85 YEARS OF SOLUTIONS.

Since 1937, Fletcher has been answering some of underground mining’s toughest questions. At Fletcher we provide more than solutions, we provide an atmosphere for an open dialogue with customers to ensure their operations are reaching maximum efficiency. Fletcher provides lifetime support through an experienced, knowledgable team of sales staff, engineers and field service technicans. Is your operation facing obstacles that mass produced equipment isn’t addressing? Get your custom solution started today. Learn more at www.jhfletcher.com

CONTENTS

08

Jorge Uzcategui and Kirill Kirilenko, CRU, UK, look at some of the key trends defining the gold mining industry’s mid-term profile and production levels.

14

Product Development Through Collaboration

Perttu Aho, Robit, Finland, highlights the importance of collaboration with customers and partners when designing new products – bearing in mind that no two work sites are the same.

22 Six Reasons Why An Open Ecosystem Is The Future Of Mining

Greg Lanz and Simon van Wegen, Komatsu, USA, outline the need for greater collaboration in the mining industry and the potential advancements an open ecosystem approach could bring about.

27 Maximising Flotation

Eric Wasmund, Eriez Canada, Jose Concha, Eriez Peru, and Homie Thanasekaran, Eriez Australia, examine how innovations in cell technology can help maximise mineral recovery from froth flotation – resulting in more profitable and sustainable projects.

31 Something To Bear In Mind

Jason Ludwig, Regal Rexnord, USA, reviews several examples of how significant savings were generated by selecting the right type of bearing.

33 A Solar Hybrid Solution

Alistair Jessop, Vivo Energy, South Africa, discusses the potential for renewable energy in Africa’s mining sector and how solar hybrid solutions can help the industry become more sustainable.

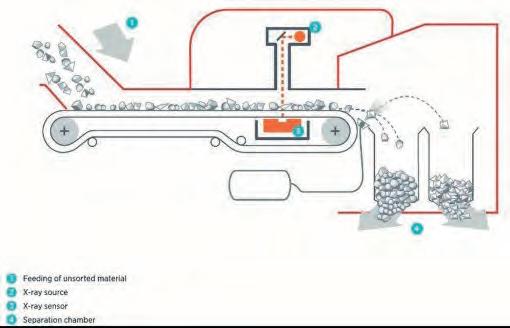

36 Sorting The Best From The Rest

Jordan Rutledge, TOMRA, Australia, evaluates the emerging role of sensor-based particle sorting in the race to electrify vehicles.

41 Foam To Improve Safety

18 Stay Ahead Of The Storm

Martin Adam, Orica, Australia, explains how wireless blasting technology can reclaim hundreds of production hours at risk of being lost during storm seasons.

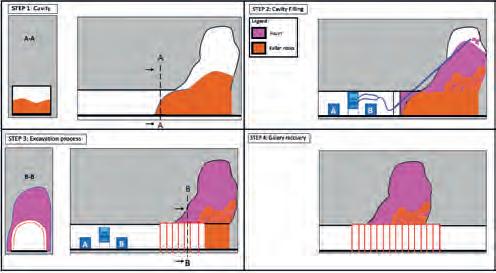

Anthony Ferrenbach, Weber Mining & Tunnelling, Mexico, details how cavity filling with foam product can be safer than using other methods and delves into a case study where foam filling was used to great effect.

45 A Surface Mining Mission

Steve Seabolt, Trencor, USA, presents five tips for maximising the productivity of surface miners and how they can usher in a new era of mining.

Robit

is the expert focused on high quality drilling consumables for mining and construction markets globally – to help you drill further, faster. Through our high and proven quality Down-the-Hole, Top Hammer and Geotechnical products, as well as our expert services, we deliver saving in drilling costs to our customers. More at robitgroup.com.

Our expertise goes beyond the bench with a mindset focused on outcome-based fragmentation. Together, we can help you maximize your return on investment through solutions that reduce your total cost of operations while increasing your productivity.

Guest Comment

It is well known that the mining sector is currently the oxymoron example of the energy transition – it is the supplier for the critical minerals essential for decarbonisation, whilst under significant investor pressure to plan and progress its own energy transition. Recently the hydrogen industry, though less understood than most renewable energy sources, is gaining traction in the mining sector as a potential avenue for mine site, and wider scope, decarbonisation.

MANAGING EDITOR

James Little james.little@globalminingreview.com

SENIOR EDITOR

Callum O’Reilly callum.oreilly@globalminingreview.com

EDITOR

Will Owen will.owen@globalminingreview.com

EDITORIAL ASSISTANT

Isabelle Keltie isabelle.keltie@globalminingreview.com

SALES DIRECTOR

Rod Hardy rod.hardy@globalminingreview.com

SALES MANAGER

Ryan Freeman ryan.freeman@globalminingreview.com

PRODUCTION MANAGER

Kyla Waller kyla.waller@globalminingreview.com

ADMINISTRATION MANAGER

Laura White laura.white@globalminingreview.com

EVENTS MANAGER

Louise Cameron louise.cameron@globalminingreview.com

EVENTS COORDINATOR

Stirling Viljoen stirling.viljoen@globalminingreview.com

DIGITAL ADMINISTRATOR

Leah Jones leah.jones@globalminingreview.com

DIGITAL CONTENT ASSISTANT

Merili Jurivete merili.jurivete@globalminingreview.com

Scope 1 emissions are direct greenhouse gas (GHG) emissions from sources owned or controlled by an organisation, while Scope 2 emissions are indirect GHG emissions resulting from the generation of purchased or acquired electricity, heating, cooling, and steam consumed by an organisation. Rio Tinto, BHP, Anglo American, and Vale all have goals to reduce Scope 1 and Scope 2 emissions in the short term by 2030, and long-term commitments to achieving net zero operation emissions by 2050. Other miners, such as Fortescue, have more ambitious goals, aiming to achieve carbon neutrality across their iron ore operations by 2030, and net zero emissions across their value chain by 2040.

Achievement of short-term goals is more attainable and likely to be achieved by divestment of operations with high GHG emissions, such as thermal coal, and changing of power purchasing and generation habits by switching to traditional renewables (with the added benefit of improved energy security). Long term goals are more uncertain however, given that the sector is largely relying upon technological innovation. Although the primary focus remains on electrification, solar, wind and energy efficiency, recently a growing number of mining companies have been proactively investing in the hydrogen industry. Anglo American have conducted a feasibility study into a hydrogen valley and partnered with First Mode to develop a hydrogen-powered mine haul truck. BHP has partnered with Hatch to design an electric smelting furnace pilot plant, which will test the production of steel from iron ore using renewable electricity and hydrogen. Fortescue is investing heavily in research and development focused on hydrogen technologies, and Fortescue Future Industries (FFI), a green energy and technology subsidiary of the miner, is a global supplier of green hydrogen.

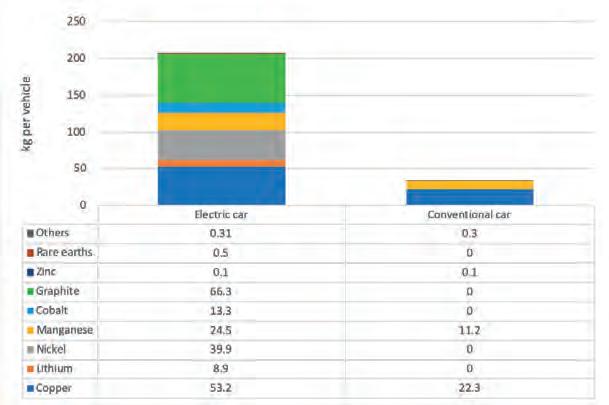

There are two forefront applications for hydrogen in the mining sector: 1) transportation, and 2) power. For transportation, the reduction in the use of fossil fuel in site activities (Scope 1 emissions) and material transportation (Scope 2 emissions) is key. Hydrogen fuel cell vehicles – in the form of drill rigs, excavators, haulage trucks, and heavy-duty trucks or trains – are a potential solution which could also decrease the volume of critical minerals currently required in electrical vehicle lithium batteries – namely lithium, cobalt, nickel, and manganese.

For power, miners may be looking at consumer and industrial supply needs to mine sites and local vicinities. Miners will also have to consider the potential to produce renewable energy onsite, or to buy such renewable energy via a corporate power purchase agreement. Hydrogen projects have the potential to be placed on mine sites and mixed with current energy sources. Permits will need to be obtained and regulations adhered to, but transportation would be localised and easier than using pipeline, train, or ship transportation.

Presently hydrogen production is classified according to colour, which differentiates between the source of power used to achieve electrolysis. Green hydrogen – favoured as it uses renewable resources, such as wind and solar, as the source of power – currently comes with prohibitive costs and the requirement for access to renewable energy sources, which can add timing complications. This is in contrast to grey hydrogen, for example, which uses existing fossil fuel combustion to generate the power for electrolysis. Miners will need to consider their ‘colour’ appetite for hydrogen, against cost, time, and new incoming regulation.

When planning their decarbonisation path, mining companies must consider the relevant regulation with respect to the qualification of hydrogen as green (or renewable) hydrogen. The EU has recently made a major development with respect to this qualification criteria. The Delegated Acts, published in February under the EU’s new Renewable Energy Directive (RED II), require that hydrogen and hydrogen derivatives (such as ammonia and methanol) can only be considered as a renewable fuel of non-biological origin (RFNBOs) if they are produced from a renewable electricity installation directly connected to the hydrogen production plant (alongside other conditions). This proposed regulation could mean green hydrogen offtakes would indirectly provide more benefits to miners than cheaper grey or blue hydrogen solutions. Mining companies should consider combining renewable energy production for hydrogen production to fuel their trucks, trains, and drill rigs directly onsite. This would have a greater impact from an ESG perspective. Long-term Scope 1 emissions could also be a relevant consideration if relying upon fossil fuel combustion for hydrogen.

In summary, whilst it is likely mining companies will focus on the production of green hydrogen because of the recent uptake of installing onsite traditional renewable sources, Scope 1 emissions and increasing regulation should also be at the forefront of considerations when discussing hydrogen in the mining sector.

STAY SAFE ON SURFACE ... ... AND UNDERGROUND

Proximity Detection Solutions from Becker Mining Systems

Reducing the number of on-site accidents in a mine is crucial; ensuring that personnel remain safe in both in underground and surface settings is necessary. Becker Mining Systems developed both the PDS4.0 and the smartdetect system with safety and proximity awareness in mind.

Level 9 compliant, and with a full range of attachments, PDS4.0 and smartdetect

have been designed to offer V2V, V2P, and V2X detection solution in one comprehensive and robust package, allowing for upgrades, and simple system modifications, based on the needs of the customer.

With smartdetect and PDS4.0 enabled vehicles; you will never again have to wonder “how close is too close”

WORLD NEWS

TOMRA Mining’s experience in the design and installation of large-scale ore sorting plants, as well as its collaborative approach, was the key to the successful design of the world’s largest lithium sorting plant. The installation has already started and is expected to reach completion in late 2023.

Pilbara Minerals owns the world’s largest, independent hard-rock lithium mine. It is located in Western Australia and produces a spodumene and tantalite concentrate. By pursuing a growth strategy to become a sustainable, low-cost lithium producer, the company has become a major player in the rapidly growing lithium supply chain. This investment will ensure the expansion of its large-scale operation in

order to meet the increasing demand for lithium driven by sustainable energy technologies, such as electric vehicles and energy storage.

Dale Henderson, Managing Director and CEO, Pilbara Minerals, comments: “This new facility to be constructed at our Pilgangoora Project will be the world’s largest lithium mineral ore sorting plant. TOMRA’s experience in large global sorting installations, innovative technology, and ability to provide local support were significant factors in our decision to work with them. From the start, the TOMRA team has been working side by side with us and our engineering partner DRA Global to deliver this important project.”

CANADA Caterpillar and NMG strengthen their zero-exhaust emission collaboration

On the foundation of their 2021 collaboration agreement and of technical work achieved together over the past two years, Nouveau Monde Graphite Inc. (NMG) and Caterpillar Inc. have signed definitive agreements to supply NMG’s Matawinie Mine (Quebec, Canada) with an integrated solution that covers a zero-exhaust emission fleet, supporting infrastructure, and service. Caterpillar is set to be NMG’s supplier of heavy mining equipment, supporting the progressive transition from traditional models to Cat® zero-exhaust emission machines as they become available. Moreover, NMG and Caterpillar have signed a non-binding memorandum of understanding (MOU) to advance commercial discussions targeting NMG’s active anode material. Through this offtake MOU, a full circular value chain could be established where NMG would supply carbon-neutral graphite materials to Caterpillar for the development of its secure, resilient, and sustainable battery supply chain that would serve to electrify heavy vehicles, including NMG’s Matawinie fleet.

Arne H Frandsen, Chair of NMG, said: “Caterpillar is providing NMG with a comprehensive solution for the Company’s Matawinie Mine, de-risking the adoption of new technologies, and optimising operational excellence through integrated infrastructure. At every stage of development,

management has worked to expand the field of possibilities for sustainability in our sector. And now, our new commercial relationship for NMG’s battery materials further elevates the impact of our collaboration with Caterpillar and the relevance of NMG’s business strategy. Today, we raise the bar again!”

Denise Johnson, Caterpillar Group President, commented: “I’m proud of the collaboration and work the NMG and Caterpillar teams have accomplished together in support of the Matawinie site. This project is an exciting one as it highlights what is possible when an effective energy transition roadmap is implemented that bridges the traditional product line to an integrated, electrified site of the future.”

Eric Desaulniers, Founder, President, and CEO of NMG, reacted: “Not only will we benefit from Caterpillar’s stellar expertise, renowned products and latest technological developments, but our team will also be at the forefront of the electric revolution in the sector, sharing insight, testing equipment for further optimisation, and providing battery materials to support electrification beyond our mine. This collaboration truly reflects our vision for leadership and unified efforts to advance responsible mining practices and global decarbonisation. I salute the commitment of Denise and Caterpillar’s team, without which our ambition would not have materialised so efficiently.”

WORLD NEWS

Diary Dates

INSIGHT SEMINAR – Digitalisation for more Sustainability: How to Reach a Digital Mine

24 May 2023

ONLINE

www.globalminingreview.com/events/ insight-seminar--digitalisation-for-moresustainability-how-to-reach-a-digital-mine

Discoveries 2023 Mining Conference

30 May – 01 June 2023

Mazatlán, Mexico

www.discoveriesconference.com

2023 Elko Mining Expo

08 – 09 June 2023

Elko, USA

www.exploreelko.com/top-events/ elko-mining-expo

Mines and Money Connect: Melbourne 2023

14 – 15 June 2023

Melbourne, Australia

https://minesandmoney.com/melbourne

9 th International Conference on Tailings

Management – Tailings 2023

14 – 16 June 2023

Santiago, Chile

www.gecamin.com/tailings

AIMEX 2023

05 – 07 September 2023

Sydney, Australia

www.aimex.com.au

China Coal & Mining Expo 2023

25 – 28 October 2023

Beijing, China

www.chinaminingcoal.com

AUSTRALIA BHP completes OZ Minerals acquisition

BHP has announced that it has completed its acquisition of OZ Minerals and the implementation of the scheme of arrangement for BHP Lonsdale Investments Pty Ltd, a wholly owned subsidiary of BHP Group Ltd, to acquire 100% of the shares in OZ Minerals Ltd (OZL). BHP Group Ltd is now the ultimate parent company of OZL.

In bringing together the BHP and OZ Minerals businesses, BHP will focus on the safe and reliable operation of the Olympic Dam, Prominent Hill and Carrapateena assets; building a shared culture of innovation and performance, and progressing sustainable growth options to establish a copper province in South Australia.

Mike Henry, BHP CEO, comments: “This acquisition strengthens BHP’s portfolio in copper and nickel and is in line with our strategy to meet increasing demand for the critical minerals needed for electric vehicles, wind turbines, and solar panels to support the energy transition. Combining our two organisations will provide options for growth, bring new talent and innovation to unlock these resources in a sustainable way, and deliver value to shareholders and communities.”

ARGENTINA Lilac Solutions achieves major milestone at Kachi Plant

Lilac Solutions has announced that it met a critical milestone at the Kachi lithium brine project, successfully producing 2500 kg of lithium carbonate equivalents (LCEs) using its proprietary ion exchange technology. Based on this successful result, Lilac has increased its ownership of the Kachi Project from 10% to 20%. The project is now on track to move from its pilot phase into commercial-scale development, which will make it the first lithium brine project in South America to produce lithium at commercial scale without the use of evaporation ponds for lithium concentration.

The achievement at the Kachi Project represents a historic advancement in lithium production technology. This is the first successful implementation of ion exchange for lithium production in South America, home to most of the world’s lithium brine resources. The milestone builds upon Lilac’s success in completing over 200 000 hours of operations at mini-pilot and pilot scale in North America.

To stay informed about upcoming industry events, visit Global Mining Review’s events page: www.globalminingreview.com/events

Dave Snydacker, CEO of Lilac Solutions, said: “Today’s announcement marks a new era in scalable lithium production. Lithium is a cornerstone of the energy transition, but limitations in production technology have led to increased costs, scarcity, and extreme price volatility. Today, we’ve proven that it is possible to produce high-purity lithium faster and without evaporation ponds, all while protecting surrounding communities and ecosystems. I’m grateful to Lake Resources for their partnership in developing this project, and I look forward to our continued success as we chart a new path in lithium production.”

Jorge Uzcategui and Kirill Kirilenko, CRU, UK, look at some of the key trends defining the gold mining industry’s mid-term profile and production levels.

In recent years, despite gold trading at prices well above marginal costs, the gold mining industry has been struggling to grow output. The pressures and challenges facing the sector are numerous and diverse. Among them, declining ore grades, rising costs, more stringent environmental regulations, increased pressure from stakeholders to deliver value, a shortage of skilled labour and dwindling reserves, have all increased the difficulties of operating in the sector. More recently, the COVID-19 pandemic and geopolitics have also added increased level of disruptions and surging inflation to the list. Yet, the mining industry is experiencing a rising wave of mergers and acquisitions, with gold miners leading the charge, as companies look to consolidate and increase their share in the market. Higher price expectations are increasing the value of mergers and acquisition (M&A) transactions, but miners focused on long-term value are entering deals that provide efficiencies, replenish reserves, and return value to stakeholders. Taking all these factors into consideration, what can we expect of the gold industry in the coming years?

Gold miners are price takers, not price setters

To set up the scene, it is important to focus first on one of the specific features of the gold market – the miners’ lack of power to immediately influence gold prices. In the mining industry, the marginal cost of production of a metal generally acts as a floor for the metal price. However, this is not the case for gold. The reason for this is that the gold price is not determined by the balance between supply and fabrication demand, but rather by the high levels of investment holdings, which is the function of the geopolitical and economic outlook.

It is estimated that around 200 000 t of gold has been mined throughout history. Gold is virtually indestructible, and its high value increases recycling, which means that almost all the gold ever mined is still around in one form or another. At current levels, 200 000 t are equivalent to 69 years of fabrication demand. To put this into perspective, if hypothetically, all the currently operating gold mines shut down today, there would still be enough metal to satisfy market needs – not for weeks or months, as is the case with other commodities, but for seven decades. It is therefore fair to say that the gold market is probably the only one where the miners, unlike in other commodity markets, are price takers, rather than price setters.

Organic growth – why is it often overlooked?

It takes 10 to 20 years to bring a typical gold mine from discovery to commercial production. This means that many gold mines starting production now are tapping mineralisation discovered more than 10 years ago. Because of the long lag time between initial investment and first output, gold producers need to invest in exploration and resource management to constantly replenish exhausting reserves at operating mines. Failure to do so poses a significant threat to their long-term sustainability and profitability.

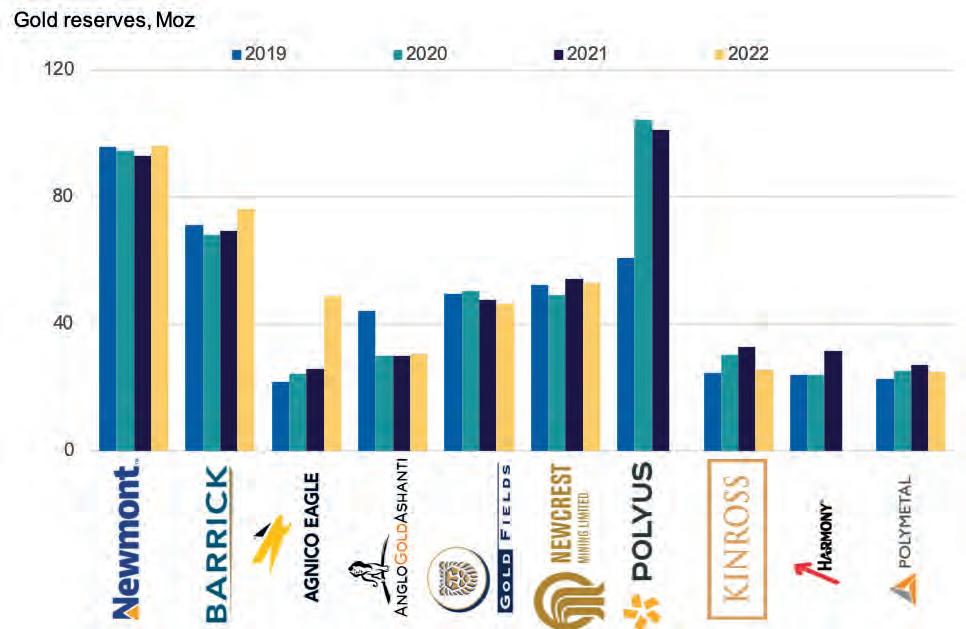

The gold industry in particular is highly impacted by a mine’s reserves base, since the industry operates on relatively short life of mine (LOM). While copper mines can operate for at least 30 years (and in many cases it is much longer), the average LOM for the top 10 gold miners is 15 years, using current production levels. This LOM average excludes Polyus, as the company has approximately 40 years of LOM, nearly three times the average, making it the largest gold company by gold reserves. The company’s reserve base increased 71% between 2019 and 2020 when it added 40 million oz from the massive Sukhoi Log project in Russia.

Aside from Polyus, gold majors have mostly seen their reserves flatline or shrink over the last four years.

Agnico Eagle is one of the top companies that has organically grown its reserves base, which increased by a CAGR of 6% between 2019 and 2021. The company also boosted its reserves by 90% in 2022 after consolidating its assets through its merger with Kirkland Lake. Newmont and Barrick Gold also saw their reserves base increase by 3.4% and 10.1%, respectively, in 2022. However, that was not the case for the rest of the top miners, who saw their reserves diminish.

Nevertheless, Polyus and Agnico show the two primary strategies that miners employ to address reserves exhaustion – investing in exploration and development and pursuing M&As. Both strategies require significant capital investments and involve certain levels of risk. However, due to the higher level of uncertainty associated with exploration and the time required to develop new mines, gold miners have tended to replenish reserves through M&As.

Gold M&A deals keep driving industry consolidation

Pursuing acquisitive growth strategies can unlock high value for miners, including access to new reserves, diversification of metals, and operational efficiencies.

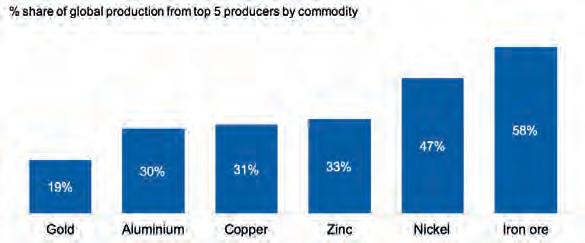

M&A transactions in the gold sector are pervasive –primarily because the gold industry is highly fragmented. Low barriers to entry, technological innovations to process difficult ores at economical costs, and the ability to remain profitable at small scales have allowed for many companies to enter the industry with relative ease. In most mining and metals industries, the top five producers account for more than 30% of global production – for gold, the top five majors produce less than 20% of global output. Therefore, gold miners look for ways to consolidate and increase their market while replenishing reserves.

Recently, the gold industry has seen a huge wave of deals. Newmont’s sweetened US$19.5 billion bid for the takeover of Newcrest could potentially be the largest merger deal in the gold industry. The increased offer came after Newcrest gave Newmont access to its book after having rejected a previous offer of US$17.5 billion.

PLENARY SPEAKERS

If successful, the acquisition would increase Newmont’s lead as the largest global gold company, raising its production by 48% to approximately 9 million oz/yr of gold and expanding its access to copper.

Furthermore, in 2022, the US$10.6 billion Agnico Eagle and Kirkland Lake merger was agreed, which created the current third largest gold producer. More recently, Pan American Silver’s acquisition of Yamana Gold’s LATAM assets and Agnico Eagle’s acquisition of Yamana’s 50% ownership in Canadian Malartic were completed at a value of US$4.8 billion.

These deals are all part of a consolidation trend that will continue growing as miners struggle to tap into new deposits and look for opportunities to improve synergies and lower costs.

Can a peak in inflation improve miners’ margins?

Over the past two years, inflationary pressures have driven up costs for the mining industry. The gradual reopening of global economies from the COVID-19 pandemic caused shocks across supply chains for many industries, with suppliers not being able to meet pent up demand due to bottlenecks and logistical disruptions. This caused an increase in consumables and raw materials prices for producers and manufacturers, raising their cost of production. Many of the problems brought up by the pandemic are still lingering and having an effect on costs. And these have been further exacerbated by Russia’s invasion of Ukraine.

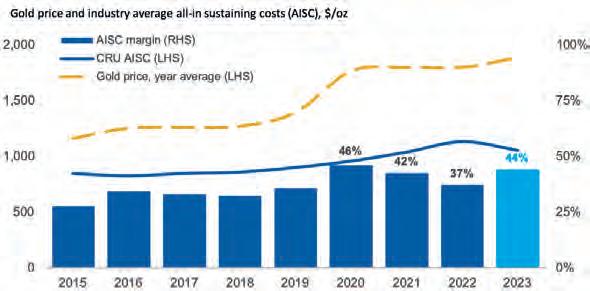

Yet, although gold miners have seen their costs increase, the average miner is still taking in healthy margins. In the pre-pandemic years between 2015 and 2019, the average

All-In Sustaining Cost (AISC) margin for gold miners was 33%. Since 2020, AISC margins have increased to average more than 40%. The year 2020 was a particular record high for miners with the average gold producer netting 46% in margins – this was the year gold prices hit their all-time high of US$2075/oz in August. Fuelled by investors’ worries of rising inflation from governments, and central banks printing large amounts of money to stimulate their economies during the pandemic, gold’s long-held view as a safe haven asset and a hedge against uncertainty drove many to stash their cash in the yellow metal.

Nonetheless, these healthy margins have not only been driven by the rise in gold prices – miners have also shifted their focus to cost discipline and operational efficiencies to remain profitable during these inflationary periods.

Looking ahead, CRU expects macroeconomic input prices to ease off from the 2022 highs. As supply chains normalise, inflation slows down with interest rate rises and energy costs decrease, it is estimated that gold miners will see overall lower input prices. Along with a higher gold price, the industry can expect increasing margins for 2023.

However, as the industry transitions towards more sustainable practices and technologies to reduce its environmental impact, can gold miners expect their costs to increase in the long term? While ESG initiatives tend to require higher upfront capital investments, they are estimated to result in cost savings over the long term. This is because improving energy efficiency in mining equipment and facilities lowers energy consumption and costs (reducing waste decreases disposal costs and integrating renewable energy sources), diversifies the power mix, provides a stable source of electricity, and mitigates risks associated with fluctuations in energy prices.

As stakeholders’ pressures mount for the industry to reduce its impact on the environment and improve sustainability performance, many gold miners are adopting ESG measures, particularly on the emissions front. Currently, all top 10 gold miners have set net zero targets by 2050. Some have started to turn their pledges into actions by investing in renewable energy sources, integrating the use of electric vehicles, improving waste and water management, and implementing more efficient processing techniques.

This is a trend we will see further develop – as 2050 approaches, government policies and investor pressure will keep driving miners to produce more sustainably.

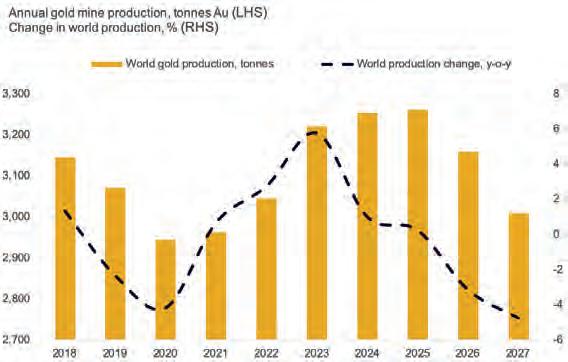

Primary gold supply may be close to its peak

According to CRU, total world identifiable mine supply (excluding artisanal, illegal, and state secret gold mining) increased from 2547 t in 2001 to 3045 t in 2022. This equates to a CAGR of 0.9% over the period. CRU expects mine production to grow for three more years – rising to a peak of 3261 t in 2025 – before falling back, as output at more mature mines begins to wane and operations draw closer to the end of their economic life. As a result, a steady

flow of new mines coming into production will be required to replace the lost output and keep growth momentum intact. However, this may prove difficult due to the natural thinning of the project pipeline resulting from insufficient investment in exploration and development activities in recent years. Moreover, many of the recently launched projects are expected to reach their nameplate capacity around that year, meaning that depleting/closed mines will no longer be fully replaced by new ones.

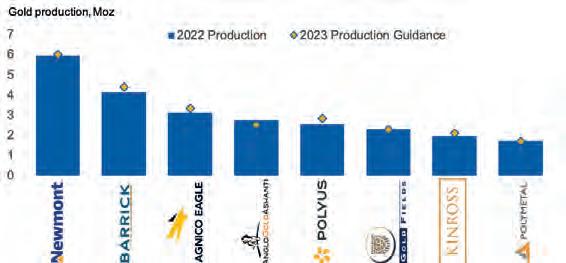

On a company-by-company basis, the top gold miners are expecting higher production growth in 2023 compared to their 2022 output. Newmont’s production outlook is approximately 1% higher than last year, when it produced 5.96 million oz. Barrick, Agnico Eagle, and Kinross estimate a 6 – 7% increase, based on their 2023 mid-point guidance range, while Polyus expects to grow its production by 12% y/y after a decline in output last year from low grades.

However, this trend is not the case for the South African miners who estimate lower output for 2023. AngloGold Ashanti will suspend its processing plant at AGA Mineraçao operations in Brazil to revamp the TSF at the site (in order to meet new tailings storage regulations in the country), and Gold Fields’ Cerro Corona and Damang mines are maturing and nearing the end of their lives.

While sanctions did not greatly impact Russian gold mine output, development plans faced challenges

Since Russia first invaded Ukraine, Russian miners have faced a number of sanctions that have affected their operations and delayed development plans. Polymetal and Polyus have reported that purchases from western contractors and suppliers have been limited in Russia, so alternative supply and logistics routes have been required to continue business as usual. Reduced access to US$ and EUR funding have meant that companies have had to borrow at higher rates in local currencies and CNY with local banks.

Polymetal, one of the country’s top gold miners, is developing a new pressure oxidation plant (POX-2) in Amursk to increase its in-house refractory ore processing capacity – reducing processing and transportation costs, and increasing gold recoveries. The initial CAPEX was estimated at US$431 million, and the plant was estimated to commence production in late 2023. However, the company announced that it would be delaying the start-up of POX-2 by six months, due to logistical complications. While Polymetal has not reported any CAPEX escalation, the plant cost is expected to be higher than originally estimated. The company is also preparing to relocate its domicile from Jersey to Kazakhstan, where it operates two mines, in order to potentially separate its Russian assets from the Kazakh ones. Currently, Russia has banned the sale of gold assets from miners domiciled in ‘unfriendly’ jurisdictions.

This being the case, sanctions do not appear to have directly impacted the country’s mined gold output. Polymetal increased its 2022 production by 2% y/y,

achieving 1.7 million oz of gold equivalent (GE), meeting its start of year production guidance. Meanwhile for Polyus, while total gold output declined 6% y/y to 2.5 million oz, the primary driver was grade decline in some of the company’s operations, not the sanctions.

Gold’s bullish momentum continues to build

Gold prices are an important driver of M&As and investment activity in the gold mining industry. Strong prices provide a favourable backdrop for prospective buyers and investors. They also give a boost to exploration budgets. The collapse of SVB and the crisis at Credit Suisse have hit investors’ risk appetite and led them to rethink their hawkish expectations from central banks across the globe. Markets are now beginning to price in rate cuts for this year on the expectation that central banks will shift towards a more dovish position to relieve stress on the financial system.

For now, CRU Economics forecast a further 25 bps rate increase by the US Fed in May, bringing the benchmark rate to 5.00 – 5.25%, where it is expected to remain throughout 2023. Over the next few weeks, gold prices are likely to remain supported by the risk of contagion in the banking sector and renewed fears of a 2008-style financial crisis. The rally may continue in 2H23 on the back of anticipated cuts in interest rates.

Figure 5. Production outlook is mostly positive for top gold miners in 2023 (DATA: CRU, Company reports). *Note: Kinross and Polymetal report production guidance in gold equivalent ounces (GEO).Perttu Aho, Robit, Finland, highlights the importance of collaboration with customers and partners when designing new products – bearing in mind that no two work sites are the same.

When developing products for use under several differing conditions, it is vital to take into account the experiences of the people actually using the products. In the modern times, it is of course possible to simulate all sorts of conditions in a lab environment, or by using computer models, however these can often only give an indication of the product’s performance in the real world. Those working in the conditions set by said real world can tell you a whole lot more.

When it comes to product development, Robit has a long tradition of working with its distributor partners and end-customers alike. The end-users know their own equipment and circumstances better than anyone, which means that they can often test new and existing products under true-to-life conditions. This way it can be ensured, that the results of the test correspond to the actual performance and durability capabilities of the products.

Collaborating towards better efficiency

One of Robit’s long-term test partners is Stevin Rock, which operates a limestone quarry in the United Arab Emirates (UAE) with a fleet of Down-the-Hole (DTH) machinery. The company has been using Robit manufactured DTH tools since 2016, starting from the first international DTH supply contract Robit won after acquiring Drilling Tools Australia (DTA). Stevin Rock has been making use of the full suite of Robit’s drilling consumables, with a 4 in. hammer as its work horse of choice and adaptors, drill tubes, as well as 110 mm and 127 mm bits aiding the work.

The initial contract was agreed in 2016 after Robit succeeded in trials conducted at the Stevin Rock quarry. Robit’s products triumphed with a longer life span and lower cost per meter than the competition at the time. While some alternatives provided a higher rate of penetration, this benefit was unfortunately trumped by the higher number of breakages it brought along with it. They decided to go with Robit, which offered known products that provided conclusive and consistent high performance.

In the years since the initial contract, Robit has proven itself with an excellent overall life span of products, as well as a high level of service and numerous supporting drill master visits. Indeed, these drill master visits have been the core of the support and collaboration towards the customer. A Robit drill master has been visiting the site on support duties a couple of times a year, with the goal of helping Stevin Rock optimise its processes. In addition to this, Robit, along with its distributor partner DeltaCorp Global, has conducted onsite practical and theoretical training sessions to the operators and mechanic teams on hammer assembly, preventative maintenance, bit wear, failure modes, and best drilling practices.

Robit always aims to find the best possible distributors for each region; the goal is to find those who understand the local market, culture, and the general way of thinking. In DeltaCorp Global, Robit has one such winner. During the years, DeltaCorp fostered a very close working relationship with Stevin Rock. This has allowed the company to consistently offer timely and relevant support to its customer, across its organisation. In addition to the visits from Robit’s drill masters, DeltaCorp’s representatives conduct at least one

visit each week to one of Stevin Rock’s three sites. The purpose of the visits ranges from stock deliveries to management meetings, where product quality and lifespan, as well as stock levels and forecasts are assessed. While the representatives are onsite, they will also pay a visit to the drill rigs, in order to receive direct feedback from the drill operators. On top of all that, the DeltaCorp representatives maintain constant communication with Stevin Rock’s site management, working swiftly in the event any concerns should be raised, such as a sudden need for urgent deliveries, an unforeseen breakage, or some other operational problem.

Thanks to the continuous support, Stevin Rock has managed to improve the results it achieves with its equipment even further. When the initial contract started in 2016, the average life span of a drill bit was 2000 m, with hammers reaching approximately 8000 m. With all the training given to the personnel to help them make the most out of their tools, the efforts to optimise the drilling processes, as well as the product improvements from Robit’s engineering and production teams based on the customer’s feedback, the average bit lifespan has been extended to 4500 m, with the hammers regularly exceeding 25 000 m.

Collaboration as the basis for product development

During its time working with Stevin Rock, Robit has conducted numerous tests on a multitude of hammers and bits. The aim of

all these tests has been to increase the life span of the products, as well as their performance, with minimal downtime and breakages, so that customers can reduce their overall drilling costs to the minimum. These tests, and others like them carried out with other customers, have been at the heart of Robit’s product development process. These trials have led to discoveries and breakthroughs that have guided the designs of new products, with the upcoming H-series hammers as an exemplary reference point.

The new H-series hammers have been designed with performance and versatility as their guiding principles. The goal was to provide customers with a hammer range that can be utilised in different environments, with minimal breakages and maximised utility for each individual operator’s circumstances. The feedback received from Robit’s customers led the company to develop a new modular design, which offers increased flexibility and adaptability to varying conditions. With a few simple changes in the assembly of the hammer, they can be customised for each customer’s needs; whether one wants to run them with improved productivity in mind or needs to be able to use a lower capacity compressor, the H-series hammers can be modelled to suit these requirements.

In practice, the modular design of the hammer allows Robit to offer four hammers in one base design. The assemblies vary between high power and low volume, as well as foot valved and tubeless. With these specifications, the following variations can be created: high power with a foot valve, high power tubeless, low volume with a foot valve, and low volume tubeless. The high-power assembly offers high blow energy and high air volume, which result in a fast penetration rate and is suitable for deep-hole drilling. On the other hand, the low-volume assembly provides lower blow energy and lower air consumption, which are ideal for soft ground while keeping the hammer energy efficient.

As an example, Stevin Rock was looking to include a faster drilling hammer in its selection, in order to improve the potential productivity. Robit provided the company with two different assemblies of the new H-series models with differing internal arrangements to control the airflow, one with low air volume and the other with high air volume. These new hammers were to be tested against the tried-and-true D45 hammer from Robit’s older hammer range. The tests showed a considerable, and consistent, improvement in the rate of penetration across the board. The penetration rates went up in all tests, with the smallest increase at 14% and the biggest improvement at 30%, compared to the previous model. The highest rate of penetration reached during the tests was 63.18 m/hr. These results also correlated with those seen from prior tests, ensuring the validity of the results.

Conclusion

With its new hammer range, Robit wants to bring more options to the market, while still guaranteeing high performance. If one thing has become crystal clear during the company’s collaboration with its customers, it is that no two drill sites are the same. For this reason, the company is making sure to let its customers’ and distribution partners’ voices be heard when developing new products and improving on existing ones.

Conventional initiation systems impose constraints that limit mining fleet productivity during thunderstorm seasons, potentially costing hundreds of production hours. Wireless initiating systems can remove these constraints and create opportunities for improvements in safety and productivity.

Innovating initiations

Orica launched WebGen™ 100 as the world’s first totally wireless initiating system in 2017. By March 2023 the WebGen system had been used in over 5000 blasts globally. In the first five years of application, wireless blasting transformed the way underground mines work by making previously inaccessible ore safely recoverable.

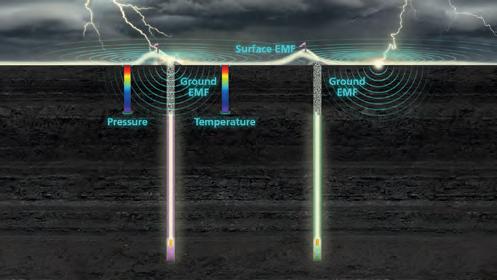

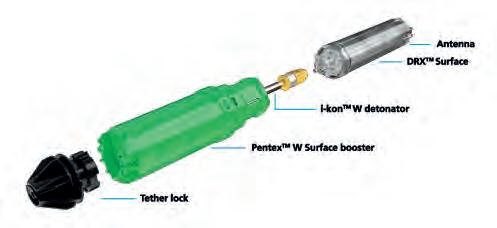

In March 2023 Orica released WebGen 200 Surface (Figure 1), a wireless primer designed for surface mining applications. Orica’s WebGen 200 wireless initiating system includes four primer variants and a wider range of booster weights, opening new segments, applications, and opportunities in both surface and underground mining. WebGen uses low frequency magnetic signals to communicate through rock to WebGen primers made of an i-kon™ W detonator, a Pentex™ W booster and a disposable receiver (DRX™).

Eliminating physical wired connections to a blast or blasthole opens a whole new range of possibilities. WebGen 200 Surface reduces blast crew exposure to hazards including stemming dust, working under highwalls, and pedestrian-vehicle interactions. It also creates opportunities for higher productivity and mine schedule flexibility, by reducing mining fleet shutdowns during lightning storms and turning loaded blast patterns into temporary haul roads.

Lightning risk in surface mines

Lighting strikes create high temperatures and pressures and induce strong electric currents that can damage and initiate sleeping blastholes primed with conventional detonators. Even electronic detonators that are immune to common industrial electrical sources are not immune to the immense energy of a lightning strike. There is no single global database of unplanned initiation due to lightning, but anecdotal evidence indicates that it happens more than a few times a year.

The conventional approach to managing lightning risk around sleeping blasts is to impose an exclusion zone around sleeping blastholes. This disrupts loading, hauling, and drilling activities within the exclusion zone. As the thunderstorm approaches the blast crew must cease work, collect explosive components on the surface, and untie connected initiation systems. This takes time and exposes the blast crew to risk if the storm approaches rapidly.

Due to thunderstorms, some mines in tropical regions lose tens of hours of production a week, most of the year. It is also notoriously difficult to predict when to stop work and impose the exclusion zone. Lightning can occur well ahead of rainfall, and tens of kilometres from what appears as a thunderstorm on a rain radar. This unpredictability leads to conservatism and causes production delays even when the risk is low.

In conventional wired and signal-tube based initiation systems, the risk exists due to the conducting path between the surface and the primer. Wireless systems remove the risk by removing the connection between the primer and the surface.

An initiation system without a physical connection from the primer at the bottom of the blasthole to the surface is practically immune to a lightning strike.

With wireless blasting, the consequence of lightning strikes on loaded blastholes is mitigated so that thunderstorm exclusion zones can be reduced or eliminated, enabling operators to reclaim hours of lost production time. Orica has extensively modelled and tested to confirm that a WebGen wireless primer in a blasthole is protected from all credible energy sources that might initiate or damage it, provided it is three metres below the surface. In a lightning event, the temperature and pressure effects of lightning are rapidly attenuated by the earth (Figure 3). Therefore, blasts primed only with WebGen do not require an exclusion zone during thunderstorms, provided explosive items are at least three metres below the surface.

While WebGen primers loaded in blastholes at least three metres below the surface can be considered safe from lightning, there remains a risk of people being struck. Blast loading operations must cease during lightning storms, and people must seek shelter in a building or a vehicle.

Case study: Vale Salobo Mine – Brazil

At Vale’s Salobo Mine in Brazil, the wet season occurs from November to April. During this season, thunderstorms frequently cause production delays because an exclusion zone must be enforced around all sleeping blastholes charged with wired detonators. Trials using WebGen demonstrated the safety and productivity benefits of eliminating wires. The blasts used 580 WebGen primers in 445 blastholes to fire 545 t of bulk explosives, breaking over 1.5 million t of rock.

These WebGen blasts reduced the downline failure rate to zero, eliminating the risk of misfires due to wire damage. The risk of unplanned initiation from lightning was also eliminated. These factors contributed significantly to the safety of operations, reducing exposure to the risk of an unplanned detonation during charging, stemming, and digging.

Case study: Terracom Ltd Blair Athol Mine – Queensland, Australia

WebGen 200 Surface has also ignited the interest of Blair Athol mine (Figure 4). Located in central Queensland, Australia, the lightning storm season lasting half the year can be challenging and disruptive to the mine. Mining activities cease during a thunderstorm, and lightning can severely impact mining activities. The ability to work for longer as a storm approaches is important to the mine. The team at Blair Athol are looking to reduce lightning related delays with the WebGen wireless initiating system.

Conclusion

Wireless blasting removes many of the constraints imposed by conventional wired and non-electric initiation systems in surface mines, by eliminating the wire or signal tube from the blasthole. When there is no surface connection to the primer, lightning exclusion zones around sleeping blastholes can be eliminated. This gives mine schedulers and production planners much greater flexibility and increases the available production time.

WIRELESS BLASTING SOLUTIONS

Space is at a premium at the bottom of the pit. WebGen™ 200 Surface eliminates traditional scheduling constraints.

WebGen™ 200 Surface reduces exposure to geological hazards by minimizing the need for revisiting blastholes. With wireless detonation, all explosives are isolated within the blasthole, eliminating the risk of vehicle interactions with explosive components. Making it safe to transform a loaded blast into a productive haul road. orica.com/wireless

GET MORE FROM YOUR BLASTING WITH WIRELESS TECHNOLOGY

Greg Lanz and Simon van Wegen, Komatsu, USA, outline the need for greater collaboration in the mining industry and the potential advancements an open ecosystem approach could bring about.

SIX REASONS WHY AN OPEN ECOSYSTEM IS THE FUTURE OF MINING

Innovation is critical to the future of the mining industry. Only through innovative solutions can mining improve the efficiency of processes, reduce costs, and meet society’s demands for sustainability and environmental responsibility.

Of course, individual companies launch new products, services, and solutions every year that help mining evolve and advance down that path, but what if innovation in mining was collaborative and more of a group effort? What if there were a way for the many companies, partners, and suppliers a mining operation uses

to work together seamlessly for the greater good of the customer, while also benefitting their own interests in the process?

This school of thought is based on a concept known as ‘network effect,’ which is a principle of open technology ecosystems. The key question to ask is: do you want to bet on the innovation of just one or a small handful of companies, or even the innovation of an entire industry?

What exactly is network effect?

When thinking about an open network, a Wi-Fi network naturally comes to mind. Of course,

Wi-Fi networks require strong security to prevent unwelcome users, but it is open to all approved participants with the right credentials. Parties that exchange data on a shared Wi-Fi network can then create

new solutions and value not directly created by the network itself.

In mining, operation centres often use mining networks to leverage technology, data, and automation to help run things efficiently and to troubleshoot issues. However, those individual technologies typically use proprietary data and interfaces, and many companies deploy ‘closed’ systems that are part of ‘one-stop’ solutions from a single vendor.

Komatsu is taking a unique stance in favour of interoperable collaboration by building an open technology ecosystem. It will be inclusive with many technologies working together and be available to customers, partners, suppliers, and vendors. This ecosystem will organically promote an atmosphere where everyone can freely share information to better understand and optimise operations – creating a safer, cleaner, and more productive environment.

This concept aligns with Komatsu’s promise of creating value together. The fact is that no one company covers the entire value chain in mining, however groups of companies working together can create an ecosystem that helps customers leverage the strengths of each individual entity, building a critical mass of efficiency and innovation in the process. The challenge is convincing everyone to participate and work together. Komatsu’s vision is that everybody will receive more from an open ecosystem than they put in.

Moreover, this is not just theory – this vision is backed up by research. A recent Multidisciplinary Digital Publishing Institute study showed that collaborating with the competition is beneficial. The research showed that when competitors collaborated for at least three to five years, their costs were reduced by up to 50%. The Harvard Business Review also studied several instances of collaborating with competitors and found a history of positive outcomes.1

What are the advantages of an open ecosystem?

There are six clear benefits that an open ecosystem could deliver to mine operators and their providers.

1) Leverages the unique breed strengths of each participant in the ecosystem

Mine operators naturally gravitate toward doing business with companies that have proven best-in-class products or solutions. Rather than a closed ecosystem, where one or a small handful of companies purport to ‘do it all’, mining operations will benefit from having access to the best-of-breed in all critical areas.

2) A holistic approach that yields greater value for all

The popular phrase, ‘a rising tide lifts all boats’, applies to an open ecosystem. A comprehensive network of many participants provides the visibility and capabilities mining operators need to hit their production targets and lower the total cost of ownership. Competitors learn from others in areas where they lack competency, perhaps unlocking

new opportunities because they have access to much richer information, while ensuring that proprietary information and confidential data that should not be shared are safeguarded.

3) More data equals greater insights

More participants means more data that can be analysed to create new and powerful insights. These actionable insights can positively impact a mining operation across the board, helping personnel make better decisions and improve key processes. Because cybersecurity and confidentiality are top concerns for any company, an open ecosystem must also have the necessary ‘guard rails’ in place to prevent abuses or breaches.

An example of this benefit on a smaller scale is a recent collaboration between Komatsu and Cummins to share data for an integrated remote equipment monitoring solution. By sharing equipment health and performance data over a common infrastructure and collaborating on health analytics, both companies can access the same secure data and develop joint analytics and insights. Data is collected on a single device, and all actions are managed in a shared case management system, allowing experts from both teams to work remotely with a customer’s maintenance staff.

4) Empowers the customer to operate more efficiently and solve problems in their own way for their unique operation

An open ecosystem gives mine operators more freedom of choice to problem-solve or improve processes. It provides mining customers with the power to connect the dots within the ecosystem as they see fit, so that everything works better together and the distinct needs of their operation are fully met.

With an open ecosystem, everyone works together to share information, so customers can optimise across the mining value chain. It is when data can be freely exchanged and collaboration is possible that really big problems

are solved. The more that can be shared, the bigger the problems that can be solved.

5) Unlock new and ‘hidden’ efficiencies

Greater visibility across the entire supply chain and value chain will highlight complex interdependencies that can be optimised and even automated. In many cases, the underlying digitalisation has already happened, but the data is locked in proprietary silos.

Many mining operations automate various tasks via software. Still, those individual solutions do not provide the full efficiency benefits. The disadvantage of automating an individual task is that bottlenecks are pushed further down the value chain. The efficiency benefits only come when there is visibility all the way through the value chain. Some vendors claim to be able to provide this by connecting automated tasks in a closed environment, but this negates the benefits of industry-wide collaboration.

6) Helps mining operators achieve their optimisation and decarbonisation goals

The industry is at a tipping point where these areas need to be firmly addressed by mining operators. Yet, no individual product, service, or provider has the complete solution. Substantial progress in these areas can only come by leveraging multiple vendors.

Consumers are increasingly demanding greater environmental transparency from producers – and that is not just the producers own environmental footprint, but that of their suppliers too. The industry needs a step change in data sharing to make this possible.

How to get started

Collaboration of key players within an industry is not a new concept. Within the mining industry, there have been various efforts through the years to improve collaboration for the good of customers, such as efforts to agree on standards. With a focus on ‘adding value together’, the team at Komatsu driving this collaborative initiative sees an open ecosystem as potentially transformative for mining.

While this kind of orchestration-level optimisation has not yet been developed, if a foundation can be established and all the right parties brought to the table, acknowledging that no one player has all the answers, that is when all participants start working with each other and innovation accelerates. The transformation the industry needs has to come from everyone, together. Putting the toolsets in place to create an open environment for change is the first step.

References

1. HAMEL, G., DOZ, Y., and PRAHALAD, C.K., ‘Collaborate with Your Competitors – and Win’, Harvard Business Review, (January/February 1989), https://hbr.org/1989/01/collaborate-withyour-competitors-and-win

Eric Wasmund, Eriez Canada, Jose Concha, Eriez Peru, and Homie Thanasekaran, Eriez Australia, examine how innovations in cell technology can help maximise mineral recovery from froth flotation – resulting in more profitable and sustainable projects.

Froth flotation is a physico-chemical process, first introduced more than a century ago, that has revolutionised metallurgy and virtually every aspect of our economy and the modern world.

Formerly, extractive metallurgy was a costly enterprise, with only a few limited methods available for inexpensively concentrating valuable ore to a level suitable to make smelting and refining economical at a scale that

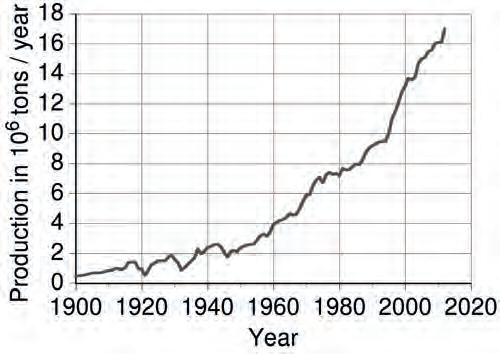

would touch the masses. Before this time, metals and alloys were largely used to make goods that would be considered luxury or ‘high tech’ items today. The discovery and industrial adoption of froth flotation around 1900, enabled the mass-scale development of metal sulfide ore bodies – such as copper, zinc, and nickel – and a significant increase in the service of these metals to mankind. An estimate of global copper production since 1900 by the US Geological Survey illustrates the rapid increase in the production and use of copper, which coincides with the development of froth flotation for porphyry copper ores

starting around 1900 (Figure 2). Curves for the other industrially significant base metals show comparable trajectories emanating from this starting point around 1900. With the advent of froth flotation, copper became a metal that could be used for modernising towns and cities around the world by way of electric motors and generators, transmission systems, telephones, piping and heat exchangers, among other familiar modern devices. We are all beneficiaries of this technological revolution.

The conventional flotation process generally consists of adding fine particles of ore, with at least some surface exposed mineral, into water and adding air bubbles and kinetic energy, usually in the form of mixing. Under the right conditions, the bubbles will collide and attach to a hydrophobic mineral surface and provide enough buoyancy to lift the bubble-particle out of the pulp and into a froth phase, which can be recovered through a launder system. By repeating this step in multiple stages, also known as rougher/scavengers and cleaners, the target mineral can often be enriched by an order of 50 or more times.

Industrial research and practise have identified some of the most significant factors – which include the amount of surface exposure of the target mineral, bubble size, and surface-active chemical additives – that can adjust the hydrophobicity of the target mineral, density, particle size, electrochemistry, and hydrodynamics of the cell. All of these parameters need to be optimised together to achieve the best flotation performance.

Industrially, this is a continuous process, consisting of cells or tanks in series. The tanks usually have a mechanism that provides mixing and introduces air. Mechanical agitation in a conventional cell achieves four functional objectives: keeping the solids suspended (so the cell does not sand), shearing the incoming air to produce fine bubbles, adding enough turbulent energy into the pulp for bubbles and hydrophobic particles to disperse and successfully collide to form bubble-particle aggregates, and providing a sufficiently quiescent fluid environment for the aggregates to rise successfully through the pulp. Efficient collisions of fine ore particles with bubbles require high energy to be successful, while recovery of bubble-particle aggregates into the froth generally requires low energy. In fact, excess turbulence in the pulp will cause bubble-particle aggregates to break apart and become lost. This phenomenon, known as drop-back, is one of the main reasons why there is an upper limit on particle size for conventional flotation. The mechanical energy added into the cells is therefore a trade-off for conventional mechanical cells.

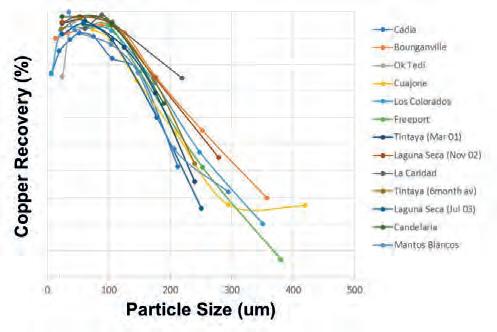

This trade-off for conventional mechanical cells is illustrated by Vollert et al, who showed typical copper flotation performance by particle size for major operations that are using mainly conventional mechanical cells. Figure 3 illustrates this trade-off; there is a narrow ‘Goldilocks’ interval between 50 and 150 microns where conventional flotation gives a good performance. As the size is decreased below 50 microns, the recovery suffers because of low energy. On the other hand, the recovery suffers above 150 microns because of excessive energy and

Worldwide

Subscribe online at: www.globalminingreview.com/subscribe

15 South Street, Farnham, Surrey, GU9 7QU, UK

Subscribe online at: www.globalminingreview.com/subscribe

Subscribe online at: www.globalminingreview.com/subscribe

T: +44 (0)1252 718999 F: +44 (0)1252 821115

E: info@palladian-publications.com

15 South Street, Farnham, Surrey, GU9 7QU, UK

T: +44 (0)1252 718999 F: +44 (0)1252 821115

15 South Street, Farnham, Surrey, GU9 7QU, UK

E: info@palladian-publications.com

T: +44 (0)1252 718999 F: +44 (0)1252 821115

E: info@palladian-publications.com

a high liberation requirement of conventional cells. Audits of major copper producers have typically shown 80 – 90% of the mineral units carried in the flotation waste (or ‘tail’) stream are either in the fine or coarse fraction. This can account for 5 – 15% of the total valuable mineral units in the run of mine feed.

This trade-off exists because of the inherent conflict between achieving successful bubble-particle contacting and bubble-particle flotation in the same cell. To avoid the trade-off, Eriez developed a two-stage mechanical cell called the StackCell® approximately 15 years ago (Figure 4). The StackCell uses two compartments: a tank within a tank. The tanks are connected in series, and isolated from one another, except where the exit from the first tank [3] feeds the second [4], and they are operated in such a way that fluid cannot move back into the first tank after it has entered the second one. As illustrated, feed is delivered through a duct [1] into the first tank, also referred to as a ‘cannister’[3], consisting of a rotor-stator configuration, which mixes the feed slurry and air with extreme energy. The specific energy inside the cannister is more than 100-times higher than the average specific energy in a conventional cell, so bubble-particle contacting is optimised. The feed travels from the bottom to the top, with a residence time distribution that is designed to approximate a plug-flow in a highly turbulent mixing environment with short residence time, on the order of several seconds. This high energy input does not cause drop-back of coarser particles because bubble-particle flotation only happens in the second tank.

Aerated pulp, ready to be floated, is pushed into the second tank based on a small positive pressure between the tanks. The second tank [4] is operated without mechanical agitation and separates the bubble-particle aggregates into a froth phase, which is recovered in a launder [6]. Water wash [7] can be used to increase the grade.

The StackCell has now been successfully introduced into coal, lithium, nickel and copper applications, as well as applications where the flotation rate is limited by kinetics. A StackCell can typically achieve the same metallurgical performance as a conventional mechanical cell that is 3 – 5 times larger. This allows StackCells to use less energy and operate in a smaller footprint.

Concerning the limitation in floating coarse particles, Klassen and Mokrousov added the following prescient commentary in their classic Flotation textbook more than 60 years ago: “In most cases, complete liberation of minerals can be obtained with particle sizes much larger than those that can be floated. The ore is therefore ground finer that is necessary for liberation, simply to enable flotation bubbles to lift these particles into the froth. If it were possible to float larger particles with high efficiency, then the cost of grinding, filtration, thickening, and drying would be much lower.”

More than 20 years ago, Eriez developed the HydroFloat® Coarse Particle Flotation (CPF) machine to overcome this weakness of conventional cells. The HydroFloat is a flotation cell that uses a fluidised bed to create lift and increase buoyancy with reduced turbulence. This unit has been used for mined fertilizer flotation for approximately 20 years, and in the last 10 years it has been tested and adopted in the base metal and lithium markets.

The first industrial application in copper was at Newcrest’s Cadia Valley copper-gold mine in 2018. The Newcrest team extensively tested and piloted this application, and the result has been that the company is able to re-process its waste stream, recovering valuable coarse ore, and also increase the grind size from its mills to increase throughput. Since then, HydroFloat CPF cells have been installed at a number of sites, including an expansion at Cadia Valley and installations at Anglo American’s El Soldado, Quellaveco, and Mogalakwena concentrators. True to Klassen’s prediction, modern practitioners of the HydroFloat have found that floating at a coarser size, typically two times coarser than required for conventional flotation, allows for the reduction of grinding energy from 30 – 50%, and reduced costs for de-watering as well as increased water recovery.

Froth flotation has indeed had a revolutionary impact on the world, and even after 100 years of practise, there are still innovative improvements that are allowing mankind to extract the massive quantities of green metals required for the net-zero carbon era. On the machine side, Eriez and its operations partners – such as Anglo and Newcrest – have commercialised two new cells, the StackCell and the HydroFloat, that are allowing miners to expand the range of flotation, increase recovery, reduce energy footprints and improve water use, resulting in more profitable and sustainable projects.

Jason Ludwig, Regal Rexnord, USA, reviews several examples of how significant savings were generated by selecting the right type of bearing.

Mining and aggregate businesses depend on a veritable fleet of equipment and machinery to maintain their constant, round-the-clock operations. Keeping these tools in working order is no small task, especially given their working hours and conditions. As far as field applications go, the mining industry offers some of the most harsh and abrasive environments in the world. Therefore, it should come as no surprise that operating costs remain one of the most critical factors affecting mining companies’ profitability. In an attempt to minimise these expenses, businesses will often allocate large portions of their budgets to regular maintenance and repair.

But, often overlooked, yet ubiquitous components found in nearly every piece of equipment commonly used in the mining industry – i.e. bearings – can play a big role in lowering operating costs and downtime losses.

Why bearings?

Bearings are essential components in the mining and aggregate industries, providing support and facilitating movement for heavy-duty equipment. From chain mills to conveyors, anything with a motor or a pivot point is going to

include a bearing. This is an important consideration in maintaining a profitable operation, as mechanical failures will often occur at points that experience the most stress, of which bearings are almost always at the forefront.

Bearings are not typically a highly designed aspect of machines. To maintain competitive pricing, manufacturers sometimes cut corners on important components that keep machines operating in harsh environments, such as bearings with the proper seals. Bearing failures frequently occur because a seal was compromised, which allows contaminants to enter the bearing and cause damage. The resulting imperfections in the bearing generate excess heat during operation and the bearing can seize up or fail completely. This results in additional damage to a gearbox or pivot point, and eventual downtime for repairs. With some of the larger mining operations estimating downtime losses at US$5000/min., this situation is to be avoided whenever possible.

Selecting the bearings that are appropriate for the application in which they will be used is crucial to ensuring reliable performance, minimising downtime, and extending the service life of equipment. This article examines several cases where mining and aggregate companies experienced

issues with their operations due to the insufficient bearings in their equipment, and how upgrading to bearings better suited for the task resulted in significant savings.

Phosphate processing chain mills

A facility processing phosphate for use in animal nutrition was using chain mills to pulverise partially crushed and cleaned raw material. In the mills, chains inside spinning drums broke down the raw material into particles small enough to be used in animal feed products. Each drum turned on a 3 – 15/16 in. shaft, and shock loading on the split-block SAF-type bearings supporting the shafts was severe enough to cause the bearings to fail after as little as three to four days of service. Replacement costs and downtime losses were beginning to accumulate.

To address the problem, the facility replaced its SAF-type bearings with higher-capacity roller bearings. The upgraded bearings were chosen based on their design that provided better sealing to protect against possible contamination, including corrosive and abrasive damage from long-term exposure to the phosphate material.

The company anticipates significant cost savings from reduced downtime and repair costs – more than US$39 000 annually according to a cost saving analysis. As bearings on additional mills fail, the company plans to replace them with the new bearing design.

Screw conveyor drive for coal transportation

A business was experiencing failures in its screw conveyor’s medium duty, 4-bolt flange bearings approximately every other day. Upon examination, it was determined that the bearings’ contact seals were responsible for the failures as they could not withstand the abrasive and corrosive contamination in this coal conveying application.

Testing a solution, the business replaced two existing bearings with an upgraded alternative designed with high-quality felt seals for the harsh application. The two new bearings ran for six months in the dust coal environment without issue. The company conducted an analysis, determining that the two bearings alone would save over US$12 500 annually, not including downtime costs. Going forward, the company has decided to specify only the highly effective felt seal bearings on all its screw conveyor drives.

Aggregate material conveyors

The Type E style bearings in an aggregate plant’s material conveyor counterweight pulley were failing frequently, causing excessive unplanned downtime. While in operation, the bearings were exposed to gritty water run-off and misalignment caused by the deflection of the belt loading. After inspecting the failed bearings, plant workers found evidence of water ingress and contamination. They determined that the misalignment was distorting the housing-mounted seals on the bearings, allowing water and other contaminants to seep in and cause damage.

The plant decided to replace its existing Type E style bearings with a tapered roller bearing capable of self-alignment with race-mounted contact seals. The design of the new bearings allowed seals to remain in positive contact with the inner ring, even when the bearings operated within an

allowable range of misalignment. For extra protection against environmental conditions, the plant selected a bearing design with fluoropolymer housings and collars.

The new, more robust bearings demonstrated superior performance in the application’s wet and dirty conditions. They increased production uptime, while reducing maintenance and replacement part costs by delivering three times the life of the former bearings, saving the plant over US$35 000.

Another aggregate producer experienced significant savings by replacing its bearings. It was plagued with downtime using SAF-type bearings on its conveyors used to transfer wet fines. The abrasive slurry being transferred by the conveyor was causing its bearings to fail in just three weeks of use due to contamination ingress. The company addressed the issue by also replacing its SAF-type bearings with heavy duty tapered roller bearings capable of withstanding up to three degrees of positive or negative static shaft misalignment while maintaining seal integrity. And after five weeks of operation, the upgraded bearings showed no signs of issues and continued to resist contamination ingress. The aggregate producer estimated savings from reduction of downtime at over US$50 000 in maintenance labour and replacement part costs.

Limestone radial stacker

An aggregate plant was building piles of 3/8 in. limestone for distribution using a radial stacker conveyor. Due to the nature of the material, the bearings on the conveyor tail pulley were being constantly exposed to moisture and limestone dust, which compromised the bearings’ substandard seals allowing the mix to flow through and cause failure every four to six weeks.

The aggregate plant addressed this issue by upgrading the conveyor with ball bearings equipped with a double-lip contact seal to keep contaminants out. After three months of continuous operation without any issues, the plant changed out all other failed bearings with the ruggedised replacements. By increasing bearing life, and thus conveyor uptime, from weeks to months, the aggregate plant quickly realised significant savings from decreased downtime and maintenance costs.

Conclusion

These application examples prove that not all bearings are created equally, and that this often-overlooked component plays a critical role in keeping mining and aggregate operations up and running.

All bearings will eventually succumb to the rigors of operation; depending on the speed of the cycle and the hours they operate, some sooner than others. But by selecting bearings that are better suited for the harsh conditions in which they will operate, companies can extend their service life, thereby minimising downtime and service costs.

When selecting a bearing provider, mining and aggregate companies should choose an organisation that features products specifically designed for their industry, as well as skilled application engineering for custom jobs. Selecting a bearings provider based on the lowest price often results in the lowest quality. When it comes to bearings, especially for harsh applications, upfront cost will usually save backend costs in abundance.

Alistair Jessop, Vivo Energy, South Africa, discusses the potential for renewable energy in Africa's mining sector and how solar hybrid solutions can help the industry become more sustainable.

Vivo Energy currently operates in 23 African countries as a leading provider of fuels and lubricants. The company has recently announced plans to partner with Engen, which is currently pending regulatory approvals and fulfilment of conditions precedent. On completion of the transaction, Vivo Energy will add five more countries and become a Pan-African energy champion.

Although fuel and lubricant sales are the core business of Vivo Energy, its power division has recently completed the pioneering Nampala gold mine solar battery hybrid energy project in Mali, which came onstream in July 2022. The project integrates fully with the mine’s existing power infrastructure, including its existing thermal plant, providing an uninterrupted supply of secure energy to the mine. By reducing the mine’s carbon footprint by approximately 60 000 t over 10 years, as well as cutting the cost of energy by displacing

over 30% of the diesel used by the thermal generation plant with low-cost, reliable, renewable energy, this project has demonstrated the potential for renewable energy to play a significant role in the mining sector.

Following the success of this project, Vivo Energy and its shareholder Vitol have committed to continue to invest in

solar hybrid battery solutions and thermal solutions to mines in Africa, reducing their cost of power and CO2 emissions. The business plan of Vivo Energy Power Division is to invest in the power solutions using only equity. The Nampala solar hybrid project, was funded 100% on the balance sheet of Vivo Energy. It features a photovoltaic solar plant and a battery storage system and provides a reliable source of electricity for the mine.