In the international arena, the American and Brazilian governments met to negotiate tariffs, but so far, practical progress has been limited. In November, there were some reductions, such as in the case of coffee, although the tariff remains at 40%. It is observed that the most critical period is behind us and that optimism is gaining ground, especially given Brazil’s strategic position in the negotiations, given the relevance of commodities not only to the United States, but also to its trade dynamics with another major economy, China.

In Brazil, the Central Bank’s Monetary Policy Committee decided to maintain the basic interest rate, the Selic, at 15% per year. The decision was widely expected. However, the institution’s president reiterated that interest rates should remain high for a prolonged period, reducing the expectations of those who predicted a possible start of the rate cut cycle as early as the beginning of 2026. With this signal, the prevailing projection is that reductions should only occur in the second half of next year.

The main information fueling expectations of early cuts was the behavior of inflation. In October, the index advanced 0.09% and accumulates a 4.68% increase over 12 months.

For this year, official inflation is projected to end at 4.55%, falling to 4.20% in 2026. Despite this, the numbers are still far from the 3% target, although within the tolerance range, whose ceiling is 4.50%. In other words, inflation would need to cool down even further for the Central Bank to feel comfortable reducing interest rates. Contributing negatively to the picture are service inflation, which remains around 6%, and uncertainties in the international environment,

which may generate additional pressure on domestic prices.

Another factor that may favor inflation control is the exchange rate. The real has remained more valued, fluctuating close to R$ 5.30. As international commodity prices are largely stable, the lower exchange rate helps to make imports and negotiations of products quoted in dollars cheaper. The Brazilian economy is growing at a moderate pace, close to 2%, supported by a strong labor market and pressured, on the other hand, by high interest rates. From the demand perspective, it is noteworthy that the unemployment rate reached 5.6% in the third quarter, the lowest level in the historical series for the period, according to IBGE (Brazilian Institute of Geography and Statistics). With the real gain in income, there was an estimated increase of R$ 17 billion in the amount available to families compared to the previous year, which has boosted activity in various sectors.

On the other hand, high interest rates restrict the circulation of resources and direct a significant portion to the financial system. The average interest rate for individuals is 58.2%, above the 52% recorded in September of last year, according to data from the Central Bank. The strong labor market offers guarantees that facilitate the granting of credit, but at considerably higher costs. This scenario has contributed to the increase in default rates, which remain at record levels in the country, reducing the potential for expansion of economic activities.

In retail, there was growth of 1.1% in September, although the year-to-date figure remains negative at -0.5%. The second consecutive month of decline in supermarket sales is noteworthy, a sector of great

importance to retail, indicating difficulties for a more significant expansion of consumption. In industry, performance was positive, with a 2% increase in September and a 1% year-to-date increase. The service sector presents a more robust picture, with growth of 4.1% in the month and 2.8% year-to-date in 2024.

Tourism continues to be one of the main highlights of the Brazilian economy. According to FecomercioSP, the sector grew 4.8% in September and recorded revenue of R$ 18.5 billion, the highest value for the month in the

Harvest: In the first projection for the 2026 harvest, IBGE estimates a 3.7% drop, with total production of 332.7 million tons. Although the data indicates a contraction, it is important to highlight that this year’s harvest reached a historical record, which means that production remains at a high level, even with the adjustment.

NOVEMBER/2025

entire historical series. No major changes are expected in the economic picture until the end of the year. The country should maintain modest growth and high interest rates. In 2025, an election year, the trend is for greater pressure on public spending and increased debt, pushing fiscal balance to 2027. This is one of the main challenges for inflation to converge to the target, for the structural reduction of interest rates, and for achieving more vigorous growth. Therefore, the economic scenario should remain relatively stable in the coming months.

2

Inflation in Tourism: The accumulated inflation over 12 months is 4.68%, but some services linked to tourism show variations above the average. This is the case of airfare and lodging, both saw increases close to 10%, reflecting the strong demand observed in the country.

3

PIX: The Brazilian instant payment system, PIX, has expanded more than a hundredfold since its implementation in 2020. Currently, it registers almost 20 billion transactions per quarter, easily surpassing the volume of the card, the traditional method, which accounted for 12.6 billion operations in the same period.

Consumer Confidence (ICC): The index recovered in October, growing 3.1% compared to September, reaching 113.6 points, but is 6.1% below the level of the same month last year.

Lower inflation, including a reduction in food prices, has brought relief to families in São Paulo, who, with the heated job market, are able to gradually recover their income.

Business Confidence in Commerce (ICEC): In October, the index showed a slight increase of 1.8%, but fell 13.4% year-on-year and remains in the pessimistic zone, below 100 points, at 95.6 points. Despite the recovery, confidence is still pressured by high interest rates that are eroding sales margins and making consumer credit more expensive.

Note: The ICC and ICEC range from 0 to 200. From 100 to 200 points is considered an optimistic level, and below 100 points pessimistic. Although the indicators are from the city of São Paulo, they follow the trend of what is happening in the rest of the country, since the city, the largest in Brazil, represents 11% of the national GDP.

In November, Latam Airlines, the airline with the largest international flight operation in Brazil (and also domestic), announced a historic expansion of its air network, reaching 63 Brazilian airports served with the opening of operations in Uberaba (MG), Juiz de Fora (MG), Caldas Novas (GO) and Campina Grande (PB) starting in 2026.

In the international market, it will serve a total of 28 direct destinations from Brazil with the debut of operations to Cape Town (South Africa), Brussels (Belgium) and Amsterdam (Netherlands). Also starting next year.

“The focus on efficiency and the frequent customer is what allows us to continue investing very carefully in sustainable markets. The new routes we are announcing have undergone responsible analysis and make sense both for the real demand for travel and for our business strategy,” said Jerome Cadier, CEO of Latam Brazil.

We asked Similarweb to list the most accessed tourism websites from January to October 2025, and the top 15 are:

1. Booking.com

36.2 million visits (+1.85%)

2. Airbnb

15.7 million visits (+17.10%)

3. Uber

21.2 million visits (+4.46%)

4. Latam Airlines

18.8 million visits (-23.11%)

5. 99 (Uber and iFood competitor)

11.5 million visits (+177.67%)

6. Tripadvisor

15.4 million visits (+1.30%)

7. Decolar

11.6 million visits (+5.69%)

8. Azul Airlines

9.6 million visits (+13.14%)

9. Gol Airlines

8 million visits (-17.42%)

10. Localiza

6.8 million visits (+5.99%)

11. Clickbus

6.3 million visits (-3.08%)

12. Skyscanner

5.8 million visits (+4.34%)

13. AeroIN

9.2 million visits (+5.90%)

14. QueroPassagem (bus tickets)

6.1 million visits (-11.61%)

15. CVC

4.8 million visits (-5.30%)

Source: Similarweb

The PANROTAS.com.br portal is the only B2B media in Brazil to appear in the Top 100, occupying the 63rd position.

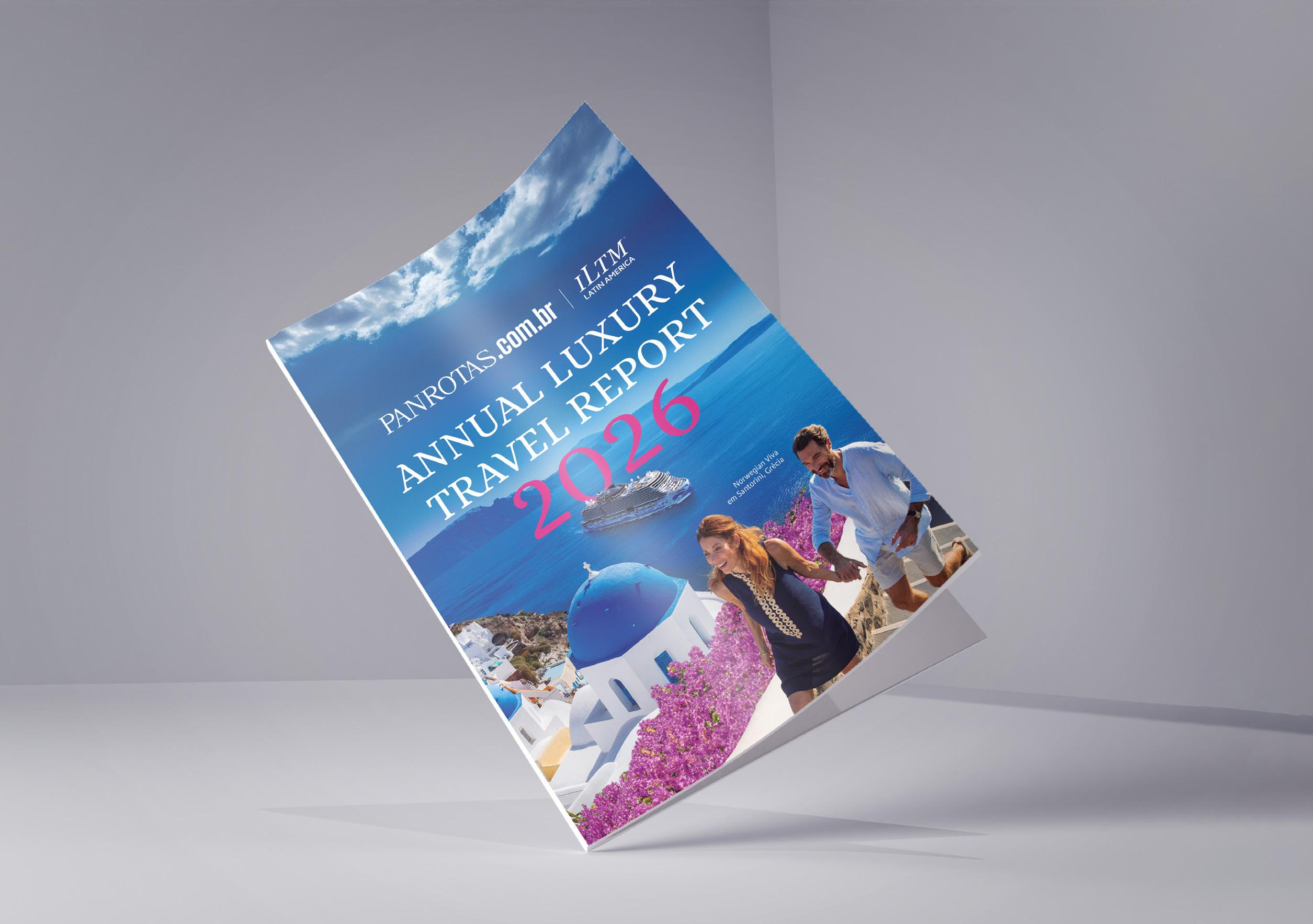

The PANROTAS.com.br portal revamped its Luxury Travel section with a cleaner, more modern design, highlighting photos and statistics from the segment. The change coincided with the ILTM Cannes event, for which PANROTAS is a media partner, and which brought together around 10,000 professionals on the French Riviera. ILTM and PANROTAS launched the fifth edition of the ILTM & PANROTAS Luxury Travel Yearbook – Brazil and Latin America at ILTM Cannes, featuring two exclusive surveys, one with luxury travelers and the other with travel agencies in the segment. The publication also includes reports on Luxury Travel trends in Brazil, Latin America,

and the world, as well as an economic analysis of Brazilian millionaires.

You can view the ILTM & PANROTAS Yearbook here, but below are some data on the most sought-after destinations by the travelers surveyed.

n Their next trips will be to the United States, Italy, and France abroad, and Rio de Janeiro, Fernando de Noronha, and Gramado in Brazil.

n Japan, Italy, and China lead the intentions (to visit) abroad, while in Brazil, Fernando de Noronha remains at the top, followed by Manaus and Gramado. In other words, these are destinations they haven’t visited yet, and which they have added to their wish lists.

n Among the trends highlighted, we see the growth of show and performance tourism, the increased value placed on recommendations from specialized travel agents, the strength of set jetting (trips inspired by films and series), and the advancement of themes such as diversity, inclusion, and sustainability in the choices of luxury travelers.

Check out the complete coverage of ILTM Cannes – produced by PANROTAS – by clicking here.

Brazilians promise to invade the United States, Mexico, and Canada for the 2026 FIFA World Cup, and the good news is that the first three

games will take place in New York/New Jersey (the debut of the Brazilian National Team), Philadelphia, and Miami. Be prepared for these peculiar tourists, who follow our players whereever they go.

“I was here just two years ago. It’s one of our key markets and its importance is growing. For the last 30 years, the company’s success has been largely based in the Northern Hemisphere (North America, China, Korea, Japan). In the coming years, I am convinced that this will shift towards the Southern Hemisphere. First to Latin America, but also to Africa, Southeast Asia and Australia.” The quote is from Carsten Spohr, CEO of the Lufthansa Group, who was in Brazil in early December, including with the aim of researching new destinations for the German company. He even met with representatives of candidate destinations, such as Fortaleza.

The 10 most read news stories on the PANROTAS Portal from January to November 2025, in the INTERNATIONAL DESTINATIONS category. In other words, what most caught the attention of our readers regarding travel abroad. Most of them related to obstacles that may hinder the free movement of Brazilian tourists around the world. We want to travel. That’s the message.

1 Closure of US consulates may hinder visa issuance for Brazilians

2 Europe of authorizations: ETA, EES and ETIAS

impose new rules for tourists in 2025

3 Spain implements new fees and rules for tourist entry; check it out

4 US creates an extra US$250 fee for American visas, with the possibility of reimbursement

5 Argentina tightens rules and requires travel insurance for tourists

6 US will require a deposit of up to US$15,000 for certain types of visas

7 US announces new restrictions on scheduling visa interviews

8 Is it possible to renew an American visa before it expires to avoid the price increase?

9 The US will have changes to the visa issuance process starting in September.

10 It’s now official: Mexican visas will once again be electronic for Brazilians.

Brazil totaled US$6.617 billion (R$35.4 billion) in spending by foreign tourists from January to October, a growth of 10.19% compared to the same period in 2024. The data is from the Central Bank and reveals that, in October alone, spending by foreigners totaled US$573 million (approximately R$3 billion).

On the other hand, spending by Brazilian tourists abroad reached US$1.91 billion (R$10.2 billion) in October, while the accumulated result for 2025 reaches US$18.1 billion (R$97 billion), almost triple what was spent here in the same period.

Brazil is expected to close 2025 with 8 million foreign tourists, a historical record, according to a projection announced by Embratur.

This report is produced by PANROTAS and FECOMERCIOSP to support your business decisions. The contents are valuable assets to Destinations and Travel Organizations, both domestic as well as international. For further information please contact ri@ fecomercio.com.br redacao@panrotas.com.br