DUST CONTROL & FILTRATION

31 The Art of Passive Dust Control

REGIONAL REPORT: INDIA

10 India In Focus

Dr S B Hegde, Jain College of Engineering and Technology, provides a comprehensive analysis of the Indian cement industry.

CHAINS & CONVEYORS

22 Raising Resistance

Dr. O Mielenz, B. Bergmoser, Dr. S. Benito and Prof. Dr. W. Theisen, HEKO, highlight a new development in round steel chain technology that enhances wear resistance and extends service life under challenging operating conditions.

27 Time Will Tell

Conveyor belt specialist, Leslie David, explains why investing in high-quality heat resistant conveyor belts ultimately reduces long-term operational costs and improves performance.

Todd Swinderman, Martin Engineering, delves into how passive dust control measures using curtains and skirting are transforming conveyor transfer point efficiency, enhancing workplace safety, and reducing operational costs.

CLINKER COOLING

35 The Pendulum Swing

David Jansen, IKN, explores how the transition from outdated satellite coolers to new, innovative designs is helping the cement industry meet demands for energy efficiency and reduced emissions.

MILLING OPTIMISATION

39 Ball Mill Enhancements

Ana Esther Gonçalves, Christian Pfeiffer, explains how replacing intermediate diaphragms in ball mills enhances cement grinding efficiency.

DIGITALISATION

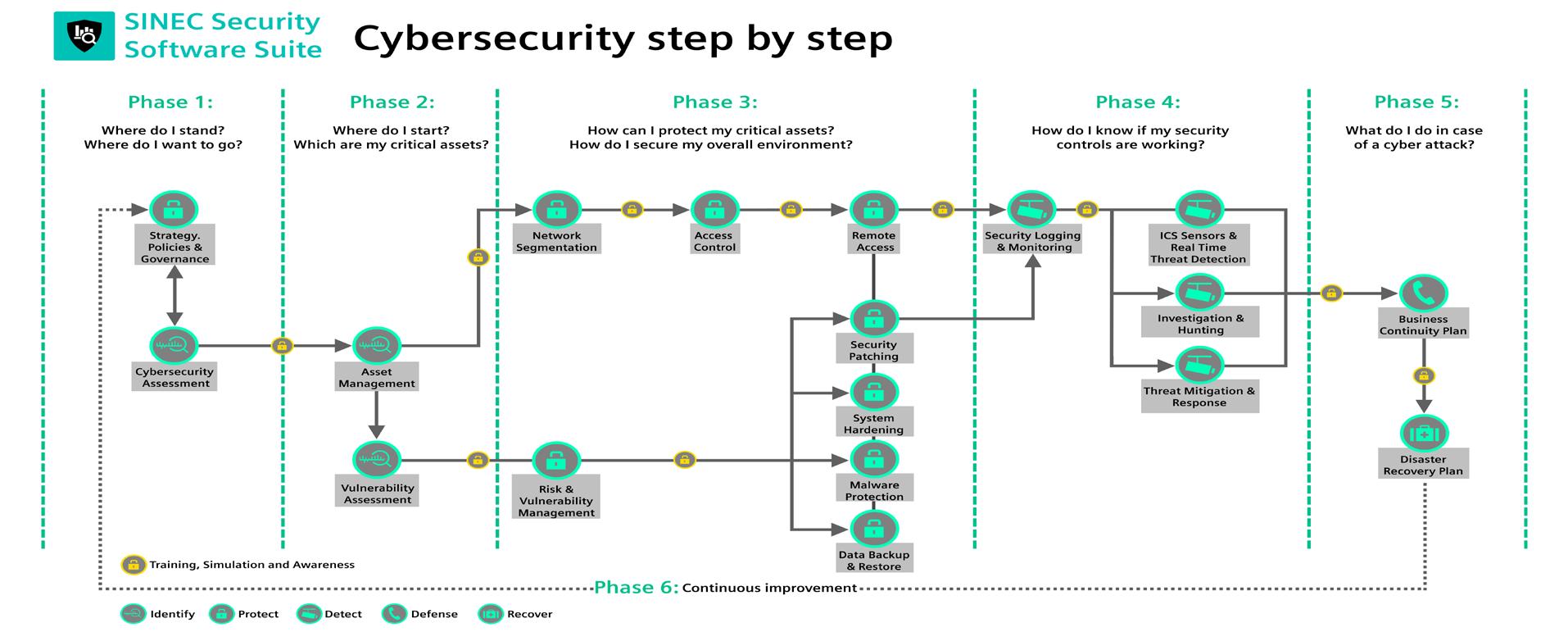

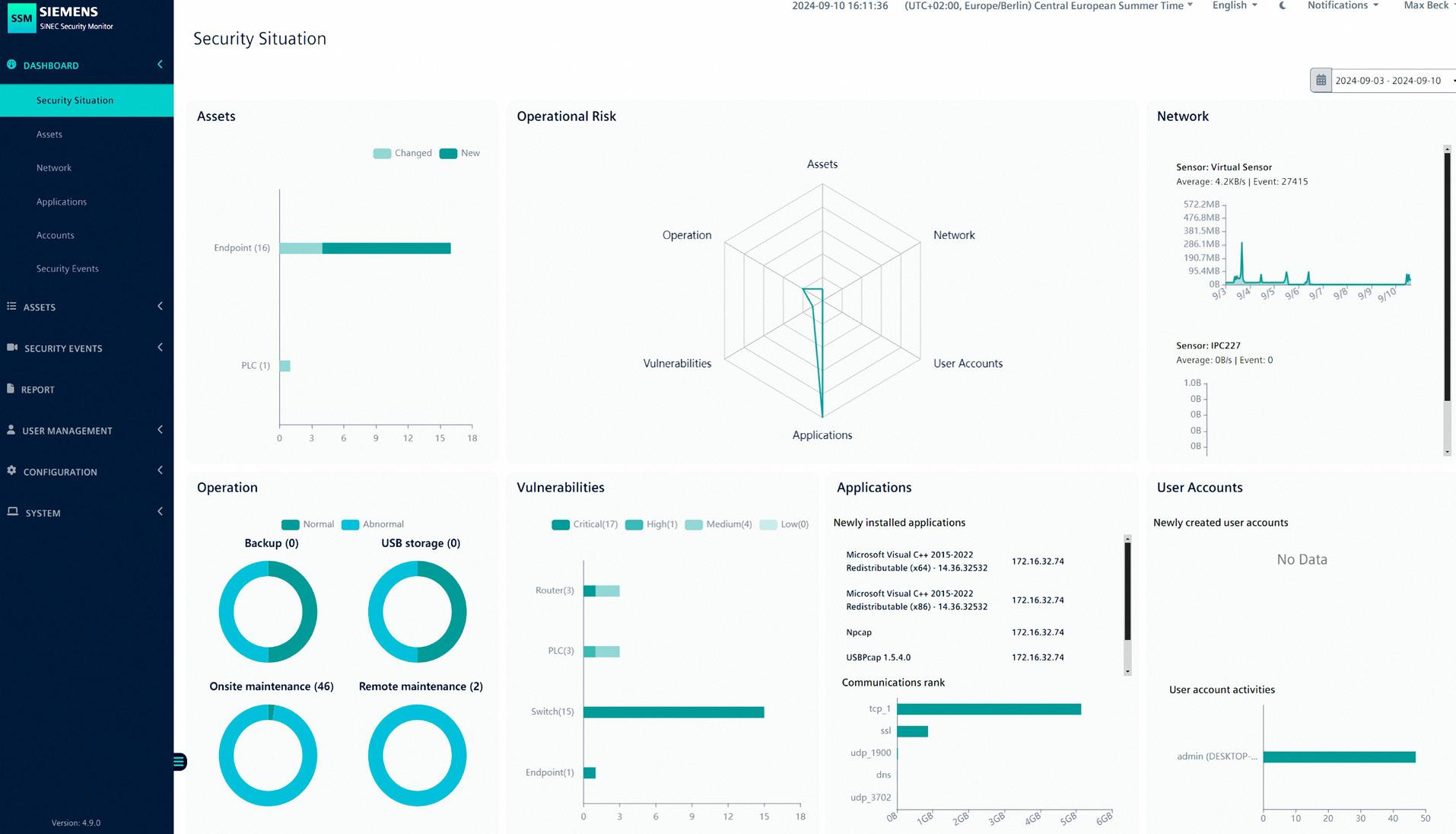

47 Cementing Cybersecurity

Sander Rotmensen, Siemens, explains how integrating advanced cybersecurity solutions can protect cement plants from evolving digital threats while ensuring uninterrupted operations.

XRF, SAMPLING & ANALYSIS

53 Securing Success With XRF

Didier Bonvin, Ling Schneider, and Christina Drathen, Thermo Fisher Scientific, detail how advanced X-ray fluorescence technology is enabling the cement industry to enhance quality control, sustainability, and regulatory compliance.

HEKO Ketten GmbH, Germany, has supplied conveyor chains for the bulk handling industry for more than 100 years. Chains made in Germany are running in thousands of conveyors worldwide.

No matter if it is cement, clinker, ash, or fertilizer that needs handling, HEKO’s customers agree that the company’s chains run smoothly. HEKO´s experience solves conveyor problems together with the customers. A wide range of chains and sprockets – even individually manufactured for a specific problem – provide a solution for all demands.

irborne contaminants from uncontrolled cement production can threaten worker health, impair equipment performance, and impact your bottom line. Martin Engineering delivers comprehensive solutions to keep that dust out of your hair and your facility up and running.

While our easy-to-install Transfer Point Kits, with modular loading, settling and stilling zone configurations, provide optimal dust containment, Martin's Insertable Air Cleaners remove 99.9% of residual particles of 0.5 micron and larger. For added fugitive material control, an associated system of support cradles, self-adjusting skirting, and exit-point curtains arrest potential problems while maintaining material flow.

You can trust Martin for a cleaner, safer, and more productive operation.

rod.hardy@palladianpublications.com

Sales Manager: Ian Lewis ian.lewis@palladianpublications.com

Sales Executive: Sophie Birss sophie.birss@palladianpublications.com

Head of Events: Louise Cameron louise.cameron@palladianpublications.com

Digital Events Coordinator: Merili Jurivete merili.jurivete@palladianpublications.com

Digital Content Coordinator: Kristian Ilasko kristian.ilasko@palladianpublications.com

Junior Video Assistant: Amélie Meury-Cashman amelie.meury-cashman@palladianpublications.com

Digital Administrator: Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

Administration Manager: Laura White laura.white@palladianpublications.com

Reprints reprints@worldcement.com

ACBP019982

Annual subscription (published monthly): £160 UK including postage/£175 (€245) overseas (postage airmail)/US$280 USA/Canada (postage airmail). Two year subscription (published monthly): £256 UK including postage/£280 (€392) overseas (postage airmail)/US$448 USA/Canada (postage airmail). Claims for non receipt of issues must be made within 4 months of publication of the issue or they will not be honoured without charge.

Applicable only to USA and Canada: WORLD CEMENT (ISSN No: 0263-6050, USPS No: 020-996) is published monthly by Palladian Publications, GBR and is distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831.

Periodicals postage paid at Philadelphia, PA and additional mailing offices. POSTMASTER: send address changes to World Cement, 701C Ashland Ave, Folcroft PA 19032

Copyright © Palladian Publications Ltd 2025. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Uncaptioned images courtesy of Adobe Stock. Printed in the UK.

Palladian Publications Ltd 15 South Street, Farnham, Surrey GU9 7QU, UK Tel +44 (0)1252 718999

Email: mail@worldcement.com Website: www.worldcement.com

DAVID BIZLEY, SENIOR EDITOR

s I type this, we are now just over a month away from the 2025 edition of WorldCement’s decarbonisation-focused conference – EnviroTech: The Gateway to Green Cement, with this year’s show taking place in Athens, Greece, on 9 – 12 March.

The decarbonisation of the cement production process remains one of the most significant (and urgent) challenges facing the industry. As I mentioned in my opening presentation at last year’s EnviroTech, climate change is now an inescapable scientific reality.

Indeed, it has since been confirmed by the UN that 2024 was the hottest year on record, marking an unfortunate capstone on a decade of record-breaking temperatures starting back in 2015. And we are already feeling the impact of that extra energy pumped into the climate through increasingly erratic weather patterns, and ever more frequent and severe environmental disasters. As the UN Secretary General, António Guterres, said in statement earlier this year: “Blazing temperatures in 2024 require trail-blazing climate action in 2025.” And with cement production responsible for ~8% of all man-made CO2 emissions, this industry has an opportunity to play a key role in leading that action.

That’s why we set up EnviroTech to act as a hub for leaders and experts from across the cement industry to network, collaborate, share insights and expertise, and forge new partnerships with other leaders in the decarbonisation process.

So, who can you expect to see on the agenda at EnviroTech? Our line-up includes leaders in sustainability and subject matter experts from companies, such as: FLSmidth Cement, Holcim, KHD Humboldt Wedag, Heidelberg Materials, Sinoma, Titan, ABB, Mannok, McKinsey & Company, CEMEX, Technip Energies, VICAT, and many more.

In addition to 3 days of high-quality presentations, we’ll be hosting a range of live Q&As and in-depth panel discussions, so you can put your questions directly to industry experts. You’ll also be able to meet leading equipment and solution providers in our exhibition, wind down and build lasting relationships at our multiple networking events, and make the most of the facilities at our five-star venue, the Divani Caravel.

There’s not long left now, so make sure to avoid disappointment: book your tickets today and secure your place at the forefront of the cement industry’s decarbonisation discussion.

Until then,

Convey units

Truck loading

Cemex has announced its participation in multiple government-sponsored sustainability initiatives, and have secured funding from state and federal programmes to deploy several lower-emission vehicles across it's US footprint. This remarkable investment is a crucial step in Cemex's ongoing efforts to decarbonise its operations.

Through the Texas Emissions Reduction Plan (TERP), Cemex was awarded approximately US$13 million to obtain four lower-emission locomotives and two haul trucks for its cement and aggregate sites in New Braunfels and Katy, Texas. The TERP programme provides financial incentives to eligible individuals, businesses, or local governments to reduce emissions from polluting vehicles and equipment. Three of the four new locomotives and both haul trucks entered service in late 2023 and mid-2024 in New Braunfels, respectively.

Looking ahead, Cemex will continue its commitment to protecting air quality by deploying additional equipment in 2025. A US$2 million grant from the US Environmental Protection Agency's (EPA) Diesel Emissions Reduction Act (DERA) programme will allow for two lower-emission locomotives to enter Cemex's service in Jacksonville and Miami in summer 2025.

"Through these state and federal programmes, significant strides toward advancing responsible business practices are more attainable," said Cemex US President Jaime Muguiro. "Our new lower-emission vehicles play a key role in the development of building materials for roads, schools, hospitals, and more, while also pivotal to our CO2 reduction roadmap."

Upon placing these emissions-reducing vehicles into service, Cemex decommissions the conventional vehicles they replaced, meeting a core requirement of the programmes and reinforcing Cemex's commitment to a more sustainable future.

This initiative continues Cemex's efforts at other locations, particularly in Victorville, California, where multiple lower-emission locomotives were added to the fleet. In 2022, nearly 40 low-emission natural gas trucks were introduced to the Southern California fleet, replacing an

equal number of older, diesel-powered vehicles. Additionally, in 2023, another lower-emission locomotive was put into service, supported by a US$2.5 million grant from the EPA's Targeted Airshed Grants (TAG) programme.

Decarbonising its operations is a fundamental aspect of Cemex's Future in Action programme, which focuses on achieving sustainable excellence through climate action, circularity, and natural resource management with the primary objective of becoming a net-zero CO2 company by 2050.

Martin Engineering has announced fresh expansion in Central Asia with a new business unit in Kazakhstan. Based in the country’s largest city and commercial centre, Almaty, in the South East of Kazakhstan, the new venture will act as a regional hub enabling Martin to bring its full range of products and services to the fast-growing mining sector across Central Asia.

Kazakhstan is the world's ninth-largest country by land area (approximately 1 000 000 square miles) and has a diverse geology comprising a rich array of metal ores and mineral resources. Consequently mining and minerals production is playing an increasingly important role in the Kazakh economy with most materials exported.

The decision to establish a business unit in Kazakhstan builds on the Martin Engineering’s success in the country to date. That includes delivering innovative conveyor belt cleaning solutions to one of Kazakhstan’s largest copper producers to maximise plant efficiency and productivity.

Now Kazakhstan’s mining and mineral processing companies have access to a broader portfolio of exceptional conveyor products, such as Martin’s revolutionary CleanScrape® belt cleaners, versatile Orion SQC2S™ Secondary Belt Cleaner, and high performance Air Cannons featuring SMART™ Series Nozzles to ensure optimal material flow.

Kazakh customers can also benefit from faster service response times, improved supply chain logistics and new product trials, as well as enhanced problem-solving services like Walk The Belt™ and tailor-made Foundations™ training for in-house maintenance teams.

The new business will be led by General Manager Oleg Glukhov, who has worked with Martin Engineering for the past seven years. He says Martin is well placed to support Kazakhstan’s leading minerals processing firms to improve operational performance and safety.

09 – 12 March, 2025 Athens, Greece worldcement.com/envirotech2025

Join industry leaders and technical experts from around the world to help forge the cement industry's path to net zero.

bauma 2025

07 - 13 April, 2025 Munich, Germany bauma.de/en/trade-fair

IEEE-IAS/PCA Cement Conference 04 – 08 May, 2025 Birmingham, AL., USA cementconference.org

CEMENTTECH 2025

15 – 17 May, 2025 Hefei, China www.cementtech.org

POWTECH

23 – 25 September, 2025 Nürnberg, Germany www.powtech-technopharm.com

“Kazakhstan is one of the world’s key sources of metals and industrial minerals,” he explained. “Processing materials safely, efficiently, and profitably is important, and that’s where Martin Engineering comes in – our market-leading products and services are proven to solve materials handling challenges for the world’s biggest mining and minerals companies.”

Heidelberg Materials joins Dow Jones Sustainability

For the first time, Heidelberg Materials is included in the Dow Jones Sustainability Index (DJSI) Europe. The index is composed of European companies that have achieved outstanding results in the S&P Global Corporate Sustainability Assessment.

The assessment is one of the world’s most prestigious ESG ratings and based on a transparent, comprehensive disclosure and assessment process. Heidelberg Materials is among the top-performing companies in the S&P CSA 2024 with a score of 80/100, placing it in the top 3 percentile. Topics in which Heidelberg Materials' performance was rated particularly high include climate strategy, transparency and reporting, business ethics, and product stewardship.

“I am very pleased with this recognition and proud of what we achieved to date”, said Dr Katharina Beumelburg, Chief Sustainability and New Technologies Officer. “Our ranking in the DJSI Europe demonstrates how seriously and consistently we are approaching our transformation to net zero addressing the full spectrum of environmental, social, and governance topics. This is a clear signal to our shareholders, who are closely following our transformation.”

America announces launch of IPO

Titan Cement International S.A. has announced that its Belgian subsidiary, Titan America SA, has launched a roadshow for an initial public offering (IPO) of 24 000 000 common shares.

The IPO consists of 9 000 000 new common shares to be issued and sold by Titan America and 15 000 000 existing common shares to be sold by Titan Cement International SA. Titan Cement International SA expects to grant the underwriters a 30-day option to purchase an additional 3 600 000 common shares to cover over-allotments, if any. The IPO is currently expected to price between US$15 and US$18 per share. Titan America has applied to list its common shares on the New York Stock Exchange under the ticker symbol 'TTAM.'

After the completion of the IPO, Titan Cement International SA is expected to own 160 362 465 common shares of Titan America, representing 87% of the total outstanding common shares (or 85% if the underwriters exercise in full their over-allotment option).

Citigroup and Goldman Sachs & Co. LLC (in alphabetical order) are acting as joint lead book-running managers for the IPO. BofA Securities, BNP Paribas, Jefferies, HSBC, Societe Generale and Stifel are acting as bookrunners for the proposed offering.

Capsol Technologies begins carbon capture demonstration at Akmenes Cementas in Lithuania

Capsol Technologies’ first of two CapsolGo® demonstrations campaigns for cement producer SCHWENK has commenced operations at Akmenes cement plant in Lithuania.

"This carbon capture campaign marks a significant step in our journey towards decarbonisation, enabling us to evaluate an innovative solution that contributes to a more sustainable and environmentally friendly future," said Arturas Zaremba, CEO of Akmenes Cementas.

SCHWENK, one of Europe’s most innovative building materials producers, will test Capsol’s technology at two cement plants, with a combined carbon capture potential of up to 1.5 million t of CO2 per year.

"This initiative provides SCHWENK with invaluable data on Capsol's End-of-Pipe capture technology, reinforcing our commitment to reducing carbon emissions across all our cement plants and advancing our sustainability goals," commented Reinhold Schneider, CEO of SCHWENK Northern Europe.

Following the demonstration campaign at the Akmenes plant, the CapsolGo unit will be transferred to SCHWENK’s Broceni cement plant in Latvia, where a Capsol feasibility study was conducted in 2024.

The cement industry is a significant contributor to global CO2 emissions, accounting for about 7% of total emissions. The production of cement involves the

calcination of limestone, which releases CO2 as a byproduct. Carbon capture and storage (CCS) is increasingly recognised as essential for achieving deep decarbonisation in the sector.

Growing decarbonisation targets among cement producers, coupled with regulatory incentives, are accelerating the demand for carbon capture solutions. One such driver is the European Union’s Carbon Border Adjustment Mechanism (CBAM), introduced in October 2023. Under CBAM, cement importers must report emissions, with financial obligations beginning in 2026, to prevent carbon leakage and promote decarbonisation within the EU.

With a mature project pipeline totalling 8 million t of potential CO2 capture from cement plants annually (as of Q3 2024), Capsol is solidifying its position as the preferred carbon capture provider for the cement industry.

Capsol’s CapsolEoP® technology stands out due to its lower energy consumption, optimised for higher CO2 concentrations, and further cost reductions achieved through the elimination of external steam supply requirements.

Claudius Peters announce the arrival of the ETA Cooler 5.0

Claudius Peters have announced the arrival of the Eta 5.0, the latest iteration of our acclaimed Eta Cooler series. The Eta 5.0 offers significant energy savings, lower maintenance down-time, and reduced environmental impact.

Claudius Peters engineers have achieved remarkable efficiency improvements by designing a new low-pressure-drop system and by reducing friction in the transport system.

Significantly, the Eta 5.0 can be retrofitted to existing installations with minimal intervention.

Kurt Herrmann, Managing Director Global Sales Claudius Peters Group GmbH: "We are very excited to announce the launch of Eta 5.0, a product that combines features of our most successful cooler technology with new advancements that meet the evolving needs of the cement industry.

By enhancing efficiency and reducing emissions, this latest iteration of our clinker cooler supports our customers in achieving both their performance and sustainability goals.”

Dr S B Hegde, Jain College of Engineering and Technology, provides a comprehensive analysis of the Indian cement industry.

The Indian cement industry is a key pillar of the nation's infrastructure and economic growth. As the second-largest cement producer globally, it significantly contributes to India’s GDP, industrial output, and employment. With an installed capacity of around 690 million tpy, the sector plays a crucial role in housing, transportation, and urban infrastructure. Cement production for FY23 – 24 is estimated at 390 million tpy, reflecting steady demand supported by government initiatives and private investments.

The industry’s growth has been marked by substantial capacity additions, with over 15 million tpy added in 2022 – 23 by major players like UltraTech Cement, Shree Cement, and ACC-Ambuja. However, capacity utilisation is mixed, averaging 65 – 70%, with North and East India operating at near 80%, while the South faces overcapacity with utilisation as low as 50 – 55%.

Housing accounts for 60% of cement consumption, followed by infrastructure projects (25%) and commercial real estate (15%).

Government programmes like Bharatmala, Sagarmala, and Pradhan Mantri Awas Yojana (PMAY) are major drivers, with demand expected to exceed 500 million tpy by 2030. Urbanisation – projected to reach 40% by 2030 – further fuels the demand for robust infrastructure, solidifying the industry's importance.

Indian cement plants are among the most energy-efficient globally, achieving thermal energy consumption levels of 725 kcal/kg of clinker and electrical energy usage of 75 kWh/t of cement. Advanced technologies like waste heat recovery (WHR) systems and digital automation have reduced production costs and environmental impact, meeting global sustainability benchmarks.

The industry is also prioritising green technologies and low-carbon solutions, focusing on reducing clinker factor and increasing alternative fuel (AF) use. These efforts reflect the sector's commitment to balancing economic growth with environmental responsibility, ensuring its continued importance in India’s infrastructure and economic aspirations.

The Indian cement industry, with an installed capacity of approximately 590 million tpy as of FY23 – 24, is the second-largest globally, behind China. Production for FY23 – 24 is estimated at 390 million tpy, with sector-wide utilisation rates averaging 65 – 70%. However, regional variations

exist, with northern and eastern regions operating near 80% due to strong infrastructure demand, while southern regions face overcapacity, with utilisation rates as low as 50 – 55%.

Consumption trends and drivers

Cement consumption in India is influenced by both rural and urban demand. Rural areas account for 40% of total consumption, driven by home building and government housing schemes like PMAY, while urban areas contribute the remaining 60%, spurred by infrastructure, commercial real estate, and industrial projects. Housing remains the dominant sector, absorbing around 60% of cement production, followed by infrastructure projects (25%), driven by initiatives like:

f Bharatmala Pariyojana: developing 34 800 km of highways by 2027.

f Sagarmala programme: modernising 577 ports.

f Smart cities mission: urban development in 100 cities.

Commercial real estate and industrial sectors make up the remaining 15%, backed by private sector investments.

Key players and market distribution

The industry is led by major players like UltraTech Cement, Ambuja Cements, ACC, Shree Cement, and Dalmia Bharat, which collectively account for over 60% of total production. The recent merger of Ambuja and ACC under the Adani Group has reshaped market dynamics, intensifying competition, particularly with UltraTech. Regional players like Ramco Cements, JK Cement, and the India Cements cater to specific regional markets.

Regional disparities in production and consumption

Northern and western regions benefit from balanced demand and supply dynamics, supported by infrastructure activity and urbanisation. Eastern India faces strong demand but struggles with logistical constraints. In contrast, Southern India is burdened with excess capacity, leading to price wars and lower profitability.

Technological advancements and manufacturing excellence

Indian cement plants are globally recognised for their energy efficiency. Thermal energy consumption averages 725 kcal/kg of clinker, and electrical energy usage is 75 kWh/t of cement, both among the best globally. Investments in WHR systems have surged, covering 20 – 25% of power requirements. The industry is also adopting digital technologies such as predictive analytics, IoT, and process

automation to improve productivity and reduce operational costs.

Blended cements like Portland Pozzolana Cement (PPC) and Portland Slag Cement (PSC) are gaining popularity, driven by sustainability awareness, government regulations, and rising raw material costs. Demand for these greener alternatives is expected to grow by 7 – 8% annually, aligning with the global shift toward carbon-neutral construction practices.

The Indian cement industry, despite its importance in infrastructure and economic growth, faces significant challenges, primarily due to rising input costs and operational issues that impact profitability, production efficiency, and quality.

Rising costs of raw materials, energy, and transportation

Coal and petcoke prices, key fuels for cement kilns, have surged dramatically. Imported coal prices averaged around US$200 – 220 per t in FY23 – 24, up from US$100 – 110 two years ago. Petcoke prices have doubled, rising from RS7500 – 8000 per t to over RS15 000 per t. This has led manufacturers to explore AFs like industrial waste and biomass, but these options face issues of inconsistent quality and availability, disrupting kiln operations, and affecting clinker quality.

Impact on kiln operations and clinker quality

The shift to AFs has caused operational challenges, including:

f Unstable flame temperature, impacting clinker mineralogy.

f Higher refractory wear, leading to increased maintenance and downtime.

f Reduced clinker reactivity, lowering early strength development in cement.

These issues complicate the consistent production of high-quality clinker, affecting cement strength

and durability, and making compliance with quality standards more challenging.

The growth forecast for the Indian cement industry in FY25 has been revised down to 4 – 5% (445 – 450 million t), primarily due to slo ted recovery in construction activities, particularly in housing and infrastructure sectors, as reported by ICRA. Earlier, a growth rate of 7 – 8% was anticipated for the second half of FY25, but a slower-than-expected post-election recovery has impacted projections.

f Key drivers and challenges:

» Muted volumes: cement consumption grew by just 2% YoY to 212 million t in the first half of FY25, mainly due to the slowdown caused by elections and heavy monsoon rains.

» Rural demand: a strong Rabi season, supported by good monsoons and improved farm incomes, is expected to drive higher demand for rural housing in the second half of FY25.

» Urban and infrastructure boost: urban housing demand remains strong, and government spending in infrastructure is set to rise in H2 FY25, with capital spending projected to increase from RS4 trillion in H1 to RS11.1 trillion by the end of the year. This will help boost cement demand.

f Pricing and margins:

» Cement prices have fallen by 10% YoY to RS330 per bag in H1 FY25 due to oversupply and weak demand, impacting revenue.

» Operating profit margins dropped to 12% in Q2 FY25, reflecting a 375 basis points decline YoY, despite reduced costs for coal and pet coke (down 38% and 13% YoY, respectively).

f Capacity expansion:

» The cement industry is expected to add 70 – 75 million t of capacity during FY25 – 26, including 33 – 37 million t of clinker capacity.

» Regional growth: the eastern and southern regions are expected to lead the capacity additions, contributing 38 – 40 million t evenly over the next two years.

» Utilisation: capacity utilisation is expected to rise slightly to 71% in FY25 from 70% in FY24.

f Outlook:

» The cement sector is expected to recover in the second half of FY25, driven by increased rural and urban housing demand and higher government spending. However, challenges like pricing pressures and oversupply will persist. With total installed capacity at 690 million t and moderate utilisation rates, there is potential for growth driven by demand.

Rising costs and subdued prices have caused a 30 – 35% reduction in EBITDA per t, from RS1100 – 1200 in Q2 FY22 – 23 to RS750 – 800 in Q2 FY23 – 24. This decline in margins has challenged many companies' financial stability.

Bottlenecks and logistics inefficiencies

Supply chain challenges, including rising diesel prices, have made long-distance transportation more expensive. Rail freight rates for cement have increased by 15 – 18% over the past two years. Inconsistent availability of raw materials like fly ash and slag has disrupted production, increasing reliance on costly alternatives.

with environmental regulations

Cement plants face pressure to reduce carbon emissions and meet global climate commitments by using blended cements, AFs, and carbon capture technologies. However, these measures add to the operational and financial strain. India's CO2 emissions from cement production average 670 – 690 kg/t, above the global benchmark of 550 – 600 kg, requiring significant investment in technology.

Overcapacity in certain regions versus underutilisation in others

South India suffers from overcapacity, with a utilisation rate of 50 – 55%, while regions like

Less than 1 month after switching to LE’s kiln lubricant, a cement company reduced its lube consumption by 7 times, achieving approximate annual savings of $63K for a single kiln. At the same time, gear temperatures dropped and maintenance time decreased.

North and East India operate at 75 – 80%, creating pricing inefficiencies and heightened competition in oversupplied markets.

Workforce skill gaps and technological adoption

The industry's move toward automation and digital solutions has exposed a skill gap. Technologies like digital twins and predictive maintenance face challenges in implementation due to the lack of trained personnel. Bridging this gap requires substantial investment in upskilling and training programmes.

on the horizon

The Indian cement industry, despite its challenges, is poised for significant growth, innovation, and sustainability, with opportunities that align with India’s economic trajectory and global trends.

Surge in infrastructure investments

India’s infrastructure sector is undergoing a major

India’s strategic location offers growth in cement exports to neighbouring countries like Nepal, Sri Lanka, and Bangladesh, as well as increasing demand for clinker in Africa and Southeast Asia. The cost-efficient production and proximity to these markets give India a competitive edge. In FY22 – 23, India exported 7 – 8 million t of cement, with significant potential for further growth.

Advancements in digital technologies

Digital technologies are transforming cement manufacturing:

f Predictive maintenance: IoT sensors help predict equipment issues, reducing downtime.

f Digital twins: virtual replicas optimise plant operations.

f AI and machine learning: enhance quality control and consistency in cement properties.

These innovations improve operational efficiency, reduce costs, and align with sustainability goals. Companies like UltraTech and ACC are leading the adoption of these technologies.

Potential in blended cements and greener alternatives

Demand for blended cements like PPC and PSC, which use fly ash and slag, is rising due to their lower carbon emissions. Calcined clay, which can replace up to 50% of clinker, offers significant environmental benefits and is gaining momentum. India is at the forefront of researching calcined clay-based cements, with companies like Dalmia Cement piloting these projects.

India’s urban population is expected to grow from 35% in 2020 to 40% by 2030, driving demand for housing, commercial spaces, and infrastructure. The real estate market is projected to reach US$1 trillion by 2030, boosting cement demand. Mega projects like the Mumbai Coastal Road and the Delhi-Mumbai Industrial Corridor further contribute to growth potential.

Sustainability and carbon-neutral cement

Global decarbonisation trends offer Indian manufacturers the opportunity to lead in carbon-neutral cement production. Investing in carbon capture, utilisation, and storage (CCUS) and AFs can reduce emissions and produce green building materials. Policies like the National Action Plan on Climate Change (NAPCC) support innovation in sustainable manufacturing, presenting long-term growth opportunities for companies aligned with these goals.

Sustainability is a critical part of the Indian cement industry's strategy, driven by the need to reduce carbon emissions and ensure long-term resilience. As cement production accounts for 8% of global CO2 emissions, Indian manufacturers are focusing on initiatives that reduce their environmental impact while maintaining economic viability.

Current initiatives by Indian cement companies

f Co-processing of waste and AFs: the adoption of AFs, including waste materials, has increased significantly. Over 5% of India’s cement plants' thermal energy now comes from AFs, up from 2 – 3% five years ago. Companies like UltraTech and ACC are leading the way with initiatives like using refuse-derived fuel (RDF) and pre-processing industrial waste.

f Adoption of blended cements and low-clinker formulations: blended cements, such as PPC and PSC, have grown in production, incorporating supplementary materials like fly ash and slag to reduce clinker use and lower CO2 emissions. Blended cements now account for around 70% of India's cement production, with companies like JSW Cement using granulated blast furnace slag to reduce emissions.

f WHR system implementation: over 1600 MW of WHRS capacity has been installed, covering 25 – 30% of power needs. Companies like Shree Cement and UltraTech have implemented these systems to reduce reliance on grid power. Shree Cement, for example, has saved energy equivalent to 600 000 tpy of coal.

f Investments in carbon capture and utilisation (CCU) technologies: Dalmia Cement is setting up the world's largest CCU facility in Tamil Nadu, aiming for a 10% reduction in CO2 emissions by 2030. While CCU technologies are in the early stages, they are crucial for decarbonisation.

Challenges in scaling sustainability measures

f Raw material availability:

» Fly ash shortages: demand for fly ash exceeds supply in regions with fewer thermal power plants.

» AFs: inconsistent availability and quality of AFs like RDF and biomass remain challenges.

f Technology costs:

» High capital costs, such as RS400 – 500 million per WHR installation, are barriers, especially for smaller players.

f Operational challenges:

» AFs can lead to issues like clinker quality deterioration and kiln instability, requiring significant R&D for optimisation.

Our sustainability partners:

Impact of ESG goals and green financing

f ESG commitments driving strategies:

» Companies are increasingly integrating Environmental, Social, and Governance (ESG) metrics. UltraTech Cement, for example, plans to reduce CO2 emissions to 462 kg/t of cementitious material by 2032.

f Green financing initiatives:

» Green bonds and sustainability-linked loans provide financial incentives for sustainable projects. Ambuja Cements raised RS30 billion through green bonds in 2022 to fund energy-efficient projects.

f Carbon markets:

» The Perform, Achieve, and Trade (PAT) scheme offers companies opportunities to monetise energy efficiency improvements.

The Indian cement industry is evolving rapidly, driven by technological advancements, sustainability goals, and the dynamics of the construction and infrastructure sectors. Trends like digital transformation, supply chain innovations, green building practices, and industry consolidation are reshaping the competitive landscape.

Shift towards digitalisation and automation in manufacturing (Industry 4.0)

The adoption of digital technologies and automation is revolutionising cement manufacturing in India. Tools like predictive analytics, IoT sensors, and AI help optimise production processes, reduce costs, and improve product quality.

f Insights:

» Digital Twin technology helps identify inefficiencies and reduce downtime.

» AI-driven predictive maintenance cuts maintenance costs by 15 – 20%.

» Companies like UltraTech and Shree Cement lead with smart control rooms for real-time decision-making.

Adoption of smart logistics and distribution models

Logistics costs account for 20 – 25% of cement production costs. Smart logistics and digitised supply chains are becoming more prevalent.

f Trends:

» GPS-enabled trucks, RFID, and fleet management systems reduce delivery lead times.

» Multi-modal transport (road, rail, waterways) enhances cost and carbon efficiency.

» Smart warehouses improve inventory management.

Growth of green building practices and their influence on cement demand

The global shift towards sustainability has spurred the growth of green building practices, increasing demand for eco-friendly construction materials like blended cements.

f Insights:

» Over 10.27 billion ft2 of green building projects have been certified by the Indian Green Building Council.

» Blended cements, such as PPC and PSC, are in high demand due to their lower environmental impact.

» Emerging products like LC3 and geopolymer cement are gaining traction.

Public-private partnerships in infrastructure development

PPP models are driving large-scale infrastructure projects, boosting cement demand.

f Latest developments:

» RS10 trillion allocated for infrastructure development in the Union Budget 2024 – 25.

» Projects like expressways, airports, and metro systems, along with affordable housing, are creating significant cement demand.

Industry consolidation: strengthening market power

Mergers, acquisitions, and strategic alliances are driving consolidation in the Indian cement industry.

f Developments:

» Adani Group acquired Ambuja Cement and ACC, making it India’s second-largest cement producer.

» UltraTech Cement, the market leader, continues expanding its capacity.

» Regional players like Dalmia Bharat and Shree Cement are also growing through acquisitions.

f Impact: consolidation is reducing price competition, stabilising margins, and enabling investments in advanced technologies and sustainability.

Way forward: strategies for a resilient future

The Indian cement industry faces challenges like rising costs, stricter environmental regulations, and market fluctuations. However, with the right strategies, it can build a more resilient and sustainable future. Key focus areas and actionable strategies include:

Strengthening the circular economy

Adopting circular economy practices is crucial for reducing resource dependency and achieving sustainability. This includes using industrial

by-products like fly ash and slag in cement production.

f Current initiatives:

» Fly ash and slag are increasingly used in blended cements like PPC and PSC.

» Companies like UltraTech and ACC are using up to 30 – 35% fly ash and 60 – 70% slag.

» India's average clinker replacement is 29%, higher than the global average of 26%.

f Challenges:

» Availability and quality of alternative materials.

» Transportation and storage costs.

Encouraging R&D for alternative binders

Innovation is key to overcoming sustainability challenges.

R&D should focus on alternative binders, reducing carbon emissions, and developing eco-friendly products.

f Emerging trends:

» Binders like LC3 and geopolymer cement are gaining traction.

» Carbon capture and storage (CCUS) technologies are being explored.

f Challenges:

» High R&D costs and the need for supportive policies.

Streamlining supply chains with technology

Optimising supply chains is critical to reducing costs and improving efficiency. Digital tools and advanced analytics can help streamline operations.

f Key focus areas:

» AI and ML for demand forecasting and inventory management.

» Digitisation and blockchain for supply chain transparency.

» Multi-modal transport to reduce logistics costs and carbon emissions

f Potential benefits:

» Smart logistics can cut costs by 10 – 15% and reduce emissions.

Policies to incentivise green initiatives

Government policies play a crucial role in supporting sustainable practices in cement production.

f Policy recommendations:

» Tax benefits for investments in waste heat recovery and renewable energy.

» Incentives for AFs like biomass and RDF.

» Stricter carbon credit systems to encourage innovations.

f Current efforts:

» The PAT scheme promotes energy efficiency.

» The National Green Hydrogen Mission supports green hydrogen for cement kilns.

f Challenges:

» Gaps in policy implementation and lack of financial support for green technologies.

Collaboration between industry stakeholders Tackling industry challenges requires collaboration between manufacturers, policymakers, and academia.

f Focus areas:

» Addressing overcapacity by promoting regional specialisation and export opportunities.

» Decarbonising the industry with emission reduction targets.

» Enhancing workforce skills through public-private partnerships.

The Indian cement industry, the second-largest globally, is crucial to the country’s economic growth and infrastructure development. However, the sector must balance economic expansion with sustainability.

While challenges like rising costs, fluctuating demand, and stricter regulations persist, they also offer opportunities for innovation. By embracing a circular economy, advancing green technologies, optimising supply chains through digitalisation, and fostering collaboration, the industry can enhance resilience and efficiency.

Adopting greener alternatives, such as blended cements, investing in carbon capture, and securing policy support, are essential for long-term sustainability. As initiatives like Bharatmala and Smart Cities drive infrastructure growth, the cement industry must evolve to meet these needs responsibly.

With a proactive approach, India’s cement sector can lead in sustainability and innovation, contributing to both national progress and global environmental goals.

References available on request.

Dr S B Hegde, a global cement industry veteran with over three decades of experience, has held top leadership roles, including President – Manufacturing at a reputed Indian cement company. Currently, he is Professor and Director of Postgraduate Studies at Jain College of Engineering and Technology, Hubli, and a Visiting Professor at Pennsylvania State University, USA. He consults for leading cement companies, and serves on expert panels and editorial boards for prominent industry publications.

• 3 days of high quality presentations from industry leaders

• Expert-led Q&A sessions

• Panel discussions on key topics

SUPPORTED BY:

• Multiple networking events

• A full exhibition featuring leading players in the cement sector

• Luxury venue & accommodation

Is your company a member of the GCCA? If so, you can save over €400 on tickets by using the following code at registration: GCCA_ET2025

Dr. O Mielenz, B. Bergmoser, Dr. S. Benito and Prof. Dr. W. Theisen, HEKO, highlight a new development in round steel chain technology that enhances wear resistance and extends service life under challenging operating conditions.

Conveyor chains have a major influence on the efficiency and cost-effectiveness of conveying processes and are subject to high mechanical stress. Accordingly, there is enormous interest in extending service life with increased operational safety and damage tolerance.

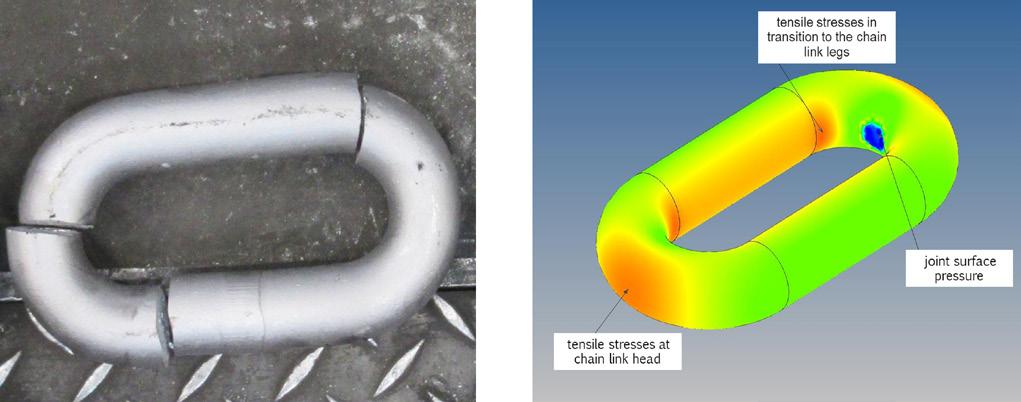

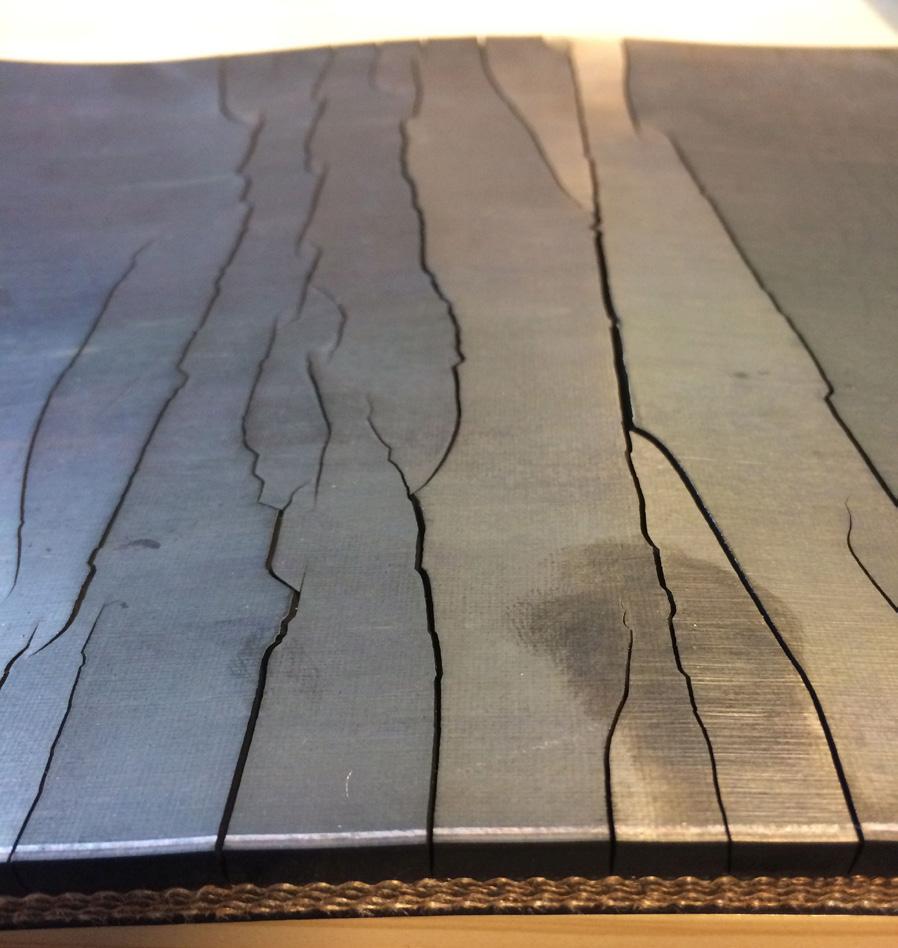

In addition to the high dynamic tensile forces acting on the chains, high wear and tear occurs in the contact area at the joints of the chain links, due to high contact pressure with relative movement to one another and the effect of the generally abrasive bulk material. This applies even more to round steel chains, where the joint contact is limited to a small area. Case-hardened steels are therefore often used. These are enriched with carbon in the edge zone through carburisation during the chain manufacturing process and, after subsequent hardening, have a high surface hardness, as well as high toughness and sufficient strength in the core. In recent decades, developments to improve the performance of round steel chains

have been particularly aimed at increasing surface hardness and hardness depths while maintaining the ductility of the core. However, these developments often do not consider the fact that most chain breaks are less often due to an insufficiently ductile core than to an insufficiently ductile surface layer in the areas of the chain links in which particularly high tensile stresses are present due to operational forces (Figure 1).

Within a joint R&D project between HEKO and the Chair of Materials Technology at the Ruhr-University Bochum, a new approach was developed to create a highly wear resistant, dynamic, and highly resilient round link chain, which was developed and successfully validated on a laboratory scale and in industrial trials. This project was supported by the Federal Ministry for Economic Affairs and Climate Action (BMWK) based on a decision by the German Bundestag.

The main idea behind this HEKO development was to provide the case-hardened edge zone of the chain links in the areas that are exposed to particularly high tensile stresses with sufficiently high ductility. At the same time, the chain joints, which are subject to increased wear, should be sufficiently wear-resistant during operation. This goal was achieved by a slight modification of the chain material chemical composition targeting grain refinement and by a newly developed case hardening and heat treatment process. The latter results in a slightly lower surface hardness of approximately 750 HV of the new chain in delivery condition, and thus, a significant increase in breaking stresses and improved fatigue strength. The particularly good wear resistance of the newly developed chain grade results from in-situ-hardening in operational use up to approximately 850 HV within the chain joints and contact areas to the sprockets that are subject to high surface pressure and greatest wear (Figure 2). Technical data for the new HEKO chain grade is summarised in Table 1.

The superior properties of this new development have been demonstrated on laboratory scales, industrial trials, and under operating conditions of a field tests on real conveyors.

In 2023, HEKO received an inquiry from the Spenner plant in Erwitte for the delivery of new round link chains KE-26x91, chain shackles, and sprocket segments for a sand

and gravel bucket elevator with a centre distance of approximately 19 m.

The service life of previous chain grades was limited to approximately one year by extreme wear of the chains due to the abrasiveness of the bulk goods and extreme caking of often wet and sticky sand on the chains and buckets, as shown in Figure 3. Moreover, the relatively small centre distance leads to an increased number of flexures.

It was decided to install the newly developed HEKO chain grade parallel to current Mn- and Cr-Ni-Mo grades. This configuration was possible without any risk of poor chain running and performance due to non-toothed sprockets and return wheels, and it enabled a performance test of the new chain grade in comparison to current chain grades (Table 2).

The chain ends of different chain grades were assembled in fixed sections of the bucket strand and the buckets were marked with welded numbers to allow an easy identification of the respected chain grade afterwards.

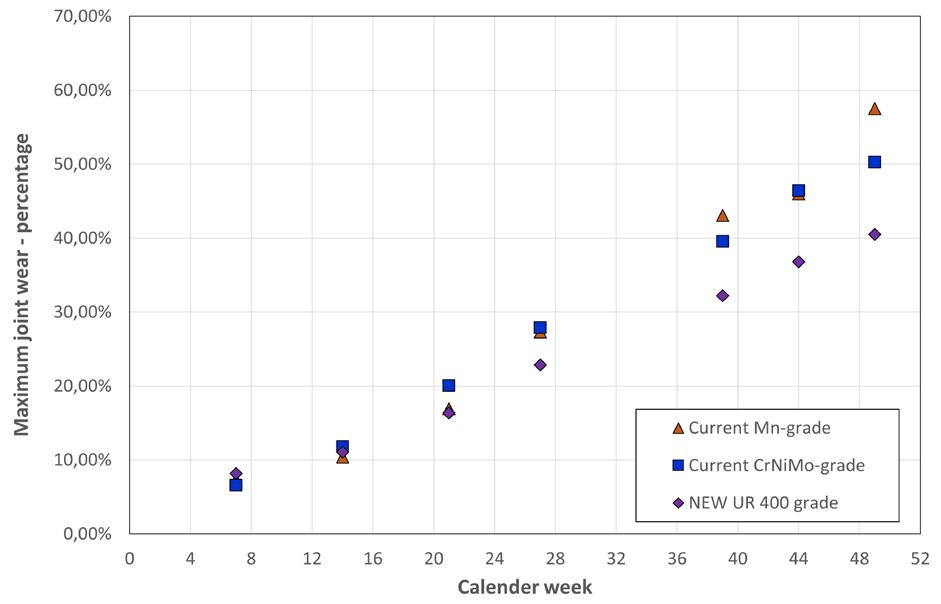

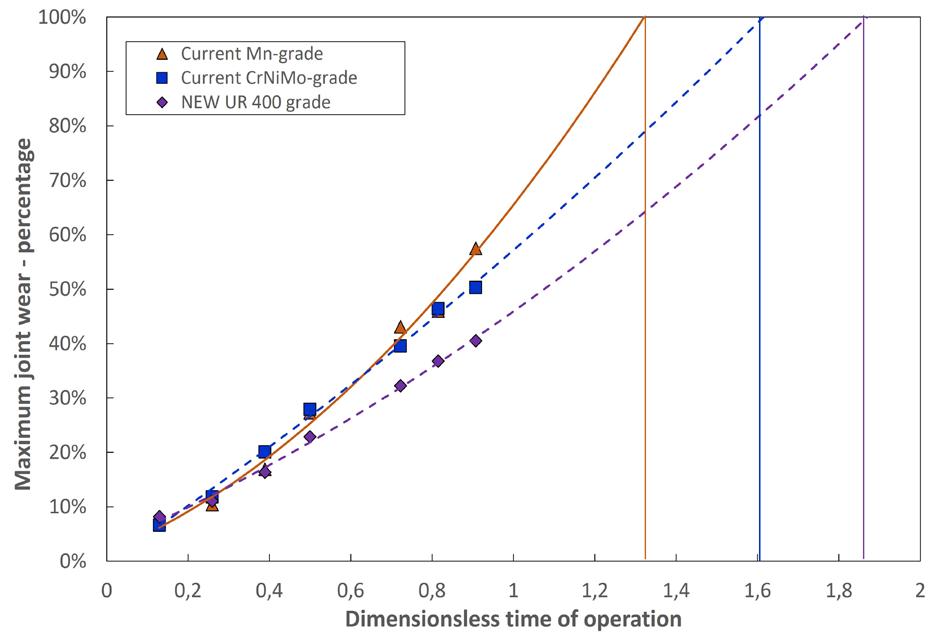

After commissioning, the chains were inspected on a regular basis by measuring the chain wear on predetermined chain sections and chain links. The results of these wear measurements are summarised in Figure 5 as the percentage maximum joint wear related to the carburisation depth of the different chain grades. Generally, the chain reaches its maximum allowable wear as

Figures 4 & 5. Percentage maximum joint wear related to the carburisation depth of the individual chain grade.

Air dampers weaken draft and waste energy in pyroprocessing units. Eliminating tempering air improves draft, increasing production capacity or cutting fan energy.

Gas cooling via evaporative cooling is ~10x more effective than tempering air by volume, ensuring superior efficiency and performance.

Lechler’s Spray Cooling Systems have the solution.

Lechler’s evaporative system comes with:

• Guaranteed GCT outlet temperature of 260°F without wetting †

• Most efficient compressed air consumption per unit of water flow-rate

• Gas Cooling System with process guarantee

† after technical review of existing duct from cyclone to fan

† automatic capability of only injecting as much water is needed, no overage

soon as the case-hardened surface layer is worn out.

It was found that, in the first weeks of operation, the wear of the new chain grade is slightly higher than the chain wear of current grades, due to its lower surface hardness in delivery status. However, with increasing operation time a lower wear rate was found on the chains of the new ultra resistant grade HEKO UR 400 leading to a 15% extended service life compared to current CrNiMo chain grade and up to 30% extended service life compared to current Mn chain grade (Figure 5).

The reason for this extension in service life of the new chain grade is due to in-situ-hardening induced by high surface pressure yielding a surface hardness >850 HV in the chain link areas that are normally subject to highest wear (Figure 6).

A new high-performance grade of round link chains has been developed leading to a new benchmark in chain performance and service life. This development is a paradigm shift and is based on a completely redesigned case-hardened surface layer of round steel chains and was only made possible by applying the most modern technology for case hardening under vacuum, which HEKO has been using successfully for more than 15 years. When delivered, the newly designed case-hardened surface layer initially has a lower surface hardness as comparable surface layers of current chain grades. This ensures higher breaking forces and breaking stresses as well as significantly increased durability of the chain. During operational use, the surface within the regions of high surface pressures and increased wear is hardened in-situ to higher levels of hardness. In combination with a significantly increased hardness depth compared to current chain grades, this leads to a significant extension of service life. The results of field tests show that the new ultra resistant chain grade HEKO UR 400 can achieve a service life extension of up to 30% compared to current chain grades, even under extreme operating conditions.

B. Bergmoser (Head of Mechanical Maintenance, Spenner plant Erwitte) said: "The significant extension of service life of the new HEKO 400 UR chain grade under extreme operating conditions has convinced us and will enable us to extend the chain change intervals in the future. This is a significant contribution to reducing maintenance costs and increasing system availability and efficiency."

Conveyor belt specialist, Leslie David, explains why investing in high-quality heat resistant conveyor belts ultimately reduces long-term operational costs and improves performance.

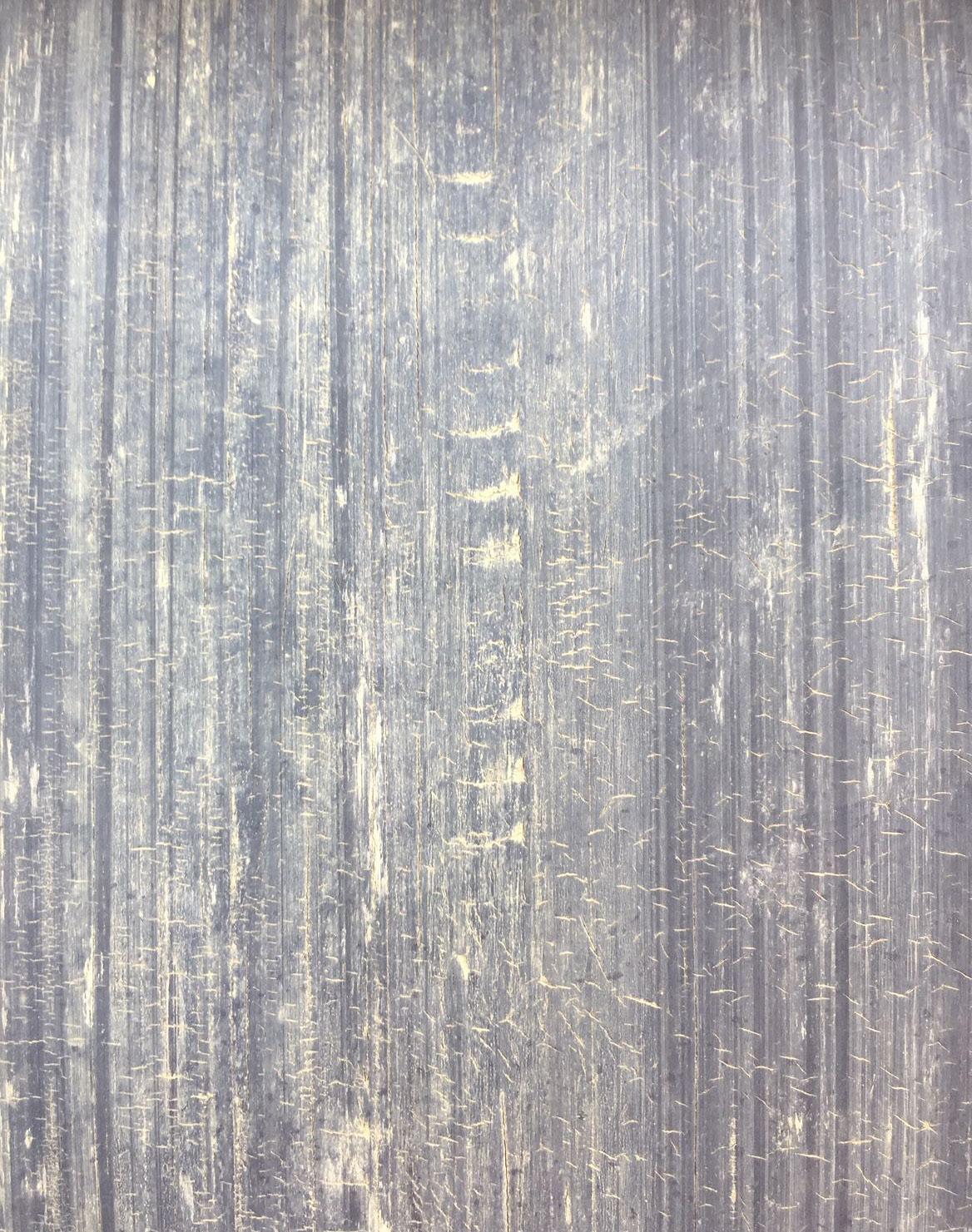

The cement industry uses more heat resistant conveyor belting than any other industry. Unfortunately, it also has the highest rates of belt replacement, as nothing destroys conveyor belts faster than heat. High temperatures accelerate the thermal ageing process of the outer covers. How long this process takes depends on how well the rubber can withstand the heat without incurring damage while also protecting the inner carcass. Consequently, there are huge disparities between the operational lifetime and whole life cost provided by belts supplied by different manufacturers and suppliers.

Although rubber is obviously not a lifeform, the one thing that it has in common with organic life is that it ages. And as it ages, it deteriorates. As far as rubber conveyor belts are

concerned, there are two forms of ageing – thermal and oxidative. High temperature materials and working environments rapidly accelerate the ageing process of rubber, causing it to harden and crack. Known as thermal ageing, high temperatures also have an extremely destructive effect on the inner carcass of the belt because heat gradually destroys the adhesion between the rubber covers on the top and bottom of the carcass, as well as between the inner plies contained within it. The result is ‘de-lamination’, which occurs when the layers of the belt literally become detached from one another. As rubber becomes harder and less elastic, its tensile strength and elongation (stretch) can decrease by as much as 80%. This effectively destroys the operational strength and flexibility of the belt, and seriously weakens the splice joints. At the same

time, surface cover wear is accelerated because the rubber’s resistance to abrasive wear decreases by as much as 40% or more. As the covers become thinner, their ability to protect the inner carcass from temperature build-up diminishes, creating a vicious cycle that further accelerates both the de-lamination and ageing processes.

Apart from thermal ageing, the other major cause of rubber deterioration and degradation is oxidative ageing, which is primarily caused by exposure to ultraviolet light (sunlight and fluorescent light) and other reactive gases, especially ground level ozone. These factors cause rubber to become brittle and crack. The dynamic stress caused by the belt flexing around pulleys and drums under tension greatly accelerates the formation of the cracks, which then allow more heat to penetrate down into the carcass.

Not all heat resistant conveyor belts of a stated specification provide a similar performance or operational lifetime. In fact, alarming differences are commonplace. To understand the reasons, it is important to first understand the different specifications applicable to heat resistant conveyor belts and the associated terminology, which can be very confusing.

The temperature limits that a belt can withstand are viewed in two ways – the maximum continuous temperature of the conveyed material and the maximum temporary peak temperature. Heat resistant grades are historically identified as grade ‘T’. The continuous and peak temperature limits are commonly combined into classes T1, T2, and T3 respectively, although some prefer to use T100, T150, and T200 instead. The most important thing to remember is that there are only two main classifications of heat resistance recognised in the market. These are T150, which relates to a maximum continuous temperature of 150˚C, and T200, which is for more extreme heat conditions up to 200˚C.

T150 should consistently withstand continuous material temperatures up to a maximum of 150˚C over long periods, but it should only be expected to cope with peak temperatures in excess of that limit for a very short period of time (literally minutes). For T150 classification belts, the necessary physical properties can be achieved using a styrene butadiene rubber (SBR) and a process of chemical alteration of the various chemical polymers together with the use of other components and accelerants. The same principle applies to the T200 classification for peak temperatures higher than 200˚C. Any period longer than just a few minutes will almost certainly cause irreparable damage to the belt.

For the higher temperature T200 classification, it is necessary to replace the SBR with more complex and expensive polymers such as EPM (ethylene propylene rubber) and EPDM (ethylene propylene diene

monomer rubber), which have a superior resistance to heat. A different, more complex vulcanising mechanism involving hydrogen peroxide is also required.

The T150 and T200 classifications should not be confused with the requirements used within the ISO 4195 test methods, which measure the heat resistance properties of rubber conveyor belts. The tests involve placing rubber samples in high temperature ovens for a period of 7 days. This testing procedure is known as ‘accelerated ageing’. At the end of the 7 day period, the reduction in mechanical properties such as tensile strength, elongation, and hardness are then measured. There are currently three ‘classes’ of ageing within ISO 4195, each with a respective ‘ageing temperature’ – class 1 (100˚C), class 2 (125˚C), and class 3 (150˚C).

It's all about the rubber

Crucial to all of this is the quality of the rubber and its ability to resist high temperatures and thereby delay the ageing process and act as an effective heat shield for the belt carcass for the longest possible time. Protecting the carcass is vital because an increase as small as 10˚C in the inner core temperature can reduce the life of the belt by as much as 50%. This is because the rate of rubber oxidation increases by a factor of eight for every 10˚C increase in

core temperature. If the inner temperature of the carcass becomes too high, it will delaminate and literally fall apart.

There are therefore two key time factors. The first is the length of time a rubber belt can carry hot materials on its surface before off-loading, thereby having the opportunity to cool down on the unladen

return run. The second key time factor is the duration of its overall operational lifetime. These two factors have the biggest influence on the day-to-day performance and ultimately the cost-effectiveness of any heat resistant conveyor belt.

The vast majority of rubber used to make heat resistant conveyor belts is synthetic. Each rubber compound consists of an extremely complex ‘cocktail’ of different chemical components, polymers and other essential substances. Added to this should be the UV stabilisers, anti-ozonates, and antioxidants needed to resist the ravages of oxidative ageing caused by ozone and ultraviolet light exposure, which is, of course, unavoidable.

The rubber compound also needs to contain, for example, sulfur or other accelerators and activators, so that it can undergo a crucial part of the production process known as vulcanisation, during which the rubber is typically heated to 140 – 160˚C.

The US$64 000 question is why are there such huge differences in both the performance and selling price of heat resistant belts that are claimed to meet exactly the same specifications and standards? The answer almost entirely stems from

the manufacturer’s approach to the market, which consists of two very distinct sectors. By far the largest is the ‘pile it high, sell it cheap’ sector, dominated by Southeast Asian manufacturers. At the opposite end of the scale is the high quality ‘big name’ sector, such as the Fenner Dunlop’s and Contitech’s of this world. The key lies with the components used to create heat resistant rubber, which constitute more than 75% of the cost of producing it. Consequently, for manufacturers who compete on price, rubber is their biggest opportunity to gain a competitive advantage. Using minimum quantities and lower cost, low-grade, environmentally unregulated raw materials and components is a massive cost-saver.

Add to this the often complete omission of essential ingredients such UV stabilisers, anti-ozonates, and antioxidants, needed to create resistance to ozone and ultra violet light. It does not stop there; another cost saver is the use of totally polyester (EE) fabric plies in a belt that they claim to have an EP (polyester/nylon mix) construction, as polyester is some 30% less expensive than nylon.

The vulcanisation process is the third area for savings to be made. Because it is a heat process, it takes appreciably longer to vulcanise heat resistant rubber. The better the heat resistant properties of the rubber, the longer it needs to spend on the production line. This costly time is further increased when producing the higher temperature T200 classification because, as touched on earlier, it necessitates the use of more expensive polymers such as EPM (ethylene propylene rubber) and EPDM (ethylene propylene diene monomer rubber), which have a superior resistance to heat. As a result, they also require a different, more complex vulcanising mechanism involving hydrogen peroxide.

All these factors help to magnify the difference in performance and price. A manufacturer that creates a premium quality belt that effectively delays the thermal and oxidative ageing process for the maximum possible time in order to achieve the longest possible working life is certainly at a significant disadvantage in terms of selling price compared to ‘economy’ manufacturers. Ironically, it is the size of the difference in selling price that is invariably the best indicator of the level of performance and longevity that can be expected. For those operators who would rather reduce costs by buying, repairing, and replacing far fewer conveyor belts, the choice is clear. When it comes to the true cost, time will always tell.

After spending 23 years in logistics management, Leslie David has specialised in conveyor belting for over 17 years. During that time, he has become one of the most published authors on conveyor belt technology in the world.

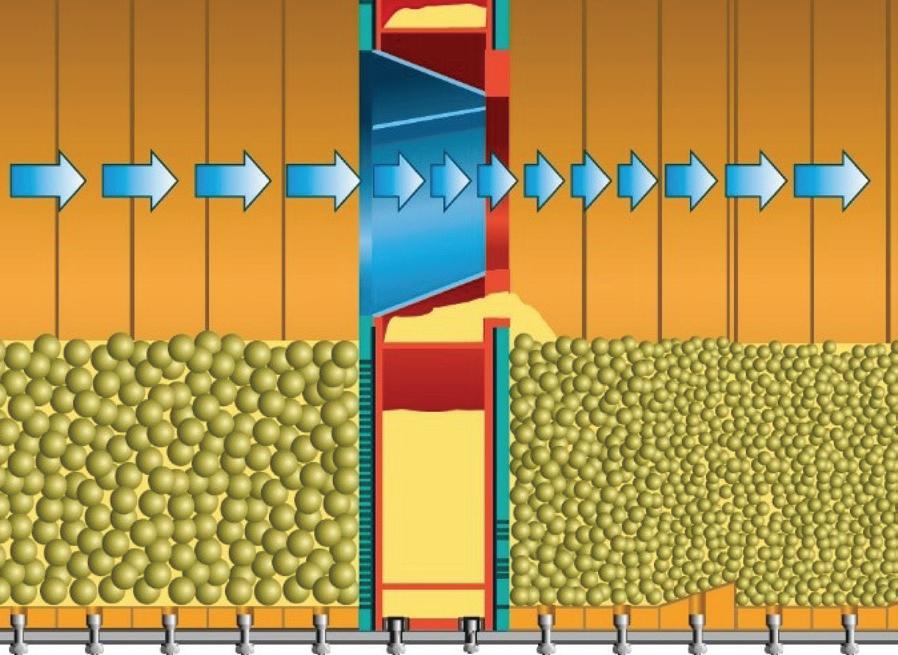

Todd Swinderman, Martin Engineering, delves into how passive dust control measures using curtains and skirting are transforming conveyor transfer point efficiency, enhancing workplace safety, and reducing operational costs.

Conveyor transfer points for cement plants are designed primarily for material throughput and secondarily for fugitive material control. However, dust control and spillage have serious workplace safety consequences that raise the cost of operation from cleanup and equipment fouling. This makes addressing dust and spillage through engineered transfer chute design both critical and practical.

The testing and application of 'passive dust control measures' in a wide range of bulk handling applications using dust curtains and skirting have proven to be an effective control measure for dust. However, this equipment needs to be installed correctly and strategically to maximise results and the return on investment.

When redesigning a dust control enclosure at a conveyor belt transfer point, skirtboard extensions (wear liners, polyurethane skirting, clamps, etc.) to seal the environment and the placement of dust curtains to control airflow are essential. Most engineering firms use the American Conference of Governmental Industrial Hygienists (ACGIH) industrial ventilation handbook design criteria for active dust control (dust machines, dust bags, sprayers, etc.).1 The design rules for skirtboard extensions are based primarily on lump size and the length necessary for the bulk material to settle down into a stable profile.

By understanding the environment inside the transfer point and how the structural components work together during operation, dust and spillage

can be mitigated and the external environment will improve.

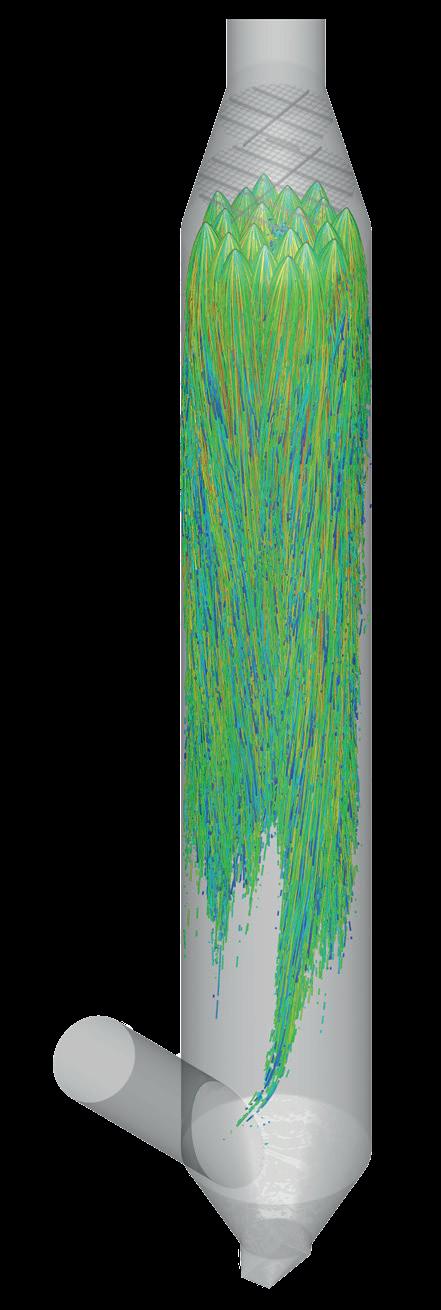

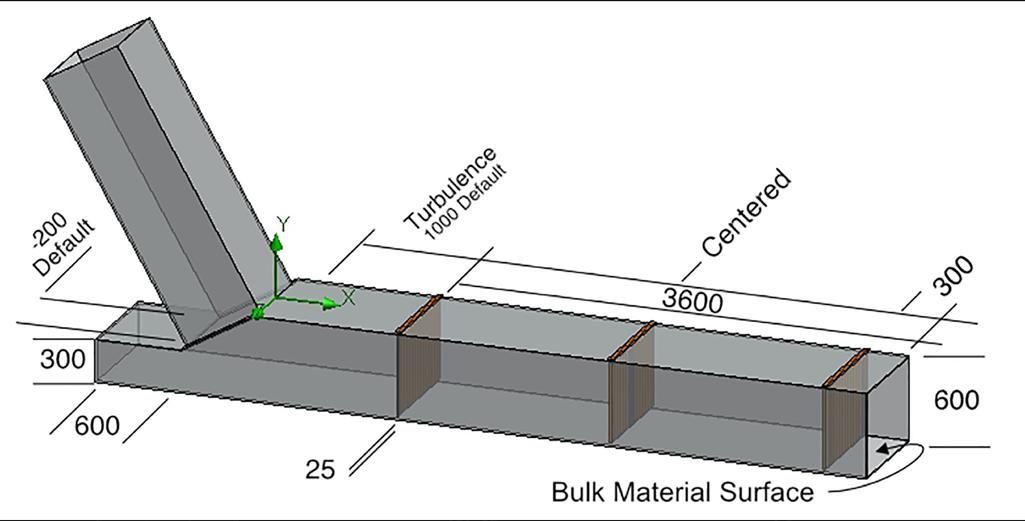

Air is very compressible and will find the path of least resistance. With current enclosure designs, the air is sped up significantly to flow under or around a single exit dust curtain with narrow slits, resulting in re-entraining the dust particles in the exhaust. Therefore, it is necessary to create recirculation regions inside a transfer point to improve dust settling (Figure 1).

The basic concept is the trajectory of a dust particle can be modelled based on the terminal velocity (Vt) of the dust particle settling in still air and the velocity of the airflow in the transfer point (Vair). The result of these two velocities using the enclosure height (H) as the vertical drop distance indicates the length (L) necessary to settle the dust particle. If the terminal velocity of the particle is very small and the transfer point air speed is relatively large, the settling distance can be quite long (Figure 2).

Using the commonly applied Stoke’s Law, a 10 μm (micrometer) respirable limestone dust particle in an air stream travelling 1 m/s (3.2 ft/s) is predicted to take 75 m (246 ft) to settle by gravity alone. This makes a well-designed enclosure with the proper height, seal, and air control with curtains essential to controlling dust.

When reducing dust emissions, field tests have shown the difference in performance for longer and taller skirtboards of 4800 mm (15 ft) long and 900 mm (3 ft) high compared to 3600 mm (~12 ft) long and 600 mm high is negligible. It was the placement of dust curtains that had the greatest impact on dust settling.

In both transfer point sizes, enclosures with 3 curtains spaced 300 mm (~1 ft) apart from the entrance and exit and one in the centre offered superior performance as compared to one dust curtain at the end.

The best value for the cost of the skirtboard enclosure and its effectiveness is 600 mm high and 3600 mm long, using either the retrofit or mitred discharge chute-to-skirtboard connection (Figure 3).

The junction between the discharge chute and the skirtboards was found to be an important design detail for creating recirculation. Most conveyor engineers and manufacturers use 300 mm high skirtboards, because this height is about the minimum for installing a sealing system and wearliners.

In most of the models, the discharge chute was 200 mm (7.78 in.) narrower than the skirtboards. Making the width of the discharge chute narrower than the width of the skirtboard helps to fold the airflow going into the first curtain, and that encourages the distribution of the airflow toward the top of the enclosure rather than along the surface of the bulk material. Extending the head chute back to the first full troughing idler on the carrying side and using 2 curtains plus sealing the area between the top and bottom runs is critical in reducing induced airflow.

The tail box had little effect on dust emissions out of the exit end of the skirtboards. In most configurations, the height of the tail box was set at 300 mm. The tail box length was set at 600 mm to match the typical 600 mm idler spacing used in the load zone by most conveyor manufacturers and engineers. Very little airflow or pressure increase was observed in the tailbox for most configurations, so its main function should be considered reducing roll back of material and creating a means to effectively seal past the corner of the loading chute.

In field tests, three different airflow volumes of 0.25, 0.50 and 0.75 m3/s (0.82, 1.64, and 2.46 ft3/s) were used to represent induced air. (For reference, 0.50 m3/s is about 28.3 cmm (1000 cfm)) As would be expected, the average air velocity through the skirtboards was directly proportional to the induced airflow. The maximum air velocities in the skirtboard are almost always found where the air flows under the curtains. Air velocities of 30 m/s (98.4 ft/s) were common under the curtains, with up to 90 m/s (295 ft/s) observed.1 These high air speeds keep the respirable dust suspended, so lowering induced air into the chute is important for improving performance.

The length of the skirtboard had some effect on dust discharges for the standard conveyor with a single exit curtain. With 3 curtains spaced 25 mm (~1 in.) above the belt, there was a similar reduction in the emission ratios, but at a much lower percentage of particles escaping. Keeping the airflow (and therefore the flow of bulk material) consistent through the transfer is important to improving dust settling. Different baffle arrangements were tried to encourage recirculation within the discharge chute and the skirtboards, with little effect.

Testing has shown that, in most cases, curtain strips were nominally 50 mm (~2 in.) wide with a gap between the strips of at least 5 mm necessary to cause airflow through the curtain rather than under it. While it varies by application, it appears that a gap of 10 – 15 mm (0.4 to 0.6 in.) produces the best combination of recirculation and keeping the average air speed inside the skirtboards more uniform and at a lower velocity.

When multiple curtains were tried, the best combination was with a curtain 300 – 450 mm (1 – 1.5 ft) from the beginning of the skirtboards, one curtain in the centre and an exit curtain 300 to 450 mm from the end of the enclosure. This pattern was found for all skirtboard lengths, heights, and belt widths. A minimum of two chambers created by the spaces between curtains was necessary to create recirculation patterns within the skirtboards.

Recirculation within the chambers created longer settling paths for the respirable dust, which improved dust control performance. A slight improvement was found by increasing the number of curtains and evenly spacing them. Configurations of up to 6 curtains were tried. Staggered curtains and combinations of full width and staggered curtains did not improve performance. And above all, the dust curtain systems must be accessible and maintainable to gain the benefits of passive dust suppression (Figure 4).

Singleton Birch, a provider of quicklime and chalk products to cement and mortar producers, had a significant fugitive material and dust emissions problem at its conveyor located at the Melton Ross Quarry. Producing approximately 1.5 million tpy of processed limestone and chalk, limestone is crushed to 150 mm minus (6 in. minus) and transported by conveyor to a kiln. Due to the light material, this conveyor system posed a serious dust and spillage issue.

Dust emissions would build up around the loading zone and encapsulate the tail pulley, eventually causing the belt to just slide over the built-up material rather than riding on the rollers, which fouled the return side of the belt and the face of the tail pulley. Fugitive material would travel freely throughout the long tunnel containing the conveyor, piling up and restricting access for maintenance workers to address these issues. Anyone entering the enclosed area was required to wear personal protective equipment (PPE) and the area needed to be cleaned by two workers once per week, taking up nearly an entire shift (Figure 5).

After an on-site inspection, technicians from the Martin Engineering Britain team installed conveyor transfer point solutions that addressed the dust and spillage issues.

They designed a 4 m long (13 ft) chute extension and tail box to control the air flow and material rolling back onto the tail pulley. The overhaul integrated Martin® ApronSeal™ Double Skirting HD and External Wear Liners to protect the chute wall and seal in the dust.

To control airflow through the chute and allow material to settle, a series of dust curtains were strategically placed inside creating clear stilling and settling zones.

Since the installation, according to operators close to the project, spillage and accumulation along walkways and around the mainframe have been eliminated. There has been no encapsulation of the belt or tail pulley and rolling components are far less prone to fouling. Moreover, protective suits are no longer required and the maintenance schedule for cleaning has been adjusted to only occur during schedule outages (Figure 6).

Controlling the amount of airflow through the transfer chute is critical. The results of field tests and applied techniques clearly indicate that when dust curtains are properly spaced and kept adjusted close to the bulk material profile, the passive reduction of dust emissions is significant. Retaining a proper seal using skirting set in the modern skirtboard extension configuration will eliminate gaps where air can escape taking dust and fines with it.

Passive dust control has gone beyond merely adding some skirting and a dust curtain at the end of a chute. New retrofitted curtain and skirting designs require little monitoring and only occasional maintenance while significantly improving the work environment around the transfer point. The amount of labour saved in the cleanup around the transfer point and the cost of replacing fouled equipment lowers the cost of operation and improves the return on investment.

1. Industrial Ventilation: A Manual of Recommended Practice for Design, 30th Edition, American Conference of Governmental Industrial Hygienists, Cincinnati, OH, USA, March, 202. – https://www.acgih.org/ventilation/

R. Todd Swinderman earned his B.S. from the University of Illinois, joining Martin Engineering’s Conveyor Products division in 1979 and subsequently serving as V.P. and General Manager, President, CEO and Chief Technology Officer. Todd has authored dozens of articles and papers, presenting at conferences and customer facilities around the world and holding more than 140 active patents. He served as President of the Conveyor Equipment Manufacturers’ Association (CEMA) was the editor of CEMA's 6th and 7th editions of Belt Conveyors for Bulk Materials, The Design Guide for Belt Conveyors. Todd is active on several CEMA committees including Chair of the Bulk Safety Committee and is a member of the ASME B20 committee on conveyor safety which set US conveyor safety standards. Swinderman retired from Martin Engineering to establish his own engineering firm, currently serving the company as an independent consultant.

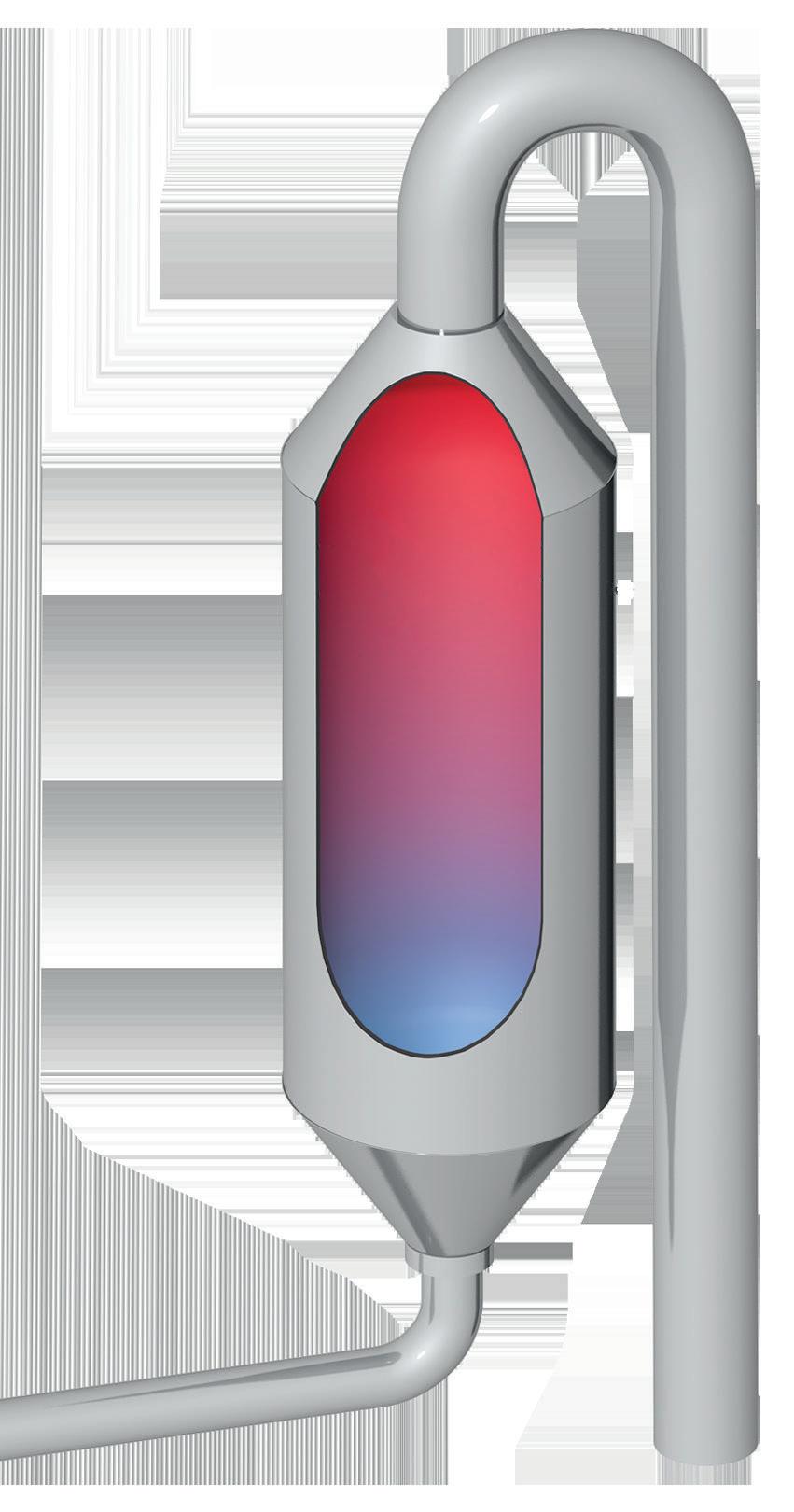

David

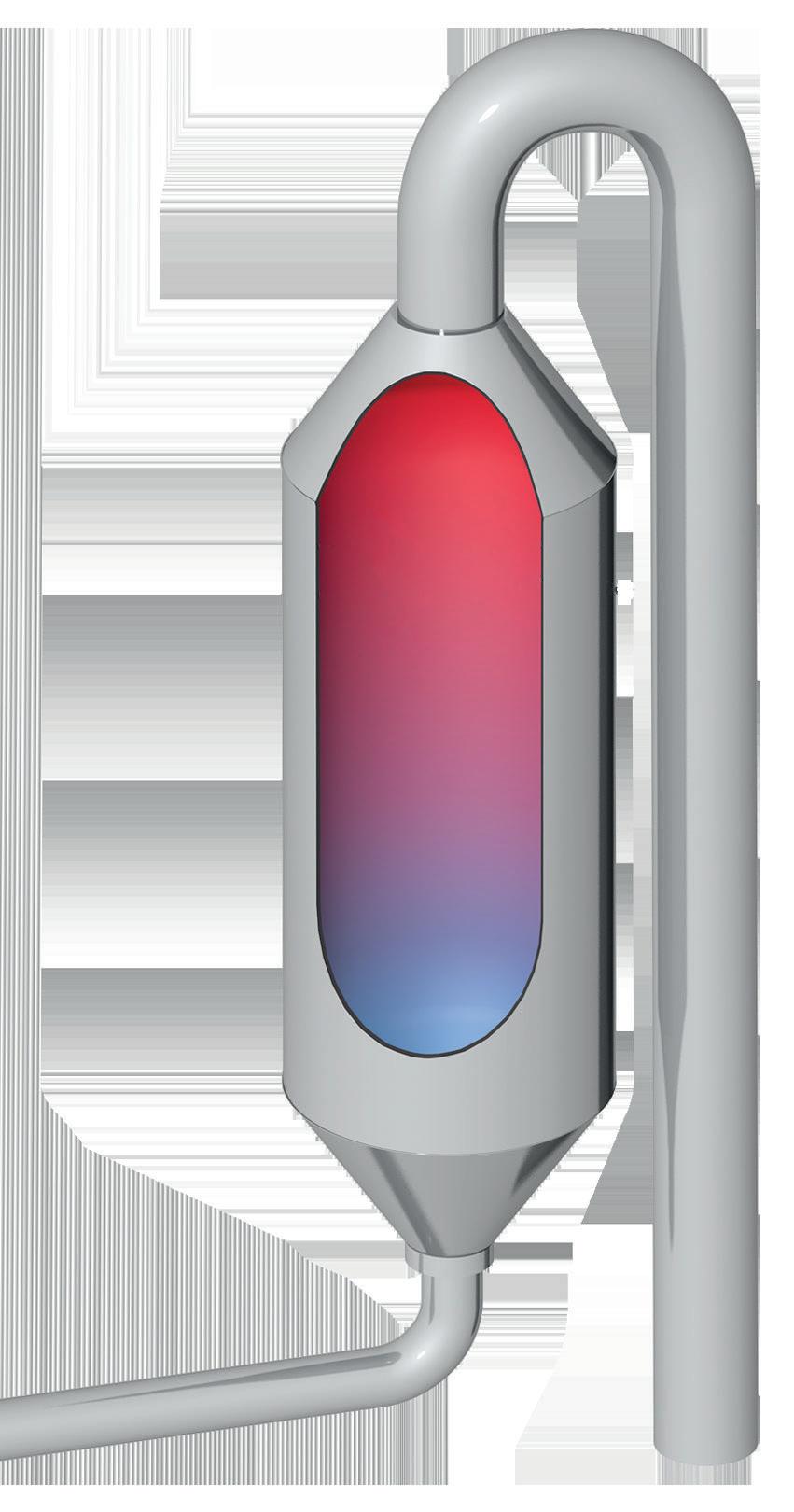

Jansen, IKN, explores how the transition from outdated satellite coolers to new, innovative designs is helping the cement industry meet demands for energy efficiency and reduced emissions.

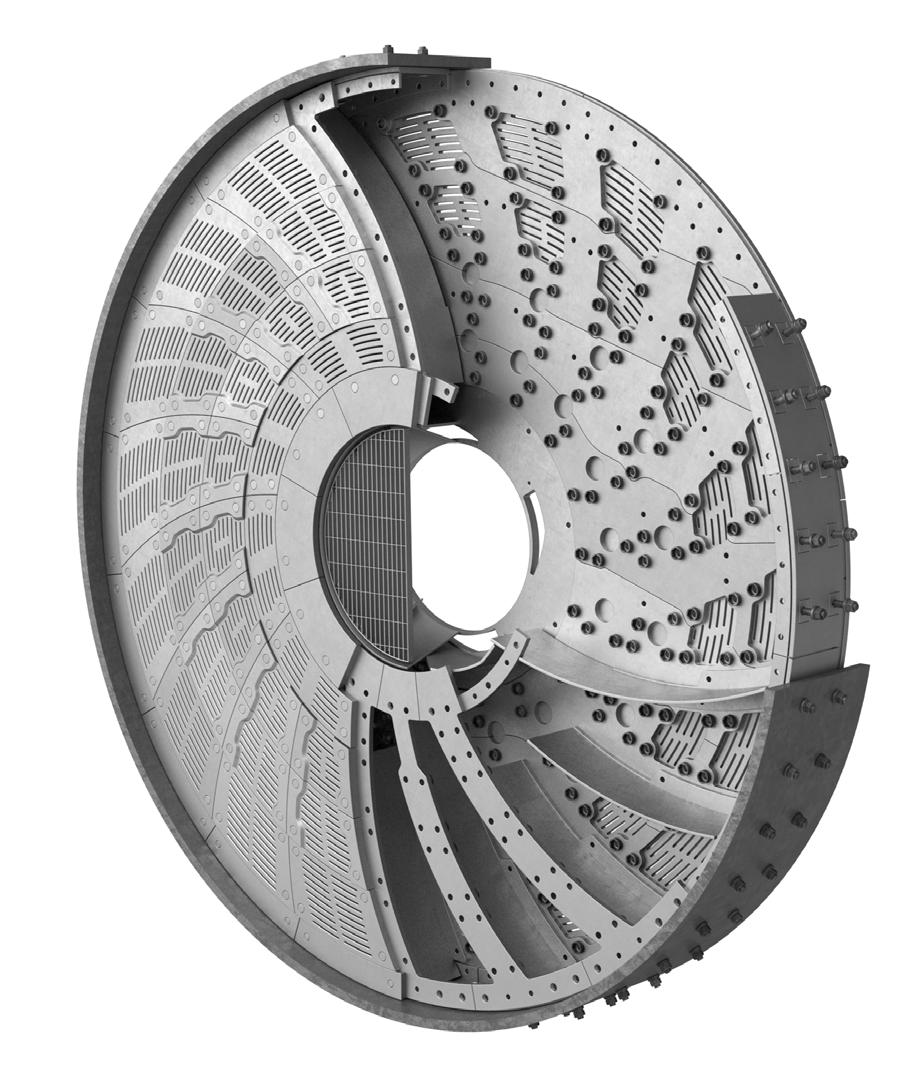

In the ever-evolving landscape of cement production, replacing outdated satellite clinker coolers represents a dynamic step toward greater efficiency and sustainability. Once favoured for their simplicity and capacity, these ageing technologies now struggle to meet the industry's modern demands for energy efficiency and lower emissions.

Leading this development is IKN's Pendulum Cooler, a technology designed to minimise energy consumption by maximising heat recovery and therefore significantly reducing CO2 emissions while requiring minimal maintenance efforts.

Additionally, its adaptable design allows for seamless integration into existing facilities, even in constrained spaces. This ensures minimal disruption during the installation process and helps plants to optimise performance without significant downtime.

The cement industry faces increasing pressure to optimise operations and meet sustainability goals.

Upgrading clinker cooler systems with IKN Pendulum Coolers offers cement producers an opportunity to reduce costs, improve efficiency, and meet environmental expectations set by governments and communities.

Economic advantages: fuel savings and energy efficiency

Energy costs are among the largest operational expenses for cement plants. Satellite coolers, with their outdated designs, waste valuable energy that could otherwise be captured and utilised.

The Pendulum Coolers directly address this inefficiency, saving approximately 60 kcal per kg of clinker produced.

For a plant producing 3000 tpd this leads to:

f 753 GJ of energy saved daily, or around 248 000 GJ annually (based on 330 operational days).

At a fuel cost of approximately €3 per GJ, these energy savings result in:

f Daily cost savings of €2260.

f Annual fuel cost reductions of approximately €750 000.

This significant reduction in operational expenses highlights the tangible economic impact of upgrading tan existing satellite or drum cooler. Such savings not only improve profitability but also provide a quick return on investment.

Environmental benefits: reduced CO2 emissions

Energy efficiency also translates into reduced carbon emissions, aligning with the industry's sustainability goals. For every 1 GJ of energy saved, approximately 0.093 t of CO2 are avoided. Using the same example:

f Daily CO2 savings amount to around 70 t.

f Annually, this reduces CO2 emissions by approximately 23 000 t for the plant.

Lower emissions are increasingly critical as governments and regulatory bodies implement stricter environmental standards. Plants adopting Pendulum Coolers not only reduce their carbon footprint but also enhance their reputation as environmentally responsible operations.

For cement producers operating within Europe, the financial benefits of reducing CO2 emissions are amplified by the European Union Emissions Trading System (EU ETS). Under this system, producers are allocated a certain number of free allowances based on benchmarks for efficient production.

However, when these free allowances are insufficient to cover total emissions, producers must purchase additional CO2 certificates.

With free allowances deemed to be reduced to zero in the near future, this creates a strong motivation to adopt measures such as converting outdated satellite coolers to modern clinker cooler systems, which significantly reduce emissions.

For a 3000 tpd production line, annual CO2 savings of approximately 23 000 t translate into tangible economic gains. With CO2 certificates averaging €83.66 per t in 2023 (as per EEX report).

This additional aspect not only strengthens the business case for a satellite cooler conversion, but also highlights the strategic value of reducing emissions in a market increasingly shaped by environmental regulations and carbon trading incentives.

The increase of recuperation air leads to another advantage of the conversion to a Pendulum Cooler. By improving the energy of the recuperation air, the cooler provides a higher and more stable temperature profile in the kiln system. This optimised heat recovery creates ideal conditions for the use of alternative fuels (AFs), such as waste-derived fuels or biomass, which often require a more controlled environment to burn efficiently.

Key benefits of increased recuperation air:

f AF adoption: With better heat utilisation, plants can reduce their reliance on traditional fossil fuels like coal and shift to AFs, lowering both costs and emissions.

f Operational flexibility: the system allows for the introduction of fuels with varying calorific values without compromising kiln stability or clinker quality.

f Sustainability impact: increased use of AFs significantly contributes to sustainability goals, reducing dependency on non-renewable resources.