VOLUME 117/6 | JULY 2025

VOLUME 117/6 | JULY 2025

Mine safety is about more than technology. Change management and data insights are important, too. Hexagon integrates systems for collision avoidance, operator alertness and vehicle intervention into your mining workflows. On top of that, we partner with customers to engage and re-engage operators in a cycle of continuous improvement.

Mining technology has come on strong in recent years, with surface operations becoming a playground for innovation. Automation, electrification and a new era of digitalisation are unlocking pioneering technologies, delivering enhanced production, safety and environmental outcomes for mining companies.

To celebrate the best in surface mining, the July edition of Australian Mining sees a range of METS companies – from OEMs to engineering firms to technology providers and contractors –showcase their offerings.

This includes Bradken, Caterpillar, Komatsu, MASPRO, RPMGlobal and Boom Logistics, among others, each discussing various solutions and methodologies that are pushing the boundaries of what’s possible.

Bradken graces the cover with its advanced mill liner technology in tow.

The company’s core strength lies in its ability to design wear liner products and digital solutions tailored to the unique operational needs of its customers.

Bradken is also prioritising sustainability, recently embarking on an initiative to recycle more than 2000 tonnes of unused mill liners.

Caterpillar discusses best practices for dozer operation, while Komatsu’s GD9557 motor grader is front and centre; with its power, accuracy and toughness underlined, this machine has been purpose-built for Australian mining conditions.

Elsewhere, Australian Mining spotlights Tivan, which is looking to develop Australia’s first fluorite mining operation, while five years on from Juukan Gorge, we look at how the country’s mining industry is working with Traditional Owners to avoid future incidents.

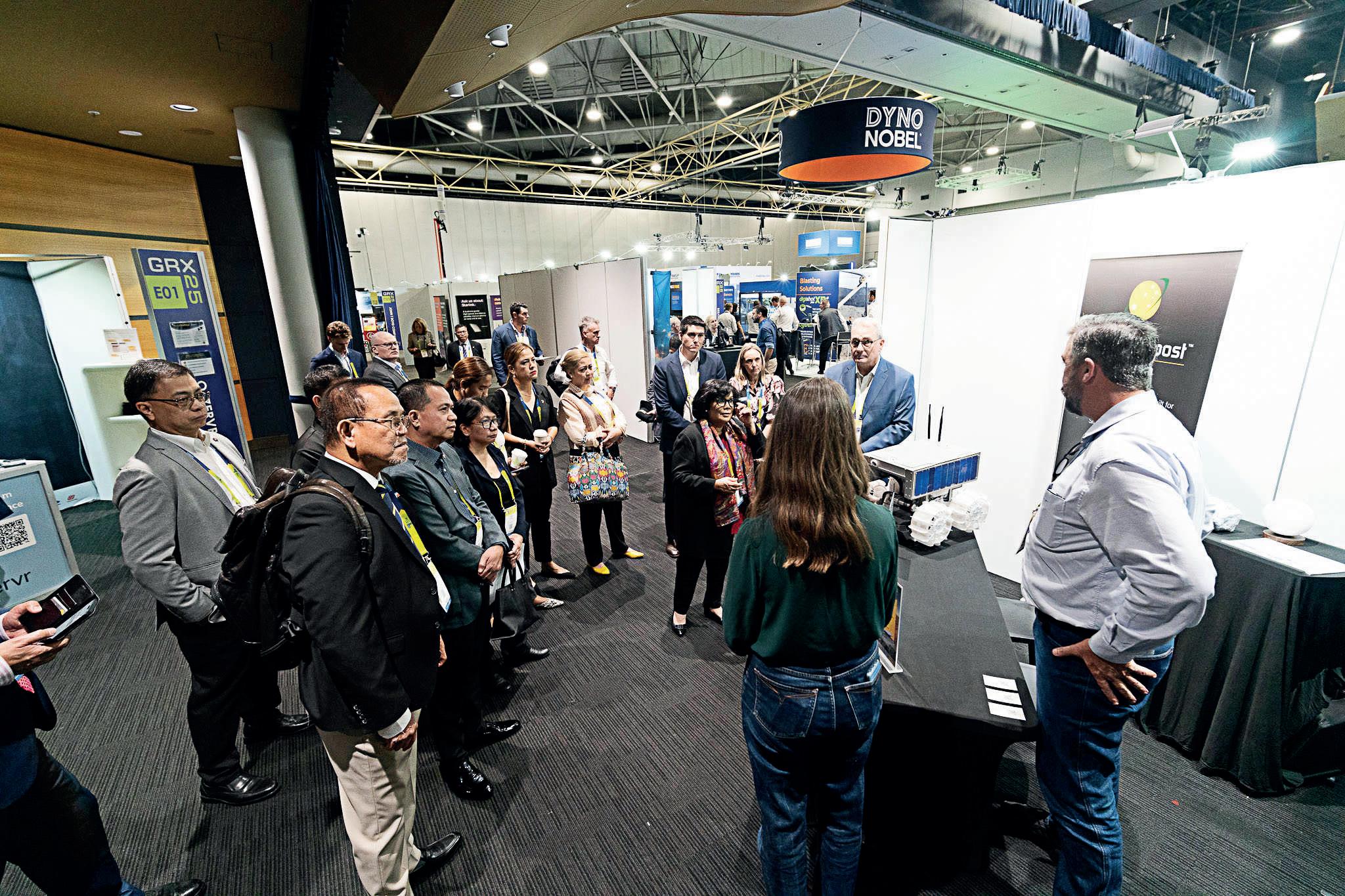

With Asia-Pacific’s International Mining Exhibition (AIMEX) returning in September, BHP has been announced as the naming rights sponsor of the AIMEX Mining Pavilion. Australian Mining takes a closer look at what’s in store for the event.

Other events in the spotlight include PNG Expo, WA Mining Exhibition and QME, and we wrap-up GRX25, which took place in Brisbane in May.

Happy reading.

years, supporting customers by adopting solutions to meet changing requirements. Its portfolio of mill liner solutions, including highperformance alloys and rubber-composite liners, ensures compatibility with a range of mining environments. Composite liners have become a standout Bradken solution, incorporating materials such as rubber, alloy, and cast inserts. These liners offer tailored resistance to specific wear mechanisms like corrosion, abrasion and impact, supporting high volume and throughput. Whether it’s improving service life, increasing uptime, supporting decarbonisation, or creating new value streams, Bradken continues to deliver cutting-edge solutions.

CHIEF EXECUTIVE OFFICER

JOHN MURPHY

CHIEF OPERATING OFFICER

CHRISTINE CLANCY

MANAGING EDITOR

TOM PARKER

Email: tom.parker@primecreative.com.au

JOURNALISTS

OLIVIA THOMSON

Email: olivia.thomson@primecreative.com.au

DYLAN BROWN

Email: dylan.brown@primecreative.com.au

ELIZA FREEMAN

Email: eliza.freeman@primecreative.com.au

Tom Parker Managing Editor

CLIENT SUCCESS MANAGER

JANINE CLEMENTS

Tel: (02) 9439 7227

Email: janine.clements@primecreative.com.au

SALES MANAGER

JONATHAN DUCKETT

Mob: 0498 091 027

Email: jonathan.duckett@primecreative.com.au

BUSINESS DEVELOPMENT MANAGERS

JAMES PHIPPS

Mob: 0466 005 715

Email: james.phipps@primecreative.com.au

ROB O’BRYAN

Mob: 0411 067 795

Email: robert.obryan@primecreative.com.au

ART DIRECTOR MICHELLE WESTON michelle.weston@primecreative.com.au

SUBSCRIPTION

Cover image: Bradken

A fluorite revolution

Tivan is leading Australia’s entry into the global fluorite supply chain, building an industry from the ground up.

12 SURFACE MINING

Smarter, greener liner solutions

Bradken is setting new industry standards by combining advanced mill liner technology with a strong commitment to sustainability and operational efficiency.

20 SURFACE MINING

Mastering mine shutdowns

Tier 1 contractor Boom Logistics has become a trusted partner in delivering safe, efficient

32 SURFACE MINING

For the long haul

The Haulmax 3900 series of trucks encompasses more than 25 years of Elphinstone experience and research in mining haulage applications.

34 INDUSTRY EVENTS

BHP heads to AIMEX

BHP has been announced as the naming rights sponsor of the 2025 AIMEX Mining Pavilion.

40 GRAPHITE

Charging the graphite resurgence

Quantum Graphite is poised to become a major supplier of high-purity, scalable graphite with its Uley 2 project in SA.

Reaping rich rewards

Hexagon Drill Assist increases equipment lifespan, enhances drill operator performance and improves blasting outcomes.

58 INDUSTRY PARTNERSHIPS

Spearheading drilling solutions

Master Drilling helped resolve engineering challenges at a gold miner’s operation with the help of two consulting firms.

76 INDUSTRY EVENTS

Leading the way at WIIA

Becky Felstead took home the Excellence in Mining award at the recent Women in Industry Awards in Melbourne.

KEEP UP WITH THE LATEST EXECUTIVE MOVEMENTS ACROSS THE MINING SECTOR, FEATURING RIO TINTO, FORTESCUE, EVOLUTION MINING AND PLS.

Rio Tinto chief executive officer (CEO) Jakob Stausholm is set to step down from his role in late 2025 after being at the major miner for seven years.

Stausholm joined Rio Tinto in 2018 as executive director and chief financial officer (CFO), before becoming CEO in January 2021.

“Under Jakob’s leadership, Rio Tinto has restored trust with key stakeholders, aligned our portfolio with the commodities where demand growth is strongest, built a diverse and talented management team and set a compelling growth trajectory,” Rio chair Dominic Barton said.

“Our focus on these things is undiminished and our strategic priorities are unchanged. This is a natural moment to appoint Jakob’s successor, as we look ahead to our next phase in which we will double down to deliver greater operational performance to realise the full potential of our assets.”

Stausholm has played a major role in shaping Rio’s strategy for the energy transition and laying the groundwork for a decade of profitable growth.

He will continue in his role and remain on the board while the company looks to appoint his successor.

“It has been an absolute privilege to lead Rio Tinto, one of the great mining and materials companies in

the world,” Stausholm said. “We have built on Rio Tinto’s historic strengths to deliver profitable, stable growth and significant shareholder value. I know the company will continue to thrive long into the future.”

Elsewhere, Dino Otranto has been promoted to Fortescue CEO of metals and operations, after previously being solely head of the company’s metals business. In this expanded role, Otranto will oversee global electrification, decarbonisation and hydrogen production.

“This new leadership cements our One Fortescue commitment to operate as an aligned team driving innovation, delivering value, and accelerating our transition to a successful and profitable green future,” Otranto said.

Agustin Pichot moved into the role of Fortescue CEO growth and energy on July 1.

“Fortescue has a clear and resolute vision to eliminate emissions and decarbonise profitably,” Pichot said. “In this unstable market where most others are wavering, the world is replete with opportunities. We are seizing on this instability to grow and harness new innovations emerging in green metals, energy and technology.”

The appointments of Otranto and Pichot coincide with the retirement of Fortescue Energy CEO Mark Hutchinson and chief operating officer Shelley Robertson.

In the gold sector, Evolution Mining has chosen Frances Summerhayes as its new CFO, taking effect in early September.

“I am delighted that Fran is joining Evolution and our leadership team as chief financial officer,” Evolution managing director and CEO Lawrie Conway said.

“It is an exciting time in our business as we deliver against our strategy and build a premier global gold company.

Joining us from BHP, Fran brings extensive experience and strong financial acumen and will be a welcome addition to our team.”

Summerhayes was previously BHP’s vice president finance for its Minerals Americas division for a little more than four years.

She also held the position of head of finance for BHP’s Iron Ore business and served in several other senior finance roles across the Big Australian.

With 20 years of industry knowledge and experience under her belt, Summerhayes brings international experience across a range of commodities, having worked throughout South and North America, as well as South Africa.

“It is a privilege to be joining Lawrie and the team at Evolution Mining, continuing to execute the strategy with a strong portfolio, disciplined capital allocation and unlocking long-term stakeholder value,” Summerhayes said.

Evolution isn’t the only miner experiencing a CFO change.

Pilbara Minerals (PLS) CFO Luke Bortoli is stepping down to pursue other opportunities.

The company said Bortoli will remain in his role during a transition period to ensure a smooth handover. At the time of writing, a formal search process was underway to identify Bortoli’s successor, with internal and external candidates to be considered.

PLS managing director and CEO Dale Henderson thanked Bortoli for his contributions during a pivotal period in the company’s growth.

“On behalf of the board and the broader team at PLS, I would like to thank Luke for his valuable contribution during his time with the company,” Henderson said.

“Luke has played a key role in strengthening our financial and operational platform during a period of significant growth and transformation.

“Notable achievements include securing the company’s $1 billion revolving credit facility and supporting the successful acquisition of Latin Resources, among other major milestones. We wish Luke all the very best in his future endeavours.”

Pilbara Minerals said further updates regarding the CFO appointment will be provided in due course.

Innovative designs focusing on power, efficiency, and operator comfort. Eco-friendly operations with smart connectivity for optimal fleet management.

Tivan Limited has rapidly positioned itself as a trailblazer in Australia’s emerging fluorite sector.

After a change of control two and a half years ago, Tivan quickly shifted focus from a struggling predecessor to a promising new critical mineral opportunity.

“We had to find a different project path quickly and we did that with the acquisition of Speewah in early 2023,” Tivan executive chairman Grant Wilson told Australian Mining

The company initially concentrated on the large vanadium and titanium resource at Speewah, located in northeast Western Australia, working on vanadium and associated minerals processing technology.

However, vanadium proved challenging to commercialise due to depressed prices and immature offtake markets.

A major turning point came when fluorite was added to Australia’s critical minerals list, a move that unlocked government grants and significant industry support.

“At the end of 2023 there was a really important announcement from Canberra, when fluorite was included on the critical minerals list,” Wilson said.

“We switched our priorities straight away and announced the Speewah Fluorite Project at the end of January 2024. It’s been our dedicated focus since that time.”

A strategic pivot Fluorite has never been mined in Australia at scale but its strategic applications in semiconductor manufacturing and electric vehicle batteries create major global demand.

Tivan’s existing relationships in Japan positioned it to capitalise on this opportunity.

“We recognised it has really important strategic use cases, principally in semiconductors and EV (electronic vehicle) batteries, as well as the shift in China’s profile from net exporter to net importer over the past decade,” Wilson said.

This led to a binding joint venture with Japanese trading giant Sumitomo Corporation, announced

in May, marking a major milestone for the company.

“It was a year-long journey to reach the binding joint venture,” Wilson said.

Having shifted its focus to the Speewah Fluorite Project, Tivan quickly secured support from the Australian Government.

“We were awarded the International Partnerships in Critical Minerals grant and major project status in early December of last year,” Wilson said.

“This went some way to legitimise fluorite in the eyes of investors. Like lithium 10 years ago, no one had heard of fluorite before.”

The Australian Government’s signalling helped close a perception gap, validating fluorite’s role in national strategies, including the battery initiative and energy transition.

“Major project status aids facilitation of key workflows, particularly environmental sign-offs, which can sometimes get caught up between state and federal jurisdictions,” Wilson said.

Wilson said fluorite’s strategic importance to Australia’s economy has

FROM THE GROUND UP.

grown significantly, particularly as the country looks to expand its role in global technology supply chains.

“Despite Australia’s success in mining, we have never been upstream of the semiconductor sector,” he said.

“Semiconductors are arguably the most important supply chain in the global economy and demand is escalating with the AI (artificial intelligence) wave.”

Tivan’s project will be the first Australian operation to directly feed semiconductor supply chains in Asia.

“Those supply chains are fragile and contested and we have the opportunity to play a pivotal role,” Wilson said.

EV batteries are another major fluorite market, with its elemental properties making it irreplaceable for battery performance.

“Fluorinated chemicals are in the separators, binders, anodes, pretty much everywhere in next-generation lithium-ion batteries,” Wilson said.

With China currently dominating the market, Australia’s emergence as a fluorite supplier could influence strategic supply chains.

TIVAN’S

historical occurrences,” Wilson said. It found Sandover near Alice Springs, a project that could surpass Speewah in grade and size. Early field surveys confirmed the project’s potential, and drilling is planned for October.

“It might become the most significant fluorite resource on the planet. We think it’s that important,” Wilson said.

“This gives us a unique commercial position in Australia’s critical minerals sector.”

Unlike fragmented lithium ownership, Tivan controls both major fluorite resources, having completed the acquisition of Sandover in March.

“That dominant position appeals to trading houses like Sumitomo, who want to work with companies that have strong capabilities and reputational standing, and that have long-duration assets,” Wilson said.

With Sumitomo having never previously invested in critical minerals, the joint venture is a landmark deal.

“It speaks to the strength of the project and our team,” Wilson said.

“It’s highly unusual for a major Japanese trading house to invest this early in a critical minerals project with a junior company.”

Tivan is now advancing a feasibility study for late this year, with definitive feasibility and final investment decision targeted in the third quarter of 2026.

With a footprint in Speewah and Sandover, plus a third exploration project in Timor-Leste, Tivan’s progress provides great potential.

“Our mission is to build a strategically important company across northern Australia,” Wilson said.

Tivan’s rapid rise and strategic partnerships position it as the leader in Australia’s first fluorite industry. With strong government support, international partnerships, and a clear pathway to production, Tivan is driving Australia’s entry into a critical global supply chain. AM

FIVE YEARS ON FROM JUUKAN GORGE, HOW DOES THE AUSTRALIAN MINING INDUSTRY WORK WITH TRADITIONAL OWNERS TO AVOID FUTURE INCIDENTS?

In May 2020, Rio Tinto was searching for iron ore at its Brockman 4 mine in Western Australia when it conducted a blast at Juukan Gorge, situated in the Hamersley Range within the Pilbara region.

The blast resulted in the destruction of Aboriginal heritage sites, including two culturally significant rock shelters.

The blast at Juukan Gorge took place after the Puutu Kunti Kurrama and Pinikura (PKKP) Traditional Owners advocating for its protection.

Since the incident, several changes have been made on operational and legislative levels to help ensure similar instances never happen again.

Operational change

Rio Tinto has also introduced measures to increase transparency in terms of its approach to cultural heritage protection via communities and social performance (CSP) practices.

Rio Tinto has at least 500 CSP professionals working on 60 operations across 41 countries.

“In 2021, the board conducted a joint exercise with the executive committee to learn the lessons from the destruction of

the rock shelters at Juukan Gorge, and the group’s response to the tragic events,” Rio Tinto said on its website.

Following the exercise, Rio Tinto committed to “promoting an inclusive, open and transparent culture that empowers people to raise and escalate concerns on operational and ethical issues” and “applying a more values-driven approach to guide decision making” through care, courage and curiosity.

The company also created a Juukan Gorge Legacy Foundation in 2022 to provide financial support to the foundation to progress major cultural and social projects and established a committee to facilitate communication about the desired rehabilitation of Juukan Gorge in 2023, among other initiatives.

Ahead of the five-year anniversary of the Juukan Gorge incident, the PKKP Aboriginal Corporation and Rio Tinto signed a co-management agreement.

Advisory group Jarden defines co-management as a Traditional Owner-led initiative that acts as a framework for mining companies and Traditional Owners to work together and collaborate in mine

exploration, planning, closure and rehabilitation. It sets out expectations and responsibilities for all project stages, and ensures mining companies have social licence to operate and that significant sites are protected.

The agreement between the PKKP Aboriginal Corporation and Rio Tinto is designed to ensure knowledge-sharing and joint design is at the heart of Rio Tinto’s iron ore operations on PKKP Country, allowing significant heritage to be preserved and co-managed.

“The effect of this agreement is that PKKP Traditional Owners will receive certainty that our important places on Country will be protected from mining, while at the same time Rio Tinto will receive certainty around where they can develop much earlier in the mine cycle,”

Pinikura Traditional Owner and PKKP Aboriginal Corporation chairperson Terry Drage said.

“Ultimately, this is good for us as Traditional Owners, and it is good for business.”

Rio Tinto chief executive officer (CEO) iron ore Simon Trott reflected on how the Juukan Gorge incident changed the company.

“Simply put, (the Juukan Gorge incident) should never have happened, and for that we will forever be sorry,” he said.

“Through the open and gracious sharing of knowledge and experiences, the PKKP have helped to shape a renewed approach to managing cultural heritage protection and mining activities.”

The First Nations Heritage Protection Alliance and the Minerals Council of Australia (MCA) are calling for the Federal Government to prioritise cultural heritage reform.

“Traditional Owners and the mining industry have done the hard work to find common ground and now it’s over to the (Federal) Government to honour its commitment to our people,” First Nations Heritage Protection Alliance co-chair Leon Yeatman said in May of this year.

“We may not agree on everything all the time, but on this, we agree it is time to act. These cultural sites are not only sacred to Aboriginal people; they should also be sites of national pride as proof of the world’s oldest continuous culture.

“The distress caused to the Puutu Kunti Kurrama and Pinikura People

THE MINERALS COUNCIL OF AUSTRALIA IS ADVOCATING FOR THE FEDERAL GOVERNMENT TO PRIORITISE CULTURAL HERITAGE REFORM.

by the destruction of the caves must be recognised and action finally taken so this cannot be repeated.”

Yeatman pointed to identifying those who speak for Country on a federal level as a good starting point.

“This will provide protection and certainty for community and industry so business can create new economic assets and opportunities while protecting our cultural assets,” Yeatman said.

MCA CEO Tania Constable said the mining industry has used the last five years to regain trust from Traditional Owners.

“There is broad agreement on the way forward, and we are now looking for the (Federal) Government to ... work alongside the MCA and the First Nations Heritage Protection Alliance to provide a once in a generation change and see this as a genuine opportunity for healing,” Constable said in May.

Legislative change

Rio Tinto CEO in May 2020, JeanSebastien Jacques, apologised for the destruction of Juukan Gorge and said the company would cooperate with the Northern Australia inquiry and support WA’s reform of the Aboriginal Heritage Act 1972, which was led by WA’s the Indigenous Affairs Minister, Ben Wyatt.

The Federal Government’s ‘Never Again’ report was released in December 2020, highlighting “the disparity in power between Indigenous peoples and industry in the protection of Indigenous heritage, and the serious failings of legislation designed to

protect Indigenous heritage and promote Native Title”.

Recommendations from the report included Rio Tinto committing to:

• a moratorium on mining in the Juukan Gorge area

• rehabilitating the Juukan Gorge site

• conducting a review of all agreements with Traditional Owners

• committing to a stay of all actions under section 18 of the Aboriginal Heritage Act 1972

• pledging a voluntary moratorium on section 18 applications under the Aboriginal Heritage Act 1972

• returning all artefacts to the PKKP People.

The WA Government introduced the Aboriginal Cultural Heritage Act 2021 to prevent similar incidents to Juukan Gorge from happening in the future.

The Bill came into effect in July 2023. Under the legislation, WA landowners were required to check if cultural heritage sites were present on the land before undertaking anything which may compromise the sites.

However, following public workshops, education sessions, and consultation with key stakeholders, the WA Government made the decision to revert back to the Aboriginal Heritage Act 1972, with several key amendments:

• The newly formed Aboriginal Cultural Heritage Council taking on the role of the committee that was established under the 1972 Act to make ministerial recommendations

• Proponents and Native Title parties will have the same right of review

for Section 18 decisions, with clear timelines and an ability for the Premier to call-in a decision of ‘state significance’, to act in the interests of all Western Australians

• When a Section 18 has been approved, making it a requirement for the owner to notify the minister of any new information about an Aboriginal site.

Today, the WA Government is assessing the Native Title and Aboriginal cultural heritage processes in the state’s mining industry alongside the National Native Title Tribunal.

Commencing for a four-month period from June, the targeted review comprises on-Country meetings, targeted roundtables and workshops.

improve the efficiency, effectiveness and equity of WA’s current Native Title and

Aboriginal cultural heritage processes by analysing the interaction of consultation processes under current legislation, the capacity of relevant stakeholders to participate in these processes, and how these procedures deliver social, economic and community benefits

It will also determine how the current Native Title and Aboriginal cultural heritage processes contribute to WA’s commitments under the National Agreement on Closing the Gap. Legislative amendments will not be considered under the review.

Looking ahead, it is clear maintaining positive relationships with Traditional

BRADKEN IS SETTING NEW INDUSTRY STANDARDS BY COMBINING ADVANCED MILL LINER TECHNOLOGY WITH A STRONG COMMITMENT TO SUSTAINABILITY AND OPERATIONAL EFFICIENCY.

With more than 100 years of expertise in the design and manufacture of mining solutions, Bradken delivers innovative wear parts that improve wear life, productivity and throughput, while boosting efficiency and safety.

Bradken’s ability to offer customers comprehensive mill liner solutions includes its scrap metal buyback program.

In a recent initiative aiming to enhance sustainability, operational efficiency, and strategic customer alignment, Bradken collaborated with a customer to clear over 2000 tonnes of unused mill liners, unlocking scrap buyback credits and bringing both parties towards greater mutual alignment with UN Sustainable Development Goal (SDG) #12: Responsible Consumption and Production.

Bradken proposed a new scrap buyback credit agreement that provided a consistent and fair market pricing agreement, while supporting the customer to more efficiently manage mill liner waste as a transition towards a more sustainable liner lifecycle.

The collaboration resulted in an alignment with the customer’s sustainability goals and Bradken’s future circular economy strategy, which focuses on closing the loop on the circularity of mill liners in a transparent and traceable manner. Steel from the liners is now being returned to foundries for recycling.

According to research from the Steel Manufacturers Association, each tonne of recycled steel saves an estimated 74 per cent of emissions compared to when it is produced from virgin material.

This initiative not only highlights the tangible benefits of a forward-thinking scrap strategy but also the power of collaborative innovation between Bradken and its customers. This is a step towards greater resource and operational efficiency, with potential for enhanced tangible outcomes –cementing Bradken’s role as a trusted mill solutions partner.

For another Australian-based customer, Bradken’s expert mill solutions team provided recommendations to use the company’s composite liners. This solution supported an increase in the service life of their discharge end liners, reduced the quantity of liners required, and enabled increased throughput.

The customer’s high-impact conditions required the installation of additional liners. Bradken’s team provided a composite liner solution that met the mill grinding conditions and reduced the weight and quantity of the additional liners.

An industry pioneer

Bradken is a market leader for the design, manufacture and supply of mill liners to the global mining industry, specialising in innovative wear liner products and digital solutions for AG, SAG, ball and rod mills.

With a global team backed by engineering solutions, advanced data analysis, and simulations, Bradken’s mill solutions team of experts provides recommendations that enhance the operational productivity, safety, efficiency and energy consumption for a customer’s mill processing operations.

The company’s range of composite liners incorporates materials such as rubber, alloy and cast inserts, offering distinct advantages for applications across various wear mechanisms, including corrosion, abrasion, impact, and mill volume and throughput.

Bradken is on a journey to become carbon-neutral by 2030 for Scope 1 and 2 emissions, through a combination of process efficiency, electrification and procurement of renewable energy. The company has already seen a reduction in process emissions, and its global foundries are shifting away from gas use.

Buying back its own scrap instead of using virgin steel helps to reduce emissions in the supply chain, and maintain the quality of product material, while also supporting customers and suppliers with their Scope 3 emission carbon goals.

BRADKEN HAS EARNED ITS REPUTATION THROUGH A COMBINATION OF TECHNICAL INNOVATION AND CUSTOMER-FOCUSED ENGINEERING.

BRADKEN SPECIALISES IN THE DESIGN, MANUFACTURE, AND SUPPLY OF MILL LINERS.

Paving a sustainable future

Looking ahead, Bradken’s ambitions remain firmly focused on aligning high-performance product development with responsible environmental practices.

Supporting this commitment, up to 75 per cent of the energy used in Bradken’s manufacturing processes comes from renewable energy sources, and up to 98 per cent of the materials used in its liner production are sourced from recycled scrap and returned products.

What sets Bradken apart is its ability to integrate these environmental goals without compromising on product performance or operational value for its customers.

Its holistic approach ensures customers are not only investing in advanced mill liner systems but are also partnering with a company that shares their values around efficiency, safety and sustainability.

As the mining sector faces increasing pressure to improve output while reducing environmental impact, Bradken’s position as a trusted partner becomes even more important.

The company’s dedication to engineering excellence, coupled with a genuine commitment to reducing the mining industry’s carbon footprint, ensures its mill liner solutions encapsulate both innovation and responsibility. Whether it’s improving service life, increasing mill uptime, supporting decarbonisation efforts, or creating new value streams from waste, Bradken continues to deliver solutions that go beyond wear performance.

It’s this combination of product innovation, environmental foresight and collaborative customer engagement that cements Bradken’s position as a leader in mining mill solutions. AM

WITH MINING COMPANIES ENCOUNTERING DIFFICULT OREBODIES ACROSS AUSTRALIA, EFFECTIVE AND RELIABLE SCRUBBING HAS BECOME ESSENTIAL.

With large feed capabilities, reduced maintenance requirements and site-specific adaptability, McLanahan’s rotary scrubbers are helping miners across Australia streamline ore processing from pit to plant.

In the competitive Australian mining industry, where operational efficiency and equipment reliability are non-negotiables, McLanahan’s rotary scrubbers are proving to be gamechangers in mineral processing.

Mining operations across the country are faced with challenging orebodies that demand robust and efficient scrubbing.

McLanahan’s rotary scrubbers are built for these exact conditions. Capable of processing large feed sizes of up to 300mm and handling high throughput capacities, these machines are ideally suited to primary ore washing applications.

The scrubbers are particularly effective in removing lights and loamy clays, and similarly soluble deleterious materials from a variety of ore feeds.

The result is a cleaner, more consistent feedstock that enhances downstream processing efficiency.

Inside the drum, internal lifters create a vigorous tumbling action that breaks down contaminants and liberates valuable minerals.

This pre-treatment step improves the quality of the material and optimises plant performance at every stage that follows.

Every orebody is different, and that is reflected in McLanahan’s approach. The company works closely with miners to customise its rotary scrubbers to suit the feed characteristics, throughput targets, and infrastructure constraints of each site.

MCLANAHAN’S ROTARY SCRUBBERS ARE HELPING AUSTRALIAN MINERS STREAMLINE ORE PROCESSING FROM PIT TO PLANT.

This approach was illustrated through a South Australian mine site that aimed to double its processing capacity from 200 to 400 tonnes per hour.

Instead of simply upsizing the machine, McLanahan’s engineers redesigned the unit. They reduced the scrubber barrel length and expanded the trommel screen area to maintain scrubbing efficiency while boosting screening capacity.

The result was a tailored, highperformance solution that met the customer’s requirements while maintaining quality and efficiency.

McLanahan combines experience with innovation to solve complex processing challenges.

Efficiency and throughput are only half the equation, with strong equipment life and reliability being just as important.

McLanahan’s rotary scrubbers are designed with durability in mind, with key features such as self-aligning trunnion assemblies, wear-resistant liners and heavy-duty structural supports all contributing to reduced wear and lower maintenance demands.

The self-aligning trunnion assemblies address a common issue in rotary equipment – misalignment.

these assemblies extend component life and improve uptime.

To complement its rotary scrubbers, McLanahan offers condition monitoring systems to track machine health in real time.

Predictive maintenance strategies can be implemented to minimise unscheduled downtime and extend service intervals, supporting lower total cost of ownership for mining operators.

McLanahan’s legacy in equipment manufacturing spans more than 190 years, and that experience is reflected in every piece of equipment it delivers.

But just as important as the product itself is the support that comes with it.

McLanahan has invested in a strong local presence across Australia, offering technical support, commissioning, training and spare parts to ensure ongoing success for its customers.

This service has paid dividends for sites like those in the Pilbara, where rapid-response field teams and in-depth knowledge of local conditions have helped keep operations on track.

As the mining industry pursues greater efficiency and more sustainable operations, rotary scrubbers are becoming a valuable tool in reducing waste and improving resource recovery.

By removing unwanted materials early in the process, these machines help ensure only high-quality ore enters further processing stages, contributing to more efficient energy and water use across the plant.

McLanahan is also exploring new ways to support sustainability through improved automation, condition monitoring and design enhancements that reduce power consumption.

For Australian miners looking to optimise operations in today’s market and prepare for the challenges of tomorrow, McLanahan’s rotary scrubbers offer a smart and scalable solution. AM

MASPRO’s high-performance parts and components for surface drill rigs - used across quarrying and mining - are engineered to outperform in the toughest conditions. Precision-built and fully compatible with leading OEMs, every product is designed to maximise uptime, extend equipment life, and deliver superior reliability. Backed by relentless innovation and rigorous testing, MASPRO parts give your operation a critical edge - cutting downtime, driving productivity, so you lead, not follow.

Komatsu has raised the bar with the launch of its GD955-7 motor grader. This machine combines power, and toughness to meet the unique challenges of Australia’s mining sector.

With an operating weight of 46,740kg and delivering a formidable 426 horsepower from a Komatsu SAA6D140E engine, the GD955-7 is engineered for serious work.

The GD955-7 matches the demands of large mining operations and large off-road haul trucks to deliver higher productivity, reduced operating costs and extended component life in even the most rugged environments, Komatsu said. A standout feature is its productivity advantages, made possible by its high horsepower, increased operating weight, and 5.5m moldboard as standard, with an optional 6.1m blade.

Compared with the previous GD825A-2 model, the GD955-7 can grade more efficiently and productively than its predecessor, due to its enhanced power and wider working range.

“Productivity and durability have been front of mind in the GD955-7’s development,” Komatsu said.

“With high horsepower, a longer wheelbase, and a larger standard blade, the GD955-7 can grade between 33 per cent (with 5.5m blade) and 46 per cent (with 6.1m blade) more area per hour than the GD825A-2.”

The 50 per cent increase in operating weight means the GD955-7 can easily grade a hard-packed road surface.

In addition, the expanded tread and increased axle weight keeps work stable in various conditions.

The GD955-7 features a lock-up torque converter transmission with dual auto and manual modes. This enables the machine to shift seamlessly between torque converter drive for smooth control and direct drive for optimal efficiency.

Operation in auto mode prevents engine stall during grading should the grader encounter unexpected high load grading conditions.

The torque converter not only enhances controllability during tough grading tasks but also reduces shift shock, contributing to a smoother operating experience.

An articulate auto-centre return system, fingertip blade controls, palm steer and lever combination help to ensure operators can work comfortably and confidently in any terrain. A conventional steering wheel is also provided for increased control during high-speed tramming.

Komatsu has gone to great lengths to improve the operator environment in the GD955-7. Inside the ROPS (roll-over protective structure)/FOPS (falling object protective structure) cab, operators will find an ergonomically designed console with fingertip controls, reduced arm movement,

and improved visibility from a wide, hexagonal layout.

A high-comfort operator seat, electric height-adjustable control consoles, low interior noise levels (75 decibels), and powerful air-conditioning contribute to a safer, more productive workspace.

Added conveniences such as a lunchbox tray, multiple power outlets, a mobile phone holder, and a seven-inch colour LCD monitor with maintenance and operation data further enhance the operational interface experience.

Komatsu’s KomVision offers a bird’s eye view of the work area, providing high visibility to blind spots in the grader’s working vicinity.

The GD955-7 incorporates several maintenance features to limit downtime. These include a bearing type circle that eliminates the need for frequent circle play adjustments, and an automatic greasing system that reduces manual servicing. Servicing is made easier with ground-level access to major service points, including refuelling and drain ports for engine, hydraulic, and transmission fluids.

Centralised filters and long oil change intervals (up to 2000 hours for hydraulic oil) help to further streamline routine maintenance and boost machine availability.

Modularity has been incorporated into the major powertrain components, resulting in reduced downtime during major component change intervals.

The GD955-7 also includes Komatsu’s Komtrax Plus system, which remotely monitors machine health and performance, allowing fleet managers to access vital data such as fuel consumption, engine hours, and maintenance intervals from anywhere. This helps to optimise equipment utilisation and reduce operating costs.

Durability is core to the GD955-7’s design, with its redesigned front and rear frames – constructed with high-tensile steel plates and optimised powertrain layouts – delivering a frame life double that of its predecessor.

Komatsu has engineered this machine to handle the extreme heat, dust and terrain of remote Australian sites, all while maintaining peak performance.

The GD955-7 includes intelligent fuel management modes, allowing operators to choose between productivity, economy, or middle-speed mode to suit specific tasks. These modes are designed to help extend component life, reduce tyre wear and lower fuel consumption based on site conditions and operational demands.

Backed by Komatsu’s national support network, customers receive expert guidance from machine selection through to ongoing product support.

With the GD955-7, Komatsu has delivered a production grader to meet the growing demands of Australian mining operations. AM

Since 2006, MASPRO has engineered solutions for the most rugged mining environments.

Driven by customer collaboration and a commitment to quality, MASPRO’s rotation heads have become a trusted solution for miners requiring longevity, reliability, and performance across their drilling operations.

“Productivity and durability is our focus,” MASPRO regional business development manager Matthew McCulloch told Australian Mining

“Our heads are Australian-made, robust, and quality assured. We’ve engineered modifications to prevent premature failure and help our Tier 1 mining customers reach the production hours they require.”

These enhancements were not made in isolation. MASPRO worked with a leading mining client experiencing consistent rotation-head failures in highproduction environments.

The customer sent back failed units, which were dissected and analysed by MASPRO’s engineering and sales team.

“We re-engineered the internal parts of

downtime, lower costs, and ultimately improve productivity,” McCulloch said.

MASPRO’s rotation heads are fully compatible with OEM drill rigs, specifically the Epiroc D65.

While the external design remains unchanged to allow for seamless integration, the internal modifications set the rotation head apart.

“MASPRO delivers high-

customer support.

MASPRO doesn’t just sell equipment, it works closely with its clients to continuously improve outcomes.

After initial trials, a Tier 1 client conducted a full cost-benefit analysis, comparing the MASPRO heads with OEM alternatives.

“The results showed significant savings over 12 months – not just in unit

it’s premature wear, material performance, or system compatibility, MASPRO continues to develop engineered solutions tailored to specific operating conditions.

This is central to MASPRO’s business model, as the company continuously advances its mining product technology to keep pace with the evolving needs of the industry.

DRIVEN BY A COMMITMENT TO QUALITY, MASPRO’S ROTATION HEADS HAVE BECOME A TRUSTED SOLUTION FOR MINERS. MASPRO

We are now better equipped than ever to help you to optimise your comminution and material handling operations for maximum performance, safety and efficiency. Our industry leading expertise in crushing, screening, feeding, loading and wear protection allows us to bring you an unrivalled equipment line-up. We underpin this unique offering with our expert process knowledge, full range of digital tools, high quality OEM spare parts, consumables and life-cycle services.

Scan the QR code to discover why we are the industry’s partner in eco-efficient mineral processing.

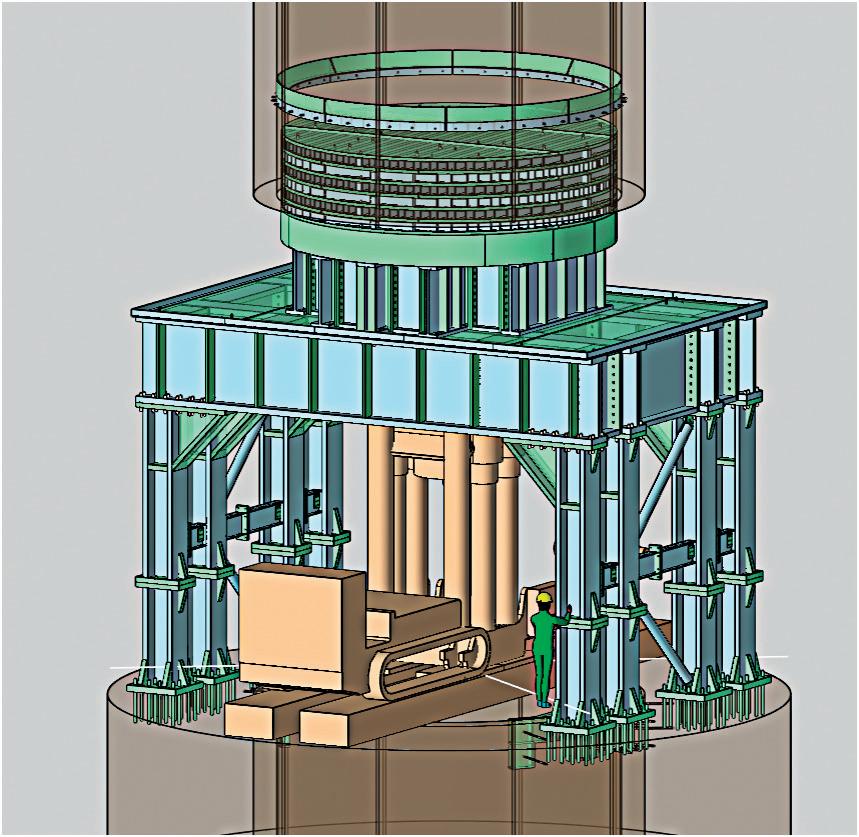

Boom Logistics’ expansive services offering means the company is always busy.

“We’re a Tier 1 contractor and the only publicly listed crane company in Australia,” Boom Logistics director

of operations Lester Fernandez told Australian Mining

“By virtue of that, we have a national client base, whether it be gold in WA and the Northern Territory, the copper belts of South Australia, or the coal hubs of Queensland and New South Wales.

“We have 16 strategically located depots across the country, including key service centres in Port Hedland, Newman, Leonora, Mackay, Olympic Dam and Singleton. Boom is never far from where we’re needed the most”

The safe delivery of mine shutdowns is a key capability of the company.

Boom Logistics understands that shutdowns are a critical window for equipment upgrades, repairs and preventive maintenance – all essential for long-term performance.

They also help to prevent critical failures, where the sudden breakdown of equipment can lead to hundreds of thousands of dollars in lost revenue per hour.

Boom Logistics general manager – west Chris Vas emphasised that effective shutdowns hinge on preparation and teamwork.

“The success of every shutdown is contingent on how much effort goes into planning, and then it’s about operational execution,” Vas told Australian Mining

“To achieve this, open communication within your team and with the client is paramount. It doesn’t matter how well you plan or how well you think you can execute the shutdown; if you’re not talking to one another, it can go downhill very quickly.”

Vas said communication is borne from internal and external relationships, something on which Boom Logistics prides itself.

“The best shutdown teams are those that are the best connected,” Vas said. “This is a key focus for Boom Logistics, where a culture of connectivity is fostered across Boom’s national operations.

“We have the operational expertise to deliver a shutdown, but we’ve also established the team camaraderie to execute to plan while meeting or exceeding client expectations.

“It’s important that the shutdown team is engaged and delivering safely, and building camaraderie is a key enabler of this.”

So exactly what goes into preparing a mine shutdown?

“We do a lot of detailed front-end planning,” Vas said.

“We seek to understand the client’s needs, then it’s a case of putting the puzzle pieces together, ensuring the right resources are available and optimised to the specific site.

“Then it comes down to execution. This involves frontline leadership and supporting our crews – being in it with them, while constantly communicating with other working groups and the client to ensure the shutdown is on track.”

During the planning phase, Boom Logistics goes out and assesses the site

well in advance. This helps the company bed down a shutdown strategy tailored to specific site requirements.

“Compliance is critical in the shutdown space,” Fernandez said.

“Compliance is the right people for the job and the right assets for the scope of works.

“Chris’ operations team, our regional managers and superintendents go out and assess site well before the shutdown occurs to understand site specifications. We then come up with a plan that gets finessed, optimised and tweaked as the shutdown nears.”

Fernandez provided some pearls of wisdom for effective shutdowns.

“The best preparation is having the crane and crew ready, positioned and on standby the moment they’re required – because there could be a crew of 50 or more personnel relying on them to remove and reinstall critical plant components, such as screens, feeders or belts,” he said.

“The timing of that puzzle piece being delivered is critical to the success of each subsequent puzzle piece, and

there are many other cogs that must be sequenced to ensure the success of an entire shutdown.

“Putting all those puzzle pieces together safely and effectively at the right time is where Boom Logistics excels.”

When a planned shutdown takes place, there is also potential for emergent work to take priority. This could take the form of a critical breakdown.

“A breakdown could occur and suddenly the planned works are not the first priority,” Vas said. “We have to be quick enough and agile enough to shift and adapt our operations.”

Fernandez said carrying out a shutdown can be akin to playing “threedimensional chess”, particularly when emergent work takes precedence.

“Whilst we might move an asset or crew from point A to point B to accommodate emergent work, it’s just as important to be able to adjust or reorder your list of priorities on the fly,” he said.

“It’s a fine and complex balance to get right: ‘I’m moving this job here, that comes here, and that goes there’. This reorganisation is carried out by

the frontline supervisors and staff in conjunction with our operations team.”

Boom Logistics recently delivered a successful shutdown for an iron ore operation in Western Australia, which was achieved through detailed planning, clear communication, and coordinated execution.

“The shutdown was executed effectively through extensive preplanning, which started months before,” Vas said.

“We visited site to understand the work scope, the technical aspects involved, and the resourcing required.

“Pre-planning was most of the job, ensuring we had all our ducks in a row –from resource allocation to mobilisations and everything in-between – and then it came down to execution.”

Vas said Boom’s frontline leadership came to the fore to ensure the shutdown was delivered safely and on-schedule.

“We are really proud of our output and what we delivered to the client, and we have received great feedback from

them as well,” he said. “The shutdown was successful for both parties.”

Boom Logistics’ expansive mining services offering extends beyond planned shutdowns , with the company also known for its day-to-day maintenance capabilities.

Boom supports most assets on-site, with cranes assisting reclaimer builds, conveyor maintenance, HVAC (heating, ventilation and air-conditioning) installation and removal, and major plumbing and hydraulic upgrades, to name a few applications.

“We’ve been on a really strong growth trajectory over the last three years, and this is sustainable, profitable growth, not just growth for growth’s sake,” Fernandez said.

“We want to go where we can add value and where we are valued. This methodology has helped us establish strong relationships across the mining industry, enabling us to consistently deliver shutdowns and maintenance works safely and effectively.”

BY PAIRING BARRACUDA

In the world of surface mining, particularly in Australia’s hard rock mining sector, every tonne counts.

With operations running at scale and equipment operating under intense conditions, efficiency, durability and optimisation of the load and haul cycle are critical.

It is no longer enough to focus on one component – true value is found when each element works in harmony.

Schlam’s evolution as a global leader in load and haul attachments has seen the company embrace this challenge by engineering a complimentary system that brings together the loading and hauling ends of surface mining operations.

Through its Hercules mining truck beds and Barracuda mining buckets, Schlam delivers a high-performance, pass-matched solution designed for the rigorous demands of today’s mining operations.

Schlam’s flagship Hercules mining truck bed, first introduced in 2003, has become a fixture in hard rock mines across Australia and around the globe.

The Hercules range is known for its unique curved design, which not only facilitates easier and cleaner material discharge but, according to Schlam, enables a payload increase of more than 10 per cent compared to standard beds.

Built specifically to perform in the challenging environments common to hard rock surface mining, Hercules beds are constructed from highstrength steel and are engineered with thicker wear materials in high-impact zones, while maintaining lightness in structural areas

Their proven performance includes examples like Hercules A0071, which operated for 16 years in the Western Australian goldfields before retirement.

As Schlam nears the milestone of delivering its 3000th Hercules mining truck bed, the company continues to evolve its product range to meet the shifting demands of modern mining.

The recent launch of the Hercules Ultra, an advanced truck bed engineered specifically for ultra-class mining trucks,

represents the next step in Schlam’s journey as a global leader in load and haul innovation.

“We develop our products based on the specific site needs of our customers, forever working on our principle of working ‘stronger together’,” Schlam Payload managing director Hendrik Mueller said.

“A lighter and stronger truck bed enables miners to carry more ore, which not only translates into increased payload but also savings in terms of fuel and ultimately carbon emissions.”

Precision loading

At the front end of the load and haul cycle, Barracuda mining buckets deliver Schlam’s solution for precision loading in hard rock mining environments.

Engineered for excavators and wheel loaders, these buckets are carefully customised to suit ground conditions, material properties and sitespecific requirements.

“The mining bucket is the business end of the load and haul process, so it’s important to match the right bucket with your haul equipment,” Schlam vice president of innovation and strategic focus Amit Bareja said. “Filling a haul truck with three and a half buckets rather than three is inefficient no matter which way you spin it.”

That principle lies at the heart of pass matching, the process of aligning the bucket size and fill factor with the haul truck’s capacity to ensure optimal loading with the fewest number of passes. Misalignment often leads to underloading (wasting payload potential) or overloading (increasing mechanical stress and compliance risk), both of which are costly.

“Not correctly payload matching excavator, shovel and wheel loader buckets with haul trucks means the mine risks giving away productivity and money with every load,” Bareja said.

By pairing Barracuda buckets with Hercules truck beds, Schlam offers miners a complete, integrated solution tailored for surface mining in hard rock environments, where every cycle and every pass counts.

The Barracuda range continues to evolve, with the T2 model representing a major leap in durability and maintainability. Designed in close collaboration with miners, the Barracuda T2 bucket features two distinct zones: a structural base, and a replaceable highwear lower shell.

The replaceable lower shell is engineered without the need for heel shrouds or liner packs, making it lighter and easier to service. Constructed from thickened steel to wear down to a pre-defined threshold, it can be rapidly swapped out during scheduled maintenance, significantly reducing downtime.

The T2’s design also removes the risk of stored energy hazards common with traditional rolled wear plates. Its unique configuration makes it up to 15 per cent lighter than conventional buckets, Schlam said.

The first Barracuda T2, commissioned at a major Pilbara iron ore mine in 2022, has clocked more than 10,000 hours. T2s are now operating across surface mining operations throughout Australia.

One notable deployment came in 2023 when Fortescue introduced Australia’s first operational electric excavator, a Liebherr R 9400 E, fitted with a specially designed Barracuda T2, further

highlighting Schlam’s ability to deliver future-ready equipment for a loweremissions mining landscape.

From the outset, Schlam has focused on a core belief: “Built for miners, with miners”. This ethos not only applies to product development but continues through the ongoing support it provides its customers.

“Our sales and technical support teams work closely with our customers to ensure that every product that we build is uniquely designed and built to meet specific site requirements,” Mueller said.

“We’re also further growing our after sales support, ensuring that the customer experience is exceptional at every step.”

The on-site support provided by Schlam’s Product Life Cycle Care program includes payload optimisation, wear mitigation and planning for asset longevity, all backed by Schlam’s teams and manufacturing facilities in Australia and key global markets.

Global strength, local focus Schlam’s evolution as a global mining partner is also underpinned by significant investment in advanced manufacturing, especially at its main production centre in WA.

The company has adopted LEAN manufacturing, introduced robotics and automation, and developed digital production systems, allowing it to increase throughput without compromising safety or quality.

The result is a production line capable of delivering customised Hercules and Barracuda units for the world’s leading miners, including BHP, Fortescue, Glencore, Northern Star and Newmont.

“With the help of our customers and our own people, we’ve developed into a truly global company, providing leading load and haul solutions to leading global miners,” Mueller said.

In surface mining, where load and haul is the backbone of daily operations, Schlam’s integrated Hercules and Barracuda solution offers a significant competitive edge, the company said. The synergy between loading and hauling

equipment helps to ensure precise pass matching, maximising each truckload while minimising machine wear and energy use.

For Australian miners in the hard rock sector, this is more than a product pairing – it’s a high-value system engineered for the realities of mining operations.

As demand grows for efficiency, sustainability and safety in surface mining, Schlam continues to evolve, showing that when the mining bucket, the mining bed and the team behind them are working together, performance takes care of itself. AM

CATERPILLAR CONTINUALLY MAKES ENGINEERING UPGRADES TO HELP CUSTOMERS GET MORE VALUE OUT OF THEIR DOZERS.

Cat large dozers are common to mines and quarries around the world, serving as both production and support machines in multiple applications.

While experienced personnel make operating look easy, implementing specific techniques can help maximise dozer productivity and efficiency.

Caterpillar continually makes engineering updates and incorporates innovative technology solutions to help customers get more value out of their dozer investment. Plus, application experts and equipment trainers focus on training operators and encouraging best practices.

The operator is key to maximising dozer efficiency, performance and productivity. Using the wrong techniques can significantly reduce overall productivity, so it is critical that even experienced operators understand and execute dozing best practices.

• Load the blade downhill, maintain a steady dozing pressure, and minimise unloaded travel distance

While there are dozens of dozer operation best practices, a good starting point is the dozing cycle itself.

Caterpillar application experts have studied multiple slot dozing scenarios and identified techniques that can make the dozing cycle more efficient and productive.

While it’s a common dozer practice in mining, the back-each-pass technique – where the operator starts each pass at the back of the cut and uses the length of the cut at a uniform depth – is the least productive and has the highest cost. Efficiency and productivity suffer because the machine travels the entire length of the cut in both directions.

Efficiency suffers, however, from loading the blade uphill, and the slot is not fully utilised throughout the cut.

“Even though it is pushing shorter distances, the dozer is pushing uphill, which reduces productivity and increases fuel burn,” Metz said. “Like back-eachpass, it will also create windrows.”

With the front-to-back technique, the operator starts at the front of the slot and progresses towards the back with each pass. This approach enables the blade to be loaded downhill, creating a slot that can be utilised throughout the whole cut.

“A slot will help hold the material in front of the blade, so there’s no spillage or windrows, maximising the load on the blade,” Metz said.

“This technique uses the weight of the machine to more efficiently load the blade downhill while reducing the average push distance significantly.”

Dozers are ideal tools for a variety of applications, from production dozing to reclamation operations. Regardless of application, Caterpillar application experts recommend several general best practices:

• Most applications dictate dozing in first gear with a fully loaded blade to achieve maximum productivity

• Reverse in second gear, when applicable, to reduce unloaded time

• Steer with blade tilt cylinders rather than steering clutches when the blade is loaded

• Minimise corner loading, prying and impact dozing to only required passes

“A dozer is not being productive in reverse,” Caterpillar large dozer product application specialist Corey Metz said.

“With back-each-pass, the dozer traverses a longer average push distance as it travels the entire length of the slot for each pass. The blade isn’t loaded while pushing downhill since the blade is gradually loaded over the length of the slot.

“Since this technique is not utilising a slot, there’s also the risk of material spilling out of the blade, creating windrows, especially during the first few passes.”

Dozing back-to-front increases efficiency but is not the most efficient. Commonly used for stockpile applications, the operator progresses from back to front of the slot, so push distance is reduced with each pass as the dozer works to the front of the cut.

Push distance is a key metric when measuring dozer productivity. The

average push distance on this technique is about half that of back-each-pass, and the amount of time spent in reverse is reduced. The carry cycle gets longer with each pass as the dozer progresses from the front to the back of the slot.

Metz said a dozer with a large load pushing slowly will out-produce one that pushes a smaller load faster.

“A dozer can only push so much material in a higher gear, so it takes, for example, four passes in second gear to push the same amount of material that could be pushed in three passes in first,” he said.

“With an increased number of passes, the operator spends more time in reverse and isn’t pushing full loads. This makes the machine work harder while reducing productivity.”

Improper dozing technique can negatively impact dozing efficiency. Coaching operators on a proper dozing technique can lead to significant cost-per-tonne benefits for a CATERPILLAR DISCUSSES

Bradken® is a leading mill liner solutions provider, we specialize in delivering innovative products tailored to suit AG, SAG, Ball, and Rod Mills.

Our customers strive for safety, productivity, and efficiency in their mineral processing operations. That’s why we offer a diverse range of mill lining solutions, including steel and rubber-composite liners, each solution is designed to meet application requirements across various conditions.

Bradken® leverages over 100 years of expertise in parts design and manufacturing, combining advanced data analysis and expert simulations to help customers optimize productivity, throughput, availability, safety, efficiency, and energy consumption.

Our team is focused on delivering quality Mill Solutions targeted to improve mill operations through optimised liner designs, manufacturing expertise and advanced material innovation.

Mining companies are always looking for ways to maximise the performance of their fleets. However, every site is different and has specific requirements.

This is something RPMGlobal, a software solutions provider with more than 50 years’ experience, understands.

With headquarters in Queensland, RPMGlobal uses deep domain expertise to address the needs of miners in more than 125 countries.

One of the company’s flagship offerings is its AMT asset maintenance software, a digital solution that optimises maintenance strategies by providing real-time insights.

“AMT was introduced in 2002, originally developed for Caterpillar to manage complex maintenance contracts between OEM (original equipment manufacturer) dealers and customers,” RPMGlobal product manager – asset management Antonio Carioca told Australian Mining. “The goal was to offer a dynamic and transparent system to manage asset maintenance and lifecycle costing at a component level. It was created by maintenance and finance professionals and has since evolved into a global standard for asset management in mining.”

Designed for the mining sector by industry experts, AMT uses dynamic lifecycle costing (DLCC), a method that regularly updates the lifecycle cost of every asset based on real-time maintenance and operational data from enterprise resource planning (ERP) systems.

“AMT is not just another CMMS (computerised maintenance management system) or ERP bolt-on,” Carioca said.

“It complements and enhances ERPs like SAP by providing specialised functionality that these systems lack and bespoke spreadsheets try, often poorly, to fill the gap.”

DLCC forecasts don’t only feature costs; they cover all maintenance requirements, including components, parts, availability and labour resources.

AMT measures component performance against an operation’s budget and allows users to analyse historical performance by failure mode, symptoms and cause of failure.

The software also possesses multiple versions of an asset’s maintenance strategy to perform predictive analysis without impacting the machine’s current strategy.

This allows users to trial and test different scenarios to evaluate the best maintenance strategy for each

AMT’S DYNAMIC LIFECYCLE COSTING REGULARLY UPDATES THE LIFECYCLE COST OF EVERY ASSET BASED ON REAL-TIME MAINTENANCE AND OPERATIONAL DATA.

AMT ALLOWS USERS TO TRIAL AND TEST DIFFERENT SCENARIOS TO EVALUATE THE BEST MAINTENANCE STRATEGY FOR EACH MACHINE WHILE GAINING REALTIME BUDGET VARIANCE ANALYSIS.

machine while gaining real-time budget variance analysis.

“It continuously adjusts the plan based on real-world occurrences, giving users accurate, real-time visibility into maintenance needs and budgets,” Carioca said. “Align that with powerful ‘what-if’ scenario capabilities and extensive integration, and AMT is the ideal tool to manage all your maintenance needs, whether it’s right now or in five years’ time.

“It’s the de facto industry standard and helps operations manage costs, component rebuilds, equipment availability, and contract forecasting across a wide variety of fleets.”

Ease of use

AMT is available to use on a computer or mobile app, and is available in various forms, including AMT4SAP, AMT for OEMs, and AMT for contractors.

“While there are core AMT capabilities that are applicable to every customer, we also have specific ‘flavours’ of AMT,” Carioca said.

“OEMs and dealers use AMT for contract management, rebuild tracking, and quoting. Miners use it for budgeting, benchmarking and variance analysis, and contractors focus on quoting and maintaining high availability at low cost.

“Each of these could mix and match different modules and add features such as the mobile app or work management as needed. This segmentation ensures each group gets a solution tuned to their needs while still powered by the same

RPMGlobal uses its decades-long expertise, implementation teams, data integration specialists, and onsite training capabilities to seamlessly integrate AMT at various mining sites.

“The system’s flexible architecture allows it to integrate with ERPs, historian data, and planning systems,” Carioca said. “There’s a strong focus on change management and user adoption.

“We have a dedicated deployment and customer success team with years of experience that ensures not only proper implementation but also

A winning solution worldwide AMT has seen great success around the globe, with the software being used to manage or track more than 60 per cent of the world’s large mining equipment.

“Customers often highlight improved maintenance forecasting accuracy, reduced unexpected failures, and greater confidence in budgeting,” Carioca said.

“One client mentioned they avoided millions of dollars in component overhauls in a single year due to AMT’s early warnings.”

Carioca said AMT complements and works alongside RPM’s other scheduling, planning, simulation and operations tools.

These include XECUTE, RPMGlobal’s short-term planning and execution solution; and XPAC, a mid-term and strategic scheduling tool that considers the unique characteristics of almost any mining operation.

“Since RPMGlobal acquired AMT via iSolutions in 2016, it has become a core part of RPM’s offering,” Carioca said.

“AMT helps bridge long-term plans with day-to-day execution by ensuring assets are available when needed. It’s a critical part of RPM’s digital mine ecosystem.”

Digitisation and automation are

swiftly growing more and more popular across several industries.

In a bid to further transform operational efficiency, RPMGlobal is always adapting its product offerings to meet the evolving needs of the mining industry.

“RPMGlobal is embedding meaningful AI (artificial intelligence) capabilities into AMT to deliver practical, data-driven

Mining companies across five continents rely on our mining tire expertise, independent supply and our KalPRO innovation tools and solutions.

We’re pushing the boundaries of what’s possible for tire performance and fleet use—all while protecting technicians and promoting sustainability at every stage of tire life.

value,” Carioca said. “For example, AMT Insights, which is released in August, will act as a built-in AI consultant, constantly analysing data to deliver actionable insights across strategies, work orders, and budgets.

“Looking ahead, AI will also support automated short-term planning, machine-learningdriven reliability forecasting, and

AMT’S DETAILED SHORT-TERM PLANNING AND SCHEDULE MODULE.

intelligent data cleansing through the upcoming Data Tuner module.

“These enhancements will further reduce manual effort, sharpen decisionmaking, and maximise the benefits AMT delivers across the mining process chain.”

Mining companies are always looking for ways to maximise productivity on-site.

Enter Komatsu’s RF-5, a reliable feeder designed with ease of use at the forefront.

“The RF-5 was developed in 2019 and launched to the market in 2020,” Komatsu Mining product support manager – crushing Daniel Hurse told Australian Mining

“We previously had a broad range of feeders. The RF-5 has allowed us to provide a standard offering to the global market, with common stock available worldwide, reducing the lead time on the machines.”

Komatsu’s reclaim feeders are constructed with a drag chain or chain and flight conveyor, drawing material in from a stockpile at a controlled rate.

The machine then feeds the material to a downstream system such as a conveyor.

“A reclaimed feeder could be used to draw material from a stockpile that needs to be sized down,” Hurse said. “Or it’s at the other end, supporting the final product being fed into a plant or taken away to another site.”

Ideal for a range of industrial materials such as aggregates, coal and iron ore, the RF-5 has a throughput of up to 4000 tonnes per hour and a power rating range of more than 370 kilowatts.

Hurse highlighted the low cost of ownership and operation as another key benefit of the machine.

“There’s minimal installation costs and site preparation in setting up a reclaimed feeder – all you need is some solid, flat ground,” he said. “It’s a low cost-per-tonne machine with minimal wear components, making it easy to install, operate and maintain.”

Operating in fixed or semi-mobile installations, the RF-5 can be easily moved and relocated depending on the needs of the mining operation.

The machine boasts a heavyduty design with steel components, supporting an operating life of more than 20 years. The system’s components are the same as other Komatsu machinery, reducing lead times across the fleet.

“Whether it’s gone through our feeder breaker and our double roll sizes, resulting in the final product, or whether it’s feeding one of our crushers, the RF-5 is designed to be loaded by Komatsu trucks, loaders, dozers,” Hurse said.

“It fits in seamlessly with our broader product offerings.”

A plug-and-play machine, the RF-5 can be fitted with a control system supporting local or remote operation.

“Our remote monitoring and data logging system assists in tracking machine wear and pain points, with data available to the customer to help maintenance planning,” Hurse said.

“The customer may have their own control system we can tap into, or we can go with the links so they can access that data.”

Any maintenance issues logged can be turned into actionable insights to enrich decision-making.

The RF-5 can also operate while electric and automatic lubrication is taking place, further reducing downtime. These capabilities are sweeping the resources sector, with one RF-5 machine available for purchase in Australia.

“It’s a cost-effective, reliable machine to get material from the ground onto a belt,” Hurse said. “It’s versatile and suited to any application. We have a machine that can meet the customer’s needs straight away.

THE RF-5 RECLAIM FEEDER SERVES MATERIAL TO A DOWNSTREAM MINING SYSTEM SUCH AS A CONVEYOR.

Canary Systems has developed a comprehensive slope stability monitoring system to help open-pit mines streamline their approach to safety.

The company offers a full portfolio of monitoring tools that bring together instrumentation, hardware, software, and support in one cohesive solution.

By consolidating data from multiple geotechnical and remote sensing sources, Canary Systems provides mines with an integrated overview of slope conditions.

The company’s core software platform, MLSuite, enables users to ingest and analyse data from a wide range of devices including prisms, radar systems and piezometers.

This integration enables early detection of ground movement and potential slope instability, giving mines a better opportunity to act before issues escalate.

MLWeb, the web-based data visualisation component of MLSuite, features advanced charting tools that correlate multiple datasets including prism velocity, pore pressure, and radar displacement, helping users identify patterns and changes over time.

Surface and sub-surface data can be viewed in 3D, and users can apply spatial

MLWeb also supports manual and automated data collection, and offers flexible import tools, logger programming, calculations, and data validation features. This enables mine staff to convert raw data into meaningful information, displayed in a web-based 2D and 3D environment.

With the help of GIS-enabled decision-making tools, the focus shifts from manual processing to strategic safety planning.

Solutions from Canary Systems have already been deployed at complex mine sites globally, demonstrating strong results in challenging conditions.

At a large open-pit mine located on a stratovolcano, hundreds of instruments are being monitored, including piezometers, inclinometers and prisms, along with weather and flow stations.

The site integrates InSAR (interferometric synthetic aperture radar), radar, and DTS (data transformation services) data within MLWeb to evaluate slope behaviour and identify unstable areas. Alerts are issued based on trigger action response plan (TARP) levels, taking into account the severity and frequency of slope movement and changes in pore pressure.

Another example is the Coeur Rochester mine in Nevada, US, where

positioned in the dumping area. Two MLGPS units were also deployed to measure 3D slope movement and provide continuous updates on terrain deformation. One GPS unit was placed at the top of the dumping area while the other served as a data relay point, transmitting information to the server. In addition, 50 prisms that had previously been installed in the pit were integrated into MLWeb for a unified view.

Within the platform, alerts were configured to match specific tolerance thresholds, and graphical outputs allowed for detailed analysis of trends and deviations.

This implementation delivered several key benefits, including improved data collection efficiency, reduced manual workload, and a central access point for geotechnical teams.

At a major gold mine in the Dominican Republic, Canary Systems replaced manual processes with an automated monitoring solution.

Prior to the upgrade, the mine relied on manual instrument readings and spreadsheet analysis, which proved timeconsuming and less responsive.

In order to improve performance, Canary Systems installed more than 80 MLRemote units and two

CANARY SYSTEMS IS SUPPORTING OPEN-PIT MINING OPERATIONS WITH INTEGRATED SLOPE STABILITY SOLUTIONS.

The solution allowed automated collection of data from more than 200 instruments across two pits, a processing plant, and a tailings facility.

MLWebHardware was used to manage connections and organise programming for remote data collection across the site.

New data is now recorded hourly, and additional monitoring tools such as radar, prisms, inclinometers and InSAR have been integrated into the same platform.

To support site-wide access and 3D data processing, a multi-server deployment was implemented.

Despite dense vegetation and complex connected to the MLBase system using a

The site now receives scheduled automated reports, eliminating the need for manual spreadsheet analysis and enabling compliance with International Council on Mining and Metals (ICMM) reporting requirements.

By automating the data collection process, the mine achieved more consistent decision-making, greater insight into infrastructure performance, and reduced operational risk. This has led to safety improvements and longterm cost savings.

Canary Systems’ innovative slope stability monitoring system is enabling open-pit mines to detect ground movement early, respond faster to changing conditions, and maintain safer working environments.

By combining automated data collection, multi-source integration, and near-real-time analysis, the company continues to drive more effective slope management and deliver strategic value to mining operations worldwide. AM