Rotary calciner for upgrades

Based on the familiar principals of clinker production, rotary clay calciners are ideal for mothballed clinker production lines.

Rotary calciner for upgrades

Based on the familiar principals of clinker production, rotary clay calciners are ideal for mothballed clinker production lines.

Cement producers around the world are pursuing clay calcination as part of e orts to cut the carbon intensity of cement.

But how best to implement these projects?

That depends on a range of site-specific factors.

Our clay calcination solutions have been developed from proven components and processes to deliver a high-quality Portland cement substitute. And they come backed by our advanced process and plant engineering skills to ensure they deliver the best possible results for your application.

We can also combine them with our leading alternative fuel solutions to further reduce carbon emissions. So, when you’re looking for your clay calcination partner, think KHD.

And let’s deliver Cement beyond Carbon together. www.khd.com/clay-calcination

Flash calciner for new projects

Ideal for greenfield projects, our flash calciner delivers cost-e ective clay calcination, including for very sticky clays and clays with up to 40% moisture.

Benefit from extra AF potential

Alternative fuel solutions like the Pyrorotor® o er signifcant extra benefits with regards to emission reduction.

Our clay calcination solutions produce material that is the same color as ordinary cement –thanks to advanced process control. No additional processes required.

03 Comment

05 News

ACHIEVING NET ZERO

10 The Blended Cement Boom

DIGITALISATION

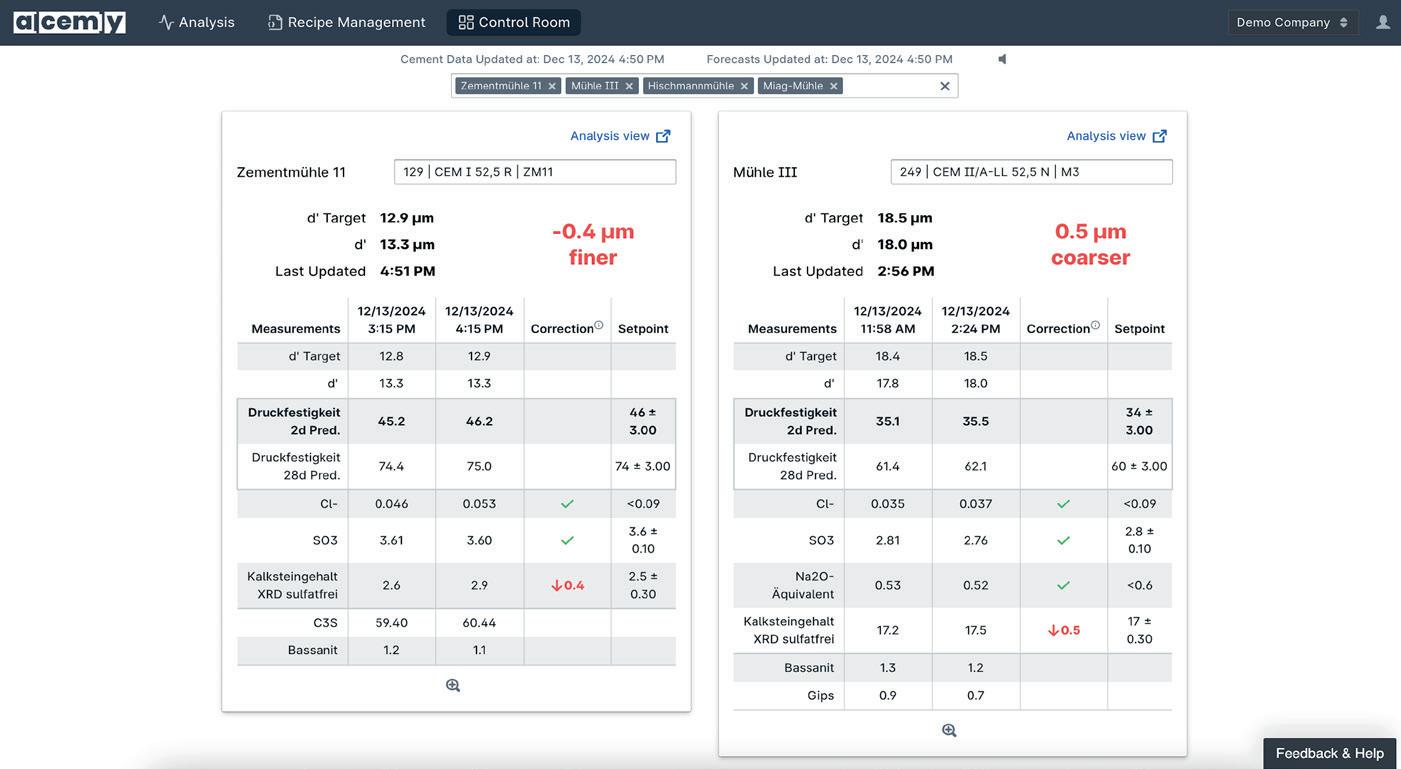

56 Unlocking AI’s Cement Potential

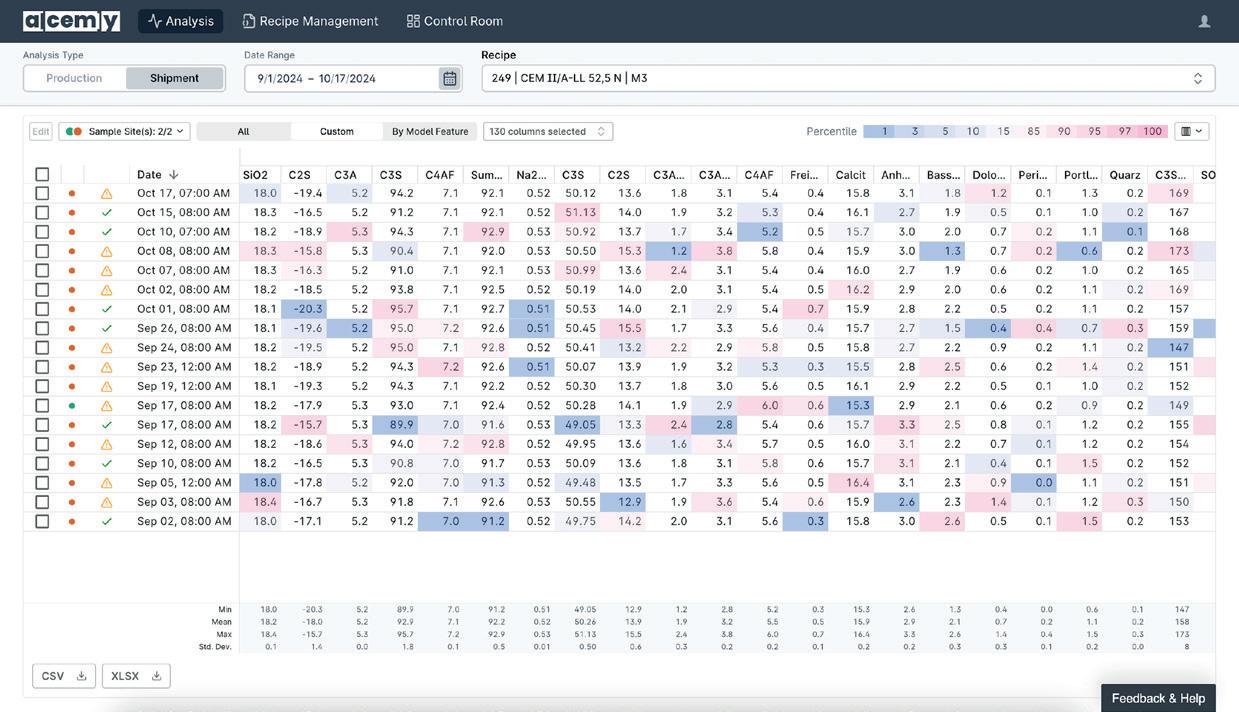

Isabel Rask, alcemy, explores how well-designed interfaces are key to overcoming AI adoption challenges in the cement industry and ultimately driving decarbonisation efforts.

62 Digitally Decarbonising Cement

Mike Ireland, Portland Cement Association (PCA), examines the opportunities and challenges arising from the growing demand for blended cements in the US.

15 Affordable Actions For Clean Cement

Elliot Mari, Industrial Transition Accelerator (ITA), outlines some affordable policies for decarbonising the cement industry.

20 Disruption Through Startups

Eduardo Gomez, CRH Ventures, explains why partnering with startups is key to the decarbonisation revolution.

24 The Carbon Solution

Rob Cumming, Lafarge Canada (East), explores how a ‘silver buckshot’ approach can achieve net-zero concrete without the high costs of CCS or e-fuels.

31 The Blueprint for Cement’s Carbon Crusade

Bodil Recke, ABB Process Industries, discusses the strategies driving the cement industry’s transition to sustainability.

SCMs & LOW CARBON CEMENTS

36 Partnering For Progress

Olivier Guise, Ecocem, discusses how collaboration and scalable low-carbon solutions can accelerate the cement industry’s path to net zero.

42 Scaling Up Low Carbon Cement

David Hughes, Material Evolution, explores the benefits of ultra-low carbon cement in transforming the built environment.

49 Crucial Clay Activation Conditions

Mylène Krebs, Jean-Michel Charmet, and Damien Chudeau, Fives FCB, discuss the key factors influencing the calcination process and present insights from a calcination test centre in Northern France.

53 Ashes To Innovation In Concrete

Grant Quasha, Eco Materials Technologies, reveals how the innovative use of coal ash and other supplementary cementitious materials is helping the concrete industry reduce its carbon footprint and improve performance.

Pascal Gaillot, Yokogawa Europe, explains how the integration of digital technologies and decarbonisation strategies is preparing the cement industry for the future.

67 The AI Advantage

Molly Pace, Imubit, explains how closed loop AI optimisation is reshaping cement manufacturing by boosting efficiency, reducing emissions, and enabling real-time process control.

CARBON CAPTURE, UTILISATION, & STORAGE

72 The Enablers And Disablers of CCUS

Rohan Dighe, Ismael Justo-Reinoso, Tania Alvarez, and Peter Findlay, Wood Mackenzie, consider a range of factors that could impact the deployment of CCUS in cement production.

77 Consolidating Carbon Capture

Jeffrey Tyska, Honeywell, highlights how advanced carbon capture technologies can help cement producers significantly reduce CO2 emissions and achieve their decarbonisation goals.

81 CCS 101

Katherine Romanak, The University of Texas at Austin, underscores the crucial role that carbon capture and storage (CCS) will play in driving decarbonisation within the cement industry.

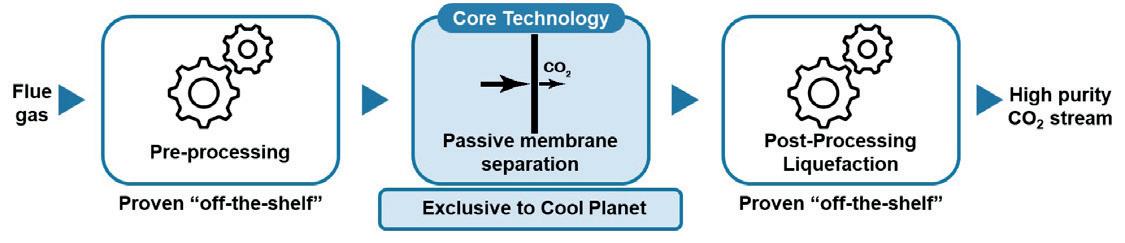

85 Mastering Emissions With Membranes

Cool Planet Technologies discusses the implementation of advanced membrane carbon capture technology in the cement and lime industries.

High-performance lubricants from Klüber Lubrication offer opportunities to increase uptime and lower specific energy consumption. Saving energy is top of the agenda for most cement plants these days. Lubricant and service solutions from Klüber Lubrication can help operators to reduce costs – while increasing the sustainability of their plant. Get in touch to learn more about increasing the availability of kilns, mills, coolers, crushers and compressors whilst evidently saving energy and reducing cost. Visit: www.klueber.com/cement

rod.hardy@palladianpublications.com

Sales Manager: Ian Lewis ian.lewis@palladianpublications.com

Sales Executive: Sophie Birss sophie.birss@palladianpublications.com

Head of Events: Louise Cameron louise.cameron@palladianpublications.com

Digital Events Coordinator: Merili Jurivete merili.jurivete@palladianpublications.com

Digital Content Coordinator: Kristian Ilasko kristian.ilasko@palladianpublications.com

Junior Video Assistant: Amélie Meury-Cashman amelie.meury-cashman@palladianpublications.com

Digital Administrator: Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

Administration Manager: Laura White laura.white@palladianpublications.com

Reprints reprints@worldcement.com

DAVID BIZLEY, SENIOR EDITOR

Hello Dear Reader, and welcome to the March 2025 issue of WorldCement.

I hope you’re keen to get reading because this is no ordinary issue. Of course, all the usual aspects are here – regional industry analysis, technical insights, case studies, and the latest news. However, a glance at the Contents page should highlight a common theme: decarbonisation.

So, why have we made this choice? Well, aside from the importance of the topic, it’s finally time for the 2025 edition of our flagship decarbonisation focused conference: EnviroTech – The Gateway To Green Cement. This issue has been commissioned from the ground-up to act as something of a companion piece for the show. Throughout the following pages, you’ll hear from cement producers, industry associations, and technology providers as they provide their insights and expertise on a range of decarbonisation-related topics – insights and expertise that are needed now more than ever.

Looking back to my comment from the March 2024 issue of WorldCement(published just prior to our first EnviroTech conference), I noted how the cement industry found itself caught between the twin challenges of building the world of the future, whilst also helping to ensure that same world remained liveable.

CBP019982

Annual subscription (published monthly): £160 UK including postage/£175 (€245) overseas (postage airmail)/US$280 USA/Canada (postage airmail). Two year subscription (published monthly): £256 UK including postage/£280 (€392) overseas (postage airmail)/US$448 USA/Canada (postage airmail). Claims for non receipt of issues must be made within 4 months of publication of the issue or they will not be honoured without charge.

Applicable only to USA and Canada: WORLD CEMENT (ISSN No: 0263-6050, USPS No: 020-996) is published monthly by Palladian Publications, GBR and is distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831.

Periodicals postage paid at Philadelphia, PA and additional mailing offices. POSTMASTER: send address changes to World Cement, 701C Ashland Ave, Folcroft PA 19032

Copyright © Palladian Publications Ltd 2025. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Uncaptioned images courtesy of Adobe Stock. Printed in the UK.

Palladian Publications Ltd 15 South Street, Farnham, Surrey GU9 7QU, UK Tel +44 (0)1252 718999

Email: mail@worldcement.com Website: www.worldcement.com

As I write this a year later, those twin challenges remain. Cement and, by extension, concrete are still the only building materials capable of meeting the world’s infrastructure demands. And the clock is ticking, ever faster, when it comes to tackling climate change. I mentioned last month how 2024 is now officially the hottest year on record according the UN. And, as Katherine Romanak (Research Professor for the University of Texas), points out in her article on pg 81: “If we continue with our current policies, we are on a path towards a global temperature rise of 3.1˚C by the end of the century.”

It’s clear that action is needed now – from industry, from government, from every level of society. And, by being responsible for the oft-quoted figure of 7% of global CO2 emissions, the cement industry has a golden opportunity to play a lead role in combatting this global crisis. Thankfully, the industry has grasped this opportunity with both hands. Progress continues to be made on multiple fronts, with new developments showcased throughout this issue, all moving the industry forwards, toward a greener future.

For those of you reading this at our venue in Athens, then:

You’ll be able to hear more about the latest developments in cement’s decarbonisation journey in-person from our line-up of expert presenters and panellists. You’ll also have ample opportunity to share your own insights, build relationships, and collaborate at our multiple networking events.

And for those of you who weren’t able to join us, stay tuned for highlights from this year’s edition of EnviroTech. And perhaps consider registering your interest for our 2026 outing here: https://bit.ly/EnviroTech2026

Meanwhile, wherever you are, I hope you enjoy the issue. Until next time: Αντίο.

Molins receives a visit from President Salvador Illa at Sant Vicenç dels Horts

Molins welcomed the President of the Generalitat of Catalonia, Salvador Illa, to its headquarters in Sant Vicenç dels Horts (Barcelona). During the meeting, Molins highlighted its commitment to decarbonisation and shared the progress made in its Sustainability Roadmap plan, which outlines the path to reducing its CO2 emissions by 20% by 2030.

This plan accelerates the efforts Molins has been undertaking since 1990, with the ultimate goal of supplying carbon-neutral concrete by 2050.

During the meeting, Molins highlighted the ongoing sustainability projects, such as its alternative raw materials (MPA) plant, which enabled the reuse of more than 93 000 t of construction and demolition waste in 2024.

Additionally, Molins delved into innovative initiatives it is developing, including energy efficiency projects aimed at reducing thermal consumption and CO2 emissions at its plants, as well as projects from its artificial intelligence laboratory focused on industrial applications.

Marcos Cela, CEO of Molins, emphasised Molins commitment to decarbonising the cement sector: “At Molins, we have been driving concrete initiatives for years to accelerate the transition toward a more sustainable industry. We are aware that the goal is highly ambitious, but at the same time, we know that, as a society, we cannot afford to aim for anything less. That is why we continue to push forward with cutting-edge innovation projects that will allow us to develop new solutions. The visit of President Salvador Illa has been an excellent opportunity to share our progress and reaffirm our commitment to sustainable industrial development.”

The visit also included the presence of Government Delegate Pilar Díaz and the Mayor of Sant Vicenç dels Horts, Miguel Comino, alongside President Illa. Representing Molins were its President, Juan Molins, and CEO, Marcos Cela, along with Salvador Fernández, Executive Vice President Cement & RMC Spain & Mexico; Carlos Martínez, Chief Strategy & Sustainability Officer; and Ignacio Machimbarrena, Chief Innovation Officer.

Holcim & Gebr. Pfeiffer collaborate on GO4ZERO green cement project.

Gebr. Pfeiffer has received an order to supply a vertical roller mill of the type MVR 5000 R-4. The mill is intended for the new 4800 tpd kiln line of Holcim (Belgique) SA in the existing Obourg cement plant in Belgium.

Holcim (Belgique) SA has chosen Gebr. Pfeiffer's ultra-modern grinding technology for its GO4ZERO green cement project. A vertical roller mill of the type MVR 5000 R-4 will be used for cement raw material grinding. The mill will grind 370 tph of cement raw material to a fineness of ≤ 15% R to 0.090 mm. At the same time, the cement raw material is dried in the mill from a feed moisture content of approximately 4% to a residual moisture content of < 0.7%.

In addition to efficient comminution and the associated high power density, MVR mills are also characterised by very smooth running and very low pressure drop. These features increase the technical availability and reduce both emissions and specific operating costs. In this project, the mill is integrated into the pioneering 'oxyfuel operation', with all the resulting requirements. This is, for example, the longest possible uninterrupted mill operation, to achieve the highest possible efficiency in the subsequent 'CO2 capture process'. The mill will be equipped with a SLS 4000 VR classifier.

Gebr. Pfeiffer is very pleased to be able to contribute again to reducing the carbon footprint. The contract is being handled by the Chinese general contractor CBMI. The MVR mill is expected to be put into service in the second half of 2025.

thyssenkrupp Polysius and SaltX to develop emission-free facilities

thyssenkrupp Polysius and SaltX have signed a letter of intent (LOI) to jointly develop the next generation of fully electrified production facilities. This partnership aims to scale innovative technologies and advance the decarbonisation of the industry. New technologies, fresh ideas, and exciting opportunities were the focus of a workshop between thyssenkrupp Polysius and SaltX, an innovative start-up from Sweden driving the electrification of calciners.

Together, they discussed potential collaborations and the integration of this groundbreaking concept into various business areas.

bauma.de/en/trade-fair

IEEE-IAS/PCA Cement Conference

04 – 08 May, 2025 Birmingham, AL., USA cementconference.org

CEMENTTECH 2025

15 – 17 May, 2025 Hefei, China www.cementtech.org

Carbon Capture Technology Expo North America

25 – 26 June, 2025 Houston, TX., USA www.ccus-expo.com

POWTECH

23 – 25 September, 2025 Nürnberg, Germany www.powtech-technopharm.com

As part of this collaboration, SaltX's patented electric arc calciner (EAC) technology will be integrated into thyssenkrupp Polysius' green system solutions. The EAC process enables the electric calcination of materials, replaces fossil fuels with renewable energy, and isolates the released carbon dioxide, resulting in an emission-free production process.

Dr. Luc Rudowski, Head of Innovation at thyssenkrupp Polysius, stated: “The partnership with SaltX is a significant step towards a sustainable industry. By integrating the electric arc calciner technology, we can expand our portfolio of green solutions and offer our customers innovative and environmentally friendly production methods. This collaboration is an important milestone on the path to decarbonising the cement and lime industry.” The electrification of calciners could be a game-changing technology for both thyssenkrupp Polysius and the entire industry. There is great potential in the areas of cement, lime, and direct-air-capture (DAC). Cement is a key sector where sustainable technologies are becoming increasingly important. In the lime sector, electrification could bring new efficiency and environmental benefits. DAC is an innovative process for capturing CO2 directly from the ambient air.

Lina Jorheden, CEO of SaltX, added: “The collaboration with thyssenkrupp Polysius is of great importance to effectively implement our technology and drastically reduce CO2 emissions in the industry. Together, we can set new standards and offer our customers fully electrified and emission-free production facilities.”

Lukas Schoeneck, Head of Green Solutions at thyssenkrupp Polysius, commented: “This partnership is based on mutual trust and shared goals. Both sides benefit from the collaboration by combining our strengths and developing innovative solutions that are both ecologically and economically advantageous.”

Materials Processing institute unveils £1 million sustainable cement and concrete centre

The Materials Processing Institute (MPI) is taking a significant step in supporting the construction industry’s drive toward decarbonisation with the opening of its £1 million Sustainable Cement and Concrete Centre (SCCC) later this month.

Supported by MPI’s Advanced Materials Characterisation Centre, The SCCC will focus on cutting-edge research and material development, including novel formulations for low-carbon cement and concrete and the use of electric arc furnace (EAF) slags in aggregate and clinker production. It will also provide consultancy services to further support clients to accelerate innovation, offering expertise and project management from concept through to pilot stage production.

MPI hosted a meeting of the Cement Standards and Technical Group of the Mineral Products Association (MPA). Delegates were given an exclusive, advanced tour of the facility, showcasing its advanced capabilities to drive sustainability within the built environment.

Process improvement is like sailing. With an experienced partner, you can achieve more.

Optimizing processes and maximizing efficiency is important to remain competitive. We are the partner that helps you master yield, quality, and compliance. With real-time inline insights and close monitoring of crucial parameters, we support manufacturers to optimize processes, reduce waste, and increase yield.

Terry Walsh, CEO of MPI, said: “The SCCC is a critical step in supporting the UK construction industry’s journey to net zero. Cement and concrete are the backbone of our built environment, and by focusing on decarbonising, we can significantly reduce emissions across the sector. This facility demonstrates our commitment to sustainability, providing the tools, expertise, and innovation required to enable a greener future through fuel switching, low-carbon cements and concretes, and innovations such as carbon capture, utilisation, and storage (CCUS) technology.

Roger Griffiths, Manager – Innovation Projects of the MPA, commented: “MPI’s investment in this facility will help support cement and concrete research and testing to strengthen the UK’s position as a leader in sustainable construction innovation.”

Concrete and cement play a vital role in the UK economy, with over 90 million t used annually. The industry contributes £18 billion to GDP and supports 3.5 million jobs, underpinning critical infrastructure and housing. Decarbonising this essential material is a significant opportunity to reduce emissions, ensuring sustainability and resilience in the construction sector.

The SCCC is a key part of the broader EconoMISER programme, led by the Foundation Industries Sustainability Consortium (FISC), which aims to accelerate the decarbonisation of the UK’s foundation industries. It builds on MPI’s role as a national leader in research and innovation, and its track record in delivering transformational change across the sector.

Titan Cement International SA have announced that its Belgian subsidiary, Titan America SA, parent of its US operations, has priced its initial public offering (IPO) of 24 000 000 common shares at a price to the public of US$16.00 per share.

The IPO consists of 9 000 000 new common shares to be issued and sold by Titan America and 15 000 000 existing common shares to be sold by Titan Cement International SA. Titan Cement International SA has granted the underwriters a 30-day option to purchase up to an additional 3 600 000 common shares to cover over-allotments, if any, at the initial public offering price, less underwriting discounts and commissions.

Titan America’s common shares are expected to begin trading on the New York Stock Exchange

under the ticker symbol 'TTAM' on February 7, 2025. The offering is expected to close on February 10, 2025, subject to the satisfaction of customary closing conditions.

Titan America expects to receive net proceeds of approximately US$136 800 000, after deducting underwriting discounts and commissions, which will be used for capital expenditures and other general corporate purposes, including to fund investments in technologies and Titan America’s growth strategies and to pursue strategic acquisitions that complement Titan America’s business.

Titan Cement International SA expects to receive net proceeds of approximately US$228 000 000, after deducting underwriting discounts and commissions.

After the completion of the IPO, Titan Cement International SA is expected to own 160 362 465 common shares of Titan America, representing 87% of the total outstanding common shares (or 156 762 465 common shares, representing 85% of the total outstanding common shares, if the underwriters exercise in full their over-allotment option).

Citigroup and Goldman Sachs & Co. LLC (in alphabetical order) are acting as joint lead book-running managers for the IPO. BofA Securities, BNP Paribas, Jefferies, HSBC, Societe Generale, and Stifel are acting as bookrunners for the IPO.

The Innovandi Open Innovation Challenge 2025 will unite start-ups with leading global cement and concrete manufacturers to collaborate on cutting-edge solutions for low-carbon concrete.

The Open Challenge is looking for start-ups from around the world working on next generation materials towards net zero concrete, e.g. low-carbon admixtures, supplementary cementitious materials (SCMs), activators, or binders.

Thomas Guillot, Chief Executive of the GCCA, said: “Advanced production methods which are decarbonising our sector are already being used in cement and concrete production in many parts of the world. Through the Innovandi Open Challenge, start-ups can bring in even newer ideas and further accelerate our industry’s push."

Mike Ireland, Portland Cement Association (PCA), examines the opportunities and challenges arising from the growing demand for blended cements in the US.

The demand for lower-carbon cements in the US has quickly grown from a trickle to a flood, as sustainability continues to emerge as a key metric for end users on par with resilience and reliability. In a short time, the market has shifted significantly, with more advanced cement blends being developed for the future.

In some areas of the US, 100% of the cement currently being produced is portland-limestone cement (PLC). The rest of the country is moving in a similar direction, making blended cement the new default for modern construction projects. This blended material carries substantial

environmental benefits, with up to 10% less embodied carbon than traditional portland cement. PLC offers a way for concrete producers to achieve a lower-carbon footprint, much like fly ash and slag cement have done for decades.

The transition to using greener cements has been underway for many years, but the pace has dramatically picked up recently as more producers, contractors, engineers, and architects have gained experience and confidence working with PLC. In 2020, blended cements like PLC represented about 3% of the 100 million metric t of cement consumed annually in the US. By 2024, blended cements grew to more than half of the total US cement consumption.

With this shift came significant climate benefits. In 2023, replacing traditional portland cement with PLC resulted in more than 3.9 million metric t of carbon avoided. That is roughly equivalent to a year’s worth of emissions from one coal-fired power plant, according to the US Environmental Protection Agency.

While traditional portland cement has long dominated the construction and infrastructure market in the US, blended cements offer an opportunity to maintain ambitious climate goals of net zero building without adding costs to projects. Traditional portland cement was patented almost 200 years ago, and challenges today call for new solutions.

In addition, those who have worked with PLC are realising benefits such as a lighter colour, which can be advantageous in certain architectural uses, and similar, or even improved, performance. A primary advantage is that PLC also offers carbon reduction with the ability to meet the same proven performance as traditional cement.

Contractors start with the same amount of PLC to replace portland cement, then test the mixture to confirm fresh and hardened properties. As the quantity of PLC produced in the US continues to grow, so does the number of projects it is being used in – and there are now numerous examples across the country that showcase the successes of blended cements.

A prominent example of PLC being at the centre of a new project’s design is the new US$64 million training facility for the WNBA’s Seattle Storm. In construction, all the cement used was Type IL: the project used ASTM C595 Type IL PLC produced by Ash Grove Cement, a CRH company. As the team plays in Seattle’s Climate Pledge Arena, in a city that passed new building performance standards to reach net zero by 2050, sustainability was a critical key metric, leading the contractors to use PLC throughout the structure. The completed project not only exceeded LEED Gold standards but was also named a winner in the National Ready Mixed Concrete Association’s (NRMCA) 2024 Concrete Innovation Awards.

This same commitment to sustainability and responsible building was the driver behind the decision by the designers of Drexel University’s new Health Sciences Building in West Philadelphia to not only use PLC from Heidelberg Materials, but also source concrete materials locally. Some phases of the project used up to 25% Class F fly ash as a supplemental cementitious material to further reduce CO2 emissions from concrete by up to 35%.

There has also been an increase in the number of roadway and other paving projects using PLC to reduce emissions without compromising performance. PLC was recently used in a project reconstructing a 4 mile stretch of California’s Highway 101, which Caltrans estimates will cut emissions by 28 000 tpy – the equivalent of taking more than 6000 cars off the road.

Beyond California, several other state Departments of Transportation have had success placing PLC concrete pavements for more than a decade. 2024 was a watershed year as all 50 state DOTs and the District of Columbia approved PLC for their projects, paving the way for this material to be used in transportation infrastructure across the US.

PLC has also been used in dam projects, such as the Gross Reservoir Expansion Project in Colorado, where it was the material used to produce nearly 1 million cubic yards of roller-compacted concrete (RCC) and conventional concrete. The use of PLC will avoid more than 5600 metric t of CO2. PLC also has its own ASTM standard and is permitted for use in airport construction projects by the Federal Aviation Administration.

In the near term, this dramatic shift in the market will continue as PLC is consistently taking over applications where traditional portland cement once reigned. Helping end-users transition to PLC and other blended cements will remain a top priority for the Portland Cement Association (PCA), including assisting with adoption, serving as a source of information, communicating why this change is worthwhile, and educating the rest of the supply chain on PLC best practices. PCA represents more than 75% of US cement production capacity and is actively engaged with both the NRMCA and the American Society of Concrete Contractors (ASCC) to help everyone who works with PLC execute high-quality results that match performance requirements.

Looking to the future, there is an opportunity for more widespread adoption of ternary-blend alternatives. Ternary blends use a third ingredient to further reduce embodied carbon and lower overall environmental impacts. They can also help producers take advantage of locally available, abundant materials.

The rehabilitation of a highway exit in upstate New York is a useful case study in how ternary cement systems are being used in real world settings. Cold Spring Construction used a ternary cement blend on an I-86 bridge structure in Coopers Plains, NY, with a cementitious system comprised of a binary Type 1P

cement (6% silica fume) blended with 20% Class F fly ash. As part of construction work to rehabilitate exit 42 of the highway, the project included reconstruction of the bridge and adjacent roads as well as drainage and box culvert replacement. All concrete was mixed at a central mix plant with locally sourced materials for the ternary blend, including crushed gravel and river sand from a contractor in nearby Erwin, NY. Initial and final sets occurred at 5.76 hrs and 6.72 hrs, respectively, with hardened properties showing 3160 psi compressive strength at seven days and 3970 psi compressive strength at 28 days. The contractor reported no difficulties with using this particular blend.

PCA is actively looking for other projects using ternary cements so the industry can learn from on-the-ground experience. The association also works to educate regulators, concrete producers, and other decision-makers on how these cements are performing and what testing is needed. A key challenge to increasing consideration of blended cements is regulatory lag that doesn’t keep up with the pace of innovation.

How are teams overcoming these challenges?

A well-trafficked stretch of road in Henry County, Tennessee, provided the Tennessee Department of Transportation (TDOT) with the opportunity to work with suppliers to use PLC with a 25% fly ash replacement. This project relied on 450 trial batches to confirm compressive strength at 28 days (4000 psi), noting little-to-no difference between PLC and their typical mixes. As a result, TDOT reduced the carbon footprint for several bridge decks while repairing the bridge with concrete that possessed the required properties.

In conversations with regulators and others, it is critical to continue focusing on how the market is shifting from prescriptive specifications to performance-based specifications. As more projects consider ternary cement systems, trial batching and field verification will remain the best method to determine the performance of a concrete mixture. Trial batching should evaluate factors such as compressive strength, slump/water demand, slump loss, setting time, air content, strength development, and bleeding. Additionally, speciality mixes are tested in a subset of trial batches for factors like sulfate resistance, chloride resistance, shrinkage, and more.

The shift toward lower-carbon cement is coming from both suppliers and users. An increasing number of projects is taking advantage of incentives available to lower the carbon footprint of construction. As of 2024, 13 states have implemented 'Buy Clean' initiatives to reduce the embodied carbon of construction materials. Similar to efforts involving PLC, PCA will work across the value chain to educate about these new ternary options. It will be especially critical for these blends to be included in new sustainable construction codes and considered for inclusion in

green rating systems to inform better decisions for longer-term, sustainable projects.

The cement industry in the US has a longstanding commitment to reduce the carbon impact of products, pledging to reach carbon neutrality by 2050. As materials continue to evolve, it is possible there will also be widespread usage of quaternary blends that offer further environmental benefits and cost savings to construction projects. For this to gain traction, regulation will need to be nimble enough to capture the latest, state-of-the-art materials. In the private sector, industry leaders will need to remain focused on combatting institutional inertia and providing guidance on testing so new blends can be considered.

It is also important to avoid relying on older materials when newer options are cleaner and perform just as well. Some of the most exciting projects with quaternary blends will be pushed forward by innovative companies at the forefront of change, such as tech giants committed to net-zero goals. These cutting-edge projects can serve as important proof points for the advantages of new cementitious material mixes and help the rest of the US tap into available resources, setting a global standard for a sustainable future.

It is clear that achieving carbon neutrality across the value chain by 2050 will require a deep and lasting commitment from both the industry and its customers. These new cement blends remain a major part of the puzzle.

Concrete – made with cement – is central to the American built environment, with 88 million t of cement and 400 million t of concrete produced in the US in 2023. The cement, concrete, and related industries directly and indirectly employ nearly 600 000 people and contribute US$150 billion to the US economy. By working with partners across the value chain, the industry can reach carbon neutrality while continuing to provide the buildings, roads, and runways people rely on to lead productive lives across the country and around the globe.

Michael 'Mike' Ireland is the President and CEO of the Portland Cement Association (PCA). Previously, Mike was Associate Executive Director of the American Society of Mechanical Engineers (ASME), as well as CEO of two other professional associations. He is a seasoned association executive, with expertise in all phases of organisational management, including executive leadership, marketing and communications, workforce development, philanthropy and fundraising, and membership development. Throughout his career, he has been known for fostering a culture of camaraderie and customer focus, thanks to his sense of creativity and ability to help organisations positively navigate strategic change.

Unlike some other sectors, such as petrochemicals or heavy transportation, it is fair to say that the technological pathway to deep decarbonisation of cement production has now crystallised around fundamentals. Although their relative importance fluctuates, global and regional cement roadmaps all acknowledge the need for:

� More efficient use of cement and concrete.

� Switching from fossil fuels to waste and biomass to generate heat.

� Reducing the average clinker content through the use of supplementary cementitious materials (SCMs).

� Carbon capture, either for utilisation or storage (CCUS), to tackle residual emissions.

Publications have also evidenced the massive investments needed to transform the cement industry, especially due to CCUS. While most in the industry believe that public funding will be needed to drive the transition, many early policy options with little or no direct financial support can be adopted. This article will illustrate three of these potentially impactful policies that require limited financial effort.

Some types of SCMs are already commonly used for cement blending (e.g. limestone filler, blast furnace slag, pozzolans) and other very promising sources are emerging (e.g. calcined clay, recycled concrete, reclaimed coal fly ash). While blended cements usually do not pose a major technical challenge and can find areas to compete with ordinary portland cement, they are still far from their full potential deployment. Their penetration in the construction market has often been impeded by a slow evolution of building codes and product standards which tends to reflect the conservative nature of public and private stakeholders in the industry. Government intervention should focus on transitioning from the traditional recipe-based to the performance-based approach whereby

SCMs and blended cements can be introduced to the market when demonstrating certain performance criteria. The Rocky Mountain Institute (RMI) has recently published a guide with very practical recommendations for developing performance standards and specifications for concrete. Besides, given the high cost of CCUS and its slow deployment, reducing clinker production through SCMs will only alleviate the future reliance on carbon capture to address residual emissions.

Landfilling is a common waste management practice in many jurisdictions. Yet some materials such as tyres, textiles, foams, sawdust, or agricultural residues have a valuable energy content and a fraction of biogenic carbon that can contribute to climate mitigation. Thanks to very high temperatures, cement manufacturing has the ability to process such waste and destroy most residuals which are potentially hazardous. Many manufacturers already resort to alternative waste fuels owing to attractive economics (e.g. in the EU, more than 40% of the thermal energy comes from waste and biomass) but changes in regulation can further support the phase-out of fossil fuels. Implementing waste legislation to divert waste streams from simple disposal and recognising co-processing as a viable waste management solution would further support the reduction of fossil fuel use in the sector. For instance, the cement industry in Poland rapidly increased its average thermal substitution rate to 45% in 2011 and more than 60% in 2017 partly due to strong enforcement of waste regulations, particularly those related to landfilling. In oil producing and refining regions, such as the Middle East, oil sludges used in well drilling are often disposed of in dedicated lagoons.

These sludges are still largely recoverable and can be used as fuels for clinker manufacturing.

Cement is probably one of the most promising candidates to be stimulated through Green public procurement (GPP) policies, with the public sector accounting for 40% to 60% of concrete sales globally. Public buyers can leverage their purchase power by imposing more stringent sustainability criteria in their projects and, especially, limits on embedded carbon emissions in materials. The Industrial Deep Decarbonisation Initiative (IDDI) has been collecting national commitments to procure low-carbon construction materials under the Green Public Procurement Pledge to encourage this practice globally. Promoting the use of novel blended cements and chemistries in public construction through GPP is essential to showcase their technical performance and create the market confidence they often lack. By absorbing the higher initial cost, governments can also contribute to create lead markets that should trigger economies of scale once green demand has sufficiently aggregated.

Although it is not the focus of this article, it is worth mentioning that GPP criteria can be calibrated to reinforce the economics of CCUS. More generally, demand-side policy measures (as presented in the Green Demand Policy Playbook published by the ITA at COP29) are essential to stimulate early adoption of green materials.

A case study published by Ramboll in November 2024 on the construction of a new school building in Zürich, Switzerland, concluded that the inclusion of GPP criteria has allowed the reduction of embodied emissions from concrete use by almost 25% for a modest 2% increase in cost (the so-called 'green premium'), compared to a business-as-usual scenario.

CCUS probably represents the most challenging, yet indispensable, piece of the cement net zero journey. However, a series of other solutions (totalling about 50% of the cumulative GHG emissions savings between 2022 and 2050 according to the MPP Net Zero scenario for the cement industry) can be deployed more rapidly to put the industry on track to the 2030 target. As hurdles are mostly linked to the regulatory framework and industry conservatism, rather than economics, some well-calibrated policy measures entailing limited public money can be taken to stimulate these levers.

Eduardo Gomez, CRH Ventures, explains why partnering with startups is key to the decarbonisation revolution.

The importance of innovation and emerging technologies to drive progress in reducing carbon emissions, optimising the use of resources, and delivering process efficiencies has never been greater. While the adoption rate and impact of innovation is increasing, there remains huge scope for more transformative strategies as the industry responds to the changing needs of customers and society.

At CRH, constant innovation is key to improving processes and developing new technologies that play a crucial role in the journey to net-zero. The company's commitment to innovation, alongside other corporations and governments, is critical in order to accelerate and provide resources for large-scale change. There is also a growing recognition of the importance of working with industry startups, whose challenger mindset helps rethink, reimagine, and reinvent systems, processes, and technologies.

The industry is rich in expertise and knowledge, with a proven track record showing that sustainability and profitability can go hand in hand. Embedding innovation is vital in converting challenges into value-creation opportunities. Ideas and innovation are emerging from various sources, including businesses, academia, and startups. However, the real challenge lies in converting these ideas and small-scale technologies into large-scale, economically viable solutions. Combining the entrepreneurial spirit and determination shared by startups and those in the cement industry already addressing decarbonisation, with the scale, weight, and backing from the established industry players, is one of the most impactful ways to advance the development of viable sustainable solutions.

Innovation in areas such as AI-driven material optimisation, alternative cementitious materials, and novel production

methods is now supporting the cement decarbonisation journey. Capable of demonstrating real impact, startups in this space are attracting growing interest from institutional and strategic investors as their solutions offer the potential for long-term cost savings, enhanced performance, and a competitive edge in a rapidly evolving market. However, the construction industry’s complex systems of standards and regulations can make for a challenging environment to deliver transformative ideas. Startups are known for their ingenuity and courage, often pushing the boundaries of what is possible. They need assistance in navigating the complex industry landscape and in scaling solutions which require significant capital investment, regulatory approval, and widespread adoption – substantial hurdles for small ventures. At CRH, there is a strong belief in the importance of playing a key role in accelerating the most promising innovations and technologies, whether through partnerships or funding. Accelerators and incubators focused on climate-tech also play a vital role in bridging the gap between early-stage innovation and large-scale implementation.

Interest from construction technology (ConTech) startups willing to tackle the industry's challenges is directly linked to the significant growth in funding from institutional and strategic investors. As a result, collaboration between those who own and operate the assets and those bringing forward new outside thinking to transform them is increasingly recognised as the most effective and efficient way forward. CRH is playing an important role in embedding this way of working, partnering with startups on a range of technologies, material innovations, and new processes designed to deliver a more sustainable built environment. For example, CRH has invested in AICrete – a company using AI to better predict recipe formulations for concrete and optimise the amount of cement used. Results from a pilot project indicate potential savings of 3.5% on material costs, and an average 5% reduction in carbon emissions. Through a focus on resource efficiency and circularity, CRH is also working with partners to advance the development of new and novel materials, as well as the use of non-traditional materials, in the cement manufacturing process. Carbon Upcycling Technologies is able to transform local industrial by-products into high-performing supplementary cementitious materials (SCMs), which can reduce the clinker factor and associated embodied carbon. The Canadian startup has used 30 different feedstocks in its process so far, including fly ash, glass, biomass, volcanic rocks, natural pozzolans, metal mine tailings, aggregate fines, silicates, and clays. With the transformation process taking place in-situ at cement plants, there is the additional benefit of logistical environmental performance gains.

The commercialisation of breakthrough technology that avoids both mineral and fossil fuel emission sources in the cement manufacturing process is also advancing. Massachusetts-based Sublime Systems, for example, is at the forefront of developing an innovative electrochemical, near-ambient-temperature approach to cement production. This technology aims to replace traditional kiln processes and achieve a 90% reduction in cement’s CO2 emissions at full commercial scale. By utilising calcium-rich minerals and industrial byproducts like slags and kiln dusts, Sublime Systems produces a material that is a novel alternative to traditional portland cement.

For new and emerging technologies like these to realise their potential in accelerating the decarbonisation of the industry, they must be encouraged and combined with the strategic advantages and expertise of the leading building materials companies.

The path to decarbonisation in the industry requires collaboration and a concerted effort from all stakeholders. Startups, established companies, investors, and policymakers must work together to drive innovation and investment.

While the backdrop to scaling new technologies and innovations which support industry and government decarbonisation ambitions is complex and challenging, it also presents unparalleled opportunities. The key to success lies in driving forward innovative thinking and delivery, supported by strategic partnerships between industry leaders and startups which can ensure that promising technologies receive the funding, expertise, and market access needed to scale effectively.

CRH Ventures are committed to fostering collaboration and investing strategically in ConTech and climate technology startups. Doing so means CRH can continue to develop new, cutting-edge mutually beneficial partnerships to accelerate decarbonisation and enable safer, smarter, and more sustainable construction.

Eduardo Gomez is the Head of CRH Ventures, where he leads efforts in investing and partnering with innovative startups across the construction value chain. With a strong background in venture capital and a passion for sustainable development, Eduardo is dedicated to fostering long-term partnerships that drive the development of sustainable solutions. Under his leadership, CRH Ventures focuses on making the construction industry safer, smarter, more efficient, and more resilient. Eduardo holds a degree in Engineering and an MBA, and he brings over 15 years of experience in the industry to his role.

Rob Cumming, Lafarge Canada (East), explores how a 'silver buckshot' approach can achieve net-zero concrete without the high costs of CCS or e-fuels.

As the cold, hard reality of the expense of carbon sequestration weighs heavily on the industry’s shoulders, it is important to question whether it truly is the ultimate solution. Geologic sequestration projects, or their even more expensive cousin ‘sustainable’ e-fuels, are high stakes ventures with significant electricity and water needs – and eye watering costs – with no benefits beyond decarbonisation (as important as that is).

Has this question been approached from the wrong angle? Cement is an engineering-intensive industry, and 'big problems call for big technical solutions' is the rallying cry. Or, as often heard, the only proven, full scale solutions are carbon capture & storage (CCS) or sustainable e-fuels (fuels made by combining H2 with captured CO2).

But what if the perspective shifts to that of the concrete user – those needing concrete for buildings, infrastructure, or other applications?

Perhaps key performance indicators (KPI) should focus on kg/m3 of delivered concrete, which ties nicely into customer KPIs of kg/m2 of floorspace or kg/km of highway. ‘What gets measured gets done’ is a proven management mantra, and so the selection of the KPIs will steer the entire strategy.

Can net zero concrete in buildings and infrastructure be achieved without relying on CCS or e-fuels by rethinking final products from the buyer's perspective?

Can a ‘silver buckshot’ approach – targeting multiple solutions – be more effective than searching for a single 'silver bullet' to decarbonise the industry?

The silver buckshot approach

There are a number of decarbonisation strategies that make sense even without monetising the carbon benefit attained. These include energy efficiency measures, replacing fossil fuels with lower carbon fuels (often financed by waste tipping fees), new low

clinker content formulations, and new cementitious products. Even electrification is becoming a low cost choice in multiple applications. These investments can be considered 'no regrets' investments, even in uncertain times where decarbonisation policies are in political flux. Carbon pricing systems or tax credits can make them even more profitable. Adding smart design practices in collaboration with the builder can further decarbonise the final building. In a recent collaboration between The Daniels Corporation and Lafarge Canada (East), a 25% reduction in carbon in the delivered concrete was achieved simply by identifying where schedule slack in non-critical path project components could be tolerated and applying a smart mix design strategy.

Thirty five different mix designs were used to accomplish this reduction, with no impact on the building’s schedule.

Some net zero roadmaps, like the 'Concrete Zero Roadmap' prepared by the Cement Association of Canada (CAC), show that a combination of all of the above ‘no regrets’ measures could reduce the carbon content of new buildings and infrastructure by two thirds, much of this at low or no cost. Certainly nowhere near the cost of CCUS, which is well over US$100/t of CO2.

How about measures that come with a cost? If the last measure in a net zero strategy is CCS at over US$100/t of CO2, then this opens the door to solutions that are still expensive, but less so in comparison. Many other solutions with lower costs than CCUS have yet to be fully explored. Plants that have installed CCS or e-fuel systems may find themselves competing against plants that have pursued a different, multi-path approach to achieving net-zero status, at much lower costs.

Some examples of these multi-path solutions are provided in this article, and innovators who forsee the future need for decarbonisation are actively working on these solutions. It is worth noting that many of these alternative solutions produce sellable products in addition to their decarbonisation benefits, and their environmental benefits contibute to the industry’s overall decarbonisation efforts (not always the case in CCS and e-fuels strategies).

There are a number of sources of calcium that are already in the oxide form and so do not produce CO2 during cement production. Natural minerals such as wollastonite, serpentine, and olivine may be able to play a partial role in the formulation of clinker. Of course, the mineral resources may not be co-located near the cement plant and a processing step may be needed, but in comparison to CCS & e-fuel costs these added

by providing a new process optimization solution: CemAI Process Optimizer . Combining the power of AI/ML with cement-specific expertise, CemAI Process Optimizer enables a step-change in production volumes, energy efficiency and consistent quality output.

Predictive Maintenance & Real-Time Optimization are now in your hands.

Please

info@cemai.com | +1 (502) 322 0433

costs could be much lower. In other cases, waste materials from other industries and mining operations may provide many of the necessary minerals needed for traditional clinker production, often at a much lower cost than virgin minerals. Concrete rubble is already being used as a raw material in cement production. Solidia Technologies continues to explore alternative cement formulations, similar to wollastonite, which produce cement and resulting concrete that cure with CO2

Mineralised aggregates in concrete

Mineralisation can be defined as the reaction of CO2 with metal oxide bearing materials (e.g. Ca, Mg, Fe) to form insoluble carbonates. An example of one chemical reaction (for wollastonite) is provided below:

CaSiO3 + CO2 → CaCO3 + SiO2 + 90 kJ/mol CO2

Carbonation terminology is often used in this context but typically refers to the natural consumption of CO2 by concrete in buildings.

‘Negative carbon’ mineralised aggregate products in a cubic metre of concrete can fully or partially balance out or offset remaining embodied carbon content after other measures have been implemented. Akin to the natural carbonation of CO2 in-situ in buildings, concrete rubble through an industrialised process can be used to absorb CO2 from cement production (or any CO2 producing source). The resulting negative carbon aggregate can then be used in mix designs or road construction, etc. This is already being done by Switzerland based Neustark.

All mineralisation strategies face one major achilles heel: the need for a supply of geomass to chemically react with CO2. The IPCC has defined RCO2 as a metric to define the ratio of the mass of mineral needed to the mass of CO2 captured at 100% efficiency. In the case of crushed concrete rubble, the practical RCO2 ratio is around 20, meaning that 20 million t of concrete rubble are required to absorb 1 million t of CO2. Mineralisation has some advantages:

� The capture and utilisation occur in a single step, in contrast to technologies which require capture first and then a subsequent reaction step.

� Mineralisation is an exothermic reaction and occurs naturally.

� The need for expensive flue gas cleaning and conditioning to enable capture is non-existent or less critical given the nature of the process itself and the final product produced.

� Any biogenic carbon in a flue gas, from biomass fuels, will further contribute the carbon sequestered in the mineral product.

The aggregate products produced can be sold, and if used in concrete mix designs,they offset CO2 from cement production – potentially even making

advanced concrete products carbon-negative in the future.

Start-ups are active in this space. A short list of companies includes: BluePlanet, Carbon8, Carbon Upcycling, Fortera, Carbfix, Hyperion, and Solidia.

Neutral or negative carbon filler in concrete

A number of emerging technologies produce materials that can be added to concrete as a filler. An example is the use of biochar, which exploits the biogenic nature of the char to effectively sequester CO2 in concrete, offsetting in whole or in part CO2 from cement production. Other aggregates that do not have cementitious properties but provide other mix design benefits can be used as well and synergistically reduce clinker content. Global norms and standards need to evolve to unleash the maximum benefit these creative mix designs can achieve in terms of low cost decarbonisation. Even under the current standards, the Lafarge – Daniels example noted earlier achieved a 25% reduction, and as standards evolve further, this capability will continue to grow.

Carbon removal through mineralisation and other pathways

There are already companies selling minerals for agricultural use that not only provide nutrients but also naturally remove CO2 from the air through mineralisation. Three examples include:

� UNDO, which uses wollastonite in an agricultural additive which contributes minerals to the soil, enhancing soil quality while also absorbing CO2 over time in a natural weathering process, which is monitored and credibly accounted for to allow the sale of removal offsets.

� A non-mineralisation example is CarbonRun, which treats acidified rivers through the addition of finely ground limestone, restoring fish habitats and forming a bicarbonate, in another form of carbon removal. Both of these examples demonstrate the use of aggregates to address decarbonisation.

� Ottawa based Hyperion is producing precipitated calcium carbonate, a high value aggregate product used in a wide variety of applications, including toothpaste and paint. Hyperion relies on chemical feedstocks rather than mineral geomass. In this case the CO2 will come from industrial sources.

When decarbonisation is viewed from the customer perspective, transportation emissions become relevant. Without a doubt clinker production remains the lion's share of CO2 emitted in the supply and delivery of concrete to the customer, but other sources add up and must also be managed to deliver a net zero product for customer projects. Electric ready-mix trucks are already in use in Europe.

For example, Holcim has committed to purchasing 1000 trucks for its European operations. As battery costs come down, this trend will spread to other parts of the world.

The case for silver buckshot in meeting concrete buyer net zero needs

It is easy to dismiss any individual solution presented above as 'just a small solution' or reject it as 'too expensive'. Strangely though, in the context of cost, published net zero strategies for the cement and concrete industry list CCUS as the final technology to be deployed. CCUS is the universal black box piece in the puzzle of net zero roadmaps. Interestingly, the KPI used by most cement producers is kg of CO2/t of cementitious product produced. This metric ignores a wide swath of the available solutions noted earlier and is not a great fit with the KPIs of the industry’s customers.

It is quite conceivable that, through a combination of known low- and moderate cost solutions, the concentration of CO2 embodied in a delivered cubic metre of concrete in a few years can be reduced by over two thirds when compared to historical concrete – as shown in many net zero roadmaps. The use of higher cost but negative carbon mix components could offset that cubic metre, turning it into a net zero product. This pathway would not rely on big bets such as CCS and e-fuels, but rather on dozens of small solutions which collectively add and subtract to net zero. If the alternative is a US$100/t of CO2 solution, as is the case with CCS and sustainable fuels, this seems a smarter approach.

The industry must revisit offsets – but in a narrow, credible way. The outcry when the Science Based Targets Initiative proposed allowing offsets in net zero strategies was widely noted. Perhaps a more focused offset strategy, one that is a) strictly for use within the industry and b) includes removal technologies that use products from within the industry itself.

This would necessitate excluding avoidance offsets and broad-based nature based offsets. A ‘book and claim’ market system, similar to the airline industry, could be an effective model. This system would be restricted to concrete industry players and would incorporate supply chain data accounting, tallying up the decarbonisation strategies leading to the delivered cubic metre of concrete, including only those offsets that meet the specified criteria.

It is possible that net zero can be achieved without CCS and e-fuels by taking a concrete buyer’s perspective, using a kg/m3 of delivered product KPI, and thus contributing to the affordability of decarbonised critical housing and infrastructure needs.

From individual components to upgrades to complete plants, InterCem provides customized solutions for operators and investors of cement plants all over the world. InterCem is therefore also the right partner for you when it comes to planning, detailed engineering, project management of greenfield projects and conversion/modernization of production plants.

Contact us: The InterCem professionals will also find the right solution for your requirements.

ementtech

May 15-17, 2025

Organizer:

China Building Materials Federation

China Cement Association

CCPIT Building Materials Sub-council

Exhibition/Conference/Plant Tour/City Walk

---Your direct gateway to China cement market

Bodil Recke, ABB Process Industries, discusses the strategies driving the cement industry's transition to sustainability.

Cement is integral to economic growth, and demand is on the rise as urbanisation increases and infrastructure projects escalate worldwide. However, with cement production responsible for around 7% of global CO2 emissions,1 the industry must reconcile its necessity with its environmental impact. Addressing this challenge means rethinking the fundamentals

of cement production, from energy sources to material composition. Emerging strategies, including electrification, carbon capture, alternative materials, and digitalisation are shaping the path toward sustainability.

Decarbonisation demands an integrated approach that considers the entire value chain, from raw material extraction to final application. It goes beyond the

implementation of isolated technological solutions, instead requiring a comprehensive shift in process efficiency, material usage, and policy alignment.

For decades, cement production has depended on fossil fuels to power the high temperatures required for clinker formation. The initial step to move away from this has been to replace fossil fuels with various waste materials, like plastics or agricultural waste. Electrification is one of the most discussed strategies for decarbonising cement production as it involves shifting energy inputs from fossil fuels to electricity, ideally from renewable sources. However, the transition to electrification is complex and presents various operational challenges. At the heart of cement production, cement kilns require continuous high temperatures, which grid-based electricity alone cannot reliably supply in many parts of the world. The volatility of electricity supply, particularly in regions where the grid remains heavily reliant on coal, creates significant risk. Electrification could help reduce direct emissions by switching to cleaner electricity, but there are still complexities related to energy reliability, cost, and scalability that remain.

While renewable energy sources are central to this transition, direct partnerships are becoming critical. By securing dedicated renewable energy supplies as partners, cement plants can reduce their exposure to fluctuating energy costs and instabilities in the grid. This could stabilise the energy input costs in cement production while reducing emissions from energy consumption. Coupled with robust energy storage systems for continuity and reliability, electrification can significantly reduce emissions. From electric plasma-based calcination and rotary kiln electrification to electric arc calciners capable of reaching the necessary high temperatures, electrification also offers a cleaner means of processing raw materials.

Electrification has emerged as a strategy for decarbonising cement production as it offers an opportunity to shift away from fossil fuels. Ongoing developments in technologies such as electric

plasma-based calcination and rotary kiln electrification provide alternatives to the traditionally fuelled kilns. Alternatively, electric arc calciners, capable of reaching the high temperatures needed for cement production, offer a cleaner means of processing raw materials.

Decarbonisation through electrification is one strand of the solution which must be considered alongside its operational and infrastructural challenges. Replacing fossil-fuel-fired kilns with electric alternatives can generate the necessary heat cement manufacturers need while significantly cutting back on emissions. However, a shift in energy policy and infrastructure development is required to overcome energy supply volatility and cost considerations.

Transitioning from traditional fossil fuels to alternative energy sources, such as biomass or municipal waste, is a viable avenue for reducing emissions in cement production. However, these alternative fuels (AFs) have distinct combustion characteristics that can affect process stability. Biomass and waste-based fuels typically have lower energy content compared to coal, and their combustion can result in inconsistent temperatures and potentially affect the chemistry or increase emissions of certain pollutants.

To mitigate these issues, cement producers must invest in modifying kiln technologies and optimising their combustion processes to ensure that AFs can be used effectively without compromising the quality of the final product. Furthermore, this fuel substitution must be accompanied by broader energy efficiency improvements across cement production.

Rather than implementing isolated upgrades, cement producers should consider the adoption of a plant-wide strategy for optimising energy use. This could include integrating renewable energy sources, improving energy storage, and ensuring that heat recovery systems are used to their full potential.

Despite advancements in cleaner energy, some emissions in cement production remain unavoidable. The calcination process, involving the transformation of limestone into clinker, releases substantial amounts of CO2 as a natural byproduct. As these emissions are inherent to the chemical reaction, capturing them at the source becomes essential. This is where CCUS technologies come into play.

CCUS technologies offer a way to mitigate emissions, as demonstrated by the cement plants in the industry already piloting CCUS systems that capture CO2 from kiln flue gases before it enters the atmosphere. This captured carbon can either be stored underground in geological formations or repurposed for industrial applications, such as synthetic aggregate production or carbon-infused concrete curing. However, for CCUS to be implemented at scale, investments in carbon transportation and

storage infrastructure are necessary. Industry collaboration is driving these initiatives forward, laying the groundwork for a future where carbon capture might become a standard feature of cement plants. Cement producers can also look to integrate CCUS with other industrial sectors to increase its viability. Captured CO2 can be used in chemical processes, contributing to the circular economy by turning emissions into valuable inputs. For example, research into mineral carbonation explores how captured CO2 can react with industrial byproducts to create new construction materials, permanently storing carbon while producing commercially viable products. The economic feasibility of these applications depends on continued investment and policy support, underscoring the importance of cross-industry collaboration.

Modifying cement’s composition is a more direct approach to reducing the industry’s carbon footprint. Clinker, the key binding component of cement, is also its most emission-intensive ingredient. Reducing the clinker factor by incorporating supplementary cementitious materials (SCMs) provides an achievable means of lowering emissions without compromising structural integrity.

As industries such as coal-fired power plants and steel production transition towards cleaner processes, the availability of traditional SCMs may decrease. This creates a challenge for the cement industry, which has traditionally relied on waste products from other industries to meet its demand for supplementary materials. To overcome this, the cement industry must invest in developing new supplementary materials that are not reliant on industrial byproducts. Alternatives such as calcined clay and other natural pozzolans have long been explored as clinker substitutes and can also enhance cement performance in specific applications while reducing the overall carbon footprint.

Research into alternative binders continues across the industry, with innovations in blended cement

formulations allowing for greater customisation based on performance needs. Shifting toward performance-based cement standards, rather than ingredient-based requirements, would further enable wider adoption of low-carbon alternatives. Additionally, repurposing recycled concrete as aggregate offers another opportunity to reduce raw material consumption, closing the loop on cement production.

One of the most promising approaches to reducing the environmental impact of cement production is adopting a circular economy model. Recycling concrete from demolition and reusing materials such as aggregates and cementitious components has the potential to reduce the need for raw materials. However, the challenges are not only technical but logistical as well. While the potential for circularity in cement is significant, the industry must first implement large-scale recycling programmes to keep up with demand.

Technologies and systems need to be developed to make the recycling process more efficient. This includes grinding, sorting, cleaning, and reprocessing recycled concrete and other materials. The logistics of collecting and transporting these materials for reuse in cement production also need to be streamlined to ensure that they are cost-effective and scalable.

Another critical element of circularity is the development of closed-loop systems, where the waste generated from cement plants or construction sites is systematically reused, reducing the need for new resources. Adopting circularity in cement production will not only reduce carbon emissions but will also enhance resource efficiency, ensuring a more sustainable material flow within the construction industry.

While technological solutions exist, the decarbonisation of cement production also relies on the policy frameworks and investment structures that incentivise long-term change. No single company or sector can achieve meaningful decarbonisation in isolation. A transition towards low-carbon cement production necessitates broad collaboration among cement producers, technology developers, policymakers, and construction firms. Cross-industry cooperation is already yielding innovative solutions, with companies jointly investing in electrification, CCUS, and digitalisation.

Policymakers play a crucial role in shaping the regulatory landscape for sustainable cement production. Clear regulatory frameworks and long-term policy stability are also essential in creating predictability for cement manufacturers, allowing the industry to make the long-term investments in sustainable technology. The alternative to clear, stable

policy runs the risk of creating hesitancy within the industry, slowing down decarbonisation efforts. Additionally, establishing standardised emissions reporting frameworks allows companies to benchmark their progress, share best practices, and collectively push the industry toward decarbonisation goals. The shift toward performance-based cement standards also holds promise, enabling manufacturers to innovate while ensuring product integrity and structural performance.

Decarbonisation presents significant challenges in the cement industry, but with the right strategies, the sector can meet its sustainability targets. Electrification, CCUS, alternative materials, and process optimisation are the individual steps that, when combined, can provide the industry with a solid foundation to achieve these goals.

The path forward is complex, and there is a need for action. Cement manufacturers who act now will position themselves as leaders in the transition to a low-carbon economy, securing their place in the future of sustainable construction. The question is not whether the cement industry can decarbonise, but how it should leverage the tools and solutions available to accelerate the transition.

1. 'WCA supports full decarbonisation of the cement industry', World Cement Association – https://www. worldcementassociation.org/about-us/sustainability

Bodil Recke joined ABB in September 2024 and has over two decades of experience in the cement industry. With broad expertise in both operational efficiency and environmentally sustainable solutions, her career has evolved from focusing on cost reduction to addressing the urgent need for decarbonisation in cement production. Bodil's vision for the future emphasises the critical role of collaboration across the value chain, ranging from cement production to concrete manufacturing and recycling. She believes that achieving significant progress in reducing CO2 emissions will require a diverse set of solutions tailored to local contexts, including raw materials, green energy sources, and digital automation.

Passionate about contributing to a more sustainable world, Bodil sees her role at ABB as a unique opportunity to drive environmentally friendly innovations that support the cement industry’s journey toward net zero emissions. Her work not only aims to reduce the environmental footprint of cement products but also ensures that the industry continues to meet the global demand for infrastructure, improving the quality of life for people across the globe.

GEA Waste Heat Recovery units are tailored systems that combine proven ORC technology with an innovative heat recovery concept to harvest most of the waste heat out of the cement process & transform it into electricity.

Smaller carbon footprint, waste energy reuse, cost optimization and higher overall efficiency are only some of its advantages.

Learn more, get in touch: gea.com/contact

Olivier Guise, Ecocem, discusses how collaboration and scalable low-carbon solutions can accelerate the cement industry's path to net zero.

he buildings and construction sector faces a crucial challenge in reducing its carbon emissions, and despite advancements, the current pace of change is still too slow.

Accounting for 37% of global emissions, the sector is at a crossroads. The EU's latest 'Copernicus Climate Change Service' report confirmed 2024 as the warmest on record and the first year ever to exceed the 1.5˚C above pre-industrial levels in the annual average temperature, reinforcing the urgency with which emissions reduction must be accelerated.

Cement is one of the largest contributors to the construction industry’s emissions – accounting for

almost 8% of global CO2 alone. According to the International Energy Agency (IEA), there needs to be an annual 3% reduction in the industry’s emissions, if the industry is to align with the net zero scenario.

While there is widespread investment in innovation – including research into alternative materials and processes – many of the proposed solutions to get the industry to net zero, including carbon capture, utilisation, and storage (CCUS), mean increased production costs. And despite some clear advancements, such as the electrification of heating processes during the manufacture of cement, the industry is not yet fully addressing the core carbon issue: clinker. Clinker is the primary reactive ingredient in cement and is responsible for approximately two-thirds of its carbon emissions – primarily due to the calcination process, when limestone is burned to produce clinker and releases CO2

The reality is simple: unless CO2 production is avoided, which can only be done by dramatically reducing the amount of clinker in cement and concrete production, net zero will remain a distant dream.

To reduce clinker volumes, the industry must embrace new thinking and approaches. The cement sector is – quite rightly – highly regulated to ensure the safety of any construction in which cement and concrete are used. However, the industry is a conservative one, slow to adopt new technologies and reliant on traditional practices. Adopting the widest possible range of viable, emerging technologies as fast as possible is essential to tackle the emissions crisis.

Cement and concrete technologies have advanced significantly in recent years, making it possible to use half the amount of cement in concrete compared with historical levels, while still maintaining essential performance metrics in the concrete it is used to make, namely workability, strength, and durability. Halving the amount of cement produced means halving the CO2 associated with cement production. The industry’s footprint can be reduced even further, up to 70%, by maximising the use of locally available alternative materials, known as supplementary cementitious materials (SCMs). The more SCMs incorporated, the greater the positive impact will be.

Low-carbon cement is not new. What is new is the ability to scale these cements using a variety of readily available SCMs. Industry reluctance

toengage with these solutions has been rooted in the belief that there are not sufficient volumes of these SCMs available to make a real impact. This is no longer the case.