8:45 AM

8 : 4 5 S a l e A n n o u n c e m e n t s a n d p r e - s a l e d r a w i n g f o l l o w e d b y I n o p s , B l a n e , C E l a n e , a n d D E l a n e

9:15 AM S a l e s t a r t s o f f e r i n g 1 0 0 0 + v e h i c l e s

6 A u c t i o n L a n e s

1 0 0 0 U n i t s W e e k l y

I n - H o u s e T r a n s p o r t a t i o n

D i g i t a l L i s t i n g C a p a b i l i t i e s

P o s t S a l e I n s p e c t i o n s

F u l l R e c o n d i t i o n i n g

S e r v i c e s

T r u c k a n d S p e c i a l t y s a l e o n

t h e l a s t T h u r s d a y o f e v e r y

m o n t h

VIEW INVENTORY IN-LANE / ONLINE

1 1 0 0 S o u t h Y o r k S t r e e t | M e c h a n i c s b u r g , P A 1 7 0 5 5

7 1 7 - 6 9 7 - 2 2 2 2 | a a a h a r r i s b u r g p a . c o m | # a m e r i c a s a u t o a u c t i o n

The official magazine of the MIDATLANTIC INDEPENDENT AUTOMOBILE DEALERS ASSOCIATION PENNSYLVANIA • MARYLAND • DELAWARE

1501 North Front St., Harrisburg, PA 17102 (717) 238-9002 midatlanticiada.org

Noah Melamed, Chairman Ticket to Ride Auto, Lancaster, PA nmelamed@yourttr.com

Bert Straub, President 1st Choice Auto LLC, Fairview, PA bertcstraub@gmail.com

Vacant, President - Elect

Lisa Cohowicz, Interim Treasurer North East Pennsylvania A/A, Scranton, PA lisac@nepautoauction.com

Clint Weaver, Secretary America’s Auto Auction Harrisburg, Mechanicsburg, PA clint.weaver@americasautoauction.com

Tom Hodges, Vice-President Tom Hodges Auto Sales, Hollywood, MD tom@tomhodgesauto.com

Dan Limongelli, Vice-President Jo Dan Motors, Plains, PA jodanmotors@gmail.com

Michael Mansour, Vice-President Car Connection, Inc., New Castle, PA mike@carconnection1.com

Beth Melamed, Vice-President Ticket to Ride Auto, Lancaster, PA bmelamed@yourttr.com

April Hollobaugh ajautosalestitusville@gmail.com

A&J Auto Sales, Titusville, PA

James Makia james@exclusivemotorcarsmd.com Exclusive Motorcars, Randallstown, MD

Dan McNamee dtlcars@aol.com

Daniel Thomas Auto Sales, Croydon, PA

Gregg Pachik gregg.pachik@manheim.com Manheim Philadelphia, Hatfield, PA

Kerri Rotunda kerrir@corryade.com

America’s Auto Auction Erie, Corry, PA

Danielle Royer royers322motors@gmail.com Royer’s 322 Motors, DuBois, PA

Tom Brandis • Executive Director

WOULD YOU LIKE TO RECEIVE A DIGITAL EDITION OF THE MIDATLANTIC DEALER NEWS MAGAZINE?

Email steve@piada.org

Copyright 2024

2 | It’s time to Nominate the Best of the Best

Please take a moment to consider a nomination for the 2024 MidAtlantic IADA Dealer of the Year and send it in today!

3 | A Generous Donation by America’s Auto Auction Erie Ignites Community Spirit: A Chevrolet Spark Auction for Royale Family Kids Camp

The America’s Auto Auction Erie event showcased the power of giving back. It raised over $5000, thanks to a generous bid from Jamie Young of Pinegrove Auto Sales.

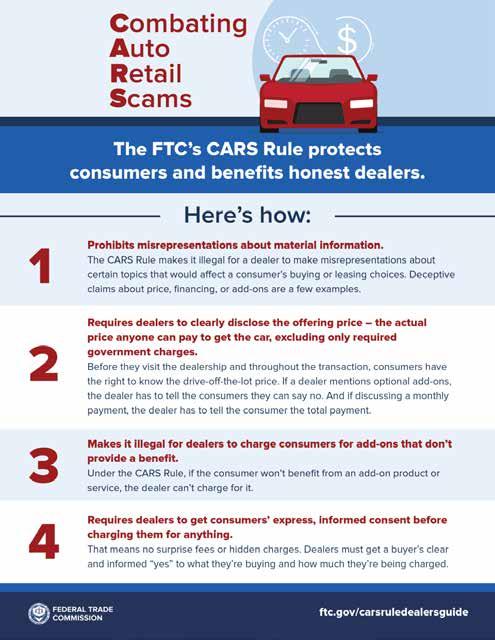

6 | A Legislative Update - FTC: CARS Rule

Note: The FTC CARS rule is currently being challenged legally by the National Automobile Dealers Association and the Texas Automobile Dealers Association. The legal challenges highlight that this rule was an abuse of discretion by the FTC. The 5th Circuit Court of Appeals has agreed to hear the petition.

8 | NIADA Convention & Expo Announced!

10 | Celebrating 20 Years of Automotive Excellence: The Legacy of Greater Erie Auto Auction

Greater Erie Auto Auction proudly celebrates its 20th anniversary on April 23rd, and it’s a moment to reflect on the legacy it has built in Fairview, Pennsylvania.

14 | PA Title & Registration Services for MidAtlantic IADA Members

15 | MidAtlantic 20 Groups Meets in May

Have you been thinking about joining a 20 Group but can’t spend multiple days away from your dealership? Are you in a 20 Group and tired of expenses for fancy hotels in exotic destinations? We have the answer for you. Join our MidAtlantic 20 Groups! Future plans may include a second BHPH group and a RETAIL group!

19 | Let’s Make Sure We Are All On the Same Page – Lender/Consumer!

CFPB Supervision Alert: CFPB Issues First Risk-Based Supervision Order

22 | Financial Management in Car Dealerships: 4 Essential Tips

This article explains essential tips from industry insights and successful methods to guide automotive dealerships toward financial prudence and strategic growth.

Bert Straub President MidAtlantic IADA

Bert Straub President MidAtlantic IADA

In a world often marked by its relentless pace and individual pursuits, giving back to the community is a beacon of hope and solidarity. It embodies the idea that collective well-being is not just a noble aspiration but a tangible reality that can be achieved through generosity, compassion, and selflessness.

Giving back to the community encompasses many actions, from volunteering at local shelters to organizing charity events, donating resources, or simply lending a helping hand to those in need. While the forms may vary, the underlying principle remains constant: the desire to positively impact and create a better world.

At its core, giving back is about recognizing our interconnectedness and understanding that our actions, no matter how small, can ripple outward and affect the lives of others. It fosters a sense of belonging and solidarity within our communities, where individuals come together to support one another and address common challenges.

One of the most remarkable aspects of giving back is its transformative effect on both the giver and the recipient. For those who engage in acts of service, whether through volunteering their time or donating their resources, there is a profound sense of fulfillment and purpose that comes from knowing they have made a difference in someone else's life. Studies

have shown that altruistic behavior boosts psychological well-being and contributes to overall happiness and life satisfaction.

Moreover, giving back fosters a culture of empathy and compassion, nurturing a sense of empathy and understanding toward others' struggles and hardships. It encourages us to look beyond our own needs and desires and instead consider the needs of those around us. It cultivates a spirit of solidarity and mutual support, where individuals come together to uplift and empower one another.

However, the most significant impact of giving back lies in its ability to create lasting change and build stronger, more resilient communities. By investing in social causes, supporting local initiatives, and championing meaningful causes, we can address systemic issues and work towards building a more equitable and inclusive society. Whether providing access to education, healthcare, or basic necessities, every act of giving back contributes to the collective well-being of our communities.

In a world that often seems fraught with division and strife, giving back serves as a powerful antidote, reminding us of our shared humanity and our capacity to make a positive difference in the lives of others. It is a testament to the strength of the human spirit and the inherent goodness within each of us.

As we navigate the complexities of modern life, let us remember the profound impact that giving back can have on our communities and the world at large. Let us embrace the spirit of generosity and kindness, knowing that lifting others up ultimately elevates ourselves. Together, through compassion and solidarity, we can create a brighter, more compassionate future for generations to come. n

Please take a moment to consider a nomination for the 2024 MidAtlantic IADA Dealer of the Year and send it in today!

Each year, MidAtlantic IADA recognizes and presents the Dealer of the Year Award to one carefully selected dealer. The award was created to recognize the remarkable accomplishments of MidAtlantic independent dealers. For many years, award recipients have exemplified their commitment to quality and excellence in the industry, outstanding customer service, and giving back to their community to make it a better place for everyone.

This prestigious award not only celebrates business success, but also honors dealers who embody ethical practices and community stewardship. Your nomination plays a crucial role in acknowledging and spotlighting those who go above and beyond in shaping the automotive industry with integrity and a positive impact.

In a heartwarming display of generosity and community spirit, a Chevrolet Spark was donated to the Royale Family Kids Camp. This sparked a chain reaction of kindness and culminated in a successful auction at the America’s Auto Auction Erie. The event showcased the power of giving back. It raised over $5000, thanks to a generous bid from Jamie Young of Pinegrove Auto Sales.

The donation of the car exemplifies the commitment to making a positive impact. It highlights the importance of supporting organizations dedicated to helping children in need. Royale Family Kids Camp, a non-profit organization focused on providing memorable camp experiences for children in the foster care system, was the grateful recipient of this thoughtful gesture.

The Chevrolet Spark, a compact and fuelefficient vehicle known for its reliability and practicality, proved to be an ideal item for auction, attracting the attention of bidders eager to support a worthy cause. As the bidding commenced at the America’s Auto Auction Erie, the atmosphere was filled with excitement and anticipation as participants vied to drive home in the stylish, ecofriendly vehicle.

Among the bidders was Jamie Young of Pinegrove Auto Sales, whose generous bid ultimately secured the Chevrolet Spark and contributed significantly to the auction's success. Jamie's unwavering support and

commitment to giving back underscore the profound impact that individuals and businesses can have when they come together to support a common cause.

The auction's success goes beyond the monetary value raised; it represents a collective effort to make a difference in the lives of children who deserve love, support, and opportunities to thrive. The funds generated from the auction will enable Royale Family Kids Camp to continue its vital work, providing transformative experiences and positive memories for children who may have faced adversity in their young lives.

Moreover, this gesture reminds us of the importance of corporate social responsibility and the power of businesses to effect positive change within their communities. By giving back and supporting local initiatives,

companies enhance their reputation, foster goodwill, and strengthen ties with their customers and neighbors.

As we celebrate the success of the Chevrolet Spark auction, let us also reflect on the broader significance of giving back. It is a testament to our kindness and generosity and the profound impact that small acts of kindness can have on those in need. Whether donating a vehicle, volunteering time, or contributing resources, every effort counts and has the power to make a difference.

In the spirit of this inspiring example, let us continue to support organizations like Royale Family Kids Camp and work together to create a brighter, more compassionate future for all. Together, we can ignite change, uplift communities, and make a lasting difference in the lives of those who need it most. n

Tommy Brandis

Tommy Brandis

To say that March has been a whirlwind would be an understatement. I must give major props to our Deputy Executive Director Kathy Sabaski on being front and center on multiple issues this month.

Kathy and I were invited to participate in a specialized task force with our associates from Pennsylvania Automotive Association (PAA), Pennsylvania Association of Notaries (PAN) and several of the Commonwealth’s largest online service providers. We had a very productive first meeting and will continue to work to ensure consumer identity safety and streamline PennDOT required documentation for vehicles sold online. We will be working together with PAA to formulate solutions that will be beneficial to both consumers and dealerships for submission prior to our next task force meeting in April.

MidAtlantic IADA relaunches in-person training in cooperation with our member auctions. Kathy has recently obtained certification to teach PennDOT courses in Agent & Title Training. Please visit MidAtlanticIADA.org/EDUCATION for a “Basic” class location near you. Enrollment is easy and available either via the website or call Cyndi in Member Services at 717-238-9002. “Advanced” classes will be launched in the second quarter. Our IN-PERSON classes offer the opportunity to ask your own questions, hear other dealers’ challenges, and include a 300+ page manual for participants to retain as a reference guide.

MidAtlantic IADA is continuing to expand our presence in Maryland in 2024. We have been working with John Fiastro of Fiastro Consulting on multiple proposed bills brought before the Maryland State House. MidAtlantic filed testimony in opposition to bills with the potential to be detrimental to our Maryland members. Kathy Sabaski met with MD Delegate Bagnall, representatives from the Alliance for Automotive Advancement (AAA), MD Attorney General’s office, and Maryland Automotive Association (MAA) to discuss mitigating the unintended impact of her proposed bill on independent dealerships. We will continue to monitor all legislation to advocate on behalf of our members, regardless of their home state.

If you would like to discuss these topics or anything pertaining to the independent dealers, I can be reached at tom@midatlanticiada.org or my direct cell phone at 215-805-2034.

Until next month,

Tommy

MidAtlantic IADA is currently seeking qualified candidates for these roles:

• Title Department Lead –Pennsylvania (starting at $23/ hour)Ideal candidate will have a minimum of 3 years PennDOT and/or CVR experience

• Title Clerk – Pennsylvania, Retail and/or Salvage (starting at $20/hour) Ideal candidate will have a minimum of 1 year PennDOT and/or CVR experience

• Administrative Assistant (starting at $18/hour)

Administrative Assistants are given preference for future title clerk positions.

All pay plans are based on proven experience. We also offer medical, dental, vision and retirement plans. There will be additional upcoming advancement opportunities.

Submit resume and cover letter to: kathy@piada.org or call Kathy at 717-238-9002 for more information.

How may we help you?

Learn more about the Association staff members serving you! Our friendly and knowledgeable staff is always here to help members.

Call or email us today!

Tommy Brandis Executive Director (717) 317-3098 tommy@piada.org

Kathy Sabaski Deputy Executive Director (717) 238-9002 kathy@piada.org

Steve Smith Operations Manager (717) 238-9002 x118 steve@piada.org

Cynthia Slemons Membership Specialist (717) 238-9002 x16 cynthia@piada.org

Nicole Autry Dealer Set-Up Unit (717) 317-1966 nicole@piada.org

Christine Everett Lead Title Clerk (717) 238-9002 christine@piada.org

India Thomas Title Clerk (717) 238-9002 india@piada.org

Ally Lanious Title Clerk (717) 238-9002 ally@piada.org

Tammy Farmer Receptionist (717) 238-9002 tammy@piada.org

will

Members/Nonmembers: $169

IADA is currently working with our national partners and lobbyists to ensure that our industry is properly represented as the new Federal Trade Commission (FTC) rule regarding Combating Auto Retail Scams (CARS) is promulgated. PIADA wanted to ensure that our members are aware of the content of the rule as it could have a drastic impact on our industry.

IMPORTANT NOTE: The FTC CARS rule is currently being challenged legally by the National Automobile Dealers Association and the Texas Automobile Dealers Association. The legal challenges highlight that this rule was an abuse of discretion by the FTC. The 5th Circuit Court of Appeals has agreed to hear the petition.

SUMMARY OF THE CARS RULE:

The FTC CARS Rule is primarily broken up into 4 parts:

1The CARS Rule Prohibits misrepresentation about material information.

The definition of “material” in this context means “likely to affect a person’s choice of, or conduct regarding, goods or services.”

Under this rulemaking the CARS rule would make it illegal for dealers to make misrepresentations about material information in all of these categories:

a. The costs or terms of buying, financing, or leasing a vehicle;

b. Any costs, limitation, benefit, or any other aspect of an add-on product or service;

c. Whether the terms are, or transaction is, for financing or a lease;

d. The availability of any rebates or discounts that are factored into the advertised price but not available to all consumers;

e. The availability of vehicles at an advertised price;

f. Whether any consumer has been or will be preapproved or guaranteed for any product, service, or term;

g. Any information on or about a consumer’s application for financing;

h. When the transaction is final or binding on all parties;

i. Keeping cash down payments or trade-in vehicles, charging fees, or initiating legal process or any action if a transaction isn’t finalized or if the consumer doesn’t wish to go forward with a transaction;

j. Whether or when a dealer will pay off some or all of the financing or lease on a consumer’s trade-in vehicle;

k. Whether consumer reviews or ratings are unbiased, independent, or ordinary consumer reviews or ratings of the dealer or the dealer’s products or services;

l. Whether the dealer or any of the dealer’s personnel or products or services is or was affiliated with, endorsed or approved by, or otherwise associated with the United States government or any federal, state, or local government agency, unit, or department, including the Department of Defense or any branch of the military;

m. Whether consumers have won a prize or sweepstakes;

n. Whether, or under what circumstances, a vehicle may be moved, including across state lines or out of the country;

o. Whether, or under what circumstances, a vehicle may be repossessed; and

p. Any of the disclosures required by the Rule.

2The Cars Rule requires dealers to clearly disclose the offering price- the actual price.

The CARS Rule requires dealers to display the offering price of a vehicle clearly and conspicuously. The offering price is defined as the full cash price for which the dealer will sell or finance the vehicle to any consumer. The only costs that can be excluded from the offering price are required government charges. In addition, the offering price must be displayed in any ad that references expressly or by implication a specific vehicle; in any ad that represents, expressly or by implication, any monetary amount or financing term for any vehicle; and in any communication with a consumer that refers, expressly or by implication, to a specific vehicle

or to any monetary amount or financing term. If the communication or response is in writing, the offering price must be disclosed in writing.

In addition, the CARS Rule requires that dealers clearly and conspicuously display t he fact that add-ons aren’t required , the dealer must clearly disclose that the addon isn’t required, and that the consumer can buy or lease the vehicle without the add-on.

The CARS Rule also requires that dealers clearly and conspicuously display the total of payments for a financed or lease transaction . The dealer must clearly disclose the total amount the consumer will pay after making all payments as scheduled.

Finally, the CARS Rule requires that dealers disclose monthly payment comparisons . If a dealer makes any express or implied comparison between payment options that includes a discussion of a lower monthly payment, the dealer must clearly disclose that the lower monthly payment will increase the total amount the consumer will pay to buy or lease the vehicle if that is the case.

3 The CARS Rule Makes it illegal to charge consumers for add-ons that don’t provide benefit.

According to the current version of the CARS Rule, dealers would be prohibited from charging for add-on products or services if the consumer would not benefit from it. In their explanation of the Rule, the FTC directly cites two examples:

“Examples include charges for “nitrogenfilled tires” that contain no more nitrogen that naturally exists in the air. Other examples are add-ons that don’t provide coverage for the vehicle, the consumer, or the transaction or are duplicative of the car’s warranty coverage. It would be illegal for a dealer to charge consumers for a GAP Agreement – a term the CARS Rule defines – if the consumer’s vehicle or neighborhood is excluded from coverage or the loan-to-value ratio means the

consumer won’t benefit financially from the product or service.”

4 The CARS Rule requires dealers to get consumers’ express, informed consent before charging them for anything.

The final change that the CARS Rule makes is to require that dealers must get the consumers’ express, informed consent before charging them for anything. In this instance “express, informed consent” means an affirmative act communicating unambiguous assent to be charged, made after receiving clear

and conspicuous disclosures of: (1) what the charge is for and (2) the amount of the charge, including, if the charge is for a product or service, all fees and costs the consumer will be charged over the period of repayment with and without the product service.

PIADA will continue to work in conjunction with our other industry partners to ensure that our industry and specific concerns are represented as this rule proceeds through legal challenges and promulgation. n

GROW YOUR BUSINESS AT THE

Network with more than 800 dealers from across the nation at the largest convention and expo for independent car dealers.

9 A.M.

TUESDAY, JUNE 18

Michael Darrow kicks off the convention and starts his term as NIADA President. Darrow owns and operates The Car Finders, Inc., in Durham, N.C., and is looking forward to building on the association’s past and moving it forward. The session also includes the NIADA annual analytics report, a great way to benchmark your dealership and start your convention education.

Join us at the Wynn in Las Vegas June 17-20, 2024 2 4 ‘

3:30 P.M.

TUESDAY, JUNE 18

Sugar Ray Leonard, John Taffer, Michael Irvin, Dick Vital, Captain Richard Phillips, and Bobby Bowden are just a few of the big names who have addressed the NIADA attendees on the big stage in past years. You will not want to miss this year’s keynote speaker who will address attendees just before the grand opening of the largest expo hall in the used vehicle industry.

2:45 P.M.

THURSDAY, JUNE 20

Celebrate the milestones for the industry at the NIADA Awards Celebration. The closing session will give attendees a chance to network, unwind and close out the convention in style. The session will culminate with the naming of the 2024 National Quality Dealer of the Year.

“I would recommend attending the NIADA convention as you always leave the convention with a better business plan for your dealership than when you arrived,”

Jeffrey Myers, All Wheel Drive Motors in Denver, Colo.

Early-bird

Member $545 $745

EARLY-BIRD

*ONLY $174 ROOM RATE AT THE BEAUTIFUL WYNN. Book early as these rates will not last. REGISTRATION IS OPEN.

*$174/night + taxes and reduced resort fee of $25/night.

The NIADA Convention and Expo will feature more than 50 hours of education in our five tracks –BHPH, Compliance, Management, Marketing and Retail – including theses dealer-led sessions.

RETAIL

Marshall Zoerner

PORTLAND, ORE.

MCCLOSKEY MOTORS, INC.

BUILDING YOUR TEAM TO CREATE A CUSTOMER FOR LIFE

Marshall Zoerner has used processes, policies and practices to build one of the strongest used car dealership teams in the country. He will share how he keeps the focus on the customer to keep the customer coming back for life.

MANAGEMENT

Luke Godwin

COLUMBIA, S.C.

GODWIN MOTORS, INC.

KEEPING SCORE TO KEEP EVERYONE ACCOUNTABLE

Luke Godwin says keeping employees accountable can be fun. He finds ways to keep the score at everything and encourages healthy competition. He will share how he uses a scoreboard to promote accountability.

BHPH

Jeff Watson

ST. GEORGE, UTAH

4 SEASONS AUTO, LLC.

BEST IDEAS FROM THE BHPH DEALER FORUM

Jeff Watson will share some of the best practices from last fall’s BHPH Dealer Forum, including make-ready lead generation, collections, technicians’ pay plans.

On April 23, 2024, Pennsylvania will hold its primary election. This upcoming election, both primary and general, could have massive impacts on the Pennsylvania General Assembly. The following is a summary of the Pennsylvania races in the upcoming primary election.

Currently, the Pennsylvania House of Representatives is controlled by a humble Democratic majority, which recently expanded from a 1-seat to a 2-seat majority with the resignation of Rep. Joe Adams (R-Pike).

In the House, barring any withdrawals, we are expecting that there will be 26 primary challenges. The chart (at right) is the list of primary challenges in the Pennsylvania House of Representatives.

The Pennsylvania Senate is currently controlled by the Republicans who hold 28 seats, while the Democrats hold 22 seats.

We anticipate only one primary challenge in the Pennsylvania Senate.

District s001

Incumbent: Sen. Nikil Saval (D)

Primary Challenger: Allen King (D)

Outside of the Pennsylvania General Assembly, Pennsylvanians can expect to see the Attorney General race on their primary ballot as well as the primary for Auditor General and Treasurer.

To follow is a list of candidates for their associated race:

Republican Candidates:

• Dave Sunday

• Craig Williams

Democratic Candidates:

• Eugene DePasquale

• Joe Kahn

• Keir Bradford-Grey

• Jared Solomon

• Jack Stollsteimer

Republican Candidates:

• Timothy DeFoor (Incumbent)

Democratic Candidates:

• Malcolm Kenyatta

• Mark Pinsley

Republican Candidates:

• Stacy Garrity (Incumbent)

Democratic Candidates:

• Ryan Bizzarro

• Erin McClelland

We will be sure to keep the MidAtlantic Independent Dealers Association’s membership updated with the results of the Pennsylvania primary and any changes ahead of the general election that could affect your industry. n

As the nation’s leading provider of end-to-end wholesale vehicle solutions, Manheim is here to help you be more successful with the in-lane and online tools you need.

VISIT OUR MID-ATLANTIC LOCATIONS

Manheim Baltimore-Washington

Manheim Keystone Pennsylvania

Manheim New Jersey

Manheim Pennsylvania

Manheim Philadelphia

Manheim Pittsburgh

In the realm of automotive commerce, where cars find new homes weekly, milestones mark not just the passage of time but the journey of innovation and dedication. As Greater Erie Auto Auction proudly celebrates its 20th anniversary on April 23rd, 2024, it's a moment to reflect on the legacy it has built in Fairview, Pennsylvania.

Since its inception two decades ago, Greater Erie Auto Auction has been a beacon of reliability, trust, and efficiency in the automotive marketplace. From its humble beginnings with Todd and Patty Briggs in 2003 to its current stature, the auction has consistently upheld its commitment to providing a platform where every transaction is done with honesty and integrity and we strive to be known as the auction that is always working hard to be greater.

Greater Erie Auto Auction has dealt with economic ups and downs, a global pandemic, and everything in between. What started as a dream in an auctioneer’s mind has blossomed into a thriving dealer hub, fostering connections, and facilitating transactions that transcend borders and boundaries. Having sold cars to 49 of the 50 states in the US - any Hawaii dealers reading this, please reach out, would love to have you

attend, and finding volunteers to transport your purchases wouldn’t be an issue – along with Puerto Rico, Mexico, Canada, Uganda, and more, Greater Erie has truly blossomed into a global, world-class facility.

Our team at Greater Erie is small but mighty, and we wouldn’t be where we are today without all of our employees – it truly takes a team effort from sunup to sundown, every day of the week, to do what we do; Thank you to all our staff: the drivers, our recon crew, the lot/registration team, our office team, the sales team that’s on the road daily, and the management team. Seeing all the repeat buyers and sellers that come back to Greater Erie weekly, and have been for 20 years, makes it worth it every Tuesday when its “Sale time and time to go at Greater Erie”

On behalf of all of the employees, present and past, of Greater Erie Auto Auction, if you’re reading this and have visited, bought or sold at the auction in our last 20 years, I offer a heartfelt thank you to you. And if you haven’t joined us at Greater Erie in Fairview, PA yet, join us soon! We run every Tuesday at 1pm, offering a great mix of dealer consignment, repo and Hyundai Capital off-lease vehicles. Check us out at greater-erie.com. n

Here’s our monthly article on selected legal developments we think might interest the auto sales, finance, and leasing world. This month, the developments involve the Consumer Financial Protection Bureau, Federal Trade Commission, and the Federal Communications Commission. As usual, our article features the “Case(s) of the Month” and our “Compliance Tip.” Note that this column does not offer legal advice. Always check with your lawyer to learn how what we report might apply to you or if you have questions.

On January 23, the Consumer Financial Protection Bureau issued a notice and request for comment in connection with its request for the Office of Management and Budget to approve information collection from auto finance companies. The CFPB proposes to collect data annually from auto finance companies that originated more than 20,000 auto financings in the previous calendar year, which would mirror the information the CFPB collected from nine large auto finance companies in its Auto Finance Data Pilot launched in February 2023, and annually from auto finance companies that originated between 500 and 20,000 financings in the previous calendar year, which would include information on the number of vehicles repossessed and the number of loan modifications. Comments are due by March 25, 2024.

On January 31, the Federal Trade Commission announced that a federal

district court imposed a civil penalty of approximately $28.7 million on two telemarketing companies and three individual owners for making phone calls, or assisting and facilitating other telemarketing companies to make phone calls, to consumers whose numbers were on the National Do Not Call Registry, in violation of the FTC's Telemarketing Sales Rule and the FTC Act's prohibition against unfair or deceptive acts or practices. In the fall of 2023, the court granted summary judgment in favor of the FTC, finding that the corporate defendants bought consumers' contact information primarily from websites claiming to help people find jobs and illegally called those consumers to market vocational training and post-secondary education programs. The court found that the corporate defendants had knowledge that their acts and practices were prohibited by the TSR. The court further found that the individual defendants participated in the violative acts or practices and/or had authority to control them and knew or should have known of the corporate defendants' violative acts and practices and that those acts and practices were prohibited by the TSR.

On February 1, the Federal Trade Commission announced that it reached a proposed consent order with Blackbaud, Inc., a South Carolina corporation that provides a variety of data services and financial, fundraising, and administrative software solutions to over 45,000 companies, nonprofits, foundations, educational institutions, healthcare organizations, and individual customers throughout the U.S. and abroad. According to the FTC's analysis of the proposed consent order, Blackbaud maintains the personal information of millions of U.S. consumers who have donor, student, patient, and other relationships with Blackbaud's customers. Despite representing that it would protect consumers' data from unauthorized access, from February through May 2020,

Blackbaud's networks suffered a data breach from an attacker that exfiltrated data from thousands of Blackbaud customers. This data included the personal information of millions of consumers, including social security numbers and bank account information. The FTC alleged that when Blackbaud informed customers of the breach in July 2020, its initial breach notification statement inaccurately stated that the hacker had not stolen sensitive consumer data, and it did not correct this information until October 2020, despite knowing that it was inaccurate only a couple of weeks after the initial breach notification. In addition to allegations that Blackbaud failed to implement appropriate safeguards to protect consumers' personal information, the FTC alleged that Blackbaud retained customer data far longer than necessary for the purpose for which it was maintained, including information belonging to former customers. The FTC alleged that Blackbaud violated Section 5 of the FTC Act by: (1) failing to employ reasonable information security practices to protect consumers' personal information; (2) failing to implement and enforce reasonable data retention practices; (3) failing to accurately communicate about the breach in its initial breach notification; (4) misrepresenting that it used appropriate safeguards to protect consumers' personal information; and (5) misrepresenting the scope of the breach by stating that consumers' personal information had not been impacted by the breach in its initial notification. The proposed order will, among other things, require Blackbaud to delete personal data that it no longer needs to provide products or services to its customers, prohibit the company from misrepresenting its data security and data retention policies, and require the company to establish and implement a comprehensive information security program and a data retention schedule that details the purposes for which it maintains consumers' personal information and the timeframe for deletion of such information.

On February 8, the Federal Communications Commission released a declaratory ruling stating that "the [Telephone Consumer Protection Act's] restrictions on the use of 'artificial or prerecorded voice' encompass current AI technologies that resemble human voices and/or generate call content using a prerecorded voice. Therefore, [absent an emergency purpose or exemption], callers must obtain prior express consent from the called party before making a call that utilizes artificial or prerecorded voice simulated or generated through AI technology." The FCC reasoned that "AI technologies such as 'voice cloning' fall within the TCPA's existing prohibition on artificial or prerecorded voice messages because this technology artificially simulates a human voice. Voice cloning and other similar technologies emulate real or artificially created human voices for telephone calls to consumers. They are 'artificial' voice messages because a person is not speaking them, and, as a result, when used they represent the types of calls the TCPA seeks to protect consumers from. The Commission also recognized in [its November 16, 2023, Notice of Inquiry] the potential for AI technologies to communicate with consumers using prerecorded voice messages. Where this occurs, [the FCC] conclude[s] that the call is 'using' a 'prerecorded voice' within the meaning of the TCPA."

On February 12, the Federal Trade Commission provided its annual letter to the Consumer Financial Protection Bureau summarizing the Commission's enforcement actions, research and policy initiatives, and education efforts in 2023 related to the Equal Credit Opportunity Act.

On February 15, the Federal Communications Commission adopted rules that address consumers' ability to revoke consent to receive robocalls and robotexts under the Telephone Consumer Protection Act. Specifically, the FCC's new rules: (1) clarify that revocation of consent can be made in any reasonable manner; (2) require that callers honor do-not-call and consent revocation requests within a reasonable time not to exceed 10 business

days of receipt; and (3) limit text senders to a one-time text message confirming a consumer's request that no further text messages be sent and confirm that any revocation of consent applies only to those robocalls and robotexts for which consent is required under the TCPA.

On February 15, the Federal Trade Commission announced that it finalized a rule that prohibits the impersonation of government, businesses, and their officials or agents ("Trade Regulation Rule on Impersonation of Government and Business"). The final rule enables the FTC to directly seek monetary relief in federal court from entities that use government seals or business logos when communicating with consumers by mail or online, spoof government and business emails and web addresses, and falsely imply government or business affiliation. The final rule is effective 30 days after the date it is published in the Federal Register. In response to comments it received during the public comment period on the Trade Regulation Rule on Impersonation of Government and Business that revealed an increase in the use of artificial intelligence to impersonate individuals and additional harms to consumers posed by the impersonation of individuals, the FTC also released a supplemental notice of proposed rulemaking ("SNPRM") that would amend the Trade Regulation Rule on Impersonation of Government and Business to revise the title of the rule, add a prohibition on the impersonation of individuals, and extend liability for violations of the rule to parties who provide goods and services with knowledge or reason to know that those goods or services will be used in impersonations of the kind that are themselves unlawful under the rule. Comments on the SNPRM will be open for 60 days following the date it is published in the Federal Register.

On February 22, the Consumer Financial Protection Bureau published in the Federal Register a revised process by which financial institutions can appeal findings from supervisory examinations. The supervisory appeals process was last updated in 2015. The CFPB revised its process to broaden the officials eligible

to evaluate appealed matters, the options for resolving an appeal, and the matters subject to appeal. Specifically, the revised supervisory appeals process broadens the pool of potential members of the appeals committee to include any CFPB manager who did not participate in the underlying matter being appealed and who has relevant expertise on the issue(s) raised by the appeal, not only managers from Supervision as under the previous process. The Supervision Director will select three CFPB managers who meet the criteria to serve on the appeals committee, which will advise the Supervision Director on how to resolve the appeal. The CFPB's General Counsel will designate legal counsel to advise the committee. Also, the revised supervisory appeals process provides a new option for resolving an appeal - remanding the matter to Supervision staff for consideration of a modified finding - in addition to the existing options of upholding or rescinding the finding. Finally, under the revised process, financial institutions may file an appeal as to any compliance rating issued to the institution, not only an adverse rating as under the previous process. The revised process is applicable to appeals pending as of February 22, 2024.

On February 23, the Consumer Financial Protection Bureau announced its first decision designating a nonbank lender for supervision based on potential risk to consumers. As the CFPB emphasized in its press release, however, the CFPB's order is not a finding that the lender has engaged in wrongdoing. The CFPB's first public supervisory designation comes after an April 2022 announcement that it planned to start invoking its supervision authority over nonbanks whose activities the CFPB has reasonable cause to determine pose risks to consumers regarding the offering or provision of consumer financial products or services. Director Chopra announced that the CFPB planned to use this "dormant" authority to supervise nonbanks and issued a new procedural rule. After accepting comments, the CFPB updated the procedural rule again in November 2022. Section 1024(a)(1)(C) of the Consumer Financial Protection Act, 12 USC 5514(a) (1)(C), grants the CFPB authority to supervise nonbank covered persons when

it has reasonable cause to determine that the entity is engaging, or has engaged, in conduct that poses risks to consumers. In 2013, the CFPB issued a procedural rule that outlined the steps the Bureau must take to invoke this authority, including issuing a Notice of Reasonable Cause to the entity and providing the nonbank entity an opportunity to respond to the Notice. The updated 2022 procedural rule made a notable change by allowing the Director to publicize the final decisions and orders, even though the procedural process is considered Confidential Supervisory Information and publication could have reputational consequences for a company. For the first time since the CFPB updated the procedural rule, the CFPB has published an order, although with some redactions for consumer privacy and for "good cause." In the CFPB's Summer 2023 Supervisory Highlights, it noted that it entered discussions with several entities across various markets about the supervision program. The CFPB issued several Notices of Reasonable Cause, and several entities voluntarily consented to the CFPB's supervisory authority. Until last week, the CFPB had not published a decision or order designating an entity for risk-based supervision. In establishing the procedural rule, the CFPB specifically highlighted a desire for transparency and the ability to use an order as precedent in future supervision designations. The published Order provides some clarity on the Bureau's interpretation of the "reasonable cause" standard, the meaning of "risk" under the statute, and the use of unverified consumer complaints on the CFPB's portal. The Order specifies that the Bureau does not need to determine that an entity has violated federal consumer protection laws or regulations to determine that the Bureau has reasonable cause to determine that the entity poses risks to consumers. In the Order, the Director noted that section 1024(a)(1)(C) does not specify the character or magnitude of "risks to consumers" that is required to subject an entity to supervision because "Congress intended to grant the CFPB significant discretion in determining whether the character and magnitude of the risks posed by a particular covered

person's conduct merit supervision." Although "risk" is not defined in the statute, the CFPB looks to the dictionary definition and states that it refers to "the possibility of loss or injury." The CFPA does not define "reasonable cause," but, in the Order, the Director states, "Whatever the precise meaning of 'reasonable cause,' it must be less demanding than the default preponderance-of-the-evidence standard generally applicable in noncriminal matters." The Order also notes that the Bureau can rely on consumer complaints in its portal in making a risk-based supervision determination. The Order states that section 1024(a)(1)(C) allows risk designation to be "based on complaints ... or information from other sources," and because Congress did not reference "verified complaints" or a similar qualifier, Congress did not intend to limit the types of complaints that can serve as the basis for a risk determination.

Court Refused to Grant Car Buyer Summary Judgment on Claims that Dealership Deprived Her of Right to Redeem Car by Selling Car After Eight Days Despite Notice Giving Her 10 Days to Redeem: A woman bought a car from a dealership. After she failed to make her deferred down payment, the dealership repossessed and sold the car. The dealership calculated that the buyer owed a deficiency of $195 but never sought to collect that amount from her. The buyer sued the dealership, claiming that it improperly calculated the payoff amount and charged unlawful fees in connection with the repossession and resale of the vehicle, in violation of Kentucky and federal law. The buyer moved for summary judgment on her Kentucky Consumer Protection Act claims and one of her federal Truth in Lending Act claims, and the U.S. District Court for the Western District of Kentucky denied the motion. The buyer asserted that the dealership deprived her of her right to redeem the car, in violation of the KCPA, by sending her a notice giving her 10 days to redeem but selling the car after only eight days. The dealership's owner asserted

in an affidavit that the buyer visited the dealership and stated that she would not be able to redeem the car. The court found that the affidavit of the dealership's owner created a genuine issue of material fact as to whether the dealership's decision to sell the vehicle two days before the expiration of the redemption period was false, misleading, or deceptive. The buyer asserted that the dealership miscalculated her payoff amount and determined that she still owed money when in fact she was entitled to a refund, in violation of the KCPA. In particular, she argued that the dealership failed to refund certain unearned finance charges, including the amounts she paid for a service contract, service contract tax, motor vehicle usage tax, title fee, and lien fee. The court found that the buyer did not establish that the dealership failed to refund unearned finance charges because she did not show why these amounts should be considered finance charges. The buyer asserted that the dealership charged her a repossession fee and a cleaning fee without justification, in violation of the KCPA. The dealership's owner explained in an affidavit that the repossession fee, which is typical in the industry, includes a fee charged by a third-party repossession company and that the cleaning fee is appropriate to get the car prepared for sale. The court found that, based on the owner's affidavit, there was a genuine issue of material fact as to whether the repossession and cleaning fees were false, misleading, or deceptive. Finally, the buyer alleged that the dealership violated TILA by failing to refund unearned finance charges that she paid for a service contract, service contract tax, motor vehicle usage tax, title fee, and lien fee. As it stated in connection with the buyer's KCPA claim, the court found that she did not show that these amounts were unearned finance charges required to be rebated to her and, therefore, was not entitled to summary judgment on her TILA claim. See Johnson v. Taylor Auto Sales, Inc., 2024 U.S. Dist. LEXIS 5134 (W.D. Ky. January 9, 2024).

Top of mind to a dealer right now should be the FTC’s Combating Auto Retail

Scams Trade Regulation Rule (“CARS Rule”) related to the sale, financing, and leasing of covered motor vehicles by covered motor vehicle dealers. The CARS Rule is a modified version of the FTC’s initial proposed Motor Vehicle Dealer Trade Regulation Rule, called the Vehicle Shopping Rule. The Rule will have a profound impact on how covered motor vehicle dealers advertise vehicles, communicate with its customers, and sell vehicle protection products. The Rule will also require new disclosures and forms, getting the consumer’s “express, informed consent” before charging a consumer for any item, require additional trainings, monitoring, and compliance responsibilities, require a dealer to make substantial recordkeeping changes, and increase the time it takes to sell and finance a vehicle. If a covered motor vehicle dealer violates the CARS Rule, it is considered an unfair or deceptive act or practice (UDAP) punishable by a $51,744 fine for each violation.

Although the CARS Rule’s effective date has been stayed by the FTC, dealers can’t afford to wait to see what happens in the NADA/TADA litigation before getting ready to comply with the Rule. The FTC is actively enforcing UDAPs and practices against dealers for practices it doesn’t like, including many of which would be covered by the CARS Rule. A dealer should risk preparation that may not ultimately be needed over being unprepared if the Rule becomes effective.

So, there’s this month’s roundup! Stay legal, and we’ll see you next month. n

Eric (ejohnson@hudco.com) is a Partner in the law firm of Hudson Cook, LLP, Editor in Chief of CounselorLibrary.com’s Spot Delivery®, a monthly legal newsletter for auto dealers, and a contributing author to the F&I Legal Desk Book. For information, visit www.counselorlibrary. com. ©CounselorLibrary.com 2024, all rights reserved. Single publication rights only to the Association. HC# 4859-6310-1610.

Are you able to prove transparency when it comes to your consumer interactions during the final transaction? The CFPB finalizes its rule to increase transparency when it comes to interactions with consumers. SecureClose has helped thousands of dealers PROVE what was said during the closing with its audio and video recording of the closing to eliminate the “He Said She said” after the sale. It is our mission to help show what was said during the closing and eliminate any confusion of the consumers responsibilities. We understand that the process of buying and financing a vehicle can sometimes take several hours or even days. During that time a lot of information is passed back and forth and consumers sometimes get overwhelmed with all the information they receive. That is why we record and deliver the entire closing to the consumer after the closing. It gives the consumer the ability to review vital information and helps remind them what they committed to. This is more important today than it has ever been, now that the CFPB has the supervisor power over our financial entities.

On February 23, the Consumer Financial Protection Bureau announced its first decision designating a nonbank lender for supervision based on potential risk to consumers. The Order states that section 1024(a)(1)(C) allows risk designation to be “based on complaints...or information from other sources,” and because Congress did not reference “verified complaints” or a similar qualifier, Congress did not intend to limit the types of complaints that can serve as the basis for a risk determination.

We want to make sure that before a consumer files a complaint, both the lender and consumer are on the same page. Contact us today to find out more about our transparent, compliant, closing tools. n

SecureClose is an e-contracting tool that levels the playing field in compliance management. Providing the Right Message, Every Time. During our audio and video recorded avatar closing, the customer uses our e-sign for all documents, which are stored in our UCC compliant vault. SecureClose was created by auto dealers, for auto dealers. Your customers will love the convenience. You’ll love the security. You’ll both love the speedy automation, where sluggish closings are a thing of the past!

PENNSYLVANIA

ADESA MERCER

758 Franklin Road, Mercer, PA 16137 724.662.4500 / Fax: 724.662.8716

Friday 9:00 AM

Office M-W: 9-4:00; TH: 9-5:00; F: 8-5:00 adesa.com

ADESA PA

I-83 Ex. 28 (Old Ex. 12), 30 Industrial Rd. York, PA 17406

717.266.6611 / Fax: 717.266.7650

Wednesdays 9:00 AM; INOPS 8:30 AM

Specialty Sale every 4th Wed 8:30 AM adesa.com

ADESA PITTSBURGH

378 Hunker Waltz Mill Rd. New Stanton, PA 15672 724.925.4700 / Fax: 724.925.4701

Tuesday 9:00 AM pittautoauction.com

AMERICA'S AA - HARRISBURG

1100 S. York St., Mechanicsburg, PA 17055 717.697.2222 / Fax: 717.697.2234

Thursday 8:45 AM harrisburgautoauction.com

AMERICA’S AA - LANCASTER

1040 Commercial Ave., P.O. Box 406 East Petersburg, PA 17520 717.569.5220 / Fax: 717.569.3109

Wednesday 9:00 AM; INOPS 8:30 AM americasautoauction.com

AMERICA’S AA - PITTSBURGH

55 E. Buffalo Church Rd. Washington, PA 15301 724.225.1777 / Fax: 724.225.7223

Thursday 12:30 PM americasautoauction.com

AMERICA’S AA – ERIE

P.O. Box 317, 12141 Route 6 West Corry, PA 16407

814.664.7721 / Fax: 814.664.7724

Thursday 10:00 AM

3 Lanes Dealer Consign, Fleet/Lease americaserie.com

BLAISE ALEXANDER AUCTION

350 Fairfield Rd., Montoursville, PA 570.435.8391

Mondays: 10:45am blaisealexanderauction.com

BLOOMSBURG AUTO AUCTION 25 Ridge Road, Bloomsburg, PA 17815 570.784.2306

Wednesday 10:00 AM bloomaa.com

CAPITAL AUTO AUCTION

5135 Bleigh Ave., Philadelphia, PA 19136 215.332.2515

Monday thru Friday 9:00 AM - 4:30 PM capitalautoauction.com

CENTRAL PENNSYLVANIA AA

Exit 178 of I-80, Lock Haven, PA 17745 800.248.8026 / Fax: 570.726.7841

Thursday 9:45 AM

Office: MTF 8-5:30 W-Th 8-6:00 cpaautoauction.com

GARDEN SPOT AUTO AUCTION

Robert Rd. & Apple St., Ephrata, PA 17522 717.738.7900 / Fax: 717.738.7930

Tuesday 10:00 AM gardenspotautoauction.com

GREATER ERIE AUTO AUCTION

7700 Avonia Road, (Exit 16 of I-90 & PA Route 98) Fairview, PA 16415-0916 814.474.3900 / 877.474.GEAA

Fax: 814.474.4969

Tuesday 1:45 PM greater-erie.com

LEHIGH VALLEY AUTO AUCTION

3880 Lehigh St., Whitehall, PA 18052 610.435.5554 / Fax: 610.435.5557

Wednesday 5:00 PM lehighvalleyautoauction.com

MANHEIM KEYSTONE

488 Firehouse Road, Grantville PA 17028 717.469.7900 / Fax: 717.469.2842

Every Monday 11:00 AM manheim.com

MANHEIM PENNSYLVANIA

1190 Lancaster Rd., Manheim, PA 17545 717.665.3571 / Fax: 717.665.9265

Exotic Highline Sales every other

Thursday - 9:00 AM

Every Friday Sale 8:30 AM manheim.com

MANHEIM PHILADELPHIA

2280 Bethlehem Pike, Hatfield, PA 19440 215.822.1935 / Fax: 215.822.8140

Tuesday 9:30 AM

TRA Sale - Tuesday 12:30 PM

Office: M-Th 8:30-5:00; F 8:30-1:00 manheim.com

MANHEIM PITTSBURGH AA

21095 Route 19, Cranberry Twp., PA 16066 724.452.5555 / Fax: 724.452.1310

Wednesday 9:00 AM manheim.com

NORTH EAST PENNSYLVANIA AA

860 N. Keyser Ave., Scranton, PA 18504

570.207.CARS / Fax: 570.207.1860

Tuesday 10:00 AM nepautoauction.com

PERRYOPOLIS AUTO AUCTION

Route 51 S. Perryopolis, PA 15473 724.736.4445 / Fax: 724.736.0466

Friday 9:45 AM perryautoauction.com

MARYLAND

BSC AMERICA/BEL AIR AUTO AUCTION 4805 Philadelphia Rd., Belcamp, MD 21017 410.879.7950 / Fax: 410.893.1515

Thursday 8:30 AM at Clayton Station

Thursday 8:00 AM at Bel Air in Belcamp bscamerica.com

MANHEIM BALTIMORE-WASHINGTON 7120 Dorsey Run Rd., Elkridge, MD 21075 410.796.8899 / Fax: 410.799.0512

Tuesday Sale, 9:30 AM

Tuesday Frontline Sale, 9:00 AM TRA/Salvage, 1:00 PM manheim.com

NEW YORK

STATE LINE AUTO AUCTION 830 Talmadge Hill Rd. S., Waverly, NY 14892 607.565.8151 / Fax: 607.565.3915

Ally Financial Open Sale –EVERY

FRIDAY, 9:20 AM

GM Financial Open Bi-weekly. Simulcast in all lanes. statelineauto.com

WEST VIRGINIA

MOUNTAIN STATE AUTO AUCTION

Route 2, Box 835, Shinnston, WV 26431 304.592.5300 / Fax: 304.592.3510

Monday 10:30 AM; Office: 9:00-5:00 mtstateaa.com

PUBLIC AUCTIONS

Capital Auto Auction 5135 Bleigh Ave., Philadelphia, PA 19136 215.332.2515 / Fax: 215.332.2534 capitalautoauction.com

Capital Auto Auction 5001 Beech Rd, Temple Hills, MD 20748 301.316.4980 / Fax: 301.316.4982 capitalautoauction.com

Carriage Trade Public Auto Auction 1200 W Ridge Pike, Conshohocken, PA 19428 800.441.6717 / Fax: 610.834.8274

Monday Sale Day 3:00 PM carriagetrade.com

In the dynamic and competitive world of automotive dealerships, mastering the art of financial management is not just a necessity; it’s a critical factor for success and sustainability.

The dealership landscape is marked by intricate financial dealings, including sophisticated lending and borrowing scenarios, compliance demands, and the ever-present need to balance risk and growth. In this context, dealerships must navigate their financial path with precision and foresight.

This article explains essential tips from industry insights and successful methods to guide automotive dealerships toward financial prudence and strategic growth.

It’s crucial for car dealerships to borrow what is necessary for their growth and operations. Avoid overreliance on debt, especially for daily functioning, and be cautious about maxing out credit lines.

In this context, monitoring the debtto-asset ratio is important. This ratio compares the total debt a dealership owes to its total assets, giving a clear picture of its financial leverage and stability. A lower debt-to-asset ratio indicates a healthier financial position, as it suggests that the dealership is not overly dependent on borrowed money and has sufficient assets to cover its debts if needed.

For example, if a dealership has $500,000 in debt and $1,000,000 in assets, its debt-to-asset ratio would be 0.5, indicating that half of its assets are financed by debt. It’s wise for dealerships to aim for a balanced ratio that supports growth while minimizing financial risks, ensuring stability even in fluctuating market conditions.

It is imperative to adopt a proactive approach like static pool analysis to determine loss reserves. This method focuses on the actual performance of past loans and historical data of ‘pools’ of loans to predict the likelihood and magnitude of future losses.

For example, consider a dealership with a history of selling cars on credit. Over the years, it has accumulated data on the repayment patterns of its customers. By employing static pool analysis, the dealership can analyze the performance of these loans based on factors such as the age of the loan, type of vehicle sold, customer credit score, and economic conditions at the time of the sale. This analysis might reveal that certain categories of loans have a higher default rate.

Armed with this knowledge, dealers can set aside a more precise amount in their loss reserves to cover these anticipated losses.

Also, they will follow more prudent lending practices moving forward to increase the overall stability and sustainability of their dealership’s financial operations.

Banks, the primary lenders, expect dealerships to mirror their standards, ensuring mutual understanding and smoother financial

relationships. So, dealerships need to align their financial practices with those of the banking sector. This includes meticulous attention to payment histories, proper accounting of troubled loans, and compliance with consumer protection laws. To achieve this alignment, dealerships should:

• Adopt Rigorous Credit Assessment: Implement strict credit assessment procedures similar to those banks use, especially thorough checks on customers’ credit histories and financial stability before approving loans.

• Maintain Accurate Financial Records: Keep detailed and accurate financial records, including proper documentation of transactions, loan agreements, and customer payment histories.

• Ensure Compliance with Regulations: Stay up-to-date and compliant with all financial regulations, such as those related to lending, borrowing, and consumer protection.

• Implement Robust Risk Management: Develop and maintain a risk management framework to identify, assess, and mitigate financial risks, a standard practice in the banking industry.

4

Prioritize Consumer Protection and Compliance

Automotive dealerships must focus on developing a robust compliance framework that emphasizes transparency, ethical

lending practices, and adherence to consumer protection laws. This involves providing clear and accurate information on financial transactions, assessing customers’ repayment abilities fairly, offering educational resources, and ensuring a suitable complaint-handling system.

Regular staff training in these areas is crucial. By doing so, dealerships not only avoid legal issues but build trust and loyalty with customers and lenders, enhancing their reputation and long-term success in the industry.

In summary, effective financial management is crucial for the success and resilience of car dealerships.

By borrowing wisely, employing static pool analysis for accurate loss reserves, aligning with banking standards, and prioritizing consumer protection and compliance, dealerships can confidently navigate the complex financial landscape. These strategies strengthen financial stability, foster customer trust, and enhance the dealership’s long-term viability in a competitive market. n

Sean Toussi is CEO of the tech startup Glo3D. He regularly writes for Forbes magazines about new technology trends and is part of Forbes magazine technology counsel. He is also a regular speaker at the UN economic forum. If you have any questions or comments regarding this article, please email Toussi at Sean@Glo3D.com.