Welcome to the 150th issue of the Aussie Painting Contractor Magazine.

This has been a massive year for me personally as well as APN as an organisation. From our humble beginnings almost 15 years ago when we were told we couldn’t do it. To now being recognised for all the work we have been doing.

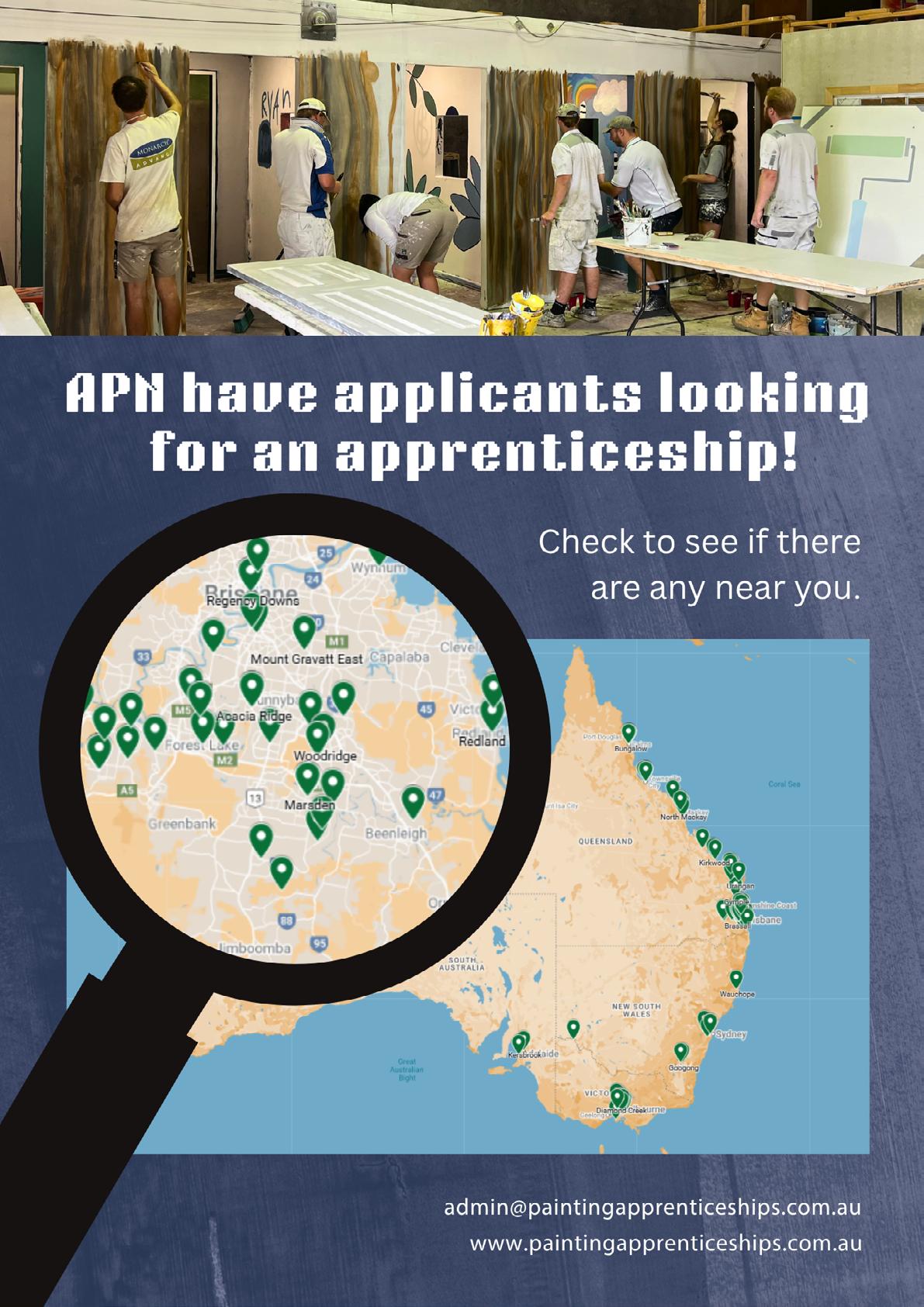

On a personal note, I am honoured to have been recognised as the Qld Metropolitan Trainer of the Year. Having now trained almost 1,000 painting apprentices, set up our own training facility in Brisbane as well as 10 years of having the Painting Training Wheels to look after the Regional Apprentices, this is just the beginning. Without the amazing team we have it would not have been possible.

Continuing on from what we have done, we are excited to launch BrushHand , it’s a Business Management and Quoting System. We have listened to 1,000’s of painting business owners and have developed BrushHand to make it a simple but very effective tool for any painting business. We have just released Version 1 with more updates currently in testing and getting launched in the near future. Check out the information in this edition.

'Til next month, Happy Painting!!

Nigel Gorman nigel@aussiepaintersnetwork.com.au

CONTRIBUTORS

• Anthony Igra

• Ashish Nanda

• Jim Baker

• Jongkil Jay Jeong

• Jon Whittle

• Leo Babauta

• Nigel Gorman

• Oliver Kay

• Peter Thomas

• Robert Bauman

• Sandra Price

EDITOR

Nigel Gorman

GRAPHIC DESIGNER

J. Anne Delgado

Opinions and viewpoints expressed in the Aussie Painting Contractor Magazine do not necessarily represent those of the editor, staff or publisher or any Aussie Painters Network’s staff or related parties. The publisher, Aussie Painters Network and Aussie Painting Contractor Magazine personnel are not liable for any mistake, misprint or omission. Information contained in the Aussie Painting Contractor Magazine is intended to inform and illustrate and should not be taken as financial, legal or accounting advice. You should seek professional advice before making business related decisions. We are not liable for any losses you August incur directly or indirectly as a result of

of the

There’s an age-old dilemma when it comes to trying to improve your life: how do you focus on the longterm goal while also enjoying life right now?

It can often feel like a trade-off — I should go to the gym (or study, write, work on that hard project, etc.) … but I also want to relax, veg out while watching TV, eat donuts, play video games, etc.

Should I enjoy myself now, or do what’s good for my future? Should I work hard and then get the reward, or forget about the hard stuff and just enjoy this moment?

For me, there is no right answer … but I learned a “trick” that helps me combine the two approaches into one.

Here’s how it works:

I figure out what will make me happiest in the longrun — what is the life that I really want?

Then I figure out what I can do today to make that happen. What steps can I do repeatedly to build the life I want?

Then I find a way to love the hell out of that activity.

Let’s dive into these things to really put them into action in our lives.

Take the Long-View

People often make the mistake of mostly taking a view that’s too short-sighted — spend all my money now on shopping online, instead of save and invest. Eat all the sweet things, instead of going for the run.

Now, to be clear, I don’t think there’s anything wrong with enjoying yourself! Savor the sweets, treat yourself! The problem is when the short-term becomes your main view. It becomes more a matter of impulse than doing what will benefit your life.

So I like to take the long view more often than not. What do I want to build for myself over time? For me, that might be things like: a meaningful impact at work, health and longevity, learning and growing, and loving relationships.

What would it be for you?

Once I have some clarity on what matters most over the long term, I ask myself: what steps can I do on a regular basis that will lead to that long-term vision?

Things like daily exercise, eating whole foods, daily writing sessions, spending meaningful time with loved ones.

These things might come into conflict with shortterm impulses (distractions, junk food, laying on the couch) … and so I try to prioritize the long-term over the short-term … most of the time. Not always, but if I’m doing those repeatable steps on a regular basis, then I’m golden.

Here’s the trick: learn to absolutely love the repeatable steps that lead to long-term success. You don’t have to sacrifice your happiness when you do those steps.

For example, if you love eating junk food … but eating mostly whole foods is what will lead to your long-term health … then could you love the whole food diet? For me, the answer is absolutely yes! I eat delicious bowls of beans and veggies, topped with avocado and hot sauce. For me, that’s eye-rollingly good!

For exercise, I’ve been playing basketball lately and going on walks. I adore these kinds of activities!

You can bring play and curiosity and a sense of wonder into anything. Including those things that are good for you over the long term. It just takes a willingness to find the delight in those beautiful actions.

Leo Babauta ZEN HABITS

Depending on the current state of your finances, financial freedom might seem a long way away. For many people, financial freedom—when you don't have to worry about how to pay the bills and your money is invested and making money for you—is a far off dream. What they don't understand is how close financial planning can get them to that dream. Financial planning isn't all staring at ledgers and creating spreadsheets, although if you like that sort of thing you're welcome to do it. It's about creating a list of your financial goals and figuring out how to get yourself there.

Here are some steps to take to get started on your financial plan.

1. Decide your goals

Figure out what your financial goals are in a year, five years, 10 years, and 20 years. Do you want to buy a house? Retire? Buy a car? Make sure you know what you want as that will guide your financial planning.

2. Determine where your money goes

You need to understand your cash flow so you can figure out where your money has to go, where you like spending it—but can cut back if necessary— and how much you're spending and saving. Create a list of income and expenses and track both for a few months. Put expenses into lists based on how necessary they are so you can see where you can save a little extra money.

3. Commit to saving

You don't need to cut out all your expenses - you have to have some fun in life—but figure out a way to at least get a couple of months' basic living expenses into a savings account. See if you can cut

back on meals out or change some of your utility plans to less expensive packages. Don't get into a situation where you need money for an emergency only to find out you don't have any.

4. Commit to paying off debt

Yes, you can save and pay off debt at the same time. You might have to cut back on your entertainment expenses or clothing budget for a while, but getting yourself out of high-interest debt will help your finances greatly in the long run, not to mention your credit score. Over the course of years you could pay more than double what you initially owed on some credit cards and loans if you don't pay them off.

5. Be aware of your credit score

Your credit score impacts your finances greatly, including affecting your interest rate and your ability to be approved for loans. Check on your score at least once a year and, if there is an issue with your score, reach out to the credit agency to dispute it.

6. Talk to a financial planner

A financial planner can help you set your goals, figure out how much you can- or should- save, and the pros and cons to paying down debt versus saving or investing. Furthermore, a financial planner can determine if your goals are realistic and achievable or if they should be revised somewhat and can ask questions to help you clarify your goals and your plan.

You can go through life without a financial plan, but chances are you won't be as financially healthy as you would if you had a systematic way of creating goals, achieving those goals and then reviewing to see how successful you've been.

Having a financial plan is certainly a better strategy than just crossing your fingers that one day you'll feel financially secure.

Please get in touch with us if you have any questions.

Sandra Price www.tradiebookkeepingsolutions.com.au

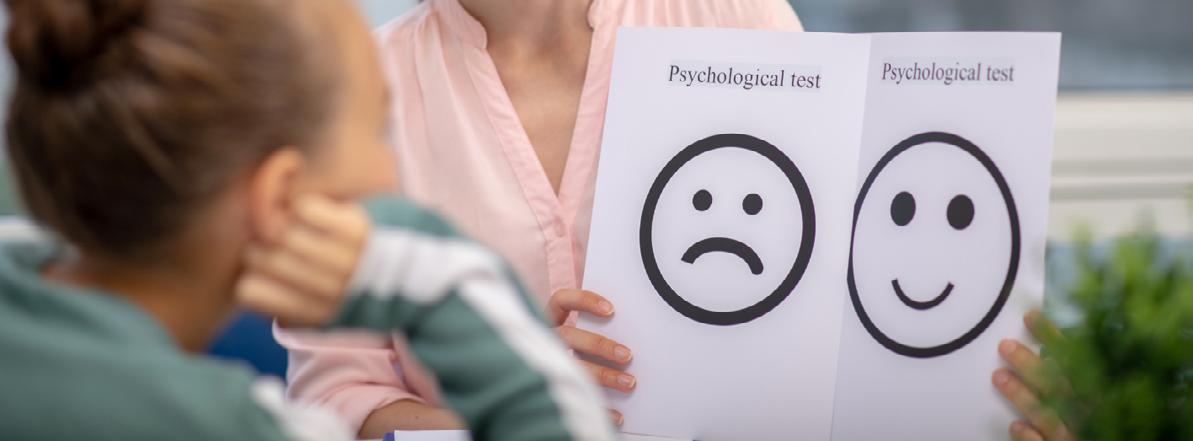

If you’re a registered psychologist or run a psychology practice, you need to be aware of the upcoming regulatory shift. From 1 December 2025, the Psychology Board of Australia will implement a new Code of Conduct for psychologists, replacing the current reliance on the APS Code of Ethics.

This is the first time the Board has published its own code, aligning psychology with other regulated health professions. The new code sets out the professional and ethical standards expected of all psychologists in Australia and will form the basis for both compliance assessments and regulatory action.

For practice owners, this means it’s time to review how your business operates – not just clinically, but also legally and operationally.

Until now, psychologists were required to comply with the APS Code of Ethics as part of their registration. From 1 December 2025, that responsibility shifts to the new Board-authored Code of Conduct, which will be enforceable and admissible in legal proceedings.

This new code is designed to reflect community expectations and support safe, ethical, and culturally respectful psychological services across all practice settings.

Key Changes in the Code You Need to Understand

Cultural Safety

The Code places a strong focus on culturally safe care, especially for Aboriginal and Torres Strait Islander clients. Psychologists must:

• Respect cultural identity

• Communicate in culturally appropriate ways

• Enable involvement of cultural support persons when needed

Tip: Your consent forms and policies should explicitly reflect cultural safety and inclusive practice.

Professional Boundaries and Conduct

Expectations around dual relationships, conflicts of interest, and maintaining appropriate therapeutic boundaries have been strengthened.

Tip: Review how your consent documents, service agreements, and practice policies communicate these limits clearly.

Informed consent must now go beyond a signature. Psychologists must ensure that clients:

• Understand the nature and scope of the service

• Know what to expect from the process

• Are informed about confidentiality, data use, risks, and fees

Tip: Consent forms should be written in plain English and clearly outline all relevant information in line with the new standards.

To prepare your practice for compliance, here are five practical steps to take now:

1. Download and review the advance copy of the Code of Conduct from the Psychology Board of Australia’s website.

2. Update all key documents, including consent forms, privacy policies, intake forms, and any professional services or contractor agreements, to ensure they reflect the new code.

3. Educate your team, including both employees and contractors, about their responsibilities under the new code to maintain consistent standards across your practice.

4. Review your approach to cultural safety – assess whether your processes, language, and documents reflect a commitment to culturally safe, respectful service delivery.

5. Seek legal advice if you’re unsure whether your contractor arrangements or consent documentation meet the new standards. This is particularly important if you use percentage-based split models or independent contractors, as misclassification or vague terms can expose your business to risk.

At Rise Legal, we specialise in supporting psychology practices and allied health businesses across Australia with fixed-fee legal advice, practical solutions, and compliance support.

Our Legal Audit is a deep dive into your practice, designed to uncover the top five legal risks and provide clear, actionable steps to protect your

business. It’s not a generic checklist – it’s a tailored, one-on-one review with a commercial lawyer who understands your industry.

We’ll review:

• Your business structure

• Consent forms and client documentation

• Contractor arrangements and fee splits

• Superannuation obligations

• Cultural safety, privacy, and Code compliance

Learn more or book your Legal Audit here

Need Help Just With Consent Forms?

If you don’t need a full audit, we also offer free discovery calls to help you work through specific updates – such as rewriting your consent forms or clarifying how the new Code applies to your team.

Book your free discovery call here

This new Code of Conduct isn’t just another regulatory update – it’s a significant shift in how psychologists are expected to practice. The good news is that there’s time to prepare, and the team at Rise Legal is here to make the process simple and practical.

If you want peace of mind that your practice is compliant, legally sound, and ready for the changes ahead, get in touch with us today.

Remember, while this information provides a general overview, legal advice tailored to your specific circumstances is invaluable. Don’t hesitate to contact Rise Legal for personalised guidance or book in a free Discovery Call.

Disclaimer: This blog post is intended for informational purposes only and should not be considered legal advice. Consult with a qualified commercial lawyer for personalised advice related to your specific circumstances.

Success in business is not solely measured by profits, staff size, or the value of contracts. More important factors include enjoying life with minimal stress, spending quality time with family and loved ones, having the freedom to take holidays at will, and cultivating a reliable team who can work independently. These elements should be prioritized above all else; financial and operational achievements are secondary and can follow in due course.

Attempting to do everything alone, as if emulating France’s emperor, Napoléon Bonaparte born in 1769, is neither realistic nor sustainable. Real success comes from learning how to delegate responsibilities. Entrusting tasks to employees and expecting them to deliver quality results is essential. Although this may be challenging for some employers, mastering the art of delegation brings immeasurable benefits.

To transform your business, it is crucial to shift from being a dictator to becoming a leader. Empowering employees to take on responsibilities and alleviate pressure from management begins with involving them in decision-making processes. Instead of dictating how something should be done, seek your staff’s input before finalizing decisions. If employees feel that an idea originated with them, they are more likely

to embrace it. There may also be instances where employees identify problems or suggest improvements that management may have overlooked. Engaging staff in open discussions not only brings solutions but also demonstrates respect for their perspectives.

It is important to recognize that a business’s success depends on the people who contribute to its income. Making employees feel valued and involved in company decisions enhances motivation and morale. Small gestures that include them in the process foster a sense of belonging and purpose.

Trust and patience are key when delegating tasks. Do not expect perfection on the first or second attempt. If staff reach out with minor questions while you are away from the worksite, resist the urge to answer every call—encourage them to develop their own problem-solving skills. Giving employees the opportunity to find solutions builds their confidence.

If something is not done as you would have preferred, avoid expressing disappointment. Doing so can undermine an employee’s confidence and willingness to tackle future challenges. Instead, acknowledge their effort and, in a calm manner, suggest ways the task might be approached differently next time.

To conclude, consider this revised version of Napoléon’s enduring advice: “If you want a thing done well: Train your staff well.”

Jim Baker www.mytools4business.com

It starts with a call from someone claiming to be your bank. They know your name. They know your bank. They even know your credit card number. There’s been “unusual activity” on your account, they say – and they just sent you a one-time passcode to verify your identity so they can assist.

You read out the code and feel reassured. Moments later, your funds are gone and the bank refuses reimbursement, citing a breach of terms because you voluntarily shared your passcode.

This is not a niche or isolated scam. It’s part of a growing pattern we’re seeing across Australia and beyond: cyber criminals are merging digital and real-world tactics in ways that make these frauds more convincing, harder to stop, and far more damaging.

It

These scams don’t begin with a phishing email or fake app. They begin with data – your data – stolen in one of countless breaches, such as the latest Qantas incident that exposed the details of up to 5.7 million customers.

Sometimes the personal data has been sold through third-party data brokers. Names, phone numbers, emails, even card details are routinely leaked and traded online.

Once they have this information, scammers get to work. The phone call mimics a real interaction with a bank, perhaps with a spoofed caller ID. Victims are pressured in urgent language to “verify” their identity, often by reading out a one-time passcode that, unbeknownst to them, is authorising a transaction using their own card details.

We refer to this as a “convergence scam” – where online data leaks, psychological manipulation and weak enforcement come together. It’s a sophisticated hybrid of digital theft and physical-world exploitation, and it’s on the rise.

These scams are deeply personal and can be financially devastating. But what makes them even more alarming is the system-wide failure surrounding them.

For starters, many credit card fraud insurance policies contain clauses that exclude coverage when the customer “voluntarily” provides account credentials – including one-time passcodes – even if they did so under duress or deception. One victim we spoke to lost nearly A$6,000 after a scammer posing as their bank prompted them to read out a passcode over the phone. The transaction was verified using that code, and the bank later refused to reimburse the loss.

In a formal response, the bank stated that by voluntarily sharing the one-time passcode, the customer had breached the epayments code, even though they were manipulated into doing so. As a result, the customer was held liable and ineligible for a chargeback.

Law enforcement may not help

Even when the criminals leave a physical trail, followup is rare. Law enforcement rarely investigates. In the cases we’ve seen, reports are acknowledged but not pursued. Officers don’t explicitly say the case is too small or not worth the effort, but their inaction suggests it, especially given how resource-intensive most cyber-crime investigations tend to be.

In many instances, particularly when the total loss isn’t deemed significant, victims are simply told to follow up with their bank, based on the assumption they’ll be reimbursed.

In one case we reviewed, stolen card details were used in-store at major Australian retailers such as Woolworths and Coles – indicating that a cloned card had been physically used. These purchases could, in theory, be tracked back to in-store CCTV footage. But no investigation was launched.

This reluctance to act, even when the evidence is tangible, sends a dangerous message: that scammers can operate with near-impunity.

Meanwhile, banks and regulators are slow to update verification systems. One-time passcodes are still widely used, even though scammers now exploit them routinely. There’s little recourse for victims, and minimal accountability for data brokers whose records fuel these scams.

For individuals, the first line of defence is simple but vital:

• never share a one-time passcode or security code over the phone, even if the caller seems legitimate

• if in doubt, hang up and call the bank directly using the number on your card

• be cautious about where and how you share your personal information, especially online

through websites or social media. Only disclose what personally identifiable information you have to.

The true answer is systemic change

Banks and other institutions need to put into place stronger identity verification systems that don’t rely solely on SMS codes. We need greater transparency and regulation of data brokers.

Read more: 70% of Australians don’t feel in control of their data as companies hide behind meaningless privacy terms

Crucially, we also need active enforcement of cyberenabled fraud, especially when there’s physical evidence, such as in-store purchases and CCTV footage.

Banks should also reassess their policies and procedures on how they communicate with customers. If scam calls closely mimic real ones, it’s time to change the script. More proactive education, clearer warnings, and redesigned verification processes can all help prevent harm.

The real danger of these convergence scams isn’t just financial loss. It’s the erosion of trust: in our banks, in our security systems, and in the institutions meant to protect us.

Once that trust is gone, it’s not easily recovered.

Jongkil Jay Jeong

Senior Fellow, School of Computing and Information System, The University of Melbourne

Ashish Nanda

Research Fellow, Deakin Cyber Research and Innovation Centre, Deakin University

Peter Thomas

Director, Centre for Future Skills and Workforce Transformation, RMIT University

Building relationships with people that will last, create win-win connections and who will become your ‘raving fans’ are all based on a few simples rules.

Firstly, you need to establish trust. I ask you, do you trust yourself and your ability to make good judgments? Trust is all about knowing yourself and how authentic you come across to people meeting you for the first time. Do you give the feeling to others that you are someone who can be relied upon and can keep their word? Do you have faith and belief in others? Can you be relied upon to do the right thing?

These are all questions one needs to ask oneself when looking at the basics in relationship building.

By trusting someone it does not necessarily mean that, that person is trustworthy. Being too trusting without thinking about it carefully can be dangerous. There are people who gain trust and then break it, so you need to use discretion on where you give your trust.

I believe that building your credibility is the next thing to look at when creating solid relationships. Credibility is how your words and deeds are seen by others. Are you trustworthy and do you have the expertise on the subject you are talking about? To gain credibility in the business world you need to prove it firstly by the way you act as well as knowing that the information you pass on is correct and reliable. People will view you by the company you keep and what is perceived as your established reliability.

Personalised SWMS for Platinum

Members Beta version available for Gold

How you treat others is a reflection on you as a person. It has been said that ‘one should treat others as they would like to be treated’. I personally disagree with this statement. I believe that we ‘should treat others as they would like to be treated’. This is far better from my perspective, as the first way is assuming that the person has the same values as you yourself.

The way I would like to be treated would be very different from many other people. Take for example, the giving of a gift. How many times have you been given a gift by someone who gives what they like and is their taste, but quite contrary to your own? It is very easy to assume what others like. The only way to truly know what someone likes is to listen to what they say, watch how they live and observe how they do things.

I believe that making a habit of acknowledging people is a wonderful attribute to have. Making others feel good and worthwhile helps create a relationship. We are not aware, I believe, on what is going on in others lives and praise or kindness can change a person’s life dramatically if they are someone who does not get enough of this in their life. It must be sincere though and come ‘from the heart’. Observing people and acknowledging what they are doing or have created

can be very powerful. It is important that we create win-win situations in all our relationships.

To remember important dates and significant events in another’s life can show your awareness of them. Isn’t it nice to be remembered on your birthday or anniversary or if your work mates and friends acknowledge something you have done well? We are sometimes very aware of what is not necessary to remember, and all too often forget the significant times in people’s lives. Bringing joy and happiness to others life can be very easy and simple. Like a smile, it is free!

If you want to create a lasting relationships, be prepared to invest time and energy into that relationship.

Take the first step … don’t wait for the other to take that first action. Relationships that last and are productive for both sides are worth the time and energy that one needs to put into them.

So remember these attributes: trust, credibility, the way you treat and acknowledge others, by remembering important dates and events as well as investing time and energy, are all the basic ingredients to building relationships that last forever.

If you’re like most tradies, you work hard for your money—but that doesn’t mean you should be handing more of it over to the ATO than you need to.

We get it—tax isn’t exciting, and it’s easy to just let your accountant handle it each year without digging too deep. But here’s the thing: there are some simple (and legal) ways to reduce your tax bill—if you know where to look.

Here are five common mistakes we see tradies make that end up costing them thousands more in tax than necessary.

Waiting until after the financial year ends to “see how you went” is one of the biggest missed opportunities tradies make when it comes to tax.

A good tax strategy needs to happen before 30 June—not after. That way, you can still take advantage of deductions, adjust how income is received, top up your super, or make a smart equipment purchase to reduce this year’s tax bill.

Tip: Book in a tax planning session around April–May each year.

Many tradies start out as sole traders—and that’s fine at the beginning. But if you’ve grown, brought on staff, or started making decent profits, staying in the wrong structure could be costing you more in tax than necessary.

Companies, trusts, and other structures might offer better tax flexibility and asset protection depending on your situation.

Tip: Have your structure reviewed every few years, especially as your income or setup changes.

3. Paying Yourself Inefficiently

Do you know the most tax-effective way to get money out of your business?

We often see tradies who take drawings randomly, or pay themselves in a way that leads to higher tax (either personally or in the business). There are smarter ways to structure how you pay yourself, your partner, or family if they’re legitimately involved in the business.

Tip: Work with your accountant to set up a tax-efficient profit distribution plan.

4. Not Maximising Deductions or Missing What You Can Claim

You’d be surprised how many deductions tradies miss—tools, safety gear, training, vehicles, phones, even home office use. At the same time, some claim things incorrectly and end up on the ATO’s radar.

A proper review of your expenses can help you identify what’s legit to claim and ensure you don’t leave anything on the table.

Tip: Keep good records and speak with an accountant who understands your trade.

5. Doing It All Yourself or Only Talking to Your Accountant at Tax Time

If the only time you speak to your accountant is when your tax return is due, you’re probably missing out.

Tax planning is an ongoing process—not a once-ayear event. And if you’re trying to manage it all on your own, it’s easy to overlook things that could save you serious money.

Tip: Find an accountant who works with tradies, stays in touch regularly, and actually helps you plan—not just file.

So, Are You Paying Too Much Tax?

If any of these sound familiar, chances are you’re giving more to the tax office than you need to. But it’s fixable—with the right advice and a proper plan in place.

Want to know where you could be saving tax in your business? Book a free discovery call

Copyright © 2025 Robert Bauman.

Perhaps you have noticed that it is not always the smartest or most capable person that gets a promotion or has management roles seemingly thrust at them. Studies have shown that a person with better communication skills can typically achieve a higher level of success than someone who simply has the highest qualifications on paper. This is good news for anyone looking to develop the skills it takes to stand out as an excellent leader and communicator. Here are just a few ways you can improve your communication skills.

1. Always maintain control of your emotions in stressful situations

Leaders are often called upon to make difficult decisions under circumstances that are not ideal. If you can keep a cool head and calmly make decisions in a

crisis, the people around you will begin to recognize you as the go-to leader when new or challenging situations arise.

2. Remain focused on the conversation at hand

When you are in the middle of working on a project it is easy to get tunnel vision that prevents you from focusing on what is happening around you. When someone engages you in conversation always make an effort to stay focused on what they are saying. One way to make sure you are truly focused on the conversation is to occasionally repeat back your understanding of what the other person just told you, not only will this behavior make them feel you value their input enough to listen, it will also increase the level of respect they have for you as a leader.

3. Pay attention to your body language

As a leader, it is important to remember that your body language can be just as important as what you say. If you are in the middle of a conversation with someone and they see you furrowing your brows or not making eye contact, they could walk away with the impression that you are disinterested or angry with them. Try to maintain a neutral expression when conversing with your staff or coworkers.

4. Do not interrupt

When you are a leader, people will often approach you because you have the answers, however, it can be easy to speak without a full understanding of what is being asked and provide someone with incorrect information. Always allow the other person to finish their thought and ask their question in its entirety so you can provide a thoughtful, helpful answer.

5. Do not make snap judgments when speaking to someone

Occasionally, leaders are sought out when someone has made a mistake or poor business decision. If someone you are leading comes to you and admits something they have done something wrong, try your best to withhold judgment. Sometimes this will

require you to simply listen to their side of the story and reschedule a meeting later in the day or week to discuss a more productive course of action. Other times, it may be as simple as asking them what their solution to the issue would be and addressing it from that angle.

6. Be consistent with your feedback

When you are leading people, ensure that you look for opportunities to consistently offer positive and negative feedback. Many issues in corporations can be prevented by simply mentioning positive behavior when you see it and constructively pointing out negative behaviors as they occur in hopes of it ending there.

If you are looking for ways to lead more effectively, communicating better is one of the easiest and most valuable skills you can learn. Effective communication will help you to gain the trust and respect of individuals around you, which is one of the most valuable assets you can acquire as a leader.

Sometimes, your life just feels like a mess. What you really want is to do a full reset — start with a blank slate, wipe away all of the mess, and start to build a life you’re proud of.

What I recommend is to focus on the power of small actions.

It sounds so simple that it can’t be that important — but it’s perhaps the most important thing you can do. It changed my entire life. And I’ve seen it change the lives of thousands of people in my Fearless Living Academy and my 1-on-1 coaching clients.

Let’s take a look at how it works.

Before we get to the small action, I’d like to advocate for something important: create a very simple vision of what you’d like your life to be like.

This might seem daunting, but I just mean: if you could start with a blank slate, what would you want?

For example, maybe you’d like to be eating better and exercising regularly. Maybe you want to get off your phone and get outside more. Maybe you want to socialize a bit, and read more. Maybe you want to do something you’re passionate about. And declutter your home.

It can be that simple: think about the life you’d like.

Go for a walk, and sit out in nature, and let yourself dream. What would feel really good to you?

You don’t have to have a detailed vision, nor does it need to be complete. Just something to start with.

As you think about this vision, imagine that it can really happen (set aside the doubts for now). How does it make you feel? Let yourself be inspired.

Most people will stop here, because they feel intimidated, overwhelmed, or resigned to the idea that it’s not possible. Don’t stop here!

What I encourage you to do is start to practice really small actions. Every day.

Just pick something small and do your best to take that action. Do it several times a day — up to 10 times a day if you feel motivated. If you’re not motivated, take just 1–3 small actions that day. But try to take at least a small step or two just about every day (and forgive yourself if you miss a day).

What are small actions? Here are some that relate to the example vision I shared above:

• Go out for a 5-minute walk

• Eat one fruit

• Declutter just 1–2 items (put them in a box for donation)

• Listen to a podcast about something you might get passionate about

• Reach out to a friend and say hello

• Find a book to read, and just read the first paragraph

As you can see, most of these (if not all of them) are super easy. Sometimes they might feel too easy. That’s perfect! Do a bunch of actions that feel way too easy.

If an action feels too hard, then do a smaller, easier version of it. For example, if you want to meditate for 10 minutes, but can’t bring yourself to do it — can you meditate for just 1 minute instead? It should feel easier than you can handle.

In the end, these small actions create a “life reset” — you are creating a new life, one tiny action at a time. Instead of doing your default, you’re trying something different. Give this life reset some time — a few weeks, a couple months — and you’ll see a ton of change.

Leo Babauta ZEN HABITS

There are plenty of tradie memes about clients who choose the lowest quote. Typically it involves a picture of terrible building work!

But the fact is that most people are looking for a cheap quote, and that includes tradies looking for business insurance.

What’s important of course is to find the most competitive quote for quality insurance cover that suits your business.

Whether you have Trade Risk do this for you, or you choose to go DIY and shop around yourself, these ten tips should help you to save money on your trade insurance.

The first five tips relate to starting a new policy, and the next five relate to existing policies and renewals.

If you’re starting a new business insurance policy, chances are you’re starting a new trades business.

Cashflow is so important at this point, so saving money on your insurance is vital. These five tips should help get you started.

5. Don’t assume direct is cheaper

This is probably the biggest mistake that tradies make when trying to save money on insurance.

They assume that going direct to a big brand insurance company, like NRMA or AAMI for example, will get them the cheapest quote.

We’re so used to doing this with our home and car insurance, that it just seems to make sense. You get a few quotes from the big guys, choose the cheapest and you’re good to go.

Business insurance can be more complex in terms of pricing, and the big guys with their online quotes and call centres aren’t necessarily the cheapest.

Extend your search to some of the smaller players, and especially the trade specialist providers.

We can provide instant online quotes for standard trade businesses with up to five staff, and you’ll find the rates are typically more competitive than the big name brands for similar (if not better) cover.

PS. We help plenty of trade businesses with more than five staff, it’s just that we provide tailored quotes for these clients rather than quoting them instantly online.

Whether you go direct to an insurance company or via an insurance broker, paying monthly will generally cost you more.

Sometimes it’s worth it, especially with cashflow being a constant challenge for many trade businesses, but keep in mind that the overall cost will be higher.

With the direct insurers, generally they just increase the overall premium. So if you multiply the monthly payment by twelve, the total would be higher than the annual premium.

If you use a broker, generally the premium will stay the same, but you’ll be charged interest via a structure known as premium funding, or premium financing.

In this case the funder (typically a third party) is essentially lending you the money to pay the premium, and you then pay them back over 10-12 months depending on the setup.

Either way, if you can pay the full premium for your trade insurance you’ll generally pay less.

3.

This one’s a little trickier to explain, but it’s so important to understand what you need and what you’re paying for.

A classic example is tradies, and especially handymen, undertaking work for real estate agencies and property managers.

The standard paperwork will state that you need a range of insurances including public liability and professional indemnity.

If you don’t know what you really need, you’ll just go off and buy both policies, but in reality, you most probably don’t need professional indemnity insurance.

As brokers we have to explain this to handymen on a weekly basis, and we’ve even written an article about it!

Knowing what you need, and what you’re paying for, can help you save money by not paying for insurance that isn’t even relevant for your business.

Tip: A good insurance broker will be able to tell you all of this!

2. Package your policies

If you have multiple policies you might be able to save money by combining them.

Most trade businesses, even if you’re just one person, will have a need for at least three policies. Your public liability, your tools and your vehicle.

You can probably include personal accident insurance too.

Combining them can mean one of two things. It could mean combining them into a single policy with the same insurer, or it could mean having multiple policies

with multiple insurers but managed via a single insurance broker.

Combining or packaging your policies is no guarantee of saving money. Sometimes spreading your policies across insurers can actually work in your favour, as a single insurance company isn’t necessarily going to be the cheapest across all of the covers you need.

For example Company 1 might be cheapest for public liability and tools, Company 2 might be cheapest for your vehicle and Company 3 might be cheapest for your personal accident cover.

Never assume that having everything on a single policy will be the cheapest option!

We are an insurance broker, so of course we’re going to list this as one of our tips! But we can back it up…

We save tradies money by doing the shopping around for them. You tell us all about your business, and we’ll use our knowledge and experience to find the most competitive premiums to suit your needs.

In many cases we’ll be able to find you a better premium than you could on your own, simply because of our size and experience in having helped over 10,000 tradies with their insurance needs.

One of the first mistakes that a tradie can make with business insurance is assuming that using a broker will cost them more. In most cases, a good broker will actually cost you less.

Once your business insurance is in place it can be easy to get lazy and let it roll over each year without shopping around or making changes.

The is especially true for tradies, as you have so much else going on trying to juggle work on site as well as all the paperwork.

But if you can spare an hour or two each year to look at your renewal properly, you could definitely save yourself some good money on your trade insurance.

Most public liability insurance policies are priced based on the size of the business. It’s not the only factor, but it is one of the big ones.

Size is measured differently by different insurers. Some look at the size in terms of staff numbers, and other look at the size of your annual revenue.

Often we’ll ask for both measures, which allows us to obtain quotes from different insurers regardless of how they measure size.

A trade business can grow and shrink in size from year to year depending on many factors, including the timing of completion on larger projects.

If your revenue was $1 million last year and you don’t provide any updated figures for this year, your policy will be renewed assuming the same revenue.

But if you have fewer projects being completing this year, or perhaps you’ve just downsized, you’ll be paying more for your insurance than you need to.

So if you’re expecting reduced revenue in the upcoming renewal period, make sure you let us or your insurance company/broker know.

The same applies to staff numbers if that’s how your insurer rates your policy. If you’re expecting to have fewer staff this year because you have fewer projects on the go, make sure you update your policy.

Some insurers take into account the percentage of your revenue that goes to subcontractors.

The higher your use of subcontractors, the higher the cost of your public liability could be.

If you’ve reduced your usage of subbis from one year to the next, make sure you let us know as this could result in a significant saving on your public liability insurance.

Another factor that the insurance companies use to calculate your public liability insurance cost is the activities you undertake.

Not just what trade you do (although that is part of) but any higher-risk activities you undertake.

For example, an electrician would be considered a standard trade under a liability policy, but if you’re doing work at power stations or airports, you’re now in the higher-risk category.

If you were undertaking this type of work when you took out your policy, you’d be paying considerably more than a standard policy.

You will continue to pay that higher amount until you tell your insurer or your broker that you’ve stopped.

If you don’t tell us, you could be paying hundreds (or thousands) more for your insurance each year than you need to.

The reverse is also true though… If you’ve started undertaking higher-risk activities and don’t tell us, you’ll be paying less for your insurance, but any claim relating to those activities will be declined.

So whether you’ve stopped or started undertaking higher-risk activities, make sure you tell us!

We’ve already covered this in the new policy section, but the same applies to renewals.

Paying monthly will almost always cost you more than paying annually. This is regardless of whether you’re going through a broker or direct to an insurance company.

But before you curse the monthly option for being more expensive, you need to consider the value of managing your cashflow.

Spreading the cost of your trade insurance across the year might cost you more, but it could also free up cashflow that you can spend in other areas to help grow your business, rather than having to pay the full amount on day one of your policy.

And don’t think that financing your insurance through a premium funding company is just for companies that can’t afford the full premium. Large companies with tens of millions in revenue often fund their insurance with premiums in the hundreds of thousands.

This is another tip that we already shared in the section on new policies.

Packaging your policies can be done two different ways. If you’re dealing directly with an insurance company, it would mean having all of your covers with a single insurer.

This rarely works out for the best, as the cheapest company for public liability mightn’t be competitive on tool insurance or vehicle insurance.

The other option is to have all of the policies with a single insurance broker, such as Trade Risk.

We can have multiple policies spread across multiple insurers to ensure we’re getting the best deal on each one, but you still have a single point of contact, being us.

If you’re paying monthly we can combine them all into a single monthly payment, even when the policies are with different insurers.

We recently helped an electrical contractor who had most of his business insurance with us, but his five vehicles were insured elsewhere. He had them with the same big name car insurance company, but each vehicle was on a separate policy.

He thought he was doing the right thing, but we combined the five vehicles onto a fleet policy and managed to save him $250 a month!

Last but not least, use a broker!

A good broker (like us, with over 600 five-star reviews!) will not only help you when first setting up your insurance, but also at renewal time.

Every renewal we’ll look around to see if we can find a more competitive deal for you, along with ensuring your cover is still appropriate for your trade business.

We’ll ask you the right questions to help us to shop around, which saves you having to do the running around. So not only will a good broker help you to save money, but also time. And in any business, especially a trade business, time is money!

Starting a new business is an exciting time for anyone who has a wish to do something that is their passion or has been a hobby in the past. Many people who commence business for the first time have no actual structure and as a result make their start-up very difficult and with a propensity for failure.

Here are my 10 Tips for someone wishing to start a new business.

• Know WHY you want to create a business

Knowing your WHY is one of the most important things you need to know before you start a business. If the passion is not there you will not be able to survive the tough times as business gets tough!

• Have a Vision for what you want that business to be in the future

It is important that you have a clear and concise vision of where you see your business in say 3 years and 5 years. If you do not have this, it is virtually impossible to be on track and focussed.

• Understand who your audience is and how you can reach them

Knowing where your niche/audience is will show you where you can promote / pitch your business. You need to know where to go to meet your future clients/prospective clients.

• Set up a solid platform / structure on how the business is to run

If you have no clear structure around your business it will be impossible for you to focus and prioritise what needs to be done to move forward.

• Systemise all aspects of the business

• Create a basic Business Plan

A basic Business Plan will help guide you initially. Even though this is something that will probably more than likely go into the bottom draw, you need to have one to forward plan what you want your business to become in the future.

• Create a Financial Plan and have an accountant

A financial plan for where you are now and for forecasting where you want to go is necessary. Find a good accountant who can guide you to set this in place. They will be worth it in the long run.

• Create a details Marketing Plan including Social Media / Advertising

Once you know your marketplace you need to create a marketing plan for how you are going to get your message out to prospective clients. This covers your website, social media, advertising, business cards, flyers and the branding of your business.

• Goal Set and create a 90 Day Action Plan every 90 days

Setting goals for the future are important and having a 90 Day Action Plan will keep you on track.

• Find a mentor and mastermind group to support you

We all need to have someone to support us and keep us moving forward. A mentor/coach will help your but a business mastermind group will give you the on-going support 24/7 if necessary and give you your independent board of directors for future growth.

Of course there are more things you need to do but these are the basics to get your business moving.

This is critical if you are to have a smooth running business. This is easier to do in the beginning that to try doing it after operating for years. If you are going to leverage in any way, it is imperative your systems are in place in all areas of your business.

There’s been much talk recently – especially among politicians – about productivity. And for good reason: Australia’s labour productivity growth sits at a 60-year low.

To address this, Prime Minister Anthony Albanese has convened a productivity round table next month. This will coincide with the release of an interim report from the Productivity Commission, which is looking at five pillars of reform. One of these is the role of data and digital technologies, including artificial intelligence (AI).

This will be music to the ears of the tech and business sectors, which have been enthusiastically promoting the productivity benefits of AI. In fact, the Business Council of Australia also said last month that AI is the single greatest opportunity in a generation to lift productivity.

But what do we really know about how AI impacts productivity?

Put simply, productivity is how much output (goods and services) we can produce from a given amount of inputs (such as labour and raw materials). It matters because higher productivity typically translates to a higher standard of living. Productivity growth has accounted for 80% of Australia’s income growth over the past three decades.

Productivity can be thought of as individual, organisational or national.

Your individual productivity is how efficiently you manage your time and resources to complete tasks. How

many emails can you respond to in an hour? How many products can you check for defects in a day?

Organisational productivity is how well an organisation achieves its goals. For example, in a research organisation, how many top-quality research papers are produced?

National productivity is the economic efficiency of a nation, often measured as gross domestic product per hour worked. It is effectively an aggregate of the other forms. But it’s notoriously difficult to track how changes in individual or organisational productivity translate into national GDP per hour worked.

AI and individual productivity

The nascent research examining the relationship between AI and individual productivity shows mixed results.

A 2025 real-world study of AI and productivity involved 776 experienced product professionals at US multinational company Procter & Gamble. The study showed that individuals randomly assigned to use AI performed as well as a team of two without. A similar study in 2023 with 750 consultants from Boston Consulting Group found tasks were 18% faster with generative AI.

A 2023 paper reported on an early generative AI system in a Fortune 500 software company used by 5,200 customer support agents. The system showed a 14% increase in the number of issues resolved per hour. For less experienced agents, productivity increased by 35%.

But AI doesn’t always increase individual productivity.

A survey of 2,500 professionals found generative AI actually increased workload for 77% of workers. Some 47% said they didn’t know how to unlock productivity benefits. The study points to barriers such as the need to verify and/or correct AI outputs, the need for AI upskilling, and unreasonable expectations about what AI can do.

A recent CSIRO study examined the daily use of Microsoft 365 Copilot by 300 employees of a government organisation. While the majority self-reported productivity benefits, a sizeable minority (30%) did not. Even those workers who reported productivity improvements expected greater productivity benefits than were delivered.

AI and organisational productivity

It’s difficult, if not impossible, to attribute changes in an organisation’s productivity to the introduction of AI. Businesses are sensitive to many social and organisational factors, any one of which could be the reason for a change in productivity.

Nevertheless, the Organisation for Economic Co-operation and Development (OECD) has estimated the productivity benefits of traditional AI – that is, machine learning applied for an industry-specific task –to be zero to 11% at the organisational level.

A 2024 summary paper cites independent studies showing increases in organisational productivity from AI in Germany, Italy and Taiwan.

In contrast, a 2022 analysis of 300,000 US firms didn’t find a significant correlation between AI adoption and productivity, but did for other technologies such as robotics and cloud computing. Likely explanations

are that AI hasn’t yet had an effect on many firms, or simply that it’s too hard to disentangle the impact of AI given it’s never applied in isolation.

AI productivity increases can also sometimes be masked by additional human labour needed to train or operate AI systems. Take Amazon’s Just Walk Out technology for shops.

Publicly launched in 2018, it was intended to reduce labour as customer purchases would be fully automated. But it reportedly relied on hiring around 1,000 workers in India for quality control. Amazon has labelled these reports “erroneous”.

More generally, think about the unknown number (but likely millions) of people paid to label data for AI models.

Amazon’s Just Walk Out technology intended to reduce labour as customer purchases would be fully automated. John G. Mabanglo/EPA

The picture at a national level is even murkier.

Clearly, AI hasn’t yet impacted national productivity. It can be argued that technology developments take time to affect national productivity, as companies need to figure out how to use the technology and put the necessary infrastructure and skills in place.

However, this is not guaranteed. For example, while there is consensus that the internet led to productivity improvements, the effects of mobile phones and social media are more contested, and their impacts are more apparent in some industries (such as entertainment) than others.

The common narrative around AI and productivity is that AI automates mundane tasks, making us faster at doing things and giving us more time for creative pursuits. This, however, is a naive view of how work happens.

Just because you can deal with your inbox more quickly doesn’t mean you’ll spend your afternoon on the beach. The more emails you fire off, the more you’ll receive back, and the neverending cycle continues.

Faster isn’t always better. Sometimes, we need to slow down to be more productive. That’s when great ideas happen.

Imagine a world in which AI isn’t simply about speeding up tasks but proactively slows us down, to give us space to be more innovative, and more productive. That’s the real untapped opportunity with AI.

Jon Whittle Director, Data61, CSIRO

Aussie Painters Network aussiepaintersnetwork.com.au

National Institute for Painting and Decorating painters.edu.au

Australian Tax Office ato.gov.au

Award Rates fairwork.gov.au

Australian Building & Construction Commission www.abcc.gov.au

Mates In Construction www.mates.org.au

Comcare

WorkSafe ACT

Workplace Health and Safety QLD

WorkSafe Victoria

SafeWork NSW

SafeWork SA

WorkSafe WA

NT WorkSafe

WorkSafe Tasmania

comcare.gov.au worksafe.act.gov.au worksafe.qld.gov.au www.worksafe.vic.gov.au www.safework.nsw.gov.au www.safework.sa.gov.au commerce.wa.gov.au/WorkSafe/ worksafe.nt.gov.au worksafe.tas.gov.au

actcancer.org cancercouncil.com.au cancercouncilnt.com.au cancerqld.org.au

cancersa.org.au cancervic.org.au

cancerwa.asn.au