Welcome to the 152nd issue of the Aussie Painting Contractor Magazine. We are celebrating our 14th year since the initial release and we look forward to bringing more to you for the coming years.

It's been a massive month with the Queensland Training Awards which I was lucky enough to be recognised for the work I do with the apprentices and the industry. It was fabulous getting the APN team together for some good times together. Without them we couldn't do what we do to help those within the industry.

In the last month we completed the School to Work Transition Program that saw many new school students trailing their abilities in the painting industry. We still have many students looking for apprenticeships. If you are looking for the future of our industry contact us for your next team member.

We have been getting some great feedback regarding the BrushHand Application, painting business owners are finding it a revelation to their business now they are starting to understand their businesses better and are now making inroads into their businesses profitability.

I have been contacted by some regarding the changes they would like to see in our industry. I am looking for those that might be interested in assisting with making those changes. If you would like to be part of this team please contact me for more information. 'Til next month, Happy Painting!!

Nigel Gorman

nigel@aussiepaintersnetwork.com.au 07 3555 8010

CONTRIBUTORS

• Anthony Igra

• Deb Batterham

• Jim Baker

• Leo Babauta

• Nicholas Procter

• Nigel Gorman

• Oliver Kay

• Robert Bauman

• Sandra Price

• Zoe Goodall

EDITOR

Nigel Gorman

GRAPHIC DESIGNER

J. Anne Delgado

5 Ways to Break Out of a Dull Life

Opinions and viewpoints expressed in the Aussie Painting Contractor Magazine do not necessarily represent those of the editor, staff or publisher or any Aussie Painters Network’s staff or related parties. The publisher, Aussie Painters Network and Aussie Painting Contractor Magazine personnel are not liable for any mistake, misprint or omission. Information contained in the Aussie Painting Contractor Magazine is intended to inform and illustrate and should not be taken as financial, legal or accounting advice. You should seek professional advice before making business related decisions. We are not liable for any losses you October incur directly or indirectly as a result of reading Aussie Painting Contractor Magazine. Reproduction of any material or contents of the magazine without written permission from the publisher is strictly prohibited. Becoming a Better Leader by Developing

Managing mould, housemates, and landlords: New research reveals sharehousing horror stories

Legal Expense Insurance for Sole Traders

5 APPS FOR TRACKING Smallll Businessss Expenses

Revitalizing Your Business for a Fresh Start STAY INFORMED Without Drowning in Anxiety Financial stress is on the rise in Australia. Here’s what to do if money worries are affecting your mental health

If you have been lucky enough to encounter generous people, you understand that they have a truly unique gift for garnering the respect and admiration of individuals around them. When you are a leader, having a positive relationship with the people who follow you is a huge asset that you simply cannot put a price on. If you are looking for ways to become a better leader, increasing your generosity can improve your effectiveness and contentment.

Here are a few things you can begin doing to increase your generosity.

Fully understand the benefits of being a generous person

Being generous because you know it is the right thing to do and being generous because it is something you value are two different things. If you want your generosity to be effective it is important that it comes from a place of sincere care and concern for those you are leading. Being generous to others not only lowers their anxiety and increases their appreciation for you, it also adds to your personal happiness and health.

Look for moments to be grateful

Being grateful could be as simple as sending out a brief and personal thank you email when the occasion arises. You don't need to create a large display or spend a lot of money to make people feel valued. Simply look for positive behavior in others and when you see it, make a mental note to acknowledge it and express your gratitude.

Find ways to give back to your community

Depending on your resources and the capacity in which you are leading others, the extent of your reach may vary, but don't let that stop you from finding ways to give back to your community. Most homeless shelters have standing requests for donations of socks, bottled water, coats and blankets. Speak to your company to gauge their interest and help to organize a supply drive or fundraiser to give back to your community. When the people you lead see you being generous, it puts your character on display and often increases the level of respect they have for you.

Become more optimistic and hopeful

Naturally generous people are often idealists. They have a perception of how the world around them should be and they believe in the goodness of people. If you are naturally pessimistic, becoming an optimist could be a struggle for you, but it is not insurmountable. Next time a challenge arises on the team you are leading, go above and beyond to believe the best in others and trust that the outcome will be positive even when it may not look that way on the surface.

for opportunities to trust others

Trusting others may not seem like a quality of a generous person, however, one of the greatest ways you can be generous with others is by trusting them enough to allow them to take the lead on things that matter to them. Trust their ideas and more importantly, their ability to complete the task at hand. When you loosen your grip as a leader and trust the people around you to do what needs to be done, they will in turn see you as a more trustworthy, generous leader.

There are many ways you can express your generosity towards others. When you look for opportunities to be more understanding and helpful, the people you lead will become more secure following you.

Running a trade business isn’t just about quoting jobs, managing tools, and keeping clients happy. Once you bring people on board—whether apprentices, casuals, subcontractors, or full-time employees—you step into the world of human resources (HR) compliance. This is an area where many tradies get caught out, and the consequences can be costly in terms of fines, back pay, and reputational damage.

Here are the key HR compliance issues tradies need to keep on their radar.

Most employees in the trade sector are covered by a Modern Award (for example, the Building and Construction General On-site Award or the Electrical, Plumbing and Mechanical Services Award). These awards outline minimum pay rates, penalty rates, overtime, allowances, and conditions.

Common pitfalls for tradies:

• Paying a “flat rate” that doesn’t account for overtime or allowances.

• Not updating wages when the Fair Work Commission announces annual increases (usually in July).

• Assuming apprentices or trainees can be paid less than the award minimum.

Employers must keep accurate employment records and provide payslips within one working day of payment. The Fair Work Ombudsman actively audits small businesses, and non compliance can lead to hefty penalties.

What to keep records of:

• Hours worked (especially for casuals and overtime).

• Pay and leave entitlements.

• Superannuation contributions.

Employers are required to pay superannuation guarantee contributions (currently 11.5% from 1 July 2024, rising to 12% by 1 July 2025). Payments must be made quarterly to the employee’s nominated fund.

Missing or late super payments not only attract penalties but also impact your workers’ trust and retention.

One of the biggest traps for tradies is misclassification of workers.

• A casual worker has different entitlements to a permanent part-time or full-time employee.

• Subcontractors must genuinely run their own business. If they’re treated like employees, you may still be liable for leave, super, and tax obligations.

Getting this wrong can lead to back pay claims and fines.

Every employer has a duty of care to provide a safe work environment. For tradies, this is particularly important given the physical nature of the work.

WHS responsibilities include:

• Conducting risk assessments on job sites.

• Providing safety equipment and training.

• Keeping incident and injury records.

Failing to comply with WHS laws can result in serious penalties and, more importantly, increased risk of injury to your team.

Full-time and part-time employees are entitled to annual leave, sick leave, and in some cases, parental leave. These entitlements must be calculated correctly and recorded accurately.

Casuals, while not entitled to paid leave, must receive a casual loading (usually 25%) in lieu of these benefits.

As an employer, you’re legally required to ensure the workplace is free from discrimination, harassment, and bullying. Even in small trade businesses, a “she’ll be right” attitude can land you in trouble if issues aren’t handled properly.

Having clear policies and processes for resolving disputes is essential—even if you only have a small team.

Ending employment is another area where tradies often stumble. Employers must follow fair dismissal procedures, including providing proper notice, valid reasons, and in some cases, redundancy pay.

Unfair dismissal claims can be costly and stressful, especially for small businesses.

For many tradies, HR compliance can feel like paperwork that gets in the way of running the business. But ignoring it can expose you to fines, back pay claims, and legal disputes.

The good news is, with the right systems—payroll software, clear contracts, and professional advice—you can stay on top of your obligations and focus on what you do best: delivering quality work for your clients.

Book a free discovery call with Straight Talk Accountants today to make sure you’re business practices are HR compliant.

Copyright © 2025 Robert Bauman.

Easily

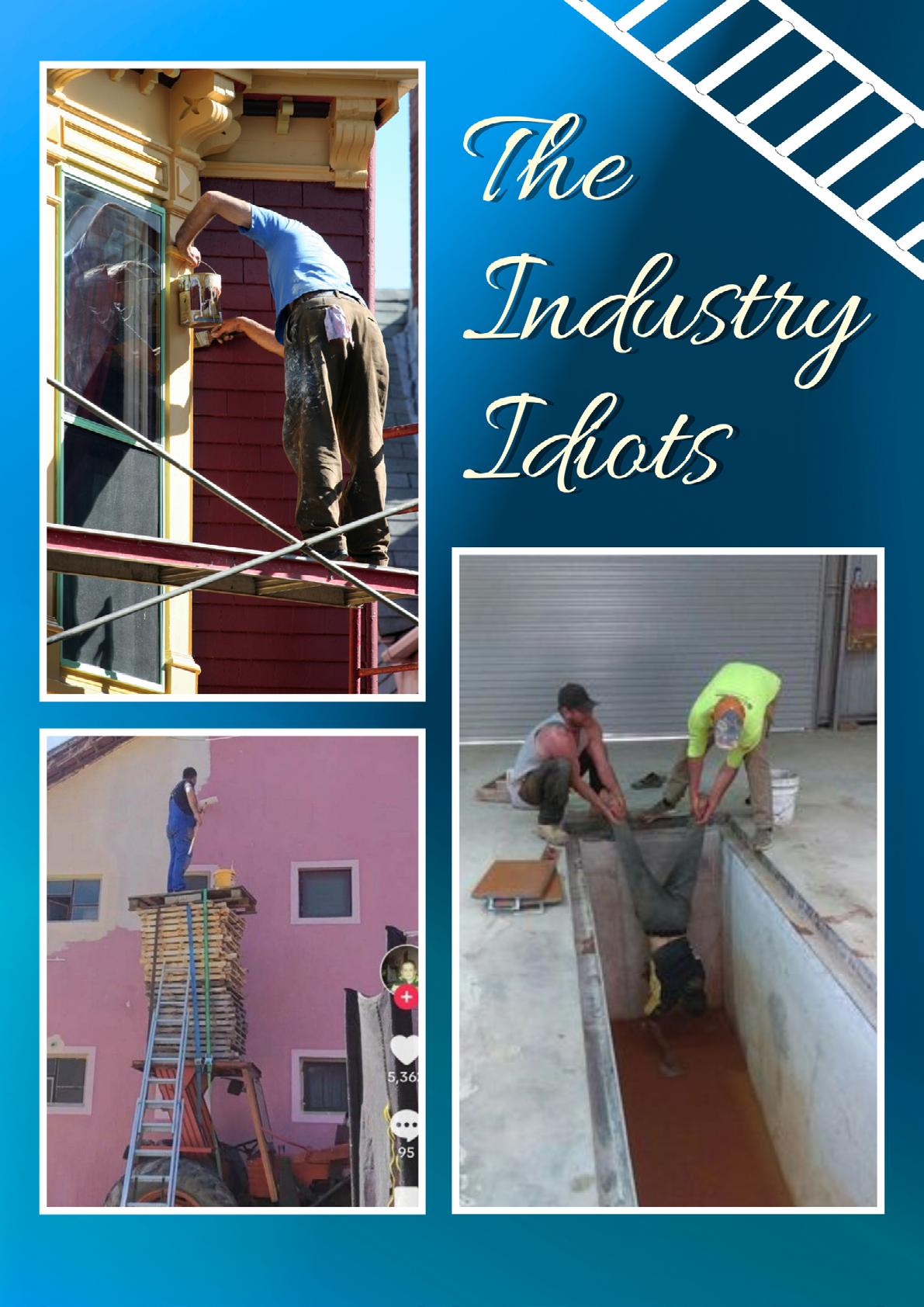

Many painters hesitate to raise their prices, fearing customer rejection and feeling pressured to match competitors. This mindset harms the industry and stems from a lack of confidence in their own work.

Get out of this mindset. You are a professional. You produce quality work. You have the experience. Most of all, you want to do the right thing by the customer.

This struck a chord with painters, leading to over 100 comments in weeks. Here are three notable responses that capture industry experiences.

James Vanderhaak

Back when I first started in business, I had no idea how to quote. I always did good work but was ‘shit scared’ to charge too much. After listening to a business podcast where it was said, ‘Charge 10% more and see what happens, and then do it again a month later.

I did that and pretty much continued doing so over the course of a year until I was charging 3 times more than I used to. My close rate is 30%, which funny enough was 30% when I was 3x cheaper. My best close rate of about 60% was when I was over double my original pricing.

The best balance is charging enough that you seem professional, but not too much that you don’t win any work.

If you raise your rates by 10% and lose 10% of your jobs, you'll earn the same with less work.

Anthony Sorbello recounted a situation where a client opted for a cheaper competitor, only to return when the lower-priced painter delayed the job:

A regular client of mine told me they decided to accept a cheaper quote if I couldn’t match it, which was 30% cheaper. It’s been now 6 months, and the other painting mob haven’t started the job yet as they’ve been waiting. They told me yesterday they will now accept my quote. I kinda mentioned my quote says 90 days valid.

Maggie Clews, a third-year apprentice, expressed gratitude for the conversation, highlighting how challenging it can be for newcomers to navigate pricing:

As a third-year apprentice hoping to run my own jobs, I appreciate your advice. With so many opinions on quoting, it gets confusing, but as you said, ’knowledge and confidence are fundamental’.

As professionals, it's important to remember that not every job is worth pursuing, especially if customers are only concerned about cost. It's natural for your acceptance rate to dip slightly when you raise prices, but the additional income per job compensates for this.

So, are you lacking confidence and afraid to increase your price? If the answer is ‘Yes’, you may find it difficult to progress in business. Do yourself and the industry a favour—be proud of the value you bring.

Jim Baker www.mytools4business.com

In the business world, protecting your interests is super important. Whether you’re running a small business, a financier, or involved in any commercial activity, getting to know the Personal Property Securities Register (PPSR) is a must. This blog will break down what the PPSR is, why it matters, and how it can benefit your business.

The Personal Property Securities Register (PPSR) is like an online noticeboard set up by the Australian government. It’s a platform where individuals and businesses can register their security interests in personal property. But what exactly is personal property? Well, it’s anything you own other than land, buildings, and fixtures attached to the land. This includes a wide range of items such as cars, machinery, crops, livestock, and even intellectual property like trademarks and patents.

Think of the PPSR as a place where you can officially record your claim or interest in these kinds of assets. If you’ve provided goods on credit, leased equipment, or loaned money using personal property as collateral, you can register your interest here. This registration acts as a public notice to others that you have a stake in the property. It’s a way of saying, “Hey, I have a claim on this item if something goes wrong.”

By using the PPSR, you’re protecting yourself from financial loss. If the person or business you’re dealing with defaults on their loan or goes bankrupt, your registered interest gives you a better chance of recovering your assets or at least their value. So, whether you’re lending out farming equipment, leasing a vehicle, or providing goods on credit, the PPSR is an essential tool for safeguarding your interests.

Protecting Your Interests: When you provide goods on credit, lease equipment, lend money, or sell items under a retention of title arrangement, there’s always a risk that the other party might not fulfil their obligations. This is where the PPSR comes in to help safeguard your interests. By registering your security interest on the PPSR, you establish a legal claim over the property or goods you’ve provided.

This registration means that if the debtor defaults on their payments or goes bankrupt, your registered interest gives you a priority claim over the specified assets. Essentially, it ensures you get in line ahead of other creditors who might be trying to recover their debts from the same debtor. Without this registration, you might end up losing out, as unregistered interests generally have less legal standing.

For example, if you lease machinery to another business and they fail to make their payments, having your interest registered on the PPSR means you can reclaim your machinery or its value before unsecured creditors get anything. This level of protection can make a significant difference, especially in scenarios where multiple parties are trying to recover their investments from a struggling debtor. So, registering on the PPSR is a smart move to secure your assets and minimise potential losses.

Reducing Risk: Registering on the PPSR is a smart move to reduce the risk of financial loss. Here’s how it works and why it’s beneficial for your business:

• Enforcing Your Rights: When you register your interest on the PPSR, you’re creating a legal record that shows you have a claim over a specific piece of personal property. This means that if someone owes you money and can’t pay, you have a legal right to reclaim the property or its value.

• Priority in Claims: In situations where multiple parties might have claims over the same asset, having your interest registered on the PPSR gives you priority. This is crucial in cases of debtor insolvency or bankruptcy. If the debtor’s assets are sold to pay off debts, your registered interest ensures you’re at the front of the line to get paid.

• Clarity and Certainty: The PPSR provides a clear and structured way to secure your interests. This clarity reduces confusion and disputes about who has rights to what, making it easier to enforce your claims if needed.

• Mitigating Financial Loss: By securing your interests through the PPSR, you significantly reduce

the risk of financial loss. If your client or debtor fails to fulfil their payment obligations, your registered interest means you can recover the asset or its monetary equivalent, safeguarding your investment.

• Peace of Mind: Knowing your interests are legally protected allows you to engage in business transactions with greater confidence. Whether you’re selling goods on credit, leasing equipment, or providing loans, the PPSR gives you peace of mind that your assets are secure.

Enhancing Business Confidence: Knowing that your security interests are protected can significantly boost your confidence when extending credit or entering leasing arrangements. Here’s how:

• Peace of Mind: When you register your security interests on the PPSR, you gain peace of mind knowing that your assets and investments are safeguarded. This protection reduces the worry of losing money if a client or partner fails to meet their obligations.

• Encouraging Growth: With the assurance that your interests are secure, you’re more likely to take calculated risks that can lead to business growth. Whether it’s expanding your product line, investing in new equipment, or entering new markets, the confidence from knowing your assets are protected can encourage you to make these moves.

• Strengthening Relationships: Security interests help build trust between you and your business partners. When they see that you’re serious about protecting your interests, it fosters a sense of reliability and professionalism. This trust can lead to stronger, more fruitful business relationships.

• Better Negotiation Power: Confidence in your security interests can also give you an edge in negotiations. Whether you’re discussing terms with a supplier, a client, or a financial institution, being secure in your position allows you to negotiate from a place of strength.

• Increased Lending Opportunities: Lenders are more likely to provide financing to businesses that have registered their security interests. This registration signals that you are a low-risk borrower, which can result in more favourable loan terms and higher approval rates.

• Simplifying Transactions: The PPSR simplifies the process of securing credit and leasing agreements. This simplicity can make it easier to close deals quickly and efficiently, allowing you to focus on other important aspects of your business.

Registering a Security Interest: Registering a security interest on the PPSR is a straightforward process, but it requires a few key steps to ensure everything is done correctly. Here’s a detailed look at how to get started:

• Create an Account: First, you need to create an account on the PPSR website. This account will allow you to manage your registrations and keep track of your security interests. The sign-up process is simple and only takes a few minutes. You’ll need to provide some basic information about yourself or your business to get started.

• Gather the Necessary Details: Before you begin the registration process, make sure you have all the required details. This includes:

• Information about the Property: You’ll need to provide a clear description of the personal property you’re registering a security interest in. This could be anything from vehicles and machinery to inventory and intellectual property.

• Details about the Debtor: You’ll also need information about the person or business that owes you money or has granted you a security interest. This typically includes their name, address, and other identifying information.

• Complete the Registration Form: Once you have all the necessary details, you can start filling out the registration form on the PPSR website. The form will guide you through the process, asking for specific information about the property and the debtor. It’s important to be accurate and thorough when completing this form to ensure your registration is valid and enforceable.

• Submit Your Registration: After you’ve filled out the form, you’ll submit it through the PPSR website. There may be a small fee associated with registering a security interest, so be prepared to make a payment. Once your registration is submitted, the PPSR will process it and add your interest to the public register.

• Confirmation and Record Keeping: After your registration is completed, you’ll receive a confirmation notice from the PPSR. This notice will include important details about your registration, such as the registration number and the date it was recorded. Make sure to keep this confirmation for your records, as it serves as proof of your registered security interest.

• Monitor and Update: It’s important to regularly monitor your registrations on the PPSR. If there are any changes to the property or the debtor, or

if the security interest is no longer needed, you’ll need to update or discharge the registration accordingly. The PPSR website allows you to easily manage and update your registrations as needed.

• Searching the PPSR: Before you commit to buying or leasing significant assets, it’s a smart move to conduct a search on the PPSR. Here’s why:

When you search the PPSR, you can see if there are any existing security interests registered against the property you’re interested in. This is crucial information because it tells you if someone else has a legal claim over the asset. For example, if you’re buying a piece of machinery, a search will show if it’s being used as collateral for a loan. Knowing this can help you make an informed decision and avoid potential legal hassles down the road.

By doing this due diligence, you protect yourself from unexpected surprises. If you skip this step, you might end up purchasing something that could be repossessed by a creditor who has a prior claim on it. This could lead to financial loss and legal disputes, which are definitely not what you want.

In short, a PPSR search is a way to ensure that the asset you’re buying or leasing is free from hidden claims. It’s a simple step that can save you a lot of trouble and help you make smarter, safer business decisions.

Managing Registrations: The PPSR offers flexibility when it comes to managing your security interests. Here’s how you can make the most of it:

• Updating Registrations: Over time, the details of your security interests might change. Maybe you’ve renegotiated terms with a debtor, or perhaps the value of the secured property has increased. The PPSR lets you update your registrations to reflect these changes. By keeping your information current, you ensure that your security interests are always accurate and valid.

• Amending Registrations: Sometimes, you might need to correct an error or add additional details to your registration. The PPSR allows you to amend your registrations easily. This could include changing the debtor’s name, modifying the description of the secured property, or updating contact information. Amending your registrations helps maintain the integrity and accuracy of your records.

• Discharging Registrations: When a security interest is no longer needed—maybe because the debt has been paid off or the lease has ended—you can discharge the registration. Discharging a registration officially removes the security interest from the PPSR, indicating that the obligation has been fulfilled. This is an important step to ensure that your records are up-to-date and to avoid any confusion or disputes in the future.

• Renewing Registrations: Security interests on the PPSR have a set duration. As the expiry date approaches, you’ll need to renew your registrations to maintain protection. The PPSR system

allows for easy renewal, ensuring that your security interests remain active and enforceable. Regularly checking the status of your registrations and renewing them as needed is key to uninterrupted protection.

• Monitoring Registrations: The PPSR provides tools to monitor your registrations and alert you to important changes or upcoming expiries. This proactive approach helps you stay on top of your security interests, ensuring that you can take timely action when needed.

By actively managing your registrations on the PPSR, you can ensure that your security interests are always protected. Keeping everything up-to-date not only safeguards your assets but also reinforces your business’s legal standing and credibility.

Remember, while this information provides a general overview, legal advice tailored to your specific circumstances is invaluable. Don’t hesitate to contact Rise Legal for personalised guidance or book in a FREE DISCOVERY CALL.

Disclaimer: This blog post is intended for informational purposes only and should not be considered legal advice. Consult with a qualified commercial lawyer for personalised advice related to your specific circumstances.

Very often, we can get caught up in a life of routine — we do the same things over and over again, until the days blend into each other.

Work is the same grind every day — we begin to lose our souls in a grind like this. Outside of work, we might be too tired or too caught in a rut to have fun.

So how do we break out of this life of dull drabness?

Just being willing to ask the question and explore this is a huge start!

Let me share some ways I’ve found to bring some light to a life where dullness and routine are the norm …

Create a curiosity challenge for a week. In this first challenge, you’d spend just 10-15 minutes a day getting curious about something. Maybe something you take for granted, like the trees near your house or sewer pipes. Maybe explore a new area of your neighborhood, or talk to someone at work who you’ve

never gotten to know. Let your curiosity be sparked. You can extend this challenge to a month if it feels fun.

Let yourself find a passion or expressive outlet. There’s probably been something you’ve been wanting to learn or explore for ages — from learning an instrument to expressing yourself through art or writing, to learning to knit or sew or build chairs. Give yourself a few sessions like this every week, read up on it, watch YouTube videos, let yourself dive in with a passion. This spices up life, and gives you something to look forward to, and a new way to express yourself.

Find fun and wonder in anything you do. Any activity, from washing dishes to tidying up your room to answering emails, can contain wonder or a sense of play. We just don’t usually approach things this way, so we don’t think of it. But try it! How can you create a sense of fun, play or wonder in any activity? Try to find it in at least one activity a day, but perhaps even more!

Say yes to things that are intriguing. Sometimes you’ll get an invitation that’s unexpected — to a social event, a trip or conference, or a project that you wouldn’t normally do. Try saying yes to some of them! It’ll break you out of your routine, which will require you to step out of your comfort zone. This is where we learn, explore, and have adventures — outside of our comfort zones. Not easy, but so interesting!

Make a game out of achieving micro-goals. I like the idea of making a game to play with yourself during the day, and in this game, you set some really small goals to achieve, and see how many you can achieve in a day or week. You’re not competing, you’re just challenging yourself. Some examples of micro-goals: instead of “workout regularly,” a micro goal might be “do 5 pushups.” Not a whole workout. Something small you can do in a few minutes. It’s motivating to make progress towards something you care about, but in tiny steps.

Of course, these aren’t the only ways to make life brighter and more interesting. You could do things that feel impossible — talk to a stranger, volunteer, be vulnerable. You could join a social group, or join a weekly board game night, or explore art galleries, or decide to train to run a 10K. You could devote the next month of your life to a grand adventure.

But try some of these! Let me know how they work out for you.

Leo Babauta ZEN HABITS

Sharehousing has traditionally been a rite of passage for many young people and students in Australia, but is also increasingly common among all age groups.

Conflicts with landlords – over issues such as repairs, leaks or mould – are too often part of the renting experience. Our new research explores how renting is complicated for sharehouses – where relationships between housemates can vary from a tight-knit group of friends who share everything and care for each other, to renting a room from a stranger.

Our paper, published today in the journal Housing, Theory and Society, is based on interviews with 25 sharehouse tenants in Melbourne.

We found that achieving “housing justice” is often no simple matter for people living in a sharehouse. Problems with housing conditions, between housemates, and the landlord or real estate agent, can overlap and compound each other.

When faced with these issues, sharehouse tenants can pursue legal action, attempt to negotiate, move out, or just put up with it. But these strategies can cause problems for tenants, especially when not not everyone in the sharehouse agrees on the way forward.

Many participants spoke about living – currently or previously – in poor-quality housing. One enduring theme that emerged was the problem of mould. Penelope (all names changed to protect identities) said she’d lived in a sharehouse that was “decrepit” and

excessively damp and mouldy, to the point where all of our furniture and clothes and stuff started to get mould on it.

She considered taking the landlord to the Victorian Civil and Administrative Tribunal (VCAT) but “didn’t end up getting all the way to VCAT, because it’s extremely difficult.”

In the end, Penelope and her housemate had to leave the house very urgently because our stuff was starting to get ruined.

They were temporarily homeless, while the landlord and real estate agent “got away with it” and continued to rent out the house.

Lucas, meanwhile, described the futility of trying to negotiate with property managers who would not respond to maintenance requests, meaning he had to put up with “untenable” housing:

There’s definitely been times where I’ve just felt like, all I have to do is grit my teeth and take it. Because otherwise, I’m just gonna lose.

Sharing as a source of both solidarity and conflict Housemate relationships are at the heart of sharehousing.

One positive aspect of these relationships is that they may help build solidarity when experiencing problems with housing quality or other conflicts with the property manager.

One participant, Sarah, told of how her housemate successfully secured compensation from their property manager after the landlord started major renovations while she and her housemates were still living there. Seeing her housemate gain compensation enabled her to do the same.

On the other hand, relationships with housemates can complicate attempts to achieve justice.

Stacey, another interviewee, reported how efforts to negotiate with a property manager eventually led to “internal conflict within the house”, and how one housemate became hostile during the process.

Another interviewee, Tayler, also experienced problems with a landlord who was also his housemate, which intensified the conflict.

One participant, Jess, had also experienced domestic violence from a housemate.

I had to, I left before the lease was up. Like I moved back in with my parents because it was so bad. But I continued paying rent because […] I just didn’t want to deal with the further consequences of that.

While Jess was able to move out in this scenario, others described how this wasn’t possible due to a shortage

of affordable housing. For example, Janet described how she’d prefer to move out rather than confront a housemate, but didn’t always have the option: I’ve only left when I’ve had the capacity to do so. Often I’ve had to stay quite a lot longer than I would have liked to, because [I] don’t have the option to move, can’t afford it or nothing available.

Relationships and regulations

Regulations surrounding renters and landlords are framed in a way that assumes there are two parties in a dispute: the tenant and the property owner.

This renders the relationships within sharehousing invisible. Yet, there is clear evidence they impact the way tenancy disputes are managed and addressed.

For example, one interviewee named May was invited to move into a sharehouse by her friend. However, the friend’s property manager said May could not move in if she brought her cat (which is illegal in Victoria).

This shows how sharehousing depends on relationships between housemates and relationships with the property manager. May was aware of the need to put up with this to secure housing: renters aren’t in a position of power. So, you kind of have to play the game just to have a roof over your head.

Relationships matter when we think about renting problems. While this research focused on sharehousing, there are implications for other renter households especially where conflict or even family or intimate partner violence occur.

Our future research will look at possible policy solutions to better capture the nuances of sharehousing in Australia.

Zoe Goodall Research Associate, HHAUS research group, Swinburne University of Technology

Deb Batterham Postdoctoral research fellow, Swinburne University of Technology

Quoting is one of the most important parts of running a successful painting business. In this video, we break down the process of creating accurate, professional quotes that win jobs and keep your business profitable.

Finding and keeping the right people is one of the biggest challenges for painting and decorating businesses.

Smoko isn’t just a break – it’s a tradition in the trades. In this video, we take a look at what smoko means on site, why it’s important, and the stories that come with it.

Whether we like it or not, Australia is becoming a more litigious country.

People seem to be more willing to jump straight into legal action than ever before.Depending on the reason for that legal action, you might be covered by your public liability insurance, but not always…

Public liability insurance will cover you in the event that legal action is taken due to property damage or personal injury suffered by a third party, that has resulted from your negligence.

But that’s not the only reason you’ll find yourself needing legal assistance, and as a sole trader you’re particularly exposed.

We certainly don’t want to be scaremongering, but it’s part of our job to highlight the risks involved in being a self-employed tradie, and which insurance products are available to protect you.

Most tradies will go through their working lives without having a major legal issue, just like most of us won’t have our houses burn to the ground…

But that’s not to say it doesn’t happen, and shouldn’t be insured.

Leading legal expense insurance provider ARAG have put together some case studies that relate specifically to tradies:

“Following an accident on their worksite, SafeWork attended the premises and issued a Prohibition Notice requiring the business to stop work. The business challenged the Prohibition Notice on the grounds that the system of work was deemed safe. The insured contacted ARAG and a claim was lodged. ARAG appointed lawyers who ran proceedings to challenge the Prohibition Notice with the result being that the Prohibition Notice was cancelled. ARAG paid the business’ legal costs in relation to the proceedings.”

“Knock on Wood, a carpentry business, was approached by a customer to install skylights in their customer’s home. Knock on Wood is a small enterprise and engaged a Skylight contractor to supply and install the skylights. The skylights were installed and not properly sealed. The cost of installation of two skylights was $7,000. Following complaints by the customer, Knock on Wood arranged for the skylights to be replaced by a different contractor, they then claimed damages from the original contractor. The originally contractor refused to compensate Knock on Wood. Knock on Wood contacted their broker who then contacted ARAG Claims team, and formally lodged a claim on behalf of their client. ARAG reviewed and accepted the claim, appointed lawyers who forwarded a demand for payment of compensation to the contractors which resulted in negotiations and a quick settlement with damages paid to Knock on Wood. As there was a nil excess there were no out of pocket expenses and ARAG paid the legal costs incurred.”

“Perfect Plumbing has been lodging its BAS statements and Tax returns regularly. The ATO has announced its intention to look at compliance in several industries including the plumbing industry. The then ATO randomly selects Perfect Plumbing for a tax audit. After preliminary inquiries the ATO advised Perfect Plumbing’s accountant that it intended to audit their BAS lodgements. ARAG appointed accountants to assist with the audit and demonstrate BAS has been appropriately accounted for. ARAG met all costs of the appointed accountant other than the excess which was paid by Perfect Plumbing to the appointed accountant.”

“Bright Spark Electrics purchased bespoke lighting, with accompanying accessories for a large residential project. Mid-way through the installation the client changed their mind and wanted different lights. They asked Bright Spark to cancel the remaining order. Bright Spark explain that the client will need to pay for the change as the lights were non-refundable. The client agreed and Bright Spark ordered and installed new lights. However, when issued with the final invoice, the client then refused to pay for the unused lights. The client refused all requests for payment and denied they had agreed to pay for the unused material, despite text messages and emails. Bright Spark contacted the ARAG Legal Information Helpline, and then referred to ARAG claims. Lawyers were appointed to recover damages from the client. After debt recovery proceedings commenced the client agreed to pay for 80% of the total invoice. ARAG paid all legal

costs incurred in the proceedings, and Bright Spark Electric paid a $1,000 excess.”

In a perfect world we wouldn’t need lawyers and accountants to settle disputes, but it’s a far from a perfect world…

As a sole trader your exposure to such matters can be even more serious, since you’re personally liable for any legal costs incurred by your business.

Legal expense insurance can give you considerable peace of mind, knowing that you have access to legal assistance when you need it, without ending up with a huge legal bill.

As with any type of business insurance, the cost of legal expense insurance will vary depending on the size and type of business you run.

Our experience shows that for sole traders, legal expense insurance will sometimes cost no more than your public liability insurance. So we could be talking well under $1,000 per year.

Compare that to the cost of a solicitor, which could be anything up to $3,000 per day if you end up in court, and it’s incredible value. Included in the policy is access to a legal helpline, so even if you just need some quick advice and don’t end up in court, you can still benefit from the policy.

DOESN’T PUBLIC LIABILITY COVER LEGAL COSTS?

Yes, public liability insurance will cover legal costs, or more specifically, your defence costs.

But it only covers defence costs for something that will be (or could be) a public liability insurance claim.

If the potential claim relates to property damage or personal injury suffered by a third party, then your public liability policy may cover those legal / defence costs as part of the overall claim.

But if the issue is not related to a public liability claim, then it will not cover any legal or defence costs.

This could include contractual disputes, licensing issues, employment disputes, tax audits or many other potential legal issues which don’t relate to public liability insurance.

Legal expense insurance is available for Pty Ltd companies, it’s just that this guide focuses on sole traders.

We can help trade businesses of any structure – company, trust or otherwise – with legal expense insurance.

We know that for most sole traders, the cost of an insurance policy is a major consideration.

If what you’ve read so far has piqued your interest, the next step is to request a quote from us.

For existing Trade Risk clients we recommend speaking with your dedicated account manager. If you don’t have their details, call our office on 1800 808 800 and we’ll transfer you through.

For new clients, call our office on 1800 808 800 and one of our brokers will help you out with quotes and information.

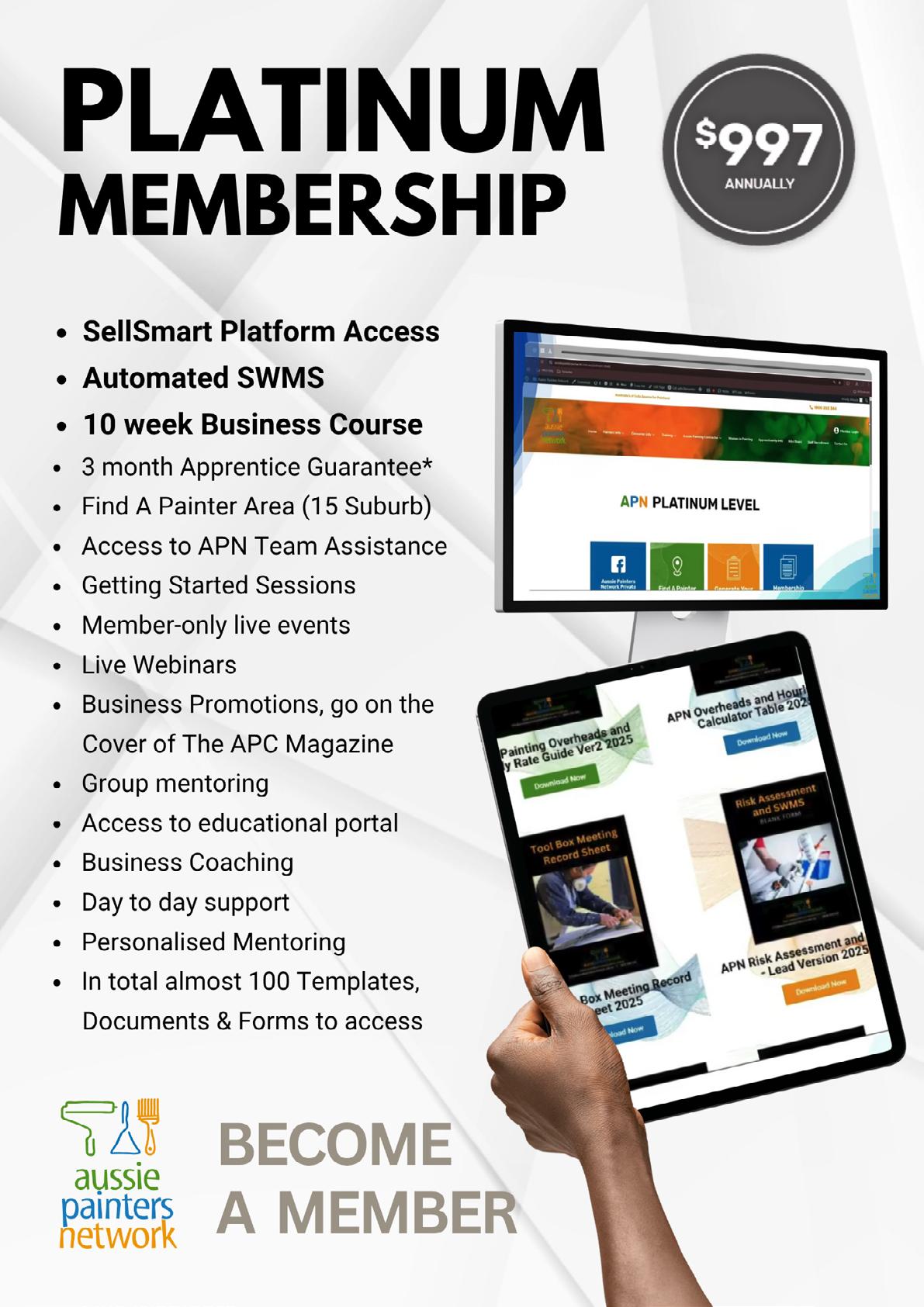

Personalised SWMS for Platinum

Members Beta version available for Gold

Did you know that 50% of small business expenses are generated on the go? It’s no wonder the majority of expense receipts end up shoved in coat pockets or an old shoebox.

In spite of all of the high-tech options out there, 47% of small businesses are still using spreadsheets for expense management, leaving room for errors that could really hurt their bottom line come tax time.

Why not take the uncertainty and disorganization out of expense tracking by going mobile?

These five apps can be used anywhere, anytime, to ensure no penny goes unlogged or unclaimed.

1. Receipt Bank: eliminate data entry

With Receipt Bank, you can easily do away with expense-related data entry altogether. Simply snap a photo of your receipt and submit it for processing; the app automatically extracts all relevant data including vendor, total amount, payment method, and date.

Receipt Bank also integrates with Xero, QuickBooks, Sage 50, FreeAgent, and Kashflow accounting software to streamline your bookkeeping.

Receipt Bank must be doing something right because this app has earned high praise, including Xero’s 2015 'Add-on of the Year' award (UK winner).

2. Avaza: 5-in-one functionality

Australian software company, Avaza, recently announced a brand new app that combines project management, collaboration, time tracking, expense, and invoice management.

Users can opt for a single feature, or select all five for streamlined, on the go business management.

Some features of this app include:

• Daily and weekly timesheets;

• Per-person and per-category billable rates;

• Flexible tax configuration; and

• Trackable expenses and attachable receipts.

3. iClaimIt: mileage tracking made simple

iClaimIt is a straightforward, simple to use tool designed to help UK-based “road warriors” log their miles more easily and accurately. When travelling by car iClaimIt makes it a snap to record mileage with a click of a button and email your expense and mileage data as a CSV file.

As a bonus feature, this app also supports a simple receipt-capturing feature. Just attach a photo of each receipt to the corresponding expense to organize your fuel receipts and other travel expenses.

4. Expensify: your “virtual accountant”

Expensify makes it easy to capture receipts, record business-related mileage, log billable hours, and more.

Stand-out features of this app include:

• SmartScan technology that “reads” your receipt and creates an expense automatically;

• GPS mileage tracking to automatically calculate distance traveled for work;

• Bank and credit card import (the app can automatically pull all your business transactions into your Expensify account).

Budget-conscious business owners take note: Expensify’s SmartScan feature allows 10 free scans per month.

5. Shoeboxed: the “ultimate receipt-manager”

Like Receipt Bank, Shoeboxed allows you to snap a picture of your receipt, and then the app extracts vital information for you. This tool also allows you to create an expense report on your phone in a matter of seconds, using your stored images.

Another great feature is a searchable, categorized archive of logged receipts, which facilitates expenseexporting into QuickBooks, Wave Accounting, Excel, Outright, and Xero.

With mobile apps like these, you’ll never lose track of a receipt or claimable expense ever again.

Sandra Price

An opportunity to get things right for your business and provide it with the rejuvenation it requires. Achieving success in business demands more than just diligence; it necessitates a diverse set of management skills and a proactive planning approach.

As a business owner, your key responsibilities include:

• Conducting market research

• Establishing clear business goals

• Creating (or revising) a business plan

• Reviewing your expenses

• Check your overheads

The pressing question is: how confident are you in managing these crucial areas?

Planning for the future is vital. This could involve delegating tasks to a business partner, enhancing your skills through training, or hiring specialists such as a bookkeeper, graphic designer, or merchandiser. Let’s delve into the essential areas to concentrate on.

Market research enables you to grasp the needs of your customers, understand your competitors, and stay informed about industry trends. It offers insights into:

• Your customers: who they are, their needs, and their willingness to pay.

• Your competitors: what they offer, their pricing, and their market positioning.

This knowledge empowers you to make informed decisions about pricing, marketing strategies, business location, and competitive tactics. In essence, market research ensures you’re not navigating blindly.

Profitability is a universal goal for any business, typically involving increasing revenue while minimizing expenses. For instance:

• Revenue goals: Aim for a 10% annual sales increase or acquire three new clients each month.

• Expense goals: Lower rent by $200 monthly or reduce utility costs by 15%.

Additionally, consider customer service goals, such as establishing a reputation for being easy to work with or enhancing response times to customer inquiries. Remember, nothing tarnishes your credibility faster than tardiness—or failing to show up altogether. Reliability is one of the simplest avenues to earn customer trust

A business plan serves as more than just a document; it’s your navigational guide for the future. Whether comprehensive or a brief outline, it should clearly articulate:

• Your current business status.

• Your desired position in 3–5 years.

• The steps you’ll take to get there.

Your plan should evolve alongside your business. Revisiting it annually keeps you focused, aligned, and adaptable.

A solid understanding of your costs is essential. Begin with your immediate expenses, which include:

• Your hourly rate (regularly review and adjust it).

• Materials and supplies.

Any direct costs associated with production or delivery.

Having clarity on these figures ensures you’re setting the right prices and maintaining profitability.

5.

Regular monthly expenses can significantly impact your business. Review and monitor costs such as:

• Equipment replacement and maintenance

• Insurance

• Advertising and marketing

• Rental and Utilities

• Taxes and debt repayments

• Payroll and owner’s draw

• Working capital needs

Being aware of your overheads empowers you to take control, identify waste reduction opportunities, reinvest savings, and enhance your bottom line.

A thriving business doesn’t operate on autopilot; it flourishes when its owner consistently reviews, adjusts, and plans for the future. This year, pledge to work on your business, not just within it. Strengthen your systems, sharpen your goals, and stay vigilant regarding your costs. By doing so, you’ll position yourself for enduring profitability and growth.

These days, a lot of people are feeling anxiety about what’s going on in the world, and reading the news or looking at social media seems to trigger our fears and worries more than ever. But we can’t just bury our heads in the sand.

So how do we stay informed but not get crushed with anxiety and overwhelm from current events?

There aren’t any easy answers, but I thought I’d share a few ideas:

Limit: I like to limit my checking of the news to twice a day, on two different sites I trust (that aren’t sensationalist, for the most part). And I just check for 10-15 minutes each time.

Wait: Don’t get caught up in reacting instantly. Wait a day before sharing or reacting. Let yourself process it, let the anxiety die down, and breathe.

Focus: Keep yourself focused on what you can control. Are there any actions you can take in your local community? Can you get involved with a national campaign? Are there conversations you can have with people that will help the situation? If not, then focus

on the actions you can actually take, and don’t take on the responsibility of having to fix everything or worry about everything in the world.

Notice: Practice noticing when you’re feeling anxiety or overwhelm or frustration, and notice how it feels in your body. Focus on the sensations, and let it be OK that you’re feeling things, without adding extra fuel to the fire.

Breathe: Some slow, deep breaths can really help calm your nervous system when you’re feeling riled up. A nice walk can help too, or sitting in some stillness.

These obviously don’t solve the problems of the world, but they can help you cope a little more. Take care of yourself, and don’t let yourself get too caught up in what you can’t control.

Leo Babauta ZEN HABITS

Stories about interest rates and cost-of-living often focus on Australians’ hip pockets. But what about the impact on our mental health?

The National Mental Health Commission’s most recent “report card” shows financial stress has taken a significant toll in the last few years.

It found the proportion of people finding it “difficult” or “very difficult” to cope on their income doubled from 17.1% in November 2020 to 34.6% in January 2024. Women consistently reported higher levels of financial stress compared to men.

More people are also delaying seeing a mental health professional due to cost – or not seeing one at all (20.4% in 2023–24, compared to 12% in 2020–21).

But whether you’re experiencing a job loss, struggling with debt, or just worried about day-to-day expenses, it’s important to take your mental health seriously.

Financial stress and mental health

We often focus on the medical aspects of mental health, for example, whether someone has a certain mental health condition such as depression or anxiety.

But broader social factors can also influence our

mental health, including access to housing, income, unemployment and food insecurity. These are known as social determinants of health.

These are the things that often feel out of our control – and therefore can make us feel helpless. The report card also found people who experience a high sense of control over their lives declined slightly between 2019 and 2023.

Being able to save and pay off debt is linked to significantly better mental health.

In contrast, having to forgo meals or medicine, or struggling with bills and rent or mortgage payments, is stressful and over time can affect our physical and mental health.

Financial stress can lead some people to develop anxiety or depression, or use alcohol and drugs to cope. If you have a pre-existing mental health condition, it can also make things more challenging.

We also know that rates of suicide are often higher in groups that experience economic disadvantage and financial hardship.

Feeling overwhelmed can make it harder to take care of yourself, but it’s important – and will also make it easier to work through your financial situation.

Try taking one step at a time. The first is to take notice of what is happening.

Signs financial stress is affecting your health and/or relationships might include:

• arguing a lot about money

• having difficulty sleeping

• fatigue

• feeling angry, scared or experiencing mood swings

• feeling guilty and worried about spending money

• delaying health care because of the cost.

These are normal responses to money stress. But if they’re not addressed, they may lead to further difficulties.

Mental distress can also affect how you deal with your personal finances – and make it harder to get on top of them.

For example, people who have struggled with money in the past – or who grew up in circumstances without much money – may have a difficult relationship with managing finances.

You may have patterns of behaviours – such as frequently spending above your means or borrowing money – that make you more stressed about money. Maybe you cope by avoiding the problem, ignoring emails from banks or not reading bills.

Some people may find it helpful to understand how money is linked to emotional wellbeing. This means getting to know your money and mood patterns.

You might start by keeping a diary of your spending and your mood, considering when you’re more likely to spend and why, what emotions come up, and how best to manage them.

Beyond Blue’s money, financial wellbeing and mental health quiz is another good place to start.

Beyond Blue and the National Debt Helpline provide a breakdown of what might be causing financial distress and can help you find free financial counselling.

Free online tips and advice about managing your finances and household debt are also available via the government website MoneySmart, or Financial Counselling Australia (a not-for-profit).

For mental health symptoms, such as trouble sleeping or feeling anxious, Medicare Mental Health is a free service that connects you with support services, either via the website or by calling 1800 595 212 (weekdays 8:30am – 5pm). You can also talk to your GP.

Remember, no matter how difficult the situation, it’s never too early – or too late – to get support.

If this article has raised issues for you, or if you’re concerned about someone you know, call Lifeline on 13 11 14.

Nicholas Procter

Professor and Chair: Mental Health Nursing, University of South Australia

Aussie Painters Network aussiepaintersnetwork.com.au

National Institute for Painting and Decorating painters.edu.au

Australian Tax Office ato.gov.au

Award Rates fairwork.gov.au

Australian Building & Construction Commission www.abcc.gov.au

Mates In Construction www.mates.org.au

Comcare

WorkSafe ACT

Workplace Health and Safety QLD

WorkSafe Victoria

SafeWork NSW

SafeWork SA

WorkSafe WA

NT WorkSafe

WorkSafe Tasmania

comcare.gov.au worksafe.act.gov.au worksafe.qld.gov.au www.worksafe.vic.gov.au www.safework.nsw.gov.au www.safework.sa.gov.au commerce.wa.gov.au/WorkSafe/ worksafe.nt.gov.au worksafe.tas.gov.au

actcancer.org cancercouncil.com.au cancercouncilnt.com.au cancerqld.org.au

cancersa.org.au cancervic.org.au

cancerwa.asn.au