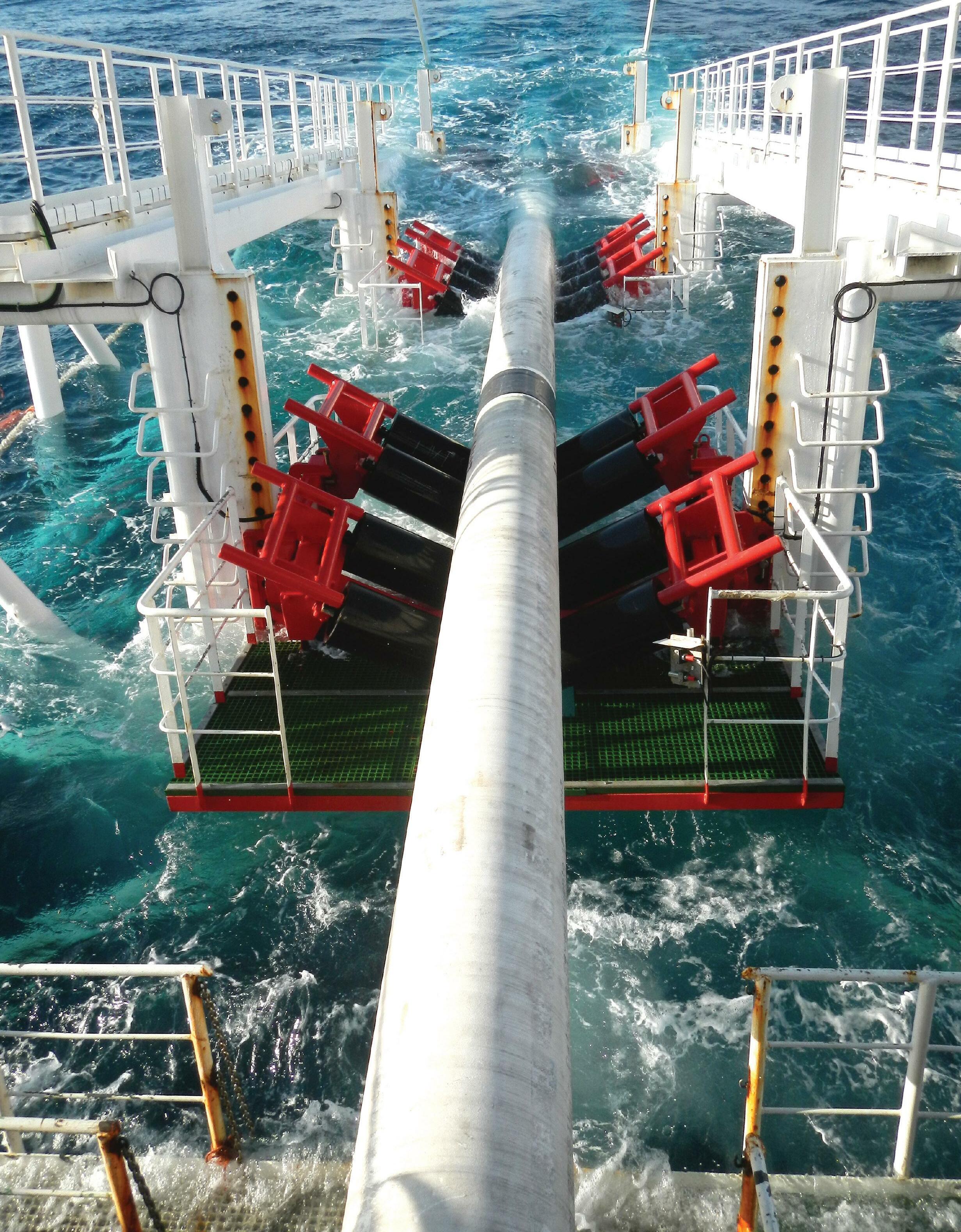

IT IS MY ENDURING PLEDGE

to always deliver on my commitments, never underestimating the critical role that pipelines play as energy lifelines in fueling everyday life and unforgettable experiences.

It is who I am. I am a pipeliner.

We are pipeliners too.

Keeping product in the pipe is a big job that’s critical to protecting the environment, requiring specific expertise and technology to ensure success.

TDW brings industry-leading application engineering teams, innovative solutions and world-class technicians to help you deliver on your goals. We remain committed to supporting you and the industry in moving toward a more sustainable energy future.

The world counts on you. You can count on us.

For the life of your pipeline.

©2022 T.D. Williamson

tdwilliamson.com

Rome wasn’t built in a day, and neither will your cybersecurity defences be, says Michael Bradley, Director of Utility Services, Everline, USA.

8

f you’re an interstate transmission operator, especially a TSA ‘top 100’, this isn’t the article for you; this one is for the utility operators. In the world of pipeline security, I am starting to see that there is a significant understanding gradient ranging from those ‘critical’

transmission operators who have been continuously engaged by the TSA for years, to utility operators who are just learning what cybersecurity has to do with pipelines. Over the last couple of years, I have been in numerous meetings in the utility space where

directives and guidelines have been discussed, and confusion abounds.

Part of the confusion, I feel, can be attributed to the very nature of security rules and regulations; they aren’t promulgated in the same way that pipeline safety regulations are. Another issue is that they just

9

don’t read like the federal and state regulations that most pipeliners can recite by heart. Lastly, natural gas distribution has, until recently, not been a strong focus of America’s security apparatus, and thus gas utilities are, for the most part, getting in the game late (when compared to the decade-plus that electric operators have had with NERC CIP).

Since 2005, the electric side of the energy delivery industry has been working within the guidelines of the Critical Infrastructure Protection standard published by the National Electrical Reliability Council. If you aren’t already familiar with it, you may have at least heard of it by its acronym: NERC CIP. NERC’s standards include prescriptive guidance on security topics such as personnel training, information protection, supply chain risk, and incident reporting, all of which are key to keeping the Bulk Electrical System safe from would-be bad actors. Fast forward to 2022, 17 years later, and the gas side of the business is now getting its CIP treatment, beginning with TSA directives, which will inform rulemaking moving forward.

New directives

In the wake of the Colonial Pipeline incident that resulted in significant disruptions to the East Coast’s access to vehicle fuels, the TSA dusted off its 2018 ‘Pipeline Security Guidelines’ and gave them a brief update. In parallel, they issued Security Directives to the top 100 ‘critical’ pipeline operators in the US. ‘Security Directive Pipeline-2021-01’ (SD1), issued 28 May 2021, essentially required operators designated by the TSA as ‘critical’ to do the following: report cybersecurity issues to the Department of Homeland Security, assign a point-person to be reachable by the TSA and CISA 24/7, and perform a gap assessment against the guidelines.

SD1 was followed by ‘Security Directive Pipeline-2021-02: Pipeline Cybersecurity Mitigation Actions, Contingency Planning, and Testing’ (SD2) in July 2021. This directive was of limited circulation under the protections of 49 CFR 1520, the Sensitive Security Information (SSI) standard. However, the general requirements were as follows: implement a list of mitigations prescribed by the TSA, develop a cybersecurity response plan, and test the effectiveness of cybersecurity practices annually. SD2 was eventually superseded by ‘SD2C’ in July this year, which incorporated feedback from industry and Congress. Essentially, the Directive was revised to provide additional flexibility in achieving the expectations set out in SD2.

As you read those last two paragraphs, you may be inclined to think this was straightforward. But, consider that there are thousands of pipeline operators in the US, and only a fraction of them received letters with these prescriptive instructions. SD2 was classified as SSI and thus not publicly released. But of course, the entire industry heard that there was a second directive, and many wanted to get ahead of what they felt would come to them anyway. Some non-critical operators even commissioned gap analyses against the SD2 criteria, even though they

could not know the criteria. Within larger organisations, I would often come across stakeholders that were generally aware of the directives, perhaps even some of what they required, but were still unclear as to whether the company they worked for was considered critical, what specifically was required, and what role their organisation needed to play. Thankfully, trade associations jumped in to host calls and workshops, align on practical interpretations of vague language and seek clarification from the TSA on various points. It is worth noting here that while the guidelines weren’t new in 2021, they, like most of the written standards and practices on pipeline security, were focused on interstate transmission. Much of the language and requirements were found to be challenging to utilities on the first read.

A global perspective

At this point, I think it may be prudent to explain that my background is in pipeline operations, not security. I spent the first decade of my career with large, investorowned utilities, working in roles spanning field operations to compliance and ethics. The federal and state pipeline safety regulations have been drilled into me since my first day as an associate engineer, and I think that’s why I struggled so much the first time I laid eyes on the TSA’s guidelines. While they came from a US government agency, and they refer to pipelines, they certainly didn’t read like any regulations I had interacted meaningfully with to date. I was embarrassed to admit this until I realised I wasn’t alone. Whether it was the confusion around ‘guidelines’ being mandated (as opposed to being guidance), the lack of definitions provided for key terms, the strange omissions/inclusions in the critical asset methodology, or all the above.

But really, the language wasn’t the toughest part; implementation was. Of course, you might say, it’s always easier to plan than it is to implement, and sure, but perhaps not for the most obvious of reasons.

The challenges with executing what the TSA was expecting also presented a unique challenge – the centre of the Venn diagram depicting those who speak pipeline and those who speak operational cybersecurity is very small. And that shouldn’t have surprised me; in my time in the industry, I hardly ever heard of a significant correlation between pipeline operations and security apart from vandalism. Every so often, either at a company I worked for, or elsewhere in the industry, we would see examples of physical vandalism as a form of protest or amusement, and occasionally performed with malice. Terrorism, while not unimaginable, was not top of mind to the average pipeliner. But it needs to be.

We need to look no further than the news to see that the global energy supply chain is the focus of both the average consumer and nation-states alike. Major international pipelines are being used as economic weapons in the European conflict, and the global stability of energy supply and pricing is delicate. What better time to create further chaos or damage to an adversary than

10 World Pipelines / OCTOBER 2022

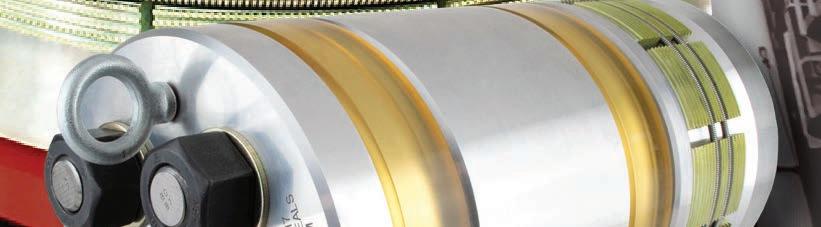

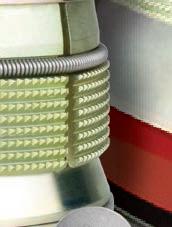

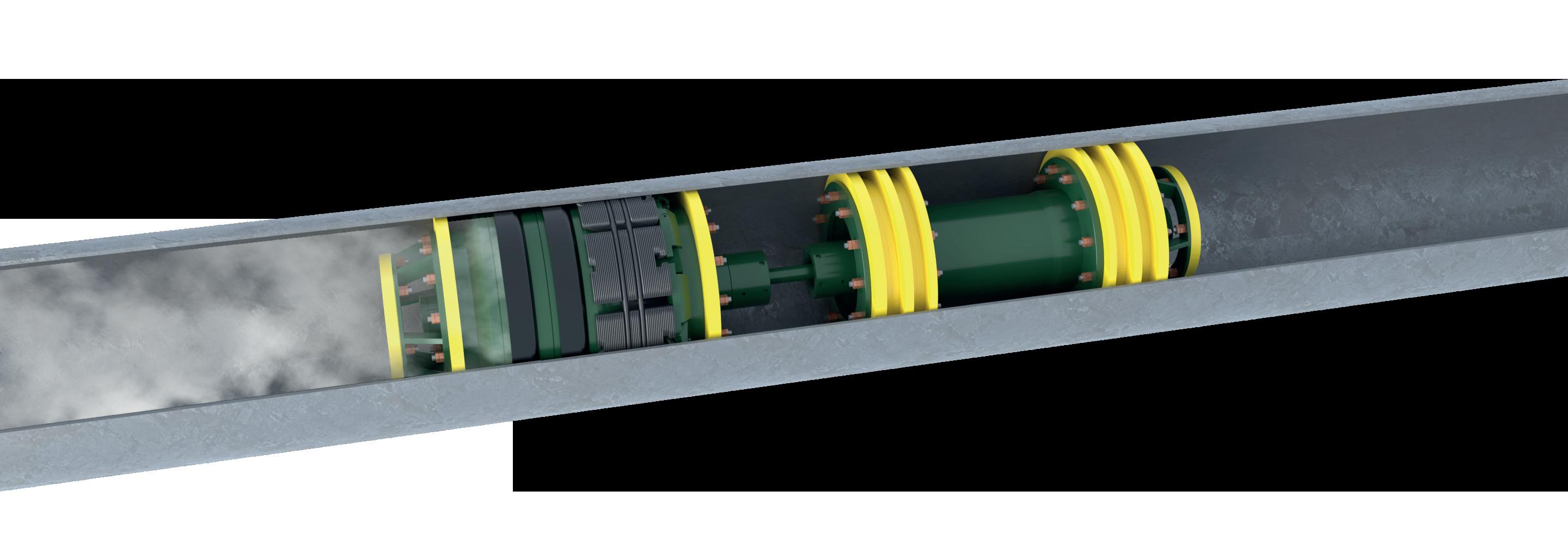

STATS GROUP Managing Pressure, Minimising Risk Remote Tecno Plug® Non-intrusive Inline Isolation The Remote Tecno Plug® provides fail-safe double block and monitored isolation of pressurised pipelines while the system remains live and at operating pressure. ZERO-ENERGY ZONE PIPELINE PRESSURE DUAL Leak-Tight Seals double block & monitor isolation isolated pipeline taper lock grips TYPE APPROVED 10” - 56”

when its population already feels the pressure of rising prices and unsteady availability.

OT systems

The challenge is that while electric infrastructure operators have had nearly two decades of practice with NERC CIP, pipeliners are playing catch-up when considering the threats to the world’s energy infrastructure today. Security is not just a concern for the major transcontinental pipelines and metropolitan utilities; bad actors will gladly exploit any vulnerability they can find. Some of the juiciest targets are the OT systems operators, big and small, used to monitor and control the physical assets. OT systems include a myriad of hardware, software and communications networks, and require specific expertise to be secured. Herein lies two challenges for pipeline operators (amongst others) that I would categorise ‘domain’ and ‘resources’.

Domain

Let’s start with domain. To successfully design and implement a mitigative risk strategy to meet TSA’s expectations, the responsible party needs both the technical expertise and the ownership of the asset(s) or department(s) which must implement the mitigations. The expertise needs to be in one’s knowledge domain, and the assets that need protection must be in their responsibility domain. Likely, your company doesn’t yet have a Director of OT Security or similar, so there may not be a perfect ‘owner’ for operational cybersecurity preparedness.

Large pipeline operators will likely need the collaboration of departments such as corporate security, human resources, pipeline operations, control rooms, integrity management, and of course, IT, to address the breadth of the TSA guidance. Each of these departments will have its own plans, policies, procedures, and budgets, much of which may need to be adjusted to accommodate the cross-cutting cybersecurity mitigations. No single entity satisfies either the expertise or responsibility domain question.

For smaller operators, the opposite problem appears; the likely owner would be the owner of every other pipeline programme, the Manager/Superintendent/ Director of Gas Operations, who likely does everything from writing procedures to updating the NPMS. Accountability domain is almost guaranteed in these situations, but a lack of domain expertise (OT security specifically) is likely a hindrance.

Resources

On to resources. While the largest operators are typically better resourced than the smallest operators, they also typically have the largest installed asset bases and more complex operations, policies, and processes. Frankly, there’s both more to secure, and it’s often more difficult to secure than for smaller operators. Security, like most cross-cutting risks, affects the business in a myriad of ways, from how we conduct employee background checks, to how we secure

mobile devices, to how we configure PLCs. The more complex an operator, the more analysis, planning, and investment is likely required. At the smaller end of the spectrum, assessing an operator’s attack surface is likely a simpler task, however, the mitigations may carry an outsized price tag. The replacement of hardware, communications devices, or the procurement of services could present a significant cost. Because the ‘guidelines’ are not currently mandated for most operators, it may be difficult to convince ratepayers, interveners, or boards to bear the costs.

Explaining cybersecurity

I believe that to lay out and execute a successful cybersecurity defence strategy, you should first solve the domain issue. Ensure that your team(s) focusing on this topic possesses adequate security expertise, knows the pipeline operations as it is done specifically at your company, and are granted the authority (not just influence) to implement mitigations where needed.

Resource constraints will always be present, for operators of all sizes, from investor-owned, to private, co-ops, and municipalities. The key here is that Rome wasn’t built in a day, and neither will your cybersecurity defences be; however, they should be built in a riskprioritised manner. Not all mitigations need to be expensive, either; often, there are security hygiene and process improvement opportunities that cost very little (Hint: ditch the thumb drives and airport Wi-Fi).

Once the internal team is in place and equipped for success, a third-party gap analysis against regulatory guidelines, such as the National Institute of Standards and Technology’s (NIST) ‘Cybersecurity Framework’ (CSF), NIST SP 800-82: ‘Guide to Industrial Control Systems (ICS) Security’, and industry-standard IEC 62443 will populate the areas in need of attention. Documentation is key; not all gaps need to be fixed simultaneously, but it is likely better to demonstrate due diligence in finding and road-mapping the gaps than to have nothing to show an auditor, regulator, or investigator should you need to.

The inclusion of cybersecurity threats on your risk registers and in your 49 CFR-driven emergency management plans and transmission integrity management plans are a must; PHMS has partnered with DHS/CISA to include specific questions in their integrated audit protocol related to these programmes. The next time you see PHMSA or your state programme for a programmatic audit, they will also ask you how you intend to operate your pipeline ‘manually’ should your IT or OT systems be compromised.

Conclusion

Put simply, the threat of hacktivists, or terrorists, prodding our infrastructure, looking to cause damage, is significant. It spares no operator, and most are at least somewhat unprepared to tackle it alone. The best approaches, regardless of scale, require installing the right programme leadership, engaging expertise in both security and pipeline operations, and equipping the team with the authority and resources needed to implement.

12 World Pipelines / OCTOBER 2022

ne of the most important aspects of control room management in pipeline operations is effective alarm management. Every control room should focus on proactively preventing escalation to abnormal operating conditions (AOCs) or emergency situations.

To achieve this goal, operators should look for ways to optimise human performance in alarm management. This includes building a system where control room operators can achieve situational awareness during all operating

conditions. This way, your control room can operate safely and effectively.

What goes into an alarm management system?

Pipeline operators need to strike the balance of accomplishing business objectives while doing no harm to people, property, or the environment. By implementing a system that equips human operators to respond to alarms, your operation can improve alarm response to any threats.

Ross Adams, General Manager, EnerSys Corporation, USA, talks optimising the human element of alarm management to support control room performance.

13

Ideally, an alarm management system should be designed to ensure that all alarms are received at the pipeline operator’s console in the appropriate time frame, and with the most relevant information. This way, the operator is equipped to act before an unplanned situation or shutdown occurs.

The ideal flow is that an alarm comes into the system, a pipeline operator performs activity to address the alarm, support personnel are mobilised, and a situation is prevented before an operator’s system needs to be shut down.

The goal of alarm management is not to never trip safety shutdowns. Rather, the idea is to prevent escalation to a shutdown by effectively responding to alarms. Alarm management focuses on how to equip the operator with notifications, graphics, and action plans to see and understand the abnormal operating condition, and provide them with the proper action steps to avoid tripping safety shutdowns.

1. Rationalisation

The starting point to effectively operate without shutdown is ‘rationalisation’. This includes defining the severity of each alarm, the time available to respond, the possible root causes of the alarm, the methods of diagnosis, and the recommended actions. In many existing alarm management systems, it is common to find that most alarms aren’t designed to achieve this operating goal.

Often, the most challenging constraint is that there is very limited time available for human response. For example, when the alarm setpoint is at or near the safety trip, the operator typically has very little time to respond and avoid a shutdown. Providing adequate response time often requires redesigning the facility, the automation, and/or the process. This can place significant strain on operations. However, operators must find ways to improve the performance of their system so that human operators and support personnel have ample time to identify, analyse, and respond to each alarm. What’s the solution?

2. Analysis

Pipeline operators should engage in a regular and intensive alarm analysis process in order to identify bad actors and prevent alarm floods that inhibit the pipeline operator’s ability to process the alarms they are seeing.

A key aspect of this analysis is defining effective alarms that will provide operators with adequate time to recognise and respond to the threat so that you can maintain safe operations without shutting down. It’s important to place operators in a position of strength instead of constantly reacting to alarms.

Operators need to translate the desire to accomplish their business objectives into operational instructions for the operator to be able to identify alarms and manage situations before they escalate.

3. The plan-do-check-act cycle

Operational instruction is critical to provide control room operators and support personnel with the necessary information and guidance so that they can perform the

plan-do-check-act cycle (PDCA). Following the PDCA cycle will ensure that personnel can achieve situational awareness in all operating conditions.

• Plan: Do your personnel understand the alarm management plans, processes, and procedures that you have implemented?

• Do: Are personnel following the proper sequence of steps in alarm response to formulate the proper response to each alarm?

• Check: Are you checking to see whether personnel followed the steps when responding to each alarm so that you can drive continuous improvement?

• Act: Are you acting on the check by holding personnel accountable for following the steps to help reduce the risk of safety incidents?

Implementing the full PDCA cycle in the control room carries additional benefits of strengthening your safety culture. It will positively influence how operators act, behave, and think during each operating condition.

The importance of culture to support alarm management

If the purpose of alarm management is to enable you to operate without shutdown, then each alarm presented to a pipeline operator must be meaningful. If not, there is a risk that the operator will ignore or de-prioritise certain alarms.

Over time, a pipeline operator may become conditioned to mentally separate or filter alarms in their mind. Instead of treating each alarm as a threat that needs to be addressed, they might ignore alarms that do not appear to be a threat. But, what about when there is a threat that needs to be contained?

This culture of complacency was a contributing factor to the high-profile Enbridge Pipeline Oil Spill in Marshall, Michigan, USA, in July 2010. According to the official incident report, the control room operators did not take the threat seriously because they ‘misinterpreted’ the rupture and ignored warning signs.

This scenario captures the importance of control room culture. Pipeline operators must reinforce the value of treating each alarm with healthy concern when an alarm is displayed in their console. It’s not up to the operator to pre-determine whether an alarm is actually critical or not. Operators need to remain vigilant when analysing the alarm to formulate the right response.

There are many ways to support a healthy safety culture. Consider actions that should be included in your refinement of the alarm management system:

) Rationalise and re-rationalise the alarms.

) Perform monthly AOC response reviews.

) Utilise monthly AOC findings in lessons learned training.

) Maintain communication involving controllers in setpoint and descriptor reviews.

14 World Pipelines / OCTOBER 2022

) Validate proper change management by including the control room in key conversations.

) Ensure that point-to-point, rationalisation, setpoint review, and training occur before the asset comes under control.

Improving and refining the system will give human operators confidence in the quality of the alarms presented to them in their consoles. Furthermore, this process will enable operators to execute the PDCA cycle during all operating conditions.

A key component of the PDCA cycle is building strong feedback loops to gather input from personnel to understand how best to present information to them. The alarm management system needs to be optimised for the human element so that each individual can effectively use the SCADA system to perform duties. Consider gathering the following input from operators:

) What is working in the alarm management system?

) What is confusing (e.g. bad actors generating false alarms)?

) Are the alarm activation steps clearly defined for you?

) What is unclear when responding to each alarm (e.g. alarm floods)?

) Do you understand the alarm priority sequence?

Then, pipeline operators should continue to refine their presentation of alarms to personnel to continue strengthening human performance. This captures the importance of optimising pipeline SCADA and HMI systems to support the operator.

The role of pipeline SCADA and HMI

Effective alarm management depends on robust SCADA systems so that pipeline operators can quickly gain clarity about what they see on their HMI displays and achieve situational awareness.

Operators in the control room need to be able to identify abnormal situations and follow the appropriate intervention steps. This can be achieved when the SCADA system is set up so that crucial information is presented to the operator when needed, and in the form they need.

1. Software tools

Once the SCADA system is set up properly, your operation needs access to the right tools to streamline your operation’s alarm response. Specifically, you should utilise alarm management software tools that are designed for pipeline operations and enhance the effectiveness of your SCADA.

2. Services

Additionally, it’s important to work with subject matter experts who can provide you with guidance on how

to blend technology and the human elements of alarm management to optimise performance.

The combination of software tools and services creates the right solutions that fit the unique characteristics of your pipeline operation.

At EnerSys Corporation, we provide a software module, ALMgr, within our POEMS® Control Room Software Suite (CRM Suite) that is specifically designed for alarm management. The features and functionality included in ALMgr enable operators to manage the alarm rationalisation process and assist with real-time response to alarms.

We back our software tool with expertise from a team of consultants that can analyse your control room, SCADA systems, HMI displays, and human activity to identify ways to improve performance effectiveness.

Through our combination of software and support, your operation will be able to:

) Generate alarm response sheets (ARS) to guide operator response.

) Streamline your operation’s alarm response.

) Reduce alarm frequency and floods.

) Enable situational awareness to help human operators perform their duties effectively.

) Improve response time to plan, do, check, and act.

) Cut the cost of the rationalisation process.

) Determine whether fatigue is a factor in alarm response (i.e. fatigue management).

) Analyse the results of each alarm event to improve operational efficiency.

) Enable communication with supervisors about bad actors in the system.

) Generate records that track results that can be used to improve future performance.

Many companies can provide your operation with software tools for alarm management. Others can provide you with consulting. But, it’s rare to find a provider of both software and services/support. Through our natural compliance solutions, we foster strong relationships with pipeline operators to drive toward continuous improvement in the control room.

Consider ways that your operation can take the appropriate steps to build an effective alarm management system. Then, look for ways to strengthen your safety culture. Finally, consider utilising our solutions to ensure that personnel in the control room can perform critical duties in a safe and effective manner.

16 World Pipelines / OCTOBER 2022

alls for new and improved critical infrastructures globally are being tied more and more often to the modernisation of energy transportation for a cleaner, more sustainable future.

To meet demands while figuring out the short and longer-term planning and problem-solving aspects, in consideration of this cleaner energy transition, there is much discussion to be had in regards to the potential performance, capacity and throughput of liquids and gas pipelines.

The analysts envision a novel blend of repurposed oil and gas pipelines and networks, as well as the development of new pipeline systems, compressor stations and storage reservoirs. These efforts will support expanding industry requirements to sequester carbon while effectively transporting, storing and moving hydrogen-enriched natural gas.

Expected to take several decades, the move away from carbon intensity and toward net-zero emissions won’t be swift. By and large, it will be dependent on the build-out and optimisation of such energy related pipelines, storage hubs and infrastructures. A considerable amount of cooperation will be required as governments, policymakers and forward-thinking organisations consider the legal and regulatory frameworks that have already been or will need to be constructed, to launch a contemporary and more interconnected era of energy production, transmission, and distribution.

Added to this list of complexities are tests related to outcroppings of geopolitical issues and socioeconomic concerns associated with rising demands around different parts of the globe for greater energy independence, energy security, and more access to renewable forms of energy.

There has been a global increase in demand for products being transported by pipeline, including natural gas, carbon dioxide (CO2) and hydrogen. Part of this is being fuelled internationally by carbon capture, utilisation, and storage (CCUS) projects, hydrogen blending, and similar decarbonisation-related activities in Europe, the US, and other parts of the globe.

For pipeline operators, the cleaner energy transition must come to pass concurrently with keeping everyone safe, protecting one’s corporate reputation, and seizing on opportunities to stay on top of design, engineering, and operational scenarios, in addition to increasing pipeline profitability by optimising movement cost.

It would be difficult to overstate the role reliable, built-for-purpose technologies will play to help companies overcome roadblocks found on the pathway to decarbonisation.

Paul Dickerson and Dr. Jennifer Worthen, Emerson, USA, discuss building pipeline capacity to plan for a cleaner, optimised energy future.

17

The overarching question for many draws back to, “How can we meet future demands for more energy, with lower costs and fewer emissions, while taking a more sustainable approach that is responsible, reliable, and adds value across the entire pipeline supply chain?”

The chain

From an operations standpoint, one quandary is to better manage and optimise pipelines amid increasingly diverse sets of product flows – by ensuring the capacity is available to plan and perform –and deliver.

Pipeline networks go far beyond point A to point B; there are numerous supply points, delivery points and interconnections. Pipeline operators also routinely deal with fluctuations in demand that require near-constant re-evaluation of consumption rates that change on a daily, hourly, or minute-by-minute basis.

Pipeline assets are managed as part of an overall supply chain – with products making their way to buyers from the production site to pipelines, and finally to distribution points. To optimise the movement of products and improve both profitability and flexibility of the pipeline, operations must be planned in the most efficient way possible. They must not only satisfy the demands of shippers, but also maximise internal efficacies.

View this from the perspective of a food trucking company hired to deliver assorted produce, including the logistical responsibility of caring for many different types of fruits and vegetables while they are being transported both from and to their respective pick-up locations and drop-off points.

From this point of view, getting the correct products to the right market while still ripe and on-time requires certain sets of preplanned actions, perhaps starting days in advance. There is logistical aptitude involved as products are both categorised independently and taken into account as a whole.

At a certain point, these types of premeditated actions may become so common that it feels as if they could be automated –the various tasks that must be performed to allow for the trucking, shipping, and delivery of goods to continue.

In this same vein, pipeline operators and energy companies are seeking to leverage immense amounts of raw data via investments

in tech-enabled software – helping automate the evaluation of delivery capacities within networks. This trend will help ensure operational successes as end users become more dependent on robust and timely access to sufficient supplies of energy resources, such as hydrogen and natural gas.

Effective overall

In the long-term, what can be done to plan for and optimise both the design of pipelines, as well as pipeline operations and product flows, as more carbon sequestration and pure or enriched-hydrogen projects shine through?

How do I make the most efficient use of a new energy pipeline or expand an existing network to move product? What is the appropriate diameter of pipe and the potential need for additional pressure on my systems? Can I keep construction costs low while meeting capacity requirements? How do I determine the amount of energy needed to drive gas from a line or electricity to drive compressors?

In short-term planning, supply chain issues must be met head-on, day-to-day, while remaining vigilant by preparing for peak season demands, as well as contingencies such as cold snaps, prolonged freezing temperatures, major weather swings, or excessive heat waves. Drains on the power grid caused by an unforeseen circumstance or a peak-season weather event have been known for knocking out power, sometimes for days or weeks.

Such extremes are being reported on more often and on a more granular level with greater attention being called to events, such as requests to limit power, rolling planned outages, and prolonged power outages that can impact residential, commercial, and non-profit communities.

What could go wrong? What could go right?

Emerson has been enabling oil and gas companies to mitigate and overcome related challenges. Its PipelineStudio software has a singular focus – provide solutions to planning, engineering, and design problems. It was developed to support the ongoing decisionmaking processes of pipeline owners and operators by giving them the confidence to act.

It has been used as an application to achieve favourable business outcomes, firstly from an engineering applications point-ofview and secondly from an operational applications perspective. As a design, planning and analysis tool, the software combines graphical configuration and reporting devices with simulation engines.

Pipeline operators are tasked daily with maintaining optimal operating conditions to satisfy demand while considering all pipeline constraints. From an economic comparative standpoint, software such as PipelineStudio, as one example, can help determine the appropriate equipment – and associated costs – for looping a pipeline or adding pump or compressor units to improve throughput.

The software was engineered to provide design analysis of networks, line size and capacity studies, as well as deliverability analysis, which may be used to determine whether a given network can meet increasing future demand, either with or without additional equipment.

Figure 1. Companies able to leverage raw data via simulation software such as Emerson’s advanced pipeline applications will benefit from greater network capacity to transport both existing and newer energy products.

Figure 1. Companies able to leverage raw data via simulation software such as Emerson’s advanced pipeline applications will benefit from greater network capacity to transport both existing and newer energy products.

18 World Pipelines / OCTOBER 2022

Using innovative, ever-evolving solutions and our expert knowledge, we provide the best services to support all of your operations.

We have the in-house capabilities to combine the services you need: inspection services, pipeline management, environmental services, and industrial services.

Contact our team for more details: info@intero-integrity.com

intero-integrity.com

An example of this is the determination of maximum throughput, which requires calculation of the largest possible flow increase without violating a minimum delivery pressure. Users can compare and evaluate different operating scenarios such as variable flow and delivery pressures over specified time periods.

Rapid configuration and simulation of various supply/demand scenarios makes way for determining the most economical pump strategy. When the associated performance curves and detailed operating specifications are provided, the software allows for detailed calculations and a report for each unit, including the power used during the operation.

At times, cyclical flow conditions in some pipelines cause certain pump or compressor stations to operate below peak efficiency. Shutting these stations down and shifting the load to others enables the user to maximise the available horsepower and thus conserve energy or power.

Using a fixed configuration of the network, PipelineStudio is supplied with flow and pressure boundary conditions from a pipeline system. Nominations, provided by a gas load forecaster, are used to create a transient scenario. Steady-state and transient simulations run automatically at the start of the gas day. Essentially, it is a decision-support application designed to complete a fasterthan-real-time simulation of the pipeline for the next gas day – with results presented to the operator. This helps identify any problems associated with the nominations and provides information ensuring that the pipeline is operated safely, all while satisfying contractual obligations.

Pipeline systems operating during peak season can be analysed to determine whether the system can meet increasing future demands, or whether additional equipment is necessary. Maintenance of key pressures in the network, line pack analysis, and manipulation of supply or delivery setpoints can each be performed.

2050 blend

The Heartland Institute reported that in the US alone, total liquids pipeline safety incidents have decreased by 17% over the last five years, including a 31% drop in incidents impacting the environment or people. That’s good news for pipelines and operators as they are still considered among the safest, most economical methods of transporting oil and natural gas.

CCUS is attractive because it can reduce emissions from existing oil and gas production capacity quickly through retrofits, and can enable large-scale dispatchable hydrogen production. By 2030, the total length of hydrogen pipelines globally will need to quadruple to >20 000 km, according to the International Energy Agency (IEA) and their Net Zero Emissions (NZE) by 2050 initiative.

Interest in projects that combine CCUS with conventional technologies is on the rise, yet the ability to reach hydrogen-strategy targets will rely on faster development of hydrogen transmission systems. The IEA data suggest fast action is needed in the next 10 years to meet projected net-zero targets, and recent analysis of the current project pipeline had proposed that only ~18% of this demand would be met.

Total hydrogen demand from industry, the IEA stated, is expected to expand 44% by 2030. This will occur alongside the increasing importance of low-carbon hydrogen – amounting to 21 Mt in 2030.

Large-scale hydrogen deployment will need to be buttressed by an effective and cost-efficient system for both storage and transport. The goal is centred on the strategic design and positioning of such critical infrastructures to connect supply sources to centres of demand, in turn establishing a highly liquid market. The scale-up to meet global demand, reduce costs and make improvements in efficiency, lifetime or process integration will also include technologies such as electrolysers, fuel cells and CCUS-equipped hydrogen production.

Optimisation equations

The optimisation of both renewable and non-renewable sources of energy are key factors for many pipeline operators, including those closely monitoring the correlation between investments in technologies and desired business outcomes. The industry has embraced optimisation, including various optimisation tasks that exist from design to operation in all stages of the pipeline sector. The focal point is on the ability to reduce pipeline costs.

Frictional resistance is the main reason for energy loss, and how to reduce it while retaining delivery capacity is one of the primary concerns. Polymetric drag reduction application techniques are essential for energy optimisation and emission reductions initiatives in the transmission and distribution market. Known as drag-reducing agents (DRA), these long-chain hydrocarbon polymers have properties that reduce friction and allow increased throughput and flow volume. The chemical additive is in high demand as it allows for the pumping of greater quantities of product through pipelines.

DRA optimisation considers pump schedules, flow rates during specified times, and suggested DRA injection rates designed to meet user-defined target throughputs. Multiple variables including different boundary conditions, product properties and devices in the configuration will have an impact on the probable solution.

There is a price associated with the energy consumption to transport a barrel of oil, as well as the cost of DRA utilised. Cost vs production movement is of special interest to pipeline operators who find value in figuring out the sweet spot for options to

Figure 2. Emerson’s PipelineStudio allows companies to accurately predict future capacity based on simulations generated from available data to proactively manage nominations, maintenance, etc.

Figure 2. Emerson’s PipelineStudio allows companies to accurately predict future capacity based on simulations generated from available data to proactively manage nominations, maintenance, etc.

20 World Pipelines / OCTOBER 2022

minimise the total cost to move each barrel of oil from origin to destination.

Pipe size, the scale of pipeline lengths, velocity, viscosity, the spacing of pumps and compressor stations, the cost of electricity, the cost of DRA, minor frictional losses, and other variables may all influence optimisation outcomes, and may be included in the final analysis.

DRA, however, does not work alone. Pumps in the pipeline, for example, are still needed at various stages to increase compression. Timing is also super critical to both peak and off-season pricing, as well as when figuring out a more cost-effective way to run at a higher flow rate overnight, or to meet spikes in demand because of unforeseen events. The scope of demand can change on a dime.

In other words, it is possible for unrealistic capacity estimations to be generated based on inaccurate DRA performance predictions, meaning more than one solution may be required to make adequate assessments. Furthermore, empirical data have proven that DRA degradation is unavoidable. One of the things that means is that more volume will be required to produce the same amount of energy.

There is automation available that allows for very simple analysis and clearer achievement of the desired results. Emerson’s PipelineOptimizer software is designed to simulate the hydraulic and thermodynamic behaviour of fluid in a pipeline network. It was built to catalyse liquid pipeline hydraulics and operations by way of understanding and minimising operational costs.

These governing laws of fluid flow are solved many times during an optimisation simulation, potentially tens of thousands of times, before generating data that is output in reports, trends, and graphs. The result is an accurate representation of the fluid dynamics in the pipeline system, allowing the user to analyse the effect of various pipeline routes, pump station locations, and pump unit selections.

The features built into PipelineOptimizer software automatically choose the best pump combinations and DRA usage for a pipeline system, including the effects of new facilities or changes in available pipes and pumps. Built-for-purpose software can also simulate a full line of products at various target flowrates, allowing for greater optimisation of DRA usage based on flow rate.

These solutions rely on good, clean source data as optimisation modules can choose which pump units to operate, what speed variable-speed units are operated at, and where and how much throttling should occur – so that operational costs can be kept to a

minimum while running in accordance with a variety of user-input operating rules.

CCUS and hydrogen

The IEA lists energy efficiency, behavioural change, electrification, renewables, hydrogen, hydrogen-based fuels, and CCUS as key pillars of decarbonising the global energy system. The importance of hydrogen in the 2050 emissions initiative is reflected in its increasing share in cumulative emission reductions.

Strong hydrogen demand growth and the adoption of cleaner technologies for its production enable hydrogen and hydrogenbased fuels to avoid up to 60 Gt of CO2 emissions, based on estimates from the 2021 to 2050 net-zero emissions initiative, representing 6% of the total cumulative emissions reduction.

Hydrogen has the highest energy per mass of any fuel. However, the low energy density of hydrogen by volume when compared with natural gas (approximately four times less energy dense) means that advanced, large-volume transportation and storage methods with higher capacities will additionally be needed to compensate – to get the same amount of energy.

The ability to achieve optimal operating conditions to satisfy demand, while considering all pipeline constraints, is one example of how the determination of maximum throughput is essential in pipeline operations.

In the lean towards natural gas to produce electricity as part of the clean energy transition dynamic, it is noteworthy to consider that pipelines can be used to store power. The push toward netzero emissions targets, while considering both current and future energy demands and critical infrastructure, is certain to include new pipelines, repurposed pipelines, and the enhancement of existing commercial systems.

Such value decisions are important as they can have a big impact on the degree of operational execution that is possible. Where and how big to build? To and from where to extend? The best location for pump units or compressor stations? What are the effects of pump drive size on capacity? How long will it take for product to get there? What can be done to better ensure the successful flow of single-phase fluids from the reservoir to the point of sale?

There will be more questions. And more answers to come.

The IEA frames the NZE as a “normative IEA scenario that shows a narrow but achievable pathway for the global energy sector to achieve net-zero CO2 emissions by 2050, with advanced economies reaching net-zero emissions in advance of others.”

Purveyors in the newly emerging landscape that’s trending heavily toward cleaner energy prerogatives are also becoming more dependent on their ability and capacity to both plan and optimise. Operators want less unscheduled downtime, greater pump and compressor efficiency, a better understanding of capacity inefficiencies, and the overall optimisation of throughput.

In light of corporate emission minimisation strategies, they are on the hunt for solutions to help offset utility and compliance costs – in tandem with a reduced number of flaring events, fewer reportable environmental events, and greater thermodynamic proficiency.

It is widely accepted that reliable simulations and automated solutions will be even more representative – both offline and online – of the real-time technologies used to bolster competencies in association with the optimisation of pipeline operations, and the future of pipeline systems and networks overall.

Figure 3. Emerson’s PipelineOptimizer software simulates the hydraulic and thermodynamic behaviour of fluid to optimise station DRA usage and minimise costs.

22 World Pipelines / OCTOBER 2022

As one of the world’s largest natural gas producers, the US is now the leading global exporter of LNG. US export capacity for LNG is approximately 12 billion ft3/d, or about 15% of total natural gas production. Due to recent geopolitical turmoil, European demand for LNG has risen dramatically, requiring current suppliers to increase production and open new production facilities. There is significant political pressure and economic opportunity for the US to make up the shortfall of Russian-supplied natural gas with LNG. Given the commitments made to potential European recipients, US LNG production would have to increase by more than 20% (about 3 billion ft3/d) over the next 12 months. This LNG will have to be converted from natural gas which must be produced and transported to the LNG plants.

An increase of 20% in US-exported LNG corresponds to an increase of 3% in US natural gas production. That may not sound like much, but becomes a staggering figure in the context of existing infrastructure and required new machinery.

In the US upstream sector – gas production and gathering – there are approximately 15 000 installed compressors, mostly smaller reciprocating compressors driven by engines or electric motors. In the midstream or gas transport sector, there are about 8000 mid-size and large installed compressors, made up of a mix of older low-speed

Klaus Brun, Director of Research & Development, Elliott Group, USA, discusses building new pipeline compression infrastructure to meet worldwide LNG demand.

Klaus Brun, Director of Research & Development, Elliott Group, USA, discusses building new pipeline compression infrastructure to meet worldwide LNG demand.

23

integral reciprocating, high-speed separable reciprocating, and gas turbine or electric motor-driven centrifugal compressors. Finally, there are about 3000 mostly large compressors in downstream and LNG applications.

Ignoring downstream and LNG plants for now, there is an estimated 25 million hp in the upstream sector and 40 million hp in the midstream. Upping this by 3% requires another 2 million hp of new compression in the US alone, of which half will be for new pipeline compressors. It is critically important that this new compression infrastructure operates as efficiently as possible to reduce energy waste, preserve critically needed natural resources, and minimise greenhouse gas (GHG) emissions.

Demand background

In the oil and gas industry, compressors are used for natural gas gathering, transport, processing, storage, and distribution. The US has approximately 1700 midstream natural gas pipeline compressor stations. An estimate from the US Department of Energy indicates that 1 - 1.5% of US natural gas is utilised by oil and gas compressors for consumption and leakage. The average age of US pipeline compressors is 30 - 35 years, and industry estimates indicate that about 3 - 5 million hp of US compressors must be replaced within the next 10 years. To this we must add the new capacity requirements for LNG production and the expected typical growth demands. This results in a need for a total of 4 - 6 million hp of new pipeline compression over the next 10 years in the US alone. Clearly, with this huge quantity of new compression, there is significant potential to reduce energy usage in the gas transport sector through modernisation of the compression infrastructure.

Pipeline compression

Compressors are installed in natural gas pipelines to inject gas into the pipeline at its operating pressure, and then re-compress the gas at certain distances along the pipeline to compensate for its viscous pressure drop. Typical pipeline operating pressures range from several hundred psi to about 1500 psi for standard pipe diameters, which range from a few inches up to greater than 60 in. In the US alone, there are currently over 7000 compressors installed in natural gas pipeline compression service on over 2.6 million miles of pipelines. Approximately 25% of these compressors are old, low-speed, integral reciprocating machines that were originally installed between 1940 and 1970, making them technically outdated and mostly obsolete. This, in combination with additional natural gas demands driven by increasing LNG exports, new/refuelled fossil power plants, and increasing domestic consumption, has led to the need to rapidly increase the North American pipeline compression capacity, both by the installation of new units, and by replacing older, low-power units with modern, higher-power units. At the same time, environmental regulations require the reduction of carbon emissions and gas leakage from pipeline operations, which has resulted in the preferred installation of electric motors over gas engines or turbines as pipeline compressor drivers.

Most centrifugal compressors that are currently being installed in pipelines were originally derived from process gas barrel beam style compressors. For this design, a long, multi-stage impeller shaft is mounted on bearings and seals at both ends of the casing, and a balance piston and thrust bearing are used to limit axial movement of the shaft. This design evolved from classical refrigeration, refinery, and chemical process compressors that were originally intended for handling high-pressure ratios and a wide range of different gases at high pressures. However, this design style is sub-optimal for basic pipeline service where the pressure ratios are relatively low and the gas composition is fairly constant, but the operating conditions are highly variable. The design also must be reliable to operate for long periods without scheduled or forced outages. Furthermore, because of the traditional preference of pipeline operators to utilise gas turbine drivers, most current pipeline compressor designs are speed matched to provide optimal performance at high, gas turbine speeds, rather than the lower speeds of electrical motors. Driving

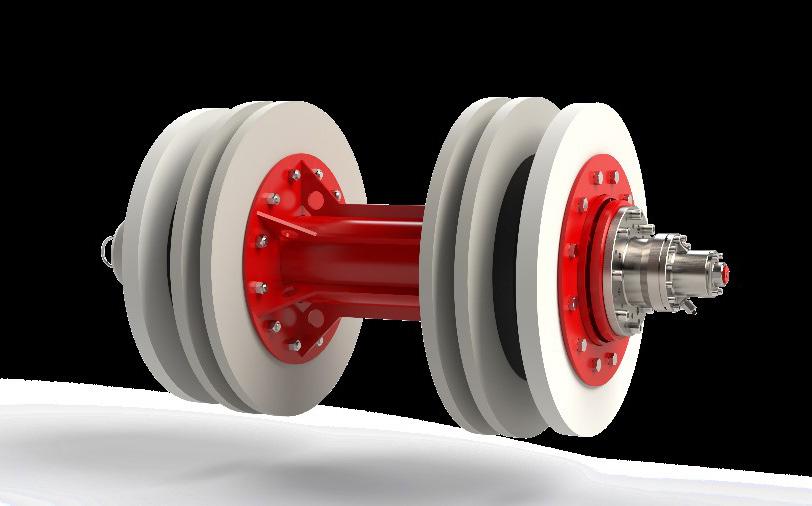

Figure 1. Elliott 140 TCH pipeline compressor on a baseplate.

Figure 2. Elliott 140 TCH cross-section.

Figure 1. Elliott 140 TCH pipeline compressor on a baseplate.

Figure 2. Elliott 140 TCH cross-section.

24 World Pipelines / OCTOBER 2022

QUALITY RELIABILITY FLEXIBILITY RENTALSALES L AYING BENDING WELDING MAATS PIPELINE PROFESSIONALS P.O. Box 165 | 7470 AD Goor the Netherlands T + 31 547 260 000 F + 31 547 261 000 E info@maats.com your equipment partner since 1981 CO2 neutral rental STAAMmoc. MAATS.com

centrifugal compressors with electric motors requires the use of a gearbox in most pipeline applications.

Electric, motor-driven centrifugal compressors have been available for pipeline compression since the 1960s, but they were originally neglected by the industry because of the need to install additional electrical infrastructure on the pipeline. However, due to stricter environmental compliance regulations, centrifugal compressors driven by electric motors have become more popular over the last 15 years and now represent approximately 50% of all new, installed mainline pipeline compression equipment. This trend is continuing with an increased focus by the pipeline industry to reduce GHGs, carbon dioxide, and methane emission point sources.

Electric, motor-driven centrifugal compressors are available from low, single-digit power to well above 100 000 hp

applications. There are several technical options to electrically drive a centrifugal compressor for pipeline service. These include fixed speed, variable speed using a VFD, variable speed using a hydrodynamic coupling, direct drive, and indirect drive using a gearbox. Since pipeline service by nature is highly variable in throughput, variable-speed solutions are preferred over fixed-speed drivers to avoid the need to recycle gas, and to maintain a high efficiency over a wide operating range. Also, gearboxes add complexity and cost to the design while reducing reliability. However, since many centrifugal compressors designed for pipeline service were speed matched to be driven by gas turbines, they usually require a gearbox when driven by a conventional electric motor. It is important to note that this is a design decision that can be avoided if a centrifugal compressor is designed from its outset for a lower speed driver, such as a synchronous or induction electric motor.

To meet the demand of new compression for the replacement of old legacy compressors and the increased power demand for natural gas, the industry needs a simple, reliable, and highly efficient electric motor-driven compressor that is optimised for pipeline service.

The Elliott 140 TCH pipeline compressor addresses some of these shortcomings with features that were specifically designed for the natural gas pipeline service. This compressor uses a 1 - 2 stage impeller overhung design to reduce the number of bearings and seals. It does not require a balance piston, has an axial inlet for optimal aerodynamic performance and reduced leakage, and is speed matched to conventional, induction electric motors without the need for a gearbox.

Elliott 140 TCH pipeline compressor

Elliott has successfully provided centrifugal compressors for the oil and gas industry for over 80 years, including hundreds of machines in the pipeline or midstream service. The Elliott 140TCH (Figure 1) is derived from Elliott’s many years of experience with overhung compressor designs, but it has features that are specifically designed for optimised, natural gas pipeline service.

The Elliott 140 TCH is a single or dual-stage, overhung design with an axial inlet that is electric motor-driven without a gearbox (Figure 1). This design approach results in higher efficiency, reduced leakage from a single, dry gas seal, and the avoidance of a balance piston. The 140 TCH comes with a direct connect, variable speed (VFD) motor and a standard footprint, in addition to custom

Figure 3. Elliott 140 TCH pipeline compressor operating range.

Figure 4. Elliott 140 TCH package and maintenance access.

26 World Pipelines / OCTOBER 2022

Harness the power of fibre optics to gain real-time visibility of your pipeline network with LivePIPE®II www.fotech.com team@fotechsolutions.com +44 1252 560 570 One system – multiple benefits • Detect and locate smaller leaks faster • Monitor third parties and avoid mechanical damage • Locate and prevent product theft attempts • Monitor pigging operations To find out more, call our experts on +44 1252 560 570 or email us at team@fotechsolutions.com

aerodynamics for optimum efficiency and extended operating time between scheduled overhauls. The gearless configuration provides several advantages including a smaller footprint, reduced lube oil requirements, and higher net efficiency. The high-speed VFD-powered motor significantly reduces CO2 and NOX emissions as compared to a gas turbine driver. The VFD addresses starting issues and allows for adjustable operation to match load/capacity requirements. The pipeline compressor’s single lift plug-and-play design includes auxiliaries such as lube oil, a buffer gas panel, and integrated, customised controls. Piping and wiring are included on the skid. The Elliott 140 TCH pipeline compressor is available from 10 000 - 42 000 hp to accommodate the full range of gas transport applications.

The 140 TCH is designed to handle most modern, mid-size and large pipeline compression applications. Its design is lean and simple, and focuses on making pipeline compression efficient, reliable, and cost-effective. The impeller aerodynamics are based on Elliott’s advanced and proven EDGE technology. With the axial inlet and flexible or customisable aerodynamic design, efficiencies of greater than 85% can be obtained. The direct drive compressor, with a variable speed electric motor, provides a wide operating range, including efficient turndown operation. With three standard frame sizes, 15MW, 25MW, and 35MW, the centrifugal compressor is designed for applications up to 7000 million ft3/d with a pressure ratio ranging from 1.15 - 1.8. The typical operating range for the 140 TCH is shown in Figure 3.

The machine design philosophy allows for simpler installation with a standardised package, an axial inlet, and selectable discharge

for right or left piping configurations. The package includes an integral lube system for the compressor and motor, a simplified buffer or seal gas panel (the compressor only has one seal), an on-skid control system, and all compressor piping and wiring included on a single-lift skid for reduced footprint and weight. The compressor internals are contained in an inner-barrel design and can be removed from the driver side. This allows for easy maintenance and removal of the compressor internals without the need to move any piping. The removable barrel also allows for quick and easy, installable spare bundles or compressor restaging to change aero components, as needed (Figure 4).

The 140 TCH is designed to increase reliability by minimising component count. The compressor design allows for a direct drive electric motor, which does not require a gearbox, making the footprint small and light. The axial inlet and overhung design allow for a single seal. This results in a simpler, more reliable design with reduced emissions. The balance piston and balance piston line have been eliminated, further increasing reliability and reducing losses, which leads to increased efficiency.

With a clean and simple design and industry-proven components, the reliability, availability, and time between maintenance intervals has been increased. To meet modern pipeline compressor requirements for efficiency, reliability, and low emissions, Elliott has responded with a state-of-the-art pipeline compressor, incorporating years of experience and evolution into the design of the 140 TCH. This compressor is ideally suited to meet the increased capacity demands of modern pipelines efficiently with minimal GHG emissions.

IPLOCA - encouraging sustainable energy transitions in the pipeline industry visit www.iploca.com to find out more International Pipe Line & Offshore Contractors Association Geneva - Switzerland

s natural gas moves from well sites to end users along a pipeline, friction, travel distance, and elevation changes slow gas movement and reduces its pressure along the entire line. Compressor stations are placed strategically along the pipeline to maintain the pressure and flow at an operable level. The stations are an integral part of the network, and the compressors must perform this critical task with high reliability and little maintenance requirements.

To gauge the importance of compressor stations for the gas industry, the US relies on a network of over 480 000 km of gas transmission pipelines. Typically, a compressor station is required at intervals of between 80 and 160 km, so many thousands are in operation across the country.

Historically, compressors have utilised gas or steampowered turbines to maintain the natural gas pressure. Currently, some 90% still utilise this technology. However, these turbines produce high greenhouse gas (GHG) emissions, offer low efficiency, and are hard to maintain, especially in remote locations. Since a typical compressor station will require 10 MW or more, there is now a clear incentive to seek more energy-efficient alternatives. That is why there is now a growing trend to adopt electric drivetrains, both for newbuild projects and for upgrades of existing stations.

It is not only a question of saving costs through energy efficiency. Following the COP26 climate summit in late 2021, political leaders expressed a renewed focus on reducing

Anand Jha, Vice President of Global Sales for Chemical, Oil & Gas, ABB, USA, outlines a compelling alternative for pipeline gas compressors.

Anand Jha, Vice President of Global Sales for Chemical, Oil & Gas, ABB, USA, outlines a compelling alternative for pipeline gas compressors.

29

emissions and setting targets. As a result, most European countries and North America have set net-zero targets in their policy documents.

Whereas in the past, pipeline operators could have been tempted to stick with gas turbines since gas was the most accessible energy source, the political commitment to net-zero is compelling them to change tack. Since they now get penalised for GHG emissions, many of the world’s top oil and gas companies have set goals to eliminate such emissions from energy consumption and operations by 2050.

Electrical drive systems

The traditional approach to gas pipeline compression is to use natural gas to fuel a large, stationary engine driving a turbine. An electrical drivetrain uses very much the same principle, but with the gas engines substituted by an electric motor operated by a variable speed drive (VSD).

One of the main reasons for using gas compression was that it uses a fuel readily available from the pipeline itself, while compression stations were often located in areas where there was no electrical infrastructure. That has changed in recent years with electrification becoming much more widespread, even in remote rural locations.

The primary function of VSDs is to control the speed and torque of the motor driving the compressors. VSDs are positioned between the electrical supply and the motor. Power from the electrical supply goes into the drive, and the drive then controls the power being fed to the motor.

Converting the incoming AC electrical power to DC power smooths out the electrical waveform and adjusts the frequency and voltage based on current process demands. This means operators can run an AC motor at the speed or

torque dictated by the demand, resulting in considerable savings.

Energy-efficient benefits of VSDs

Running a compressor at full speed and controlling the flow rate and destination by manually opening and closing the valves makes the start-up process highly labourintensive. Starting up a gas compressor station can also be a time-consuming process – the labour costs add up when personnel have to travel long distances to remote sites, although this is an automated process in some facilities. But energy consumption is poor.

Running these applications with VSDs is a more cost and energy-efficient alternative, as it brings instant savings in energy consumption. The actual energy savings depend on the specific application: since the relationship between motor speed and energy consumption is non-linear, even a slight speed reduction can result in 25% or more energy savings. Startup is also usually only a matter of seconds.

VSDs also bring long-term competitive advantages like low maintenance costs, reduced waste and CO X and NO X emissions, increased production hours, and even lower ambient noise emissions. These all play a vital part in meeting environmental goals.

Other factors to consider in favour of electric drives are the capability to benefit from the high reliability and excellent control properties of the electronically adjustable AC drives and the need to avoid GHG emissions.

The advent of electric compressors

The oil price collapse of 2014 forced changes upon the gas pipeline market, including capital cost reductions and downsized budgets. But even as energy costs increase, as is currently the case, the need to achieve a good return on investement (ROI) on infrastructure remains as valid as ever.

The excessively high operational expenditure of gas turbines in terms of maintenance prompted operators to pay closer attention to the cost aspect. They started looking for an optimised solution focusing on the total cost of ownership (TCO) and not just the initial cost.

This, together with stricter environmental regulations, saw electricdriven compressors entering the market in the early 2000s. Carbon tax and credits and investors’ environmental, social,

Figure 1. The Troll A platform features electric compressors driven by high-voltage 40 MW motors.

Figure 1. The Troll A platform features electric compressors driven by high-voltage 40 MW motors.

30 World Pipelines / OCTOBER 2022

Table 1. Comparison of gas turbine and electric drive characteristics

Compared feature

G as turbine Electric drive

Efficiency Low Very high

Investment cost High Medium

Maintenance High V ery low

Reliability/availability Medium High

Mean time to repair

A factor to consider

Low - 4 hours

Pollution/emissions High None

Speed control range Limited

Wide and easily adjustable

Speed control accuracy Medium High

Design flexibility Low High

Torque pulsation

Starting time

Low

Medium - minutes

A factor to consider

Low - seconds

Noise level High Medium

Impact on power supply Not applicable

Total life cycle cost (LCC ) Depends on energy costs

and governance (ESG) demands added to the sector’s shift towards decarbonisation.

However, since gas turbines usually operate in remote areas, electricity supply was regarded as an initial hurdle, but with advanced technology, this is no longer the case. A good example is the Troll oilfield in Norway’s sector of the North Sea. The operator, Statoil, was looking to boost production on the giant Troll A platform by installing two compressors.

Requires investigation

Depends on energy costs

ABB’s solution brought together two ground-breaking technologies: the world’s first high-voltage DC power-fromshore connection to a platform and the first commercial installation of very high voltage synchronous motors, each with a power rating of 40 MW.

The solution takes 132 kV power from the mainland grid and turns it into DC at a converter station at Statoil’s gas processing plant. Two HVDC Light power cables, each with

a capacity of 40 MW, then transport the power at 60 kV to Troll A 70 km away. There, a compact, lightweight converter station turns the power back into AC, which then feeds to the two ABB motors that drive the compressors.

This method of supplying power to the compressors was better than the conventional solution of installing gas turbines on the platform because the capital, operating, and maintenance costs were significantly less. With no penalties to pay for exhaust and maintenance costs, payback for the total investment of US$270 - 280 million happened in less than three years. The solution also reduced the environmental cost of running the compressors by 230 000 t of carbon dioxide a year. The compressors are expected to extend the field’s productive life to 2063.

Replacing a gas turbine with an electrical drive

With the push towards decarbonisation, most new compressor installations use electrical drives. While in some installations they might require a higher initial investment than gas turbine drives, their real benefit is seen over the operational life of the station. The reason is that electric drives have much lower operating expenses, leading to significant savings, especially when they’re factored in early in the plant’s design. With the right knowledge and assistance, it can also be relatively straightforward to replace an existing gas turbine with an electric system.

The main steps to assess feasibility are a torsional analysis, mechanical calculations, checking the turbine’s foundation to see if an electric motor will fit, and whether there’s a need for an intermediate frame. These steps are followed by harmonic studies, string analysis, control and power interconnection analysis, and piping.

Next in line is installing the electrification hardware, which includes the electrical house, switchgear, power and VSD transformer, MV and LV distribution, and the drive train with motor and drive. The final steps in the replacement process are process control and instrumentation integration, concluded by project commissioning.

Efficiency gains and TCO

The energy conversion efficiency of a gas turbine is typically about 47% and this is only reached at peak performance. Conversely, a corresponding electric drive system achieves around 95% efficiency over quite a wide range.

In addition, the downtime of a gas turbine is costly, with multiweek shutdowns to repair mechanical wear and tear. The average maintenance interval for gas turbines could be six months or 4000 hours.

On the other hand, electric drives offer much more efficiency and less downtime. Even if they do go down, maintenance will require a few hours or half a day at most. The electric drive system typically has an availability higher than 99.9%.

With all these factors considered, using an electric-driven turbine could enable an operator to increase the uptime of their compressor station by approximately ten days a year. This results in significant savings by reducing lost productivity. Overall, electric drive trains (VSD and motor) can save

significant operational costs, with a typical payback time of one to three years. This might even be reduced to a few months when the opportunity cost of selling the gas saved by electrification to the market, or using it in other processes, is included in the return on investment (ROI) calculation.

Recent successes: North America and globally

Over the past decade, ABB has helped operators in North America to electrify their gas compression stations in order to increase reliability and flexibility by supplying electrical drive systems ranging from 4 to 29 MW. Although globally, ABB also has proven references and the capability to offer VSD packages above 30 MW. In a typical example, ABB was appointed to replace the existing equipment at a compressor station and upgrade it to higher horsepower while maintaining the existing maximum operating pressure. The objective was to utilise the existing infrastructure and enhance the pipeline’s output capacity.

ABB supplied an ACS5000 liquid-cooled medium voltage drive with a 36-pulse oil type isolation transformer and a fin-fan cooler to drive a high-speed compressor application (0 - 167 Hz). The ability to situate the converter transformer outside the electrical house, and the efficient liquidcooled design of the drive, has reduced the HVAC cooling to a minimum. This has resulted in significant capital and operational cost savings for the project and asset.

Later, ABB supplied another ACS5000 liquid-cooled medium voltage drive for another compressor station This project resulted in a considerable cost saving, as it was possible to reuse an existing transformer and fin-fan cooler.

A critical element in these projects has been the capability to work with different local compressor manufacturers to develop and engineer solutions tailored to suit the requirements of individual locations. This has enabled operators to receive a flexible solution, rather than having to take off-the-shelf equipment.

The critical nature of the compressor stations has also placed a major emphasis on service, especially in enabling on-time commissioning within very tight deadlines. This has been made possible by ABB’s network of service engineers located across North America. The aim is to ensure a rapid response onsite in the unlikely event that a drive should ever go down.

To take service to the next level, talks are ongoing with operators to discuss approaches for remote condition monitoring of compressor stations. This will enable proactive servicing to be scheduled before any issue develops into a fault.

The future is all-electric

The simplicity of implementing an all-electric drive system for both new installations, or converting existing gas compressor stations, and the added safety and operational benefits, make it a highly compelling choice. The short payback time, reduced fuel consumption and GHG emissions lead to substantial savings in operating expenditure. In this context, the reduced environmental impact of electrification becomes a highly prized added benefit.

32 World Pipelines / OCTOBER 2022

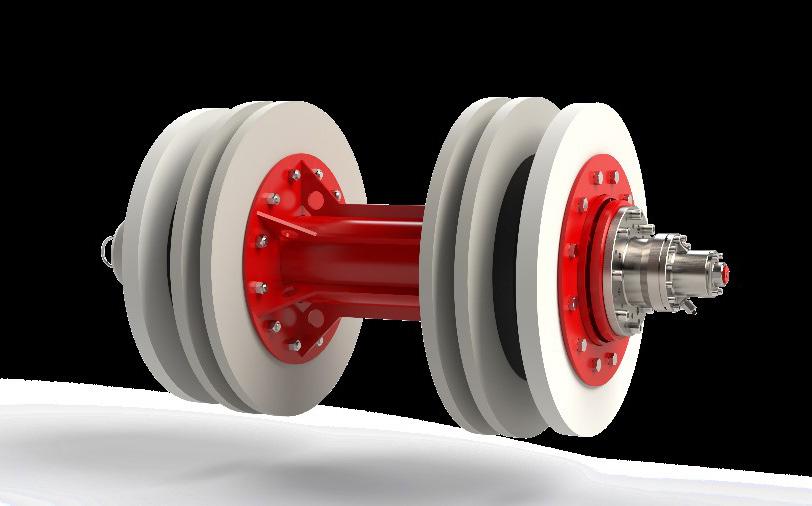

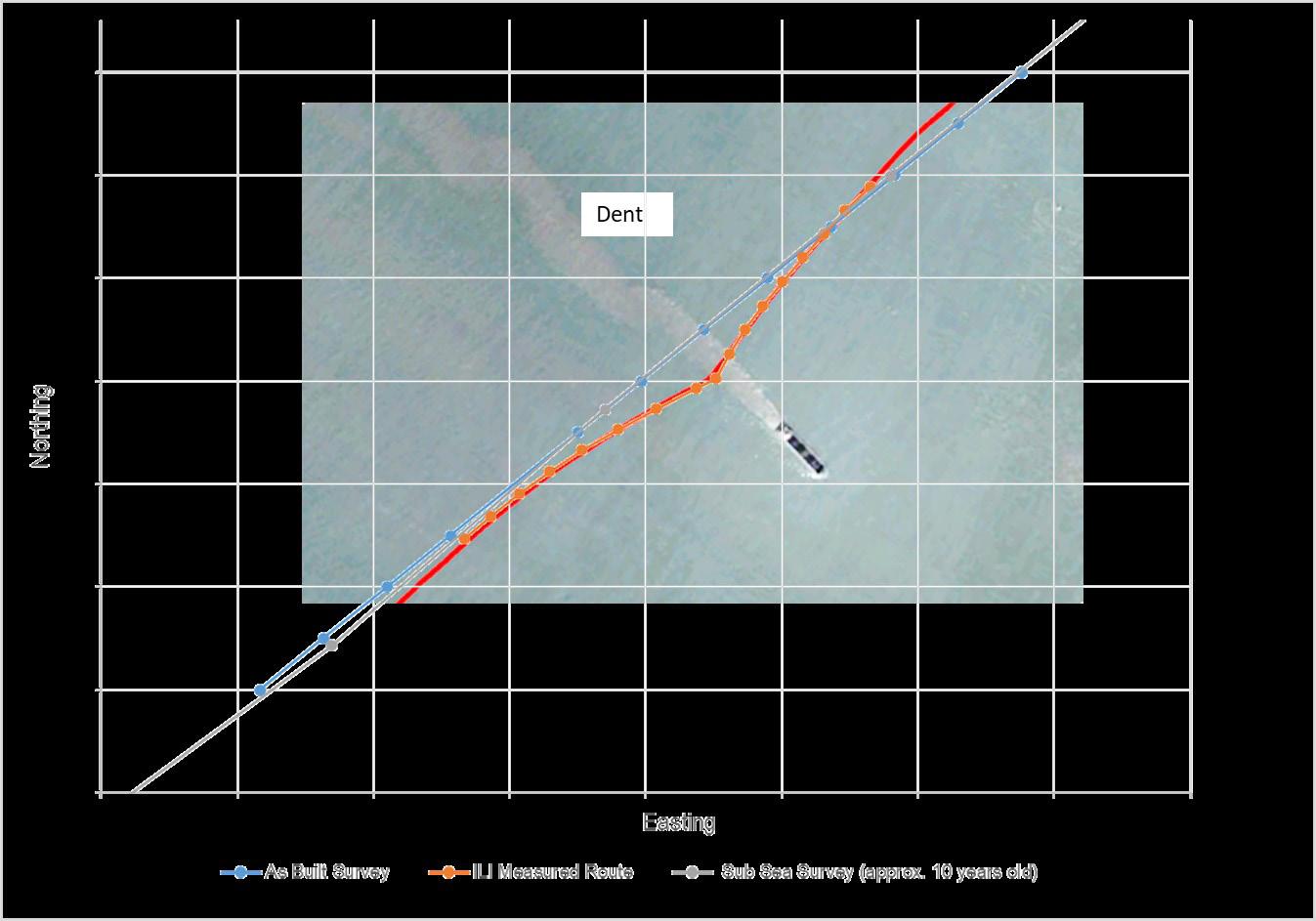

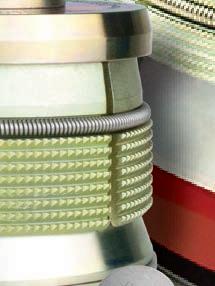

hen it comes to isolating gas distribution pipelines, there are routine challenges, and then there are extraordinary ones. And sometimes – perhaps surprisingly so – those problems have a similar root cause. And even the same solution.

One of the more common challenges is isolating a pipe that is out-of-round, or slightly oval. Although ovality is occasionally associated with third-party damage, more often it is traced back to the manufacturing process.

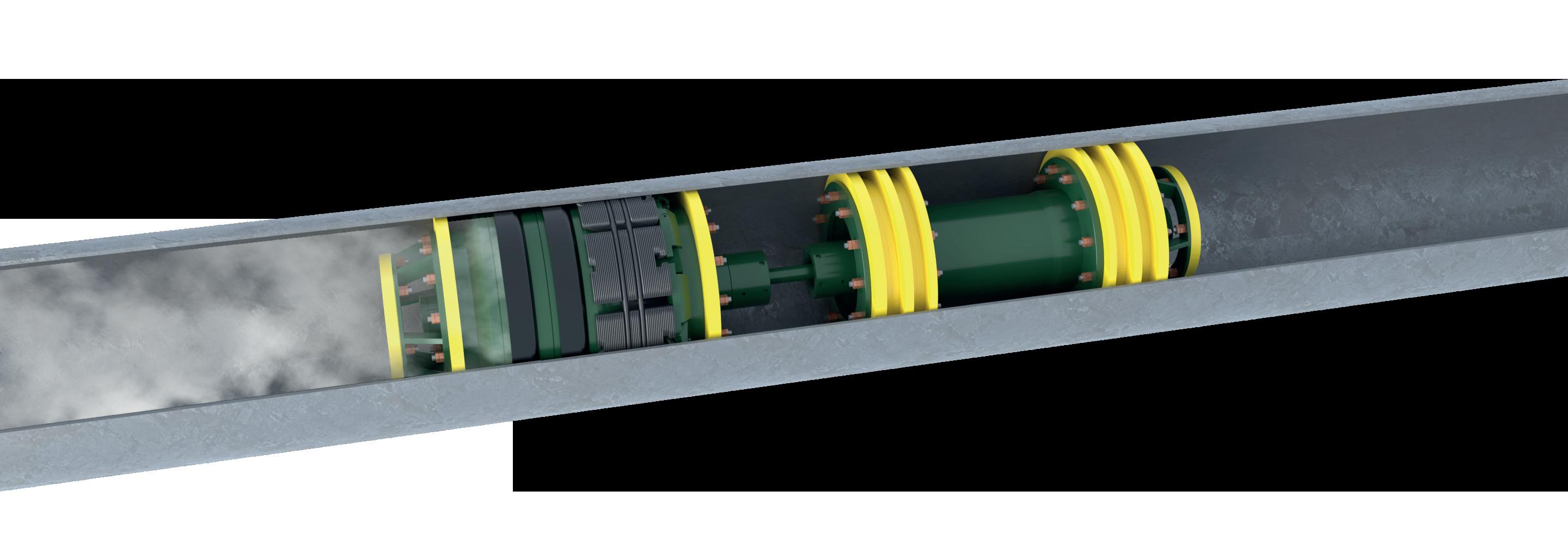

For decades, local distribution companies (LDC) have used a single, round, static seal to successfully isolate pipelines. In recent years, though, the concept of an ‘energised’, or expandable, seal that would be easier to insert into and retract from the pipeline became an attractive alternative. Combining a seal that could expand and adhere to the internal topography of the pipeline with the assurance of double block and bleed (DBB) would be a game changer.

Especially for those pipelines with extreme ovality or that are not perfectly round.

That concept became a reality in 2020. That’s when global solutions provider T.D. Williamson (TDW) introduced ProStopp® DS isolation technology, the gas distribution market’s first and only low-pressure DBB isolation equipment with an energised seal.

Widely accepted technology

Because of its DBB feature, ProStopp DS technology ensures total leak protection on

For ‘run of the mill’ and unique challenges, Ryan Ragsdale, Senior Product Manager, T.D. Williamson, USA, presents an isolation solution for gas distribution pipelines.

33

in-service pipelines the first time, every time. The area between the two plugging heads is depressurised through an internal bleed port, eliminating the need for extra taps or fittings to engage the bleed functionality. That

means the ProStopp DS tool achieves double the sealing capability through a single fitting.

In addition, it includes a patented, hydraulically activated – or ‘energised’ – seal that compresses against the pipe’s inner wall, regardless of its shape or whether there are dents, gouges or irregular weld seams. The ProStopp DS also has a chip sweep function that removes excess cutter shavings that could interfere with the seal. What’s more, the seal can accommodate multiple wall thicknesses and can be used over and over again, reducing the need to replace consumable parts. All of which makes the ProStopp DS an ideal solution that’s gained strong market acceptance in just two short years.

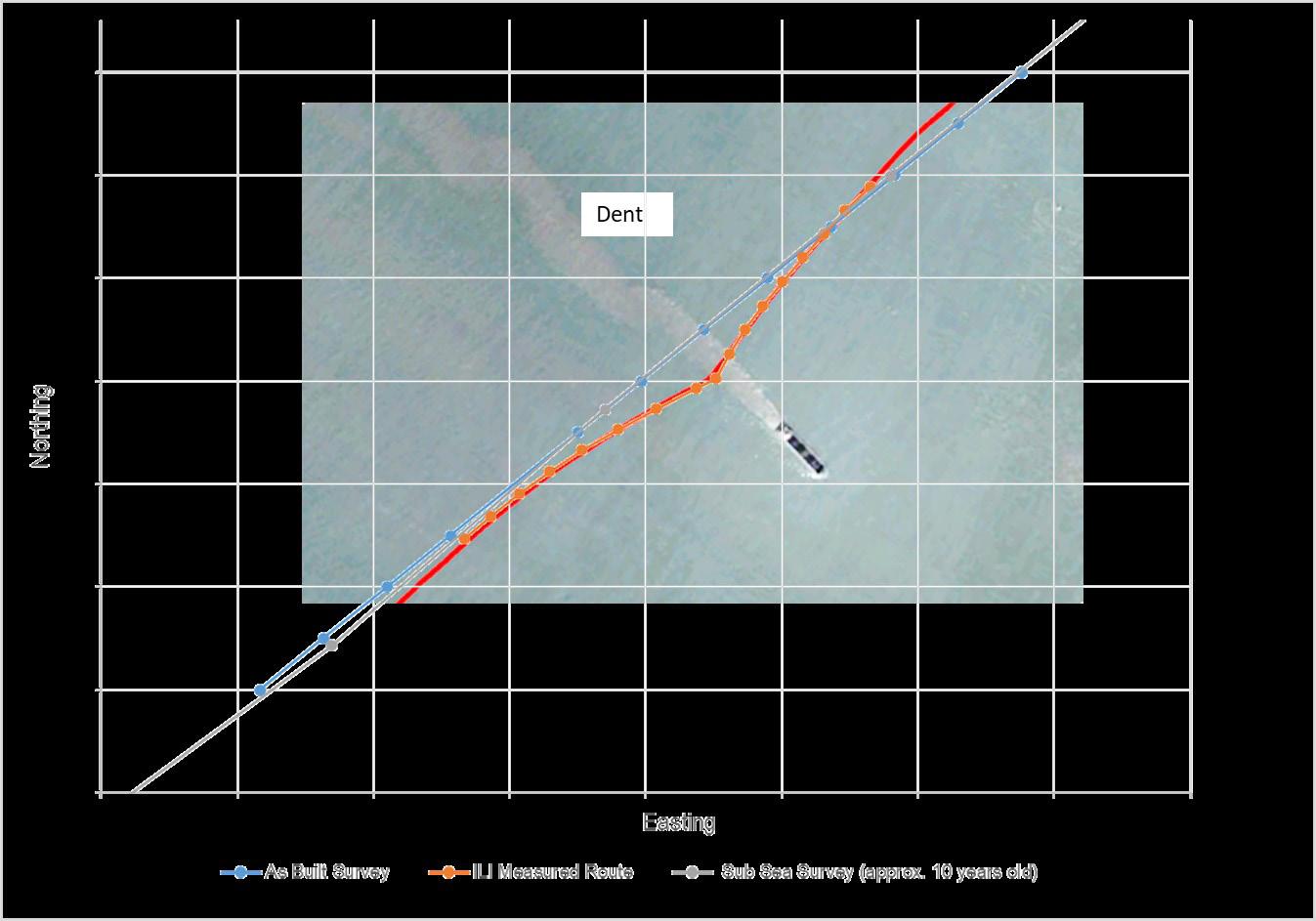

For example, when TDW Partner Channel Onstream Pipeline Solutions (OPS) isolated a slightly oval 12 in. gas distribution pipeline near Antwerp, Belgium, it was one of the 300-plus times the technology has been put into action since 2020. “OPS invested in 12 in. ProStopp DS technology because it is universally applicable on 12 in. pipelines and is insensitive to ovality,” Danny Vreys, OPS General Manager, said. “The result was perfect, a 100% seal on the primary and secondary plugging heads.”

But it’s not just routine challenges that the tool is well suited for. As the operator of a gas distribution system in Florida, USA, recently learned, its flexibility also makes ProStopp DS technology appropriate for jobs that present extreme challenges. Including the isolation of a 10 in. pipe that had gotten out-of-round in a very unusual way.

In the thick of things

TDW hot tapping and plugging (HT&P) technicians are always prepared for the unexpected. When they arrived at a Florida jobsite to isolate a 10 in. gas distribution pipe prior to rerouting, though, it was with the understanding there was nothing abnormal about the 0.375 in. thick pipe wall.

As soon as they cut the coupon to allow access into the pipe, a different story began to emerge.

Instead of being smooth and uniform as anticipated, the interior surface of the coupon was covered with a thick and rocky substance that appeared to have passages cut through it. The technicians reasoned that the rest of the pipe was in similar condition.

What could have created the black, pitch-like overlay?