Produced by:

Produced by:

The mission for today is to have everyone in this room prepared to succeed in 2026. In order to do that, you must have a solid footing to start the year and that begins with the busiest time of the year. January can be slow if you aren’t prepared, but after today, you will walk away with a game plan on how to kick off the year prepared and ready for the busiest time of the year.

The purpose of this workbook is for everyone in the room to have something tangible to leave with. This workbook will be your game plan on how to WIN in 2026 and how to WIN in the first quarter. For most dealers, Q1 sets the tone for the year and we want everyone in this room to start off STRONG.

For this to work, I encourage/require the participation from everyone in this room. We are going to hear about best practices from the speakers today, but we are also going to hear about best practices from EVERYONE in the audience as well. After every brief presentation, we will open up a 5 – 10 minute discussion as we fill out the workbook that relates to each session. We will not move forward until we are ready, until you are ready.

How many cars do you want to sell in:

Oct. _______________

Nov. _______________

Dec. _______________

*Inventory is on average $500 per car higher these months

*Jan. ______________

*Feb. ______________

*Mar. ______________

Measure your actual sales against your plan. Research variances so you can be more accurate next tax season. Your sales goals will influence a lot of your decisions.

Mike Downey is the President at Auto Master Systems. He has spent over 25+ years in the Buy-Here Pay-Here (BHPH) industry developing and implementing technology solutions for auto dealers and finance companies. Mike served as VP of Business Development for a 26 store, multi-lot BHPH operation and has provided consultinga and training to hundreds of dealers across North America. He is a regular presenter at nationwide industry events where he speaks on how technology can help BHPH operations. Mike has a BS in Computer Information Systems.

About Auto Master Systems, LLC.

Since 1987, Auto Master Systems has provided comprehensive software solutions for the BHPH/LHPH industry. Our platform extends beyond a traditional Dealer Management System (DMS), offering integrated capabilities for customer relationship management, underwriting, sales, collections, reporting, and analytics. In 2025, we launched a browser-based system to support CRM, sales, and inventory management, further enhancing

accessibility and operational efficiency for our clients. By incorporating advanced AI-driven solutions, Auto Master Systems continues to set the standard for innovation, delivering the tools dealerships need to operate with effectiveness, efficiency, and confidence.

www.auto-master.com

Bill Neylan founded Tax Refund Services in 1995 and acquired Tax Max in 2006 to become the largest tax preparation company in the United States to focus solely on the car dealer customer. In June of 2019, Tax Max has partnered with the Autotrader BHPH Center to help dealers generate leads and leads specific to consumers wanting to use the tax refund or future tax refund to purchase a vehicle. In 2020, Tax Max created the “File & Drive” Sales event where the customer files directly with Tax Max and the dealer no longer does any of the work. And NEW for 2025, Tax Max is launching our Tax Season Consulting Groups where we will help your tax season program from November to March. Tax Max has processed over 1 MILLION returns and Bill’s 31 years of experience in the automotive industry ranges from annual face to face interaction with the customer to participation in a number of state, regional, and national automotive and BHPH associations and trade groups.

Each year, the Tax Max program generates $100 to $200 MILLION in tax refund checks for their dealerships to disperse to their customers. Tax Max dealers

operate under one simple concept: by being the company to hand the customer the tax refund dollars, they are in the best position to be the first place the tax refund money is spent every year.

To be brief, Tax Max gives the dealer the ability to convert a paystub and/or a W2 into a down payment using various programs to maximize tax season such as our 1st quarter “File and Drive Program”, 4th quarter program which allows you to sell cars starting in October, collections, repairs and their new all year-round program – Tax Season 365.

Greg Neylan is a National Accounts Manager at Tax Max with over 16 years of experience in the tax preparation industry and its affiliation in the automotive sector. In his current role, he builds strong working relationships with prospective and existing dealers on a national level. Greg also serves as the Tax Max corporate trainer where he has designed effective training methods, educational material, seminars and workshops, hosted daily webinars as well as created/ hosted/narrated training videos. Greg holds a BS degree from the University of South Florida and is a Registered Tax Return Preparer with the Internal Revenue Service.

A passionate expert in phone skills and internet leads since 2010, Maggie Pugesek specializes in crafting customized word tracks and processes tailored to each dealership’s unique needs. By leveraging customer psychology and rapport-building techniques, she helps teams convert more sales calls into appointments and works to maximize call efficiency and success in collections departments. At her company, C&M Coaching, Maggie focuses on improving call quality across Sales, BDC, Collections, and Service departments. She also shares her expertise through her podcast, Elevate with C&M Coaching, offering free training and actionable insights. A sought-after speaker, Maggie has presented at NIADA and State dealer conferences, Buy Here Pay Here United, Dealer Used Car Week, Compliance Unleashed, and to dealer 20 groups of all sizes - dedicated to helping dealers improve performance and drive industry success.

C&M Coaching offers a unique approach to their custom word tracks, using customer psychology to develop the foundation and drive success. Our training is built on customer psychology because trust drives every sale, service interaction, and collection call. In fact, 91% of customers say trust is a major factor in their decisionmaking. We start by creating custom word tracks tailored to your business. Then, every customer-facing team member works one-on-one with a dedicated coach in live Google Meet sessions. They’ll learn voice inflection, trigger words, objection handling, and how to confidently control the call. Next comes real-world coaching. Using recorded calls from your CRM/call tracking, our coaches guide your team through challenges, highlight wins, and score performance. Progress is tracked on a clear dashboard so you can see appointment-set ratios, payments taken, and overall improvement. When it comes to sales, service, and collections, you can’t afford to leave money on the table, or customers with a bad experience. That’s why we train your team with the right words, tone, and psychology to earn trust and close results.

Training your team isn’t an expense. It’s the best investment you can make.

Bret Buike

Bret Buike grew up in the automotive business, where his family owned and operated several retail and Buy Here Pay Here dealerships across Ohio and Pennsylvania. With deep roots in both independent and franchise operations, Bret has managed multi campus new and used car dealerships and gained firsthand insight into dealership operations, asset management, and risk mitigation. Beyond retail, Bret’s experience includes leadership roles in salvage yard operations and other industries where managing high-value assets and financial exposure is critical. His understanding of both operational and financial risk makes him a trusted resource for dealers seeking long-term profitability. Bret has served as a Dealer Performance Group moderator for both retail and BHPH dealers and is currently a Business Development Manager with Buckeye Risk Services where he helps clients implement smart reinsurance and protection strategies.

Efrat Bogoslavsky

With a proven track record of driving business growth, Efrat Bogoslavsky is a seasoned sales, service, and marketing executive with over 20 years of experience across multiple industries. As VP Revenue & Service at Ituran USA, she spearheads marketing strategy, sales initiatives, and service team management, consistently delivering double-digit growth and expanding business segments. Throughout her career, Efrat has demonstrated expertise in market research, competitor analysis, pricing strategy, and team leadership. Her background spans various sectors, including insurance, real estate, and publishing, allowing her to bring a unique perspective and adaptable skillset to her roles. With a strong foundation in business development, Efrat excels at identifying new opportunities, building strategic partnerships, and fostering senior client relationships. Her experience in managing high-performing teams and driving business results has earned her a reputation as a resultsdriven leader.

Ituran GPS is a leader in the AVL (Automatic Vehicle Location) services world-

wide. With over 2.5 million active devices and 3,200 employees and publicly traded in the Nasdaq. Proudly servicing the Automotive Sub-prime & BHPH Industry in the USA with superior product, advance software and enhance API Integrations with DMS and Payment Processing companies to ensure efficiency and compliance.

Terry MacCauley marketing blueprints that not only bolster sales but optimize operations.

Big Time Advertising & Marketing

Terry MacCauley stands as a beacon of insight in the automotive industry. With an enriching journey spanning over three decades, Terry's diverse experience encompasses the realms of sales, management, and a notable expertise in advertising & marketing. His deep-rooted comprehension of the automotive retail dynamics empowers dealerships to not just meet but surpass their business milestones. A history steeped in success, Terry's past roles have seen him in various leadership capacities at premier OEM dealerships, earning him a reputation as an esteemed speaker and consultant. His charisma, blended with the right dose of candor, energy, and humor, never fails to captivate his audience, rendering them eager for more of his unparalleled insights.

Currently helms the role of CEO at both Big Time Advertising & Marketing and newly formed Get Best Used Cars. Terry and his proficient team champion the cause of digital marketing for auto dealers. Their commitment? A focus so sharp on sales volume and gross results, it's practically laser-like. Collaborating with dealerships, they craft and implement complete advertising and

Terry's legacy doesn't just rest on his credentials but on the transformative impact he has on auto dealers aiming to triumph in a fluid marketplace. Whether it's the stage of an industry seminar or a personalized advertising and marketing consultation at a dealership, Terry's mission remains unchanged: to furnish actionable insights and pragmatic advice, ensuring results that matter.

Professional Experience Highlights:

Founder & CEO, Get Best Used Cars (May 2025) Creating a groundbreaking platform, DaraCoreAI, that empowers independent auto dealers with faster, smarter vehicle feed hosting, the highest performing automotive websites with AI integration and digital marketing solutions.

Founder & CEO, Big Time Advertising (2014 - present): Driving results with a full-suite of advertising and marketing solutions tailored for dealerships.

General Manager, Big St. Charles Motorsports & St. Charles Harley-Davidson (2008 - 2014): Pioneered marketing strategies for a multi-dealership powersports group, propelling them to the top ranks in sales volume across multiple brands.

General Sales Manager roles at Dave Croft Motors (2006 - 2008) and Bob Brady Dodge, Chrysler, & Hyundai (2003 –2006): Demonstrated consistent growth and sales leadership in diverse dealership environments.

by Greg Neylan

One Big Beautiful Bill Act to boost refunds

Increase average tax refund by $500, plus even more for families

The AVG. customer will spend entire refund in 24-48 hours.

Child tax credit increased in 2025

Earned income tax credit increase in 2025 to maximum of $8,046

Increase in standard deduction for all

Reduced SALT tax

No tax on Tips, OT and SSI (if over 65)

IRS does not release most refunds until the end of February due to the PATH ACT.

Tax Max Refund Advance allows a customer to receive a loan on their future tax refund same day up to $7,000 beginning January 2.

By having a tax season marketing partner you can provide a solution to every customer and help them get approved using their tax refund money right at the time of sale.

by Terry MacCauley

1. How many vehicles are sold in the United States every year with a portion or all of a consumer's tax refund?

Answer: ________ million vehicles

2. What percentage did used vehicle sales increase during February?

Sales Increase: ________ %

3. How much did inventory levels decrease in March?

Inventory Decrease: ________ %

4. What is the key message for your tax season advertising?

Key Message: ___________________________________________

5. Which digital channels will you focus on? (Rank in order of importance)

1. ________________________________________

________________________________________

________________________________________

6. What metrics will you track to measure success?

Metric 1: ___________________________________________

Metric 2: ___________________________________________

Internal Team: ________ Employee Name: _________________

Third-Party Vendor: ________ Who: _____________

Combination of Both ________

8. What resources or tools will they need?

7. Who will manage your tax season strategy? (It works best when someone is accountable and hold them accountable as they will be the go to person)

Resource 1: ___________________________________________

Resource 2: ___________________________________________

by Terry MacCauley

Section 5: Workbook Action Plan

9. List two critical actions to include in your action plan:

Action 1: ___________________________________________

Action 2: ___________________________________________

10. When will you review and adjust your strategy?

Review Date: //________

Section 6: Preparing the Sales Team

11. What are the 7 actionable steps/best practices to help the sales team be ready for the promotion?

Section 7: Terry's List and Group Participation

12. Terry's Must-Do List:

13. What did YOU add to YOUR action plans FOR 2025?

Idea 1: ___________________________________________

Idea 2: ___________________________________________

14. How much do you want your ad spend to be per car?

From PAGE 3, how many cars do you plan on selling in:

= Oct. ______________ X __________ ______________ Marketing spend for the month

= Nov. ______________ X __________ ______________ Marketing spend for the month

= Dec. ______________ X __________ ______________ Marketing spend for the month

= Jan. ______________ X __________ ______________ Marketing spend for the month

= Feb. ______________ X __________ ______________ Marketing spend for the month

= Mar. ______________ X __________ ______________ Marketing spend for the month

Social Media: ________ %

PPC: ________ %

OTT (Over the Top): ________ %

What percentage of your digital marketing budget will be allocated to each channel?

Measure your actual marketing spend against your plan. Research variances, so you can do better next year/promotion

by Bill Neylan

When should I start my tax season promotion?

What are the 3 refund opportunities for my dealership to take advantage of?

Best practices:

Who in your dealership is going to manage this? (It works best when you have someone dedicated to make sure these deals are done correctly. Hold this person accountable.)

Analyze which deals went bad and why. You need to know, so you can adjust your strategy for next tax season 3

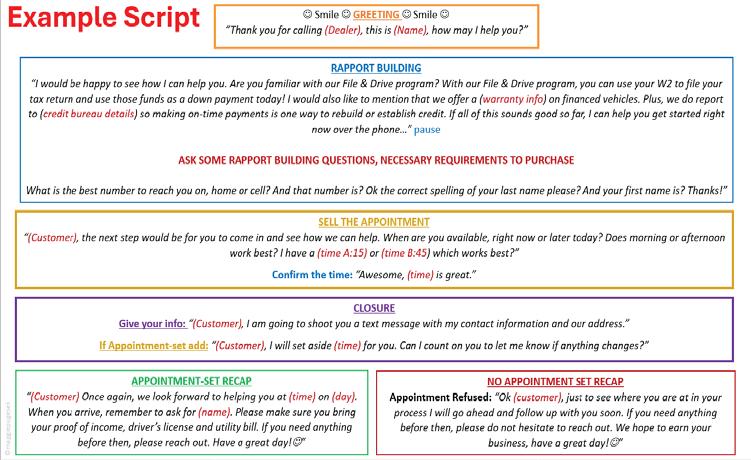

by Maggie Pugesek

Remember to train your team on the program in detail.

• The more they know, the easier it is to sell.

• Put together some talking points.

• Watch related webinars and listen to podcasts to train.

Ask customers if they are familiar with the program.

• Keep it simple: “are you familiar with our File & Drive program?”

• Regardless of the customers answer, we want to tell them brief talking points about it.

• “With our File & Drive program, you can use your W2 to prepare and file your tax return, and use those funds as a down payment today. I can help you get started right now over the phone…” pause and wait for a response.

If the customer states they are not interested, ask some questions and listen to the customers situation.

Remember the File & Drive program can be a good solution, when you explain the program, be enthusiastic – speak to their pain. Use your voice inflection as a tool. Customers who see a clear financial benefit are 35% more likely to proceed with a purchase. So remember to bring value to your dealership and programs.

Prepare emails & text message campaigns that have details surrounding your tax program.

Your tax season partner should have everything you are looking for listed above. (training, webinars, phone scripts, email & texting templates, answers to hesitations and much more)

Who will manage training at your dealership?

Employee:

Vendor: Both Employee & Vendor:

(It works best when you have a dedicated staff member making sure employees are trained correctly, follow up and constant monitoring. You will need a go to person to maintain standards)

Ask your sales staff for a list of the most common objections they are facing as they attempt to sign customers up. Write rebuttals for your reps.

Record your phone calls so that you can learn together as a team. When a program is sold over the phone, play that call so everyone can hear the call, and visa versa for a failed attempt. Everything is a learning experience!

• Listen to the customer

• Ask if they have heard about the File & Drive Program

• Build value in purchasingfrom you by explainingthe program & dealer perks (warranty etc.)

• Ask questions to better understand if this customer is a good fit (location, valid DLetc.)

• Inbound calls: obtain contact info

• Opening“thankyoufor calling”

• StoreName

• Your name

• How can I help

• Smile

• Give out your info/text

• Directions

• Offer choices: Today or Tomorrow

• Don’t be weak

• Next steps/appt details

• What to bring

• Who to ask for

by Maggie Pugesek

What steps are you not doing? Let’s put your plan together for your dealership:

Greeting:

Rapport Building:

Appointment:

Closure:

Recap:

80% of buyers say their decision is influenced by their first phone call. How do your calls sound?

Call your customer within 15 minutes of receiving a lead for the highest connection rate. If they don’t answer – send a text but always try to call the customer first! Leave one voicemail only per day.

Response time customer-contact rates:

• 70-80% within 5 minutes

• 50-60% within 30 minutes

• 30-50% within 60 minutes

• 10-30% if you call after an hour

Less than 15% of reps ask for a solid appointment.

• Asking “How soon are you looking to make a purchase” is not asking for an appointment.

• Stay away from weak words “Do you wanna come in?” is not strong enough.

Appointment show rates:

• 60-70% for same-day appointments

• 40-50% for next day or later

• 20-30% anything over 5 days or more

Follow-up aggressively for at least three days and always put customers on some type of follow-up plan based on their situation.

• 3 month

• 6 month

• 9 month

• 12 months

Once I receive a lead, how long are we taking to respond?

What methods of communication are we using to connect with the customer? (text, email, phone)

How often should I follow up and is my team following the guidelines?

Other best practices: How can a dealer measure success on the phone?

What is your average recon per car? __________

Do you post all the parts to the car or use a pack only? _________

When was last time you checked to see if it was enough? _________

Pack x Number of Cars reconned – Total expenses for the month =__________

What would you need to save PER CAR for it to matter?

$_____ x Every car you recon a month x 12 = ___________

When is the last time you broke up with a vendor?

Rebate Programs -----

Warranty Claims – Winning or Losing

BHPH-LHPH vs Retail

Reinsured or NOT?

What do you buy with your used parts 6 month, 12 month, etc…?

www.teamprp.com

www.U-R-G.com

Analyze your recon process

Diag does not hang parts, mix it up

Do you have a parts inventory, WHY?

Are credits being issues, are you sure?

Use CC to help reconcile bills… YES they will all take a CC…

Workshop Goals:

• Questions every BHPH car dealer should ask

• Understand the most common operational blind spots in BHPH Dealership

• Identify where inefficiencies or losses are hiding in your current processes

• Learn how visibility tools like Ituran GPS can help dealerships run smarter

• Leave with 2–3 practical steps you can apply immediately

Potential blind spots examples:

• One of your cars was involved in an accident

• A customer paid after hours, and no employee is available to send the paid command.

• You found on Repo Day that your GPS device is not working properly

As discussed in the session, Ituran GPS tools can help overcome blind spots by:

• GPS device equipped with a crash sensor will alert you on a car accident

• With GPS / DMS integration you can set business rules to automate commands

• Smart Device Diagnostic Dashboard can analyze your portfolio and alert if action is needed.

Workshop Reflection: My Blind Spot Map

Use this space to note blind spots and solutions specific to your dealership:

Customer Support

2. How reliable is the reporting data? Do you have a dashboard that differentiates the reasons for a non-working device?

1. How easy is it to contact the provider when needed? Is your GPS provider providing 24/7 live customer support?

2. How responsive are they to your inquiries and issues?

3. how do you train your team? When was the last time your team had a training session?

4. do you keep a record of GPS complaints? How do you handle them?

1. What measures does your current GPS provider take to ensure data security and privacy?

2. what tools do you use to handle compliance?

Technical

1. How do you handle installation?

2. Is your provider providing technical training? installation videos? Wiring diagrams? Verified activation process?

Reporting and Analytics

1. What types of reports does your current GPS provider offer? Do you get daily reports to your email?

2. Can you schedule automated report delivery?

Inventory

1. How do you manage inventory in different locations?

2. How do you apply extra theft protection to your lot inventory after hours?

by Mike Downey

A seasonal payment is a deferred payment, pick up payment or an irregular payment that is scheduled to be paid at a certain time of the year. For example, a seasonal tax payment is expected to be paid between January and March.

When do I want to start my Pre-Season tax season promotion?

How many cars per month do I want to sell using a special tax season payment? (30% - 40% Participation Rate)

Oct. _________ X $1,000 = ___________

Nov. _________ X $1,000 = ___________

Dec. _________ X $1,000 = ___________

Jan. _________ X $1,000 = ___________

Total ___________ Extra Cash Flow

What DMS do I use?

Can my DMS support Irregular Payments?

Does my state allow Irregular Payments? PA does not.

If not, my dealership can do pickup payments or deferred down payments.

Are we going to use the Secure Close Tax Season Avatar?

What part of our closing process is this step added?

Who from my dealership is going to manage this? (You need to hold this person accountable to make sure best underwriting practices are being adhered to.)

Analyze which pre-season deals went bad and why. You need to know so you can adjust your strategy for next tax season.

How to underwrite a Pre-Tax Season Deal? (See next page)

Approved for normal underwriting

Ask customer: “Would you like to better your deal by utilizing a small portion of your future tax refund today?”

Customer signs 4th Quarter Sales Agreement/Tax Refund Estimate and Consent Form Call Treasury Offset Hotline (800-304-3107)

Dealer is taking less than 30% of the anticipated tax refund

Customer has minimum down payment of $_______ or has a tradein, in addition to the anticipated refund

Schedule irregular/deferred down payment

Tag the sale as special tax season payment in DMS

What part of our underwriting process is this checklist used?

Other Best Practices:

What are your collection goals for:

Past Due accounts: ________

Communication Plan:

Seasonal Tax Payments: ________

Communication Plan:

Repair Notes: ________

Communication Plan:

Repossessed Customers: ________

Communication Plan:

Who in your dealership is going to manage this for:

Past Due accounts:

Seasonal Tax Payments:

Repair Notes:

Repossessed Customers:

Best Practices:

You need to hold these people accountable to achieve your collection goals. Measure actual success against your goals.

by Bill Neylan

Final Thoughts:

Tax Max prepares and files the customer’s tax return You get the down payment Customer gets the car

Tax Max is just like an H&R Block that works for your dealership

Customers file their tax return with Tax Max from your website (File & Drive Sales Event - see above)

Same day tax refund advance up to $7,000 upon approval for down payment

No additional work required from your dealership staff - Tax Max does it all

Tax refund checks print at your dealership FIRST

Be first and start tax season January 2nd! Don’t wait for the IRS

Tax Season Consulting Groups - We will run your tax season for you

Tax Refund Collections Assistance - We will assist in collecting all tax season payments

$1,711 Average increase in approved customer down payment with Tax Max

2026 Tax Law Changes: One Big Beautiful Bill Act (OBBBA) tax law changes are expected to increase your customer’s tax refunds in 2026, providing an even bigger boost to down payments and helping more customers get approved! Don’t miss out this tax season - be the FIRST with Tax Max.