After its own employees opposed an attempt to sell Samba Bank two years ago, the Saudi owned bank is up for sale again.

After its own employees opposed an attempt to sell Samba Bank two years ago, the Saudi owned bank is up for sale again.

UBL, Meezan Bank, Askari Bank, and Fatima Fertiliser among others had sought to buy the Samba. Will Bank Alfalah succeed where all of the others failed to close the deal?

By Mariam UmarIn 2021 Samba Bank decided to put the “For Sale” sign out in the yard. For anyone in Pakistan looking to buy a bank, it was a perfect opportunity. Samba was up for sale not because it was doing badly, but simply because the ownership of Samba’s parent company in Saudi Arabia was changing.

The bank itself was small (the smallest commercial bank in Pakistan in fact), clean, and well-run. Samba was the suburban white picket home of bank shopping. Which is why a number of buyers stepped up to the plate rang-

ing from United Bank (UBL) to Askari Bank and a consortium led by Fatima Fertiliser.

Despite the interest, Samba failed to strike a deal with any of the potential buyers. In fact in May 2022, the bank announced it was terminating the process for the sale due to “unstable market conditions.” It seemed the new owners of Samba’s parent companies were starting to catch up to Pakistan’s smallest commercial bank. Now after just under two years, Bank Alfalah has made a non-binding indicative offer to the bank’s Saudi owners to acquire their entire shareholding in Samba Pakistan. In turn, the Saudis have agreed to evaluate the non-binding offer and invited Bank Alfalah to

conduct diligence on Samba Pakistan.

To put it in very simple terms, the sale is back on the table. But what were the circumstances that led to the bank to go on sale, go off the market, and then once again be up for grabs? To understand, we go back to Samba Bank’s origins in Pakistan.

The origins of Samba go back to as early as 1955 when Citibank first established itself in Jeddah, Saudi Arabia. However, it wasn’t until

1980 that the Saudi American Bank (Samba) was formed as the result of a change in the law which required all foreign banks to be at least 60% Saudi-owned. Samba continued to grow, expanding its international presence by entering the United Kingdom in 1984, and creating one of the largest financial institutions in the Middle East after a merger with United Saudi Bank in 1999.

By 2004, Citibank had sold all of its remaining shareholdings to local investors, making the Samba Financial Group a wholly Saudi-owned subsidiary, looking to expand internationally. In 2007, Pakistan did not seem like a bad place to be, with other foreign banks such as RBS and Barclays entering the market the same year. Samba bought a majority stake in a fledgling 5-year old Crescent Commercial Bank and began operations.

In the 17 years since, Samba Bank has proven itself to be a small but reliable presence in Pakistan’s banking sector. The bank has never been overly ambitious, seemingly perfectly content with a small to medium presence in all aspects from its network of branches to its revenues and deposits.

It is then no wonder its market share in terms of deposit size has remained between 0.3%-0.5% over the past eleven years,

the lowest in the industry. At the same time however, although the deposit base is small, its 5-year CAGR for deposits is an impressive 15.9% compared to the industry’s 5-year CAGR of 13.9%.

It seemed, almost, as if Samba Bank was always meant to be sold. A neat little headstart for anyone that wants to buy a bank. So when the bank finally went up on the market, hands shot up immediately.

Now this here was the conundrum.

On the one hand, Samba Bank was a great opportunity for a number of players. On the other hand, the bank’s owners were in no rush to sell it off and could afford to be picky. But why were the bank’s owners selling in the first place?

Essentially, in April 2021, Samba Bank’s ownership changed when Saudi Arabia’s largest corporate lender National Commercial Bank (NCB), successfully merged with Samba Financial Group to become the kingdom’s biggest bank, Saudi National Bank (SNB), with an asset base of $239 billion. Samba Financial Group had a stake of 84.5% shareholding of the bank which was transferred to SNB.

Profit covered it in its story: Who will buy Samba Bank and why?

Eight months later, the SNB decided to pack up its Pakistan operations as Samba Pakistan was merely a speck in NCB’s portfolio that did not generate a lot of revenue.

To maintain its operations here, no matter how small, it has to allocate some capital, capital it could use elsewhere more efficiently. Following the financial crash of 2008, ‘basel 3’ was formed, a regulatory framework that sets and monitors global minimum capital standards for commercial banks. According to one senior banker, the minimum liquidity requirement relative to Pakistan would roughly translate into SNB deploying an extra $1 to cover each dollar of capital it has parked with Samba Pakistan.

The new ownership did not view this as a viable cost to do business in Pakistan where it would take a tonne of more capital to grow in size and make more money. Another consideration for a foreign financial group investing in Pakistan is the dearth of foreign banks left in the country, with practically only Standard Chartered Bank qualifying as one with a considerable presence and scale of operations. Others, such as Citibank and Deutsche operate on a very minuscule scale and in a specialised

manner.

Hence, SNB decided to sell the bank. As mentioned earlier, multiple contenders came forward and expressed interest in the bank which included United Bank Limited, Askari Bank Limited, and a consortium led by Fatima Fertilizer, TAG, and Meezan Bank.

The hopes of such contenders were soon crushed when SNB announced a change of plans and terminated the of its equity stake in Samba Bank in May 2022 due to uncertain market conditions. This was the most that the group gave in terms of an explanation for why they stopped their plans for selling Samba Pakistan. Sources have said that perhaps one reason might have been that there was a major employee pushback and discussions of management buyout but bank insiders have remained mum over this subject. In any case, SNB went back on its plans and decided to continue retaining its existing equity stake in Samba Bank Limited, given the banking sector outlook in Pakistan. Later, SNB communicated its intent to remain committed to Samba Bank, including its commitment to invest in the strategy of the bank.

Approximately two years later, SNB has once more responded favourably to a contender, Bank Alfalah, agreeing to assess their

non-binding offer. SNB has extended an invitation to Bank Alfalah to conduct due diligence on Samba Pakistan.

As per a report by Business Recorder, the divestment plan was not taken well by employees of Samba Bank who urged the central bank to ask Saudi National Bank to provide an appropriate package to Samba Bank staff on apprehensions of downsizing post divestment of shareholding.

According to the employees, the majority shares of the SBL were acquired in the year 2007-8 by Saudi Arabia Financial Group when Samba Bank was a loss-making entity with a bleak future within the banking industry in Pakistan. Despite this, the bank transformed into a profitable institution by 2013 through the dedication of employees. And the bank declared dividends in 2020 and 2021 amounting to Rs 1.36 billion.

The employees argued that at the point of a growing sense of economic stability of the bank, SNB suddenly decided to exit from Pakistan by disinvesting shares in SBL.

They said new sponsors would bring in their own business strategy, stating that two out of three shortlisted bidders had plans to merge operations of SBL within and into their existing banking operations, which would result in job termination for many employees.

As per a report by Dawn, the foreign investor was put off by the banking sector’s “low multiples” amid deteriorating economic conditions. “There’s no point in divesting at a time when valuations are this low,” he said while requesting anonymity because of a possible conflict of interest. The price-to-earnings (P/E) multiple, which measures a bank’s share price relative to its income per share, of the bank for the trailing 12 months is 8.16 versus the sector’s 4.52.

Moreover, the bids received from the interested parties were lower than expected. A secondary reason was that the foreign investor was doubtful about the swift repatriation of dollars given macroeconomic conditions of the country and the foreign exchange crunch the country was facing.

The memo notifying SNB’s termination of sale process hinted at all these reasons. “As part of this strategic review, SNB has concluded that it will continue to retain its existing equity stake in Samba Bank Limited, given the Paki-

stan banking sector outlook. This process may have created uncertainty amongst some of our employees and stakeholders. Regardless of the outcome of the strategic review, SNB has and will continue to focus on Samba Bank Limited’s commitment to its customers and employees. We look forward to the contribution of all employees to continuing the positive momentum of the business and financial performance of Samba Bank Limited”, read the notification.

Before we delve into the books of Samba Bank, it is important to look at industry trends first to understand why the sale has not happened up until now. Because in the period from 2022 to now, Pakistan’s banking sector has seen some major changes. With interest rates going as high as 23% in 2023, banks have relied on making easy money by lending money to the government.

High interest led to higher funding costs for banks and impacted borrowers’ debt servicing ability. Consequently, banks adjusted by decreasing lending, increasing provisions for potential loan losses, and writing off non-performing loans. On the flip side, rising interest rates mean wider bank margins, which would partially offset the decline in earnings, with lower business volumes, while still allowing for improved profitability.

With economic slowdown and inflation hitting record highs and interest rates still capped at 22%, businesses haven’t exactly

been lining up for credit. So what do the banks do? They lend to the one entity that constantly needs money no matter what: the government. To ensure wide margins, banks stress on accumulation of low-cost deposits like current accounts and Islamic savings accounts.

All of these culminated in improved profitability for the banking sector. Commer¬cial banks posted an impressive 83% earnings growth during 2023, with almost all banks recording historic profits.

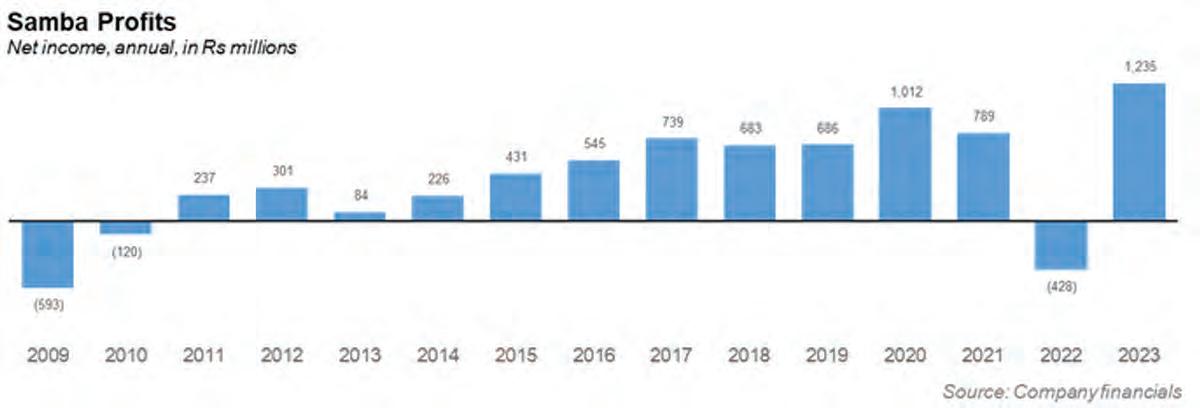

Samba Bank was no different as the bank’s net interest income increased by 71% over 2022. In fact, the bank’s profit after tax reached a 14-year high of Rs 1.2 billion, that too just a year after the bank recorded a loss of Rs 428 million in 2022. The bank incurred a loss in 2022 due to a disproportionate increase in interest expense on liabilities as compared increase in markup income on earning assets. Similarly, a persistent decline in capital markets resulted in a capital loss of Rs. 1,284 million on the investment portfolio. Moreover, the bank offloaded high-market risk securities resulting in lower mark-to-market losses in 2023 which led to the bank improving profitability in 2023.

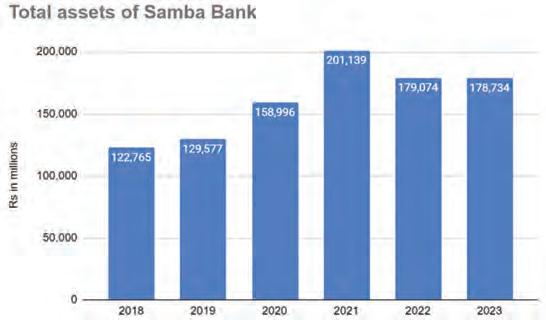

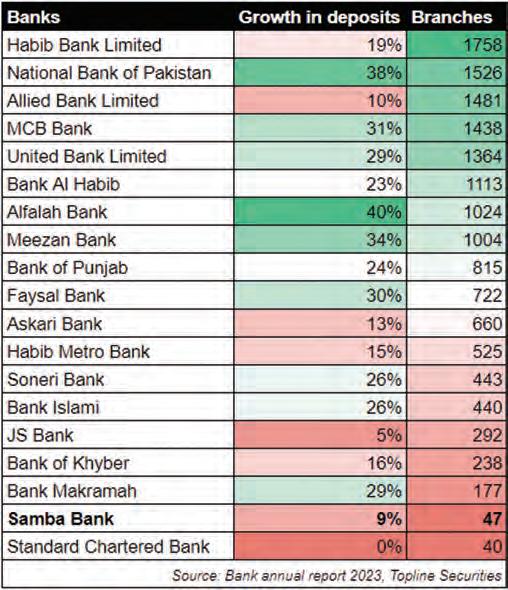

Overall there has been a nominal growth in revenue and profitability, with a notable 22% compound annual growth rate (CAGR) in gross income (comprising interest and non-interest income) over five years, and a 13% CAGR in net profit after tax during the same period. As mentioned earlier, Samba Bank is one of the smallest banks in Pakistan. The bank’s growth trajectory suggests that the bank had no intention to grow fast and exponentially. This is evidenced by the small size of its branch network. Samba Bank had a branch network of 47 branches at the end of 2023, only branches more than the Standard Chartered Bank, the smallest local foreign bank. As a result, its market share in deposit size has remained between 0.3%-0.5% over the past 14 years, the lowest in the industry. Similarly, its 5-year CAGR for deposits stood at 11.96% compared to the industry’s 5-year CAGR of 15.8%.

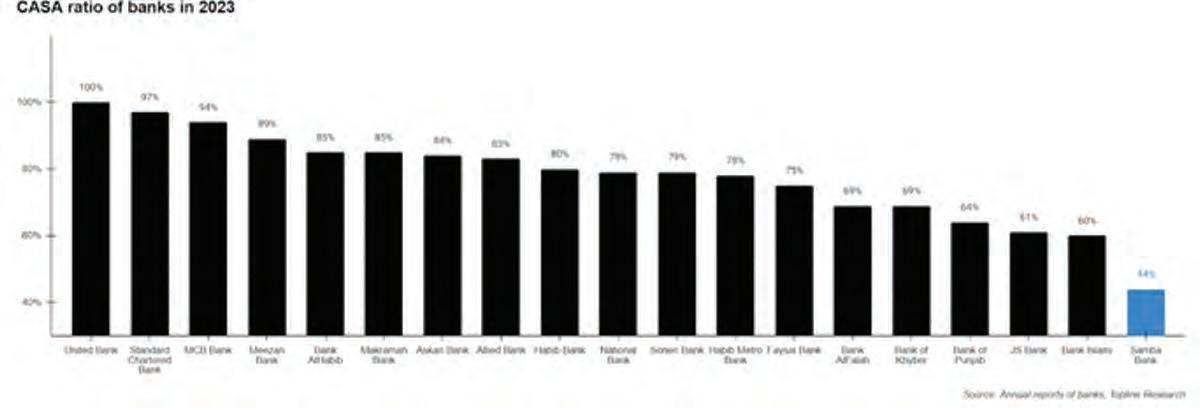

A small branch network means that Samba Bank’s ability to attract low-cost funding is restricted. The bank’s deposit base is concentrated with term deposits from the public sector and institutions. The bank’s current account and savings account ratio to total deposits stood at 44% in 2023, almost half of the industry average of 84%.

The bank has realised the need to enhance its outreach and attract a low-cost deposit base. “The bank is continuously right-sizing its earning assets mix vis-à-vis credit risk. In the wake of the rising interest rate scenario, the momentum has shifted towards mobilisation of low-cost deposits and gradual reduction in borrowings.” read the 2023 annual report.

However, the bank’s limited branch network means that the bank’s ability to attract low-cost deposits is limited. While deposits increased by a nominal 9% in 2023 as compared to 2022, the rate of increase is much smaller as compared to its peers: the industry deposits grew by 24%. Moreover, the growth in the deposit base has come mainly from public sector /institutional deposits.

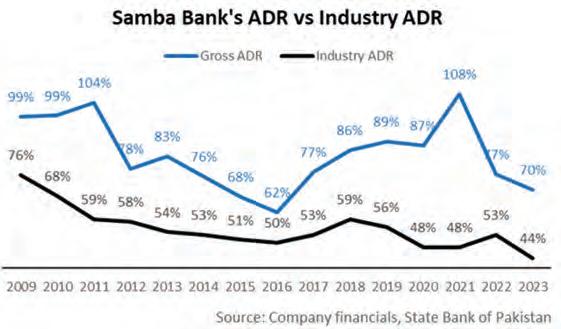

A bank’s business is to accept deposits from customers and lend it to other customers. In the case of Samba Bank, advance (lending) to deposit ratio (ADR) has remained historically higher than the industry ADR. In fact in 2022, when most banks were trying to improve their ADR to avoid paying extra taxes, Samba Bank was trying to reduce its lending, as gross ADR dropped from 108% in 2021 to 77% in 2022. To some extent, Samba has been successful in this pursuit, as gross ADR continued to decline to 70% in 2023. While ADR is still high, it has declined as deposits grew in 2022 and 2023.

In a high interest environment, high lending could lead to high non performing loans (NPL), people default on loans as servicing becomes more expensive.

Samba Bank’s NPLs have risen over the years. Recognising this risk, the bank has strategically set out to deleverage the balance sheet to maintain adequate liquidity and a low-risk profile. Hence, the advances portfolio has been declining in 2022 and 2023. Moreover, borrowings have also declined as the bank reduced its repo borrowing and reduced its interbank and treasury transactions together with offloading its fixed-rate investments to avoid steep losses in a rising interest rate scenario. Similarly, the duration of securities was deliberately decreased to minimize the risk.

Consequently, the size of Samba’s balance sheet declined slightly.

Yet, overall the bank’s financial performance is much better than other ‘undercapitalised’ banks that have been up for sale for quite some time. It remains to be seen if the bank will be sold for good or will SNB once again have a change of heart. n

Malnutrition remains a formidable challenge globally, manifesting in various forms such as undernutrition, micronutrient deficiencies, obesity, and diet-related non-communicable diseases. It’s a leading contributor to disease and mortality worldwide, with around one-third of the global population affected. This includes 2.5 billion adults grappling with overweight or obesity, 390 million being underweight, and millions of children facing stunting, wasting, or excessive weight at a young age. These figures highlight the pervasive impact of malnutrition, leading to

serious health issues ranging from heart diseases and bone softness to diabetes and vision impairments.

In Pakistan, the situation is particularly alarming, with malnutrition rates significantly surpassing both regional and global averages. This underscores an urgent need for nutritional interventions to combat this crisis effectively.

In response to this global health challenge, Unity Foods is leading the charge in nutritional empowerment, aligning with the ideals of World Health Day. The company has taken a formidable stance against malnutrition by infusing its flagship brands, Sunridge and Good Goodies, with fortified nutrition. Their commitment is not just to food production but to enhancing the health and wellness of the community through nutritional innovation.

Unity Foods has introduced the Fiber Fit range, emphasizing the importance of digestive health and general well-being. This range, rich in soluble fiber, aids in digestion, blood sugar regulation, and weight management while also supporting cardiovascular health by lowering cholesterol levels.

Moreover, the Sunridge Products fortified Atta stands out as a staple in combating nutritional deficiencies. Enriched with essential vitamins and minerals, this flour is produced using advanced technology to ensure purity and safety. It represents a critical tool against malnutrition, especially in vulnerable groups.

Additionally, the Good Goodies range, with its Energix fortification, offers a sustained energy source through fortified snacks and cakes. This innovation supports active living and nutritional well-being, enabling consumers to maintain energy levels and overall health.

As World Health Day unfolds, Unity Foods reiterates its dedication to fortified nutrition and well-being. By championing nutritional enhancements, the company plays a pivotal role in the global initiative to improve health outcomes. Their efforts not only cater to immediate dietary needs but also contribute to a broader vision of ensuring access to healthy living for all.

On this World Health Day, reflecting on “My Health, My Right,” it’s essential to acknowledge the impact of nutrition on our health. Unity Foods empowers consumers to embrace a healthier lifestyle through fortified nutrition, embodying the principle that a healthy life is a fundamental right. n

t seems like Pakistan is alway teetering on the cusp of the worst from happening. Whether it is facing a default or being demoted on different indexes and lists, the cliffhanger suspense never seems to end. And just when there is a chance that the fingers will slip, the country is saved miraculously. With the deadline on the Iran Gas pipeline looming, it seems the roller coaster is not going to end anytime soon.

On an optimistic note, on 28th of March 2024, news broke that Pakistan had avoided being demoted in the FTSE Russell watchlist. The decision meant that Pakistan would stay as part of its Secondary Emerging classification and could be included in different indexes.

What even is the FTSE Russell watchlist and what impact does this decision have on the stock market? Profit explains.

Now when one hears the word index, the most common one that comes to our mind might be the KSE-100 (Karachi Stock Exchange) index, NASDAQ or Dow Jones Industrial. The goal of an index is to track performance of an asset. Let’s say a person wants to track the performance of 100 of the top companies trading in the Pakistan Stock Exchange. In order to have that, 100 companies will be selected based on performance and they will be indexed at a starting date.

When the KSE-100 index was initiated in 1991, 100 stocks were chosen and a date was set which was the starting point for the index itself. Now as time goes on, the price of the companies change and the index reflects those changes. After 10 years, just by looking at the index, a person can determine how the index, and conversely the companies themselves, have performed.

Indexes help in providing a snapshot of performance to the participants of the capital markets. In November 1991, the index was initiated at 1,000 points. From then till now, the index has surpassed 67,000 points over a period of 33 years. An annual average of 2,000 points have been added to the index which shows that the market has fared very well compared to where it started.

We expect Pakistan will remain engaged with the IMF and will request for a longer and larger size of fresh bailout package under the Extended Fund Facility (EFF). The new program will come with its tough conditions but given recent resolve shown by the government and limited options, we expect the government to implement the tough conditions

Mohammed Sohail, CEO at Topline SecuritiesJust like the movement in the index is dynamic, so is the composition of the index itself. The initial index is made based on certain criterias that the stocks need to meet. Over time, certain companies might see that they have fallen below the criteria while other companies might have met the criteria which they were not able to previously. Due to the liquid nature of the stocks and market, the index is revised twice a year and companies are added and deleted periodically.

Similar to the likes of KSE 100 index that tracks the performance of the top 100 companies, PSX also manages other indexes like KSE all share which tracks the whole stock market, KSE 30 which is made up of 30 top companies and KMI 30 index which tracks the 30 most liquid Shariah Compliant companies. Indexes are also made for certain sectors like the Oil and Gas Tracking Index (OGTI) and Banking Tradeable Index (BKTI) which track only a sector of the stock market. This allows investors to gauge how a sector is performing and gives them a comprehensive view on the sector alone.

So now that we know what an index is, what is FTSE Russell?

Financial Times Stock Exchange (FTSE) is a subsidiary of the London Stock Exchange group which is involved in producing, licensing and marketing of stock market indices. FTSE Russell was constituted in 2015 when FTSE integrated its indexing services with the Russell index series. The main operation of FTSE Group is to operate 250,000 indices that are calculated across 80 countries and earn a subscription fee based on providing access to this data to its users. In addition to that, the company also licenses index based products which it sells to its clients.

The KSE 100 index which has been talked about would fall into the first category of indices that FTSE tracks for its clients. In the case of Pakistan, the data is readily available

and disseminated by the stock market itself. In the case of FTSE, they can provide this data at the fee and ask for subscription in return for provision of this data. The other part of the service provided by FTSE is that it creates index based products which the investor can invest in based on their requirements.

Consider an example to understand the difference between the two services. Let’s say a person wants to find out how the top 3,000 US companies are performing. In order to provide that information, they can get access to the data of the Russell 3000 index which tracks 3,000 companies in the US which represent 96% of the US market. Similarly, they can get information about the Russell Top 50 Mega Cap Index which tracks the performance of companies with the highest market capitalization all over the world.

This data will be provided at a cost and that cost will be paid for by the clients. The data comes at a premium as it will give all the details on the companies that are part of the index and the returns they have made. Fund managers, brokerage houses and traders value this data as it has been sourced from thousands of sources and rely on it. Due to the depth and breadth of the data provided, FTSE charges a fee.

On the other hand, FTSE Russell also creates index based products which can be invested in. Let’s say an investor wants to invest in Shariah Compliant companies that are operating around the world. Rather than opening accounts in different jurisdictions and countries, the investor can invest directly with the FTSE Russell indexed product and get a share in the investment in all the companies that are a part of the index related product. As these companies will perform, the index will rise and so the investor can end up making a gain on his investment.

Even though they may sound familiar, in reality they are very much different. In one case, the index is only tracking the price changes and telling that to the clients. In the other one FTSE Russell is actually investing in the shariah compliant companies based on their own investing guidelines. FTSE Rus-

sell will actually use funds to buy stocks of companies which meet the criteria that they have set out and then earn a return on those investments.

So how does this impact an investor in a stock market?

Consider the case of the U.S. Executive Order 13959. Under the executive order, investment in Chinese companies was prohibited based on the security threat which was posed by Chinese technology companies to the US. As investment was limited, the FTSE Russell index had to strip its indexes of Eight Chinese companies which it was covering. Similarly, after the invasion of Ukraine, FTSE had to remove all the Russian securities from all its indexes in response to that.

As these companies are removed from the indexes, they are also removed from the index related products that the company is marketing. What does it mean? They liquidate these positions or sell them off which causes the share price to fall.

When a stock or a company is added to an index, it means that not only will FTSE start covering its performance, they will also start to invest in these stocks in order to make them a part of their product portfolio. As they start to buy shares of these companies, the share price starts to increase. A decision and a stroke of a pen by an investment committee has real world implications and the stock price moves accordingly.

With a kitty size of $ 15.9 trillion, the stroke of pen has a lot of heft to it.

The investment products that these companies promote are not only for individuals. These products are bought by fund managers, asset management companies and large corporations based on their performance and their attractiveness. Being included by FTSE also increases the visibility of these companies to the broader investment ecosystem who become aware of these companies and are able to

provide free publicity to these stocks as well.

In order to make the companies part of the index, there are different criterias that are used in order to make sure that the stocks being selected have passed a threshold that has been set. The index sets the criteria and then periodically reclassifies its index to make sure that all companies are meeting the merit that has been set out. All throughout the year, the performance of the whole universe of capital markets is considered and then at the end of the period, new stocks are added and old ones are deleted.

Other than stocks being evaluated, the FTSE also considers different countries and classifies them as either developed, advanced emerging, secondary emerging and frontier. These go from the most developed markets to the ones which still have some maturing to do.

The Watchlist is a service provided by FTSE where it gives out a list of countries it sees either getting demoted down the scale or being promoted. In September 2023, the review added Egypt and Pakistan as two countries which were going to be added to the Watch List. Pakistan was added as a possible demotion from secondary emerging to frontier market status.

The decision was based on the market failing to meet the minimum investable market capitalization exit level threshold which was required to maintain the secondary emerging market status. As the country was seeing a deterioration in its capital markets, there was a risk that the country could be removed. The September review is based on June end data which showed that the country had $ 3.01 billion in terms of its investable market capitalization in the FTSE Emerging All Cap Index while the minimum threshold set was $3.49 billion. The decision to formally demote the country would be carried out in the March 2024 review.

With the sword of Democles hanging over the country, there were reports that the country had to show an economic turnaround in its results in order to avoid the demotion. Pakistan saw a massive rebound in its equity markets from July to December with the index increasing by 50% while the bond markets also saw an increase due to IMF disbursements. With capital controls being reduced and liquidity being improved, the country did see considerable recovery from June 2023. The market saw an addition of $11 billion in market capitalization from July and FTSE had to decide whether this was ample enough to save the country.

When the results for the latest review were announced, they were nothing short

of underwhelming. Just like a child passing with the bare minimum, the report stated that the country marginally passed the Minimum Investable Market Capitalisation exit level which needed to be maintained. A report card of D in other words.

There will be another review which will be carried out in June 2024 whose results will be announced in July 2024. Based on these results, the review will be carried out in September 2024 which will decide whether the failing child needs to be demoted once and for all. The name will remain on the Watchlist till then.

To try to predict the future at this point would seem premature but it seems that early signs are promising. At December end, the KSE-100 index was trading at 62,451 which is currently at 66,593 as on 2nd April 2024. This is an increase of 6.6% which is a step in the right direction. Similarly, bond prices were trading at 93.53 in December and have increased to 98.39. This is due to the convergence of bond prices towards 100 as it reaches maturity and due to macroeconomic indicators getting some support due to the IMF review being successful.

As per a report by bloomberg, “Pakistan’s biggest problem since 2017 has been a steady erosion in market size. However, a rebound has been underway since September, with the market adding almost $11 billion of shareholder wealth.”

“The country’s stocks have rallied 5.7% this year, outperforming EM peers. Dollar bonds have returned 28%, the third-best performance in the asset class,” read the report.

The optimism is also shared by experts in the capital markets who feel that the latest

review being successful and going towards a new IMF program will provide some much needed relief to the markets. The multiples in the market are still seen to be cheap and with reforms being implemented in the economy, the multiples will move towards a fairer value stimulating the markets. The core issue right now is inflationary pressures which are expected to fall which will lead to an ease in the monetary policy. As interest rates are expected to be cut, the market will get another boost in terms of funds flowing into the capital markets.

“We expect Pakistan will remain engaged with the IMF and will request for a longer and larger size of fresh bailout package under the Extended Fund Facility (EFF). The new program will come with its tough conditions but given recent resolve shown by the government and limited options, we expect the government to implement the tough conditions.” states Mohammed Sohail, CEO at Topline Securities.

Around the end of last year, when the index was trading at 62,000 points, there were brokerage houses which were bullish and were expecting the index to settle above the 100,000 mark in a year’s time. Topline Securities also released a report stating that the market recovery had just begun back in November of 2023 and expected the index to reach 75,000. With recent statements by the Finance Minister of a longer and larger package being sought from the IMF, there is potential that the mark will be hit sooner than expected.

Sohail further adds that “given the new IMF program on the cards market capitalization will increase and Pakistan will manage to retain its position in FTSE Secondary Emerging Market.”

Whatever will end up happening, time will tell. Join us again for the next thrilling installment of “Pakistan and the (almost) impending Doom” *echoes* n

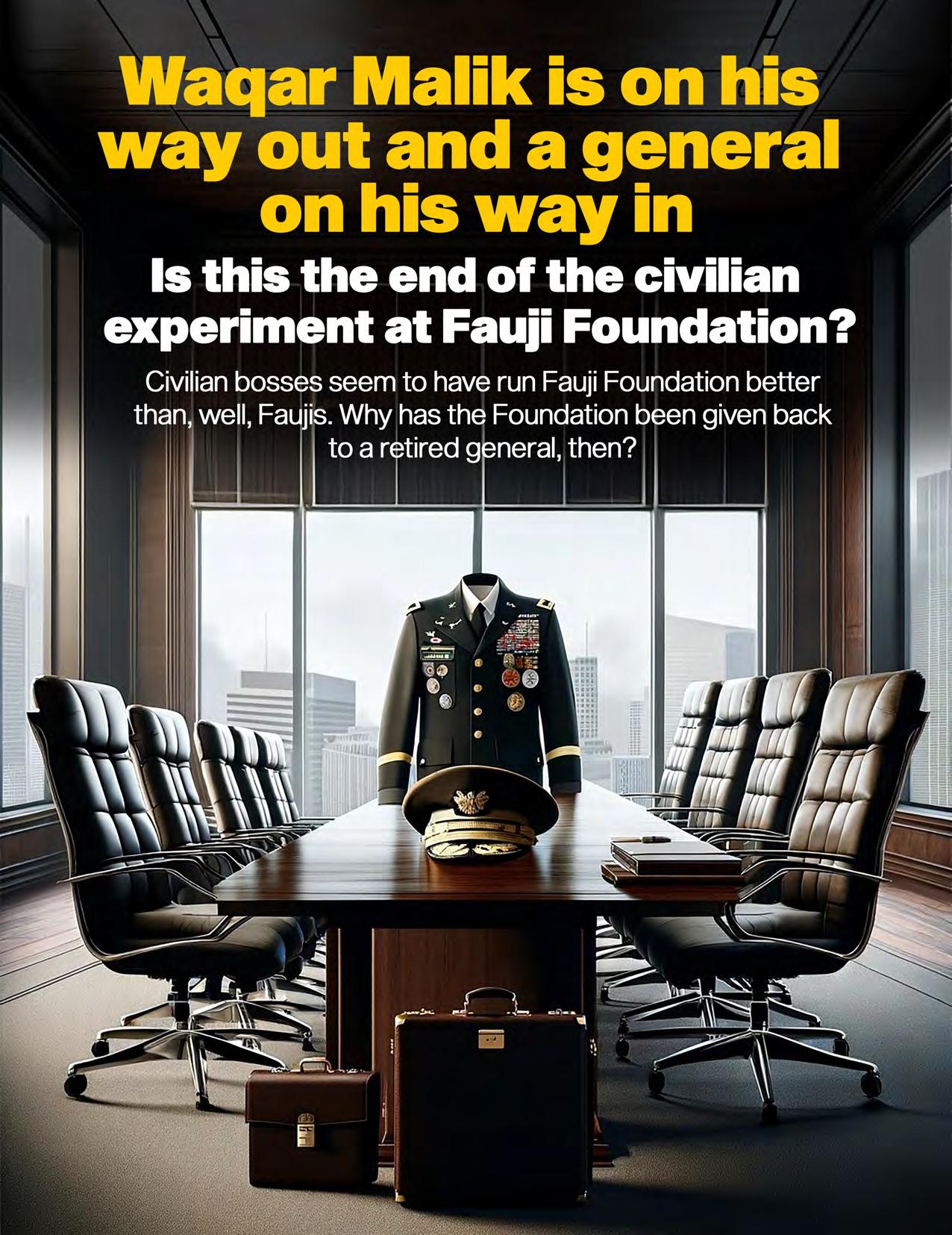

Four years after becoming the first civilian CEO and Managing Director (MD) of the Fauji Foundation, Waqar Ahmed Malik is on his way out. For the past two weeks he has been going from subsidiary to subsidiary of the Fauji Foundation on the sort of farewell tour that the Chief of Army Staff (COAS) usually takes upon retirement.

By most measures Mr Malik’s tenure has been a success. A number of the company’s publicly listed companies have seen an uptick in performance. In particular, the Fauji Foundation’s perennial problem subsidiary, Fauji Foods, witnessed profits for the first time in years as well as improved margins at a time when its competitors have actually seen a dip. It is a wonder how it took so long for a civilian to lead what is one of the largest conglomerates in Pakistan. His secret? Bringing in industry professionals to helm the different businesses of the Fauji Foundations in place of military management.

None of that, it seems, was enough to convince the Faujis of the benefits of allowing an outsider to come in and captain the ship. Not only has Mr Malik been replaced, Lt General (r) Anwar Ali Hyder has been given the charge. The cigar-smoking, smooth-talking General Hyder has been one of the most active ex-servicemen in the country. He was previously the chairman of the Naya Pakistan Housing and Development Authority and just finished a stint as caretaker defence minister in the caretaker cabinet of Anwar Kakar.

The flamboyant Mr Malik has been replaced by the Faujiest of Faujis in a clear indication that the Fauji Foundation is done with its little experiment with civilian supremacy. But this four year period leaves behind many questions. How did Waqar Malik rise to the top of what is considered the crown jewel of the Pakistan Army’s economic interests? How did he manage the foundation? And where will the good general that has replaced him take the Fauji Foundation? Based on conversations with Waqar Malik, discussions with former high-ranking military officials, and the analysis and comparison of financial data, Profit investigates.

In April 2020, Waqar Malik walked into the boardroom at the headquarters of the Fauji Foundation and took his seat at the head of the table. Looking back at him were the faces of high-ranking military officials. Some of them had been working at the Fauji Foundation for many years. Some of the men at the table had served together. There were even some whose

fathers had also worked at the Fauji Foundation after completing their service in the armed forces. This is the same organisation that was described by one former high-ranking officer of the Pakistan Army as “the heart of the military’s economic machine.”

And here was this hotshot civilian about to tell them how to run their foundation. The reception Mr Malik got was understandably frosty, but he was unnerved by the hardened faces that greeted him. One must understand the gravity of the moment. The Fauji Foundation is run by a two-tiered management structure. There is first the Committee of Administration consisting of serving representatives of all three branches of the armed forces (two stars or more). This committee has overarching control of the foundation and its investments without being involved in the day-to-day oversight.

Then there is the Board of Directors, which consists of retired members of the armed forces that manage the day-to-day running of the foundation. The CEO and MD of the company chairs the latter and is a second lead on the former body. This makes him the link between the armed forces and the management of the foundation.

Never before 2020 had a civilian been in this role. In fact, the armed forces have had total control of the Fauji Foundation through retired officers since 1954. The story of the Fauji Foundation actually starts with a sum of $5 million left by the British in 1945 for the Indian veterans of the second world war.

The money was left in the Post War Services Reconstruction Fund (PWSRF) for Indian War Veterans, which remained unused and was divided between India and Pakistan in 1947 at the time of partition. The civilian administration transferred control of this still unused money to the Pakistan Army in 1954.

At the time, Pakistan’s share was around Rs 1.82 crore. Instead of distributing this remaining money, the army invested it in setting up a textile mill. Why would the army do this? Because there are essentially two kinds of charitable organisations. The first kind are the ones which for the most part collect donations and funds and spend those directly on charitable endeavours. They rely on a constant stream of donations. The second type is a little more complicated. These are organisations that operate as profitable entities. They undertake business and use the profits from these businesses to engage in charitable activities.

Fauji Foundation, set up under the Endowments Act of 1870, is the latter kind of organisation. Using that initial Rs 1.82 crore, the foundation has grown into a massive conglomerate that looks after the needs of retired servicemen and their families. For example, with the money they made from that first textile mill, the Fauji Foundation set up the first 50-bed tubercu-

After taking charge of the Fauji Foundation, Waqar Malik went on a hiring spree. He replaced former military officers as CEOs of a number of subsidiaries of the group and replaced them with corporate professionals. These were some of the prominent changes:

Fauji Foods

Previous CEO: Lt General Javed Iqbal

New Civilian CEO: Usman Zaheer Ahmad

Fauji Fertilizer

Previous CEO: Lt General Tariq Khan

New Civilian CEO: Sarfraz Ahmed Rehman

Fauji Cement

Previous CEO: Lt General Muhammad

Ahsan Mahmood

New Civilian CEO: Qamar Haris Manzoor

Mari Petroleum

Previous CEO: Lt General Isfaq

Nadeem Ahmed

New Civilian CEO: Faheem Haider

losis hospital in Rawalpindi.

It is an entirely self-sustaining entity. Over time, the business interests of the Fauji Foundation have expanded including ventures in the fertiliser, banking, food, energy, and cement industries. Almost since the inception of Pakistan, the Fauji Foundation has been a point of pride for the armed forces and has been run by them. Which is why when Waqar Malik showed up, there was a sense of apprehension within the conglomerate.

Perhaps what surprised the old guard over at Fauji Foundation had less to do with Mr Malik’s appointment and more to do with the route it took. In his own words, his journey to the top of Fauji Foods happened almost out of nowhere. Standing in the offices of the foundation’s managing director, Mr Malik cuts an eccentric and flamboyant figure. Profit interviewed him last year while he was still in

office. Standing behind his desk, arms folded over his chest he spoke candidly in English in an accent we couldn’t quite place.

A veteran of the corporate world, he had retired after serving stints as CEO first of ICI Pakistan and then Lotte Chemicals. During his retirement period he would occasionally consult for different companies. It was on one such consulting mission that he first found himself involved with the Fauji Foundation. “My first engagement with the foundation was around 2018, I got a call out of the blue from the then MD of FF asking me to consult with them on governance related issues. I initially came in, had a few conversations and took four or five months to prepare some research on the welfare side as well. I eventually got to present this research at General Headquarters (GHQ) where General Bajwa was present too.”

Mr Malik claims this is the first time he met General Bajwa, and that the COAS took an immediate liking to him. Impressed by his presentation, General Bajwa told the foundation that Mr Malik should continue consulting on different matters. At the time, General Qamar Javed Bajwa was in his last year as Chief of Army Staff. There were other matters on his mind, and he did not have the time to see through a major change over at Fauji. But the idea, according to one official close to the former COAS, had taken root already by then. While he didn’t have much time left in office, the COAS was expecting a three year extension from the freshly formed government of Imran Khan. After some legal technicalities, the extension came in by the end of 2019. In April 2020, just a couple of months after the extension was confirmed, Mr Malik was appointed CEO and MD of the Fauji Foundation.

This automatically raises some questions. Why Waqar Ahmed Malik? Sure, he is an immensely qualified individual with the correct education, pedigree, and experience at running large companies. He is an effective communicator, and his behaviour with his staff and colleagues indicates a man that knows how to get work done from a team. But he isn’t the only one with such qualifications. There are plenty of others out there as passionate and as qualified as him that would jump at such a chance.

So either it must have been one hell of a presentation he gave at GHQ or something else made him trustworthy to General Bajwa. According to one source, there is a link between General Bajwa and Mr Malik. It seems that the COAS had felt for some time that the Fauji Foundation was not performing well and there was a dire need to fix its operations and profitability. The idea of a corporate professional coming in to fix the problem had been on his mind for some time, he just had to wait to secure his extension first. Mr Malik presented the perfect opportunity to implement this plan.

He had been engaged as a consultant by

“But the most important thing that we did was to bring the best people possible in. I needed to find the best of the best to head my companies. And to this end I have to give my sponsors credit they gave me a very free hand. They did not interfere at all which I might even have expected. Instead I was given a free hand to do what I wanted,”

Waqar Ahmad Malik, former CEO and MD of Fauji Foundation

the Fauji Foundation. The same senior source from the armed forces that told us about the initial pressure faced by Waqar Malik said that the consulting role he had been called in for was on merit. But later it turned out he was a friend and colleague of Matin Amjad. Matim Amjad is the son of Major General (r) Ijaz Amjad who is the father-in-law of General Bajwa. Matin Amjad had started his professional career at ICI Pakistan in 1998. In 2005, Waqar Malik would become CEO of ICI.

This connection was further cemented in 2018, around the same time that Waqar Malik had started to consult for the Fauji Foundation. After his retirement, Waqar Malik was also involved in a Capital Holdings company called Adira that he had founded with Atif Bukhari, Fawad Anwar and Siraj Dadabhoy — other business leaders with similar experience as him. In 2017, Adira acquired Linde Pakistan, which had been a leading player in the industrial gases industry in Pakistan for more than 70 years.

Through this acquisition, they launched PakOxygen which is an Oxygen manufacturing company established in 2018. When this company was created, Waqar Malik was the chair of its board. And for the position of CEO he brought in Matin Amjad — the brother-in-law of General Bajwa.

Waqar Malik was competent, he had the right experience, he had the right connections and he had found himself leading one of the largest conglomerates in the country. But there was a small problem. While he had the trust of General Bajwa, others in the military brass and in particular those on the Committee of Administration felt slighted. On top of this, officers began to worry about how this would affect their retirement plans, since the Fauji Foundation also provides employment to a number of retired officers.

On top of this, Mr Malik had come in with the plan of changing things up at a lot of the subsidiaries that the Fauji Foundation owns. As we mentioned earlier, the Fauji Foundation itself is a charitable entity that uses its profits to work for the betterment of military personnel. But to make these profits it owns majority shares in a number of subsidiary companies. Many of these subsidiaries are listed on the Pakistan Stock Exchange (PSX) and have their own minority shareholders and management. They are inde-

Lt. General (R) Muhammad Mustafa Khan

Lt-Gen Khalid Nawaz Khan 2015-2017

pendent companies. But because the majority shareholding belongs to the Fauji Foundation, the CEO of the foundation is the chairman of many of the boards of these subsidiaries. So along with being responsible for the welfare activities of the foundation, Waqar Malik was suddenly also responsible for the profitability of these other companies. He was the chairman of the board of Fauji Fertiliser, Askari Bank, Mari Petroleum, Fauji Cement, and 15 other companies.

At the time that he took over, many of these companies were staffed with retired army personnel. When Malik was made the Chairman, he started off by trying to bring in people with experience in the corporate world. Positions which were seen to be held for retiring army generals were now being given to business oriented people who had experience in running successful organisations.

In fact, many of the CEO positions in these subsidiaries were filled by Mr Malik as per his comfort. People like Zaheer Ahmed, Sarfaraz Rehman, Qamar Manzoor, Atif Bokhari and Faheem Haider were brought in. These people had a wealth of knowledge and experience behind them and had served in local and international experience in running businesses. The aim was to bring a touch of professionalism in order to make these companies successful.

“The most important thing that we did was to bring the best people possible in. I needed to find the best of the best to head my companies. And to this end I have to give my sponsors credit they gave me a very free hand. They did not interfere at all which I might even have expected. Instead I was given a free hand to do what I wanted,” he told Profit last year. “They were focused on outcomes, not inputs, which is the right way. They wanted to see the outcome of that strategy. And I must say, I got a great deal of support from all of them. So these CEOs who have come in are industry veterans. Together, if you look at the top tier that I’ve got, and my CEOs, and people who are supporting me, we’ve got 300 years of cumulative experience.”

Lieutenant General Syed Tariq Nadeem Gilani

2018-2020

Waqar Malik 2020-2024

This is the part of the story where we try to see what effect Waqar Malik brought on the Fauji Foundation. To assess his performance and the performance of the organisation’s subsidiaries after Waqar Malik’s reforms, we need to compare financial performance with two different factors. The first is to try and understand how each company did before and after the management changes that came after Mr Malik took charge. The second is to see how these subsidiaries did compared to their main competitors, so we can also contextualise the performance in the time that it took place.

In order to carry out a fair analysis, five of the listed companies of Fauji Group are taken and are compared with other listed companies which are operating in the same environment. The performance is being analysed to see how the company was performing before 2020 and how the performance of these companies changed. A caveat needs to be placed here that when the past performance is being seen, it is done in context of the competition.

By adding this context, it is made sure that the performance of the Fauji company is compared to a company which is operating in the same business environment. For example, consider that a Fauji company was earning a net profit margin of 10% before 2020 which actually decreased to 8% after that. This tells in absolute terms that the company has performed worse. But what if a competitor in the industry was previously earning 15% net profit margin which fell to 5%? This would show that actually, in context, the Fauji company did not suffer to the same extent as others did which shows that the Fauji company actually performed better under the new structure.

It is also important to note here that corpo-

Lt General (r) Anwar Ali Hyder

rations are massive and huge in size. A decision taken today at the top will see its impact long into the future. Imagine a corporation like a large cruise liner. Even when the captain has turned the wheel, it takes a long time for the ship to actually turn. Corporations also experience this lag. CEOs or captains make a decision and the effects of those decisions take time to manifest themselves.We have also listed for the sake of clarity all of the management changes that took place in each company.

So let’s begin.

Previous CEO: Lt General Javed Iqbal

New Civilian CEO: Usman Zaheer Ahmad

Main competition: FrieslandCampina Engro Limited

The first company that is being considered for this analysis is Fauji Foods. Fauji Foods came into being when Noon Pakistan, the company which launched the Nurpur brand, was taken over. The company is known for its range of dairy products running from milk, butter and cheese products.

Before 2020, the company was being led by Lt Gen Javed Iqbal who was replaced by, first, Muhammad Haseeb Alam and then by the Chief Financial Officer of the company Ebad Khalid. As the fortunes of the company were not changing, a final change was done by bringing in Usman Zaheer Ahmad who is still at the post.

Zaheer Ahmad had a strong corporate and commercial track record of over 20 years in local and international markets. He is seen as someone who has strong leadership credentials as he has delivered performance and profitability. He is result oriented and was seen as the missing cog that would bring success to a company like Fauji Foods.

In addition to the CEO, many of the directors were also brought in who did not have military service in their past. Arif ur Rehman, Nadeem Inayat, Syed Bakhtiar Kazmi, Ali Asrar

Hossain Aga, Javed Kureishi, Basharat Ahmed Bhatti, Sarfaraz Ahmed Rehman and Nosheen Akhtar were also elected as new directors in 2023. All of these individuals have experience of working in the corporate sector and bring in an outside view and perspective which was not being seen at the company in the past.

As recent as 2019, most of the retired army personnel serving on the board have been replaced by civilians. So how did the company perform after 2020?

In the four year period before Mr Malik was appointed, Fauji Foods made losses of Rs 12 billion with Rs 3 billion loss made every year. In contrast, FrieslandCampina made profits of Rs 2 billion or Rs 0.5 billion per year on average. Once Malik was appointed, Fauji made losses of Rs 6 billion or Rs 1.5 billion per year while FrieslandCampina made a profit of Rs 6 billion of Rs 1.5 billion per year. This shows how Fauji was able to see turnaround as they were able to decrease losses by half while FrieslandCampina performed the same.

The share price for Fauji Foods was at Rs 14 at the start of 2020 which has fallen to Rs 9 by now. This shows that the public perception of the company worsened even when performance improved. FrieslandCampina went from Rs 80 to around Rs 70 right now. The return for both companies has been negative. Fauji lost 36% in 2020 while FrieslandCampina lost 12.5% in the market. Both companies gave no dividends in the period.

Previous CEO: Lt General Tariq Khan

New Civilian CEO: Sarfraz Ahmed Rehman

Main competition: Engro Fertiliser, Fatima Fertiliser,

Fauji Fertilizer is a company which was set up in 1978 and is involved in manufacturing of chemical fertilisers. They produce different fertilisers like urea, DP, SOP, MOP, Boron and Zinc. The main brand that is promoted by the company is under the name of Sona. The company has set up its plants in Sadiqabad and Mirpur Mathelo.

Fauji Fertilizer was headed by Lt Gen Tariq Khan in 2020 who was replaced by Sarfaraz Ahmed Rehman. Rehman has provided management expertise to companies like Unilever, GlaxoSmithKline, Jardin Matheson and PepsiCo in the past. He was the one who established Engro Foods as their CEO in 2005 when they became one of the leading dairy companies of the country. He has also carried out consultancy based projects. Before becoming CEO at Fauji Fertilizer, he was the CEO at Fauji Fertilizer Bin Qasim where he turned the company into a profitable entity.

Just like Fauji Foods, the board of directors at Fauji Fertilizer also saw directors being elected who had experience in running or operating

businesses. Names like Nadeem Inayat, Saad Amanullah Khan, Maryam Aziz, Syed Bakhtiar Kazmi, Shoaib Javed Hussain, Ayesha Khan, Jehangir Shah, Yasir Ghiyati Ibn Ziyad and Qamar Haris Manzoor became directors who bring a plethora of experience with them.

In 2018, Chairman of the board, CEO and 4 other directors were from the army which is not the case anymore.

How successful was the change?

The results seem like a mix bag to say the least. Yes performance has improved since 2020 but performance was the same back in 2014 as well so to shower all the praise on the new management would be premature.

The performance of Fauji Fertilizer is compared to Engro Fertilizers which is a comparable company. They are both situated near the border region of Sindh and Punjab and cater to the same market.

In the span of four years before 2020, Fauji Fertilizer made profits of Rs 54 billion with an average prof13.of Rs 13.5 billion each year. Engro Fertilizer made the same profits of Rs 54 billion or Rs 13.5 billion per year on average. When the new management came in, Fauji made profits of Rs 92 billion or Rs 23 billion per year while Engro made a profit of Rs 81 billion of Rs 20 billion per year. Where the older management was able to match Engro, the new management has been able to surpass even Engro which is a vote of confidence for the new management.

In terms of market return, the new management came when share price was at Rs 101 which has increased to Rs 126 in 4 years time. The company has also given out dividends of more than Rs 40 which means that the company has made a return of more than 66% in the last 4 years. In the same period, Engro went from Rs 73 to Rs 152 and gave out dividends of more than Rs 50 which means that the market return is in excess of 100% for Engro fertilisers.

Previous CEO: Lt General Muhammad Ahsan Mahmood New Civilian CEO: Qamar Haris Manzoor Main Competition: Gharibwal Cement

Fauji cement was set up in 1997 and is one of the largest cement producers in the country. The company can produce 11,000 tons per day. It is considered to be the second largest cement producer in the North region and the third largest in Pakistan. In 2021, the company merged with Askar Cement which further enhanced the market share and production capacity.

Lt Gen Muhammad Ahsan Mahmood was the CEO of the company till 2020 after which Qamar Haris Manzoor was appointed by the board. Manzoor has 37 years of experience in plant and project management. He started his career in ICI and then went to work for Exxon

Chemical Pakistan Limited. He has also served as a COO at Habibullah Coastal Power Company expanding his expertise in chemical and power sectors of the country.

The board of directors also saw a change in 2020 where Nadeem Inayat, Syed Bakhtiar Kazmi, Maleeha Bangash and Naila Kassim were elected as directors. All these individuals have an array of skills that they have acquired working in different companies locally and internationally.

In 2018, 5 out of the 8 board members had served in the army while in 2023 there were 2 out of 7.Fauji Cement is compared to Gharibwal Cement which is another company which is categorised to serve in the Northern part of the country.

From 2016 to 2019, Fauji Cement made profits of Rs 14 billion with Rs 3.5 billion made every year. Gharibwal cement made profits of Rs 7 billion or Rs 1.8 billion per year on average. Fauji cement was making double the profits before the new management. In the years since 2020, Fauji made profits of Rs 18 billion or Rs 4.5 billion per year while Gharibwal made a profit of Rs 4 billion of Rs 1 billion per year. The new management has been able to perform even better than the older management in comparison.

In terms of market return, the new management came when share price was at Rs 15.5 which has increased to Rs 18 in 4 years time. The company has also given out bonus shares worth Rs 1.2 which means that the company has made a return of more than 24% in the last 4 years. In the same period, Gharibwal went from Rs 14 to Rs 23 and gave out dividends of more than Rs 1.75 which means that the market return is in excess of 78%.

Always run by corporate professionals.

Askari bank was established in 1991 before it was taken over by Fauji Foundation in 2013. The bank has around 600 branches and 500 ATMs all over the country. The bank provides financial services, banking services, islamic banking, capital market related services and asset management. The company earned revenues of Rs 72 billion in 2003 and has assets of Rs 2.124 trillion.

Askari Bank has always been run by corporate professionals and in 2020 was being led by Abid Sattar. After Waqar Malik became the Managing Director, he brought in Atif R Bokhari to run the operations of the bank. Bokhari was a career banker and had 38 years of experience in local and international banking. He started his career in 1985 at Bank of America and worked there for 15 years. He later joined Habib Bank in 2000 and UBL in 2004 as President and CEO till 2014. He was able to help UBL become a diversified bank by increasing its revenue streams in consumer financing, branchless banking and

insurance.

The board of directors at Askari also elected Sarfaraz Ahmed Rehman, Arif Ur Rehman, Nadeem Inayat, Zoya Mohsin Nathani, Kamran Yousaf Mirza and Samina Rizwan. The directors had background in finance, banking, accountancy and corporate governance which were the reason for them being chosen for the positions.

In 2018, there were 4 retired army personnel on the board which has decreased to 1.

In terms of performance, it was seen that the company actually saw worse performance since 2020 which shows that the change in the senior management actually saw the company perform worse in terms of all three metrics.

In order to put the performance of Askari in context, Allied Bank is chosen which has a similar asset base of around Rs 2 trillion just like Askari Bank.

For Askari Bank, the period of four years saw profits of Rs 22 billion with Rs 5.5 billion loss made every year. Allied Bank made profits or Rs 54 billion or Rs 13.5 billion per year on average. The multiple between the two was around 2.5 times. After the new management, Askari made profits of Rs 56 billion or Rs 14 billion per year. Allied Bank made a profit of Rs 97 billion of Rs 24.25 billion per year. The multiple shrank to 1.76 times in favour of Askari.

The share price for Askari was at Rs 18.5 at the start of 2020 which has gone to Rs 20 by now. With dividends of Rs 8.5, the total return in the share has been 54%. Allied Bank went from Rs 100 to around Rs 87 right now. In addition to Rs 30 in the form of dividends, the company made a return of 18% for the period.

Previous CEO: Lt General Isfaq Nadeem Ahmed

New Civilian CEO: Faheem Haider

Mari Petroleum is a petroleum exploration and production company which is operating the second largest gas reservoir at Mari Field in Ghotki, Sindh. The company is engaged in exploration, development and production of hydrocarbon products which include natural gas, crude oil, condensate and liquefied petroleum gas. In 1983, Fauji Foundation, Oil and Gas Development Company Limited and Government of Pakistan acquired the business.

In 2020, Lt Gen Ishfaq Nadeem Ahmad left the post of CEO and Faheem Haider was put in charge in his place. Faheem Haider has a career spanning 29 years in various technical and leadership positions at international companies like Union Texas Petroleum, OMV Pakistan Exploration GmbH, Helix RDS Limited and Neptune Energy group. He has a deep understanding of the exploration and production industry and has worked in development, organisation, and transformation of companies

Mari board also elected individuals like

Nadeem Inayat, Muhammad Amir Salim, Abid Niaz Hasan and Seema Adil who bring their own sets of skills to the table.

Due to the shareholding of the company, many of the directors are nominated by sponsors and change on a regular basis. In 2018, 3 of the directors had an army background which now stands at two.

From 2016 to 2019, Mari Petroleum made profits of Rs 55 billion with Rs 13.75 billion made every year. Pakistan Oilfields made profits of Rs 45 billion or Rs 11.25 billion per year on average. Mari was making 22% higher profits before the new management. In 2020, Mari made profits of Rs 151 billion or Rs 37.75 billion per year while Pakistan Oilfields made a profit of Rs 92 billion of Rs 23 billion per year. The new management was able to grow the multiple to 1.64 from 1.22.

The new management came when share price was at Rs 1,310 which has increased to Rs 2,517 in 4 years time. The company has also given out dividends worth Rs 516 which means that the company has made a return of more than 132% in the last 4 years. In the same period, Pakistan Oilfields went from Rs 450 to Rs 435 and gave out dividends of more than Rs 275 which means that the market return is in excess of 57%.

That is the million dollar question. On the one hand it seems clear that bringing in professional management with Mr Malik on top has been good for Fauji Foundation. The experiment that was carried out by General Bajwa seems to have worked with results improving to some extent. The real test would have been to give a longer time period and tenure to Malik, or for that matter to his civilian successor, to have an even clearer answer.

Then why wasn’t he given more time? From 2020 to 2023 Fauji Foundation was clearly doing better than before. It is not to say that the organisation was in the dumps and was taken out of it, but rather that Waqar’s time clearly made a difference. In 2023, at the end of his three year term, Mr Malik was given a one year extension as CEO and MD of Fauji Foundation.

But there was a massive change for him this time around. He had initially been appointed during General Bajwa’s time for a three year period. His presence had not been appreciated by the military brass in the foundation but they had deferred to his wisdom. After all, General Bajwa seems to have been of the opinion that a corporate professional was exactly what the Fauji Foundation needed. When General Bajwa retired in November 2022, however, there was a new man in charge of the Pakistan Army.

At the time there was a lot else going on in the country. There was political instability, the

country was on the brink of default, and the army was facing opposition from within the political sphere. The Fauji Foundation was probably not the top priority at the moment. Plus, with the ship very much on course, Mr Malik was given an extension. But the signs were clear. The usual extension for situations like this are for three years, so it was already evident that the CEO was on thin ice.

Now, a year after that extension, he has not been granted another extension. The reason for why Mr Malik has been replaced is not clear as of yet. But it is also clear that the Fauji Foundation does appreciate what these four years have meant for them financially, and they’ve sent Mr Malik off with a farewell tour fit for a General and adulatory goodbye posts on social media.

There are a few possibilities for why this has happened. The popular theory going around is that this is a regression. That the military brass was unhappy with civilians being given control of the foundation and its subsidiaries, and the recent decision is in response to this perceived unhappiness. An attempt, perhaps, to give officers something to be chuffed about. It is plausible, but one source gives us a different perspective.

According to this former officer, the reason Waqar Malik was not given another extension was the impression that he was appointed by General Bajwa. The new military leadership wanted to have their own people leading the Fauji Foundation. And while this might be true, our source also says it will be difficult to justify removing those CEOs and their staff that have proven to be successful. Now it will all be a question of what approach the new CEO takes.

With most indicators in its favour, it can be seen that having a board with a background in business and corporate experience is good for a company. For now, the replacement has come in. Lt General (r) Anwar Ali Hyder brings experience as well. As mentioned earlier, General Hyder just finished a stint as Defence Minister and has previously managed DHA Islamabad, the Army Welfare Trust and the famous Naya Pakistan Housing Authority. While the success or failure of NAPHDA’s projects is up for debate, by all accounts he is a rare example of a military man with natural corporate acumen.

But as we have seen in the past four years, running the Fauji Foundation is not a one man job. We have listed at least four CEO level appointments of former officers that were replaced by corporate professionals in this story. One wonders if the new CEO and MD of the Fauji Foundation will be tempted to reverse these changes or will stay on the path. That, only time will tell. n

rivate labelling or developing a store brand is not a novel concept by any means. Walmart has been doing it since 1983, when they launched their first ever privately labelled dog food brand Ol’ Roy. However, as great a branding strategy as it may be for retailers, the trend did not take the global market by storm until the COVID-19 pandemic hit the world. All of a sudden packaged consumer goods vanished from the shelves as people bought everything in bulk to store away in case things got worse.

Thanks to these hoarders, the ones left behind were forced to buy the store’s private labelled goods instead and it wasn’t long before they realised these products were not only much cheaper than branded goods, but also quite decent in quality. At least in the States. And that’s when retailers, having recently unlocked the potential of owning private labelled goods, wasted no time in jumping on this bandwagon.

According to McKinsey and Co., nearly 40% of US consumers have tried new products or brands since the onset of the COVID-19 outbreak and more than 45% said price was the primary reason. However, the second most cited reason was the lack of availability of their preferred national brands. So, from a retailer’s point of view, there was massive potential to be exploited.

Private labels by grocery retailers are so common that Walmart, Target, Costco and others have their own private labelled brands. Even some local retailers like Imtiaz, Al Fatah and Jalal Sons saw the opportunity and launched goods under their brand name.

Despite some local retailers tapping into the potential of having a brand identity through their private labels, the trend of private labelling is not as big among Pakistani retailers. Only the big organised chains have ventured into private labelling. A big chunk of Pakistan’s grocery retailers are small convenience stores that do not have enough financial muscle to launch their brands.

Krave Mart, which began its journey in 2021 competing with Pandamart and

Airlift, thinks it has the financial muscle and channels to bring their private-label products to the market. The startup, one of the two remaining grocery delivery startups has surprisingly been able to avoid closure. The startup has raised $12 million in two $6 million rounds.

Now, it plans to venture into private label, which not only gives it stability but also reduces operational challenges. A similar bet had earlier been made by Cheetay back in 2021, with the launch of their private-label brand called Sahar, under which the company sold dry fruits, spices, pulses, beans, honey and dairy. Cheetay didn’t see the light at the end of the tunnel and eventually decided earlier this year to wrap up all operations.

But Krave Mart on the other hand is focused on the bigger picture. Why not take these products and sell them on other digital platforms also? Why not also take these products to neighbourhood stores and sell them offline and compete directly with the likes of Unilever, Reckitt, Shan Foods?

So what is Krave Mart up to? Let’s start with what they are currently offering.

While this trend originated in the West, we aim to encourage retailers in Pakistan to embrace private labelling as a means to foster brand loyalty and recognition. For instance, if a customer associates a particular product with a specific retailer, such as Poonam with Imtiaz, they are more likely to return to that retailer for future purchases

Ahsan Kidwai, CCO Krave MartIn conversation with Krave Mart’s CCO Ahsan Kidwai, Profit sought to map out Krave Mart’s journey to launching their products under a private label.

Kidwai told Profit, “It’s been a little over two years since we launched Krave Mart. It was only six to eight months into our launch, when we introduced our private label. We initiated a few categories, eventually scaling to multiple categories and today we have a total of approximately 150 SKUs as a part of our private label portfolio.”

They first launched Kdaily, a Krave Mart brand under which they sold spices, rice and pulses. Then they launched Baydat Kabira (Big Egg), which as the name implies are eggs and Breadly, which is the brand name under which they sell bread. They also introduced frozen foods, with Breadly frozen parathas as the main product. Krave Mart’s Berrynoms and Choconoms are a snack the company launched. These breadsticks come with a chocolate or berry-flavoured dip on the side.

Apart from food, Krave Mart’s product portfolio includes Spencer & Cole hand wash, Turbo Scrub toilet cleaner, and Fine Print paper.

Kidwai told Profit, “Another product we recently launched is farm fresh milk. This stems from the fact that Pakistan is a fresh milk consuming country, so 90% of the milk that’s consumed in Pakistan is fresh milk and the remaining 10% is branded milk, which comes from all your branded UHT and pasteurised milk providers. So, since it’s a massive market it has massive potential too.”

Now you may be wondering whether Krave Mart manufactures these products or simply white labels imported products under its brand name.

Kidwai told us that it’s a mix between the two. “We are having to import a few of our Private Label products because naturally,

Pakistan is not so renowned towards growing them, so some of the spices and lentils are imported. However, rice is grown, dehusked and polished locally. We are directly in touch with the growers and the mill owners, who supply us.”

He continued to explain that they have a manufacturing agreement with a factory in Pakistan for Krave Mart’s bread and parathas.

“Returning to rice and pulses, although some are imported, others are locally sourced. What we do next is set up a small factory within one of our dark stores, where we package them into smaller pack sizes after acquiring them in bulk. The process of repackaging the products is quite straightforward since we obtain them pre-packaged in bulk.”

Coming onto eggs; Kidwai told us that Krave Mart has a contract with a poultry farm that supplies them with eggs that are then white labelled. Similarly, Krave Mart has a contract with a cattle farm, where the farmers milk their cattle daily. “Fresh milk is then supplied to us the very next day, which has a very short expiry of three days because naturally it hasn’t gone through the UHT nor pasteurisation process. So, it goes bad in three days, which is why we only carry a day’s stock cover.” Kidwai elaborated.

What’s interesting is that Krave Mart sells products such as toilet bowl cleaner under its private label but also sells the same product by renowned brands like Harpic and Domex. We asked Kidwai how that works.

“Our private label products receive premium visibility, though other options are available too however, since most brands are partnering with us on the ancillary front, we offer visibility to our partners as well. Ultimately, it’s the customer’s choice. While competing with established brands like Harpic and Domex does present their own challenges, our product, such as Turbo Scrub, is priced 35% lower, offering the same quality,” Kidwai explained.

Other than competitive pricing, Kidwai

highlighted that the quality of their products attracts customers, “Our commitment to providing top-quality products results in decent retention and repeat purchases. Our strategy is to hook customers with competitive prices and maintain their loyalty through consistent quality.”

What is the appeal of private labelling for Krave Mart?

Private labelling comes with better margins, which are crucial for sustainability these days for a startup that is delivering groceries. The nature of retail business is such that margins are thin in FMCG retail, going up to 20% on average at gross level and 3-5% on average as net margins. These margins are good if the customer walks up to a store and buys groceries.

But if these groceries are to be delivered to a customer through a network of warehouses, the margins are not enough to meet the costs associated with maintaining such network and delivery operations. This results in a model that requires a lot of cash to be spent, making it unsustainable. But if a startup can launch its private label brands, the startup can essentially bag the margins of the middlemen in the FMCG supply chain, thereby improving its margins, and becoming more sustainable.

At Krave, the private labelled goods help the business in two ways: firstly, they can attract more volumes because they can sell the private label goods at a cheaper rate compared to international brands. A low-priced good is likely to attract more customers in the current high-inflation environment that has squeezed the size of expenses on groceries. Being in groceries delivery business, Krave Mart has

the data of purchases by customers that it can analyze and map trends. In their words, big brands have been taking a hit because of rising inflation and moving towards cheaper alternatives.

If the startup can provide cheaper alternatives, chances are customers will move towards those as well. Secondly, the cost benefits associated with this arrangement result in better margins for the company, leading towards profitability.

“There is a significant cost impact. Our Turbo Scrub for instance is 35% cheaper than Harpic and Domex, yet we can make a 40% margin on that. We source it much cheaper and give competitive pricing to customers.”

Perhaps this is why Kidwai claims that the company has had positive unit economics for the last 12 months, and is on track to achieve EBITDA-level profitability, and that too with stable GMV numbers. The sales of privately labelled goods at Krave Mart have picked up, forming 18-20% of the overall GMV, claims Ahsan.

Besides, there have been other operational challenges that have led to Krave Mart venturing into private labels. These are the challenges associated with ensuring consistent supply and reducing price uncertainty.

For instance, in certain commodities supply shortages can be frequent. A sudden shortage means reduced supply on the platform which affects conversion. On the other hand, shortages also lead to price fluctuations affecting demand. But if these goods are privately labelled, both supply shortages and price uncertainty can be reduced.

“We are a platform that can not afford shortages because shortages directly affect our conversion rates. To cater for that, we went into the supply chain and ordered directly with wholesalers and importers and booked orders so that we could better prices and we ordered

a sizeable chunk with them for say the next three months.”

“This also serves as a hedge against the dollar because certain commodities are imported and therefore dollar fluctuation impacts prices. Secondly, it also ensures that the demand is met,” Ahsan says.

If executed properly and Krave Mart can create brand loyalty, customers would not only come for repeat purchases of these goods but also for purchases of products from other manufacturers that are listed on the platform.

Even though Kidwai, several times during the conversation, stated that profitability has been the main focus of Krave Mart from the beginning, he also acknowledged that Krave Mart’s private label serves a purpose greater than just that – it allows Krave Mart to create a brand identity, which would later translate into brand recognition and eventually brand loyalty.

But we imagine pricing must be a slippery slope for Krave Mart, competing with well-known household brands also sold at Krave Mart. Startups are known to offer subsidised products and services to inflate GMV numbers and achieve a higher valuation. But if Krave Mart does that, it is essentially subsidising branded products, making them cheaper. This means that their own private labelled products are competing with other branded products discounted by Krave Mart.

Kidwai shuns the idea of discounts anymore saying that the current environment of building sustainable business models doesn’t allow giving discounts anymore, “We ensure that any discounts we offer to our customers are supported by the brands in the form of Consumer Promotions rather than us having to bear them.”

He explained that these discounts typically stem from consumer promotions provided by the brands, which are then passed

on to consumers by Krave Mart. This approach allows them to prioritise sustainability, while still providing value to customers.

“Private labels in itself are not discounted on the platform and we’re selling all our private SKUs at full price. That is because since we have gone back in the value chain for each of the products, they are anyways much more cost-effective than the competition,” Kidwai answered.

“Today, 40%+ of our orders have at least one private label SKU and this contribution is fast growing.”