3 minute read

Cultivating safety culture

Figure 2. While AR is still an emerging technology, a growing number of companies list it in their filings. Source: GlobalData.

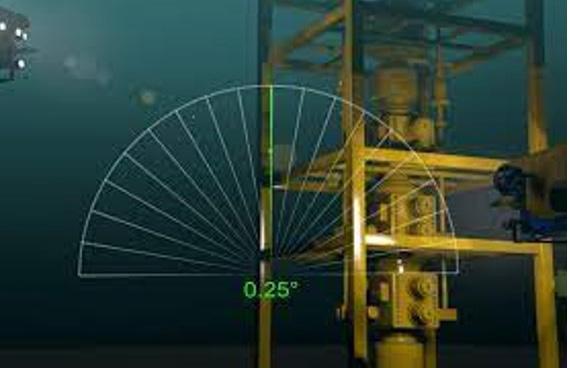

Figure 3. Fugro’s QuickVision AR protractor tool. Source: Fugro.

AR and VR suggests that oil and gas companies continued to invest in emerging technologies despite the financial hardship. The pandemic disrupted the travel of experts to different field sites. Consequently, demand for remote assistance was very high, contributing to the increased AR and VR hiring activity. However, realising cost and time savings will mean that elevated hiring activity within AR and VR is likely to be a mainstay as the industry undergoes digitalisation.

AR in oil and gas: case study Although GlobalData’s alternative datasets reveal that AR is becoming more prevalent as a technology within the wider oil and gas industry, certain companies are leading the way in terms of innovation. For example, Fugro is a geo-data company that helps oil and gas companies with the subsea asset positioning process.

Fugro has developed a tool called QuickVision (Figure 3), which harnesses the power of AR to reduce the time required for subsea installations. The solution uses a subsea camera capable of mixing video with VR measurement tools and Fugro’s Starfix navigation suite. This software-hardware combination provides numerous tools and capabilities, such as a bounding box, which helps measure the position and orientation of a structure. Other tools, such as the virtual protractor, allow incline measurement, while virtual marker buoys indicate the proposed location of a structure. These virtual measuring tools overlaid onto livestream footage eliminate the need for other pieces of physical equipment, and provide a touchless survey solution. This greatly reduces the risk associated with the installation project.

Several oil and gas companies have used this tool within their operations. For example, in 2018, Shell used the QuickVision tool to save 10 days on its drilling operations in the North Sea. This is a significant reduction and would have resulted in large cost savings for Shell. Fugro continues to assist oil and gas companies with their subsea installations and, in January 2022, was awarded a contract to support the installation of an anchorage system for the Sepetiba vessel in Petrobras’ deepwater Mero 2 project off the coast of Brazil. In January 2021, Fugro also agreed to deploy RealWear HMT-1 voice-enabled AR headsets throughout its fleet.

Where next for AR in oil and gas? Ultimately, AR is an emerging technology capable of delivering a significant return on investment to companies. This technology can streamline maintenance and repair activities by providing a remote collaboration tool between onsite technicians and disparately located experts, reducing lengthy site visits and machine downtime. As seen in the case of Fugro, AR can also be used for remote planning and surveying activities, which, in potentially hazardous environments, saves time while mitigating risk. As AR technology becomes more affordable and use cases within the industry broaden, we can expect adoption to increase within oil and gas.

AR technology can also be used to bridge the growing skills gap within the oil and gas industry, as it continues to suffer from an ageing workforce. Remote collaboration tools that use AR can provide hands-on collaboration between retiring workers seeking more flexible working arrangements and younger workers requiring training. This arrangement is also pandemicproof to some extent, which presents an advantage as COVID-19 continues to cause disruption in parts of the world. As a result, AR will become a mainstay within the training programmes of all major companies operating in the sector. Overall, companies that invest in this technology stand to gain against competitors that fail to realise its potential.