COVER SHEET

Full Name)

Address: No. Street City/Town/Province)

4 0 9 7 9 SEC Registration Number

Full Name)

Address: No. Street City/Town/Province)

4 0 9 7 9 SEC Registration Number

7th Floor, JMT Building, ADB Avenue Ortigas Center, Pasig City

8637-2917

Telephone Number

31 December 2022 Fiscal Year Ending

Notice of Regular Annual Stockholders’ Meeting

SEC Form 20-IS Information Statement Pursuant to Section 20 of the Securities Regulation Code Form Type

NOTICE IS HEREBY GIVEN that the Regular Annual Meeting of the Stockholders of Seafront Resources Corporation (the “Company”) will be conducted virtually (or via online means of communication) on Thursday, June 22, 2023 at 4:00 PM, with the following agenda:

(1) Certification of Service of Notice;

(2) Determination of Quorum/Call to Order;

(3) Approval of Minutes of the last Regular Stockholders’ Meeting held on June 23, 2022;

(4) Approval of Management Report and the 2022 Audited Financial Statements contained in the 2022 Annual Report;

(5) Confirmationand Ratification ofall acts, contracts and investments made and entered into byManagement and/or the Board of Directors during the period June 23, 2022 to June 22, 2023;

(6) Election of nine (9) members of the Board of Directors for the year 2023-2024:

(7) Appointment of External Auditors;

(8) Other Matters; and

(9) Adjournment.

Only stockholders of record at close of business on May 05, 2023 shall be entitled to vote at said meeting or any adjournment thereof.

Pursuant to the alternative modes of notice as provided for in the Securities and Exchange Commission’s NOTICE dated March 13, 2023, this notice to Stockholders shall be published in the business section of two (2) newspapers of general circulation, in print and online format, for two (2) consecutive days not later than 21 days before the scheduled meeting. The Information Statement, Management Report, SEC Form 17-A, Minutes of the Annual Stockholders Meeting for the year 2022 and other pertinent meeting documents shall be made available in the Company’s website (www.seafrontresources.com.ph) and via PSE Edge.

As allowed under the Company’s Amended By-Laws, the Regular Annual Meeting shall be held virtually or via online/remotecommunication. Thestockholdersshallbeallowed tocasttheirvotesbyproxy,orbyremotecommunication, or in absentia pursuant to Section 49 of the Revised Corporation Code of the Philippines and SEC Memorandum Circular No. 6-2020.

To participate in the Annual Meeting, stockholders must register from 9:00 a.m. of June 01, 2023 until 5:00 p.m. of June 08, 2023 through the following link: http://seafrontresources.com.ph/investor_relations and follow the steps provided therein. The procedures for participation via remote communication and in absentia can be found in the said link. Please see Annex “B” of the Information Statement.

Stockholders who wish to appoint proxies may submit proxy forms until 5:00 p.m. of June 08, 2023 to the Office of Corporate Secretary at 7th Floor, JMT Building, ADB Ave., Ortigas Center, Pasig City or by email to asm@seafrontresources.com.ph. Validation of proxies will be held on June 09, 2023. A sample proxy form will be enclosed in the Information Statement for your convenience.

ATTY. SAMUEL V. TORRES Corporate Secretary

DATE : June 23, 2022

TIME : 4:00 p.m.

MANNER : Through Electronic Means of Communication

The Chairman, Mr. Roberto Jose L. Castillo, welcomed all the stockholders to the 2022 Regular Annual Stockholders’ Meeting (ASM), and mentioned that the ASM will be conducted through online and recorded video-streaming meeting in order to help avert the ongoing threat posed by the COVID-19 pandemic and to comply with the mandate of the Inter-Agency Task Force on Emerging Infectious Diseases’ advisory of avoiding physical mass gatherings.

He also mentioned that the procedures for the ASM were embodied in the Company’s Definitive Information Statement, which the Securities and Exchange Commission (SEC) approved. He then proceeded to mention that to accord the Stockholders the opportunity to participate in the ASM, the Stockholders were advised to register online. The stockholders were informed that only questions and concerns submitted online prior to the given deadline will be addressed during the ASM; and that those given during the ASM will be addressed through email after the ASM.

He then introduced the incumbent members of the Board of Directors of the Company, who were then present, while their pictures were being shown onscreen, as follows:

Ms. Milagros V. Reyes – Director/President

Mr. Medel T. Nera – Director/Treasurer

Mr. Basil L. Ong – Lead Independent Director

Mr. Nicasio I. Alcantara – Independent Director

Atty. Ernestine Carmen Jo D.

Villareal-Fernando – Independent Director

Ms. Yvonne S. Yuchengco – Director

Mr. Raul M. Leopando – Director

Mr. Victor V. Benavidez – Director

Mr. Roberto Jose L. Castillo – Chairman

The Corporate Secretary, Atty. Samuel V. Torres, was called to submit proof of the notice of meeting. The Corporate Secretary certified that, pursuant to the alternative mode for distributing and providing the notice of meeting in connection with the holding of the Annual Stockholders’ Meeting for 2022, notices of the meeting were sent to all stockholders of record as of April 25, 2022 in four (4) ways to reach as many stockholders as possible

First, by publication of the Notice of the ASM, including the agenda, on May 30 and 31, 2022 in The Manila Bulletin and the Philippine Star, both in print and online editionsfor two (2) consecutive days, as evidenced by the Affidavits of Publications executed by the respective representatives of the publishers. Second, by disclosure with the Philippine Stock and Exchange, Inc. Third, by posting on the Company’s website. Finally, through email for those who have successfully registered online, consistent with applicable SEC Rules and the Company’s internal guidelines on participation by electronic means of communication or in absentia

The Corporate Secretary certified that there was a quorum for the transaction of any business that may be properly brought before the body, with attendance of shareholders represented remotely or in absentia covering 4,148 shares (0.003%) and 107,333,284 shares (65.849%) represented by proxy, for a total of 107,337,432 shares (65.851%) out of the 163,000,000 total outstanding shares. Thereafter, the Chairman called the meeting to order.

The Chairman mentioned that the minutes of the last Regular Annual Stockholder’s Meeting held on June 24, 2021 was made available in the Company’s website

SRC - Annual Stockholders’ Meeting, June 23, 2022 Page 2

Stockholders owning 65.851% of the outstanding shares have voted in favor of the following resolution:

“RESOLVED, That the Minutes of the Regular Annual Stockholders’ Meeting held on June 24, 2021 be, as it is hereby, approved.”

The Chairman then requested the President, Ms. Milagros V. Reyes, to deliver the Management Report as follows:

“Dear Fellow Stockholders:

We are now entering a new phase into this pandemic with high hopes and a more positive outlook as we complete vaccination roll outs and resume business as usual. However, the lingering effects of the pandemic has undeniably affected our Company’s bottom line.

Seafront Resources Corporation’s net income decreased by 24% from P26.50 million in 2020 to P20.13 million in 2021. Most of our earnings came from dividends on our investment in Hermosa Ecozone Development Corporation (HEDC) amounting to P31.71 million. But this inflow was offset by the depressing and volatile market performance brought by the pandemic, and recently by major global and national events.

On a positive note, Hermosa Ecozone managed to sell 56,527 sqm of lots in 2021 translating to P323 million in revenues. We expect a more dynamic, lively investment atmosphere as the world starts to recover and we are hopeful that locators will be more optimistic with their investments. With your trust and support, our Company will be able to take advantage of this renewed confidence.

Thank you.”

SRC - Annual Stockholders’ Meeting, June 23, 2022 Page 3

After the presentation by the President, the Corporate Secretary reported that Stockholders owning 65.851 % of the outstanding shares have voted in favor of the following resolution:

“RESOLVED, as it is hereby resolved, that the 2021 Management Report and the 2021 Audited Financial Statements, as made available to the stockholders, be as they are hereby, noted and approved.”

JUNE 24, 2021 to JUNE 23, 2022

A resolution for the confirmation and ratification of all acts, resolutions, contracts and investments made and entered into by the Management and/or the Board of Directors for the period June 24, 2021 to June 23, 2022 was shown on the screen.

After which, the Corporate Secretary reported that stockholders owning 65.851% of the outstanding shares have voted in favor of the resolution, to wit:

“RESOLVED, as it is hereby resolved that all acts, resolutions, contracts and investments made by Management and/or the Board of Directors for the period June 24, 2021 to June 23, 2022, be as they are hereby confirmed, ratified and approved.”

The Chairman then tackled the next item in the Agenda. He then asked the Corporate Secretary if he has the list of nominees to the Board of Directors. The Corporate Secretary replied in the affirmative and that, as of April 25, 2022, the deadline for nominations, there were nine (9) nominees, screened and short listed by the Corporate Governance Committee for election as members of the Board of Directors, namely:

SRC - Annual Stockholders’ Meeting, June 23, 2022 Page 4

1. MILAGROS V. REYES – Director

2. ROBERTO JOSE L. CASTILLO – Director

3. MEDEL T. NERA – Director

4. YVONNE S. YUCHENGCO – Director

5. RAUL M. LEOPANDO – Director

6. VICTOR V. BENAVIDEZ – Director

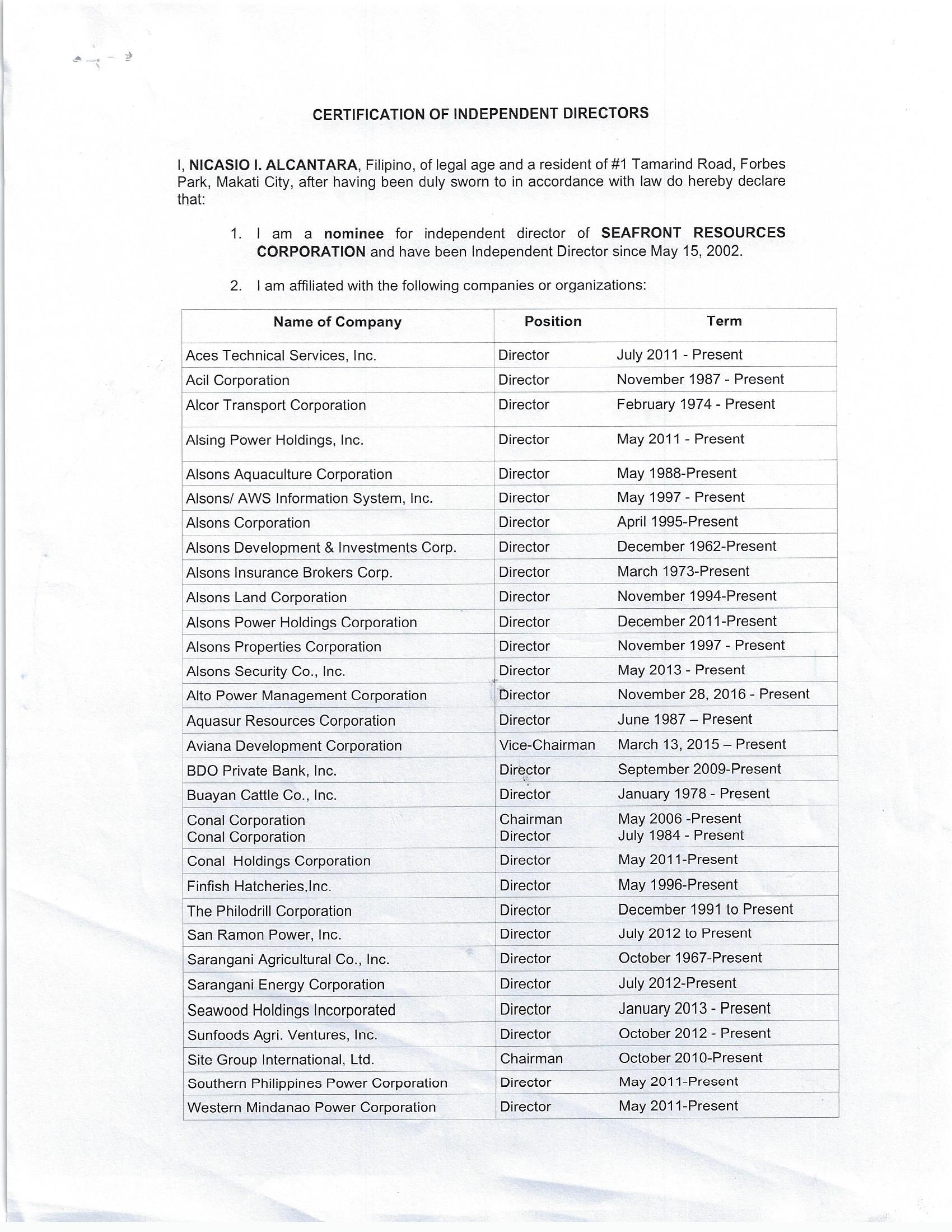

7. NICASIO I. ALCANTARA – Independent Director

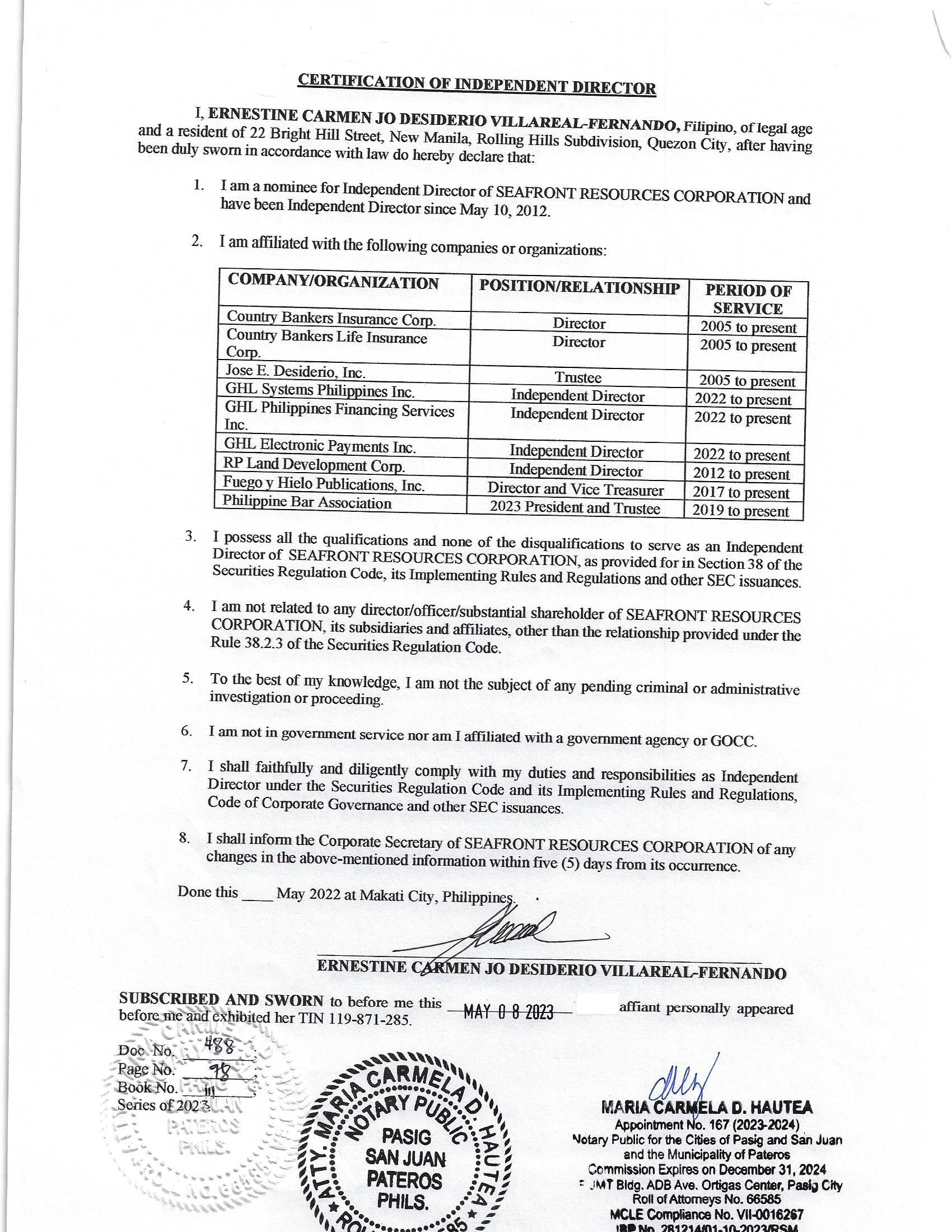

8. ERNESTINE CARMEN JO

D. VILLAREAL-FERNANDO – Independent Director

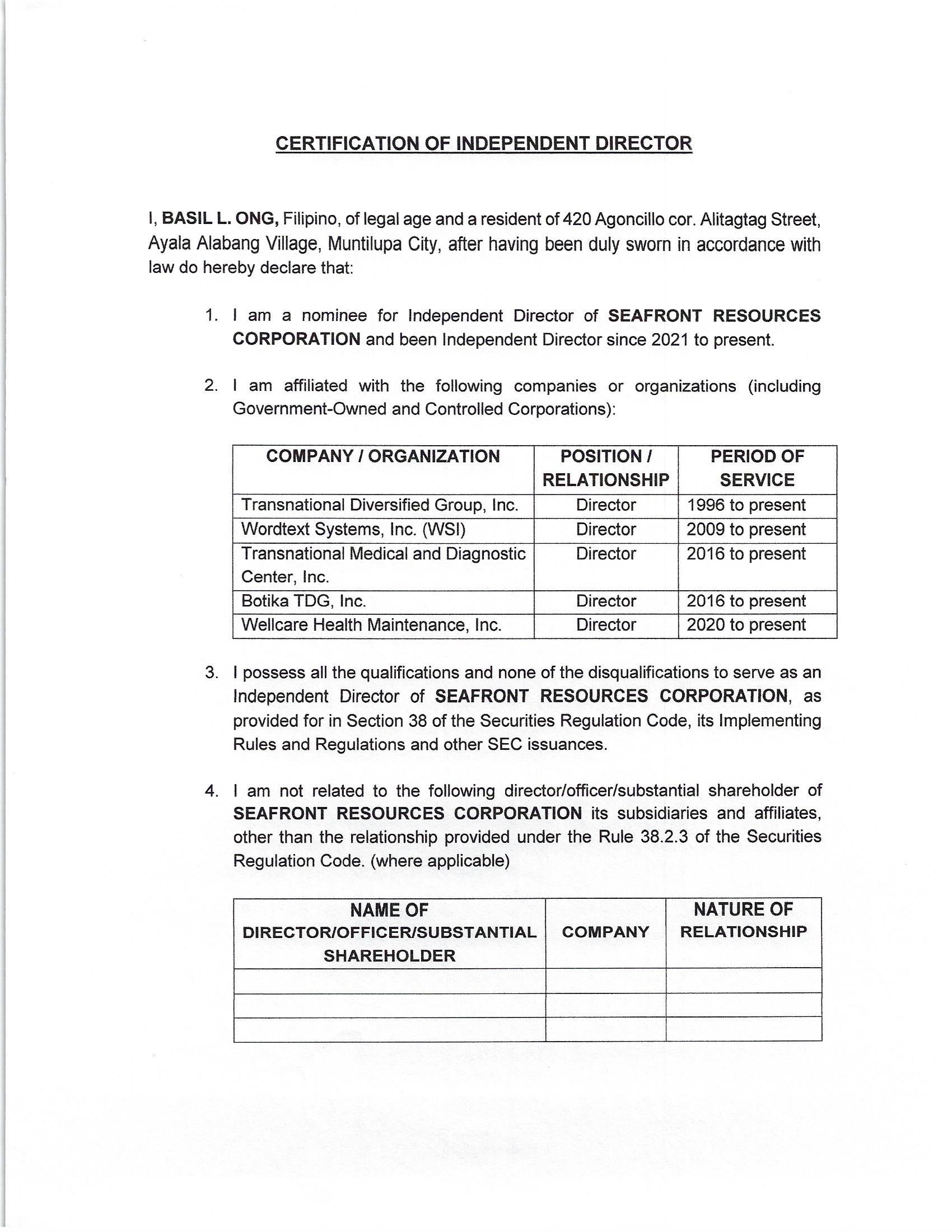

9. BASIL L. ONG – Lead Independent Director

Among these nominees, Mr. Nicasio I. Alcantara and Atty. Ernestine Carmen Jo D. Villareal-Fernando, whose respective terms as Independent Director have reached the nine (9) years maximum term limit in 2021, were nominated for retention and reelection as Independent Directors. As set by the Company’s Manual on Corporate Governance, pursuant to Securities and Exchange Commission (SEC) Memorandum Circular No. 19, Series of 2016, they can be retained and reelected upon meritorious justification and Stockholders’ approval The justification for said retention and reelection has been provided to the Stockholders in advance through the Information Statement.

The Corporate Secretary reported that all the shares represented in the meeting or 65.851% of the outstanding shares, have been voted in favor of the election of all the nine (9) nominees, including the extension and retention Mr. Alcantara and Atty. Villareal-Fernando as Independent Directors.

The Chairman then declared/proclaimed the above named nominees as elected members of the Board of Directors of the Corporation for the years 2022-2023

The Chairman stated that the Audit Committee recommended the re-appointment of the firm SyCip Gorres Velayo & Company (SGV) as the Company’s external auditor for the year ending December 31, 2022.

SRC - Annual Stockholders’ Meeting, June 23, 2022 Page 5

PRESENT:

2022 Annual Stockholders’ Meeting List of Attendees

Mr. Roberto Jose L. Castillo – Chairman Quezon City

Ms. Milagros V. Reyes – Director/President Pasig City

Mr. Medel T. Nera – Director/Treasurer

Quezon City

Mr. Nicasio I. Alcantara – Independent Director

Makati City

Atty. Ernestine Carmen Jo D. Villareal-Fernando – Independent Director

Quezon City

Mr. Basil L. Ong – Independent Director

Metro Manila

Ms. Yvonne S. Yuchengco – Director

Makati City

Mr. Raul M. Leopando – Director

Pasig City

Mr. Victor V. Benavidez – Director

Quezon City

SRC - Annual Stockholders’ Meeting, June 23, 2022 Page 7

OFFICERS:

Atty. Samuel V. Torres – Corporate Secretary Office/Grepalife

Atty. Louie Mark R. Limcolioc – Assistant Corporate Secretary (PetroEnergy Resources Corporation)

Carlota R. Viray Consultant/ PetroEnergy Resources Corporation

Maria Cecilia L. Diaz de Rivera PetroEnergy Resources Corporation

Shirley E. Belarmino

Maritess D. Reyes

Ma. Helen D. Agtarap

PetroEnergy Resources Corporation

PetroEnergy Resources Corporation

PetroEnergy Resources Corporation

Ma. Theresa Calate Seafront Resources Corporation

Kenneth C Lee

Narciso Jun T. Torres, Jr.

Ana Lea C. Bergado

Edward Joseph A. Maglinte

Martin Guantes

SyCip Gorres Velayo & Co.

SyCip Gorres Velayo & Co.

SyCip Gorres Velayo & Co.

SyCip Gorres Velayo & Co.

SyCip Gorres Velayo & Co.

Victoria T. Tomelden House of Investments

Alexander Anthony Galang House of Investments

Maria Elisa De Lara House of Investments

Leah Grace Ignacio House of Investments

MODERATORS:

Ms. Vanessa G. Peralta

Mr. Jerome A. Jardinero - END OF LIST -

SRC - Annual Stockholders’ Meeting, June 23, 2022 Page 8

1. Call to Order.

The Chairman of the Board of Directors, Mr. Roberto Jose L. Castillo, will call the meeting to order.

2. Certification of Notice and Quorum.

The Corporate Secretary will certify that the written Notice for the meeting was duly sent to stockholders of record, including the date of publication and the newspaper where the notice was published. He will also certify that the quorum exists, and the Stockholders representing at least a majority of the outstanding capital stock, present in person or by proxy, shall constitute a quorum for the transaction of business.

Pursuant to Sections 23 and 57 of the Revised Corporation Code and SEC Memorandum Circular No. 6, Series of 2020, stockholders may participate and vote through remote communication or in absentia. Stockholders may register by submitting the requirements via email at asm@seafrontresources.com.ph and vote in absentia on the matters for resolution at the meeting. A stockholder who votes in absentia, as well as a stockholder participating by remote communication, shall be deemed present for the purpose of quorum.

Please refer to Annex “B” on the Procedures and Requirements for Voting and Participation in the 2023 Regular Annual Stockholders’ Meeting for complete information on remote participation or voting in absentia, as well as on how to join the livestream for the 2023 ASM.

3. Approval of the Minutes of the Annual Stockholders’ Meeting held on June 23, 2022.

The Minutes of the Meeting held on June 23, 2022 are available at the Company’s website: www.seafrontresources.com.ph and at the PSE Edge.

4. Approval ofManagement Report and the 2022 Audited Financial Statements contained in the 2022 Annual Report.

The Report summarizes the milestones and key achievements of Seafront Resources Corporation (the “Company”) and provides a clear picture of how the Company achieved its goals and strategic objectives for the year 2021. The Company’s audited financial statements, the highlights of which are explained in the President and Chief Executive Officer’s Report and in the Information Statement. Copies of the 2022 Audited Financial Statements, previously approved by the Board of Directors, were also submitted to the Securities and Exchange Commission (SEC) and the Bureau of Internal Revenue (BIR). Please see Annex “D” for AFS 2022.

5. Confirmation and Ratification of all acts contracts and investments made and entered into by the Management and/or Board of Directors during the period June 23, 2022 to June 22, 2023.

The actions for approval are those taken bythe Board and/orits committees and the Management since the Annual Stockholders’ Meeting on June 23, 2022 until June 22, 2023, including the internal procedures for participation in meetings and voting through remote communication or in absentia. Agreements, projects, investments, treasury-related matters and other matters covered by disclosures to the SEC and the Philippine Stock Exchange will likewise be presented for approval. The acts of the officers were those taken to implement the resolutions of the Board or its committees or made in the general conduct of business.

6. Election of Nine (9) members of the Board of Directors for the year 2023-2024.

At its meeting held on May 08, 2023, the Corporate Governance Committee, as the standing committee of the BoardofDirectorsconstitutedforthepurposeof reviewingandevaluatingthequalificationsofpersonsnominated to become members of the Board ofDirectors (includingthe independent directors) and pursuant to the provisions of the Revised Manual on Corporate Governance Manual of the Company, reviewed the candidates for director to ensure that they have all the qualifications and none of the disqualifications for nomination and election as members of the Board of Directors.

The nine (9) nominees will be submitted for election to the Board of Directors by the stockholders at the Annual Stockholders’ Meeting. For this year, the candidates to the Board are the following:

a. As Regular Directors:

1) Mr. Roberto Jose L. Castillo

2) Mr. Medel T. Nera

3) Mr. Raul M. Leopando

4) Mr. Victor V. Benavidez

5) Ms. Milagros V. Reyes

6) Ms. Yvonne S. Yuchengco

b. As Independent Directors:

7) Atty. Ernestine Carmen Jo D. Villareal-Fernando

8) Mr. Nicasio I. Alcantara

9) Mr. Basil L. Ong

Please refer to Item 5 – Directors and Executive Officers of the Information Statement for the profile of the nominees to the Board. Stockholders will have the opportunity to elect the directors who will serve for the term 2023- 2024 by way of individual voting, by ballot and by proxy

7. Appointment of the Company’s External Auditors.

The Company’s Board Audit Committee assessed and evaluated the performance for the previous year of the Company’s external auditor, SYCIP GORRES VELAYO & CO. (SGV). Based on the Board Audit Committee, the Board of Directors will recommend the reappointment of SGV as the Company’s external auditor for 2023

SGV, one of the top auditing firms in the country, is fully accredited bythe SEC. A resolution for the appointment of the Company’s external auditor for 2023 shall be presented to the stockholders for approval.

The Chairman of the meeting will inquire whether there are other relevant matters and concerns to be discuss.

10. Adjournment

Upon determination that there are no other relevant matters to be discuss, the meeting will be adjourn on motion duly made and seconded.

Check the appropriate box:

Preliminary Information Statement √ Definitive Information Statement

Name of Registrant as specified in its charter: SEAFRONT RESOURCES CORPORATION

Province, country or other jurisdiction of incorporation or organization: PASIG CITY, PHILIPPINES

SEC Identification Number: 40979

BIR Tax Identification Code: 000-194-465

6. Address of principal office: 7TH FLOOR, JMT BUILDING, #27 ADB AVENUE, ORTIGAS CENTER PASIG CITY 1605, PHILIPPINES

7. Registrant’s telephone number, including area code: (632) 8637-2917

8. Date, time and place of the meeting of security holders: June 22, 2023 at 4:00 p.m. virtually or via online/remote communication. http://seafrontresources.com.ph/investor_relations.

9. Approximate date on which the Information Statement is first to be sent or given to security holders: May 23, 2023.

10. Securities registered pursuant to Section 4 and 8 of the RSA (information on number of shares and amount of debt is applicable only to corporate registrants):

Title of Each Class Number of Shares of Common Stock Outstanding Common 163,000,000 shares

11. Are any or all of registrant’s securities listed on the Philippine Stock Exchange? Yes______________No_____________

If so, disclose name of the Exchange: The Philippine Stock Exchange, Inc.

Information Required by Items of SEC Form 20-IS

The Regular Annual Meeting of the Stockholders of Seafront Resources Corporation (the “Company”) will be held on Thursday, June 22, 2023, at 4:00 p.m. To be called and conducted and presided virtually or via online/remote communication by the presiding officer at the Company’s principal office address at 7th Floor, JMT Building, ADB Avenue, Ortigas Center, Pasig City http://seafrontresources.com.ph/investor_relations

Mailing Address –7th Floor, JMT Building, #27 ADB Avenue, Ortigas Center, Pasig City, Philippines.

Approximate date of which the Information Statement is to be first sent or given to security holders: 23 May 2023

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

There are no corporate matters or actions that will entitle dissenting stockholders to exercise their right of appraisal as provided in Section 80 of the Revised Corporation Code of the Philippines (RCC).

The Dissenter’s Right of Appraisal shall be available under the following instances:

a. In case of any amendment to the articles of incorporation has the effect of changing or restricting the rights of any stockholders or class of shares, or of authorizing preferences in any respect superior to those outstanding shares of any class, or extending or shortening the term of corporate existence;

b. In case of sale, lease, exchange, transfer, mortgage, pledge or other disposition of all or substantially all of the corporate property and assets as provided in the RCC;

c. In case of merger or consolidation; and

d. In case of investment of corporate funds for any purpose other than the primary purpose of the Company.

In the event that a dissenting stockholder exercises his Right of Appraisal, he shall be entitled to demand payment of the fair value of his shares. The right of appraisal shall be exercised by making a written demand to the Company for the payment of the fair value of shares held, within thirty (30) days after the date on which the vote was taken. Failure to make the demand within such period shall be deemed a waiver of the Appraisal Right. If the proposed corporate action is implemented, the dissenting stockholder shall be paid the fair value his shares as of the day before the vote was taken, excluding any appreciation or depreciation, upon surrender of the certificate or certificates of stock representing the stockholder’s shares (Sec. 81, RCC).

If the dissenting/withdrawing stockholder and the Company cannot agree on the fair value of the shares within sixty (60) days from the approval of the corporate action, the same shall be determined and appraised by three (3) disinterested persons, the first shall be named by the dissenting/withdrawing stockholder, the second by the Corporation, and the third by the two (2) thus chosen. The findings of the majority of the appraisers shall be final, and their award shall be paid by the Company within 30 days after such award is made, but no payment shall be made unless the Company has unrestricted retained earnings in its books to cover such payment. Upon payment by the Company of the agreed or awarded price, the stockholder shall forthwith transfer the shares to the Company (Sec. 81, RCC)

No director, nominee for election as director, associate of the nominee or executive officer of the Company at any time since the beginning of the last fiscal year had any substantial interest, direct or indirect, by security holdings or otherwise, in any of the matters to be acted upon in the meeting, other than election to office.

No director has informed the Corporation in writing that he intends to oppose any action to be taken by the registrant at the meeting.

Item 4 Voting Securities and Principal Holders Thereof

a) Number of Shares Outstanding as of April 30, 2023:

Number of Votes Entitled One (1) vote per share

Foreign Equity Ownership as of April 30, 2023: The Company Foreign equity ownership, as follows: No. of Shares

held by Filipino

b) Only holders of the Company’s stock of record at the close of business on May 05, 2023, acting in person or by proxy, on the day of the meeting are entitled to notice and to vote at the Annual Stockholders Meeting to be held on June 22, 2023 Stockholders of record are entitled to one vote per share. Voting may be done viva voce or by balloting or in absentia

c) Manner of Voting

Section 5.0 of Article II of the By-Laws of the Corporation provides that stockholder may vote at all meetings the number of shares registered in their respective names either in person or by proxy executed in writing, or through remote communication or in absentia as allowed by the Board of Directors. No proxy shall be recognized unless presented to the Secretary for inspection and registration at least ten (10) calendar days before the date of said meeting.

The stockholders have cumulative voting right with respect to the election of the Company’s Directors: (See also Page 17 Item 19 Voting Procedures).

1. Election of Directors shall be held at the Annual Stockholders’ Meeting It shall be done by majority (2/3 for the amendment of the By-Laws) of stock represented in the meeting, or vote through remote communication or in absentia, and shall be conducted in the manner provided in Section 23 of the RCC, and with such formalities and in such manner as the presiding officer at the meeting shall then and there determine and provide:

a) he/she may vote such number of shares for as many persons as there are Directors to be elected;

b) he/she may cumulate said share and give one candidate as many votes as the number of Directors to be elected multiplied by his/her shares;

c) he/she may distribute them on the same principle among as many candidates as he/she may see fit. In any of these instances, the total number of votes cast by the stockholders should not exceed the number of shares owned by him/her as shown in the books of the Corporation multiplied by the total number of Directors to be elected.

d) Discretionary authority to cumulate vote is not solicited.

d) Security Ownership of Certain Record and Beneficial Owners and Management

1. Security Ownership of Certain Record and Beneficial Owners:

The following table sets forth information with respect to a record or beneficial owner directly or indirectly owning more than 5% of the Company’s Capital Stock as of April 30, 2023

The corporate acts of PMMIC are carried out by its Board of Directors and Management.Ms. Michele Y. Dee is the President of

3. The Corporate acts of Alsons Cons. Res., Inc. are carried out by its Board of Directors. Mr. Nicasio I. Alcantara is the current

and

of the Company. 4. CBC T/A-SSC#0010 and T/A-SSC#0011 are Trust Accounts with China Banking Corporation as Trustee. The Corporate acts of CBC are carried out by its Board of Directors and Management. Mr. Romeo D. Uyan, Jr. is the current President and CEO of the Company * PCD total shares include Filipino and Non-Filipino.

2. Security Ownership of Management as of April 30, 2023.

The following are the number of shares owned of record by the Directors, the Chief Executive Officer and each of the key officers of the Company and the percentage of shareholdings of each:

Title of Class

Common

Name of Beneficial Owner Name and Position

Roberto Jose L. Castillo

Common Milagros V. Reyes

and Director

Common Basil L. Ong

Common Yvonne S. Yuchengco

Common Nicasio I. Alcantara

Common Medel T. Nera Director/Treasurer

Common Ernestine Carmen Jo D. Villareal-Fernando

Common Raul M. Leopando

Common Victor V. Benavidez

Common Samuel V. Torres

Common Louie Mark R. Limcolioc Asst. Corporate Secretary

As of April 30, 2023, the Company’s directors and executive officers owned an aggregate of 4,926 shares equivalent to 0.40% of the Company’s outstanding shares. None of the members of the Company’s directors and management owns more than 2% of the outstanding capital stock of the Company.

Voting Trust Holders of 5% or more -The Company is not aware of any voting trust or similar arrangement among persons holding more than 5% of a class of shares.

Changes in Control - There had been no change in the control of the Company since the beginning of the last fiscal year. The Company has no existing voting trust or change in control agreements. Item 5

2018 to present

1999 to present

2021 to present

2017 to present

2000 to present

1995 to present

2017 to present

2011 to present

2012 to present

2011 to present

2006 to present

to present

2022 to present

The Directors of the Company are elected at the annual meeting of stockholders to hold office until the next annual meeting and until each respective successor shall have been elected and qualified. Each Board member serves for a term of one year or until his successor is duly elected and qualified.

The following are the incumbent directors of the Company and their business experience for the past five (5) years:

Mr. Roberto Jose L. Castillo, 69, Filipino, Chairman (Non-Executive Director)

Publicly-Listed Companies: Mr. Castillo is the Chairman of the Board since 2018. .

Non Listed: He is the Director of the following companies PetroWind Energy, Inc., PetroGreen Energy Corporation, PetroSolar Corporation, Brightnote Assets Corporation, Hermosa Ecozone Development Corporation, Kubota-Kasui Philippines Corporation, SQ Resources, Inc., SN Resources, Inc., Somerset Hospitality Holdings Philippines, Inc., Ascott Hospitality Holdings Philippines, Inc. and Tong Hsing Electronics Philippines, Inc. He is also Chairman of the Advisory Board, Carmelray Industrial Corporation and Chairman CJC Corporation.

Educational Background: Master’s degree in Business Administration, Wharton Graduate School of the University of Pennsylvania, Bachelor of Science in Commerce, University of Santo Tomas, Bachelor of Arts, University of Santo Tomas. Professional Qualification: Certified Public Accountant (CPA)

Ms. Milagros V. Reyes, 81, Filipino, Director/President

Publicly-Listed Companies: She is the Director and President of PetroEnergy Resources Corporation and formerly of iPeople, inc.

Non-Listed: She is presently the Chairman of PetroGreen Energy Corporation, Chairman of Maibarara Geothermal, Inc. and Chairman/President of PetroSolar Corporation; Director/Treasurer of Hermosa Ecozone & Development Corporation. She was formerly a Director/Consultant of PNOC-EC and a Senior Vice President of Basic Petroleum and Minerals, Inc.

Educational Background: Bachelor of Science in Geology and Physical Sciences (Double Degree) from the University of the Philippines. She pursued various technical trainings from the National Iranian Oil Co., University of Illinois and Ajman Fields in U.A.E.

Ms. Yvonne S. Yuchengco, 69, Filipino, Director

Publicly-Listed Companies: She is a Director of House of Investments, Inc. Director/Treasurer of PetroEnergy Resources Corporation and Director of iPeople, Inc

Non-Listed: She is the Chairperson/President/Director of Phil. Integrated Advertising Agency, Inc., Royal Commons, Inc., Y RealtyCorporation, Y Tower II Office Condominium Corporation, Yuchengco Museum, Inc., Yuchengco Tower Office Cond. Corporation, Chairperson of XYZ Assets Corporation, Director/President of Alto Pacific Corporation, RCBC Land, Inc., Mico Equities, Inc. She is Director/Treasurer of Honda Cars Kaloocan, Inc., Malayan High School of Science, Inc., Mona Lisa Development Corporation, PetroEnergy Resources Corporation, Water Dragon, Inc., DirectorTreasurer/CFO of Pan Malayan Mgm’t. & Inv’t. Corp., Director/Vice Chairperson of Malayan Insurance Co., Inc., Director/Vice President/Treasurer of Pan Managers, Inc., Trustee/Chairperson of The Malayan Plaza Condominium Owners Association, Inc., Trustee of AY Foundation, Inc, Mapua Institute of Technology, Inc., Phil-Asia Assistance Foundation, Inc., She is a member of Advisory Committee of Rizal Banking Corporation, Director/Corporate Secretary of MPC Investment Corporation. She is also a member of the Board of Directors of the following companies: Annabelle Y. Holdings & Management Corporation, Asia-Pac Reinsurance Co., Ltd., A.T.Yuchengco, Inc. DS Realty, Inc., Enrique T. Yuchengco, Inc., GPL Holdings, Inc., House of Investment, Inc., HYDee Management and Resource Corp., iPeople, inc., La Funeraria Paz, Inc.-Sucat, Luisita Industrial Park Corp., Malayan College Laguna, Inc., Malayan Colleges, Inc., Malayan High School of Science, Inc., Malayan International Insurance Corp., Manila Memorial Park Cemetery, Inc., National Reinsurance Corporation of the Philippines, Pan Malayan Express, Inc., Pan Malayan Realty Corporation, Shayamala Corporation and YGC Corporate Services, Inc, Yuchengco Center, Inc.

Educational Background: Bachelor of Arts in Interdisciplinary Studies from the Ateneo De Manila University

Mr. Medel T. Nera, 67, Filipino, Director/Treasurer

Publicly-Listed Companies: Mr. Nera is the Director of iPeople, Inc.; EEI, Inc. and House of Investments, Inc.

Non-Listed: He is also a Director of Generika Group. His past experience include: President and CEO of House of Investments, Inc., Director and President of RCBC Realty Corp.; Chairman of the Board of Greyhounds Security & Investigation Agency Corporation, and Zamboanga Industrial Finance Corporation (ZIFC); Chairman and President of Honda Cars Kalookan, Inc.;DirectorofHI-Eisai Pharmaceuticals, Inc., Investment Managers, Inc., LandevCorp.,Malayan Colleges Laguna, Inc.Manila Memorial Cemetery Park, Inc., YGC Corporate Services, Inc., Chairman of Risk Oversight Committee and member of the Audit Committee of Rizal Commercial Banking Corp.; and Senior Partner at Sycip Gorres Velayo & Co.

Educational Background: Master in Business Administration from Stern School of Business, New York University, USA and Bachelor of Science in Commerce from Far Eastern University, Philippines, International Management Program from Manchester Business School, UK, Pacific Rim Program from University of Washington, USA.

Mr. Nicasio I. Alcantara, 80, Filipino, Independent Director

Publicly-Listed Companies: He is presently Chairman and President of Alsons Consolidated Resources, Inc., an Independent Director of The Philodrill Corporation and Phoenix Petroleum Philippines, Inc.

Non-Listed: Chairman and President of ACR Mining Corporation, Alsons Development and Investment Corporation, Sarangani Agricultural Company, Inc., Conal Corporation, Thermal Energy Corporation, Alto Power Management Corporation and many other subsidiaries under the Alcantara Group. He is the Chairman of the SITE Group International, Ltd. Mr. Alcantara serves as the Chairman ofboththe Corporate Governance Committee and Related PartyTransactions Committee of theBDO Private Bank, Inc. and a member of the Bank’s Audit Committee. He is the Vice-Chairman of Aviana Development Corporation. Director of Enderun Colleges, Inc. Prior to this, Mr. Alcantara held the position of Chairman and President in various corporations, namely, Petron Corporation, Iligan Cement Corporation, Alson Cement Corporation, Northern Mindanao Power Corporation and Refractories Corporation of the Philippines. He was also the Chairman of Alsons Prime Investments Corporation until recently and served as Directorof the BankOne Savings Bancasia Capital Corporation,C. Alcantara &Sons,Inc. and AlsonsCorporation.

Educational Background: Bachelor of Science in Business Administration from the Ateneo de Manila University, Master’s in Business Administration from Sta. Clara University, California, USA

Atty. Ernestine Carmen Jo Villareal-Fernando, 61, Filipino, Independent Director

Non-Listed: She is the Director of various corporations such as: CountryBankers Insurance Corporation, CountryBankers Life Insurance Corporation, Jose E. Desiderio, Inc. and Fuego y Hielo, Inc., Founding Partner, Platon Martinez Flores San Pedro Leano Fernando Panagsagan Bantilan Law Office from1996-2004. IndependentDirectorofRCBC Securities, Inc., RCBCForex Brokers Corporation and RP Land Development Corporation, Treasurer – Trustee of Philippine Bar Association.

Educational Background: Bachelor of Laws from the University of the Philippines, A.B. Economics-College Scholar, Dean’s Medal from the University of the Philippines, Certificate in Math and Computer Programming at Michigan State University, Computer Center.

Mr. Victor V. Benavidez, 71, Filipino, Director

Publicly-Listed Companies: He is a Director of Boulevard Holdings, Inc.

Non-Listed: He is formerly the General Manager of Alakor Securities, Inc, Director, Mariwasa Siam Holdings, Anglo Philippines Holdings Corporation, VP and Director Mabuhay Holdings Corporation and Tagaytay Properties & Holdings Corporation, Columnist, The Daily Globe, Investment Research Consultant of James Capel, Manager/Corplan of Banco Filipino and Manager/Investment Research of Anselmo Trinidad & Co.

Educational Background: Bachelor of Science in Economics from the Universityof Sto. Tomas, Master’s Degree in Economics from the University of Sto. Tomas, Professional Development Program from CRC.

Mr. Raul M. Leopando, 72, Filipino, Director

Publicly-Listed Companies: He is presently a member of a Board of Director of UPSON International Corporation. Non Listed: He is a Director of Maibarara Geothermal Energy Corporation. He was formerly President/CEO of RCBC Capital Corporation; Chairman of the Board of RCBC Securities Corporation, Vice Chairman of the Board of RCBC Bankard, Senior Consultant to the Chairman of RCBC; Director of PetroEnergy Resources Corporation and PetroGreen Corporation. He was also member of the Board of Directors of several other corporations. He was also formerly President of Investment Houses Association of the Phils. (IHAP). He is a lifetime member of the Financial Executive Institure (FINEX).

Educational Background: Bachelor of Arts in Economics from the University of the Philippines and Bachelor of Science in Commerce-Accounting from San Beda University

Mr. Basil L. Ong, 71, Filipino, Independent Director

Publicly-Listed Companies: He is formerlyan Independent Director at PetroEnergyResources Corporation since 2011 to 2020 Non-Listed: Mr. Ong likewise has board membership in various corporations, namely: Transnational Diversified Group, Inc., Wordtext Systems, Inc. (WSI),Transnational Medical and Diagnostic Center, Inc. Botika TDG, Inc., Wellcare Health Maintenance, Inc.

Educational Background: Mr. Ong, received his Bachelor’s Degree in Management from the Ateneo de Manila University and he completed his post graduate the Program for Management Development at the Harvard Business School.

Executive Officers:

Ms. Milagros V. Reyes, 81, Filipino, Director/President

Publicly-Listed Companies: She is a Director and President of PetroEnergy Resources Corporation and formerly of iPeople, inc. Non-Listed: She is presently the Chairman PetroGreen Energy Corporation, Chairman of Maibarara Geothermal, Inc. and PetroSolar Corporation; Director/Treasurer of Hermosa Ecozone & Development Corporation. She was formerly a Director/Consultant of PNOC-EC and a Senior Vice President of Basic Petroleum and Minerals, Inc. Educational Background: Bachelor of Science in Geology and Physical Sciences (Double Degree) from the University of the Philippines. She pursued various technical trainings from the National Iranian Oil Co., University of Illinois and Ajman Fields in U.A.E.

Atty. Samuel V. Torres, 58, Filipino, is the Gen. Counsel/Corporate Secretary of AY Foundation, Alto Pacific Company, Inc. (Formerly: The Pacific Fund, Inc.), Bankers Assurance Corp., FBIA Insurance Agency, Inc., Bluehounds Security & Invt. Agency, Enrique T. Yuchengco, Inc., First Nationwide Assurance Corp., GPL Holdings, Inc. GPL Cebu Tower Office Cond. Corp., GPL Holdings, Inc., Grepaland, Inc., Grepa Reality Holding Corporation, Hexagon Integrated Financial & Insurance Agency, Hi-Eisai Pharmaceutical, Inc., Honda Cars Kalookan, Inc, House of Investments, Inc.,Hexagon Integrated Fin. Ins. Agency, Inc., Hexagon Lounge, Inc., iPeople, Inc., Investment Managers, Inc.,Landev Corporation, La Funeraria Paz-Sucat, Inc., Malayan High School of Science, Inc., Malayan Insurance Co., Inc., Mico Equities, Inc., Malayan Colleges, Inc., Malayan Colleges Laguna, Inc., Malayan Securities Corporation, Mapua Information TechnologyCenter, Inc., MJ888 Corporation, Mona Lisa Development Corporation, Pan Malayan Management & Investment Corporation, Pan Malayan Realty Corporation, Pan Malayan Express, Inc., Pan Pacific Computer Center, Inc., People eServe Corporation, PetroEnergy Resources Corporation, Philippine Integrated Advertising Agency, Inc., Royal Commons, Inc.,RCBC Forex Corporation, RCBC Realty Corporation, RCBC Land, RCBC Securities, Inc., RCBC Bankard Services Corporation, RCBC Securities, Inc., RP Land Development Corporation,SunLifeGrepa Financial,Inc.,YuchengcoMuseum,YGCCorporateServices, Inc., YRealtyCorporation,Y Tower II Office Condominium Corp., Yuchengco Tower Office Condominium Corp. and Xamdu Motors, Inc.

Educational Background: Bachelor of Science in Business Economics from the University of the Philippines and Bachelor of Laws from Ateneo de Manila University.

BOARD ATTENDANCE

The record of attendance of the Board of Directors in the Board Meetings and Stockholders’ Meeting for the calendar year 2022 and also Board Committee Meetings.

Nominees for Election as Members of the Board of Directors for the year 2022-2023:

The following incumbent directors have been nominated to the Board of Directors of the Company for the ensuing year 2023-2024 and have been approved for election by the Corporate Governance Committee at its meeting on May 08, 2023.

1. Mr. Roberto Jose L. Castillo – Director 6. Mr. Nicasio I. Alcantara – Independent Director

2. Ms. Milagros V. Reyes - Director 7. Atty. Ernestine Carmen Jo D. Villareal-Fernando–IndependentDirector

3. Mr. Raul M. Leopando – Director 8. Mr. Basil L. Ong – Independent Director

4. Ms. Yvonne S. Yuchengco - Director 9. Mr. Victor V. Benavidez– Director

5. Mr. Medel T. Nera– Director

Nomination and Election of Independent Directors:

Atty. Arturo B. Maulion, a stockholder of record, formally nominated Mr. Nicasio I. Alcantara, Atty. Ernestine Carmen Jo D. Villareal-Fernando and Mr. Basil L. Ong as Independent Directors. Atty. Maulion has no relations with the Nominees. (Please see attached Annex “A” for the Certification of Independent Directors).

Re-election of Mr. Nicasio I. Alcantara and Ernestine Carmen Jo Villareal-Fernando as Independent Directors

Mr. Nicasio I. Alcantara, 80, Filipino, Independent Director

Mr. Alcantara is a product of Ateneo de Manila Universitywith a degree in BS Business Administration in 1964. He then pursued his studies abroad and finished his Masters in Business Administration post-graduate diploma atSta. Clara University, California, U.S.A. in 1968. Mr. Alcantara is a distinguished and an astute businessperson who has been at the helm of numerous different companies in finance, real estate, agriculture, mining, oil and power. He is presently the Chairman and President of Alsons Consolidated Resources, Inc., Alto Power Management Corp., Alsons Thermal Energy Corp., ACR Mining Corp., the Chairman of Site Group International Limited, an Australian company, and Conal Corporation, and the Vice Chairman of Aviana Development Corp.

From 2001 until 2009, he led Petron Corporation, the largest oil refining and marketing company, one of the leading oil suppliers in the Philippines, as its Chairman and CEO. He likewise served as Chairman and President for various corporations, namely, Western Mindanao Power Corporation, Northern Mindanao Power Corporation, Southern Phil. Power Corp., Refractories Corporation of the Phils., Davao Industrial Plantation, Inc., Alsons Insurance Brokers Corp., Alsons Cement Corporation, Alsons Aquaculture Corporation, and Chairman of Acil Corporation.

In addition to the aforementioned executive positions, Mr. Alcantara held and continues to hold directorships with numerous companies. Alcantara’s first directorship experience traces as far back as 1973 with Alsons Insurance Brokers Corp. and has been well-sought as director by several companies ever since. For five (5) decades, or from 1973 onwards, Mr. Alcantara served and continues to serve as director for various corporations, namely: Aces Technical Services, Inc., Acil Corporation, Alabel Sa Lipa Farms, Inc., Alcor Transport Corporation, Aleca Corp., Alsing Power Holdings, Inc., Alsons Aquaculture Corporation, Alsons/AWS Information System, Inc., ACR Mining Corporation, Alsons Corporation, Alsons Development and Investments Corp., Alsons Land Corporation, Alsons Power Holdings Corporation, Alson Properties Corporation, Alsons Security Co., Inc., Alsons Thermal Energy Corp., Alsons Prime Investments Corp., Alto Power Management Corporation, Alsons Cement Corporation, Alsons Consolidated Resources, Inc., Aquasur Resources Corporatioon, Buayan Cattle Co., Inc., C. Alcantara and Sons, Inc., Bank One Savings & Trust Corp., Bancasia Finance and Investment Cop., Bancasia Capital Corporation, Conal Corporation, Enderun Colleges Inc., Finfish Hatcheries, Inc., Indophil Resources NL, Kennemer Foods International, Lima Agri Farms, Inc., Lima Land, Inc., Roscal Corporation, Samal Agricultural Dev’t. Corporation, San Ramon Power, Inc., Sarangani Agricultural Co., Inc., Sarangani Cattle Co., Inc., Sarangani Energy Corporation, Sagittarius Mines, Inc., Seawood Holdings Incorporated, South Star Aviation Corporation, Sunfoods Agri. Ventures, Inc., Site Group International, Ltd., Southern Philippines Power Corporation, T'boli Agro-Industrial Development, Inc., Trusto Corporation, Western Mindanao Power Corporation, WWFPhilippines,United Pulp and PaperCo. Mr. Alcantara likewise holds independentdirectorposition with BDO Private Bank, Inc., Phoenix Petroleum Philippines, Inc., and The Philodrill Corporation.

With the above, Mr. Alcantara’s extensive experience in various industries and remarkable professional reputation is beyond question. His guidance, through the knowledge and wisdom he gained over the years, would therefore be more than necessary in stimulating the Company’s financial growth.

Atty. Ernestine Carmen Jo Villareal-Fernando, 61, Filipino, Independent Director

Atty. Villareal-Fernando graduated fromthe Universityof the Philippines with a degree in A.B. Economics in1982 with a Dean’s Medal award and having been a college scholar. Atty. Villareal- Fernando pursued her law studies in the University of the Philippines and graduated Bachelor of Laws in 1987. Prior to her UP education, she was granted a scholarship and secured a Certificate in Math and Computer Programming from Michigan State University. She was also granted a scholarship in the revived UP LLM Program. She is a member of the UP Delta Lambda Sigma Sorority and served as its Grand Archon in 1986. She was also President of the UP Delta Lambda Sigma Alumni Association.

Atty. Villareal-Fernando was admitted to the Philippine Barin 1988. In the early years of Atty. Villareal-Fernando’s law practice, she worked with Siguion Reyna Montecillo & Ongsiako Law Office, one of the oldest law firms in the Philippines, wherein she became its first female partner. She subsequently became one of the founding and Senior Partners of Platon Martinez Flores San Pedro Leano Fernando Panagsagan Bantilan Law Office in 1996, one of the top and prominent law firms in the Philippines. She co-headed its Labor Department as well. Her law practice covers the areas of general litigation, product liability, labor law, corporate law, property and due diligence.

Atty. Villareal-Fernando left the Firm in 2004 to live overseas. She continued a distinguished career in the corporate practice as she held and continues to hold directorships with various notable corporations. Atty. Villareal-Fernando serves as independent director for RCBC Forex Inc., RP Land Development Corp., Seafront Resources Corporation. She also sits on the board of directors of Fuego y Hielo Publishing, Country Bankers Insurance Corporation, Country Bankers Life Insurance Corporation, and Jose E. Desiderio, Inc. Simultaneous to these directorships, as Independent Director of RCBC Securities Inc., she presided as Chairman of RCBC Securities Inc.’s Audit Committee and Corporate Governance Committee; and was a member of various committees such as Risk Management Committee and Compensation and Remuneration Committee. She is also on the Audit Committee of Seafront Resources Corporation. She is likewise in the Executive Committee, Corporate Governance Committee and Audit Committee of both Country Bankers Life Insurance Corp. and Country Bankers Insurance Corp. She is also on the Board of the Philippine Bar Association, the oldest voluntary lawyers’ group of the Philippines where she is likewise its Treasurer. She is with the Universityof the Philippines Law Alumni Foundation where she is Vice Treasurer. She is also a Fellow of the Institute of Corporate Directors.

Notwithstanding the above, Atty. Villareal-Fernando still finds the time to share her knowledge and wisdom as an academe in several institutions and companies. She is a lecturer at the UP College of Law and is the lone Lecturer representative on the UP Law Academic Personnel Committee. She was once Chairman of the UP Law Commercial Law Cluster. She has likewise lectured for the National Convention of the Integrated Bar of the Philippines, the UP Law Center and private corporations. She has been trained in the United Kingdom and in the Asia Pacific region on litigation and evidentiary training.

Given Atty. Villareal-Fernando’s aforementioneddeepandimpressive professionaltrack-record in thefieldsoflaw andcorporate practice, together with her passion as an academe, it is undeniable that her knowledge and wisdom would prove to be invaluable in leading and guiding the Company towards a much robust future.

Considering the above, the Corporate Governance Committee passed upon the qualifications of the above-named nominees and found no disqualifications in accordance with Rule 38 of Republic Act No. 8799 or otherwise known as the Securities Regulation Code (SRC) and the Company’s Manual on Corporate Governance, and as provided for in the Company’s By-Laws, as amended and approved by the Board of Directors and Stockholders on June 29, 2020, and July 27, 2020, respectively

The Corporate Governance Committee adheres to the criteria and guidelines governing the conduct of the nominations as set forth in the procedures under SRC Rule 38 on the Nomination and Election of Independent Directors, Amended By-Laws, and the Company’s Manual on Corporate Governance.

The Company has adopted SRC Rule 38 and compliance therewith has been made. Only nominees whose names appear on the Final List of Candidates shall be eligible for election as Independent Director. No further nominations shall be entertained or allowed on the floor during the actual annual stockholders’ meeting. An Independent Director is a person who is independent of management and the controlling shareholder, and is free from any business or other relationship which could, or could reasonablybe perceived to, materially interfere with his exercise of independent judgement in carrying out his responsibilities as a director.(Please see Annex “A” for the Certification of Independent Director).

The members of the Board of Directors and the Independent Directors are elected at the general meeting of stockholders, who shall hold office for the term of one (1) year or until their successors shall have been elected and qualified.

The Management Committee members and other Officers of the Company, unless removed bythe Board of Directors, shall serve as such until their successors are elected or appointed.

Other than the aforementioned Directors and Executive Officers identified in the item on Directors and Executive Officers in this Information Statement, there are no other employees of the Company who may have significant influence in the Company’s major and/or strategic planning and decision-making. The Corporation values its human resources. It expects each employee to do his share in achieving the Corporation’s set goals.

Family Relationship

There are no family relationships known to the Company.

Certain Relationships and Related Transactions (refer to Note 13 of the 2022 Audited Financial Statements)

Related party relationship exists when one party has the ability to control, directly, or indirectly through one or more intermediaries, the other party or exercise significant influence over the other party in making financial and operating decisions. Such relationship also exists between and/or among entities, which are under common control with the reporting enterprises and its key management personnel, directors, or its shareholders. In considering each related party relationship, attention is directed to the substance of the relationship, and not merely the legal form. The Company in its regular conduct of business has entered into the following transactions with related parties consisting of reimbursement of expenses and management and accounting services agreements.

All of the related party transactions disclosed in the Notes to the AFS are required disclosures of the law under the SEC and BIR regulations.

For the past five (5) years, none of the Directors or Executive Officers was involved nor has any such officer or director has been involved in any legal cases under the Insolvency Law or the Philippine Revised Penal Code either as defendant or accused, nor has anysuch officer or director been the subject of anycourt order, judgment or decree barring, suspending or otherwise limiting him from engaging in the practice of any type of business including those connected with securities trading, investments, insurance or banking activities.

As of this report, the Company is not a party to any litigation or arbitration proceedings of material importance, which could be expected to have a material adverse effect on the Company or on the results of its operations. No litigation or claim of material importance is known to be pending or threated against the Company or any of its properties.

As of the record date, to the best of Company’s knowledge, there are no legal proceedings against the directors and executive officers of the company within the categories described in SRC Rule 12, Part 1V paragraph (A) (4).

Stocks Warrants or Options

NO warrants or options were granted to the Directors and Officers from 1999.

No director has resigned or declined to stand for re-election for the Board of Directors since the date of the annual meeting of security holders due to any disagreement with the Corporation relative to the Corporation’s operations, policies and practices.

Summary Compensation Table (CEO and Top 4 Highest Paid Executive Officer) Name Designation Compensation *

Milagros V. Reyes President -

Medel T. Nera Treasurer -

Atty. Samuel V. Torres Corporate SecretaryAtty. Louie Mark R. Limcolioc Asst. Corporate Secretary -

Summary Compensation Table (All Directors as a group)

All Directors as a group*

*all executive officers of the company do not receive any compensation. ** 2023 projected per diem during BOD meetings.

There is no employment contract between the registrant and the Chairman and all others Executive Officers. Director’s per diem is at P5000.00 per BOD meeting.

There are no other arrangements pursuant to which any director of the company was compensated, or is to be compensated, directly or indirectly.

The external auditor of the Corporation is the auditing firm of SyCip Gorres Velayo & Co. (SGV), which was endorsed by the Audit Committee to the Board. The Board approved the endorsement and submitted the same for stockholders’ approval at the scheduled annual meeting of the stockholders. SGV accepted the Company’s nomination for re-election this year.

SGV performed the following audit services for the calendar year ended December 31, 2022 and 2021: 1) the examination of the financial statements of the Company; 2) review of income tax returns; and 3) such other services related to the filing of reports made to the SEC and the Bureau of Internal Revenue (BIR).

The representatives of SGV were consistently present during previous shareholders’ meeting and are expected to attend this year’s stockholders’ meeting to address questions as regards matters for which their services were engaged.

In compliance with SRC Rule 68 Paragraph 3 (b) (1V) (Re: Rotation of External Auditors), Ms. Ana Lea Bergado’s engagement as signing partner for SGV for the purpose of examining the Company’s 2022 financial statements, did not exceed the five-year term limit. Ms. Ana Lea Bergado’s engagement as signing partner of SGV for Calendar year 2023 is likewise subject to the approval by the shareholders. A two-year cooling off period shall be observed in the re-engagement of the same signing partner or individual audit.

with Accountants on Accounting and Financial Disclosures

As of December 31, 2022, there were no reported disagreements with Accountants on Accounting and Financial Disclosure.

Audit and audit- related fees

External audit fees amounted to P410,496 (inclusive of VAT) for the period ended December 31, 2022 and December 31, 2021 The fees were for the audit and review of the Company’s annual financial statements, and for services normally provided in connection with statutory and regulatory filings, and other similar engagements for year end 2022 and 2021

Aside from those discussed above, there were no other fees incurred for the assurance and other services, such as tax accounting, compliance, advice, planning and and any other form of tax services for year end 2022 and 2021

It is the policy of the Company that all audit findings are presented to its Audit Committee which reviews and make recommendations to the Board on actions to be taken thereon. The Board of Directors of the Companypasses upon and approves the AuditCommittee/BROC’s recommendations. The Audit/Board RiskOversight Committee (BROC), the Board of Directors and the stockholders of Seafront Resources Corporation approved the engagement of SGV & Co as the Company’s external auditor. The members of the Audit Committee/BROC are as follows:

Nicasio I. Alcantara

- Chairman - Independent Director

Basil L. Ong - Member – Independent Director

Ernestine Carmen Jo Villareal-Fernando - Member - Independent Director

Item 8 Compensation Plan

No actionistobe taken with respect toanyplan pursuanttowhich cashornon-cashcompensation maybe paidordistributed.

Item 9 Authorization or Issuance of Securities Otherwise than for Exchange

There is no matter or corporate action to be taken up in the meeting with respect to issuance of securities.

Item 10 Modification or Exchange of Securities No Modification of Outstanding Securities

Item 11 Financial and Other Information

The Audited Financial Statements of the Company is attached as Annex “D”. The Management’s Discussion & Analysis is incorporated in the attached Management Report.

Item 12 Mergers, Consolidation, Acquisition and Similar Matters Not Applicable.

Item 13 Acquisition or Disposition of Property Not Applicable.

Item 14 Restatement of Accounts None.

a) Approval of the Minutes of the 2022 Annual Shareholders Meeting;

The Minutes of 2022 Annual Shareholders Meeting reflects the following:

1. Approval of Management Report and the 2021 Audited Financial Statements contained in the 2020 Information Statement.

2. Confirmation and Ratification of all acts, contracts and investments made and entered into by Management and/or the Board of Directors during the period of 24 June 2021 to 23 June 2022

3. Election of Nine (9) members of the Board of Directors for the year 2022-2023.

4. Appointment of External Auditors.

b) Approval of Management Report and the 2022 Audited Financial Statements;

c) Confirmation and Ratification of all acts, contracts and investments made and entered into byManagement and/or the Board of Directors during the period of 23 June 2022 to 22 June 2023;

1. Constitution of various Committees and Appointment of Chairman and Members: (Organizational Meeting held June 23, 2022). Such as:

Corporate Governance Committee

Chairperson - Ernestine Carmen Jo D. Villareal-Fernando - Independent Director Members - Nicasio I. Alcantara - Independent Director - Basil L. Ong – Independent Director

Audit Committee/BROC

Chairperson - Nicasio I. Alcantara – Independent Director Members - Ernestine Carmen Jo D. Villareal-Fernando - Independent Director - Basil L. Ong – Independent Director

Corporate Information Officer/ -Atty. Samuel V. Torres

Asst. Corporate Information Officer/ Compliance Officer - Atty. Louie Mark R. Limcolioc

2. Ratification of acts and resolutions of Management and of the Board of Directors as referred to in the Notice of the Annual Meeting refers only to acts and resolutions done in the ordinary course of business and operation of the Company. Ratification is being sought in the interest of transparency and as a matter of customary practice or procedure undertaken at every Annual Meeting of Stockholders of the Company.

There are no other acts and resolutions of Management and of the Board of Directors that needs the approval of the stockholders.

d) Election of Nine (9) members of the Board of Directors (including Independent Directors) for the year 2023-2024

a) Proof of the required notice of the meeting b) Proof of the presence of a quorum

Item 17 Amendment of Charter, By-Laws or Other Document None.

Item 18 Other Proposed Action None.

Considering that the Company will dispense with the physical attendance of its stockholders, the Board of Directors has adopted an internal procedure for the voting and participation in the 2023 Annual Stockholders’ Meeting, which covers both electronic voting in absentia and proxy voting. For the detailed steps and guidelines, please see attached Annex “B” Procedures and Requirements for Voting and Participation in the 2023 Annual Stockholders’ Meeting.

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this report is true, complete and correct. This report is signed in the City of Pasig on May 05, 2023.

By: SAMUEL V. TORRES Corporate Secretary

MANAGEMENT REPORT TO STOCKHOLDERS

INCORPORATED HEREIN ARE THE AUDITED CONSOLIDATED FINANCIAL STATEMENTS OF SEAFRONT RESOURCES CORPORTION FOR THE YEAR ENDED DECEMBER 31, 2022 WITH THE CORRESPONDING STATEMENT OF MANAGEMENT RESPONSIBILITY.

For the last five (5) years, there have been no disagreements with the independent accountants on any matter of accounting principles or practices, financial statement disclosures or auditing scope or procedure. (Please see discussion on page 15 of the Information Statement Item 7 – Independent Public Accountant, Audit and Audit-Related Fees.

Seafront Resources Corporation (the “Company”) was registered with the Securities and Exchange Commission (SEC) on April 16,1970asanoilexplorationandproductioncompany. OnOctober18,1996,theCompanyamendeditsArticlesofIncorporation which provides for the revision of its primary purpose from engaging in the business of oil exploration and production into a holding company and to include oil exploration and production business as one of its secondary purposes.

The Companyimplemented a quasi-reorganization plan whereby(a)its authorized capital stockwas decreasedfromP800 Million divided into 800 Million shares, to P388 Million divided into 388 Million shares, both at par value of P1; and (b) its issued and subscribed capital stock were decreased from P575 Million to P163 Million applied proportionately for all stockholders. The reduction surplus resulting from the quasi-reorganization was used to offset the Company’s deficit as of December 31, 1997. The quasi-reorganization plan was approved by the SEC on October 5, 1998.

The registered office address of the Company is 7th Floor, JMT Building, ADB Avenue, Ortigas Center, Pasig City.

The Company’s shares of stocks are listed and are currently traded at the Philippine Stock Exchange.

A. Investments in Financial Assets at Fair Value through Profit and Loss (FVTPL) (Notes 8 and 14 of the AFS)

The Company maintains a portfolio of investments in stocks traded in the Philippine Stock Exchange and investment in Government Securities. These financial assets at FVTPL are carried at fair value as follows:

B. Investment in Financial Assets at Fair value through other comprehensive income (FVOCI) (Notes 8 and 14 of the AFS)

Financial assets at FVOCI consist of quoted and unquoted shares of stock held for long-term investment purposes and are carried at fair value. The carrying values of these investments are as follows

securities:

On January 31, 1997, the Company entered into a Project Shareholders’ Agreement with five other companies led by Investment and Capital Corporation of the Philippines (ICCP) and Penta Capital Investment Corporation (PCIC) to develop 500 to 600 hectares of raw land in Hermosa, Bataan into a new township consisting of industrial estates, residential communities, a golf and country club and a commercial center.

To date, HEDC has already developed 1,244,769 sqm. of lots in Hermosa Ecozone Industrial Park (HEIP) area, of which 1,034,103 sqm. were sold as of December 31, 2022. Out of this total, 31,876 sqm. were sold in 2022. While the 200,000 sqm. are still awaiting for the PEZA Presidential Proclamation.

The fair value of investment in HEDC is determined using the adjusted net asset method wherein the assets of HEDC consisting mainlyof parcels of land are adjusted from cost to its fair value. The valuation of the parcels of land was performed by a Securities and Exchange Commission - accredited independent valuer as at December 31, 2022 and 2021. This measurement falls under Level 3 in the fair value hierarchy.

Fair value measurement disclosures for the determination of fair value of unquoted equity securities are provided in Note 14 of the AFS.

Transaction with and/or dependence on related parties

Not applicable

Percentage of sale or revenue and net income contributed by foreign sales

Revenues which are mainly from the unrealized gains on market value changes of FVPL, interest income, dividend and rental income are denominated in Pesos. There are no revenues from foreign sales.

Total number of employees

The Company has no employees; PERC provides administrative, accounting and legal services to the Company. The Company does not anticipate any special undertaking that would warrant hiring some people for regular employment.

Competition

The Company itself has no competitor because it is a holding company. Its major investment, HEDC has competitors such as Clark Development Corporation, Subic Gateway Park and other nearby industrial zones.

Patent, trade, copyright, licenses and etc.

The Company has no existing patents, trademarks, copyrights, licenses, franchises, concessions or royalty agreements.

Research and development activities

No amount of moneywas spent for development activities for the last three fiscal years. The Companydoes not intend to acquire additional properties in the next twelve (12) months. However, the Company can sustain its need for operating expenses in the ordinary course of business.

Products

The Company has its investments in stocks (as discussed in the “Business of the Issuer”) as its principal product. Total revenue as of December 31, 2022 amounted to P3.222 million, bulk of which is from the interest income from the money market placements and net gain on fair value changes on financial assets at FVTPL. Other than discussed, the Companyhas no principal product which contributes 10% or more to sales or revenues. No government approval is needed for its principal product.

Risk Factors

Political, Economic and Legal Risks in the Philippines

The Philippines has, from time to time, experienced military instability, mass demonstrations, and similar occurrences, which have led to political instability. The country has also experienced periods of slow growth, high inflation and significant depreciationofthePeso. Theregionaleconomiccrisiswhichstartedin1997negativelyaffectedthePhilippineeconomyresulting in the decline of the Peso, higher interest rate, increased unemployment, greater volatility and lower value of the stock market, lower credit rating of the country and the reduction of the country’s foreign currency reserves. There has also been growing concerns about the unrestrained judicial intervention in major infrastructure project of the government.

There is no assurance that the political environment in the Philippines will be stable and that current or future governments will adopt economic policies conducive to sustained economic growth.

The general political situation in and the state of the economy of the Philippines may influence the growth and profitability of the Company. Any future political or economic instability in these countries may have a negative effect on the financial results of the Company.

The Company entered into a Project Shareholder’s Agreement with five (5) other companies led by Investment and Capital Corporation of the Philippines and Penta Capital Investment Corporation to develop 500-600 hectares of raw land in Hermosa, Bataan. Into a township consistingof industrial estates, residential communities, a golf and countryclub and a commercial center. This situation may involve special risks associated with the possibility that the equity partner (i) may have economic or business interests or goals that are inconsistent with those of the Company; (ii) take actions contrary to the interests of the Company; (iii) be unable or unwilling to fulfill its obligations under the Project Shareholder’s Agreement; or (iv) experience financial difficulties. These conflicts may adversely affect the Company’s operations. To date, the Company has not experienced any significant problems with respect to its equity partners.

The Company’s financial instruments comprise cash and cash equivalents, receivables, financial assets, accounts payable and accrued expenses and subscriptions payable. The main purpose of these financial instruments is to fund its own operations and capital expenditures. The BOD reviews and approves policies for managing these risks. Also, the Audit Committee of the BOD meets regularly and exercises oversight role in managing these risks.

The main financial risks arising from the Company’s financial instruments are liquidity risk, market risk and credit risk.

Liquidity risk is the risk that the Company is unable to meet its financial obligation when due. The Company has substantial investments in shares of stock which are not listed in the Philippine Stock Exchange and may not be readily convertible to liquid assets necessary to meet any potential additional liquidity requirements of the Company. Investments in unquoted equity securities classified as financial assets at FVOCI amounted to P507 96 million and P404.38 million, as of December 31, 2022 and 2021, respectively

The Company monitors its cash position and overall liquidity position in assessing its exposure to liquidity risk. The Company maintains a level of cash and cash equivalents deemed sufficient to finance operations and to mitigate the effects of fluctuation in cash flows.

The Company’s accounts payable and accrued expenses are all settled on a monthly basis.

Please refer to Note 14 of the AFS for the maturity profile of the Company’s financial assets and liabilities

Market risk is the risk of loss on future earnings, on fair values or on future cash flows that may result from changes in market prices. The value of a financial instrument may change as a result of changes in interest rates, foreign currency exchanges rates, commodity prices, equity prices and other market changes. The Company’s market risk emanates from its holdings in debt and equity securities.

The Company closely monitors the prices of its debt and equity securities as well as macroeconomic and entity-specific factors which could directly or indirectly affect the prices of these instruments. In case of an expected decline in its portfolio of equity securities, the Company readily disposes or trades the securities for replacement with more viable and less risky investments.

The Company closely monitors the prices of its debt and equity securities as well as macroeconomic and entity-specific factors which could directly or indirectly affect the prices of these instruments. In case of an expected decline in its portfolio of equity securities, the Company readily disposes or trades the securities for replacement with more viable and less risky investments

Such investment securities are subject to price risk due to changes in market values of instruments arising either from factors specific to individual instruments or their issuers, or factors affecting all instruments traded in the market.

The Company’s exposure to market risk for changes in fixed interest rates relates primarily to the Company’s money market placements and debt securities.

There is no other impact on the Company’s equity other than those already affecting net income.

Credit risk is the risk that one party to a financial instrument will fail to discharge an obligation and cause the other party to incur a financial loss. With respect to credit risk arising from cash and cash equivalents, receivables, financial assets at FVTPL and financial assets at FVOCI, the Company’s exposure to credit risk is equal to the carrying amount of these instruments. The Company limits its credit risk on these assets by dealing only with reputable counterparties.

For cash and cash equivalents, the Company applies the low credit risk simplification where the Company measures the ECLs on a 12-month basis based on the probability of default and loss given default which are publicly available. The Companyalso evaluates the credit ratingof thebankand otherfinancial institutions to determinewhetherthe debt instrument has significantly increased in credit risk and to estimate ECLs.

The Company considers its cash and cash equivalents as high grade since these are placed in financial institutions of high credit standing. Accordingly, ECLs relating to these debt instruments rounds to nil.

The Company’s receivables are aged current as of December 31, 2022 and 2021. No receivables are considered creditimpaired.

As of December 31, 2022 and 2021, the carrying values of the Company’s financial instruments represent maximum exposure as of reporting date.

Please refer to Note 14 of the 2022 AFS for the maximum credit risk exposures on the financial instruments.

The primary objective of the Company’s capital management is to ensure that it maintains a strong credit rating and healthy capital ratios in order to support its business and maximize shareholders’ value.

The Company manages its capital structure and makes adjustments to it, in light of changes in economic conditions. To maintain or adjust the capital structure, the Company may adjust the dividend payment to shareholders or issue new shares.

The Company monitors capital using a debt-to-equity ratio, which is total debt divided by total equity. The Company includes within total debt the following: accounts payable and accrued expenses and subscriptions payable. Total equity includes capital stock, net unrealized gains (losses) on financial assets at FVOCI and retained earnings (deficit).

The Company has no externally imposed capital requirements as of December 31, 2022 and 2021

Please refer to Note 15 of the AFS for the table of the debt-to-equity ratios of the Company as of December 31, 2022 and 2021, respectively:

There were no changes in the objectives, policies or processes for the years ended December 31, 2022 and 2021

There are no pending legal proceedings to which the Company is party or which any of its property is the subject.

There were no matters submitted to a vote of security holders during the fourth quarter of the fiscal year covered by this report.

Item 5 – Market for Registrant’s Common Equity and Related Stockholders Matters

a) Market Price of and Dividends on Registrant’s Common Equity and Related Stockholder Matters

1. Market Information

Stock Market Price and Dividend on Registrant’s Common Equity (last 2 years).

1.

3.

The Company’s common equity is traded in the Philippine

2. Holders

As of April 30, 2023, the Company has 4,683 stockholders.

Hereunder is the list of the top 20 Stockholders as of 30 April 2023:

4. China Banking Corporation T/A-SCA-#0010

5 China Banking

6. House

7. Yuchengco, Alfonso T.

8. Hydee

9. China Banking Corporation T/A-SCA-#0013

10. China Banking Corporation T/A-SCA-#0012

13. Pacific Basin Sec. Co., Inc.

14. Floreindo, Antonio O.

15. Paz, Wenceslao R. de

16. A.T. Yuchengco, Inc.

17. Pua Yok Bing

18.

Vicenta S.

Note:1. None of the holders of the Company’s common shares registered under the name of PCD owns more than 5% of the Company’s common shares.

2. The corporate acts of PMMIC are carried out by its Board of Directors and Management. Ms. Michelle Y. Dee is the President of the Company.

3. The corporate acts of Alsons Consolidated Resources Inc. are carried out by its Board of Directors. Mr. Nicasio I. Alcantara is the current President of the Company.