Euromel® Melamine - the leading and most advanced technology for the production of high-quality melamine used in wood-based products, laminates, moulding compounds and fire-extinguishing foams in the last 40 years.

Delivers high purity, high consistency melamine with total zero pollution (TZP) with extremely lower energy consumption using 30% lesser steam import and 20% lower fuel utilisation than the closest competitor.

Euromel® Melamine Process is now used in 28 plants worldwide, accounting for more than 8 million tonnes of melamine produced cumulatively, making it the most traded and widely used melamine worldwide.

32 Enhancing Sustainability In The Phosphate Industry

James Byrd, JESA Technologies, USA, discusses the management of fluorine in phosphoric acid plants.

10 Analysing The European Fertilizer Industry

Contributing Editor, Gordon Cope, discusses the innovative nature of the European fertilizer sector and why it seems set to thrive over the coming decade.

15 Producing Fertilizer Fit For The Long Haul

Barbara Cucchiella, Ahmed Shams, and Branislav Manic, Stamicarbon, the Netherlands, consider how new granulation technologies could result in a more premium end product that can better withstand challenging storage and shipping conditions.

19 Reaching New Levels

Christian Keon, Nanoprecise Sci Corp., Canada, discusses how operational efficiency and reliability in fertilizer production can be enhanced with the help of advanced technologies.

24 Buffered Heat Exchangers For Safe Cooling

Alexandre Rossi, Breno Avancini, Laura Borges and Victor Machida, Clark Solutions, Brazil, examine how mindful and considered heat exchanger design could be the key to preventing dangerous chemical reactions and increasing fertilizer plant safety.

29 Navigating The Future

Pratibha Pillalamarri, Aspentech, USA, discusses how fertilizer companies can enhance asset integrity and plant reliability.

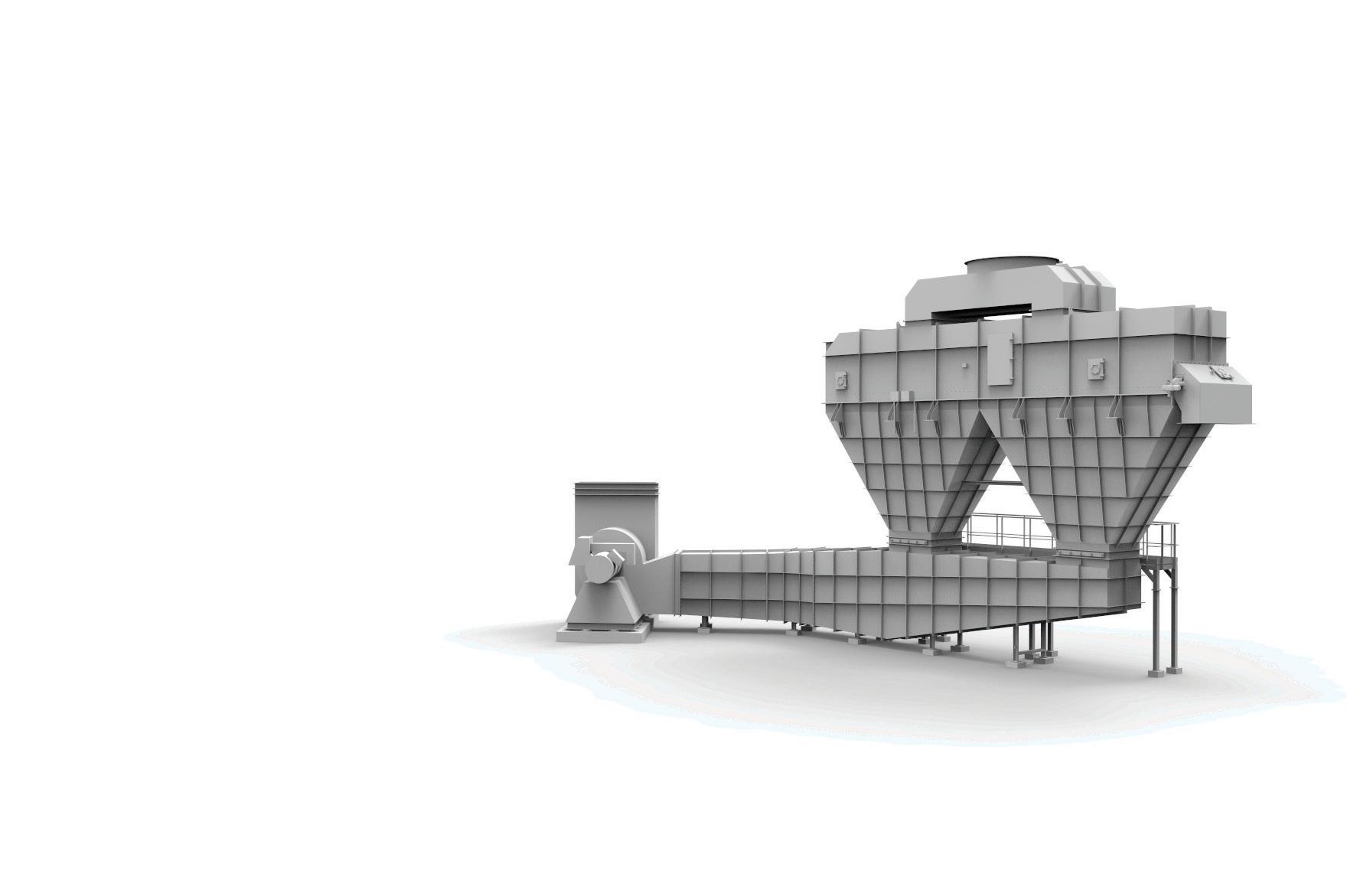

37 Striving For Efficient Recycling Solutions

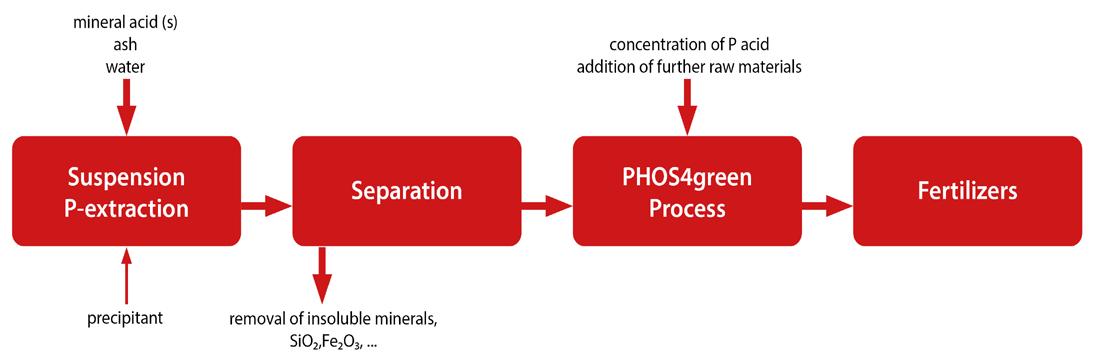

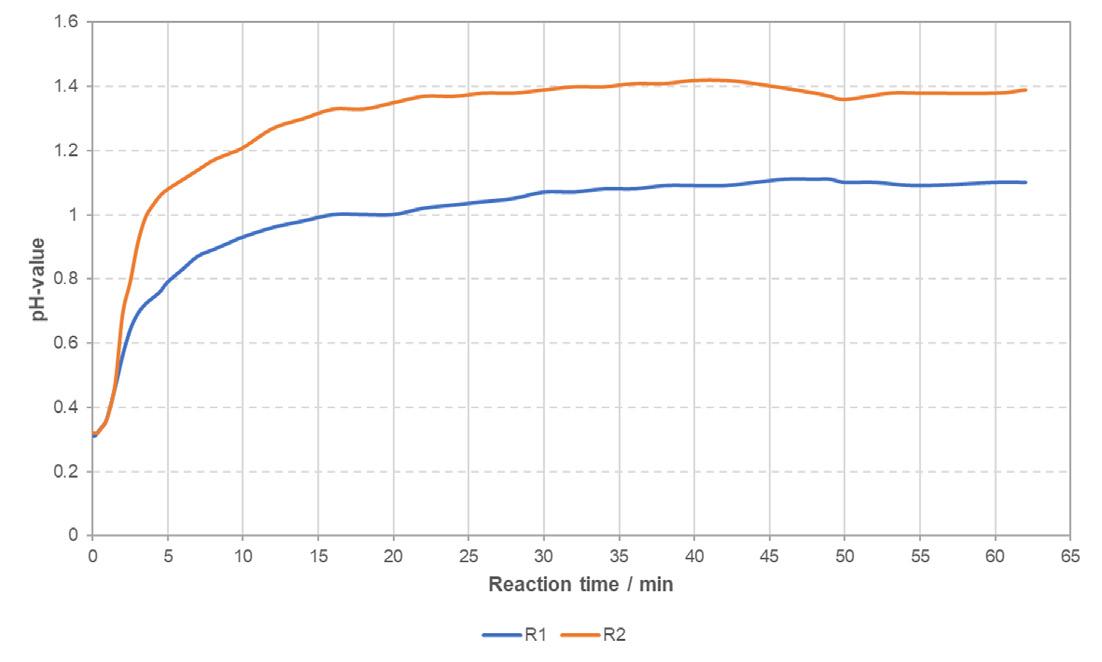

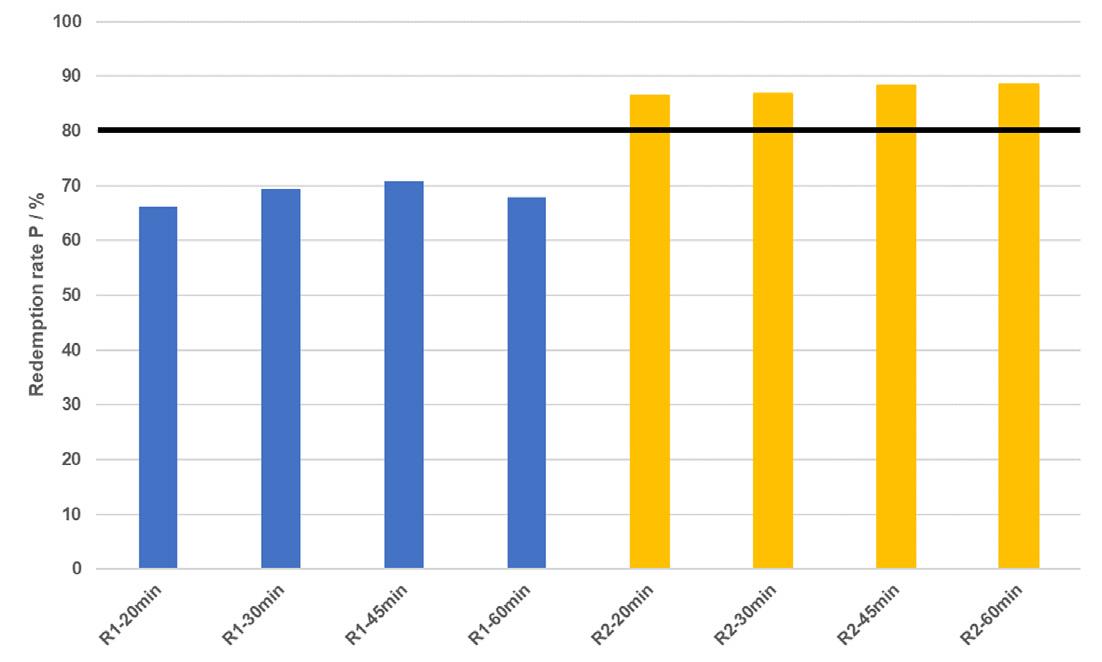

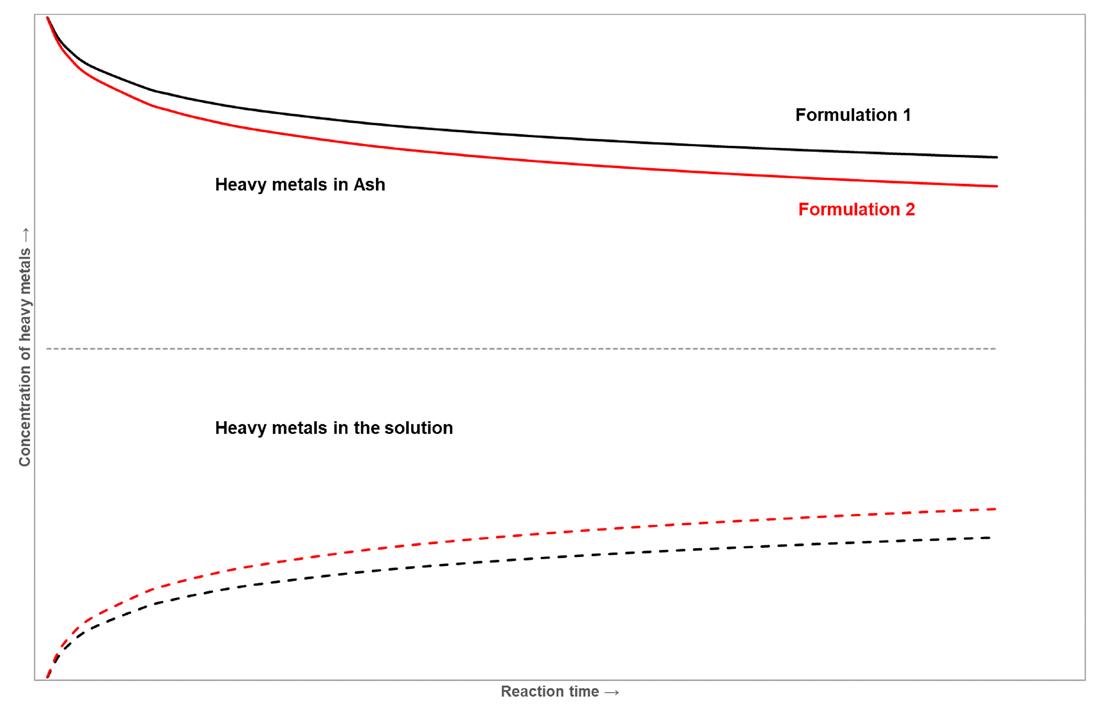

Johannes Buchheim, Glatt Ingenieurtechnik, Germany, explains how innovative technologies can help to overcome the challenges of phosphorus recycling and contribute to a more sustainable circular economy.

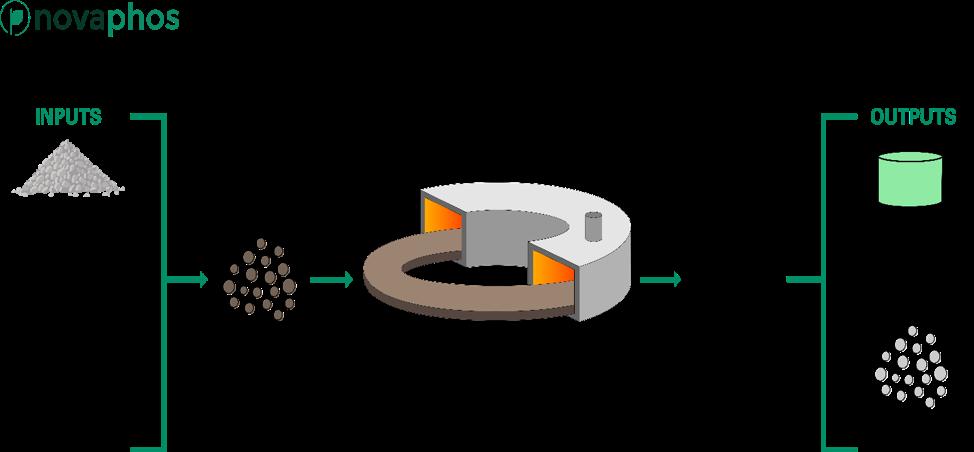

42 Phosphate Technology For A New Era

Evgeny Fedoseev and James Samuelson, Novaphos Inc., USA, outline a new economic and sustainable approach to effectively deliver high quality phosphate for the fertilizer market.

46 Improving Efficiency Sustainably

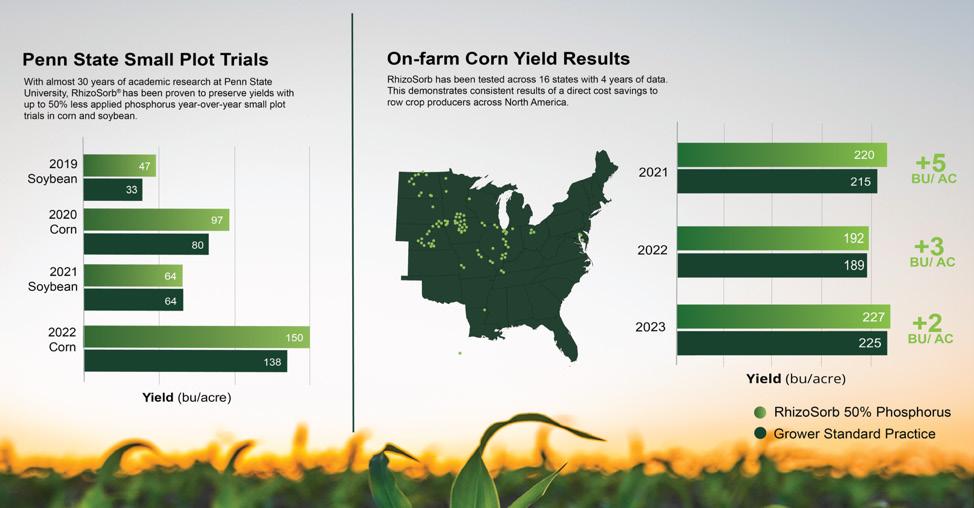

Phospholutions Inc, USA, discuss how the efficiency of phosphorus fertilizer can be enhanced in order to make its application more sustainable.

50 Reducing Response Time In Fertilizer Production

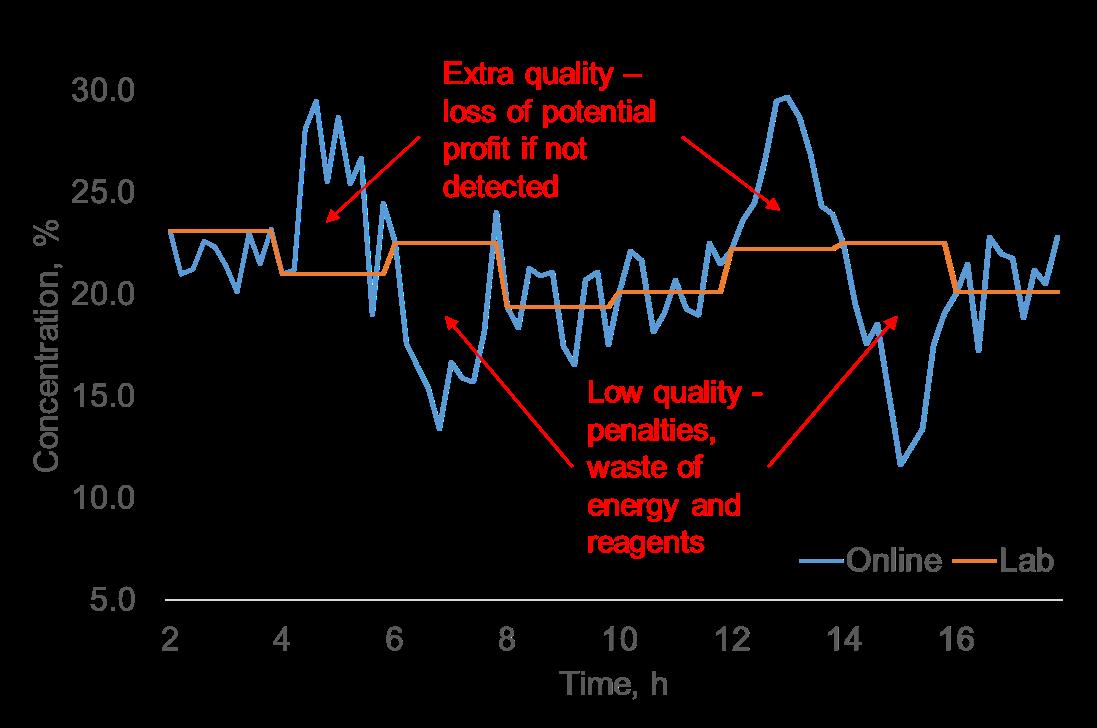

Lucas de Clercq, Alsys International BV, the Netherlands, considers the opportunity for faster and more accurate factory data acquisition and explores its potential impact on the fertilizer industry.

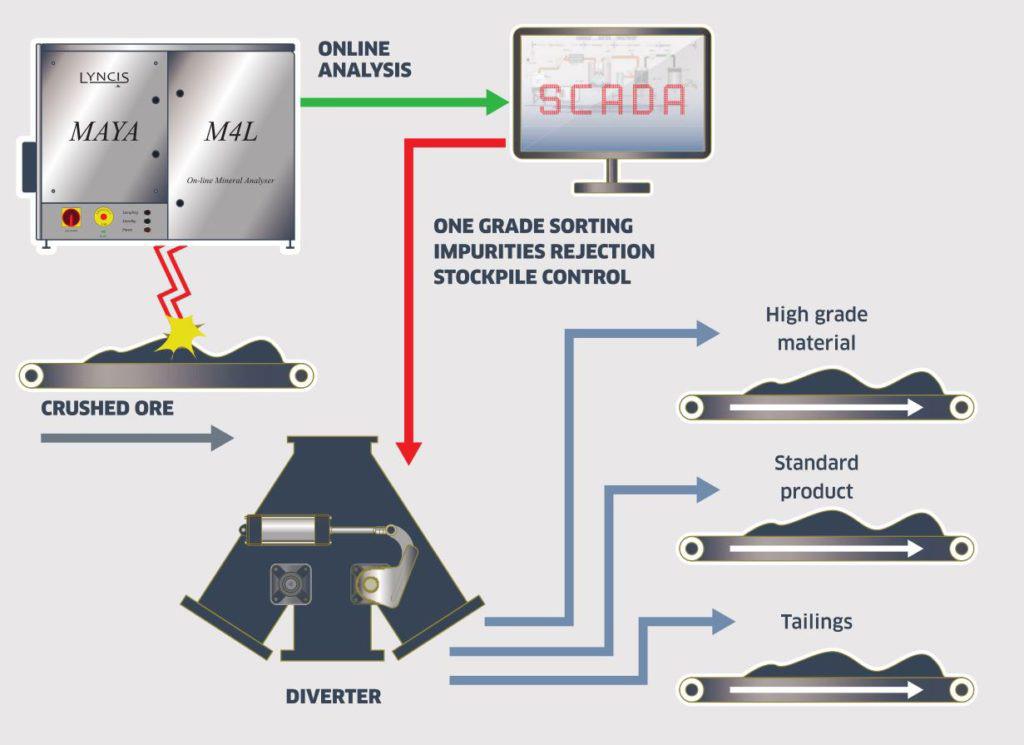

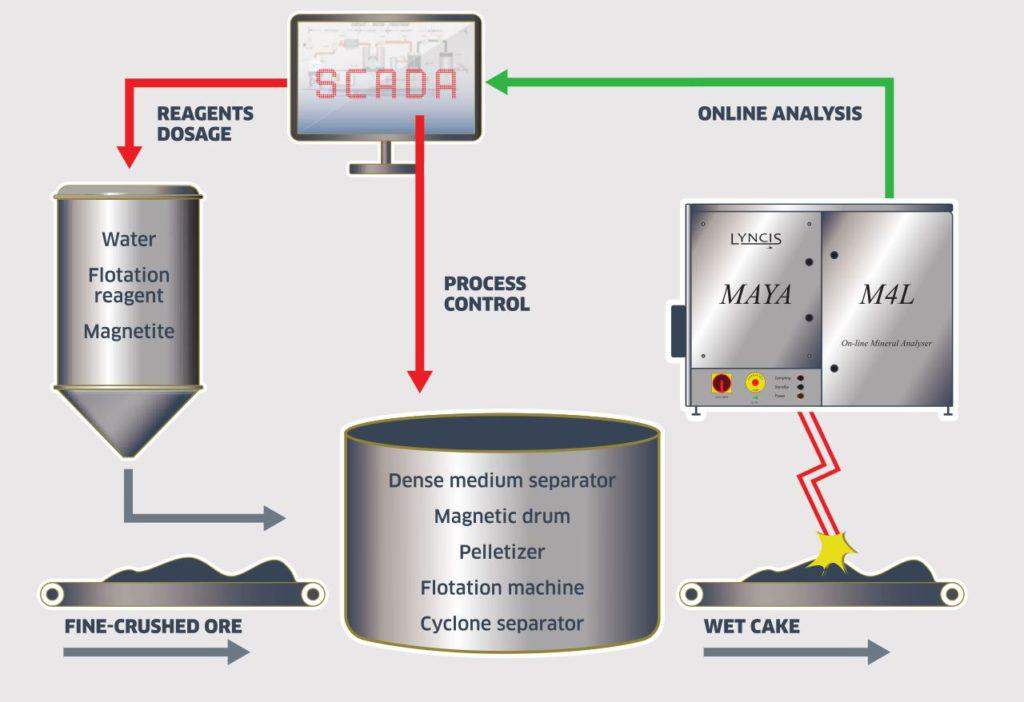

53 Moving Online

Alexander Baryshnikov and Mindaugas Dailide, Lyncis, Lithuania, outline safe and cost-effective techniques for online elemental analysis in fertilizer production.

58 All In Good Sense

René Braun, Grandperspective, Germany, explains how intelligent ground-based remote sensing systems can bring both safety and environmental protection to fertilizer manufacturing.

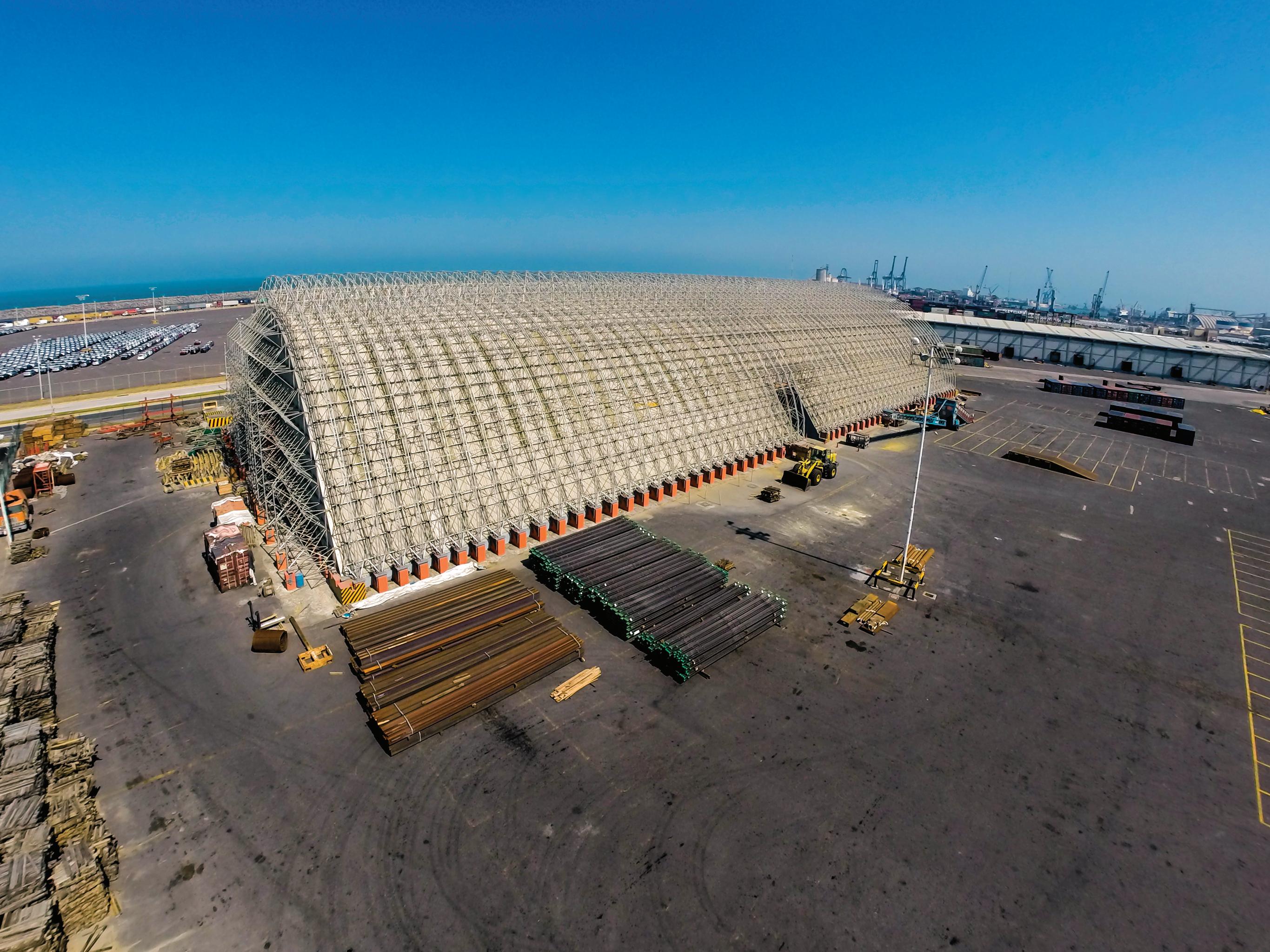

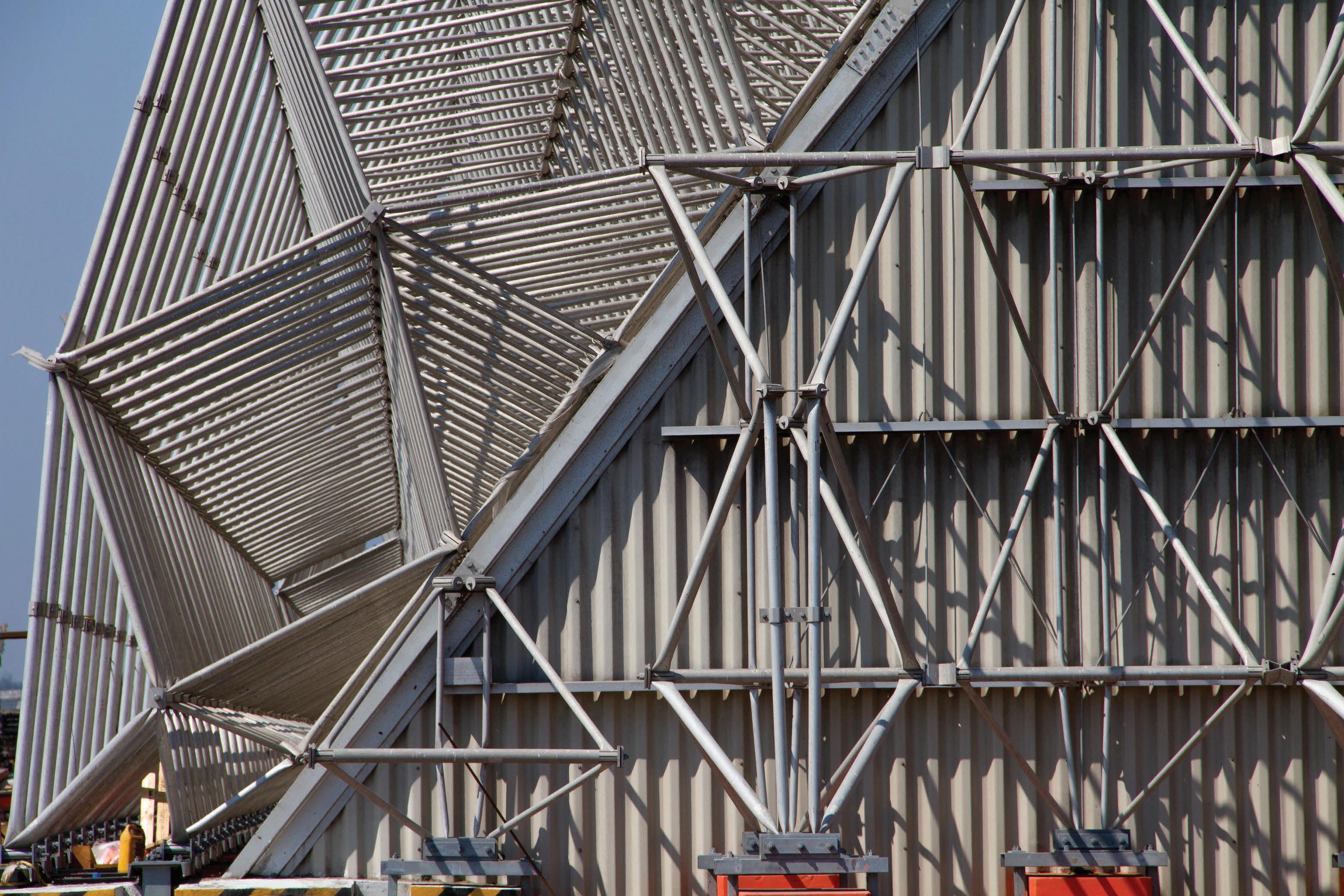

64 No Place Like Dome

Rebecca Long Pyper, Dome Technology, USA, outlines the benefits of domes for fertilizer storage, including structural longevity, handling options and customisation.

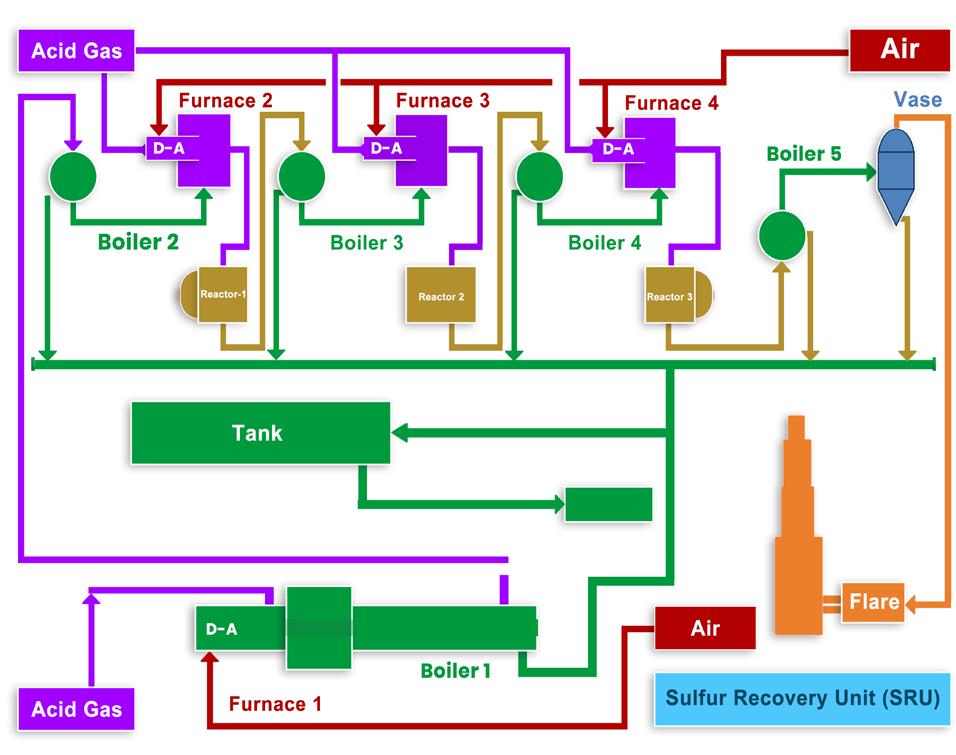

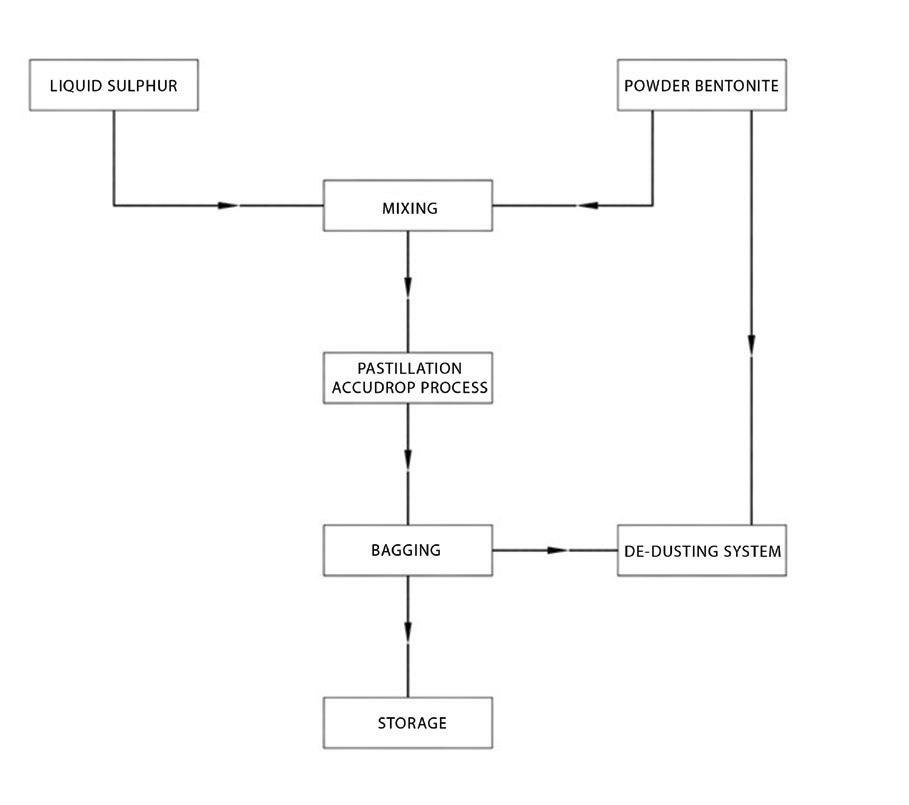

68 The King Of Chemical Elements

AK Tyagi, Nuberg Engineering Ltd., India, examines the role of sulfur in modern society and its significance for the fertilizer industry.

ASME PCC-2 Compliant Heat Exchanger Tube Plugging System

Trusted by fertilizer plants around the world as their go-to solution for heat exchanger tube leaks, Pop-A-Plug Tube Plugs from CurtissWright are engineered for optimal performance throughout the life cycle of equipment. Controlled hydraulic installation eliminates welding and time-consuming pre-/post-weld heat treatments that can cause damage to tubes, tube sheet ligaments, and joints.

• Simple hydraulic installation − no welding

• Helium leak tight seal to 1x10 -10 cc/sec

• 100% Lot tested to ensure unmatched quality

• Pressure ratings Up to 7000 PsiG (483 BarG)

• Wide range of sizes and ASME/ASTM certified materials available

MANAGING EDITOR

James Little james.little@palladianpublications.com

SENIOR EDITOR

Callum O’Reilly callum.oreilly@palladianpublications.com

DEPUTY EDITOR

Emily Thomas emily.thomas@palladianpublications.com

EDITORIAL ASSISTANT

Jack Roscoe jack.roscoe@palladianpublications.com

SALES DIRECTOR

Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER

Ryan Freeman ryan.freeman@palladianpublications.com

PRODUCTION

Iona MacLeod iona.macleod@palladianpublications.com

ADMINISTRATION MANAGER

Laura White laura.white@palladianpublications.com

EVENTS MANAGER

Louise Cameron louise.cameron@palladianpublications.com

DIGITAL EVENTS COORDINATOR

Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL CONTENT ASSISTANT

Kristian Ilasko kristian.ilasko@palladianpublications.com

DIGITAL ADMINISTRATION

Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

Palladian Publications Ltd, 15 South Street, Farnham, Surrey GU9 7QU, UK Tel: +44 (0) 1252 718 999 Website: www.worldfertilizer.com

World Fertilizer Subscription rates: Annual subscription: £50 UK including postage £60 overseas (postage airmail) Two year discounted rate: £80 UK including postage £96 (postage airmail).

Subscription claims: Claims for non receipt of issues must be made within 3 months of publication of the issue or they will not be honoured without charge.

Applicable only to the USA & Canada: World Fertilizer (ISSN No: 2398-4384, USPS No: PENDING ) is published 8 times a year by Palladian Publications Ltd GBR and distributed in the USA by Asendia USA, 701 Ashland Ave, Folcroft PA. Application to Mail at Periodicals Postage Prices is pending at Philadelphia, PA and additional mailing offices. POSTMASTER: send address changes to World Fertilizer, 701 Ashland Ave, Folcroft, PA. 19032.

Writer, historian, broadcaster, and all-round national treasure, Sir David Attenborough, not only saw in his 98th birthday this month, but also celebrated a milestone 70 years on our screens, having captivated audiences through his boundless exploration of our planet and the creatures that inhabit it. The celebrations are a reminder of just how far-reaching Attenborough’s influence has been. With a host of plant and animal species having been named in his honour, including the ‘Attenborosaurus’ and the ‘Attenboroughi’ butterfly, and a Guiness World Record and a knighthood to add to his list of accolades, Sir David has well and truly earned his reputation as a spokesperson for conservation and a leader in the fight against climate change.

Back in 2019, at a screening of the BBC nature series, Seven Worlds, One Planet, Sir David offered his advice to a five-year old child who asked what he could do to save the planet. “Don’t waste electricity, don’t waste paper, don’t waste food. Live the way you want to live but just don’t waste. Look after the natural world, and the animals in it, and the plants in it too. This is their planet as well as ours. Don’t waste them,” Attenborough said.1

Five years on, Attenborough’s words carry more weight than ever. Currently, a staggering 2.12 billion tons of waste are generated globally every year. Food waste makes up a hefty 1.3 billion tons of this waste, which is equivalent to around three trillion meals.2 Alarmingly, in 2022, Tesco reported that forgotten food was costing families approximately £800 annually, labelling Britain a nation of ‘dinner binners’. Waste in every capacity is a social, humanitarian, environmental and financial problem, and its reduction is vital across all sectors; the fertilizer industry is no exception.3

The process of fertilizer production is notoriously energy-intensive and both heat and energy are by-products which often go to waste. It is refreshing, however, to see several key producers becoming more innovative in utilising waste, to enhance both plant efficiency and sustainability.

Alfa Laval’s system upgrade for Kemira’s sulfuric acid plant in Helsingborg, Sweden, is one shining example. The heat generated in the plant’s absorption and drying circuits using the old direct cooling system was simply emitted into the sea next to the plant. A full reconstruction of the cooling system was performed, using plate heat exchangers in a closed loop cooling circuit. Heat could then be recovered to use for the district heating network, resulting in economic and sustainability gains. The project produced annual savings of 240 GWh and covered 25% of the city’s heating needs and all domestic hot water in the summer months.4

As part of the EU’s ambition to become carbon-neutral by 2050, carbon capture, storage, utilisation and reuse offers another opportunity for innovation. Yara appears to be a step ahead of the curve, with its clean ammonia initiative designed to capture 800 000 tons of CO2. Carbon is then liquefied, loaded onto ships, and subsequently locked away below the seabed in Norway. Earlier in the year, Linde Engineering also signed a contract with Yara to build a CO2 liquefaction plant in the Netherlands adjacent to the company’s ammonia plant.

Navigating waste management and utilisation is a recurring theme in this issue of World Fertilizer; Stamicarbon discusses its granulation process which incorporates acidic scrubbing for ammonia capture and avoids disposal streams entering the atmosphere (p.15). Nanoprecise also considers how energy wastage stemming from minor faults in engines and motors could be mitigated (p.19), and both JESA and Novaphos examine the possibility of by-products and co-products of fertilizer production being utilised in other industries (p.32 and p.42). There is always potential for further action and innovation in this sphere, but the industry has certainly put its best foot forward on the journey to minimising environmental damage, maximising efficiency and promoting sustainable development.

*References are available on request.

In Astana, EuroChem has signed an agreement with China National Chemical Engineering Co. (CNCEC) for the design, construction and commissioning of a chemical complex in Janatas, Jambyl Region, Kazakhstan. CNCEC is a global provider of industrial engineering technologies with 70 years of experience in constructing petrochemical facilities.

The combined total investment to date and planned CAPEX will exceed over US$1 billion, and the project is included in the Integrated Kazakhstan Industrialization Roadmap.

During Phase I, a phosphate mining complex was built and commissioned. As part of Phase II, a contract has been signed and the company has started construction of a sulfuric acid facility to be commissioned in 2026. Following the realisation of Phase III, in 2027, the group will launch a chemical complex.

“The total annual output will exceed 1 million tpy of mineral fertilizers and associated industrial products. The products from the new complex will be in high demand in Kazakhstan and other Central Asian countries, as well as in China, Russia and European countries,” said EuroChem Group President, Oleg Shiryaev.

The new plant’s unique technology will enable it to avoid phosphogypsum waste, common in such operations, replacing it with eco-friendly synthetic gypsum and calcium chloride – by-products used in construction materials and as reagents for road construction, coal and hydrocarbon industries.

FertigHy is set to build its first factory in the Hauts-de-France region in Northern France. The €1.3 billion CAPEX investment build is expected to be in operation by 2030 and will produce low-carbon fertilizers. The production process will use renewable and low-carbon electricity to produce hydrogen, a substitute to imported natural gas. FertigHy will receive support from the French government to assist its kickstart operations in France. The announcement was made at the Choose France Summit, hosted by Emmanuel Macron, President of France.

The agriculture sector alone is responsible for more than 10% of the EU’s total greenhouse gas emissions, with European farmers using over 11 million tpy of nitrogen fertilizers. The European Commission has identified the energy-intensive sector as key for decarbonisation, supporting the transition to low-carbon, affordable alternatives which are produced locally.

Backed by its founding investors, EIT InnoEnergy, RIC Energy, MAIRE, Siemens Financial Services, InVivo, and HEINEKEN, FertigHy plans to build, own and operate several large scale fertilizer factories across Europe producing cost-competitive, low-carbon fertilizers for European farmers – starting in France.

José Antonio de las Heras, CEO of FertigHy, said: “A long-standing agricultural base and strong governmental support were principle triggers for FertigHy to choose Northern France to develop its first fertilizer manufacturing plant. Running on renewable and low-carbon electricity, this plant is a decisive step towards the production of European-made fertilizers and towards reducing imports of mineral nitrogen fertilizers. FertigHy will therefore contribute to the decarbonisation of French agriculture, where fertilizer production and use currently account for 30% of the sector’s total greenhouse gas emissions.”

Roland Lescure, Deputy Minister for Industry and Energy of France, commented: “We’re delighted to confirm the commitment of the French state for helping FertigHy to set up its first industrial facility in France. This project is undoubtedly a unique opportunity for France and its agriculture. This project represents one additional step towards the industry’s decarbonisation and strengthens Europe’s sovereignty in this sector. Choosing our country for the building of this first facility is further proof of France’s appeal.”

Laurent Saint-Martin, CEO of Business France, added: “We welcome the establishment in France of this first low-carbon fertilizer production plant, supported by our teams. This investment demonstrates our commitment to promoting an industry with a reduced carbon footprint and contributes to building a sustainable future for all.”

Construction of the factory will begin in 2027. Once complete in 2030, the plant will bring 250 direct jobs to the area and deliver 500 000 t of low-carbon nitrogen-based fertilizer annually, which equates to around 10% of France’s agricultural sector’s consumption. A second FertigHy factory is planned to be built in Spain and will become operational soon after the French one.

USA Agrimin signs binding offtake agreement with Gavilon Fertilizer

Minbos provides phosphate fertilizer project update

Yara International and Kongsberg Digital enter collaboration on digital twin technology

Reward Minerals is granted Carnarvon Potash Project licence thyssenkrupp Uhde and Johnson Matthey sign MOU to offer blue ammonia solution Visit our website for more news: www.worldfertilizer.com

Agrimin has announced that it has signed a binding offtake agreement with Gavilon Fertilizer, for the supply of 50 000 tpy of SOP produced from the Mackay Potash Project for sale and distribution in the US.

Gavilon is a leading wholesaler of NPK bulk blending grade fertilizers and has one of the largest distribution systems throughout major agricultural growing areas across the US, including on railroads, rivers and ports. Gavilon imports and manages a wide portfolio of essential plant nutrition products, soluble fertilizers and enhanced efficiency fertilizers in bulk.

Agrimin has now secured offtake agreements for a total of 315 000 tpy of SOP, representing 70% of the Mackay Potash Project’s planned production capacity of 450 000 tpy. In May 2021, Agrimin signed a 10-year binding offtake agreement with Sinochem Fertilizer Macao Ltd for the supply of 150 000 tpy and, in January 2022, Agrimin signed a seven-year binding offtake agreement with Nitron Group, LLC for the supply of 115 000 tpy.

Mark Savich, CEO of Agrimin said: “Gavilon is another Tier 1 offtaker for Agrimin and we look forward to partnering with them to successfully market and sell Agrimin’s low carbon, organic SOP throughout the US.”

Cinis Fertilizer has started up the production of mineral fertilizer potassium sulfate at its first production facility in Örnsköldsvik, Sweden.

With a fossil-free production method, they are the first in the world to produce an environmentally-friendly potassium sulfate with a low carbon footprint using industrial waste products as one of the inputs.

Just over a year ago, in mid-February 2023, ground was broken for Cinis Fertilizer’s first production facility for circular and environmentally-friendly potassium sulfate in Köpmanholmen, just outside Örnsköldsvik. Now, 15 months after the ground-breaking, Cinis Fertilizer has started up the production.

“This is a green industrial project that has been realised in record time. In the coming weeks, we will now gradually increase production and we expect to have full production for 2H24. This means that we will contribute to reducing the carbon footprint from agriculture already this year,” said Jakob Liedberg.

“I would like to extend a big thank you to all the employees and partners who worked hard to build and put into operation a brand-new production facility in a remarkably short time. The fact that we in all essentials managed to keep the very tough schedule is an outstanding achievement and without your efforts this would not have been possible,” continued Jakob Liedberg.

Cinis Fertilizer’s production facility in Örnsköldsvik is built for a production capacity of 100 000 tpy of potassium sulfate. All potassium sulfate from the production facility in Örnsköldsvik will be delivered to the Dutch fertilizer producer Van Iperen International. The first delivery to Van Iperen International is planned for 2Q24.

• ONE-STOP-SHOP

Our compact, modular green ammonia plant technology is a comprehensive, sustainable, and economical solution that can significantly boost local production. Use renewable energy sources to create ammonia right where it’s needed most. Ready to build your own future-proof and carbon-free ammonia plant? Start small to create a big impact at www.stamicarbon.com.

• CARBON-FREE PRODUCTION

• COMPETITIVE CAPEX

• COMPACT & TAILOR-MADE DESIGN

• PROVEN TECHNOLOGY

ACHEMA 2024

10 – 14 June 2024 Frankfurt, Germany achema.de/en

Turbomachinery and Pump Symposia 2024

20 – 22 August 2024 Texas, USA tps.tamu.edu

AIChE 2024 Annual Safety in Ammonia Plants and Related Facilities Symposium 09 – 12 September 2024 California, USA

aiche.org/conferences/annualsafety-ammonia-plants-andrelated-facilities-symposium/2024

INDIA Yara Clean Ammonia and Greenko ZeroC sign term sheet for supply of renewable ammonia from AM Green’s production facility

Yara Clean Ammonia and Greenko ZeroC have signed a term sheet for supply of renewable ammonia from Phase 1 of AM Green’s ammonia production facility in Kakinada, India.

This term sheet and the subsequent offtake agreement covers the long-term supply of up to 50% of renewable ammonia from Phase 1 of AM Green’s ammonia production facility in Kakinada. The plant will produce, and export renewable ammonia derived from round-the-clock carbon free energy by 2027.

Renewable ammonia and other sustainable fuels from AM Green’s platform will be compliant with EU RFNBO and Renewable Energy Directive requirements. For Yara Clean Ammonia, the renewable ammonia supply will contribute to produce low-emission fertilizer and for decarbonising other industries like shipping, power and energy intensive industries.

Mahesh Kolli, President of AM Green, said: “We are delighted to partner with Yara Clean Ammonia to propel the transformation of various industries and several OECD economies. Continuous focus on innovation combined with execution reinforces AM Green’s leadership position as a global clean energy transition solutions platform for low-cost green molecules such as hydrogen, ammonia, fuels and other chemicals.”

Hans Olav Raen, CEO of Yara Clean Ammonia, added: “The AM Green Kakinada project expands our portfolio of ammonia produced with renewable energy and consolidates Yara Clean Ammonia’s position as a reliable supplier of low-emission ammonia to established and emerging markets like fertilizer production, cracking of clean ammonia to hydrogen, shipping fuel, power generation and other industrial applications.”

ANNA 2024

29 September – 04 October 2024 Montréal, Canada annawebsite.squarespace.com

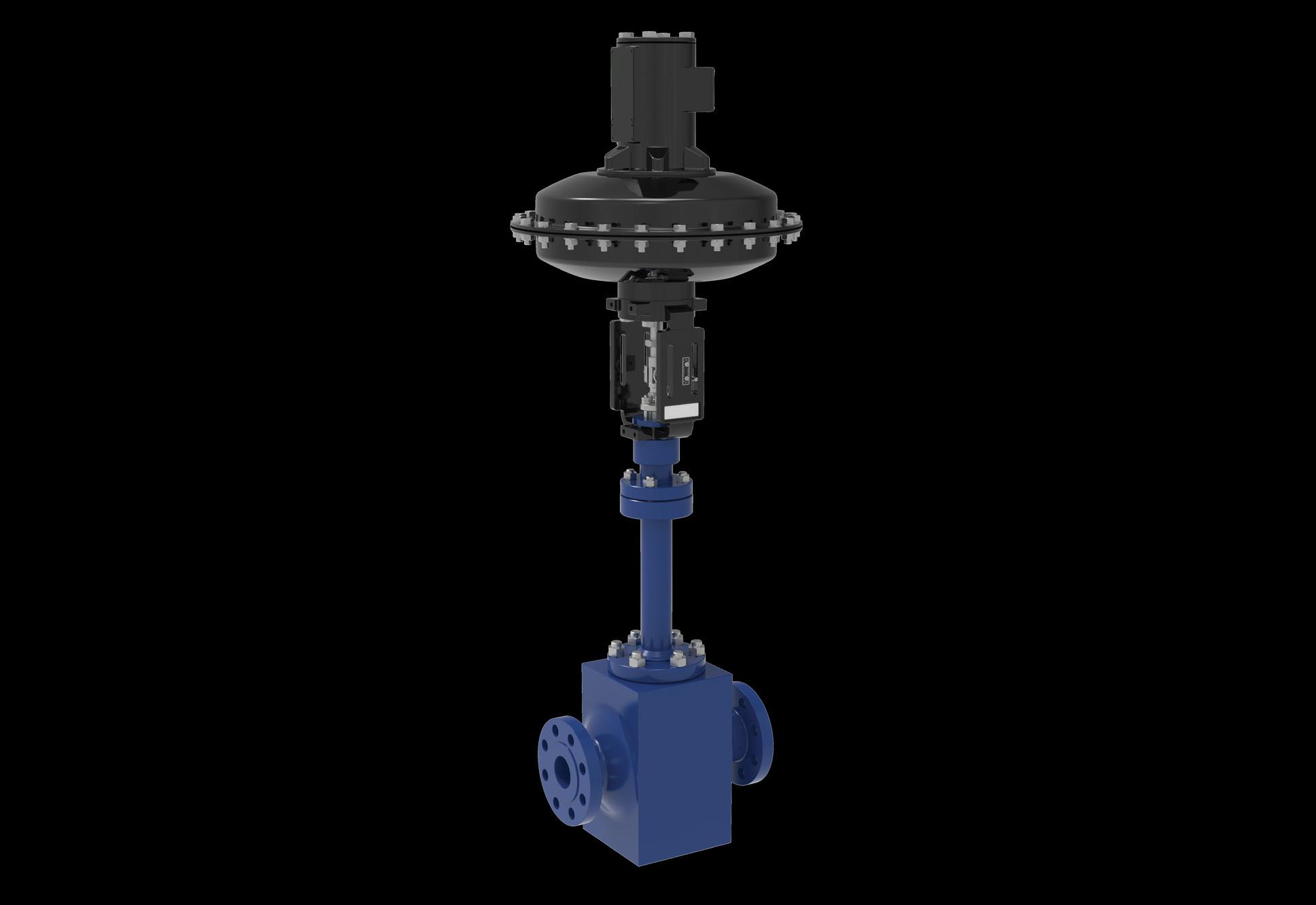

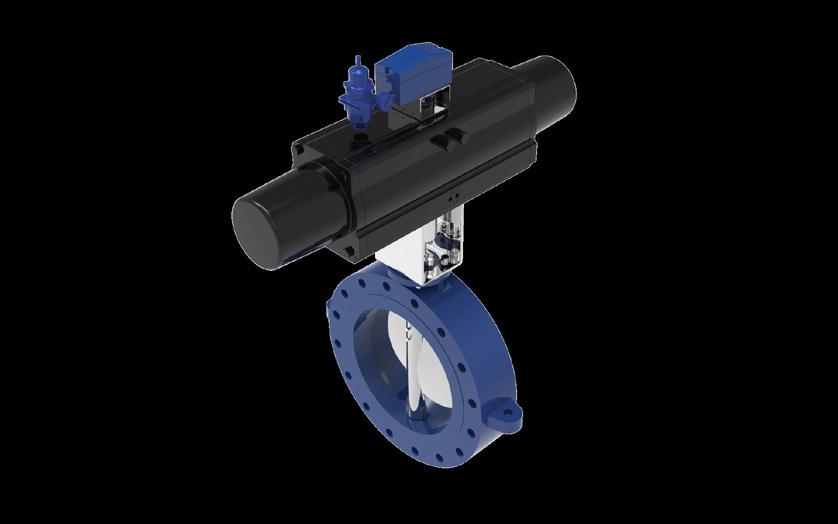

IMI is launching its first control valve for urea plants, which is set to be installed at one of the major fertilizer plants in the MEA region for the first time later this year.

The newly designed urea valve draws on IMI’s experience in designing, installing and maintaining valves in power plants and oil and gas refineries, as well as extensive engagement with the industry. The valve is a product of IMI’s Growth Hub innovation engine, which aims to accelerate the development of new products in collaboration with customers.

YKNOW2024

28 October – 30 October 2024 Texas, USA yokogawa.com

The fertilizer industry faces wide ranging challenges such as gland leakage, corrosion and erosion of valve internals, as well granulation at lower fluid temperatures. Additionally, the flashing liquid is a particular challenge for the design of urea valves because it impinges on the body or trim parts at higher velocities due to changes in fluid phases.

IMI’s solution features an angle over-the-plug configuration with its straight outlet for the flashing fluid, while a rapid increase of the flow diameter downstream where the fluid expands avoids flashing damage downstream of the valve.

As well as being designed to withstand highly corrosive urea with no dead zone in the body, the valve has been designed with ease of maintenance in mind, featuring a split body and integral bonnet.

Contributing Editor, Gordon Cope, discusses the innovative nature of the European fertilizer sector and why it seems set to thrive over the coming decade.

Over the last several years, Europe has been beset by multiple challenges, including the Ukraine war, sanctions against Belarus, pipeline sabotage and high gas prices. Each has had a profound effect on the fertilizer market, with far-reaching consequences.

Prior to 2021, the EU produced approximately 13 million tpy of nitrogen fertilizers, 2.9 million tpy of potash and 2.2 million tpy of phosphate products, while consuming 11.2 million tpy of nitrogen, 2.6 million tpy of

potash, and 2.6 million tpy of phosphates. While the numbers look fairly well balanced on paper, the equation concealed a vulnerability; around 8 million tpy of fertilizers were being imported from Belarus, Russia and the Ukraine.

Without a doubt, the major geopolitical events impacting potash in Europe have been the international sanctions imposed against Belarus in 2021, and the invasion of

Ukraine by Russia in 2022. Both Belarus and Russia were major potash exporters, but the restrictions have crippled their domestic sectors; Russia’s output dropped 45%, to around 5 million tpy, and Belarus over 60%, to around 3 million tpy. The EU had to scramble to fill a hole amounting to approximately 1 million tpy.

The most obvious, near-term solution was to rely on imports from North America. Nutrien, K+S Saskatchewan and Mosaic all announced plans to expand production in Canada by several million tpy.

The EU, however, has limited expansion potential. Most EU production of potash ore originates in Germany (87%), and Spain (13%). Production has been slowly dropping over the last decade as economic deposits are depleted, and now stands at approximately 3.3 million tpy of potash ore. Mines in Germany face significant environmental opposition generated by massive waste deposits. The closest potential for new production is in Spain. In November 2023, Highfield Resources released an updated feasibility study outlining the favourable economics of its proposed Muga-Vipasca mine in northern Spain. Capital costs are estimated at €735 million; the mine has sufficient reserves to produce 1 million tpy of muriate of potash for 30 years. The Austrian-based company noted that the project is fully permitted and construction-ready, subject to financing.

In the UK, Anglo American continues to develop its 13 million tpy Woodsmith polyhalite project in the Yorkshire region. The underground mine involves digging 1.6 km-deep mine shafts and a 37 km tunnel to transport raw material to the port of Teesside. The rock will then be milled into sulfate of potash magnesia (SOPM) for export around the world. In late December 2023, Anglo American announced that it was preparing to sell a 49% minority stake in the US$9 billion project. Estimates suggest that a further US$4 billion will be required to finish the tunnel, with operations now expected to begin in 2027.

Except for a small amount of production in Finland, there is no commercial mining of phosphate in the EU. Traditionally, Europe has relied on two main sources; Russia accounted for almost 60%, and Morocco around 40%. While the EU has imposed sanctions and restrictions on a wide range of Russian exports, they do not include food or fertilizers. Complications arising from financial payment restrictions and transportation insurance premiums have greatly impeded their movement, however.

Morocco, which holds the world’s largest phosphate reserves, is stepping in to meet EU demand. State-owned OCP announced that it will boost shipments by 50%, and is building three 1 million tpy granular phosphate units at Jorf Lasfa.

The EU has also renewed interest in recycling through the European Sustainable Phosphorous Platform (ESPP), a broad-based coalition dedicated to recovering phosphorous compounds. The EU generates over 800 000 tpy of phosphorous in animal byproducts, food scraps and sewage; when sewage sludge is incinerated, for instance, the fly ash contains up to 11% phosphorous compounds. Fertilizer maker ICL is recycling phosphates from waste streams at its Amfert fertilizer plant near Amsterdam. The recycled mineral

displaces approximately 10% of the mined phosphate feedstock at the plant.

These efforts have been overshadowed by a recent development, however. In July 2023, Norge Mining announced that it had discovered an immense reserve of high quality phosphate rock in southern Norway. The 70 billion t deposit of igneous rock is sufficient to meet global demand for fertilizer, EV batteries and renewable power storage for decades to come. The company is contracted with ABB, an international engineering firm, to develop the front-end engineering and design (FEED) study. The goal is to design a completely electrified mine, with a tentative start-up date of 2028.

While North America has over 20 million tpy of new ammonia capacity either planned or under construction, the EU has relatively little new capacity being added. ANWIL is an exception, having recently finished expanding nitrogen capacity at its complex in Wloclawek, Poland. Three new modules, a 1200 tpy nitric acid unit, an ammonium nitrate solution unit, and a drum granulation unit, will increase total fertilizer capacity from 966 000 tpy to 1.46 million tpy. The company, which expects the expansion to come online in 2024, will increase Poland’s security of supply.

There are several reasons for the slowdown in Greenfield investment. The manufacture of ammonia using steam methane reforming requires lots of natural gas as both feedstock and energy. In 2022 when the Ukraine war drove spot prices at the Netherland’s TTF hub over €300 per megawatt hour (MWh), as much as 40% of ammonia output was shut-in. Natural gas prices have recently eased under €30 per MWh, but they still remain three times as expensive as the US Henry Hub spot prices for the foreseeable future. Other factors limit European competitiveness. Ammonia manufacturing emits 2.5 kg of CO2 for every 1 kg produced. The EU has enacted the renewable energy directive (RED III), which requires the fertilizer industry to replace 42% of grey hydrogen with renewable fuel of non-biological origin (RFNBO) by 2030.

The latter, along with hefty government subsidy programmes, is spurring an investment in green ammonia. Yara has been working with Orsted, a Netherlands-based offshore wind-farm developer, to convert a portion of its ammonia output at its existing plant in Holland to 75 000 tpy of green ammonia using wind-generated electricity and hydrolysis.

In late 2022, Cepsa announced a new green energy corridor between southern and northern Europe. The Spanish firm intends to initially produce 750 000 tpy of green hydrogen at its San Roque Energy Park near the port of Algeciras. The hydrogen will then be converted into ammonia and shipped to the Port of Rotterdam in Holland. In June 2023, Yara Clean Ammonia joined Cepsa in a strategic partnership to supply its global supply base and logistical footprint in order to establish a robust supply chain to transport and redistribute clean energy to fertilizer customers in northern and central Europe.

thyssenkrupp and partners are planning a new 365 000 tpy plant in Duisburg, Germany. The green ammonia will use wind

and solar power and electrolysis in its production process. First output is expected in 2025.

In order to meet RED III fertilizer goals alone, however, the current renewable hydrogen capacity in Europe would have to expand by at least two orders of magnitude. The fertilizer sector would also have to compete with utilities, steel, petrochemicals and refineries for low-carbon feedstocks.

European fertilizer companies aiming to keep costs down and meet low-carbon regulations are thinking outside of the box. Traditionally, ammonia production has been integrated, in which breaking down natural gas into hydrogen, combining it with atmospheric nitrogen to create ammonia, then forming it into farm-ready fertilizer is all done in one facility. Companies are now looking to decouple the process by shifting emission-intensive hydrogen and ammonia production to jurisdictions where natural gas is lower in cost and regulations are less strict.

In March 2023, Yara signed a binding offtake agreement to purchase 100 000 tpy of renewable ammonia from ACME Group of India. The ammonia will be produced from a facility in Oman, using 300 MW of electrolyser capacity powered by 500 MW of solar. The project, scheduled to start up in 2027, is part of ACME’s larger goal to establish up to 900 000 tpy of renewable ammonia capacity in Oman’s Duqm special economic zone. The cost of the facility, and Yara’s purchase price, have not been disclosed. While Yara intends to reduce the carbon footprint of its ammonia output, it is also developing markets for other sectors that need NH3 which meets the EU’s renewable fuel of non-biological origin (RFNBO) standards.

The US also beckons. In September 2023, Netherlands-based OCI Global reached an agreement with New Fortress Energy to buy all clean hydrogen output from the latter’s ZeroPark 1 project in Texas. The 200 MW plant is expected to produce approximately 17 000 tpy of hydrogen, which OCI will then convert to 80 000 tpy of green ammonia at its Beaumont complex. Plans are underway to double capacity to 160 000 tpy by 2026, in order to supply exports to Europe.

Yara is planning on building a blue ammonia plant with Enbridge, a major North American pipeline company, in Texas. The latter operates the Enbridge Ingleside Energy Center (EIEC), a large terminal located in Corpus Christi, Texas, on the Gulf of Mexico. Yara has been searching for a Greenfield site to produce large amounts of blue hydrogen for use in both fertilizer and marine transportation purposes. If confirmed through front-end engineering and design (FEED), production would start-up in 2027/2028. Once operational, the plant will have a capacity of up to 1.4 million tpy of blue ammonia.

German-based RWE, LOTTE Chemical of Korea, and Japan’s Mitsubishi plan to build a clean ammonia production and export facility in the port of Corpus Christi, Texas. The complex will feature a series of units with a final capacity approaching 10 million tpy by 2030. Output will be in the form of both blue and green ammonia, and will be exported to Asia and Europe for use as both fuel and a source of renewable hydrogen.

Aside from green ammonia, organic fertilizer remains a low-carbon alternative. The EU's animal population

includes 75 million cows and over 1.6 billion poultry. Chicken manure is about three times higher in NPK than cow manure (guano being the original commercial fertilizer), but the latter produces only 1 kg per day, vs 30 kg for the average bovine. When all added up, however, farms produce around 3.5 million tpd of dung.

Organic fertilizer has been formally adopted under the EU’s Green Deal, a €1 trillion growth strategy designed to transition the continent to a climate-neutral, sustainable economic model. Actions include establishing 25% of arable land under organic practices. Many farmers are eager to increase use of organic fertilizer for both sustainability reasons and a higher premium paid for organically-produced products. Studies conducted by the Weihenstephan-Triesdorf University of Applied Sciences over a 10-year period confirmed that organic fertilizer improved soils and reduced energy usage. The downside was 50% lower yield rates; the goal of reaching 25% organic farming in Europe would place significant pressure on conservation lands to maintain levels of output.

While analysts believe that building the new hydrogen economy in Europe will require trillions of dollars, geologists may have found a way to drastically reduce costs. Explorers are now uncovering immense quantities of unattached H2, also called white hydrogen; up to 46 million t of pure hydrogen have been discovered in the Lorraine region of France alone. Tapping into hydrogen deposits would simply require commonly-used natural gas drilling equipment, and would produce low-carbon hydrogen at a fraction of the cost of hydrolysis.

While demand for all fertilizer products is expected to expand as consumers in the developing world shift their palate towards more protein, the growth in non-agricultural uses of ammonia will dominate the sector. Marine transportation holds special promise. Transporting and burning hydrogen itself is rather costly and complex; a much easier method is to convert the gas into liquid ammonia, which can then be consumed in ICE engines with minor alterations. Rystad Energy predicts that by 2035, there could be over 170 marine export terminals focusing on converting hydrogen into clean ammonia for use in marine transport vessels. The consultancy estimates that this market could create over 50 million tpy of new demand by 2035, and up to 100 million tpy of demand by 2050.1

Over the near-term, Europe will rely on sources in North America to replace potash imports from Belarus and Russia. In the longer-term, ammonia producers will shift energy-intensive segments of their operations to lower cost jurisdictions in North America and the Middle East. The growth in new uses for ammonia in the utility and marine transportation sectors promises immense opportunities. While many challenges remain, the European fertilizer sector has proven itself to be innovative and responsive for over a century, and will continue to thrive over the coming decade.

References

1. www.rystadenergy.com/news/hydrogen-exports-shift-ammoniaproduction-2035

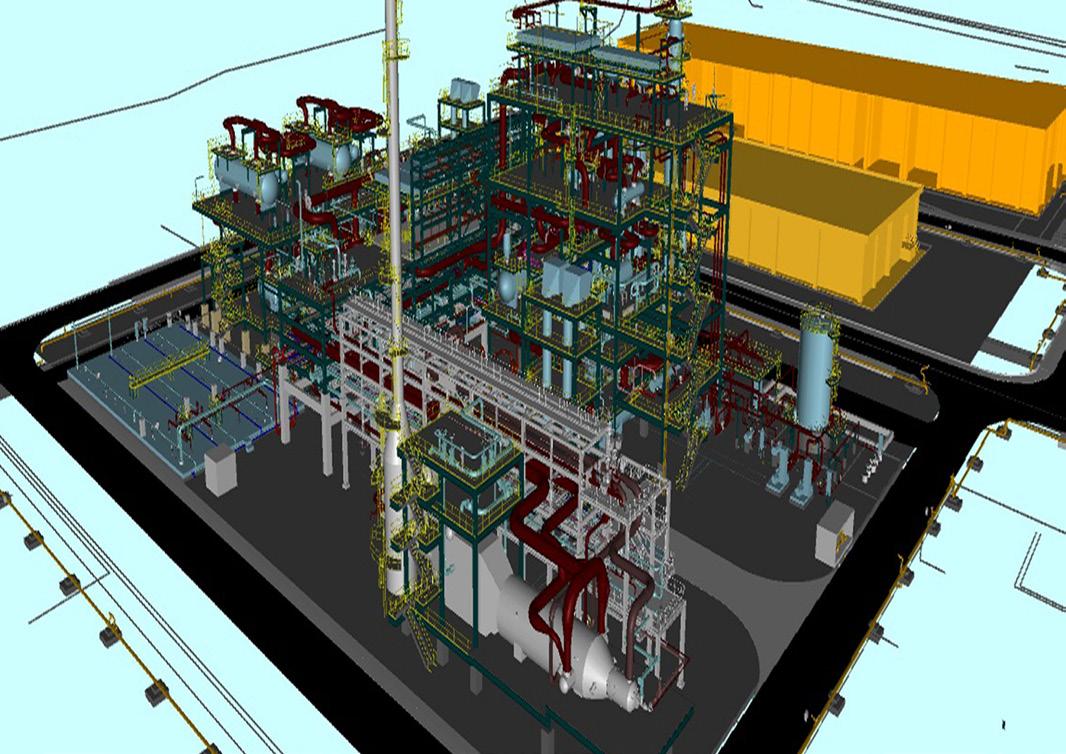

BarbaraCucchiella,AhmedShams,andBranislavManic, Stamicarbon,theNetherlands,considerhownew granulationtechnologiescouldresultinamorepremium endproductthatcanbetterwithstandchallengingstorage andshippingconditions.

Urea is one of the world's most vital commodities, frequently travelling long distances to meet global demand. Over a quarter of its production is intended for international markets, emphasising the importance of maintaining urea's physical qualities, such as higher crushing strength, low caking, and lower dust formation during transit. In this context, granulation technology plays a crucial role. This final step in urea synthesis is recognised as an effective method for producing high quality granules capable of withstanding shipping and storage challenges. Furthermore, granulation technology proves to be economically favourable for large-scale operations targeting exports. This article explores granulation technology and the advantages it offers to the global fertilizer sector.

Stamicarbon has extensive experience licensing urea granulation plants in various markets. In 1998, the first test facility was contracted in Belarus. Here, a small granulation unit with a capacity of 280 tpd was converted to the Stamicarbon LAUNCH FINISHTM granulation design. Subsequent scaling up occurred in Canada, where two existing granulation lines, each with a capacity of 625 tpd, were converted to the new design. The first grass-roots plant, with a capacity of 2000 tpd, was

started up in June 2006 in Egypt. Later, that plant was revamped to run at a higher capacity.

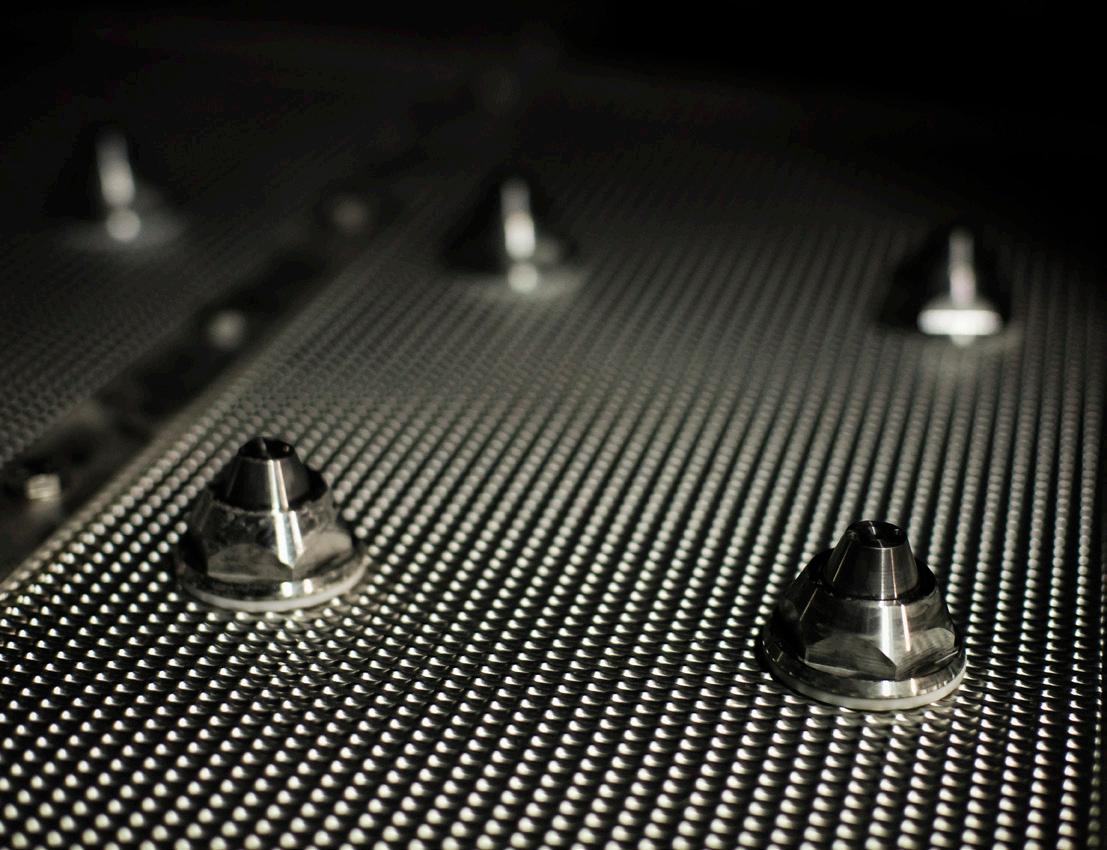

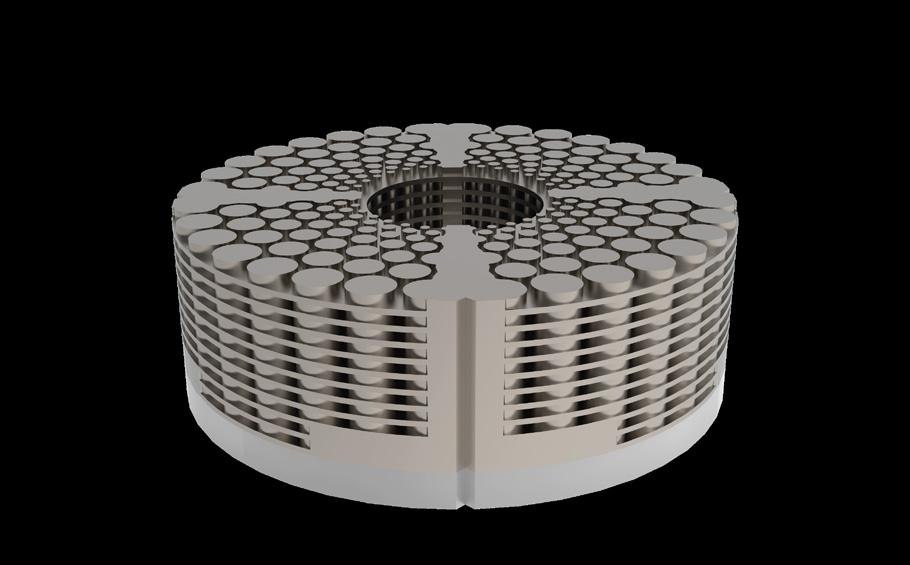

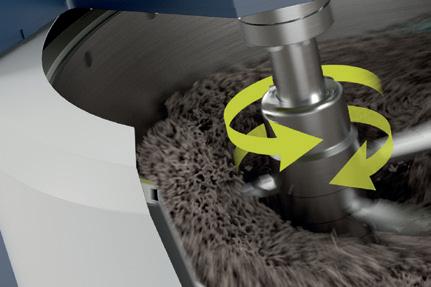

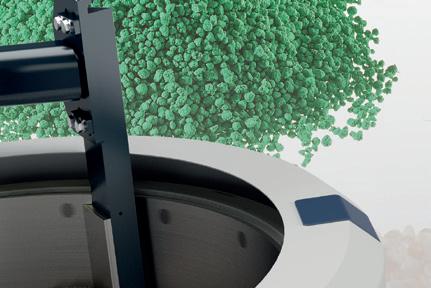

Through Stamicarbon's urea fluid bed granulation process, urea melt with a concentration of about 98.5 wt% is distributed by film spraying nozzles of proprietary design (Figure 1). Granule seeds are coated with thin layers of urea melt film until they reach the required product diameter. The granulation design is cost-effective in terms of operational costs due to reduced formaldehyde content in the final product and low dust formation. In practice, this design has been seen to operate for up to three months without the need for cleaning. Since the first implementation, nearly 20 plants of various capacities have been licensed, designed, and put into operation.

The largest running granulation plant based on the standard granulation design is the Pardis III plant (Figure 2), with a nameplate capacity of 3250 tpd, contracted in 2011 and started up in 2018. The plant can operate at 110% capacity with a turndown ratio of 60% of the nameplate capacity. It is connected to a fertilizer-grade urea plant. An on-stream time of more than two months can be achieved during extreme heat conditions in summer.

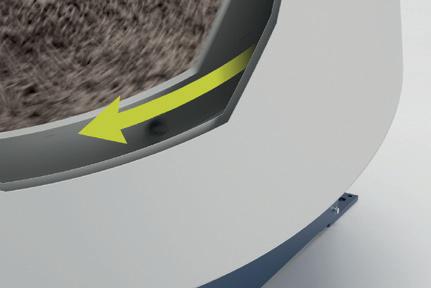

An optimised granulation design was introduced by Stamicarbon in 2008, in line with the company's commitment to innovation and sustainable development. The layout is simplified with fewer equipment items, enabling a significant reduction of CAPEX and OPEX costs while maintaining its original performance and high on-stream times. In this improved design, the urea melt is fed to the granulator the same way as in the standard design. The key difference is in the last compartment, where the granulated product is cooled down to a lower temperature. After passing the lump screen, the product is directly lifted with a bucket elevator to the classification equipment. Furthermore, the complete solid product flows, using gravity force, through the main screens. The coarse product is fed to the crusher after cooling to a temperature of 70°C. The crushed product and the fines recycle flow are combined and recycled into the first compartment of the granulator as so-called seeds. The on-specification end-product in the outlet of the main screens is cooled to a storage temperature in a solid flow cooler that makes use of cooling water instead of cooling air. The dust-loaded air from the granulator, coarse cooler, and all the de-dusting points are collected and fed to a single granulator scrubber.

The omission of two main fluidisation fans helps lead to cost savings in power consumption. The fluid-bed granulator cooler was omitted by increasing the length of the cooling zone in the original granulator, and the fluid-bed product cooler was replaced by a solids flow cooler. Furthermore, the respective granulator cooler scrubber with all necessary pumps and a fan were omitted as well.

Additionally, to reduce the amount of fluidisation cooling air, a water injection system was installed in the discharge of the fluidisation air fan. This water injection system produces very fine droplets that evaporate along the air path to the granulator, cooling the fluidisation air. This feature is efficient on exceptionally hot days or when

CorrSolutions Delivers Tailored Asset Integrity Solutions

A Gulf Coast refining company revolutionized their corrosion monitoring location (CML) program with CorrSolutions’ innovative BOAR analysis. Using a combination of advanced analytics and expert collaboration, we transformed their piping CML management program, setting a new standard for efficiency and proactive maintenance strategies.

We specialize in asset integrity solutions tailored to your facility’s inspection and maintenance goals. We deliver the industry’s highest-quality services while helping you improve profitability and reliability by managing risk and controlling inspection costs throughout an asset’s lifecycle.

Contact CorrSolutions today and unlock total asset support at your facility.

© 2024 CorrSolutions

CorrSolutions@E2G.com

the plant operates at production rates above its nameplate capacity. During such times, a higher amount of fluidisation air is expected, and using this system can help mitigate the challenge.

The reduction of equipment items resulted in a significant reduction of the granulation plant footprint and the overall capital cost of the plant. The total CAPEX cost reduction is not only achieved by eliminating equipment, but there are also savings in equipment shipping cost, cost of insurance, construction, and the effect of reduced land use. Less operational equipment will also likely result in a reduction in maintenance costs and further operational savings.

During the crystallisation process of the urea melt in a granulator, the ammonia present in the urea melt is released and, in most cases, emitted into the air. The granulation process, designed for efficient and environmentally friendly production, incorporates acidic scrubbing for effective ammonia capture. After the dust scrubbing stage, sulfuric or nitric acid is injected into a circulating aqueous solution brought into contact with the ammonia-laden air. The applied acid reacts with ammonia, effectively reducing its concentration in the exhaust air. An ammonium salt generated in this reaction can be sent outside battery limits or, if sulfuric acid is applied, incorporated into the end product. In this way, no disposal streams are sent to the atmosphere.

To develop this design, several obstacles needed to be addressed. The salt produced by the scrubbing system is about 55% water by weight and can not be directly mixed with the main urea melt, which only contains 1.5% water and is fed into the granulator through nozzles. Therefore, to manage the water content in the recycled liquid urea ammonium sulfate (UAS) sent back to the granulator, a specific evaporation process is required (Figure 3). This recycled UAS solution is then combined with the urea melt inside the granulator. The sulfur content in the end product is minimal,

roughly 0.05 – 0.1% S, allowing the granules to be marketed as standard urea.

To meet the growing demand for sulfur as a plant nutrient, a flexible modular process for producing granulated urea with higher concentrations of ammonium sulfate has been introduced. A common approach involves recycling and concentrating liquid urea ammonium sulfate (UAS), allowing the salt to exit the granulation plant in solid form after being combined with molten urea. In this design, solid ammonium sulfate is added to molten urea. Existing granulation plants can be retrofitted to use this design with some modifications, upgrades to construction materials, and the installation of additional equipment.

Over the decades, there has been a rapid increase in projects designed with an increased maximum capacity of installed plants. Practical experiences with urea granulation plants with capacities above 3000 tpd have been positive, meeting the overall and on-stream customer expectations.

Stamicarbon explored designing larger capacity plants, up to 5000 tpd, while maintaining the proper design philosophy and product quality. This investigation led to the conclusion that a single-line configuration is more advantageous than a double-line configuration (two lines of 2500 tpd each), offering approximately 30% in CAPEX savings on total investments.

Based on the company's experience with scaling up the conventional design, certain operational and manufactural challenges and supporting measures have been solved to scale up the optimised granulation design.

In 2019 Stamicarbon licensed its first single-line 4000 tpd urea granulation plant, which entered the construction phase after completing the design phase. The plant is equipped with an MMV scrubber to comply with environmental regulations. In 2022 and 2023, the company secured contracts for licensing two more plants with a capacity of 4000 tpd each for a customer in Africa.

New granulation technologies offer a premium end product that can withstand long storage and extreme shipping conditions. This advantage makes granulation technology especially appealing in regions with an abundant supply of natural gas at lower costs. Thus, producers can focus on exporting a commodity product that is easier to transport and grants a premium, compared to directly exporting natural gas. Additionally, the larger size of a high end granulation technology product makes it highly attractive to many fertilizer markets.

Christian Keon, Nanoprecise Sci Corp., Canada, discusses how operational efficiency and reliability in fertilizer production can be enhanced with the help of advanced technologies.

In the dynamic world of fertilizer production, navigating challenging conditions is an everyday struggle for plant staff. High temperature and pressure characterise the environment, posing formidable obstacles to traditional condition monitoring techniques. Ensuring optimal performance with differing equipment sets at varying speeds is difficult, and these situations demand precise monitoring that can adapt to an ever-changing landscape.

Another significant challenge the industry faces is the constant risk of sudden damage induced by exposure to corrosive elements and abrasive materials. These adversaries not only impair equipment efficiency but also jeopardise the safety of personnel working in such environments. Moreover, the critical nature of the equipment amplifies the consequences of even the briefest downtime, leading to costly production delays and cost setbacks. Not to mention, monitoring unmonitored machines, particularly those located in remote or difficult-to-reach areas, can also be challenging, making maintenance hazardous and inefficient.

To combat these challenges head-on, the fertilizer industry must embrace advanced monitoring technologies capable of withstanding the rigours of high temperatures, intense pressures and varying speeds. These technical solutions should offer real-time insights into equipment performance, enabling proactive maintenance measures to mitigate the risk of unexpected failures.

The importance of predictive, prescriptive maintenance and energy monitoring has never been more evident.

Recent advancements in condition-based maintenance solutions have made it easier for fertilizer plant managers to safeguard their investments and personnel while optimising operational efficiency.

Leveraging data analytics and machine learning algorithms, predictive maintenance allows plant operators to anticipate equipment failures before they occur, thus minimising downtime and maximising productivity. This proactive approach enhances equipment reliability, reduces maintenance costs, and prolongs asset lifespan. In today's fast-paced industrial landscape, a holistic maintenance approach has transitioned from a ‘nice to have’ to a ‘need to have’ for plant managers seeking to stay ahead of the curve in ensuring the productivity of their organisation.

Multi-modal, wireless sensors represent a significant advancement in predictive maintenance technology, by providing comprehensive insights into equipment performance in fertilizer production. Sensors such as these can measure six machine health parameters: triaxial vibration, acoustic emissions, temperature, true RPM, humidity, and magnetic flux. In a world where there is never too much data that can be captured and leveraged, these sensors deliver visibility into the condition of industrial assets.

In the fertilizer industry, the quick implementation of monitoring solutions is crucial for maintaining operational efficiency. Tools like Nanoprecise's MachineDoctor offer simple setup and connectivity, ensuring uninterrupted operations during deployment. These tools can also be adapted to diverse operational conditions and are certified for safety in any number of hazardous environments.

The amount of data coming from these industrial IoT devices is more than a vibrational analyst could ever comb through to find correlations; this is why AI solutions are needed to analyse machine health data. These solutions detect small changes in the baseline performance of the six modalities, providing early alerts to minimise downtime and enhance productivity and safety in fertilizer plants, while ensuring the reliable performance of critical machinery. These platforms help to ensure uninterrupted fertilizer production by empowering maintenance technicians to address issues promptly. In summary, embracing predictive and prescriptive maintenance strategies is key to driving efficiency and competitiveness in the fertilizer industry.

Another common challenge is energy wastage, often stemming from minor faults in motors and engines. These faults can result in significant increases in energy

Effective water and process treating is imperative to successful ammonia and fertilizer plant operations. Large amounts of high pressure steam and high purity water are required in the production process.

Halliburton has a long and successful track record in the following areas:

Raw water pretreatment

Cooling water

Boiler feedwater

Steam

Process condensate

CO2 removal

UAN corrosion inhibition

Value-add projects

consumption, with electric motors consuming up to 20% more energy when in a fault state to compensate for inefficiencies. Addressing these challenges goes beyond issue detection and requires robust energy monitoring solutions. With energy consumption visibility, industries are offered the tools to address inefficiencies proactively, maintaining equipment well before there is an escalated issue, to avoid downtime, reduce energy costs and reduce carbon emissions by around 5 – 10%.

A major producer of complex fertilizers in Asia faced recurring failures of critical machinery at its plants. The Fortune 500 company also faced the daunting task of monitoring critical machinery in remote and hard-to-reach locations. Their biggest challenge was ensuring the reliability of critical pumps, which historically failed every 6 – 12 months. With each day of downtime costing the plant US$145 000 in lost production and unplanned repairs adding significant expenses, they sought a solution to detect faults early and reliably predict remaining useful life.

To address these challenges, six-in-one wireless sensors were placed to monitor crucial components, including the non-drive side and drive side bearings of the pump, as well as the drive side bearing of the electric motor. Once deployed, the robust battery-powered wireless sensors continuously monitored the pump and motors, transmitting data securely to an AI and SaaS-based platform for analysis using advanced algorithms. These sensors provided end-users with notifications, fault identification and remaining useful life (RUL) predictions. The RUL prediction was just 37 days.

The solution alerted operators to a fault on a process condensate pump, specifically detecting a bearing outer race failure (BPFO) in its stage 3 fault alarm.

Upon closer observation and analysis, the damaged bearing was identified as the root cause of the fault. Recommendations were made to grease the bearing of the condensate pump and inspect or replace the bearing during the next scheduled shutdown. This proactive approach prevented costly shutdowns and optimised equipment performance and longevity, showcasing the power of precise prescriptive predictions. This critical alert saved the company over US$145 000 in potential downtime costs, with over 32 hours of downtime avoided.

In addition to the bearing failure, an early misalignment was detected and corrective action was also taken, further highlighting the importance and value organisations can drive from solutions like this.

Potash mining presents unique challenges, where equipment uptime is paramount for operational success. Traditional intermittent hand-held vibration monitoring proves to be labour-intensive and often fails to capture equipment faults promptly. Downtime from gearbox or motor failures in underground conveyor systems can lead to significant production losses and costly repairs.

For one customer, a solution was implemented on a critical conveyor, deploying sensors on the gearbox and

motor assemblies as part of their IoT and digitalisation initiatives. Wireless communication facilitated data transmission to a secure cloud-based platform. The solution was designed to detect anomalies, diagnose fault types, and predict remaining useful life.

Early detection of a fault on the multi-stage gearbox correctly identified a ball pass frequency inner (BPFI) signature, allowing for maintenance to be scheduled. The client's proactive approach, informed by the solutions predictions, significantly reduced downtime by half for each conveyor system and prevented close to US$0.7 million in production losses.

The following describes the essential criteria for choosing a predictive, prescriptive, and energy-monitoring solution tailored to the fertilizer industry.

Implementing industry best practices is essential for optimising operational efficiency and ensuring equipment reliability in the fertilizer sector. Complete and straightforward solutions that can be installed quickly, that also seamlessly integrate into fertilizer manufacturing environments without causing disruption, are necessary.

Another key point is connectivity – cellular networks and other forms of wireless connectivity are ideal for providing reliable and secure communication, without complex wiring.

Continuously monitoring critical parameters like acoustics, vibration, temperature, RPM, magnetic flux and humidity offers valuable insights into equipment health and performance. These parameters enable proactive maintenance strategies specific to production, which are necessary in the fertilizer industry.

Additionally, ATEX and IECEx Zone 0 certifications ensure suitability in hazardous environments commonly found in fertilizer plants, enhancing safety and compliance.

Looking for a solution that can detect subtle changes in machine performance, facilitate early fault detection, and minimise unplanned downtime is crucial for maintaining uninterrupted fertilizer production. Another important factor to consider is tracking energy efficiency alongside condition monitoring, which supports efforts to optimise operational performance and reduce environmental impact in the fertilizer industry.

The advanced technology that is available today for the fertilizer manufacturing industry makes it possible to enhance operational efficiency and reliability. From empowering teams with great monitoring scope in remote and hard to reach areas, to providing visibility into remaining useful life and energy consumption, IIoT and AI solutions are helping the industry reach new levels of productivity and sustainability.

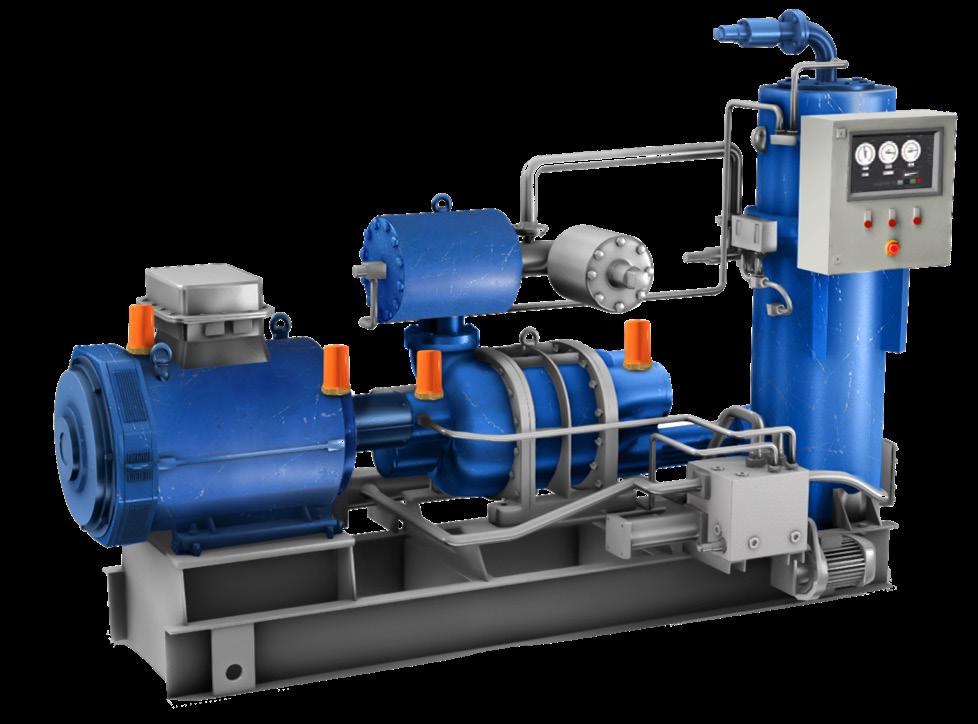

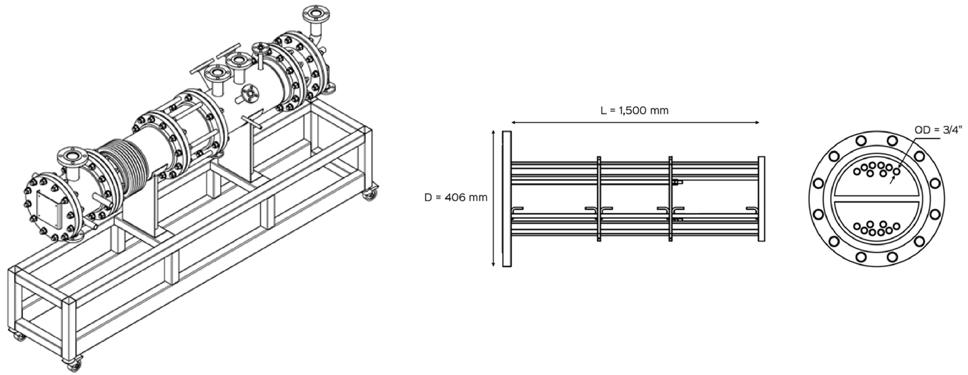

Alexandre Rossi, Breno Avancini, Laura Borges and Victor Machida, Clark Solutions, Brazil, examine how mindful and considered heat exchanger design could be the key to preventing dangerous chemical reactions and increasing fertilizer plant safety.

Plant reliability is strongly connected to safety. One of the aspects that can increase plant integrity is related to the process itself, and a careful design could prevent an undesirable mix between two substances and a dangerous chemical reaction.

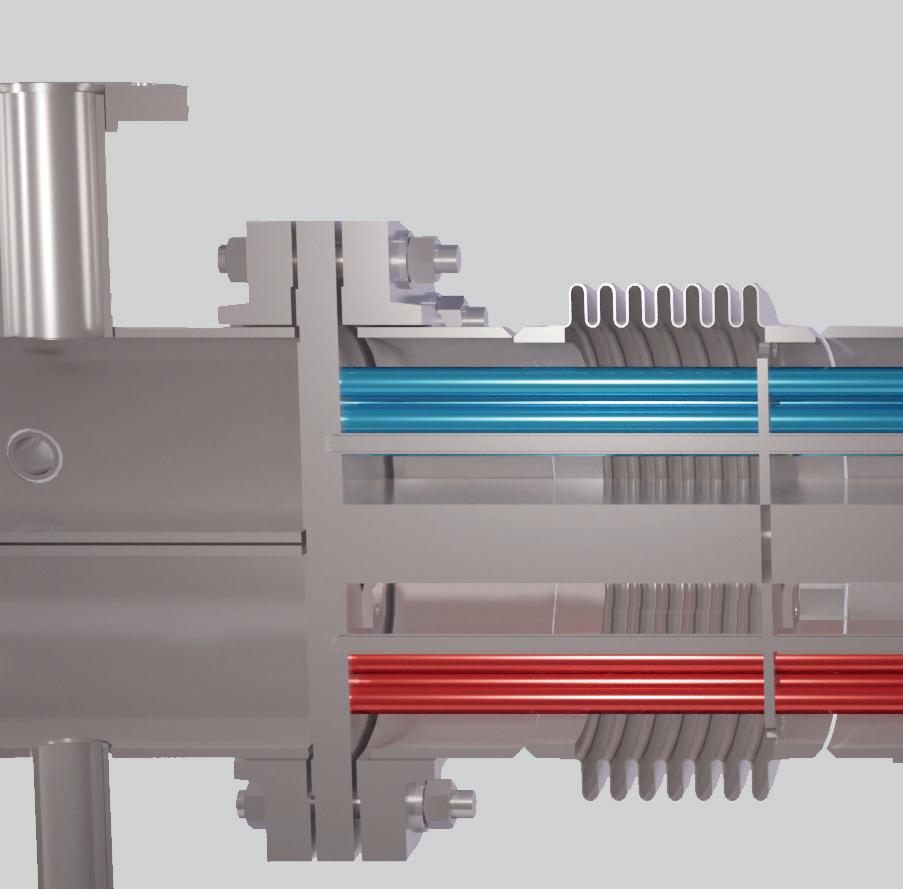

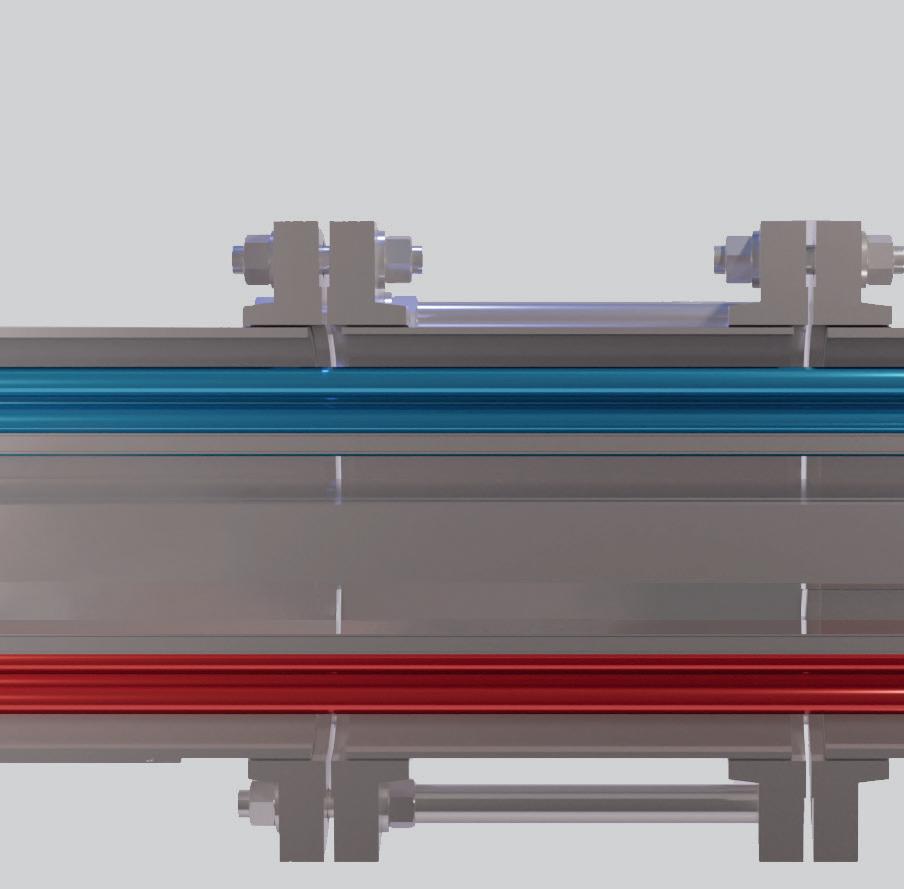

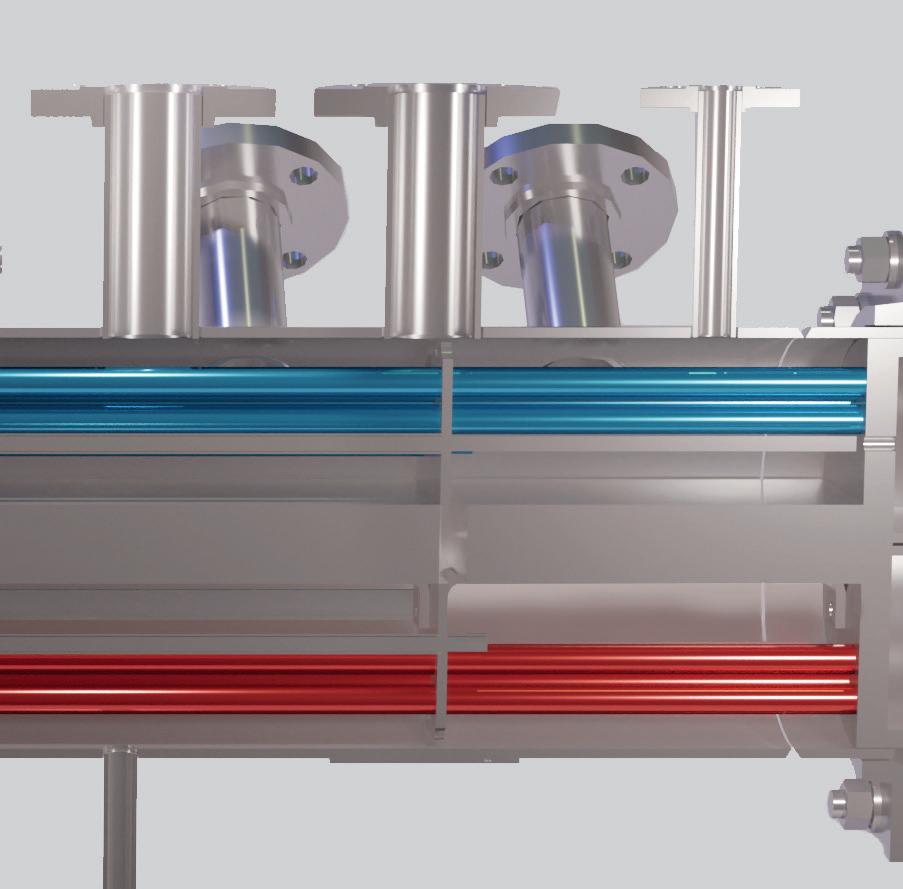

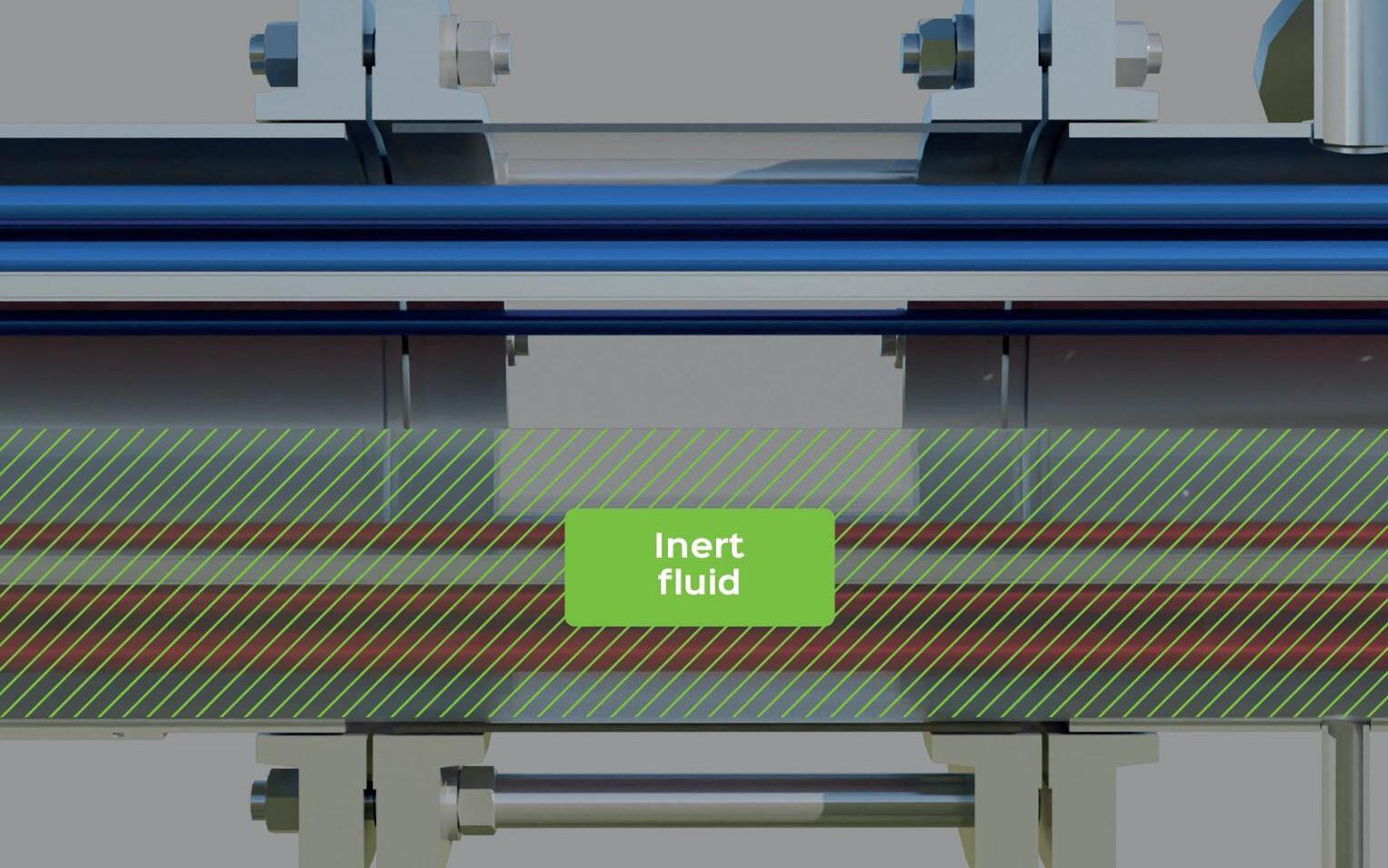

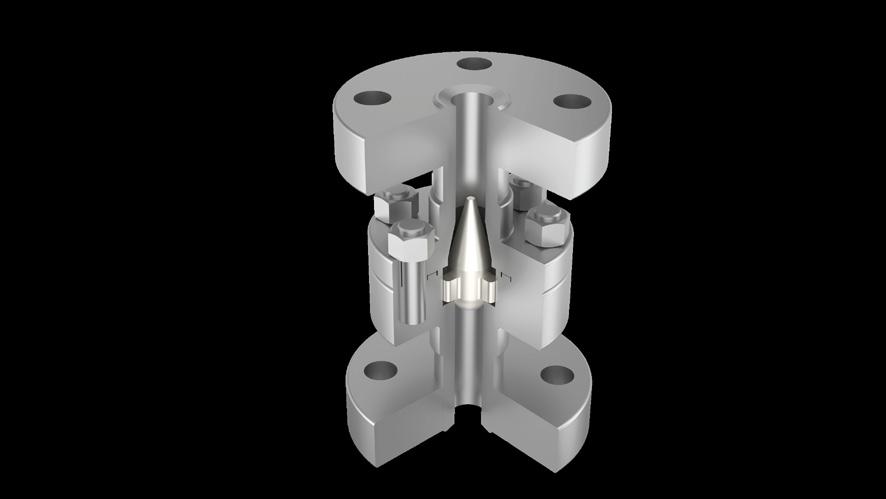

SAFEHX® is a patented heat exchanger technology developed by Clark Solutions which implements a method of separation between fluids that should not come into contact, while optimising heat transfer. Extensive tests have been executed in an industrial scale pilot plant facility to evaluate the performance of this heat exchanger technology. The discussion of the results will be the focus of this article.

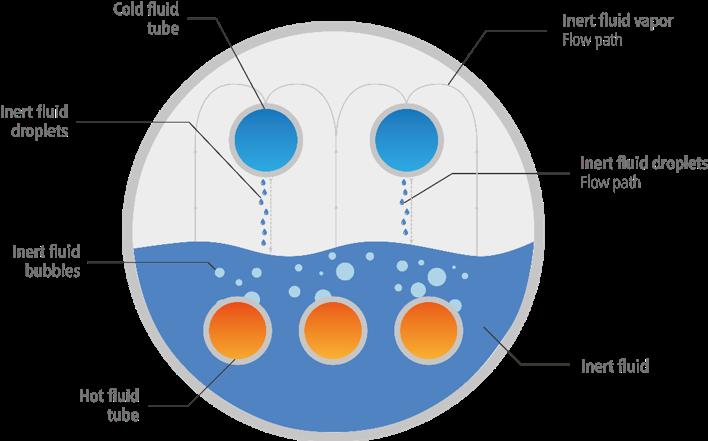

The new product is a single heat exchanger that has three compartments: hot fluid in lower tubes, cold fluid on upper tubes and an inert fluid in the shell side.1 The hot fluid heats and boils the inert fluid, which will vapourise, and its gases will reach the cold tubes. When in contact, the gases will condensate and rejoin to the pool of liquid, closing the loop. The inert fluid must be selected to have a boiling and condensation point between the inlet temperatures of the hot and cold fluids. There are two main benefits of this configuration compared to more traditional heat exchanger technologies:

n The phase change heat exchange mechanism to enhance the exchange rate.

n There are no risks of direct contact between the hot and cold fluid in case of a leak at any side (tube or shell).

This heat exchanger technology was originally conceived for heat recovery in sulfuric acid plant towers, where conventional configurations remove the heat generated in the absorption process with cooling water, sending it to the cooling towers for heat rejection to the atmosphere.

To improve plant thermal efficiency and make good use of the heat generated, the traditional practice is to direct the hot acid to a boiler feedwater heater or a steam generation system. The problem here is that water could come into contact with the acid through a tube leakage, causing acid dilution, excessive heat generation and increased equipment corrosion in an autocatalytic process that, besides often requiring an emergency shut down, leads to hydrogen formation, caused by the metal corrosion process. This can lead to hazardous incidents, putting people and assets at risk.

The new concept separates acid and water by an intermediate buffer fluid, that boils and condenses inside the exchanger shell, while the process fluids flow through the independent tube bundles. This eliminates the water-acid

contact risk, causing the fluids in the event of a leak, to leak into the buffer-fluid-containing shell. From here, they can be removed without the need for plant stoppages or any damage to equipment.

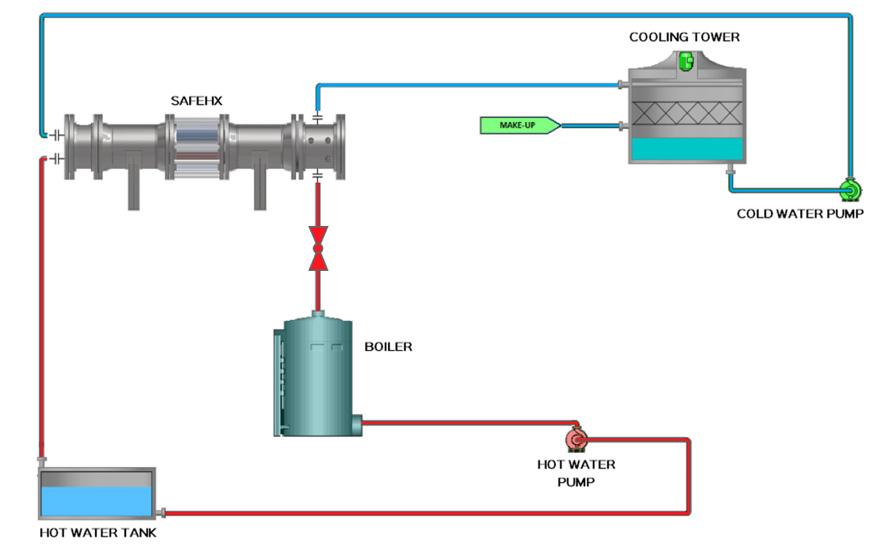

After validating the heat transfer concept and phenomena in a laboratory scale pilot unit, an industrial scale unit was built to allow for the mathematical modelling and technical improvement of the technology.

The SAFEHX prototype was designed in HTRI®, for thermal and hydraulic analyses, and Autodesk Inventor®, for mechanical analyses.1

The thermal design was optimised to enhance the heat exchange capacity for the same cost of production of the heat exchanger and tweaks were made to refine the mechanical design to increase its mechanical performance (safety factor and weight). The final configuration can be seen in Figure 1.

The prototype is connected to two utilities systems. One of them is responsible for supplying hot liquid water and the other for supplying cold liquid water, therefore, one is the heating system, and the other is the cooling system.

In the heating system, there is a segmented ball valve for pressure control, five-stage centrifugal 3 hp pump with a variable frequency driver (VFD) for flow control, and a boiler with a diesel burner to provide heat energy and temperature control.

In the cooling system, there is a cooling tower to remove heat, and a 1-stage centrifugal 5 hp pump with a VFD to adjust volumetric flow.

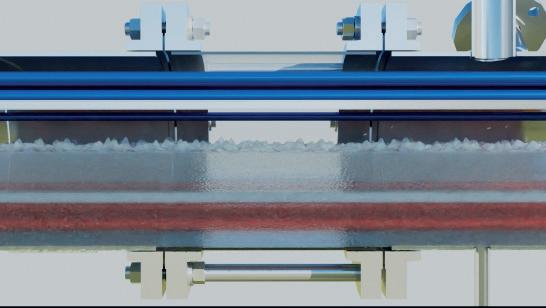

SAFEHX Prototype critical operational data for three of the runs (following a series of test runs) is summarised in Table 1. The experiment consisted of continuous countercurrent water flowing on the cold and hot tube bundles, until a steady state was achieved.

The heat exchange coefficient in the cold side was found to be within the expected ranges for a steam condenser and the heat exchange coefficient in the hot side was within the expected ranges for pool boiling heat-transfer coefficients of water2, however it is possible to increase these values to improve the performance by using heat transfer augmentation equipment such as finned tubes. The overall heat exchange coefficient was also within the range of typical values for shell-tube heat exchanger and water-water systems.3

In every test, the hot side exhibited a higher heat exchange coefficient compared to the cold side, which was expected since the boiling heat exchange mechanism is known to be more efficient than film-type condensation. The trajectory of heat is from the hot tubes to the intermediary fluid and then to the cold fluid. As the heat exchanged on both sides was similar,

Want to see it in action? Check the video.

the logarithmic mean temperature difference (LMTD) on the hot side was lower and the temperature gradient was greater on the cold side.

During the tests, both boiling and condensation phenomena were visually clear, confirming the effectiveness of heat transfer on both sides.

Some calculations were made in order to compare SAFEHX results with a conventional technology. Since volumetric flows and temperature are available from the tests, Q and LMTD are defined. The UA (overall heat exchange coefficient multiplied by heat exchange area) must also be the same. The geometry of the standard heat exchanger was modified until both UA were equal.

The following numbers are a normalised proportion between SAFEHX and a standard heat exchanger:

n Weight = 2.2 : 1.

n Number of tubes = 2 : 1.

n Pressure drop in cold side = 1: 0.36.

n Pressure drop in hot side = 1: 0.60.

SAFEHX is heavier due to the presence of an additional bundle of tubes. Both weights do not consider the respective fluids in the tubes and shell. Regarding the pressure drop, it is important to emphasise that the fluid flows through tubes on SAFEHX, while it traverses the shell and tubes in the conventional heat exchanger. Naturally, pressure drop will be lower on the shell side due to the

much higher cross section area. Considering this fact, the difference between pressure drop is minimal.

The SAFEHX heat exchanger promotes high heat transfer with a compact design using an intermediary fluid as a safety measure. The heat transfer principle utilises the process of boiling and condensation, two very high efficiency heat exchange mechanisms. This system reduces the costs of maintenance and instrumentation and helps increase process security, avoiding contact between the fluids and keeping the tube wall temperature under control.

Despite the fact it is heavier than conventional S&T heat exchangers, since the corrosive acid is contained within the lower tube bundle, only this part of the equipment needs to be manufactured in stainless steel or special materials while the shell and upper tube bundle can be manufactured in lower alloys or in plain carbon steel, reducing the overall investment cost.

Another interesting finding is that since the boiling and condensation of the intermediate fluid takes place at fixed temperatures, the inner and outer upper bundle tubewall temperatures are independent of the hot side fluid temperature and are stable along the process. Sudden changes or increases of the hot side fluid temperature will affect the overall heat transfer but not the said tubewall temperatures, allowing the technology to be useful in thermally sensitive fluids where a precise control of tubewall temperatures is required to avoid degradation, such as amine systems.

Moreover, within processes such as sulfuric acid cooling and similar processes where hot-cold fluid contact can generate a hazard, the technology arrangement provides an intrinsically safe environment; in the event of a leak, both tube bundles will not be enough to put the fluids in contact. This feature removes the need for double or triple instrumentation redundancy, or ‘quick emptying’ devices frequently used in standard systems operatings in similar conditions.

The test results indicated an efficient operation in a steady state with heat transfer coefficients as expected and performance compatible with a standard shell and tube heat exchanger, as well as with high potential for designing and performance improvements.

The test runs also validated the product under relevant operational conditions and demonstrated that the product in an industrial environment allows for the increased safety of the operation, while at the same time contributing to a longer and hassle free lifetime.

1. HOLMAN, J.P., Heat Transfer, 10 ed., pp. 507, 523.

2. CLARK, N., FERRARO, B., and STURM, V., “SAFEHR®: Mutually increasing safety and heat recovery in sulfuric acid plants,” Sulphur, November 2018.

3. CLARK, N., BAUTISTA, P., ROSSI, A., and AVANCINI, B., "Engineering Challenges of Innovation," Sulphur, November 2023.

n ÇENGEl, Y.A., Heat and Mass Transfer, 3 ed., New York, 2007, p. 673.

n CLARK, N., “SAFETY BUFFERED MULTI-FLUID HEAT EXCHANGER AND SAFETY BUFFERED MULTI-FLUID HEAT EXCHANGER PROCESS”. Brazil Patent 11,604,031, March 2023.

n CLARK, N.,“SAFETY BUFFERED MULTI-FLUID HEAT EXCHANGER AND SAFETY BUFFERED MULTI-FLUID HEAT EXCHANGER PROCESS”. United States of America Patent 11,604,031, March 2023.

Pratibha Pillalamarri, Aspentech, USA, discusses how fertilizer companies can enhance asset integrity and plant reliability.

The global market for fertilizer is showing steady growth, having been valued at US$202 billion in 2023. According to Global Market Insights, it is also expected to record a compound annual growth rate (CAGR) of over 2.7% between 2024 and 2032.1

This growth is driven by several factors. Increasing demand for food production requires higher crop yields, which can be achieved with the help of fertilizers. With limited new land available for cultivation, farmers need to improve the productivity of existing farmland, often relying on fertilizers. Finally, specific minerals like nitrogen, phosphorus, and potassium are crucial for plant growth, and their demand is expected to remain high.

Scoping the challenge

There are significant opportunities for fertilizer producers and manufacturers operating across the world today.

Unfortunately, these opportunities are counteracted by a wide range of challenges that fertilizer companies of all kinds have to face.

The cost and availability of raw materials, such as natural gas (a primary input for nitrogen fertilizer production), potash, and phosphate rock, can be highly volatile. This volatility affects production costs and planning. The production of fertilizers, especially ammonia and nitrate-based products, involves hazardous materials that pose risks of explosion, leaks, and environmental contamination. Ensuring plant safety and managing these risks is a constant challenge.

Keeping up with technological advancements in production processes and automation is essential for improving efficiency, reducing costs, and enhancing safety. However, investing in new technologies requires significant capital and can disrupt existing operations.

Arguably most important of all, effective maintenance of plant equipment is critical to preventing unscheduled downtime, which can be costly. Balancing regular maintenance with ongoing production demands requires careful planning and management.

The risk factors fertilizer companies face in this regard are many and varied. As a rule, these challenges stem from the complex and demanding nature of fertilizer production, which involves handling hazardous chemicals, operating under harsh conditions, and adhering to stringent environmental and safety regulations.

Some of these challenges relate to the potential for corrosion and material degradation in harsh chemical environments. Fertilizer production involves the use of aggressive chemicals, such as ammonia, nitric acid, and sulfuric acid, which can cause rapid corrosion and degradation of plant equipment and infrastructure. This not only threatens the integrity of assets but also poses safety risks.

Coupled with this, processes taking place within fertilizer plants and facilities generally often operate at high temperatures and pressures, exacerbating wear and tear on equipment and increasing the risk of failures.

There are also a wide range of challenges that fertilizer manufacturers and providers face in relation to ageing infrastructure. One of the most prevalent in real-world operational terms is that of deferred maintenance: in an effort to reduce costs or due to budget constraints, firms may decide to put off maintenance. While this allows them to save costs, it is also likely to lead to a deterioration in asset condition over time.

Upgrading or replacing ageing infrastructure requires significant investment. Companies often struggle with the decision to invest in new technology vs extending the life of existing assets.

To mitigate the risk of unplanned downtime or inefficient operational flow that these challenges heighten, it is key that fertilizer providers and manufacturers can find ways to ensure the highest levels of asset integrity and plant reliability. The operational and financial success of capital-intensive organisations is, after all, often largely dependent on their ability to avoid (or minimise) asset failures and any resulting disruptions to process. Traditional maintenance programmes are, in comparison, limited and typically reactive, as well as being equally cost intensive.

This is where asset performance management (APM) tools come in. APM solutions are designed to leverage big data analytics and machine learning to predict equipment failures and prescribe detailed actions to mitigate or solve complex operational issues. In the context of a fertilizer plant, where operational efficiency, reliability, and productivity are paramount, they can significantly enhance maintenance strategies through data-driven insights.

One way that APM can help drive uptime and operational efficiencies for fertilizer companies across their assets and plants is through maintenance strategies that diagnose potential breakdowns before they happen and identify sub-optimal operations.

The best of such solutions can analyse historical and real-time data from equipment sensors and maintenance records to identify patterns or anomalies that precede failures. They can also complement existing condition monitoring strategies and incorporate custom codes written by subject matter experts for consistent equipment health monitoring and alert management. By providing early warnings, often weeks or months before a failure would occur, the solutions enable maintenance teams to be proactive, preventing unplanned downtime and reducing the risk of catastrophic failures. They embed FMEA codes and provide prescriptive guidance, allowing for planned intervention. Utilising advanced machine learning algorithms, APM tools can predict potential equipment failures with high accuracy. This precise prediction capability allows for targeted maintenance activities, ensuring resources are allocated efficiently and effectively.

Beyond purely reducing downtime, APM can also play its part in driving up operational efficiency levels. By predicting when equipment is likely to fail, it enables fertilizer plants to schedule maintenance activities during optimal times. This approach minimises disruptions to production, ensuring that maintenance is performed only when necessary and before failures can impact productivity.

Data-driven maintenance can also significantly reduce costs associated with over-maintenance, emergency repairs, and spare parts inventory. APM can help in identifying the exact maintenance needs, allowing for better inventory management and reducing unnecessary maintenance activities.

Continuous monitoring and predictive analytics improve the reliability of assets by ensuring they are operating within their optimal conditions and receiving timely maintenance. This reduces the likelihood of equipment failures that could lead to production stoppages or safety incidents.

Preventive maintenance strategies, informed by predictive insights from APM solutions, can extend the operational life of equipment by addressing wear and tear before it leads to significant damage. This not only enhances asset reliability but also optimises capital expenditure over time.

By preventing equipment failures, APM contributes to a safer working environment. Many accidents in industrial settings are caused by equipment malfunctions; predictive maintenance can therefore play a crucial role in preventing such incidents. Equipment operating efficiently is less likely to experience failures that could lead to environmental incidents, such as leaks of hazardous materials. Predictive maintenance helps ensure compliance with environmental regulations by maintaining equipment in peak condition.

While APM is clearly a key tool in addressing the challenges fertilizer firms face in ensuring asset integrity and plant reliability, it has to be implemented as part of a more multifaceted approach. On one level, process optimisation software can be deployed to help fertilizer companies enhance efficiency, reduce energy consumption, and optimise production processes. These tools allow for the simulation and optimisation of chemical processes, helping companies to identify opportunities for

efficiency improvements and cost reductions, leading to more sustainable and reliable operations.

Coupled with that, advanced process control (APC) solutions can significantly improve plant performance by maintaining process variables within optimal limits, enabling fertilizer companies to reduce process variability, improve yield, and decrease energy consumption.

In addition, digital twins of physical assets or processes allow for real-time monitoring, simulation, and analysis of plant operations. They can thereby help fertilizer companies predict potential issues before they occur, optimise maintenance schedules, and improve overall plant reliability and performance.

Alongside this, firms need comprehensive training and skill development programmes to ensure that employees are well-equipped to leverage advanced software solutions effectively. They will need to engage stakeholders across the organisation to ensure alignment and buy-in for technology adoption and foster a culture of continuous improvement that encourages innovation and the proactive use of technology to address challenges.

Performance management and evaluation is also important here. That means putting in place clear key performance indicators (KPIs) and metrics to measure the impact of technology on asset integrity and plant reliability and conduct regular reviews of technology performance and its contribution to business objectives, adjusting strategies as needed. Equally, it requires implementing a feedback loop from operations to management to continuously refine technology use and processes.

Finally, it is important to establish strong partnerships with technology providers for ongoing support, updates, and training, and work collaboratively with providers to explore innovative

solutions and customisations that address specific operational challenges.

By implementing these kinds of processes around the technology solutions they implement, fertilizer companies can ensure they are effectively leveraging technology to enhance asset integrity and plant reliability. This holistic approach not only addresses operational challenges but also aligns with broader business objectives, contributing to sustainable, efficient, and competitive operations.

Fertilizer companies face significant challenges in maintaining asset integrity and plant reliability amidst volatile raw material costs, hazardous production environments, and the need for technological advancement. However, by leveraging asset performance management (APM) tools and adopting a multifaceted approach that includes process optimisation, advanced process control, digital twins, and continuous training, these companies can effectively navigate these challenges.

Such strategies not only enhance operational efficiency and safety but also ensure compliance with environmental regulations, ultimately contributing to sustainable and competitive operations. Embracing these solutions allows fertilizer firms to optimise asset use and achieve their operational objectives, securing a strong position in the global market.

1. Global Market Insights, Fertilizer Market - By Form (Dry, Liquid) By Product (Organic, Inorganic), By Application (Agriculture, Horticulture, Gardening), Forecast 2024 – 2032 (https://www.gminsights.com/industry-analysis/ fertilizer-market ).

For processes with high temperatures and high pressures to ensure maximum reliability and efficiency.

Discover our share by scanning the QR-Code or meet us at the ACHEMA 2024 in Hall 4.0 at booth F23 !

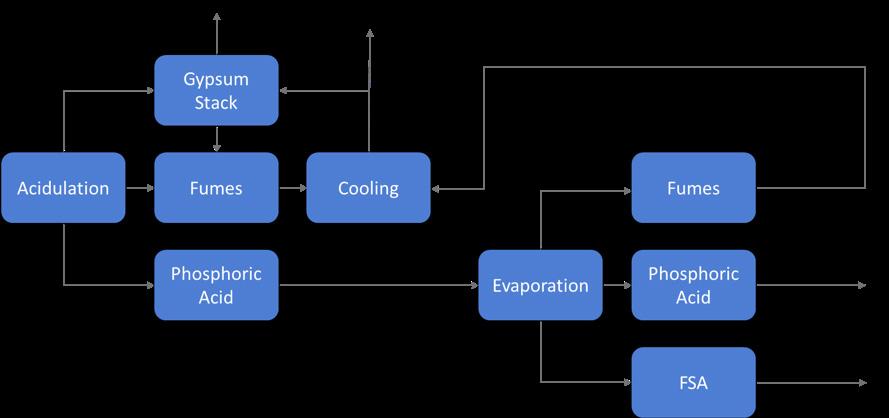

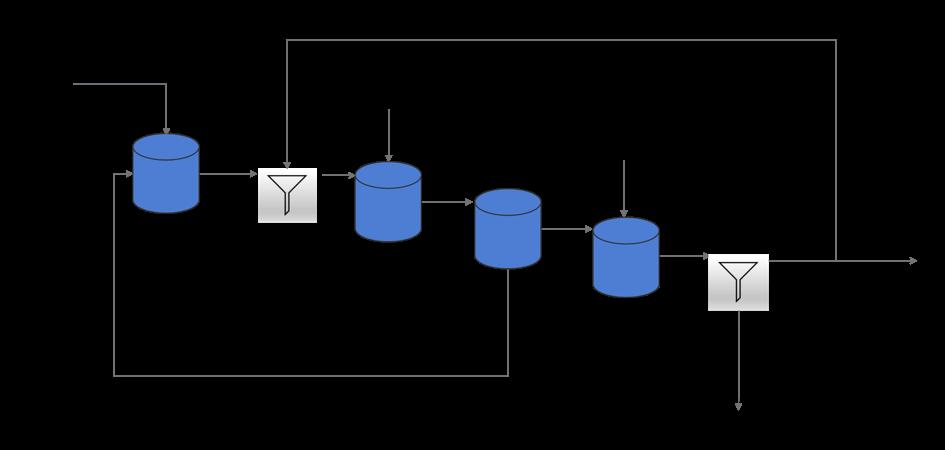

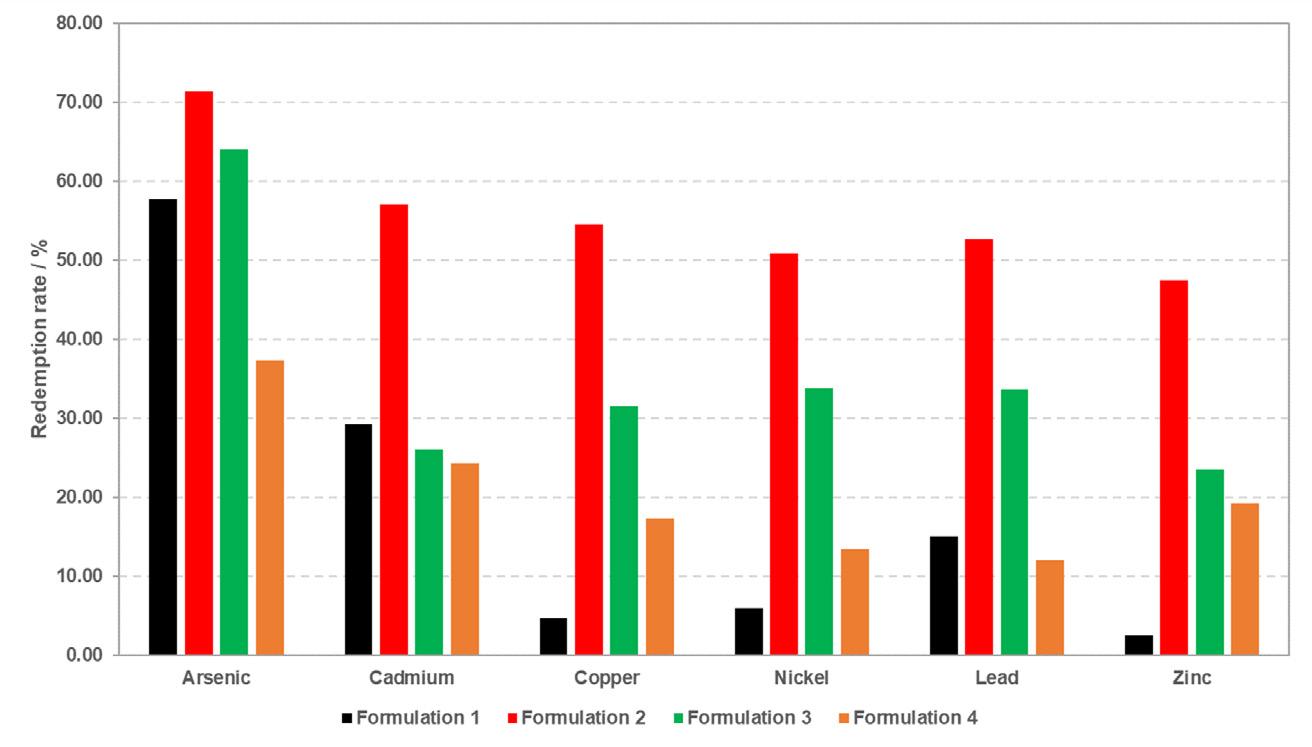

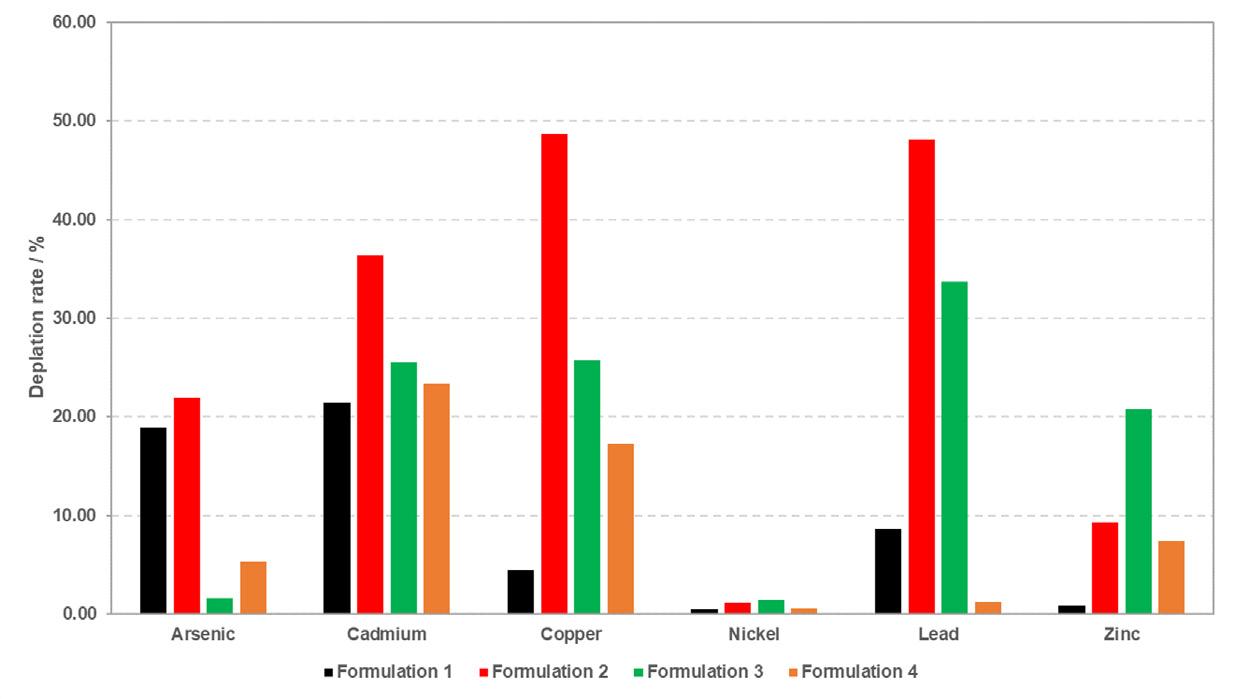

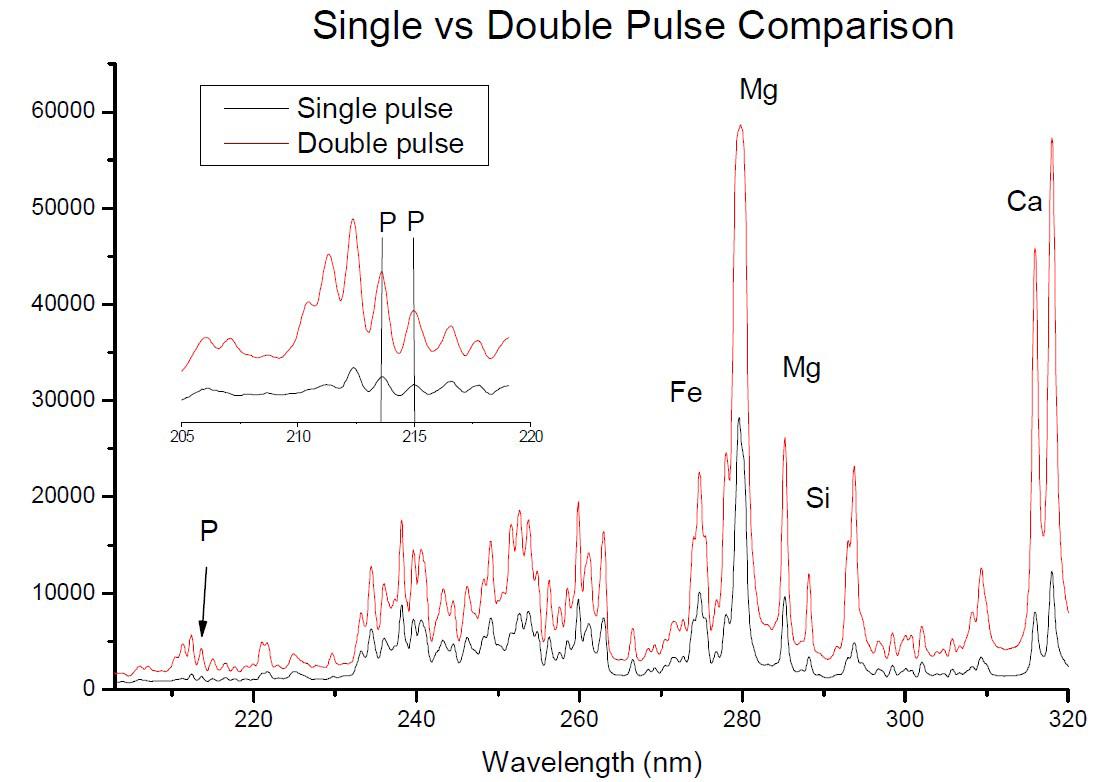

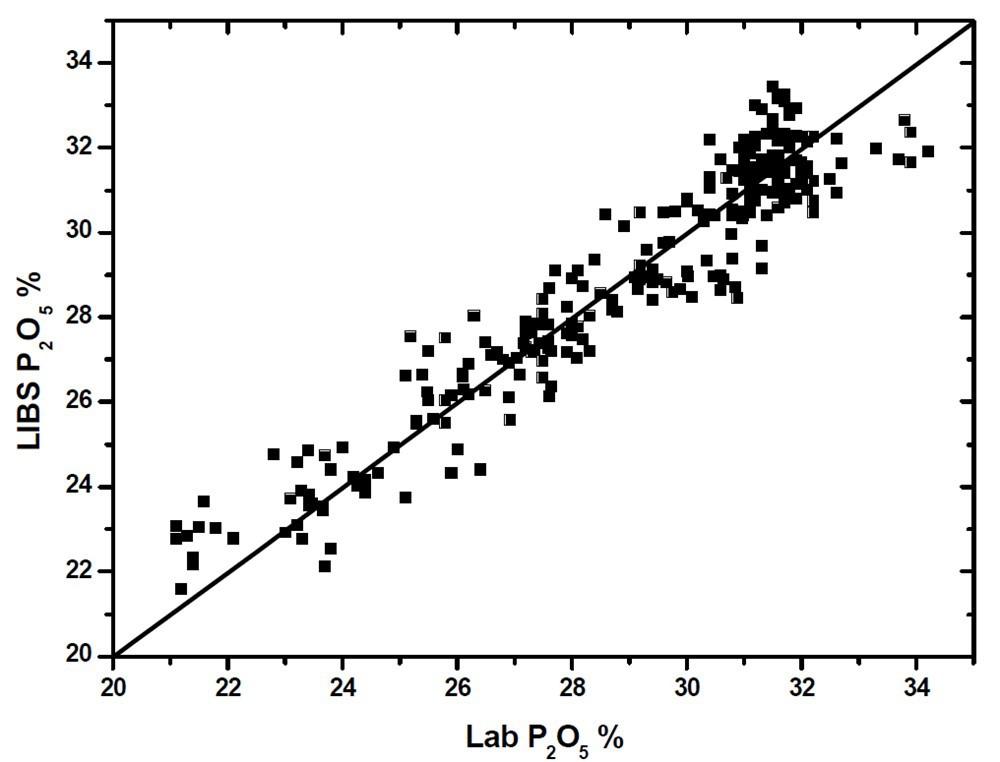

James Byrd, JESA Technologies, USA, discusses the management of fluorine in phosphoric acid plants.