ENERGY AUSTRALIA

Welcome to the latest edition of ecogeneration

This issue lands as Australia’s clean energy sector accelerates into a defining decade. From electric vehicles to grid rewiring, the challenges are as immense as the opportunities.

We begin in Melbourne, where All Energy Australia once again gathers the world’s renewable leaders. This edition brings some extra details as delegates debate the next phase of EV infrastructure, the rise of real-time data in operations, and the role of international partnerships.

The conversation around transmission is sharper than ever. We look at why building new lines is essential to unlocking renewables, and how national providers are stepping up to deliver trusted and tailored services.

Victoria has released a 15-year roadmap, while a decade of investment is laid out for New South Wales – critical moves as states and Federal Government wrestle with the speed of the transition.

On the technology front, this issue tracks how innovation is reshaping the market. From a new entry into Australian storage to advances in back contact solar, the pace of change is undeniable. We also explore partnerships powering local supply chains, and how international players are adapting their strategies for the Australian context.

For installers, the magazine brings the latest product developments, including upgradeable inverter technology, flow-based energy solutions, and emerging devices designed to improve safety and efficiency on rooftops. Climate ambition remains a central theme: with 2030 targets looming, our contributors argue that delay is no longer an option.

This issue’s coverage reflects both scale and urgency. Transition is not only about megawatts and gigawatts – it’s about timing, trust, and the capacity of industry to collaborate across borders and sectors. Whether in the control room, on transmission lines, or on suburban rooftops, progress depends on clear strategy and bold investment.

The next decade will test Australia’s resolve, but as this issue shows, momentum is building – and the energy transition is no longer a distant ambition, but a very present reality.

Tim Hall ecogeneration Editor

Follow ecogeneration on LinkedIn

ecogeneration acknowledges the Cammeraygal people, traditional custodians of the land on which this publication is produced, and we pay our respects to their elders past and present. We extend that respect to all Aboriginal and Torres Strait Islander people today.

For the latest industry news, sign up for the FREE WEEKLY NEWSLETTER

Half of the Waratah Super Battery is now live, providing a critical “shock absorber” function for New South Wales’ highvoltage network.

The first 350 megawatt (MW) (700 megawatt-hour) tranche of the 850MW/1680MWh system has entered service ahead of full commissioning later this year.

Located on the site of the former Munmorah coal-fired power station, the battery is the most powerful utility-scale energy storage system in the world and the first of its scale used to increase network capacity.

Commissioned by the NSW Government through EnergyCo and operated by Akaysha Energy, the project is designed as a System Integrity Protection Scheme (SIPS).

The SIPS monitors 36 transmission lines in real time, ready to inject up to 700MW of guaranteed capacity within seconds of events such as lightning strikes, bushfires or major faults.

Paired generation agreements allow the control system to simultaneously instruct generators to reduce output, balancing load and frequency.

“This achievement is the result of a tremendous collective effort spanning our global business units across all areas such

as delivery, engineering, commercial and legal, technical integration, grid modelling, software, operations and trading,” said Akaysha Energy CEO Nick Carter.

Transgrid has delivered the SIPS control system – the largest and most advanced in Australia – and completed upgrades at 22 substations and four transmission lines to increase capacity.

“Specialist crews have also carried out upgrade work … to deliver additional energy to consumers when it’s needed,” said Transgrid CEO Brett Redman.

Once fully operational, the Waratah Super Battery will provide at least 1400MWh of

The gates have been thrown open for 3000 megawatts (MW) of new renewable generation and storage on Australia’s east coast.

A key section of the $3.3 billion HumeLink transmission project is now open to connection enquiries, providing a pathway for projects to access the National Electricity Market.

HumeLink, a new 500-kilovolt (kV) high-voltage line linking Wagga Wagga, Bannaby and Maragle, has achieved “considered project” status under the National Electricity Rules, enabling proponents to lodge formal applications to connect.

The $3.3 billion project includes 365 kilometres of new transmission lines and new or upgraded infrastructure at four substations.

“HumeLink is a once in a generation investment in Australia’s energy capability, increasing the amount of renewable energy that can be delivered to

the National Electricity Market, and helping move towards a net zero future,” said Transgrid Acting Executive General Manager of Network Jason Krstanoski.

“Once the project is connected to the network, it will unlock the Snowy Hydro Scheme expansion project, Snowy 2.0, which will provide an additional 2200 megawatts of on-demand energy into the grid – enough energy storage to power three million homes for a week.”

The new line will also open up direct connection opportunities for large-scale solar, wind, battery and pumped-hydro projects, improving supply resilience as coal-fired stations close.

Transgrid estimates HumeLink will deliver more than $1 billion in net benefits to consumers through increased access to lower-cost renewable power.

Construction works are due to ramp up within weeks. Transgrid says it is offering industry briefings and free preconnection engagements to help fast-

usable storage.

The system can fully charge in two hours and discharge instantly, capable of supplying 970,000 homes for an hour or 80,000 homes for a day. Its oversizing allows for capacity degradation over time while enabling excess energy to be traded in the National Electricity Market, potentially reducing the cost of SIPS to consumers.

“This is the first of our projects to go into operation, and there are many more to come,” said EnergyCo Chief Executive Hannah McCaughey.

“We look forward to more milestones in our renewable energy zones this year.”

track connections and minimise delays.

“We are working hard to better support our current and future customers to make the connection process as seamless as possible… I encourage proponents of new renewable energy generators and energy storage facilities to start discussions with us to enable direct connection to HumeLink to support electricity generation growth and reliability as demand grows and coal-fired power stations retire,” Krstanoski said.

Samsung Construction and Trading (C&T) has secured the engineering, procurement and construction (EPC) contract for FRV on Australia’s largest battery storage project.

The Gnarwarre Battery Energy Storage System (BESS) reached financial close in August.

The 250 megawatt (MW)/500 megawatt-hour (MWh) facility in Victoria is designed to deliver grid-forming capability and firming services at scale.

Once operational, it will bring FRV’s total installed solar and storage capacity to about 1.4 gigawatts (GW). It follows the 100 MW/200 MWh Terang BESS currently under construction.

Samsung C&T will deliver the project as a “full-wrap” EPC contractor, providing vendor-agnostic, turnkey solutions.

The company said the contract “showcases our global capabilities in delivering complex, grid-critical energy infrastructure” and marks a “milestone moment” in its Australian market expansion.

The Gnarwarre battery will deliver grid-forming and firming.

The facility will integrate grid-forming inverter technology, enabling it to supply system strength and inertia services traditionally provided by synchronous generation such as coal and gas.

This functionality is a key focus of the Australian Renewable Energy Agency’s Large-Scale Battery Storage Funding Round, which has granted $15 million to the Gnarwarre project.

Financing was secured from a syndicate including Westpac, United Overseas Bank, Intesa Sanpaolo, KfW IPEX-Bank, and Export Development Canada.

The Clean Energy Finance Corporation supported the project during early financing stages before stepping aside when sufficient commercial funding was secured. Legal advisers were White & Case for FRV and Allens for the lenders.

FRV Australia CEO Carlo Frigerio said: “The financial close of Gnarwarre is a major step for FRV Australia as we expand our battery storage projects and strengthen our position as a leader in renewable energy in Australia. Largescale storage like this is essential to provide firming capacity that supports a reliable and clean energy system. This project also helps the State of Victoria reach its ambitious renewable energy and net-zero targets.”

Once complete, Gnarwarre will join FRV’s growing portfolio of integrated generation and storage assets, which includes nine operating PV facilities across Australia and New Zealand and two large-scale batteries totalling 350 MW.

The former Deputy Premier of Queensland takes the top role at the Clean Energy Council (CEC) at a pivotal moment in Australia’s energy transition.

With three decades in government, policy and reform, Trad brings significant experience to the peak body for the renewable energy sector.

The appointment was announced by the CEC Board in late August, with Trad to begin in October. Chair Ross Rolfe AO says the decision followed an exhaustive search.

“After an exhaustive executive search, the Board is pleased to announce Jackie’s appointment as the industry’s new CEO,” Rolfe says.

“The Board welcomes Jackie’s addition to the Clean Energy Council who will bring sophistication and focus to the organisation’s efforts as we deliver the new energy system that will power Australia into the future. Jackie brings a wealth of experience in building consensus across a wide group of stakeholders and a deep understanding of policy development and design.”

Trad succeeds Kane Thornton, CEO since 2014, as the sector faces pressure to accelerate project delivery while supporting communities and consumers through change.

“Jackie is also passionate about delivering a smooth and just transition ... to maximise the benefits … and minimise the adverse impacts on Australian consumers and communities,” Rolfe says.

As Deputy Premier and Treasurer of Queensland, Trad helped establish CleanCo, the state-owned renewable company launched in 2018 to expand low-emissions generation. She also allocated $250 million in the 2019 budget to support its growth.

Her record also includes steering reforms in mining rehabilitation law. The 2018 Mineral and Energy Resources (Financial

Provisioning) Act required miners to fund rehabilitation upfront and prepare closure plans – considered a world-leading move for environmental safeguards and community certainty.

“I am incredibly excited to be part of the Clean Energy Council – the leading voice for the companies and organisations delivering the clean energy infrastructure, generation and firming for Australia’s clean energy future,” Trad says.

“As someone with a long-standing commitment to action on climate change, I know we are now in an important period of delivery, where policy reform and impactful advocacy, across governments and within communities, is critical and necessary to achieve a successful jobs and energy transition for Australians.”

Shaping the sector’s next chapter

Her appointment signals continuity with the CEC’s push for clear, ambitious policy and pragmatic delivery. Stakeholders will look to her for outcomes on grid connection, planning approvals, workforce skills and investment certainty.

The CEC represents developers, retailers, manufacturers, investors and service providers across solar, wind, storage and emerging technologies. It advocates for stable policy, streamlined regulation and recognition of renewables’ role in energy security and decarbonisation.

Trad’s consensus-building skills could be critical as the industry addresses land use, community benefit-sharing and grid integration. Her work on mining rehabilitation reforms showed she could forge agreements between groups with competing interests.

Her appointment also comes as state and federal commitments push renewables in the National Electricity Market towards more than 80 per cent by 2030. Meeting those targets requires unprecedented investment in transmission, storage and generation. The CEC has long argued for stronger coordination and faster approvals.

For the CEC, the appointment reflects both ambition and pragmatism. The council has become one of Australia’s most influential industry groups, shaping regulatory debate, supporting workforce development and ensuring the sector’s voice is heard nationally.

Trad’s first year will be closely watched. Challenges include fixing grid bottlenecks, accelerating transmission investment, scaling up storage and equipping the workforce for record project pipelines.

The CEC must also manage community expectations, land-use tensions, and international competition for capital and supply chains.

With a background that blends policy, politics, reform and leadership, Trad steps in with the tools needed to meet these challenges. As Australia’s energy transition accelerates, her leadership should shape how the sector delivers on national renewable targets while ensuring jobs, communities and consumers remain at the centre.

We are completing our all-in-one package –with the Fronius Reserva. Our new battery storage system provides even more independence, more security, and more control. Scan here to find out more

Fox ESS has established itself as a leading force in Europe’s energy storage market and is now making a determined push into Australia.

Fox ESS, a Chinese-headquartered manufacturer of inverters, batteries, and electric vehicle (EV) chargers, and heat pumps, entered the Australian market in 2022 and is now expanding with intent. Founded in 2019, Fox ESS has grown at speed, securing recognition as one of Europe’s top residential storage brands.

According to Lyren Liu, CoFounder of Fox ESS, the company’s Australian expansion is “a statement of long-term commitment.”

“Australia has always been at the forefront of the global solar market, with the highest solar capacity per capita worldwide. Now, the market is rapidly shifting towards energy storage. As a comprehensive storage solution provider, Fox ESS sees this as the perfect time to expand strongly into Australia,” he says.

The timing is deliberate. With the Cheaper Home Battery Program rebate opening the

door for households to adopt storage at scale, Fox ESS believes it is entering precisely when the market is hungry for credible players.

The company’s expansion rests on three pillars: the right products, the right people, and the right structure.

Fox ESS offers a complete portfolio of battery storage solutions, from the stackable EQ4800-L series with capacities ranging from 9.36 to 41.93 kilowatt-hours (kWh), to the single-pack unit EP11 that can be expanded with up to four parallel units.

The company has also built a dedicated Australian team of 25, local warehousing, local sales, local technical support, and strong partnerships with distribution channels and installers.

This kind of groundwork positions Fox ESS to deliver in Australia as it has in Europe.

“We want distributors, installers and end

users to know that Fox ESS is here for the long term,” Liu says.

Not leaning on offshore call centres, Fox ESS has prioritised boots on the ground.

Eight engineers are based in Melbourne, three in Sydney, two in Brisbane, and one each in Adelaide and Perth. Another 10 experts provide remote support.

“The Australian market is very installerdriven, so we made it a priority to build a 25member nationwide team early on,” says Liu.

“This means when issues arise, installers can reach a local technical expert right away – often in person – ensuring faster resolution and minimal downtime.”

That responsiveness, he argues, will be a defining factor in building trust.

“Installers know support isn’t just a hotline, but a team that can stand beside them. This reliability gives them confidence to adopt and promote Fox ESS solutions.”

Battery design shaped by policy Australia’s subsidy regime has shaped Fox ESS’s product roadmap.

The EQ4800 and EP11 batteries, the company’s flagship models for residential users, were designed with the 50-kWh rebate threshold in mind.

Fox ESS believes aligning with Australia’s policy framework was essential to maximise customer benefits – both economically and for efficiency.

The EQ4800 can stack up to 41.93 kWh, while the EP11 scales to 41.6 kWh across four units, both comfortably under the policy cap.

Beyond compliance, the company stresses the emphasis on safety and longevity.

“We adopt multiple layers of protection –including temperature sensors, the dual relay design, and more – to ensure higher safety and reliability,” Liu says.

“More importantly, our BMS [battery management system] algorithm captures accurate battery cell condition data, calculates the optimised behaviour, and allows the battery to work at the most efficient condition, prolonging battery life.”

Fox ESS is not pitching storage in isolation. Its ecosystem includes inverters, batteries, EV chargers, heat pumps, and the ‘Fox Cloud 2.0’ energy management platform.

“With the ‘Fox Cloud 2.0’ artificial intelligence [AI] tool, we provide intelligent energy usage recommendations,” he says .

“Our full ecosystem – integrating inverters, batteries, and electric vehicle chargers – is designed to maximise overall

energy efficiency for Australian households and businesses. This holistic approach goes beyond what solar-only or battery-only providers can offer, delivering smarter and more sustainable solutions.”

This strategy reflects a global shift. In competitive storage markets, companies with integrated portfolios are increasingly favoured for the ability to simplify procurement and management for installers, while giving end users a unified app-driven experience.

One of the hurdles new entrants face in Australia is overcoming scepticism about warranty claims and long-term reliability. Fox ESS is tackling this directly.

“All our products come with a 10-year warranty,” Liu says.

“The battery cell warranty, based on energy throughput, is 20 per cent higher than the industry average, ensuring longterm reliability and peace of mind.”

For installers used to seeing brands arrive and exit, these signals matter. Fox ESS is betting that robust warranties, combined with visible service capacity, will help it sidestep the wariness that often greets new suppliers.

Another marker of seriousness is Fox ESS’s early move into virtual power plant (VPP) partnerships.

The company is already collaborating with four VPP solution providers in Australia, including Amber, Evergen, GloBird Energy, and Reposit, as well as nine distribution

network service providers.

“We plan to continue expanding our integrations in the future,” Liu says.

By opening its systems to aggregators, Fox ESS aims to future-proof its offer.

With state and federal policy leaning heavily into distributed energy resources, VPP participation will soon be an expectation rather than an option.

“It’s important to be open towards VPP providers and aggregators. We are willing to support local integration as well as cloud-tocloud integration,” Liu says.

This year’s All Energy Australia exhibition is not just another trade show for Fox ESS. The company has chosen the Melbourne event to signal to the market that its Australian story is only just beginning.

In Europe, Fox ESS has already established itself as a credible challenger to incumbents. Its A-Class rating from HTW Berlin and recognition by BloombergNEF as a Tier One battery storage manufacturer have reinforced its global profile.

Yet the company is entering a crowded field, where installer loyalty, warranty reputation, and policy compliance often outweigh glossy brochures.

By investing in local service capacity, tailoring its products to subsidy caps, and signalling long-term presence, Fox ESS is attempting to sidestep the pitfalls that have tripped up others.

The goal now is simple: to be seen as a brand that delivers on its promises.

Once reserved for high-end projects, Back Contact solar technology is now ready for the mainstream.

AIKO’s latest Back Contact (BC) solar panels promise higher efficiency, higher durability, better aesthetics –and mass-market affordability.

By stripping away complexity and slashing material costs, AIKO has made the new solar architecture viable at scale.

Back Contact in plain language

BC’s appeal has always been straightforward: no front busbars mean no optical shading, more light absorbed, and more current generated. With stronger passivation on the rear, lower resistive losses, and better thermal behaviour, the result is a design with major efficiency potential.

But those same strengths come with weaknesses. Traditional BC manufacturing required precision alignment across multiple complex steps, expensive photolithography processes, and wafer quality standards that made mass production a pipe dream. With heavy reliance on volatile silver pricing, the technology could only survive in niche, highmargin projects.

While much of the industry has made incremental improvements to Passivated Emitter and Rear Cell (PERC) and Tunnel Oxide Passivated Contact (TOPCon) architectures, AIKO saw an opportunity to rewrite the rules entirely.

“AIKO isn’t here to copy what already exists,” says Thomas Bywater, AIKO Country Manager for Australia and New Zealand.

“Our role is to set the pace – delivering technology that doesn’t just redefine efficiency but makes the industry’s best architecture accessible and affordable at scale.”

Breakthroughs in manufacturing

AIKO’s patented self-masked two-step passivation process has revolutionised BC cell production. By independently optimising the p-type and n-type tunnelling oxide and poly-Si layers, AIKO achieves world-leading passivation quality and greater than 27 per

cent cell efficiency in mass production. The streamlined process reduces contamination risks, boosts yield and removes scalability barriers.

Perhaps more transformative is AIKO’s complete elimination of silver from the manufacturing process. While traditional panels have relied heavily on this scarce metal, AIKO has developed a proprietary

copper interconnection system that delivers superior performance at a fraction of the cost.

“Copper actually is a better conductor,” says Bywater.

“So you don’t need as many solar cells and glass to make the equivalent amount of power.”

Beyond technical advantages, the shift

sustainable scaling without commodity risk.

Why now?

AIKO’s breakthrough arrives at a critical inflection point. Rising energy costs,

AIKO has expanded its impact across the entire energy ecosystem. Homeowners can generate more power from limited rooftop space, accelerating payback periods. For developers, EPCs, and commercial buyers,

this represents the first viable path to premium performance without premium penalties – delivering measurable advantages in project IRR, land utilisation, and long-

According to Bywater, putting “high tech into the hands of everyday Australians” helps homes and businesses generate more from the same space – and take more control

AIKO’s achievement extends far beyond a single product breakthrough. By proving back contact can be manufactured at scale and priced competitively with mainstream expectations across the entire industry.

At the same time, much of the solar industry has been slow to move. Many manufacturers have been focusing on datasheet wattage and lab-only claims of innovation. Panels got bigger, numbers on paper went up, but the underlying technology

“A lot of the manufacturers have been resting on their laurels… They’re not going to be able to keep doing that,” Bywater says.

The market has responded decisively. Industry analysts now project back contact architectures will dominate global solar production by 2030, with capacity forecasts reaching one terawatt. Manufacturers previously committed to TOPCon and heterojunction technologies are accelerating their own BC development programs.

AIKO will be showcasing its latest tech at All Energy Australia, including both black and white variants of its Infinite 3S and 3P panels, as well as a new 60-cell, 520-watt 2P module.

“We really encourage you to come have a look, come have a chat with our people,” Bywater says. “Record an interview for your solar business and show your expertise in doing your due diligence.”

He’s also hoping to see real discussions around stewardship and quality.

“We’ve got to really get behind recycling and stewardship. It’s going to be a painful transition… but if each panel has that same cost, no one’s disadvantaged,” he says.

By transforming back contact from laboratory curiosity to market reality, AIKO has elevated expectations across the solar industry. The company believes that innovation, scaled affordably and reliably, is now the proven path forward.

As Australia races toward decarbonisation, the nation’s energy sector faces a hidden risk: operational blind spots.

From distributed energy resources to tightening cybersecurity obligations, the sector’s complexity is growing.

Yet many operators still rely on legacy systems that fail to provide a complete picture of their assets and operations. The result is fragmented insights, slower decision-making and escalating risks that can cost millions.

For decades, utilities and energy providers relied on SCADA (supervisory control and data acquisition) systems, telemetry feeds and manual reporting designed for a different era.

Today, those systems are struggling to keep pace with the demands of electrification, AI (artificial intelligence)-led automation and modern compliance. The result is an industry in transition where field crews, engineers and executives are often forced to make high-stakes decisions with only fragments of the full picture.

This matters more than ever in 2025.

As infrastructure modernises, the ability to transform raw data into clear, actionable insights is fast becoming the foundation of operational excellence. Without it, efficiency falters, resilience erodes and compliance risks escalate.

When visibility is partial, operators face a series of cascading problems.

Alarm overloads pile up with no rootcause traceability. Faults escalate because systems are fragmented. Maintenance is triggered by time rather than condition. Long-term planning relies on stitchedtogether spreadsheets that fail to capture the bigger picture.

The outcome is slower reactions, higher costs and a greater risk of outages.

Four forces in particular are driving the urgency.

First is the rise of distributed energy resources (DERs), which require seamless integration to avoid creating fresh blind spots. Second is cybersecurity, where compliance with the Security of

Critical Infrastructure (SOCI) Act and Australian Energy Sector Cyber Security Framework (AESCSF) now demands real-time awareness and response. Third is decarbonisation, with environmental, social and governance (ESG) mandates requiring verified, near-real-time data for accurate emissions reporting. Finally, workforce constraints mean that as experienced operators exit, digital systems must carry more of the load.

The consequences of partial visibility are already clear.

A crew sent to repair a fault may discover it originated upstream, losing hours and risking safety. A minor alarm, unnoticed amid noise, can escalate into a major shutdown. Capital projects can be deferred or derailed because reports lacked the right context. These are not anomalies – they are the predictable outcomes of fragmented systems.

Solutions are emerging. Real-time asset visibility, enabled by digital twins and integrated SCADA, Internet-of-Things and edge devices, can provide a single source of truth.

Predictive maintenance, powered by AI analytics, allows failures to be forecast weeks in advance and addressed during low-demand periods. Cybersecurity by design, built into governance and aligned

with SOCI Act requirements, ensures 24/7 monitoring and compliance across both IT and operational systems.

Australian automation and operational technology specialist SAGE Group asserts that the pathway forward is clear: assess and align data flows, modernise SCADA and edge analytics, embed AI models at scale, and strengthen cybersecurity with continuous monitoring.

Collaboration – across operators, regulators and technology providers – will be essential to standardise protocols, upskill workforces and secure flexible funding models that match the pace of innovation.

In today’s energy market, visibility is no longer optional. Those seeking to close the gap will make better decisions, strengthen compliance, and lift output. SAGE Group emphasise that those who do not risk falling behind in a sector where resilience and agility define long-term success.

SAGE Group will showcase solutions at Stand BB127 during All Energy Australia, or visit www. gotosage.com to learn how turning noise into knowledge can deliver smarter, more resilient energy operations.

Raystech is Australia’s top renewable energy wholesale distributor. With an extensive portfolio of premium solar panels, inverters, batteries and EV solutions, we partner with leading global manufacturers to deliver trusted technology to the local market.

Raystech’s exclusive strategic partnership with LONGi brings the world’s leading solar technology directly to Australian installers and projects. Founded in 2000, LONGi is committed to being the world’s leading solar technology company, focusing on customer-driven value creation for full scenario energy transformation. Through this collaboration, Raystech provides unmatched access to LONGi’s premium, high-efficiency panels backed by global innovation and local expertise, including the new Hi-MO X10 module which delivers enhanced durability, higher power output and cutting-edge aesthetics to meet the demands of today’s solar market.

For more information about LONGi solar panels visit longi.com/au or raystech.com.au

Australians are turning to home batteries in record numbers, with integrated all-in-one systems reshaping how households generate and use power. PowerPlus Energy’s Whispr is one of the leaders in this shift.

For PowerPlus, the country’s largest rack-mounted battery manufacturer, the launch of the Whispr represents a defining step. Australian engineered, designed and supported, this true all-in-one home battery delivers simplicity, reliability and energy independence – all with quiet confidence.

For PowerPlus, the new home battery is more than just technology; it is the culmination of years building trust in the toughest conditions and a reflection of the company’s belief that energy independence starts with the Whispr.

The Kyneton story

When Barney and Carolyn, long-time residents of Kyneton in Victoria, looked to upgrade their solar system, they were already well-versed in the shortcomings of a fragile regional grid. Blackouts, brownouts and a five-day outage after a storm had forced them to rely on a noisy generator. They wanted stability and affordability.

“We’ve had panels for more than ten years,” Carolyn says.

“They worked well, but the impact on our bills wasn’t as strong as we hoped. With more outages happening, and new rebates for batteries, it felt like the right time to reinvest.”

The couple turned to Matt Wilson from Central Spark Victoria, their local installer, who recommended the Whispr.

“The fact it’s from an Australian company gave us confidence. We wanted something we could set and forget,” Barney says.

For Matt, the decision was clear.

“The Whispr sits in a sweet spot – 13 to 35 kilowatt hours of storage, slimline, modular and flexible. It’s perfect for a standard Australian home. And because PowerPlus stands behind its products with real local support, we know if anything happens, the homeowner will be looked after,” he says.

Heritage meets the home

Shane Pollard, Executive General Manager of PowerPlus Energy, says Whispr represents the company’s shift into the mainstream.

“Our background has been in off-grid, commercial and industrial projects. We’ve proven our products in harsh environments, and the challenge was to make something that looks and feels like a household appliance but still carries that durability,” he says.

That durability is born of experience. PowerPlus batteries already underpin hundreds of off-grid systems across Australia. The Whispr takes that engineering heritage and repackages it for homes – a true All-inone that combines solar, maximum power point tracking (MPPT), hybrid inverter, artificial intelligence, app monitoring and batteries in a streamlined unit.

Ease of installation was critical. Feedback from PowerPlus’ nationwide installer network – including Matt – shaped the Whispr from the beginning.

“It’s a two-way street,” says Shane.

“Our installers tell us what works in the field, and we listen. That’s how Whispr came to life – designed for the home, built for installers.”

Matt agrees.

“From an installer’s perspective, the modularity is a big win,” he says.

“One person can lift each battery module, stack it and lock it in place. Access to cabling is simple, weatherproofing is neat, and the monitoring app makes handover easy for homeowners.”

Smarter, quieter, easier to live with For Barney and Carolyn, quiet operation and simplicity mattered just as much as resiliency.

“Generators are loud and chew through petrol,” Barney says.

“The Whispr just runs. We’re not technical people – we need something that looks after itself.”

That ease is backed by intelligent software.

Every Whispr includes an AI-enabled app that lets households track usage, optimise consumption and, where permitted, participate in energy trading.

“The homeowner can bring up all the

information on their phone in a snapshot,”

“It gives Australians a chance to participate in a future grid, not just consume

It lives up to its name. With E-Capless Technology removing a common weak link in conventional inverters, Whispr runs with no fans and no moving parts, delivering quiet performance and reliable long-term operation with fewer points of failure.

“That’s why it’s called Whispr,” Shane says.

While battery manufacturing is a global industry, PowerPlus insists on a strong

“Australian engineered, Australian designed, Australian supported – that’s what defines us,” Shane says.

The company’s rack-mounted products are manufactured in Scoresby, Victoria, while the Whispr incorporates Australiandeveloped software and engineering smarts. Its patented battery management system, developed in Queensland, is now recognised internationally.

“This is what excites me most,” Shane says.

“Australia isn’t just following the world – we’re leading in areas like battery management systems and integrated design. That’s something we all should be proud of.”

The Federal Government’s battery rebate has supercharged demand across the industry, and PowerPlus has seen immediate impact.

“We’ve gone crazy – you can quote me on that,” Shane laughs.

Not only has demand spiked for Whispr, but also for PowerPlus’s rebate-eligible Eco4847P rack-mounted model.

“Our traditional products have benefited enormously. The whole nation is embracing what has been a very popular rebate,” Shane says.

Matt has seen the shift first-hand.

“With the subsidy, batteries have gone from a nice-to-have to a must-have. Discounts of up to 30 per cent make the Whispr and other PowerPlus systems affordable, and the payback period can be under five years. For regional customers especially, that’s transformative,” he says.

Support as strategy

Behind the technology, PowerPlus has built its reputation on service.

“We’ve invested a lot in making sure we’ve got people who can answer the phone and give reasonable answers to whomever calls, be those installers or homeowners,” Shane says.

It’s a philosophy that comes from his time

in the automotive industry.

“A salesperson sells the first car, but aftersales sells the second,” he says.

“It’s good business, but it’s also essential in this industry because these are complex items and more often than not, relationships are long-term due to the products’ long-term warranty.

For installers like Matt, that commitment is invaluable.

“We’ve worked with PowerPlus for years. Their support is two-way. If they need a trusted installer to help a customer, we’ll get the call. That’s why I’m comfortable recommending the Whispr – I know the backup is there,” he says.

For homeowners like Barney and Carolyn, the benefits go beyond bills.

“We freeze a lot of produce from our orchard and veggie garden,” Carolyn says.

“When the power goes out for days, you lose it all. That’s heartbreaking. Knowing the freezer

will stay on gives us real peace of mind.”

“Almost everything we do runs on electricity,” Barney says.

“To have that continuity means we can just get on with life.”

Recycling, regulation and the road ahead

As demand grows, Shane is realistic about the hurdles.

“Two things worry me. Recycling is a big one – Australia needs a clear plan for millions of tonnes of lithium batteries at end of life. The other is software complexity. Too many platforms and rules could stop systems working together,” he says.

Even so, he is optimistic.

“Integrated systems are already mainstream. This is the next phase – a chance for Australians to take part in the grid, not just rely on it. They won’t be at the mercy of fluctuating power prices anymore. That’s energy security,’ Shane says.

Matt echoes the sentiment.

“In regional areas, one storm can take out power for days. With a battery like Whispr, families barely notice. They keep living their lives,” he says.

“How do you put a price on that kind of security?”

From Kyneton to communities nationwide, the Whispr is showing how Australian engineering and support can redefine home energy.

True all-in-one, designed for the home and built for installers, it is helping households secure their power, stabilise the grid and embrace independence.

For Barney and Carolyn, the decision feels both practical and profound.

“It just makes sense,” Carolyn says.

“It’s affordable, reliable and Australian. We’re excited to see the difference on our next bill.”

For PowerPlus Energy, the Whispr is not just a product – it is a promise of a quieter, more resilient energy future.

Scan here to see testimonials from homeowners:

Australia’s clean energy market is evolving fast – with new incentives, tougher compliance standards, and rising demand for both home and commercial storage.

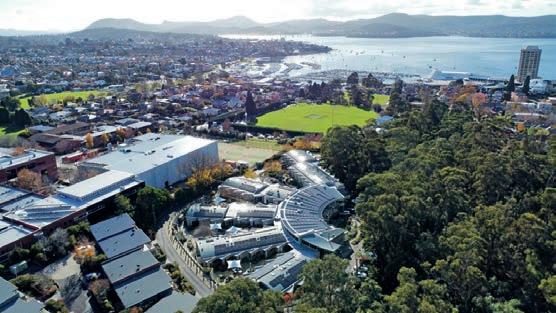

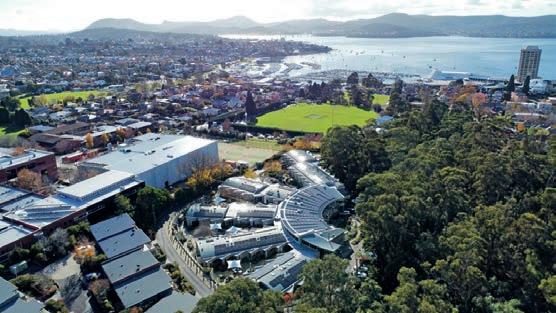

At this year’s All Energy Australia conference, Growatt will showcase a portfolio designed to evolve with Australia’s changing needs: three advanced inverter platforms that combine localised engineering with future-proof performance.

From single-phase hybrid workhorses to battery-ready commercial systems, Growatt’s new releases demonstrate a clear focus – giving Australian households and businesses more power, more flexibility, and more options for energy independence.

Battery-ready power for projects

For small to medium-sized commercial and industrial sites, Growatt’s new MID 10-30KTL3-XH battery-ready inverter offers a simple pathway from solar-only to full hybrid capability.

Installed first as a high-efficiency gridtied system, it can later integrate battery storage without major rework – a compelling proposition for businesses wanting to lock in today’s solar benefits while keeping upgrade options open.

To meet diverse Australian regulations, the 10 kilowatt (kW) MID 10KTL3-XH features a 9999 volt-amp (VA) power rating for Queensland compliance, plus an inbuilt Australian standard solution for Victoria and South Australia.

With only a smart meter needed for dynamic export limit functions, installers avoid the extra cost and complexity of separate controllers.

Three maximum power point tracking (MPPT) units, each with dual-string inputs, allow six photovoltaic (PV) connections in total.

High-current input support (16 A per string) ensures compatibility with the latest large-format panels, while DC-coupled battery charging minimises energy losses.

Built-in arc fault circuit interrupter (AFCI) protection, Type II surge arrestors, and an IP66 enclosure ensure reliable operation even in harsh conditions.

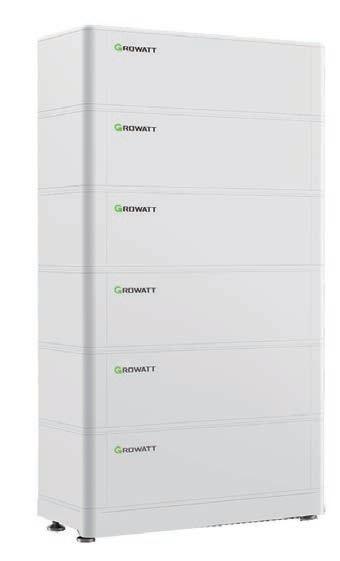

When paired with Growatt’s APX-S2 battery – expandable from 5 kilowatt-hours (kWh) to 60kWh, with the option to mix new and old modules – the system scales easily for larger energy demands. Up to nine inverters can be paralleled for 270kW inverter output and 540 kWh storage, serving larger commercial sites such as shopping centres and industrial plants.

All-in-one residential storage

For households, Growatt’s SPH 3.6-6KTLHUB inverter with an advanced lithium-ion phosphate (ALP) battery has been purposebuilt to leverage the upcoming Cheaper Home Batteries Program.

Since July 2025, eligible buyers have been saving up to 30 per cent on system costs through federal support, with additional state-based incentives in New South Wales and Western Australia.

Certified for the scheme, the all-in-one package delivers both upfront savings and ongoing returns via Virtual Power Plant (VPP) participation.

The system has already proven itself in Australian conditions, with over six months of deployments and strong installer and homeowner feedback following an 18-month local co-development program.

Technical features include a 3.6-6 kW inverter, modular ALP batteries expandable from 5 kWh to 40 kWh, and an integrated smart meter.

The pre-wired design cuts installation time by half compared to typical setups. One-click diagnostics and built-in monitoring streamline commissioning and ongoing management.

With blackout protection, VPP readiness, and scalable storage, the system is positioned for today’s needs and tomorrow’s grid services.

For homeowners chasing lower bills and more energy independence, the timing is ideal – especially for those ready to act before rising demand stretches supply.

Hybrid systems for high-power homes

Growatt’s SPM10KTL-HU pushes the limits of single-phase residential hybrid performance.

Designed specifically for Australian grid rules, it delivers 9990 VA output with three MPPTs optimised for high-current modules. Two trackers accept 16 A each, while the third handles dual parallel strings at up to 32 A – giving designers exceptional flexibility. Where most single-phase hybrids max out at around five kW for charging or backup, the SPM10KTL-HU doubles that figure, offering 10 kW in both modes.

This means batteries recharge faster while still powering heavy household loads, enhancing both daily energy use and outage resilience. With two times DC/AC ratio, it can charge at 10 kW and export or run loads at another 10 kW simultaneously.

An integrated Automatic Transfer Switch

ensures instant switchover during grid loss, and generator compatibility extends its off-grid appeal. AC or DC coupling allows retrofits as well as new builds, and up to six units can be paralleled for 60 kW total capacity – a rare option for large single-phase sites.

When matched with the ALP-E2 battery range, the inverter can fully exploit its high-power capability both on and off-grid. A 10-year warranty covers both inverter and battery, and compliance with Australian common smart inverter profile (CSIP-AUS) standards ensures easy VPP integration and grid support participation.

Viewed together, these three systems highlight Growatt’s push to cover every major segment of Australia’s solar-storage market. Each is tuned for local distribution network service provider (DNSP) requirements, with built-in CSIP-AUS support and future-oriented features like VPP readiness.

Battery scalability is a recurring theme – from the modular ALP home

systems to the APX-S2’s commercial-scale flexibility – reflecting a market shift toward staged energy upgrades rather than one-time installs.

Compliance integration is another differentiator. By embedding grid-interaction and export-limit capabilities in the inverter firmware, Growatt reduces the need for extra controllers and cabling, simplifying installation and reducing costs.

For installers, that means less time on site and fewer points of potential failure; for endusers, it is a cleaner, more reliable system.

Growatt will attend the All Energy Australia conference to present its latest inverter and battery technologies for both residential and commercial applications.

The event will provide an opportunity for industry professionals, installers, and energy users to learn more about the MID 10-30KTL3-XH, SPH 3.6–6KTL-HUB, and SPM10KTL-HU systems, along with its compatible battery solutions.

Attendees will be able to speak directly with Growatt representatives to discuss

technical specifications, compliance features, and system integration options relevant to Australian conditions and regulations.

Australia’s clean energy growth is being driven by both performance demands and the need for regulatory compliance. Solutions that are flexible, scalable, and designed to integrate smoothly with evolving grid requirements will be crucial in the next phase of adoption.

Growatt’s portfolio combines localised engineering with modular storage options and advanced inverter capabilities, enabling customers to start with the capacity they need now and expand over time.

This approach supports both immediate savings and long-term energy resilience for homes and businesses.

Growatt will be exhibiting at Stand R135 at All Energy Australia 2025, October 28 to 30, at the Melbourne Convention and Exhibition Centre.

As grid reliability declines and household energy costs surge, more Australians are turning to decentralised energy solutions.

Australia’s energy landscape is shifting fast. With electricity prices fluctuating, rooftop solar uptake rising, and blackouts becoming more frequent, households are seeking more control over their energy use.

For many, the answer lies in smart home storage – and BLUETTI’s EP760 is leading that charge. This scalable, all-in-one energy storage system is designed to put power back into the hands of consumers, supporting everything from self-consumption and blackout protection to full off grid living.

The EP760 is an all-in-one energy storage ecosystem purpose-built for Australia’s unique solar profile and policy environment. Fully approved by the Clean Energy Council (CEC) and eligible under the Cheaper Home Batteries Program, it delivers not only technical performance but also economic viability – offering up to 29.76 kilowatt-hours (kWh) of scalable storage across its stackable B500 battery modules (4.96kWh).

“Making clean energy accessible to everyone has been our mission since day one,” says Tiger Han, BLUETTI spokesperson.

“With our EP760 home battery, you can store solar power for self-consumption, lower your bills, and maintain power during outages. It’s designed to give households true energy independence with confidence and ease”.

The EP760 reflects a broader shift toward distributed energy resources (DERs). BLUETTI positions its system as not a just a storage unit, but a catalyst for the decentralised energy model. Households can operate on-grid, off-grid, or within Virtual Power Plant (VPP) networks, offering enormous flexibility.

The system features a built-in hybrid PV inverter, which means it can either be retrofitted to an existing rooftop PV system (AC coupling) or directly connected to solar panels in a new installation (DC coupling). And its hybrid inverter delivers up to 7.6 kilowatts (kW) of rated output power, backed by three independent maximum power point tracking (MPPT) inputs that can accommodate up to 15.2 kilowatt-peak (kWp) of solar array input.

Where BLUETTI separates itself

from traditional home batteries is in its design approach – particularly for the Australian landscape.

“Our solution features an all-in-one modular design, enabling users to flexibly stack battery modules to meet their specific energy needs,” Han says.

“Every system uses long-lasting LiFePO₄ cells, backed by an advanced battery management system and multiple safety certifications”.

The EP760 is engineered for reliability during peak demand and grid disruptions. Its IP65 rating makes it suitable for outdoor installation, while noise levels under 50 decibels (dB) ensure the system runs unobtrusively.

“Even households without solar panels can benefit by using a ‘Peak-Shaving’ strategy – storing low-cost electricity during off-peak hours for use during peak tariff periods,” Han says.

Subsidy synergy

Policy has played a critical role in driving uptake. As a CEC-approved, VPP-ready system, the EP760 qualifies under Australia’s

Cheaper Home Batteries Program.

This offers a 30 per cent discount on battery systems between 5 and 100 kWh, significantly reducing the barrier to entry for households eager to decouple from the grid.

“Policy support is essential. Subsidies not only make systems more affordable but also give customers confidence to invest in renewable technologies,” Han says.

“This drives faster adoption across the country”.

The modular nature of the EP760 also future-proofs the investment. Homeowners can start with two B500 units (9.9 kWh) and scale up to six (29.76 kWh) as their needs change or energy tariffs evolve. The system is also certified under AS/ NZS 4777 and UL 9540A, among other global standards, making it compliant for widespread deployment.

Australia’s residential energy landscape is far from homogenous. BLUETTI reports strong interest from suburban solar adopters, as well as rural and off-grid communities. For these households, the company’s local warehousing, installer network, and 10-year warranty provide

additional peace of mind.

“Essentially, it’s anyone who wants to cut energy costs, improve reliability, and reduce reliance on the grid,” Han says.

Convenience, fast installation, and mobile app control also rank high on the reasons customers choose BLUETTI over competitors.

This versatility is particularly critical in a country as vast and climatically diverse as Australia. During extended blackouts, the EP760 can be paired with a generator to provide reliable overnight backup. In remote regions, the system enables true off-grid living, connecting directly to rooftop solar arrays and functioning without any grid input.

With more than 3.5 million users worldwide and over 700 patents across its research and development portfolio, BLUETTI has carved a niche as one of the most inventive players in the global energy storage space. The company’s Australian operations are expanding via local partnerships, improved logistics, and participation in major industry expos.

“Innovation is core to our mission,” Han says.

“We’re launching new products like the EP2000 three-phase system and the Apex off-grid solution, while increasing investment in AI-driven energy management”.

At the heart of BLUETTI’s roadmap is a simple but powerful vision: to turn every home into a mini power station – one that’s clean, resilient, and part of a broader, people-powered energy network.

The value proposition of the EP760 goes far beyond backup power. In a landscape where the grid is no longer the sole provider, systems like BLUETTI’s are redefining what it means to be energy secure.

They enable households not just to ride out power outages, but to participate actively in energy markets, reduce carbon emissions, and exert greater control over their energy destiny.

From its LiFePO₄ foundation to VPP integration, the EP760 is a blueprint for where residential energy is heading: smart, modular, decentralised – and designed for Australian realities.

Delivering expert electrical solutions for renewable infrastructure –from Solar PV and BESS to Wind, Hydrogen, VPPs, and next-gen energy systems.

HyperStrong is redefining Australia’s energy storage future by deploying advanced energy storage solutions tuned to various utility, commercial and industrial needs.

Australia’s energy storage boom is accelerating. According to the Clean Energy Council, six large-scale battery energy storage system (BESS) projects in the first quarter 2025 secured $2.4 billion in funding, adding 1.5 gigawatts (GW) capacity – Australia’s second-best quarter on record.

With federal policy now targeting 82 per cent renewables by 2030, dispatchable storage has moved from concept to critical infrastructure.

Against this backdrop, HyperStrong’s Asia-Pacific (APAC) headquarters in Sydney positions the company at the nexus of market expansion and tailored innovation.

Kevin Changbin Qiu, Senior Vice President of HyperStrong International, explains how the company intends to lead not just with energy storage systems, but with integrated storage solutions designed for Australia’s diverse landscape.

He says there is a clear shift beyond raw capacity.

“We built HyperStrong to deliver more than power,” Qiu says.

“In Australia, our focus is integrating storage with solar, microgrids, data centres, oil fields and mining areas under the ‘Energy Storage + X’ framework to serve various applications in different sites.”

Australia’s unique energy needs

Large-scale solar developments, mining and oilfield operations in remote regions, booming data centres, and grid instability across remote areas demand more than lithium-ion batteries alone.

Long-duration storage, virtual power plants (VPPs), and hybrid microgrids are needed to balance seasonal generation, support dispatchable demand and reduce reliance on ageing coal infrastructure.

Calls for longer duration batteries and pumped hydro projects like Snowy 2.0 hint at the scale required to keep the lights on in 2050.

Qiu says HyperStrong’s response is multipronged and client centric.

“We don’t just sell energy storage systems; we offer integrated solutions coupled with an artificial intelligence-empowered platform

for optimised performance and value,” he says.

“‘Storage + X’ means coupling BESS with solar and many other applications, providing load-shifting, grid auxiliary services, backup and more revenue sources in one package.”

He highlights partnerships forged since the Sydney office launch in 2024:

“We signed collaborations with Tesseract ESS and other partners in the APAC region to target commercial and industrial, and grid-scale projects in Australia. We also forged agreements with partners in Singapore and the Philippines to deploy utility-scale [energy storage system] ESS projects and electric vehicle EV [electric vehicle] charging plus storage projects in other parts of the market,” Qiu says.

HyperStrong’s footprint spans over 40 gigawatt-hours (GWh) deployed across more than 300 global projects, including major installations in Europe and Asia.

Some projects have been designed to act as

virtual transmission assets – storing surplus renewable energy to relieve grid congestion.

“In Germany,” Qiu says, “storage is increasingly being integrated directly into grid operations – supporting transmission stability, reducing congestion and deferring CAPEX [capital expenditure]. We believe that same approach will apply in Australia’s Renewable Energy Zones [REZs], where colocated storage can maximise utilisation of existing infrastructure.”

Indeed, Australia has designated multiple REZs across New South Wales, Victoria and Queensland to coordinate generation, storage and transmission infrastructure rollout.

“Our experience in high-density REZ environments in China and Europe teaches us how to co-optimise location, timing and control strategies,” Qiu says.

“In Australia, that means deploying ‘storage + solar’ or combining mining microgrids with firming layers for remote operations.”

Earlier this year, HyperStrong unveiled its “Energy Storage + X” models for multiple scenarios – grid-scale, commercial and industrial (C&I), data centre and remote industrial applications.

“Functions we have developed for Chinese microgrids – such as integrated solar-battery hybrid systems using AI-optimised dispatch –translate well to remote Australian mines or First Nations microgrid initiatives,” Qiu says.

In remote mining regions of Australia, unstable local grids, unreliable diesel supply

HyperStrong intends to deploy containerised or C&I storage units, for example, ESS products tailored for two to eight hour storage durations with coupling for solar plus storage application.

“Those products allow flexibility in deployment – scalable modules that can support a single mine camp or cluster multiple sites under one VPP,” Qiu says.

“They integrate with smart EMS [energy management systems] and AI technologies for predictive dispatch and peak shaving.”

“In remote and microgrid systems,

controls so that our systems can island safely and maintain power quality without grid support.”

He notes that storage remains vital to the national transition.

“We’re also working on utility-scale systems tied into REZ playbooks. Our German approach to virtual transmission is instructive: strategic placement of batteries to relieve grid congestion and support throughout,” he says.

The Capacity Investment Scheme (CIS) has been expanded by 25 per cent – adding underwriting for an additional eight GW of generation and storage capacity, with dispatchable projects eligible for revenue-sharing contracts. Reports indicate consistent growth in storage project finance and construction pipelines throughout this year.

“This policy certainty matters,” Qiu says.

“Investors and offtakers want predictable revenue frameworks. Our ability to propose AI-optimised storage systems that can deliver frequency control, arbitrage, and piling firm capacity positions us well for CISsupported tenders.”

Qiu cites Victoria’s REZ targets: up to 6.3 GW of storage by 2035, co-located with REZ generation hubs. He says HyperStrong is advancing designs for mid-size storage nodes that can serve multiple contracts seamlessly.

The result, he suggests, is dual value: Australia gains resilience and firming capability; HyperStrong embeds deeply into the Asia-Pacific region’s evolving energy ecosystem.

Challenges and local integration

That opportunity comes with hurdles.

Planning pathways for BESS remain inconsistent across regions, and community concerns persist – particularly around safety and land-use issues in local planning zones.

“We design systems to meet AS/NZS safety standards, and our TüV-certified ESS, certified in Europe, North America and Australia to AS/NZS standards, demonstrates our commitment to safe operations,” Qiu says.

“We also work closely with local stakeholders to ensure community trust and transparency. The company is also planning a large-scale burn test as part of its safety validation program.”

HyperStrong’s Sydney-based team is working through local certification and engagement.

Its five MWh ESS product received TÜV Rheinland certification to AS/ NZS standards in 2024, now underpins deployments in Australia and the AsiaPacific region.

Qiu projects storage demand across the region will accelerate through to at least 2030.

“With 40 GWh deployed globally, we’ve built unmatchable know-how. APAC’s markets – from Indonesian industrial zones to Australian remote campuses – will lean heavily on hybrid systems,” he says.

“‘Storage + X’ gives us flexibility to tailor across use-cases – ancillary services, diesel substitution, desalination support.”

He forecasts lessons from Europe and China – especially grid-stabilisation schemes, revenue stacking, and remote microgrid ops –will prove essential across APAC markets.

Australia’s energy evolution demands storage systems that do more than hold charge. HyperStrong, led locally from Sydney and drawing on global experience, is positioning itself to deliver solutions aligned with remote, hybrid and grid-support needs.

With technical roots in grid-form services, strategic policy alignment and growing local collaborations, the company is forging a new path to make its mark in a market hungry for capacity.

Modular and upgradeable systems have become an excellent answer to the question of ‘what’s next in household energy?’

When Fronius launched its GEN24 inverter in Australia three years ago, the market was not yet buzzing with battery rebates or urgent conversations about grid independence. The company had to build for a different timeline.

“In 2020, we saw an opening in the market – people who wanted to take control of their home energy,” says Joel Atkins, Head of Sales at Fronius Australia and New Zealand.

“The battery costs were still a hurdle, but we realised we could give customers the option to take that step later without starting again.”

The GEN24 was designed to do just that.

As a standard photovoltaic (PV) inverter it manages solar generation for a home, but with a software upgrade it transforms into a hybrid system ready to connect to battery storage – no rewiring, no hardware replacement, no waste.

That foresight is paying off now.

With the Federal Government’s Cheaper Home Batteries Program reducing the cost of home storage systems by around 30 per cent, early adopters of Fronius equipment are already poised to take advantage.

“We’ve seen a fourfold increase in GEN24 upgrades since the rebate was announced,” Atkins says.

“The customers already have the inverter, the data, the hardware – it’s just a matter of software and a battery install.”

There are over 65,000 GEN24 units installed across Australia and New Zealand. Many of these were sold as standalone PV systems with the promise of future batteryreadiness – a promise now proving to be worth its weight in lithium.

For Fronius, the upgrade path is part of a deep sustainability ethos rooted in the company’s 80-year history.

“Fronius started in 1945 by developing battery chargers to stop car batteries from going to waste,” Atkins says.

“That same philosophy – of extending

product life, not discarding it – runs through everything we do, including the GEN24.”

That focus on longevity is as technical as it is ethical.

The GEN24 uses active cooling – a rare choice in the industry, where passively cooled inverters are more common due to lower manufacturing costs.

“We use a mechanical fan and a specially designed heat sink to keep the inverter cool,” Atkins says.

“That means we can maintain peak power performance up to 45 degrees ambient temperature. There’s less stress on the components, and you don’t lose efficiency during heatwaves.”

This choice costs more upfront, but

according to Atkins, it dramatically extends the life of the unit and preserves its performance in harsh Australian conditions.

“Longevity is part of sustainability,” he says.

“A five-year product that needs replacing isn’t a green solution.”

The installer’s perspective

For Matt Williams, General Manager at GI Energy with over a decade’s experience in solar, reliability is crucial.

“It’s imperative,” Williams says.

“We’ve seen so many manufacturers come and go. If a product fails, we need to know it’s going to be supported, and that it won’t come back to bite us.”

General Manager at GI Energy.

Williams says the GEN24’s dependability makes it a smart recommendation – not just for his customers, but for his own business risk. The fact that it can be upgraded with minimal disruption is a major bonus.

“It’s a much nicer conversation when you’re not telling a customer they need to pull out a perfectly good inverter,” he says.

“With the GEN24, we can add a battery seamlessly. There’s no waste, no confusion –it’s just a clean upgrade.”

With the new rebate sparking a surge in customer interest, Williams says his team has been flat out with inquiries.

“I’ve never seen anything like it,” he says.

“The number of calls is off the charts. We knew this would be popular, but it’s still blown us away.”

That demand is now moving from the inbox to the installation queue.

For customers who already have a GEN24, the process is relatively simple: check their usage and generation data, recommend a battery size, and activate the hybrid functionality through a software key.

“We try to keep it really straightforward,”

says Williams.

“We’ve done enough of these now that it’s become second nature.”

Timing is everything

One of the challenges now, both Williams and Atkins says, is managing stock and delivery logistics as the rebate drives uptake faster than expected.

But the upgradeable pathway has given both installers and homeowners a head start.

Many early GEN24 adopters have already accumulated solar usage data through their Fronius monitoring platform, allowing for smarter battery sizing.

“Without data, you’re guessing,” says Atkins.

“With data, we can model exactly what battery size is right for the customer and deliver a solution that genuinely supports energy independence.”

That data visibility is part of a broader strategy Fronius calls its “24 Hours of Sun” vision. The strategy seeks to enable energy self-sufficiency not only during sunlight hours, but around the clock through smart

generation, storage, and consumption.

“Our inverters manage production, our new battery handles storage, and our EV chargers optimise usage,” says Atkins.

“It’s a full loop, and the GEN24 is the heart.”

Reserva battery: The next phase

That loop will tighten further this year when Fronius launches its own home battery –Reserva. It is designed to work natively with the GEN24, giving Fronius full control over the inverter-battery ecosystem.

“Previously we partnered with BYD, which has been a great relationship,” says Atkins.

“But now with Reserva, we’ve developed the battery management system in-house. It improves commissioning, data analysis, and lets us push over-the-air updates in future.”

Williams says that integration is important – not just technically, but in terms of accountability.

“One manufacturer, one point of call,” he says.

“That’s a big deal when something goes wrong. You don’t want finger-pointing between brands – you want a fix.”

With the subsidy only applying to the first battery installation, Williams says his team is encouraging customers to think years ahead.

“We’re telling people: install the biggest battery that your budget and solar generation can support,” he says.

“You’ll only get the rebate once. And with more EVs, more electric homes, and the rise of virtual power plants, you’re going to want that capacity.”

The Reserva battery is expandable, but sizing correctly up front makes the most of the subsidy.

“There’s no one-size-fits-all,” says Williams.

“But there’s definitely a right-size-for-you. And with a GEN24 already on the wall, you’ve got a huge head start.”

Atkins agrees. While the current rebate has brought battery storage into focus, the broader shift toward energy autonomy is a long-term market transformation.

“This isn’t just a spike in demand – it’s a shift in mindset,” he says.

“People want control. They want resilience. And they want products that won’t end up in landfill.”

With GEN24 customers cashing in on a decision made years ago, the case for planning ahead has never been stronger.

A landmark distribution agreement between Raystech and LONGi is set to shake up how solar technology reaches Australian rooftops.

In late 2024, Raystech and LONGi announced an exclusive partnership: from 2025, Raystech has become the sole distributor of LONGi modules in Australia’s distributed market.

For Raystech, which has grown rapidly since its founding in 2019, the agreement is a major step toward becoming not just a distributor, but a key enabler of technology access across the national solar landscape.

For LONGi, one of the world’s largest solar technology companies, it signals a shift in how it wants to serve the Australian market – still with boots on the ground, but through a sharper distribution lens.

“Australia has always been an important market for us,” says Yang Hui, Marketing Manager of LONGi Solar Australia.

“But it’s fragmented. This partnership is about refining our delivery, simplifying the channel, and making sure the right customer gets the right product with the right support.”

Exclusive distribution agreements are rare in Australia’s solar sector. But according to Raystech Marketing Manager Sara Cheng, the timing made sense for both commercial and structural reasons.

“This is not just about selling more panels – it’s about setting up a system that can scale more intelligently,” Cheng says.

“Installers want simplicity, certainty, and speed. We’ve built our business around delivering those, and now with LONGi exclusively behind us, we can go even further.”

LONGi’s reasoning reflects a maturing view of what markets like Australia require, and how to play to strengths.

“You reach a point where more channels don’t mean more coverage – they mean more duplication,” Hui says.

“This gives us reach, consistency, and deeper alignment with a partner that knows how to operate efficiently at the local level.”

Central to Raystech’s pitch is its national warehousing and distribution footprint –one the company claims is unmatched by other Australian PV distributors.

Warehouses in every capital city, supported by regional nodes, allow for faster delivery and lower freight costs. That translates to reduced lead times and less project risk for installers.

“In many cases, we can deliver same-day or next-day, even to more remote sites,” says Cheng.

“It’s not just about stocking inventory – it’s about locating that inventory strategically.”

This logistical capability was one of the key factors in securing LONGi’s confidence.

“They’ve proven they can scale quickly without losing service quality,” Hui added.

“That’s critical when we’re introducing new technologies into the market.”

One of the first outcomes of the partnership will be the exclusive Australian launch of LONGi’s new Hybrid Passivated Back Contact (HPBC) 2.0 modules in early 2025. This includes its Hi-MO X10, with three powerful features: anti-shading, anti-heat and anti-dust.

The high-efficiency, HPBC series is designed for superior performance in residential and light commercial applications, with improved temperature coefficients and low-light behaviour. The Hi-MO X10 is characterised by its cell level bypass diode like design, giving the panels anti-shading functionality.

“It’s a product that rewards precision in installation and design,” says Hui.

“That’s why distribution matters – it’s not just getting it into hands, it’s getting it into the right hands, with the right training and support.”

Raystech plans to roll out accompanying installer education initiatives around the HPBC 2.0 launch, including tech briefings, continuing professional development webinars, and live demo events.

“We’re not just shifting boxes – we’re investing in the installer,” says Cheng.

“A smarter product deserves a smarter rollout.”

So far, the market response has been positive.

Some installers may have concerns about access – particularly those with relationships through other distributors – but Raystech and LONGi maintain that the transition will be managed carefully, with no disruption to aftersales service or warranty support.

LONGi’s local team in Sydney will continue handling product claims, technical queries and project support.

“Our support model stays the same – it’s just the channel that changes,” Hui says.

“We’re not stepping back from the Australian market; we’re stepping in more precisely.”

Cheng adds that Raystech’s existing relationships with installers across every state puts it in a strong position to absorb the change.

“We already have accounts in most metro and regional centres. The aim is to make this transition smooth, not sudden.”

The broader context

The exclusivity move also reflects broader shifts in the economics of solar distribution.

With margin pressure rising and project risk increasing, manufacturers and distributors are under pressure to eliminate friction and inefficiency.

“It’s about building in resilience,” says Hui. “Whether it’s freight costs, warehousing, or exchange rates, we’re always looking for ways to remove uncertainty from the value chain. Having a single, capable distributor helps us do that.”

At the same time, customer expectations are rising. Installers want shorter lead times, better technical advice, and streamlined claims. End-users want consistent performance and reliability. For Cheng, this creates a new role for distributors: less middleman, more integrator.

“Distribution used to mean shifting stock. Now it means managing risk, managing complexity, and managing relationships,” she says.

Raystech’s rapid rise has turned heads, even before the LONGi deal. In just five years, the company has gone from a newcomer to a recognised brand, twice named Australia’s Best Distributor by EUPD Research.

Many have wondered what is driving that momentum.

“Responsiveness, for one,” says Cheng. “We’re fast. We don’t over-complicate things. And we treat installers as partners, not customers.”

The company has also invested heavily in internal systems – digital ordering, logistics integration, and customer support platforms designed to reduce friction.

It’s this balance of local agility and operational maturity that helped seal the LONGi agreement, and that both companies say will underpin its success.

Both Raystech and LONGi stress that the partnership is not static. While it begins

with distribution, future steps may include co-marketing campaigns, joint technical development, and broader collaboration on installer training and digital platforms.

“There’s a lot of potential to align more deeply – whether it’s around product planning or market strategy,” Hui says.

“This is the start of something, not the finish.”

While the partnership is exclusive for now, neither party rules out further innovation in how solar reaches customers in Australia.

“The market is growing fast, but it’s also getting more complex,” says Cheng.

“We believe this model gives us the clarity, control and flexibility to meet that complexity head-on.”

The Raystech–LONGi partnership may not be the first exclusive agreement in Australia’s solar sector – but it is arguably the most ambitious. It is a bet on consolidation, clarity, and capability at a time when the industry is under pressure to deliver faster, cleaner, and more costeffective energy.

For installers, it offers a streamlined pathway to one of the world’s most trusted module brands. For LONGi, it’s a way to stay deeply connected to the Australian market without diluting focus. For Raystech, it’s a defining moment – moving from challenger to cornerstone in a national supply chain.

“We’re not just distributing solar,” says Cheng.

“We’re helping shape how solar gets done in this country.”

That ambition will be on full display at All Energy Australia 2025, booths JJ113 and PP123, where the companies will showcase the next phase in how solar is sold, supported and delivered across Australia.

What began as a consultancy navigating deregulation has grown into a market-shaping force in clean energy. Flow Power’s founder and CEO, Matthew van der Linden, is now aiming to rewrite the rules of retail electricity.

Fifteen years after launching Flow Power, Matthew van der Linden is still tackling the same challenge that inspired him at the start: a sector weighed down by complexity, inefficiency and poor transparency.

Over that time, the scale of his ambition has changed. From humble beginnings in energy management, Flow Power is now helping reshape how Australian businesses – and increasingly households – interact with energy, making consumption smarter, cheaper and more renewable.

“We started Flow Power as an energy management business in a newly deregulated market,” van der Linden says.

“Over time, we evolved from helping customers manage their load on the wholesale market to becoming a fully licensed retailer – and ultimately, a renewable energy generator too.”

Today, Flow Power supplies hundreds of commercial and industrial (C&I) customers

with access to wholesale energy, backed by a portfolio of owned and affiliated wind, solar and battery storage projects. However, its real innovation lies in how it delivers energy: with dynamic pricing, smart tech, and a deep commitment to education.

“Our vision is to build a retailer designed specifically for a 100 per cent renewable energy market,” van der Linden says.

“That means we’ve had to do many things differently – building our own hardware, writing our own software, designing our own products. Everything we do is focused on helping customers use energy more efficiently.”