11 minute read

Africa awash with potential

Victoria Tchen, ICIS, UK, investigates the LNG sector in Africa, and how the continent offers significant potential in both export and import avenues.

While progress in new African LNG projects has been slow in recent times, the continent offers huge opportunities for developers of both export and import infrastructure.

Several LNG export projects are underway in Mozambique, Senegal, and the Ivory Coast. The most significant remains Mozambique, which could see the country overtake Nigeria as the largest exporter on the continent. But local insurgency and security threats have put doubts over the completion of LNG projects in the country.

On LNG imports, Ghana’s Tema terminal is approaching completion and is expected to come online in 2022.

A range of conventional import projects are planned for South Africa, with a recent start for a small scale LNG project.

Mozambique projects delayed, Tanzania talks resume

Local insurgency has delayed the 12.9 million tpy Mozambique LNG project’s start-up beyond 2025. French major TotalEnergies postponed the project’s start to 2026.

Local insurgency in Mozambique ended with the Rwandan and Mozambican security forces taking back control of the key port city of Mocimboa da Praia near the Mozambique LNG project in August 2021.

The worsening security situation previously led TotalEnergies to declare force majeure on the project in early 2021.

In its 3Q21 earnings call, TotalEnergies reiterated its commitment to Mozambique LNG but only when peace is fully restored.

Meanwhile, negotiations have resumed on the troubled Tanzania LNG export project, with the state aiming to push things forward amid higher global gas and LNG prices.

Project negotiations restarted in November 2021 between the government of Tanzania and international oil and gas companies, according to Norwegian energy company Equinor.

This was confirmed by the Tanzanian Minister for Energy January Makamba who added that a Final Investment Decision (FID) on the export project will come sooner than expected – but gave no indication of a date.

Talks are expected to focus on fiscal, legal, and regulatory frameworks, Equinor said.

Despite the Tanzanian Minister for Energy’s optimism, sources have said that Tanzania is unlikely to start producing LNG until the 2030s.

South Africa starts small scale LNG output

In southern Africa, small scale LNG projects are on the rise with possible large scale imports to be seen in 2022.

South African energy company Renergen told ICIS that production from its small scale truck LNG Virginia Gas Project was expected to start in December 2021, with Phase 2 expected in mid-2024.

Cool-down operations are due to take place in January 2022. Commercial operations are then expected to start between February and March 2022.

The gas will be used to supply LNG to trucks using filling stations in cities such as Johannesburg and Durban and industrial customers looking to diversify away from liquefied petroleum gas (LPG).

In the large scale LNG market, South Africa has been on course to become an importer for some time and is steadily coming closer.

In November 2021, the first-ever commercial shipment of LNG arrived in the country. The cargo was from Rotterdam, the Netherlands. It was received by South African energy company DNG Energy.

The cargo delivery came ahead of DNG’s planned commissioning of its first FSRU in 1Q22.

In November, South Africa’s Central Energy Fund also issued a notice asking for information on the potential for an LNG import terminal at the port of Ngqura in the Eastern Cape region.

The information collected will be used for a Request for Proposal. It is thought that an FSRU would be the preferred option for Ngqura, as opposed to a land-based terminal.

If it happens, Phase 1 of the Ngqura project would have an import capacity of approximately 600 000 tpy of LNG, with second and third phases planned.

The information request on the project’s potential closed on 3 December 2021.

Turkish shipping company Karpowership is in the process of gathering required approvals and licences to meet the financial close in a bid to develop LNG-to-power infrastructure in South Africa with a delayed deadline of 27 January 2022. Karpowership was elected as one of the preferred bidders by South Africa’s Ministry of Energy to provide LNG-to-power vessels across three sites in Saldanha Bay, Coega, and Richard’s Bay totalling 1.22 GW for a 20-year period from March 2021.

The bidding process has been criticised and ICIS understands a legal case around the process will continue.

Ghana LNG terminal commissioning delayed again

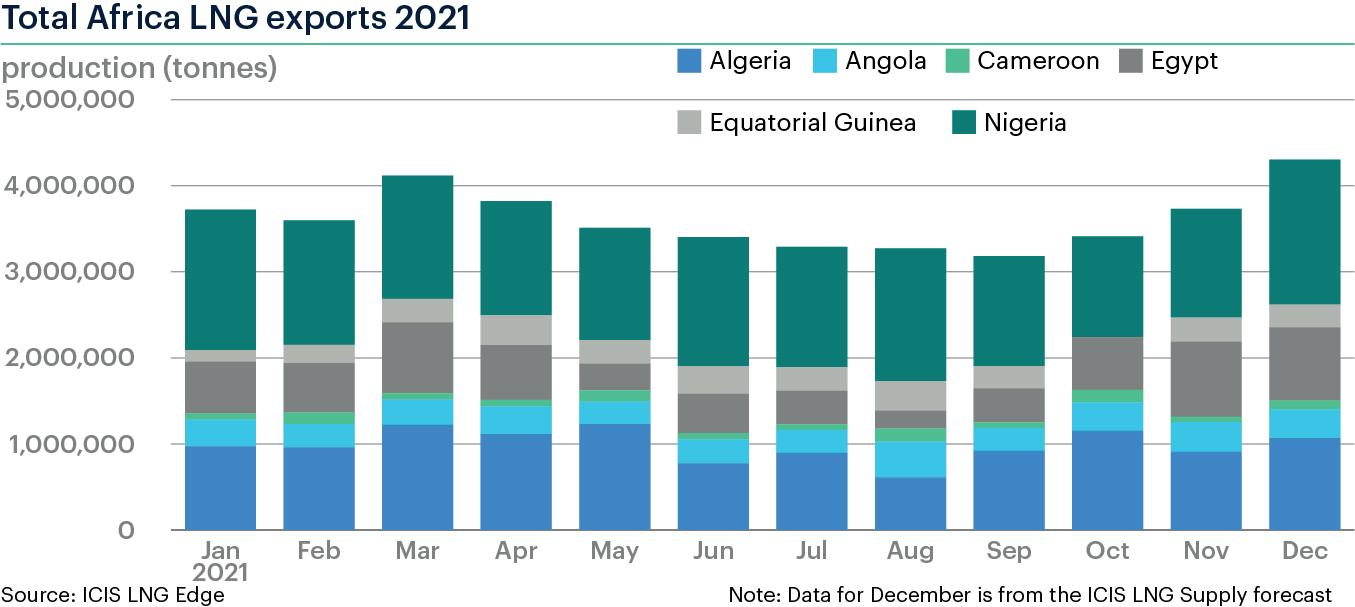

Figure 1. Nigeria and Algeria underpin LNG exports as Egypt rises. In West Africa, the commissioning of Ghana’s Tema LNG import terminal continues to be pushed back.

Tema LNG was expected to receive a commissioning cargo in the last week of November or first week of December, according to market sources close to the project, but delays continue.

Tema LNG was previously expected to receive a commissioning cargo in October 2021 with full commercial operations to start several weeks after that. But delays to the onshore part of the project pushed back the start date further into 4Q21.

The floating regasification vessel Torman is in position, but pipeline connection work is still in progress.

Further testing will be needed prior to approval for the project to start but ICIS understands that commissioning is expected shortly after the pipeline interconnection is completed.

The commissioning will also depend on the movements of the 180 000 m3 Vasant, which has been chartered by Tema LNG as a floating storage vessel. The vessel was chartered until March 2022 for approximately US$20 000 - US$23 000/d. It has been stationed at Tema since June 2021. It is not clear if the vessel will remain in Ghana as it was recently offered for charter given current high rates. If the vessel is chartered it could lead to further delays in commissioning. One source said the project may not come online until January 2022. ICIS understands that Shell will supply the LNG to the terminal under an oil-price linked contract. The delay of the project is unlikely to have an impact on Ghana’s gas supply, as the country currently receives enough pipeline gas from

Nigeria through the West African pipeline to meet short-term domestic demand.

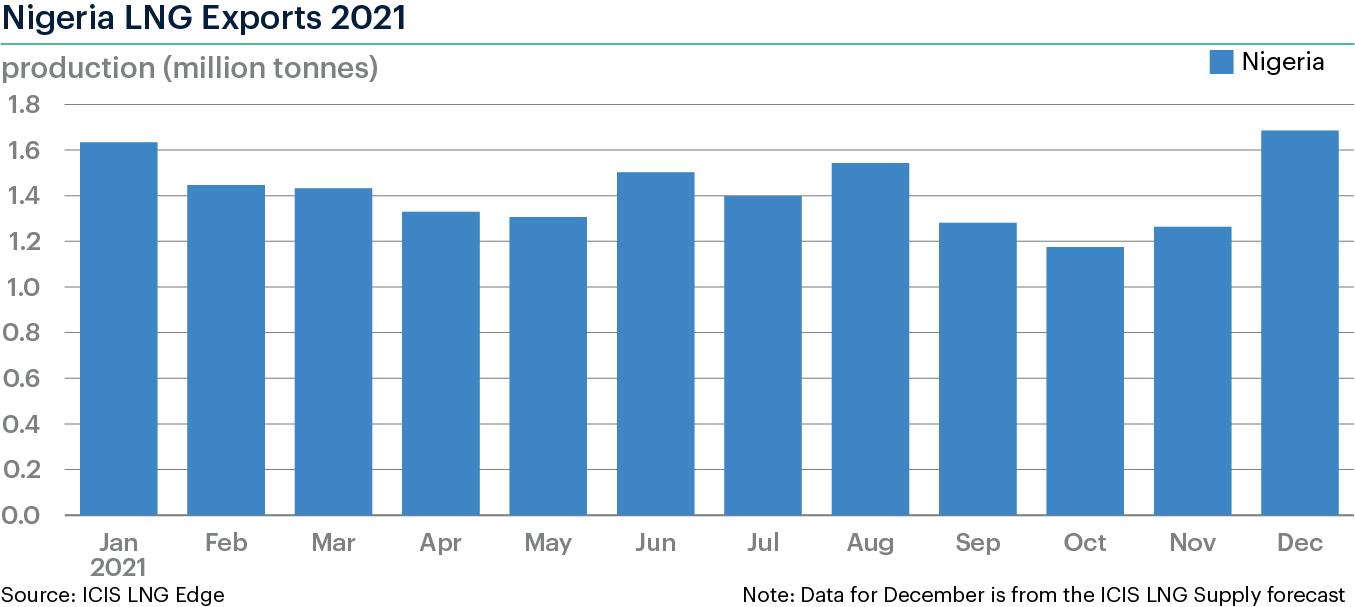

While Nigerian gas continues to meet Ghana’s domestic demand, Nigeria LNG has itself faced some production issues.

Nigeria LNG production issues

Africa’s largest LNG producer, Nigeria, may be experiencing some production issues as several Nigeria LNG (NLNG) vessels were reported on offer in the first week of December, and were subsequently chartered out. This could be indicative of production issues as a similar process was seen in November when the Bonny plant faced an unplanned outage.

In November, Nigeria LNG experienced issues with two trains, including train 5. As many as five ballast NLNG vessels were loitering outside the 22.2 million tpy plant. No cause or duration was confirmed but ICIS estimates that production was lowered by 20% over 15 days. As a result, Nigeria exported 1.3 million t of LNG last month, almost a 14% loss y/y.

ICIS LNG Analytics forecasts show that Nigerian LNG exports could still climb to 1.6 million t in December 2021, a 5% gain y/y but a 7% fall from December 2019. This would bring total Nigeria exports to over 17 million t of LNG in 2021.

Train 7 at the 7 million tpy Nigerian LNG project is due to start up in 2024.

First LNG from Tortue still on track for 2023

First gas from the 2.5 million tpy phase one of the Greater Tortue Ahmeyim LNG project off Senegal and Mauritania in West Africa is on track for 2022 along with FID on phase two of the project, upstream company Kosmos Energy said in its 3Q earnings calls on 8 November.

The news comes as shipowner Golar reported that work on the vessel that will be used as the floating LNG (FLNG) part of the project, the Gimi, is 75% complete and is approximately two years from being ready. This ties in with the 2023 start date for LNG production and export.

Phase one LNG volumes have been contracted to BP at a slope price of approximately 10% of Brent.

Kosmos Energy expects the bulk of its income to come from the phase two expansion. Work on phase two of the project continues with plans to utilise infrastructure currently put in place for phase one, in order to reduce the cost of the project.

The 2.5 million tpy phase two of Tortue is expected to deliver LNG into Japan at a breakeven cost of just over US$4/million Btu, although Kosmos did not further elaborate on how this cost was calculated.

As gas for phase two is currently uncontracted, the current high price environment and low breakeven point will grant Kosmos Energy greater flexibility on pricing, the company said.

FID on phase two is also expected in 2022.

A possible phase three expansion could see LNG production from the Tortue field expand to 10 million tpy.

LNG-powered fleet

Turkish company Karpowership, which operates several powerships across Africa, including Gambia, Ghana, Guinea

VACUUMVACUUM JACKETEDJACKETED PIPEPIPE

WEWEWE HAVEHAVEHAVE YOUYOUYOU COVEREDCOVEREDCOVERED YESTERDAY,YESTERDAY,YESTERDAY, TODAYTODAYTODAY ANDANDAND TOMORROW.TOMORROW.TOMORROW.

AAA cmecmecme Cryogenics’Cryogenics’Cryogenics’ PRODUCTPRODUCTPRODUCT LINELINELINE includesincludesincludes mobilemobilemobile high-pressurehigh-pressurehigh-pressure supplysupplysupply equipment,equipment,equipment, manifoldmanifoldmanifold systemssystemssystems forforfor hydrogenhydrogenhydrogen fuelfuelfuel cellcellcell technology,technology,technology, andandand completecompletecomplete fuelingfuelingfueling stations.stations.stations.

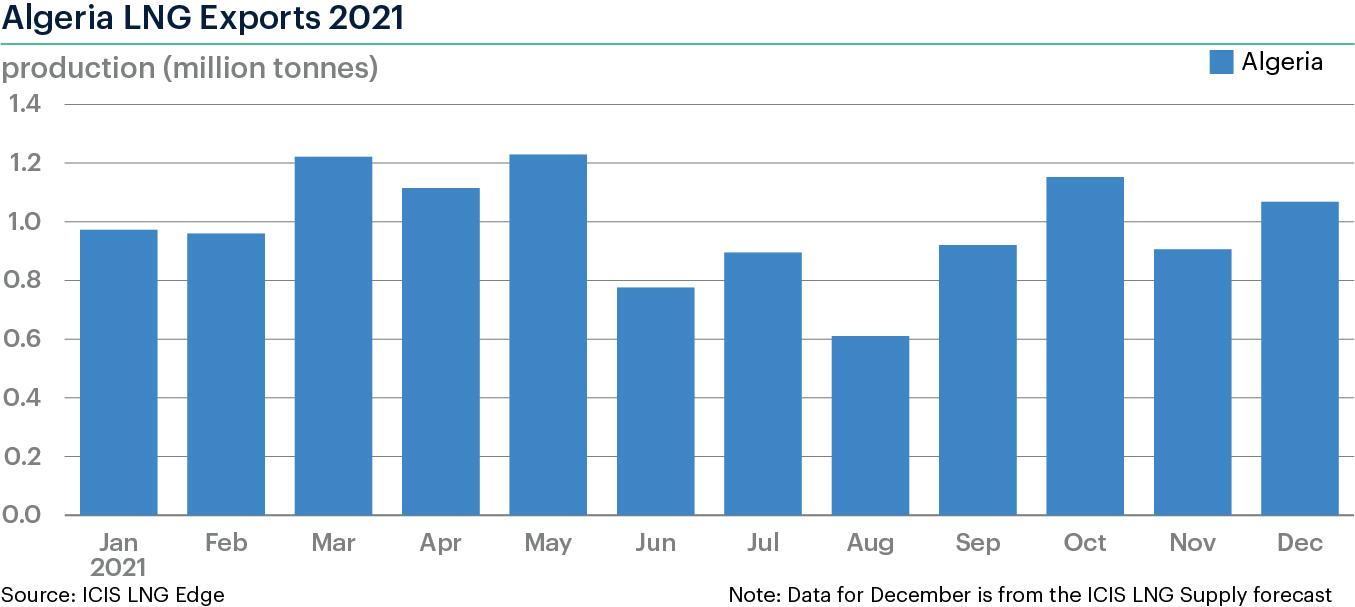

Figure 2. Volatile, but Algerian LNG exports up in 2021.

Figure 3. Nigeria leads African LNG exports despite production issues.

Bissau, Guinea, Mozambique, and Sierra Leone, has started to switch its entire fleet from running on low-sulfur heavy fuel oil to LNG, starting with Senegal.

The FSRU, Karmol LNGT Powership Africa, arrived in Senegalese waters on 31 May 2021.

Due to external factors, such as weather, the FSRU was not moored in its final position until late June.

The vessel is still undergoing the commissioning process, which includes connection and testing.

A new FSRU is expected to be deployed in Mozambique in 1Q22. The FSRU is expected to have a capacity of 125 000 m3 .

Cameroon to expand capacity

In central Africa, upstream company Perenco is likely to expand its capacity use further between 2023 - 2026, linked to drilling exploration work it is carrying out in Cameroon.

The 2.4 million tpy floating liquefaction project in Cameroon, the Hilli Episeyo, first began production in 2018 with two trains.

The Cameroon FLNG project produced 1.9 million t of exports in 2020 and is expected to produce 1.1 million t of LNG in 2021, according to ICIS LNG Analytics.

In Angola, exports have fallen from 2020 with the project on course to produce 3.7 million t of LNG, 1 million t less than the previous year.

Morocco weighs gas and LNG import options

In northern Africa, ongoing tensions between Algeria and Morocco reached breaking point in early 2021.

The Moroccan government is said to be weighing up gas and LNG imports options as Algerian flows to Morocco were cut. The agreement for supply through the Maghreb-

Europe (MEG) pipeline, which connects Algeria and Spain through Morocco, expired on 31 October, when the ownership of the pipeline was passed to Morocco. This cut

Algerian flows to Spain via Morocco. The MEG pipeline has a capacity of 12 billion m3/y. The Moroccan government said it will install an FSRU after gas flows from Algeria were cut off. Plans to install an FSRU off the country’s coast have been considered for years. UK oil and gas company

Predator had expressed interest in the construction and operation of a floating LNG import terminal in Morocco in a tender in early 2021, but it is not clear if it was awarded. Media reports have suggested that plans on where to place a unit are still under discussion, with Tangier being one option. The Moroccan government is also looking at reversing flows via the 12 billion m3 Maghreb-Europe pipeline linking Algeria to Morocco and Spain, said a source. Plans would mean sourcing regasified LNG, possibly from Algeciras which is near to the Tarifa entry-point in

Spain. Meanwhile in Algeria, a 2 billion m3/y expansion to the 8 billion m3/y Medgaz natural gas pipeline connecting

Algeria directly to Spain is expected to be complete by early January 2022, Spanish energy company Naturgy has told ICIS. Once completed, the expansion of the pipeline will support Algerian gas flows to Spain.

It will also mean that less Algerian LNG will be needed to plug the Spanish gas supply gap, opening opportunities for Algerian LNG exports to other countries.

Following the end of the MEG pipeline, Algeria exported 567 448 billion m3 of LNG into Spain in November 2021, up from 74 534 billion m3 in November 2020.

In July, Spanish energy company Naturgy and Algerian state-owned Sonatrach announced an agreement to expand the Medgaz pipeline by 2 billion m3/y from 4Q21, expanding the pipeline’s capacity to 10 billion m3/y.

According to Sonatrach, the expansion was expected to be completed by the end of November, but no update has been given since then.

Longer-term plans for pipeline gas supply to Europe from Nigeria via Algeria have in the meantime reached an advanced stage, according to the Algerian Minister of Energy.

But major security concerns linked to some of the territory the pipe would pass through persist.

Algerian LNG exports

Algerian LNG exports have remained relatively strong in 2021. Exports were expected to surpass the 1 million t mark in December 2021. This would bring total LNG exports to almost 12 million t in 2021, close to a 14% gain y/y.

Total African LNG exports

Total African LNG exports are expected to reach approximately 40 million t in 2021, according to ICIS LNG Analytics. African export capacity is expected to continue to grow into 2022, increasing its supply of LNG to the world.

Global LNG imports for 2022 are expected to reach 385 million t, with over 46 million t expected to come from Africa, almost a 16% gain y/y.