Welcome to the 149th issue of the Aussie Painting Contractor Magazine.

Can you believe we’re already at the end of the financial year? Time seems to be moving faster than ever, and with each passing month, more is getting done across the industry. Hopefully, you’ve managed to tackle the workload you had planned over the past six months.

This month, we had the privilege of celebrating the very best of the next generation of painters at the WorldSkills Australia competition. A huge congratulations to Xai for taking out the top spot—an outstanding achievement in a field full of exceptional talent. The standard of work continues to rise each year, and we’re proud to be part of an industry that nurtures such excellence.

On the apprentice front, our recruitment efforts are showing strong results. We currently have 178 applicants in our system, with 30 in trials and 38 either signed or in the final stages of being signed up as apprentices. If you're looking to grow your team, now is a great time to consider taking on an apprentice. With a bit of training and support, they’ll soon be adding value to your business.

As always, if you need assistance—whether it’s with staffing, training, or support—get in touch. We’re here to help.

'Til next month, Happy

Painting!!

Nigel Gorman

nigel@aussiepaintersnetwork.com.au 07 3555 8010

CONTRIBUTORS

• Anthony Igra

• Caroline Miall

• Colette Southam

• Connie Vitale

• Leo Babauta

• Nigel Gorman

• Oliver Kay

• Robert Bauman

• Robert B Whait

• Sandra Price

EDITOR

Nigel Gorman

GRAPHIC DESIGNER

J. Anne Delgado

The Tradie’s Guide to Staying Compliant (Without the Stress)

7 ways your trades business can market its services

Small

Regaining Your Creative Flow: Tips to Reignite

Painting Your Career: Transforming Futures, One Student at a Time!

3 Mistakes That Strangle Growing Businesses

How record keeping can protect your trade business LACK OF SLEEP Makes It Hard to Take Action

Opinions and viewpoints expressed in the Aussie Painting Contractor Magazine do not necessarily represent those of the editor, staff or publisher or any Aussie Painters Network’s staff or related parties. The publisher, Aussie Painters Network and Aussie Painting Contractor Magazine personnel are not liable for any mistake, misprint or omission. Information contained in the Aussie Painting Contractor Magazine is intended to inform and illustrate and should not be taken as

legal or accounting advice. You should seek professional advice before making business related decisions. We are not liable for any losses you July incur directly or indirectly as a result of

Running a trade business isn’t just about doing quality work and keeping clients happy—you’ve also got to stay on top of all the compliance rules that come with running a business in Australia.

And let’s be honest, compliance is rarely at the top of a tradie’s to-do list. Between quoting, invoicing, managing staff, and actually getting on the tools, it’s easy for things like BAS, payroll, and registrations to fall behind.

But falling behind can mean penalties, stress, and time wasted dealing with the ATO. So, here’s a simple guide to help you stay compliant—without the overwhelm.

One of the most common compliance headaches for tradies is missing BAS and tax deadlines. It might not seem like a big deal, but late lodgements can lead to penalties, interest, and unwanted attention from the ATO.

The key here is consistency. Whether you’re lodging monthly or quarterly, set calendar reminders, use automated software, or better yet—hand it off to someone who’ll make sure it’s done on time, every time.

It’s one thing to lodge your BAS and tax on time—it’s another to actually have the money ready to pay it.

We recommend setting aside a percentage of every payment you receive into a separate bank account— ideally 15–30%, depending on your tax setup. This simple habit takes the stress out of BAS time and helps you avoid scrambling for funds or dipping into personal savings to cover business tax.

Treat that account like it doesn’t exist—and you’ll thank yourself later.

If you have staff, you’re responsible for meeting all your payroll obligations—including Single Touch Payroll (STP), superannuation, PAYG withholding, and entitlements like leave and WorkCover.

This area can get complex fast, especially as rules change. Make sure your payroll system is set up correctly and reviewed regularly. Getting this wrong can be costly—both in fines and in employee trust.

4. Maintain Your Registrations and Insurances

Every trade business needs to keep its paperwork in order. That means ensuring your ABN, GST registration, ASIC company details, and the relevant licences in your state (if applicable) are current and correct.

It’s also critical to keep your insurances up to date— like public liability, income protection, and tools cover. Not having the right coverage can leave you exposed if something goes wrong.

5. Get the Right Professional Support

This one’s the game-changer. You don’t need to be an expert in tax, payroll, or bookkeeping—you just need the right support.

A good bookkeeper can keep your accounts in order week to week. A great accountant can help you stay compliant, reduce tax, improve cash flow, and plan for the future. If you’re currently doing it all yourself—or chasing someone who never calls you back—it’s time for an upgrade.

Compliance doesn’t have to be stressful. With the right systems and support, you can keep your business running smoothly and confidently.

Need help making compliance easier?

Book a free discovery call with Straight Talk Accountants—we’ll show you how we help tradies like you stay on track without the stress.

Call our office on (07) 3399 8844, or just visit our website at www.straighttalkat.com.au and complete your details on our Home page to book a call.

Please Note: Many of the comments in this article are general in nature and anyone intending to apply the information to practical circumstances should seek professional advice to independently verify their interpretation and the information’s applicability to their particular circumstances.

Copyright © 2025 Robert Bauman.

When you go into business as a tradie, your focus is often on performing your trade to the best of your ability – as it should be. With time, the quality of your work will speak for itself, which is the most valuable testimonial of all.

However, any tradie accountant or bookkeeper will tell you there’s more to it these days. While your good reputation preceding you is undoubtedly essential, there are a few other ways that you’ll want to market your services to ensure that you have a steady stream of work. Read on to learn 7 ways you can market your trades business.

Since setting up a new business is usually a digital experience these days, it’s easy to overlook the step of making sure you appear on a physical list where people can find you. Ensure your business is on whatever relevant trade directories run in your area.

Additionally, make sure you appear in the online equivalent. Yelp, Google, and Facebook each have business directories. And let’s not forget the old standby: the phone book. Yes, they still exist! They are valuable resources for some people looking to hire a tradie.

2.

Some website-building platforms are very userfriendly, but if you feel that’s beyond you, hire someone to do it. Almost everyone does an online search before they hire a business, and not having a website is like waving a giant flag that says you’re out of touch, old-fashioned, or possibly not legitimate. Meanwhile, having a website reassures people that you are who you say you are, and can provide the services they need.

Nothing is stronger than a good referral, and people naturally turn to social media to find out what your customers are saying if they don’t know someone who’s used your services personally.

Keep your social media presence strong and engaged. If you’re uncomfortable doing this, hire someone to do it for you. It’s critical when doing business today.

When you wind up with a happy customer, provide them with an easy way to speak positively about you and suggest you to their friends. A card or a thankyou email with a discount code will do the trick.

5. Run ads

Tradie marketing can be tricky because, typically, your services aren’t always needed. But when you are needed, it’s usually urgent.

If your trades business doesn’t appear on the first page of Google, it might be worth your while to take out an online ad. That way, when someone searches for a tradie in your area, your business will appear next to their search. The only way someone can click on your information is if they see it – so make sure they have that chance, whether through an organic search or a paid ad.

6. Make yourself visible in the real world

Make sure your business’s name and logo appear on any equipment you use and make clothes for your team to wear when they’re out and about in the world.

It may be smaller than a billboard, but driving and walking around letting people know who you are, what you do, and how to contact you will go a long way to market your trades business. If people become familiar with your business name, they’ll be more likely to turn to you when they need you.

7. Good old-fashioned snail mail

Believe it or not, print campaigns are alive and well! If you operate a trades business whose services are sorely needed in a specific area, consider making a print ad to pop into mailboxes. A word of warning, though – make sure your print ad is relevant, valuable, and eye-catching. You don’t want to spend money producing something that will immediately go to the recycling bin.

Marketing for trades businesses is a lot like any other type of business in that you have to understand your audience and their needs and show up when they’re looking for you. With some research and proactive planning, you can be sure your business will appear in the right place and at the right time.

Need help growing your business? Get in touch with our specialists today or Book a strategy session HERE to see how we can improve your bottom line.

One of the questions I get asked a lot is how to choose what to do. It seems like a simple question, but for most people, it’s actually not simple at all. In fact, it’s an overwhelming question!

What gets in the way:

• A thousand things on my list

• A never-ending pile of emails and messages to answer

• A thousand browser tabs open

• Ten thousand things to do in my daily life (finances, cooking, shopping, cleaning, etc.)

• Interruptions and new demands on my time

• Things never go according to plan

• Projects, books, courses, and more that are waiting for me to start (or continue) them

As you can see, it’s not so simple to choose. No wonder people get stuck on the question.

The way to work with this, though, is pretty simple. In fact, usually too simple for most people, who hear the advice and then don’t tend to heed it.

Here’s what I recommend:

• Make a long list of everything you need to do, pulling from emails and projects and browser tabs and more. This can be overwhelming, but it really helps to put everything down so you feel you’ve got it all. This list isn’t to be finished, just a place to pull from for your short list (below). Btw, I like to start with a fresh piece of paper or digital note for this list, when things feel out of hand.

• Make a short list of 3–5 things you need to do first. How do you decide? Listen to your gut. There’s no right answer, so practice choosing from your gut.

• Pick one thing from the short list and focus on it exclusively. Let it be your entire world.

This is a pretty simple and flexible system, because if something comes up that interrupts you, you can decide whether to put it on the long list, the short list, or to make it the one thing you’re focusing on right now. Decide that from the gut as well.

With practice, you get good at choosing from the gut.

Take some time every week to get the long list updated. Also take some time to clear out some of the smaller tasks that pile up. Take some time at the end of each day (or beginning) to make your short list. If you finish the short list, give yourself the chance to do some of the smaller things.

That’s the simple system! Give it a wholehearted try and see how it goes.

If choosing what to do feels overwhelming, if your mind gets tangled in uncertainty, second-guessing, or pressure to get it right — you’re not alone.

In Fearless Living Academy, we practice something different: trusting ourselves in the choosing. Taking action even when it feels imperfect. Returning to what calls for our focus, again and again.

Join us and build this practice with the support of a community that’s committed to doing the same.

Leo Babauta ZEN HABITS

In the fast-paced world of allied health, you’re busy focusing on client outcomes, compliance with the NDIS, and growing your clinic but there’s one silent threat that could unravel all your hard work: client ownership.

If your service agreements don’t clearly define who owns the client relationship, particularly in multipractitioner setups, you could lose clients, revenue and goodwill overnight.

f you’re a solo allied health practitioner, there’s no question, your clients are your clients. But once your business grows and you start bringing on additional practitioners, contractors or casual therapists, things get a whole lot more complicated.

In a clinic model, especially one operating under the NDIS framework, client loyalty often lies with individual practitioners rather than the brand. Without clearly defined terms around client ownership in your practitioner agreements or service contracts, your business could be exposed to serious risk.

It’s not just a theoretical problem, it’s a very real legal and commercial issue. Here’s why:

No ownership clause? No legal protection. Without a written clause that defines who owns the client relationship, the law often assumes that the relationship belongs to the person delivering the service, not the clinic. That means a therapist can leave and legally continue working with “your” clients.

Revenue can walk out the door. If a valued team member moves on, and clients follow them, your clinic could suffer a major drop in income overnight.

NDIS providers are especially at risk. The NDIS encourages client choice and control and while that’s great for participants, it also means they’re free to follow their favourite therapist unless your agreements put boundaries in place.

This issue pops up most often in multidisciplinary or mobile allied health practices (think occupational therapy, physiotherapy, psychology, and speech pathology clinics), where contractors or employees work independently under your brand.

Without clear client ownership terms, you’re leaving the door wide open for:

• Loss of goodwill you’ve spent years building

• Disruption to continuity of care

• Difficulty onboarding new practitioners (because clients are already loyal to someone else)

A Real-World Example: When Client Ownership Isn’t Clear, Everyone Loses

Emma is the founder of a thriving speech pathology clinic operating under the NDIS. As demand for services grew, she brought on Liam as a subcontractor to help manage her growing client base. He was great with clients, delivered consistent results, and quickly became a trusted part of the clinic.

But there was one big oversight.

Liam’s contractor agreement didn’t include any provisions around client ownership. There was no clause defining who “owned” the client relationship, no terms around what would happen if Liam ever left, and no non-solicitation clause. Like many clinics, Emma had assumed the clients would remain with the business.

Eighteen months later, Liam gave notice. He’d decided to open his own practice just five minutes down the road.

And he didn’t leave empty-handed.

Several clients followed him to his new clinic. He’d built strong rapport, and without anything in his service agreement restricting client poaching or requiring a handover process, there was nothing Emma could do. He didn’t need to transfer clinical notes, maintain continuity, or even notify her who had gone.

Emma was blindsided. Not only did she lose income, but her reputation took a hit as some existing clients experienced gaps in their care. The worst part? It was completely avoidable if her allied health service agreements had been properly drafted.

This isn’t uncommon. In fact, it’s one of the most frequent pain points we see when reviewing NDIS provider contracts and service agreements for allied health clients. Many clinics rely on free templates or assume that general employment rules will protect them but without the right legal clauses, those assumptions don’t hold up.

If you’re operating under the NDIS, you already know how intense the compliance landscape can be, from audits and reporting to participant service plans. But there’s one crucial gap many providers still overlook: who actually owns the client relationship.

Most NDIS service agreements focus on what the participant can expect from the service provider, but they say very little about what happens internally, especially when a therapist leaves or transitions out of the business.

Try Googling NDIS client ownership agreement or client ownership in allied health and you’ll quickly see how little guidance is out there. That silence isn’t just inconvenient, it’s dangerous for your business.

If you:

• Work with subcontracted or casual allied health practitioners

• Depend on strong therapist-client bonds (as most NDIS providers do)

• Don’t have any post-employment or exit clauses in your contracts

…then you’re leaving the door wide open for misunderstandings, disputes, or worse, for clients to follow a practitioner out the door, with no legal grounds to prevent it.

And under the NDIS, continuity of care matters. If a therapist leaves suddenly, and there’s no proper handover or communication plan, you risk not just client loss but also potential complaints or compliance flags.

Whether you’re running a solo NDIS practice or managing a team of therapists, having a professionally drafted service agreement is essential. A clear and comprehensive allied health service agreement does more than tick a compliance box, it protects your client relationships, reputation and business value.

Here’s what we include in our tailored agreements at Rise Legal:

✅ A clear statement of who owns the client relationship

This is the foundation of your protection. Your agreement should clearly state that the clinic or business, not the individual practitioner owns the client relationship. This clause is particularly critical for NDIS service providers, where clients may receive care from multiple therapists over time.

Without this in writing, there’s room for interpretation, and that’s when things go wrong.

✅ Contractor obligations on exit, including notice periods and handover requirements

Your service agreement should outline what happens when a practitioner leaves. That includes how much notice they must give, how client files and notes are to be handed over, and whether they can inform clients of their departure. A smooth exit process protects the continuity of care and reduces disruption to your clinic.

✅ Clauses covering client data, notes and privacy

Client data is a legal and ethical minefield, especially under the NDIS Quality and Safeguards Framework. Your agreements should confirm that all client notes, reports and records remain the property of your clinic and must be returned or securely stored on exit. Practitioners must also acknowledge their ongoing obligations around confidentiality and privacy, even after they’ve moved on.

✅ Post-engagement restrictions (like reasonable non-solicitation clauses)

A well-drafted non-solicitation clause prevents former team members from actively encouraging clients to follow them to a new practice, without being overly restrictive. These clauses are different from non-competes and must be reasonable in scope, duration and geography to be enforceable under Australian law. This is especially relevant for businesses looking to maintain NDIS client continuity and service delivery.

✅ Clear rules around marketing, branding and social media use

Your team represents your brand. Make sure your agreement sets out how your name, logo, website,

client lists or testimonials can (or can’t) be used. Also, include rules about what practitioners can post on social media during and after their time with your clinic. This protects your reputation and minimises confusion for clients who may not realise someone has moved on.

Don’t Make It Personal. Make It Contractual.

When it comes to client relationships, relying on goodwill or a handshake isn’t enough, especially in allied health, where client trust and continuity are everything. This isn’t about being possessive or paranoid. It’s about putting your business on solid legal ground.

By formalising client ownership through properly drafted service agreements or contractor contracts, you create a clear legal framework that protects your clinic from unnecessary risk.

what having the right clauses in place can do:

• Set expectations from day one – Practitioners and contractors know the boundaries, your policies, and their obligations if they ever leave.

• Avoid misunderstandings – You eliminate grey areas that can lead to disputes or awkward conversations down the track.

• Reduce legal risk – If a practitioner tries to take clients with them, you’ve got enforceable terms in place to protect your business.

• Enhance your clinic’s value – When it comes time to sell or scale, clearly defined client ownership makes your business more attractive to buyers and investors.

• Safeguard NDIS client relationships – For registered providers, protecting your client base under the NDIS is not just smart, it’s essential for compliance and long-term growth.

Too many clinic owners only think about these issues after something’s gone wrong. But putting proactive agreements in place now is one of the simplest and smartest legal protections you can invest in.

Not Sure What Your Agreements Say? We can help. If you’re not 100% confident that your current agreements cover things like client ownership, post-engagement restrictions or data handover obligations, you’re not alone.

Most allied health clinics we speak to are running on old templates, DIY documents or generic contracts that don’t reflect how their business actually operates. And when something goes wrong (like a practitioner taking clients or a messy contractor exit), those gaps become very real, very fast.

Whether you’re a solo operator growing your team, or an established clinic with multiple practitioners, we make sure your contracts clearly spell out who owns the client relationship, what happens when someone leaves, and how to protect your business long-term.

Here’s what you get with us:

✅ Fixed-fee pricing (no clock-watching or surprise bills)

✅ Tailored legal documents that reflect how your clinic actually works

✅ Plain English drafting because you shouldn’t need a law degree to read your own contracts

We’re commercial lawyers who get allied health. And we’re here to make sure your legal foundations are strong, so you can focus on what you do best, helping people.

Whether you’re running an NDIS clinic, a multidisciplinary allied health practice or growing your team of contractors, it’s critical to have legally sound agreements in place.

At Rise Legal, we specialise in custom service agreements for allied health providers, with clear clauses around client ownership, practitioner obligations, and data protection.

Don’t wait until a valued team member leaves and takes your clients with them. Let’s get ahead of the risk now and make sure your client relationships are protected not just in practice, but legally documented and enforceable.

Book a free, no-obligation chat with our legal team today to discuss your agreements and how we can help you safeguard your business.

Remember, while this information provides a general overview, legal advice tailored to your specific circumstances is invaluable. Don’t hesitate to contact Rise Legal for personalised guidance or book in a free Discovery Call.

Disclaimer: This blog post is intended for informational purposes only and should not be considered legal advice. Consult with a qualified commercial lawyer for personalised advice related to your specific circumstances.

This month, I had the great honour once again of judging the Painting and Decorating category at the WorldSkills Australia National Championships. It was an inspiring few days, with the 16 top apprentice painters from across the country going head-to-head for gold—and the prestigious title of being the best in Australia.

The standard of work this year was nothing short of exceptional. All judges agreed: the level of detail, precision, and professionalism on display was among the best we’ve ever seen. It’s a credit not only to the apprentices, but to the mentors, trainers, and institutions behind them.

Behind the scenes, it takes a serious team effort to make the competition happen. A massive shout out goes to the judging panel and Nick from Skillstech, who helped ensure everything ran smoothly. Many people wouldn’t know that it's the judges who build and prepare the competition booths before the event even begins. In just a couple of days, we had everything ready for the competitors’ arrival on Wednesday, with the competition kicking off Thursday.

From the moment the clock started, the pressure was on. Competitors had just an hour to get set up, followed by a brief 15-minute break—then straight into the infamous 90-minute wallpaper speed test. With only just enough wallpaper provided to complete the task, it’s a true test of skill and nerve, often separating the top contenders from the rest.

And the pace didn’t slow down. Day one also included a colour matching test and the beginning of a series of detailed tasks that would carry through the competition. By day two, the apprentices were back early, ready to dive into more complex elements— including their colour stripes, background wall, and their feature wall. At this stage, time management became critical. Any unfinished components were scored as incomplete, meaning significant point deductions.

The final day brought with it the challenge of completing the door and rebate section, as well as the main design wall—a centrepiece of the competition requiring creativity, consistency, and a steady hand. I’m thrilled to report that every competitor finished their work, and the quality across the board was simply outstanding.

Congratulations to this year’s medalists:

�� 1st Place: Xai (Queensland)

�� 2nd Place: Jemma (South Australia)

�� 3rd Place: Casey (ACT)

Special thanks to our sponsors—Dulux for supplying the paint, and Monarch for providing the tools that helped these young painters bring their visions to life.

Competitions like WorldSkills highlight the incredible talent emerging in our trade. It’s not just about who wins—it's about pushing the boundaries of craftsmanship, celebrating skill, and inspiring the next generation. Well done to all involved!

Nigel Gorman nigel@aussiepaintersnetwork.com.au

Small businesses are an innovation powerhouse. For many, it’s still too hard to raise the funds they need

The federal government wants to boost Australia’s productivity levels – as a matter of national priority. It’s impossible to have that conversation without also talking about innovation.

We can be proud of (and perhaps a little surprised by) some of the Australian innovations that have changed the world – such as the refrigerator, the electric drill, and more recently, the CPAP machine and the technology underpinning Google Maps.

Australia is continuing to drive advancements in machine learning, cybersecurity and green technologies. Innovation isn’t confined to the headquarters of big tech companies and university laboratories.

Small and medium enterprises – those with fewer than 200 employees – are a powerhouse of economic growth in Australia. Collectively, they contribute 56% of Australia’s gross domestic product (GDP) and employ 67% of the workforce.

Our own Reserve Bank has recognised they also have a huge role to play in driving innovation. However, they still face many barriers to accessing funding and investment, which can hamper their ability to do so.

We all know the saying “it takes money to make money”. Those starting or scaling a business have to invest in the present to generate cash in the future.

This could involve buying equipment, renting space, or even investing in needed skills and knowledge.

A small, brand new startup might initially rely on debt (such as personal loans or credit cards) and investments from family and friends (sometimes called “love money”).

Having exhausted these sources, it may still need more funds to grow. Bank loans for businesses are common, quick and easy. But these require regular interest payments, which could slow growth.

Alternatively, a business may want to look for investors to take out ownership stakes.

This investment can take the form of “private equity”, where ownership stakes are sold through private arrangement to investors. These can range from individual “angel investors” through to huge venture capital and private equity firms managing billions in investments.

It can also take the form of “public equity”, where shares are offered and are then able to be bought and sold by anyone on a public stock exchange such as the Australian Securities Exchange (ASX).

Unfortunately, small and medium-sized companies face hurdles to accessing both kinds.

Private investors’ high bar to clear Research examining the gap in small-scale private equity has found 46% of small and medium-sized firms in Australia would welcome an equity investment – despite saying they were able to acquire debt elsewhere.

They preferred private equity because they also wanted to learn from experienced investors who could help them grow their companies. However, very few small and medium-sized enterprises were able to meet private equity’s investment criteria.

When interviewed, many chief executives and chairs of small private equity firms said their lack of interest in small and medium-sized enterprises came down to cost and difficulty of verifying information about the health and prospects of a business.

To make it easier for investors to compare investments, all public companies are required to disclose their financial information using International Financial Reporting Standards.

In contrast, small private companies can use a simplified set of rules and do not have to share their statements of profit and loss with the general public.

Share markets are costly and complex

Is it possible to list on a stock exchange instead? An initial public offering (IPO) would enable the company to raise funds by selling shares to the public.

Unfortunately, the process of issuing shares on a stock exchange is time-consuming and costly. It requires a team of advisors (accountants, lawyers, and bankers) and filing fees are high.

There are also ongoing costs and obligations associated with being a publicly traded company, including detailed financial reporting.

Last week, the regulator, the Australian Securities and Investments Commission (ASIC), announced new measures to encourage more listings by streamlining the IPO process.

Despite this, many small companies do not meet the listing requirements for the ASX.

These include meeting a profits and assets test and having at least 300 investors (not including family) each with A$2,000.

There is one less well-known alternative – the smaller National Stock Exchange of Australia (NSX), which focuses on early-stage companies. Ideally, this should have been a great alternative for small companies, but it has had limited success. The NSX is now set to be acquired by a Canadian market operator.

Our previous research has highlighted that small and medium-sized businesses should try to make themselves more attractive to private equity companies. This could include improving their financial reporting and using a reputable major auditor.

At their end, private equity companies should cast a wider net and invest a little more time in screening and selecting high-quality smaller companies. That could pay off – if it means they avoid missing out on “the next Google Maps”.

What we now know as Google Maps began as an Australian startup. Susan Quin & The Bigger Picture, CC BY

There are other opportunities we could explore. Australia’s pool of superannuation funds, for example, have begun growing so large they are running out of places to invest.

That’s led to some radical proposals. Ben Thompson, chief executive of Employment Hero, last year proposed big superannuation funds be forced to invest 1% of their cash into start-ups.

Less extreme, regulators could reassess disclosure guidelines for financial providers which may lead funds to prefer more established investments with proven track records.

There is an ongoing debate about whether the Australian Prudential Regulation Authority (APRA), which regulates banks and superannuation, is too cautious.

Some believe APRA’s focus on risk management hurts innovation and may result in super funds avoiding startups (which generally have a higher likelihood of failure).

In response, APRA has pointed out the global financial crisis reminded us to be cautious, to ensure financial stability and protect consumers.

The author would like to acknowledge her former doctoral student, the late Dr Bruce Dwyer, who made significant contributions to research discussed in this article. Bruce passed away in a tragic accident earlier this year.

Colette Southam Associate Professor of Finance, Bond University

Is your creative spark gone? What actions can you take to get your creative spark back?

Recently, my creativity has taken a significant dip, leading to frustration due to a lack of results. What caused this shift? Life, it seems. Everything was flowing smoothly, so what changed? Our lives usually follow a steady rhythm, but occasionally, unexpected challenges arise. Suddenly, the elements that created that perfect creative atmosphere become unbalanced. Just one disrupted factor can send your creative flow tumbling. Writers may call it writer's block, while painters might refer to it as an artistic block; other creative professionals might simply see it as a lack of ideas and inspiration. So, how do you get those creative juices flowing again?

Identify the Disrupted Parameter: Take a moment to pinpoint what in your life may be out of sync—be it relationships, job situation, health, finances, friendships, family, or skills. Reflect on what has changed since you were in your creative flow. Approach this without self-judgment; treat it as a straightforward fact-finding mission. Jot down any thoughts that arise. Address the Imbalance: Once you have clarity on which area of your life has shifted, start making small, creative adjustments to restore balance. Ensure these steps include an element of fun, which will ultimately have a positive impact on your well-being.

Creative Activities to Reignite Your Spirit

• Write a mission statement to remind yourself of your core purpose—review it daily.

• Embrace the present moment and savor the here and now.

• Keep a journal to track your daily emotions and observations; they may reveal clues about your creative block.

• Capture old things from a fresh perspective through photography.

• Perform a kind act for a friend or a stranger.

• Immerse yourself in inspiration; there’s no such thing as too much.

• Continue asking questions and take time to reflect; answers will come in time.

• Step out of your comfort zone and confront a fear.

• Watch an uplifting movie.

• Find joy in the little things and appreciate the details in everyday life.

• Explore creative blogs brimming with inspiration.

• Reflect on your achievements and be amazed at what you’ve already accomplished.

• Spend time with friends, sharing laughter through lighthearted activities.

• Write about a topic you love.

• Allow yourself to play and engage in imaginative activities.

• Expand your horizons by learning something new, like a word or skill.

• Choose a guiding keyword—such as happiness, contentment, or inspiration—to shape your focus.

• Remember, you’re never too old to play—join a team sport or enjoy a board game

• List your personal goals that inspire you and start working towards them today!

• Dream up your ideal world and visit it often; create a vision board to visualize it!

• Meditate—take a moment to sit and breathe, creating some inner space.

Inspiration can ebb and flow; some days it’s abundant, and other days it feels nonexistent. Don’t lose hope— your blocks may serve a purpose.

Be Inspired!

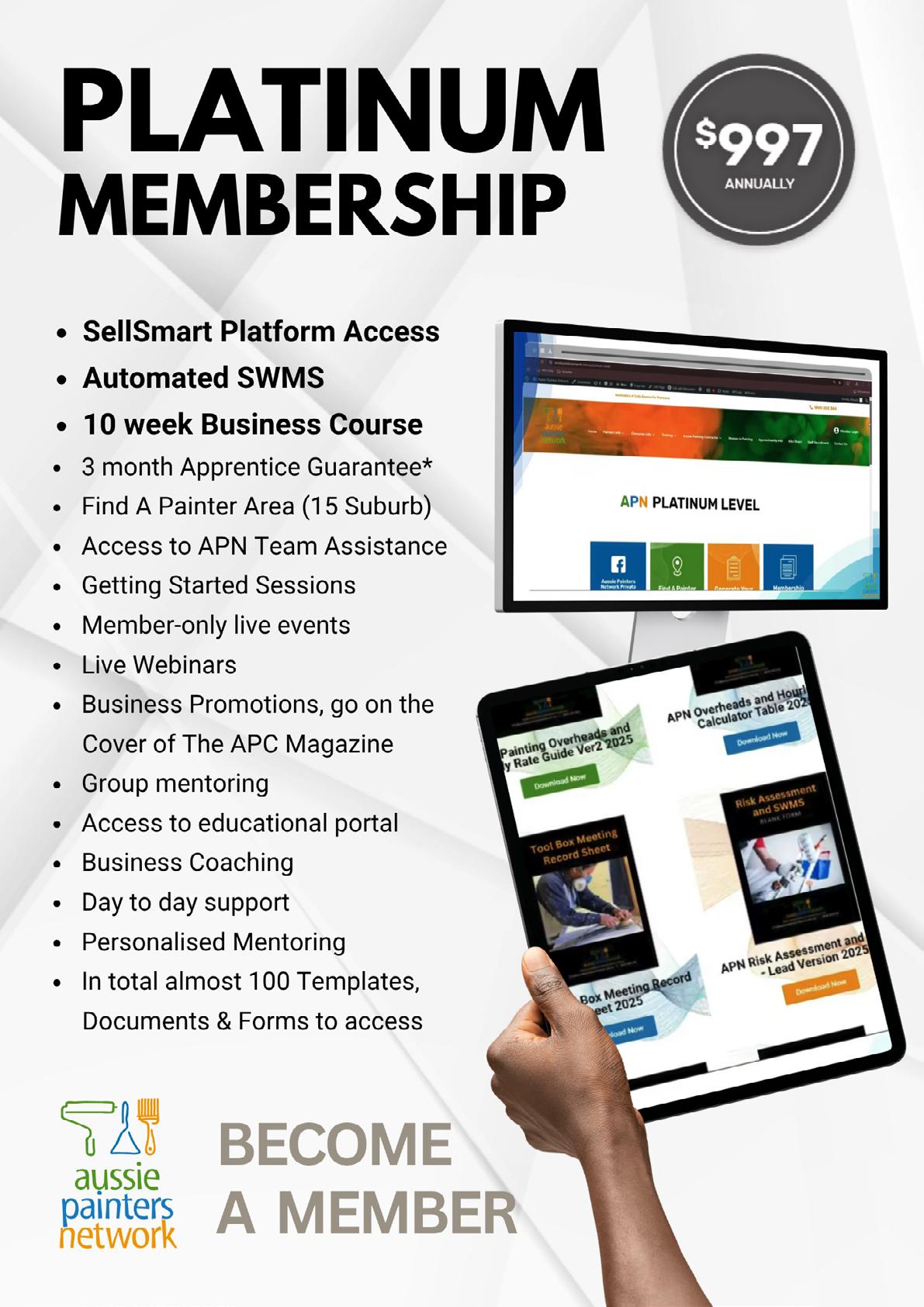

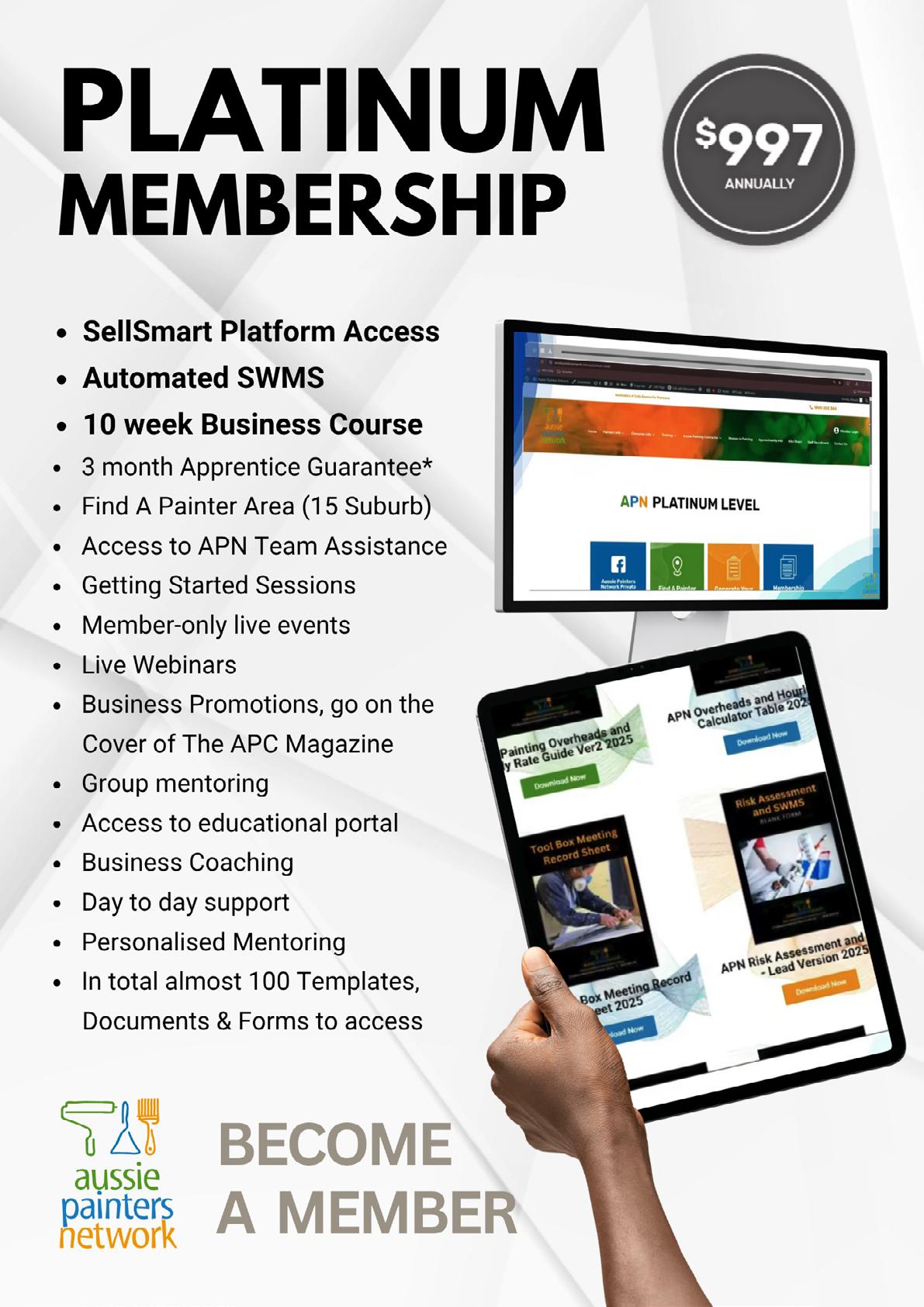

Personalised SWMS for Platinum

Members Beta version available for Gold

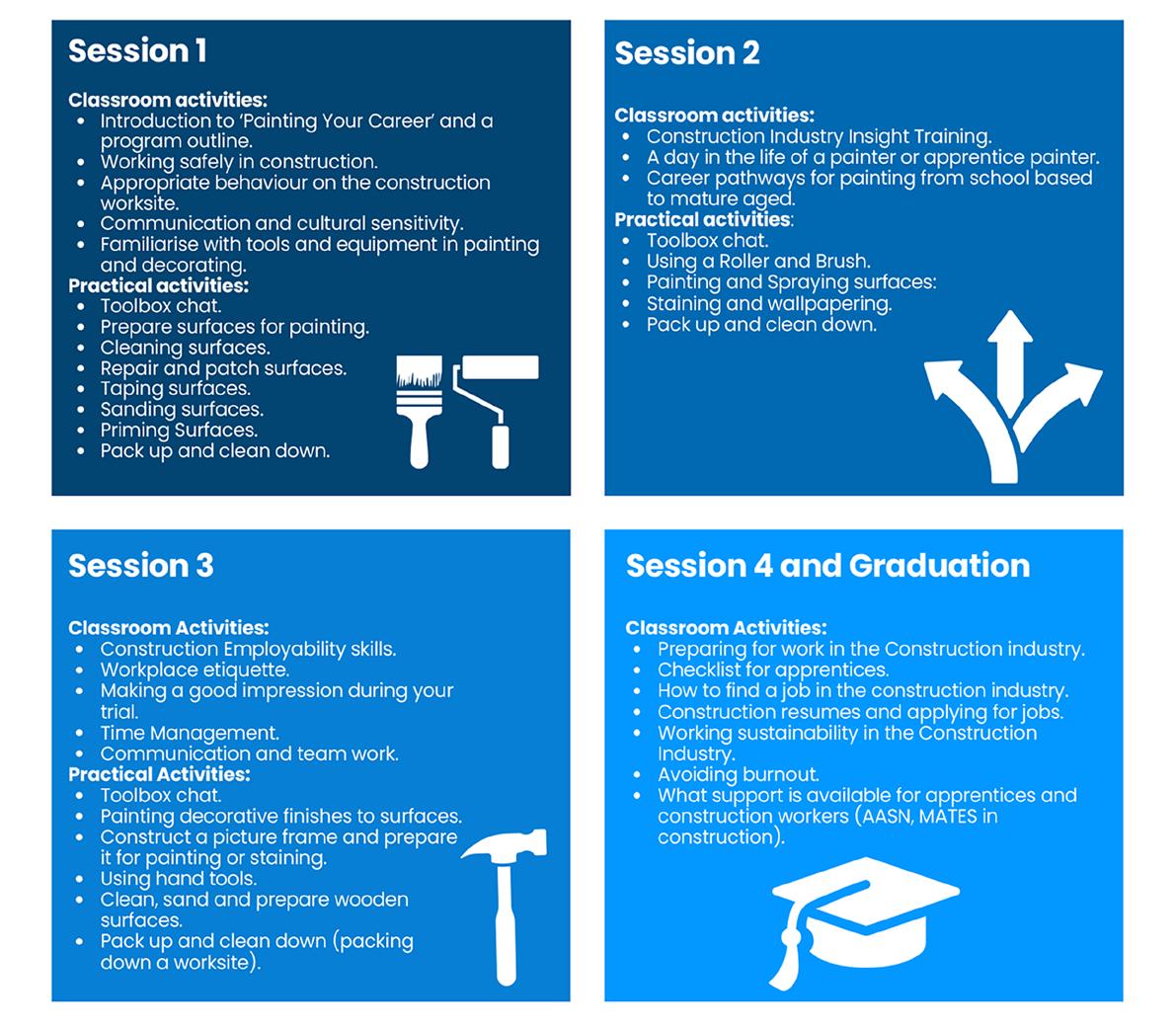

Painting Your Career— proudly made possible by the Queensland State Government’s School to Work Transitions Program— continues to deliver outstanding results across Southeast Queensland, creating real opportunities for young people to explore the painting and decorating trade as a viable, rewarding career.

To date, 13 schools have taken part in the program, with students gaining hands-on experience, industry insight, and meaningful mentorship in a safe, supportive environment. We’ve welcomed flexi schools YMCA & The BUSY Schools, independent First Nations schools and local state high schools with a keen vocational interest. The engagement and outcomes have been nothing short of remarkable: in several groups more than half or all are now actively pursuing further training or trade-based career pathways.

At the heart of this success is trainer Matt Christopher, whose passion, energy, and connection with the students has made all the difference. School staff regularly report that previously disengaged students have shone through the program and now show an enthusiasm for their future pathway that they lacked before.

"Matt has been instrumental in making each and every student’s experience not only enjoyable, but truly inspiring," said Caroline Miall, Program Coordinator. "Many of these young people had never considered painting as a career until they had the chance to learn from someone who genuinely cares and brings the trade to life with every session."

Matt’s ability to engage, educate, and entertain has created a ripple effect—students who previously struggled with direction are now stepping up with confidence, equipped with real skills and a newfound sense of purpose.

As the program continues to work with applicants as they progress through high school or leave full time schooling. We’re currently seeking apprenticeship opportunities for over nearly 20 enthusiastic and jobready students across Southeast Queensland. These young people are ready to take the next step, and we’re calling on painting businesses to open the door to the future of our industry.

“Painting Your Career is about more than paint,” said Nigel Gorman, Founder of Aussie Painters Network. “It’s about possibility, and every student who picks up a brush has the potential to become a leader in our trade and earn a good living. We need more employers willing to guide them on that journey in the interest of investing in great future professionals.”

If you're an employer looking to support the next generation—or even just curious about how you can get involved—now is the time. We would love to hear from any employers in the region interested in offering work experiences, leading to school based and full time apprenticeships.

Connect with us at www.paintingapprenticeships.com.au or contact Aussie Painters Network on 1800 355 344.

Together, we’re creating pathways, inspiring futures, and building a stronger painting and decorating industry.

Painting Your Career, School to Work Transitions Program is powered by the Queensland Government’s Good people. Good jobs: Queensland Workforce Strategy 2022–2032.

Caroline Miall Founder, Women In Painting caroline@aussiepaintersnetwork.com.au

Businesses want to grow and help a larger audience, but too many make mistakes that crip-ple their growth.

Even worse, they keep repeating them! Don't do the same; avoid the blun-ders.

Businesses hire more staff as they grow. But if they expand too quickly, they will feel pres-sure to fill positions on their team, even if the job candidates have a few personality flaws. While some people change, others don't, and a few toxic personalities will poison your com-pany culture.

This is why controlling growth is so important. Though it is hard to predict, you can create a game plan when you exceed your projections. Creating a team of healthy personalities is an-other priority. If you don't, toxic employees will look for coworkers with similar values. If they can't find them, they will try to hire them!

But what personalities should your company avoid? There are many, but micromanagers are one of the most common. Instead of letting their coworkers do their jobs, they bug them over minor details, sabotaging team goals. Managers do manipulate emotions as part of their job, but some abuse this power. They will try to ruin people with gossip, or tell bosses what they want to hear, even when they know it is terrible advice.

Instead, always look for team members that value their coworkers and employer, and have enough emotional maturity to find and fix their own weaknesses. They will become better team members over time, and will face problems even when it makes them feel uncomforta-ble.

Businesses always want to find new markets, and while they could woo customers in more places, creating new products is another way to reach a larger audience. Bringing a new product to market is an investment new businesses should consider, as long as they know the risks.

Instead of creating a new product from scratch, some businesses tweak their old ones. While this can work, change isn't always an improvement. Testing your product with con-sumers will help mitigate risk, but tastes shift quickly; fads don't stay popular forever.

Customers often develop an emotional connection to their preferred brands. Experimenting might feel like a betrayal of their trust, and it is almost impossible to win back a customer's loyalty. Growing businesses don't always have enough resources to create new products, and focusing on your successes might be your best strategy. You can even ask for customer feedback while you build capital.

Demand shifts randomly. People don't always know what they want, and why, and products soar and plummet in popularity for reasons no business can predict. Sadly, too many com-panies overestimate their brilliance, and pay for their arrogance when their predictions and investments fail.

Understanding your niche will help you create reliable strategies. Infrastructure helps; liqui-dating assets quickly is better than storing them indefinitely. The more time you spend learn-ing the intricacies of your niche, the more money you will save when a strategy fails.

Keep in mind, too, that predictions fail both ways. Some companies don't release products that would become hits, while others spend millions advertising obvious failures. Every mis-calculation is an opportunity; learn and take advantage! For example, use a failed product launch to discover more about your core audience.

If your business sells great products and services, it will grow if you get out of the way. Every business should ponder the blunders outlined in their article; their customers' happiness could depend on it.

Sandra Price

www.tradiebookkeepingsolutions.com.au

Paperwork can be one of the least enjoyable aspects of running a trades business.

But you know what’s worse than paperwork? It’s dealing with a dispute or a public liability insurance claim, and still having to do all the paperwork anyway!

Even if you’re in the vast majority of tradies and builders who do the right thing and produce quality work, it doesn’t always stop a client from trying to lodge a claim or make a complaint against you.

So aside from doing your own quality checking and ensuring that your work is of a high standard, how else can you protect yourself from disputes? Especially those which could end up as a public liability claim?

The answer is good record keeping. We’re not just talking about your standard contracts, but various forms of record keeping and evidence that will help to prove your side of the story.

Here are a few good ideas that we’ve seen over the years, that could potentially be implemented in any trades or building business.

We see plenty of builders and tradies taking photos of their finished work to share on social platforms such as Instagram.

As well as being great for marketing, photos can also be a great way of protecting yourself in the event of a dispute.

Whilst it may be a pain to take before, during and after photos of each job, it’s a very effective way of recording evidence and settling disputes.

There was a recent insurance claim where an electrician scratched a glass splashback in a kitchen whilst installing a new rangehood.

In this case the electrician knew he caused the damage and was happy to lodge a claim via his insurance broker. Whilst his insurance covered the cost of replacing the splashback, he still had to pay a $500 excess, which is still better than having to cover the full cost of course.

But what if the electrician didn’t believe he caused the damage? Without any evidence it would be his word against the homeowner’s.

His insurance would still cover him, but he’d be paying a $500 excess and potentially suffer an increased premium at his next renewal.

If he’d have taken before and after photos however, it would be clear whether the scratches were caused by him or not, and it may never make it to a claim as he could prove he wasn’t responsible for the damage.

If you wish to take it a step further, you could consider video recording your work.

This is probably a step too far for most tradies, but it would certainly give you near irrefutable evidence that you did or did not do a particular thing.

No one wants to stop halfway through their work and start writing down notes, but have you considered using your voice?

Virtually all modern smartphones will have a voice recorder app that is preinstalled and easy to use.

Whilst no one wants to record a running commentary of every job, if you see something that seems noteworthy, you could grab your phone and record a quick note.

Should a dispute or issue of some sort arise in the future, your voice note recorded on the spot could prove to be pivotal.

We recently had building and landscaping work done at our house, and the builder would walk around the site talking into his phone making notes about the work and his observations.

He might never need to refer to those notes, but if he did need to try and recall a small detail from weeks, months or even years ago, he could always refer back to those notes.

There are services available now that can transcribe your speech notes to text, which could make searching them at a later date much easier.

You might feel a little odd at first walking about talking into your phone, but those recordings or notes could be invaluable in the event of a dispute or claim.

For larger jobs it’s a given that a detailed scope of works will be in place. But what about those smaller maintenance jobs?

By having a written document in place that clearly outlines to both you and the client what is being done, you’ll can help to avoid potential issues down the track.

Maybe you’re a plumber going out to replace a leaking tap. A fully detailed scope of works would seem overkill, but a quick single-page document could prove invaluable if something was to go wrong.

If something does go wrong which results in a claim on your business insurance, the insurer will often ask for a scope of works as part of the claim anyway.

Whether it’s a printed and signed document or just an email trail between you and the client, any type of written evidence is going to be better than none.

Having a building contract in place is obviously required in many cases. We’re not experts in that department and won’t be going into it.

Suffice to say though, if you’re doing work that requires a contract, make sure you have a signed contract before undertaking any work.

If you do have a client who makes a complaint that could lead to a claim it’s always best to bring your insurance broker into the picture as soon as possible.

Even if you don’t believe it’s your fault or that you’ve done anything wrong, getting the insurance company involved earlier will typically lead to better outcomes.

Your insurance isn’t just there to protect you when you’re in the wrong. It’s also there to defend you when you’re accused of being on the wrong.

A public liability policy includes cover for defence costs, meaning that the insurer will pay for legal representation to defend you.

So don’t want until you’ve argued it out with your client or whoever is making the complaint against you. Get your insurance broker and insurance company involved, as we’re all on your side!

Whatever evidence you’ve collected along the way will be hugely beneficial as the claim progresses.

This article has been all about protecting your trade business in the event of public liability insurance claims.

Those are claims involving property damage or personal injury caused by you (or your business) and suffered by a third party.

But we should also touch on the importance of record keeping when it comes to another popular form of tradies insurance – tool insurance.

If you’re insuring your tools, it’s imperative that you keep a record of those tools so you’re prepared for a claim.

Typically you’ll need the following details regarding the tools:

• A list detailing each item

• The replacement value of each item

• Serial numbers where applicable

• Tax invoices or other evidence of ownership

It won’t be good enough to just tell your broker or insurance company that you had $5k worth of tools stolen and expect to be paid that amount. You need to provide evidence of ownership.

So if you want to make sure a tool insurance claim will run smoothly, good record keeping is going to help you here too.

Do you have any other ideas or methods for protecting yourself and your trades business from potential disputes and claims?

Of course having the right insurance backed by a great insurance broker is vital, but anything else you can do along the way can only help.

If you have any tips to share please get in touch.

Over the past week, as I write this, I got myself into a bit of a sleep deficit. Waking in the middle of the night and having trouble going back to sleep, there was about a week in a row when I had less than 6 hours of sleep. My brain wasn’t too happy.

The problem was a few things going on in my personal life that had my brain become super active. Everything is OK, and I’m OK, but my brain couldn’t seem to stop in the middle of the night.

So my days were a lot harder. Not only was I tired, but of course I had a really hard time concentrating. I took short naps in the afternoons, which helped, but I couldn’t get a lot of things done.

Work piled up, emails went unanswered, none of it felt very good. I noticed myself really wanting to get more done, but not having the energy or powers of focus that I needed.

So here’s what I did:

I gave myself a bit of compassion and grace — it’s hard operating on low sleep, and I was dealing with a lot. I didn’t need to be perfect, and could give myself a bit of a break.

I gave myself days where I didn’t do a lot. I got the minimum done, and let that be OK. That’s all my brain could handle.

I started to deal with the underlying fear. My brain was on hyperactive mode because my personal life situations were full of uncertainty, which brings up fear. The brain goes on hyper mode when it’s feeling insecure, uncertain, and afraid. So I just let myself soothe the underlying fear, to let my brain calm down a bit.

I prioritized rest. Going to sleep earlier than usual, doing what I can to clear my mind and make myself feel good before bed, destressing and showering and meditating.

Once rested, I attacked my pile of tasks and emails with gusto! Today I came back to work well rested, after a good 7 hours of high quality sleep. It felt so good to be rested! I gave myself most of today to tackle the tasks that had piled up, from writing tasks to financial and administrative tasks, to emails that I haven’t replied to, and more. I probably won’t get it all done today, but it sure feels good to start to clear things out.

I’m feeling good today, and I’m appreciating the value of sleep more than ever. I’m wishing you some high quality sleep and days of beautiful powers of concentration.

If you’d like support moving your life forward, please consider joining my Fearless Living Academy.

Leo Babauta ZEN HABITS

Soon, more than 15 million Australians should be lodging a tax return with the Australian Taxation Office in the hope of receiving at least a small refund.

About 60% of taxpayers use an accountant to prepare their tax return while the other 40% lodge their returns via their MyGov account. This links them to the tax office, Medicare and other government services.

The tax office receives about 1000 tip-offs a week from people who know or suspect evasion. Of these, the office deems about 90% warrant further investigation.

These days, the tax office prefills much of your income information. The ATO will let you know through your MyGov account when your income statements from your employer are “tax ready”.

But other income including bank interest, dividends and managed investment funds distributions may take longer to appear, so don’t rush to complete and lodge your tax return on July 1 if these aren’t there. When these items prefill, check them for accuracy and correct any errors.

The tax office does not know about all your income so remember to provide details of other sources including capital gains on investments and income from other jobs for which you have an Australian Business Number.

Some items, such as private health insurance information, are only partially pre-filled so be sure to check that all questions have been answered and all necessary information provided.

To claim a deduction you must have spent the money yourself and were not reimbursed from another source.

The expense must be directly related to earning your income from either employment or services provided, from investments such as shares or a rental property, or from a business you operate.

And you must have a record to prove your expense. This usually needs to be in the form of a receipt or a diary.

If you don’t know how to record your deductions, an easy option is to use the tax office myDeductions app. You can scan receipts and allocate them to the correct section of your return.

Each year the tax office targets particular areas. For 2025, these are:

Working from home expenses: you can choose between two methods: the fixed rate method or the actual cost method.

The fixed rate method allows you to claim 70 cents for each hour worked from home during the year. You do not need to keep receipts, but you must keep a record of the hours worked at home. The actual cost method allows you to claim the costs of working from home, but taxpayers must have a dedicated room set aside for the office and remove all private use.

You cannot claim personal items like interest on a home loan or rent expenses unless you are operating a business from home.

Personal items, such as coffee machines, are not claimable even if you use them while working from home. Mobile phone and internet costs are included in the 70 cents per hour fixed rate. The ATO will be looking for taxpayers who claim these twice – for example, on their return and from their employer.

The 70 cents per hour rate does not include depreciation of work-related technology and office furniture, cleaning of the home office and repairs to these items. So these amounts can be claimed separately.

Motor vehicle expenses: there are also two methods to work out this claim. The log book method requires you to have kept a record for 12 weeks. You then need to work out the percentage you used your car for work or business which is applied to your expenses.

The cents per kilometre method allows you to claim 88 cents for each kilometre up to 5,000 km of work or business travel. No receipts need to be kept for this method, but you must be able to justify the total kilometres that you have claimed.

If you use the cents per kilometre method, do not double dip by claiming additional motor vehicle expenses.

Rental properties: make sure the expenses you claim do not include your personal costs. For example, the interest expenses must only be for the rental property and not interest from your personal home.

Also, if you own 50% of the rental you can only claim 50% of the expenses, even if your taxable income is higher than the other owner. If you have a holiday home you can only claim expenses for when that home was rented out, not the whole year.

Cryptocurrency: many taxpayers are buying and selling cryptocurrency. These transactions need to be reported in your tax return when they are sold as a capital gain or capital loss.

Other forms of income: if you earn money through the sharing or gig economies, you must include all income from these activities in your return. If you sell goods online, the tax office may consider it to be a business, and it will expect the income to be declared.

you include in your return against data provided by other parties including share registries and your health insurer. It also gathers information from the internet.

If the data doesn’t match your return, or your claim is considered excessive, the ATO may contact you. You may be asked to explain why and, if your explanation is unsatisfactory, you might be audited.

Penalties of 25% to 75% of the tax owed may apply for falsely claiming deductions. The more dishonest the claim, the higher the penalty).

The link between what you claim and what you earn has to be real. So do not claim the cost of your Armani suit as a work uniform or your pet as a mascot for your business. Even the cost of a massage chair to relieve work stress cannot be claimed.

Dubious claims received by the tax office in recent years are many and varied. They have included Lego, school uniforms and sporting equipment purchased for kids, $9000 worth of wine bought by a wine expert while on a European holiday, for personal consumption, and a claim using receipts lodged by a doctor for an overseas conference he didn’t attend.

What if I make a mistake or the ATO finds an error? If you make a mistake in your tax return, you can always amend it via MyTax.

The tax office will not fine you unless you did not take reasonable care, but you will have to pay back the shortfall in tax.

The due date to lodge your own return is October 31. If you are having trouble meeting this date, contact the tax office and ask for an extension.

Disclaimer: this is general information only and not to be taken as financial or tax advice.

Robert B Whait Senior Lecturer in Taxation Law, University of

South Australia

The ATO already knows a lot about your tax situation, which makes it harder than ever to cheat.

The tax office uses data matching to check information

Connie Vitale

Senior lecturer tax and accounting,

Western Sydney University

Aussie Painters Network aussiepaintersnetwork.com.au

National Institute for Painting and Decorating painters.edu.au

Australian Tax Office ato.gov.au

Award Rates fairwork.gov.au

Australian Building & Construction Commission www.abcc.gov.au

Mates In Construction www.mates.org.au

Comcare

WorkSafe ACT

Workplace Health and Safety QLD

WorkSafe Victoria

SafeWork NSW

SafeWork SA

WorkSafe WA

NT WorkSafe

WorkSafe Tasmania

comcare.gov.au worksafe.act.gov.au worksafe.qld.gov.au www.worksafe.vic.gov.au www.safework.nsw.gov.au www.safework.sa.gov.au commerce.wa.gov.au/WorkSafe/ worksafe.nt.gov.au worksafe.tas.gov.au

actcancer.org cancercouncil.com.au cancercouncilnt.com.au cancerqld.org.au

cancersa.org.au cancervic.org.au

cancerwa.asn.au