NORTH AMERICA

03 Comment

05 A young but vibrant industry

Fred H. Hutchinson, President and CEO of The USLNG Association, looks to the future as the US LNG industry turns eight.

11 LNG

bunkering in North America: A success story

LNG has been the dominant alternative marine fuel in the US for over a decade, but new long-term options are emerging writes Rostom Merzouki, Director – Global Gas Development, ABS Qatar.

14 LNG decarbonisation strategies for a cleaner future

Dr Öznur Arslan, Dr Justin Bukowski, Richard Fong, Dr Christine Kretz, and Dejan Veskovic, Air Products, identify strategies for decarbonising the LNG value chain.

21 Elevate ethane trade to another level

Thibaut Raeis, GTT, explores how ethane carriers can be designed to accommodate LNG in the future.

27 Making more out of less

Justin Ellrich, LNG/Liquefaction Solutions Process Manager, and Micky Clifford, AVP – Process Solutions Leader, Black & Veatch, USA, assess how advances in scaling up proven technologies can help meet the growing demand for LNG

30 Taking modularisation to new levels in LNG

Dominique Gadelle, Vice President of Early Engagement at Technip Energies, discusses the rise in popularity of modular LNG.

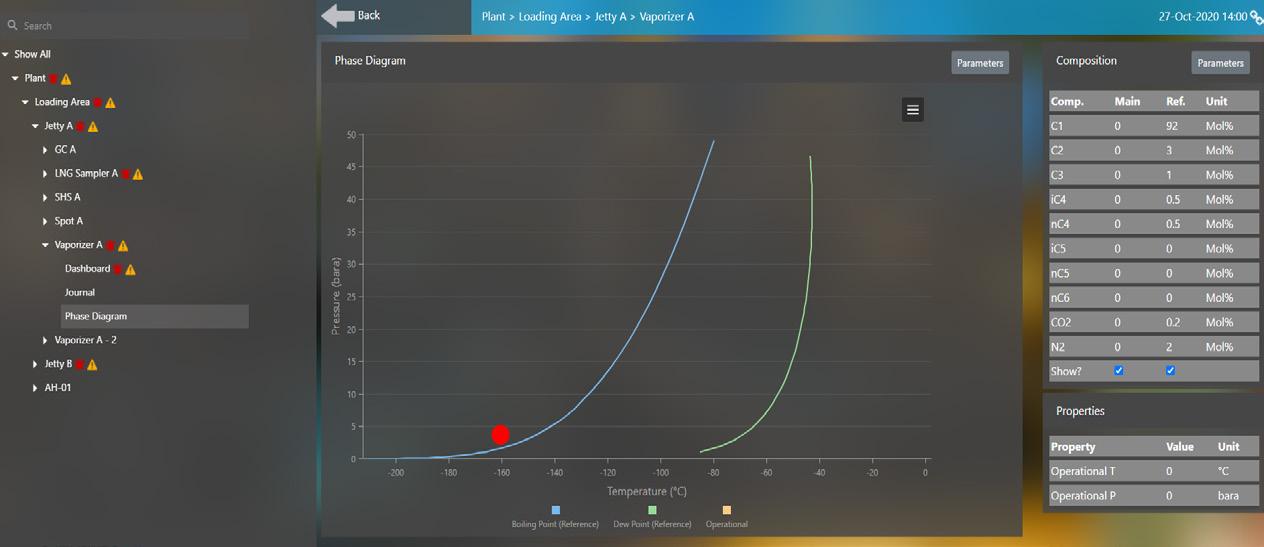

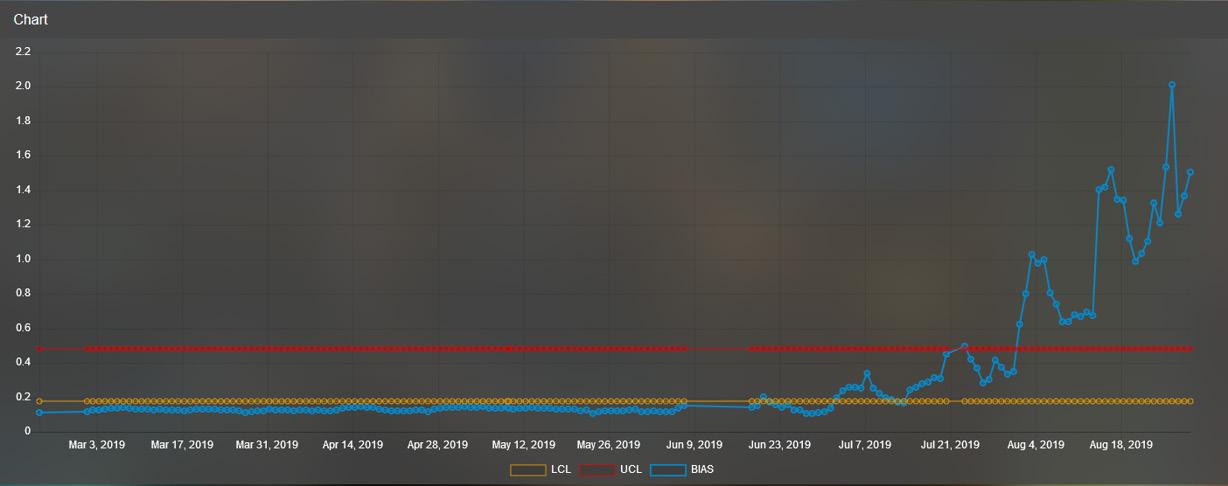

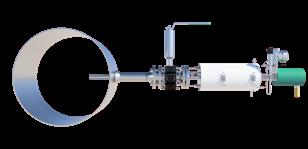

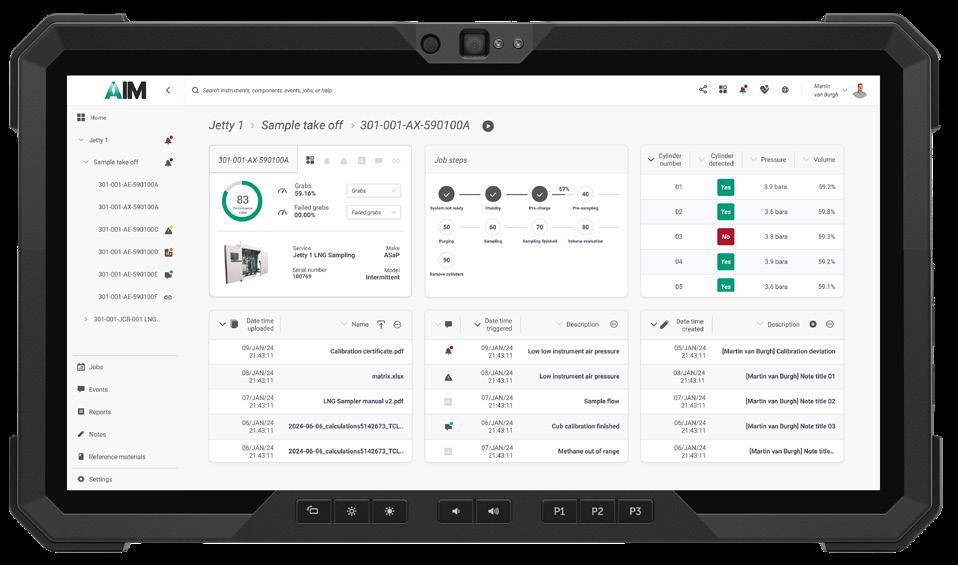

35 The analyser technician of the future

Hans-Peter Visser and Martin van Burgh, Analytical Solutions and Products B.V., consider the idea of one virtual AI analyser maintenance and reliability engineer for the whole LNG plant.

39 Global energy security towards a closer future

Mexico Pacific provides an insight into the role the company's Saguaro Energía LNG Facility will play in the future of global energy security.

43 Major projects without major impacts

Christine Kennedy, President of Woodfibre LNG, explains how the Woodfibre LNG project is building with impact mitigation at the forefront.

48 From LNG import to export

Lake Charles LNG details how the project is preparing for the energy transition as a global supplier.

TM – Chart combines its core cryogenic and compression products and process technologies to create engineered solutions that facilitate decarbonisation and improve efficiency across multiple industry sectors within energy, industry, water treatment, and food and beverage. Chart was one of the pioneers of small and mid scale LNG that provides complete end-to-end solutions, bringing increased energy security and independence through natural gas and is at the forefront of the energy transition to hydrogen. To learn more, visit www.chartindustries.com

JESSICA CASEY EDITOR

COMMENT

Welcome back to the second edition of LNG Industry’s North America supplement.

It has certainly been a busy year for the region’s LNG industry, with US President, Joe Biden, putting a temporary pause on the approval of permits to non-FTA countries to new US LNG export projects. You can read more on the potential impacts of this ‘pause’ on the US’ LNG industry in The USLNG Association’s keynote report (p.9).

Nevertheless, the US has still got plenty of projects that have been approved and operating or are being constructed to help maintain the US’ status as the top exporter. One of these projects is Lake Charles LNG, and their article on p.48 discusses how the project is preparing for the energy transition as a global supplier.

Canada’s LNG export projects are also moving along nicely, with Woodfibre LNG having recently received a compliance order from the BC Environmental Assessment Office to deploy the floatel to site and use the vessel for non-local workforce accommodation in accordance with the amended Environmental Assessment Certificate.1 You can read more on the Woodfibre LNG project in their article, starting on p.45.

Moreover, Black & Veatch has received full notice to proceed from Cedar LNG LP to construct the project’s floating liquefaction facility, with Black & Veatch responsible for complete topside design and equipment supply, while Samsung Heavy Industries will be providing the hull with the containment system and fabrication and integration of all topside modules.2

In addition, since the last North America supplement, ECOnnect has also delivered two jettyless transfer units to New Fortress Energy’s Fast LNG project in Mexico, and has received first gas.3 You can also read about Mexico Pacific’s Saguaro Energía project in their article, starting on p.41.

Another segment of the industry that has progressed is the use of LNG as a marine fuel – particularly bunkering.

Managing Editor James Little james.little@palladianpublications.com

Senior Editor Elizabeth Corner elizabeth.corner@palladianpublications.com

Editor Jessica Casey jessica.casey@palladianpublications.com

Editorial Assistant

Théodore Reed-Martin theodore.reedmartin@palladianpublications.com

Sales Director Rod Hardy rod.hardy@palladianpublications.com

Editorial/Advertisement

In April 2024, JAX LNG and Seaside LNG conducted the inaugural LNG bunkering in the Port of Savannah of CMA CGM SYMI during the ship’s call at the Garden City Terminal. The ship received approximately 4600 m3 of LNG from North America’s largest LNG articulated tug and barge, the Clean Canaveral, during simultaneous operations.4 Galveston LNG Bunker Port has also joined the SEA-LNG coalition, and will develop, construct, and operate the US Gulf Coast’s first dedicated facility supporting the fuelling of LNG-powered vessels, expected to be operational late-2026.5 For more insight into North America’s history with and future role in LNG bunkering, turn to p.13 to read ABS’ keynote report on this topic.

I hope you enjoy this second edition of this special issue of LNG Industry, – make sure to grab a copy of the issue at Gastech in Houston, Texas, in September 2024. We’ll see you there!

References

1. ‘Woodfibre LNG receives BCEAO order to move floatel to site to house non-local workforce’, Woodfibre LNG, (17 June 2024), https://woodfibrelng.ca/news/2024/06/17/woodfibre-lng-receivesbceao-order-to-move-floatel-to-site-to-house-non-localworkforce/

2. ‘Black & Veatch Receives Full Notice to Proceed for Canada’s First FLNG Project’, Business Wire, (11 April 2024), www.businesswire. com/news/home/20240411379492/en

3. ‘ECOnnect advances global LNG access with jettyless IQuay units for NGE’s Fast LNG projects’, ECOnnect Energy, (19 January 2024), www.econnectenergy.com/articles/econnect-advances-global-lngaccess-with-jettyless-iquay-units-for-nfes-fast-lng-projects

4. ‘SEA-LNG members conduct first USA SIMPOS LNG bunkering of 15K TEU vessel’, SEA-LNG, (22 May 2024), https://sea-lng. org/2024/05/sea-lng-members-conduct-first-usa-simopsbunkering-of-15k-teu-vessel/

5. ‘Galveston LNG Bunker Port joins SEA-LNG coalition’, SEA-LNG, (21 February 2024), https://sea-lng.org/2024/02/galveston-lngbunker-port-joins-sea-lng-coalition/

Sales Manager Will Powell will.powell@palladianpublications.com

Production Designer Kate Wilkerson kate.wilkerson@palladianpublications.com

Head of Events Louise Cameron louise.cameron@palladianpublications.com

Digital Events Coordinator Merili Jurivete merili.jurivete@palladianpublications.com

Digital Content Assistant Kristian Ilasko kristian.ilasko@palladianpublications.com

Digital Administrator Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

Administration Manager Laura White laura.white@palladianpublications.com

Subscribe online at: www.lngindustry.com/subscribe

Fred H. Hutchison,

President and CEO of

The USLNG Association, looks to the future as the US LNG industry turns eight.

On 24 February 2016, the LNG tanker Asia Vision left Cheniere’s export terminal on the Sabine-Neches Waterway – which runs along the border between Texas and Louisiana – and delivered its cargo of 3 billion ft3 of natural gas to Brazil a few days later. Since then, the US LNG export industry has grown at an exhilarating average annual rate of 11 million tpy of installed baseload capacity, propelling the US to the top of the global LNG leader board.

The foundations

To understand what will be needed to ensure that the US retains its LNG leadership position in the decades to come, it is useful to examine the seven main ‘pilings’ upon which this young but vibrant industry has been built.

Abundant supply

The US is blessed with tremendous oil and gas resources and an exploration and production industry that continues to innovate, and thus produce more and more dry gas and associated gas (a byproduct of oil extraction). While some gas is still imported by pipeline from Canada (and some is exported to Mexico), US gas production continues to exceed domestic demand, leaving plenty of headroom for LNG exports without harming US residential or industrial consumers.

The Potential Gas Committee estimated that future US gas resources and reserves total nearly 4 trillion ft3, which is more than 100 years of consumption at present domestic and export levels (Figure 1).

Regulatory predictability

Unlike other fuels, US government licenses are required to build natural gas infrastructure (both interstate pipelines and liquefaction terminals) and to export natural gas. Under the Natural Gas Act as amended, a prospective exporter must obtain a siting and construction permit from the Federal Energy Regulatory Commission (FERC) and a second permit from the U.S. Department of Energy (DOE) to export the gas itself. This two-step regulatory process is extremely time consuming and costly, but – until very recently – has been stable and predictable.

Affordability

Unlike LNG sold from other nations, the long-term contracts which underpin US exports contain modest take-or-pay requirements. Contractual liquefaction fees provide a sufficient cash flow for debt service, but most US contracts do not require offtakers to pay for either gas or shipping unless they ‘lift the cargo’. This means that in severe

market downturns (such as those that occurred during the pandemic), US LNG shipments can be cancelled at far lower cost than LNG from nations such as Qatar, which have much greater take-or-pay requirements. In addition, US LNG is generally sold at the Henry Hub price marker, which is often less than oil-linked prices from other suppliers.

Destination flexibility

Another innovation in US LNG export contracts is the flexibility for the offtaker to direct a cargo to a destination of their choosing. This is possible because most US LNG is sold on a free-on-board (FOB) basis with only small volumes sold on a delivered ex-ship (DES) basis, which stipulates a certain port for delivery. It is this ‘destination flexibility’ that allowed US LNG cargoes to be diverted to Europe in 2021 and 2022 as Russia moved against Ukraine.

Low emissions

In recent years, the climate imperative has grown and global attention has focused on the reduction of methane leaks and flaring within the oil and gas industry. Gas companies in the US are reducing their carbon footprint in numerous ways, including the replacement of leaky equipment, enhanced monitoring, and third-party certification and audits. A recent, full lifecycle analysis conducted by the Berkeley Research Group (BRG) for LNG Allies confirmed that US LNG has less than half the emissions intensity of coal in European and Asian markets and far fewer emissions than pipeline gas from nations such as Russia.

Pipeline infrastructure

Distribution of US LNG 2021-2023

Figure 2. Regional distribution of US LNG shipments, demonstrating the value of ‘destination flexibility.’

Many of the natural gas pipelines built in the US prior to the shale energy revolution (which began in earnest in 2006) were constructed to move natural gas north from production zones in Texas and Louisiana and offshore in the Gulf of Mexico. With the ramp-up of US LNG exports, many of these pipelines have reversed flow and now deliver gas south from the Marcellus/Utica and Haynesville basins to LNG terminals in Louisiana, Texas, Maryland, and Georgia. Like LNG export projects, interstate natural gas pipelines require FERC permits. These interstate pipeline applications have become highly contested and construction timelines and costs have expanded. Pipelines that do not cross state boundaries are not subject to FERC jurisdiction and are, therefore, often less controversial.

Bipartisan political support

Under the Natural Gas Act, the Secretary of Energy must approve US LNG export requests unless to do so would be “inconsistent with the public interest.” Although the presumption favours export license approvals, applications have become increasingly controversial as environmental organisations have zeroed-in on DOE’s public interest process in an effort to indirectly limit US gas production. These e-NGOs had little success during the Obama and Trump administrations but their cries to ‘keep it in the ground’ have resonated with certain Biden administration officials, especially those on the White House climate team.

Having examined the seven items that have underpinned the rapid growth of the US LNG industry over the past eight years, a look through a ‘virtual spyglass’ may U.S. Natural Gas Imports/Exports by Source

Accelerating Modular LNG Solutions

Invisible. Invaluable.

Sometimes the things you can’t see make all the difference. Our integrated team of consultants, engineers, technicians, and construction professionals leverage our extensive history and expertise in mid-scale LNG technology and pioneering work in FLNG EPC to seamlessly bring our modular designs to life. Our modular LNG solutions enable fast-to-market results, so you can arrive at your destination on your terms, regardless of the technology, processes, or path.

The invaluable difference:

• Minimize interfaces and reduce prolonged onsite installation time and manpower

• Flexibility in compressor driver selection, cooling medium, and capacity from 1–2 MTPA per train

• Utilize the same modular philosophy for gas treating, heavies removal, product and boil-off handling

• Complete modular solutions for onshore and offshore applications between the pipeline and storage tank

provide a glimpse of the issues that are steaming along, just over the horizon.

Resource availability

On 26 January 2024, the Biden administration instituted a ‘pause’ on issuing new US LNG export authorisations until DOE updates certain economic and climate studies. One of the updates now underway looks at how future levels of US LNG exports might affect domestic prices. Numerous economic studies – from both public and private sponsors – have found that US LNG exports have little (if any) economic impact on American consumers. The findings in these forward-looking studies were confirmed by backward-looking studies commissioned by the American Petroleum Institute and LNG Allies, which found that since 2016, US LNG exports have not had any “significant and sustained impact” on domestic prices.

Despite the findings in these studies, US LNG export opponents mistakenly conclude that future US natural gas supply growth may not keep pace with demand, especially if significant electric power increases materialise as artificial intelligence, data centres, and electric vehicles take hold. Gas demand and supply is a delicate dance that is only ever off balance for brief periods. The US gas industry can and does

U.S. Natural Gas Imports/Exports by Source

respond expeditiously to market signals, a post-pandemic development encouraged and endorsed by investors and other stakeholders.

Politics, regulatory stability, and infrastructure

An epic struggle is occurring in the US (and within other OECD countries) among factions with differing – and sometimes misinformed – views of global energy realities. This struggle takes many forms, including polarised political discourse which is becoming more combative as protests to ‘end fossil fuels’ escalate and activists lose sight of the central goals of decarbonisation, which are to reduce emissions and diversify resources.

But the skirmish over natural gas and LNG is only one misplaced battle in a much larger conflict.

The US has been deeply divided between the two political parties – the Democrats and the Republicans – for at least 45 years. This deep divide manifests itself in perpetually close elections and nonstop political posturing. This is true every year, but is particularly pronounced in a quadrennial election year (such as 2024) when control of the White House, Senate, and House of Representatives are all ‘in play’. To put it mildly, the political climate could not be hotter right now.

All this leads directly to ‘the LNG pause’.

While the Biden administration defends its move to pause US LNG export licenses “so that the studies can be updated,” the decision was made not by the political officials at DOE most directly responsible for such authorisations but by the White House climate staff. The political nature of the pause is evident to even the most casual observer and it will undoubtedly continue until after all the 2024 electoral out-comes have been determined.

Thus, the question asked by everyone who has ‘a dog in this fight’ is: What will happen in 2025?

Both former President, Donald Trump, and President, Joe Biden, have each served one four-year term and are, therefore, barred by the US Constitution from serving more than one more term. With no prospect of re-election in 2028, both Biden and Trump and their political appointees would likely expand and accelerate their party’s agenda. Of course, the US Constitutional system of ‘checks and balances’ means that while the President may control the executive branch, their power can be ‘checked’ by either Congress or the courts.

It is clear from their first terms that Biden and Trump have radically different approaches to energy, climate, and environmental policies. Perhaps most relevant to this article, the Trump administration’s Energy Department issued US LNG export licenses within an average of 49 days after FERC had approved the underlying project. Even before the White House announced the US LNG pause in January, the Biden administration had instituted a de facto pause; DOE has not approved a single US LNG application since March 2023.

According to press reports, several oil, gas, and LNG CEOs met with President Trump at his Mar-a-Lago Club in Florida in April 2024. He reportedly told the assembled group that he would reverse Biden’s LNG pause ‘on day one’ (meaning 20 January 2025) if he is re-elected. The outcome if President Biden is re-elected is more difficult to predict. Some within the Biden administration understand the

Figure 3.US LNG export levels approved during the Obama, Trump, and Biden administrations. U.S. Natural Gas Imports/Exports by Source

Figure 4. Comparison of time delays between FERC order and DOE export license approval illustrates the lengthy time it has taken the Biden administration to act.

energy security value of US LNG exports but these officials are pitted against others who feel that American leadership in the energy transition is of overriding importance.

Conclusion

Regardless of the outcome of the presidential election, the US LNG industry will continue to build a bipartisan coalition to expand LNG exports, which provide tremendous economic rewards to the US and measurable climate, environmental, economic, and security benefits to America’s global allies.

For the most part, the ‘pilings upon which the US LNG industry has been built remain sound. America has ample gas resources to meet future domestic demand and export requirements. US LNG contracts have modest take-or-pay requirements and flexible destination clauses.

US gas production, transport, and liquefaction processes have fewer carbon dioxide and methane emissions than coal and gas produced in many other countries. And US gas pipelines and LNG export facilities continue to receive FERC authorisations, although not always at an optimum pace.

Finally, federal elections will be held on 5 November 2024, and within a few weeks (at most) it will be revealed which party controls the Senate, House of Representatives, and White House. Hopefully, with the 2024 elections in the rear-view mirror, bipartisan support for US LNG exports will return and the LNG ‘pause’ quickly lifted. After all, there is a growing awareness both in the US and overseas that, in the words of Maroš Šefčovič, the European Commission’s Executive Vice President, ‘America is now the guarantor of global energy security’.

Figure 5. US LNG export projects operating, under construction, or in review.

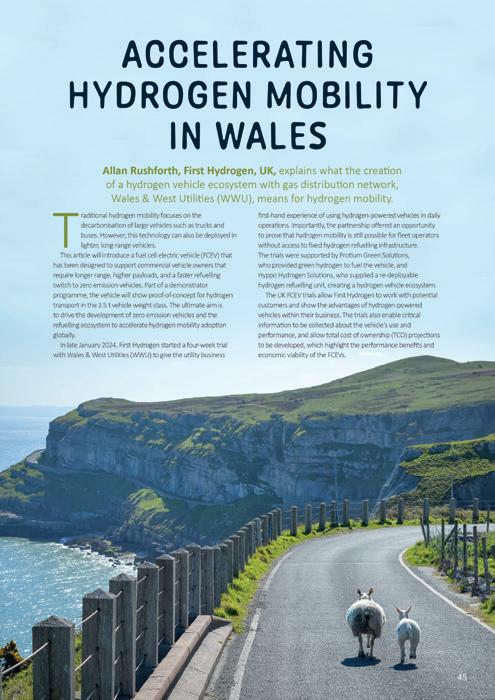

LNG bunkering in North America: A success story

LNG bunkering in North America: A success story

Rostom Merzouki, Director –Global Gas Development, ABS Qatar.

Over the last decade, LNG as a marine fuel has gained significant traction in North America as a cleaner alternative to conventional marine fuels like heavy fuel oil. This development is driven by stringent environmental regulations, the availability of gas, and its cost effectiveness supporting the maritime industry’s shift towards sustainability.

Infrastructure development

As demand has grown, LNG bunkering infrastructure has expanded significantly in key North American ports. Substantial investments have been made in the Port of Los Angeles/Long Beach to establish LNG bunkering facilities to cater to the growing demand for LNG-powered vessels in the region. For example, the port’s LNG bunkering terminal, operated by a joint venture between Pivotal LNG and Southern California Gas Company, boasts a capacity of up to 540 000 gal. of LNG storage and can accommodate both ship-to-ship and truck-to-ship bunkering operations. Additionally, the port has implemented shore-to-ship power capabilities to further reduce emissions during vessel berthing.

The Port of Vancouver’s commitment to reduce greenhouse gas emissions has spurred the development of LNG bunkering infrastructure to support the transition to cleaner maritime fuels. As an example, the Tilbury LNG facility, operated by FortisBC, serves as a key LNG bunkering hub in the region, offering truck-to-ship bunkering services with a capacity of approximately 100 000 gal./d of LNG.

The facility also provides storage capacity for over 3.5 million gal. of LNG, ensuring reliable fuel supply for vessels operating along the West Coast. In addition to bunkering infrastructure, small scale LNG facilities, such as the Woodfibre LNG project, contribute to the region’s LNG supply chain by providing liquefaction and export capabilities for LNG distribution to domestic and international markets.

The Port of Jacksonville (JAXPORT) has been a pioneer in LNG bunkering in North America. JAXPORT established LNG bunkering facilities and partnered with TOTE Maritime, which operates LNG-powered vessels between Florida and Puerto Rico. LNG bunkering terminals, truck-to-ship bunkering facilities, and vessel-to-vessel bunkering capabilities have been LNG has been the dominant alternative marine fuel in the US for over a decade, but new long-term options are emerging writes

established to accommodate various bunkering scenarios and vessel types, with capacities tailored to meet the specific needs of port operators, shipping companies, LNG suppliers, and downstream consumers. These integrated infrastructure networks support the growth of LNG as a cleaner and more sustainable marine fuel solution, enhancing the competitiveness and resilience of North America’s maritime industry in the global market.

This development has been the result of extensive industry collaboration. Public-private partnerships have played a pivotal role in driving the development of LNG bunkering infrastructure in North America. The collaboration between government agencies, port authorities, LNG suppliers, shipping companies, and technology providers has facilitated the planning, funding, and implementation of infrastructure projects.

The collaboration between Seapath, Pilot LNG, and the Port of Houston to develop North America’s largest LNG

bunkering facility is a good example of this collaboration. Industry stakeholders have worked together to address challenges such as investment barriers, regulatory compliance, and infrastructure interoperability.

Growth drivers

LNG as a marine fuel has proven particularly popular in the US because of the extension of the International Maritime Organization’s Emission Control Area (ECA) regulation to the coastline of North America. For vessels trading in the ECA and to and from local international ports, LNG as fuel simplifies compliance and operational logistics.

In addition to regulatory drivers, the particular shipping trades and the availability of LNG have driven expansion of bunkering of LNG as a marine fuel in North America. Indeed, for vessels operating on long haul and liner/fixed schedule routes, LNG is the most cost effective and available transitional fuel with reliable technology to meet future reductions in maritime greenhouse gas emissions.

From an economic perspective, historically, LNG prices have been volatile, influenced by factors such as global oil prices, geopolitical events, and changes in supply and demand dynamics. Over the last decade, there have been periods when LNG was significantly cheaper than heavy fuel oil (HFO) and marine gasoil (MGO), making it an attractive option for ship operators.

In regions like the US Gulf Coast, where there is abundant natural gas supply due to shale gas production, LNG has been consistently competitive. This geographical advantage has fostered local development of LNG bunkering facilities and adoption by maritime operators. According to the U.S. Energy Information Administration (EIA), the Henry Hub spot price, a benchmark for US natural gas, ranged from about US$2 – US$4/million Btu for most of the past decade, peaking at higher levels during cold winters or during supply disruptions.

Future projections

To make a meaningful prediction on the future of LNG as a marine fuel, the development of emerging alternative fuels to meet the market segments where LNG has a strong position needs to be assessed. As the maritime industry continues to evolve towards more sustainable practices, several alternative fuels are emerging that could compete with LNG. These include blue and green methanol and ammonia, each with unique attributes and challenges.

Blue methanol is produced from natural gas with carbon capture and storage (CCS), whereas green methanol is derived from renewable sources using carbon captured from the air. Green methanol produces significantly lower lifecycle greenhouse gas emissions compared to blue methanol and LNG, as it utilises renewable energy sources.

Methanol is already used as a marine fuel in smaller volumes. Its liquid state at ambient conditions makes it easier to handle than LNG, which requires cryogenic temperatures. However, infrastructure for large scale production and distribution, particularly for green methanol, is still in development.

Ammonia is typically produced through the Haber-Bosch process from hydrogen (which can be produced from natural gas or via electrolysis of water using renewable energy)

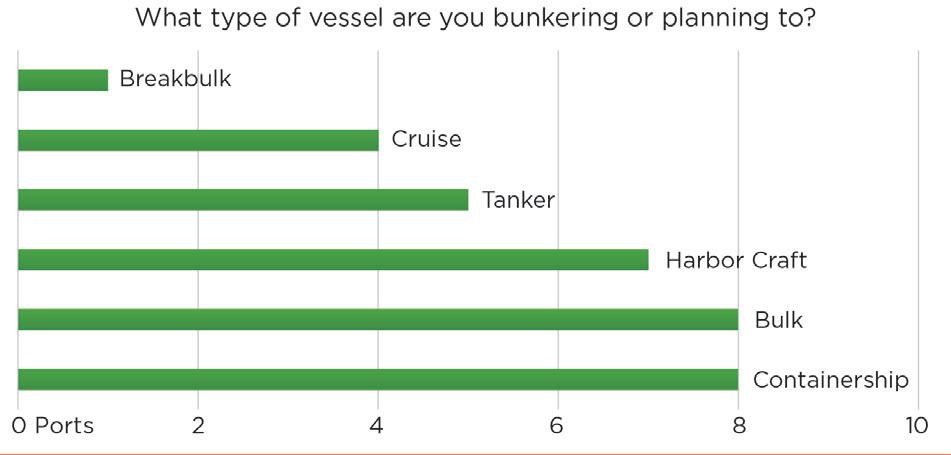

Figure 1. Data from the joint publication between ABS and the American Association of Port Authorities (AAPA), Port Decarbonization Survey: Trends and Lessons Learned.

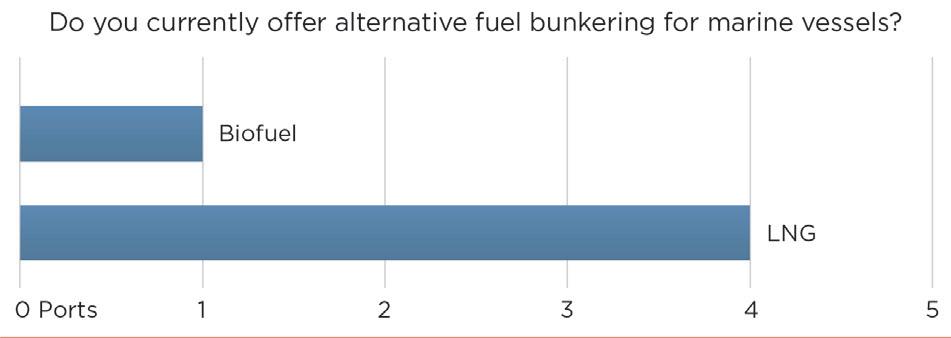

Figure 2. Data from the joint publication between ABS and AAPA, Port Decarbonization Survey: Trends and Lessons Learned

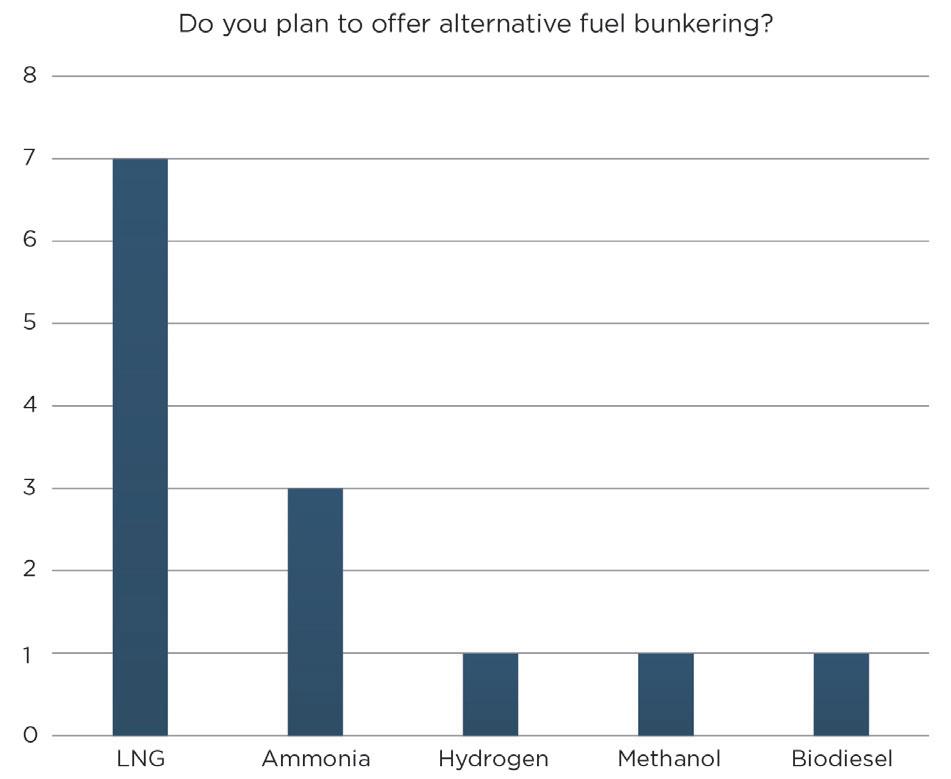

Figure 3. Data from the joint publication between ABS and AAPA, Port Decarbonization Survey: Trends and Lessons Learned

and nitrogen from the air. Green ammonia can be produced from renewable energy, results in a ‘zero carbon emissions’ fuel.

However, safety concerns due to its toxicity and corrosiveness still need to be addressed. Ammonia has a lower energy density than LNG and methanol, making it a challenging fuel for long-distance shipping. The development of engines and bunkering infrastructure for ammonia is actively progressing.

The cost of both green methanol and ammonia is currently higher than for LNG and blue methanol, primarily due to the high costs associated with renewable energy production and electrolysis. However, these costs are expected to decrease as technologies mature and scale up.

It should be noted that LNG technology is the most mature among the alternative fuels discussed. Methanol and ammonia-powered ships and the required fuelling infrastructure are still under development, but installations are increasing for methanol while pilot projects and research are increasing for ammonia.

A threat to the Jones Act?

The U.S. Jones Act mandates that all goods transported by water between US ports be carried on ships that are US-built, US-owned, and crewed by US citizens. This has meant that all bunkering vessels previously operating in the US have been constructed there, in accordance with the Jones Act.

A ruling made by U.S. Customs and Border Protection in January 2024 introduced an exception that allows foreign-built or foreign-flagged LNG bunkering vessels to operate within US waters, potentially impacting the number and types of vessels

in the local market. This exception could have a significant impact on the bunkering market in the US.

Future outlook

The US was arguably the first major market in which LNG took root and flourished as an alternative fuel, with commitment shown by operators to building the necessary infrastructure and procuring the required product. The success of this strategy can be seen in the growth of facilities around the country and the diverse markets they serve.

Significant investment is required in both renewable energy sources and carbon capture technologies for the viability of green methanol and ammonia as maritime fuels. The industry is likely to witness an increase in projects bringing these fuels into the energy mix.

Partnerships across sectors, including energy producers, maritime operators, and technology developers, will be key. Governmental policies supporting research and subsidising the development of green fuel infrastructure will play a critical role in determining which fuels become viable in the long run.

So, while LNG currently holds a prominent position in the maritime industry due to its relative maturity and availability, the future might see a shift towards more sustainable alternatives like green methanol and ammonia, especially as technologies mature and environmental regulations become stricter.

These fuels represent the next step in the maritime industry’s journey towards sustainability. But until the challenges of supply, price and technology are overcome, LNG as a marine fuel for large vessels with regular trading patterns will remain a popular choice for owners.

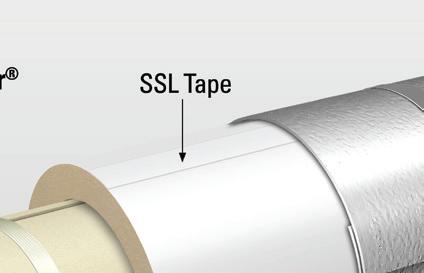

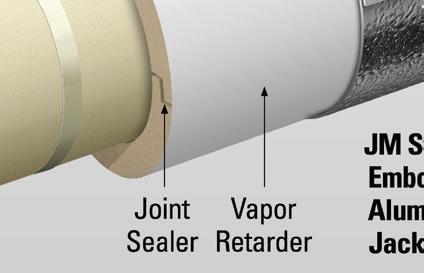

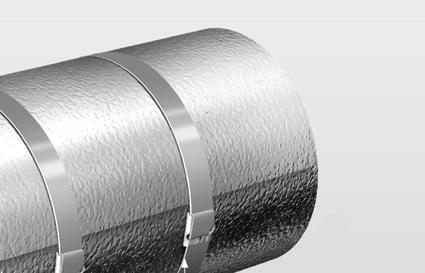

KEEP IT Explore Insulation for LNG Systems COOL!

A well-designed insulation system is critical to ensure safe and efficient operations in an Liquefied Natural Gas (LNG) facility. Johns Manville is here to assist you with all the details you need to properly design, specify and install your cryogenic and LNG application. Scan here for

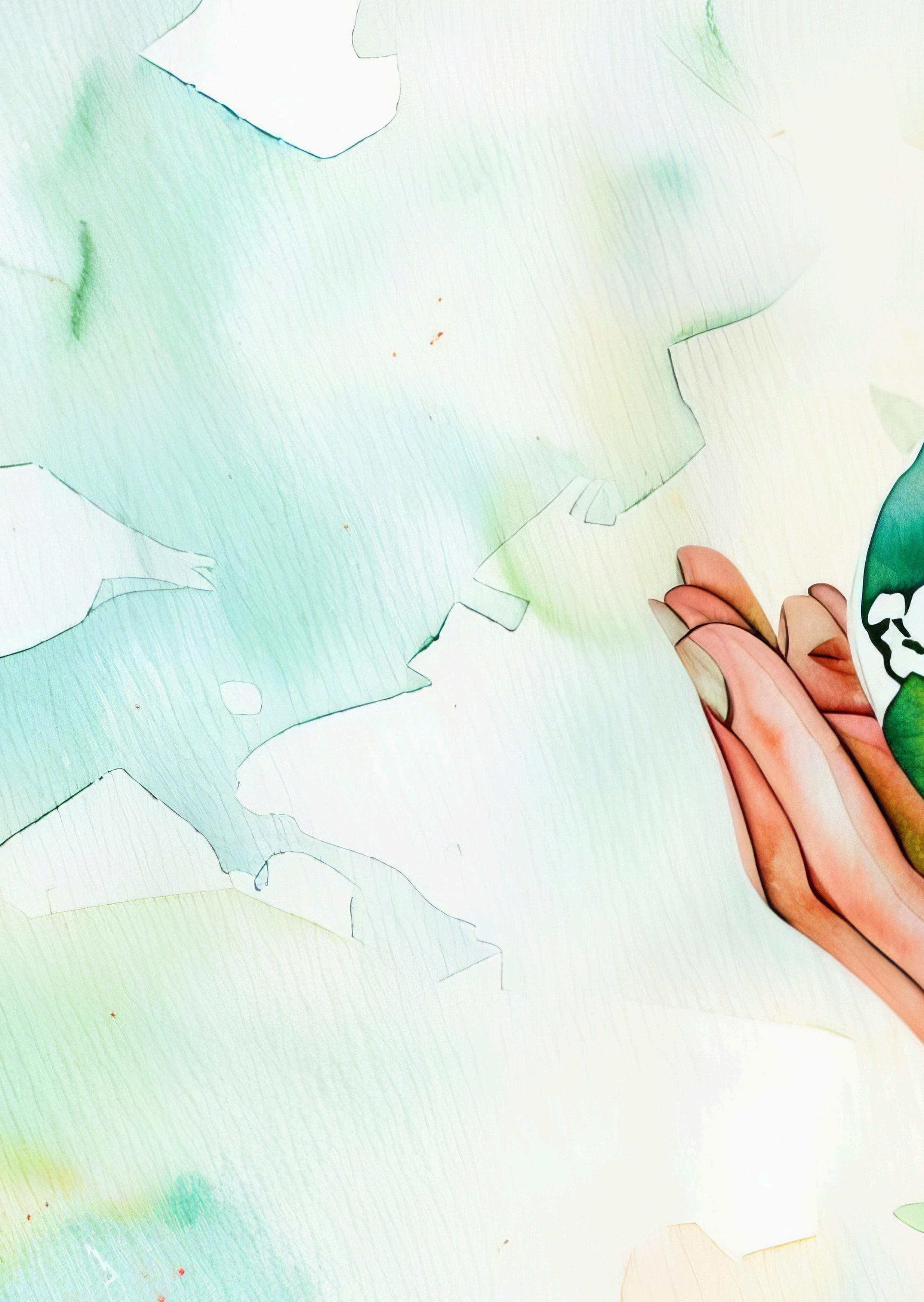

As the emphasis on decarbonisation and minimising greenhouse gas (GHG) emissions increases in many countries and markets, LNG is continuing to maintain and grow its share of the world’s changing energy portfolio due to its lower intrinsic carbon content than oil and coal. Green energy sources like wind, solar, hydro, and nuclear present an opportunity for the LNG industry to push decarbonisation further throughout the LNG value chain.

The LNG value chain consists of three main sections:

– exploration, production, and processing of natural gas.

2. Midstream – liquefaction and transport by LNG carriers and bunkering vessels.

3. Downstream – storage, regasification, distribution, and end use.

GHG emissions occur in all three sections of the value chain. Upstream emissions occur due to leakage, flaring, and the generation and utilisation

1. Upstream

Dr Öznur Arslan, Dr Justin Bukowski, Richard Fong, Dr Christine Kretz, and Dejan Veskovic, Air Products, identify strategies for decarbonising the LNG value chain.

of energy for pipeline compression. Midstream processes contribute to emissions from liquefaction processes and LNG transportation. The downstream section of the value chain is responsible for the most GHG emissions, as carbon dioxide (CO2) and other greenhouse gases are released when the LNG is regasified and combusted. To carry out decarbonisation of the LNG supply chain, a detailed understanding of the emissions produced by each stage is required to select the proper strategy. As a leading liquefaction technology licensor and equipment supplier, Air Products is developing solutions for decarbonisation of the liquefaction process.

Prior to liquefaction, natural gas requires pre-treatment to remove impurities such as mercury, CO2, sulfur compounds, water, and heavy hydrocarbons. The high-pressure natural gas is cooled by heat exchange with one or more refrigerants to approximately -150˚C before it is reduced in pressure to remove nitrogen and helium and generate methane flash gas for fuel. It is then stored at atmospheric pressure for shipment. During LNG production, greenhouse gas emissions are produced from the following sources:

z Venting of CO2 removed from the natural gas feedstock during pretreatment.

z Combustion of fuel to generate power to drive refrigerant compressors in the liquefaction process.

z Combustion of fuel to provide ancillary power and process heat for the facility.

z Flaring of natural gas during plant operation.

z Fugitive methane emissions.

Reducing the GHG emissions of LNG production requires consideration of these sources to reduce CO2 and hydrocarbon emissions to the atmosphere. While the ultimate goal of decarbonisation is to achieve zero carbon, there is value in partial decarbonisation. Some strategies are lower in installed cost and may provide positive financial returns to the liquefaction project, while others are higher cost and may not be adopted without financial incentives or regulation that bring the reduction of carbon emissions within the project scope.

Pretreatment decarbonisation

Natural gas may contain from 1 – 10% or more CO2, and this must be reduced to about 50 ppm prior to liquefaction

to prevent freeze-out of the CO2 and subsequent blockage of equipment in the cryogenic liquefaction process. For a natural gas feed with 6% CO2 in the natural gas, the CO2 content is about 0.14 t CO2e/t of LNG. CO2 is removed from the natural gas in an acid gas removal unit (AGRU) using an adsorbent or solvent and may be recovered for commercial use or vented to the atmosphere. Recovery of CO2 for commercial purposes such as the manufacture of urea fertilizer, production of dry ice, or carbonation of beverages results in only temporary prevention of carbon emissions. Capture of the CO2 followed by underground sequestration is being used to permanently reduce some of these emissions.1

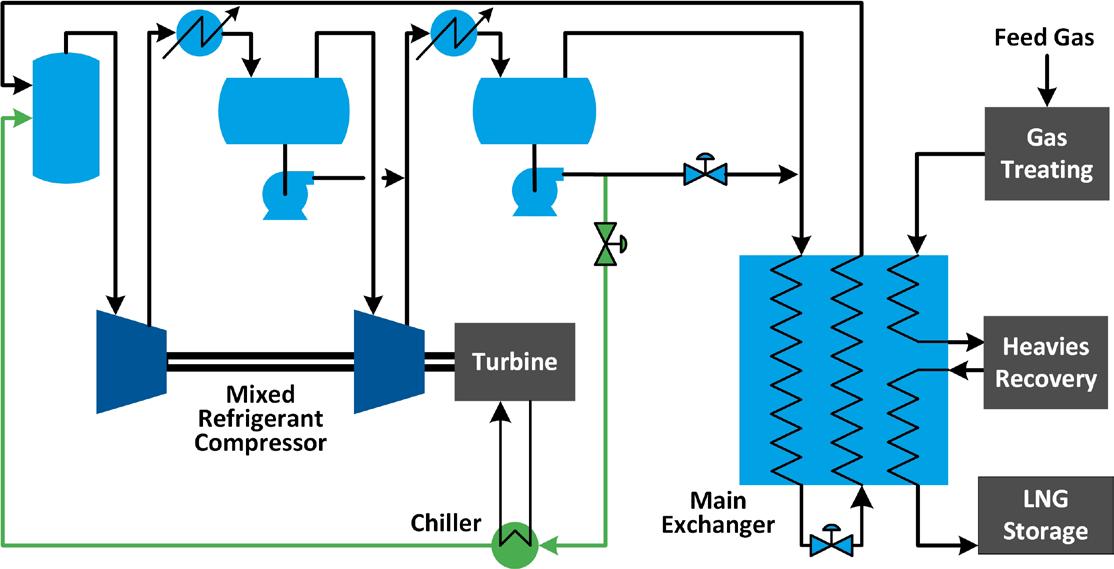

Energy efficient liquefaction technology

The clean natural gas from the pretreatment system is cooled in the liquefaction unit by heat exchange with a circulating refrigerant. A discussion of the many refrigeration process cycles that are available is beyond the scope of this article, and references are included below.2,3,4 The liquefaction phase incorporates refrigerant compressors which consume a large amount of power, on the order of 275 KWh – 375 kWh/t of LNG produced, depending on the process cycle selected and project details. The compressors are typically driven by gas turbines, with fuel supplied by the methane flash gas generated in the LNG pressure reduction step prior to storage. With simple cycle gas turbine drivers (about 35% thermal efficiency) the corresponding CO2 emissions are about 0.15 t – 0.21 t CO2e/t of LNG.

A straightforward way to reduce carbon emissions is to select a process cycle with high efficiency to reduce the power requirement and consequent fuel consumption. High process efficiency also provides a financial benefit: reduced auto-consumption of feedstock for fuel and/or reduced power import costs. Guidelines for choosing a higher efficiency process include consideration of:

z Vapour compression refrigeration cycles, such as mixed refrigerant processes and pure component cascade processes, use liquid refrigerants and generally have higher efficiency than gas expansion cycles with vapour refrigerants, due to more favourable thermodynamics and lower refrigerant circulation rates.

z Mixed refrigerant cycles such as single mixed refrigerant (SMR) can provide higher process efficiency than

Figure 1. The LNG value chain includes liquefaction of natural gas.

pure component cycles due to smaller temperature differences between refrigerant and natural gas.

z Processes with separate precooling and liquefaction refrigerants such as propane precooled mixed refrigerant (C3MR) and dual mixed refrigerant (DMR) generally have higher process efficiency than single refrigerant processes such as SMR due to additional flexibility in optimising the process to meet specific cooling requirements.

A C3MR or DMR process typically has a 5 – 15% efficiency advantage over SMR or pure component cascade, and therefore 5 – 15% lower emissions. A similar production benefit provides a significant financial advantage to the owner as well.

Low emission power source options and CO2 capture

Given a particular power requirement, the next step to reducing emissions is to generate that power at a lower carbon intensity. One method is to substitute combined cycle generation for the simple cycle generation that has been commonly used for LNG facilities. A single-shaft industrial gas turbine may have a thermal efficiency of 35%, and an aeroderivative gas turbine may increase that to 45%. By using waste heat recovery to generate steam for the direct or indirect drive of compression, the overall thermal efficiency may reach 55 – 60%, reducing fuel usage and the intensity of emissions by 20 – 40% compared to simple cycle drivers. It should be noted that combined cycle generation can be applied to any liquefaction technology. Therefore, carbon intensity can be minimised by combining the high efficiency liquefaction processes described earlier in the article with the high thermal efficiency of combined cycle generation. Matching gas or steam turbine power capacity to compressor power consumption can be achieved in various ways to optimise the plant layout and use of capital:

z Direct drive of all compression with gas turbines and steam turbines provides high overall plant efficiency by avoiding electricity generation and transmission losses, and low capital by eliminating electrical infrastructure.

z On-site combined cycle electric power plant to power motor drives for all compressors allows flexibility to independently size individual turbines and motors.5

z Direct drive of some compressors with gas turbines and electric generation with steam turbines to power motor drives for other compressors may offer a useful intermediate solution.

Further emissions reduction can be achieved by post-combustion carbon capture from the flue gas using an absorption system similar to that used for removing CO2 from the natural gas feed. The CO2 then can be sequestered along with the CO2 captured from the front-end pretreatment. While this can be performed for any gas turbine arrangement (simple or combined cycle, direct or indirect drive), there are several important considerations.

z Achieving high process and thermal efficiency will minimise the amount of flue gas to be processed, reducing CO2 capture CAPEX.

z Space limitations may make integration more difficult with gas turbines for direct drive compared to gas turbine electric generators.

z The low pressure of the flue gas presents difficulty for the absorption process and may require either back-pressuring the combustion process or using a blower to pressurise the flue gas, both of which are not optimal.

z There is limited data on large scale post combustion CO2 capture for flue gas derived from gas turbine exhaust.

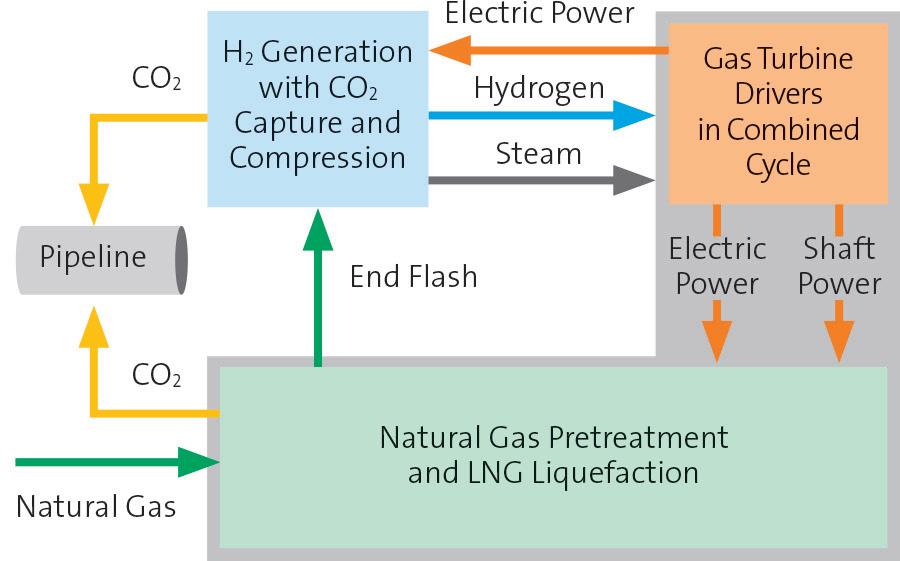

An alternative to post-combustion capture is pre-combustion capture, such as the blue LNG process shown in Figure 2. The methane fuel provided by the LNG unit end flash gas is converted to hydrogen and carbon dioxide using well-referenced technologies.6 The CO2 is then removed to create a carbon-free fuel for the gas turbines. Considerations for this process include:

z The hydrogen production equipment increases CAPEX.

z The gas turbines must be designed to operate with hydrogen fuel.

z The conversion of methane to hydrogen includes a thermal energy loss that must be supplied by additional methane fuel consumption. Somewhat counterintuitively, sourcing more methane fuel from the pressure reduction flash step in the liquefaction process provides an LNG production increase for the facility due to improved liquefaction process efficiency.7

z Capture of the CO2 is performed at high pressure, which reduces the size and cost of the capture equipment. The capture equipment can also be sited away from the gas turbines.

Figure 2. The blue LNG process uses pre-combustion carbon capture to lower emissions.

BY DESIGN ®

Chart cryogenic storage products are integral to the virtual pipeline facilitating increased energy independence and security through LNG and liquid hydrogen. By utilizing cryogenics to store gas in liquid form the tanks are much smaller than their gaseous equivalents. Cryogenic tanks are shop built and total storage capacity is modularized, reducing project cost, complexity, risk and timescale.

Zero-emission power source options and integrated nitrogen removal units technology

With carbon capture and sequestration, the strategies mentioned can be used to build a near zero-carbon emissions facility. Replacing the methane fuel used for power generation with electricity sources like solar, wind, hydro, and nuclear provides another path to zero-carbon emissions liquefaction.8 On-site renewable generation can be coupled with grid-connected renewables and nuclear to power the liquefaction process by electric drive, although this strategy has some caveats:

z Suppressing the generation of flash gas, no longer needed for fuel, during the pressure reduction between liquefaction and storage requires further cooling of the LNG and higher power consumption (lower process efficiency). Alternatively, the flash gas can be recompressed and recycled to the natural gas feed, potentially requiring additional power consumption.

z Removal of excess nitrogen from the LNG cannot be performed through the combustion of flash gas used as fuel since no fuel demand exists. For natural gas feeds with excess nitrogen, additional equipment for a nitrogen rejection unit (NRU) must be included in the plant scope. While beyond the scope of this article, there are many references for this technology.7,9 Integration of the NRU with the refrigeration system and main cryogenic heat exchanger (MCHE) can provide benefits of reduced equipment count and better efficiency.10

Design for low carbon operation

Operational sources of emissions include flaring of feed gas and hydrocarbon refrigerant as well as fugitive emissions. Flaring of natural gas and hydrocarbon refrigerants may occur during process upsets, start-up, shutdown, and other operations, and is highly dependent on process selection, plant design, and quality of operation. Leakage from flanges, valve packing, and other sources can also occur during operation. One study of three liquefaction facilities indicated a leakage rate of 0.07% of methane processed.11 Strategies for low and zero-emission designs include:

z To reduce flaring during equipment cooldown and start-up, use best practice cooldown methods such as AP-AutoCoolTM to minimise natural gas flows, and recycle natural gas to the plant front-end instead of flaring off-spec (warm) LNG.12

z Design with parallel refrigerant compression to keep cryogenic equipment cold in the event of machinery trips.

z Include lines for refrigerant recovery and holding vessels to minimise flaring during process upsets or while shut down.

z Use variable-frequency drive (VFD) electric motors or multi-shaft gas turbines to minimise refrigerant flaring on restarts.

z Minimise leakage from flanges and valves through both monitoring and equipment design, specifically the use

of coil wound heat exchangers for liquefaction which incorporate aluminium/stainless steel transition joints to eliminate flanges and provide dual containment of high-pressure process streams to minimise potential leakage to the environment.

Conclusion

The design of liquefaction facilities for low or zero-carbon emissions is within the capabilities of today’s technology. Air Products is well positioned to develop these solutions. Recent LNG plants leveraging Air Products LNG technology have adopted some of these strategies to reduce emissions while also providing financial benefits to operations by minimising loss of costly refrigerant and feed gas.13 Adopting more of these techniques will enable the process of turning natural gas into LNG to achieve low or zero-carbon emissions while maintaining LNG as the preferred fuel for the energy transition and into a greener future.

References

1. ‘Safe start up and operation of the carbon dioxide injection system at the Gorgon natural gas facility’, Chevron Australia, (8 August 2019), https://australia. chevron.com/news/2019/carbon-dioxide-injection

2. KRISHNAMURTHY, G., ROBERTS, M.J., and OTT, C.M., ‘Precooling strategies for efficient natural gas liquefaction’, Gas Processing & LNG, (September 2017), pp.19 – 29.

3. ROBERTS, M., WEIST, A., KENNINGTON, W., ‘Two Is Better Than One? Not Always’, LNG Industry, (October 2020), pp.21 – 24.

4. CACCIAPALLE, M., ROBERTS, M., OTT, C., and FEI CHEN, F., ‘Leave Refrigerants out in the Cold’, LNG Industry, (October 2021), pp.28 – 31.

5. OTT C., SCOTT, K., ELKO C., and KRETZ C., ‘Turning LNG Greener: LNG Liquefaction using Electric Drive [Conference session]’, Gastech 2022, (September 2022), Milano, Italy.

6. VESKOVIC, D., BEARD, J., ROBERTS, M., GRAHAM, D., and PALAMARA, J., ‘Blue LNG: Decarbonized LNG Production via Integrated Hydrogen Fueled Power Generation [Conference session]’, Gastech 2021, (September 2021), Dubai, UAE.

7. SAUNDERSON, R. P., ‘End-flash is Totally Cool’, Hydrocarbon Engineering, (May 2021), pp.31 – 34.

8. ‘Oman: TotalEnergies launches the Marsa LNG project and deploys its multi-energy strategy in the Sultanate of Oman’, TotalEnergies, (24 April 2024), https:// totalenergies.com/ system/files/documents/2024-04/PR_Oman_TotalEnergies_ launches_Marsa_LNG_project_pdf.pdf

9. OTT, C.M., ROBERTS, M.J., TRAUTMANN, S.R., and KRISHNAMURTHY, G., ‘State-of-the-Art Nitrogen Removal Methods from Air Products for Liquefaction Plants’, LNG Journal, (October 2015), pp.6 – 10.

10. OTT, C., BUKOWSKI, J., SHNITSER, R., and DUNN, J., ‘Dealing with Rejection: Selecting the Best Nitrogen Removal for Your LNG Plant’, LNG Industry, (January 2022), pp.15 – 18.

11. INNOCENTI, F., ROBINSON, R., GARDINER, T., NEIL HOWES, N., and YARROW, N., ‘Comparative Assessment of Methane Emissions from Onshore LNG Facilities Measured Using Differential Absorption Lidar’, Environmental Science & Technology, (2023), Vol.57, No.8, pp.3301 – 3310, https://doi.org/10.1021/acs.est.2c05446

12. SABRAM, T.M, CHEN, F., and DUNN, J.P., ‘Less is More: Flare Minimization During Cooldown [Conference session]’, LNG2019, (April 2019), Shanghai, PRC.

13. BOCHEREL, P., STROHMAN, J., MARTINEZ, J., WINK, B., SHAH, K., RAY, J., THOMPSON, R., MCLANDSBOROUGH, R., PEARSALL, R., STEMETZKI, E., GALLINELLI, L., and TOCI, E., ‘Converting Dominion Cove Point LNG Into Bidirectional Facility [Conference session]’, LNG18, (April 2018), Perth, Australia.

Elevate ethane trade to another level

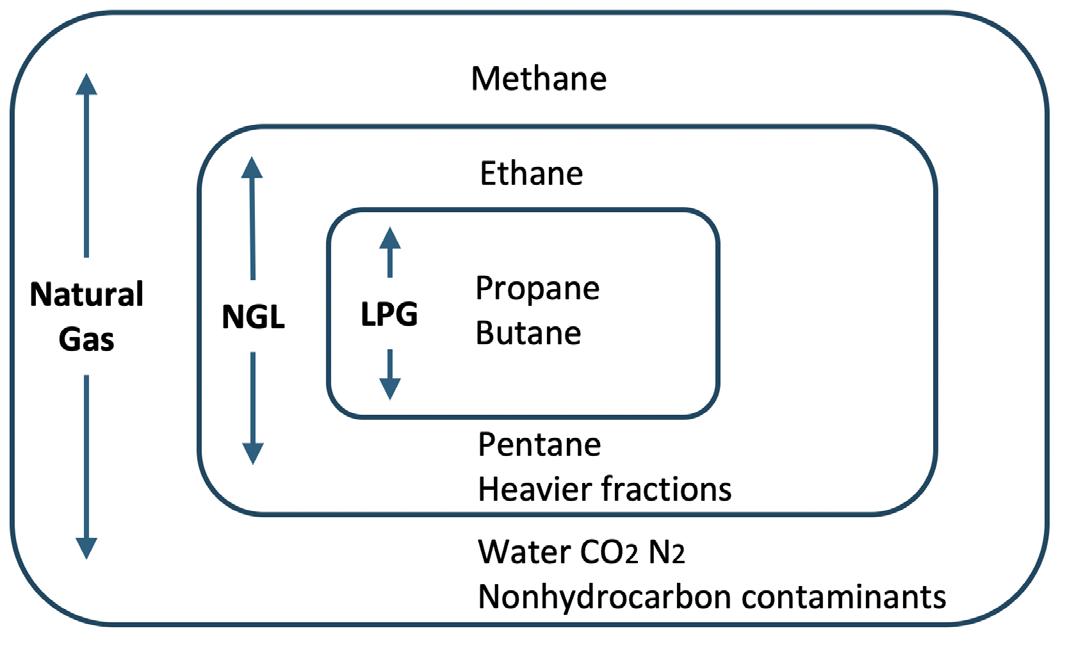

Ethane is a versatile hydrocarbon that can be found on both oil and gas fields, and plays a crucial role (among others) in the petrochemical industry, primarily as a raw material for creating a multitude of products that are critical to modern life. From a chemical point of view, ethane – like methane (natural gas) – is a colourless and odourless hydrocarbon, and it is the second lightest hydrocarbon after methane; it is made up of two carbon atoms and six hydrogen atoms (chemical formula C2H6). Ethane is part of the NGL category, itself between the liquefied petroleum gas (LPG) and LNG categories. When ethane is cooled down to -88˚C (-126˚C), it changes from gas to liquid. At this cryogenic temperature, liquefied ethane gas (LEG) volume is significantly reduced, facilitating its transportation in bulk. The ethane is in practice never pure, and always contains other gases such as methane, etc. Therefore, its temperature when in liquid form is always cooler than -90˚C (-128˚F).

Thibaut Raeis, GTT, explores how ethane carriers can be designed to accommodate LNG in the future.

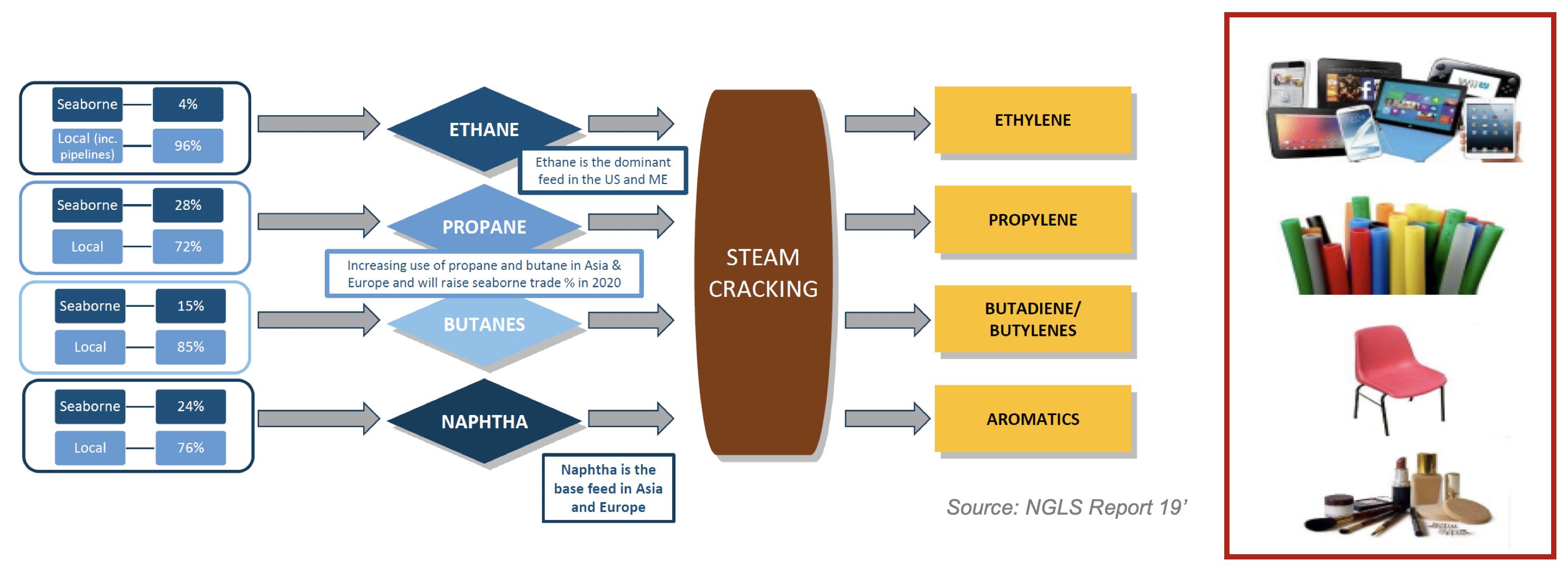

The petrochemical industry uses ethane in several ways:

z Feedstock for petrochemical processes: Ethane is a pry feedstock to produce ethylene, which is a basic building block for a wide range of products including plastics, antifreeze, and solvents. In a process known as steam cracking, ethane is heated to very high temperatures so that it breaks down (or ‘cracks’) into smaller molecules like ethylene and propylene. These are used to make various types of plastics and synthetic fibres.

z Energy production: Ethane can be burnt as a fuel, although it is more valuable as a chemical feedstock than as a source of energy.

Expanding horizons: the growing market for liquefied ethane shipping

Before the US shale gas revolution, the ethane market was considered as a low potential trading market and decisions to remove ethane from the natural gas stream were made daily by gas processers, according to ethane prices. The US shale gas revolution has created a surplus of ethane production which cannot be monetised in the US alone. Several ethane crackers have sprung up near Texas, but ethane remains in significant surplus. This new supply provides opportunities for increased ethane trading between the US and Europe, South America, and Asia.

Early ethane transport was dominated by ethylene gas carriers fitted with IMO Type-C cargo tanks. These vessels with a capacity of up to 10 000 m3 and a minority from 10 000 – 36 000 m3, were not the best option to cope with increased ethane export from shale production. Therefore, dedicated ethane carriers (which most of the time can also transport LPG) started to be designed.

In 2013, EVERGAS (acquired by SEAPEAK in 2023) first ordered ethane/LPG carriers at Sinopacific Offshore & Engineering. The eight vessels’ design (known as

Dragon-class) were contracted by INEOS to transport US ethane to the UK. The first Dragon-class vessel was delivered to EVERGAS in 2015 and the last one, JS INEOS Invention, in 2017. In 2014, Navigator Gas ordered ethane carriers (35 000 m3) to Jiangnan shipyard in China. The first vessel, Navigator Aurora, was delivered to Navigator Gas in 2016 and was chartered to Borealis Group to transport ethane from Marcus Hook (Pennsylvania) to Borealis facilities in Stenungsund, Sweden. In 2016, Hartman Group, in partnership with Ocean Yield, ordered three 36 000 m3 LEG carriers. The first vessel, Gaschem Beluga, completed her gas trials in 2017. Gaschem Beluga was contracted to transport US ethane (from Enterprise Products Terminal in Morgan’s Point, Texas) to SABIC’s ethane cracker facilities in the UK. Also in 2016, United Ethane Carriers (UEC) showcased the design of the largest type-C ethane carrier. The first vessel, built by Dalian Shipbuilding, was delivered in 2019 and was contracted to transport ethane from the US to China.

Shipping costs are a significant portion of the value chain. To be more competitive and make new projects viable, new generations of ethane carriers have progressively gained traction. These new generations of ethane carriers tend to be larger (87 000 ~ 100 000 m3) and more flexible in terms of their range of gas carrying capability, from LPG to LNG, attracting stakeholders from the petrochemical (NGL) and LNG shipping sectors.

Thus, in late 2014, the Indian-based conglomerate Reliance Industries took the initiative of ordering the first of a new generation of ethane carriers fitted with membrane cargo tanks, reaching a total capacity of 87 200 m 3. This new breed of vessels is known as very large ethane carriers (VLECs). The order was placed at Samsung Heavy Industries (SHI). The first vessel, the Ethane Crystal, was commissioned in 2016 to transport ethane from the enterprise products terminal in Morgan’s Point – Texas to India. The Ethane Crystal is currently operated by MOL to transport US ethane to reliance crackers in India. Following the success of this first generation, a second generation of membrane type VLECs was then ordered in 2018 to SHI and Hyundai Heavy Industries (HHI) by Delos, to fulfil the demand of US ethane trading to crackers in China. This second generation came with design improvements and with a step-up on vessel capacity to 98 150 m 3. In 2020 –2021, a total of 12 VLECs with membrane tanks were ordered at SHI and HHI for Zhejiang Satellite import project from Energy Transfer’s US export terminal. More recently, ethane shipping welcomed new players such as WANHUA Petrochemicals and SP Chemicals on the chartering side, but also Pacific Gas, IINO, EPS, and Tianjin Southwest Marine on the shipowner side.

The number of stakeholders could largely expand if some Middle East oil majors confirmed their ethane export project in the region, or if traders entered the ethane market. As VLECs constitute a significant financial investment and are currently exposed to geopolitical uncertainties, financial investors are worried of trade scenarios that rely on a

Figure 1. Feedstock categories.

Table 1. Main characteristics of liquefied gases

GTT, technology for a sustainable world

For over 60 years, GTT has been developing cutting-edge technological solutions for greater energy efficiency. We bring our passion for innovation and technical excellence to the service of our customers, to meet their transformation challenges of today and tomorrow.

We design cryogenic membrane containment systems for the transport and storage of liquefied gas, digital solutions to improve the ship performance, consulting services, training, maintenance assistance and technical studies.

We ensure the highest system performance by offering comprehensive support before, during, and after construction, leveraging the knowledge and know-how of our experts.

More than ever engaged in the energy transition, GTT is committed to the development of hydrogen through its subsidiary Elogen, which designs and assembles electrolysers for the production of green hydrogen, and by developing our very first liquefied hydrogen carrier.

The GTT teams are at the heart of our mission. Committed and united, we are determined to contribute to the construction of a sustainable world.

gtt.fr

single ethane supplier and seek options offering diversification to mitigate such risk.

An ultra-large ethane carrier: a revolutionary design

Pioneering the ULEC concept

With the ethane market maturing, there is a growing interest among industry stakeholders in transporting larger volumes of ethane across the oceans. As a result, ship owners are increasingly inclined towards investing in vessels with greater cargo capacities instead of opting for smaller ones. This preference extends to exporters and importers terminal operations as well, who are particularly drawn to 150 000 m3 ultra-large ethane carriers (ULECs). These larger carriers facilitate increased annual loading and unloading volumes, enhancing petrochemical plants outputs and companies’ revenues.

Therefore, in 2020, GTT launched a study to address the limitations for ships calling Enterprise Morgan’s Point terminal and Energy Transfer’s Nederland terminal, both in the US. Among this study, several interviews of pilot associations, export facilities, and the US Coast Guard were carried out. During the interviews, discussions were conducted to identify channel restrictions and the context for the restrictions that may impact the ship’s design.

The access to the Morgan’s Point Terminal goes through a narrow waterway, with safety rules developed by

the Houston Pilots. The terminal itself is in Laporte, Texas, in the Barbour’s Cut area of the Houston Ship Channel (HSC), approximately 32 nautical miles from the Galveston Bay Sea buoy. The HSC, in the segment between the Galveston Bay Sea buoy and channel buoy 18, is 800 ft (243.8 m) wide. The HSC segment between buoy 18 and the entrance (Barbour’s Cut) to the Morgan’s Point terminal is 530 ft (161.5 m) wide. The channel depth is 45 ft (13.7 m) throughout.

The Nederland Terminal is in Southeast Texas, on the Neches River in Nederland, approximately 34 nautical miles from the Sabine Bar. The access to Nederland terminal goes through the Sabine Neches Waterway (SNWW) and ships must follow rules developed by Sabine Pilots. The majority of the SNWW is 500 ft (152.4 m) wide until reaching the Sabine Neches Canal and the Neches River junction where the width is reduced down to 400 ft (121.9 m). The channel depth is 40 ft (12.2 m) throughout.

There are two critical requirements to call the port:

z The Martin Luther King Bridge has a 136 ft (41.5 m) vertical clearance. ULEC’s air draft must be designed accordingly.

z The maximum draft of a ship that the Sabine Neches Waterway Pilots will navigate to the Neches River is 40 ft (12.2 m) in fresh water, equivalent to 39 ft (11.9 m) in sea water. This allows for a limited safety margin depending on tides.

By triangulating views of pilot associations, export facilities, and the US Coast Guard, the following key ship dimensions formed the basis of the ULEC ship design: length overall of 274 m, 42 m width, and vessel draft of no more than 12 m in sea water.

Operational and economic advantages of ultra-large scale liquefied ethane transport

Right after the US terminals study completion, GTT and its partners began the development of the ULEC design. SHI, HHI, but also Chinese shipyards and designers including Hudong-Zhonghua, Dalian Shipbuilding, Jiangnan, MARIC, and Deltamarin, have all developed their own ULEC design.

Figure 2. World’s first VLEC, Ethane Crystal, loading at Morgan’s Point Terminal. Source: Enterprise Products.

Figure 3. Petrochemical basic building block value chain.

CERTIFIED

Complies with the requirements of ISO12617:2017

Patented nozzle safety stop feature is recognized in the market as a major failsafe advantage for the operator.

Ball cage interface with receptacle adapter ring guides and locks the nozzle in place for optimum engagement and user interface to increase environmental seal life.

While the conventional ULEC design is with four cargo tanks, GTT has also studied and validated a ULEC design with three cargo tanks in order to improve the overall volume efficiency and optimise shipbuilding costs.

Compared to VLECs, ULEC’s main engine is to be equipped with a seventh cylinder to increase the maximum continuous rating, while the reliquefaction unit is equipped with an additional fourth train of 50% capacity.

The ULEC ship design was reviewed by various Classification Societies who delivered approval in principle to the design team.

The cargo containment system of an ULEC can be either of Mark III type or Mark III Flex. The latter not only offers a lower BOR and therefore a reduced use of the reliquefaction unit and faster loading operations, but also a significant improvement in trade flexibility. Indeed, with the

Mark III Flex technology onboard, the ULEC would also be competitive as an LNG carrier to deliver LNG cargoes to FSRUs or to LNG terminals looking for volumes smaller than conventional ones, as explained in the next section.

Futureproofing with LNG-ready advanced membrane technology

Bridging ethane and LNG

During the Gastech 2021 exhibition in Houston, ABS unveiled at a joint event with GTT, the first LNG cargo ready notation for ethane carriers.

The notation confirms that an ethane carrier (VLEC or ULEC) equipped with GTT Mark III technologies is capable of future modification to trade LNG cargoes. Since then, sub notations have been added to confirm the LNG readiness of items such as piping, dual fuel systems, and other essential components.

Seamlessly transitioning from VLEC to LNG carriers: A practical conversion approach

Investing in ethane carriers with membrane technology enables the owner to mitigate financial risk, but also penetrate LNG shipping if necessary. Indeed, the asset comes with this dual cargo compatibility, which can perfectly answer market uncertainties. Technically speaking, the conversion from ethane carrier to LNG carrier shall happen at a conversion yard. The main work expected will focus on the main engine tuning, potentially also auxiliary engines, and the reliquefaction unit.

The vessels shall preferably be fitted with deepwell cargo pumps, contrary to the submerged type applied on first generations of VLECs. Indeed, deepwell pumps are easier to maintain as pump motors are outside the cargo tanks, unpumpable volumes are reduced and multi-cargoes (including LNG) can be pumped without the need of anti-freezing line for grade changing.

Finally, should new trade routes emerge, for instance, from the Middle East to Northeast Asia, the ethane carrier sizes could potentially be further increased to reach the size of conventional LNG carriers of approximately 175 000 m3

These unique ship designs attract major interest from stakeholders in the NGL and LNG shipping sectors. Synergy between LNG and ethane shipping, with larger ships and optimum technologies, considerably reduces the unit cost of transportation, lowering the break-even point for ethane feedstock competitiveness and potentially unlocking new

Table 2. Overview of VLEC projects in service and under construction

Figure 4. Satellite STL Nanhu VLEC built at SHI. Source: Energy Transfer.

Justin

Ellrich, LNG/Liquefaction Solutions Process Manager, and Micky Clifford, AVP – Process Solutions Leader, Black & Veatch, USA, assess how advances in scaling up proven technologies can help meet the growing demand for LNG.

The majority of the world’s LNG export facilities were primarily stick built with capacity now exceeding 5 million tpy/train. The challenges many of those projects faced in construction and operation have led many current projects and major players in the LNG industry to take an approach of using multiple smaller modular liquefaction trains to meet the same total capacity. They are finding solutions by employing technologies and execution strategies more typically seen in mid scale developments. This does not mean the economy-of-scale principle is being turned upside-down, but rather they are implementing a different approach to achieve a competitive project.

Smaller trains result in lower risk for project execution, but are often perceived as more costly due to economy of scale. Technology providers and EPC’s have been working hard to erase

this perception and prove there is another competitive approach to building large scale export. By using current manufacturing capabilities for machinery and heat exchangers as well as maximising modularisation, mid scale technologies like single mixed refrigerant cycles can realise commensurate US$/t figures while lowering execution risk and maintaining certainty in performance.

Multiple mid scale trains also afford a better opportunity for a phased implementation with smaller increments of CAPEX and required LNG offtake that enable a faster route to market while planning for the ability to expand in the future. In floating LNG (FLNG), the size constraints of the vessel have driven the industry toward the multiple train, modular mid scale approach. This approach maximises production volumes, and accounts for nearly 60% of the FLNG capacity in operation or under construction.

Other benefits of multiple mid scale trains include faster time to first LNG, increased overall availability, better turndown flexibility, and simpler startup and operations compared to more complex multi-loop technologies.

Train size

There are currently two main approaches to constructing a large facility out of smaller mid scale blocks. The first is to use the existing, proven mid scale train capacity, with a large multiple of trains required. The second approach is to scale up capacity of mid scale technology, which reduces the train count relative to the first approach.

Multiplication of small scale

One approach that has been put into production at several US facilities is to limit each individual liquefaction train to historically comfortable capacity, about 0.2 – 0.6 million tpy, and build as many trains in parallel as are required to achieve the total LNG capacity desired. The unit operations in this size are well-proven, and generally have multiple supplier options for key equipment. On the other hand, the principle of multiplication increases other elements of risk by increasing the number of site hookups and extending commissioning durations, for example. Some of these designs require dozens of liquefaction trains, so the sheer numbers of machinery, instruments, valves, etc. can cause issues and increase risk during startup and operations.

Scaled-up train

A more balanced approach is to maximise the train size achievable but still fit the train into a single module. This brings the benefits of modularisation and diversity of equipment supply that mega-trains lack, but minimises the multiplicity required by smaller trains. Black & Veatch’s PRICO® technology is currently being applied on several of these projects for 1.4 – 2 million tpy per train, including projects for both onshore and floating liquefaction. This is a more efficient execution strategy in line with the traditional economy of scale mantra – one larger train is cheaper than three small ones – but applied to the individual unit and not the total facility. This maintains the phased and duplicate mid scale philosophy while taking advantage of capabilities proven in the large scale realm.

This capacity range for a single train is not currently as common as the smaller ones described previously, mainly due to the historical delineation of projects – peaking and transportation fuel use smaller trains and export facilities stick-build the larger multi-loop trains. There is significant opportunity for optimisation by taking the best facets of each extreme and fitting into a single mid scale module – the simplification of small trains combined with the efficiency and economy-of-scale of large trains. By recognising the experience of major equipment in the same service for large trains, each component can be analysed to instil confidence in performance with proven references in operation.

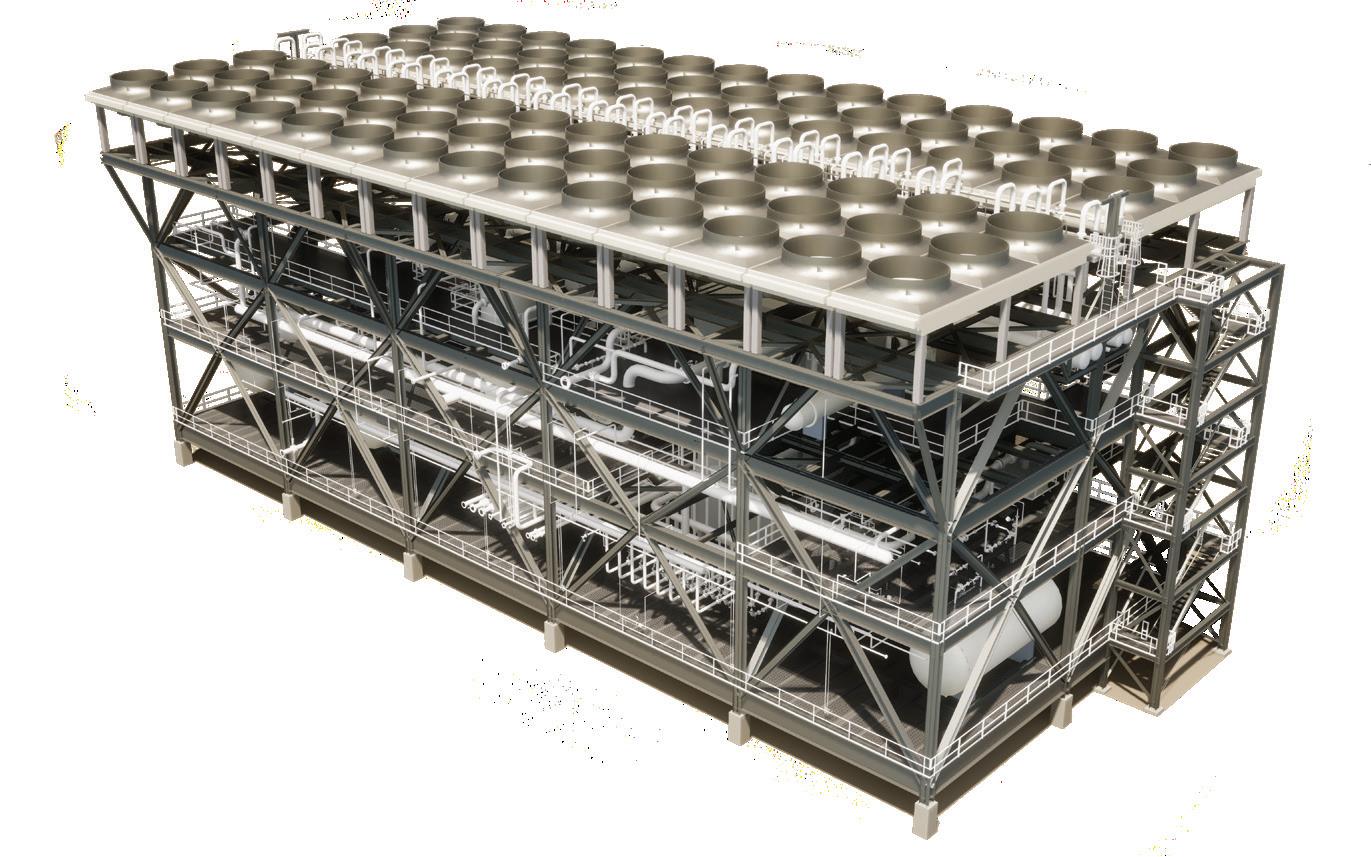

Modularisation

The use of modules allows for rapid and straightforward installation with a significant reduction in the required field works and laydown as compared to standard stick-built construction. By modularising and pre-assembling most of the project, the peak manpower at the job site is substantially reduced to less than half of a stick-built plant. Moving this work to the manufacturing setting of a fabrication yard will typically improve productivity and safety metrics as well. For mega scale trains, modularisation is less useful because the equipment sizes are so large that module weight and dimensions become untenable and each module has a bespoke design. When direct marine offloading is available, a standardised design for a single module per LNG train can be installed – ‘One Train, One Module’ – in the range of 4000 – 6000 t depending on train size and cooling medium ultimately selected. For onshore applications, the refrigerant compressor and driver are set to the side of the module on a single base frame already significantly modularised by the manufacturer. As the refrigerant compressor and driver are separate from the module, their selection is flexible which allows for easy optimisation. FLNG applications incorporate the machinery into the module for ease of constructability and to shrink footprint, and now include electric motor applications, as well as gas turbine drivers.

Equipment scale-up

The major equipment required for 1.4 – 2+ million tpy mid scale trains can be systematically analysed at a component level to confirm there is an equivalent application currently in-service to mitigate the scale up risk. The refrigerant compressor and main cryogenic heat exchanger are the

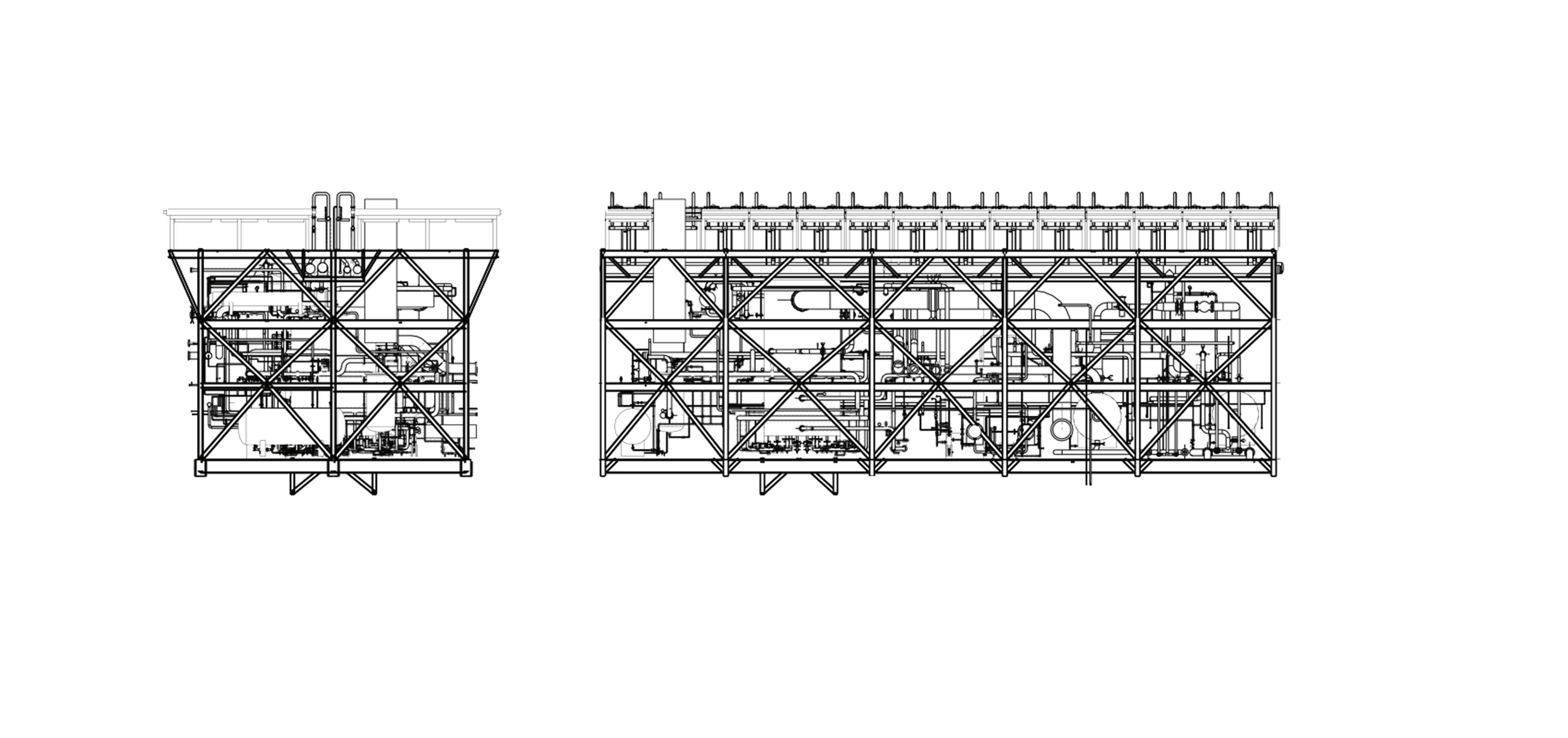

Figure 1. 1.4 - 2 million tpy onshore PRICO® module.

Figure 2. PRICO-Boost modification.

heart of the liquefaction plant and imperative to be provided with low risk and certain performance.

Refrigerant compressor

Large compressor casings and rotors have been proven for decades by multi-loop technologies which apply directly to scaling-up mid scale equipment – after all, it is still light hydrocarbon refrigerant service at similar pressure. Dozens of mixed refrigerant compression services fall in the range of 75 – 100 MW, larger than mid scale trains would employ. But because mid scale is staying below that range, the casing needed for the service is the same size or smaller and does not carry new risk.

Other major elements of the complex machinery like impellers, seals, and auxiliary systems go through the same review process to ensure that each individual component will perform like many other applications. If there is a situation where any component would be outside the proven references for the desired mid scale train size, parallel compression just like multi-loop technology has shown for some time can be employed while also significantly increasing the train capacity to 2 million tpy and beyond in some cases.

Main cryogenic heat exchanger

Main cryogenic heat exchangers also scale quite well with little-to-no risk. Larger coil-wound exchangers are used in mega-trains and proven sizes of brazed aluminium cores are just placed in parallel to achieve desired capacity. Coil-wounds are applicable to this size, but brazed aluminium technology offers simplification, lower cost, and footprint reduction that is more advantageous for mid scale train sizes.

Brazed aluminium exchanger fabrication techniques have significantly improved to allow for manufacture of larger units with greater heat transfer characteristics than those used in early designs. As an example, three trains installed in the mid-1970’s using Black & Veatch’s PRICO technology contained eight cold boxes with five cores each, for a total of 40 cores per 1.3 million tpy train. That train size today would fall into a single cold box with 6 – 8 cores.

Due to the unitised nature of brazed aluminium cores, there is no risk in scale-up of each individual core – the performance of each core is known because it is the same size and construction that is running in smaller scale facilities. Size per core is limited by the brazing furnace size of the manufacturer, so the thermal and mechanical performance is known many times over in previous facilities as cores are just churned out at the same size and placed in parallel. A one core design at a small scale facility can be the same size as those at a 10 million tpy multi-train project, with just the number in parallel being different. Black & Veatch’s control philosophy across each and every core remains the same from the 1970’s through today as it is easily scalable to any number of cores with assurance of success that has been proven over 200 times at the core level.

Process enhancements

There are several flowsheet optimisations to single mixed refrigerant loops that are not justifiable at smaller capacities but easily pay off for larger trains to close the efficiency gap compared to multi-loop processes. Liquid expanders used commonly for large scale trains (in place of J-T valves on LNG and refrigerant streams) can enhance LNG production by approximately 5% from the same driver power compared to a conventional offering. Other improvements to PRICO, which have

been patented and published with 2.5 – 6% production or efficiency increase, may be applied if a fit for the specific project conditions.

One such enhancement Black & Veatch developed is a modification to the single mixed refrigerant loop to integrate turbine inlet air chilling (TIAC) to increase capacity from a set gas turbine driver. TIAC is well known in the power industry and is being applied more commonly for LNG facilities as well, but usually with a separate packaged refrigeration unit that adds to cost and footprint. By utilising a slipstream of refrigerant already being processed for liquefaction, significant simplification, and space savings can be achieved. PRICO-Boost (Figure 2) enables up to 6% greater LNG production for minimal additional cost and footprint of the refrigeration system thus providing a better US$/tpy metric.

Decarbonisation

Smaller compressor power requirements, generally in the range of 30 – 50 MW for mid scale trains, open options for compressor drivers. The gamut of aeroderivative turbines fit mid scale train sizes quite well, and they consume significantly less fuel per kilowatt than traditional industrial turbines used throughout mega-train facilities. And while there are 65 – 75 MW motors now operating in a couple of LNG facilities, smaller, proven motor sizes de-risk the selection.

Similar to the refrigeration process enhancements becoming economically viable at larger sizes, so too does waste heat recovery from turbines. It is another well-known technology employed at large scale facilities to provide process heat or even steam for power generation in a combined cycle fashion that is not widely applied to smaller scales as the economic and emissions incentives are muted. Increasing train and facility size and employing waste heat recovery is another step to making mid scale facility efficiency and emissions competitive with other world scale developments.

Smaller power requirements can be particularly attractive if power is sourced from renewables which results in a significant reduction of the facility’s emissions. Either a phased approach or overall smaller facility may better fit the available renewable generation in the area. Even if not fully renewable, the electrical infrastructure required for mid scale vs mega facilities better enables full or partial grid connection instead of necessitating on-site power generation which increases both costs and emissions.

Summary

The scale-up risks associated with applying mid scale LNG technology to large scale facilities are now well known, as are the mitigations. Multiple current and newly proposed projects are proving there is a competitive approach in the global LNG export market in scaling down from mega-trains by scaling up other proven technologies.

Mid scale technology, such as Black & Veatch’s PRICO with a single train per module and proven equipment, can de-risk project execution. Fabricating and installing duplicate modules in parallel moves vast labour hours to controlled offsite yards, thus increasing productivity to remain competitive with the traditional mega-project approach. Consolidating operations of a single liquefaction train into one module enables more capacity with less footprint, evidenced by its leading adoption in the FLNG space. Pushing the technology and equipment to the upper end of proven operations and applying viable enhancements to efficiency furthers the competitiveness achievable by mid scale applications.

Taking modularisation to new levels in LNG

Taking modularisation to new levels in LNG

Dominique Gadelle, Vice President of Early Engagement at Technip Energies, discusses

the rise in popularity of modular LNG.

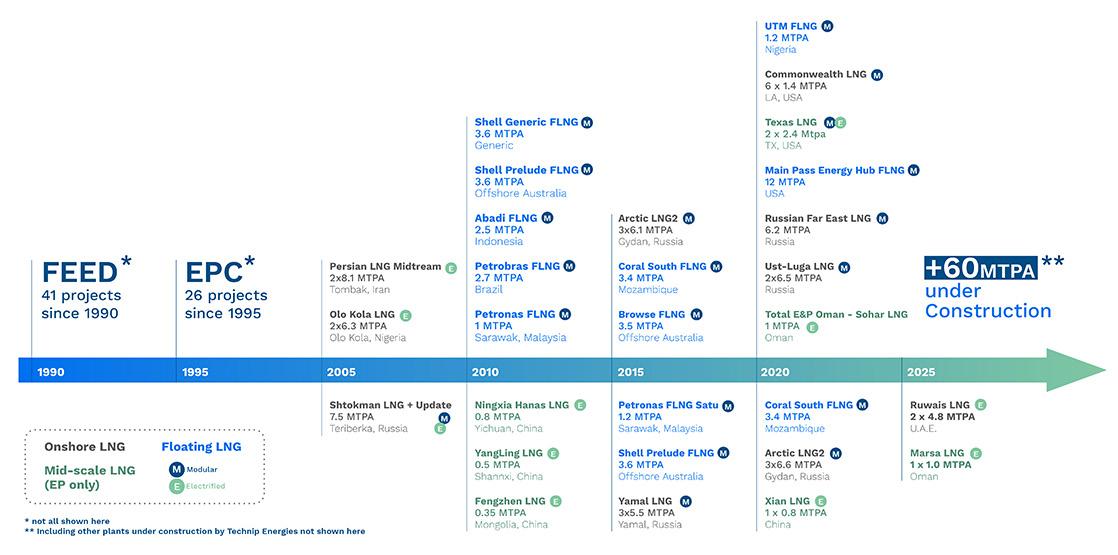

Pioneered primarily by the LNG industry, large scale modularisation of LNG plants has expanded a lot in the past 15 years. Challenges related to construction in high-cost OECD countries, the growth of floating LNG and the long search for a viable method of developing liquefaction facilities within the Arctic Circle have all pointed to modularisation. This created an enthusiastic investment climate on all continents, especially in Asia with China as a leading location. It meant that spacious waterfront construction sites could be equipped with fabrication shops, cranage, and loadout wharfs custom designed for this new market.

After 2016, an opportunity arose in the US to develop LNG export capacity based on multiple modularised mid scale trains. It became possible to embark on project execution schemes entirely locked into modularisation, greatly reducing peak site manpower and risk. Standardisation fits well with the federal regulations that apply to US LNG. It fits the near-constant quality of feed gas taken from the US grid and the flexibility of smaller equipment. Lastly, the dynamic US gas industry has been able to sharply increase supply in the same period.

There are now several operating facilities that demonstrate this approach. However, attention to economy of scale has yet to be fully exploited, which is where the development described below has its starting point (Figure 1).

Increasing the scale of standard LNG modules

In 2022, relying on its engineering, technological, and project execution expertise, Technip Energies started to develop generic FEED based on its SnapLNG by T.ENTM concept at the large capacity end of the envelope. SnapLNG by T.EN combines a compact modular design for mid scale LNG trains with standardised components and technology. This solution benefits from speed to market, with greater certainty around costs and schedule and best available process technology, refrigerant compression, and digitalisation. It also offers clients a new approach to decarbonise their LNG production and

reach their carbon reduction target thanks to lower emissions, and is suited for low to zero-carbon LNG (Figure 2).