Manufacturers

“We are able to produce approximately 10 end-products, such as granular sub base, 40mm, 20mm,

05 COMMENT

The aggregate numbers game.

06 INDUSTRY NEWS

The latest news and updates from around the global quarry and aggregates sector. 50 EVENTS

All the key events in the quarrying and aggregates world

08 MARKET REPORT

A look at the major players in Indonesian quarrying and aggregates.

12 QUARRY PROFILE

How Metso is supporting Indian quarry operators to find operational improvements.

14 MARKET ANALYSIS

GAIN founder and president Jim O’Brien shares the latest insights from the organisation’s annual report into the aggregates sector.

18 PEOPLE ON THE MOVE

The latest appointments across the global industry.

20 INTERVIEW

Pablo Zambianchi discusses how Holcim Italy is embracing technology.

McLanahan and SunEnviro open the doors for a major industry open house event.

Through its latest case study, CDE showcases how it tailors solutions for the quarrying sector.

The latest updates and innovations from global loading equipment manufacturers.

From new haulers to successful case studies, hauling manufacturers take centre stage. 38 CRUSHING AND SCREENING

The latest equipment is unveiled in the crushing and screening market.

42 TYRES –2

40 DRILL RIGS, ROCKBREAKERS AND HAMMERS

Rockbreakers and drill rigs are becoming increasingly prominent –with impressive results.

The unsung heroes of the quarrying operation, the latest tyre developments are here.

44 DIGITAL SOLUTIONS

Volvo CE showcases its range of digital solutions for quarries.

46 FLEET MACHINERY

Develon’s machinery continues to impress.

48 CONEXPO-CON/AGG

The latest updates ahead of the North American trade show’s return in 2026.

HEAD OFFICE

Prime Global Publishing Capitol Square 4–6 Church Street Epsom, KT 17 4NR

EDITOR

Guy Woodford +44 (0) 7879 408 069 guy.woodford@primeglobalpublishing.com

ASSISTANT EDITOR Adam Daunt adam.daunt@primeglobalpublishing.com

BUSINESS DEVELOPMENT MANAGER

Les Ilyefalvy +61 423 177 966 les.ilyefalvy@primeglobalpublishing.com

CHAIRMAN

John Murphy

CHIEF EXECUTIVE OFFICER

Christine Clancy GROUP MANAGING EDITOR

Paul Hayes

CLIENT SUCCESS MANAGER

Janine Clements +61 432 574 669 janine.clements@primeglobalpublishing.com

ART DIRECTOR

Michelle Weston COVER IMAGE CREDITS Komatsu Holcim Italy Volvo CE Metso

SUBSCRIPTIONS subscriptions@primeglobalpublishing.com

No part of this publication may be reproduced in any form whatsoever without the express written permission of the publisher. Contributors are encouraged to express their personal and professional opinions in this publication, and accordingly views expressed herein are not necessarily the views of Prime Global Publishing. From time to time statements and claims are made by the manufacturers and their representatives in respect of their products and services. Whilst reasonable steps are taken to check their accuracy at the time of going to press, the publisher cannot be held liable for their validity and accuracy.

PUBLISHED BY Prime Global Publishing

AGGREGATES BUSINESS USPS: is published six times a year.

PRINT: ISSN 2051-5766

ONLINE: ISSN 2057-3405

PRINTED BY: Warners (Midlands) PLC

his issue of Aggregates Business International includes the latest analysis of key national and regional aggregates markets from the Global Aggregates Information Network (GAIN), a unique voluntary coalition of aggregates associations around the world with the express purpose of openly sharing best practices for the greater sustainability of the industry globally.

Founded in 2010 with only ve members, GAIN now has 20 members on all six continents, with its member countries representing 75 per cent of global aggregates production of 39 billion tonnes.

Given the above, I always look forward to poring over any new GAIN industry commentary.

GAIN member country data from 2019 to 2025 shows a decline in aggregate demand in China, while India is now growing very strongly, as are Brazil and Malaysia. The trends also show the negative effect the COVID pandemic had in developing regions in 2020.

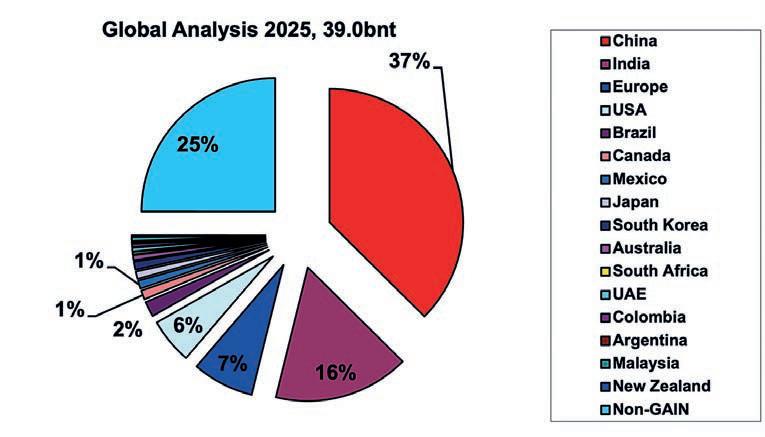

Global aggregates production is still dominated by China at 37 per cent, with India coming second at 16 per cent, followed by Europe at seven per cent and the US at six per cent; these top four comprise two-thirds of global aggregates demand.

“At a global level, it would therefore appear that the slowing rate of declining demand in China can be counterbalanced by growth in India and many other regions,” GAIN founder and president Jim O’Brien wrote.

“Thus, it is likely that the decline in global demand for aggregates since 2019 has now levelled off in 2025, portending guarded optimism for an increasing global demand for aggregates out towards 2030. Given a positive global geopolitical outlook in the next 5 years, with resultant economic growth, it is likely that global demand can again reach 40 billion tonnes or even more by 2030.”

GAIN’s analysis noted that the aggregates sector remains a fragmented sector globally. The biggest players are CRH, Heidelberg Materials and Holcim, each with a global production of

over 250 million tonnes, followed by Cemex, Vulcan Materials, Martin Marietta, and the three Chinese players CNBM, CRCH and CONCH, now producing over 100 million tonnes each. The top 25 aggregates players make less than 10 per cent of global production, in contrast with the top 25 cement producers, which represent around 40 per cent of global cement production. GAIN’s analysis said that further consolidation is likely in the aggregates sector as cement players see the mutual bene ts of vertical integration.

I will be attending the eighth GAIN Meeting in Córdoba, southern Spain, in October 19–24, with a packed agenda sure to generate several insightful global aggregates industry features for future issues of Aggregates Business International Home to more than 280 million people, Indonesia is a Southeast Asian nation with a vibrant national aggregates industry, as highlighted in this edition’s market report. Situated between the Indian and Paci c oceans and a country made up of 17,000 islands, including Sumatra, Java, and Sulawesi, Indonesia is going at out to deliver President Subianto Djojohadikusumo’s target of 8 per cent economic growth each year for the next four years. President Djojohadikusumo believes this ambitious goal can be achieved through infrastructure development, requiring $625 billion to be spent on 55 major projects, including the new national capital Nusantara in East Kalimantan province, airports, railways, ports, roads and housing schemes.

Indonesia’s bold infrastructure plans will require huge volumes of aggregates, concrete, cement and asphalt, creating exciting commercial opportunities for quarry operators and national, regional, and global building materials suppliers. The need for premium off-highway machinery to work on so many infrastructure project sites and in linked quarries and cement concrete plants also creates great business opportunities for major manufacturers, such as Volvo Construction Equipment and Metso, which are both featured in our must-read feature. GW guy.woodford@primeglobalpublishing.com

SDLG (Shandong Lingong Construction Machinery) has opened its new East African regional hub at its LGQH subsidiary’s of ces in Dar es Salaam, Tanzania, and has shipped 300 units of its construction equipment to Africa under a new innovative Manufacturer-Partner Joint Go-Global (MPJGG) export model.

The Chinese off-highway machinery manufacturer has shipped its rst large batch of machines under the MPJGG to Tanzania, Kenya, Nigeria, Zimbabwe, and other African countries. The consignment includes excavators, wheeled loaders, road rollers, and motor graders products tailored to meet Africa’s diverse needs in cross-border highways, rail

networks, ports, and mining development.

The shipped machines are being deployed in key projects such as Kenya’s Africa Infrastructure Development Plan, injecting powerful ‘Made in China’ momentum into local construction.

According to SDLG of cials, the milestone not only highlights the company’s deepening footprint in Africa but also signals the scaled rollout of its innovative ‘ManufacturerPartner Joint Go-Global’ model, marking a signi cant step forward in SDLG’s global strategy.

“Africa is an essential and highly promising part of SDLG’s global strategic map. The successful shipment of

300 machines, especially under the innovative ‘ManufacturerPartner Joint Go-Global’ model powered by LGQH, marks

a critical step in deepening our African presence,” SLDG executive deputy general manager Song Xiaoying said.

and improved overall ef ciency for the customer.

“I would like to congratulate Voltas on their 25-year journey with Powerscreen and commend them for their vision and forwardthinking. Together, we have transformed the crushing and screening industry in India, and I look forward to our continued innovation and shared success.”

The consistent performance of Powerscreen equipment helped strengthen the Voltas footprint in India, especially in the large-scale road-building and civil works sector.

Powerscreen has recently celebrated the 25th anniversary of the appointment of UMPESL –Voltas (A Tata Enterprise) as its rst of cial distributor in India.

The appointment in 2000 came at a pivotal time for the Indian mining and construction industry, when the need for track mobile crushing and screening plants was becoming increasingly evident.

“Most clients relied on stationary set-ups, which required two to three months for erection and commissioning,”

Terex Materials Processing vice president and managing director Jaideep Shekhar said.

“The frequent shifting of these large, xed installations presented signi cant logistical and operational challenges, often delaying project timelines and escalating costs.

“Voltas recognised this need early on and introduced Powerscreen track mobile plants to India, a strategic move that transformed the way infrastructure and mining projects were executed throughout the country.

The quick deployment, ease of mobility, and minimal setup time of this equipment drastically reduced project execution timelines, leading to cost savings

Voltas successfully sold its rst track-mounted Powerscreen unit to a signi cant aggregates customer engaged in major national and state highway construction projects in and around Bangalore, India.

This marked the beginning of several milestone deployments across India, with successful installations at high-impact infrastructure sites.

“Powerscreen equipment is designed to handle a wide range of applications, from aggregates and iron ore to municipal solid waste and riverbed materials,” Terex India director for commercial aggregates Chandrasekhar Venkataraman said.

“This versatility is evident in the case of Voltas, which has used our equipment to serve diverse customer needs, expand into new sectors, and adapt as market demands evolve, supporting their long-term business growth.”

Construction materials are gaining increasing importance in the South African market, and AfriSam is poised to play a signi cant role within it.

AfriSam construction materials executive for sales and product technical Amit Dawneerangen said this demand meant established companies like AfriSam had an important role to play.

Dawneerangen said that megaprojects, such as roads, dams, and energy infrastructure, have the potential to accelerate economic development signi cantly. However, the extended downturn in the construction sector has raised

concerns about its readiness to meet the demands of these massive undertakings.

“This longevity is no accident; it is the result of a deliberate effort to retain capabilities and worldclass expertise throughout various economic cycles,” he said.

AfriSam is an experienced company in the South African market, able to draw on 90 years of experience to tackle any challenges that may arise within a major project. This includes changes in scope, procurement of materials, and quality control.

Dawneerangen said that the early-stage collaboration in mega-

projects was important, ideally at the bidding or even pre-bidding phase, to ensure that all players in the supply chain are aligned and prepared for the high production volumes and extended shifts such projects often demand.

AfriSam has invested heavily in its business to ensure it can manage the volume and quality demanded by major project works. AfriSam employs computerised batching systems in its ready-mix operations to ensure precise adherence to engineer-approved mix designs. Quality checks are implemented at every stage – from pre-dispatch testing of ready-mix concrete to on-site sampling – to provide the required strength and performance of the nal product. Batch printouts further guarantee that mixes consistently meet speci cations.

AfriSam relies on its extensive footprint of facilities and vehicle eets, all of which are managed through advanced, exible planning systems. This logistical strength enables the company to support demanding projects nationwide, including landmark developments such as the Leonardo in Sandton, the PwC headquarters in Midrand, and various major road upgrade initiatives.

Volvo CE’s launch of the New Generation A40 Articulated Hauler in Singapore is said to underscore the company’s commitment to addressing urban infrastructure challenges.

By combining smart technology with robust design, Volvo CE said the hauler delivers measurable gains in safety, e ciency, and job site productivity for local contractors, including Kok Kiat Machinery, which is using the A40 on the Tuas Terminal Phase 2 land reclamation project.

Following the successful launch in Asian markets earlier this year, Volvo CE has now brought its New Generation A40 Articulated Hauler to Singapore, rea rming its commitment to delivering rugged, intelligent machines designed for the country’s most demanding job sites.

Held at a dedicated customer event in July, the Singapore launch provided key players from the heavy infrastructure sector with an upclose look at the machine’s upgraded features, with particular focus on how the New Generation A40 is engineered to meet the challenges of Singapore’s dense urban infrastructure and tropical climate.

In Singapore, where construction projects often face challenges such as limited space, heavy tra c, and stringent safety and environmental regulations, the New Generation A40 is built to perform with precision and reliability. Its tight turning radius, intelligent traction systems, and superior visibility make it especially e ective for complex infrastructure and tunnelling applications frequently encountered across the city-state.

One of the first contractors to use the New Generation A40 is Kok Kiat Machinery, which has deployed the hauler on the Tuas Terminal Phase 2 land reclamation project in the southwestern region of Singapore.

Holcim has completed the $US1 billion sale of its Nigerian business, selling its entire 83.81 per cent shareholding in Lafarge Africa to Huaxin Cement. The deal aligns with Holcim’s strategy to streamline its portfolio and focus on high-growth regions, including the spin-o of its North American business, now trading as Amrize.

“We are pleased to have found in Huaxin Cement a trusted buyer that is committed to further developing the business in Nigeria. At the same time, the sale proceeds give Holcim additional capacity for our growthfocused capital allocation. We wish Lafarge Africa PLC and Huaxin Cement continued success,” Holcim regional head of Asia, Middle East and Africa Martin Kriegner said.

The machine is being used to transport sand and soil as part of the large-scale port infrastructure development.

Kok Kiat Machinery manager Ng Say Kok said the new Volvo machinery had impressed its operators.

“We chose the New Generation A40 for its fuel e ciency and reduced downtime compared to other machines in the market. It has proven easy for our operators to use, while also delivering improvements in uptime, traction, and control across challenging terrain,” Kok Kiat Machinery manager Ng Say Kok said.

Ng said that the investment supports Kok Kiat Machinery’s business goals by contributing to more sustainable operations through fuele cient performance and smart connectivity features such as Haul Assist and Connected Map.

PNG

Nestled between the Indian and Pacific oceans, Indonesia comprises around 17,000 islands and is looking to develop the country by mopping up resources from all sides, including government, private sector, foreign direct investment, and contributions from the state-owned enterprises.

Indonesian president Prabowo Subianto Djojohadikusumo has set a target of eight per cent economic growth each year for the next four years, which he believes can be achieved by developing infrastructure. The ambitious plan requires an estimated $625 billion to be spent between 2025 and 2029.

The Indonesian Government is executing 55 major projects, including the new national capital Nusantara in East Kalimantan province, airports, ports, roads and housing schemes.

With the US and Indonesia reaching a ‘historical deal’ that will provide Americans with access to the Indonesian market recently, the Indonesian authorities have drawn up plans to attract $53 billion in private rail investments to expand their network from 6461 kilometres (km) to 10,524km by 2030, boosting passenger and freight capacity nationwide. Key railway projects include 1200km of new track in Kalimantan and 100km in Papua. The rail lines in Sulawesi will be expanded from 71km in 2025 to 734km by the end of the decade. In Sumatra, the network will increase from 1854km to 2900km.

Infrastructure funding

In her presentation at the 2025 International Conference on Infrastructure (ICI) in Jakarta on June 12, Indonesia’s minister of nance Sri Mulyani Indrawati said that the Government needs $625.37 billion to fund infrastructure projects between 2025 and 2029.

“Of this, the Government can meet $143.84 billion [23 per cent] of total infrastructure investment needs by 2029, while regional budgets can provide $106.31 billion [17 per cent]. The Government expects the remainder to come from private sector participation - both domestic and foreign – and the creation of innovative nancing mechanisms,” she said.

Notable Indonesian projects include the continued development of the Nusantara Capital City, the 21.6km Jakarta Elevated Toll Road project costing $1.43 billion, which will run between Jatiasih in East Jakarta and Ulujami in South Jakarta, the Indonesian state-owned electricity company, PT PLN‘s program outlined in its 2025–34 Electricity Supply Plan (RUPTL), which is set to increase power capacity by 71 gigawatts (GW) by 2034.

A large portion of the 2828km TransSumatra Toll Road is already operational and is scheduled for completion in 2029.

Several housing projects, including president Prabowo Subianto’s ambitious three-million-homes-per-year programme, are being taken up to help Indonesia achieve its objective of eight per cent economic growth in 2029. For this programme, the Indonesian Government has set aside $1.72 billion for the Public Housing Loan Program (FLPP), intending to provide a cheap nancing scheme for over 220,000 housing units.

Ministry for Public Housing and Settlements director general for urban housing Sri Haryati said the Government had so far delivered 104,000 affordable houses under this housing programme with more housing projects in the works.

“The Government is currently deliberating Public Private Partnership [PPP] in which affordable houses are built over government-owned land through investment from the private sector,” Haryati said at the Indonesian Economic Summit 2025 in February.

According to data from the Indonesian Cement Association (ASI), the demand for cement declined and production fell by 7.4 per cent in Indonesia during the rst quarter of 2025, falling from 14.5 million tonnes (Mt) in 2024 to 13.4Mt in 2025.

Indonesian cement production in March 2025 was low compared to the year prior, with sales for the month falling to 3.8Mt. The nation’s capacity utilisation rate was estimated at just 57 per cent, according to the ASI. In its latest budget, the Government has also reduced funding to the Nusantara Capital City, from $4.63 billion spent in the last two years to $2.99 billion this year.

Volvo CE head of market Indonesia and Timor-Leste (East Timor) Erwin Listya Budi said Indonesia’s construction equipment (CE) market has experienced remarkable growth, increasing by 145 per cent compared to the same period in 2024.

He said the most signi cant surge was seen in general-purpose (GPE) crawler excavators in the 20-tonne class, which rose by 182 per cent.

“This strong demand is largely driven by the Indonesian Government's strategic food estate programs in Kalimantan and Papua. Thousands of 20-tonne excavators have already been deployed to support large-scale land development for new rice elds in these regions,” he said.

According to Budi, one of the major challenges faced by CE companies in Indonesia is the uctuation of exchange rates, particularly after the strengthening of the US

dollar against the Indonesian Rupiah. Since most construction machines are imported, a stronger US dollar puts pressure on pricing and can squeeze margins if price adjustments are not feasible.

To mitigate these risks, he said the CE companies must implement strategic measures such as nancial hedging or offering added value to justify pricing.

“We have recently launched the New Generation EC210 excavator equipped with advanced technologies aimed at improving productivity and fuel ef ciency. To support customers further, we also offer attractive nancing packages through our leasing partners, helping businesses invest in equipment more affordably,” Budi said.

Budi said that Indonesia has long been one of the most strategic markets for the CE industry in Asia, driven by diverse sectors such as construction, mining, agriculture, and forestry.

The country continues to grow rapidly, with substantial investments in infrastructure by both the Government and private sectors, and abundant natural resources. While the market can be cyclical due to uctuations in commodity prices and global geopolitics, the long-term outlook remains positive.

“Over the past ve years, Chinese OEMs have aggressively expanded in Indonesia by importing large volumes of equipment and establishing local networks. At the same time, leading brands such as Volvo CE continue to strengthen their capabilities to stay competitive and deliver more value to customers,” he said.

To maximise project ef ciency, CE companies are introducing advanced technologies in their latest machine generations. The New Generation Excavators of Volvo CE feature an electro-hydraulic system that can improve fuel ef ciency by up to 15 per cent.

He said other innovations, such as smart cooling systems and engine speed regulation, also contribute to signi cant fuel savings and environmental bene ts.

“In our new generation articulated haulers, we have integrated enhanced drivetrains, operator-centric design, and intelligent features. These include an advanced electronic system, Volvo-designed transmission for optimised fuel use, and innovations like Terrain Memory and Volvo Dynamic Drive, all of which deliver improved traction, stability, and overall cost-ef ciency for customers,” Budi said.

Adopting innovative technologies

Metso distribution business manager in Indonesia Unggul Aribowo said that the country's CE sector was experiencing signi cant growth, driven by infrastructure projects such as toll road construction and public infrastructure development, urbanisation, and technological advancements.

The CE market has also witnessed growth in the adoption of innovative technologies like the Internet of Things (IoT), arti cial intelligence (AI), and automation. This enables real-time monitoring, predictive maintenance, and improved ef ciency.

“The Government has enacted regulations to ease import restrictions on essential capital goods, including construction machinery, supporting the industry's growth,” he said.

According to Aribowo, the CE companies and suppliers in the country were facing several challenges, such as increasing costs in acquiring the latest machines due to high import tariffs and taxes, making it dif cult for construction companies to afford new equipment, coupled with a shortage of skilled labour to operate and maintain sophisticated equipment, leading to inef ciencies and safety concerns.

The CE companies are required to adopt eco-friendly practices due to stricter environmental regulations. However, many have been unable to transition to low-emission technology due to nancial and technological constraints. Aribowo said that volatility in raw material prices can restrict their market expansion.

Despite these challenges, companies were leveraging opportunities in the market by providing eco-friendly heavy equipment for various projects, supported by advanced technology, developing green building capabilities, investing in digital technologies, and building strong local supply chain networks to maintain their market position.

Aribowo said for smaller companies that cannot afford new CE machinery, suppliers are providing more affordable second-hand equipment options,.

Aribowo said the Indonesian market is well-positioned to supply construction equipment to meet growing demand from mega projects.

There has been a growing demand for electric and hybrid machines, driven by carbon-credit incentives and lower operating costs. Regions like Kalimantan and Java are emerging as high-growth areas, fuelled by infrastructure development and industrial projects.

Aribowo said companies are also developing electric and hybrid machines that produce zero emissions on-site, reduce noise pollution, and lower operating costs over time. Smart energy management systems are optimising energy use on-site by integrating renewable energy sources, monitoring fuel consumption, and automatically adjusting power to equipment based on real-time needs to ensure a reduction in waste and save energy.

Aribowo said that some companies are offering heavy equipment rental services, providing reliable and high-quality machinery for construction, mining, and infrastructure development projects. He said this has been helping the infrastructure project developers to achieve project goals on time and within budget.

US tariffs and the construction equipment market

While countries across the world are grappling with the US tariff policies, the Indonesian CE market, which is expected to grow at a compound annual growth rate (CAGR) of 4.12 per cent from 2024 to 2030, is moderately affected by them, the market research rm ResearchAndMarkets.com said.

The report said that several construction equipment brands, have local manufacturing facilities in Indonesia, partly due to its low dependence on imported raw materials like steel, aluminium, and rubber from the US market. However, for some US-based brands, which hold a strong market presence in Indonesia, the prices of imports for these brands have increased due to the impact of tariffs.

Earthmoving equipment accounted for the largest market share in the Indonesian construction equipment market in 2024, ResearchAndMarkets.com said.

Excavators in the earthmoving segment accounted for the largest share, as the demand for 4.5-tonne excavators was the second largest after 20-tonne excavators in Indonesia in 2024.

ResearchAndMarkets.com said it expects the construction industry in Indonesia to expand by 4.1 per cent in real terms in 2025.

The market research store said this would be supported by investments in transportation infrastructure projects, particularly rail and road infrastructure projects, coupled with rising public and private sector investments in housing and power construction projects. AB

A premium Metso production set-up is enabling an Indian company to achieve its ambitious sand production targets.

In the heart of India’s infrastructure boom, Harenahalli Stone Crushers has emerged as a prime example of innovation meeting demand. With a clear vision to support the nation’s transition to sustainable construction materials and in response to the increasing restrictions on river sand mining, the company embraced manufactured sand as the future of aggregates.

Established in 2023, but backed by over two decades of experience, Harenahalli Stone Crushers partnered with Metso to install a highperformance, fully integrated crushing and sand production setup. This collaboration resulted in a state-of-the-art plant capable of producing 100,000 tonnes of material, with 40 to 45 per cent high-quality manufactured sand. The plant con guration includes advanced equipment like the Nordberg C117 jaw crusher, HP300 cone crusher, and the Barmac B7150SE Barmac B7150SE impact crusher with dual drive, all supported by a MWS Compact Sand Plant CSP10 and Metso’s life cycle services (LCS).

“We are able to produce approximately 10 end-products, such as granular sub base, 40mm, 20mm, 12mm, 6mm, manufactured sand [M-sand] and plaster sand [P-sand]. The rest is produced into 40 aggregate products. We are producing around 40 to 45 per cent sand of the total output,” Harenahalli Stone Crushers partner Ashik Shiva said.

“We chose the Nordberg C117 jaw crusher to ensure very good production and get a bigger feed size through the plant. We chose the HP300 [cone crusher] for its automation, safety sensors, and the wide variety of features that it offers.”

Today, Harenahalli Stone Crushers delivers up to ten different end products ef ciently, meeting the growing demand for manufactured sand in road and irrigation projects. Using Metso’s equipment and LCS support, the plant operates at over 90 per cent uptime, offering reliability, scalability, and peace of mind. Its success has already paved the way for future expansions, with new Metso plants planned to support upcoming projects.

“The plant is still running like new, and I’m con dent that with LCS, we can run it like we are for the next 20 years,” Shiva said.

“We are very happy to have purchased this plant, which is why we are planning to purchase another Metso plant for our newer projects.”

A Metso customer since 2017, Harenahalli Stone Crushers began discussions with the quarrying plant solutions giant in 2020 regarding a new state-of-the-art production setup.

“As we know, India is moving towards a ve-trillion-dollar economy. There is a ban on using natural sand [for building works], which is creating higher demand for P-sand and M-sand. As infrastructure development increases, demand for M-sand will rise further,” Metso India vice president for aggregates sales Harpreet Singh said.

What is LCS for aggregates?

LCS takes Metso’s entire aftermarket portfolio and conveniently bundles it into customisable, easily manageable packages. Depending on the scale of customer needs, the packages are exible and equipped to cover a single event or to span multiple years, measured against strict key performance indicators.

Whether acting as a supplement to a customer team or managing all aspects of the customer’s maintenance and operations, LCS packages are designed to help customers meet their performance and sustainability goals.

Metso has been offering innovative LCS solutions for over 15 years, and no one solution has looked the same.

The company collaborates closely and designs a programme that works for each customer. Each programme can focus on a speci c goal or develop a partnership based on continuous improvement and optimisation.

For added simplicity, Metso has categorised LCS into progressive packages, each building on one another, yet still personalised to what the customer needs.

Additionally, each package is backed by exible commercial models including leasing and rental options, monthly payments, costper-tonne, or payment deferrals. AB

Aggregates are the most-used bulk material on the planet; however, the true scale and dynamics of the sector are not always appreciated. Global Aggregates Information Network now o ers improved industry production data, and founder and president Jim O’Brien writes about the latest insights into global aggregates production trends.

The Global Aggregates Information Network (GAIN) is a voluntary coalition of aggregates associations around the world with the purpose of sharing best practices for the greater sustainability of the industry. Founded in 2010 with only ve members, GAIN now has 20 members on all six continents, with its member countries representing 75 per cent of the global aggregates production of 39 billion tonnes (Bt).

The 7th GAIN Meeting took place in Córdoba, Argentina, in October 2024.

GAIN is non-commercial and operates on a strict antitrust basis.

GAIN is uniquely successful in its highly interactive global membership, thanks to the very positive cooperation between its members.

GAIN members hold bi-monthly virtual meetings, each focused on a speci c topic, complemented by an annual physical meeting, the most recent being held in Córdoba, Argentina.

The wide-ranging agenda focused on sharing best practices on key industry challenges. Annual GAIN meeting attendees found the industry to be in resilient recovery post-pandemic and poised to address and bene t from future sustainability challenges and opportunities. The most recent physical GAIN meeting was held in Córdoba, Spain, in October 2025, at which all existing and new GAIN members will be welcomed. The 2026 meeting will be held in Shanghai, China.

One function of GAIN is to compile the best available estimates of aggregate production from data provided by its members, the most recent of which is from mid-2025.

The GAIN total of 34.1Bt in 2019 has declined to an estimated 29.3Bt in 2025, the decline of 4.8Bt or 14.1 per cent, mainly due to economic slowing in China.

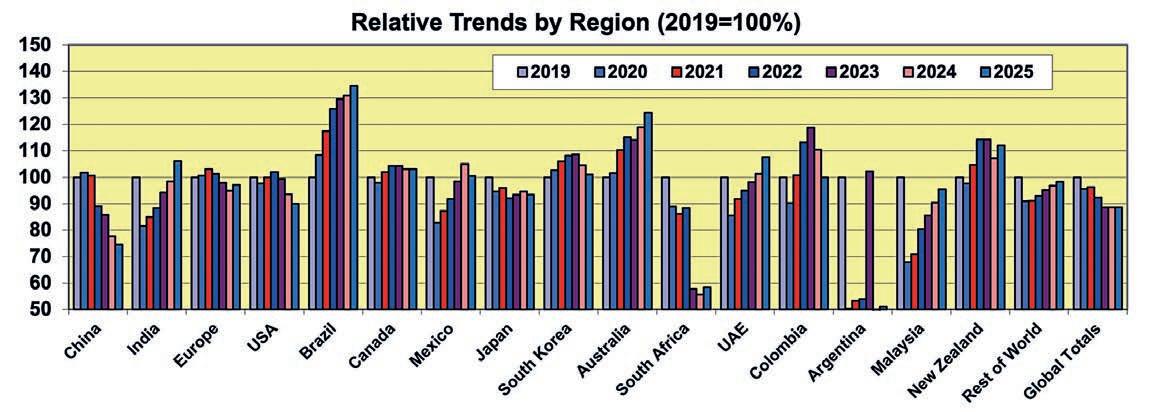

ABOVE: Estimated 2019-2025 Regional and Global Aggregates Production Tonnages.

ABOVE: Production trends 2019-2025 by GAIN member country (taking 2019 as 100 per cent).

When estimates for non-GAIN countries are added (these based on national populations x their estimated tonne per capita), the global totals of 44Bt in 2019 have actually declined by 11.4 per cent to an estimated 39Bt in 2025.

The 2019-2025 trends by GAIN-member countries demonstrate the decline in demand in China, while India is now growing very strongly, as are Brazil and Malaysia.

The trends also show the negative effect of the pandemic in 2020 in developing regions, while developed regions fared better.

The global breakdown by region is still dominated by China at 37 per cent, with India coming second at 16 per cent, followed by Europe at seven per cent and the US at six per cent; these top four comprise 66 per cent of the global demand. The total for all GAIN members comes to 75 per cent of the 2025 global total of 39Bt.

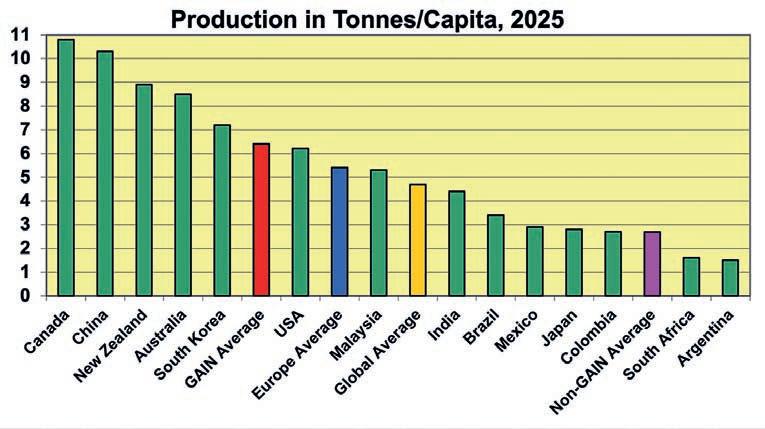

Of signi cance is how the production in tonnes per capita (t/c) varies by region. Amongst GAIN members, these range from just over 10t/c in Canada and China to less than 2t/c in Argentina and South Africa.

The global average is 4.7t/c; for GAIN members, the average is 6.4t/c, and the non-GAIN average is 2.7t/c (many of these being undeveloped countries).

Industry experience shows that the national aggregates demand in tonnes per capita can be empirically related to a country's gross domestic product (GDP) per capita, or more precisely, the rate of change in GDP per capita, plus upward adjustments can be made for other prevalent factors including national terrain ruggedness and winter climate severity.

Global outlook to 2030

The gradual decline in demand over the last ve years in China is now being counterbalanced by strong growth in India, the second largest aggregates market globally, as well as nascent growth in the Southeast Asian economies such as Malaysia and Vietnam. Although Europe saw declines in 2023 and 2024, the outlook for 2025 is

positive, driven primarily by defence and infrastructure spending.

The US experienced a decrease in 2024, which continued into 2025. However, this trend may be offset by the mandated national major transportation upgrades. Trends in Canada and Mexico will depend on the outcome of tariff negotiations.

Fortunes vary by country in Central and South America, with Brazil, the region’s largest economy, being the shining star. Little information on aggregates is available for Africa, however, the continent has immense growth potential. In Oceania, both New Zealand and Australia are in a stable growth mode. At a global level, the slowing rate of declining demand in China can be counterbalanced by growth in India and many other regions. Thus, it is likely that the decline in global demand for aggregates since 2019 has now levelled off in 2025, portending guarded optimism for an increasing global demand for aggregates out towards 2030.

Given a positive global geopolitical outlook in the next ve years, with resultant economic growth, global demand can again reach 40Bt or even more by 2030.

Aggregates remain a fragmented sector globally. The biggest players are CRH, Heidelberg Materials and Holcim, each with a global production of over 250 million tonnes (Mt), followed by CEMEX, Vulcan, Martin Marietta, and the three Chinese players CNBM, CRCH and CONCH, now producing over 100Mt each. The top 25 aggregates players make less than 10 per cent of global production, in contrast with the top 25 cement producers, which represent around 40 per cent of global cement production. Further consolidation is likely in the aggregates sector as cement players see the mutual bene ts of vertical integration.

Achieving access to resources, particularly near major urban markets, for the coming decades is a universal challenge for GAIN members. Some countries are suffering acute shortages of aggregate supply due to planning and permitting constraints; of note in that context is that New Zealand recently placed aggregates and sand on its critical minerals list.

The common drivers of aggregate demand are inward migration, population growth, urbanisation, the need to upgrade ageing infrastructure, and providing resilience in climate adaptation.

Like the cement sector, the aggregates sector has an increasing focus on sustainability. Aggregates have a minuscule carbon footprint at about 5kg of CO2 per tonne (Scope 1 and Scope 2), meaning that the aggregates sector has a total global footprint of only about 200Mt CO2, approximately eight per cent of that of the cement sector. For aggregates, Scope 3 emissions depend on the distance and mode of transport to market.

Despite the low footprint on the aggregates sector, there is an enduring focus on greater ef ciency on all activities from extraction to crushing, screening and transport, for strong commercial as well as environmental reasons. Every cent per tonne saved translates into millions in the aggregates sector.

The aggregates sector is focused on its water usage. FFEven with extensive water recycling, the sector average consumption is some 133L per tonne of aggregates, less than half the equivalent cement industry average gure. However, since the global aggregates production is 10 times that of cement, the aggregates sector consumes about ve times as much water in comparison, so in the aggregates sector, water reduction is increasingly a priority.

On the positive side, the aggregates sector is dedicated to restoration (often based on water features) and the associated fostering of biodiversity, and there are many case studies of which the industry is justi ably proud.

As might be expected, there is continual innovation towards optimising extraction, crushing and screening performance, with better control of product gradations and increased power ef ciency.

Plant design is more modular, more compact in space, enclosed as far as possible, with extensive controls on both dry and wet emissions, often using long conveyor belts instead of truck haulage.

Digitisation, coupled with increasing use of arti cial intelligence (AI), continues to improve operations at all stages of the process, including transport to market; there are case studies in China of completely autonomous quarries, which, in their case, can now have up to 50Mt per year production capacities.

Like the cement sector, the aggregates sector is also strongly focused on circularity. Europe leads with an average of 12 per cent of production supplied by recycled and secondary materials; this gure is up to 25–30 per cent in the UK, Belgium, the Netherlands,and Germany.

Recycling is now assuming greater importance in its exciting potential for re-absorbing carbon and returning liquid materials into the cement process.

Another signi cant innovation is in the production of high-quality manufactured sands (M-Sand) from crushed rock nes,

which can not only replace natural sand but also lead to improved concrete mix design, potentially reducing binder content.

Many GAIN members are seeking to ameliorate post-pandemic labour shortages by making the industry more attractive to young people and improving its work-life balance.

The global aggregates industry is estimated to employ 3.5 million people worldwide, offering often-overlooked career opportunities.

In parallel, GAIN members are enhancing communications to stakeholders, explaining the vital role the industry plays in supplying a product essential to societal wellbeing, while providing secure local employment, promoting circularity, caring for the environment and fostering biodiversity.

GAIN is encouraged by steadily increasing membership across all six continents and growing success over the 15 years since its founding in 2010.

GAIN sees particular opportunities in attracting new members in key quarrying and aggregates markets including SouthEast Asia, in Latin America, in the Middle East, in the Central Asian republics and particularly in Africa.

Overall, the organisation continues to support its members as they drive the sustainability ambition for the global aggregates sector in the coming years. AB

The international quarrying and aggregates sector continues to attract world-class talent to its ranks with new appointments.

Construction material producers, industry associations and original equipment manufacturers have been busy con rming a series of key appointments in recent months.

Mariusz Mlodawski has of cially started his new role as the Cemex country director for the United Arab Emirates (UAE).

Mlodawski brings nearly two decades of experience, including, according to Cemex, major UAE projects like One Za’abeel in Dubai.

Mlodawski will support the introduction of Cemex Vertua as well as its other low-carbon range in the UAE market.

“At Cemex, safety is paramount. Pursuing operational excellence, fostering innovation, and encouraging collaboration are critical pillars of our success,” Mlodawski said.

“By reinforcing these values, we aim to strengthen partnerships, empower our people, and deliver longterm value for employees, customers, stakeholders and industry.”

Elsewhere, global construction materials producer CRH has welcomed Patrick Decker to its board of directors.

The appointment became effective on October 1. Decker was the president and chief executive of cer of Xylem from March 2014 to December 2023.

“We are delighted to welcome Patrick to our board of directors,” CRH chairman Richie Boucher said.

“With his extensive experience in leading global organisations and his deep understanding of the industrial and water technology sectors, Patrick brings invaluable insights and expertise to our team.

“His proven track record of driving innovation and achieving strategic goals will be instrumental as we continue to execute our vision and deliver value to our shareholders.”

Over in the US, the Texas Aggregates & Concrete Association (TACA) revealed Andrew S. Pinkerton is the organisation’s new president and chief executive.

Pinkerton joins the TACA after an extensive career in the construction materials industry, including a stint at the Cement Council of Texas as an executive director.

“Andrew’s extensive background in the construction materials industry, combined with his proven association leadership, makes him the ideal person to guide TACA into the future,” TACA board of directors chair Rich S. Szecsy said.

“His passion for delivering value to member companies – along with his commitment and advocacy for safety, sustainability and the communities where we operate and ultimately build – will strengthen our industry and bene t the great state of Texas.”

Pinkerton has experience from roles at US Concrete Inc. and Texas Industries Inc., as well as bachelor’s degrees in marketing and management from the University of Oklahoma.

“I have always believed that strong associations are the cornerstone of a strong industry,” he said.

“As Texas continues to grow each day, our industry plays a critical role in aligning population growth with a sustainably built environment, the conservation of natural resources and continuing to deliver the materials that satisfy the state’s unprecedented demand for aggregates and concrete.

“I am honoured to advocate for the safe, resilient infrastructure and advanced mobility solutions our members provide today – and for generations of Texans to come.”

It is not only associations and construction materials producers that have been adding to its ranks. Original equipment manufacturers have also been busy bolstering their employee ranks.

Rokbak has added Graeme Blake to its newest product development team, where he will play a role in shaping the future of Rokbak’s trucks and haulers. Blake joined the Volvo Group in 2014, where he started as a CNC (computer numerical control) machinist and was nominated for apprentice of the year. In recent times, he has held roles in fabrication and testing before joining the product management team at Rokbak.

Blake said his hands-on experience would hold him in good stead in his new role.

“I’ve gone from building the basics of a truck to testing it in extreme conditions. Now, I’m excited to help shape the product itself,” he said.

“I learnt a lot in my previous job as a test technician and I’m looking forward to utilising that insight in my new role, where I’ll be focusing on product updates and developments.

“I want people, engineers, operators, whoever, to say, ‘He’s knowledgeable. I can go to him and he will help me with this’.

“It’s about trust. If a customer comes to us with a problem, they should feel con dent leaving it in our hands knowing it’ll be sorted.”

Blake, who lives locally to Rokbak’s Motherwell production facility, was excited to spend more time being hands-on with the manufacturer’s quality products, including the RA30 and RA40. Rokbak carries out the engineering, manufacturing, testing and feedback of its articulated dump trucks (ADT) at its Motherwell factory.

Blake said the factory will continue to be integral to the company’s quality products.

“Customer input is essential to us at Rokbak. Whether it’s ergonomic feedback from operators or lessons learned from eld experience, it’s all valuable information,” he said.

“Operators spend a lot of time in their trucks, so they need to be comfortable. If something can be improved – whether it’s greater visibility, the ergonomics of the controls, better HVAC or more seat comfort – we listen.

“We’ve got everything we need here to design and build robust and reliable haulers – the people, the knowledge, the skills and the infrastructure.” AB

Aggregates Business is a go-to source for up-to-date news and views on the European, Asian, African, Middle Eastern and American aggregates and building materials sectors. Our wide-ranging features line-up includes in-depth articles on the latest crushing and screening, loading and hauling machines. Subscribe today:

subscriptions@primeglobalpublishing.com

Holcim Italy’s Paolo Zambianchi talks to Aggregates Business about the critical importance of aggregate supply and why he is advocating the use of technology to optimise primary and secondary production.

Holcim Italy technical director of aggregates and ready-mix Paolo Zambianchi believes the current global geopolitical landscape has awakened politicians and policymakers to the critical importance of essential raw materials, including aggregates, and the need to secure their supply for the health of their nations.

“I have seen over the last 20 years a political regression regarding the critical importance of raw materials, at a national and European level,” Zambianchi said.

“After dramatic events, including the Russia–Ukraine war, perspectives are changing. The European community now understands the crucial role of raw materials as strategic resources. Without raw materials, there is nothing.”

An Italian national, Zambianchi has been in his current role since 2011 and is responsible for production, maintenance, safety, and investment at Holcim Italy’s four aggregate quarries and 22 ready-mix plants. The former produce a combined 1.3 million tonnes of aggregate and sand annually, while the latter generate up to 1.5 million cubic metres of ready-mix per year.

“Holcim concentrates its operations in northern Italy. I am also in charge of these sites’ environmental side and their relationships with the authorities,” he said.

Another key element of Milan-based Zambianchi’s work is securing operating permits and licenses for Holcim’s aggregate and ready-mix sites. This increasingly complex and challenging aspect of production has long been a focus of the European sector.

“Permitting and licensing for our business is crucial. Without approvals, we won't produce any more aggregate and ready-mix cement, and we won’t have the civilisations we have now,” Zambianchi said.

“Every region and every state in Europe has to be able to guarantee the quantities and supply timing of raw materials for more than 50 years, but we are getting permits and licenses for only two to ve years. It’s such a short time.”

Zambianchi said ensuring work site safety is his most signi cant constant challenge.

“Holcim wants to achieve a fundamental target of zero Injuries. It’s a tough target we face every day,” he said. “This is not just for Holcim employees; we work with many third parties.

“While Holcim is already a sustainable company, we want to reduce our CO2 footprint further and also do more to improve our circularity. We have tough targets to reach by 2030, so our transformation must be achieved in a short time.”

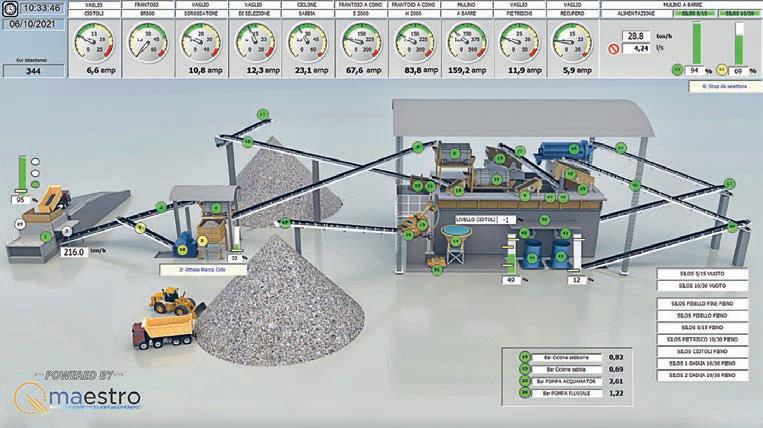

1. Example of a Ma-estro digitalised quarry plant optimisation solution. Ma-estro was among the key partners involved in the Holcim Italy Pioltello DigiEcoQuarry pilot.

2. Paolo Zambianchi believes big geopolitical changes have brought home to politicians and policymakers the critical importance of essential raw materials, including aggregates.

A keen advocate of the role of technology in modern aggregate production, Zambianchi led Holcim Italy’s involvement in the fouryear, EU-funded DigiEcoQuarry project, the brainchild of Asociación Nacional de Empresarios Fabricantes de Áridos (ANEFA), one of Spain’s oldest and most reputable associations for the national extractive industries and construction products.

DigiEcoQuarry saw ve pilot quarry sites (in Italy, Germany, France, Spain and Portugal) with different characteristics adopt Innovative Quarrying Systems (IQS), comprising sensors, processes, tools, and methods for data capture, processing and sharing, to provide integrated digitalised, automatic, and real-time process control for aggregate quarries.

Completed last year, the results of and conclusions from the DigiEcoQuarry project were shared by Zambianchi and other pilot leaders via in-person presentations to an independent international advisory board and other stakeholders at Aggregates Europe’s headquarters in Brussels in June.

Each pilot site reported signi cant improvements in health, safety and security, as well as in ef ciency, selectivity, and pro tability, while reducing environmental impact and increasing social acceptance.

With DigiEcoQuarry technology now rmly embedded in each pilot site, the project offers best practice examples for aggregates processing sites in Europe and the wider world.

“Holcim’s Pioltello San Bovio sand and gravel quarry, a 400,000-tonnes-a-year operation near Milan, was one of the pilot sites,” Zambianchi said. “It was exciting to be part of the DigiEcoQuarry project and to be working with so many great people. We focused on some key performance indicators related to the environmental and ef ciency aspects of production. Regarding the former, we explored ways to increase the amount of recycled water used in material production, thereby reducing the amount of freshwater required.

“We designed a system with around 80 to 90 machine sensors to add to the site’s

existing automation and help the quarry team focus on how they were processing materials through crushing, screening and washing. We also focused on safety, installing new sensors on some of the site’s heavy mobile machinery and utilising arti cial intelligence [AI] for stockpile measurement.

“We built a cloud platform where all the data was collected and analysed. It was a very interesting experience. Across the 25 or so partners involved, we had representatives from IT, software and arti cial intelligence companies.”

Firms working with Zambianchi and his Pioltello San Bovio project quarry team included Ma-estro, the Italian quarry

“I designed the CavoExpoTech brand and patented the name under ANEPLA. We’ve run it for 10 years and it’s the reference event for quarrying in Italy.”

and plant optimisation specialists; Arco, a leading Spanish industrial weighing solutions business; Sigma Cognition, a Spanish end-to-end, data-centric AI and machine learning solutions business; and Mintek, South Africa’s national mineral research organisation and one of the world’s leading technology companies specialising in mineral processing, extractive metallurgy, and related elds.

“The overall systems we and the other pilot sites chose had to be cheap and easy to install and manage, as this was linked to quarrying rather than mining,” Zambianchi said. “Over the four years of the project, Pioltello achieved around 10 per cent more productivity and ef ciency, cut production costs, and reduced freshwater use by two per cent. With ANEFA, the DigiEcoQuarry project leader, we are studying some other technology that we can test at Pioltello and the other pilot sites.”

Zambianchi is also excited about the circular economy opportunities offered by Holcim Italy’s rst construction and demolition (CDM) waste recycling hub at Gorla Quarry in Varese, around 60km northwest of Milan.

“This is a very important new development in our decarbonisation journey,” he said. “The EU target for recycling CDM [construction and demolition] waste is 75 per cent by 2030, and in Italy, we are already at 85 per cent. It’s a big success story.”

Zambianchi told Aggregates Business about his insights into the current state of the Italian aggregates market.

“The situation is dif cult for many reasons, including high energy costs and the fallout from what is happening internationally. More positively, the European Union is investing in large-scale infrastructure projects, such as new high-speed train lines and highways, which are bene cial for companies like Holcim,” he said.

“As a country, Italy is also investing in infrastructure, particularly in the north of the country.

“We have the [Milan Cortina] Olympics in February 2026, and Holcim is giving a lot of aggregate, cement and ready-mix to construction works, including our ECOPlanet green cement.

“The market is very interested in how our sustainable products relate to environmental product declarations [EPDs]. Enhancing

sustainability in building works is a key strategy for us. Holcim Italy is focused on supplying ECOPlanet and other sustainable products to bigger infrastructure projects, as the regulations are clear around the amount of recycled and low-carbon materials that need to be used by contractors.”

Zambianchi is the vice chairman of Aggregates Europe’s environment committee and continues to serve on the board of ANEPLA, having previously served as the association’s president from 2014–20. Under Zambianchi’s leadership, ANEPLA became a prominent association member of Aggregates Europe and launched CavaExpoTech, an annual meeting place for producers of mining goods and services and quarry entrepreneurs.

Each event, held at different ANEPLA member sites throughout Italy, is traditionally divided into classroom-based professional development on current industry trends, followed by static and dynamic demonstrations of quarrying machinery and linked technology. In addition to each live event, a series of CavoExpoTech webinars is staged throughout the year.

In his six years as president, Zambianchi also signi cantly increased ANEPLA’s membership, bringing in aggregate industry service companies, and strengthened the association’s working relationship

with Con ndustria, the main association representing manufacturing and service companies in Italy.

“I designed the CavoExpoTech brand and patented the name under ANEPLA. We’ve run it for 10 years and it’s the reference event for quarrying in Italy,” Zambianchi said.

“We do one or two CavaExpoTechs per year. If we host two events, based on member demand, one will be held in the north and the other in the south of Italy. We invite industry stakeholders and local politicians, and always have one quarry site day for families, with children participating in all kinds of fun activities.

“At a CavaExpoTech event last year, Caterpillar and CGT, its Italian dealer, attended with Cat Command [remote control machine solutions]. Some important politicians heard about this and were eager to try it, so they took turns operating the excavator remotely. It was very nice to see.”

A geology graduate who also holds a master’s degree in business administration with a focus on the oil, gas and raw materials industries, Zambianchi spent three years working in the Italian oil and gas sector before entering the aggregates industry with Holcim Italy in 2001.

“I think we need to do more with schools and universities as industry companies

and, in ANEPLA’s case, as associations, otherwise we will lose the next generation’s interest and quarrying and mining industry competencies,” Zambianchi said.

“This is why Holcim Italy has started an academy near our headquarters in Milan that teaches local schoolchildren industry knowledge and skills.”

After an extensive career, Zambianchi is clear that there is still plenty wants to achieve in the Italian and wider European aggregates industries.

“Like in a rugby match, it is impossible to win without the support of your team and playing for each other. My team at Holcim Italy aggregates and readymix is crucial,” he said.

“You come to Milan, and in the last 20 years it has undergone signi cant changes, with skyscrapers, subways and buildings made from green, sustainable building materials supplied by Holcim.

“It’s a big transformation, and it makes me very proud. I am also proud of being the rst Holcim Italy manager to receive authorisation for a CDM waste recycling hub [at Gorla Quarry]. I want this hub and Holcim Italy in general to be the reference point when it comes to recycled materials to enable sustainable construction, not just in Italy but the whole of Europe.” AB

SunEnviro is expanding its waste processing capabilities to produce premium aggregate products and sand at its site in Thetford, England, following a £3 million investment in a state-of-the-art McLanahan waste recycling plant. Aggregates Business visited the site for a close-up look and to hear about the long-term expectations for the set-up.

When Aggregates Business toured the SunEnviro open day, the company’s managing director Mat Stewart said his three business brands, SunSkips, SunDemolition and SunAggregates, generate no waste that is directly sent to land ll.

SunEnviro’s new up-to-70-tonnes-perhour (tph) waste recycling plant in Thetford, Norfolk, one of several SunEnviro operates in eastern England, will process up to 100,000 tonnes of waste annually into premium aggregate products and sand in compliance with (BSE 9321) British Standards.

While SunEnviro’s signi cant seven- gure investment in the comprehensive McLanahan set-up has already started to prove its worth since becoming fully operational in May, the rm’s notable increase in its waste processing is likely to also prove highly shrewd.

Introduced in 1996 to encourage more sustainable waste management practices, the Land ll Tax applies to taxable disposals at land ll sites and, more recently, unauthorised sites. In April 2025, HM Treasury, the UK Government’s economic and nance ministry, and HM Revenue & Customs, the UK’s tax, payments and customs authority, launched a consultation on Land ll Tax reform, proposing the removal of the lower rate of Land ll Tax (£4.03 per tonne for inert materials such as rocks and soil) by 2030. In its place, an escalator will be applied to the lower rate until it reaches the standard rate level (currently £126.15 per tonne), with the qualifying nes regime and quarries and dredging exemptions being removed from April 2027. The new Land ll Tax rules will be coupled with increased penalties for illegal disposals.

Stakeholders, including the Mineral Products Association (MPA) and British Aggregates Association (BAA), have expressed concerns about the economic impact of the Land ll Tax reform proposal. Consultation closed in July, with a wide range of industries, including quarrying, construction and recycling, awaiting the UK Government’s next steps.

Stewart, who has nearly 30 years of experience working in environmental services, with SunEnviro, which started as SunSkips in Stowmarket in May 2020, now covering sites in Thetford, Cambridge, Haverhill, Ipswich, Dereham and Hoddesdon, told Aggregates Business this could present an opportunity for his company.

“If all goes to plan, we thought we’d start seeing a return on our investment in three to four years, but if the Government do what they say they are going to do [on Land ll Tax

reform], it will be a lot quicker, potentially 12 months,” he said.

“We are saving £600,000 to £700,000 a year by not having to put 30,000 to 40,000 tonnes of waste and nes into land ll, and that’s at the lower [Land ll Tax] rate. If the standard tax rate applies, I don’t know how many businesses like ours will be able to put a skip out and be competitive.

“We are also fortunate in being able to control what we bring here in our own vehicles. We can keep material coming in, but our guys have got to sell the recycled aggregate and sand product that goes back out, so we adjust the daily volumes we are processing.”

SunEnviro’s bespoke waste recycling plant features a McLanahan UltraSCRUB, UltraSAND and HRT10 Thickener, which work together to ensure high throughput, minimal water usage, and full site circularity, culminating in the nal step of the process: a McLanahan Filter Press.

The McLanahan set-up at Thetford, which washes and recovers materials from construction and demolition sites, excavation waste and trommel nes, is part of SunEnviro’s nationwide effort to turn waste into valuable recycled aggregates under its SunAggregates brand.

Comprised entirely of McLanahan equipment and plants, the Thetford solution has been designed to minimise water intake and ensure the process retains as much material and water on site as possible.

The site’s tight two-acre footprint has necessitated a considerable planning process for McLanahan. The system forms an ‘L’ shape along two sides, maximising room for feed material and clean, sorted end products.

Stewart said a lot of research went into the decision to opt for a McLanahan waste recycling plant at SunEnviro Thetford.

“I looked at eight suppliers and then a friend of mine at Global Machinery Solutions introduced McLanahan to me,” he said.

“I whittled it down to three suppliers and then worked with McLanahan to optimise what we wanted here, looking at the site we had available. It was good to work with people who wanted to provide us with a solution: a, to t on the site; and b, to wash what we wanted to wash.

“McLanahan was the easiest to work with and had the breadth and depth of knowledge that others didn’t, or didn’t want to share. I also think they really wanted to work with us. The whole [recycling plant investment] deal took around 10 months.”

SunEnviro manages more than 120,000 tonnes of waste across the east of England, with an inventory of 4000 skip containers and a eet of 65 fuel-ef cient vehicles. The company only processes waste collected from its SunSkips and SunDemolition sites.

“The plant feed is half crushed rubble and half trommel nes, which is turned into 0–4mm sand, and 4–10, 10–20 and 20-plusmillimetre aggregate,” Stewart said.

“I like to say that what we do is spinning plates. All of our [SunSkips and SunDemolition] sites are full of nes and

With support from McLanahan, SunEnviro is turning waste into valuable recycled aggregates under its SunAggregates brand.

rubble, which is great feedstock for here. This Thetford site sits in the middle [of SunEnviro’s site network], and I can bring nes in from, say, Norwich and take washed sand or 0–10mm aggregate back to sell out of bags at that site.

“We sell to local construction companies, housing developers, highway contractors, and civils and utilities companies.”

SunEnviro and McLanahan partnered for an open day at SunEnviro’s Thetford site in September. The two companies welcomed around 80 industry professionals representing a variety of construction and civil engineering companies, as well as council highways authorities, to experience SunEnviro Thetford’s innovative McLanahan recycling system.

This open day offered those looking to improve or add a recycling process to their plant, as well as those who are struggling with the upcoming costs associated with the end of qualifying for trommel nes in the UK, signi cant insight into best practices for building a circular system.

“We are really excited about what’s happening in Europe. We made a substantial investment in the market over the past veplus years and have over 100 employees in the UK and [mainland] Europe,” McLanahan chief executive of cer Sean McLanahan said.

“We are continuing to expand, and part of that is in construction and demolition [C&D] waste recycling, which is extremely important to us.

“The two areas in which our company continues to grow around the world are

in C&D recycling and water management, utilising our thickeners and lter presses.”

Stewart said his company was proud to showcase its latest solutions with McLanahan.

“I think it’s great to work with McLanahan and help them get into a market that is desperate for professional businesses to sell them a product that works,” he said.

“I think [the open day] has been good for people to see how we t and operate this kind of plant on an industrial estate site. Everyone automatically thinks it would be based in a quarry.

“If you look at the Norfolk Local Plan, all inert recycling is being directed towards industrial sites rather than extending the life of quarries. We are very proud of what we have here. We want to replicate it at some of our existing sites and potentially at some new ones that we buy in the future.”

McLanahan business line director David Hunter said the process shows what could happen when suppliers and producers collaborate together,

“This installation has been a real collaboration, a lot of sitting down together, talking through the process and adjusting,” he said. “This is the rst time we’d put a plant like this in, and we were saying, ‘Guys, we will make this work’.

“Changes in legislation are increasing interest in what we can offer. There are a lot of operators who aren’t geared up yet for what might be coming. SunEnviro has got ahead of the game, and it’s great to be part of that.”

Stewart said he wants the Thetford McLanahan plant to feature an eddy current separator (ECS). This machine uses highspeed rotating magnets to induce eddy currents in non-ferrous metals, such as aluminium and copper, creating a repulsive magnetic eld that pushes them out of the waste stream. The process is used in recycling facilities to recover valuable metals from materials such as plastics and wood,

increasing recycling rates and reducing land ll waste.

“I don’t think many McLanahan customers had asked for this, but they found us a supplier we could work with and included it in their package. We didn’t want to have to nd our own supplier and add bits into the plant,” Stewart said.

“We were also clear that we wanted to meet the WRAP quality protocol (a document that sets ‘end-of-waste’ criteria for the production of a speci c recovered product, such as aggregates, compost or glass cullet). This plant does.

“We like the fact that McLanahan is a 190-year-old family business, with a similar philosophy to SunEnviro. Just looking at the quality of the equipment and the fact that they were keen to handle any problem were also big selling points for us.”

“We don’t look at changes in legislation as a pain in the neck; we look at them as opportunities.” AB

As the only national quarrying publication and the official journal of the Institute of Quarrying Australia, you’ll always be up to date with the latest developments in industry news, technology and events with Quarry Magazine. It’s quick and easy to subscribe to our monthly print issues, our annual Suppliers Directory and our weekly eNewsletter. Don’t miss out!

PMG Services has reinforced its commitment to sustainability by making its second purchase of a CDE waste recycling plant. Aggregates Business took a close-up look during a CDE openhouse event at the company’s new headquarters.

Clare McGuinness is excited about the future of PMG Services (PMG). And the managing director of the family-owned-and-operated business has every right to be given PMG’s impressive new headquarters in Severn Beach, 10 miles north-west of Bristol.

At its heart of the HQ is a new 25-tonnesper-hour (tph) CDE waste recycling plant solution, part of PMG’s ‘zero-to-land ll’ movement, which is setting the rm up for a new era of success.

“We’re on a journey to process even more waste across the south-west of England. Our vision is to keep growing the waste processing capability at PMG and be able to divert more valuable material from land ll,” Clare said.

“We’re a family-run business with over 35 years of experience, and in that time there has been a lot of change and investment.”

For over a decade, PMG operated a 10tph CDE waste recycling plant set-up at its former site in Albert Road, behind Bristol Temple Meads train station. Clare said this enabled a better understanding of CDE’s new waste recycling plant technology.

“We’d outgrown our previous city centre site and needed to move to a new one. During the early stages of this investment, we ensured that the design and layout were tailored speci cally to our operation, such as making the plant quite compact and allowing as much automation as possible. An example of this is the automated liquid feed into the plant, which was previously a manual process,” she said.

“As we were doubling the size of the operation, we also wanted to consider wider yard operations and traf c ow around the site. To gain a better understanding, we visited a few reference sites across the UK.

“It can be dif cult to process the gully waste and road sweeping waste we’re working with, so with the new design we were able to prioritise access to ensure that the operation and maintenance of the plant is easier, and so that we can continue to optimise the solution going forward.”

A signi cant amount of PMG’s waste material is recovered by the company’s vehicles, with a growing amount brought in from third parties, such as councils and other road sweeper and tanker companies.

“We service a lot of housebuilders, groundworks contractors and councils,” Clare said.

“We may collect waste from a construction site customer, and the same customer is then taking it back as PMG recycled sand for use in a building project. It’s a fantastic circular economy.

“We have a 62-strong vehicle eet and cover Gloucester down to Taunton and into south Wales with our road sweepers. We also have a depot in Swindon, which enables us to extend our service to Oxfordshire.

“Here at Severn Beach, we are open from 6:00am to 5:30pm, Monday through Friday. We can also open on Saturday and Sunday by appointment, and when we have night shifts booked we can be open for tipping then as well.”

Designed for what Clare is a decade-long growth plan for PMG, the new CDE waste recycling plant comprises an R1500, one of CDE’s R-Series primary scalping screens, an AggMax scrubbing and classi cation system, an EvoWash sand washing system, and an AquaCycle high-rate thickener and static screen.

When the tanker or road sweeper arrives on-site, it allows the water to drain out of the body into the pit, removing any solids or lightweight organics using a bespoke PMG-designed system. The remaining liquid contents are then pumped automatically into the AggMax.

Once the truck has released the liquid, it will then discharge all solid waste, such as road sweepings. This waste is then loaded into the R1500, where oversized material will begin to be processed. Anything under 80mm will continue to the AggMax, which is eventually passed to the EvoWash.

All material that remains in the liquid and can’t be extracted through solid separation is sent to water treatment. Any sludge is then sent to a centrifuge, where the silt is separated to ensure process ef ciency.

The water gets returned to the system for further processing through the AquaCycle, which recycles up to 90 per cent of the process water for immediate re-use in the system.

The solution enables PMG to produce two products: a 5–25mm aggregate and a 0–5mm sand product for use in Bristol’s construction market.

“We’ve built in the ability to add a third deck in the screener so that we can have the option of producing another stone size,” Clare said.

PMG’s recycled aggregates and washed sand are mainly used in earthworks, but also meet the speci cations for highway works, pipe bedding and cable laying.

With strict regulations on waste products that can be sent to land ll, there is a pressing need to turn gully waste and road sweeping waste into an opportunity.

Under European land ll regulations, liquid waste consisting of road sweepings with a water or liquid content of 10 per cent or more can no longer be sent to land ll. In turn, this presents a challenge for disposing of this waste.

According to the Mineral Products Association (MPA), the UK’s market share of recycled aggregates is three times higher than the European average, highlighting the increased importance of repurposing waste.

Clare said PMG’s operation not only supports sustainability objectives but also generates new revenue streams to bene t the local economy.

“This was an investment that we had been thinking of for several years, and we are delighted to see the plant in action,” she said. “We’re proud to be recovering this material to transform it into high-value materials for the local industry. We’ve also been taking on people over the past year to prepare for this next business step.

After a year living and working in Australia, Clare joined the family business in 2020, during the COVID-19 pandemic.

“I studied civil engineering at university and had worked on the other side of this business as a contractor working on major projects such as Crossrail and Thames Tideway. I understand the pains inherent in construction sites and the need to offer a seamless service to customers,” she said

“It’s been great. The CDE people visiting us are extremely knowledgeable. If they are making a minor change to the plant, they also ensure the whole plant is running as well as it can. They are very proactive and

really helpful.”

Joining Clare and the CDE team to welcome customers and dealers at the open house event in June were her father, PMG founder and director Pat McGuinness, and her brother, PMG technical lead Paul McGuinness. Clare’s mother, Bernie, who, along with Pat, is originally from Ireland, played a key role in building PMG’s nance function and continues to support the business today.

“We’ve had a very good relationship with CDE throughout the last 10 years or so,” Pat said. “About two years ago, we wanted to invest and move to a bigger site, as our site by Bristol Temple Meads station was only 0.6 acres.

CDE’s AquaFlo 450 is part of the turnkey CDE waste recycling plant solution for PMG.

“This new site spans 6.5 acres, and we already have four acres of planning approval for the waste recycling plant, of ce premises, storage facilities, lorry parking, and other amenities. We have more room to tip off and can accept more material deliveries on site at any one time. We’ve got good customers and they’ve all come with us to this new facility.”

Paul said CDE has been a great support to the family business during this process.

“We learnt a lot from the rst CDE plant and worked closely with them on designing the new one,” he said. “Their engineers have been with us these rst few months of operation, ne-tuning the plant. You always get a few teething issues, but it’s been running well. We’re happy.”