Make sure you don’t miss out on our North American supplement, coming soon! This special issue will focus on LNG activity in the US, Canada, and Mexico, with keynote articles, case studies, and more.

Make sure you don’t miss out on our North American supplement, coming soon! This special issue will focus on LNG activity in the US, Canada, and Mexico, with keynote articles, case studies, and more.

05 LNG news

Midstream natural gas presents an opportunity to achieve lasting emissions gains, starting today, says Freddie Sarhan, CEO, Sapphire Technologies, USA.

Frej Olsen, MAKEEN Energy, Denmark, considers how liquefied biogas and LNG could be the solution to creating a cleaner transportation sector.

Jos Glorie, Cryonorm, the Netherlands, explains how LNG can be utilised as an alternative fuel, outlining how this transition could help to reduce greenhouse gas emissions when compared to conventional fuels.

Karthik Sathyamoorthy, President of AG&P’s LNG Terminals & Logistics, UAE, describes the company’s approach to LNG terminal development, from the planning stage to executing a hybrid onshore and offshore model that caters to the requirements of the market while having the capability to function despite extreme weather conditions.

Praveen Lawrence and Briain O’Dowd, Royal HaskoningDHV, UK, detail how predictive simulation can aid when managing LNG terminal demand.

Fred Haney and Cathy Farina, DyCat Solutions, look at how to maximise facility owner value by utilising process control and automation lean design methods.

Gas and Heat S.p.A. is strongly committed to serving the fast-growing market of replacing tradi-tional fuels with LNG in both marine, inland waterway, and land-based areas. The company’s core business focuses on the construction of plants and tanks on board ships using cryogenic gas as cargo or as fuel. To find out more, visit: www.gasandheat.it

The energy scenario in the Southern Cone has a new paradigm due to two reasons. The sharp drop in Bolivian oil and gas reserves with insufficient exploration to replace new reserves is one reason. The other is the new production scenario of oil and gas from the Vaca Muerta formation.

Natural gas and oil do not need to be discovered in Vaca Muerta and only need to be produced efficiently, which is what YPF and at least 10 other operators have done. They have proved over a dozen sweet spots with pilot wells that have resulted in very competitive production costs. In addition, production through factory drilling can be brought up quite rapidly as demand and infrastructure becomes available.

On the other hand, Bolivia is close to producing half of what was being produced in 2014 or 2015 in natural gas, condensate, and oil. The few wells that were drilled, mainly by YPFB, were unsuccessful and there is little to be done with two more prospects to be drilled. Private operators with high fiscal systems and the need to subsidise will not venture any more resources into exploration activities. Recently, the Bolivian government announced the need to change the Hydrocarbons Law; however, the results will not change the country’s tendency to soon become an importer of natural gas and other fuels, including liquefied petroleum gas (LPG), which were previously exported to Paraguay, Argentina, Peru, and Brazil.

The bottleneck for natural gas in Argentina is infrastructure. The Néstor Kirchner Gas Pipeline is in its first stage and is almost finished for domestic demand, but they have been replacing conventional production with unconventional production for a long time, without significantly increasing their total national production. The second stage of the pipeline will allow the country to revert the Transportadora de Gas del Norte (TGN) pipeline and reach Bolivia and Northern Chile with close to 29 million m 3 /d, and the possibility to be looped further.

Then, existing pipelines to Chile and the Bolivian gas pipelines that were built two decades ago can be

used to serve a giant market of 60 – 65 million m 3 /d in Bolivia, Northern Chile, Argentina, and Brazil. Thus, in regards natural gas, the holdups for access to this huge market are TGN reversion, expansion, and reinforcement projects. This would enable for a great regional market, with almost all infrastructure developed and the possibility to develop some gas integration.

But it is not only gas, Argentina is notably increasing production of oil and LPG and can supply all deficit neighbouring countries (Paraguay, Bolivia, Chile, Uruguay, and Brazil). Existing oil lines can be expanded, or tanker trunks can be used.

With competitive natural gas, power generation in combined cycles can also be used to supply the Sothern Cone (Bolivia, Brazil, Uruguay, Chile, and Paraguay), which has an interconnected grid, meaning efficiencies can be gained relatively easy from Argentina.

Now, this is all piped gas to replace Bolivian decline regionally. LNG will still be needed in Brazil to cope with drastic swings in rainfalls. A couple more regasification terminals are expected in this regard and the swing in spot purchases will continue as water is available.

Argentina will reduce LNG purchases from 2024 with the commissioning of the gas pipelines. In the future, there will no longer be the need for the two regasification terminals. One will have to remain in place to deal with winter residential demand for 2024, which strongly influences demand in Argentina.

In Chile, increased natural demand for pipeline gas from Argentina will impact demand for LNG in the years to come. However, the two regasification terminals will remain quite active until regulatory issues are resolved and the transmission lines are built and strengthened in order to allow the movement of renewable energy, mainly solar in the north and wind power in the south, which at the moment cannot be evacuated.

Thus, the Sothern Cone will overall reduce demand for LNG on the average after 2024/2025, making Argentina the new energy supplier for the region.

China Petroleum & Chemical Corp. (Sinopec) has signed an equity participation agreement with QatarEnergy to take 1.25% shares in Qatar's North Field East (NFE) expansion project, which is currently the largest LNG project in the world.

The event marks another milestone after Sinopec and QatarEnergy inked a 27-year long-term LNG purchase and sales agreement in November 2022 for the supply of 4 million tpy of LNG to Sinopec and achieves integrated co-operation on the NFE expansion project.

Sinopec Chairman, Ma Yongsheng, and Qatari Minister of State for Energy Affairs, President and CEO of QatarEnergy, Saad Sherida Al-Kaabi, formally signed the agreement at a signing ceremony in QatarEnergy's headquarter in Doha.

China is one of the world's most important natural gas markets and key market for Qatar's energy products. The equity participation agreement fulfilled QatarEnergy's promise to further deepen relationships with major LNG clients, especially on developing long-term strategic partnerships with world's top clients like Sinopec. Sinopec is the first Asian stakeholder of the NFE project and the event marks a model of Sino-Qatar co-operation.

With a total investment of US$28.75 billion, the NFE project is projected to increase Qatar's LNG export volume from 77 tpy to 110 million tpy.

Sinopec and QatarEnergy's partnerships will help to meet the demand for natural gas in the Chinese market.

In the last quarter of 2022, SIAD Macchine Impianti (SIAD MI) was selected for the turnkey construction of a small scale LNG plant for the production of bio-LNG to be built near Röthenbach an der Pegnitz in the Bavarian region of Germany.

The client is bioplus LNG, a German company founded by Vier Gas Transport GmbH (VGT) with the aim of becoming a key player in the bio-LNG value chain in Germany. In this context, bio methane is injected in the grid at source and subsequently it is withdrawn and liquefied for distribution to filling stations, where it is marketed as a heavy-duty transport fuel.

This project is of great importance for the decarbonisation of the transport sector in Germany: the fully operational small scale LNG plant will produce 140 tpd of bio-LNG, enough to supply 350 trucks. This will prevent the emission of around 400 000 tpy of carbon dioxide into the atmosphere, more than the savings achieved by the entire German electric car fleet in 2020. It will also be possible to cut nitrogen oxide emissions by 70% and fine dust emissions by up to 95%.

The order involves the supply of a SMART TB-LNG 140 modular liquefaction plant designed and custom-built to the customer's requirements and includes an amine-based natural gas treatment unit made by Tecno Project Industriale, a member of the SIAD group of companies. The same supply will also include the installation of two oil-free reciprocating compressors, one for natural gas and one for boil-off gas, also designed and manufactured by SIAD MI, and part of SIAD MI’s range of products for the LNG supply chain.

Additionally, SIAD MI will handle the installation of the plant for the planned commissioning in October 2024.

Delfin Midstream Inc. has announced that its wholly owned subsidiary, Delfin LNG LLC, has finalised a binding LNG sale and purchase agreement (SPA) with Hartree Partners Power & Gas Company (UK) Limited, a wholly owned subsidiary of Hartree Partners, LP.

Under the SPA, Delfin LNG will supply 0.6 million tpy on a free on-board (FOB) basis at the Delfin Deepwater Port, 40 nautical miles off the coast of Louisiana, to Hartree for a 20-year period. The SPA is indexed to the Henry Hub benchmark.

The 20-year binding SPA with Hartree serves as an

additional milestone for Delfin and builds on the company’s previously announced long-term agreements with strong, strategic counterparties. Delfin has now secured commitments for 3.1 milion tpy of LNG sales which is sufficient to make final investment decision (FID) on the first floating LNG (FLNG) vessel for the Delfin Deepwater Port LNG Export Facility. Delfin expects to make FID in mid-2023.

Delfin has appointed Citi as its exclusive financial structuring advisor and is well advanced in securing project level equity and debt for the first FLNG vessel.

Texas LNG, a 4 million tpy LNG export terminal to be constructed in the Port of Brownsville, Texas, owned by Texas LNG Brownsville LLC, an affiliate of Glenfarne Energy Transition, LLC, a global energy transition leader providing critical solutions to lower the world’s carbon footprint, has announced the Federal Energy Regulatory Commission (FERC) has issued an order on remand to the project following the completion of an additional social cost of carbon and environmental justice analysis.

The order on remand includes two modified mitigation requirements regarding air monitoring and emergency response communications that Texas LNG will incorporate into its execution plan. Texas LNG expects to make a final investment decision (FID) this year and begin commercial operations in 2027.

Texas LNG’s ‘Green by Design’ approach is strategically designed to avoid emissions rather than minimising or mitigating them. By using renewable energy to power the entire facility and drive Texas LNG’s electric motors, the project eliminates most carbon dioxide emissions, with less than half of a typical LNG export project, making it one of the lowest-emitting liquefaction facilities in the world.

TotalEnergies Marine Fuels and the cruise division of MSC Group have successfully completed the first LNG bunkering operation at the Port of Marseille Fos, Southern France, for MSC Cruises’ MSC World Europa.

MSC World Europa, which was delivered in October 2022 by Chantiers de l’Atlantique at the Saint Nazaire shipyard in France, is 333 m long and the best performing large cruise ship operating in the world in terms of carbon dioxide equivalent emissions per passenger.

TotalEnergies Marine Fuels’ chartered LNG bunker barge, the Gas Vitality, refuelled the MSC Cruises vessel via a ship-to-ship transfer of 2500 m3 of LNG at the port on 22 April 2023, while guest operations continued as normal. The successful execution of these simultaneous operations (SIMOPs) underscores TotalEnergies’ Marine Fuels ability to safely deliver commercial LNG bunkering operations.

Excelerate Energy, Inc. has completed the purchase of the FSRU Sequoia for a purchase price of US$265 million from Anemoesa Marine Inc., a company incorporated under the laws of the Republic of the Marshall Islands. In March 2023, the company closed on an amended and restated US$600 million senior secured credit facility, consisting of a revolving credit facility and term loan. Proceeds from the term loan and cash on hand were used to purchase the FSRU Sequoia

The FSRU Sequoia was delivered as a newbuild to Excelerate Energy’s fleet in June 2020 under a five-year bareboat charter.

The FSRU Sequoia has a storage capacity of 173 400 m3 and can operate as both an FSRU and a traditional LNG carrier. The FSRU is currently providing regasification services at the Bahia Regasification Terminal in Bahia, Brazil.

The operation marks the start of the previously announced LNG bunker supply contract between TotalEnergies and the cruise division of MSC Group in March 2021, as the companies drive forward their respective decarbonisation plans. Under the agreement, TotalEnergies Marine Fuels will supply approximately 45 000 tpy of LNG to MSC Cruises’ vessels at Marseille.

Nikkiso Cryoquip provides clean energy solutions for applications where there is no direct connection to a pipeline, or as an option to replace more conventional fuel such as diesel or propane.

Maximum flexibility and ease of set up is provided with our equipment. Engineered, tested and built on a skid that fits on any conventional shipping trailer, our systems can be easily moved from site to site – depending on your end-use contract. This also allows for temporary installation until the pipeline reaches you.

Whether for temporary or permanent installation, our Plug and Play systems allow you to be up and running with minimum effort and maximum results.

Ask Nikkiso. Leading the change to a healthier world.

09 – 11 May 2023

Canada Gas & LNG Exhibition and Conference

Vancouver, Canada

www.canadagaslng.com

22 – 24 May 2023

ILTA International Operating Conference and Trade Show

Texas, USA

https://ilta2023.ilta.org

07 – 08 June 2023

Downstream USA

Texas, USA

https://events.reutersevents.com/petchem/ downstream-usa

13 June 2023

WEBINAR - LNG Integrated Operations – Enabling Optimisation Across Multiple LNG Assets

Online

www.lngindustry.com/events/webinarlng-integrated-operations-enablingoptimisation-across-multiple-lng-assets/

13 – 15 June 2023

Global Energy Show

Calgary, Canada

www.globalenergyshow.com

10 – 13 July 2023

LNG2023

Vancouver, Canada

www.lng2023.org

05 – 08 September 2023

Gastech Singapore

www.gastechevent.com

05 – 08 September 2023

Offshore Europe

Aberdeen, Scotland

www.offshore-europe.co.uk/en-gb.html

Hanseatic Energy Hub GmbH (HEH) has commissioned a consortium led by global EPC specialist, Técnicas Reunidas S.A., to develop the land-based terminal for liquefied gases, subject to HEH´s final investment decision (FID). Further consortium partners are the FCC Group and Entrade GmbH. The privately-organised terminal project is intended to help secure Germany's supply of LNG and green gases from 2027 and, at the same time, prepare for the market ramp-up of hydrogen. The infrastructure and commercial marketing of the hub are designed in such a way that a move to ammonia can take place in a future-flexible manner.

Técnicas Reunidas has designed and developed more than 1000 infrastructure and industrial facilities worldwide. Among them are numerous projects along the value chains for LNG and hydrogen. The company, which is headquartered in Madrid, Spain, will take over the planning and management of the construction phase and will undertake all the equipment and materials supply work for the project. The FCC Group, also from Spain, will carry out all the site preparation work at the Stade industrial park, as well as the construction of the terminal. FCC can draw on extensive experience in the construction of liquid gas tanks. In Spain alone, the company has already built and commissioned eight LNG storage plants. Entrade, a subsidiary of the Turkish ENKA Group, will be responsible for the electromechanical assembly. The engineering and construction company is already active near Stade today.

A FID will be taken in summer 2023. The projected investment volume for the terminal is around €1 billion.

The Hanseatic Energy Hub is a future-flexible modular system for the energy transition that maximises the diverse opportunities offered by the Stade energy region. In a first expansion stage, LNG, as well as green energy sources such as bio-LNG and synthetic natural gas, can be imported via the emission-free terminal from 2027. The planned regasification capacity is 13.3 billion m3/y.

The President of the Republic of the Congo, Denis Sassou Nguesso, and the CEO of Eni, Claudio Descalzi, has laid the foundation stone of Congo LNG, the country's first natural gas liquefaction project and one of Eni's core supply diversification initiatives. The project is expected to reach an overall LNG production capacity of 3 million tpy (approximately 4.5 billion m3/y) from 2025.

Congo LNG will exploit the huge gas resources of Marine XII, fulfilling the country’s power generation needs while also fuelling LNG exports, supplying new volumes of gas to international markets focusing on Europe.

The project, made though an accelerated development schedule and a zero-flaring approach, will see the installation of two floating LNG (FLNG) plants at the Nenè and Litchendjili fields – already in production – and at the fields yet to be developed. The first FLNG plant, currently under conversion and with a capacity of 0.6 million tpy, will begin production in 2023. The second FLNG plant – already under construction – will become operative in 2025, with a capacity of 2.4 million tpy.

Chart’s LNG power generation solutions provide natural gas to hundreds of thousands of homes. This is one way Chart facilitates LNG as a safe, clean-burning fuel for energy, transportation and industry.

Gas will play an increasingly important role in the energy transition from fossil fuels to renewables, and for long-term sustainability. The Ukraine crisis has placed increasing pressure on the sourcing of gas, particularly for European countries.

As a result, there has been a significant increase in orders over the last year for floating LNG (FLNG) and FSRUs, aimed at improving independence and resilience in gas supplies for those countries re-sourcing their energy.

Continuity of supply through those floating assets will be critical, particularly avoiding down time for surveys and repairs.

FSRUs are complex, high value assets and are being deployed more widely. Reliability and continuity of supply is essential. They remain on station for extended periods, either alongside, nearshore, or offshore, but mostly in shallow water. Turbid waters, high currents, and terminal operator restrictions make in-water inspections difficult, particularly for divers.

FLNG units are also high value and complex, with the different function of exploiting gas fields where little infrastructure exists or where the gas fields are ‘stranded’.

Both asset types have the normal marine integrity requirements driven by regulations and class rules, but they also have LNG tanks whose integrity must be assured with minimal operational disruption.

But is this situation exceptional, or does it need a radical change to asset integrity methodology? Drawing on a depth of experience in the floating energy production sector, particularly offshore oil and gas assets, EM&I believes that it does not need radical change from many of the strategies and methods recently developed and used.

Building on the work of industry collaboration forums, such as the hull inspection techniques and strategy joint industry project (HITS JIP), with contributors from across the value chain – energy majors, operators, class, inspection companies, and academic institutions

Danny Constantinis, EM&I Group, Malta, provides insight into new asset integrity management challenges following a rapid increase in the deployment of FSRUs and floating LNG units.

– many lessons are applicable to the growing number of floating gas assets and the maintenance of their operational continuity.

These include minimising the requirement for diver intervention, the remote inspection of confined spaces, managing marine pressure system, and ex equipment integrity.

The advantage of using modern methods is the reduction in risk and cost including, of course, the safety risk of physical human intervention, both equally applicable.

Indeed, a new JIP – the FloGas JIP – with a similar broad range of participants, is drawing on those lessons to understand how best to manage integrity, particularly routine inspection for class and other regulatory requirement, whilst minimising the impact on operations.

For floating gas assets, it remains that the routine drydocking is neither practicable nor cost-effective. FSRUs that are near shore, or wharf moored, present unique challenges with current, water turbidity, and proximity to conurbations.

FLNG units are often much further away from shore and pose similar challenges to the FPSO sector.

In a recently published article on the risk of fatalities in commercial diving, with emphasis on the floating offshore energy production sector, Professor Andy Woods stated “…if the risk of a fatality per year is one in 1 million to the general public, then the [UK] HSE deems that this is broadly acceptable. According to the data, commercial diving is one of the most dangerous professions, and the data presented above from historical incidents suggest the risk levels have in the past been close to the intolerable threshold of one in 1000.” 1

Professor Woods has come to similar conclusions on the risks involved for personnel entering confined spaces such as cargo, ballast, or void spaces.

It is incumbent on all involved in the sector to mitigate this risk, and therefore diverless alternatives to the underwater inspection and maintenance tasks must be sought.

Floating gas assets can therefore also benefit from safety risk [threat] mitigation of placing personnel in dangerous environments – particularly divers; enhanced data gathered with technology; reduced operational down time for inspection and related activities; and for offshore, immediate and through-life efficiencies and savings.

Measures include remotely operated vehicle (ROV) inspection by a team of three compared to dive spread of 15 – 20, or the expense of a diving support vessel (DSV); the ROV is also less weather dependent, ensuring optimal operating envelopes. Overall, the carbon footprint is reduced through the removal of unnecessary POB, DSV, mobilisations, helicopter, and crew support vessel traffic.

Another inspection requirement common across floating production units is of water ballast tanks (WBT). The HITS JIP has supported the development of inspection by mini-ROV in flooded WBT, again removing the risk to life and of serious injury from physical entry into the confined space. General and close visual inspection, and thickness measurement of steel, all of which are necessary to assure class, owners, and operators.

As the technology of both ROV and cameras improves, the capability is going well beyond the equivalence of visual inspection by the attending surveyor. A second significant benefit is that the FSRU can continue to operate unhindered while the inspection is conducted.

The work carried out by the HITS JIP, and the development of these capabilities, caused EM&I to think more broadly about the risk of entry in to confined spaces and working in there at height.

In a second report commissioned by EM&I, the same author reviewed the threats posed to personnel working in confined spaces, and at height, demonstrating the nexus between the risk [threat] to human safety, and the commercial impact of a fatality: “In 2020, HM Treasury in the United Kingdom assessed that the cost of an incident resulting in a fatality might be in the order of £2 million (~US$2.75 million). The ALARP principle, and regulatory guidance suggests that reasonable expenditure to mitigate the risk should be in ‘gross disproportion’ to the cost of an incident.”2

The paper goes on to consider how stakeholders can calculate the expenditure reasonably required to eliminate or mitigate the risk of fatalities, including application of technology.

Consideration was given as to what that meant for floating gas.

Developing the outcome of the HITS JIP work, attention turned to minimising the down time for the gas containment inspection. Achieving the data required, while reducing operational impact, mitigating human safety risk, and reducing cost were again the drivers.

As part of the NoMan Plus® capability, EM&I has incorporated laser scanning for remote inspection. This technique develops 3D models, allowing bending and buckling from cargo sloshing and other causes to be identified and measured, as well as creating a ‘baseline’ data set which can be compared against for future inspection to identify change.

The laser scanner is deployed remotely into the tank and, following the inspection plan developed by skilled engineers to maximise the coverage, a number of scans are completed. The output is combined, and the 3D models are generated, enabling manipulation, review, and close inspection to identify anomalies.

The initial element of the NoMan Plus inspection involves insertion of high-grade optical cameras, mounted either on structures remotely deployed to the bottom of the tank for stability, or telescopic poles from upper entry points. With significant zoom capability, this enables an initial visual inspection to meet the equivalence requirement of arms-length inspection.

The next development of the NoMan Plus capability is remote inspection by tethered UAV, which is now entering service, again to mitigate the risks.

The most important benefit of NoMan Plus, optical inspection, laser scanning and the UAV is safety. There are no tank entries and no working at height, meaning the dangerous combination of working at height while being in a confined space is avoided.

There are cost savings as the number of people on board is reduced, with the maximum number of people permitted on board an operational restraint. As fewer people are required on board for tank inspection, there are fewer emissions by travel (if offshore), and more people for other vital tasks are allowed on board.

It is acknowledged that class is generally willing to extend inspection intervals on gas containment tanks in FSRUs located nearshore where sloshing loads are minimal. EM&I is looking

at leak detection techniques from the void spaces around the LNG containment as an intermediate inspection method during these longer intervals.

EM&I was given access to an operational FSRU which was temporarily alongside for maintenance and embarked on a pilot project to validate the capabilities of the NoMan Plus system for remote optical and laser scanning inspections of cargo tanks.

The trial was deemed a success by the operator of the FSRU, as well as by the attending surveyor who judged that the output would meet and exceed class requirement.

The benefits were summarised as the optical and laser systems were able to confirm that the tank was in good condition, with no evidence of significant anomalies.

Deployment and access points for the cameras and scanners need to be clearly identified and incorporated in the inspection plan, and to optimise coverage. This requires development from the original usage which is through deck openings into cargo oil tanks on FPSOs.

The trial showed NoMan Plus inspections, including full coverage general and close visual inspection, and laser survey, could be completed in one to two days, dependent on size of the tank.

As shown in onshore trials, highly reflective surface causes ‘phantom’ and ‘dead’ points, whereas corrugations in membrane create shadow areas and blind spots; both issues are overcome through taking multiple scans from various locations and utilising software tools to manipulate the data and ensure full coverage.

An issue not considered prior to the trial was a drop out in the Wi-Fi connection required to operate the laser scanner remotely. The tank acted like Faraday cage and nullified the Wi-Fi signal. Work around was achieved, and now as part of the continuous improvement and technical development process, EM&I is working with the scanner manufacturer to develop alternative communication methods.

The rapid increase in deployment of FSRUs and FLNG units brings new asset integrity management challenges. The work completed in adjacent sectors and on other energy production and storage facilities offshore provides valuable lessons and should be incorporated to meet regulatory requirements.

The development of techniques and technology that enhance the data available from inspection, mitigate safety risk, reduce impact on operations, assist with the reduction in emissions, and save owners and operators costs are being developed through collaboration and investment.

EM&I is excited to be at the forefront of some of these developments and deliver capability enhancements to its clients globally, including for FSRUs wherever they operate.

1. WOODS, A. ‘A Report on Fatalities in Commercial Diving’, Institute of Energy and Environmental Flows, University of Cambridge, (December 2022).

2. WOODS, A. ‘Confined Space Working Study; Safety in Confined Spaces with reference to Floating, Production, Storage and Offloading (FPSO) units and other marine vessels’, Institute of Energy and Environmental Flows, University of Cambridge, (February 2023).

Economies recognise the need to migrate from traditional but dirtier fuels to cleaner and more economical energy alternatives. However, this transition is not easy given the intricacies, innate capabilities, and limitations associated with adopting sustainable technologies, such as hydrogen or a fully renewable energy platform, for each geography.

There is a need to identify pioneering solutions that address the existing challenges and inefficiencies of attaining a sustainable, cleaner, and affordable energy source as a bridging mechanism towards fully adopting renewables that enable an integrated LNG infrastructure to support the full value chain ecosystem. Many countries have started to look at LNG as a viable fuel alternative that promotes a decarbonised journey towards the energy transition by helping reduce greenhouse gas (GHG) emissions, reaffirming energy security and mobility from fuel sources – it remains a practical solution for a cleaner and less expensive fuel.

Karthik Sathyamoorthy, President of AG&P’s LNG Terminals & Logistics, UAE, describes the company’s approach to LNG terminal development, from the planning stage to executing a hybrid onshore and offshore model that caters to the requirements of the market while having the capability to function despite extreme weather conditions.

AG&P’s flexible, scalable, and modular regasification technology has made it possible for diverse markets to seriously consider LNG despite topographical and climate difficulties, or challenges of small and fragmented pockets of energy requirements. The company’s clean energy networks are affordable, scalable, nimble, and sustainable. Armed with innovative solutions and world-class partners, AG&P develops complete LNG ecosystems comprising of project development, delivery, and commissioning, including LNG supply sourcing. Its expertise helps

realise terminals and downstream networks become faster, more economic, and with proven solutions.

Global LNG investments are reaching US$42 billion by 2024, a 50% increase from 2022 spending. New supply is also expected to raise LNG availability in the market from 2025/2026 onwards. Russian supply diversion from Europe to China will rebalance the market in the coming years and additional new supply will meet demand in other markets (gas equivalent of 40 million tpy in new pipeline capacity between Russia and China coming online within two years). Upcoming LNG liquefaction trains in the Middle East, the US, and other regions are expected to have a material impact in market rebalancing. Clearly, the world is heading towards a new cycle of oversupply that will push LNG suppliers to look for new demand creation and for an ever-increasing LNG import terminals and downstream infrastructure capacity. Headquartered in Singapore, AG&P is rolling out multiple LNG import terminals and linked city gas operations to bring LNG/natural gas to important, unserved, or underserved demand centres in South and Southeast Asia and beyond. As an owner, developer and operator of LNG terminals and downstream distribution network that is run on its proprietary regasification technology, the company is positioned to roll out clean energy networks across diverse markets and accelerate adoption of LNG/natural gas demand infrastructure. The company’s proprietary LNG/natural gas solutions unlock markets and addresses the demand capacity infrastructure gap through:

z Developing tailored LNG terminals and downstream infrastructure built at significantly lower cost, higher speed, and efficiency, with the ability to adapt to demand as markets grow.

z Acquiring an initial anchor customer in each market, often with a market-leading partner.

z Linking LNG suppliers to its networks to end-customers.

For example, in India, AG&P is one of the largest private city gas distribution (CDG) companies developing 12 CGD networks, or concessions, under the brand name AG&P Pratham, across 280 000 km2, covering 8% of India, an area approximately the size of Italy. In its 12 concessions, in the Indian states of Rajasthan, Andhra Pradesh, Tamil Nadu, Karnataka, and Kerala, AG&P Pratham is responsible for developing and operating compressed natural gas (CNG) stations for vehicles, piped natural gas to homes, and the distribution of LNG to industrial and

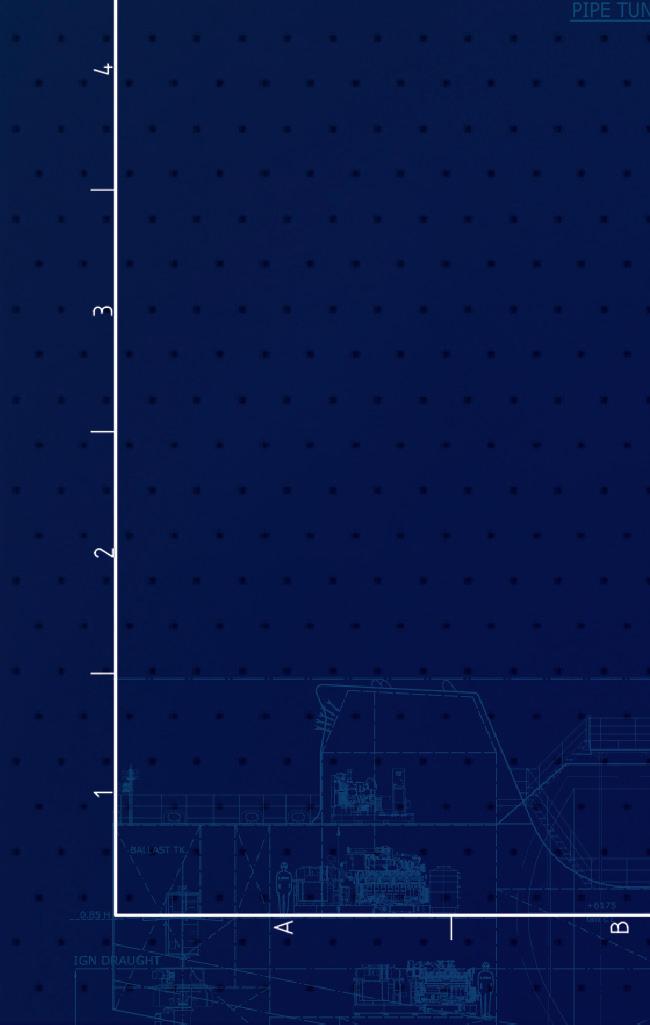

Storage

Phase 1

- Total storage capacity of approximately 197 000 m3

~ 137 000 m3 floating storage (primary).

~ 60 000 m3 onshore storage (buffer) approximately efegsix months later.

- Sufficient storage capacity to take full LNG cargo loads.

Phase 2

- Expanded storage capacity of approximately 377 000 m3

~ Additional 180 000 m3 onshore storage (primary).

~ 137 000 m3 floating storage (secondary).

~ 60 000 m3 storage (buffer).

Regasification capacity

- 420 million ft3/d through Gas Entec’s propietary regasification modules.

- Sufficient for approximately 3 million tpy of regasified LNG.

- Expandable through the addition of regasification modules to meet and increased send-out requirements.

- Sufficient for approximately 6.9 million tpy of regasified LNG by adding up to 330 million ft3/d of regasified modules when required.

commercial customers. AG&P is also the first private company to supply compressed biogas to customer. As of this year, AG&P Pratham has installed over 240 CNG stations, over 1700 km of pipeline, growing at 8 km/d and is connecting approximately 900 new homes daily.

The company actively develops efficient, right-sized LNG import terminals as gateways to new markets and makes LNG/natural gas available across diverse geographies, while serving as a dependable partner for building energy security and resiliency in the countries we operate.

The Philippines market has huge potential for developing LNG/natural gas infrastructure. The depletion of local gas field (Malampaya) has led to supply scarcity. 10 GW of coal-based planned power capacity is under threat due to current moratorium on coal power plants. With the moratorium on coal power plants and increasing renewable power capacity that depends on natural gas for solving its inherent volatility issues, natural gas-fired power plants will come online. In addition, there is a strong impetus by the government to promote gas usage for power with a possibility of a roll-out of gas concessions in the future. This is because the present 3.2 GW of gas-based power plant capacity in the country will increase to 4.5 GW by 2024, and is projected grow to 12 GW by 2032.

The Philippines’ Department of Energy (DOE) awarded AG&P the notice to proceed (NTP) for the development of its LNG import and regasification terminal in Batangas Bay on the main island of Luzon, called the Philippines LNG (PHLNG) Import Terminal. Ready to be commissioned in 2Q23, AG&P’s PHLNG, the first LNG import terminal in the country and the first modular terminal in the world, will play a critical role in addressing the country’s looming energy crisis.

PHLNG will have the initial capacity to deliver up to 3 million tpy of regasified LNG, with additional capacity for liquid distribution. On day one, PHLNG will have scalable onshore regasification capacity expandable to 5 million tpy. The world’s first hybrid-designed PHLNG import terminal, using modular Regastainers (AG&P’s proprietary regasification plug-and-play technology developed to scale terminal capacity), will be commissioned in two phases. The first phase will be commissioned with the FSU storage in 2Q23, and the two

additional onshore storage tanks will be integrated by the end of the second phase in 2024. Then, PHLNG will have scalable onshore regasification capacity of 504 million ft3/d and 257 000 m3 of storage that will ensure high availability and reliability of natural gas for its customers. The terminal will also act as a gateway in providing breakbulk LNG supply to various islands across the country. PHLNG will supply gas to one of the largest power producers in the country – SMC Global Power (SMCGP). The terminal will be primarily used to service SMCGP’s baseload/mid-merit gas-fired power plants, having a total capacity of 2.05 GW with a provision to expand its installed gas-fired capacity to 3 GW in the next 5 – 7 years.

SMCGP is the power arm of the San Miguel Corp., a prestigious Philippine-based conglomerate. SMGCP is one of the largest power producers in the Philippines, with a portfolio of over 2900 MW of installed capacity using coal, natural gas, and renewable energy. SMCGP is the operator of the Ilijan Power Plant, a 1200 MW gas-fired power plant located in Batangas. This power plant had relied on domestic gas to support its operations; however, with the domestic gas field (Malampaya) expected to be depleted in the next few years, SMCGP is looking for alternative solutions to extend the life of its current gas allocation. In addition, SMCGP has a robust pipeline of power development projects, such as the second gas-fired power plant with an installed capacity of 850 MW within the same vicinity and an additional ~1000 MW worth of gas-fired power plants in their power development pipeline.

The planning stage is the most crucial phase of any terminal development project wherein it entails a thorough analysis on critical parameters affecting the technical concept, viability of the project, customer preferences, project engineering, resources that need to be in place, local government, and the regulatory framework. AG&P’s terminal design minimises redundancies and fully utilises an optimal fit-for-purpose methodology, working around the constraints to come up with the best executable solution. AG&P employed reputable contractors and experienced professionals to construct the terminal and jetty with the highest HSSE standards, quality assurance and quality control processes at the shortest possible timeline that is aligned with the critical path execution strategy. The modularised concept not only led to reduced cost of the overall terminal, but also needed lesser maintenance and reduced manpower requirements at the project site.

The terminal is capable of receiving various LNG carrier sizes, such as Q-Max, Q-Flex and small scale feeder vessels with varying laytime allocation based upon cargo capacity.

The discharge from LNG carrier to the FSU follows a strict security and administration protocol.

The LNG terminal can operate throughout the year irrespective of weather conditions. This is only possible because of its hybrid offshore FSU and onshore regasification design. The FSU located at Batangas Bay at AG&P’s PHLNG facility on the main island of Luzon has been chartered for 15-years from ADNOC L&S. AG&P’s subsidiary, Gas Entec, converted ADNOC L&S’s Japan-built, Moss-type LNC carrier into a FSU in five months. The FSU is part of the combined offshore/onshore terminal that will have an initial capacity of 5 million tpy and provide its customers with resiliency of supply, even in storms. In addition, the rigorous berthing, mooring analysis, and technical recommendations from experts are a part of the terminal design to protect it from extreme changes in weather.

Aside from the anchor powerplant customer, the LNG terminal is also capable of loading LNG in ISO tanks and road tankers for local distribution across the geographic envelop.

The concept of utilising FSU as the primary storage and having onshore regasification system prevents any expensive vessel modification and promotes longer utilisation of the terminal given its flexibility in terms of buffer storage.

AG&P utilised GAS Entec’s RegasTainer® technology as a custom-designed feature to accommodate the hybrid solution requirement by optimising the overall design that is cost effective and easily scalable.

The construction of the terminal was envisaged in two phases. Phase 1 is designed to utilise onshore regasification, buffer storage, utilities, balance of plant, and supplemented with an FSU. Meanwhile, Phase 2 is designed to increase the terminal’s onshore storage and regasification capacity as demand for energy rises. The design has provisions for utilities including flaring, gas detection, seawater intake and outfall system design, boil-off gas handling system, and truck loading bays.

AG&P established a process block flow diagram to schematically ensure a seamless flow of liquid and gas molecules from the LNG carrier to the customer premises.

The diagram shows the terminal’s capability to transfer LNG through a series of molecule flow towards the high-pressure pumps and the boil-off gas compressor that are regasified in the shell and tube heat exchanger against glycol water to eventually

pass through the sampling and metering station at the customer premises. Another stream of LNG is transferred from the FSU through low pressure pumps which are dedicated for LNG ISO tanks and road tankers.

The jetty, FSU, and the associated mooring facility are designed to be compatible to take LNG from any visiting LNG carrier (of up to 170 000 m3) through ship-to-ship transfers. The jetty and mooring design has four berthing dolphins, six mooring dolphins, and LNG unloading arms.

The terminal is scheduled for commissioning between April-end and early May, in time for LNG supply to the 1200 MW Ilijan combined cycle power plant to address Luzon’s power supply deficit and stabilise power.

As of writing, the full ship-to-ship (STS) LNG transfer from Golar Glacier LNG carrier to the 137 500 m3 ISH FSU has been completed.

The ISH FSU is berthed at AG&P’s PHLNG Import Terminal in Batangas Bay, the first LNG terminal in the country and the first modular LNG terminal in the world.

The company complements the development stage by following through with operating and maintaining the terminal and continuously render services to improve operational efficiency, productivity, and safety of the project while reducing its downtime.

AG&P is keen to unlock the downstream market in the Philippines and is prepared to deploy substantial resources into developing downstream infrastructure in various practicable modalities to serve the energy needs of customers as a one-stop shop LNG value chain project EPC, financing, development and downstream solutions provider.

The energy industry is at a revolutionary point to ensure efficient mobility of resources and energy security despite the fact that every economy is at their own respective pace of transition towards net-zero emissions and improving quality of life. The challenge is always to bring the most innovative yet practical solution palatable to counterparties at the quickest turnaround time.

LNG is a promising alternative for a future-state norm in the industry while the technological evolution of renewable energy, hydrogen and other forms of cleaner energy materialises. AG&P has taken efforts to own, develop, and build LNG import terminals using proprietary technical solutions that address gaps in the natural gas value chain. These gaps prevent access to end-users in nascent and growing markets around the world which the company has addressed by making natural gas accessible, unlocking markets and accelerating its adoption globally, country by country.

CryoMac® 4 LNG Fueling Nozzle

Maximum safety for LNG fuel technology

The most cost-effective way to transfer cryogenic liquids

SAFE

“Safety Stop” for added safety and operator protection.

these

Praveen Lawrence and Briain O’Dowd, Royal HaskoningDHV, UK, detail how predictive simulation can aid with managing LNG terminal demand.

The war in Ukraine created an urgent need to replace Russian natural gas, with LNG representing the best alternative. To meet the spike in LNG demand, Europe is aggressively ramping up its regasification capacity by bringing FSRUs online and expanding land-based facilities. Europe has so far been able to manage its gas requirements thanks to the mild 2022 winter, but it is not out of the woods yet. Countries are facing many uncertainties with how to deal with the 2023 winter and beyond, especially when:

� The war in Ukraine is ongoing without signs of de-escalation.

� Europe still relies on Russia for 25% of its gas imports.1

� Europe needs to further reduce gas consumption to improve its energy security.2

To meet the growing need for LNG processing, Europe is investing hundreds of millions of euros in building new, and expanding existing, regasification terminals. For projects of this scale, there is usually intense scrutiny of operational contingencies, technical assumptions, and commercial risks to ensure that investment is appropriately channelled. However, the geopolitical situation means the industry is now working under tight timescales to deliver these projects of national significance. As a result, scrutiny processes must be expedited – with stakeholders needing a reliable way to de-risk projects.

Business logistics simulation software and verification services play essential roles in delivering that speed and risk reduction. This article will look at the role of predictive simulation in LNG terminal logistical performance and planning, along with two use cases.

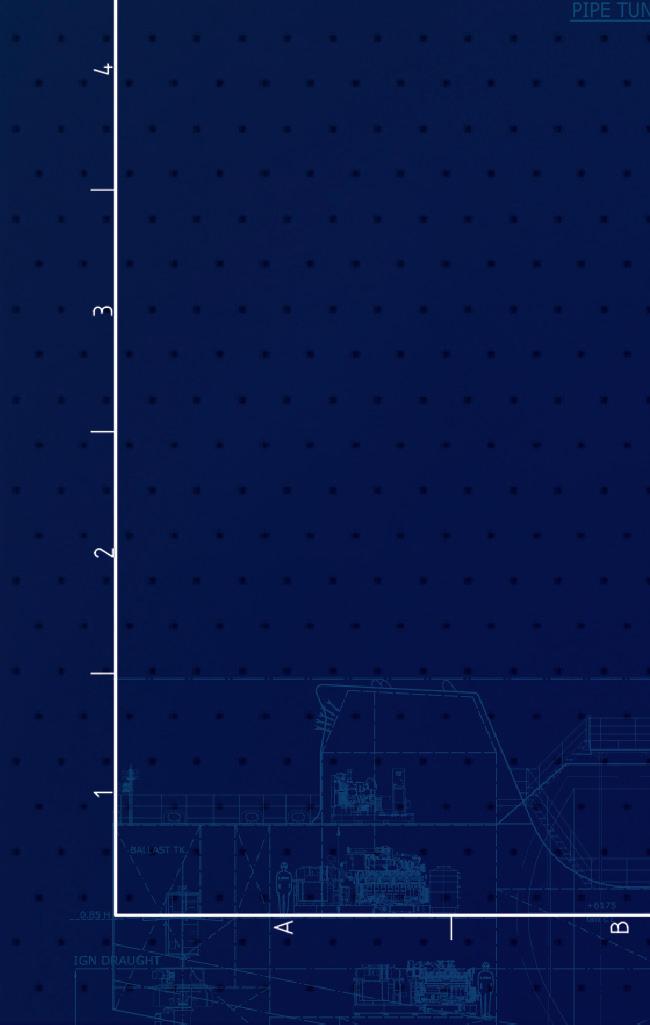

LNG terminal operations involve complex and interdependent supply chains, as well as dynamic uncertainties such as the knock-on effects of seasonal gas demand nomination, tides, and large weather disruptions (Figure 1). While scheduling tools are appropriate for short-term and tactical decision-making applications, they fall short when dealing with long-term planning and annual demand plan (ADP) assessments accounting for real-world risk factors. Business logistics predictive simulation software helps operators address these complexities, inter-dependencies, and uncertainties. It is therefore a vital tool for testing and verifying terminals’ logistical performance as part of long-term planning.

Historically, due diligence and verification exercises have been kept for later stages of design. However, when large strategic projects are delivered to very tight deadlines, there is not much leeway for delay. Using predictive simulation to verify plans as early as feasibility and pre-FEED stages helps to pick up unforeseen issues and minimise the risk of schedule slippage/asset under-performance.

Another important benefit of predictive simulation in LNG terminal planning relates to project management and co-ordination. Projects involve multiple stakeholders, ranging from marine and terminals to commercial, marketing, and legal. Predictive simulation enables commercial analysts, operation professionals, and designers to bring together all information in one environment and creates a single source of truth for all these stakeholders – helping avoid the risks associated with information silos.

Supply chain stress-testing is another valuable use case. Verification studies using high-fidelity dynamic business logistics simulations provide accurate insight to pinpoint supply chain inadequacies, find alternatives to mitigate risks,

exploit any resilience in the system, and thoroughly test terminal design and shipper contracts.

The role LNG regasification terminals play is rapidly evolving. As global LNG trade patterns change, the supply of LNG to terminals has become more flexible, with shippers mixing both long-term contract and spot market cargos to meet their demands. Moreover, terminals have become gas hubs that serve multiple shippers, including gas customers, LNG trucking and rail transfer, as well as providing bunkering. The flexibility and ability to serve multiple customers brings operational complexity and more contractual uncertainty. Therefore, those crafting and verifying terminal use and shipper contracts need to analyse the greater marketing and commercial options when balancing the needs of multiple shippers. Predictive simulation can handle this dynamic push/pull of many-to-many shipper/buyer combinations to generate, test, and optimise advantage parts solutions.

Twinn LNG Logistic Simulator (previously under the Lanner brand) has been trusted by many of the world’s leading LNG terminal operators – both liquefaction and regasification – for nearly 20 years. Powered by Twinn predictive simulation software, large European facilities, such as Fluxys Zeebrugge LNG and other new regasification terminals, use it for long-term horizon planning and verification assessments, either utilising in-house resources or, if an independent verification is required, using Twinn LNG expert services. Here are a couple of examples of how the Twinn approach to LNG logistics simulation benefits operators in practice.

A major LNG terminal operator was looking to capitalise on market conditions to diversify and expand. It needed to take a risk-based approach to this expansion – ensuring asset optimisation and a high standard of service for all traffic coming in and out of the terminal. The company therefore needed to understand what was operationally feasible and commercially viable.

Stakeholders from operations and business development were tasked with exploring what was possible given all the moving parts involved in terminal operation – from ship sizes and traffic patterns to tides, weather events, and port operator delays. This formed part of the due diligence process that would set the framework for the engineering, procurement, and construction phases to follow.

The stakeholders did a base level of static analysis internally, but as the variables

became increasingly complex, the limitations of their in-house tools became apparent. Having worked with Twinn experts in the past and benefited from their predictive simulation expertise, the Twinn experts were to help define the operating boundaries for this expansion project. Not only would the LNG Logistics Simulator facilitate more informed decision-making, but the independent validation would give stakeholders more confidence in the due diligence.

Importantly, the operations and business development stakeholders were working to a tight project timeline – they needed to present their findings to senior management within four weeks.

The terminal operator had loose boundaries they wanted to investigate based on their static analysis, so the Twinn team started by refining these to define the scope of the parametric study. The first step was to define the finish line – the key questions stakeholders needed answering using the LNG Logistics Simulator. Following discussions with stakeholders, two key areas were identified:

� Berth occupancy and utilisation – and whether there was a business case for investing in another berth.

� Risk of delays associated with different traffic levels – including which customers would be affected and what the impact would be on ship movements, storage capacity, and demurrage.

Then the Twinn team looked at a matrix of variables, including factoring in seasonal probabilities based on external data around weather, wind, and visibility. Other variables related to the terminal operating rules and the number of berths and ships.

Then, using the LNG Logistics Simulator, the terminal operator stress-tested different demand levels across several operational scenarios. By factoring in current import ship contracts and forthcoming partnerships, they experimented with different small scale traffic levels, docking and mooring patterns, ship loading times, and storage tank capacities. This enabled the team to identify sensitivities at the upper and lower limits, home in on the tipping point for an additional berth, and frame the operational boundaries for future contractual arrangements regarding delays and demurrage.

Within four weeks, the terminal operator had a precise and complete analysis to present internally. Importantly, there was validation behind each figure, helping stakeholders understand the story behind the data and make decisions with confidence. This creates deep knowledge of the constraints and the trade-offs involved in strategic expansion, with quantifiable solutions to uncertainties and challenges. The company also has a wealth of operational and commercial data to inform the investment case for an additional berth and storage tanks. Key strategic questions such as, ‘Under what circumstances would delays be incurred that are contractually and operationally destabilising?’ are now easy to answer, and the terminal operator can take proactive measures to avoid these situations and optimise services as it grows.

The data can also be used in commercial discussions as part of the sales and relationship-building process, demonstrating the business case for why their terminal is an LNG terminal of choice. The terminal operator is now in a

stronger position to capitalise on demand, develop a competitive advantage, and forge mutually beneficial partnerships.

In the current environment, operators must deliver robustly tested ADPs to ensure energy security and keep to their committed targets. This use case illustrates the key role that predictive simulation plays in this process.

A large LNG operator was experiencing serious market interest in booking its capacity. To meet this additional demand, the operator needed to undertake significant expansion across storage, send-out, and conversion.

During negotiations, shippers expressed concerns over the guarantee of their individual access in a multi-shipper environment. Most of the terminal’s equipment blocks needed to be expanded, and failing to create the right capacity at every point would cause a range of problems including insufficient storage space, inability to discharge tankers at the right time, not delivering the required send-out rate, and lower-quality gas reaching networks.

The operator chose Twinn LNG Logistics Simulator to model the expanded facility and inform ADP planning. The model incorporated each prospective supplier’s shipping activities and accommodated dynamic delivery scheduling to coincide with available slots, tidal and weather behaviour at the port, as well as the terminal’s operational constraints and processes.

The model of the proposed facility allowed the company to experiment with and fine-tune the planned extension while proving the viability of its plans to meet suppliers’ needs. In fact, the modelling even demonstrated that there would be capacity above initial projections, allowing the operator to set contracts for 6% more.

Additionally, because the team ran scenarios for different capacity expansion opportunities, the terminal operator could determine which design would deliver the best return on investment. This helped them direct US$165 million of capital investment in the most effective way – with the simulated terminal of the future providing certainty and confidence.

With European LNG terminals rapidly being brought online to ensure energy security, it is essential that all the moving parts within the LNG terminal supply chain work together to meet its dynamically changing logical performance requirements. As most of the terminals involve brownfield expansions, re-purposed FSRUs, and/or use of existing ports, business logistics simulation studies are vital to ensure terminals are built without delays and provide the energy security Europe needs.

1. ‘Infographic – Where does the EU’s gas come from?’, Council of the European Union, (7 February 2023), www.consilium.europa.eu/en/infographics/eu-gas-supply/

2. MASTERSON, V., ‘How the European Union can avoid gas shortages in 2023’, World Economic Forum, (12 January 2023), www.weforum.org/agenda/2023/01/iea-europe-gasshortages-2023/

Executing LNG capital projects has proven to be high risk, with results not meeting the facility owner’s business objectives. The resulting impact on the industry is that shareholders and management are under increased scrutiny to perform. As a result, they have developed a high-risk aversion when making go/no go decisions on projects. Using the same methodology as past projects opens the project up to repeating past mistakes. The approach to these projects requires new ways to address these concerns and innovative methodologies that increase the chance of success. According to EY’s survey conducted in 2019 on 500 oil and gas mega projects, the results found that 60% of projects experienced schedule delays and 38% of projects experienced cost overruns. 1

LNG projects are complex and therefore frequently experience an increase in cost and time to deliver. The performance from these cost and schedule overruns results in the owner not achieving the minimum internal rate of return (IRR) necessary to be profitable. In most cases, the expected compound annual rate of return that will be earned on a project needs to be a minimum of 15%, with a

minimum net present value (NPV) of 0 for an agreed discount rate of investment.

LNG facilities are mega downstream projects, which contributes to the uncertainty of achieving the desired performance objectives based on past mega project performance. Some of the complexity of an LNG facility include:

� Very large mechanical packages (i.e., compressors, exchangers).

� Very large plant input flows leading to challenging flaring designs.

� Novel large HIPPS valves.

� Complex safety studies.

� Limited flaring capacity due to limited site availability.

� Cryogenic service.

Importantly, lean engineering and design methods have provided more certainty to achieve the business objectives allowing for projects to be funded as well as be successful. Lean engineering and design methods have been implemented by facility owners, as well as EPC companies in several industries.

Traditional project executions tend to execute the project without understanding the overall business drivers and objectives, and the projects facility designs result in not aligning with the business objectives. Therefore, the project does not pass through the funding gate or meet the facility owner’s business requirements without reworking the design late in the project.

There are lean engineering and design methods that the automation and controls groups can use to help improve the projects IRR and maximise the facility owner’s overall project value. This article will discuss lean methods that can be used by the automation and controls group, including implementing new digital technologies, aligning the class of plant with business needs, performing necessary lifecycle cost analysis, utilising productisation, and optimising design margins. Managing the automation interfaces and execution with the other project disciplines are also crucial to maintain the project cost and schedule.

Incorporating these methods into a project will successfully reduce the projects’ overall lifecycle cost and help it meet the projects’ IRR requirements.

Lean thinking is a business methodology that aims to provide a new way to think about how to organise human activities in order to deliver more benefits to society and value to individuals while eliminating waste.

Lean engineering and design utilise methodologies that develop a facility design to maximise the facility owners value proposition, minimise waste, and, ultimately, meet the facility owner’s needs. Lean methods involve reviewing the ‘needs and wants’ of a particular design with all stakeholders, and only incorporating the needs into the design to ensure the design meets the required business objectives. Currently, projects are incorporating both the needs and wants into designs, increasing the cost and schedule unnecessarily. Lean design seeks to define the necessary needs of a facility early in the project

in order to minimise rework and maximise the efficiency of the work effort. This means getting automation and process controls disciplines involved much earlier and in more facets of the project requirements phase than what is traditionally done. There are tools that can be utilised to ensure a lean design is being incorporated into the automation and controls of a project.

In order to have the right mindset on a project, operators will need to ensure the automation and controls team, along with the project team, are aligned with the project business objectives, and embrace a lean thinking mindset. These methods are meant to be completed during the early stages (DBM/front-end planning [FEL2]) of the project lifecycle. A traditional approach with automation and process control is more reactive – there is little opportunity to influence the business case and process design from an automation perspective. The lean approach can also improve the effectiveness of the design with earlier automation discipline input. Novel solutions can be incorporated into the design, which would otherwise not be cost effective if done later in the project. The value of the opportunity when implemented early in a project is greater than when implemented later in the project, as indicated in Figure 1. This is due to the increased risk of change later in the project lifecycle.

LNG facility owners may implement several value improving practices and lean execution methods in the early front-end stages of a project’s lifecycle. For example, DyCat Solutions can apply 15 lean design and execution methods on projects to maximise the facility owner value. This article will focus on seven different lean engineering and design methodologies – including the business case alignment, new digital technology, class of plant, lifecycle cost analysis, productisation, optimising design margins in automation utilities, and project governance – that can be used by automation and controls teams on LNG projects to provide the most cost-effective design and provide the maximum value for the facility owner.

As part of a programme or project execution, there should be an alignment process to assure all stakeholders understand and agree on the business drivers for engineering and design. Historical reviews of projects have indicated that facility owners’ organisations are not internally aligned on the business case and key success factors which promote a successful business outcome. In addition, internal organisations have conflicting objectives to the overall business objectives. The Construction Industry Institute 2 (CII) and Lean Construction Institute 3 (LCI) recommends that alignment between the business and the project is critical to the success of the project. The business case alignment methodology is a structured approach for all stakeholders to align on the business case and drivers which should dictate the engineering and design strategies.

The automation and controls group need to be part of this alignment in order to assure an optimal design

which supports the business objectives is developed. They will need to understand and assist with the level of automation and controls that is required for the project based on the business objectives and drivers. Traditional projects will typically include the highest level of automation and control required without understanding the actual business requirements. They will also be involved in assisting to determine the project expandability, reliability, and availability requirements based on the business case. Historically, these factors are not aligned early on in the project and the project then has overdesign built in, which is not required and adds unnecessary costs. The business case alignment tool addresses: general requirements, mandatory constraints, facility design capacity, facility operational flexibility, facility expandability, facility controls and automation philosophy, and facility operations and maintenance (O&M) philosophy.

The application of automation and controls of industrial projects, such as LNG projects, has made great strides with improvements in technology through the industrial revolutions. Progress from the first industrial revolution Industry 1.0 to the future of Industry 4.0 is illustrated in Figure 2.

The LNG industry is currently implementing at an Industry 3.0 stage:

� Traditional automation is utilised: Automated control systems which apply remote I/0 connected to fibre optic back to control panels, systems, and rooms.

� Traditional smart instruments are utilised: Smart configured instruments which can direct operational data back to control displays, asset management systems, and historian/business systems.

� Wireless instrumentation: Delivers smart data remotely via the internet back to the controllers, which is at its early stages of implementation in the heavy industrial sector.

� Digital asset management systems.

� Data historian/business systems interfaces.

The automation and controls technologies have made further advancements which may not be effectively deployed on industrial projects, such as LNG liquefactions and regasification projects, and can be considered lean in application. These advancements are considered the next stage as Industry 4.0 with the application of:

� Industrial Internet of Things (IIoT): An evolution of a distributed control system (DCS) that allows for a higher degree of automation by using cloud computing to refine and optimise the process controls. It includes interconnected sensors, instruments, and other devices networked together with industrial applications and allows for data collection, exchange, and analysis to facilitate productivity and efficiency improvements.

� Big data and analytics: The obtaining of digital data and then the method to process, clean, and analyse the data for the purpose of predictive analytics and machine learning.

� Cloud computing: The on-demand availability of computer system resources, such as data storage and computing power. It allows for the use of virtual configuration and programming on remote servers, without the need to procure specialist automation hardware. It has the advantage of the latest configuration being available at multiple locations/sites. MOC and data backup is also more securely accomplished.

� Digital twin: A virtual representation of an intended or actual real-world physical product, system, or process. For LNG facilities, a digital twin would be the 3D model representation of the actual facility in real time.

� Augmented reality: An interactive virtual experience of a real-world environment where the objects that reside in the real world are enhanced by computer-generated perceptual information, sometimes across multiple sensory modalities, including visual, audio, touch, and smell.

The effective application of these tools should improve the project productivity and efficiency, leading to reduced lifecycle costs and improve the project’s IRR.

Most owners have developed a design package in the DBM (FEL2) phase to support the FEED (FEL3) phase development. The design package normally includes the facility owners’ set of specifications and standards, which have been developed based on historical input from past project experience, operational and maintenance experience, the owner’s technical team input, and recognised international technical organisations. Over time, these specifications and standards have included not only the ‘needs’ of the project or facilities, but also the ‘wants’ or ‘nice to haves’. Applying all these requirements may not meet the business objectives and could result in the project not meeting the project IRR requirements.

The class of plant is a tool that aligns business objectives with the appropriate plant class that provides the baseline for the engineering and design team. This tool also ensures that the requirements are

incorporated into the design earlier rather than having to rework the design later in the project. The first step is to establish the class of plant which supports the business objectives. Often what is enlightening to the stakeholders is the difference in the class of plant which the established specifications, standards, and code requirements compared to the class of plant that the business objectives support. Plants are specified based on various classes from a Class 1 to a Class 3 plus, with the capital cost increasing per class. The class of plant has a direct impact on the facilities’ return on investment (ROI).

The class of plant is categorised into six categories – capacity, flexibility, expandability, reliability (including loss prevention), process controls, and O&M – which measures the design requirements.

All categories identified will have an impact on the automation and controls group in developing the optimum design. Collaboration is required between all engineering and design disciplines when establishing the class which meets the specified business objectives. After the class of plant is determined, the automation and controls team can establish a lean design basis and update the project specifications or standards.

An example is provided from the process control checklist for identifying the class of plant for the category of reliability and impact of the UPS/backup power system is indicated in Table 1.

As is demonstrated by aligning all stakeholders on the class of plant, the automation and controls team has a basis for development of the optimum lean plant design specification.

Lifecycle analysis is a decision-making methodology that evaluates both the CAPEX and OPEX associated with a specific design and identifies the IRR and NPV for two or more alternative designs. Most facility owners and EPC companies struggle with developing quick lifecycle analysis for making decisions on adding or deleting capital scope to their projects. Lifecycle analysis is a tool which provides fast assessments on scope changes to determine the value the change brings to the programme or project, and whether it supports the business case. Key factors to consider when calculating the lifecycle cost for a facility include comparing the product revenue against the capital costs, O&M costs, and feedstock costs.

For example, during detailed engineering, the owner’s O&M team want to add additional platforms to access some instruments which are low frequency

Description Cost impact

Class 1

- Redundancy of power supplies is limited to safety critical systems.

Class 2

Class 3

UPS/back-up power Medium

- Plant up-time requirements do not warrant extensive redundancy.

- Power back-up is via UPS for safety critical systems.

- All controls and SIS power supplies are dual redundant or N:1 redundant and powered through a dual UPS/emergency diesel generator feed.

- No special distribution arrangements are made (i.e., standard instrument power supplies feed via a UPS distribution board).

- All controls and SIS supplies are dual redundant.

- The main UPS shall be provided via a dual (100% redundant) UPS.

- The UPS system would have multiple AC feeds, including the emergency diesels.

- The power distribution would be designed to avoid common mode failure and would include dual feeds to all control and safety systems.

maintenance items. The changes at this stage of design could add significant capital cost and delay the project. Justification by the project team to accept or reject the change could be established by performing a quick lifecycle cost analysis for current design vs change to design.

Productisation can be defined as “the process of analyzing a need, defining, and combining suitable elements, into a product-like object, which is standardized, repeatable, and comprehendible.” 4 Industrial productisation is the future of heavy industrial constructed projects, such as LNG facilities. Productisation combines both modularisation and standardisation methods for repeatable components, units, trains, or facilities. This design build method addresses most owner’s strategies of the future:

� Owners of industrial facilities are looking at innovative methods to improve the projects ROI.

� Owners of industrial facilities are looking for contributions to their environment, sustainability, and governance strategies.

Modular design is considered a section or block from a facility that is fabricated and assembled in an off-site

location from its installed position. The module can contain equipment, piping, instruments, electrical and controls cabling, and local electrical and/or instrument rooms within a structure. An example of a module is depicted in Figure 3.

Most LNG facilities are now applying a modular execution and design. Automation and controls technologies (Industry 4.0) are well suited to support modular designs but may require adjustments or deviations to the owner’s current specifications and standards.

A standardised design consists of a process envelope which is engineered and authenticated once, and executed many times. Facility standardisation is the development and use of consistent designs and standards for repeatable projects within a programme. CII recognises the value with effective application of facility standardisation and has conducted research on what is required to standardise facilities. There is a varying level of standardisation that can be applied to a facility (Figure 4).

The more standardisation that is applied to a programme, the more benefits will be realised. Standardisation is directly related to proven-in-use designs (i.e., not re-inventing the wheel each time). This approach greatly improves reliability both in project execution and operations.

For LNG facilities, there exists an opportunity to apply productisation with standardised modular process trains and standard pre-assemblies. Pre-assemblies are when materials, prefabricated components, and/or equipment are joined together by different crafts at an off-site location for subsequent installation as a sub-unit, and can consist of only one or two components.

Pre-assembly standardised examples which can be applied to LNG facilities include:

� Manifolds.

� Cabinets.

� Sample stations.

� Lighting panel or fixture.

� Utility stations.

� Instrument or cabinet support systems.

� Instrument rooms.

Automation and controls will include margins to their design calculations. The amount of margin applied can often be very conservative and create overdesigns which do not provide real value.

Design margins often become accumulative where other disciplines and vendors add additional margins based on their guarantees, warrantees, and perceived risk. It is easy to see how overdesign can create loss of value to the facility owner without careful management.

An example of how design margins can impact the value is described in the UPS design. Design margins are normally applied to:

� UPS loading.

� Conversion from DC loads.

� Redundancy.

� Segregation.

� Backup time.

These design margins then add up and cause the UPS to be greatly oversized. A solution would be when reviewing these categories, the automation and control team needs to collaborate with other disciplines, such as process and electrical. They will need to review the following to establish the realistic requirements and appropriate design margins for:

� More careful definition of spare capacity with the end-user.

� Actual expected load vs cabinet nameplate capacity.

� Realistic plant expansion.

� Realistic design margins.

� UPS standard model size vs battery capacity.

� Unrealistic battery run times.

Once the requirements have been established and aligned with, a more practical and cost-effective UPS design can be developed.

It is important to provide the necessary governance on the project to ensure the project team implements the required lean engineering and design methods and tools that are set out in order to meet the business objectives. Governance is the continuous monitoring to ensure the effective implementation of the lean design and execution methods and tools. It is typically performed by a third-party reviewer or organisation, and has been very difficult to complete on industrial projects since third-party/independent reviewers are often not deployed to perform the reviews. The process begins when a validated project concept has been identified during the business planning process and ends when the project has been completed and ready for start-up.

Utilising lean methods early on in an LNG project can set the project and automation and controls team up for success.