of scenarios, but we did forget to run the global pandemic scenario. But politics is a complicated business. It's about compromise, and you can't do everything that you'd like to do. So over the last 25 years with my involvement in politics, I've been very pleased to work with some outstanding Western Australians and support them in their work like Dr. Geoff Gallop, Alan Carpenter, McGowan and now Roger Cook as Premier for the state.

That's been a rare privilege to be able to work so closely with these outstanding Western Australians to try and make the state an even better place to live.

during your political career has been?

BJ: I think that's for other people to judge. I'm very proud of the work that I've done alongside the mining industry to keep the industry strong and to develop the exploration sector. When I came into the job, just over half of exploration activity in Australia was being done here in Western Australia and now nearly two-thirds of exploration activity is here in Western Australia. And in 2022, we had a record high level of employment.

I support the mining industry because it supports the global transition to net zero and allows people in other parts of the world to move out of poverty. But it also provides 135,000 high-skill, high-wage jobs, which is exactly what I got involved in politics to support.

MM: The mines and petroleum portfolio has been taken on by David Michael; what advice would you give to him as he takes on this new responsibility?

BJ: I'm really pleased that Roger Cook gave the portfolio to David. I think he's a great guy. We've known each other for a long period of time. I think he'll do an excellent job because he's prepared to listen. The advice I gave to him when we met up just after Christmas was that he should pay attention to what people are saying and listen. I think that's what I've tried to do in my time. I think that if David takes that approach of listening to people in the sector, making sure he understands what the challenges are, I think that will set him up very well for the future.

BJ: In the Cannington community, it's really pleasing to see a number of projects coming together at the minute. One of those is the Lynwood Senior High School refurbishment. It's an older school. We've had nearly $20 million spent on it. Of course, the big issue at the moment is seeing the massive new rail infrastructure going in that's improving the connectivity in the Cannington community, particularly removing three levelcrossings that used to divide the suburbs and cause traffic chaos. That's a great personal achievement.

There's always more to be done, but I'm very pleased that the plans for the community here in Cannington have been working to improve the community's situation.

MM: Is there anything you'd like to add?

BJ: I just want to emphasise again that I've considered it a rare privilege to be able to be Minister for Mines and Petroleum. I've enjoyed every part of it. I shadowed for four years before I became Minister, so I've worked very hard to listen to the industry and make sure that I understand, to the best I can, the industry's needs. I know that I don't always do exactly what the industry wants, but I hope people understood that all my decisions were designed to improve the outcomes for Western Australians.

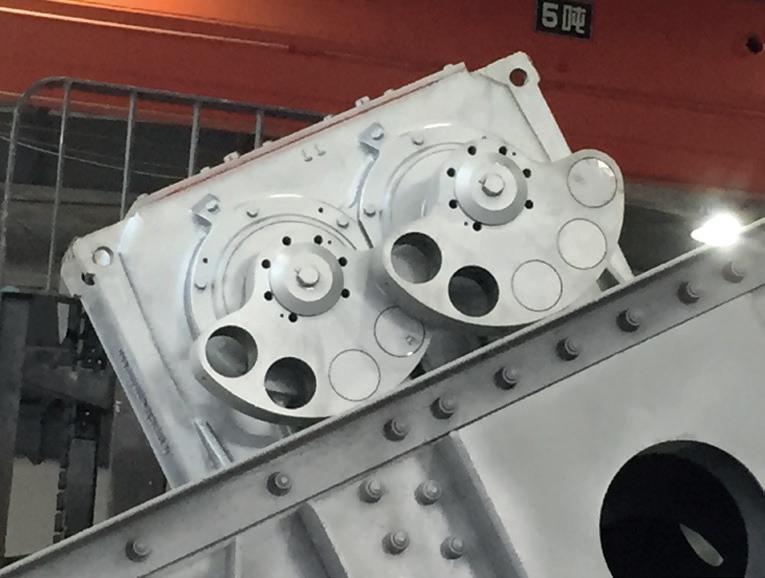

We produce Linear Motion Screens (HLS) and Circular Motion Screen (HKS) with a maximum length of 10,000mm and a maximum width of 4,000mm.

We also deliver Banana Screens, Dewatering Screens and Hot Screens for material up to 1,000 °C.

With a working moment of up to 15,000kgcm, our drive system exciters are also compatible with other brands.

Large-scale projects in Australia must adhere to a range of stringent requirements and regulations. When it comes to meeting these demands, it helps to form partnerships with Australia-based companies, securing local products and joining forces with teams who understand unique project demands.

Australia is a tempting location for large-scale projects, but companies can face lengthy delays due to supply chain disruptions and waiting for international equipment deliveries. Companies can avoid these delays and showcase their commitment to high-quality work by pairing with local companies and suppliers.

SAACKE Australia has been involved in combustion technology for more than 90 years and is considered a world leader in the field. Its products meet the highest industrial and ecological standards and as a specialist, it plans, develops and produces burners and system solutions for industrial thermal processes.

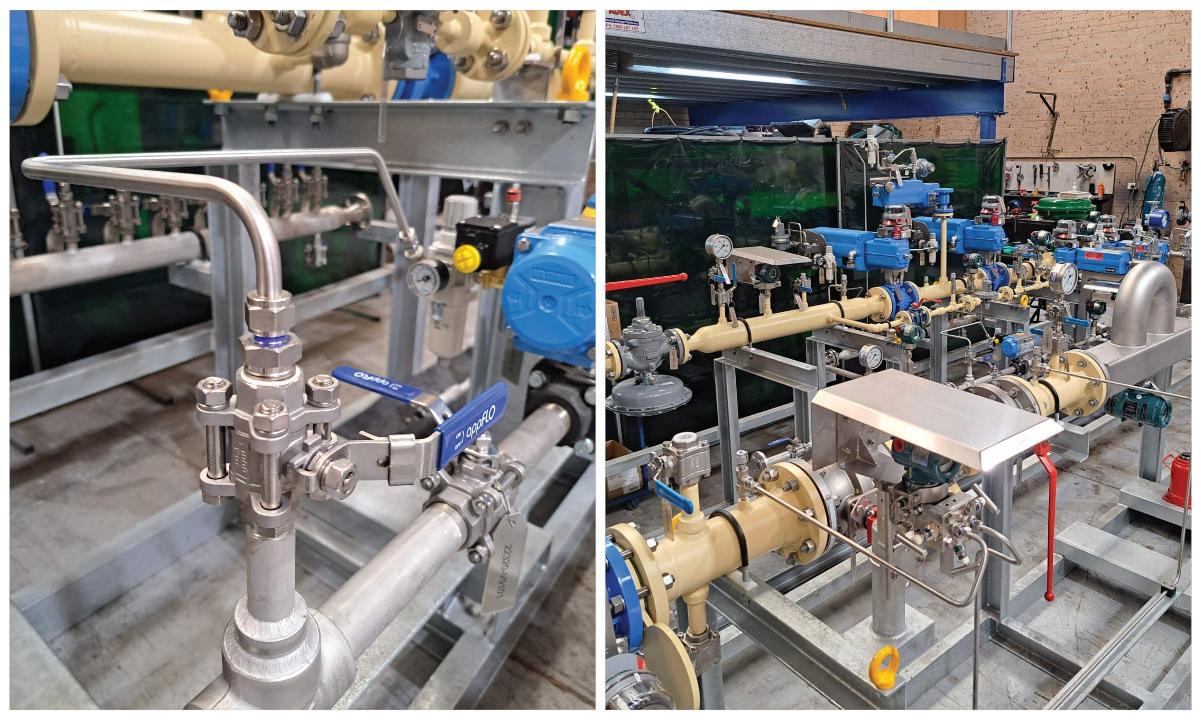

When SAACKE Australia was presented with the opportunity to create gas manifolds for use on a lithium project in Australia, taking on the project was a no-brainer. To deliver the project, SAACKE Australia’s goal was to source a local supplier of fittings that ensured it met the Australian standards and customer specifications.

A key factor in supplier selection was that SAACKE required delivery within a tight time frame. It also sought a supplier that could ensure a high-quality product. With these requirements in mind, the VIS-LOK® products from Ibex Australia attracted the attention of SAACKE Australia. Not only did VIS-LOK appear to be perfect for use in gas manifolds, SAACKE was also impressed with Ibex’s local supply and extensive customer support.

The solution delivering results

SAACKE used Ibex Australia’s VIS-LOK Stainless Steel compression fittings, as

“Fabian and the team at Ibex have always gone out of their way to make sure we get prompt deliveries and product support. The VIS-LOK system gives us a visual indication of correct tube fitment and tightness, unlike the inspection gauge we have used in the past on other brands. Pricing of VISLOK Fittings and Seamless Tube is very competitive and is an added bonus.

"I have no problem recommending this product to anyone considering a move away from the traditional suppliers.”

– Peter Carlino, Workshop Manager at SAACKE Australia

well as the VIS-LOK Seamless Stainless Steel Instrumentation Tube. Ibex Australia’s seamless tube is dual certified 316/316L, dual specified A269/A213, and is used extensively in many industries and applications, including lithium projects.

VIS-LOK Stainless Steel Compression Fittings offer an innovative design that allows for a quick and easy installation. The fittings are suitable for a range of applications, including use in gas manifolds on lithium projects. VIS-LOK requires no inspection gauge or markers and eliminates over and under tightening issues with its unique check-ring system.

Ibex Australia’s VIS-LOK products not only met the requirements of the project, but the Seamless Stainless Steel tube arrived already annealed, saving SAACKE time and making the project more efficient.

Ibex Australia is a family-owned and operated business with more than 30 years of experience delivering smarter, safer industrial stainless steel piping solutions. Ibex Australia prides itself on delivering excellence in product reliability, responsiveness and technical knowledge.

At Ibex Australia, we know that efficiency is crucial in the mining industry. That's why we offer fast, clean, and safe industrial piping systems that eliminate hot works and passivation.

With our commitment to quality, timely delivery, and responsive customer service, Ibex is your trusted partner in delivering exceptional results and boosting your bottom line.

Experience the difference with Ibex Australia.

Entering 2024, the mining and metals industry finds itself at the centre of a complex matrix of challenges and opportunities, expectations and demands.

In 2023, the geopolitical environment, which was already complex and heated, deteriorated further. Meanwhile, record levels of catastrophic weather events underscored the need for urgent action on climate change.

The global economy, already severely disrupted by the pandemic, remains challenged by levels of inflation not seen in decades and skill shortages plague many advanced economies, handicapping growth.

Meanwhile, despite mining companies' efforts to improve transparency and adopt responsible mining methods, the industry is still battling an image problem and is failing to articulate a clear sense of purpose in the face of shifting public sentiment. And of course, last year was the year that generative AI (Gen AI) truly arrived, with governments, the private sector and the public realising the immense economic opportunities and challenges the technology presents.

In Deloitte’s 2024 Tracking the Trends report, we identify the key trends that we believe will shape and impact the industry over the next 12 to 18 months.

In Australia, we find the following trends particularly relevant to mining and metals operators.

Navigating global uncertainty – building capacity to thrive in the face of disruption

The disruption of the COVID-19 pandemic has given way to the kind of complex and tense geopolitical environment we have not seen in decades, which is disrupting business-as-usual operations and creating considerable uncertainty.

During 2023, the Russia-Ukraine war continued to disrupt commodity markets, impacting supplies of everything from nickel to fertiliser. This conflict has now been compounded by a deterioration of the security situation in the Middle East that has the potential to destabilise both commodity markets and global shipping routes that underpin supply chains.

While geopolitical tensions approach boiling point, the rapid pace of technological advancement continues unabated as a notable increase in extreme weather throughout the year underscored the risks posed by climate change and the need for action at a global scale.

Critical mineral supply chains find themselves at the intersection of global geopolitical uncertainty and the push towards net zero goals. The mining of these essential minerals is heavily concentrated in specific geographical regions, with Australia dominating lithium production, China leading in graphite and rare earths and the Democratic Republic of Congo in cobalt.

However, the processing stage is even more geographically concentrated, with China accounting for more than 50 per cent of the world's refined supply of various critical minerals. It’s not hard to figure out that these supply chains are susceptible to geopolitical risks, posing a potential threat to the speed of the energy transition unless diversification efforts are expedited. In response to this landscape, businesses are shifting away from vertical integration towards an ecosystem approach. The growing complexity of these networks means that changes in markets, politics, and regulations have far-reaching impacts across industries, sectors, geographies, and suppliers.

We are also seeing dynamic strategic planning emerging as a key solution to navigate this evolving terrain. A dynamic strategy allows businesses to proactively adapt to changing scenarios, minimising operational threats and capitalising on new opportunities by incorporating flexibility and innovation into decision-making processes.

A higher emphasis on scenario planning further aids in testing strategies in a hypothetical environment before making decisions. Encouraging executives to immerse themselves in hypothetical yet plausible scenarios provides valuable insights into how organisations might need to adapt to potential future developments.

Dealmaking for future-focused growth – rethinking minerals and metals investments

This growing complexity is prompting key stakeholders to rethink how they invest in minerals and metals and position themselves for the future.

The proof is the numbers – mergers and acquisitions (M&A) activity totalled USD$88.2 billion in value across 288 deals in 2023, a level of activity not observed in a decade. This has been driven by the need for traditional minerals and metals players to increase their exposure to critical minerals or metals key to the transition to net zero – think BHP's acquisition of OZ Minerals, which increased the mining giant’s exposure to nickel and copper.

Other players prioritise organic growth into new markets while companies with portfolios centred on high-emission commodities are exploring ways to enhance investment appeal as environmental, social, and governance (ESG) concerns increasingly become a priority for both institutional and retail investors.

This shifting investor sentiment combined with major energy, resources, and industrial players adopting firm net zero targets requires executives and directors to put an ESG lens over everything they do.

ESG imperatives are leading key players into unusual alliances and partnerships. Globally, governments are also emerging as a crucial source of investment for not just ESG-focused initiatives, but also projects that enhance sovereign energy and minerals security.

For instance, the US Government's Inflation Reduction Act and the European Union's Critical Raw Materials Act are injecting substantial funds into critical minerals projects that will see the onshoring of parts of the manufacturing process for products crucial to the net zero transition, like lithium batteries.

In Australia, the Federal Government has announced a significant expansion in critical minerals financing, doubling the capacity of the critical minerals facility to support mining and processing projects.

Where government money flows, investor money follows. Organisations that put an ESG lens over everything they do and look outside the traditional partnerships and alliances box will, in the long run, prove to be more resilient.

Working toward net zero – building capacity and futureproofing ESG strategies for a credible transition

According to the UN, the world is in danger of falling short of its goal of limiting the global temperature rise to 1.5 degrees by the end of the century and could overshoot that target by as

much as one degree. The environmental and economic effects of this would be catastrophic.

Research by the Deloitte Economics Institute has found that, if left unchecked, climate change could create USD$178 trillion in global economic losses between 2021 and 2070. Conversely, a coordinated effort in climate change mitigation could deliver an additional 300 million jobs by 2050 and boost the economy by more than USD$43 trillion by 2070.

The private sector has a pivotal role to play in ensuring we not only avoid the catastrophic consequences of missing our climate goals, but that we also capitalise on the economic opportunity inherent in the transition to net zero. But first they need the capacity to do so.

A potential first step organisations can take is to think beyond mere emissions reduction. ‘Climate Related Transition Plans’ (CTAP) are a useful framework for laying out holistic decarbonisation targets over the short, medium and long

term by integrating capital allocation frameworks, operational impacts, and portfolio optimisation.

In addition to holistic plans, leaders should also look at what action is truly ‘credible’, recognising that standards may vary across sectors and geographies based on technological, physical dependencies, and equitable transition principles. It is good practice to stay abreast of evolving regulatory frameworks and socio-environmental shifts in their operational jurisdictions.

It is also important that leaders learn how to navigate ESG-focused disputes as scrutiny around global corporate climate disclosures and ESG grows around the world. Avoiding accusations of greenwashing necessitates ethical dealings and collaborative efforts with customers, suppliers, regulators, traditional owners, and competitors.

The true challenge in the transition to a net zero economy lies in swiftly ramping up supply to decarbonise economies before critical climate tipping points are surpassed. However, lengthy approval processes for critical projects endanger the ability of our industry to do all it can to help reach net zero.

S&P Global notes that the average mine takes 15.7 years to reach commercial production, emphasising the need for expedited processes. The industry should look at how it can take a collaborative approach with government to balance appropriate regulation against streamlining approvals and enhancing overall competitiveness.

The industry also needs to make strides to engage in effective project prioritisation, considering factors like power supply, water availability, and infrastructure. Economic relationships with Indigenous rights holders present both challenges and opportunities, highlighting the importance of not just mandated consultation but establishing effective voluntary collaborations. Integrating Indigenous knowledge systems into project design fosters direct community participation, addressing concerns promptly and lowering barriers to approvals.

Addressing workforce challenges through a skills-based approach – equipping mining and metals companies for the future

Lowering development approval times is a pointless exercise if the industry does not possess workers with the right skills. Skills shortages are emerging as a permanent, not a transitory, issue for the metals and mining sector and will not simply go away if the global labour market – currently running hot –cools down.

Solving this problem will require the industry to tackle the specific structural issues causing workforce challenges while keeping an eye on broader employment trends, like the importance of Diversity, Equity and Inclusion (DEI) and modern work.

The mining and metals industry grapples with the challenge of attracting talent, particularly among younger generations. According to the Australian Geoscience Council, the number of students completing geoscience degrees plunged more than 40 per cent in the eight years to 2021. Meanwhile, the Australasian Institute of Mining and Metals Industry reports that the number of mining engineer graduates more than halved between 2011 and 2020.

It has been suggested that the industry has an image problem among young people, who highly prioritise environmental and ethical concerns when searching for an employer. Despite notable strides in environmental and social commitments, the industry must evolve to appeal to the values-driven Gen Z and

millennials and articulate a clear purpose that champions the worthwhile contributions the industry makes to clean energy, global food security, and economic development.

We also must make strides to rework industry education programs, specifically by focusing on micro-credentialing, as it makes it easier for workers interested in joining the industry to gain necessary skills. It will also make upskilling easier – a necessary development in a fast-changing industry. Collaboration between industry players and universities is vital for developing relevant courses, curricula, and credentials.

A focus on workforce well-being is also important, and DEI initiatives play a central role. While the mining and metals industry is gradually becoming more diverse, a focus on systemic changes and supportive structures is necessary to reap the full benefits of diverse workforces.

Achieving gender balance, as seen at BHP's South Flank iron ore mine where women make up 40 per cent of the front-line workforce, is essential to attracting and retaining talent.

Bringing Generative AI into mining and metals –capitalising on current and future opportunities

2023 will be remembered as the year of Gen AI. While its initial impact was noticeable in consumer-facing sectors, Gen AI holds immense potential for industrial and enterprise applications and could help the mining and metals industry solve many challenges.

Realising these benefits will involve the industry overcoming its inherent conservatism. Many companies are recognising the potential of Gen AI to introduce contextual awareness and human-like decision-making into workflows, fundamentally altering business operations.

Understanding potential use cases is crucial. In the near term, Gen AI is expected to impact workforce productivity and efficiency, enhancing back-office tasks and aiding developers in code writing.

Longer term, virtual ‘field assistants’ could improve safety, bridge knowledge gaps, and guide new recruits through processes. Gen AI's simulation and modelling capabilities may support supply chain resilience and optimisation in the near future.

One of Gen AI's crucial capabilities is facilitating deeper interactions with data, an asset for mining and metals businesses that want to be as efficient as possible. Despite previous digital transformation efforts, some companies struggle with data accessibility, and Gen AI platforms offer a solution to this challenge.

While Gen AI platforms are still evolving, their capabilities are advancing rapidly. Exploring and implementing Gen AI now could provide valuable insights, allowing organisations to adapt and evolve alongside the advancing technology.

It is clear that mining and metals companies will continue to play a critical role in the energy transition.

In 2024, miners must keep advocating for the critical role minerals play in addressing climate challenges. They must lead the way purposefully to a sustainable future by addressing supply shortages and ESG challenges, and adopting emerging technologies, all while attracting the best and brightest talent to the industry. If they can, the future looks bright..

Elphinstone is excited to introduce the new E15 model to the Elphinstone Underground Hard Rock Mining Support Vehicle range. T he lo w-profile E15 is a welcome addition to the existing range of E10 (formerly W R810) s upport vehicles, both base platforms s haring a h igh l evel o f i nterchangeability of p arts and c omponents. Built to thrive in the harsh underground e nvironment, the new E15 provides o utstanding r ide and handling w ith e xcellent manoeuvrability and turning c ircle.

For more information scan the QR code or email sales@elphinstone.com

Continued demand for commodities and minerals is ensuring Australia’s resources industry remains a driving force in the nation's economy. To maximise output and operations, mine owners and operators need to partner with companies that offer high-quality products and services.

The remoteness and isolation of many Australian mine sites present a unique combination of challenges and when it comes to selecting equipment and machinery, operators want to know they’re pairing with companies that understand the challenges they’re up against.

When choosing who to partner with, mine owners and operators seek experienced companies who understand the characteristics of mining applications and offer products that can meet these challenges head-on.

Since 1995, R&J Batteries has been committed to delivering a superior product range combined with exceptional customer service. This dedication has seen R&J Batteries become one of the fastest growing battery companies in the country.

Today, R&J Batteries has over 29 company-owned stores and a footprint of more than 10,000 experienced stockists and distributors across Australia and New Zealand, cementing its standing as a trusted provider of high-quality products.

More than just selling batteries to customers, R&J Batteries backs its products, including the OPTIMA® batteries range, featuring a series of colour-coded, high-performance AGM batteries known as REDTOP®, YELLOWTOP® and BLUETOP®. The RED, YELLOW and BLUE top batteries cater for Automotive, Deep cycle and Marine applications respectively.

The unique Spiralcell Technology® in OPTIMA’s range permits more tightly compressed cells within the battery, which extends the battery’s life and gives it superior vibration resistance. As well as this, each model is 99.99 per cent pure lead and features solid cast inter-cell connections for increased durability and maximum plate height.

These features allow the battery to live up to twice as long as traditional batteries. The extreme applications and unique requirements of mine site trucks demand more from a battery and with both deep-cycle and starting capabilities with patented Spiralcell Technology, OPTIMA YELLOWTOP batteries can rise to the challenge and fulfil those needs.

A high-performance, heavy-duty battery solution

OPTIMA’s AGM batteries are the perfect fit for extreme applications, making it the ideal choice for mining equipment, military vehicles, emergency services, road transport and agricultural machinery. OTPIMA’s YELLOWTOP battery in particular is highly regarded in the mining industry for its performance capabilities in extreme applications.

Reliable batteries with a long service life – such as OPTIMA YELLOWTOP – are crucial to mitigating onsite downtime. Fulfilling a dual purpose, YELLOWTOP batteries deliver both reliable starting power and repeated deep cycling for applications packed with accessories.

With its deep cycle characteristics and extreme resistance to vibration, the YELLOWTOP provides performance vehicles with the repetitive power they need in a unique spill-proof package.

Other key benefits of OPTIMA YELLOWTOP batteries include up to three-times longer service life, 15-times more resistance to vibration, leak proof, mountable in virtually any position, maintenance-free, and more than 300 discharge/ recharge cycles.

The YELLOWTOP is one of the few truly dual-use car batteries on the market. This high-performance, heavy-duty battery is also suitable for accessory-packed vehicles. Its low internal resistance provides more consistent power output and faster recharge times.

R&J Batteries is your OPTIMA Batteries distributor in Australia with 24 branches and a strong network of more than 10,000 stockists across the nation. For more information about OPTIMA Batteries, visit rjbatt.com.au or call 1300 769 282

• High Performance Capabilities

• AGM Battery Design

• Up to 3x Longer Battery Life

• 15x More Vibration Resistant

• 99.99% Pure Lead

• Spiralcell Technology®

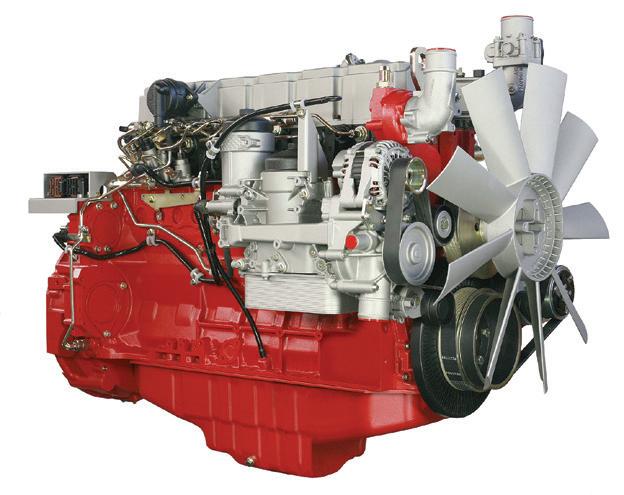

A key characteristic of a strong, successful and reliable business is its ability to secure and establish strong industry partnerships to deliver its customers with the best quality equipment and service.

In a strategic move to reinforce its commitment to excellence, CAPS Australia proudly announced its recent collaboration with Mitsubishi Heavy Industries Engine System Asia (MHIES-A) as the official Australian distributor for the esteemed Mitsubishi MGS Generator Series.

The partnership was solidified during an official signing ceremony held at CAPS Australia's headquarters in Perth, where representatives from MHIES-A were given a comprehensive tour of the in-house engineering facilities.

This collaboration marks a significant milestone for CAPS and is a testament to its standing as a respected industry player.

Renowned for reliability, efficiency, and robust performance, the Mitsubishi Generator Series provides power solutions across diverse industries and applications. At the core of its excellence are Mitsubishi Heavy Industries diesel engines, meticulously crafted in Japan to deliver outstanding performance, fuel efficiency, and reduced emissions, reflecting a balanced blend of cost-effectiveness and environmental sustainability.

CAPS’ National Sales Manager – Power Generation, Nestor DeNiese, said this collaboration is incredibly significant to CAPS.

“This partnership is a perfect alignment with CAPS Australia’s objective to offer valuable and effective solutions to the Australian mining sector. With shorter lead times due to the vertical integration and, more importantly, a reliable product, CAPS aims to propel progress and innovation in the region and beyond.”

The MGS-R Series, ranging from 455 to 3025kVA, emerges as an indispensable component in powering mission-critical systems for mining operations, data centres, and essential infrastructure.

Compliant with ISO8528 G3 transient performance standards, it holds certifications such as Data Centre Tier III/Tier IV from the Uptime Institute, along with ANSI/TIA-942 ratings ranging from Rated 1 to Rated 4.

This series is engineered with quick-start ability within ten seconds and 100 per cent one-step load capability, demonstrating its reliability in demanding situations. Moreover, the MGS-R Series adheres to seismic design codes, ensuring approval for use in seismic applications.

Setting the Mitsubishi Generator Series apart is its commitment to environmental responsibility. All MGS-R products are Hydrogenated Vegetable Oil (HVO) compatible –reducing the overall environmental impact and contributing to a cleaner, more sustainable future.

CAPS Australia, now the official Australian distributor for the Mitsubishi Generator Series, is poised to deliver top-tier power solutions through this alliance with MHIES-A. This partnership underscores CAPS's dedication to providing innovative and reliable power solutions to the Australian market.

CAPS Australia specialises in end-to-end solutions. Its in-house engineering allows the company to design, supply, and install bespoke, purpose-built systems to clients with specialised applications, and state-of-the-art factory acceptance test bays assure quality and compliance.

As an independent company with the flexibility to search globally for the best products that are price competitive, technologically advanced, and best serve Australian manufacturers, CAPS works alongside world-renowned partner brands to deliver peace of mind and ensure production continuity.

With ten branches nationwide and 24/7 service for maintenance and emergency breakdowns, CAPS makes it easy to get expert advice when you need it – leading the industry in service and solutions.

Ingersoll Rand, CAPS and Hertz brand electric compressors available as oil-flooded or oil-free.

Air recievers, air dryers, fuel tanks, blowers and gas generators specifically designed for rental allowing versatility and transport protection.

02

AIRMAN compressors customised to mine-site specifications as standard.

04 AIR TREATMENT & SPECIALIST EQUIPMENT

CAPS offers mine-spec skid packages as standard to better accommodate safety and performance in extreme conditions.

Quality AIRMAN generators from 100-300kVA are built tough and easy to use and maintain.

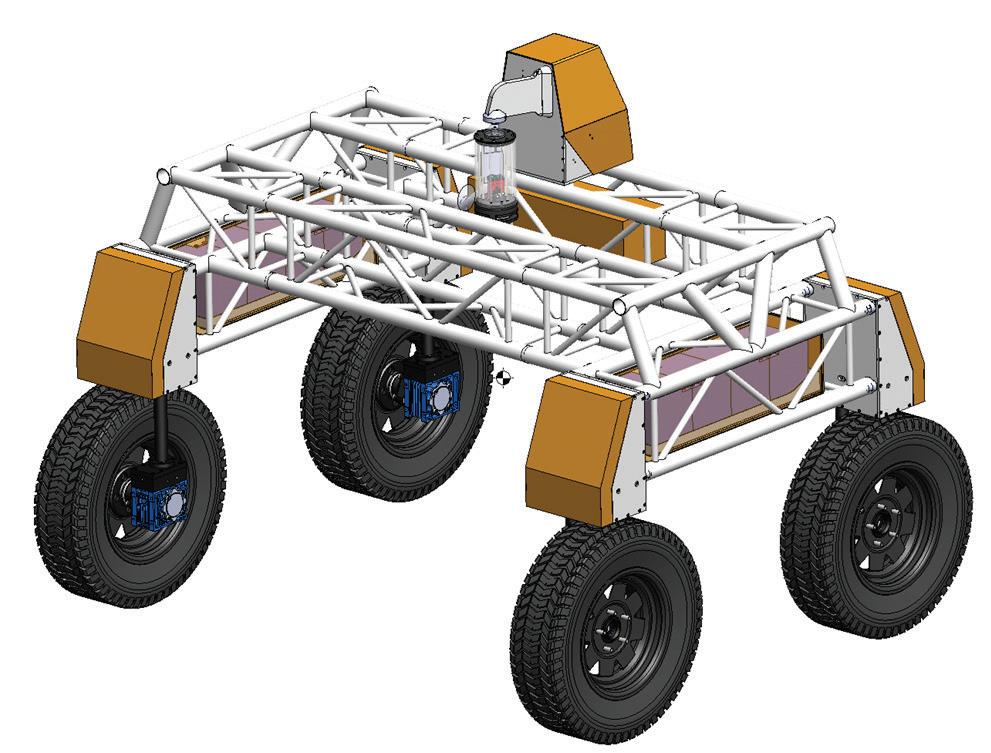

It is hard to believe that less than 20 years ago there was very little automation on even the world's largest, most complex mines. The resources sector of today is a pioneer in the development and adoption of robotics, automation, and artificial intelligence systems, and while much has been achieved there is still much more to be done.

The transformation of this sector since the mid2000s, to its position today as a global standard for industrial field robotics and automation, is truly remarkable.

Perhaps less well-known is that Australian innovation, scientific breakthroughs, and industry research collaborations with Australian universities have been a significant driver of this transformation. These achievements are proof that Australia does not need to be a passenger in global innovation but can instead be a leader in the development and export of robotic and automation technologies.

In the early 2000s, academics at the Australian Centre for Robotics (ACFR) at the University of Sydney, made groundbreaking contributions to a technology known as Simultaneous Localisation and Mapping (SLAM). SLAM gives a robot the ability to reconstruct the physical world around it in real-time and orient itself within that reconstruction – much like humans do every day, navigating and operating within their surrounding environment.

Until this point, robotic systems in industry had been largely confined to structured environments, like factory floors, where the scenario and tasks are controlled and predictable. The development of SLAM meant robotic systems could now interact with the unstructured ‘real-world’ and led to an explosion of Australian innovation in industry, with the most notable being in the resources sector.

In the mid-2000s, ACFR academics published a series of papers articulating the vision of an autonomous remotely operated mine. These seminal works and engineering contributions left a lasting legacy and helped propel the Australian mining industry to the forefront in terms of technology investment and adoption.

These innovations also led to an enduring industry research partnership – the Rio Tinto Centre for Mine Automation (RTCMA) between Rio Tinto and the ACFR, which formed in 2007 and is still around 15 years later.

Through this partnership, ACFR researchers and Rio Tinto Engineers have pioneered numerous industry-leading innovations. In the robotics and automation of physical assets, the group has developed autonomous drills, light vehicles, surveying platforms and geological data collection tools. At the fleet level, autonomous train scheduling, truck dispatch systems, haul-road network mapping and material movement planning across a complex mine network.

The proprietary Mine Automation System, or MAS, fuses data from disparate vendors and internally-developed systems to provide a centralised, real-time source of truth, allowing observations of the activities in the mine and providing analysis, insights and support for intelligent decision-making from across the globe.

Professor Ian Manchester, Director, Australian Centre for Robotics; Director, Australian Robotic Inspection and Asset Management Hub. School of Aerospace, Mechanical and Mechatronic Engineering, University of Sydney, and Dr Andrew Hill, Director of the Rio Tinto Centre for Mine Automation, Australian Centre for Robotics, University of Sydney

Data fusion has also been employed in orebody modelling, using probabilistic models to combine complementary datasets as they become available, providing more accurate representations of ore bodies aiding in the planning and design of mine pits.

These innovations only scratch the surface of what is possible.

Striving for completely autonomous operation

It is worth noting for the purpose of this article, that while automation in the resources sector is considered a global standard, we are still very much at the beginning of this journey. We are still yet to meet the inflection point where mines are wholly designed for automation, rather than the incremental automation of processes in a value chain previously undertaken by people.

In other words, a way of looking at mine automation for much of the past two decades is that it has centred on automating equipment that was designed for humans. But what does a mine and its equipment look like if it is designed for completely autonomous operation from inception?

The various answers to this question involve radically different operational modes, safety considerations, and more specialised and efficient equipment.

A popular example of this we use at the ACFR is haul trucks. On first impression one might assume that these tremendous vehicles are as large as they are because it is the most effective way to transport large volumes of crude unprocessed material, but this is not the case. They are large primarily to cater to the constraints of a human operator workforce. Namely, this is a highly-skilled but small workforce creating a potential bottleneck or a point of critical failure, should enough drivers be unavailable simultaneously.

To ensure there are no disruptions to throughput, larger trucks are required to cater to the economics of a small workforce. But if these trucks and other related load and haul equipment are no longer operated by humans, do they still need to be this large? The answer is ‘No’.

When we think about a fully autonomous haulage fleet the economics actually favour a smaller vehicle as they have standard dimensions and standard parts, are easier for mechanics to maintain and can drive on standard sized roads that require less maintenance.

When we think like this about the future of mining, examples abound.

Major assets – such as those found on mine sites – require constant inspection, maintenance and repair. This work is almost exclusively done by people and for major industry, this means a whole suite of considerations need to be accommodated into asset design.

Important elements need to be accessible not only for inspection, but designed in such a way that they can be safely repaired by an operator. Stairs, railings, safety cages and restricted areas add a layer of complexity to an operation that would not be required if operations were fully autonomous. Furthermore, many operations have such large safety exclusion areas that they must be completely stopped and isolated to just facilitate visual inspections by operators.

For a mine the scale of those found in the Pilbara, this work stoppage can rapidly accrue millions of dollars in lost production time, and inefficiencies up- and downstream.

There is a tremendous opportunity for future mine processing assets and facilities to be designed free of these safety constraints; where operations and robotic maintenance platforms are co-designed for a fully automated, more efficient system.

The ACFR is leading the development of this novel technology in partnership with over a dozen industry partners, Queensland University of Technology (QUT) and Australian National University (ANU) through the newly-created Australian Robotics Inspection and Asset Management (ARIAM) Hub. ARIAM was created to address the impending post-war ‘infrastructure cliff’. As major assets approach the end of their life it is becoming increasingly clear the development of novel robotic and intelligent systems will be essential to their management, now and into the future.

This is also true for the resources sector where mines operate on the timescale of decades, requiring constant inspections and maintenance, as discussed above. ARIAM partners like Nexxis, Abyss Solutions, Emesent and partner resource companies are working to develop novel robotic systems for asset management that take humans out of harm's way, providing more regular and reliable inspection data in the process.

An area ARIAM is focusing on where we see tremendous innovation potential is ‘whole-of-operations’ optimisation and decision-making for large, dynamic industries such as manufacturing, construction, shipbuilding, transport, and the resources sector to name a few.

Mines such as those found in the Pilbara, and their downstream supply chains, are of a size and complexity so vast it is simply not possible for human based decisionmaking across all aspects of an operation to result in efficient production and utilisation of resources.

Mining operations are often segmented or ‘silos’, each with its own priorities. While segments do of course work together to achieve a main objective, without a comprehensive real-time evaluation of an entire operation and the state of each segment within the value chain, it is impossible to efficiently determine

operational priorities on a granular level at any given moment. For example, the goal of a load-haul operation in one area is to get ore out of the pit as quickly as possible. But if the grade is lower than expected, this will need to be blended with other material. The ‘local’ solution will be to move an excavator to adjust the blend, at the cost of productivity in this shift. But it may be more efficient to stockpile in another load-haul operation with a higher grade, elsewhere in the network of mines, or at the point of sale via penalties/discounts.

It is easy to see how inefficiencies can cascade downstream, compounding opportunity costs at every step. The globally optimal solution can only be determined if the entire value chain is well tracked and modelled, and sophisticated decisionmaking tools are developed to analyse the situation and potential range of actions. Robotics are essential to achieving this vision as a means of collecting the continuous, high-quality data these systems require.

Pushing to meet net zero

Optimisation will become increasingly important as we move into a decarbonised resources sector.

Rio Tinto, BHP, Fortescue and many other major resource companies have already committed to net zero by 2050. The significance of these commitments is perhaps underestimated, not only because the resources sector is responsible for such a large proportion of global emissions, but because the scale and complexity of such a transition is typically underappreciated.

Optimisation will be important; firstly because it will reduce energy consumption by minimising waste, but even more importantly because optimisation will support the design and operation decisions of future mines powered by a completely different energy matrix.

Current design and operations are based entirely on the availability of rapidly deployable energy produced by fossil fuels, but the assumption of constant nameplate power availability will not always hold with renewable energy supply.

So what does a mine powered by renewable energy look like and how does it operate? Can operations be scaled seasonally, daily, or even on the scale of hours to milliseconds, to minimise energy storage costs, or will the generation and transmission infrastructure dictate the schedule? How will the scale of energy infrastructure required be constructed in only a few years?

Optimisation is perfectly placed to help industry make these decisions when systems are complex and ambiguous. Additionally, automation will be a huge competitive advantage for the design, construction, maintenance, and material recycling of a renewable energy matrix. For this reason, the transition

of the resources sector to net zero is possibly the greatest opportunity for robotics, automation, and AI innovation.

Many of the opportunities mentioned so far will require additional steps as part of longer-term planning commitments and thinking, and these additional steps are no less exciting or important.

One such step that is central to the ARIAM mission is emphasising the value and need for broader, more comprehensive data collection and sharing when dealing with complex assets and operations. This is especially relevant to mine operations and essential to developing the mines of the future. We cannot optimise what we cannot model, and modelling depends on high-quality data.

Resource companies are amongst the biggest companies in the country and for some, the world. But when we compare data collection and utilisation practises with the world's largest tech companies like Amazon, Meta, Apple, Google, Microsoft and others, the disparity becomes clear. Although an extreme example between vastly different businesses, the analogy is valuable just the same.

These companies are famous for the amount of data they collect, how they value it, and use it strategically. The general principle is to collect as much data as possible, knowing that its value will become apparent as new analytics and products are developed. It is this mindset that has allowed Apple to develop the most sophisticated and efficient ‘just-in-time' supply chains in the world, where components from numerous manufacturers, or the subsequent iPhone or laptop, are stationary for no more than a few hours at any stage in the supply chain to the moment it lands in a customer's hand.

When we think of resources companies through this lens, they aren’t all that different – large, complex operations, with constantly competing priorities and objectives on a global scale. It is especially true given the timescales of mine operations, measured in decades. There is no reason the resources sector cannot operate in the same league as these tech giants, but in order to achieve this, the sector needs to embrace and value data collection the same way the technology sector has. At ARIAM we strongly believe robotics will be central to achieving this as they are the mediators between digital and physical worlds, simultaneously collecting data to construct digital twins of their environment, and using the insights derived from this data to take action in the real world.

It is an exciting time for robotics, automation and artificial intelligence in the resources sector. The sector has already been successful with its adoption of this technology, to the point that one would be forgiven for thinking it is ‘mission accomplished’.

In reality, what has been achieved is a solid foundation from which the mines of the future and all the novel technology that comes with it can be developed and that is something industry can be truly excited about.

The Australian Centre for Robotics (formerly known as the Australian Centre for Field Robotics) is Australia’s largest robotics group and is a global leader in robotics research. Our research tackles deep scientific problems in core robotics technology such as sensing and perception, mapping and insights, planning, control, modelling and optimisation, learning, complex dynamic systems, as well as their applications in complex cyber-physical environments. The ACFR has a long and distinguished history of delivering first in world robotics capabilities to major industry including in resources, agriculture, aerospace and freight logistics sectors. The ACFR is also the lead organisation for the new Australian Robotic Inspection and Asset Management Hub (ARIAM Hub).

It’s no secret that Australia’s mine sites are home to some of the harshest, most unforgiving conditions in the country. Mine site vehicles and equipment are on the front line of operations and often bear the brunt of the extreme temperatures, dusty locations and continuous operation.

Taking care of equipment and vehicles is key to prolonging life cycles and when it comes to maintenance it helps to take a proactive approach. Many in the industry understand and make the effort to protect against the wear and tear that vehicle exteriors suffer on Australian mine sites, but this foresight often comes at the expense of interiors.

Although providing a safe haven from the extreme outside environment, mine site vehicle interiors can very quickly deteriorate from frequent use.

Whether it’s fabric tears from gear rolling around in the back, stains from the countless coffees needed for shift work or bringing abrasive material and dirt inside from hopping in and out in dirty boots, vehicle interiors are often quick to look a little worse for wear.

Damage to vehicle interiors often requires expensive repairs and can have a serious impact on a vehicle’s resale value, costing thousands of dollars on sale day. Seat covers are a surefire way to safeguard against occupational wear and tear and an easy way to save money.

Proudly Australian-owned and made specifically for Australian conditions, Black Duck understands the unique demands of Australia’s mining industry. Operating in Western Australia – the heart of Australia’s mining industry – Black Duck prides itself on pioneering product development to ensure its premium seat covers offer vehicles the heavy-duty protection they need while still complying with all health and safety requirements. Offering seat covers in two tried and tested materials – Canvas and exclusive 4Elements – for a wide range of vehicle makes and models, the Black Duck team provides in-depth local knowledge and understanding of the unique and harsh Australian climate, meaning its products are designed and built tough to last.

The company’s top-of-the-range seat covers are tailor-made and practical, ensuring users retain access to buttons, levers, adjusters and cup holders – enabling full functionality without sacrificing productivity.

To ensure continued high quality and high performance, Black Duck’s seat covers undergo rigorous assessment and trials.

Seat cover fabrics and manufacturing techniques are tested against nationally-recognised methods for safety and performance. The covers are also airbag compliant, with all airbag-compatible patterns dynamically tested to ensure they suit a wide range of vehicles and allow for the unobstructed deployment of airbags in the case of an emergency.

Black Duck started as a family business in 1984, specialising in new and used furniture, automotive reupholstery, canvas swags and tarpaulins. The idea to do seat covers came from a local farmer who approached the family and asked if they could manufacture a seat cover for his tractor. The rest is history, with 2024 marking 40 years of serving the mining industry.