“ENERGY SAVINGS REPORTED IN THE RANGE OF 25% TO 60% ARE VERY ENCOURAGING AS THEY INDICATE THAT POTENTIALLY HALF OF THE ENERGY SPENT FOR VENTILATION COULD BE SAVED.” —

“ENERGY SAVINGS REPORTED IN THE RANGE OF 25% TO 60% ARE VERY ENCOURAGING AS THEY INDICATE THAT POTENTIALLY HALF OF THE ENERGY SPENT FOR VENTILATION COULD BE SAVED.” —

03 Guest Comment

05 World News

10 The Indispensable Role Of Mining And Metals

Ian Sanders, Global Mining & Metals Leader, Deloitte Global, outlines 10 trends that will shape the mining and metals industry in 2023 and beyond.

18 Testing, Timing, And Accuracy

Pat Lim and Kevin Hartley, Dyno Nobel Americas, USA, use a case study to illustrate the benefits of electronic delay timing as an initiation system in mining projects.

22 Improving Operations Bit By Bit

Jorge Leal, Robit, Finland, reviews the features and uses of a new drill bit and its role in improving the productivity and sustainability of mining operations.

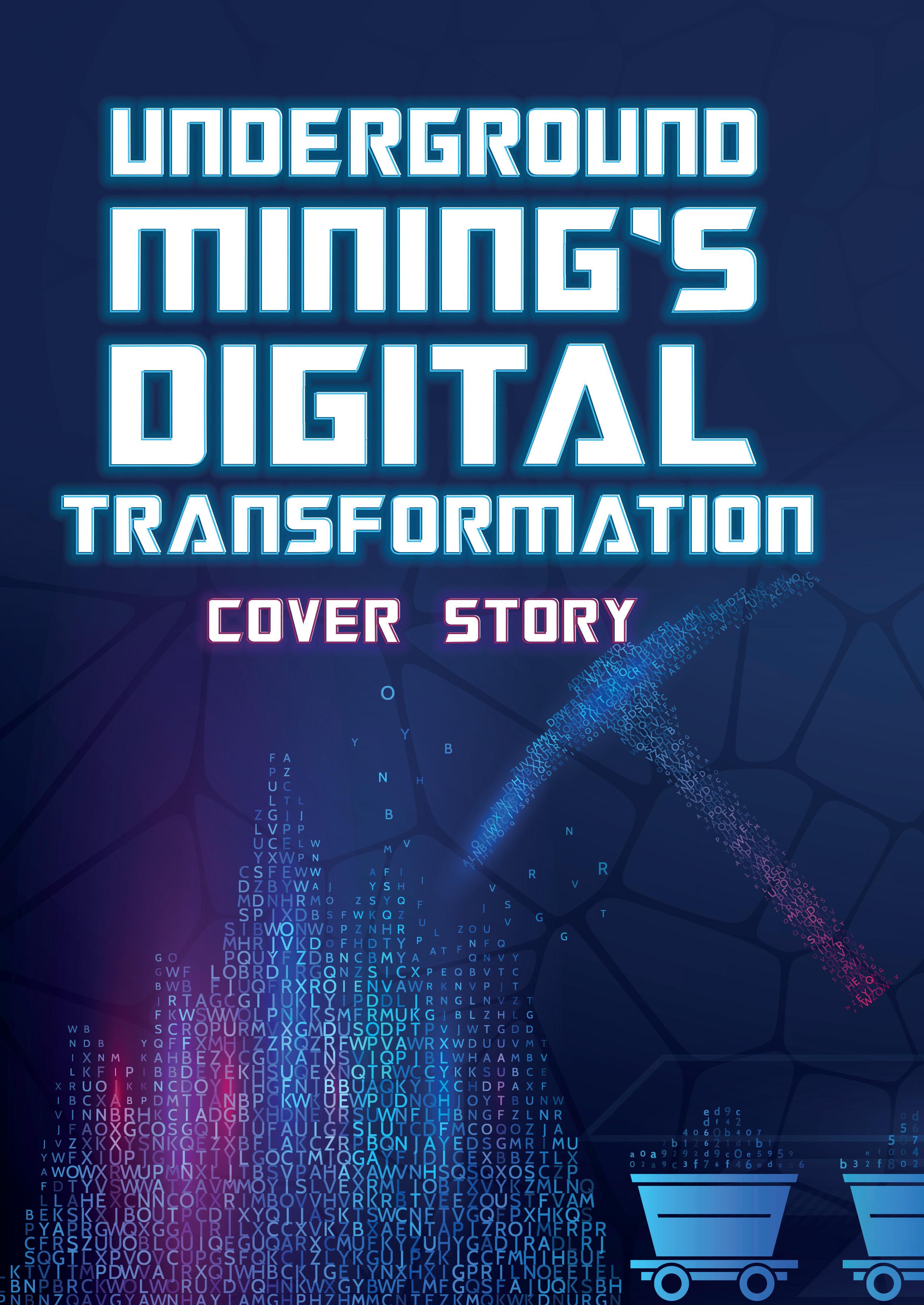

26 Underground Mining’s Digital Transformation

Emily Esterson, E-Squared Editorial, and Innovative Wireless Technologies, Inc., USA, discusses how digital technologies have become increasingly important in improving both the safety and productivity of underground mines.

31 Driving Sustainability With A Digital Roadmap

Martin Provencher and Ben Connolly, AVEVA, detail the importance of digital technologies in improving both the profitability and sustainability of mining operations.

37 Extinguishing Fire Risks

Holger Pfriem, Dafo Vehicle Fire Protection, Sweden, analyses the different fire risks surrounding the use of heavy equipment at mines, and discusses how mine operators can act to minimise downtime and optimise safety.

41 Ventilation On Demand

Joe Bacon and Shivan Singh, Becker Mining, Canada, examine the role of air ventilation systems in underground mines and why they are essential for mine safety.

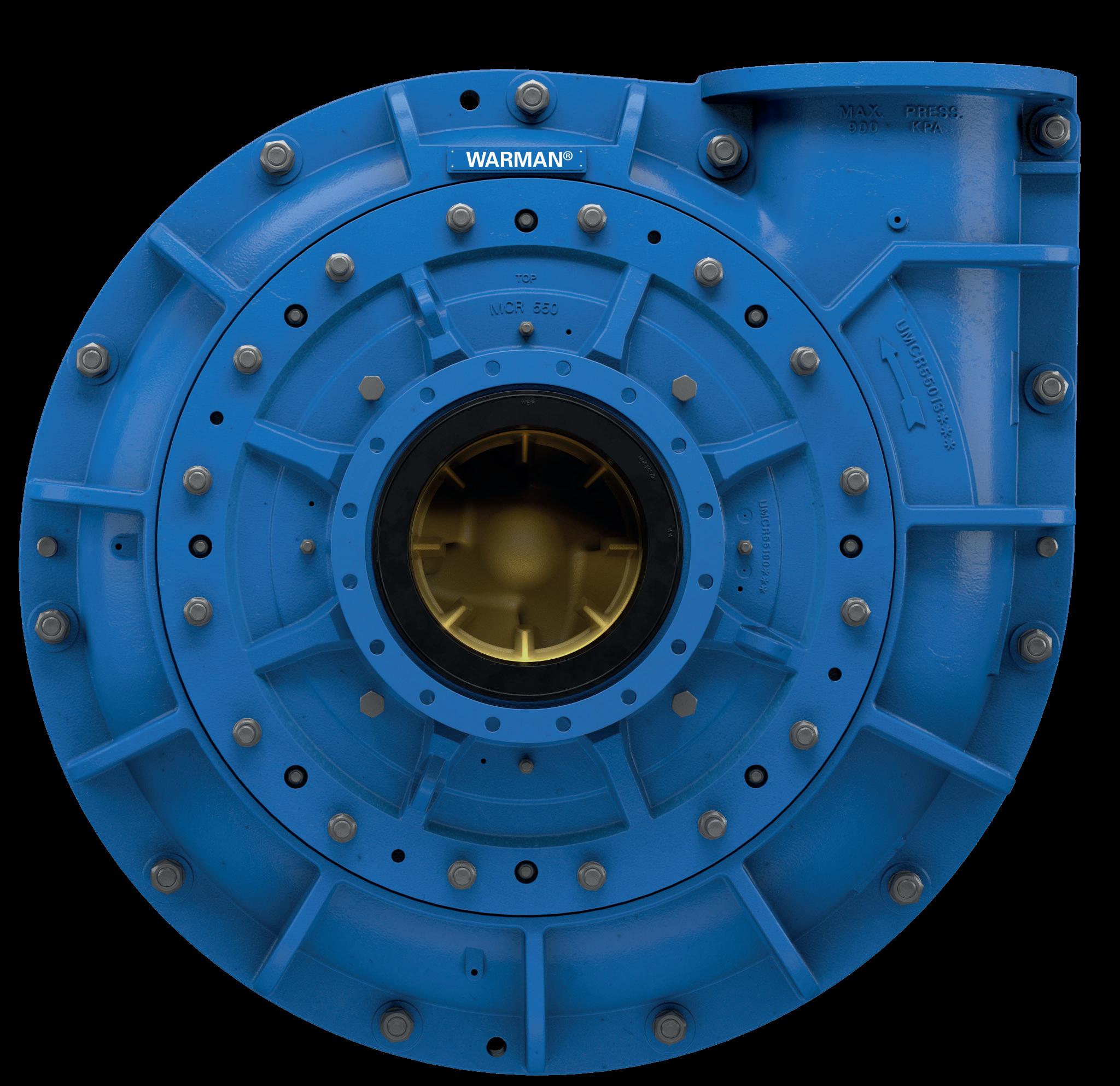

44 The Right Ingredients For Tailings Management

Amanda Adams and Anna Norris, Stantec, USA, explore how the right mixture of EORs, technologies, and ESG practices can be crucial in developing successful tailings management.

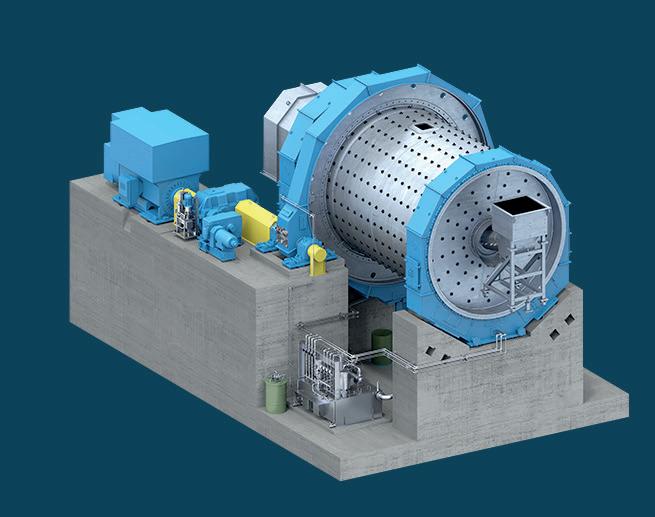

48 No Belt, No Battery, No Problem

Matt Youngblood, Railveyor, Canada, explains how a fixed, autonomous, and electrically controlled haulage system is preferable to a typical conveyor system for transporting materials in mines.

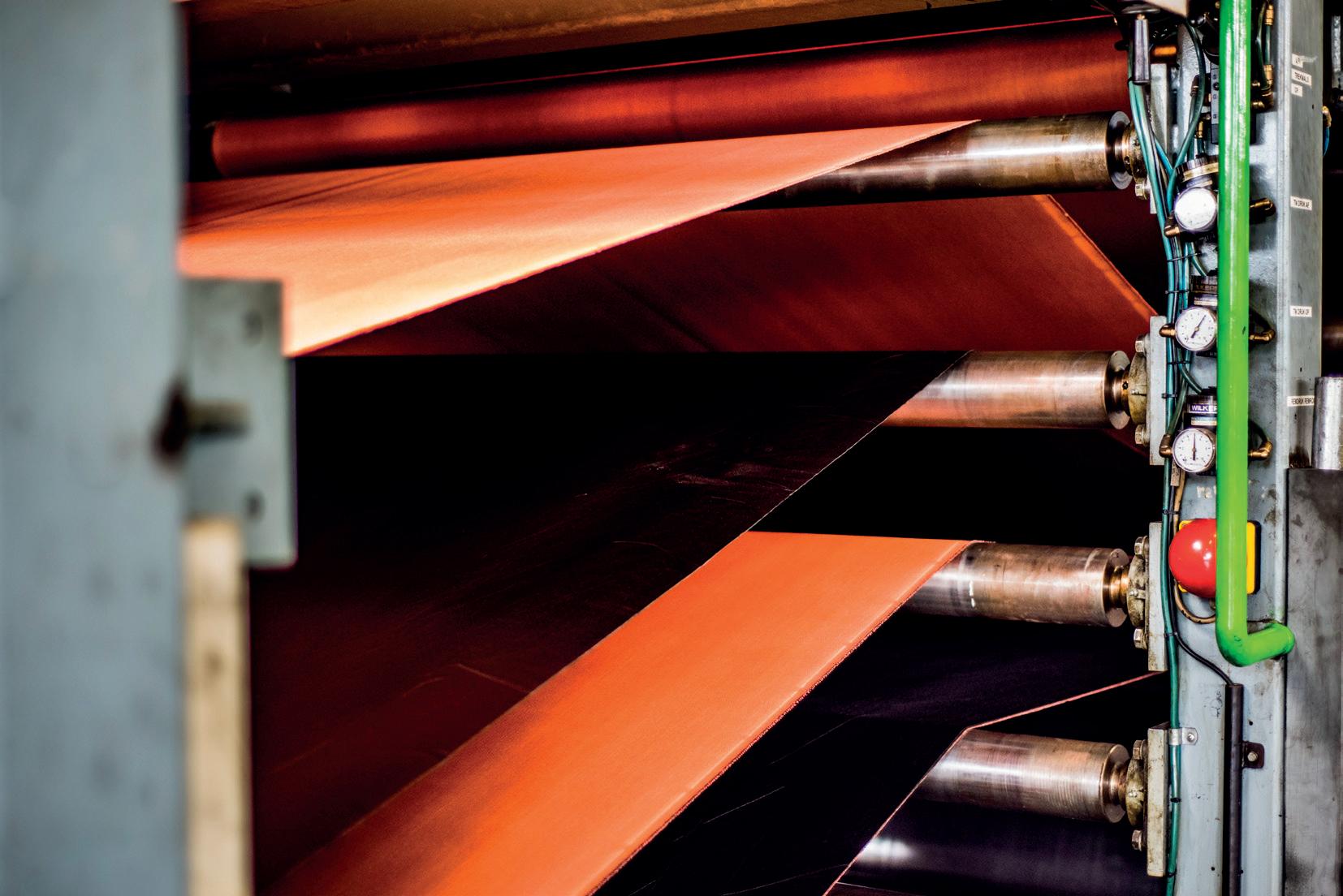

52 A Bigger Price To Pay

Leslie David, Conveyor Belt Specialist, illustrates how seemingly identical specifications of conveyor belts can differ in price from one producer to another, and why there is invariably a much bigger price to pay in the longer term.

57 Navigating The Dual Challenge With Technology

Jeannette McGill, AspenTech, Australia, highlights the importance of digital technologies in combatting the operational hurdles facing the mining industry today.

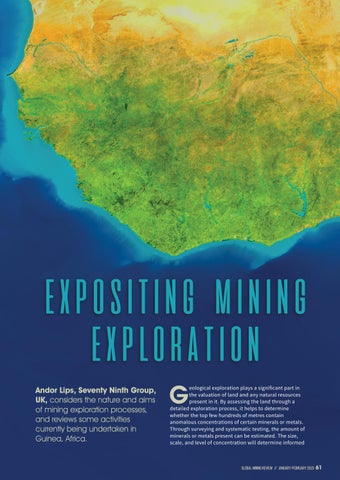

61 Expositing Mining Exploration

Andor Lips, Seventy Ninth Group, UK, considers the nature and aims of mining exploration processes, and reviews some activities currently being undertaken in Guinea, Africa.

65 Powered By Technology

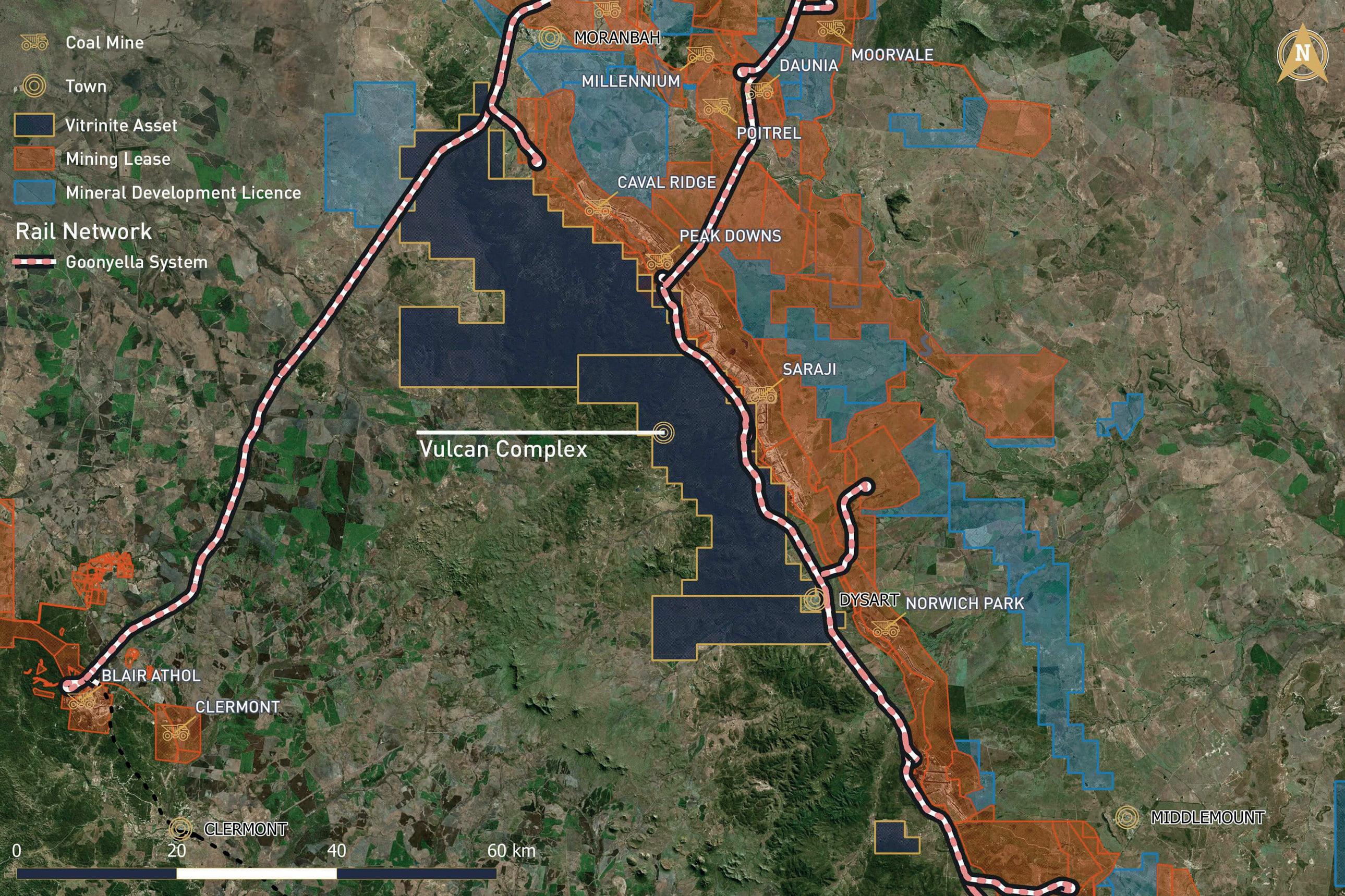

Ron Berryman, on behalf of Loadrite, Australia, evaluates the role of technology as an important ingredient in the success of the Vulcan mine, Queensland’s newest premium hard coking coal mine.

IWT is the leading provider of underground wireless communications for voice, tracking, gas monitoring, and analytics using data from machines and sensors – including IWT’s battery operated Wireless Gas Monitors (pictured). IWT’s reliable network is easy to install and maintain, while also being scalable and expandable. Learn more at iwtwireless.com.

Our expertise goes beyond the bench with a mindset focused on outcome-based fragmentation. Together, we can help you maximize your return on investment through solutions that reduce your total cost of operations while increasing your productivity.

After a turbulent year for commodities, 2023 is set to be a transformative and pivotal year for the sector; with geopolitical uncertainty, supply chain disruption, and increasing momentum towards the green transition driving the need for change. This is against a dismal economic backdrop; with soaring inflation leading to higher commodity prices, as well as higher operating costs and capital expenditures. Challenges and opportunities will see some countries, mining players, projects and initiatives thrive, while others may languish.

MANAGING EDITOR

James Little james.little@globalminingreview.com

SENIOR EDITOR

Callum O’Reilly callum.oreilly@globalminingreview.com

EDITOR

Will Owen will.owen@globalminingreview.com

EDITORIAL ASSISTANT

Joe Toft joe.toft@globalminingreview.com

SALES DIRECTOR

Rod Hardy rod.hardy@globalminingreview.com

SALES MANAGER

Ryan Freeman ryan.freeman@globalminingreview.com

PRODUCTION MANAGER

Kyla Waller kyla.waller@globalminingreview.com

ADMINISTRATION MANAGER

Laura White laura.white@globalminingreview.com

EVENTS MANAGER

Louise Cameron louise.cameron@globalminingreview.com

EVENTS COORDINATOR

Stirling Viljoen stirling.viljoen@globalminingreview.com

DIGITAL ADMINISTRATOR

Leah Jones leah.jones@globalminingreview.com

DIGITAL CONTENT ASSISTANT

Merili Jurivete merili.jurivete@globalminingreview.com

Environmental, social, and governance (ESG) will continue to feature prominently and grow in complexity for the industry as stakeholder expectations increase. As more mining companies take active steps to respond to and address ESG-related issues, while avoiding greenwashing allegations, the ‘how’ will be as important as ‘what’ they are developing and implementing. The demand for quantifiable results will only intensify as stricter regulations come into force.

The geopolitical tensions and resource nationalism we saw in 2022 will still play an influential role in mining demand and supply. Security threats and conflicts are rising as the economic outlook worsens. Miners will need to develop a deeper understanding of the impact geopolitics and regional threats will have on strategy, personnel and operations, in order to manage, minimise, and prevent risks.

Resource nationalism will only set to deepen, especially in the battery metals and minerals market, as we push towards a green transition and a low-carbon economy. As countries try to recoup pandemic debt, rises in taxes and royalties, together with changes in mining policies and ownership agreements, will mean tensions between companies and governments are more likely. The line between resource nationalism and legitimate national interest is not always easy to draw, and with several countries going to elections this year – including key resource rich African countries such as Nigeria, Mauritania, Zimbabwe, and Democratic Republic of Congo – politicians may start positioning themselves to secure greater benefits from natural resource wealth to improve livelihoods and placate voters.

The pace, trends, and demand vs price of critical raw metals and minerals needed to accelerate the global energy transition will remain top of mind in 2023 for explorers and producers, as they assess the opportunities and risks and get in front of the energy transition agenda. Finding and mining the required metals and minerals is getting harder and more expensive. There will be a heightened sense of international competition to secure resources which, in turn, may fuel protectionist rhetoric.

As demand for critical minerals grows, factors such as disrupted supply chains, high geographical concentration of production, long project lead times, and growing scrutiny of environmental and social performance will come into play. Slowing electric vehicle production has recently been one of the affected industries, tempering demand for battery metals nickel, cobalt and lithium, despite the global push for electrification of the mobility sector. China’s zero COVID-19 policy may result in further disruptions to PEV-related battery metal supply chains, which will affect global markets. The IEA estimates that soaring EV battery demand will require 50 new lithium projects, 60 nickel mines, and 17 cobalt developments by 2030.1 Unfortunately, current investment is nowhere near the scale required, signalling there will be more roadblocks ahead.

Finally, like all industries, talent attraction and retention will be a growing challenge. For the mining sector, the problem is particularly acute given the older workforce trend. Mining companies will need to adapt their workforce attraction, retention and development strategies, and ensure they reflect the changing needs and expectations of today’s workforce to succeed in the war for talent.

Tough times indeed, but set to be transformational for the industry.

References:

1. DEMPSEY, H., and CAMPBELL, P., ‘Carmakers switch to direct deals with miners to power electric vehicles’, Financial Times, (15 November 2022), www.ft.com/content/a8e0f1bb-f69a-4a77-b762-02f957e47f5c

UK t: +44 (0)1252 718999 // w: www.globalminingreview.com

Generation PGM Inc.’s Marathon Palladium-Copper project has passed an important regulatory milestone. The project, a platinum group metals (PGM) and copper mine and milling operation near the Town of Marathon in Northwestern Ontario, recently received approval from the federal and provincial governments’ coordinated environmental approval (EA) process, under the Canadian Environmental Assessment Act and Ontario’s Environmental Assessment Act.

The Marathon project is the first mining project in Ontario to be assessed through a joint review panel pursuant to the Canada-Ontario Agreement on Environmental Assessment Cooperation (2004). Generation PGM is a wholly owned subsidiary of Generation Mining.

The Marathon project will help Canada and Ontario meet the demand for responsibly sourced critical minerals, as identified in Canada’s critical minerals strategy and Ontario’s critical minerals strategy 2022 – 2027.

Stantec led and coordinated the preparation of the environmental impact statement (EIS) addendum and various technical reports as part of a collaboration with Generation PGM and other consultants. The company’s experts completed technical assessments for the EIS addendum, responded to information requests from the panel, and shared expertise at the public hearing held by the joint review panel.

Stantec’s discipline leads presented their conclusions and recommendations regarding the project as expert witnesses at the hearing in the areas of hydrology, hydrogeology, air quality, greenhouse gases, acoustics, and socio-economics.

The company coordinated the preparation of the EIS addendum based on updates to existing baseline conditions, changes to regulatory standards, and refinements to the project relative to the original EIS – which was submitted in 2012 and supported by True Grit Engineering Ltd. (acquired by Stantec in 2018). Generation PGM also retained Stantec to support consultation with agencies and Indigenous communities, consider comments and traditional knowledge, and scope follow-up programmes and environmental management plans

Stantec’s Chris Powell, Senior Environmental Planner, said: “This is a big win for the Marathon project, and Stantec is thrilled to have been a part of this process to leverage our expertise in mining and environmental assessment for Generation PGM in their efforts to proceed to the next phase of the project. This critical minerals project will provide a lot of opportunity for the region and benefits to the local Indigenous community, Biigtigong Nishnaabeg. I’m proud of our team for the hard work and dedication to deliver on such an important project.”

The joint review panel’s public review process included 10 months of written filings and a public hearing consisting of 19 oral hearing days. The panel received input from more than 50 individuals, including representatives from Indigenous groups, government agencies, and interest groups. This joint review panel process was among the largest regulatory hearings of 2022.

In order to secure the panel’s approval, Generation PGM and Stantec collaborated with experts from Ecometrix, Knight-Piésold, Northern Bioscience and WSP, with legal support from Cassels.

Mundoro Capital Inc. has announced it has entered into a definitive agreement with a wholly owned subsidiary of BHP Group Ltd, which provides BHP with the right to earn-in to three exploration areas that Mundoro holds in the Timok region

Teo Dechev, Chief Executive Officer, President and Director of Mundoro, commented: “Mundoro welcomes BHP as an exploration partner that recognises the potential of further exploration in the western Tethyan Belt. We are looking forward to commencing field exploration at the Timok properties in order

to advance targeting and testing of undercover, and near-surface, porphyry and related epithermal systems in the Timok region of eastern Serbia.”

“Mundoro has established a decade-long history of generative and early-stage exploration in Serbia and Bulgaria. Partner funded exploration programmes along with Mundoro’s generative programmes have invested over CAN$30 million of exploration expenditures, which bring value to stakeholders in the communities where we operate, to our partners, and to our shareholders.”

Mines and Money Miami 2023

23 – 24 February 2023

Miami, USA

https://minesandmoney.com/americas

MINEXCHANGE 2023 SME Annual Conference & Expo

26 February – 01 March 2023

Denver, USA

www.smeannualconference.com

PDAC 2023

05 – 08 March 2023

Toronto, Canada

www.pdac.ca/convention

CONEXPO-CON/AGG 2023

14 – 18 March 2023

Las Vegas, USA

www.conexpoconagg.com/conexpo-conagg-construction-trade-show

Expomin

24 – 27 April 2023

Santiago, Chile

www.expomin.cl

Mines and Money Connect: London 2023

25 – 26 April 2023

London, UK

https://minesandmoney.com/connect

CIMTL23 Convention and EXPO

30 April – 03 May 2023

Montreal, Canada https://convention.cim.org

China Coal & Mining Expo 2023

25 – 28 October 2023

Beijing, China

www.chinaminingcoal.com

To stay informed about upcoming industry events, visit Global Mining Review’s events page: www.globalminingreview.com/events

Thiess has announced a two-year extension to its first US contract for mining services at a hard rock mine in Colorado.

The contract, which commenced in 2021, will now continue through to the end of 2024. Under the extension, Thiess will continue providing integrated mining services through an alliance-style contract.

Michael Wright, Thiess Executive Chair and CEO, commented: “We are very pleased our client has awarded us this extension, which serves as recognition of our team’s ability to deliver innovative mining solutions and create lasting value for our clients across diverse commodities and geographies. We look forward to further collaborating with our client to safely position their operation for optimal efficiency and productivity, as we expand our presence in North America.”

Darrell White, Executive General Manager – Americas, said: “Our North American team is motivated by the confidence that our client has shown in Thiess, by extending and expanding the integration of our joint mining operations. We’re thrilled to have the opportunity to assist our client in sustainably delivering a resource that is critical to the US and global economies.”

Sumitomo Metal Mining Co., Ltd.’s Hishikari mine has become the first Japanese underground mine to utilise automated loading technology from Sandvik. AutoMine® will help enable increased productivity, improved safety and better cost control, while bringing digital transformation of the mining process closer and increasing operational transparency.

The Hishikari mine, located in northern Kagoshima Prefecture, boasts a high grade of around 20 g of gold per tonne of ore, and has been producing gold steadily since 1985. Hishikari is the only gold mine in Japan that still operates on a commercial scale today. The mine, which commissioned AutoMine Lite on a Toro™ LH307 underground loader in December 2022 to operate in its small cross-section tunnels, will utilise the system in production areas to enhance safety, accelerate underground efficiency, and improve productivity.

Hidenobu Yabu, Manager of Mining Section for the Hishikari mine, commented: “Sandvik did a great job commissioning and training our engineers and operators on the AutoMine system. Our goal is to become a corporate enterprise that produces resources with advanced technology by 2030. By implementing advanced technology and innovation, we aim to reduce costs, increase productivity and improve safety. Our commitment to sustainability is reflected in our long-term focus on the Hishikari mine.”

Jan-Douwe Wansink, Business Line Manager Automation for Sales Area Southeast Asia at Sandvik Mining and Rock Solutions, said: “We are excited to partner with the Hishikari mine on this project and look forward to contributing to the operation’s sustainability and productivity. This is an exciting opportunity for the Hishikari Mine and Sandvik.”

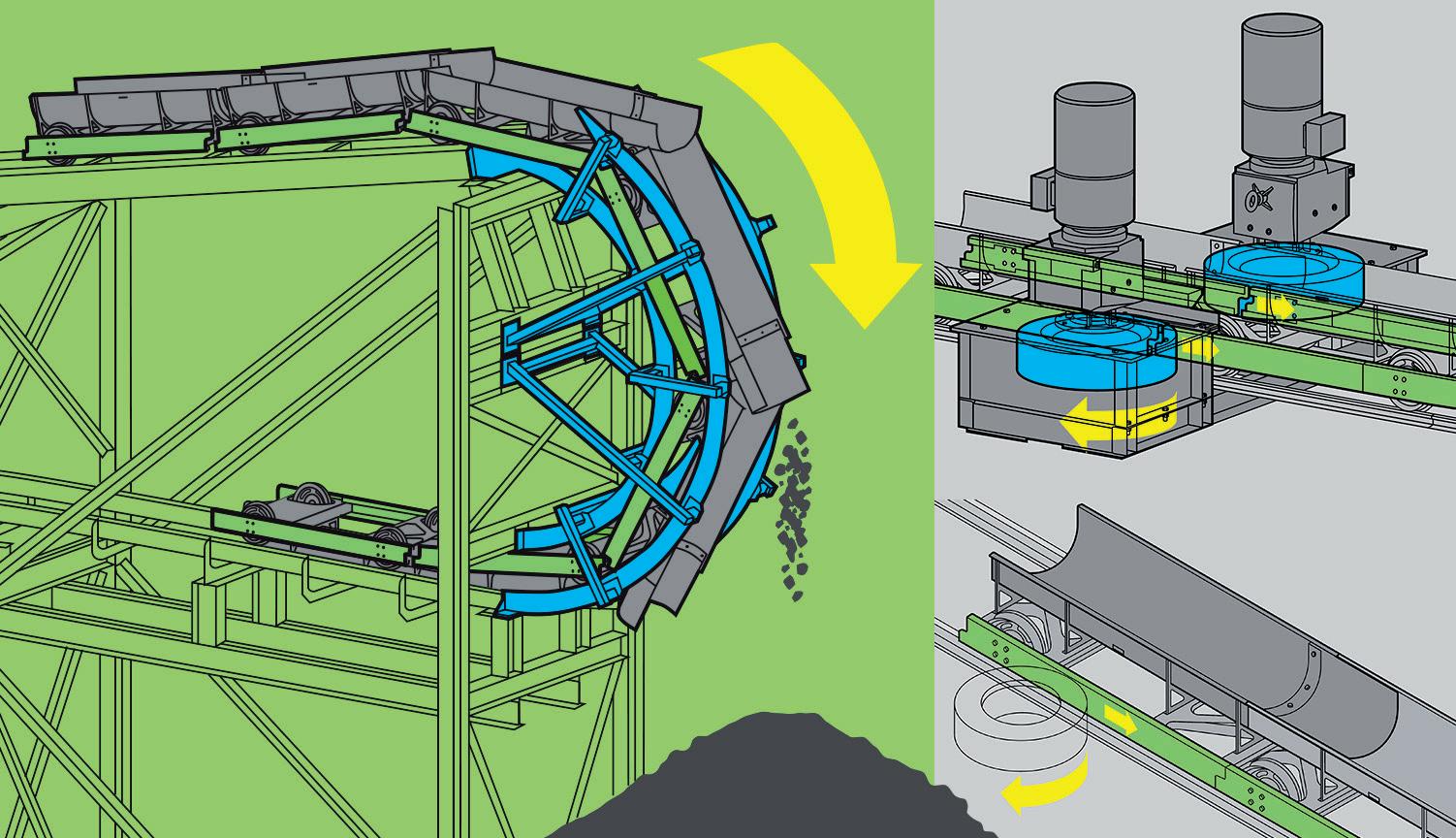

Nothing should stand in the way of your productivity – least of all the materials you move. With our compact Hägglunds direct drive systems, you can adapt easily to the job at hand, taking advantage of full torque at an infinite range of speeds. And should an overload try to stop you, the drives’ low moment of inertia and quick response will keep your machines protected. We’ll support you too, with an agile global network and smart connectivity to bring you peace of mind. Driven to the core.

COME MEET US AT SME, BOOTH 429

Hägglunds is a brand of Rexroth. www.hagglunds.com

Draslovka Holding a.s., a Czech family-owned global leader in CN-based specialty chemicals, including sustainable solutions for the metal mining industry, has announced that its glycine leaching technology has been selected to be part of OZ Minerals’ Think & Act Differently (TAD) incubator and Waste-to-Value Challenge.

The challenge sees Rio Tinto and Boliden working in collaboration with OZ Minerals to eliminate, minimise, reuse, or find new value in mine tailings and ultimately reduce the global carbon footprint of the mining industry.

The Waste-to-Value Challenge aims to unlock innovative technologies for managing tailings, helping the mining industry to reduce risk while extracting more of the materials the world needs from what was previously regarded as waste for the energy transition at large. Benefits that the initiative hopes to deliver include lower emissions and reduced waste.

Draslovka offers a range of sustainable solutions to the global mining industry, and its glycine leaching technology (branded GlyLeachTM and GlyCat™ Processes) represents an environmentally friendly alternative to traditional acid and cyanide leaching. Due to its selectivity over gangue minerals and the recyclability of glycine, it enables the recovery of both base and precious metals from lower grade resources such as tailings. This leads to a more sustainable production process and improved economics that are needed to close the looming critical metal supply deficit.

Ivor Bryan, Draslovka’s Mining Innovation Director, said: “I am proud that Draslovka has been invited to participate in the Waste-to-Value Challenge with forward looking companies that understand the need to reimagine solutions for the mining industry. This aligns with our ambition to become the leading supplier for innovative and sustainable solutions for the wider mining industry.”

SPC Nickel Corp. have announced that the company has entered into an agreement with Vale Canada Ltd designed to consolidate and unlock the full potential of the adjacent and contiguous West Graham and Crean Hill 3 nickel-copper deposits, located in the Sudbury Mining Camp

The agreement grants SPC Nickel the right to acquire a 100% interest in the surface and mineral rights of the Crean Hill 3 Property as therein described. In consideration, certain rights and royalties will be extended to Vale across the combined project.

SPC’s CEO, Grant Mourre, commented on the agreement: “The signing of this agreement with Vale represents a transformative growth opportunity for SPC Nickel and its shareholders. Over the past 12 months we have been working closely with Vale to develop an agreement that is mutually beneficial for both parties. The consolidated West Graham and Crean Hill 3 deposits gives SPC Nickel, as operator, the ability to optimise synergies during the exploration, development, and production stages of the project. We are very excited about the opportunities that this agreement brings to SPC Nickel and are looking forward to getting drills turning on the property in 2023.”

The West Graham and Crean Hill 3 deposits constitute the eastern and western contiguous portions of a large near-surface nickel-copper sulfide deposit at the base of the Sudbury Igneous Complex. The properties are located adjacent to the past-producing Lockerby and Crean Hill mines, approximately 20 km southwest of the City of Sudbury, Ontario, and Vale’s Clarabelle Mill. Haul roads and high-voltage electrical power infrastructure are present at the property boundary.

Commenting on the Crean Hill 3 Property, Mourre said: “The ability to consolidate the West Graham and Crean Hill 3 properties into one contiguous land package represents an amazing opportunity for the company. With the addition of the Crean Hill 3 Property, we see a path for SPC Nickel to significantly grow the West Graham Deposit into a high-quality nickel-copper asset in one of the top nickel mining camps in the world. Our recently completed drill programme at West Graham has provided the technical team with a firm understanding of the types of mineralisation we expect to define on the Crean Hill 3 Property, and, more importantly, the controls on mineralisation that we expect to guide us to higher-grade opportunities across the combined project.”

From civil infrastructure to transport, technology to agriculture, the products of the mining and metals industry are the building blocks upon which the global economy is built. The industry also plays an important role in helping to mitigate climate change, eradicate poverty, and restore damaged environments around the globe.

However, while everyone wants the benefits these materials provide and the global population which depends upon them is growing exponentially, opposition to new projects has seldom been greater. Despite rapid improvements in safety, as well as the industry’s environmental, social, and governance (ESG) performance over the past few decades, the mining and metals industry is working diligently and harder than ever in shifting the image that many perceive surrounds it.

The reality provides a clear contrast. Today, the sector is innovating in autonomous technologies and remote operations. Companies are collaborating up and down the value chain to close the loop on critical metals, design waste out of the system, and optimise the quality of

metals for low-carbon, recyclable products. The industry is also adopting some leading environmental practices and working with Indigenous communities to generate shared value.

The mining and metals sector is a vibrant and prospect-filled place to work. The digital transformation of operations has created many new and exciting data-centred roles. For those who want their work to have a tangible impact on society and the environment, there are few better places to be.

Changing perceptions of mining by putting people and natural capital foremost; designing organisations and products for circularity; creating safer, more respectful places of work; and collaborating to decarbonise value chains is already, and will continue to be, key to attracting talent and accelerating the industry’s transformation.

That is why, in 2023, Deloitte Global’s annual mining and metals report, ‘Tracking the Trends’, focuses on the indispensable role of the industry. The following are 10 trends expected to impact the industry over the next 12 – 18 months.

Ian Sanders, Global Mining & Metals Leader, Deloitte Global, outlines 10 trends that will shape the mining and metals industry in 2023 and beyond.

Access to capital is an important factor in organisational longevity, and the metrics upon which mining and metals investors base their decisions are changing. A more holistic approach may be needed and, subsequently, a rapidly growing area of focus is how companies interact with nature.

Impacts on nature will affect most companies over the next decade. The World Economic Forum estimates that, today, over half of the global gross domestic product (GDP) of US$44 trillion is exposed to risks from nature loss. 1 Building capability and understanding will be central to businesses’ ability to guard against these threats and capitalise upon associated opportunities.

Making greater use of nature-based solutions (NbS) is a good example. NbS can be a powerful tool for the restoration of landscapes impacted by mining. For instance, approximately 650 km of the Rio Doce Basin in Brazil was damaged by the Fundão tailings dam collapse in 2015. In 2022, the Rio Doce Panel outlined an integrated vision for restoration of the region. NbS’ will play an important role in this, including the creation of ecological corridors, filter gardens and wetlands, and the use of natural structures for sewage treatment. 2

Some companies are going even deeper, exploring how value chains interact with and impact upon nature holistically. For example, the International Union for Conservation of Nature (IUCN) is supporting Anglo American in developing and implementing strategic corporate commitments toward sustainable natural resource management that contribute to global societal goals. 3

Going forward, mining and metals companies that have an integrated and systematic approach to nature as part of their broader ESG strategy will find they may have a significant advantage in accessing capital, insurance, talent, and securing a social license to operate.

Circular economy (CE) presents a more sustainable alternative to the linear take-make-waste model upon which the global economy is currently based. The mining and metals industry is well progressed in unconscious circularity; it has a strong history of waste recycling and water reuse, and the creation of products from tailings is fast becoming a reality. However, these types of initiatives are driven by liability, regulation and resource scarcity, rather than value creation. When it comes to conscious circularity and shifting mindsets around value and materials reuse, there is still work to be done.

Viewing business activities and operations as part of an interconnected ecosystem allows investment in the appropriate innovations across portfolios. This gives companies a better understanding of the risks and opportunities surrounding them, and allows them to create meaningful value in the areas where they operate. 4 This knowledge is important in building resilience at

many levels of an organisation, in attracting new sources of investment and entering new markets.

While systematic change is daunting, rethinking the flow of value through the metals and minerals ecosystem is one of the biggest opportunities this sector has to positively influence sustainable development.

Value chain decarbonisation is one of the biggest challenges that miners and metal producers face.

According to research by Shell and Deloitte Netherlands in the recent report, ‘Decarbonizing Steel: Forging New Paths Together’, the global steel industry generates approximately 10% of global CO 2 emissions, which could increase as demand is expected to rise 10 – 35% by 2050, compared to 2019. 5 However, because the steel market is relatively concentrated, there are significant opportunities for decarbonisation through coordinated efforts in cleantech.

For example, in 2016, Swedish miner LKAB teamed up with SSAB and Vattenfall to form the HYBRIT initiative, which aims to create fossil-free steel at an industrial scale by 2026. This is expected to reduce 90% of emissions from steelmaking, and SSAB’s transition to it will reduce Sweden’s CO 2 emissions by 10% and Finland’s by 7%. 6 Work so far has been successful and, in December 2022, Epiroc unveiled a prototype battery-electric mine truck created using SSAB’s fossil-free steel. 7

Antofagasta Plc also has an interesting approach. The company is evaluating green hydrogen as a potential fuel for its locomotive fleet, which services various mines in the Antofagasta region. It is also assessing HyEx green ammonia to power its trains, haulage trucks, and ships. 8 Every organisation has a unique Scope 3 emissions profile and should select investments to create an optimised pathway to net-zero. In working together, organisations can meet their climate change mitigation goals faster, create new types of value, and secure off-take agreements in what is fast becoming a buyer’s market.

In mining and metals, the ESG revolution has proven a catalyst for renewed collaborative innovation. Companies up and down the value chain are joining forces to tackle problems, such as decarbonisation, which exceed the capability of any one organisation.

While traditional business ecosystems continue to bring forth valuable innovations, what is interesting is the way in which this model is evolving to deliver different types of value for different players. The aim is to overcome some of the stumbling blocks that have prevented certain innovations from reaching their full potential thus far.

One example of a next-generation innovation ecosystem is the Charge On Innovation Challenge.

Since the inception of our patented MMD Sizer over 40 years ago, we have been committed to delivering systems and solutions that leads the way on productivity, reliability, safety and efficiency.

Unlike conventional crushers, the Sizer can define the finished product size in all three dimensions whilst keeping dust and fines generation to a minimum. Sizers are utilised in primary, secondary or tertiary applications and offer some of the lowest power consumption per tonne of any crushing system.

The Sizer is also perfectly suited to handling a wide variety of materials –from wet and sticky to hard and abrasive, either separately or combined.

MMD remains a group of committed and experienced professionals who have the skills and knowledge to provide dedicated after-sales service and technical support via a network of local offices. Discover how we can deliver the complete sizing solution for your specific needs.

The crowdsourcing project was founded in 2021 by BHP, Rio Tinto, and Vale to accelerate commercialisation of electrical charging solutions for large mining trucks. 9 What makes Charge On different is the level of due diligence that the patron companies performed as part of the initial assessment to de-risk the adoption process, as well as the structures in place, including commercialisation opportunities with original equipment manufacturers (OEMs) and venture capital, to progress the winning entries. 10

Some tier one mining companies have gone a step further and created venture capital divisions to collaborate with innovative start-ups. For example, in August 2022, Vale announced the creation of a venture capital fund to create new business opportunities and innovative technologies to incorporate into its operations. 11

Collaborative innovation efforts, such as these, are the future of mining and metals innovation. The key lies in determining which approaches best suit each organisation to incubate, accelerate, and capture the value of different innovations.

In today’s interconnected world, mining and metals organisations depend upon their supply chains for many things, from components within their products, to the services needed to run their operations. This interdependence makes supply chain security and risk transformation a top priority.

Recent concerns – including high transportation and logistical costs, labour shortages, and increased prices of materials and components – have driven many companies to better understand their risk exposure through supply chains. Most are now diversifying their networks using near or off shoring tactics, in order to help ensure the sustainability of their operations. Third-party risk management (TPRM) evaluations – including strategic brand and risk evaluation, as well as cyber evaluations – are also becoming commonplace for suppliers.

Additionally, cyber-attacks are on the rise as criminals look for any weaknesses in a company’s defences. In addition to boosting supply-chain resilience, continuous monitoring of third-party suppliers’ cyber stance can speed up and improve compliance with operational technology (OT) regulations.

Although operational optimisation is a constant endeavour in mining and metals, next-level performance may require a more integrated and dynamic approach; one that considers the impact of new energy sources, extraction methods, and processes holistically. This is where integrated systems thinking, design, and modelling can add value.

Some mining and metals companies are already using systems-based advanced simulation and modelling technologies to assess different plans and designs at an operational level. However, these tools can also be used to identify levers across the value chain.

For instance, OZ Minerals’ Scalable & Adaptable challenge reimagined mine design using flexible and modular solutions. 12 Inspire Resources teamed up with OZ Minerals and used a collaborative approach, applying whole-system models that allowed complex interactions between elements to be revealed. The team was able to prove their hypothesis that an end-to-end simulation of the value chain can quantify the value created through flexibility, for example, by simulating management decisions in response to variable renewable power generation and volatile metal prices.

By thinking differently, mining and metals companies have a chance to generate new types of value, to see the full benefit of future technologies and energy sources, and to shape a better future for people and the planet.

The mining and metals sector continues to see unprecedented changes that are impacting its workforce and ways of working. The effects of skills shortages and the global shift toward purposeful employment are being compounded by calls for greater diversity, equity and inclusion, and efforts to rebrand the industry in line with responsible sourcing and the energy transition.

A labour landscape of this complexity can only be navigated with vulnerability. The nature of these challenges requires mining and metals leaders to accept that this is not a single-organisation challenge, but one which requires an industry-wide solution and collaboration against the backdrop of a complex stakeholder environment.

For example, bringing together private bodies and some leading thinkers in government and academia as a consortium focused on one vision – such as accelerating improvements in environmental performance – could lead to collaborative action and innovation on a broader scale, and drive accountability.

This systematic way of thinking proactively addresses many of the people problems that mining companies are encountering. By working together to solve these problems, organisations can ensure a plentiful, future-ready pipeline of talent; provide exciting new paths for career development; and create truly diverse, equitable, and inclusive workforces.

Mining and metals companies have made significant strides in improving physical safety at their operations over the past 20 years. However, safety is evolving. There are new aspects that must be considered to keep

people safe, and to allow every employee to achieve their maximum potential.

Accompanying physical safety, are psychological, cyber, and cultural safety – all important prerequisites for sustainable mining activities. People need to feel safe, be able to bring their whole self to the workplace, as well as be safe to perform their roles to the full and feel valued. In today’s digitally connected world, safety is also a virtual matter. In 2021, the number of cyberattacks and data breaches increased by 15.1% from 2020. 13

Cultural safety is also important. Respecting traditional custodians and their environments, as well as the cultures and communities in which miners and metal providers operate, is non-negotiable in winning trust and maintaining a license to operate. It is also key in boosting Indigenous employment in mining.

To maintain the high standards that they have set for themselves, mining and metals companies must continue to evolve their approach to workplace health, safety, and culture.

Mining and metals companies have been key contributors to emerging economies around the globe. With this power comes responsibility, and organisations can expect close and ongoing scrutiny of their tax and wider economic contributions from a range of stakeholders in the years to come.

For years, many mining and metals groups have supplemented their mandatory payments to government disclosures with standalone tax and economic contribution reports. These voluntary ‘transparency reports’ proactively address matters where there may be a perceived risk of mistrust or misinterpretation – for instance, explaining a group’s ongoing presence in low-tax jurisdictions. This behaviour sets a precedent, and it is likely that more companies will follow suit over the coming months.

The level of transparency this action creates will play an important part in repainting the industry as an integral force for sustainable development in regions of the globe where investment can be hard to come by.

For mining and metals companies to thrive through change requires that their structures, processes, and operations become more dynamic. This will allow them to respond faster to challenges and opportunities through new partnerships, attracting fresh talent, and speeding their innovation efforts.

Cloud computing is a proven enabler during times of disruption and has underpinned value creation in multiple industries over the past decade. Around 80% of the organisations surveyed for Deloitte Australia’s 2021 report, ‘The cloud imperative: Asia Pacific’s unmissable

opportunity’, stated that by implementing cloud they were better prepared to address future challenges and organisational needs. A similar proportion said that cloud enables them to innovate more quickly and frequently. 14

Looking to the future, some of the most promising applications for cloud, and therefore advantages for early movers, include: data integration to enable analysis of mine site data; predictive maintenance of equipment to better manage and extend asset life; and the integration of supply chains. Data integration through cloud also allows insights to be shared across supply chains, which will be vital in improving traceability and in lowering Scope 3 emissions.

1. ‘Half of World’s GDP Moderately or Highly Dependent on Nature, Says New Report’, World Economic Forum, (19 January 2020), www.weforum.org/press/2020/01/half-of-world-s-gdp-moderatelyor-highly-dependent-on-nature-says-new-report

2. ‘Integrated approaches and Nature-based solutions for the restoration of degraded landscapes’, IUCN, (3 May 2022), https://www.iucn.org/news/south-america/202205/integratedapproaches-and-nature-based-solutions-restoration-degradedlandscapes

3. ‘New IUCN-Anglo American collaboration aims to deliver collective net positive impacts for biodiversity and tackle climate mitigation through nature-based solutions’, IUCN, (11 February 2021), www.iucn.org/news/business-and-biodiversity/202102/new-iucnanglo-american-collaboration-aims-deliver-collective-net-positiveimpacts-biodiversity-and-tackle-climate-mitigation-through-naturebased-solutions

4. ‘Circular Economy: Implementing circularity and transitioning to circular business models’, Deloitte, (2022), www.deloitte.com/be/en/ pages/climate-and-sustainability/solutions/circular-economy.html

5. ‘Decarbonising Steel: Forging New Paths Together’, Shell and Deloitte Global, (2022), www.shell.com/energy-andinnovation/the-energy-future/building-low-carbon-demand-sectorby-sector/_jcr_content/root/main/section/simple_1738510183/ list_1250866868/list_item_copy_45101/links/item0.stream/1669 034355054/5b1f673472d02633f82125fef387d13c266a454d/shelldecarbonising-steel-digital.pdf

6. ‘HYBRIT: SSAB, LKAB and Vattenfall first in the world with hydrogenreduced sponge iron’, SSAB, (21 June 2021), www.ssab.com/en-gb/ news/2021/06/hybrit-ssab-lkab-and-vattenfall-first-in-the-worldwith-hydrogenreduced-sponge-iron

7. ‘Epiroc presents world’s first underground mine truck made using fossil-free steel from SSAB’, Epiroc, (1 December 2022), www.anpdm.com/newsletterweb/474A5F4B784042514678424359/4 44159427145425F4372444B594771

8. ‘Green hydrogen and Antofagasta’s drive to carbon neutrality’, Antofagasta PLC, (3 February 2022), www.antofagasta.co.uk/media/ articles/green-hydrogen-and-antofagasta-s-drive-to-carbonneutrality

9. ‘Winning technology innovators announced’, Charge on Innovation Challenge, (12 May 2022), https://chargeoninnovation.com/ winning-technology-innovators-announced

10. LEONIDA, C., ‘Miners Lead the Charge For Battery-electric Vehicles’, Engineering & Mining Journal, (January 2022)

11. ‘Vale Launches $100M Fund to Invest in the Sustainable Start-up Ecosystem’, Vale, (6 August 2022), www.vale.com/EN/aboutvale/ news/Pages/vale-launches-dollar100m-fund-to-invest-in-thesustainable-startup-ecosystem.aspx

12. ‘Scalable & Adaptable Mining’, OZ Minerals, (July 2022), www.ozminerals.com/ArticleDocuments/440/ScalableAdaptable_ Challenge%20Whitepaper.pdf.aspx?Embed=Y

13. BROOKS, C., ‘Alarming Cyber Statistics For Mid-Year 2022 That You Need To Know’, Forbes, (3 June 2022), www.forbes.com/sites/ chuckbrooks/2022/06/03/alarming-cyber-statistics-for-mid-year2022-that-you-need-to-know/?sh=6535ecdd7864

14. ‘The cloud imperative: Asia Pacific’s unmissable opportunity’, Deloitte Access Economics, (July 2021)

Pat Lim and Kevin Hartley, Dyno Nobel Americas, USA, use a case study to illustrate the benefits of electronic delay timing as an initiation system in mining projects.

Electronic initiations are the initiation systems of choice for many mining projects around the world. Compared to pyrotechnic delay timing, electronic delays are much more accurate, and the shots fire exactly as designed. As such, they can improve blasting results and vibration control, reduce overbreak, improve wall stability, minimise scaling, reduce production costs, and help save time for projects overall. This makes them the perfect solution for a variety of applications –especially when the ability to accurately time blasts can be the difference between a successful blast, and one that causes damage to nearby structures.

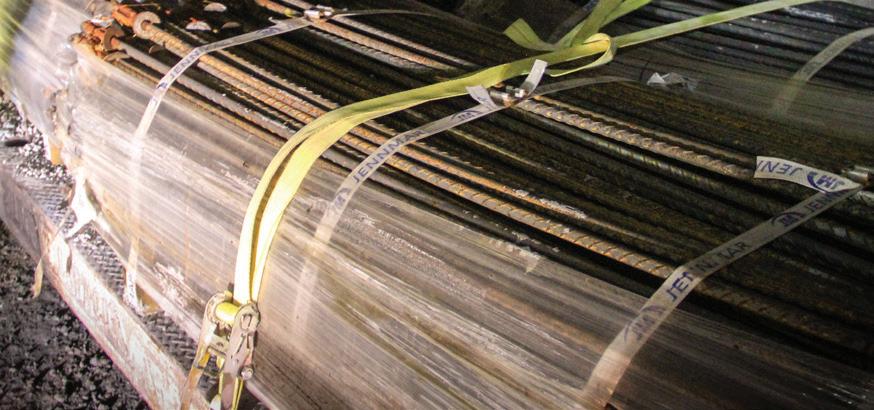

To illustrate the benefits of electronic initiations in terms of timing accuracy, a look at a recent project undertaken by the Dyno Nobel team provides a solid foundation. A drill and blast company located in Canada was blasting near an existing pipeline. Because of its proximity to the pipeline, the project

was subject to a set of vibration limits that could not be exceeded, as doing so would risk causing damage to the structure that was already in place pre-blast.

Because of the stringent vibration limits, the primary contractor for the drill and blast project mandated the use of electronic initiations, rather than pyrotechnics. This decision was made due to the increased timing accuracy offered by electronic delays. The timing accuracy would help ensure that the maximum vibration set forth by the project would not exceed the limits, thus helping to prevent any potential damage to the pipeline.

For this spread of the pipeline, EZshot® and EZ DETS were chosen for blasting. EZshot is an electronic initiation system that combines the benefits of accurate electronic timing with the ease of use of traditional NONEL systems. In this case, EZshot and EZ DETS offered the timing precision and accuracy necessary for safe blasting near the pipeline, and pre-programmed delay timing for easy implementation.

As an added benefit for this particular project, the application for EZshot is the same for conventional pyrotechnic detonators. This meant blasters would already be familiar with the usage of the system, so no additional training would be required for the crew.

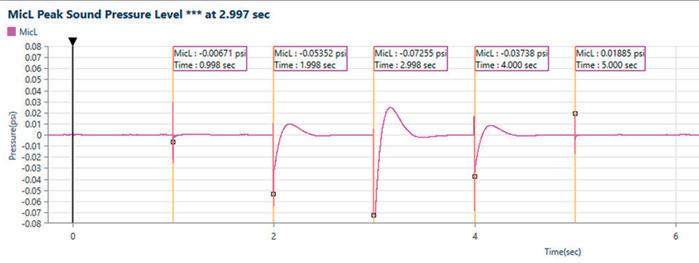

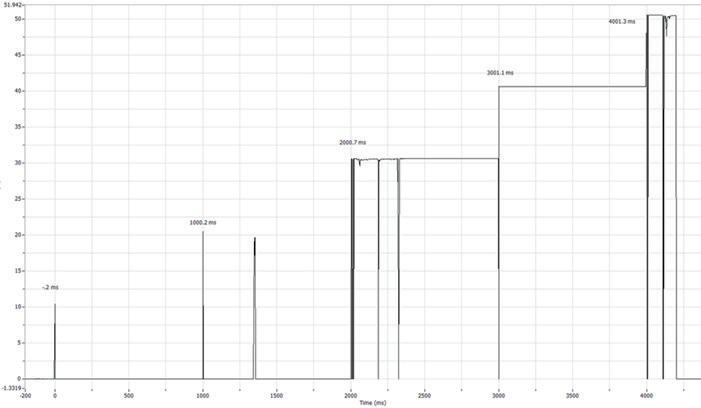

Once EZshot was chosen as the initiation system of choice by the drill and blast company, blasting began. While the project was ongoing, seismographs were used to record the levels of blast-induced air and ground vibration. Seismographs use specialised sensors called geophones to monitor ground vibration, and microphones to measure air vibration.

During blasting, seismograph readings showed that the waveforms from the geophones had differing durations than the timed patterns of 1000 msec. This discrepancy between the timed delay of 1000 msec. and the data from the seismograph brought the timing accuracy of the detonators into question. Because any inaccuracy in timing could result in vibrations that exceeded the set limits and put the safety of the pipeline at risk, the accuracy of the electronic initiations needed to be verified before the prime contractor could allow them to be used.

At this point, the goal for the project was to assess the accuracy of the timed patterns for the electronic initiations, and, if necessary, troubleshoot any potential issues that may

be causing the discrepancy between the planned timing and the timing reflected by the seismograph.

In order to assess the accuracy of the timed patterns, downhole delays were measured by attaching several detonators to a high-resistance cable, and measuring the break in the line. Normally, a VOD machine would measure distance (charge of explosive) over time. In this case, only time was considered.

Five detonators were fired using two different date codes. For the first date code, a seismograph was used to record the sound produced from shooting five detonators in a series on the surface. The resulting measurement from the seismograph showed that each detonator triggered within the target of 1000 msec. For the second test, the seismograph was used once again, this time in conjunction with a micro trap that used the detonators to break the resistance wire and trigger an event. The timing of all five detonators were within 0.5 msec. of the 1000 msec. target.

After the detonators were initiated, the resulting data from the seismograph and micro trap proved that the downhole delays did, in fact, shoot at 1000 msec., as indicated on the technical data sheet. Satisfied with the findings and the technical support from the Dyno Nobel team, the prime contractor was able to allow EZShot and EZ DETS back onto the pipeline project. Furthermore, it was insisted that the drill and blast company continue to use Dyno Nobel for technical support moving forward.

The result of this case study has implications for drilling and blasting not just near existing structures, but in any situation in which timing accuracy is essential, particularly in mining. The seismograph data clearly demonstrated that the delay timing offered by electronic initiations was both accurate and precise. Because timing has a significant impact on vibrations caused by blasting, electronic initiations allow blasters to control vibrations more accurately. In mines, this can lead to improved perimeter control, overbreak reduction, improved wall stability, minimised scaling, and less time spent mucking, hauling, and processing.

Isn’t it time for a change? With the need for tighter tolerances in manufacturing operations today, especially in extreme industrial applications, you need to have a reliable external backstop to keep your operations running smoothly. Assembled here in North America, BS-F Series Backstops can be ordered on short lead times.

USES UNIQUE GREASE LUBRICATION

› Only once yearly maintenance required for most applications, no need to monitor or refill oil levels between lubrication cycles

NARROWEST DESIGN FACILITATES DROP-IN REPLACEMENT FOR ALL MAJOR MANUFACTURERS

UNBEATABLE PRICE AND TECHNICAL SUPPORT

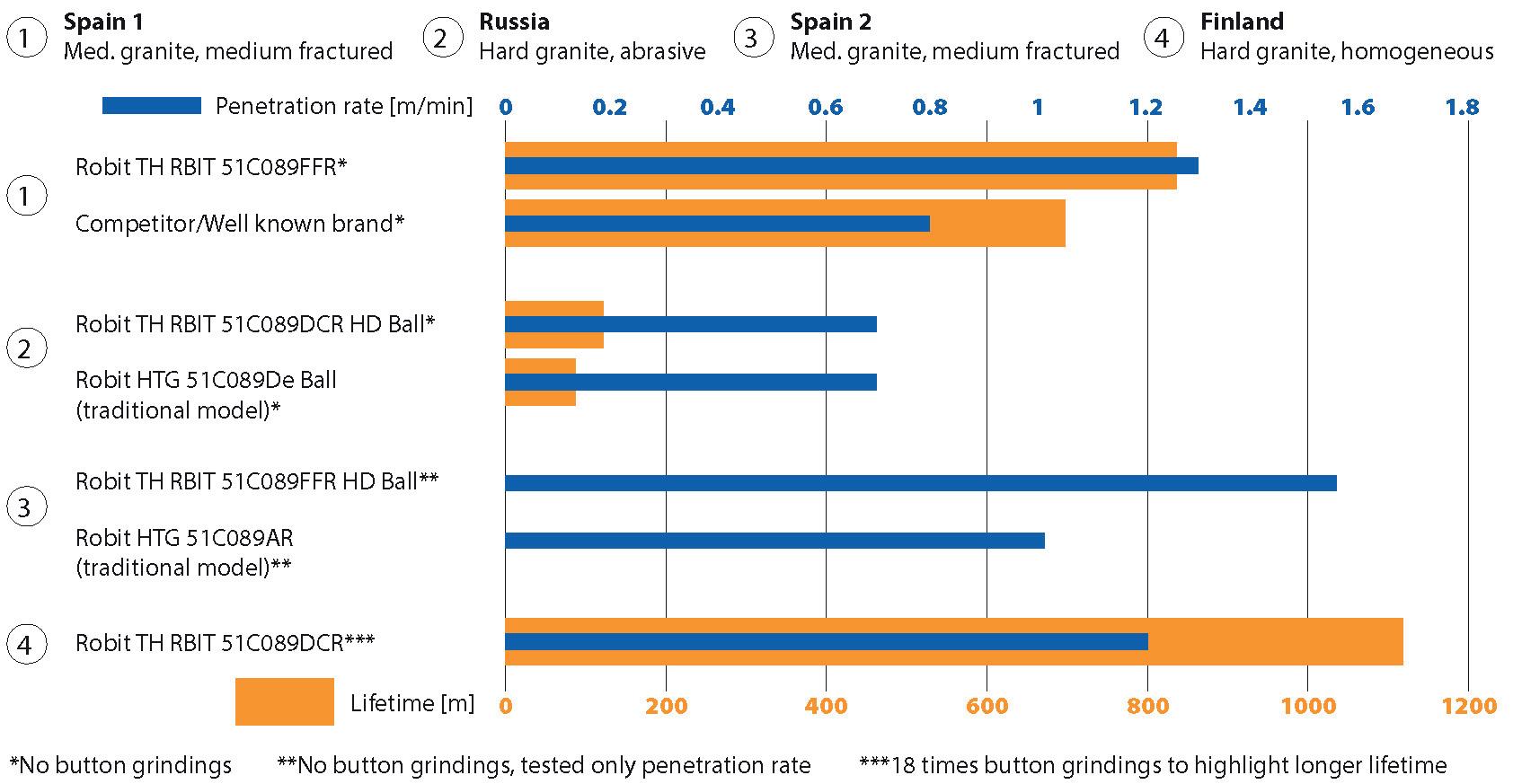

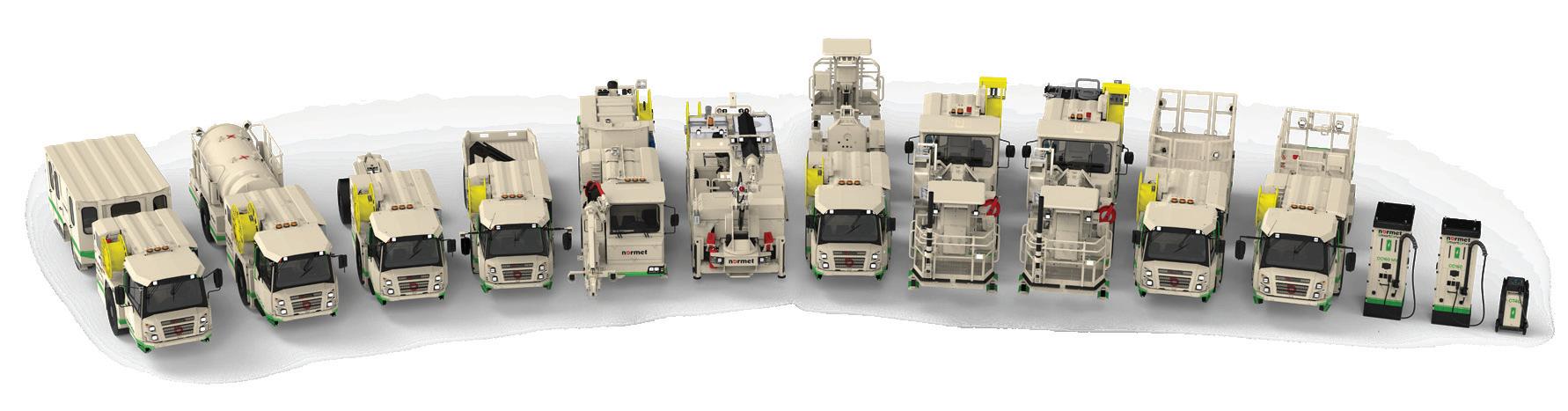

While mining is by no means a new field, the demands have never been higher and, therefore, new solutions are in constant demand. This is pushing mining equipment and drilling consumables companies to constantly reinvent themselves, and stretch the limits of what it is possible to achieve in mines. From battery-driven electric machinery to emission-cutting technologies and optimised equipment, sustainability has quickly risen to join productivity as the focal point of the industry. As productivity and sustainability can often go hand in hand in a mining operation, at least on the baseline, there are many parameters that can be optimised in order to increase productivity and lower the total drilling costs, while also contributing to the sustainability of the operation.

When it comes to drilling, there are generally two ways of determining costs: the cost per metre and the total drilling cost. There is no doubt that the former method has provided important measurements for a long time now, and will remain relevant for years to come; however, it is the latter that generally provides a better point of comparison. Cost per metre only considers the durability of the tools, which is naturally an important and suitable metric in itself. But, the total drilling cost also considers the rate of penetration of the tools, or productivity, meaning more drilled metres in less time. No matter how you look at it, total drilling costs are the ultimate measure to cover all the bases.

As already touched upon, productivity equals work done in a certain amount of time. Remembering this, it is easy to see the multiple ways to increase productivity in drilling; avoiding breakages, minimising the need to stop to replace a worn part, and simply breaking through the rock faster are all actions that can be taken to reduce drilling time. Reducing drilling time allows the driller to conclude their work faster, with less fuel consumed, and fewer hours on the drill rig’s clock. This drags the total cost of drilling down in terms of spent time, fuel costs and the cost of the machinery, whether rented or owned.

When attempting to maximise both sustainability and productivity, the choice of drill bit plays a major role. The properties of the bit have a direct impact on many variables affecting the total drilling cost and sustainability of the operation, such as fuel consumption, component lifetime, and CO2 emissions. It is naturally desirable to keep the consumption of everything as low as possible; fuel, pieces of equipment, and time.

What is more, the durability of the bits can make or break any remote-controlled drilling operation. Should the bit lifetime be too short, the controller will need to restock the reserves on their remote-controlled rigs more often, eating away at their usability and benefits.

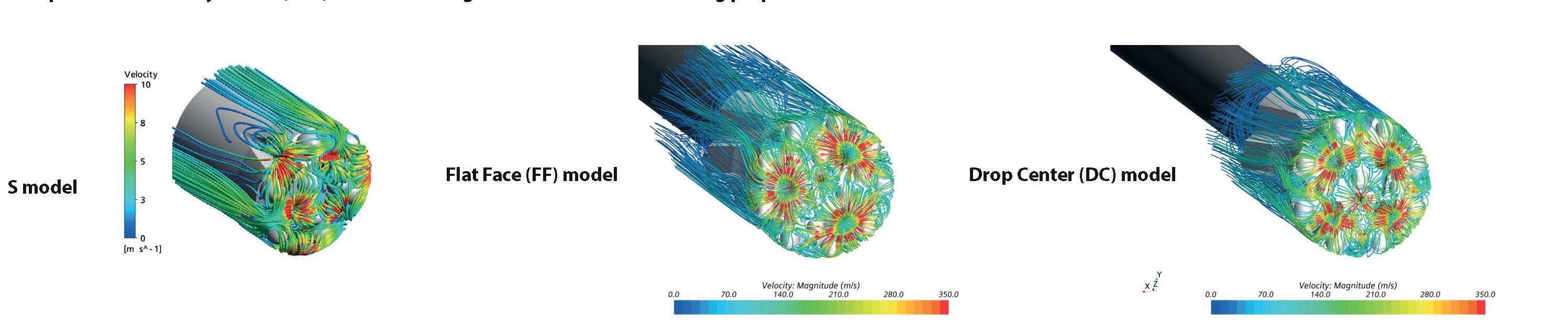

Robit’s latest generation button bit series, the Rbit, has been designed from the ground up, with productivity and sustainability in mind. The main goals of the redesign were to help the company’s customers bring down their total drilling costs by facilitating a faster rate of penetration, while further lowering the cost per metre. The new series was launched in two phases, with the larger end leading the way, from 60 – 152 mm, and the smaller 32 – 57 mm Rbits following in tow.

The whole Rbit series features an optimised button layout configuration, which ensures maximised contact with the drilled rock and optimised rock breaking dynamics, as well as an efficient energy transmission, so that the rock can be broken as quickly as possible and no energy goes to waste. Additionally, both the Flat Face and Drop Center models in the larger sizes have improved transition faces, allowing for the percussion energy to be better transmitted into the rock.

In addition to the features that enable the Rbit to break rock more efficiently, all of the bits also come with an enhanced flushing design, as well as redesigned, wider retrac grooves, which make it possible to eject the broken stone cuttings faster, thus clearing the area between the bit and the rock. This is especially important in softer rock formations, as the enhanced flushing properties prevent the Rbit from getting clogged, which was an occasional problem with the old HTG models. Finally, the larger sizes with both Flat Face and Drop Center models are also available in heavy duty versions for extremely abrasive ground conditions.

The Rbit series of button bits aims to tackle issues that have not been fully addressed by the prior generations, while also building on their strengths.

The optimised rock breaking dynamics and the improved flushing capabilities of the new bits grant them extremely competitive penetration rates in the most demanding conditions. On average, the drilling speed offered by the new Rbit series is 17.6% faster than that of the old HTG models, increasing from approximately 2.2 – 2.5 m/min. to 2.5 – 2.8 m/min. This directly impacts both the fuel consumption and the costs relating to the

Jorge Leal, Robit, Finland, reviews the features and uses of a new drill bit and its role in improving the productivity and sustainability of mining operations.

time spent drilling, providing the driller with more drilled metres each day.

The grinding interval has also been increased, making it possible for the drilling machinery to function uninterrupted for longer periods of time. Furthermore, the average lifetime of the bits increased by approximately 19% from the previous models, bringing about both monetary and environmental savings, as fewer bits are required to finish the job.

When boosting productivity, drill uptime should be one of the main focus points. Stopping the drill and spending time replacing the bits, either for grinding or for removing them from circulation, is always lost time that could be spent on drilling. And the longer the driller can keep the drill running, the more metres they will manage to drill each day.

Should a drill operator want to optimise their drill’s uptime, there is hardly a better companion for a top hammer drill than a diamond button bit. The diamond button bit will allow the driller to keep their rig running for longer, without interruptions, pushing the daily drilled metres as far as they can go. This is achieved by swapping out the traditional hard metal buttons for incredibly durable buttons with an industrial diamond coating, while still utilising the new Rbit bits’ bodies for the enhanced flushing capabilities and increased penetration rates.

As already mentioned, Robit Diamond Button Bits utilise the same bit bodies as Rbit Button Bits. This means that they deliver

the same benefits and improvements over the previous generations in terms of rate of penetration, rock-breaking dynamics, and flushing properties. What is different about the diamond button bits, however, is the industrial diamond coating on the buttons, which allows them to outlast almost any other bit.

The creation of the diamond coating takes its inspiration from how diamonds are formed, subjecting the buttons to high pressure and heat, making them even more durable than natural diamond. The coating has several layers to it, ensuring adherence and making certain that the diamond bit can withstand the temperature changes and shocks typical for top hammer drilling.

The diamond button bits have been meticulously tested, proving their benefits over traditional hard-metal button bits. The drilling metres multiply, as the industrial diamond coating eliminates the need for grinding. This means that the drill rig remains operational for longer stretches of time. Furthermore, as the diamond buttons experience practically zero wear, they maintain their high penetration rate throughout the bit’s lifetime, without deteriorations, with the lifetime further increased thanks to the flushing capabilities of the Rbit body. In addition, the lack of wear also provides consistent and predictable results ideal for blasting, due to the borehole diameter not decreasing.

Robit has been working hard to provide the industry professional with tools that fulfill their high standards. As the latest testament of these efforts, the Rbit button bit series is pushing the possibilities offered by drilling consumables. The many improvements and iterations brought about by the latest generation of bits, and improved upon by the diamond buttons, should be of interest to anyone who concerns themselves with matters of sustainability and productivity. And in this day and age, these themes should be of concern to everyone.

Reducing the number of on-site accidents in a mine is crucial; ensuring that personnel remain safe in both in underground and surface settings is necessary. Becker Mining Systems developed both the PDS4.0 and the smartdetect system with safety and proximity awareness in mind.

Level 9 compliant, and with a full range of attachments, PDS4.0 and smartdetect

have been designed to offer V2V, V2P, and V2X detection solution in one comprehensive and robust package, allowing for upgrades, and simple system modifications, based on the needs of the customer.

With smartdetect and PDS4.0 enabled vehicles; you will never again have to wonder “how close is too close”

As digital technology has become more ubiquitous in our everyday lives and businesses, mines are adopting wireless systems that are proving revolutionary to the safety and efficacy of mining operations, resulting in an improvement to the bottom line.

Mines have long been dependent on hard-wire communications systems, thanks to the fact that most above-ground systems are rendered useless, or at least highly inefficient, in the deep below-ground environment. In the US, the implementation of the MINER act in 2006, following a series of coal mine accidents that resulted in fatalities, caused the government to mandate new, more reliable systems for communication and tracking, according to the Centers for Disease Control and Prevention.

Communications technologies frequently used in mining include radio node networks, very high frequency (VHF)/ ultra-high frequency (UHF), and leaky feeder systems. Each of these has its downfalls. Traditional wire systems require laying cable, ensuring there are no cuts or breaks in the lines, and then abandoning or retrieving those lines when the mining operation moves on. Wireless underground systems, such as radio frequency systems using VHF or UHF, can be useful in certain scenarios, but obstacles, such as turns or corners in mines, can interrupt signals, impacting on reliability. The commonly used leaky feeder system is designed to radiate signals out of a coaxial cable that reaches transmitters up to 200 m from the cable itself. Although the leaky feeder system improves transmission distance over traditional

Emily Esterson, E-Squared

Editorial,

Innovative Wireless Technologies, Inc., USA, discusses how digital technologies have become increasingly important in improving both the safety and productivity of underground mines.

coaxial cabling, it still requires laying and maintaining wires and antennas. The leaky feeder, with its gap-prone wires, along with the inefficient necessity of line amplifiers at regular intervals, is expensive to operate and prone to failure.

These legacy systems are also rife with costly business inefficiencies. When a cable breaks, for example, it requires someone to get in a mine truck, travel to the surface, gather the needed cable to repair the breakage, and drive back down to site. This involves man-hours of lost productivity. In the meantime, important lines of communication might be interrupted. Additionally, when the operation moves on, those cables need to either be removed or abandoned.

The above ground environment in some mines may also lack infrastructure. Cellular towers are far and few between in remote mining locations, meaning that even communication from the mine entrance to the office can be unreliable.

Other industries have fully embraced digital technologies, but the mining industry has been a slower adopter. The Boston Consulting Group’s Digital Acceleration Index 2021 notes that the metals and mining industry is roughly 30 – 40% less digitally mature than the automotive or chemical manufacturing, for example. The index noted

obstacles in mining operations that hinder digital adoption, such as remote locations with poor bandwidth, a less technologically savvy workforce, rugged terrain, and a mistrust of automation thanks to its connection to workforce reduction. And yet, when mines did ramp up their digital systems, throughput improved by 10 – 20%.

The report notes business benefits as well. The ability to track custom data in real time through sensors, rather than through manual inputs at the end of a shift, for example, can have a positive impact on accuracy in forecasting, overhead and operating cost reduction, fuel costs, and productivity increases. Specifically, the DAI noted that in the digitally connected mines that BCG studied, productivity increased up to 30%.1

What does digital transformation in the mining industry look like? “Connectivity is a big part of that story,” says Eric Hansen, CEO of Innovative Wireless Technologies (IWT), Inc., based in Virginia. “Connectivity solutions that worked in manufacturing, pharmaceuticals, or oil and gas do not work well in the dynamic mining environment,” he adds, because mining operations are always on the move. “The foundational network systems are an important part of any digital transformation,” Hansen says. A better connected mine can track people and assets, integrate multiple siloed systems in mine operations and data collection, and lower maintenance time. It is data-driven and agile, and enables the better compliance and safety. A wirelessly connected underground eliminates costly hard-wired systems, and makes communication and tracking more efficient and reliable.

While legacy systems, such as the leaky feeder communication and tracking systems, have some capabilities, underground communication systems that run on a network of nodes provide an alternative. Built to self-heal, these nodes are not reliant on a single central server which routes data signals along a central highway, but rather on a network – if one should go down, signal traffic is instantly rerouted to a different node. The nodes can be placed in any number of locations, depending on the needs of the mine, to link miners and operations to each other, as well as emergency personnel and managers in the office. Thanks to the dynamic roaming feature in mesh networks, calls remain uninterrupted as users travel throughout an underground mine.

A wireless mesh network node can be recovered and quickly moved to another location by simply picking it up and moving it. Importantly, the digital nature of such a system means it is highly customisable and always up to date – equipment does not require removal or abandonment, nor does it require the storage of multiple spools of cables. Instead, communications are enabled through clear underground radios, with texting and embedded tracking capabilities available for any Wi-Fi enabled device, connected to a wireless high-speed fibre infrastructure that provides Wi-Fi access points at each node.

An underground network greatly improves safety and the ability for mines to comply with the US’ Mine Safety and

Health Administration (MSHA) rules. Of the top 10 cited standards, a wireless mesh network can improve efficient handling and management of nearly all of them. From the ability to notice and address blocked paths, to mine ventilation and gas monitoring, a network backbone can communicate via radio, tablet, phone, or atmospheric monitoring devices in real time. It routes data quickly out of the underground and allows companies to manage the mine in real time.

These networks can – and have – saved lives. Take, for example, the true story of a miner who was involved in a crash underground and was seriously injured. Using a legacy system, it might have taken hours to find help, clear the tunnels, and get the miner medical attention. With IWT’s wireless mesh system’s ability to track people in real time, the miner’s exact location was instantly known, as was the closest emergency medical-trained miner, who arrived quickly to the scene. They were able to call outside the mine and maintain communication with each other, but also with the first responders on their way to the scene. The mine was able to quickly clear people and machinery out of the evacuation route, as emergency services were arriving at the mine entrance. “A network like this allows you to identify when people have problems and enables you to get to them much quicker,” says Hansen. Furthermore, battery powered communication systems allow rescue personnel to go much deeper underground without losing connectivity.

A 2016 McKinsey & Co. white paper detailed the impact of the digital technology on mine productivity. The study predicted that these innovations in communication and data tracking, as well as the resulting robust analytics,

would drive productivity gains.2 McKinsey noted that mining productivity declines can be offset by the embedding sensors, and by gathering vast amounts of data that can provide granular level insights into mining activities. Data can be synthesised to provide managers with insights into operations.

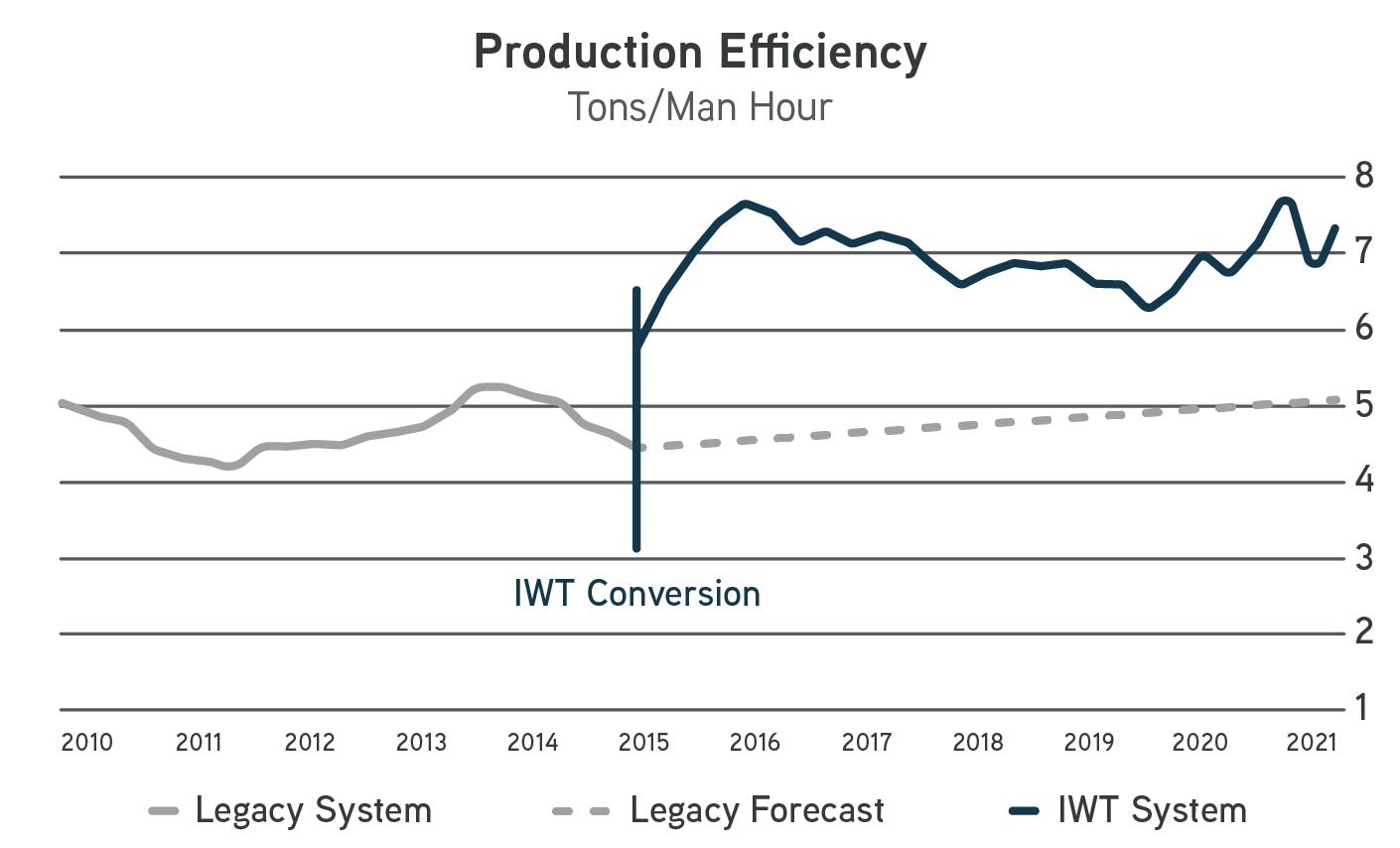

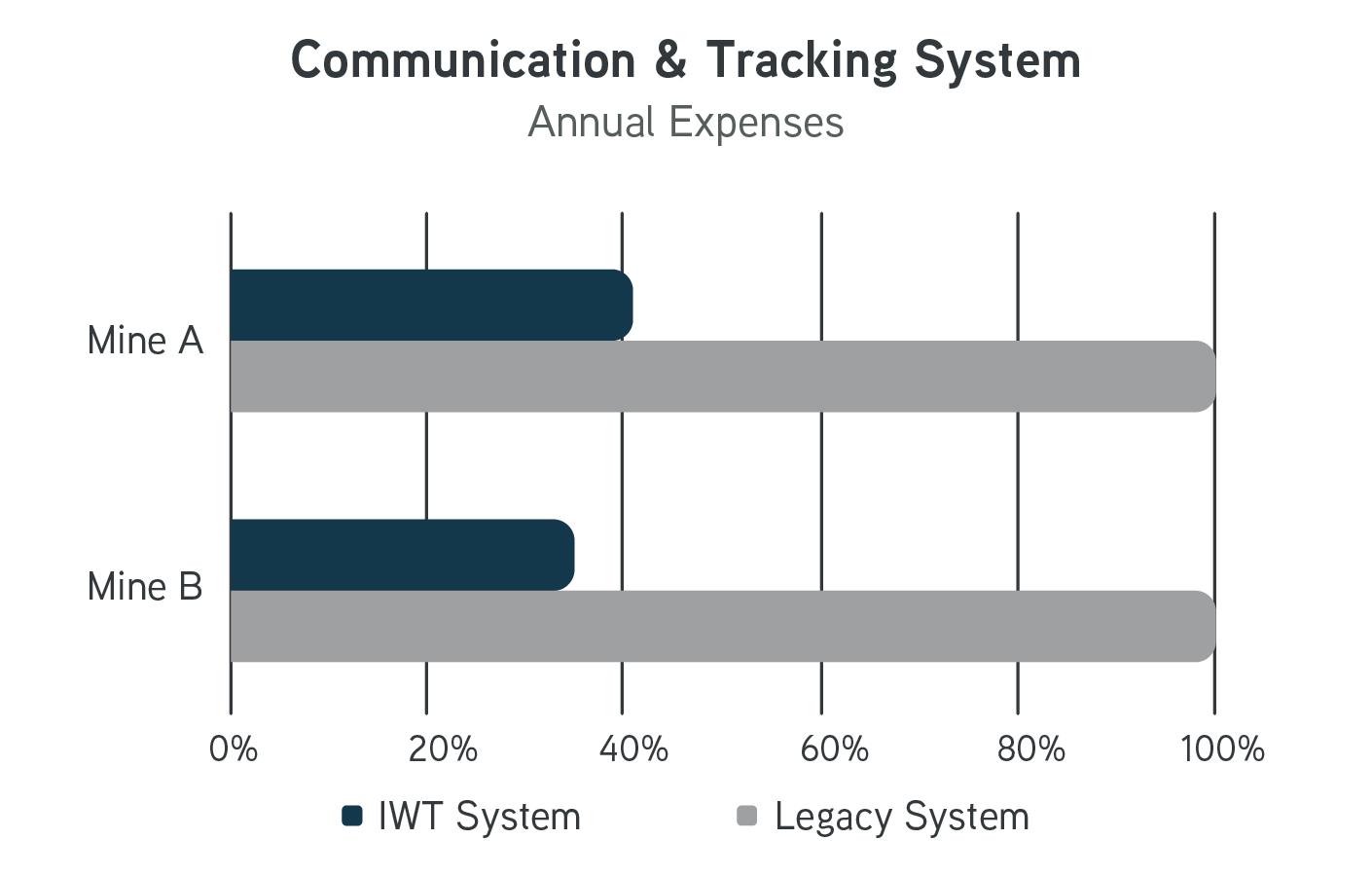

While safety is surely one of the best uses of such a network, the productivity gains can be significant. In real time, operators can see where equipment has broken down, and rapidly deploy repair or maintenance personnel to fix it. With underground wireless connectivity, the path to bringing that equipment back online is much faster. A text or radio message, the real-time tracking of personnel, and the ability to track the hours spent on the task improves efficiency. One company in the US noted that installing a remote wireless mesh network resulted in US$8 – 10 million in productivity gains per quarter, and saves them US$750 000 annually in total cost of ownership. Another example compared the productivity of two co-located mines on the same vein with the same workforce. One switched to IWT’s wireless communication system and saw 1 – 1.5 tph improvement in its operation. The sister mine, located six miles away, did not update its system, and, over the five-year time span, operated at a lower productivity rate.

Digital systems also allow mines to retrieve and reallocate labour hours too. Maintenance personnel can be deployed more efficiently, working proactively rather than reactively. With the mining labour market in short supply, workers need a good reason to join and remain in the mining workforce, and mines need to ensure their labour hours are efficient.

As the digital transformation of mining picks up momentum, future innovations will depend on reliable, flexible, and high-speed underground connectivity. Whether for productivity or health and safety, nearly all will need access to remote sensing and high-speed networks to connect people and information. Wireless communication plays key roles in proximity detection to prevent accidents; tele-remote and autonomous mining; and potential MSHA regulations that will require dust monitoring. These innovations – driven by a wireless, high-speed underground communication technology – will improve business, make it easier to attract workers to mining jobs, make them safer and more technologically enabled, and allow mine companies to deploy all their resources – human or otherwise – in a safer, more efficient manner.

1. GANERIWALLA, A., HARNATHKA, S., and VOIGT, N., ‘Racing Toward a Digital Future in Metals and Mining’, BCG, (2021), www.bcg.com/ publications/2021/adopting-a-digital-strategy-in-the-metals-andmining-industry

2. LALA, A., et al., ‘Productivity at the mine face: Pointing the way forward’, McKinsey & Company, (2016), www.mckinsey.com/~/media/ McKinsey/Industries/Metals%20and%20Mining/Our%20Insights/ Productivity%20at%20the%20mine%20face%20Pointing%20the%20 way%20forward/Productivity%20at%20the%20mine%20face%20 Pointing%20the%20way%20forward.ashx

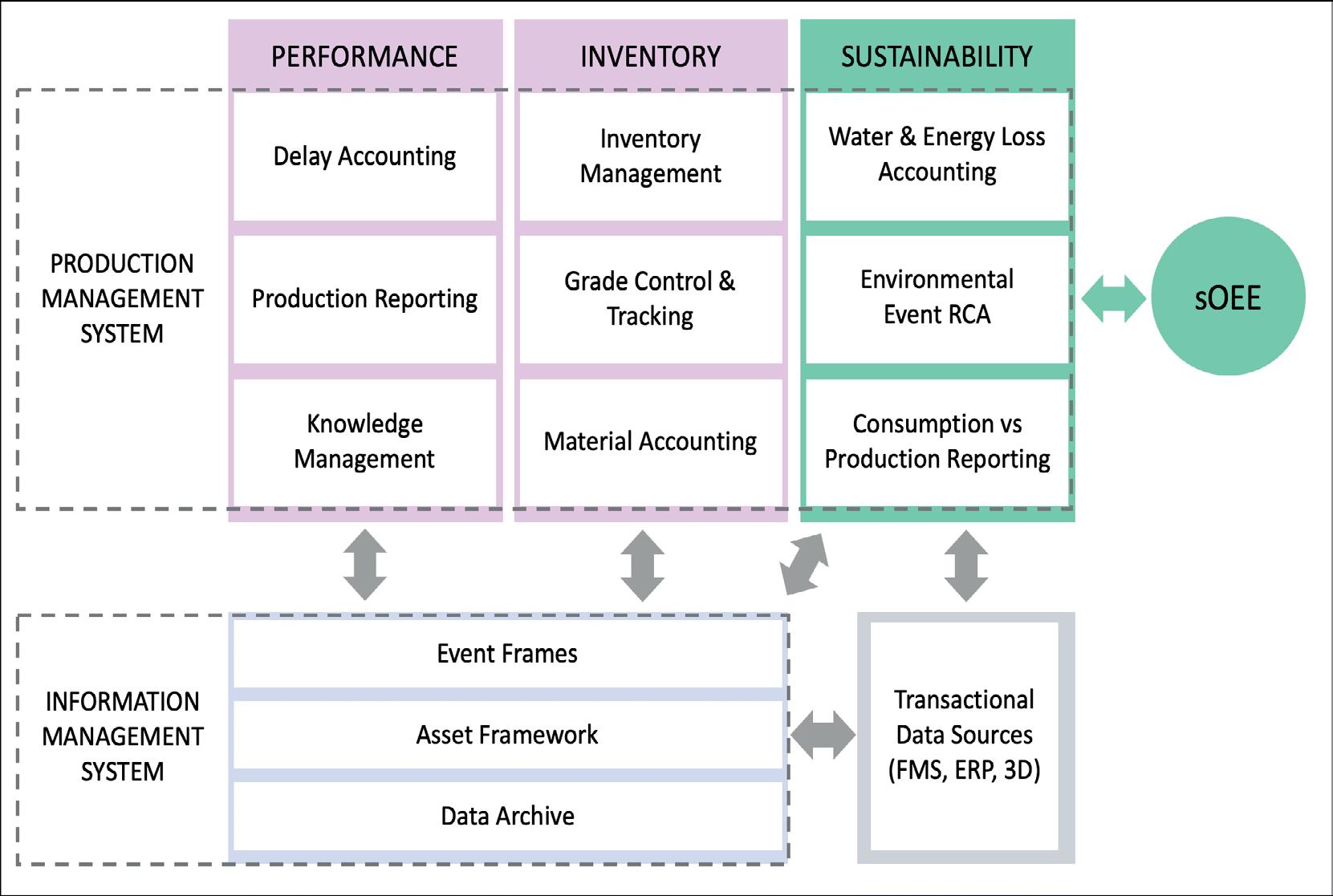

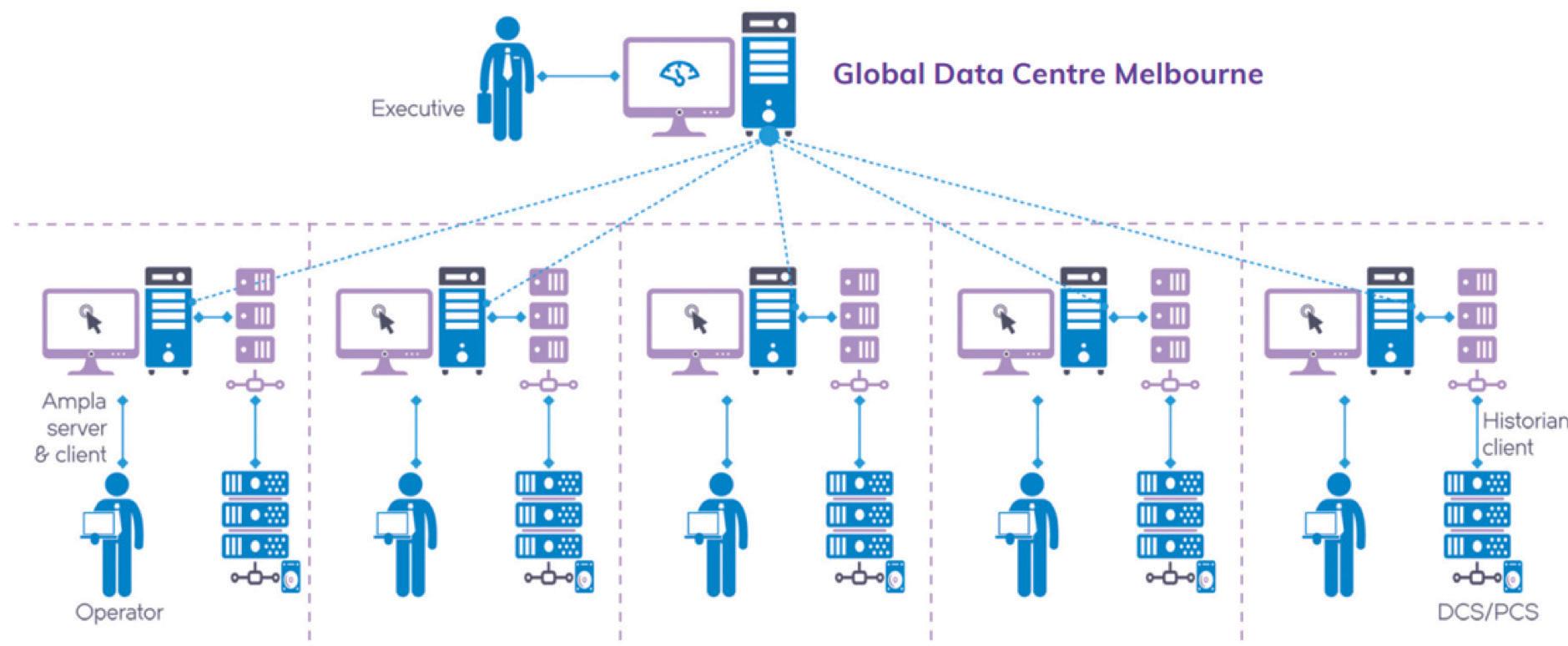

Martin Provencher and Ben Connolly, AVEVA, detail the importance of digital technologies in improving both the profitability and sustainability of mining operations.

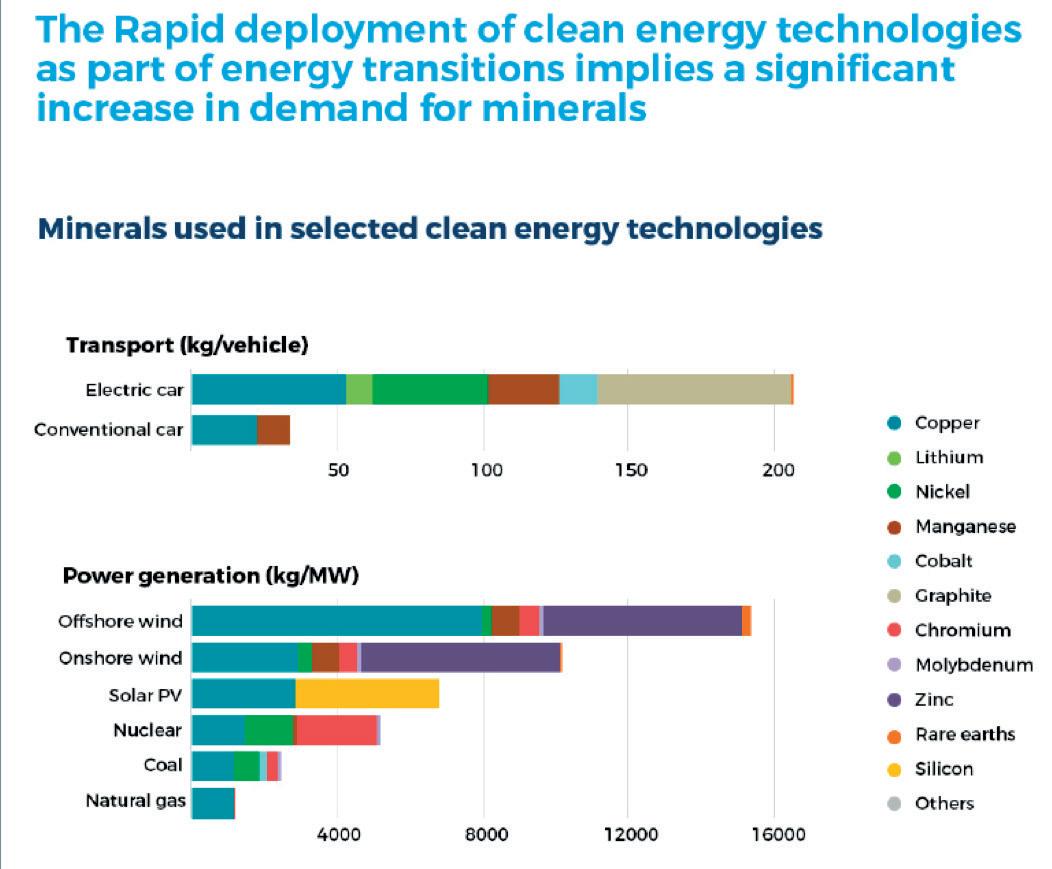

The world is calling for the transition to low-carbon energy sources to decrease greenhouse gas (GHG) emissions and avoid the worst effects of climate change. Some groups are asking for mining activities to stop, without realising that mining is critical to the clean energy transition. To accelerate the energy transition, the world will need green electrification, including wind turbines, solar panels, electric vehicles and industrial batteries, which cannot be manufactured without minerals. Large amounts of copper, nickel, lithium, cobalt, manganese, silicon and zinc will be required, increasing the demand for mining, as illustrated in Figure 1. As mining operations intensify to meet increasing

global demand towards the net-zero targets, miners must become more sustainable themselves. New, innovative facilities need to be built that use natural resources more efficiently and generate fewer carbon emissions, but this takes time and requires huge capital investments. Current facilities also need to become more sustainable immediately, while promoting business continuity. Digital technology will play a significant role in improving the sustainability of existing mines and plants, while ensuring profitable margins at the same time.

Digital investments must be the first step. Miners must establish a baseline for sustainability key performance

indicators (KPIs), identify what needs improvement, and validate how much it can be improved without major capital expenditures (CapEx) investment or compromising margins. A digital roadmap can help mining companies accomplish the following:

n Access and visualise trusted engineering and operational data. Convert data into actionable information, building a clear understanding of the plant’s current situation related to operational performance and sustainability KPIs.

n Monitor and optimise operations to improve efficiency, reduce emissions and waste, and increase the green energy mix to comply with environmental, safety, and governance (ESG) goals.

n Improve enterprise situational awareness and prevent accidents.

n Optimise value chains to drive agility and resilience, in order to respond to market fluctuations, material requirements, and transparency needed to maximise circularity.

Mining companies face several challenges as they work to implement their sustainability strategies: disparate data

sources, lack of accountability and auditability, late reporting and data without production context, among others. A digital roadmap for sustainable operations can be summarised in three main initiatives, with relevancy depending on the digital maturity of the company:

n Information management.

n Production optimisation.

n Value-chain optimisation.

The first step is to access trusted data and convert it into reliable information. The digital roadmap starts by leveraging all operational data that typically comes from disparate systems in mining operations (different OEMs and control systems). An operational data infrastructure is configured as a single placeholder to collect data from all sources. As the plant data from all the assets is gathered, the operational context is also captured. Then, several questions can be answered:

n Was the asset on operations or maintenance?

n Was it facing any emergency stoppage?

n Was it a normal maintenance procedure?

In this data infrastructure, a digital representation of the assets must be created and integrated into an asset framework, enabling easy standardisation and replication. The framework models must be templatised across plants and sites. Strong data standards can be applied for scalability, reusability, and rollout at pace – and should support data quality and security along the way.

The data infrastructure lays a foundation for the implementation of models and analytics, enabling significant improvements to production efficiency, resource management, energy savings, GHG emissions reduction, and regulatory compliance.

Once data is available and contextualised, sustainability KPIs can be monitored and improved. Typical sustainability KPIs include energy consumption, water consumption and loss, GHG emissions, waste generation, and environmental events. With contextualised data, the operational team can optimise production, aiming to improve KPIs according to the company’s goals and ensure environmental compliance. Companies must ensure operations execution is properly managed. Most companies struggle to consolidate real production and resource consumption with inventory. This is usually done as a manual reporting process that takes time and is not reliable. Production management systems enable users to perform data reconciliation (DR), and to find the optimum balance between production performance (delay accounting, production reporting, as well as knowledge management) and inventory (inventory management, grade control and tracking, and material accounting). Today, these systems combine efficiency and productivity with sustainability, by adding additional parameters to the model: water and energy loss accounting, environmental event root cause analysis (RCA), and consumption versus production reporting. With these elements combined, it is possible to track sustainable overall equipment efficiency

Since 1937, Fletcher has been answering some of underground mining’s toughest questions. At Fletcher we provide more than solutions, we provide an atmosphere for an open dialogue with customers to ensure their operations are reaching maximum efficiency. Fletcher provides lifetime support through an experienced, knowledgable team of sales staff, engineers and field service technicans. Is your operation facing obstacles that mass produced equipment isn’t addressing? Get your custom solution started today. Learn more at www.jhfletcher.com

(sOEE): sOEE = sustainability x availability x performance x quality (Figure 2).

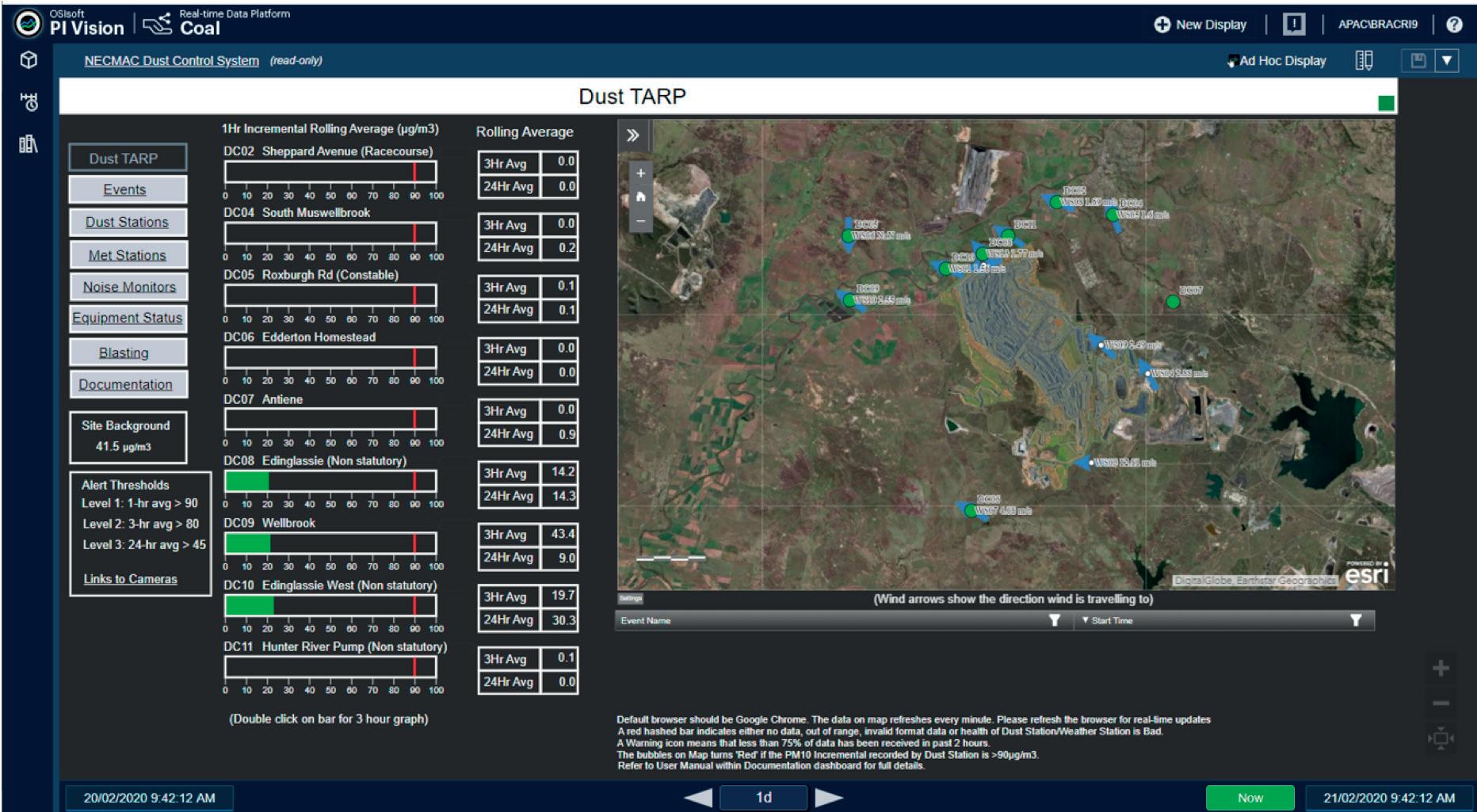

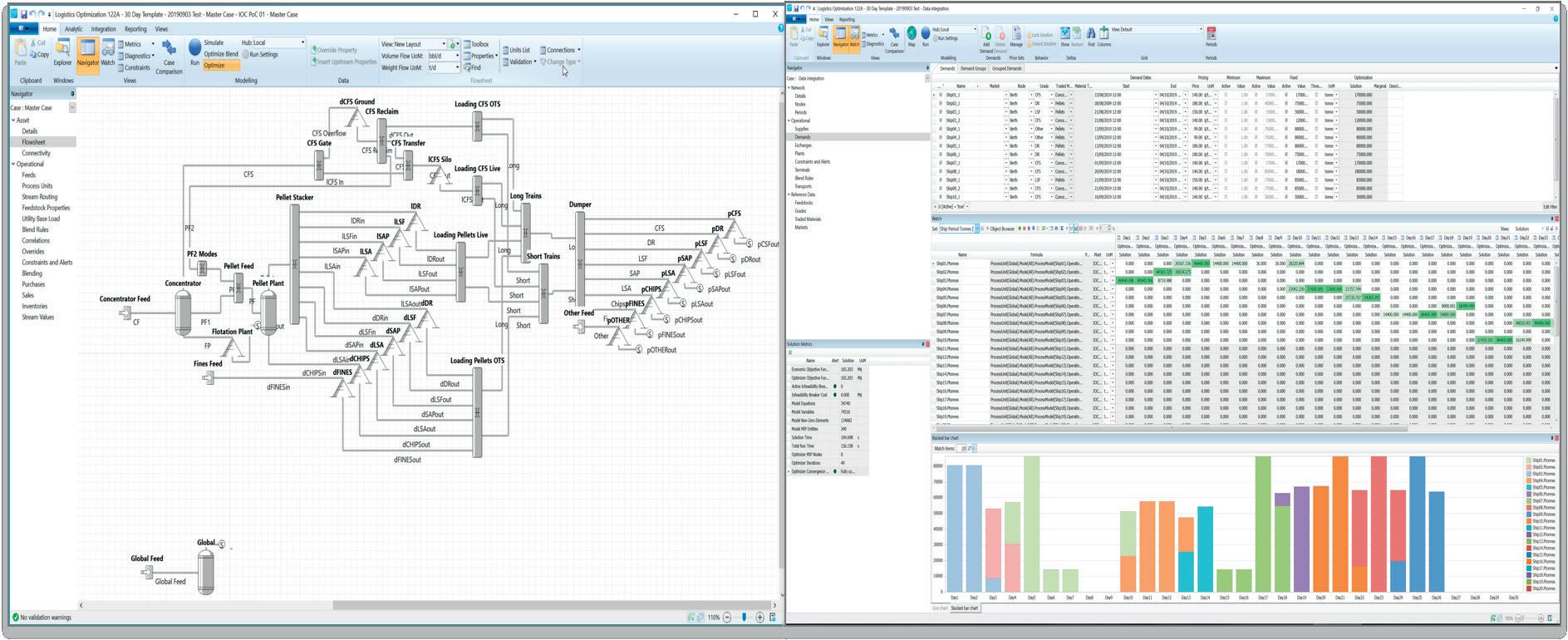

Mining supply chains from pit to port have long focused on achieving throughput and addressing bottlenecks while achieving product grade, and this has frequently been addressed through home grown manual or heuristic planning solutions relying on built-up operator knowledge. Today, however, additional constraints around ESG factors, together with sustainability considerations, means there are increasingly complex trade-offs to be considered. Correspondingly, there is an increasing need to turn to optimisation-based systems that can rapidly explore a vast array of objectives, evaluating trade-offs in order to simultaneously address throughput, quality, and ESG constraints – such as water usage and energy consumption, in addition to carbon and particulate emissions. The latest digital technology available brings the power of optimisation to bear on mining supply chains, particularly where complex processing is involved together with a broad range of objectives, as exemplified in Figure 4.

BHP is committed to playing a leadership role in responding to climate change and the use of natural resources. To minimise the impacts of its operations at every stage, BHP manages environmental risks and ensures compliance with existing legislation and its internal policies.

Across BHP’s Minerals Australia, six environmental systems operate independently. Due to disperse data, BHP faced several issues, including: unreliable data with inconsistent formats; difficulties analysing long-term trends; limited options for displaying, analysing, and reporting; and heavy reliance on vendors’ calculations and outputs. To address these issues, BHP implemented its Environmental Data Management System project with the following vision: “Support the business to focus on environmental performance, by providing environmental information efficiently by leveraging technology.”

The project requirements included:

n Capture measurements taken at specific locations over time at different frequencies.

n Trend measurements over time and raise alerts when variables were out of limits.

n Visualise information geospatially.

n Analyse environmental measurements and combine them with operational data.

n Produce reports and dashboards.

The solution combined operational data management (to collect, contextualise, and analyse time series data), geospatial analysis and mapping software (geographic information system),

and tomorrow and the next day and next year and the year after that....

Clear voice communication that you can actually HEAR in a noisy environment is just one of the many capabilities of an IWT SENTINELTM System.

And, because IWT is a trusted partner to the mining industry, we are committed to providing innovative solutions both today and well into the future. SME

and an analytics solution (to explore and visualise data through dashboards). The Environmental Data Management System included:

n Data across 35 operational sites in Australia.

n Modern map interface with trends, reporting, GHG calculation, recording of water use, and sample management.

n Features for search locations and information.

n Events and alerts.

As a result, BHP teams now have a system that provides: data quality, compliance, easy data finding, standardisation, better performance, governance, in-house support, lower costs, mobility, collaboration, and scalability.

MMG implemented a production management solution to standardise asset utilisation across five mines globally, increasing asset utilisation by at least 10% across the sites.