The Nexsys™ system was developed using hundreds of hours of field-trial data and extensive lab simulations. The results showed a 50% reduction in adapter replacement and a 40% reduction in lip maintenance—reducing unplanned downtime.

34 Transforming Mining Through Software-Defined Intelligence

10 South Africa’s Coal Crossroads

Sushmita Vazirani, Wood Mackenzie, examines how South Africa is navigating the twilight of thermal exports.

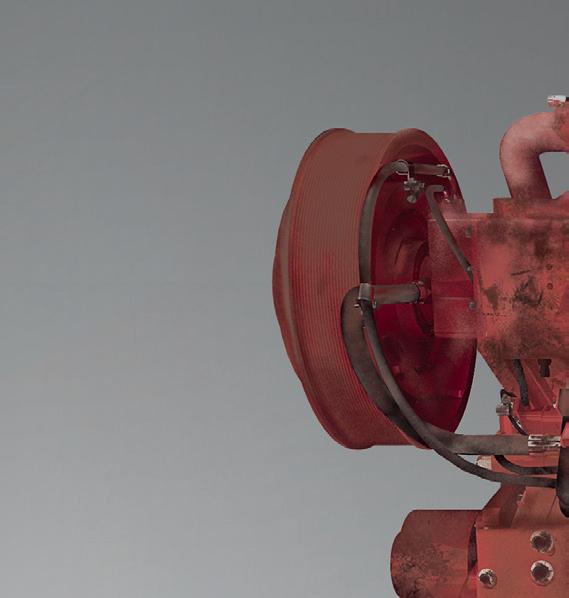

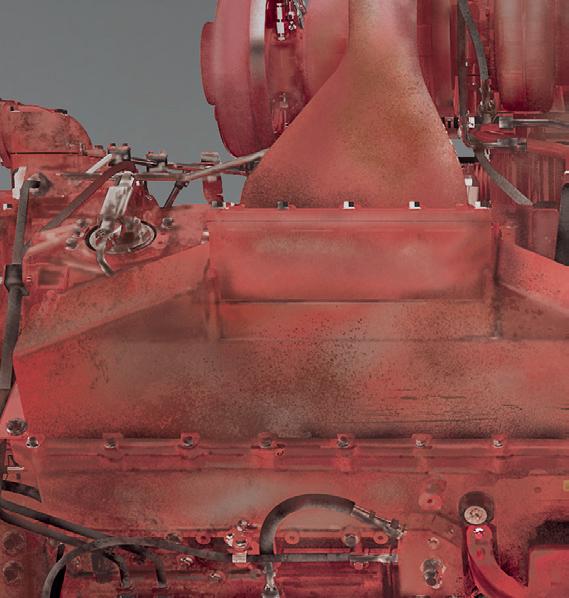

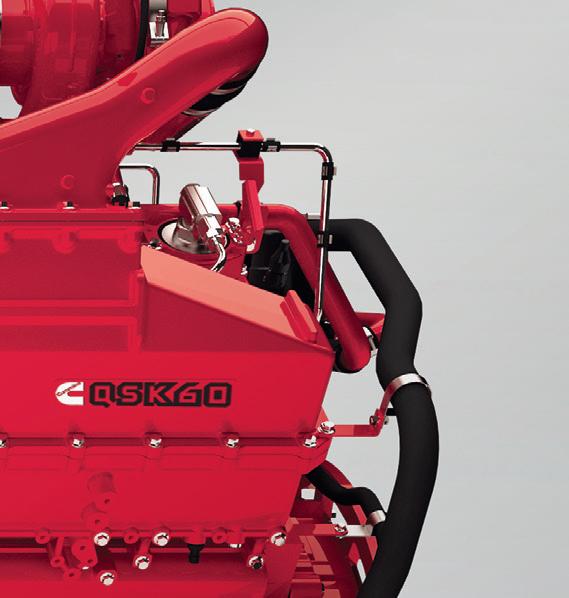

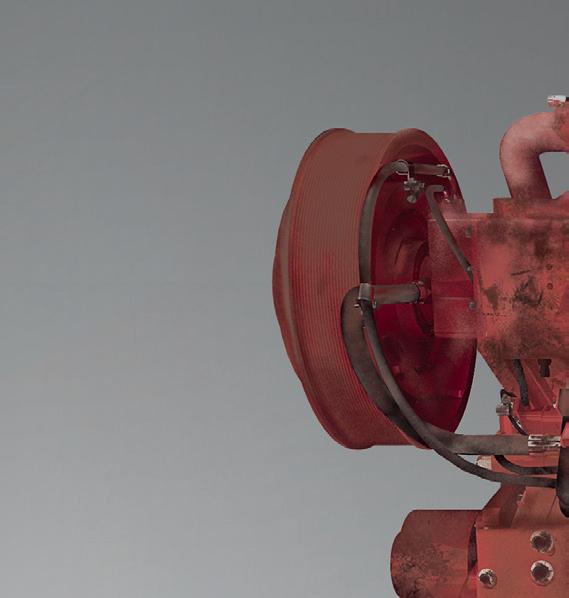

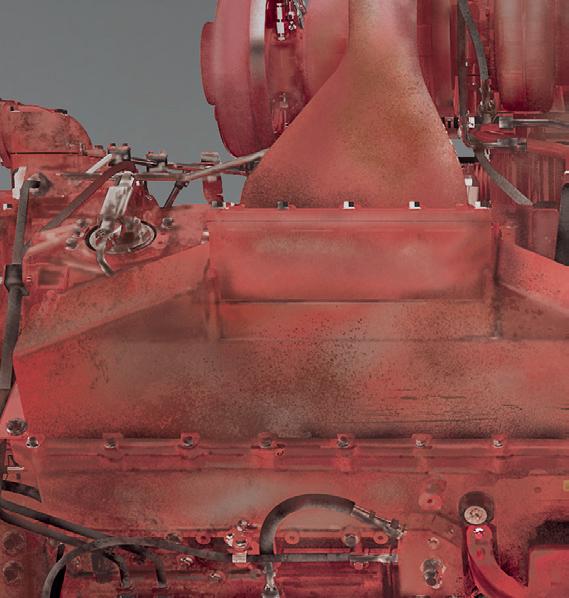

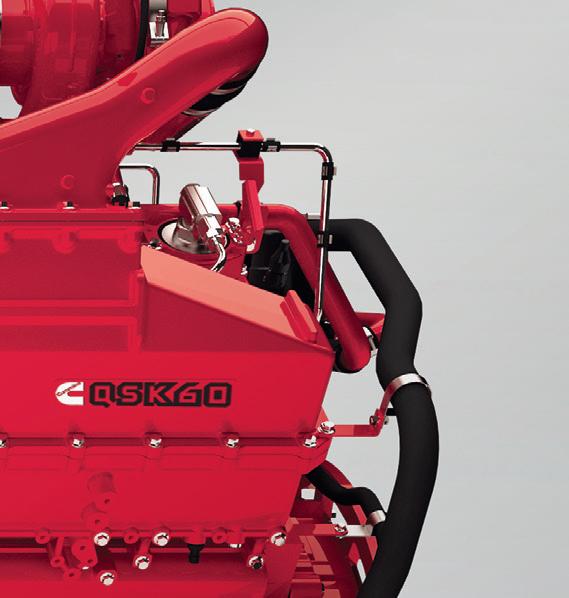

14 Maximising Engine Life For Mining Operations

Sean Lynas, Power Systems Industrial Markets Director, Cummins, UK, reviews the importance of long-term partnership and smart optimisation for extending the operational life of engines.

19 Enabling Interoperability In Rotary Drilling

Anu Niittynen, Sandvick Mining, USA, details the role of the iLink Data Interface in modern mining systems.

24 Forging A New Era In Gold Smelting

Qu Shengli, President, Shandong Humon Smelting Co., Ltd., China, considers the century-long dilemma of gold smelting and outlines how a leading Chinese smelter has remained dedicated to technological innovation in the sector.

29 From Theory To Throughput: Transforming Mine-To-Mill Optimisation

Eden Paki, Orica Digital Solutions, Australia, discusses how digital platforms are bringing about measurable gains in recovery, productivity, and sustainability.

Mike Rikkola, Vice President, Software Defined Vehicle and Autonomy Platforms, Komatsu, USA, explains the importance of collaborations with Silicon Valley for mining companies and the industry in general.

38 Connectivity: The Key To Modern Mining

Osama Oulabi, General Manager – Kingdom of Saudi Arabia & Middle East at Speedcast, addresses the increasing importance of AI and automation across MENA mining projects.

41 Mining’s New Playbook

Ben Lawrence, Gecko Robotics, USA, evaluates the optimisation of infrastructure health in mining, and considers the importance of speed, smarter CAPEX, and identifying the root cause when tackling issues.

45 Mining’s Hidden Advantage: The Untapped Power Of Data-Driven Services

Hernan Muniz, Weir, Australia, explores how the mining industry can effectively combine new technology and data insights with domain expertise to maximise the potential of mining solutions.

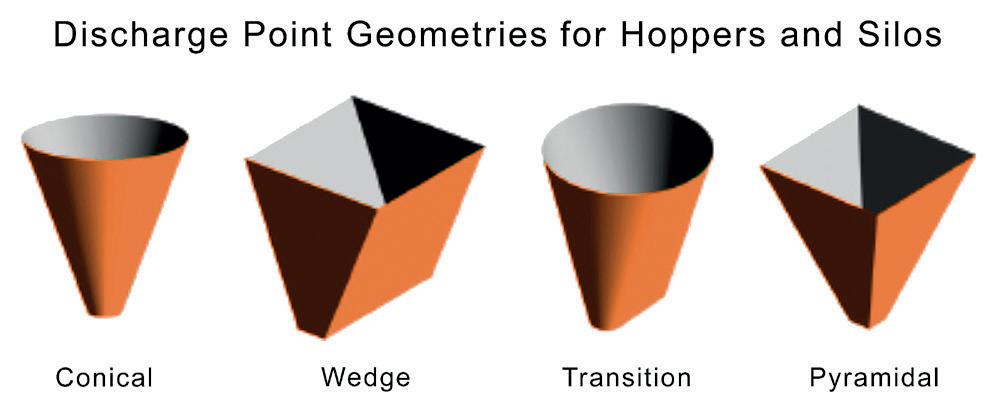

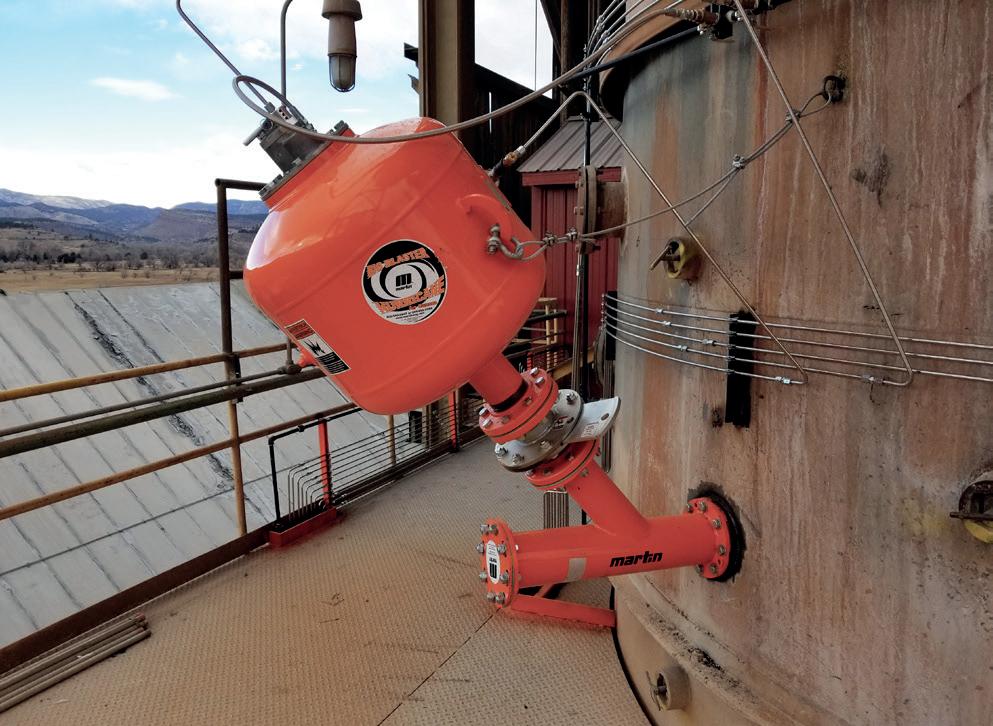

49 Blast The Blockages And Buildups

Brad Pronschinske, Martin Engineering, USA, highlights the importance of understanding material flow in silos and hoppers, and how blockages and buildups can be prevented.

53 Reaching New Depths With XRF

Ling Schneider, Product Manager, XRF, Thermo Fisher Scientific, outlines how XRF technology is driving precision and efficiency in mining.

56 Pumping Up Profits

Kelly Baker, Xylem Dewatering Solutions, USA, describes how designing the right slurry pump system is key for mining success.

61 Safety First: The Evolution Of Robotics In Mining

Alessandro Gerotto, Alberto Feletto, Daniel Devo, and Edoardo Marangoni, Gerotto, Italy, report on how the use of robotic machinery is enhancing safety for operators in the mining industry.

Through long-term partnerships, Cummins is helping miners maximise engine life using data-driven optimisation, predictive maintenance, and advanced rebuild programmes. The article on page 14 examines steps operators can take to improve reliability, reduce costs, and cut emissions when combined with long-term partnership. Offering a grounded look at how proven technologies are shaping the future of high-horsepower performance.

ulk material that gets stopped due to obstruction can cause some serious and costly problems: unscheduled downtime, potential injuries, lost production, and diminished profits.

Martin®Air Cannons are the best way to clear accummulation or buildup, simplify maintenance and ensure continuous flow. Our cannons feature innovative valve designs that deliver more power with less air volume — highly effective with challenging wet and sticky materials.

Don’t get jammed. Martin delivers material flow solutions so you can maintain throughput, improve safety and reduce operating costs.

MANAGING EDITOR

James Little james.little@globalminingreview.com

SENIOR EDITOR

Callum O’Reilly callum.oreilly@globalminingreview.com

EDITOR Will Owen will.owen@globalminingreview.com

EDITORIAL ASSISTANT

Jody Dodgson jody.dodgson@globalminingreview.com

SALES DIRECTOR

Rod Hardy rod.hardy@globalminingreview.com

SALES MANAGER

Ryan Freeman ryan.freeman@globalminingreview.com

PRODUCTION MANAGER

Kyla Waller kyla.waller@globalminingreview.com

ADMINISTRATION MANAGER

Laura White laura.white@globalminingreview.com

DIGITAL ADMINISTRATOR

Nicole Harman-Smith nicole.harman-smith@ globalminingreview.com

DIGITAL CONTENT ASSISTANT

Kristian Ilasko kristian.ilasko@globalminingreview.com

JUNIOR VIDEO ASSISTANT

Amélie Meury-Cashman amelie.meury-cashman@ globalminingreview.com

HEAD OF EVENTS

Louise Cameron louise.cameron@globalminingreview.com

DIGITAL EVENTS COORDINATOR

Merili Jurivete merili.jurivete@globalminingreview.com

EVENT COORDINATOR

Chloe Lelliott chloe.lelliott@globalminingreview.com

The mining industry has forever been subject to the consequences of international relations and politics – not to say the uncertainties caused by domestic policies in the era of resource nationalism. The recent decay of the post-war, rules-based order, together with the race for critical minerals, have taken that uncertainty to a different level.

These challenges have been amplified by the trade wars sparked by tariffs introduced under the Trump administration. The effect of those tariffs on the movement of critical minerals around the planet has yet to be definitively determined, but the need to secure supply chains has never been greater. Probably the greatest shift has been the perceived need to reduce reliance on Chinese exports. This has become especially critical in the case of resource-constrained Europe, but the issue also resonates in the US which, by common consent, is many years behind China in both sourcing mineral supplies and facilitating processing.

Just a few examples illustrate the problem – China controls more than 90% of global supply of processed graphite, manganese, and rare earths, and more than 70% of cobalt and lithium. In a level playing field within a free trade environment, this would not necessarily be an issue. However, China (and other countries) have not been afraid to use mineral dominance to reinforce political and economic imperatives. Most recently, China used its dominance in lithium mining and processing to trigger fluctuations in price. Its dominance in the supply of processed energy transition metals has the potential to cause chaos in supply chains – neither the US nor anywhere else will come close to challenging China’s dominance for many years to come.

Several Gulf nations, now with significant financial firepower and a desire to play a bigger role on the international stage, are having an impact across the industry. In the case of Saudi Arabia this has been in an attempt to boost investment in its domestic mining potential (mining is the third pillar of Saudi’s Vision 2030). In Saudi and other Gulf states, taking advantage of cheap local energy to develop metal processing infrastructure has seen significant investment. For many Gulf nations with sovereign wealth funds – in particular Saudi, Abu Dhabi, and Qatar – capital has been deployed to invest in the mining industry globally, particularly in Africa but also in South America (for example Manara’s investment in Vale’s base metal subsidiary).

A further example of geopolitical influence on the mining sector can be seen in the Sahel region of Africa, where terrorist activities have posed challenges for mining projects – particularly gold – in Burkina Faso, Mali, and elsewhere. Their emergence has no doubt been assisted by the breakdown in stable government and, in the case of Francophone countries, a fracturing of the relationship with France (since 2020 there have been six successful coups across the region). The Global Terrorism Index reported that in 2024 Burkina Faso was the country most affected by terrorism globally, repeating its position in 2023. Mining provides a lucrative source of revenue for these groups so, without effective military intervention, this is a problem which is not going to go away. Suggestions that Russia – including the Wagner group – might enable some stability appear to be wide of the mark.

These are just three examples of how geopolitics is impacting the mining industry. There are many more – and the current global political climate suggests those impacts are unlikely to fade

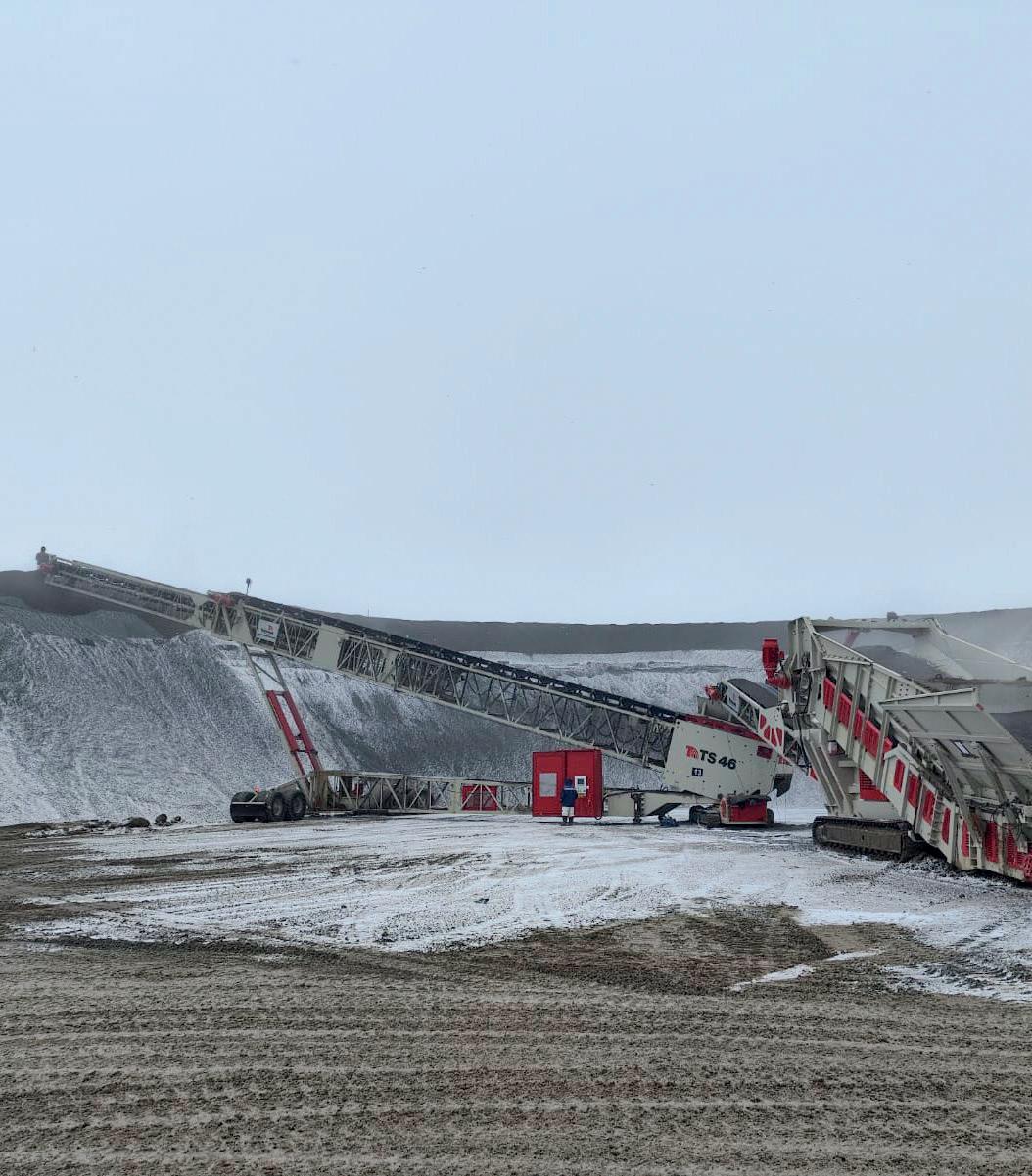

Caravan Resources Places Its Second Major Heapleaching Order with Telestack.

Discover how Caravan Resources transformed their copper ore handling at their heap-leaching operation with three TITAN 800-6 Bulk Reception Feeders and three TS 46 Radial Telescopic Stackers. This powerful Telestack configuration delivers unmatched flexibility, mobility, and throughput, streamlining material flow while reducing double handling and operational costs. Designed for high-volume copper ore applications, the system ensures precise stacking, consistent leach pad coverage, and rapid deployment across multiple sites.

Komatsu is strengthening its commitment to Canadian customers with a major investment to double the size of its parts distribution footprint and transform its Edmonton, Alberta, parts depot into a full-service distribution centre.

This expansion marks a significant step in Komatsu’s ongoing effort to enhance service levels, reduce lead times, and better support dealers and customers across Canada.

The new facility, spanning approximately 135 000 ft2, will double the capacity of Komatsu’s existing warehouse. This upgrade enables Komatsu to store and distribute fast-moving parts directly from Edmonton, significantly improving delivery times – including 24-hour delivery capabilities to its dealers in western Canada.

“Our customers rely on Komatsu for uptime and productivity, and this investment ensures we can meet those expectations faster and more efficiently than ever”, said Danny Murtagh, Vice President of Parts and Infrastructure. “By bringing parts closer to where our customers operate, we’re cutting lead times, boosting availability, and improving customer service.”

The expanded Edmonton facility will transition from a regional depot to a fully integrated parts distribution hub – serving as a cornerstone of Komatsu’s North American logistics network and streamlining supply routes from Komatsu’s global manufacturing hubs in Japan and Indonesia. Key features of the new operation include: expanded capacity for faster-moving and strategic inventory; advanced system integration with Komatsu’s global planning and warehouse management system (WMS) platforms; improved warehouse efficiency through updated layouts, automation, and new equipment; and enhanced workforce capacity, with plans to add additional staff and technological support.

The investment underscores Komatsu’s long-term confidence in its Canadian dealer partners and in the Canadian market. With the country’s mining, forestry, and construction sectors continuing to grow, the upgraded facility ensures Komatsu is well-positioned to support increased demand while maintaining its industry-leading service standards.

Epiroc, a leading productivity and sustainability partner for the mining and infrastructure industries, has partnered with Cal-Nevada Precision Blasting in the US for surface drilling equipment and aftermarket support.

Cal-Nevada Precision Blasting, a premier drilling and blasting contractor serving the states of Nevada and California, has deployed a fleet of Epiroc SmartROC D65 surface drill rigs, known for their automation and precision features. The company specialises in controlled blasting solutions for mining and infrastructure projects, with decades of experience in trenching, mass excavation, quarry operations, and speciality blasting

In addition to the equipment, Epiroc will provide a comprehensive package of spare parts, drilling tools, technical service, and training to support optimal performance.

“In the dynamic US infrastructure and construction market, we continue to see increasing demand for smart and efficient equipment that helps accelerate project timelines and

improve precision”, says Jonathan Torpy, President and General Manager of Epiroc USA. “We are proud to support Cal-Nevada Precision Blasting in delivering safe and efficient solutions for their customers.”

“At Cal-Nevada, accuracy and compliance are critical to every project we deliver”, says Don Emborsky, President of Cal-Nevada Precision Blasting. “Investing in advanced equipment from Epiroc ensures that we can maximise productivity while upholding the highest standards for safety and environmental responsibility.”

The SmartROC D65 drill rigs are built to face the toughest of conditions. The efficient machine consistently delivers high-quality blastholes with accuracy and precision and is loaded with smart features such as automated drilling and rod handling.

Delivery of the equipment has begun and will run approximately through the end of 2025.

The Mining Show

17 – 18 November 2025

Dubai, UAE www.terrapinn.com/exhibition/ mining-show

Resourcing Tomorrow 02 – 04 December 2025

London, UK www.resourcingtomorrow.com

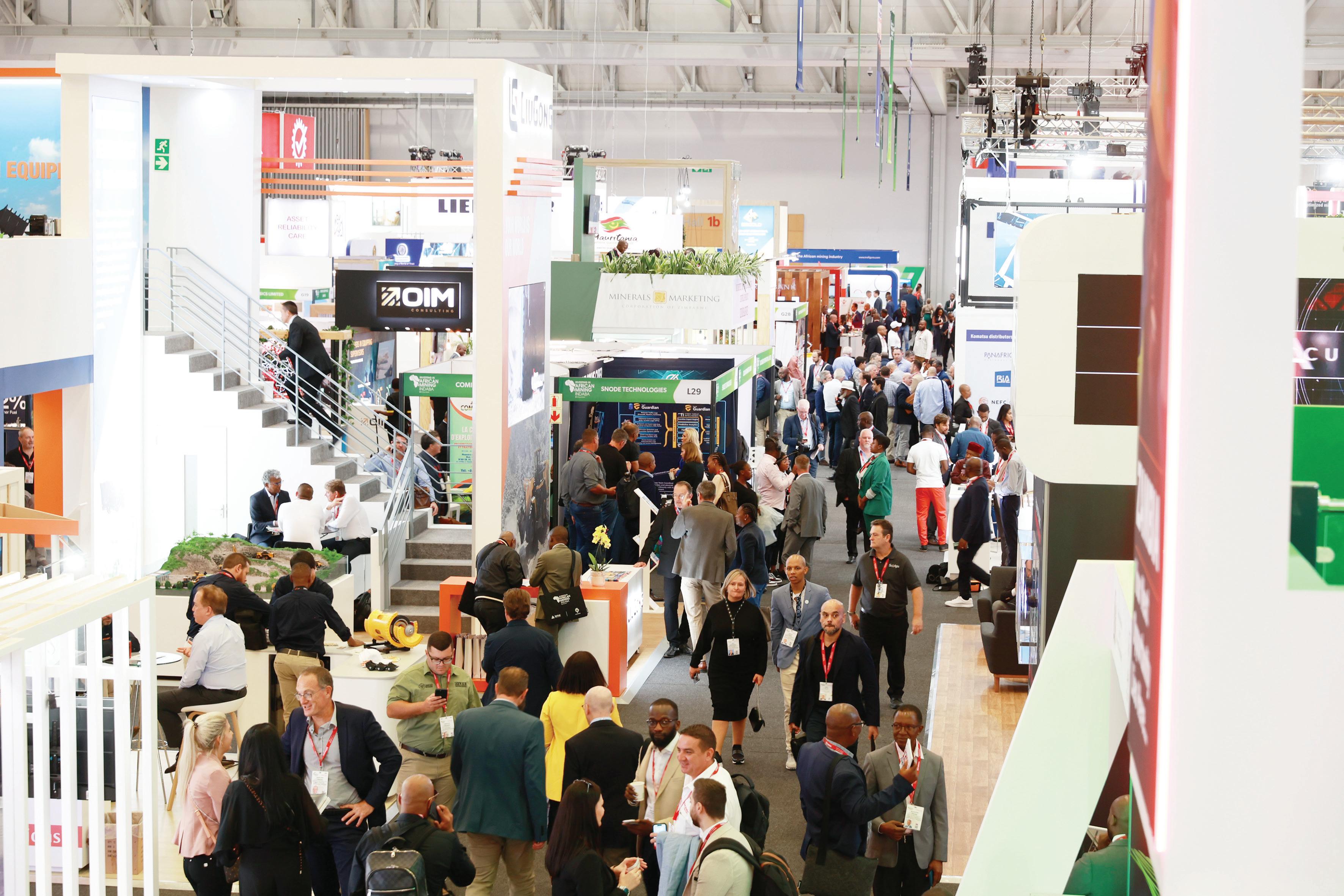

Investing in African Mining Indaba 2026

09 – 12 February 2026

Cape Town, South Africa www.miningindaba.com

SME MINEXCHANGE 2026

22 – 25 February 2026 Salt Lake City, USA www.smeannualconference.org

PDAC 2026

01 – 04 March 2026 Toronto, Canada www.pdac.ca/convention-2026

CONEXPO-CON/AGG 2026

03 – 07 March 2026 Las Vegas, USA www.conexpoconagg.com/ conexpo-con-agg-constructiontrade-show

EXPONOR Chile 2026

08 – 11 June 2026

Antofagasta, Chile www.exponor.cl/en

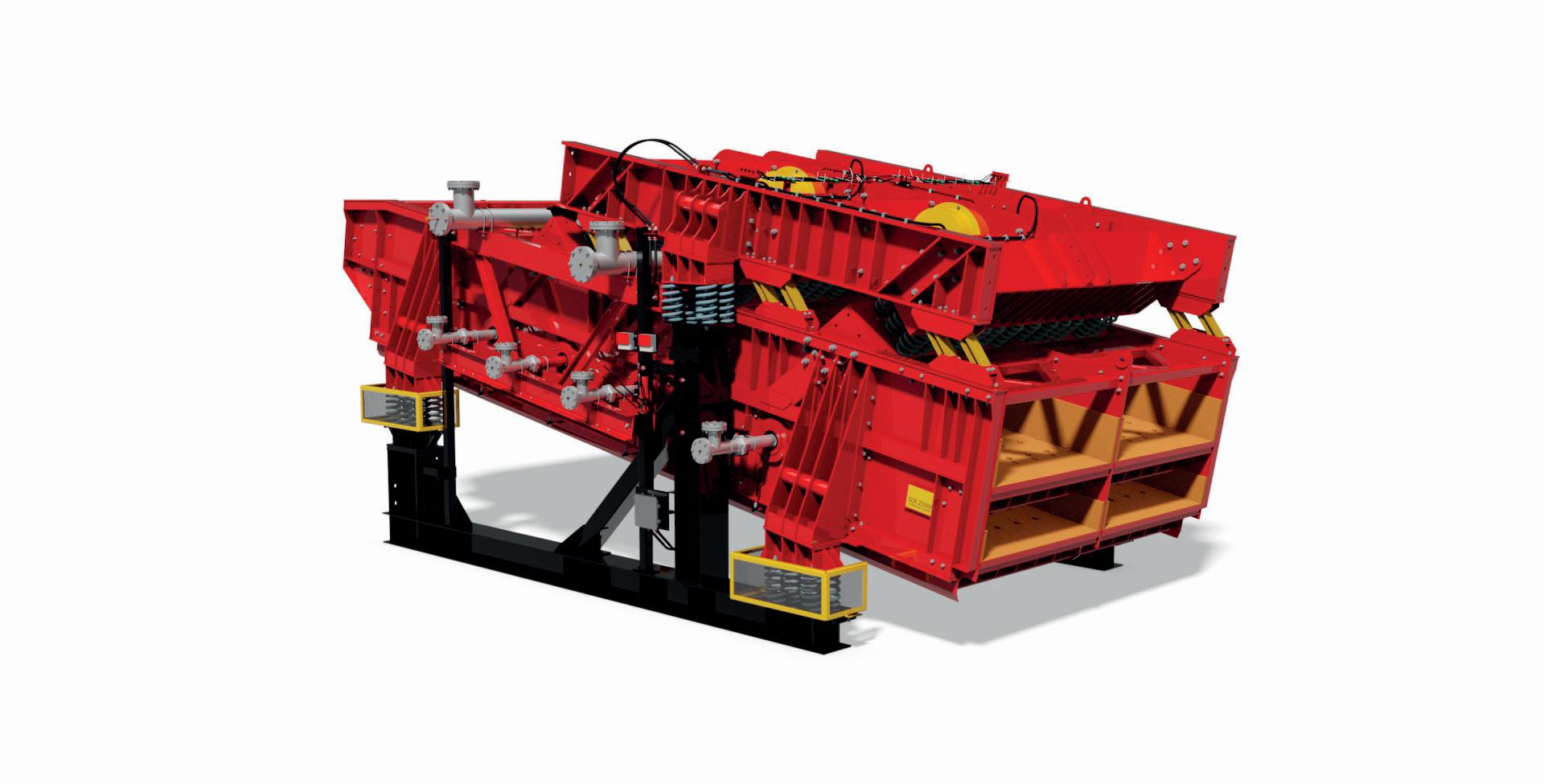

General Kinematics, a vibratory equipment manufacturer and system integrator based in Crystal Lake, Illinois, has announced its acquisition of Llambec Technology, a South African-based manufacturer and distributor of vibratory equipment.

Llambec Technologies has engineered, designed, and manufactured vibratory equipment for the mining, aggregate, and bulk materials industries for more than 40 years. By integrating Llambec’s robust capabilities, General Kinematics continues its commitment to innovation, quality, and sustainable solutions for its valued customers.

Thomas Musschoot, General Kinematics’ CEO, commented, “We are thrilled to welcome Llambec Technology into the General Kinematics family. This acquisition strengthens our ability to serve key markets across Africa and beyond, while continuing to deliver the innovative solutions our customers expect from GK.”

Davide Gado, Managing Director of GK Europe, GmbH, stated, “The acquisition of Llambec Technology represents an important milestone in General Kinematics’ strategic growth across the EMEA region. It reinforces our commitment to investing in strong regional partnerships that bring us closer to our customers and enhance our ability to deliver integrated, high-value solutions. Llambec’s established presence and expertise in the African market will accelerate our expansion and strengthen GK’s global leadership in vibratory technology and sustainable material processing.”

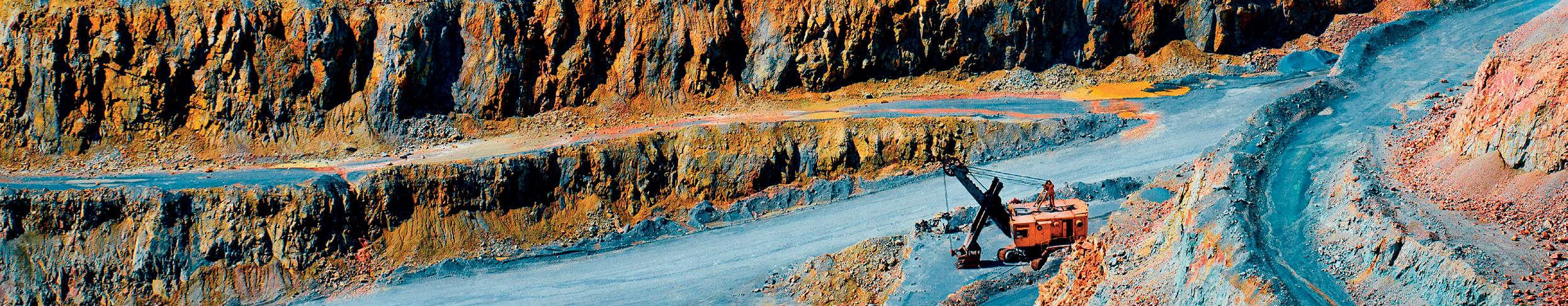

Vedanta Resources Ltd has announced the launch of CopperTech Metals Inc, a US-domiciled company with a mission to ‘Power the Copper Century’ and to bolster America’s copper security needs while capitalising on surging copper demand driven by artificial intelligence (AI), data centre expansion, grid modernisation, defence technologies, and industrial onshoring requirements.

CopperTech will own and operate the Konkola Copper Mines in Zambia, one of the highest-grade copper producing assets in the world with proven cobalt reserves. CopperTech intends to build on the existing US$3 billion investment made by Vedanta in the Konkola Copper Mines – which included construction of a deep mine shaft, a smelter, and a concentrator, and engaging in general mine development – and intends to invest an additional US$1.5 billion in the operations.

CopperTech intends to leverage advanced mining and cutting-edge AI-driven resource identification and extraction technology, as an integral part of its plans to expand production capacity and enhance operational efficiency from the current planned integrated copper production levels of 140 000 t in FY26 to 300 000 t by 2031. With future investments, and supported by proven and probable reserves, CopperTech has plans to raise production levels to 500 000 tpy, which the company believes would position it among the leading copper producers in the world.

Discover the world of Gebr. Pfeiffer Mining

Discover the benefits of dry grinding for your mining operation! Delivering improved mineral liberation, Pfeiffer vertical mills increase your yields, cut your energy and resource costs, and generate less undesirable fines. They are also ideally suited to expanding your existing plant to meet new environmental regulations.

Take the efficiency test. Tell us about your ore – we’ll advise you and carry out dry grinding tests in our technical center before surprising you with the results of the recovery.

Rock your recovery rate – Getting it done!

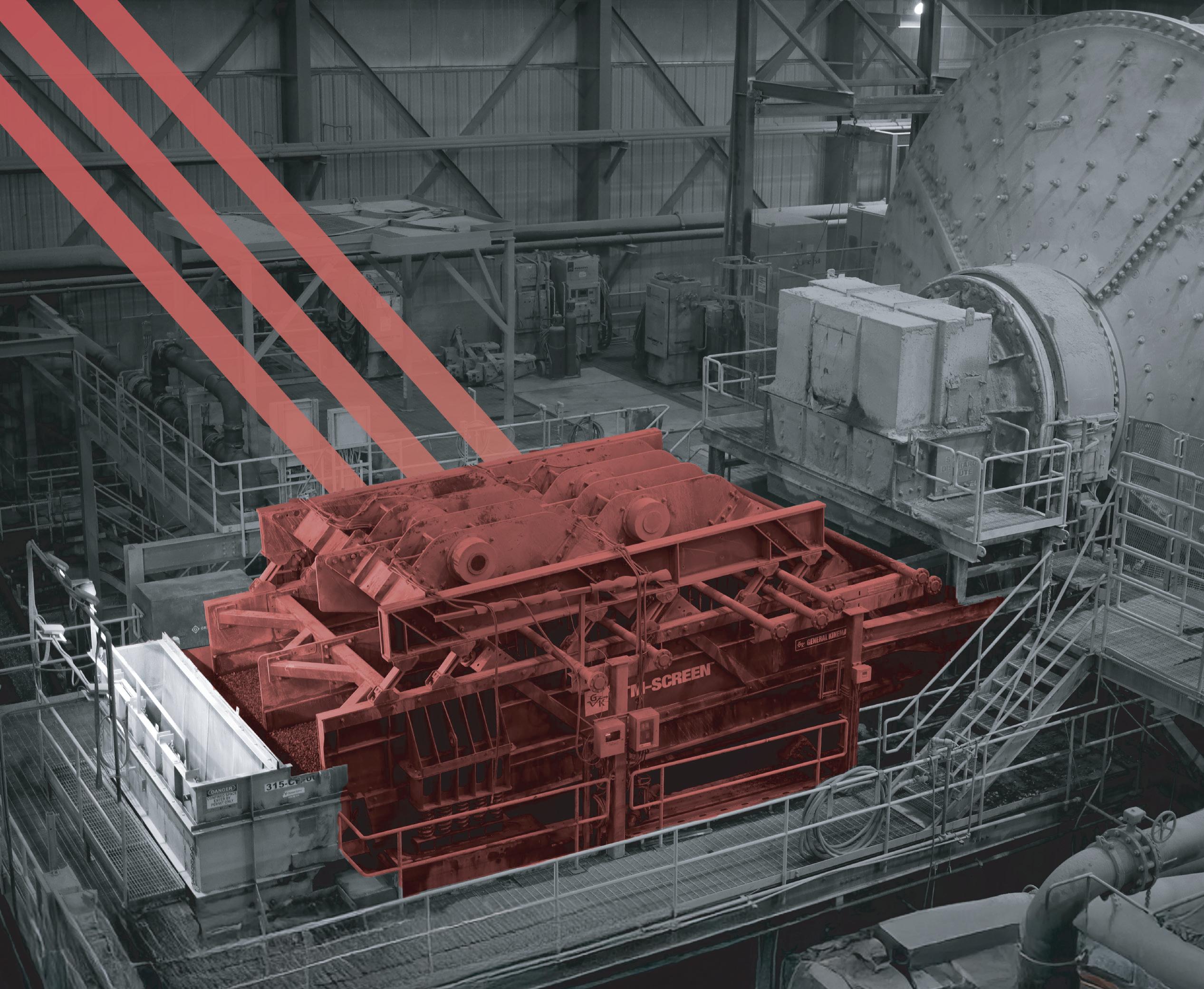

TAKRAF Group strengthens its South American presence with a key DELKOR Flotation Cell contract and commissioning of a test centre

TAKRAF Group’s liquid/solid separation technologies, marketed through the DELKOR brand, are gaining momentum in the South American market, with the award of a significant order from a major Brazilian mining and iron ore company and the inauguration of a pilot plant and laboratory facility.

The order from the Brazilian company represents an important breakthrough for DELKOR’s BQR flotation technology in one of the world’s most competitive mining markets. It includes the supply of 24 DELKOR BQR200 and 12 DELKOR BQR300 Flotation Cells. The decision by the mining company to replace its existing technology, which had been provided by another company, with the DELKOR cells was based on successful testing of DELKOR’s proprietary MAXGen™ mechanism in one of the mine’s existing flotation cells.

Since their launch in 2020, the new generation DELKOR BQR Flotation Cells have been adopted globally for their high metallurgical efficiency, reliability, and adaptability. Equipped with the MAXGen mechanism, they improve metal recovery while reducing power consumption and cost of ownership and offer greater ease of maintenance.

Developed through extensive research, MAXGen generates a swarm of air bubbles with optimum size distribution. A careful trade-off between agitation levels and the bubble

distribution facilitates the flotation of fine and coarse particles equally, which is especially relevant for the flotation of low-density minerals, while efficiently keeping solids in suspension. This maximises bubble-particle interaction and improved flotation kinetics.

The cells are used in roughing, scavenging, cleaning, and re-cleaning applications to process a range of commodities from copper, zinc, and platinum group metals to phosphates, graphite, slag, and effluents. Key design advantages include a rotor-stator configuration that allows lower tip speed to reduce operational costs from lower wear and power consumption. Air is introduced through the rotor shaft for precise control over air flow and distribution, with adjustable airflow and froth-crowder settings. Custom launder designs ensure optimal lip loading and froth carry rates, while optional internal or external dart valves enhance safety. Other features include precise froth level control instruments and cell bypass, which improves circuit flexibility and, for larger cells, facilitates quick, easy, and safe cell maintenance.

The DELKOR BQR Flotation Cells range in sizes from 1.5 m³ (BQR15) to 300 m³ (BQR3000). In addition to new installations, they can be retrofitted into units from other OEMs. This offers mining companies a fast-track method to improve recovery rates and reduce operational costs.

In a significant move to strengthen DELKOR’s presence in the South American market, TAKRAF Group recently inaugurated, in partnership with the Gorceix Foundation, a flotation cell pilot plant and a comprehensive laboratory for conducting various liquid/solid separation tests. Based in Ouro Preto, Brazil, this is the first TAKRAF Group pilot facility of its kind globally.

A significant feature of the pilot plant is its industrial scale. This provides customers with the confidence that the results achieved during testing will be replicated in the field, as opposed to making decisions based on tests that may not be representative.

The new laboratory, the largest of its kind in Brazil, will enable a full suite of tests, including filtration, rheology, and static and dynamic sedimentation analysis. These tests are key to the optimal selection and sizing of liquid/solid separation equipment – such as DELKOR Thickener and DELKOR Filter Press.

TAKRAF Group is celebrating its 300-year anniversary this year, having evolved from an iron hammer mill, established in 1725. Having grown exponentially over time, contributing many industrial and technological milestones, TAKRAF Group is, today, a major global company serving the mining and related industries, with a presence in 14 countries on six continents.

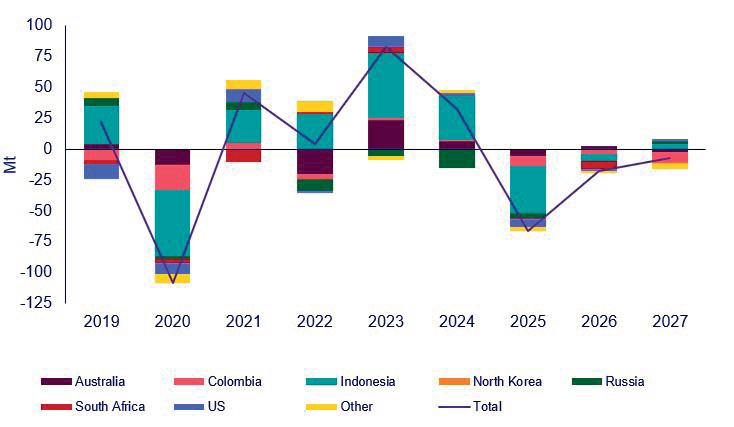

Sushmita Vazirani, Wood Mackenzie, examines how South Africa is navigating the twilight of thermal exports.

As seaborne demand begins its descent from peak levels, South Africa – once a cornerstone of international coal trade – faces mounting challenges. These illuminate broader trends reshaping energy markets worldwide.

Peak coal’s aftermath

Seaborne thermal coal exports will fall from 1.080 billion t in 2024 to approximately 1.015 billion t in 2025. This decline stems primarily from a 60 – 65 million t reduction from China. The shift signals coal’s structural retreat from global energy systems. Yet this transition proves far from uniform.

Climate imperatives and technological

advances drive long-term decline. Near-term dynamics reveal surprising resilience in specific regions. India and Southeast Asia continue modest growth trajectories through 2040.

China maintains substantial domestic production to reduce import dependence. South Africa exemplifies these contradictions. The country produces approximately 235 million t annually – 98% classified as thermal coal. The Mpumalanga Central Basin accounts for 79% of total output in 2025.

The Witbank (eMalahleni) coalfield represents the largest producer. It accounts for 56% of South Africa’s total marketable production in 2025. The Highveld coalfield

follows at 22%. Witbank’s contribution gradually decreases as major global companies divest and key mines approach depletion.

Wood Mackenzie’s asset-level analysis shows South African marketable coal production declining from 238 million t in 2024 to 209 million t by 2030. This reflects mine closures in depleting reserves rather than demand destruction.

Three critical challenges reshape South Africa’s coal landscape. These include reserve depletion, infrastructure constraints, and financing difficulties.

Reserve depletion emerges as the primary threat. Several major Australian coal mines face depletion by 2035. Key Indonesian basins confront similar timelines. The 2030s usher in faster resource depletion, sparking need for new capacity.

Beyond 2030, remaining coal lies deeper underground in thinner seams or remote locations. This dramatically increases extraction costs. A race emerges between declining demand and reserve depletion. Supply in the long term becomes a contest between these opposing forces.

Infrastructure bottlenecks compound these challenges. Over the past three years, Transnet Freight Rail’s performance has deteriorated significantly. It has fallen well below 60 million t annually. South Africa compensates through road transport to minor terminals – RB Dry Bulk, Matola, and Durban. This becomes unsustainable when seaborne prices fall below US$100/t.

Wood Mackenzie estimates total coal exports from minor terminals will fall from their peak of 19.1 million t in 2023 to 12.6 million t in 2025. Major South African producers remain locked into 10-year rail and port take-or-pay contracts until 2025. Contract renewals still underway appear unlikely at current volumes.

Financing constraints create the third major hurdle. ESG scrutiny has eliminated traditional project finance for coal developments. Equity funding shortages mean coal-related projects face increased scrutiny from institutional investors. Self-funding and non-disclosed partnerships now play important roles in project finance. Despite these challenges, South Africa maintains competitive advantages. Wood Mackenzie estimates average export total cash costs at US$65 – 68/t in 2025. This represents a 2% y/y increase compared with 2024. Local currency depreciation has preserved competitiveness over the past decade.

The evolving landscape reveals fundamental shifts in coal market dynamics. Quality premiums increasingly matter as buyers prioritise efficiency over cost considerations. High-CV suppliers gain market share whilst low-grade producers face margin compression.

Indonesia faces visible pressure. The country has long anchored global thermal supply particularly in low-CV grades. January-August shipments have been approximately 34 million t lower y/y. Higher domestic production in China and India squeezed import demand.

Meanwhile, high-CV suppliers receive relatively better support. Resilient demand from Japan, South Korea, and Taiwan drives this trend. By 2050, Pacific suppliers are expected to strengthen their positions despite overall market contraction. Indonesia is set to lead exports despite decline whilst Australia is expected to gain market share as high-CV demand grows.

Environmental considerations add complexity. Scope 1 and 2 emissions from global seaborne coal mines range widely. They span from around 9 kg/t CO2e to over 700 kg/t CO2e. This variation creates differentiation opportunities for lower-emission producers.

South Africa benefits from this trend. Exports return to traditional Asian markets led by India. However, competition with Indonesian suppliers for declining demand will intensify over the long term.

Wood Mackenzie forecasts total exports to fall below 60 million tpy in 2027 – gradually declining to approximately 25 – 30 million t by 2050.

Wood Mackenzie estimates seaborne thermal coal exports from South Africa at 65 – 67 million t in 2025. However, maintaining thermal coal exports above 60 million tpy becomes difficult as Witbank coalfield reserves deplete and many global companies divest. Take-or-pay contracts also expire in 2026.

Over the longer term, Wood Mackenzie expects average mining costs to gradually decline in real terms. They will fall from R802/t in 2028 to R729/t by 2039. Higher-cost operating mines close during this period. New mine developments focus on maintaining domestic power station supply and residual export demand. Only projects in Mpumalanga province remain economically viable. These sit 500 – 600 km from Richards Bay Coal Terminal. Limpopo province developments no longer feature in base case scenarios. They sit around 1100 km from export facilities.

This geographic concentration reflects broader industry rationalisation. Margins compress and financing

constraints tighten. Only the most efficient, well-located operations survive. The result: a smaller but potentially more profitable industry serving specific market niches.

For energy industry decision makers, South Africa’s coal transition offers valuable insights. The country demonstrates how to manage industrial decline whilst maintaining operational excellence. Its experience navigating currency volatility, infrastructure constraints, and financing challenges provides lessons applicable across commodity sectors facing similar transitions.

South Africa’s coal story continues, but its trajectory points downward. How the industry manages this descent will determine whether the transition proves orderly or chaotic – and the implications extend far beyond coal markets themselves.

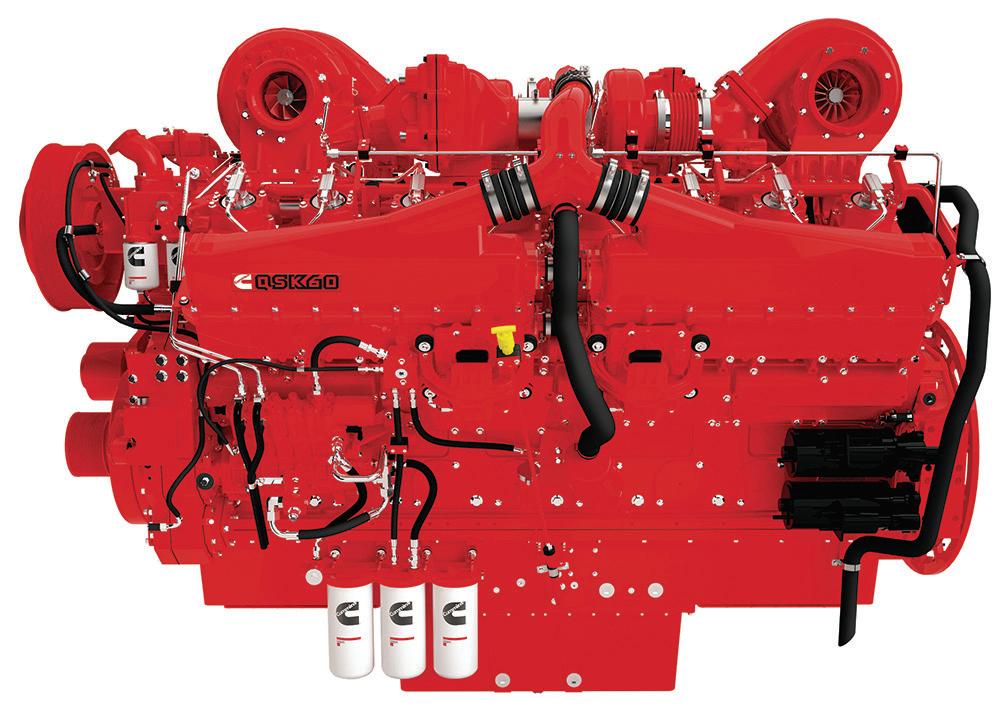

It is clear why long-term equipment stability is so highly valued within the mining sector. Operators need machines that return value on investment, can operate reliably for a long time in harsh conditions, and experience as limited amount of unexpected downtime as possible.

The engine is critical to overall equipment performance, which is why Cummins takes the long view when it comes to its support model for miners, combining a century of engineering expertise with their extensive service network to deliver powerful performance throughout the entire

engine lifecycle. How this plays out in the field can be seen in several ways.

Extending the operational life of engines is one of the most effective ways to improve productivity and reduce costs. Put simply, a long-lasting engine benefits miners in one of two ways – either through fewer rebuilds within the total machine life, or by extending the length of total life.

Sean Lynas, Power

Director, Cummins, UK, reviews the importance of long-term partnership and smart optimisation for extending the operational life of engines.

Cummins achieves this by collecting real-world data and applying engineering insights to optimise engine performance and reduce wear.

The QSK60 engine used in large mining excavators is a prime example of this approach. Originally rated for 12 000 hours under typical load conditions, Cummins extended its life to overhaul to 18 000+ hours through a combination of rigorous durability testing, component optimisation, and refined maintenance practices. These improvements are based on collaborative customer projects that allow engineers to further optimise for the challenges of specific mining environments.

Having fewer rebuilds due to extended engine life also means having less downtime and lower total operational cost, providing greater value to mining operators. This approach demonstrates that combining engineering expertise with field insights can unlock substantial benefits over the engine’s operational lifetime.

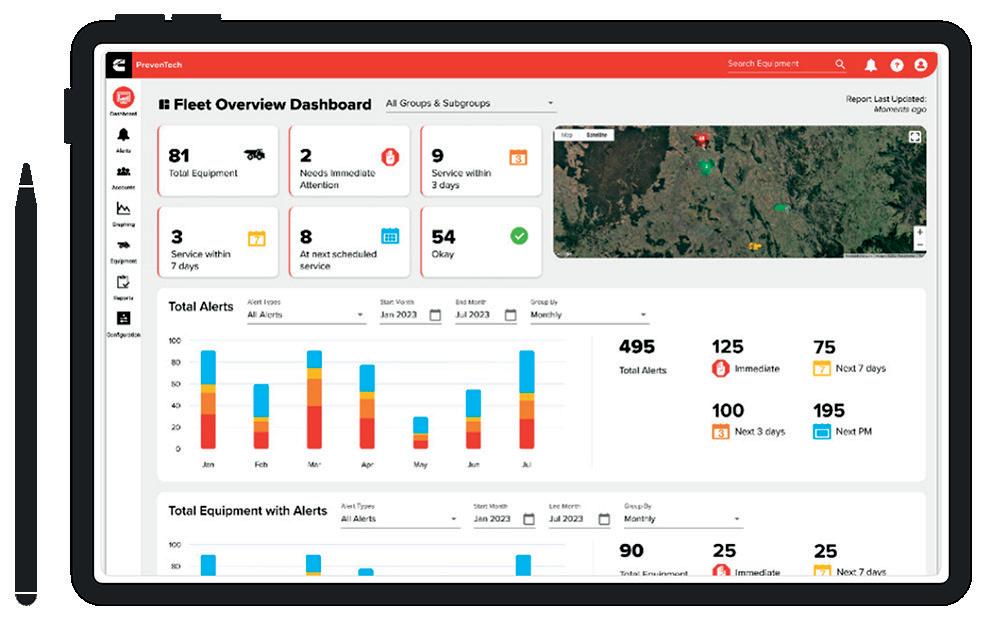

To keep fleets performing as expected, miners require real-time visibility into in-field equipment operating conditions. Modern connected systems enhance this visibility, delivering real-time insights.

Cummins’ PrevenTech is a smart, integrated engine reliability and performance solution that combines real-time data monitoring, advanced predictive analytics, and 24/7 expert support to ensure Cummins engines

operate at peak performance. Connected engines transmit alerts for urgent or potential issues, along with recommended maintenance actions based on real-world usage.

PrevenTech enables operators to:

� Optimise maintenance intervals for each site, using data insights to hone performance.

� Track component wear to identify what servicing is required for maintenance, maximising uptime.

� Monitor engine health remotely to predict maintenance requirements ahead of potential engine failures.

� Proactively plan downtime and repairs to minimise disruption.

Even with the best preventative measures, engines require routine maintenance. Repair and maintenance needs – especially when unexpected – can be difficult to manage, a challenge made easier through accessible support.

Cummins supports engine longevity and reliability not only through product design and advanced analytics, but also through its extensive global service network, spanning 190+ countries across six continents through 600+ distributor locations, 3700+ certified high-horsepower technicians, and 17 high-horsepower master rebuild centres.

Part of Cummins’ commitment to offering service programmes and options that fit every mine site’s needs includes its customisable PowerCare™ CpH contracts, which provide predictable maintenance costs, covering parts, labour, and scheduled or unscheduled maintenance over the engine lifecycle. Customers using CpH and Cummins’ global service network can achieve over 97% engine availability.

By forecasting maintenance costs related to repairs, mid-life, and rebuilds, miners can operate with reduced operational risk.

With or without CpH contracts, Cummins maintains a robust inventory of ‘swing’ – or replacement – engines to keep mine sites up and running while service is under way.

Part of the beauty of Cummins engines is that they are built to withstand 3+ rebuild cycles. When rebuilds are required, it is important to invest strategically to return the best long-term value possible.

Cummins’ global network of 17 high-horsepower Master Rebuild Centres (MRCs) extend the life of high-horsepower engines, including long-time favorites like the QSK38, QSK50, QSK60, and more. Through a six-stage process, engines are disassembled, cleaned, inspected, re-machined, re-built with genuine Cummins parts, and tested to meet or exceed factory standards, as rebuilt units include a rebuild warranty included on rebuilt units

Rebuilds provide a cost-effective option to enhance operational efficiency, reduce environmental impacts, and maximise the value of existing assets without the expense or downtime of replacing engines. While rebuilds take an average of 35 hours, they occur while the machine resumes operation with a Cummins-provided swing engine. Cummins’ HHP MRCs also support Cummins’ sustainability goals by using 85% less raw materials than new engine production, reusing water, and minimising scrap.

Approaching a rebuild also provides the opportunity to consider new ways to tailor equipment to mine profiles and generate greater efficiency.

Many operators are upgrading their QSK60 and QSK78 engines from older HPI fuel systems to Cummins’ Modular Common Rail Fuel System (MCRS). For convenience, this upgrade is performed during the engine rebuild process at Cummins’ high-horsepower MRCs.

The MCRS system provides a range of benefits:

� Fuel savings of 3 – 5% through precise high-pressure injection.

� Particulate emissions up to 63% lower compared to previous HPI systems.

� Extended engine life by up to 10% to overhaul.

� Smoother operation and faster cold starts.

� Lower total cost of ownership.

Precise fuel delivery reduces stress on engine components, improving efficiency and reliability. Operators also benefit from predictable performance improvements, with the extent of results varying depending on mine profile, equipment use, and operating conditions.

The Metso OKTOP® Conditioner is a critical component for effective slurry preparation before flotation. It ensures optimal mixing of slurry and reagents, creating the right conditions for maximum flotation cell performance and overall circuit efficiency.

Partner for positive change

Cummins site-specific calibration upgrades for engines in the QSK38 to QSK95 range optimise combustion and fuel delivery for specific duty cycles. By measuring factors like site profile, average loads, tyre pressures, operating temperatures, and driver behaviours, Cummins can build a holistic data set and make calibrations that reduce engine fuel consumption and CO₂ emissions by 2 – 5% without compromising reliability or productivity.

For operators, these upgrades can deliver measurable fuel savings while maintaining familiar engine performance, providing an immediate impact on operational costs and environmental goals. For those wanting to go further, hybrid options provide a future solution.

Hybrid retrofit programs combine internal combustion engines with battery-electric systems, providing flexible energy management across mining haul routes.

Hybridisation presents significant opportunity for the mining industry’s effort to achieve an energy transition, leveraging the large installed asset base.

Hybrid systems allow operators to:

� Capture energy through regenerative braking.

� Use battery power during low-demand periods.

� Reduce fuel consumption and CO₂ emissions by 15 – 30%, depending on mine profile.

Reduced engine loads also lower maintenance frequency and could extend engine life. Cummins’ first-fit hybrid pilot programme launched in 2024, and the acquisition of First Mode assets in 2025, expanded hybrid retrofit capabilities at scale. Early deployments include Komatsu 930E-4 trucks in Chile, with additional pilots planned across North and Latin America.

Hybrid systems provide reliability and operational familiarity for operators while delivering fuel and emissions savings, demonstrating a practical pathway for incremental decarbonisation without the need for full electrification.

Cummins is also furthering the ‘clean fuels’ decarbonisation pathway, which will also be available through retrofits for existing fleets. Cummins, in partnership with Vale and Komatsu, is developing dual-fuel systems that allow haul trucks to operate on a combination of ethanol and diesel. Modified trucks can run on up to 70% ethanol, potentially reducing CO₂ emissions by up to 50%.

Engine testing continues through 2026, followed by field validation. Dual-fuel systems leverage existing infrastructure and fleets without major modifications, making them a cost-effective option for operators seeking significant emissions reductions.

As part of efforts to support the decarbonisation of mining today, Cummins engines already support the use of drop-in fuels such as hydrotreated vegetable oil (HVO) and biodiesel blends. These fuels can be used with existing engines and infrastructure, avoiding high capital expense associated with alternate solutions while advancing decarbonisation goals.

For example, hybrid engines running with 55% HVO can achieve up to a 50% CO₂ reduction from well-to-wheel.

Drop-in fuel integration allows operators to reduce their environmental impact without major modifications to fleet or facilities, enabling significant emissions saving without high costs and integration timings.

Internal combustion engines remain the foundation of powering mining, given fleet requirements, current infrastructure limitations, and remote operating locations. Miners can protect their investment in these high-horsepower power solutions through strategic partnership for long-term aftermarket support and technology upgrades through the life of these engines.

By combining proven engine technology with emerging solutions, Cummins maximises engine life and operational reliability, while also providing a practical pathway to emissions reduction.

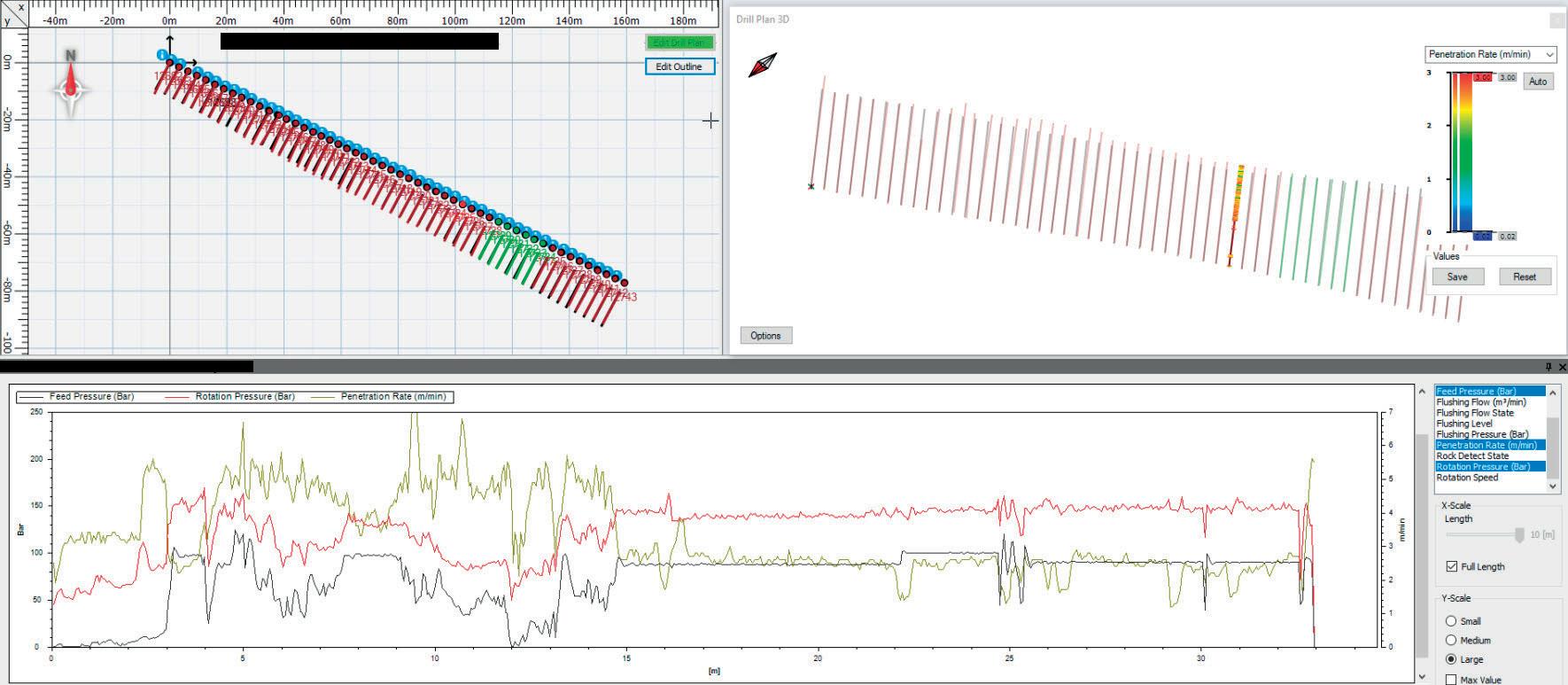

Anu Niittynen, Sandvik Mining, USA, details the role of the iLink Data Interface in modern mining systems.

As the mining industry undergoes a profound transformation driven by automation, digitalisation, and sustainability imperatives, the ability to integrate equipment into a unified digital ecosystem has become a cornerstone of operational excellence. In surface mining, rotary drilling operations are among the most data-intensive and

operationally critical processes. They serve as the starting point for the entire value chain –from ore extraction to processing and logistics. Consequently, the interoperability of drill rigs with mine planning, monitoring, and reporting systems is essential for achieving real-time visibility, process optimisation, and data-driven decision-making.

To address this need, Sandvik has developed the iLink Data Interface, a standards-based, vendor-neutral communication layer that enables secure and efficient interaction between Sandvik iSeries surface drill rigs and third-party mining systems. Built on REST web services and HTTP protocols, iLink Data Interface provides a robust and scalable foundation for integrating drilling operations into broader mine automation strategies.

Historically, rotary drill rigs operated as standalone mechanical systems, with limited connectivity and minimal integration with mine-wide IT infrastructure. Operators manually uploaded drill plans, recorded performance data on paper or local storage, and relied on radio communication for coordination. This siloed approach limited the ability to optimise drilling performance, respond to changing geological conditions, or ensure alignment with dynamic mine plans.

Today, rotary drill rigs are increasingly equipped with advanced onboard control systems, GNSS-based positioning, real-time telemetry, and onboard/remote automation features (such as auto-drill and auto-levelling). These capabilities generate vast volumes of operational data, including penetration rates, torque, and measurement while drilling (MWD) parameters. At the same time, rigs require continuous input from centralised systems – such as updated drill plans, configuration files, and safety protocols.

The challenge lies in enabling seamless, secure, and standardised communication between these systems. This is where the iLink Data Interface plays a pivotal role.

The iLink data is architected using Representational State Transfer (REST) principles, which are widely adopted in industrial automation and enterprise IT due to their simplicity, statelessness, and compatibility with web technologies. RESTful APIs use standard HTTP methods to perform operations on resources, making them easy to implement and integrate across diverse platforms.

In the iLink implementation, external systems interact with the drill rig via HTTP requests, accessing structured data in JSON format. This eliminates the need for proprietary protocols or middleware, reducing integration complexity and enabling faster deployment. The interface is designed to be platform-agnostic, allowing integration with a wide range of systems, including:

� Mine planning software (e.g. Deswik, Hexagon, MinePlan).

� Fleet management systems (e.g. Wenco, Modular).

� Data analytics platforms (e.g. Power BI, Tableau).

� Cloud-based IoT platforms (e.g. Azure IoT, AWS Greengrass).

Depending on the deployment scenario, communication can occur over local networks, VPNs, or cloud gateways. In remote or offline environments, physical connections may be required, but the communication model remains consistent.

The iLink Web Interface exposes a comprehensive set of endpoints grouped into logical modules that reflect the functional architecture of the drill rig. These include:

� Access to rig identification, software versions, and hardware capabilities.

� Read/write access to system-level settings, such as time synchronisation and operational modes.

� Read/write access to operator interface data, enabling remote visualisation of user interactions.

� Real-time access to equipment signals, including hydraulic pressures, rotary speeds, feed force, and bit position.

� Alarm and event logs for fault diagnosis and operational analysis.

� Access to TIM3D drill plan files, including hole coordinates, depths, and collar positions.

� Integration with mine design models for spatial alignment and compliance verification.

� Bi-directional file transfer for: drills plans, configuration files, MWD reports, and quality assurance documents.

� Supports automated workflows for plan deployment and report retrieval.

This modular design allows mining companies to implement only the functionalities they require, while maintaining the flexibility to expand integration as operational needs evolve.

The iLink interface supports a wide range of use cases across the mining value chain, enabling both tactical improvements and strategic transformation.

Mine planning systems can push updated drill plans directly to the rig, eliminating manual data entry and reducing the risk of errors. This is particularly valuable in dynamic pit environments – where geological conditions or production targets change frequently.

Maintenance and operations teams can monitor rig performance in real time, accessing live telemetry and alarm data. This enables proactive maintenance, reduces unplanned downtime, and improves asset utilisation.

MWD data can be automatically retrieved and analysed for quality control, ore body modelling, and regulatory compliance. This supports faster decision-making and enhances transparency.

By sharing drill hole data with blasting systems (e.g. Dyno Nobel), mining operations can optimise fragmentation and reduce overbreak. Similarly, integration with load and haul systems ensures alignment between drilling, blasting, and material movement.

With programmatic access to machine data, iLink enables the development of advanced automation applications, including:

� Predictive maintenance using machine learning.

� Autonomous drill scheduling.

� Integration with autonomous haulage systems.

� AI-driven optimisation of drilling parameters.

Given the critical nature of operational data, iLink incorporates robust security features, including:

� Authentication and authorisation: Role-based access control ensures that only authorised systems and users can access sensitive data.

� Encryption: All data in transit is encrypted using industry-standard protocols (e.g. TLS).

� Audit logging: All interactions with the API are logged for traceability and compliance.

These features support compliance with industry standards, such as ISO 27001, and ensure that data integrity and confidentiality are maintained across the mining enterprise.

The iLink interface is designed to scale with the evolving needs of mining operations. As new sensors, automation features, or analytics tools are introduced, the API can be extended to support additional data types and workflows. This extensibility ensures that mining companies can future-proof their digital infrastructure and adapt to emerging technologies without costly system overhauls.

The adoption of interoperable interfaces like iLink reflects a broader shift in the mining industry towards open architectures, vendor-neutral ecosystems, and data-driven operations. By enabling seamless integration between equipment and enterprise systems, mining companies can:

� Break down data silos and improve cross-functional collaboration.

� Accelerate the deployment of automation and AI.

� Enhance operational agility and responsiveness.

� Improve safety, sustainability, and regulatory compliance.

In this context, iLink is not merely a technical solution – it is a strategic enabler of the digital mine.

The Sandvik iLink Data Interface represents a significant advancement in the integration of surface drilling operations into modern mining systems. By providing a standardised, secure, and extensible communication layer, iLink enables real-time data exchange, automation, and analytics across the mining value chain.

As the industry continues to evolve toward intelligent, autonomous, and sustainable operations, solutions like iLink will play a central role in shaping the future of mining – where every drill hole, data point, and decision is connected.

LOW COST OF PRODUCTION

SUSTAINABLE OPERATIONS

Can mining satisfy the world’s hunger for raw materials – and meet environmental targets too?

With Cummins’ help, it can. Our range of mining engines, made even cleaner and more e icient through technologies like alternative fuels and advanced monitoring, are helping mining explore a future that can be both sustainable and profi table. It’s power: balanced.

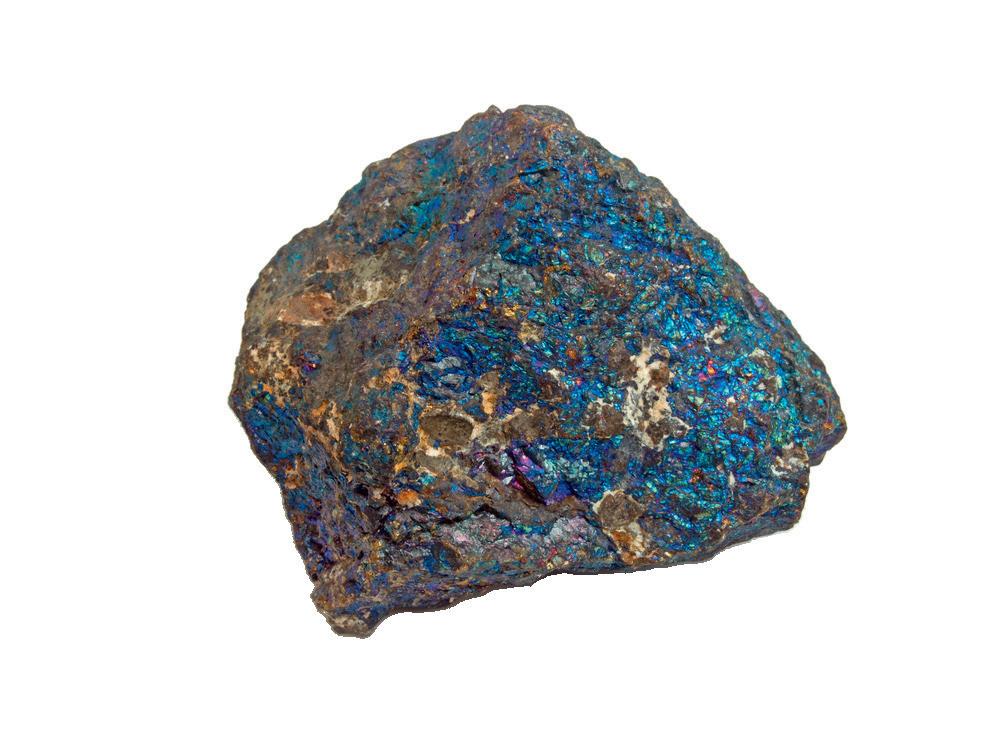

Qu Shengli, President, Shandong Humon Smelting Co., Ltd., China, considers the century-long dilemma of gold smelting and outlines how a leading Chinese smelter has remained dedicated to technological innovation in the sector.

Historically, gold smelting has undergone four major technological revolutions. From the primitive gravity concentration and amalgamation process to the invention of the direct cyanidation method, the industry was able to exploit low-grade ores, spurring a surge in global gold production. Cyanidation became the industry standard process, laying the foundation for modern hydrometallurgy. However, the extreme toxicity of cyanide also sowed an environmental crisis that has persisted for

more than a century. The third-generation, single-stage roasting–cyanidation leaching process addressed the challenge of extracting gold from sulfur and arsenic-bearing complex ores, making refractory ores economically viable. It expanded the resource base from single gold ores to polymetallic associated ores, driving a transition from pure gold recovery to multi-element recovery.

The fourth-generation, pre-treatment–cyanidation process is still widely adopted by most Chinese gold smelters and has the

advantage of low capital requirements and short metal realisation cycles. Yet, it generates enormous amounts of cyanide-laden wastewater and tailings, causing serious environmental harm. At present, more than 70% of gold in China is refined using the cyanidation process. In 2024, the country produced 534.1 t of refined gold, consuming an estimated 80 000 t of cyanide and generating over 195 million t of cyanide-bearing solid waste and 300 million m 3 of cyanide-containing wastewater. Moreover, due to inherent limitations of the process, the recovery rates of valuable metals – such as gold and silver – from complex materials remain low, while associated elements cannot be effectively recovered, leading to significant resource wastage.

It is foreseeable that the continued large-scale reliance on cyanidation for gold extraction will create compounded pressures from both historical and new issues, particularly in the generation and treatment of cyanide solid waste and in ensuring safe production. The traditional cyanidation process thus faces the

paradox of ‘easy extraction, difficult remediation, and low efficiency’.

Gold is a vital foundation of financial stability and a key strategic resource contested worldwide. Since its inception, Shandong Humon Smelting – a leading enterprise among China’s top 10 gold smelters – has positioned itself to serve national strategies as a specialised gold smelting enterprise.

How to shed the heavy burden of cyanide-based technologies and forge a truly cyanide-free and environmentally friendly ‘sword of extraction’ has long been a question for the gold industry. Humon’s technological breakthrough illustrates an adage: disruption often comes not from within the industry, but from the outside. Focusing on three core objectives –enhancing resource efficiency, reducing pollution and energy consumption, and adapting to complex multi-element ores – Humon abandoned traditional hydrometallurgical paths. Instead, it pioneered a fire-metallurgy route to cyanide-free smelting, becoming the first bold explorer in the industry.

Using its first round of funds raised after its 2008 IPO, Humon constructed a new facility and developed the world’s first oxygen bottom-blowing smelting with matte capture process. This created China’s first cyanide-free production system for processing complex gold concentrates. Remarkably, the system achieved successful commissioning at first attempt and full capacity in the same year. Its success not only removed cyanide – the industry’s toxic ‘tumour’ –from the process, but also raised gold recovery rates by 5 – 13% and silver recovery rates by 8 – 38%, ushering in a new era of pyrometallurgical gold refining.

Innovation has never ceased. In 2011, Humon pioneered a three-furnace continuous process combining bottom-blowing smelting, molten-state reduction, and oxygen-enriched volatilisation for lead-rich gold recovery. Commissioned in 2013, the new process again set industry records: recovery rates for gold, silver, and lead soared; comprehensive energy consumption dropped by 65%; sulfur dioxide emissions fell by 95%; and carbon dioxide emissions declined by 80%. This achievement won the prestigious State Science and Technology Progress Award (Second Prize) in 2016.

Realise the green development of gold mining and metallurgy

Unlock unlimited value from limited resources

Arsenic has long been regarded as an intractable challenge in gold and non-ferrous metallurgy. Traditional arsenic capture methods often fail due to gas flow fluctuations and high SO₂ concentrations. In 2010, Humon launched a five-year R&D effort that produced an integrated process combining oxygen bottom-blowing matte capture with rapid flue gas cooling and dry arsenic collection. Achieving over 90% arsenic removal efficiency, the innovation solved a global problem of high-arsenic ore smelting. Humon further advanced the concept of resource-based arsenic treatment, developing an industrial chain from arsenic trioxide to metallic arsenic to high-purity arsenic – thus transforming pollution control into industrial value creation. This ‘Humon Model’ of arsenic management won the First Prize of the China Nonferrous Metals Industry Association’s Science and Technology Progress Award, as well as support from the National Development and Reform Commission’s Solid Waste Resource Utilisation programme.

Over 37 years, Humon has made ‘continuous innovation’ its core competitiveness, revolutionising gold metallurgy and constructing a complete cyanide-free, pyrometallurgical, environmentally friendly technology system. The company has won two State Science and Technology Progress Awards (Second Prize), 11 provincial and ministerial First Prizes, and has been named a ‘National Green Factory’ and ‘Advanced Unit of Resource Utilisation in Shandong Province’. Today, Humon stands as a vanguard of modern gold metallurgy. Each iteration of gold extraction technology has resonated with the progress of human civilisation. It is foreseeable that, as global competition for mineral resources intensifies and under the dual backdrop of carbon neutrality goals and major-power rivalry, cyanide-free metallurgy – with its irreplaceable comprehensive advantages – will become the mainstream of global gold smelting.

As easily processed high-grade ores are depleted, the share of complex multi-element ores continues to rise. In China, about 70% of gold reserves – and globally, about 38% – are found in such complex concentrates. They have become the primary raw material for future gold production. Focusing solely on gold, silver, copper, and lead would cause immense resource waste and economic loss. Meanwhile, cyanide-free technologies are advancing rapidly, with breakthroughs in key processes and equipment creating the technical conditions to break barriers between different metallurgical fields. Against the backdrop of global industrial restructuring, the gold smelting sector faces unprecedented pressure to transform. In response, Humon has proposed its ‘Comprehensive Smelting’ strategy: full recovery of valuable elements, green low-carbon operations, and zero waste. In 2010, with the successful commissioning of the ‘Complex Gold Concentrate Comprehensive Recovery Technology

Transformation Project’, Humon overcame the challenge of comprehensively recovering valuable elements such as gold, silver, tellurium, copper, iron, and sulfur, thereby officially opening the door to multi-element recovery.

In 2013, alongside building the world’s first lead-carrier gold-silver recovery system, Humon further expanded into lead, zinc, and bismuth recovery.

In 2018, Humon successfully commissioned the ‘Harmless Treatment Project of Waste Residue from Gold Smelting’, turning cyanide tailings from gold and silver processing into valuable resources by recovering gold, silver, copper, and tellurium. This not only neutralised hazardous waste, but also advanced its resource-based utilisation, extending the comprehensive recovery chain and pushing toward the complete utilisation of mineral resources. That same year, to tackle the challenges of low recovery efficiency and high energy consumption, Humon launched the ‘Comprehensive Recovery and Utilisation Technology Transformation Project of Rare and Precious Metal Resources’. Working in collaboration with leading universities, the company overcame significant technical hurdles and succeeded in bringing multiple rare and precious metals – including bismuth, tellurium, selenium, platinum, and palladium – into full-scale production and industrial application. Anchored in its cyanide-free core process, Humon has since established a comprehensive recovery system for ‘all-element extraction’, creating a product portfolio built on gold as the core, with multi-metal synergy. Guided by the principle of ‘one mine, multiple recoveries; maximising resource utilisation’, Humon has transformed finite resources into virtually unlimited value. Today, its primary product matrix spans 17 elements, carving out a second growth curve for the gold smelting industry beyond the traditional model.

Innovation remains Humon’s lifeblood. In 2018, Humon extended its industrial chain into high-purity semiconductor and infrared optical materials. Driven by the ambition that ‘Humon’s height equals the world’s height, Humon’s purity equals the world’s purity’, the company has, after a decade of relentless innovation, developed seven major series with 29 high-purity and infrared optical products. Recognised as a leading new-materials enterprise in Shandong Province, Humon has become a renowned global supplier of advanced metal materials, an indispensable contributor to China’s ‘national strategic technologies’ and ‘intelligent manufacturing’.

As a visionary and responsible listed company, Humon will continue along the path of innovation, remaining aligned with global scientific frontiers, global resource utilisation, and human development. It will continue working to further advance gold smelting technologies, ensuring that more of its innovations benefit both the industry and society at large.

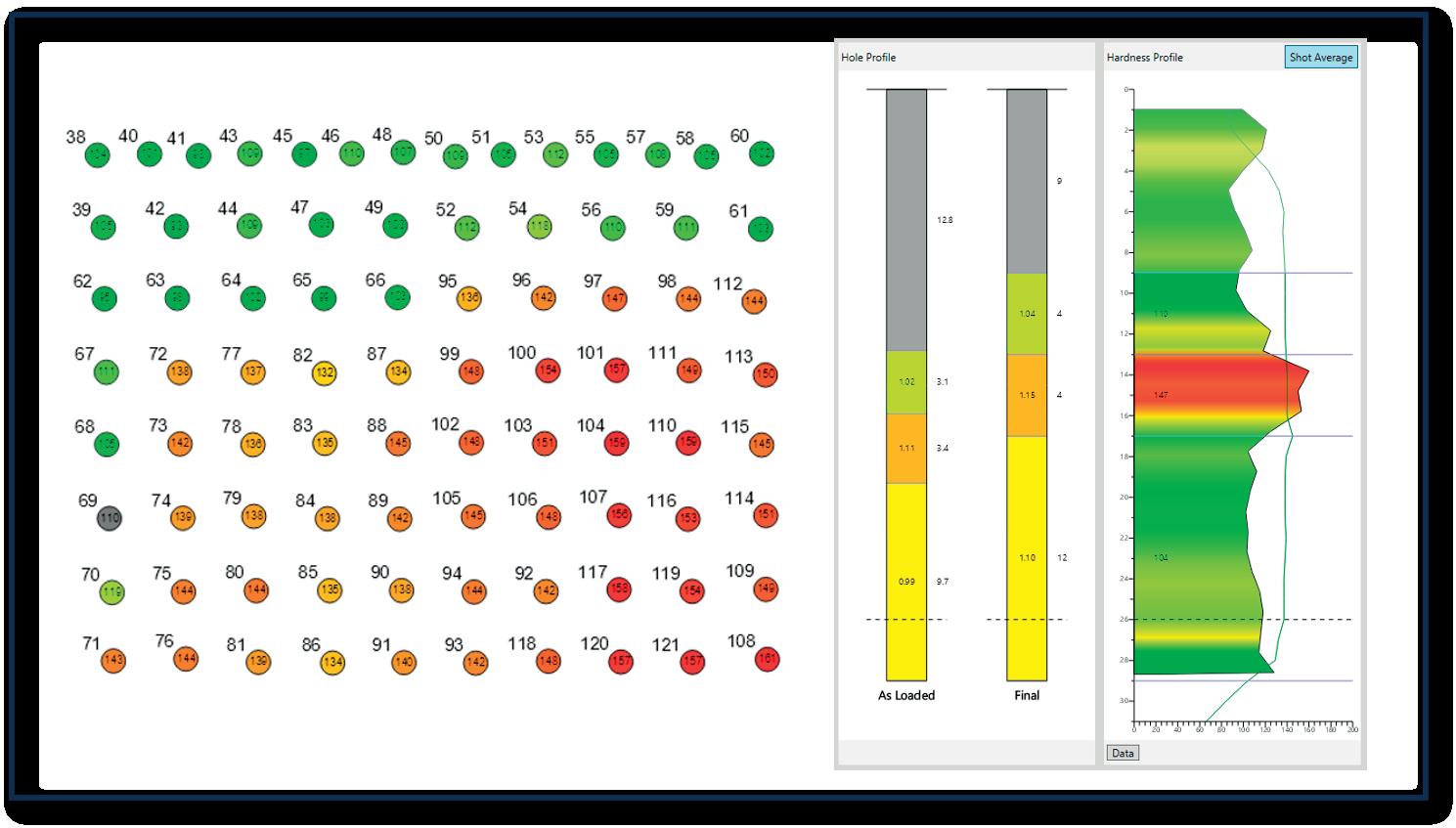

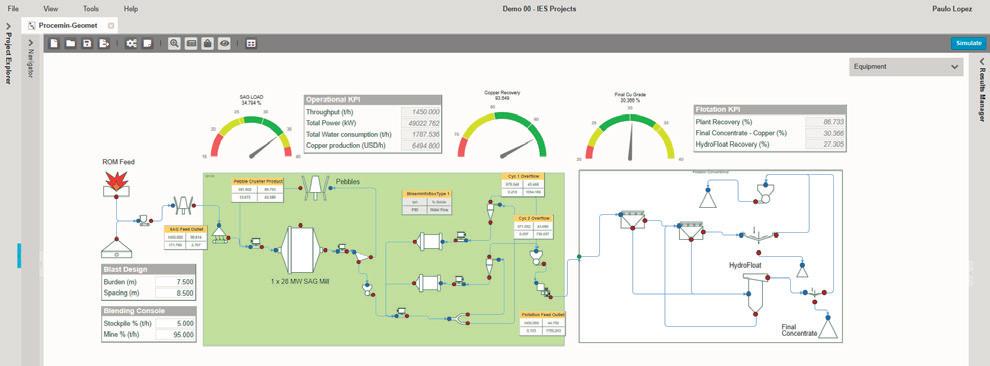

Eden Paki, Orica Digital Solutions, Australia, discusses how digital platforms are bringing about measurable gains in recovery, productivity, and sustainability.

Orica Digital Solutions’ ongoing digital expansion has sought to better connect the mining value-chain. This dedicated digital arm has delivered many well-known solutions and tools – such as the Integrated Extraction Simulator (IES) –that are becoming undoubtedly essential to mining operations.

Across the global mining sector, operations face a common set of pressures. Orebody variability, volatile

commodity markets, increasingly stringent ESG requirements, and the need to get more from existing assets all challenge traditional approaches to optimisation.

For many sites, the investment in optimisation studies is significant – but too often, the insights remain trapped in reports, disconnected from daily decision-making. Without a way to translate theoretical recommendations into operational reality, improvements stall. Critical decisions on drilling, blasting, blending, and processing are made in isolation, leading to trade-offs between throughput and recovery with no clear resolution.

The industry needs tools that connect data, processes, and people across the value chain – and allow ‘what if’ scenarios to be tested before they are implemented. This is where the IES has proven itself as more than just a modelling platform – it is a decision-support system for an increasingly complex operating environment.

The origins of the IES lie in an industry-sponsored research programme led by Australian based Cooperative Research Centre for Optimising Resource Extraction (CRC ORE), which brought together mining companies, research bodies, and technology providers to develop a platform capable of simulating the entire mining value chain in a single, integrated environment. In 2021, Orica was selected as the commercialisation partner for the IES to bring it to market globally. Since then, Orica Digital Solutions has transformed it into an award-winning, browser-based application that combines advanced

simulation with machine learning to deliver practical, site-ready insights.

The IES has evolved as one powerful, fundamental platform with two integrated applications, IES Projects and ModelNet, working together to provide a seamless environment for processing insights and operational decision-making. IES Projects enables users to model, simulate, and optimise complex mineral processing flowsheets. ModelNet allows for the creation of machine learning models that can be embedded into equipment in the flowsheet and therefore into simulations.

Together, these tools form a connected ecosystem, with the IES acting as the central simulation engine that integrates data and insights from across the operation. At its core, the IES combines physics-based equipment models with data-driven intelligence to simulate entire mining-to-processing chains or specific plant sections. It supports large datasets, multi-component modelling, and rapid configuration of alternative flowsheets, enabling mass simulation runs in hours rather than weeks. User-defined constraints keep simulations grounded in operational reality, while a diverse model library allows users to incorporate both industry-standard and custom-developed models. These initiatives are tested using block model data developed through geostatistical modelling, representing the life of mine (LOM), and utilising an integrated IES flowsheet.

The IES has been deployed across a wide range of scenarios, from early-stage project evaluation to operational fine-tuning. In each case, it has provided the integrated view needed to connect cause and effect across the mining value chain – and deliver measurable results.

Powered by ModelNet, the IES also integrates machine learning, allowing users to build MetaModels that run scenario analyses 3000 times faster than traditional methods, with prediction errors as low as 0.45%.

A major copper operation needed to determine the most valuable combination of mine plan and plant configuration. Using the IES, the team simulated ore variability, processing constraints, and product quality targets in a single integrated model. This identified the block sequence and plant setup that would deliver the highest long-term value, avoiding suboptimal plans that looked viable when mining and processing were considered in isolation.

An unplanned shutdown at a gold operation created pressure to recover lost production without overstressing the plant. The IES tested multiple recovery strategies, including accelerated milling schedules, altered blend ratios, and grind size adjustments.

EVALUATING MINERAL RECOVERY WITH SEAMLESS VALUE CHAIN SIMULATION

The selected approach regained the full shortfall within three weeks while keeping throughput and metallurgical performance at target levels.

During construction of a nickel concentrator, late-stage equipment changes altered key design parameters. The IES re-ran the flowsheet with the new specifications, quantifying the impact on throughput and recovery. It then pinpointed process control adjustments to offset performance risks, helping the project avoid costly post-commissioning modifications.

A Western Australian gold mine was approaching a transition to harder ore in its pit sequence. The IES simulated the impacts from drill and blast through to grinding energy demand, allowing the operation to implement changes to liner design and mill speed ahead of time. This proactive approach prevented the expected throughput losses once the new ore came online.

A leading South American copper producer used the IES to evaluate the integration of HydroFloat™ coarse particle flotation. Embedded machine-learning models predicted potential recovery gains of 2 – 7% while enabling coarser grinding, reducing energy use and processing costs.

In another project, a mining technology company used the IES and ModelNet to simulate its rotary air concentration system. The modelling predicted recovery of an additional 5000 oz of gold from material previously classified as waste, while lowering downstream processing volumes.

This project demonstrates how the IES can deliver value at multiple scales – from optimising existing plants to accelerating the adoption of breakthrough processing technologies.

There is a noticeable increase in software adoption, globally. IES differentiators have played an important

role in leveraging value for different types of users within the mining and minerals processing industry, along with original equipment manufacturers (OEM) and consulting companies. The value that the IES provides its users varies – from reducing uncertainty in major investment projects through to supporting the identification of opportunity for operational and equipment design.

The need to assess new technologies and quantify their performance, investigate process efficiencies, and understand financial impacts has become a prominent driver in the discovery of the IES.

The IES is designed to integrate with mine planning tools, fleet management systems, and plant control platforms, creating a digital twin that mirrors the operation’s current state. This allows sites to test potential changes in near real-time and understand the full value chain implications before implementation. Corporate users can apply the IES across multiple sites for standardised analysis and sharing of best practices, while OEM partners can test equipment performance in varied operating contexts without the cost or risk of physical trials.

The platform also supports ESG objectives, with the ability to model water and energy use per tonne, forecast carbon footprint impacts, and test alternative flowsheets or operational strategies to reduce environmental risk. Recent projects have demonstrated how the IES can help quantify and optimise sustainability metrics alongside production outcomes.

Looking forward, Orica Digital Solutions is advancing the IES with expanded neural networking and machine learning capabilities, enabling models to capture and simulate processes such as flotation where data is often available. A major focus is the development of tailored front ends that allow specific tasks to directly access and apply elements of the IES workflow, bringing the platform into operational use rather than being confined to strategic planning. This evolution, described as a shift from proactive optimisation to proactive correction, aims to close the gap between strategic intent and operational execution, while also supporting multi-site optimisation and ESG-linked modelling for energy, water, and emissions.

The mining industry’s challenges are complex and interconnected – and so are its opportunities. Digital platforms like the IES are turning mine-to-mill optimisation into a continuous, data-driven practice rather than a one-off exercise. By combining physics-based modelling, machine learning, and scalable cloud computing, the IES enables faster, more confident decisions that translate into measurable gains in recovery, productivity, and sustainability. As operations push to extract more value with fewer resources, such tools will play a central role in shaping the next generation of responsible, high-performance mining.

Global coverage on technology and market trends in the mining and minerals processing industries

Subscribe online at: www.globalminingreview.com/subscribe

Global coverage on technology and market trends in the mining and minerals processing industries

Global coverage on technology and market trends in the mining and minerals processing industries

15 South Street, Farnham, Surrey, GU9 7QU, UK

T: +44 (0)1252 718999 F: +44 (0)1252 821115

Subscribe online at: www.globalminingreview.com/subscribe

Subscribe online at: www.globalminingreview.com/subscribe

E: info@palladian-publications.com

15 South Street, Farnham, Surrey, GU9 7QU, UK

T: +44 (0)1252 718999 F: +44 (0)1252 821115

15 South Street, Farnham, Surrey, GU9 7QU, UK

E: info@palladian-publications.com

T: +44 (0)1252 718999 F: +44 (0)1252 821115

E: info@palladian-publications.com

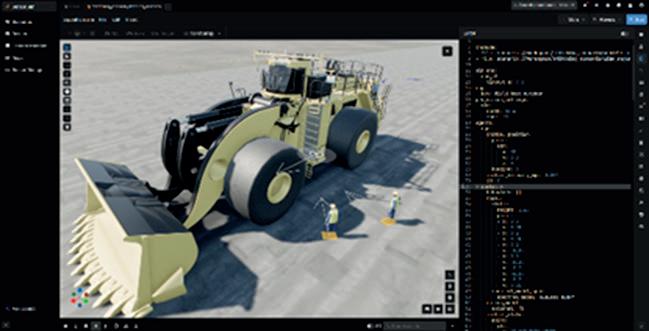

Mike Rikkola, Vice President, Software Defined Vehicle and Autonomy Platforms, Komatsu, USA, explains the importance of collaborations with Silicon Valley for mining companies and the industry in general.

In September 2025, Komatsu announced a groundbreaking collaboration with Silicon Valley’s Applied Intuition, a company renowned for its expertise in vehicle intelligence and autonomy.

This collaboration represents the most significant technology investment in Komatsu’s more than 100-year history, signalling a bold commitment to revolutionising mining operations through a unified software-defined vehicle (SDV) and autonomy platform. The relationship aims to deliver transformative capabilities, enabling mining companies to operate more safely, efficiently, and sustainably in an era characterised by rising operational costs, labour shortages, and mounting decarbonisation pressures.

The mining sector is undergoing a profound digital transformation. Technologies such as the Internet of Things (IoT), cloud computing, and advanced analytics are being integrated into every aspect of mining operations. These technologies embrace real-time monitoring of equipment,

predictive maintenance, and data-driven decision-making – all of which contribute to improved safety, efficiency, and sustainability.

Governments and regulatory bodies worldwide are imposing stricter environmental standards on mining operations. Companies are required to reduce emissions, minimise waste, and rehabilitate mining sites. The adoption of autonomous and software-defined vehicles helps companies meet these requirements by reducing fuel consumption, optimising routes, and enabling more precise control over operations.

As mining operations become more automated, the skills required of the workforce are evolving. There is a growing demand for workers with expertise in data analytics, robotics, and AI. Companies are investing in training and development programs to equip their employees with the skills needed to operate and maintain advanced technologies and improve the bottom-line.

The mining industry stands at a pivotal crossroads. By 2027, the global mining market is projected to reach US$2.78 trillion, yet the majority of mining trucks and equipment remain manually operated. Haulage and machinery-related incidents are leading causes of mining fatalities, and the sector is responsible for 4 – 7% of global greenhouse gas emissions, primarily due to diesel-powered vehicles. The convergence of rising costs, labour shortages, decarbonisation mandates, and surging demand for critical minerals has created a ‘perfect storm’ that demands urgent innovation.

Mining companies are under increasing pressure from regulators, investors, and local communities to modernise operations and reduce their environmental footprint. The shift toward digital transformation and automation is no longer optional – it is essential for survival and competitiveness. Companies that fail to adapt risk falling behind as the industry embraces new technologies that promise greater safety, efficiency, and sustainability.

Unlike conventional mining equipment, which relies on periodic hardware upgrades, the SDV platform enables continuous improvement through software updates – much like a smartphone. Factors include:

� Continuous improvement: Machines receive new features and performance enhancements over the air, minimising downtime and helping maximise productivity.

� Remote troubleshooting: Diagnostics and troubleshooting can be performed remotely, reducing the need for on-site interventions – a rising trend in the industry.

� Robust security: Built-in digital security helps to safeguard equipment and sensitive operational data from cyber threats.

The SDV architecture is the foundation of the new platform. It promotes rapid deployment and seamless integration across sites, regardless of location or scale.

Figure 1. Software-defined vehicles (SDVs) will leverage AI and automation, among others, to make real-time decisions about loading, hauling, and drilling. Operators will retain full control, when needed. This kind of flexibility ensures that mining companies can tailor the level of autonomy to meet their specific needs by balancing automation with human oversight.

Operators use familiar tools, and support is streamlined, making training and scaling easier.

The Komatsu–Applied Intuition collaboration is more than just a technology upgrade; it is a strategic leap forward toward a safer, smarter, and more sustainable mining industry. By uniting Komatsu’s legacy of innovation with Applied Intuition’s artificial intelligence (AI) expertise, the companies are setting a new standard for mining operations worldwide.

� Deliver real-time adaptability: Equipping Komatsu’s mining equipment with advanced technologies that adapt to changing site conditions, weather, and terrain, supports optimal performance in diverse environments.

� Boost productivity and precision: Supporting customers by helping maximise output and minimising downtime, using AI-driven analytics, designed to improve optimisation of haul routes and maintenance schedules, among others.

� Enable continuous feature delivery: Leveraging embedded AI and machine learning for ongoing, site-specific optimisation, allows new features and regulatory updates to be delivered overnight.

� Safer and more sustainable operations: Reducing risk exposure for personnel and helping to optimise operations for lower emissions, with autonomous systems that reduce workers in hazardous areas, as well as advanced collision avoidance enhancing site safety.

Flexible autonomy: From operator assist to highly automated

Mining operations are diverse, and not every site or task can be highly automated. The Komatsu–Applied Intuition platform supports a full range of autonomous functions, including:

� Operator assistance: Advanced driver-assist features enhance safety and efficiency, providing real-time feedback and support to operators.

� Manual control: Operators can retain full control when needed, ensuring flexibility and adaptability in complex environments.

� Autonomy: Machines can operate independently, adapting to site-specific requirements in real time, learning from every job and every environment.

This kind of flexibility ensures that mining companies can tailor the level of autonomy to meet their specific needs, balancing automation with human oversight.

learning and artificial

AI-driven analytics optimise everything from haul routes to maintenance schedules, empowering operators and

managers to make data-driven decisions to boost productivity and reduce costs. The platform provides enhanced AI and machine learning to learn from every task, process and operation:

� Predictive maintenance: The system anticipates maintenance needs, helping minimise costly breakdowns and reducing unplanned downtime.

� Route optimisation: AI can suggest more efficient haul routes, saving fuel and time, and minimising environmental impact.

� Continuous improvement: Machines receive new features and performance enhancements over the air, minimising downtime and helping maximise productivity.

Whether a company operates a single mine or a global network, the platform is designed for rapid deployment and seamless integration. Operators use familiar tools, and support is streamlined across sites, making training and scaling easier. A unified platform ensures that all sites –regardless of location or scale – benefit from the same advanced capabilities, simplifying training and support.

The Komatsu–Applied Intuition collaboration positions intelligent, AI-driven vehicles squarely at the centre of the sector’s next chapter, accelerating the shift toward greater safety, efficiency, and sustainability. Autonomous systems increase the ability to keep personnel out of harm’s way and help to prevent accidents. Advanced collision avoidance and real-time monitoring help to enhance site safety.

While the collaboration is still in its early stages, initial feedback from industry stakeholders has been overwhelmingly positive. Early successes highlight strong momentum, with proof points and strategic milestones being achieved.

Mining companies are enthusiastic about the potential of the Komatsu–Applied Intuition platform. Customers appreciate the ability to customise the level of autonomy to their specific needs, balancing automation with human oversight. The platform’s scalability and interoperability make it an attractive option for companies operating multiple sites.

Customers are beginning to report significant improvements in operational efficiency and safety. Reception has been positive with companies noting reductions in haulage-related incidents within a short time of deploying currently available autonomous platforms. Customers are noting the ease of integrating the new technology with existing equipment, reducing training time, and accelerating adoption.

Operators report that the advanced driver-assist features have made their jobs safer and more efficient.

Figure 2. In this simulation, an SDV electric rope shovel is using AI and automation to take into account physical terrain, topographical information, incoming data sets, equipment monitoring, environmental factors, operator feedback, and more, in order to make optimal decisions about safety, productivity, and sustainability.

Managers value the data-driven insights provided by AI analytics, which help them make informed decisions and optimise operations.

The mining technology landscape is rapidly evolving, with several companies vying for leadership in autonomy and AI-driven solutions. Komatsu’s work with Applied Intuition sets it apart from competitors by offering a unified SDV platform that combines deep expertise in mining applications with cutting-edge vehicle intelligence. Komatsu’s approach is differentiated by its focus on continuous improvement through software updates, flexible autonomy, and robust security features.