Are impractical daily workflows forcing you to compromise your personal safety to meet rising productivity demands? It doesn’t have to be this way. Let us introduce you to FaceCaptureTM Mapping System.

Safe, fast, and accurate geotechnical scanning in minutes – delivering real-time automatic processing and geospatial alignment ready for export into any geological modelling software. FaceCaptureTM Mapping System eliminates 100% of post processing, allowing geologists to focus on advanced analysis for improved accuracy, advanced planning, and increased efficiency.

Ata Douzdouzani, Switzerland, and Anil Kumar Verma, India, System Drives, ABB Motion, discuss how water-cooled drives can slash costs and energy usage for grinding mills.

17 A Well Oiled Machine

Gord Susinski, Petro-Canada Lubricants, an HF Sinclair brand, Canada, explores how lubricants and technical expertise can maximise equipment performance.

19 Exploring Lubricants In Mining

Dr. Lou A. Honary, Environmental Lubricants

Manufacturing, USA, highlights the development and availability of biobased and biodegradable lubricants for the mining industry.

25 Facing The Future With Digitisation

Michael Smocer, Mine Vision Systems, Inc., USA, uncovers a new an approach to mine face digitisation which benefits production, efficiency, and worker safety.

30 Digging In Sudhanshu Singh, SafeAI, USA, takes a look inside the mining industry’s decades-long autonomous evolution and looks ahead to the future.

34 OEM Agnostic Autonomy For Mining

Drew Larsen, Autonomous Solutions Inc. (ASI), USA, outlines the emergence of an alternative to the autonomous programmes offered by the mainstream truck OEMs.

38 Making Mines Intelligent

Will Owen, Global Mining Review, UK, reviews how the implementation of ICT technologies through digital transformation is helping mining companies tackle challenges and unlock benefits and social value with more intelligent operations.

42 Out With A Bang

Raymond Ippersiel, Brokk Inc., Canada, considers the benefits of remote-controlled demolition equipment for mining.

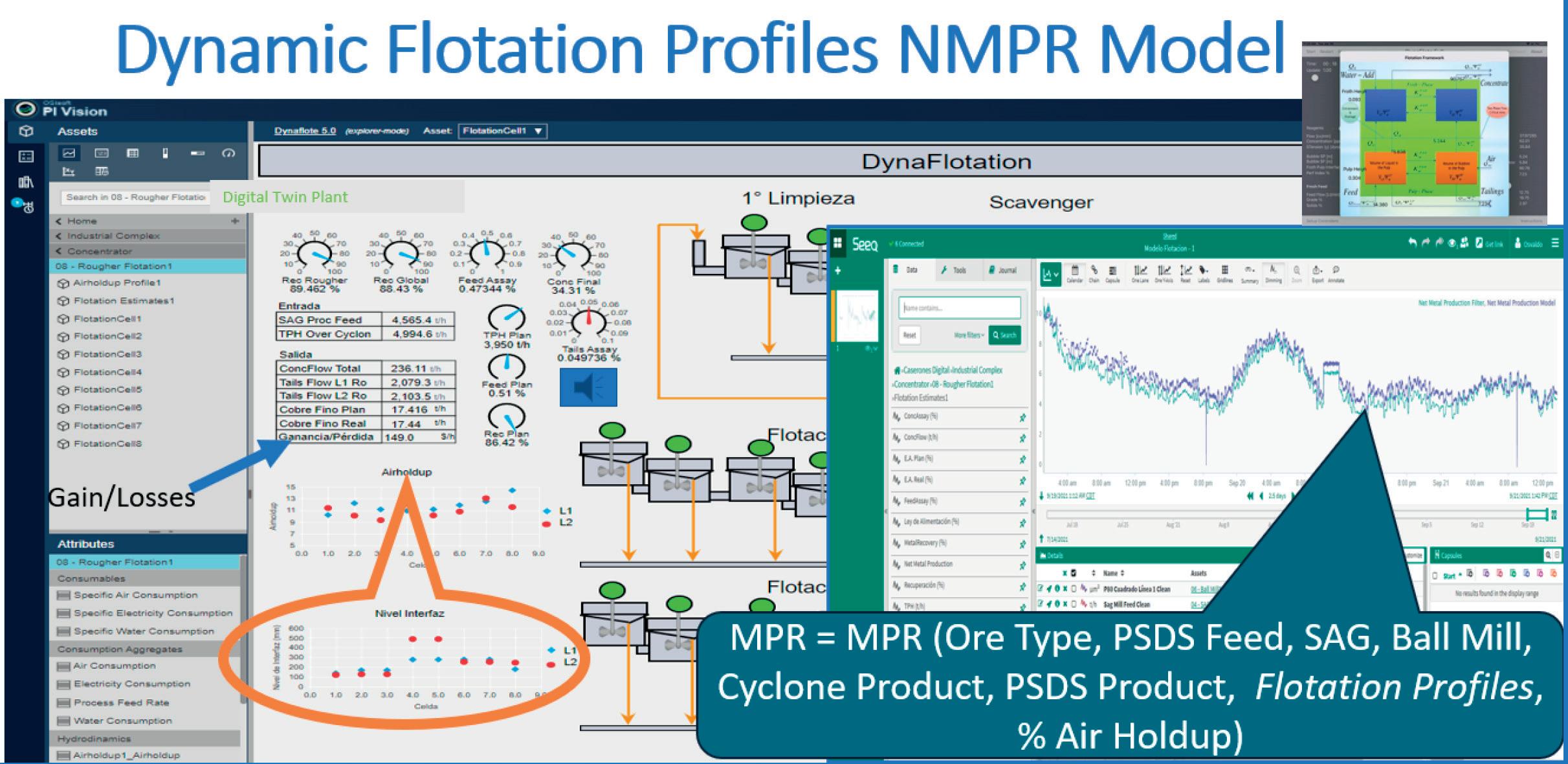

45 Advanced Analytics For Optimising Operations

Mariana Sandin, Seeq, USA, explains how advanced analytics solutions can empower business decision-makers to adopt strategies for profitable operations optimisation.

TotalEnergies Lubrifiants is a leading global manufacturer and marketer of lubricants, with 42 production sites around the world and a direct presence in 160 countries, delivering to more than 600 mines per day. TotalEnergies’ Lubricants division offers innovative, high-performance, and environmentally friendly products and services to help mining customers reduce their carbon footprint and ensure lowest total cost of ownership. For more information visit: lubricants.totalenergies.com

For over 40 years MMD have remained at the forefront of Sizer innovation. Combining unrivalled technical expertise and experience, we develop tailored Sizer™ solutions that optimize efficiency, improves safety, and delivers high productivity.

The MMD Sizer’s consistent product size and minimal fines generation, together with the ability to process any combination of wet, sticky, hard or abrasive material, has proven to be an effective formula for many industries such as; energy, precious and industrial metals, industrial minerals and recycling. The MMD Sizer’s performance and controlled product size has also led the way to develop groundbreaking reliable In-Pit Sizing & conveying systems and bulk ore sorting systems.

MMD’s support and service excellence will ensure your system always delivers optimum performance. Discover how we can deliver the complete sizing solution for your specific needs.

Technology is pushing mining to new heights in 2023; with advances in process automation, AI, sustainability, and additive manufacturing transforming a centuries-old industry. However, critical issues like pollution and resource depletion demand that the industry evolves even further.

MANAGING EDITOR

James Little james.little@globalminingreview.com

SENIOR EDITOR

Callum O’Reilly callum.oreilly@globalminingreview.com

EDITOR

Will Owen will.owen@globalminingreview.com

EDITORIAL ASSISTANT

Isabelle Keltie isabelle.keltie@globalminingreview.com

SALES DIRECTOR

Rod Hardy rod.hardy@globalminingreview.com

SALES MANAGER

Ryan Freeman ryan.freeman@globalminingreview.com

PRODUCTION MANAGER

Kyla Waller kyla.waller@globalminingreview.com

ADMINISTRATION MANAGER

Laura White laura.white@globalminingreview.com

EVENTS MANAGER

Louise Cameron louise.cameron@globalminingreview.com

EVENTS COORDINATOR

Stirling Viljoen stirling.viljoen@globalminingreview.com

DIGITAL ADMINISTRATOR

Leah Jones leah.jones@globalminingreview.com

DIGITAL CONTENT ASSISTANT

Merili Jurivete merili.jurivete@globalminingreview.com

The mining industry is responsible for 4 – 7% of greenhouse gas (GHG) emissions globally – a percentage that will continue to rise if we do not change course. Not only are the industry’s processes polluting humanity’s home, but the precious and critical metals found here on Earth are running out – leading to shortages that will bring entire industries to a halt. Despite efforts to make mining more sustainable, more action is needed in order to reverse the devastating impact of mining on our planet. We must begin to explore alternative practices, starting with outer space.

Platinum group metals (PGMs) are among some of the rarest resources available here on Earth. These metals are critical for creating essential tools, such as catalytic converters and medical applications. Currently, only a few countries have access to PGMs, making the supply chain vulnerable to disruption. In 2022, the global chip shortage underscored the importance of these metals as a key component in electronics and manufacturing. Moreover, with the rise of AI technologies, which rely heavily on PGMs for their computing capabilities, their scarcity is acute.

Space mining offers a promising solution to these challenges, as asteroids contain vast quantities of PGMs and other rare resources. It is estimated there are over 300 000 near Earth objects (NEOs) that are of the metallic type, the smallest of which is estimated to have US$24 billion worth of platinum on it. AstroForge’s research with The Colorado School of Mines found that the total concentration of PGMs on metallic meteorites varies between approximately 6 and 230 ppm, higher than almost all terrestrial ores. While the concept of asteroid mining has been around for ages, it was not until recently that enough information has become available to explore asteroid mining as a legitimate solution. The barrier of entry for space missions is lower today than ever before. The emergence and success of companies like SpaceX have created a new space economy. Now, companies can easily purchase affordable rideshare spots on rockets, making space accessible to industries that previously lacked the resources required to capitalise on the opportunity with space. Government-backed missions, such as OSIRIS REX and Hayabusa, have already shown that travelling to an asteroid and returning is possible. With the development of Brokkr-1, AstroForge’s refinery, all of the equipment and resources needed to make private asteroid mining a reality are available – it is just a matter of bringing them together.

Asteroid mining represents the next step in the evolution of the mining industry. It is the responsibility of companies like AstroForge, as industry leaders, to work together and explore the new technologies that are now available; as space mining is embraced responsibly and with a long-term perspective – ensuring that practices are sustainable, safe, and equitable. This new journey should be embarked upon with the wellbeing of our planet in mind. Asteroid mining offers the potential for innovative technologies and sustainable practices that can benefit the industry as a whole.

Mining has always been critical to powering our economy, and that will not change. But with finite resources here on Earth and continued devastation to our environment, we have no other choice than to open our hearts and minds to new possibilities and look beyond our planet. By embracing space mining as a practical near-term solution, we can help to create a more sustainable future.

Process solutions are dependent upon precise information to be most effective. As an experienced solutions provider, Conn-Weld’s approach is to partner with customers to understand their unique challenges. Utilising advanced technology to analyse data plays a key role in designing a custom-manufactured product to meet customer’s specifications. Marrying technology with experience often entails visiting a site with engineering services; whether measuring to direct fit, employing analysation, or assessing the overall operation.

Conn-Weld offers a full line of equipment supporting a wide variety of industries with installations around the world. For example, Conn-Weld’s offering to the mining industry includes its Multi-Slope Banana Style Vibrating Screen.

The banana screen takes the place of a curved-sieve, horizontal screen combination and is designed for high-capacity screening. The feed end is highly inclined, with a medium slope midway, to a low slope at the

discharge end of the machine. Material is conveyed across the screen creating a thin bed depth. This is accomplished by linear motion, (or straight-line) motion. A gearbox with out-of-balance masses is geared together so that when the masses rotate, the opposing forces cancel out. The alignment of the forces moves the vibrating screen body, based upon the angle setting. With Conn-Weld, the gearbox can be mounted onto the vibrating screen anywhere from 35 to 50 °.

Designed for higher tonnages, banana screens are used in aggregates, coal, minerals, and potash applications. A variety of product options can help extend wear life or optimise screening efficiency. By installing a fixed flat sieve ahead of the banana screen, material is distributed evenly across the feed end of the machine. Thereby reducing the impact on the screen media and increasing throughput.

Conn-Weld has been custom manufacturing banana screens since 1998, with over 900 installations worldwide. Coming in single and double decks, sizes range from 6 ft x 20 ft – 14 ft x 28 ft. The durability of Conn-Weld screens is demonstrated in providing a customer in the coal industry with 14 years of service and 35 million tons of product before being replaced with another Conn-Weld 10 ft x 20 ft SD Banana Screen.

Process solutions do not end with application and sizing. Conn-Weld partners with customers providing support and engineering services to maintain optimal equipment performance. Whether it is a maintenance seminar or analysation of equipment, technology is always backed with personal service.

Volt Lithium Corp. has announced the results from a successful pilot project to test its proprietary direct lithium extraction (DLE) technology in a simulated commercial environment.

The Pilot Project proved the company’s ability to achieve lithium recoveries of 90% based on concentrations of only 34 mg/L. The company also simulated operating conditions at concentrations of 120 mg/L, and achieved recoveries of up to 97% with operating costs under CAN$4000/t – assuming sustained average annual production of 20 000 t of lithium hydroxide monohydrate (LHM).

Alex Wylie, President and CEO of Volt, said: “Volt has achieved remarkable and groundbreaking results through the Pilot Project. I want to thank the entire R&D, operational, and engineering teams for their dedication and hard work in successfully executing this first phase.

TOMRA Mining has invested in its operations in Australia to meet the rising demand for sensor-based sorting and be close to customers on the West Coast – the heart of the country’s mining sector – with the opening of a second office in Perth, the appointment of Jordan Rutledge as new Sales Manager based at the new location, and the extension of its local support and service team. The company continues to support its Australian customers with its well-established office and test centre in Sydney.

Rutledge commented on leading the opening of the new TOMRA Mining office in Perth: “With the uptake of sensor-based sorting in the sector we are seeing a fast-growing demand for our technology. With the new office in Perth, we can be on the ground and visiting our customers on the West Coast very quickly, as they are just a short drive or flight away.”

2023 Elko Mining Expo

08 – 09 June 2023

Elko, USA

www.exploreelko.com/top-events/ elko-mining-expo

Mines and Money Connect: Melbourne 2023

14 – 15 June 2023

Melbourne, Australia

www.minesandmoney.com/melbourne

9 th International Conference on Tailings Management – Tailings 2023

14 – 16 June 2023

Santiago, Chile

www.gecamin.com/tailings

26 th World Mining Congress

28 – 30 November 2023

Brisbane, Australia www.wmc2023.org

AIMEX 2023

05 – 07 September 2023

Sydney, Australia

www.aimex.com.au

China Coal & Mining Expo 2023

25 – 28 October 2023

Beijing, China www.chinaminingcoal.com

International Mining and Resources Conference (IMARC) 2023

31 October – 02 November 2023

Sydney, Australia

www.imarcglobal.com

Resourcing Tomorrow 2023

28 – 30 November 2023

London, UK

www.resourcingtomorrow.com

To stay informed about upcoming industry events, visit Global Mining Review’s events page: www.globalminingreview.com/events

Mining automation enables key processes on mine sites; such as controlling a machine remotely, automating multiple types of equipment across a fleet, or implementing a completely autonomous fleet of haul trucks that can operate around the clock. To share its latest automation advancements, Komatsu recently hosted customers and distributors for an Automation Global User Forum at the company’s Arizona Proving Grounds (AZPG) facility in Tucson, Arizona, US.

With an emphasis on Komatsu’s interoperability strategy, the event highlighted the company’s equipment automation and system technology roadmaps, as well as customer-presented case studies – illustrating the high value autonomous haulage has brought to their mining operations and their potential paths to an automated mine site. Participants also got a first look at an autonomous light vehicle (ALV) that Komatsu and Toyota are jointly developing.

Komatsu’s partnership with Toyota is reflective of the company’s interoperability strategy for its customers’ large mining fleets. Receiving directional commands from Komatsu’s class-leading Autonomous Haulage System (AHS), one or more Toyota ALVs can integrate with and operate alongside a Komatsu autonomous haulage fleet. Integration of this kind can help improve safety and productivity in an automated mine by reducing interactions with manually operated vehicles.

The mining industry is on a trajectory to a more sustainable future. Key to achieving more sustainable operations is increased circularity throughout the whole value chain. Rio Tinto Kennecott’s (Salt Lake City, US) decision to join Terelion’s circularity programme marks a significant milestone in delivering on this ambitious goal.

Cemented carbide is a key component in high-quality drill bits. One important ingredient in the manufacturing is tungsten, a rare mineral difficult to come by. Through Terelion’s circularity programme, it is now possible to recycle all cemented carbide inserts on a drill bit back to virgin material – pure tungsten – which can then be used in manufacturing new cemented carbide inserts. Tools from recycled solid carbide require 70% less energy, which results in 40% less CO2 emissions.

Graeme McKenzie, Operations Director at Terelion, said: “At Terelion, we are committed to working towards a more sustainable mining future. Doing so will benefit all: our planet, our customers, and our business. Our aim is 90% circularity by 2030. Key in achieving this is our circularity programme. We are very happy that Rio Tinto Kennecott shares this ambition and has decided to join our programme – a clear testament also to their commitment in this area. We look forward to a successful partnership that ultimately encourages others to join this exciting initiative.”

USA Terelion adds Rio Tinto Kennecott to circularity programme

• Shorten lead times

• Reduce cost

• Reduce CO emissions

Large size bearings and housings for mills, roller presses, and HPGR:s can have delivery times of several months. With SKF Remanufacturing Services, you can shorten those lead times to weeks at a lower purchasing cost than for new bearings, and reduce CO emissions significantly.

Bearings in mining, mineral processing and cement machinery work hard in tough conditions. When bearings are removed from a machine because of wear, or another part of the machine needs repair, all the bearings are

usually scrapped. This could be a costly mistake. With SKF industrial bearing inspection and remanufacturing services, there’s a more cost-effective way to increase the remaining life in your bearings and avoid long and costly replacement times.

Our controlled remanufacturing service cleans, inspects and polishes to restore bearings to like new condition with a new bearing warranty. SKF bearings, unlike other brands can be remanufactured more than once and we can also remanufacture large size bearing housings. You save time, you save cost.

Find out more at skf.com/mining

On April 12, 2023, the US Environmental Protection Agency (EPA) delivered an announcement that will push the US auto manufacturing sector to unprecedented levels of electronic vehicle production. The new emissions standards mean that lithium ion batteries will power 67% of sedans and pick-up trucks, 46% of delivery vehicles, and 25% of buses and heavy transport trucks sold in the US by 2027.1 In 2022, EVs represented 5.8%, just over 800 000 vehicles, of total sales in the sedans and pick-up truck category – up from 3.2% in 2021.2

Beyond demand for lithium driven by the US EV market, observers saw the global consumption of lithium increase from an estimated 70 000 t in 2020 to an estimated 93 000 t in 2021, marking a 33% increase y/y.

Though the end-use of lithium varies by demand market, global end use for batteries is calculated at 74%. Ceramics and glass are estimated at 14%; lubricating greases, 3%; continuous casting mould flux powders, 2%; polymer production, 2%; air treatment, 1%; and other uses, 4%.3

Meanwhile, demand markets in China, the European Union, and the US pushed the value of lithium to record highs at the end of 2022. Though these year-end highs have slacked off some, spot prices for lithium reached US$61.50/t in the US on March 13.4 EV manufacturers drive demand in these three global markets, presenting massive profit opportunities for mining companies willing to take the risk. Though there are significant operations

Samuel Logan, Southern Pulse, USA, examines the reasons why South America’s ‘Lithium Triangle’ presents a tremendous opportunity, and also a significant challenge.

currently underway in China and Australia, steady and rising demand forces suppliers to look at South America, where the so-called ‘Lithium Triangle’ presents a tremendous opportunity, and significant challenge.

As one of the world’s top sources of lithium, South America’s Lithium Triangle – situated between Chile, Bolivia, and Argentina – represents approximately 55% of known global lithium reserves. According to the US Geological Survey, Bolivia holds 21 million t; Argentina, 19 million t; and Chile, 9.8 million t. And while Chile’s resources, relative to its South American neighbours, have been successfully brought to market, these three countries present political, environmental, and social challenges endemic to the region, yet often foreign to global suppliers seeking to benefit from the abundant supply and global demand.

Bolivia is the least productive, with 18 million t in lithium reserves and little to no production to show – in the past five years, Bolivia has produced just 1400 t of lithium.5 In 2008, then president Evo Morales referenced Bolivia’s history of natural resource protection when he nationalised all Bolivian lithium reserves, presenting a vision for transforming his country to a lithium mining powerhouse for battery and EV production, leveraging tax revenue to capitalise social programmes and infrastructure improvements. Historically, Bolivia has nationalised hydrocarbon and tin resources, as well as telecommunications and electricity services.

Since Morales entered office, his political party, the Movement Toward Socialism (MAS in Spanish), has governed the country for all but one year between 2006 and 2023. MAS leaders have kept Morales’ vision for sovereign control of Bolivia’s lithium reserves, meaning that Bolivia’s state-owned lithium mining company, Yacimientos de Litio Bolivianos (YLB), is the only company that is legally able to extract lithium from the country’s three salt flats: Uyuni, Coipasa, and Pastos Grande.

Yet Bolivia’s reserves have proven challenging to access. Traditional evaporation methods – which store salt brine pumped from underground in above-ground, open air ponds – are the primary method used for lithium extraction in Bolivia. They have delivered disappointing results, partially due to the high levels of magnesium in the brine.6 After nearly US$800 million invested in this method, Bolivia may reach an annual product of only 15 000 tpy in 2023, compared to the some 600 000 t produced globally in 2022.7

Not surprisingly, Bolivia decided to open its lithium industry to foreign investment, inviting companies from China, Russia, Argentina, and the US to submit proposals to work alongside YLB to reach the country’s mineral wealth, but with a catch: bidders would be asked to submit proposals for a modern ‘direct extraction’ (DEL) method that is less dependent on the weather and requires less water.

CATL, a Chinese consortium and the largest battery manufacturer in the world, won the initial round and is expected to inject over US$1 billion into Bolivia’s

lithium industry. The investment includes the construction of two industrial lithium extraction operations in Potosi and Oruro, and is expected to raise Bolivia’s annual lithium production to 25 000 t by 2025.8

Yet, a cloud of doubt surrounds projected numbers. A combination of ongoing state intrusion – through YLB –and local community resistance may prove to slow down or possibly stall production in a country run by a populist, indigenous rights focused government that must cede control of natural resources to foreign companies.

The Indigenous communities of Potosi, where Bolivia’s largest salt flat is located, have been working toward a social contract to define royalties and benefits from ‘white gold’ for local communities with Bolivia’s national government for the past 15 years, insisting that an agreement must be reached before extraction may begin.9 While the national government signed an agreement with CATL in January of 2023, an agreement between the national government and the people of Potosi appears to have only recently found common ground, though discussions are still ongoing, intermittently disrupted by groups of local community members blocking roads to gain leverage.10

Though proven reserves in Argentina are significantly lower than in Bolivia, the government’s willingness to open its lithium reserves to foreign investment and operations has greatly benefitted the country’s mining sector. This is despite triple-digit inflation, chronic government mismanagement of the economy, and historic drought.

In 2022, Argentina’s lithium exports jumped 234% compared to 2021, on the back of some US$5.1 billion in investment made in 2020 alone, according to Mining Ministry numbers.11 Analysts with JP Morgan agreed that Argentina could be a global top producer of lithium by 2030, offering as much as 13% of total supply, up from just 5% in 2023.12

Similar to Bolivia, Argentina has positioned its state-owned energy giant to benefit from white gold. Unlike Bolivia, however, Argentina has not directly controlled production; rather, it has closely managed foreign investment and operations while preparing domestic players to compete with international producers from China, Australia, and the US.

Argentina’s YPF has invested US$770 million in YPF Tec – its technology division – to take the lead in domestic battery production for energy storage, with plans to produce batteries for EV use with the inauguration of a new plant outside of Buenos Aires in February of this year.13 The plant’s annual production capacity is expected to reach 13 MWh – roughly the equivalent of 1000 batteries for fixed storage, or 50 batteries to power electric buses.14 It is the first battery plant to begin operation in Latin America.

On 19 April, YPF Tec signed an agreement with Camyen, a state-owned mineral exploitation company in Catamarca, for the provision of lithium to resource its new battery plant.15 Catamarca, Jujuy, and Salta are the three Argentine provinces that contribute to South America’s Lithium Triangle. They are historically rural and poor,

and heavily reliant on federal government subsidies and public jobs. Argentina’s provincial governors are known in local media as feudal lords ruling over their people and controlling jobs and the distribution of federal largesse. The most egregious example of this local political reality is in the Argentine province of San Luis, where two political allies have – together – governed the province for 34 years.16 As opportunities for lithium exploitation increase, these governors will play a pivotal role in deciding who wins concessions and who does not. They will most likely favour those projects that help them stay in power.

Most recently on 11 May, a multibillion-dollar project finally emerged in Argentina's Jujuy province with US-based Livent Corp. and Australia’s Allkem Ltd. The transaction is the largest ever in the lithium industry, and it will create the world’s third-biggest producer with a supply chain.

Meanwhile, in the capital of Buenos Aires, battle lines have been drawn for the preservation of wetlands and the control of water rights – a critical resource for the brine flats method of lithium extraction practiced in Argentina. Versions of wetlands protection legislation currently moving through the federal legislative process classify Argentina’s salt flats as wetlands.

President Alberto Férnandez publicly took a posture in favour of protecting wetlands in a late February 2023 speech, even while his government worked with local governors to mitigate the risk a wetlands protection law presents to the country’s fledgling lithium mining sector. Still, something must be done to appease farmers in Argentina’s northern province, who allegedly have been setting fires to protest their lack of water in the midst of a historic drought.17

Finally, Chile is the member of South America’s lithium triangle that has the smallest proven reserves of lithium, but has accomplished the most to exploit them. Yet Chile’s historic declaration of lithium as a national strategic resource in 1973 has over the years created a stumbling block for the country’s lithium sector. Currently, only two mining companies, SQM and Albemarle, operate the Atacama salt flat in Chile, but internal and external pressure is slowly pushing the Chilean government to open its reserves to further exploitation.

In late January 2023, German Chancellor Olaf Scholz visited South America, with stops in Argentina and Chile to sign strategic agreements, with the public intention of securing lithium resources for German auto manufacturers Mercedes-Benz and Volkswagen. Scholz echoed the message of many observers who agree that Chile must work harder to open its lithium sector to foreign investment, and focus on local battery production as a low-cost alternative to sending lithium mined in Chile to China and Korea, the destination of some 90% of all Chilean lithium.18

On 17 April 2023, the Chilean government announced that state-owned copper mining giant, Codelco, would shepherd the introduction of new mining operations in Chile’s lithium sector until a national lithium mining

company had been formed. These plans are separate from Codelco’s own study of an evaporation pond operation at the Maricunga salt flat.19 In a parallel effort, Chile’s President Gabriel Boric inaugurated in April 2021 a series of measures to cut red tape and spur investment in Chile’s lithium sector.20 Separately, the Chilean government announced its intention to publicise a 2025 – 2030 investment plan just as this article was written.

The core of the plan includes bringing to market Chile’s national lithium mining company, adjustments to the mining process in the Atacama salt flats, and what is described as a ‘decentralised’ method of lithium extraction – a foreign direct investment friendly posture which aims to open Chile’s lithium reserves up to international players.

Yet bureaucratic inertia indicates that the plan will evolve over time and could take up to two more years before it finally takes shape and turns into policy. Separately, the Chilean government will require a significant amount of private capital to bring intended policies to actual lithium production, government officials said.21

Meanwhile, concern mounts around the Chilean government’s intention to require the DEL extraction method, as yet unproven in the South American country, for new lithium projects. Similar to both Bolivia and Argentina, access and use of water in arid regions of the country square the country’s lithium mining interests with the locals’ need for water.

Balancing national and global mineral interests with the realities of what a local community needs sits at the heart of challenges presented to global lithium miners willing to risk extraction in South America’s lithium triangle. Local government leadership among indigenous communities in Bolivia and powerful, possibly corrupt provincial governors in Argentina present other hurdles. They will not stand by while international companies extract value from their lands without fair compensation and, if necessary, a fight.

Finally, there is the red tape. This is perhaps more visible in Chile, but it is also present in Bolivia – where the state company must be involved in every operation, to a detriment. Argentina is moving fast to set up its own battery processing industry and will certainly choose domestic lithium extraction operations over international operators.

Yet the economics are clear. Demand is strong and rising. With prices hovering at US$60/t, and proven reserves registered at some of the highest in the world, international players continue to line up to submit projects, meet with ministers, governors, and other regulators. Visits from foreign dignitaries, supporting their private sector peers, are almost a regular occurrence. Clearly, there are challenges. More clear, however, is that the reward is worth the risk.

References

Available upon request.

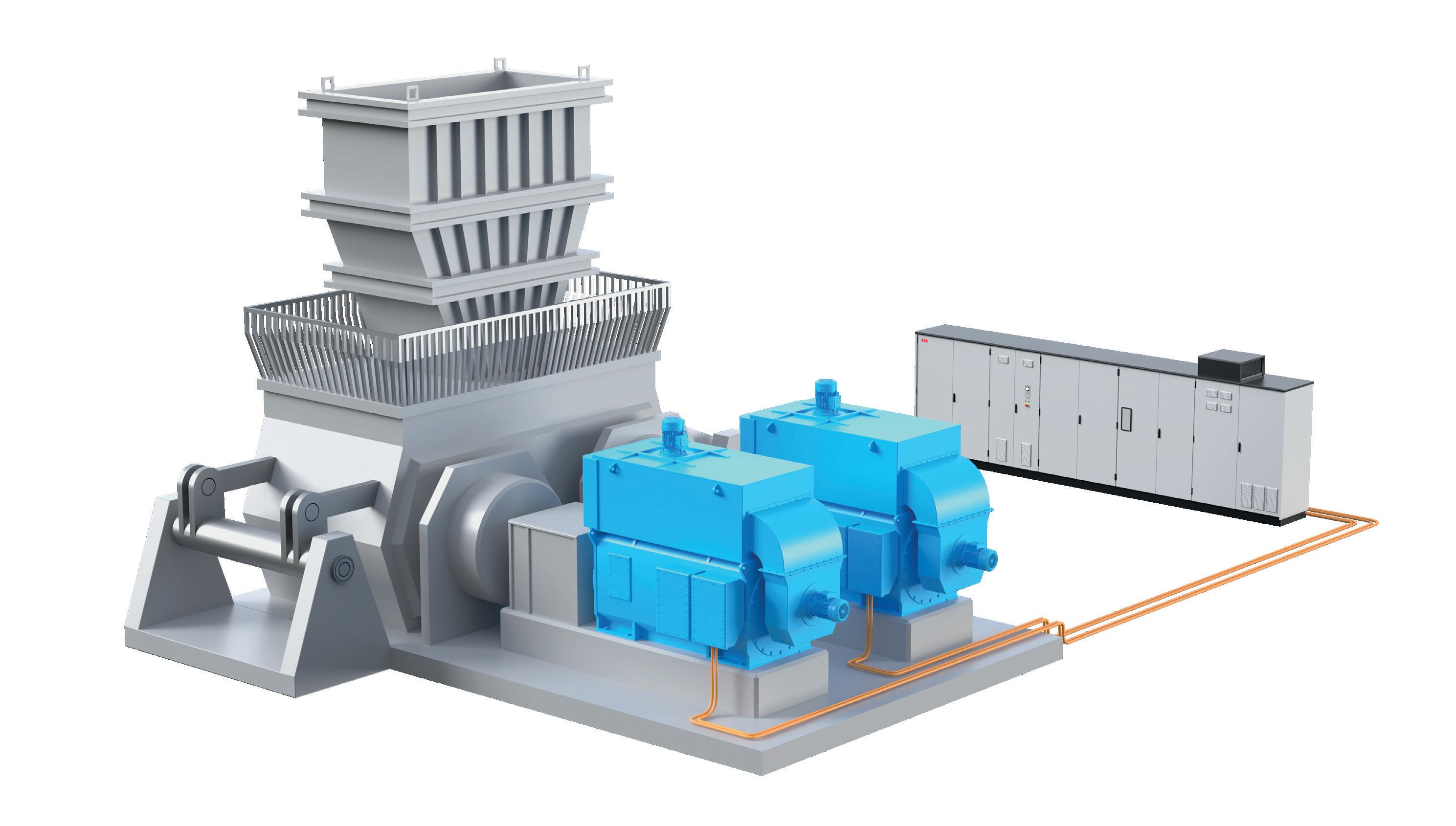

Ata Douzdouzani, Switzerland, and Anil Kumar Verma, India, System Drives, ABB Motion, discuss how water-cooled drives can slash costs and energy usage for grinding mills.

The global ambition to achieve net zero is driving an increase in demand for materials – such as lithium, nickel, cobalt, graphite, copper, aluminum, and rare earth elements – that are vital for the manufacture of clean energy technologies and enhanced energy efficiency. This calls for the mining industry to increase its output and productivity. Yet, at the same time it must focus on its own need to decarbonise, even as the energy intensity of mining operations is predicted to increase. The driving factors for this trend include new deposits being lower grade and in remote and/or deeper locations where extraction is more difficult. Clearly, mining needs to become more sustainable and productive, this requires an intense focus on improving energy efficiency across the value chain.

One area for particular attention, as identified in the Mining Energy Consumption 2021 report carried out by Engeco and commissioned by the Weir Group, is comminution. This consumes up to 40% of the total energy used by mining operations, with one single piece of equipment – the grinding mill – identified as typically the largest single consumer. Grinding applications are therefore an ideal starting point to seek improvements in energy efficiency.

Large scale grinding equipment, including ball mills, rod mills, SAG mills, and high-pressure grinding rolls (HPGRs) are rated typically above 1500 kW and generally operated by medium voltage (MV) variable speed drives (VSDs). This means the system will already be benefiting from the well proven advantages of VSDs in terms of significantly improved energy efficiency and controllability.

It is, however, worth considering the optimal design of the complete VSD system. Because using water-cooled drives can take energy efficiency to an even higher level than comparable air-cooled models.

Generally, an air-cooled MV drive setup comprises the VSDs and integrated transformer, together with upstream switchgear, often all housed in an electric room (E-Room). All the heat losses from the equipment into the E-Room must be handled by a large heating ventilation and air-conditioning (HVAC) system, with a considerable impact on both CAPEX and OPEX. It also has a relatively large installation footprint on sites where space can sometimes be at a premium. Overall, the efficiency of this approach is typically lower than 96.5%.

Furthermore, with the arrangement described above using an integrated transformer, a separate, external stepdown transformer is needed from the 33 kV grid supply to the motor voltage of 11, 6, or 3.3 kV. This incurs further energy losses of 1%, while adding further to the CAPEX and OPEX burden.

In contrast, a growing number of mining sites are adopting water-cooled drives with an external oil natural and air natural (ONAN) cooled transformer. Only the VSD panel has to be installed in the E-room, which is therefore much smaller. No step-down transformer is required. Direct connection at 33 kV means that just a single, external transformer is used that also acts as the converter transformer.

The cooling water for the drive is usually supplied by the plant’s common water system. If this is not available, then a closed-circuit cooling system is created using a chiller or fin-fan heat exchanger. Even in this case, the energy losses are much lower than when using an HVAC system to cool the air in the E-Room. In some cases, it might be possible to recover heat from the cooling circuit for use in other parts of the process to further boost the overall system efficiency.

Liquid-cooled drive systems will achieve an efficiency of greater than 97.5%. That means they will have energy losses of some 2% lower than the equivalent air-cooled drive system.

Because liquid-cooled drives generally run cooler than air-cooled versions, there is less stress on their critical electronic components. This helps ensure a longer service life.

The cumulative effect of the reduced losses, together with the reduced cost of equipment and a lower installation footprint, makes liquid-cooled drives the best choice for grinding plants in terms of the total cost of ownership (TCO) throughout a 20-year anticipated service life.

In most cases, air-cooled drives do not allow for a very high ingress protection (IP) rating of their enclosures unless a special ducting system is specified. Even in this case it can still be possible for the inlet air to enter the VFD through openings in the enclosure. This means that the HVAC system needs filters to prevent the ingress of dust and particles. However, in the dusty environment typical of mining sites these filters will need frequent replacement.

In contrast, water cooled VFDs can be specified with a high IP rating, with IP54 available as standard. Not only does this protect the drive against dust, it also provides protection against conductive particles. This helps to lower the potential risk of arc-flash.

Water cooled drives generate much lower noise in the E-Room, helping to create a more pleasant environment for operators and maintenance crew. Another comfort factor is the reduced level of air flow, as unlike air-cooled drives, the cooling system does not have to blast several cubic meters of air per second. Water cooled drives are also available in a flexible multi-drive configuration. This has a common rectifier with multiple inverters feeding multiple motors. This helps to further reduce the drive system footprint to optimise the E-Room space and costs.

High-pressure grinding rolls (HGPRs), also called roller presses, are fast gaining acceptance in hard-rock processing, mainly because of their energy efficiency when reducing mineral ore to fragments. Energy cost and water savings, a smaller installation footprint, and extended availability are the main reasons a growing number of HGPRs are being utilised within crushing and grinding circuits.

Drives play an important role in addressing one of their main challenges in the field. This is because wear and tear on the rolls may cause feed variance, which affects crushed ore quality.

An HPGR with a brand-new set of rollers starts operation with identical torque and speed. Depending on various operating factors, the rollers experience different wear rates over time. These factors include feed size, ore characteristics, and operating pressure.

Using a drive enables the grinding rolls to operate at optimal speed and provide accurate load sharing between the two rolls that can help reduce the impact of wear and tear. Water cooled drives provide this functionality, and with their emphasis on efficiency and compactness, are the ideal combination for HPGRs.

Innovative improvements do not just extend to the hardware. Digital services associated with modern technologies enable mining operators to identify and address inefficiencies. Sensors, remote connections, and services allow systems to provide real-time data on energy use, performance, and the condition of fast-moving electrical equipment.

Digital tools can even proactively recommend new parameters and operating modes that ensure the optimum amount of energy is used at all times. Consequently, operators can take informed actions that will optimise energy use, thereby improving energy efficiency. Minimising or, ideally, preventing downtime is vital. Digitalisation provides a compelling case here too, as it becomes the foundation for real-time condition monitoring and preventative maintenance.

Over the past decade, major advances have addressed the two major obstacles to the digitalisation of drives: network access and complexity. Today, the reach of digitally connected systems makes it possible to implement energy improvement and maintenance measures remotely, reducing reliance on costly onsite labour. This frees up time for existing workers to focus on more value-added activities.

Simplicity is another key to success. Effective digitalisation programmes generally adopt a ‘plug and play’ model for fast setup requiring no specialist support. In some cases, operators can even use a smartphone for easy drive configuration, product technical information, and access to remote assistance from technical experts.

The Iron Bridge Magnetite Project, located in Western Australia, incorporates the development of a new magnetite mine, including processing and transport facilities. Once fully operational, the mine is expected to produce 22 million wet t of high-grade magnetite concentrate for steel production.

A project requirement is the supply of a cost-effective, energy efficient VSD solution for eight switch rooms. The ABB-supplied drives operate with a separate transformer located outside the E-room. This reduces the heat generated inside, resulting in less energy required to maintain the 25°C room temperature. Furthermore, the compactness and high power density of the water-cooled drives, together with using an external transformer, means that the size of the E-Room has been cut by around 50%.

The drives directly support a higher voltage 33 kV network, enabling an easier connection to the electrical grid. This eliminates the need for a lower voltage intermediate switchboard and additional components, ultimately reducing the project’s total cost.

The project owners also selected ABB high-voltage induction motors to power HPGRs, grinding mills, and baghouse fans used to separate the ore from the dust. Engineered to withstand harsh conditions, the motors offer high power efficiency but in a frame size smaller than competing alternatives. The compact footprint makes the space-saving motors energy efficient, requiring less structural foundation.

The nature of the Iron Bridge ore bodies and the operator’s innovative use of a dry crushing and grinding circuit together contribute to the project’s operational efficiency across energy, water use, and cost.

Although water-cooled MV drives are more expensive on average, mining operators must consider the total investment cost. Their improved energy efficiency, reduced need for auxiliary equipment, and smaller installation footprint makes them a safe, more efficient, and cost-effective choice for mines using HPGRs and other comminution equipment. They are set to play an increasingly important role in the decarbonisation of the mining and mineral processing sector.

Gord Susinski, Petro-Canada

Lubricants, an HF Sinclair brand, Canada, explores how lubricants and technical expertise can maximise equipment performance.

Surface and underground mining operations often encounter a broad range of lubricant challenges, from the vast difference in surface and underground conditions to the complexity of managing a mixed fleet that requires a wide range of products. Added to this, the equipment is relied upon to be fully operational 24 hours a day, 7 days a week. Lubricants therefore play a vital role in the smooth running of mining equipment, contributing not only to reliability and performance but also the equipment’s broader environmental impact.

Due to the range of factors that can impact a lubricant, and in turn equipment performance, working with a lubricant technical advisor can deliver significant benefits. This article will explore how leveraging lubricant technical expertise can help improve equipment reliability and performance, while reducing maintenance costs.

This often begins with product selection. Mixed fleets are common within the mining sector and when managing both surface and underground operations, it often means that the fleet has equipment from several different original equipment manufacturers (OEMs). This can pose a challenge when selecting a lubricant, as it often means that multiple products are needed to align with the OEM’s recommendations.

By involving an expert in this process, the needs of all equipment can be taken into consideration. The expert can draw on a wealth of experience and insight to select the most appropriate lubricant, based on the OEM recommendations and operational environment. This supports improved equipment performance and reliability and, when undertaken with a lubricant expert, can offer the potential to consolidate the number of lubricants needed onsite.

Product consolidation can not only reduce the risk of selecting the wrong lubricant for an application, but it can also enhance efficiencies throughout a mining operation, from oil storage space to orders and delivery. However, the product consolidation process is extremely complex and should not be attempted without expert advice.

As already mentioned, each OEM will have recommendations to consider for each piece of equipment – all of which will have to be factored into any product consolidation. Added to this is the operating condition of each piece of equipment.

For those operating on the surface, temperature variation and emissions are key considerations, but underground, any product consolidation must take into account the stable temperature conditions.

With so many factors to consider, it is important that advice is sought in order to avoid over-consolidating products, which could mean that an operation misses out on the benefits that specific lubricants can offer, simply to reduce the number of products onsite. This could cause increased component wear, unexpected maintenance costs, and even equipment failure if not addressed.

Once lubricants have been consolidated, it is important to implement their proper storage and arrangement in a shop. This is not only crucial for further reducing the risk of incorrect oil selection, but also allows for the optimal usage of the space that is available.

When visiting facilities or a site, a technical lubricant advisor can provide valuable guidance and insight on efficient workshop organisation, optimising lubricant storage, decanting procedures, and correct labelling. These visits will also create an opportunity for a team to discuss any concerns and acquire valuable insight.

Seeking the expertise of a lubricant specialist is crucial in maximising the performance and maintenance of a fleet.

Whether face-to-face or seeking advice over the phone, partnering with a technical service advisor offers valuable practical guidance to boost performance, cut ownership costs, and minimise operational interruptions.

The ability to safely extend oil drain intervals can offer a range of benefits such as supporting the reduction of waste oil and helping align maintenance schedules to decrease downtime. However, if not extended correctly, component protection – and potentially its warranty – can be compromised.

For this reason, oil drain intervals should only be extended in collaboration with a lubricant technical expert and a comprehensive used oil analysis programme. The data from the used oil analysis is crucial in determining the condition of the oil both before and during any drain extensions. This allows any changes in the oil’s condition that could signal potential challenges to be quickly spotted and addressed.

The performance of equipment can also be enhanced through lubricant training and support. For example, technical service advisors can offer guidance interpreting and reading used oil analysis reports as well as share insight on lubricant best practice. Due to the vast amount of data points and factors that can impact on the used oil analysis results, turning the report into meaningful action that impacts on equipment performance can be challenging.

With expert support and guidance, maintenance personnel can become confident in identifying trends and anomalies, allowing them to address maintenance issues before they become serious or too expensive to repair. Over time, this can help maintenance personnel develop their own skills and the ability to make changes to the maintenance schedule based on their own insight and knowledge.

Training can also be beneficial for gaining better awareness and knowledge of key topics such as how to take a quality oil sample and recommended OEM drain intervals or lubricant recommendations.

A large part of maintaining the performance of a fleet is tackling problems on a day-to-day basis to prevent unplanned downtime. This can range from early bearing failures, spotting an increase in wear metals on a used oil analysis report to concern that the wrong lubricant has been used for a specific application.

By having access to expert support – either remotely or in-person onsite – challenges can be identified and addressed quickly. This can not only allow for the immediate issue to be rectified, but the root cause to be found – helping to prevent further issues and unexpected maintenance and downtime.

Lubricants and technical service advisors can have a positive impact on the efficiency, reliability, and performance of mining equipment. By collaborating with an expert, operators can be confident that their equipment will run smoothly and benefit from support with used oil analysis reports, the potential to safely extend drain intervals, and overcoming day-to-day challenges.

Lubricants in the form of liquids like hydraulic oils, semi-solids like greases, and solids like graphite impregnated stick lubricants are ubiquitous in the mining industry. Despite all efforts to prevent spillage, it is inevitable that some lubricants are released into the surrounding environment. Preventing the release of

lubricants becomes even more critical when mining takes place offshore or in environmentally sensitive areas. Beyond prevention of spills, a better approach is the use of products that are biodegradable and can be broken down by the bacteria in soil or organisms in water. This article will highlight the development and availability of biobased and

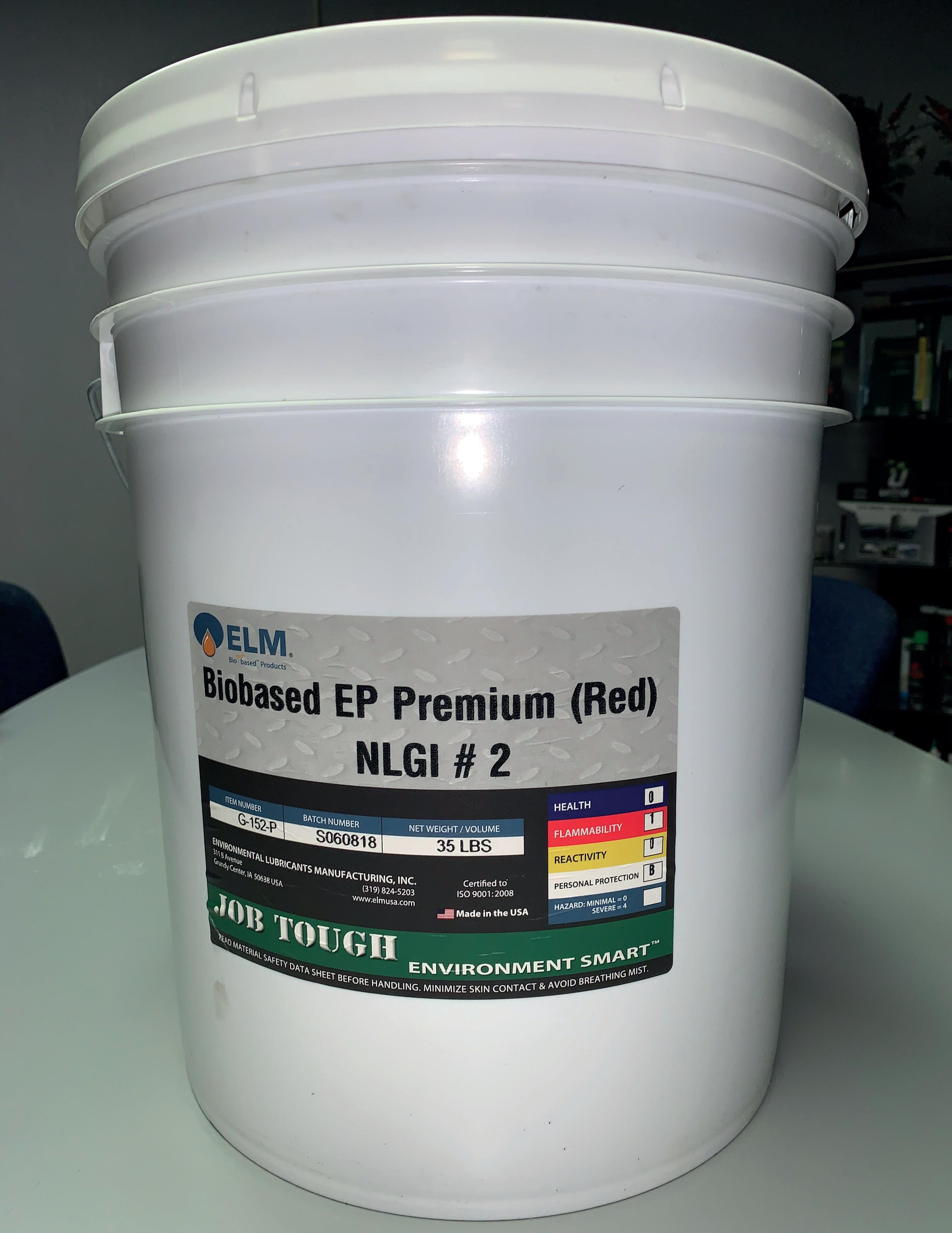

Dr. Lou A. Honary, Environmental Lubricants Manufacturing, USA, highlights the development and availability of biobased and biodegradable lubricants for the mining industry.

Dr. Lou A. Honary, Environmental Lubricants Manufacturing, USA, highlights the development and availability of biobased and biodegradable lubricants for the mining industry.

biodegradable lubricants for the mining industry and start by discussing some key terms.

Refers to products that meet the OECD 301 series of tests. These tests are based on respirometry and rely on the

respiration of standards bacteria. Simply described, a sample of the product is placed in a temperature-controlled water chamber with a standard quantity of bacteria. Another chamber with bacteria and ‘food’ is used as the control for comparison. If the bacteria can consume the sample product and survive or thrive, then the product will likely degrade in the environment also. The test instrument can monitor and record the amount of oxygen the bacteria are consuming, or the amount of carbon dioxide they put out, in both the control and test samples. The tests are 28 days in duration and for a product to be considered biodegradable, the test sample should show at least 60% of the control sample in oxygen consumption or carbon dioxide evolution to pass the test.

This term was introduced by the US Department of Agriculture (USDA) to encourage the replacement of fossilised hydrocarbons with renewable hydrocarbons. The USDA has established the ‘Biopreferred’ programme in conjunction with major US agriculture groups such as the United Soybean Board (USB) to promote the use of biobased products. The US federal purchasers are required to give purchase preference to products that meet the USDA biobased criteria. To be considered biobased, a product is sent to a USDA sanctioned laboratory for carbon dating according to the ASTM D6866 test method. This test simply shows the percentage of fossilised hydrocarbon vs renewable hydrocarbon. Plant or crop oils show to be majority renewable hydrocarbons. The USDA has a list of labeled products and their required minimum amount of biobased content.

Since some petroleum materials can actually pass the OECD 301 series test of biodegradability, a product can be synthesised from fossilised hydrocarbons to be biodegradable. An example would be some light polyalphaolefins (PAOs) or synthetic oils. Although biodegradable, a PAO oil would fail the ASTM D6866 test for biobased content because it would not be seen to contain any renewable carbon. In conclusion, most biobased oils are also biodegradable, so they are called biobased and biodegradable. However, biodegradable products that are petroleum based cannot be called biobased and biodegradable, they can only be called biodegradable. In Europe in general, regulations are focused on biodegradability regardless of renewability; whereas, in the US, the emphasis is on renewability and replacement of fossilised oils.

An important property of lubricants in mining applications is the extreme pressure (EP) performance. EP property can be enhanced naturally by using oils that are dipolar in nature and form strong bonds to metal surfaces (most vegetable oils fall in this category), and/or by using solids like molybdenum disulfide (Moly), graphite, and sulfur. Vegetable oils have some built in properties including a high Viscosity Index, meaning they do not thin down as much as petroleum oils do at high temperatures. Additionally, they have a high thin film strength for better metal to metal separation at high loads, and they

form a stronger bond to metal surfaces due to their polarity. Extreme pressure property is measured using the Four Ball Test (ASTM D2596) and Timken OK Load test (ASTM D-2509 procedure for testing greases and ASTM D-2782 for testing oils).

This property applies to many of the lubricants that are used on or near water. Wire rope grease, jack-up grease, and drill rod grease require resistance to water washout. This property can be improved by proper selection of base oils and or use of tackifiers. Aluminium complex greases exhibit a natural resistance to water washout and are often used in food production facilities, where they are frequently exposed to pressure washers. This property is tested according to the ASTM D1264 or IP 215.

Understanding the impact of metal-based additives in lubricants is important. Hazardous metals, such as lead, that were prevalent in gasoline as octane booster have been eliminated. In lubricants, zinc in zinc dialkyl dithiophosphate (ZDDP) is still commonly used, but changes are underway to eliminate its use. In greases, especially in drilling, barium has been the most prevalent thickener. Barium greases resist water washout and are fibrous in texture, forming a wrap around the rod during drilling. However, the heavy metal content of this grease is becoming an environmental concern for drillers and regulators alike.

Based on the available literature, more attention is given to the presence of barium in drinking water in the US and Canada than in Europe. In the US, the Agency for Toxic Substances and Disease Registry (2007) published the Toxicological profile of barium and barium compounds.

According to this report, barium compounds – including barium hydroxide, which is used in the manufacture of barium drill rod grease – dissolve easily in water and do not last in their natural forms for long, but they quickly combine with sulfate or carbonate that are naturally found in water and become longer lasting compounds, such as barium sulfate and barium carbonate. These are the compounds most found in the soil and water. Since 2020, due to the increasing health concerns of barium or compounds of barium in soil and water, Canada has tightened its regulations for release of barium into the environment, an indication that all heavy metals used in lubricants are on their way out in North America.

The US Environmental Protection Agency (EPA) introduced the VGP in December 2013. It requires all ships larger than a certain length entering US waters to report the release of any lubricants into US waters. Alternatively, the vessel could be issued a VGP if the lubricants used on the vessel are certified as environmentally friendly based on the VGP specifications. This has led to an increased use of biobased and biodegradable turbine oil, hydraulic oils, gear oils, wire rope, and drill rod greases. The US EPA has a history of retroactively

pursuing those considered as polluters even when some materials are not considered as pollutants at the time of release.

The attempt to create a more sustainable operation in mining requires more than just the use of a lubricant that is considered biobased or biodegradable. In support of the USDA Biobased initiatives, the National Institute of Standard and Technology (NIST) established guidelines and tools for performing life cycle analysis on products. Data from the

entire journey of the product are entered into an analysis program called BEES. It is designed to measure the environmental performance of a product based on the ISO 14040 series of standards and perform the lifecycle assessment. All stages in the life of a product from raw material acquisition, manufacture, transportation, installation, use, recycling, and waste management are analysed.

There are several environmentally friendly lubricants and greases available that could help to reduce the use of mineral oil-based lubricants in mining applications.

Biobased jack-up greases are primarily aluminium complex greases, but also available in mineral oil-based calcium sulfonate and offer natural water repellant properties and extreme pressure performance. Most such greases contain molybdenum disulfide and or graphite for an improved extreme pressure property. Using a combination of tackifiers that impart adhesion and cohesion properties, these greases can be used for jack-up and all open gear applications –including cranes, draw bridges, and the like.

Biobased-biodegradable wire rope greases are mostly made of vegetable oil or vegetable oil derived synthetic esters that are thickened with aluminum complex thickeners. These greases are often tested for aquatic toxicity using the OECD 202 test method. In July 2022, after two decades, an update to the military specifications for wire rope grease MIL-PRF-18458D was released. This update now contains specifications for two types of wire rope greases (Type 1 being for conventional mineral oil-based grease and Type 2 for biodegradable versions). To meet the requirements of Type 2, the grease has to pass biodegradability tests according to OECD 301B or 301F and aquatic toxicity according to OECD 202. One US original equipment manufacturer (OEM) and supplier of grease has already announced meeting the requirements of both Type 1 and Type 2 wire rope greases.

These greases are made of aluminum complex, lithium or organo-clay thickeners, and vegetable or biobased synthetic ester base oils to replace barium greases. Greases with inherent water repellant properties – such as aluminium complex fortified with tackifiers for a balance of adhesion to wire ropes and cohesion to fight water washout – have shown to perform well as a replacement for conventional barium greases. Vegetable oils have nearly 200˚F (93˚C) higher flash/fire points than equivalent mineral base oils, and thus offer added safety when used as base oil in making grease.

These are biobased greases that are thickened as lithium complex and offer extreme pressure and

anti-wear properties. Such greases should meet the highest performance rating of the National Lubricating Grease Institute (NLGI) with a performance rating of GC-LB – suitable for use in bearings and high-speed moving parts. They could replace all miscellaneous greases used in mining or offshore platforms without compromising performance.

Biobased derived synthetic esters, made from natural vegetable oils, offer superior oxidation stability and improved cold temperature performance. Biobased hydraulic oils reduce energy consumption observed as lower current draw on drive motors, cooler pump temperatures, and quieter operation. Beyond the oxidation stability and cold temperature performance, consideration should be given to seal compatibility. Some elastomeric seals and O-rings are not compatible with biobased oils and could cause excessive seal swell, however manufacturers have developed additives that counter the seal swell that could be present in otherwise poorly formulated products. The ASTM D4289 is a test of Elastomer Compatibility NBR L and CR with grease.

Biodegradable lubricating oils are combined with wetting agents to prepare products that outperform conventional lubricant-penetrant products. Simple applications – such as pipe threading, metal drilling, honing, reaming, etc. – could benefit from the superior lubricity and other benefits of bio-oils without compromising performance.

These products contain biodegradable heavy-duty base oils combined with wetting agents and a rust and corrosion inhibitor package for on and offshore use. They have the same benefits of mineral oil-based rust and corrosion inhibitors, but are also biodegradable and safe to use.

The current attention to sustainability is deep rooted within the industry, and a genuine attempt is underway to bring about change with limited impact on performance. To the younger generation of mining personnel, climate change and environmental stewardship have taken on a different meaning and a higher sense of urgency. The lubricants industry too has been actively searching for novel approaches to meeting the needs of the mining industry, in terms of performance and offering reliability in supplies. As the end user becomes more educated about biobased products, the increased demand and the economy of scale should make these products mainstream.

Duncan Wanblad, Chief Executive, Anglo American

Mike Henry, CEO and Director, BHP

Sinead Kaufman, Chief Executive, Minerals, Rio Tinto

Fiona Hick, Chief Executive Officer, Fortescue Metals

Ailie MacAdam, Global President, Bechtel Mining and Metals

Tom Palmer, President and CEO, Newmont Corporation

Sherry Duhe, Interim CEO, Newcrest

Cathy Foley, Australia’s Chief Scientist

Tania Constable, CEO of the Minerals Council of Australia

Rohitesh Dhawan, President and CEO, ICMM

Deborah Terry, Vice-Chancellor and President, UQ

Michael Wright, Executive Chair and CEO, Thiess

Li Xiaohong, President, Chinese Academy of Engineering

Sanjeev Ghandi, Managing Director and CEO, Orica

The Technical and Business Program has now been released and includes 14 Keynote Plenary Speakers and more than 300 Technical Discussions segmented through 13 Core Streams, three Symposia, Workshops and Industry Sessions.

There is no other mining and resources Program in the world that offers this incredible line-up of speakers all under one roof.Major Sponsor Diamond Sponsors Host State Partner

Michael Smocer, Mine Vision Systems, Inc., USA, uncovers a new an approach to mine face digitisation which benefits production, efficiency, and worker safety.

Hardware-based perception systems play an indispensable role in bridging the gap between the physical world of mining and software-based decision support systems, predictive analytics, and remote and autonomous operations. In underground mining, however, mine face digitisation technologies have shown limited potential to capture precise geo-referenced information and process the captured

data in real time without causing unacceptable production delays.

This is costly to mining companies. The benefits of digitalisation are only possible when data is digitised and structured. Currently, however, decisions to capture and digitise a mine face are in direct competition with continued production uptime. This article describes an approach that has eliminated such trade-offs and created

an indispensable relationship between mine face digitisation and production, efficiency, and worker safety.

Turbomachinery products result from incredible feats of engineering sophistication and precision. They are essential to power generation, aviation, renewable energy, and the oil and gas industry. 35 years ago, however, a walk through a drafting department at a turbomachinery company would reveal that over 90% of the work was still being done by hand. CAD stations were novelties, and only 2D.

This lack of digitisation created cascading downstream consequences. When an order comes in from the field, an aero design had to be completed. That typically was the responsibility of a small number of experts. They would pull out binders, paper and pencil and design the aero. They were brilliant. They could see and recall things based on their 30 years of experience that no one else could. The entire division was dependent on them, which made them a bottleneck and created significant risk for the company.

Despite the brilliance of the experts, every once in a while they got one wrong. A ‘wrong’ design was found out during testing after multiple stages of rotating machinery had been designed and built. This was costly, but also an acknowledged cost of doing business.

35 years later every turbomachinery company uses 3D CAD, while drafting tables are more likely to be found in museums. Contrary to this, experts will always be essential, they just now use precision engineering tools to design the aero – such as computational fluid dynamics (CFD) and finite element analysis (FEA) – and focus on higher value work for their companies. Newer employees contribute disproportionately earlier in their careers, and companies are exposed to less risk.

The requirements and risks associated with making decisions at an underground mine face are not much different today than those faced by turbomachinery manufacturers 35 years ago. A limited number of experts exist to make critical decisions that have a significant effect

on every-day business. Making matters worse, the information on which decisions are made is incomplete and cumbersome to access.

Digitisation, digitalisation, and digital transformation (collectively referred to as ‘digitalisation’ within this article) are decades-old concepts that have steadily become a dominant part of our thinking and lexicon. The value propositions are the same independent of the industry they are applied to. Efficiency, productivity, safety and risk mitigation, increased collaboration, improved employee retention and talent acquisition, and cost reduction are frequently cited objectives.

In the worst manifestations digitalisation efforts result in actions rooted in hype with limited organisational buy-in or ‘boil the ocean’ approaches that doom, limit, or delay intended outcomes. The best manifestations are truly transformational. There are innumerable studies and best practice documents written about the characteristics of each.

The mining industry is widely characterised as lagging discrete product industries in decision support systems rooted in digitalisation. While that may be objectively true, it would be incorrect to place the full blame on the mining industry. Every industry has its own complexities to master and overcome, but those in the mining industry create unique barriers to achieving the outcomes promised by digitalisation. The challenges for mining are unique even when compared to other process industries such as the chemicals and materials space. Consider:

n The ‘product’ requiring digitisation in mining was created hundreds of millions of years ago. An advanced perception system is a prerequisite to enabling the full value of digitalisation. Other industries create their own products and can easily choose digital methods at the outset of product creation.

n The choice on where to source and access the product in mining is limited to where the deposits exist. This creates pressure on hiring the right talent, upgrading legacy infrastructure, and data management best practices. Other industries have much greater flexibility to choose optimal product development locations.

Underground mining environments make all of these complicating factors even more restrictive to digitalisation, due to space limitations and lack of GPS.

Digitalisation in mining is rapidly accelerating in exploration, asset management, environmental monitoring, and mine planning. Each of these applications have characteristics that make them low hanging fruit as the mining industry waits for digitalisation technologies to mature into useful products in other areas. Where digitalisation has experienced success in mining, at least one of the following characteristics is typically present.

Some applications do not require precise information to be useful, whereas others that do are not urgent in nature, and can wait for extended processing times.

Sensor-based input involving asset health, environmental conditions, and location (GPS above ground, RFID below ground) are not unique to mining and have had the chance

to mature in other industries before being applied to mining.

Exploration and inspection applications often occur at times and in places where fewer people are present, thereby reducing the technology burden on safety. Production applications mostly do not enjoy this luxury.

Digitalisation opportunities in mining that lack these characteristics are the hardest to address. The greatest barriers are more likely to be present in underground GPS-denied environments and in upstream extraction efforts at the mine face. Decisions that are optimised at the mine face create compounding downstream benefits. The opportunity costs at the mine face alone are significant. One incorrect decision on ore grade at an underground mine face due to inadequate or delayed information can cost a mine as much US$30 000. Some estimates of the costs of overbreak exceed US$300 000 per underground mine face per year. The best-case current alternative to mitigate these risks is to shut down production until better information is available. Mines must continually choose the least bad option.

Underground mines are busy places with highly trained people extracting minerals every day that most people take for granted. It goes without saying that a technology solution that delivers incomplete and inaccurate information will not be accepted. Solely clearing those barriers, however, does not make a good technology a great solution for mining. Disruptive technology solutions with real value to the industry deliver an outcome without introducing new friction points. To address this, product development decisions at Mine Vision Systems follow a few basic principles that are embodied in the FaceCaptureTM mapping system.

How simple is it to capture complete information to make production decisions at the mine face? Hardware and perception systems are the necessary link between the physical world of mining and the enormous value of actionable and predictive insights, remote operations, and autonomy. Is the hardware portable? Does it require a new work stream or can it be leveraged within the existing work streams of mine employees? Is it capturing all the data required to optimise decision making?

How simple is the prescribed procedure to leverage the technology? Does it acknowledge and is it aware of the existing skills and responsibilities of the users? Does it leverage existing workflows or introduce duplicate efforts? The friction points eliminated in a well-designed system ranges from eliminating duplicate and/or inaccurate survey and localisation efforts to removing nuisances; such as

Figure 4. FaceCapture provides real-time on-screen data verification and simplified georeferencing within a streamlined workflow.requirements for excess equipment, including tripods, tablets, and flashlights.

What must be processed to fully leverage the knowledge and experience of the geologists and engineers making production decisions? When must it be available for the value of the insights to be maximised? The component parts of any perception system are no longer special. A system engineered for underground mine face decision making must integrate LIDAR, high-definition cameras, lighting, compute power, user interface, software and data management, and existing survey into a solution that produces real-time insights that optimise decision outcomes.

Great technologies that become great solutions in industrial applications are most often rooted in domain knowledge. An aspirational product can achieve 95% of ‘perfect’, but fail because the last 5% prohibits the product’s market utility.

100% mine face digitisation is the front door to the enormous value that can be delivered through software solutions focused on AI and predictive analytics, remote operations, and autonomy. Mine Vision Systems has the expertise and is building solutions to enable the potential in these downstream solutions. This is where digitisation migrates to digitalisation and ultimately digital transformation.

Mine face digitisation, however, need not be a boil-the-ocean long time-to-value proposition for mine operators. A properly engineered system that meets the

criteria set forth in the preceding section delivers out-of-box value by putting better information in the hands of highly trained employees at the moment it is most valuable. Every company seeks opportunities to increase the productivity of employees. Every employee seeks ways in which to be valued and fulfilled.

With FaceCapture, the risks of broadening digitalisation efforts are substantially reduced. A corporate level strategy and executive owner are not necessary to establish immediate value with a single FaceCapture system. Resistance to change is minimised since it increases employee value and fulfilment, while reducing time and proximity for employees exposed to the mine face. Lack of resources to facilitate digitalisation is a non-issue, since FaceCapture is immediately usable in existing workflows and increases resource efficiency. And organisations with misaligned priorities can buy time to get aligned without upending production goals, while still capturing critical digital information of its production data at the mine face.

Several catalysts are accelerating digitalisation in mining including: 1) the accelerating demand for minerals created by decarbonisation efforts and growing requirements for EVs; 2) population growth coupled with the westernisation of emerging markets and resulting increased demand; and 3) industry requirements to be more productive as ore grades decline and mining continues to skew more underground. Domain expertise among technology partners is a critical success factor in successful digitalisation efforts.

This article has demonstrated that pragmatic short time-to-value solutions are possible within broader digitalisation initiatives.

We hear a lot about autonomous vehicles (AVs) these days. But, while self-driving cars are just beginning to hit the roads in pilot programmes, autonomous heavy vehicles have already been successfully implemented in mining operations for over a decade.

This is because there is both an acute need and a more immediate opportunity (compared to on-road) for this technology in mining. The mining industry is poised for a boom – fuelled by a growing population, a thriving electronics industry, increasing infrastructure needs, and skyrocketing interest in resource-intensive net-zero initiatives. At the same time, the industry faces serious challenges related to safety, efficiency, and productivity. These pain points, combined with the fact that mining operations are highly controlled, repetitive work environments, make the industry ripe for the adoption of autonomy.

In the last decade, some mining companies have gotten a taste of the benefits that autonomy provides, including heightened productivity and increased site safety. However, the surface of where this technology can take the industry is only just being scratched. It is very impressive how far technology solutions have come, but there is still a long way to go to help customers solve the toughest problems that they face on a daily basis. With the industry on the cusp of entering a new era, it is time to dig into the past, present, and what has the potential to be the future of autonomy in mining.

Before exploring the future of autonomy in mining, let us take a look in the rearview mirror to understand how we arrived where we are today. Mining companies have experimented with various elements of autonomy for over 30 years. From 1994 to 1995, Caterpillar ran the first two prototype Cat 777C autonomous mining trucks at a Texas limestone quarry, successfully hauling over 5000 production loads. Caterpillar then debuted one of the first autonomous mining trucks at MINExpo in 1996. However, the commercialisation of this technology has been at a much slower rate than anticipated. Komatsu, for example, began piloting its own autonomous haulage system at Codelco’s copper mine nearly 10 years after the first mining trucks came on the scene. It finally launched commercially in 2008, after three years of trials.

In the 2010s, the mining industry, especially in Western Australia, started pushing for deployment of autonomous fleets. Six years after the Rio Tinto Group launched the Mine of the Future initiative in 2008, its mines Yandicoogina and Nammuldi in Pilbara, Western Australia, were the first two mines in the world to transport all of its iron ore via driverless trucks and vehicles, according to company reports. By 2018, Komatsu had scaled to more than 130 autonomous mining vehicles across three sites around the world. In 2019 Resolute Mining’s Syama gold mine in Mali began production aiming to become one of the world’s first fully autonomous underground mines.

The results of these early applications speak for themselves. Today, Rio Tinto has implemented over 130 autonomous haul trucks into their iron ore operations. The autonomous haul trucks are each estimated to have operated on average 700 hours more than conventional haul trucks with 15% lower costs. Other major mining companies – such as

Sudhanshu Singh, SafeAI, USA, takes a look inside the mining industry’s decades-long autonomous evolution and looks ahead to the future.

BHP, Newmont, FMG, and Teck – have achieved similar positive results with safety and productivity step change in operations with autonomous haul truck fleets.

The initial results show how autonomy can revolutionise worksites. Today, there are more than a thousand of these trucks deployed industry-wide, and they have moved billions of tonnes of earth. Yet, despite the immense potential, less than 5% of mining vehicles worldwide leverage autonomy.

It is worth pondering why the deployment of autonomy, with all its benefits in safety and productivity, has been so slow and what is needed to accelerate the journey for construction and mining customers.

Autonomous technology holds real promise to reimagine the mining industry. However, despite high demand, widespread adoption of autonomy has stalled – here is why.