September 2025

Accelerate your journey to net zero

September 2025

Accelerate your journey to net zero

Superior Defense. Optimal Catalyst Performance.

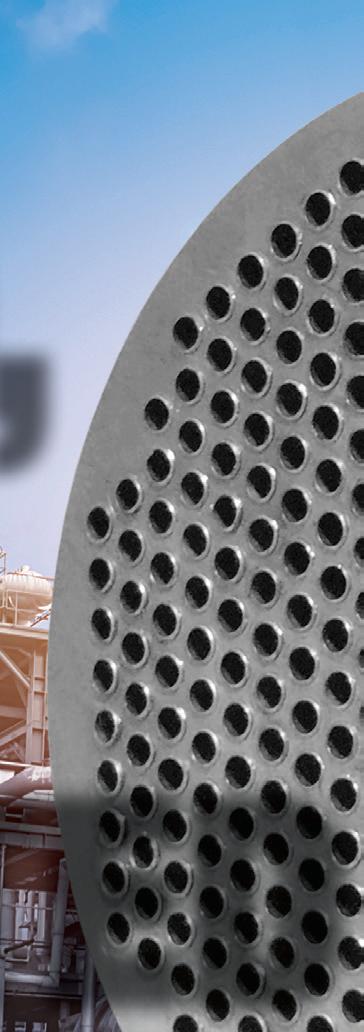

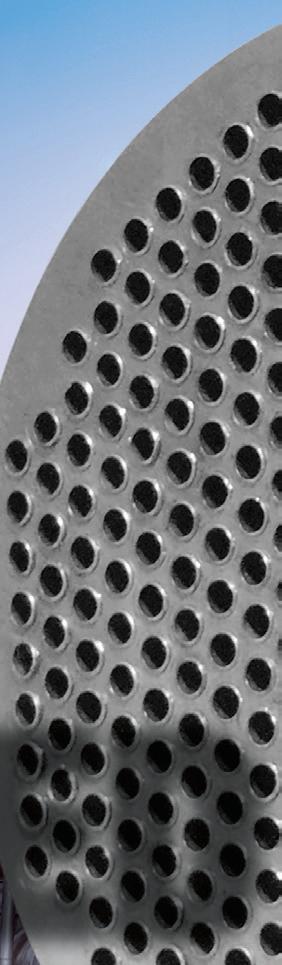

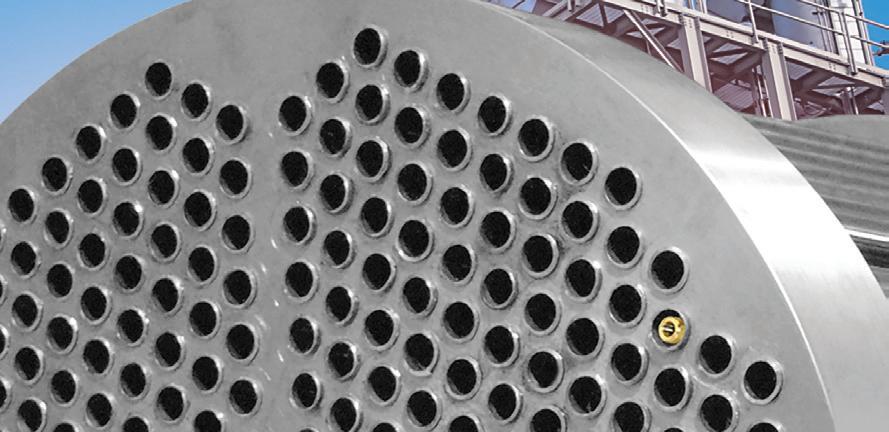

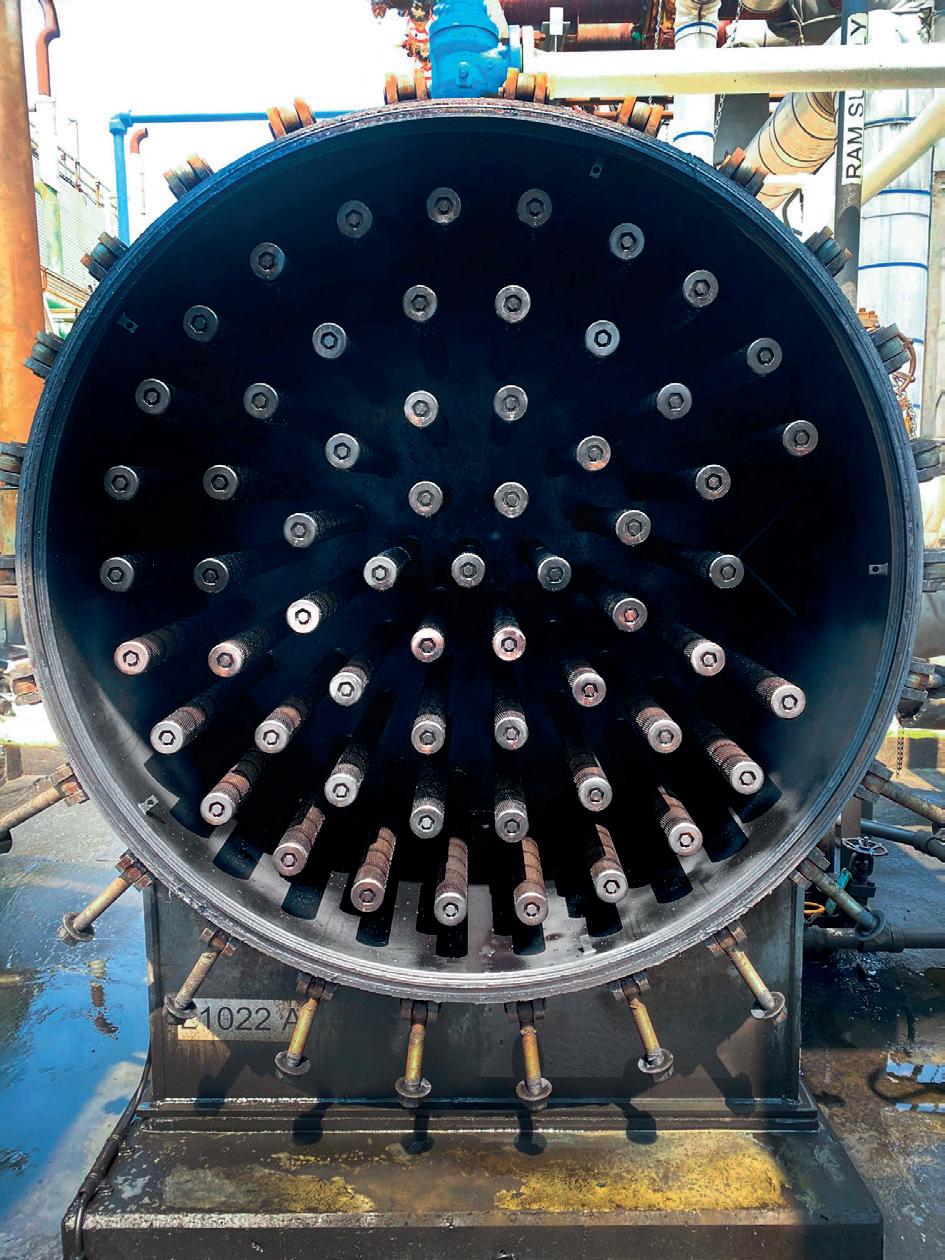

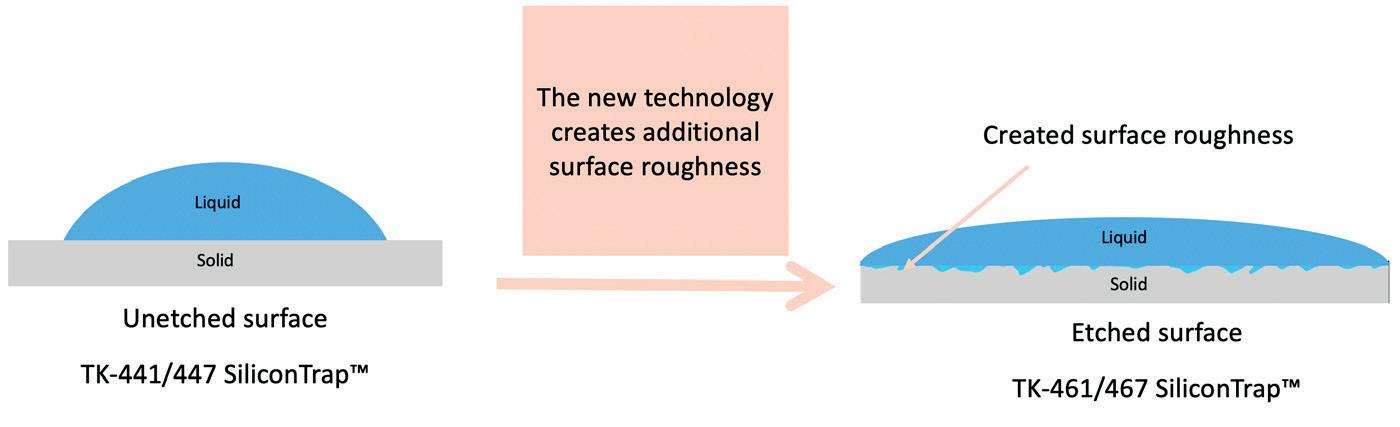

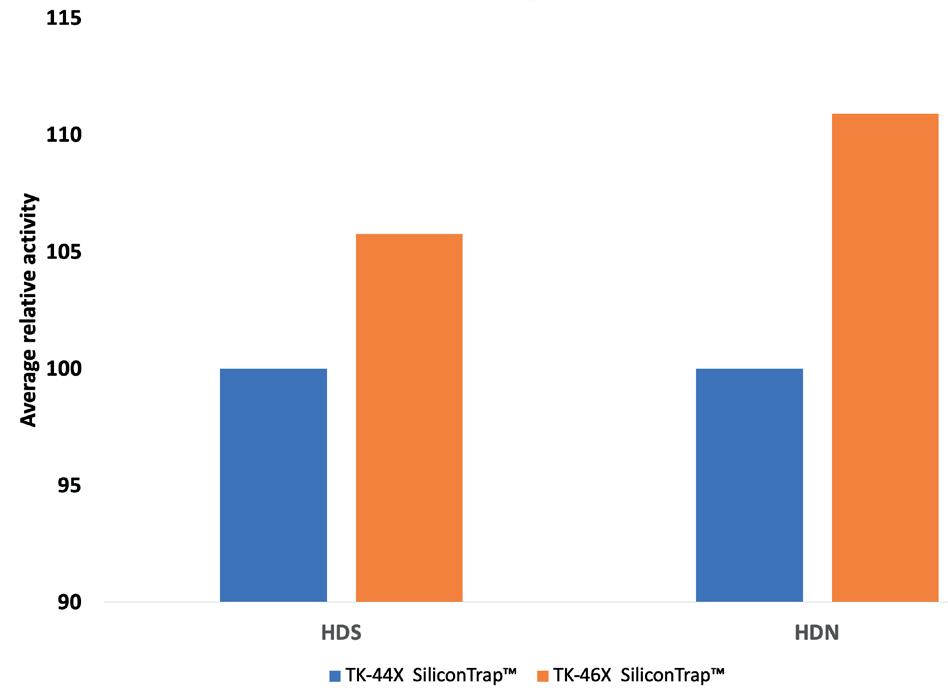

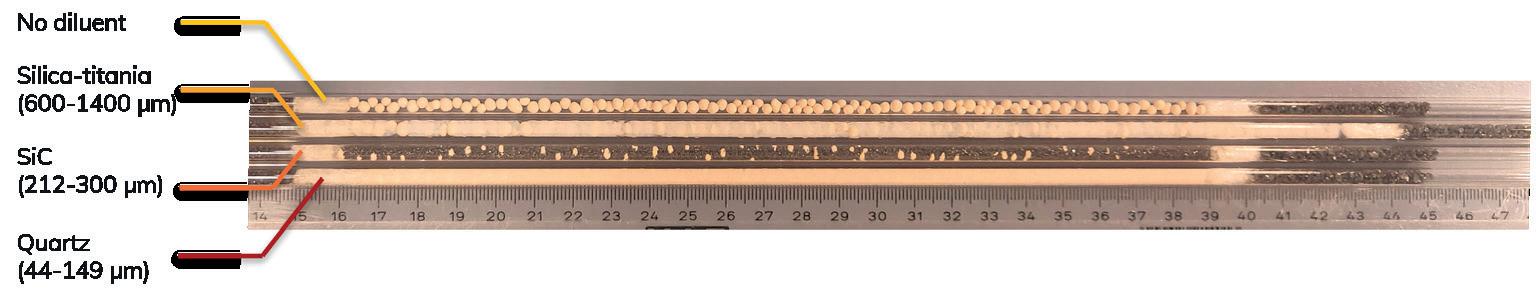

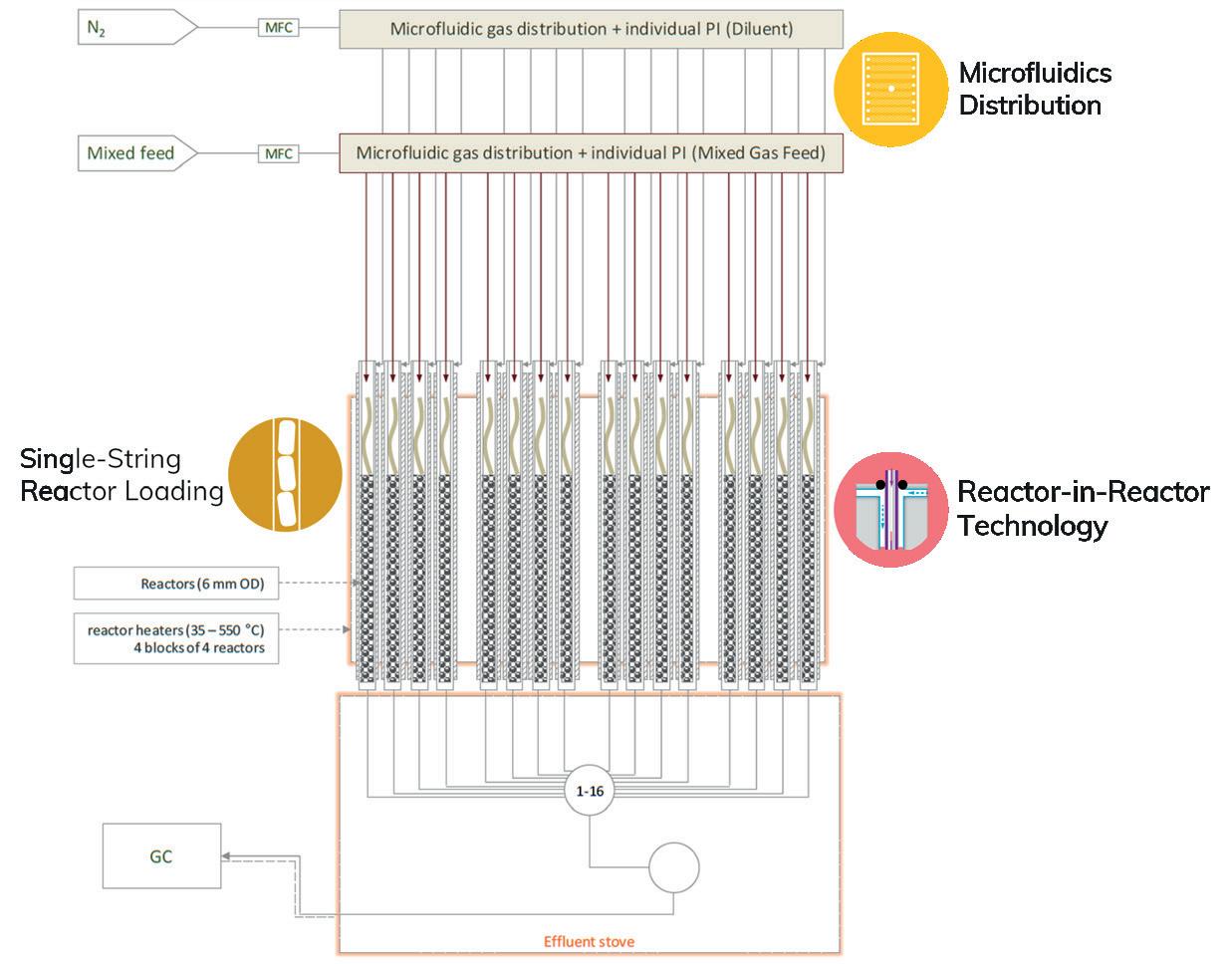

In coker naphtha hydrotreating, silicon isn’t just a nuisance, it’s a threat to performance, cycle length and profitability. Topsoe’s third-generation TK-461 and TK-467 SiliconTrap™ catalysts provide refiners with breakthrough silicon pick-up capacity on a volume basis.

Designed with next-level alumina support, they offer superior silicon pick up, higher HDS/HDN activity and seamless compatibility with your existing unit. The new SiliconTrap™ catalysts feature increased surface area per volume resulting in improved silicon adsorption.

Topsoe’s SiliconTrap™ catalysts system is built to improve profitability by providing longer cycle lengths.

43 Guarding against silicon contamination

08 Geopolitical pressures in North America

Gordon Cope, Contributing Editor, considers how the pressure from the US administration has prompted Canada and Mexico to reconsider the continent’s energy infrastructure.

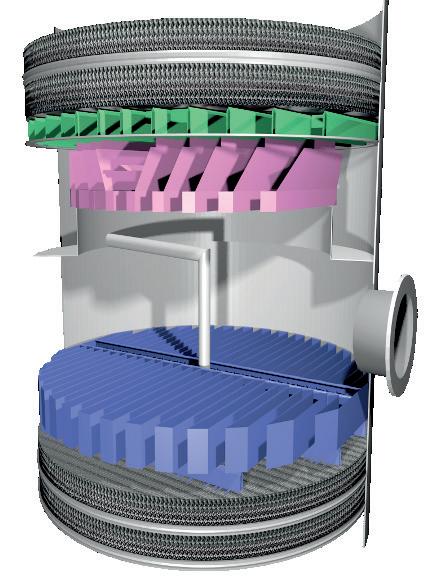

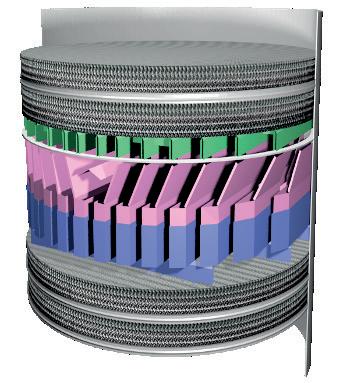

14 Reinventing the crude argon column design

Quan Yang, Ming Yang Lee, Laurent Zuber, and Jiao-Jiao Dong, Sulzer Chemtech, Switzerland, alongside Feng-Jie Xu and Feng-Hua Zhou, China National Air Separation Engineering Co., explore how to effectively mitigate liquid maldistribution through crude argon (CAR) column design.

23 Engineering the future

Emily Ruhl and Michael Krela, Koch-Glitsch, USA, explore the development of distillation tray valve types and consider how operators can best align valve selection with current demands and future challenges.

29 Effective filtration: a downstream necessity

Neil Richards, PS Filter, Canada, discusses how effective filtration through best-practice strategies ensures production integrity, operational efficiency, and regulatory compliance.

33 Beyond the brochure

Michael Clements, Filtration Technology Corp. (FTC), explores how technical evaluations in filtration trump so-called ‘brochure engineering’.

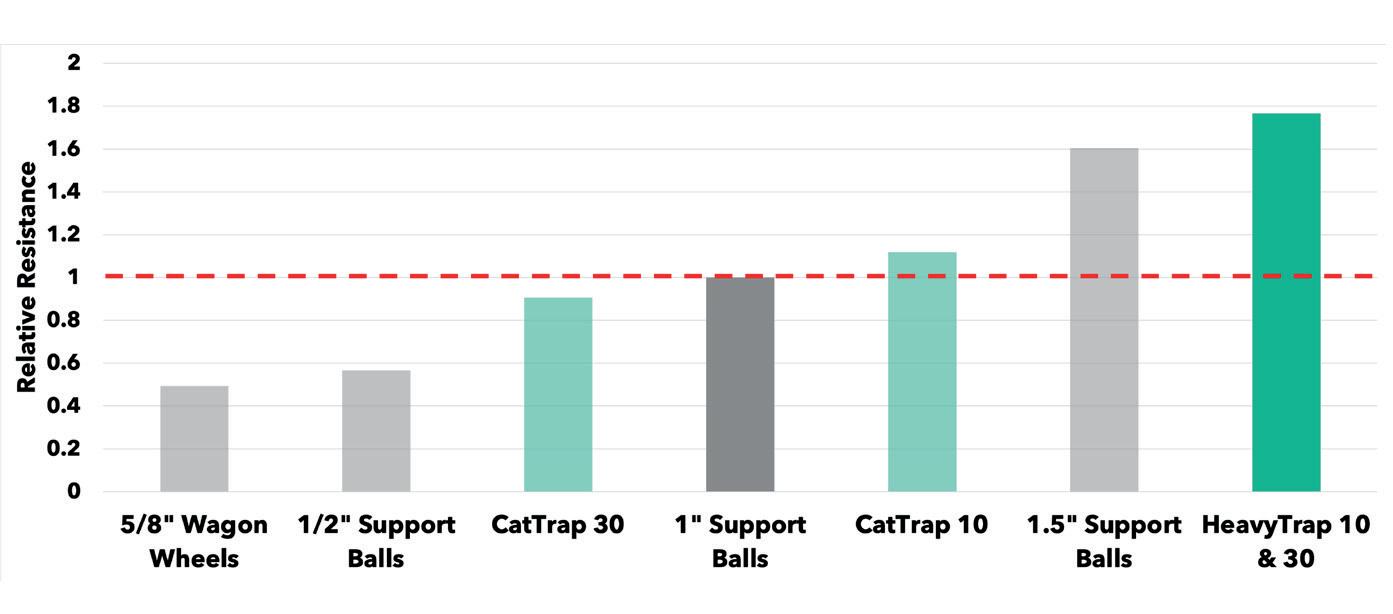

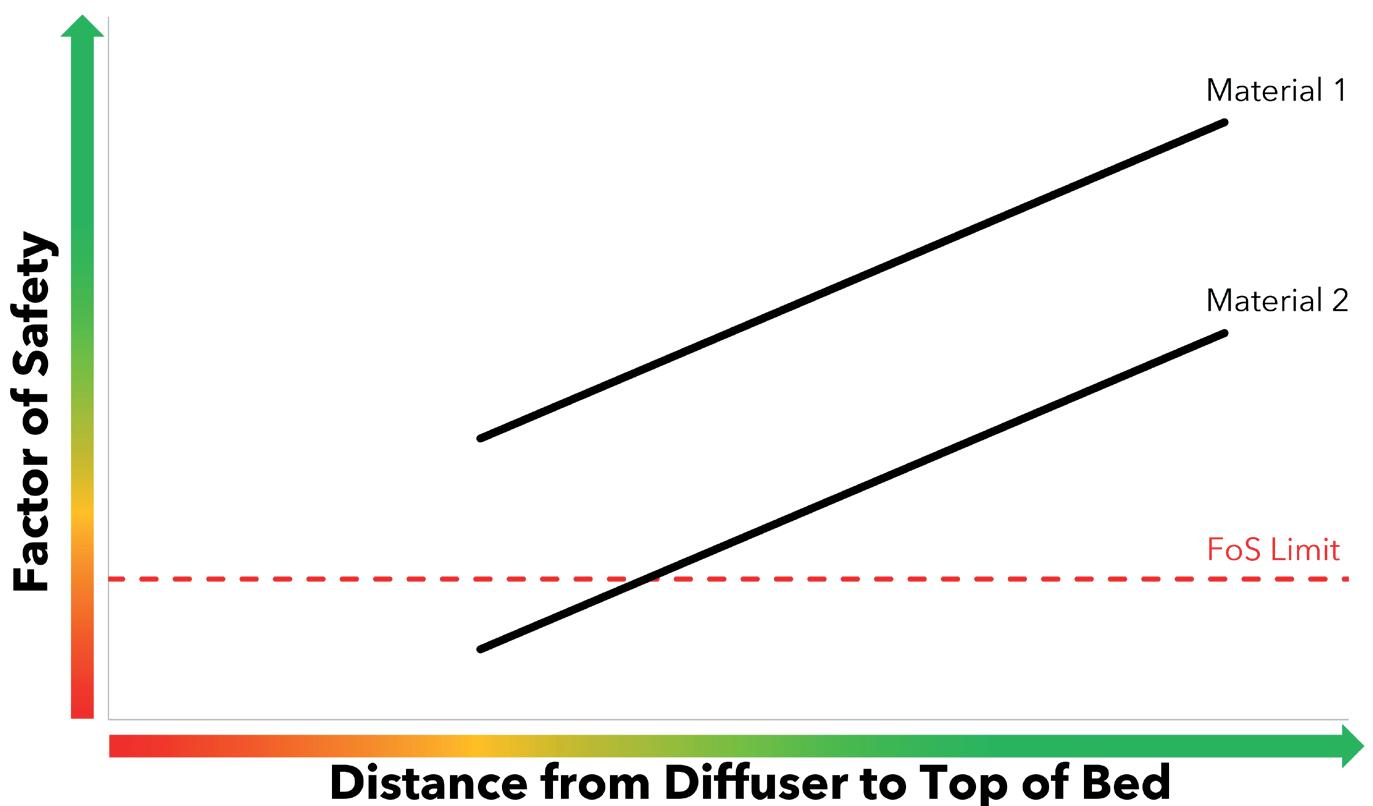

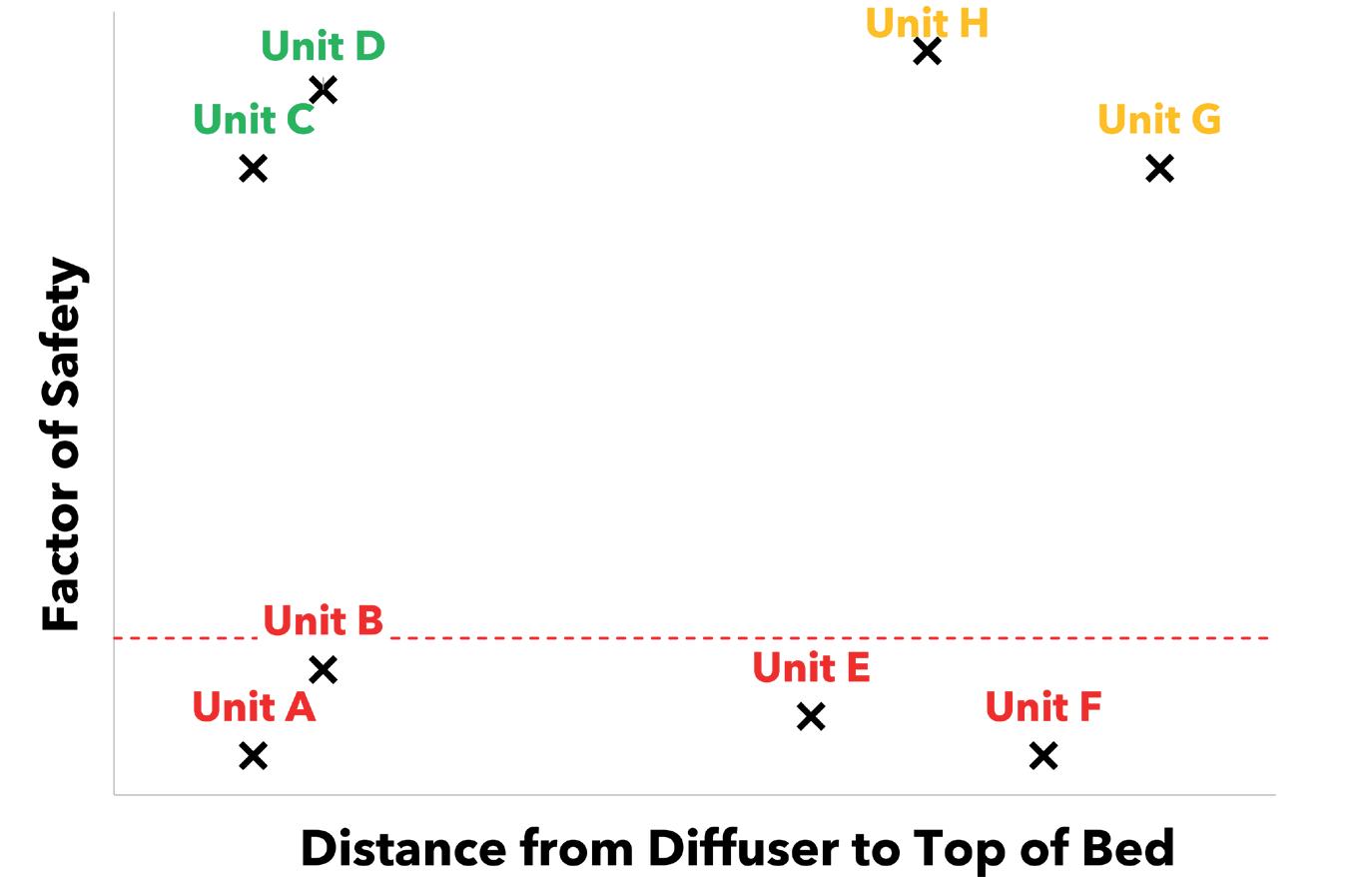

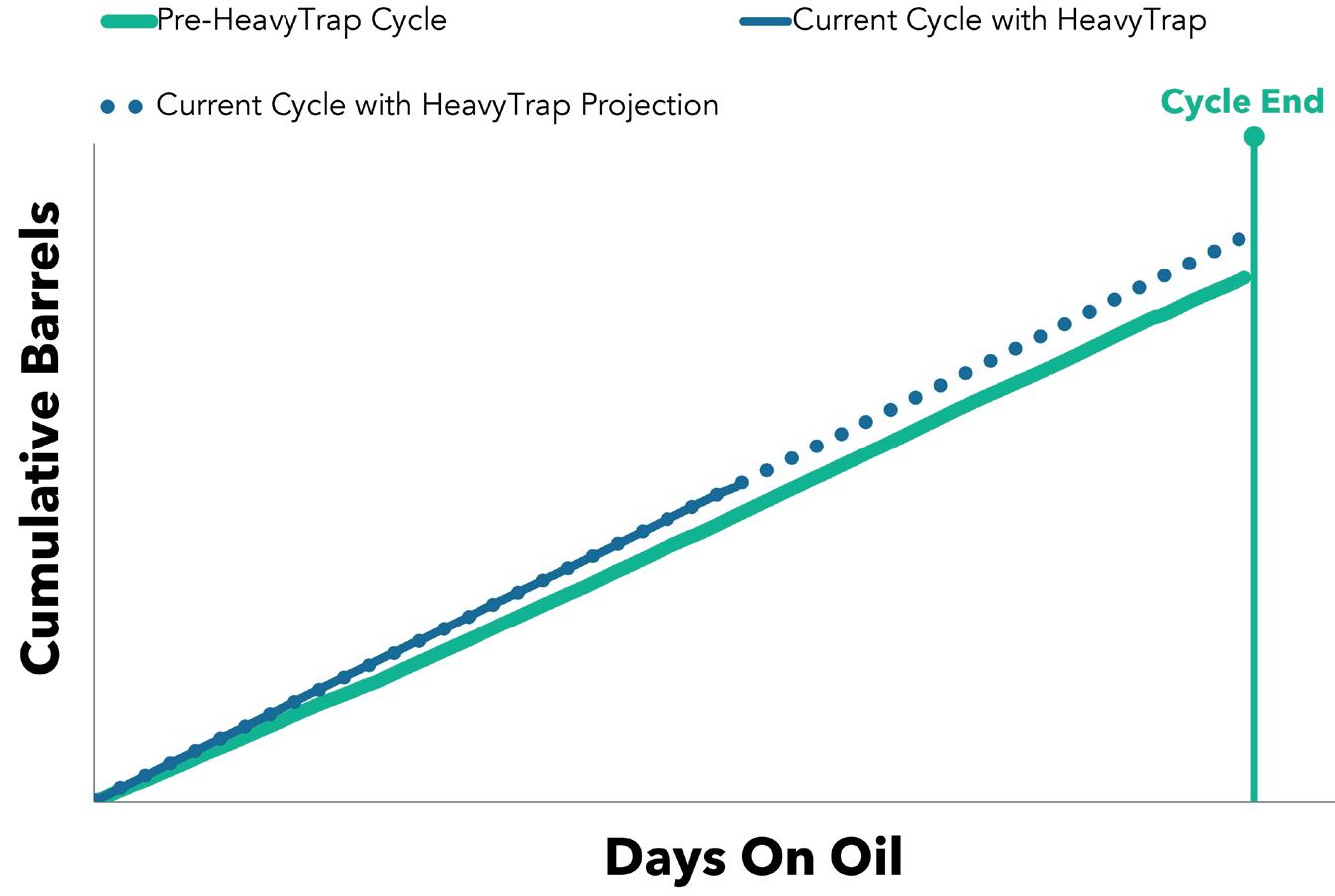

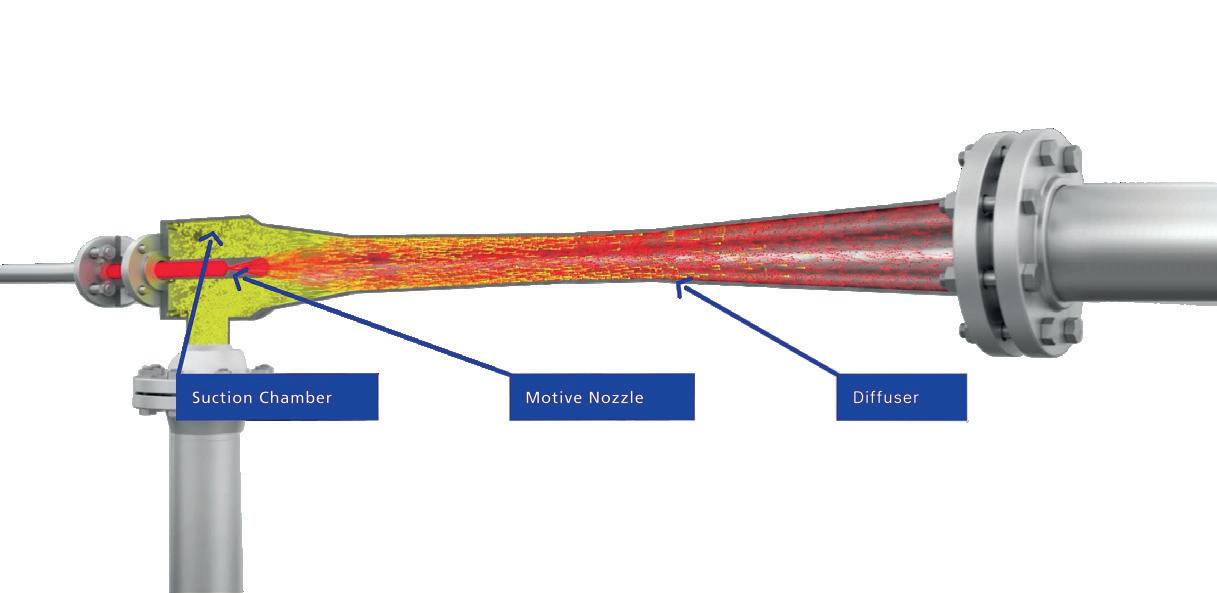

37 A new era in top-bed design and reactor performance

In reactors with high-velocity gas inlets, maintaining top-bed stability is essential for operational efficiency and profitability. Austin Schneider and Tanvi Rao, Crystaphase, USA, explore how a new type of reticulated ceramic technology can provide a comprehensive solution for top-bed management in fixed-bed reactors.

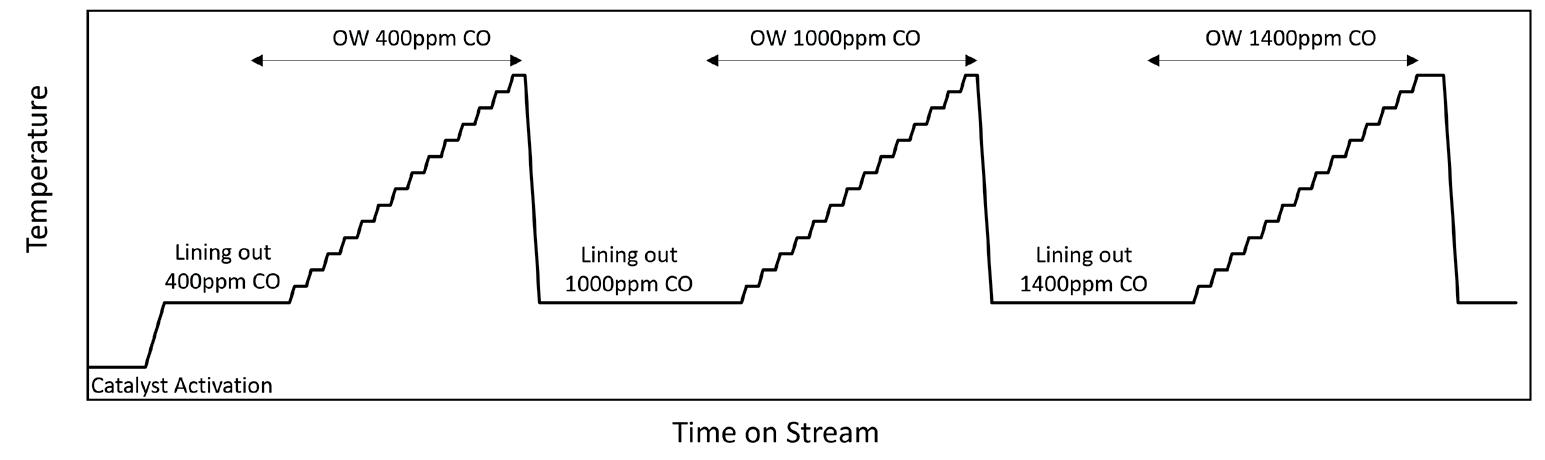

Henrik Rasmussen and Xavier E. Ruiz Maldonado, Topsoe, describe how new third generation catalysts for coker naphtha can improve performance.

47 Optimising catalyst selection

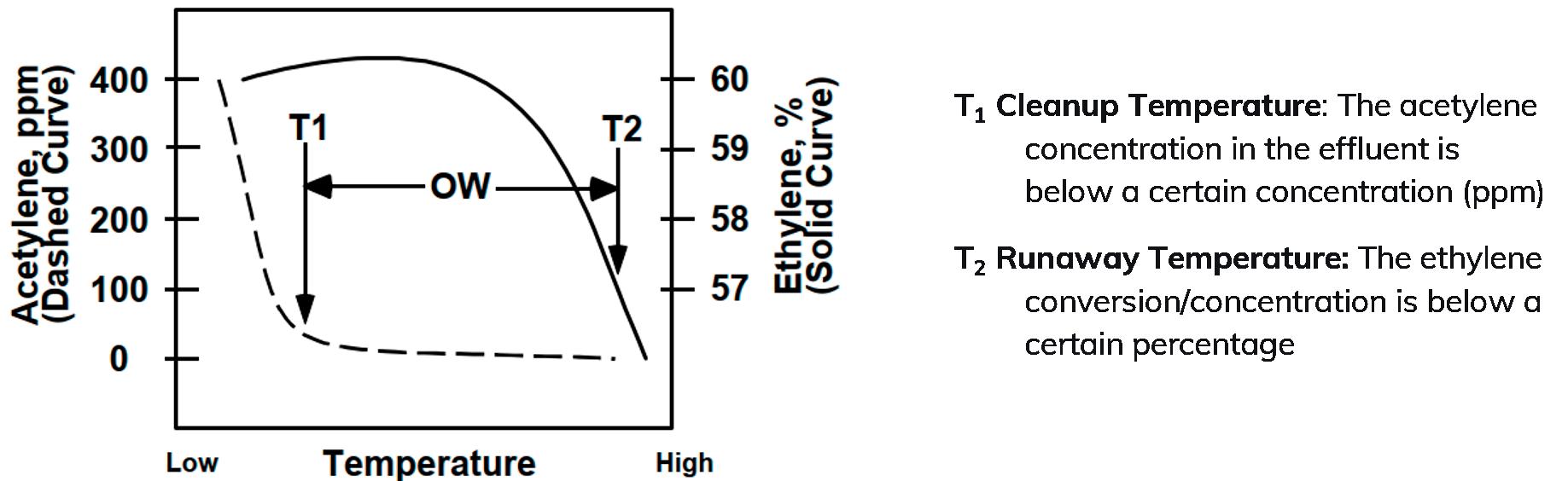

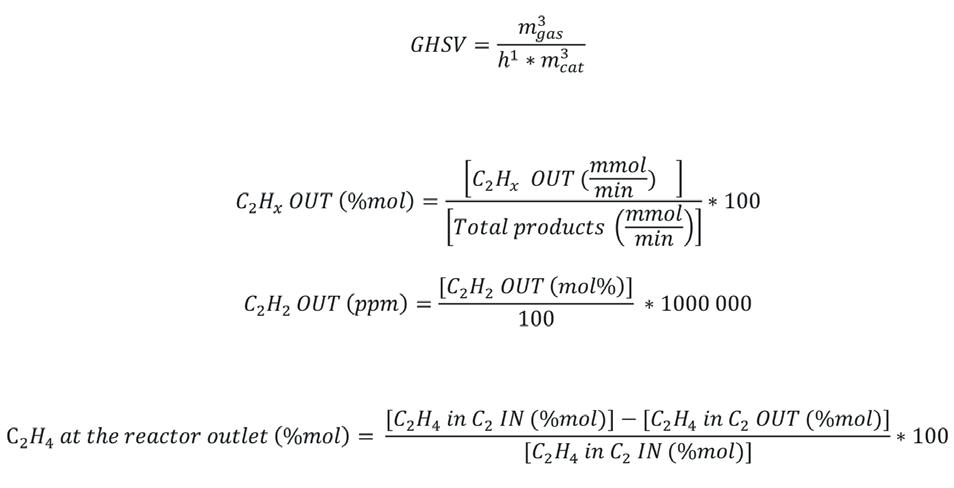

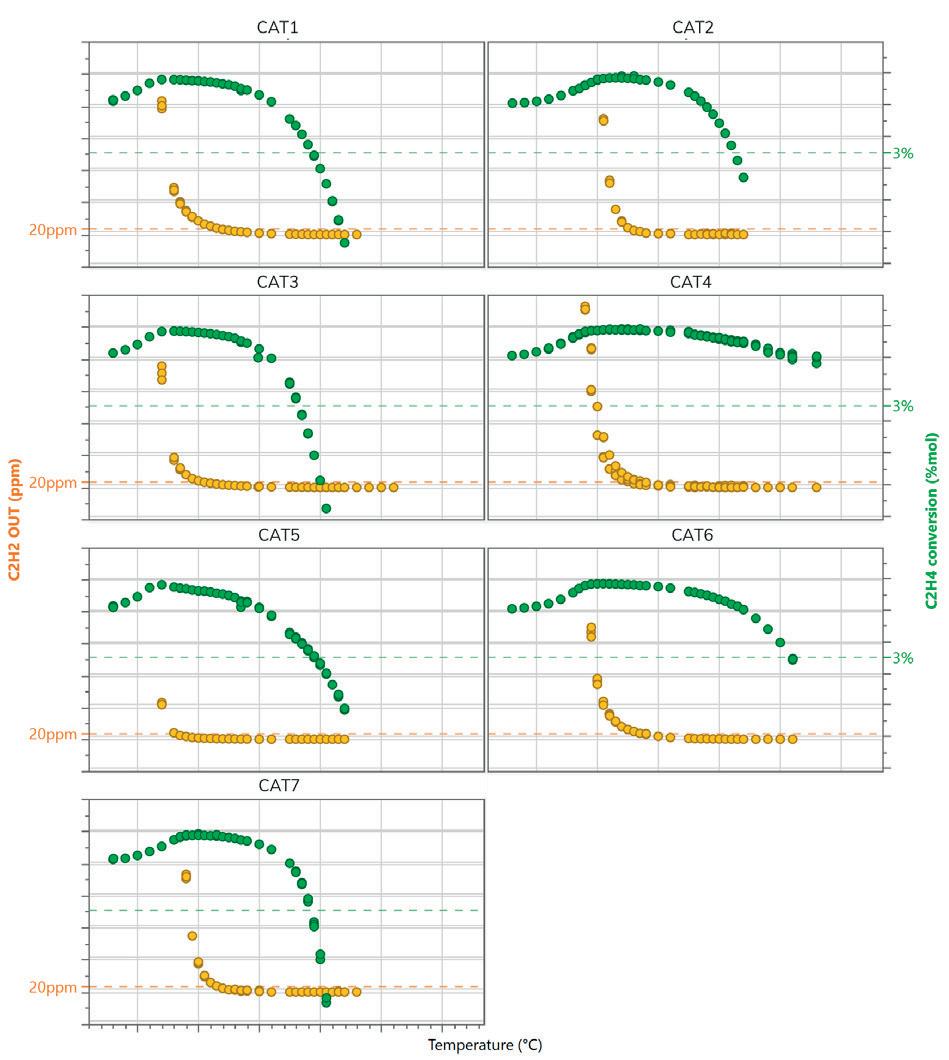

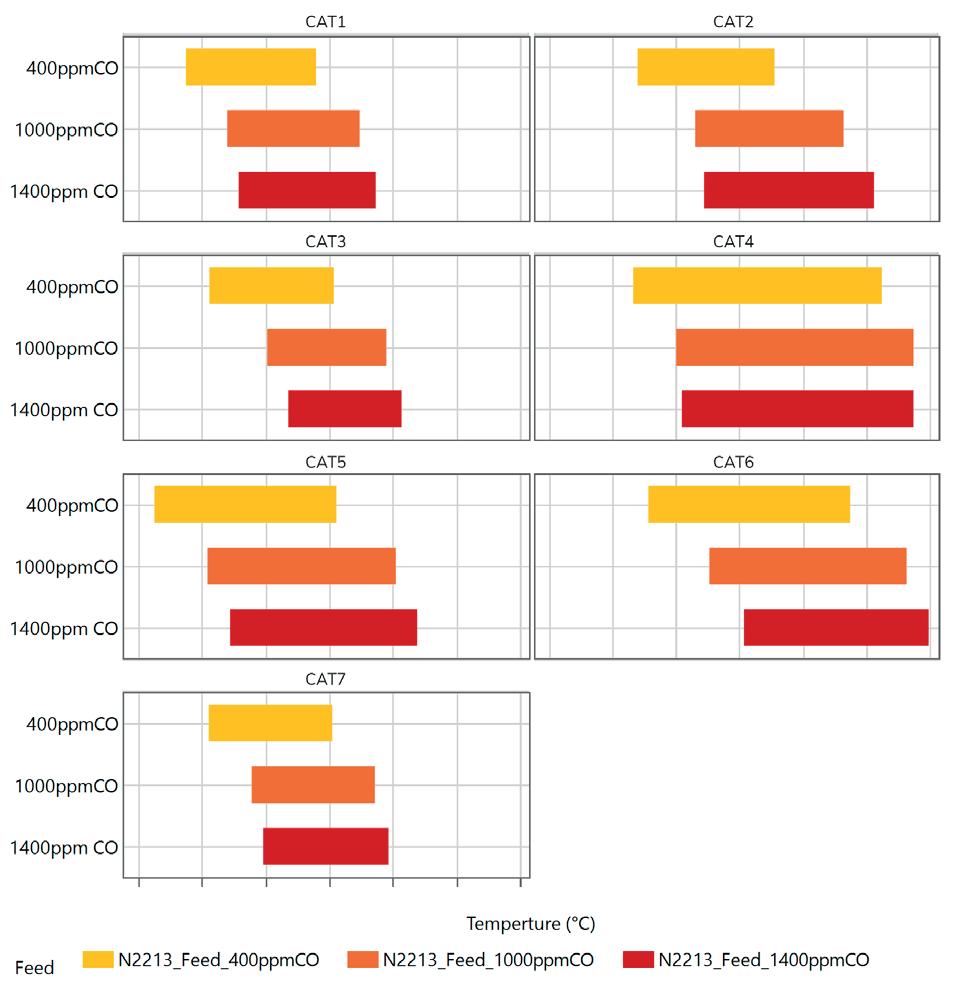

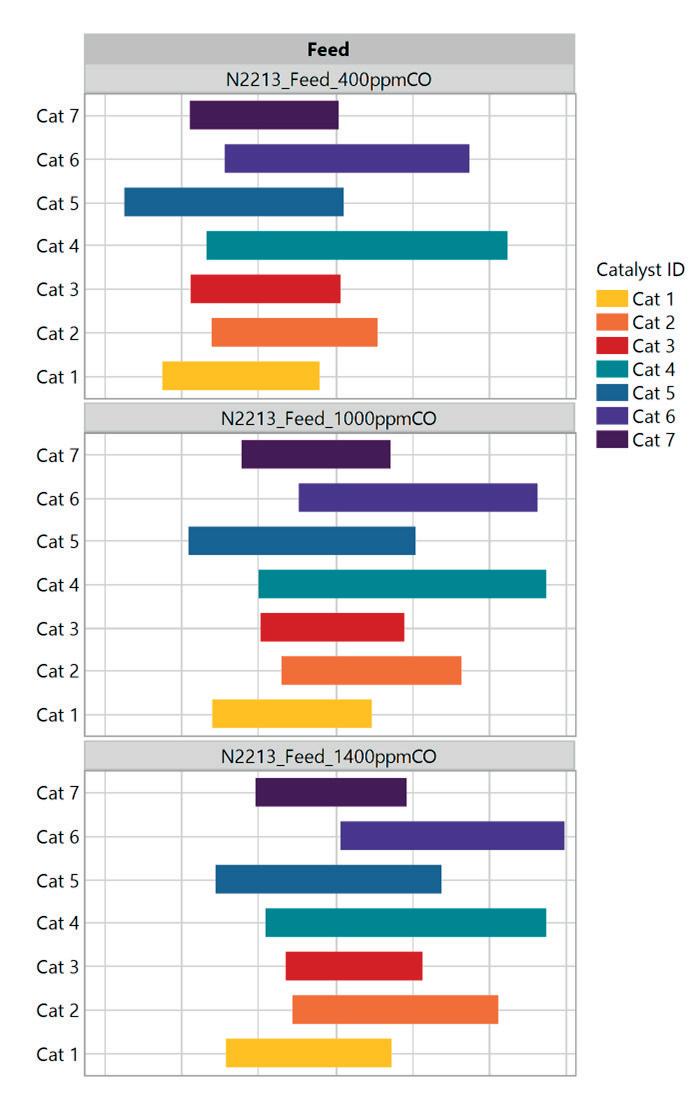

Marlene Führer, Daria Otyuskaya, Maria de la O Masa Lorenzo, Rodrigo Duarte Oliveira Silva, Francisco Maroto de la Puente, and Tiago Vilela, Avantium R&D Solutions, provide the results of a comparative study testing commercial acetylene hydrogenation catalysts, which highlights the importance of catalyst selection in line with plant requirements.

53 Reuse, recycle, repurpose

Brian Visioli, Evonik Catalysts, USA, explores how catalyst reuse can aid sustainability within the refining industry, through improving operational efficiency and providing environmental benefits.

57 Electrifying industrial process heating

Roly Juliano, and Gregoire Quere, Watlow, discuss how low voltage and medium voltage electrification of industrial process heating is emerging as an advantageous solution to reduce emissions and improve performance, moving toward industrial decarbonisation.

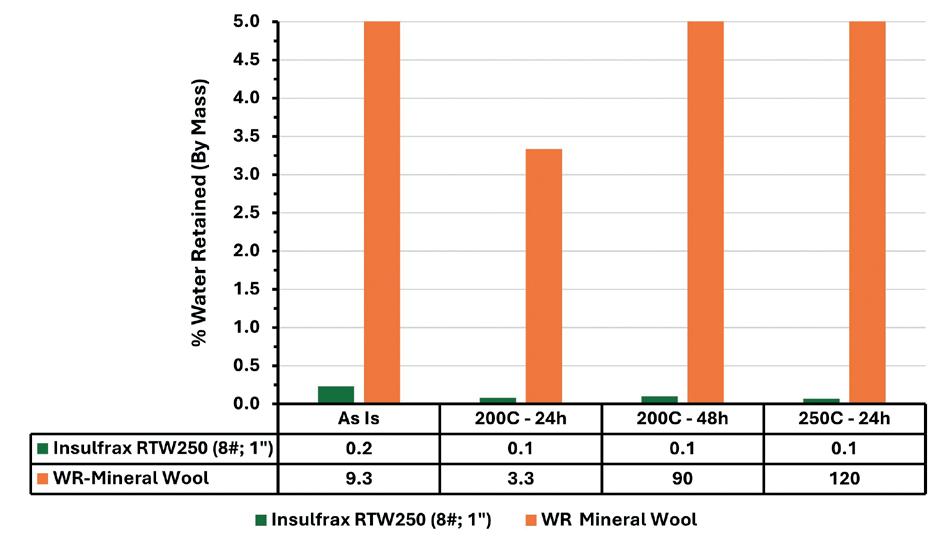

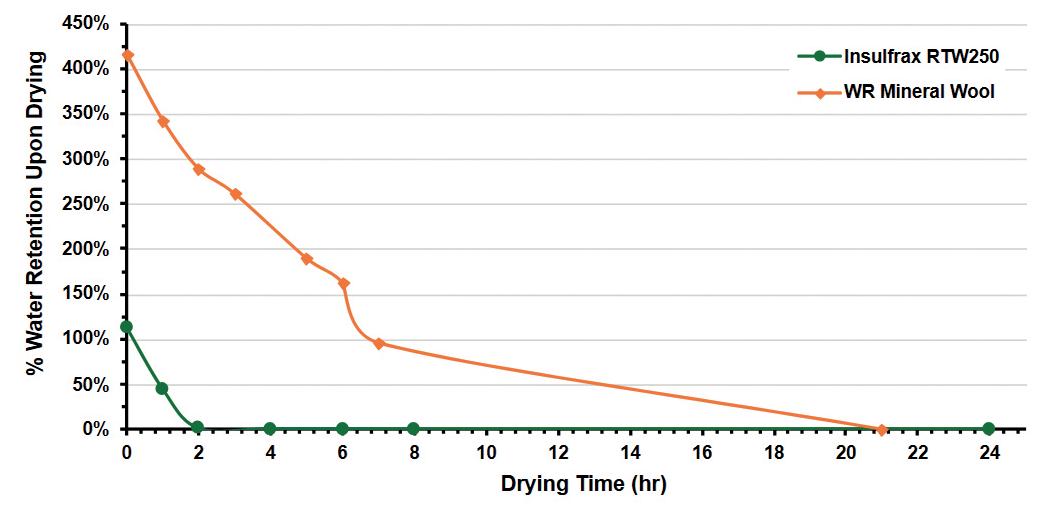

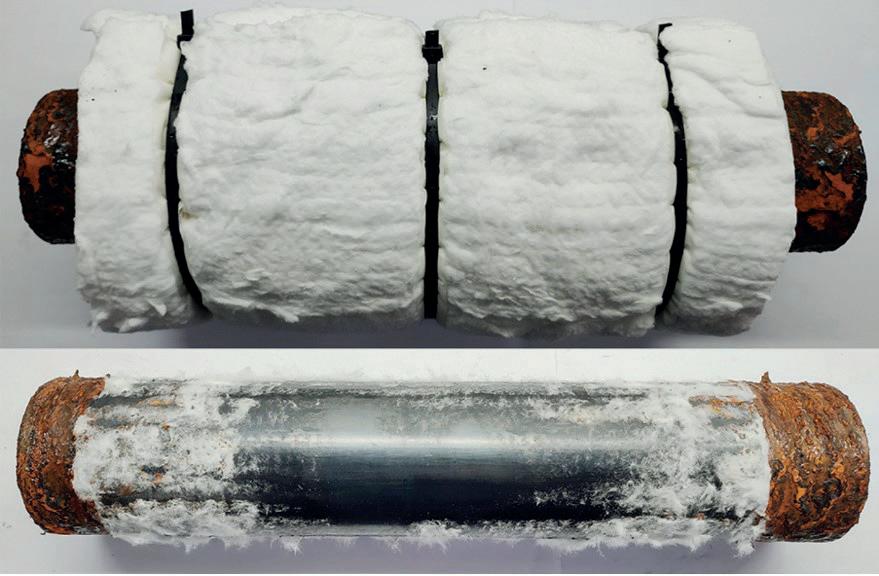

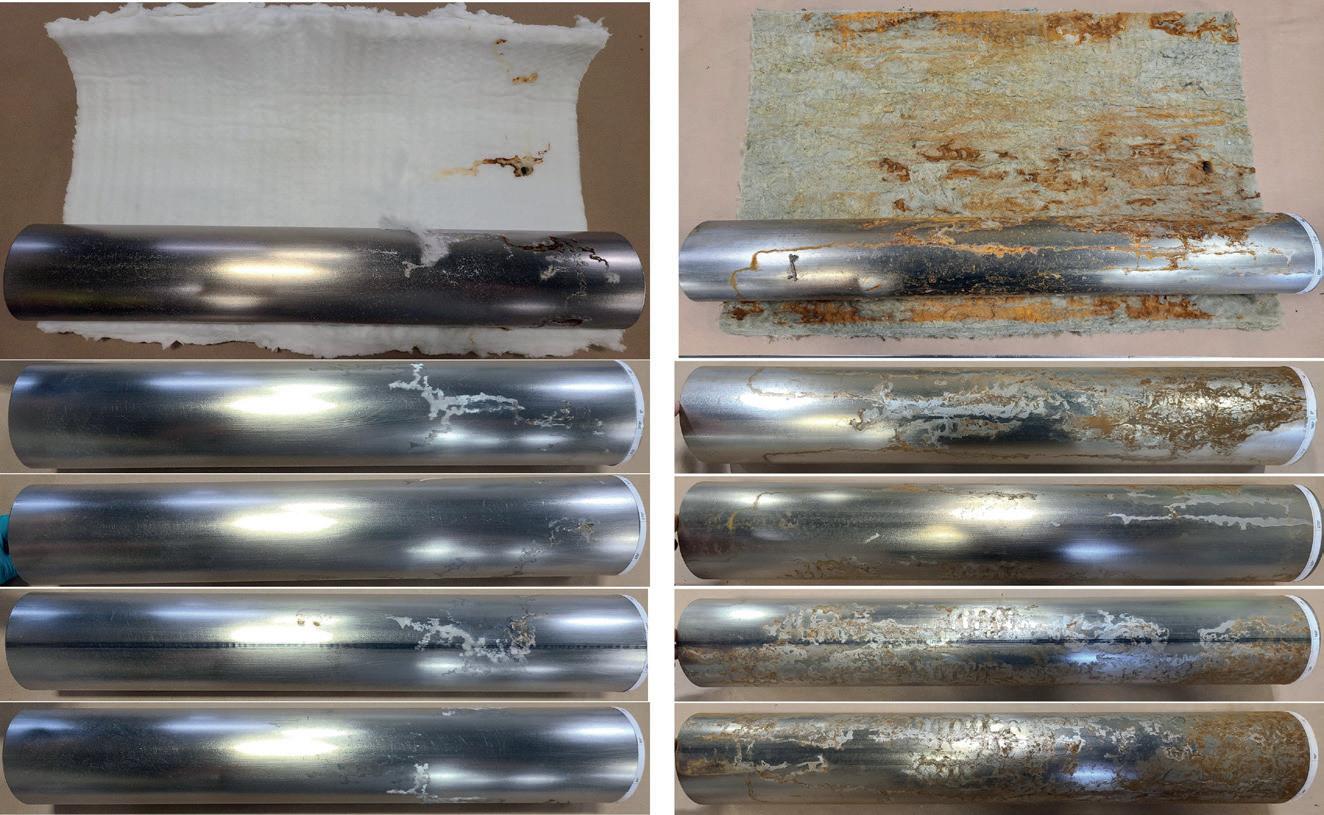

Kevin E. Siters, Alkegen, USA, outlines why corrosion under insulation (CUI) remains a significant challenge in the downstream sector, and introduces an insulation solution that can help combat this problem.

65 Enhancing safety in the downstream sector

Andy Cull, Total Safety UK, explores how safety can be enhanced in the oil and gas sector through advanced safety management and gas monitoring.

Gilles Revial, Aggreko, explores how turnarounds for petrochemical refineries can present a strategic opportunity to streamline and improve processes.

Accelerate your net-zero goals with Sulzer’s advanced separation technologies for carbon capture. The company’s proprietary solutions deliver maximum capture efficiency with the lowest pressure drop, reducing energy use and capital costs. Achieve reliable, cost-effective, and sustainable carbon capture with Sulzer’s expert engineering, cutting-edge products, and end-to-end global support.

Cut your CO2 emissions by 50% with the future of carbon black production

Compliant and innovative

Meets stringent environmental regulations, keeping your business future-ready

Unparalleled flexibility

Produce all ASTM grades and specialty grades seamlessly in a single plant

Sustainable Uses thermal decomposition of aromatic oils for cleaner production

MANAGING EDITOR James Little james.little@palladianpublications.com

SENIOR EDITOR Callum O'Reilly callum.oreilly@palladianpublications.com

EDITORIAL ASSISTANT Ellie Brosnan ellie.brosnan@palladianpublications.com

SALES DIRECTOR Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER Chris Atkin chris.atkin@palladianpublications.com

SALES EXECUTIVE Ella Hopwood ella.hopwood@palladianpublications.com

PRODUCTION MANAGER Kyla Waller kyla.waller@palladianpublications.com

HEAD OF EVENTS Louise Cameron louise.cameron@palladianpublications.com

DIGITAL EVENTS COORDINATOR Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL CONTENT COORDINATOR Kristian Ilasko kristian.ilasko@palladianpublications.com

DIGITAL ADMINISTRATOR Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

JUNIOR VIDEO ASSISTANT Amélie Meury-Cashman amelie.meury-cashman@palladianpublications.com

EVENTS COORDINATOR Chloe Lelliott chloe.lelliott@palladianpublications.com

ADMIN MANAGER Laura White laura.white@palladianpublications.com

CONTRIBUTING EDITORS Nancy Yamaguchi Gordon Cope

SUBSCRIPTION RATES

Annual subscription £110 UK including postage/£125 overseas (postage airmail). Two year discounted rate £176 UK including postage/£200 overseas (postage airmail).

SUBSCRIPTION CLAIMS

Claims for non receipt of issues must be made within 3 months of publication of the issue or they will not be honoured without charge.

APPLICABLE ONLY TO USA & CANADA

Hydrocarbon Engineering (ISSN No: 1468-9340, USPS No: 020-998) is published monthly by Palladian Publications Ltd GBR and distributed in the USA by Asendia USA, 701C Ashland Avenue, Folcroft, PA 19032. Periodicals postage paid at Philadelphia, PA & additional mailing offices. POSTMASTER: send address changes to HYDROCARBON ENGINEERING, 701C Ashland Ave, Folcroft PA 19032.

CALLUM O'REILLY

As summer comes to an end, so too does the season for music festivals here in the UK. Back in June, our largest festival, Glastonbury, welcomed Alanis Morissette to its famous Pyramid Stage for the coveted pre-headliner slot on a Friday evening. It was the first time Morissette had played the festival, and she treated the crowd to a set of her greatest hits, including ‘Hand in My Pocket’, ‘You Oughta Know’ and, of course, ‘Ironic’ – Morissette’s timeless anthem that is, infamously, almost entirely devoid of irony.

No doubt the experts at Wood Mackenzie were humming along to this tune as they penned their latest report, titled: ‘Isn’t it ironic: how Europe’s oil refiners could offer a route to scale green hydrogen production.’ Apologies if I have passed the ear worm onto you, but I promise that the report is well worth a read.1 In a rather paradoxical turn of events, Wood Mackenzie reveals that European oil refining, often seen as emblematic of carbon intensity, could hold the key to unlocking demand growth for green hydrogen.

EU regulations are forcing refiners to decarbonise faster than anywhere else on the planet, and Wood Mackenzie’s analysis suggests that the continent’s refiners are set to become significant producers or buyers of green hydrogen in order to meet this requirement.

The refining sector, alongside ammonia and methanol production, accounts for approximately 98% of all hydrogen demand. But producing this essential ingredient using traditional methods is costly, both from an environmental and economic perspective. European refiners are part of the EU Emissions Trading Scheme, which sees them charged for the CO2 that they emit beyond a certain free allowance. However, producing green hydrogen on-site would eliminate many of the CO2 emissions and, therefore, the carbon costs.

The latest edition to the EU’s Renewable Energy Directive (RED III) provides essential support for green hydrogen adoption as it promotes “renewable fuels of non-biological origin”, which includes green hydrogen. Wood Mackenzie forecasts that European refiners will require around 0.5 million tpy of green hydrogen production to comply with regulations, which would replace approximately 30% of the continent’s fossil fuel hydrogen production, at an investment of more than US$15 billion. Many refiners are now looking to produce green hydrogen on-site to decarbonise their operations and supply fuels compliant with RED III. As Wood Mackenzie points out, both Repsol and TotalEnergies confirmed in recent earnings calls that green hydrogen is the most competitive route to regulatory compliance.

While RED III bodes well for green hydrogen’s near-term growth in the European refining sector, Wood Mackenzie warns that much more is required in order to ensure significant longer-term growth. It outlines three key areas that require further action: costs, technology, and the wider regulatory environment. “Parts of the refining sector can be decarbonised quickly – and at an acceptable cost. But it requires policy intervention to lower green hydrogen production costs and increase the refineries’ offtake. Without such policies, the incentives will not emerge.”

15 South Street, Farnham, Surrey

GU9 7QU, UK

Tel: +44 (0) 1252 718 999

Perhaps the biggest irony here is that in striving to decarbonise through green hydrogen, Europe’s refiners face costs that could make their operations less viable –a paradox that only strong and consistent policy can resolve. Don’t you think?

1. DOUGLAS, M., GELDER, A, and THOMPSON, G., ‘Isn’t it ironic: how Europe’s oil refiners could offer a route to scale green hydrogen production’, (August 2025), https://www.woodmac.com/ horizons/europes-oil-refiners-scale-up-green-hydrogen/?utm_campaign=wm-press-release&utm_ medium=email&utm_source=pr-email&utm_content=horizons-august-green-hydrogen

An Asset Performance Framework Grounded In Operations Reality, And Empowered To Elevate Your Outcomes

• Straightforward configuration and user interface

• Integrated Asset Lifecycle, Production Loss, and Economic Analysis to maximize value and minimize operating and maintenance costs

• Organizational performance enhancements including MOC, Audits, and integrated Risk Assessments

Learn More

The US Energy Information Administration (EIA) expects a significant decline in the price of oil as growth in the global supply of oil vastly surpasses growth in demand for petroleum products.

In its August ‘Short-Term Energy Outlook’ (STEO), the EIA said that it expects the Brent crude oil spot price to average less than US$60/bbl in 4Q25 – the first quarter with average prices that low since 2020.

OPEC+ has announced that it will unwind its oil production cuts by

September 2025, which is a year ahead of its previous schedule. For the first time since EIA began publishing an OPEC+ production forecast in 2023, it expects most global oil production growth to come from OPEC+ countries. EIA forecasts the supply growth will outpace demand, leading to quickly growing inventories.

EIA expects lower oil prices to lead to lower US retail prices for gasoline and diesel and to pull domestic oil production down from the record highs in 2025.

Wood has secured a contract extension to provide maintenance solutions at Ampol’s Lytton refinery in Brisbane, Australia. Under the two-year agreement, Wood will continue to ensure safe, reliable, and efficient fuel production at the refinery by providing maintenance management as well as multi-disciplined technical and brownfield modification field services.

In addition, Wood will deploy maintAI, its proprietary digital maintenance technology, to optimise maintenance strategies at the refinery through AI-powered data analysis. maintAI will identify and prioritise critical activities, reduce non-essential tasks, and enhance asset reliability.

The Lytton refinery is critical to Australian domestic energy security and has the capacity to process 6.5 billion l/yr of crude oil.

Bilfinger has been awarded a major front-end engineering design (FEED) contract from Kuwait National Petroleum Co. (KNPC) for the new North Oil Pier at the customer’s Mina Al Ahmadi (MAA) Refinery in Kuwait.

The modernisation of the oil pier represents a pivotal step in Kuwait’s ongoing efforts to modernise its energy infrastructure.

With the current oil piers at MAA nearing the end of their operational lifespan by 2030 and deemed unsuitable for further rehabilitation, KNPC is taking proactive measures to

secure the future of Kuwait’s petroleum exports. The New North Oil Pier Project, along with upgraded onshore facilities, will ensure the uninterrupted export of the country’s petroleum products well beyond 2030, reinforcing Kuwait’s position as a key player in the global energy market.

Christian Rugland, President Engineering & Maintenance International at Bilfinger, said: “By providing front-end engineering solutions, we aim to enhance operational efficiency and integrate sustainable practices, thereby

Lummus Technology has announced that Vioneo has selected its Novolen® polypropylene (PP) technology for a new grassroots plant in Antwerp, Belgium.

The plant will be part of Vioneo’s complex that, once complete, will be the world’s first industrial scale fossil-free plastics production complex. The complex, based on green methanol as feedstock, will also be highly electrified using renewable electricity and use renewable hydrogen as key components to its operations.

The plant will have a capacity of 200 000 tpy and will use 100% segregated green propylene and ethylene as feedstock to produce a wide range of PP grades. With high-purity feedstock and proven technology, PP will serve as a direct drop-in replacement for fossil-based alternatives. The plastics produced will be fully traceable and CO2 negative, allowing customers to reduce their Scope 3 emissions.

reducing environmental impact and supporting Kuwait’s long-term energy goals.”

The engineering team at Bilfinger Engineering & Maintenance Middle East will provide FEED services, which include site surveys, feasibility studies, conceptual and detailed engineering, cost estimation, and risk assessment, among others.

These aim to help optimise the pier’s operations, minimise resource consumption, and ensure compliance with the highest environmental standards.

21 - 24 September 2025

GPA Midstream Convention San Antonio, Texas, USA

www.gpamidstreamconvention.org

23 - 25 September 2025

1st Annual Aboveground Storage Tank Conference & Trade Show

Long Beach, California, USA www.nistm.org

20 - 23 October 2025

API Storage Tank Conference & Expo Phoenix, Arizona, USA events.api.org/2025-storage-tank-conference-expo

03 - 06 November 2025

ADIPEC

Abu Dhabi, UAE

www.adipec.com

17 - 20 November 2025

ERTC

Cannes, France

worldrefiningassociation.com/event-events/ertc

03 December 2025

Global Hydrogen Conference

Virtual

www.globalhydrogenreview.com/events/global-hydrogen-conference-2025/

09 - 11 December 2025

18th Annual National Aboveground Storage Tank Conference & Trade Show

The Woodlands, Texas, USA www.nistm.org

10 - 12 February 2026

NARTC

Houston, Texas, USA

worldrefiningassociation.com/event-events/nartc

17 - 20 February 2026

Laurance Reid Gas Conditioning Conference Norman, Oklahoma, USA

www.ou.edu/pacs/lrgcc

15 - 17 March 2026

AFPM Annual Meeting

New Orleans, Louisiana, USA www.afpm.org/events

Amajor reconfiguration project is set to begin at ExxonMobil’s Baytown, Texas, US, complex that will increase the production of products such as base stocks and diesel.

The strategic investment is planned to start up in 2028 and will support the continued delivery of essential energy products while allowing greater flexibility to meet future demand.

As gasoline demand declines over time, the need for high quality base stocks and liquid fuels, especially diesel, will remain strong. This investment

allows ExxonMobil to shift production toward these higher-value products. Specifically, the investment enables the expansion of the product offering to include high-quality Group III base stocks, key building blocks for lubricants.

ExxonMobil’s product solutions portfolio is highly integrated, with more than 80% of sites having co-located refining and petrochemical operations. The company has said that it will also evaluate similar reconfigurations at other US Gulf Coast sites.

Chevron Phillips Chemical has completed the expansion of its low-viscosity polyalphaolefins (POA) production unit in Beringen, Belgium, significantly boosting its manufacturing capacity in Europe.

The project has doubled the site’s LV PAO production capacity to 120 000 tpy, establishing it as the largest decene-based LV PAO facility in Europe by volume.

LV PAOs are essential components in a wide array of applications, including automotive and industrial lubricants, as well as emerging technologies such as electric vehicles, wind turbines, and immersion cooling. As industries worldwide seek more sustainable and high-performance solutions, demand for LV PAOs continues to rise.

Nikkiso Clean Energy & Industrial Gases Group (Nikkiso CE&IG) has been contracted by NPG (a joint venture to be formed by Shell and a subsidiary of FOCOL Holdings Ltd) to provide LNG regasification and cryogenic equipment for the New Providence Gas Project in Nassau, the Bahamas.

The project involves an LNG receiving terminal in support of additional power generation at Clifton Pier. It aims to deliver lower-carbon infrastructure by using

LNG to feed new and retrofitted gas turbines which previously used diesel. Nikkiso CE&IG will manufacture and deliver the LNG packaged regasification system, which includes high-pressure submerged centrifugal pumps installed in a modular pump skid; a gas-fired water bath vaporiser and associated power distribution and control systems; an insulated pipeline featuring Nikkiso CE&IG’s vacuum jacketed system; and site critical ancillary equipment. The company will also provide engineering services in support of the project.

Gordon Cope, Contributing Editor, considers how the pressure from the US administration has prompted Canada and Mexico to reconsider the continent’s energy infrastructure.

North America has benefitted from the integration of crude, natural gas, and refined fuels between Canada, the US, and Mexico for the better part of a century. Producers, pipeline companies, refineries, and petrochemical plants can choose the most efficient and cost-effective way of delivering energy and related goods irrespective of international borders. In practice, this has meant billions of dollars in savings.

Since the election of President Trump, however, this has faded away. In February 2025, the White House issued energy tariffs against Mexico, Canada, and other nations. While the tariffs were followed by temporary stays of execution, the mere threat has forced both neighbouring jurisdictions to take a look at a relationship founded on trust. Several major changes are likely to emerge over the next few years.

In 2024, Canada exported approximately 4.4 million bpd of crude and 8 billion ft3/d of natural gas, primarily to the US West Coast, Midwest, and the US Gulf Coast. The US, in turn, supplied 300 000 bpd and 2.8 billion ft3/d of gas to Eastern Canada. The US also supplied about 7 billion ft3/d of gas and 1.2 million bpd of diesel and gasoline to Mexico. The primary factors governing the transactions were economic, such as supply, demand, and costs of transportation.

Canada is especially susceptible to Trump’s geopolitical manoeuvrings. It relies on the US as its primary energy customer, shipping over 85% of its crude and half of its gas to American consumers. While the reason for this dependency is primarily due to economic forces, national politics have also played a role.

Almost two decades ago, Enbridge proposed Northern Gateway, a 525 000 bpd pipeline that would transport diluted bitumen from Alberta to the Pacific port of Kitimat, British Columbia, Canada. In 2017, the Trudeau government cancelled this to assuage environmental critics, citing the dangers of marine shipments to west coast waters.

In 2013, TC Energy proposed re-purposing the natural gas mainline that ran from Alberta eastwards across Canada to Ontario, creating the 4000 km Energy East network to deliver up to 1.1 million bpd of crude all the way to tidewater in New Brunswick. The project quickly met stiff opposition from environmental groups, First Nations, and the province of Quebec, resulting in the company shelving the plan in 2017.

When the threat of US energy tariffs arose, pundits called for the resuscitation of the projects. But Enbridge has expressed little interest in revitalising Northern Gateway, citing a horde of restrictive federal regulations that would have to be repealed in order to justify the investments needed to build the line. Likewise, TC Energy has expressed no interest in renewing its proposal, having spun off its oil transportation business in order to concentrate on natural gas opportunities in the US and Mexico.

On a positive note, the expansion of the Trans Mountain pipeline (TMX) finally entered service. When the TMX project was originally announced by Kinder Morgan in 2012, expansion of the 300 000 bpd line that ran over 1000 km from Alberta to tidewater in British Columbia would cost CAN$5 billion and add almost 600 000 bpd capacity. Opposition from the government of British Columbia, First Nations, and environmental groups forced Kinder Morgan to sell the project to the federal government. While costs ballooned to CAN$34 billion, the line now has the capacity to ship almost 900 000 bpd to the Pacific market.

The newly-elected government of Canadian Prime Minister Mark Carney also campaigned on the need to diversify energy markets. While onerous federal legislation governing tanker movements on the West Coast alongside strict community and First Nations consultations hamper the development of new pipelines, TMX could relatively quickly add another 300 000 bpd capacity by installing new pumping stations and adding drag-reducing agents.

A new market for Canadian gas is also opening up. After lagging behind the US for two decades in the development of LNG export plants, Canada is belatedly realising their value. Because Pacific-coast projects are situated thousands of kilometres closer to Asian markets than those in the US Gulf Coast, transportation costs are far lower, and thus more competitive. LNG Canada, Shell’s massive 14 million tpy complex in the Pacific port of Kitimat, began delivering LNG in 2025. It is being followed by nearby Cedar LNG, which will use a floating liquefaction plant to produce 4 million tpy by 2028.

The government of British Columbia, a long-time opponent to fossil fuel development, is now promoting the 12 million tpy Ksi Lisims LNG project, the 3 million tpy FortisBC plant, and the 2.1 million tpy Woodfibre LNG project. Feedstock for the plants will come from the massive unconventional gas reserves in Northern British Columbia and Alberta.

Regardless of tariffs, US refiners will continue to buy Canadian crude. The majority of the 4.4 million bpd of heavy oil shipped to the US is in the form of ‘dilbit’, where the viscous output from the oil sands is thinned with a diluent to make it transportable by pipeline. Refineries in the US Midwest (PADD 2), which account for over 20% of American refining, are precisely configured to take the relatively inexpensive feedstock; swapping to lighter, more expensive shale crude from Texas would require billions of dollars in retrofits. It is therefore very unlikely that PADD 2 refineries would abandon Canadian crude; in fact, Enbridge announced plans in March 2025 to expand its mainline network into the US, spending CAN$2 billion to add up to 300 000 bpd capacity by 2027.

Mexico is also vulnerable to energy geopolitics. Over the last decade, state-owned electricity monopoly CFE has been converting its generators from bunker fuel to natural gas, tapping into cheap, abundant sources in Texas, US. It imports around 7 billion ft3/d; long-term plans call for doubling that amount as LNG plants in various stages of design and construction come on-stream.

Mexico has had previous experience with the White House interfering in energy matters; when the Biden administration announced a pause in LNG approvals in order to assess their environmental impact, the move side-swiped LNG projects in Mexico. While Trump cancelled the pause upon his inauguration, the Mexican government has little doubt that the US administration could leverage its dependency on US energy imports for political gain. In order to reduce the threat, Mexico’s President Sheinbaum also announced plans for Pemex to increase its current domestic production from 3.3 billion ft3/d to 5 billion ft3/d by 2030 through a multi-billion dollar exploration and drilling programme.

Pemex is also belatedly spending funds to rejuvenate its existing six refineries and increase output. Theoretically, the state-owned company has enough capacity to meet all domestic needs for diesel and gasoline, but a combination of theft, mismanagement, and neglect has seen utilisation drop below 50%. To help ween Mexico off imports, former president Andrés Manuel López Obrador (AMLO)

Process heavier FCC feedstocks without compromise. Grace’s FUSION® catalyst technology transforms heavy resid operations. It’s built on a breakthrough process platform and a proprietary matrix binding system that fuses two of Grace’s most advanced technologies into a single-particle powerhouse.

FUSION® delivers unmatched coke selectivity and bottoms-cracking performance, enabling refiners to run heavier, higher-metal feedstocks without added catalyst or circulation bottlenecks.

Units running FUSION® operate with Ecat metals levels exceeding 12,000 ppm Ni+V.

Talk to your Grace representative to learn how FUSION® can handle your heaviest feedstocks.

championed a new refinery, the 340 000 bpd Dos Bocas facility in the state of Tabasco. The project (also known as Olmeca) has been beset by delays and price inflation from the original estimate of US$8 billion, to over US$20 billion. In addition, the company used plans that had been drawn up several years ago, and the specifications are antiquated and not suited to the coastal site. So far, output has been below 50 000 bpd, but the uncertainty engendered by Trump will likely incentivise the current administration of President Sheinbaum to iron out production bottlenecks. Other nations further afield are working to leverage White House policy to their advantage. In January 2025, the US Department of Energy (DOE) officially backed the development of LNG in Alaska. The Alaska Gasline Development Corp. (AGDC) seeks to commoditise up to 34 trillion ft3 of gas that is stranded on the North Slope adjacent to the Prudhoe Bay field. The US$44 billion project would require an 800 mile mainline capable of delivering up to 3.3 billion ft3/d to the Pacific port of Nikiski, where a liquefaction plant would produce up to 22 million tpy of LNG for export to Asia. Japan is urging Tokyo-based Mitsui to invest; the massive conglomerate would bring LNG technology and marketing skills to the project.

Tariffs on steel and aluminium are having a detrimental effect on the LNG sector. Export plants are heavily dependent on specialty cryogenic metals that can withstand temperatures of -160°C; adding up to 50% to costs compounds the burden of labour wage pressures. Additionally, LNG projects need committed, long-term buyers; Trump’s willingness to unilaterally alter trade agreements motivates potential international clients to look to non-US suppliers, like Canada, Qatar, and Australia.

In June 2025, the US administration cancelled US$3.7 billion in awards to 24 green energy projects. The Office of Clean Energy Demonstration had made the awards under the Biden administration to help companies develop new technologies that reduce carbon emissions. One of the awards cancelled was US$332 million to ExxonMobil’s Baytown, Texas, refinery project, where the company was creating green hydrogen to replace natural gas in the production of ethylene petrochemical feedstock. Environmental advocates decried the move as short-sighted; the Center for Climate and Energy Solutions estimated that the cuts could result in the loss of 25 000 jobs and US$4.6 billion in economic output. Trump’s attitude toward the environment may also affect investment decisions on carbon reduction. Many major energy companies are heavily committed to clean hydrogen and carbon capture and storage (CCS) projects to lower their carbon footprint, especially after the Biden administration established subsidies of up to US$3/kg for green hydrogen, as well as US$12 billion in aid for CCS in the Inflation Reduction Act (IRA). Now that the White House and Congress are controlled by Republicans, the loss of subsidies would have made most low-carbon projects economically nonviable; a last-minute, 2-year extension in the Trump administration’s latest budget provided temporary relief.

Still, worrying trends are starting to emerge. In March 2025, Nippon Sanso Holdings Corp. announced that it would be cancelling its hydrogen plant in Mobile, Alabama, US. The plant, which was under construction, was expected to produce 30 million ft3/d of low-carbon hydrogen for use in making 75 000 bpd of renewable diesel.

In April 2025, Dow announced that it would be delaying construction of its Path2Zero project at its existing site in Fort Saskatchewan, Alberta, Canada. Phase 1 of the CAN$9 billion expansion would have added 1.3 million tpy of polyethylene production capacity to existing facilities, and phase 2 a further 600 000 tpy by the end of the decade. The project included 1 million tpy of carbon capture and sequestration equipment. Dow cited slumping market demand as the main reason for its decision.

In May 2025, Air Products announced that it would be selling a portion of its planned Louisiana Clean Energy Complex, located in Ascension Paris, Louisiana, US. The plant is designed to produce low-carbon hydrogen and ammonia by capturing and sequestering the CO2 emitted from burning natural gas. The company announced it would be selling the carbon capture and ammonia production components, citing a desire to de-risk the investment.

ExxonMobil is moving cautiously forward with its Baytown project, which is designed to produce 1 billion ft3/d of blue hydrogen by capturing and storing 98% of the CO2 produced.

Europe, which entered crisis mode when natural gas from Russia was cut off after the invasion of Ukraine, is developing a hydrogen economy in order to ensure security of energy supply and to meet environmental goals of net zero emissions by 2050. Canada faces no gas shortage, but does have a federal goal of net zero by 2050. Ottawa is encouraging hydrogen as one of a number of environmental initiatives, but it is unlikely to reach the EU’s target of over 20 million tpy of green hydrogen production by 2050. Under the Trump administration, the US may see stagnation if the subsidies and tax credits necessary to create a low-carbon economy continue to be withdrawn.

In conclusion, the integrated energy network that was the envy of the world will be a thing of the past as geopolitical considerations trump market forces. Over the next decade, Canada will invest billions of dollars to restructure its pipeline system, seeking out new markets in Asia and Europe, in order to reduce its massive reliance on the US as a customer. Mexico will continue to import Texas gas, but it will explore and develop new domestic sources and build renewable solar and wind farms to diversify its sources of electricity. It will also strive to rectify problems in its downstream sector in order to reduce fuel imports from the US Gulf Coast. On the low-carbon energy front, the EU and other jurisdictions in Asia and the Middle East will establish market dominance over their American counterparts. While Trump will eventually leave the White House, the consequences of his policies will likely resonate within the continent for decades to come.

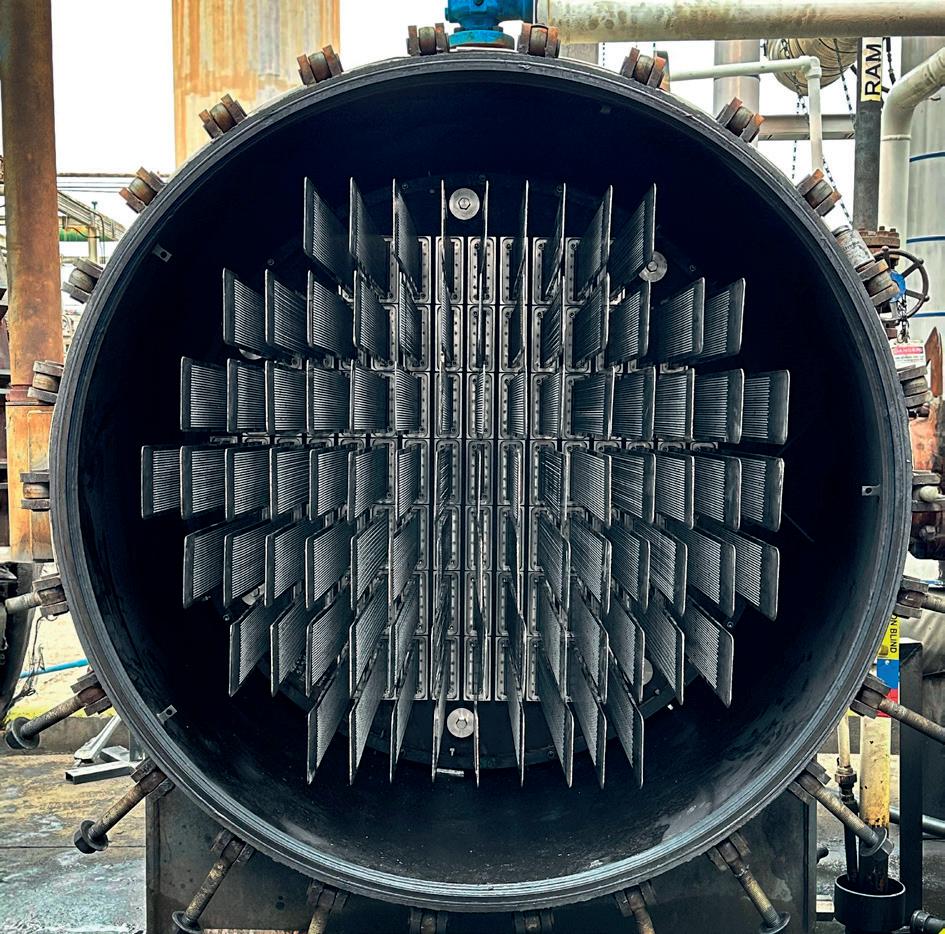

Quan Yang, Ming Yang Lee, Laurent Zuber, and Jiao-Jiao Dong, Sulzer Chemtech, Switzerland, alongside Feng-Jie Xu and Feng-Hua Zhou, China National Air Separation Engineering Co., explore how to effectively mitigate liquid maldistribution through crude argon (CAR) column design.

Air contains approximately 78 vol% nitrogen, 21 vol% oxygen, and 1 vol% argon. It is often desirable to produce a pure argon stream in air separation units (ASUs). In the low-pressure (LP) column, argon concentration peaks at 8 - 15 vol% in the middle section. Consequently, a gaseous stream is drawn from this section and fed to the bottom of the downstream crude argon (CAR) column. In the CAR column, argon is the top product, whereby oxygen is reduced at or below 1.5 ppm-vol. Due to the close boiling points of argon and oxygen, and the high purity required, the CAR column operates with up to 200 theoretical stages (NTS) and a reflux ratio of up to 40. The CAR column is therefore considered as a super fractionator in the industry.

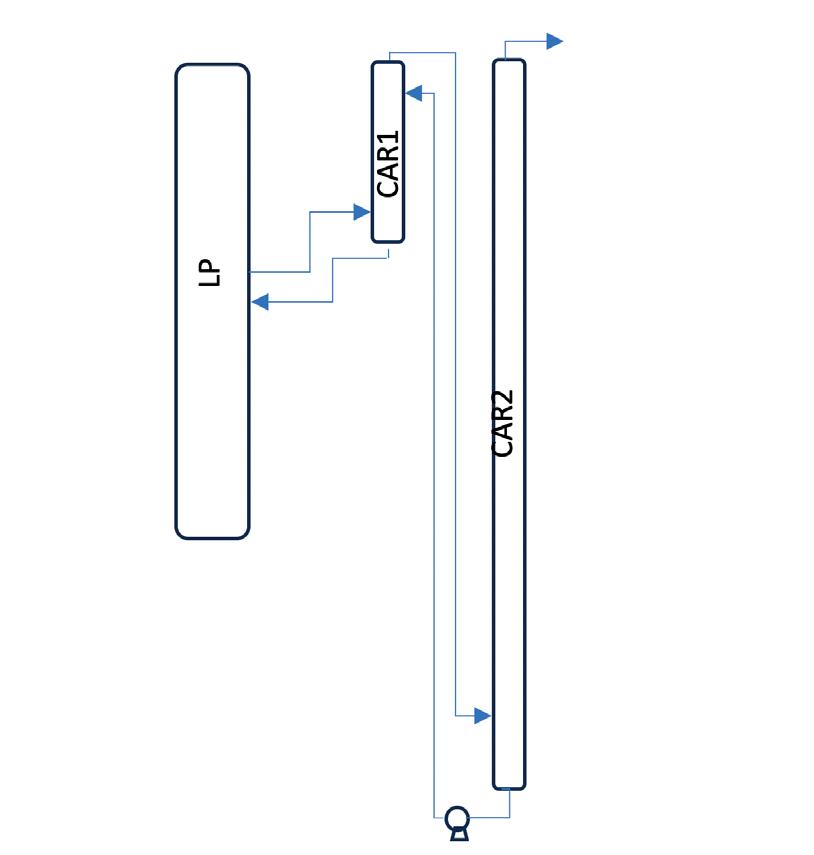

The CAR column is often physically split into two columns due to height constraints imposed by the cold box surrounding the cold section of the ASUs. Figure 1 shows the dual-column design, which necessitates a cryogenic pump, some instrumentation, as well as tortuous and large piping catering for thermal expansion and

contraction due to an up to 200°C change in temperature during start up and shutdown. In recent years, the industry is increasingly moving towards a single column solution. While this reduces overall capital expenditures (CAPEX) and enhances space efficiency within the cold box, innovations on mass transfer equipment is required, including the structured packings and column internals.

The industry has observed a decline in the separation performance of long packed beds, with laboratory research reported in 1993.1 The tests confirmed that the packing efficiency deteriorates as the bed length increases. It is now understood that, despite an effective initial liquid distribution by the liquid distributor, the liquid tends to segregate and maldistribute as it flows down the bed, worsening along the bed length. Today, standard industrial practice limits the number of theoretical stages in a packed bed to between 15 - 20. A liquid redistributor

placed between two packed beds, without intermediate feed or product streams, primarily corrects liquid maldistribution and improves liquid mixing, thus reducing radial concentration gradients caused by uneven liquid distribution.

With 200 NTS, the CAR column must be split into multiple sections to maintain the separation efficiency of the packing. However, liquid collectors and redistributors increase the column height. To keep the overall height of the column short, particularly to arrive at a one-column solution, process engineers are compelled to minimise the number of packed

beds to reduce the number of redistributor sets, each up to 1.5 m in height. Table 1 illustrates the decision-making process.

The 8-bed Option A is commonly used in CAR columns, even though it features 25 NTS per bed, which exceeds the standard range of 15 - 20 used in general applications. The preference for reducing the number of beds is understandable, but it introduces process risks. Despite advances in CAR column design, unpublished reports of periodic underperformance are communicated within the industry. In order to prevent insufficient separation performance, the bed height of the 8-bed configuration has gradually increased by up to 20%, by adding more packing layers within each bed. However, this approach can result in an overall column height greater than that of other options, potentially exacerbating the very issues it seeks to address. Furthermore, increasing bed height to counteract loss of NTS due to liquid maldistribution in an already long bed may not be an effective solution.

Process studies are showing the sensitivity of a CAR column to liquid maldistribution and the NTS per packed bed. Rather than further increasing bed heights in an 8-bed configuration, preferred column configurations are presented to design the CAR column.

To quantify the impact of liquid maldistribution on separation efficiency, a method2 using a two-column model was introduced in the 1980s. This methodology is now widely used by both researchers and industry professionals in various applications, including columns operating under tilt and motion conditions, e.g., FPSOs.3,4

A CAR column with 200 NTS serves as the basis for this study. Due to the condenser at the top, this column has a single degree of freedom, meaning the product and reflux rates cannot be independently adjusted. The crude argon product at the top is set at 2200 Nm³/h, with a feed rate of 70 000 Nm³/h (F) at the bottom. Simulations show that 90% of the oxygen in the gaseous feed is removed, achieving a 1 ppm purity level at the top. The internal liquid load at stage 175 is calculated to be 71 032 Nm³/h (L). For simplicity, a maldistribution sensitivity study is performed only for the lowest bed of the CAR column.

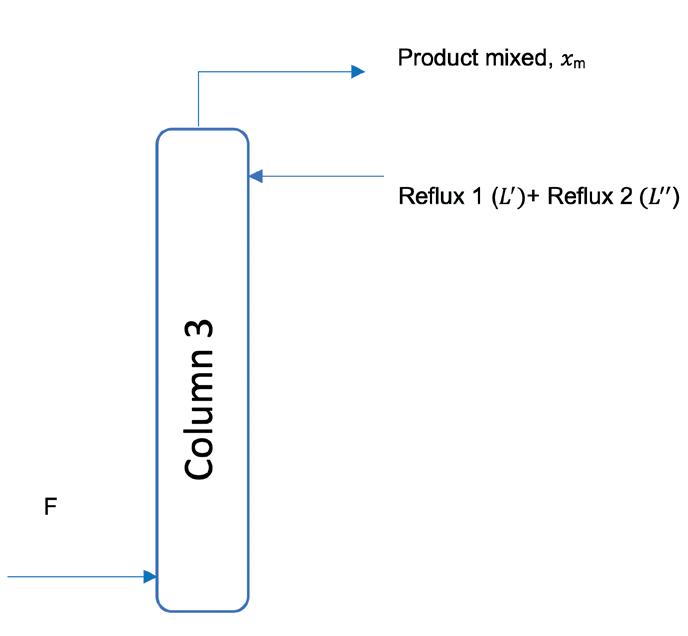

A two-column model is set, as shown in Figure 2. The CAR column lowest bed is simulated as two parallel beds of the same height and half of the section area. The columns receive an equal split of the vapour feed at 35 000 Nm³/h each at the column bottom. The liquid flow to the column top, which is the internal liquid load at stage 175, is

it to us!

Our technologies offer everything you need for process, hydrostatic, and differential pressure for process automation. Around the world, VEGA pressure solutions stand for proven reliability and trend-setting innovation. Our pressure measurement solutions go beyond just efficient, optimised processes – they provide you with peace of mind, knowing that you’ve chosen the best technology available. Everything is possible. With VEGA.

unevenly split to simulate liquid maldistribution (Table 2). Column 1 receives less liquid (L’), while Column 2 receives more liquid (L”).

The maldistribution parameter λ is defined by the relative difference of the liquid stream: (where L = L’’ + L’)

Consequently, the purities of the vapour products from Columns 1 and 2 of Figure 2 differ, represented as x1 and x2 respectively. The two product streams (Product 1 and Product 2) are then combined, and the average concentration of the mixture (x m) is determined.

The final step involves determining an ‘apparent’ NTS value, which quantifies the efficiency loss due to liquid maldistribution. The bottom bed is then simulated as a single column (Column 3), and its NTS is adjusted until the product purity matches the mixed concentration x m .

This study is repeated considering three scenarios: 20 NTS, 25 NTS, and 28 NTS in the bottom-most bed.

The bottom-most bed is the most sensitive one to liquid maldistribution compared to the top seven beds, hence this represents the worst-case scenario for a packed bed in the CAR column. The cumulative effect of liquid maldistribution across all eight beds has not been considered in this study.

Results and discussions

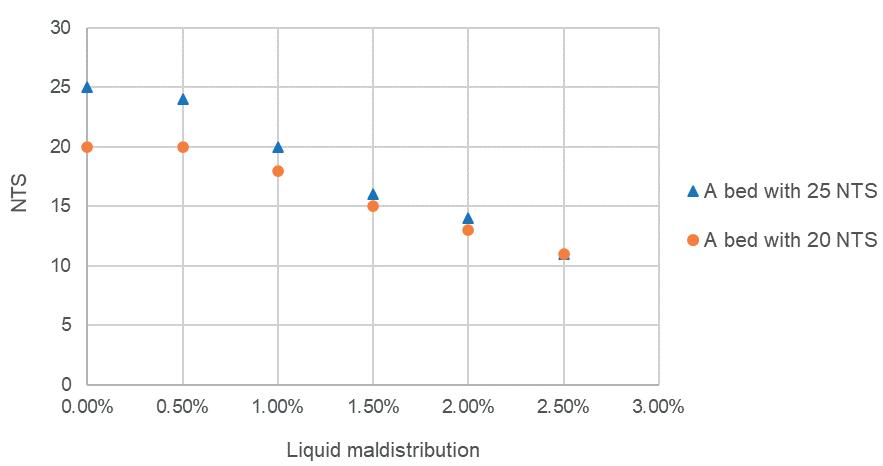

Figure 3 compares the maldistribution sensitivity of the bottom-most bed with 25 NTS (Case 1) vs 20 NTS (Case 2), while varying liquid maldistribution from 0 - 2.5% in 0.5% increments.

At 0.5% maldistribution, Case 1 loses 1 NTS, whereas Case 2 is mostly unaffected. As maldistribution increases to 1.0%, Case 1 loses 5 NTS, while Case 2 loses only 2 NTS. The disparity in lost NTS between the two cases grows with increasing maldistribution, reaching a 5 NTS difference at 1.5%, at which point the benefit of having 5 more NTS in the design phase disappears.

Figure 4 examines the effectiveness of adding extra packing height to mitigate maldistribution risks in an 8 bed CAR column, where each bed contains 25 NTS. An additional height of packing is added, expected to contribute 3 extra NTS. As shown in Figure 4, at 0.5% and 1.0% maldistribution, this added packing height contributes with 2 and 1 additional NTS, respectively. However, when maldistribution exceeds 1.5%, the extra height does not improve performance at all.

The key observations from these studies are:

n The lower section of the CAR column exhibits high sensitivity to liquid maldistribution.

n In long beds, the impact of liquid maldistribution intensifies.

n Adding extra packing height to mitigate liquid maldistribution risks becoming ineffective beyond a certain threshold.

It should be noted that besides inherent liquid maldistribution along the bed, even more severe maldistribution can be caused by other factors, such as inconsistencies in packing uniformity or excessive liquid by-passing the packed bed along the column wall. Issues with column internals, like blocked liquid discharge holes, or unevenly levelled redistributors and poor verticality of the column, especially in large-diameter columns, can also contribute to severe liquid maldistribution.

In this study, the bottom-most section of the CAR column is isolated, and interactions among beds were not considered. It is important to note that various types of redistributors exist on the market, and some mix the collected liquid better than others. Poor liquid mixing between the beds worsens the radial liquid concentration differences in each bed, as it lets it propagate to the beds below.

Based on these findings, splitting the column into 8 beds with 25 NTS each introduces process risks due to liquid maldistribution. Introducing additional packing height as a design margin has limited ability in increasing the NTS achieved. It is, however, possible to improve the CAR column designs for more robust and effective column operations.

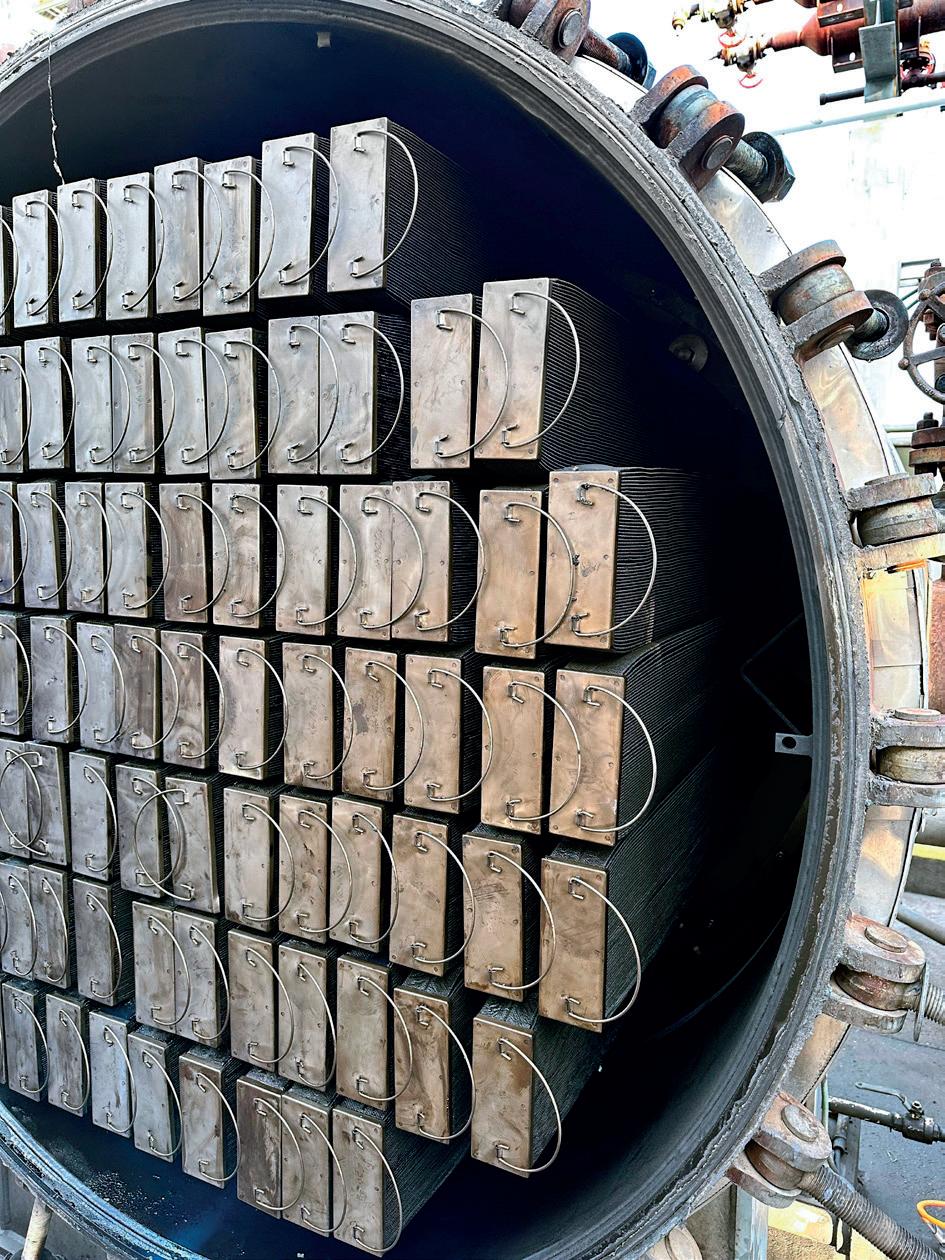

Figure 5. Various types of liquid redistributors: a standard type (left), a pan-type (middle), and a 3-in-1 type (right).

Table 3. Possible configurations for the CAR column

Sensitivity to liquid maldistribution Base High

* Between the top of the first bed and the bottom of the lowest bed

It was previously mentioned in this article that a redistributor set between two packed beds requires 1.5 m in height for the CAR column size considered in this study. This refers to the traditional standard design (Figure 5 left) comprising a packing support grid, a liquid collector, a support ring, sometimes a mixing box, and a trough-type liquid redistributor. This design offers the best minimisation of liquid maldistribution, equalising radial hydraulic and concentration gradients before redistribution to the packed bed below. However, this design is being phased out in the CAR column due to the tall height, leading to a dual-column design.

To achieve single-column designs, a pan-type redistributor is often used instead (Figure 5 middle), which can be installed at heights as low as 400 mm. It collects liquid but does not feature any liquid mixing; hence only equalises hydraulic gradients and not concentration gradients. Furthermore, it tends to have a lower distribution quality compared to the trough-type traditional redistributor shown in Figure 5 left. Therefore, CAR columns built with conventional pan-type redistributors can become prone to liquid maldistribution and suffer from a deterioration in the separation efficiency. Such columns seem to lose NTS during operation.

To solve this challenge, Sulzer has developed a 3-in-1 redistributor which performs liquid collection, mixing, and redistribution similar to the traditional standard design, while offering an average height 500 mm shorter than the traditional standard redistributor (Figure 5 right).

Because the CAR column height must be minimised, structured packing with high separation efficiency is specified for the CAR column. The MellapakPlusTM 752.Y is often the preferred structured packing for the CAR column, as it has the highest separation efficiency in the MellapakPlus family.

Since the CAR column has a low vapour load compared to the LP column, there is an opportunity to optimise the structured packing for the CAR column, focusing on efficiency more than capacity. Therefore, Sulzer recently developed the MellapakTM Air structured packing, which can offer up to 20% more efficiency compared to MellapakPlus 752.Y.

By incorporating the 3-in-1 redistributor and/or the Mellapak Air structured packing, new possibilities to configure the CAR column are unlocked while maintaining the single-column design and increasing the robustness of the column performance.

As can be seen in Table 3, a simple upgrade from the pan-type redistributor to the 3-in-1 redistributor in an 8-bed configuration already offers better liquid mixing and redistribution at a modest increase in column height. However, using 9 beds of Mellapak Air with 3-in-1 redistributors offers the best solution to assure column performance while minimising the column height.

The design of the CAR column remains a complex engineering challenge due to the close boiling points of oxygen and argon, and the extremely high purity requirements. Traditional design choices – such as limiting the number of packed beds to minimise column height – come with trade-offs in efficiency, particularly when bed lengths exceed 20 theoretical stages. This study has demonstrated that long beds are especially sensitive to liquid maldistribution, and that increasing packing height alone provides diminishing returns, especially beyond a certain maldistribution threshold.

The findings emphasise that effective mitigation of liquid maldistribution requires more than just conservative design margins. Instead, innovations in column internals – particularly improved redistributor designs and high-efficiency structured packing – offer a more robust solution. Overall, a careful rethinking of both internals and configuration allows for a better-performing, single-column CAR design that meets industry demands for purity, reliability, and compactness.

1. Fractionation Resarch Institute, ‘Progress Report: November/December Issue’, (1993).

2. YUAN, C.H., and SPIEGEL, N.H., ‘Theoretical and Experimental Investigation of the Influence of Maldistribution on the Performance of Packed Columns at Partial Reflux’, Chemie Ingenieur Technik, Vol. 54, (1982), pp. 774 - 775.

3. DUSS, M., and ROZA, M., ‘Columns Subject to Motion: Maldistribution Sensitivity and Susceptibility’, 10th International Conference on Distillation & Absorption, Germany, (14 - 17 September 2014).

4. ZUBER, L., and ROZA, M., ‘How to design distillation columns for moving conditions’, AIChE Spring National Meeting, Houston, US, (April 2001).

5. JAFARI., S., et al, ‘CFD study of mixing performance of redistribution systems for packed columns’, Hydrocarbon Processing, (June 2017).

6. MORILLO, E., and YANG, Q., ‘Optimized height is key for cryogenic ASU column design’, BIC Magazine, (September/October 2023).

Mellapak™ is the most widely used structured packing worldwide introduced by Sulzer in 1977.

The newest generation MellapakCC™, structured packing specifically developed for carbon capture, decreases operational costs through improved carbon dioxide capture, absorbing it more efficiently from flue gas streams of fossil-fueled power plants.

Sulzer MellapakCC™ significantly reduces the column size and the pressure drop across the carbon dioxide absorber, thus reducing capital and operational expenses and minimize the energy consumption. Carbon capture and storage or utilization (CCS/CCU) is a key strategy that businesses can adopt to reduce their CO2 emissions. By selecting the right technologies, pressing climate change mitigation targets can be met while benefitting from new revenue streams.

This packing is currently applied in several leading CCS/CCU facilities worldwide, delivering considerable process advantages. By partnering with Sulzer Chemtech – a mass transfer specialist with extensive experience in separation technology for carbon capture – tailored solutions that maximize return on investment (ROI) can be implemented. With highly effective CCS/ CCU facilities, decarbonization becomes an undertaking that can enhance sustainability and competitiveness at the same time. sulzer.com/chemtech

A podcast series for professionals in the downstream refining, petrochemical, and gas processing industries

Sponsored by

EPISODE 10

Lara Swett, Vice President of Technical & Safety Programs, American Fuel & Petrochemical Manufacturers (AFPM), explains how the downstream sector continues to improve its process safety record.

EPISODE 11

Graham Faiz, Head of Digital Energy, DNV, explores the current state of digitalisation in the energy sector and the key drivers behind digital transformation. Graham explains how companies can move from pilot projects to full-scale deployment of AI and digital tools.

EPISODE 12

Omar Sayeed, Centre of Excellence Leader for Reliability, and Rahul Negi, Director of AI and Industrial Autonomous, Honeywell Process Solutions, consider how new, innovative technology can help to overcome some of the challenges facing the downstream oil and gas sector.

EPISODE 13

Sarah Miller, President and CEO of the GPA Midstream Association and CEO of the GPSA, outlines the vital importance of midstream operations, and some of the key challenges and opportunities facing the sector.

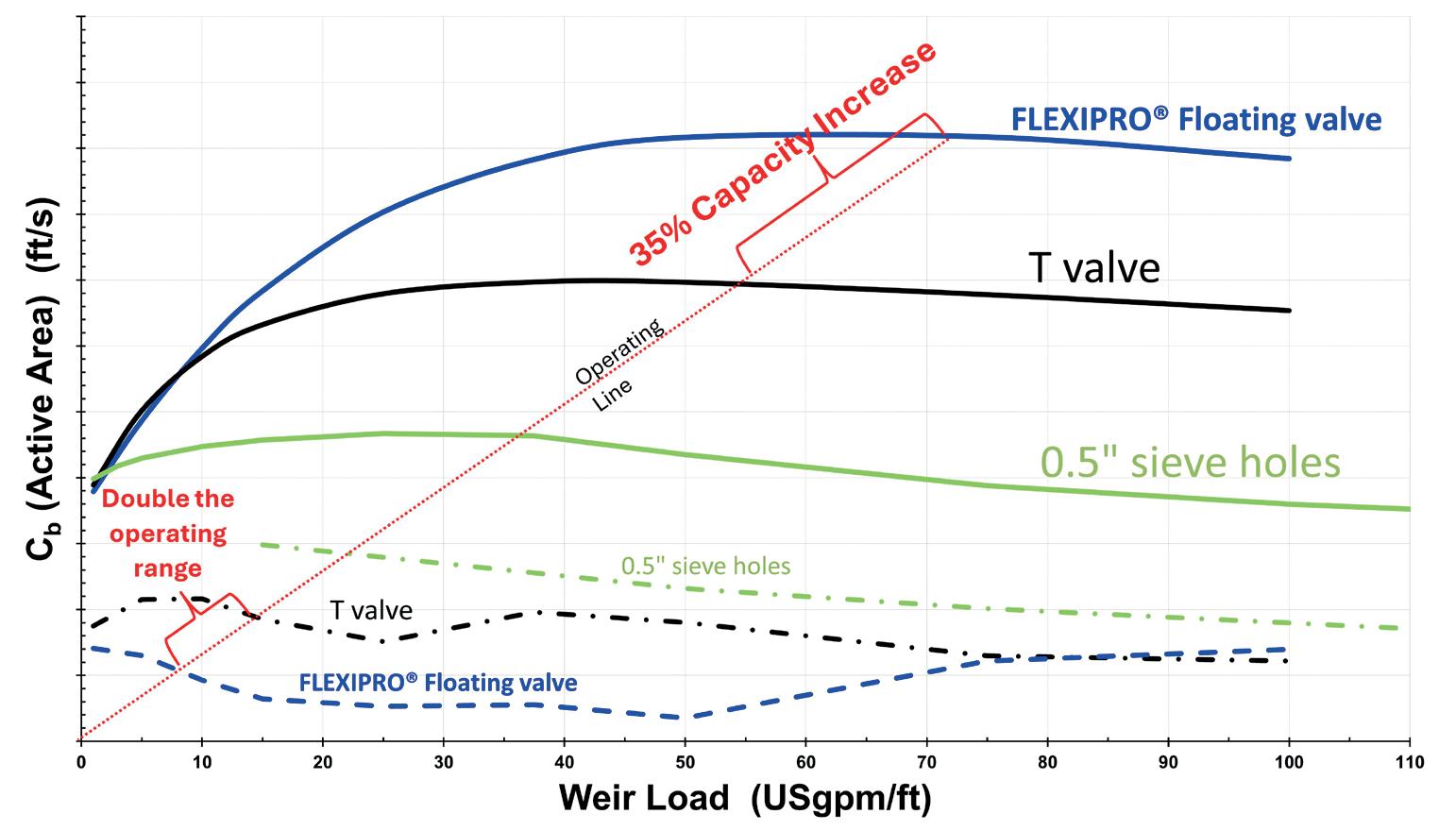

Emily Ruhl and Michael Krela, Koch-Glitsch, USA, explore the development of distillation tray valve types and consider how operators can best align valve selection with current demands and future challenges.

As the refining and chemical industries evolve, so does the focus on maximising energy efficiency and operational capacity. Distillation accounts for approximately 40% of energy consumption in refining and chemical processing1 and 6% of total energy use in the US.2 The design of distillation internals, particularly the selection of tray valve types, is an important decision that can strongly influence the energy efficiency and capacity goals of a plant. A poorly operating tower can significantly increase its energy consumption. Understanding how different valve types perform under varying conditions can simplify valve selection decisions and better align column design with long-term energy and capacity goals.

Distillation trays have been used for centuries, with the earliest consisting of simple holes in the deck (sieve trays). Another early design was the

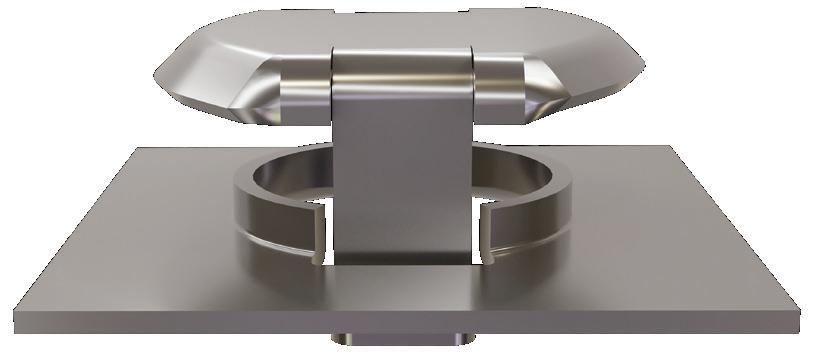

‘bubble cap’, a large, formed cap patented by Cellier-Blumenthal in 1815.3 Both devices served the industry for over a century, with the bubble cap tray used in services with a wide operating range. In the 1950s, movable valve trays were developed. These were smaller devices than bubble caps and improved on sieve trays with additional capacity and turndown by providing a cover over the hole. In the early 1990s, valves that are punched directly from the deck material were developed, which enhanced both capacity and reliability. In recent years, valve performance has been further optimised, and several new valve devices have been developed to increase capacity and efficiency compared to earlier generations.

Valve performance is directly related to the active area performance of the tray. While the valve type has some effect on the downcomer performance, the main impact of valve

performance is on the deck area. Tray efficiency depends on effective vapour and liquid interaction, which is achieved through uniform contact across the tray and thorough mixing at the deck level. Any inefficiencies in vapour and liquid contact across the tray will result in a greater energy requirement to make the separation, leading to energy inefficiency which is counter to plant sustainability goals.

The upper limit of efficient operation is defined by jet flooding, which is where a large percentage of the liquid hits the tray above (entrainment). Eventually, this leads to the column filling with liquid which makes the column inoperable.

Weeping, the lower limit of efficient operation, occurs when there is insufficient vapour pressure and liquid falls down onto the tray below through the openings in the deck, bypassing the contacting area on the tray. Weeping at the inlet of the tray is the worst type since the liquid misses contact on two tray levels, dropping near the downcomer below. This can cause inefficiency at minimum rates where more energy is required to maintain the vapour pressure and keep the efficiency at an operable level.

The feature set of an active device will have a direct influence on its performance. By examining the specific features a device has, operators can directly correlate this to the performance in the tower.

The most basic deck device is the sieve hole. This is simply a hole in the deck without any added features to direct vapour flow or prevent liquid from weeping through the opening.

Movable valves, such as type T valves, have a cage and moving valve cap over the deck hole. This gives the hole some protection from liquid weep at low vapour rates and blocks the hole as the valve closes.

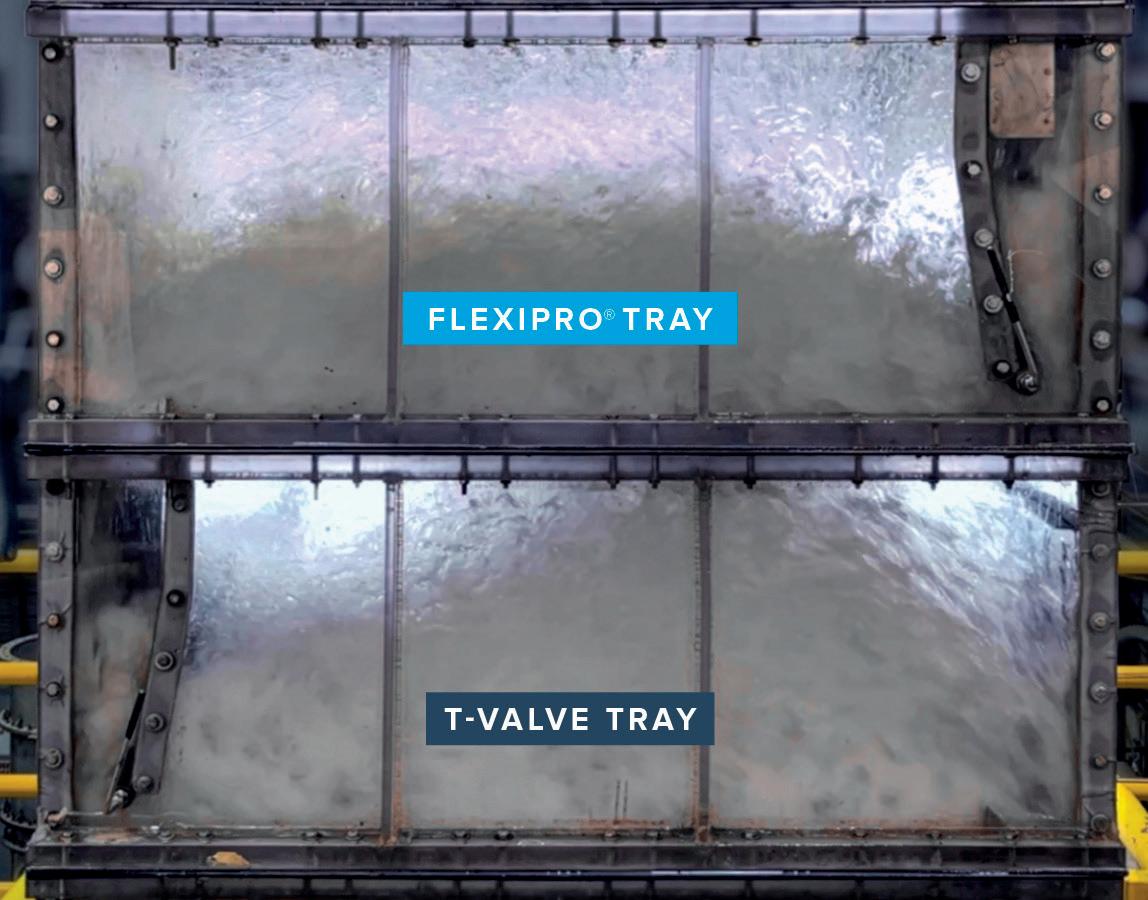

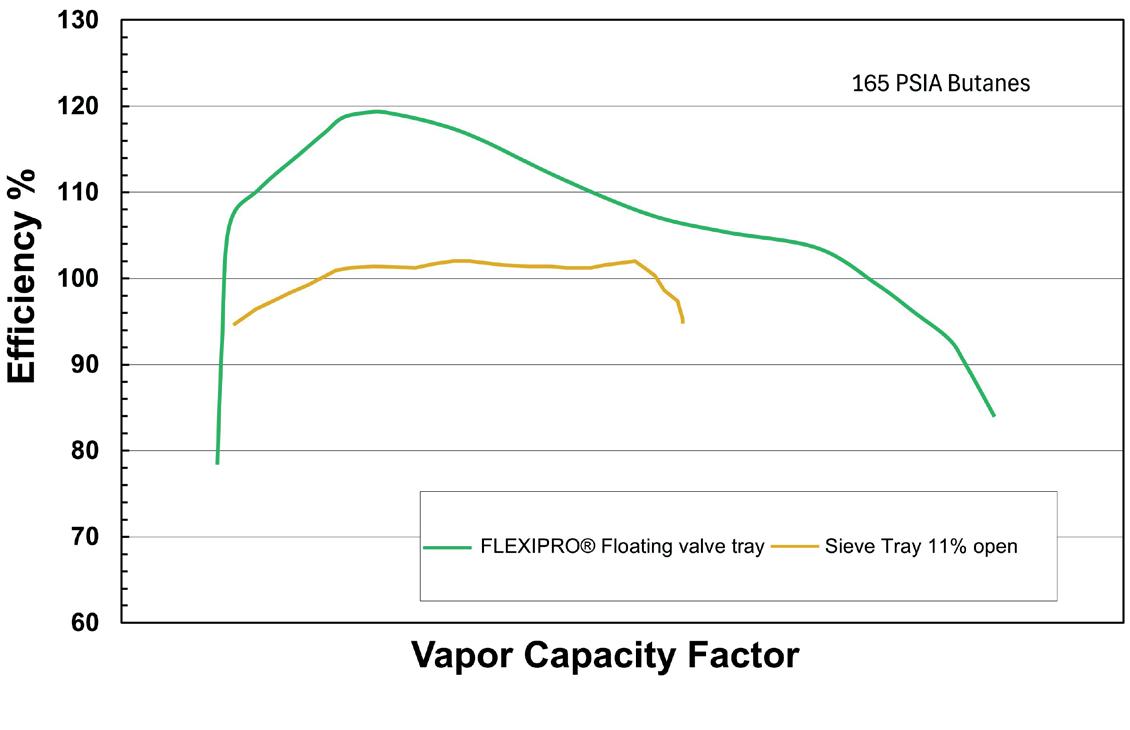

The latest generation of valves have a variety of features to enhance efficiency, capacity, and turndown performance. FLEXIPRO® floating valve trays have a shaped cap that directs the vapour flow to leave the valve in a downward fashion. The valve shape, with a narrower downstream leg, helps create a forward pushing action which helps minimise gradients in the froth. The hole is extruded upward, creating a barrier to help prevent liquid from weeping through the hole. The floating valve also includes a moving cap that is able to close at reduced vapour rates to improve vapour distribution and further prevent the liquid from weeping through the cap (Figure 1).

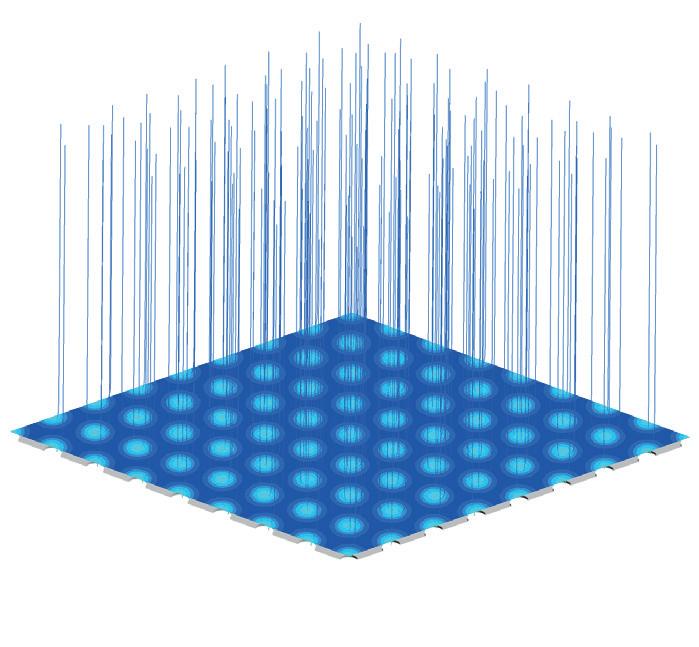

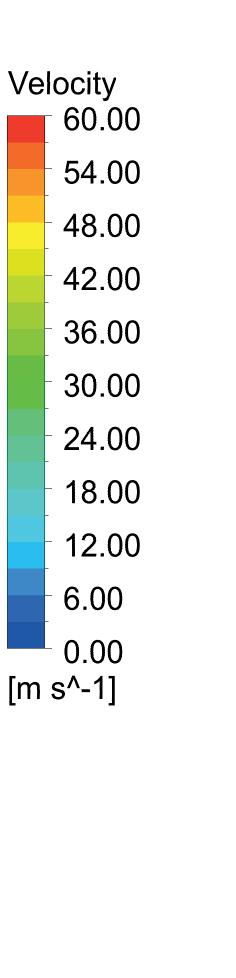

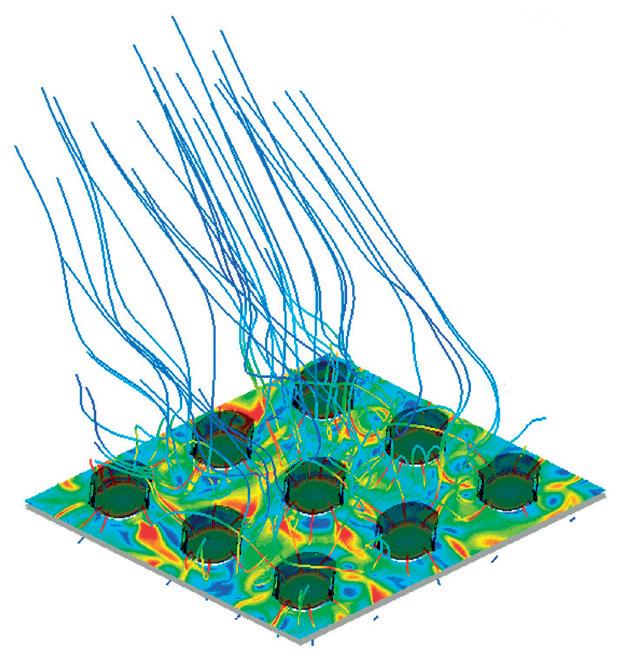

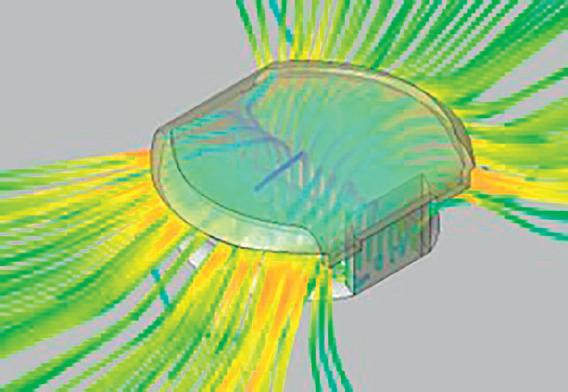

Computational fluid dynamics (CFD) simulations model fluid behaviour by using numerical methods to solve equations governing fluid flow. CFD techniques have been specifically developed to help analyse valve efficiency and capacity. These techniques can be used to model the valve features that were previously discussed and to provide a visual representation of how the features impact performance.

ASME PCC-2 Compliant Heat Exchanger Tube Plugging System

Trusted by power and process plants around the world as their go-to tube leak solution, Pop-A-Plug Tube Plugs from Curtiss-Wright are engineered for optimal performance throughout the life cycle of heat exchanger equipment. Controlled hydraulic installation eliminates welding and time-consuming pre-/post-weld heat treatments that can cause damage to tubes, tube sheet ligaments and joints.

• Simple hydraulic installation − no welding!

• Helium leak tight seal to 1x10 -10 cc/sec

• 100% Lot tested to ensure unmatched quality

• Pressure ratings to 7000 PsiG (483 BarG)

• Wide range of sizes and ASME/ASTM certified materials available

Ask about our Smart Ram 640T for fast & reliable cordless installations!

877.383.1029 l est-sales@curtisswright.com l cw-estgroup.com/HydroEng25

Vapour velocity vectors leaving the valve correspond to how well the vapour and liquid mix, and are also related to the capacity of the device.

Looking at the basic sieve hole, vapour exiting the hole has an upward only trajectory and no mixing on the deck level. This can be seen in the CFD image of that device in Figure 2a.

Conventional moving valves, like the T valve, have a cover over the deck orifice to help prevent the liquid from weeping when the tray is operating at reduced vapour loads. The trajectory of the vapour is still generally in the upward direction and there is little mixing between the vapour and liquid at the deck level, as seen in the CFD image in Figure 2b, with the lowest vapour velocity (blue zones) witnessed at the deck level. This means there is minimal vapour-liquid contact close to the tray deck.

Moving to the latest generation of valves, the CFD of a FLEXIPRO floating valve tray shows how the downturned cap on the valve directs the vapour to leave the valve downwards (Figure 2d). The downward vapour trajectory reduces the entrainment of liquid to the deck above, which directly translates to greater capacity. The CFD image (Figure 2c) shows that the downward turn also results in more intense mixing at the deck level which enhances the efficiency as shown by the high vapour velocity zones (in red and yellow).

In addition, the forward motion to the vapour as it leaves the valve results in a pushing action, as shown in the CFD image (Figure 2c) by the vapour profile lines pointing in the direction of the liquid flow on the deck. This reduces the amount of entrainment and gradients in the froth profile.

The differences in features can be seen in the data for these valves (Figure 3) in an air/water system comparing sieve holes, the moving T valve, and FLEXIPRO’s floating valves. The sieve tray has the lowest capacity and the narrowest operating range. And on the upper end, the floating valve trays have approximately 35% higher capacity than the T valve tray, which is in the middle. The tapered cap and the forward push help contribute to the valve tray’s reduced entrainment. The upwards

We’ve reimagined valve tray design to help operators increase capacity by up to 30%, extend operating range and enhance efficiency at turndown. The FLEXIPRO® floating valve tray delivers high performance you can trust.

Discover game-changing performance at www.koch-glitsch.com/flexiprofloatingvalve

koch-glitsch.com

extruded hole results in enhanced turndown performance by preventing liquid from entering the hole. The floating valve provides double the turndown performance compared to T valves due to its advanced features.

The various valve features can be best compared in an operating pilot column. Koch-Glitsch’s air/water test apparatus offers a clear view into the column at various flow conditions. From this, operators can simultaneously see two trays in operation, with the floating valves on the top tray and T valves on the bottom tray. Each tray has the same tray design, with the only difference being valve type. The left image in Figure 4 shows conditions at high vapour rate, where the T valve tray on the bottom level is entraining 10% of the liquid to the tray above, and the floating valve tray on top is in normal operating conditions. The downward turn of the FLEXIPRO valve cap and the push effect of the valve can be seen in the flat froth profile across the flow path. The first few rows of the T valve tray are less active, creating a mountain-like profile that peaks around the middle of the flow path, indicating vapour maldistribution. The disengagement area is less clear above the froth on the T valve deck, which translates to less capacity, while the floating valve tray offers additional capacity. This allows for either a diameter or height reduction for grassroot towers or an increase in capacity for existing columns.

At a relatively low weir loading of 25 gal./min per ft, some of the turndown enhancement features create a noticeable difference in the froth profile on the tray (Figure 4 right). The T valve tray has no upstream leg protecting it from liquid coming out of the downcomer and the liquid is scooped into the valve opening, particularly at the first row of valves next to the downcomer exit. This inlet weep is detrimental to the efficiency of the tray. The upward trajectory of the vapour creates a clear layer of liquid at the deck level on the T valve tray deck where there is no vapour liquid contact at all. At these conditions, additional energy would be required to maintain the efficiency of the column. The wider upstream leg and extruded orifice protect the floating valve tray from weeping. The contoured cap and pushing action of the valve create a well-mixed, uniform froth across the tray deck and at the deck level. This means that for applications with low liquid load, less vapour is required to maintain the efficiency of the tower, resulting in less energy use.

If the efficiency of these devices in a hydrocarbon system is considered, there is a large difference in the efficiency of a simple sieve hole compared to the floating valves (Figure 5). This improved efficiency can directly translate into less energy required for the same separation.

As shown in the visual analysis, the various features of the latest generation of tray valves translate into better performance. Looking at a deisobutaniser as an example, the vessel size can be reduced, which will result in a large reduction in the capital cost of the tower (Table 1).

In addition, the turndown performance will be enhanced for the valve tray, eliminating the energy inefficiencies that the sieve trays would experience at lower rates.

Decades of tray valve innovation, from early sieve holes to modern floating valve designs, highlight the critical role of advancements in distillation technology. Supported by CFD simulations, test data, and visual observation, these enhanced valve features have been shown to improve energy efficiency, increase capacity, and expand operational flexibility. As the industry continues to prioritise operational excellence and performance, such technologies represent the ongoing evolution of mass transfer equipment to meet current demands and future challenges.

1. WHITE, D., ‘Optimize Energy Use in Distillation’, Chemical Engineering Progress, (March 2012).

2. CAHILL, J., ‘Reducing Distillation Column Energy Usage’, https://www.emersonautomationexperts.com/2010/industry/ downstream-hydrocarbons/reducing_distil/

3. NIEUWOUDT, I. and PENCIAK, J., ‘Best of both’, Hydrocarbon Engineering , (July 2007), pp. 85 - 91.

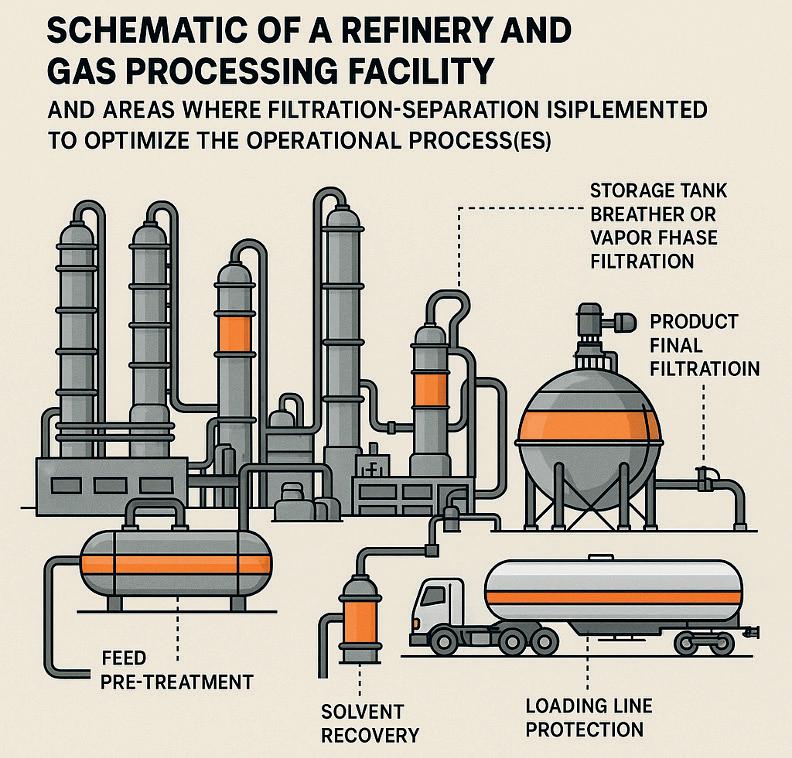

The traditional energy sector can be broadly segmented into three interlinked domains: upstream, midstream, and downstream. Each component plays a vital role in ensuring the secure and efficient delivery of energy to end users. While upstream operations focus on exploration and production, and midstream activities manage transportation and storage, it is in the downstream segment where raw hydrocarbons are refined and processed into the high-quality fuels and materials essential to modern life.

This article will highlight the often overlooked but essential role of filtration as it relates to the downstream sector. From refining to distribution, and across pipelines, trucks, and storage facilities, the reliability

and efficiency of filtration systems directly impact product quality, safety, and compliance.

Downstream operations encompass a diverse range of activities, including crude oil refining, natural gas processing, petrochemical production, and distribution of end products such as: gasoline, diesel, and jet fuel; LNG and processed natural gas; lubricants, waxes, and asphalts; and chemical feedstocks for plastics, solvents, and resins.

The downstream segment culminates in the delivery of these refined products to commercial, residential, and industrial consumers. A clean and stable fuel or feedstock stream is not just a preference – it is a requirement. This is where filtration is of paramount importance.

Neil Richards, PS Filter, Canada, discusses how effective filtration through best-practice strategies ensures production integrity, operational efficiency, and regulatory compliance.

Where filtration fits in

Filtration also provides a critical role in downstream processes, where it is an integral thread woven into multiple critical steps, including:

n Feedstock pre-treatment: before crude oil or gas is processed, particulates, water, and solids are removed to protect downstream units.

n Catalyst protection: solid and liquid contaminants can poison costly catalysts in reactors and reformers.

n Amine and glycol systems: used for acid gas removal and dehydration, these systems rely on fine filtration to eliminate degradation byproducts and extend solvent life.

n Final product polishing: filtration ensures that final fuels meet ISO cleanliness codes and remove haze, colour bodies, or residuals.

n Volatile organic compounds (VOCs) and vapour phase control: activated carbon and specialty medias are used for vent filtration, odour control, and vapour-phase recovery to protect the environment.

n Transportation assurance: filters on loading racks, tanker lines, and rail terminals help avoid contamination during delivery.

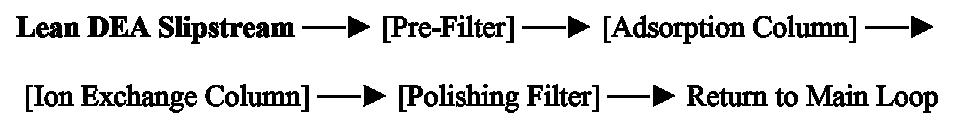

Amine systems are used in gas processing to remove CO2 and H2S (Figure 1). Over time, amines degrade and form heat-stable salts (HSS), which cannot be removed by simple mechanical filtration. They can, however, be removed by the combination of several different mechanisms in a multi-stage process.

Multi-stage filtration setup for diethanolamine (DEA): stage breakdown

Pre-filter (particulate removal)

n Removes suspended solids, corrosion products, and debris.

n Prevents clogging of downstream media.

Adsorption column (organic catch)

n Activated carbon or synthetic media to adsorb organic degradation products.

n Targets HSS precursors and surfactants.

n Helps reduce foaming tendency.

Ion exchange column (HSS removal)

n Packed with strong base anion exchange resin.

n Removes acetate, formate, and other acid anions.

n Regenerated periodically with caustic solution (NaOH).

Polishing filter (final clean-up)

n Traps trace particulates or resin fine.

n Ensures maximum amine clarity and purity.

n Equipment: efficient one micron filter or membrane filtration.

This setup gives reliable HSS control with minimal solvent loss and operational downtime.

In addition to HSS control, PS Filter® utilises process specific filter designs to mitigate the build up of particulate contaminants in amine systems. When paired with adsorbent media to remove dissolved organics, this is an effective strategy to reduce foaming tendency and protect downstream equipment fouling.

Ensuring the final product meets tight cleanliness standards is not just a box to tick – it influences everything from regulatory compliance to engine performance to the longevity of processing assets downstream. Fuel producers, pipeline operators, and petrochemical exporters all benefit from downstream filtration strategies that offer clarity and stability, longer equipment life, reduced maintenance and downtime, compliance with ISO and ASTM specifications, enhanced end user safety, and final product performance.

While filtration is well recognised in upstream production and water treatment applications, its role in downstream operations is of equal importance and should not be overlooked. From fuel desulfurisation, liquid and natural gas performance, amine and glycol loop protection, to final polishing of fuels, precise filtration can ensure that every drop of product meets the stringent clarity and quality requirements demanded by end users and meets regulatory compliance.

Even in post-refining and processing, filtration continues to play a vital role across transportation network-pipelines, tanker trucks, railcars, and storage facilities. Clean, stable products are essential to avoid fouling, ensure flow assurance, and maintain product shelf life and performance.

Downstream success depends not only on chemistry and engineering, but on cleanliness, stability, and confidence in all the products that are produced. As global fuel and gas specifications become stricter, and transportation chains more complex, filtration remains the silent enabler of product integrity. For companies engaged in the downstream sector, investing in robust filtration strategies is essential.

PS Filter has developed and implemented solutions that address real-world operational pain points, such as the following:

n LNG dew point control: coalescing filters with high-pressure housings protect cryogenic exchangers from aerosol contamination.

n Polishing systems for diesel backup power: skid-mounted modular systems are used to maintain diesel fuel clarity to meet critical standards.

n VOC scrubbers and vapour phase units: liquid-phase and vapour-phase activated carbon systems are tailored to site conditions to optimise processes and meet environmental regulations.

n Blending and loading line protection: in-line cartridge filters at terminals and truck racks ensure clean loading into transport vehicles to reduce any contamination that may be present.

In LNG applications, filtration is most critical in areas where contamination can compromise safety, efficiency, or equipment integrity. It matters most in:

Gas turbine air intake systems

n Why it matters: turbines drive refrigerant compressors in LNG trains. Ingested particulates, salts, and hydrocarbons can cause fouling, corrosion, and catastrophic failure.

n Filtration focus: multistage air filters with hydrophobic media to block water and salt-laden aerosols.

Amine and glycol systems (gas sweetening and dehydration)

n Why it matters: contaminants like hydrocarbons and solids cause foaming, solvent loss, and off-specification gas.

n Filtration focus: liquid and gas coalescers and particle filters upstream of contactors and re-generators.

Main LNG heat exchangers and condensers

n Why it matters: fouling from aerosols or particulates reduces heat transfer efficiency and increases downtime.

n Filtration focus: high efficiency coalescers and particle filters to protect cryogenic equipment.

Molecular sieve driers

n Why it matters: protecting the bed from fouling extends cycle life and prevents off-specification gas.

n Filtration focus: high efficiency coalescers and fine particle filters upstream.

Compressor protection

n Why it matters: entrained liquids and solids can damage valves and pistons.

n Filtration focus: coalescing filters and separators to remove aerosols and lube oil carryover.

Hunter’s custom modular buildings are purpose-built to support seamless maintenance, optimize reliability and meet unique operational needs. Engineered for rapid deployment and long-term performance — and designed to adapt as projects evolve — Hunter structures bring trusted protection on every front

Occupied Structures Control Rooms, Operator

Lab Buildings, Guard Shacks & Accommodations

Condensate water and rich amine treatment

n Why it matters: hydrocarbon contamination affects downstream processing and can contribute to off-specification product.

n Filtration focus: liquid and liquid coalescers for hydrocarbon removal.

practices in downstream filtration

Several key best practices have emerged for successful downstream filtration such as:

n Size for flux rate, not just flow: optimising for lower flux improves filter life and clarity.

n Use beta-rated elements: filters with Beta 5000 ratings provide consistent particulate removal vs some ambiguous products that fail to meet efficiency specifications.

n Pre-filter to protect final polishing: layered defence prevents premature fouling.

n Consider media compatibility: for amine and glycol systems, and VOC applications, ensure filters resist chemical degradation and meet the required effluent quality.

n Monitor pressure drop and changeout indicators: predictive maintenance is more efficient than reactive swaps.

n Integrate VOC recovery: storage tank breathers and media filter units to reduce emissions and mitigate environmental risks.

Figure 2 highlights some filtration integration points across a refinery or gas processing facility.

Filtration is embedded in feedstock pre-treatment, catalyst protection, amine and glycol systems, final product polishing, vapour phase control, and transportation, safeguarding equipment and product integrity. Each stage represents a risk point for contamination – and a strategic opportunity for filtration to enhance reliability and performance.

As the energy landscape evolves, downstream filtration principles are increasingly applied to the production of renewable natural gas (RNG). Raw biogas, typically derived from anaerobic digestion or landfill sources, contains high levels of moisture, particulates, H 2 S, siloxanes, and VOCs, all of which must be removed to meet pipeline specifications or end use requirements.

PS Filter designs and supplies multi-stage purification systems that integrate particulate filters for bulk solids removal, coalescing elements for fine aerosol separation, activated carbon beds for VOC and odour control, specialty media for siloxane and sulfur compound removal, and cartridge or bag filtration for pre-treatment and polishing.

These systems are modular, scalable, and customisable to meet varying flow rates, feed gas conditions, and gas quality standards. By transferring proven downstream oil and gas filtration methods into the biogas sector, companies can ensure operational uptime, regulatory compliance, and reliable gas quality – helping bridge the gap between conventional and renewable energy infrastructure.

In the increasingly complex and interconnected downstream sector, effective filtration is no longer a passive afterthought – it is a proactive strategy for delivering consistent product quality, operational efficiency, and customer trust. As environmental standards tighten and market expectations evolve, investing in fit-for-purpose filtration is essential.

Michael Clements, Filtration Technology Corp. (FTC), explores how technical evaluations in filtration trump so-called ‘brochure engineering’.

In the world of hydrocarbon processing, the smallest inefficiencies in filtration can have oversized consequences. From unscheduled shutdowns and soaring filter spend to unnecessary health and safety risks, selecting filtration systems with little more than a brochure and a price point to guide the decision – what might be called ‘brochure engineering’ – fails to account for the complexity of real-world operations.

Yet all too often, this is exactly how decisions on filtration are made. Without proper technical evaluation and validation, refineries risk implementing changes that fail to address root issues, waste capital and, in some cases, exacerbate operational problems.

A data-driven technical evaluation and validation is not only prudent – it is essential.

The process begins with a critical first step: establishing a detailed baseline of the existing system. From there, potential improvements can be designed and validated based on specific goals, such as improved fluid quality, extended

run times, reduced operational costs, and improved safety and environmental outcomes.

Before considering any filtration changes, the most crucial step, which is oftentimes skipped, is establishing a baseline for the existing system. This includes evaluating the filter element, filter vessel, and process parameters in detail.

Filter element:

n Retention, efficiency, and test method must be understood to know what performance is currently being achieved. Without all three, companies cannot truly know what the filter is doing. Listing only one or two offers clues, but not a complete or reliable picture.1

n Materials of construction matter. Media type, support layers, core structure, elastomers, and netting all influence compatibility, durability, and filtration performance.

Filter vessel:

n Ideally, access to a full drawing package ensures accurate understanding.

n Inlet/outlet line sizes, schedule, flange type/rating, and materials of construction (including pressure and non-pressure retaining components) are vital for compatibility and sizing.

n Design conditions must be reviewed to ensure safe operation under all flow and pressure conditions.

Process information:

n Operating conditions such as temperature, pressure, and flow rates need to be evaluated across their minimum, normal, and maximum values. Time duration of excursions from the norm must also be understood.

n Fluid composition should include not just the primary stream but also start up, shutdown, and blend scenarios.

n Fluid quality at both the inlet and outlet of the filter must be measured. Key data points include total suspended solids (TSS), particle size distribution (PSD), hydrocarbon and water content, and microscopy.

n Contamination profile should be established, using tools like Fourier transform infrared spectroscopy (FTIR), energy dispersive spectroscopy (EDS), and X-ray diffraction equipment (XRD) to identify particulate and fouling agents.

Equally critical is understanding the filter’s purpose. Many times, filter vessels are just considered a piece of fixed equipment – a tag number in a piping and instrumentation diagram (P&ID) or a ‘piece of the puzzle’. But a filter vessel in a processing unit serves a purpose much greater than that.

Evaluating whether the filter is achieving its intended performance is also essential. Are foaming events occurring in the amine loop? Is differential pressure (dP) in the catalyst reactor trending up? Are downstream components fouling? These questions help define the real-world effectiveness of the existing setup and identify targets for improvement.

Two case examples demonstrate how applying a structured technical evaluation process can uncover root causes, challenge long-held assumptions, and lead to practical, high-impact improvements.