VOLUME 18.3 – 2023 WHAT ROLE CAN PACKAGING PLAY? PROMOTING SUSTAINABLE CONSUMER HABITS REUSABLES • SUSTAINABILITY AND SECURITY • INSPECTION PACKAGING AND HUMAN RIGHTS • LANDA PRINT COLLABORATION

THE CONTENT TEAM

Tim Sykes Brand Director

Victoria Hattersley Senior Writer

Elisabeth Skoda Editor

Libby Munford Journalist

Fin Slater Digital Editor

Emma Liggins Junior Journalist

Frances Butler Junior Journalist

THE PRODUCTION TEAM

Rob Czerwinski Creative Lead

Meg Garratt Digital Design & Production Assistant

Syed Hassan Digital Analyst

THE OPERATIONS TEAM

Amber Dawson Operations Director

Kayleigh Harvey Advertising Coordinator

Simran Budesha Events Operations Manager

THE SALES TEAM

Jesse Roberts Sales Director

Dominic Kurkowski Senior Portfolio

Packaging Europe Ltd

Part of the Rapid News Communications Group

9 Norwich Business Park, Whiting Road, Norwich, Norfolk, NR4 6DJ, UK

Registered Office: Carlton House, Sandpiper Way, Chester Business Park, Chester, CH4 9QE. Company No: 10531302.

Registered in England. VAT Registration No. GB 265 4148 96

Telephone: +44 (0)1603 885000

Editorial: editor@packagingeurope.com

Studio: production@packagingeurope.com

Advertising: jr@packagingeurope.com

Website: packagingeurope.com

Twitter: twitter.com/PackagingEurope

LinkedIn: uk.linkedin.com/company/packaging-europe

YouTube: youtube.com/PackagingEurope

© Packaging Europe Ltd 2023

No part of this publication may be reproduced in any form for any purpose, other than short sections for the purpose of review, without prior consent of the publisher.

ISSN 2516-0133 (Print) ISSN 02516-0141 (Online)

Sales Manager Matt Byron Portfolio Sales Manager Clayton Green Business Development Manager 4 23 37 29 3 Editorial Elisabeth Skoda 4 Understanding consumers Promoting sustainable consumer habits 10 Security versus sustainability Can traceability provide a boost to both? 15 Reuse and refill Focus on cosmetics 20 Weighing and inspection Looking to the future (and the past) 23 Landa print collaboration How this issue was printed 27 drupa preview Focus on packaging print: Looking ahead to touchpoint packaging at drupa 2024 29 interpack review Unpacking interpack: A look back at the 2023 event 33 Rockwell Automation What does the digital transformation mean to packaging manufacturing? 35 Comment Circular packaging and human rights 37 UNESDA A deep dive into packaging sustainability with UNESDA Soft Drinks Europe 40 In Conversation With… A deeper exploration of self-adhesives 42 ESG McKinsey and NielsenIQ reveal broad correlation between on-pack sustainability claims and consumer spending 46 AIPIA stories Active and intelligent packaging spotlight 48 Hive stats Statistics spotlight OUR TEAM CONTENTS

ASI’m writing this, I’ve just returned from this year’s interpack along with the rest of the Packaging Europe team. My feet are still recovering after more than meeting the recommended 10,000 daily steps every day at the Messe. We greatly enjoyed covering the show, exploring the latest innovations and of course meeting many of you. Having our own booth gave us an opportunity to rest those tired feet; the focus of our exhibit was the forthcoming Sustainable Packaging Summit (taking place in Amsterdam on 14-15 November) and we were delighted by the amount of interest we had, the number of people who confirmed they’ll be attending, and by the passionate discussions the program is already provoking. Read more about the team’s digest of our interpack impressions further on in these pages.

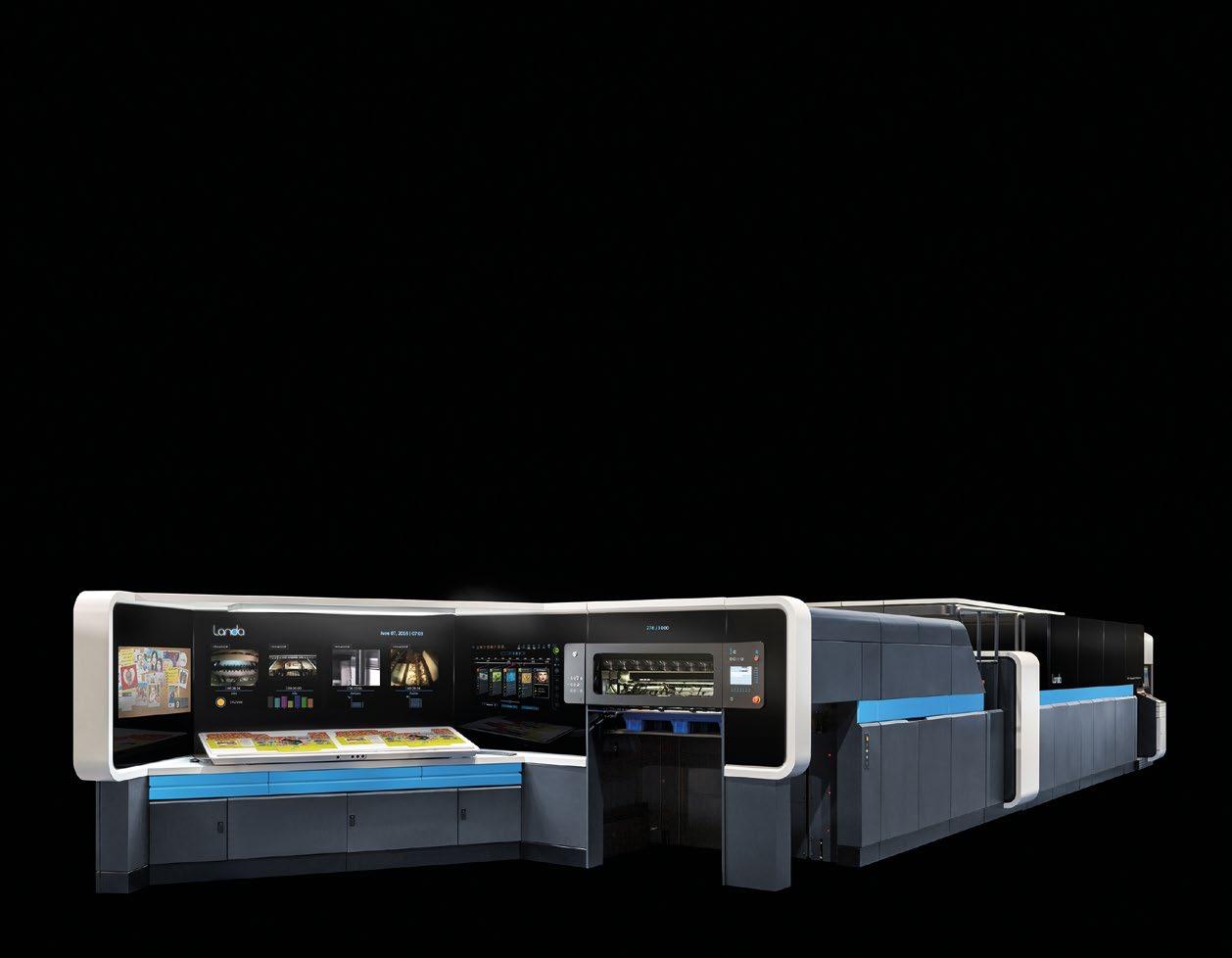

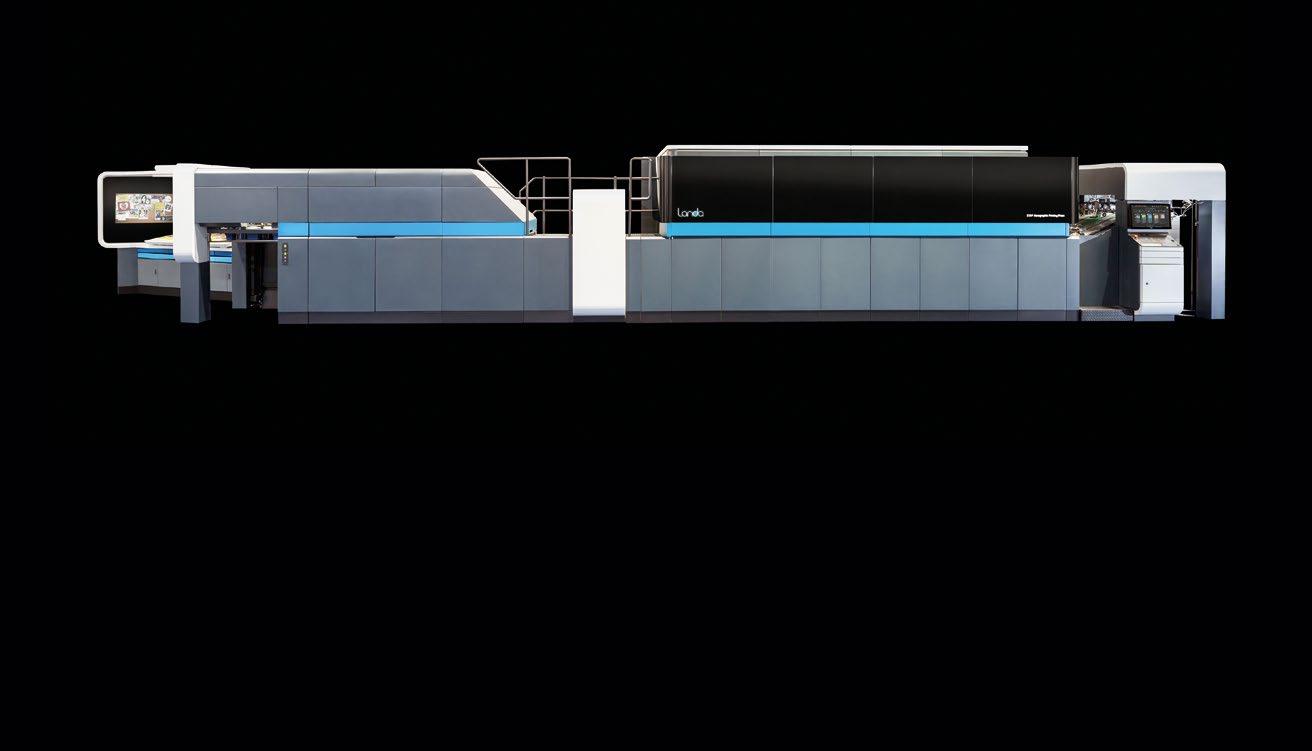

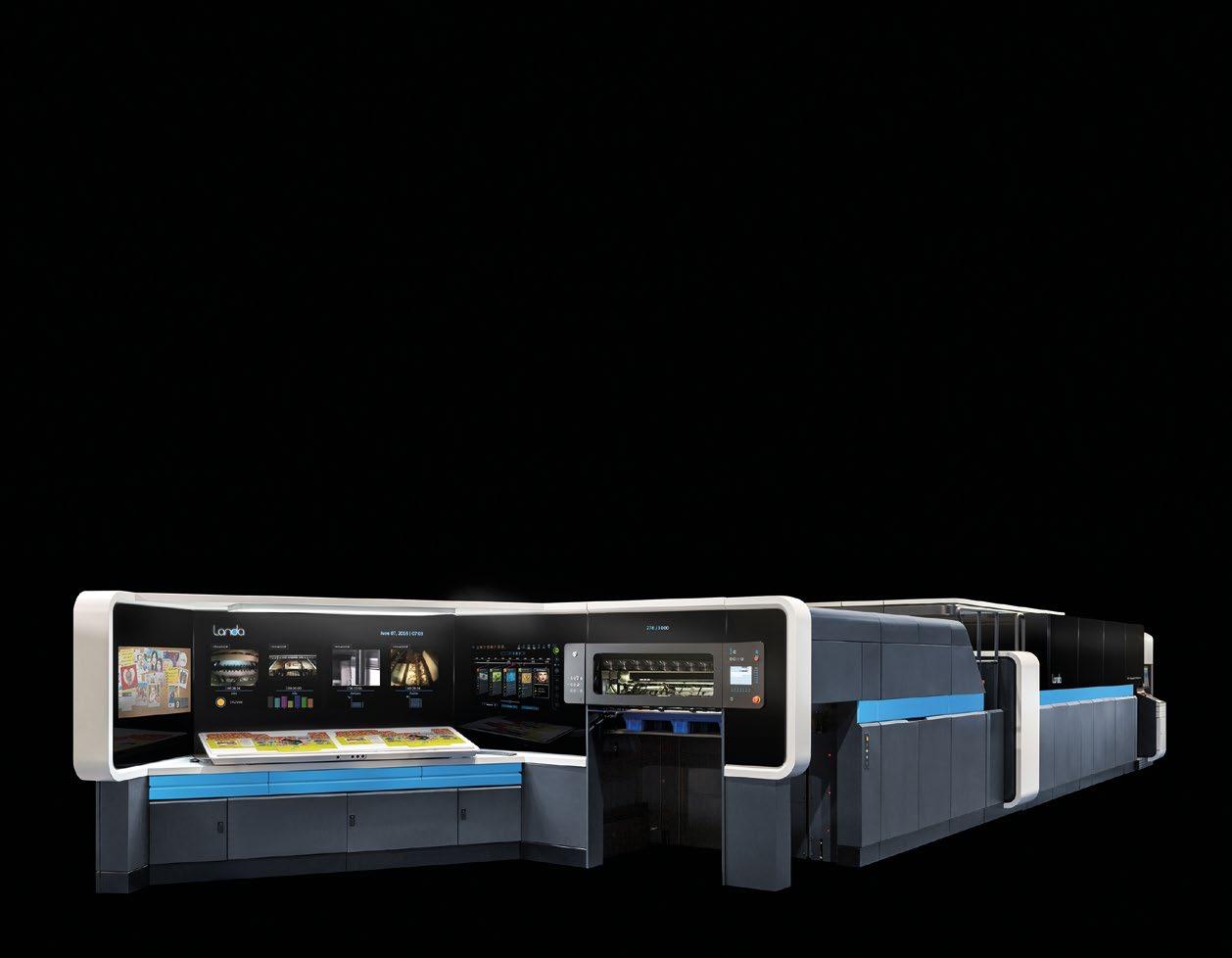

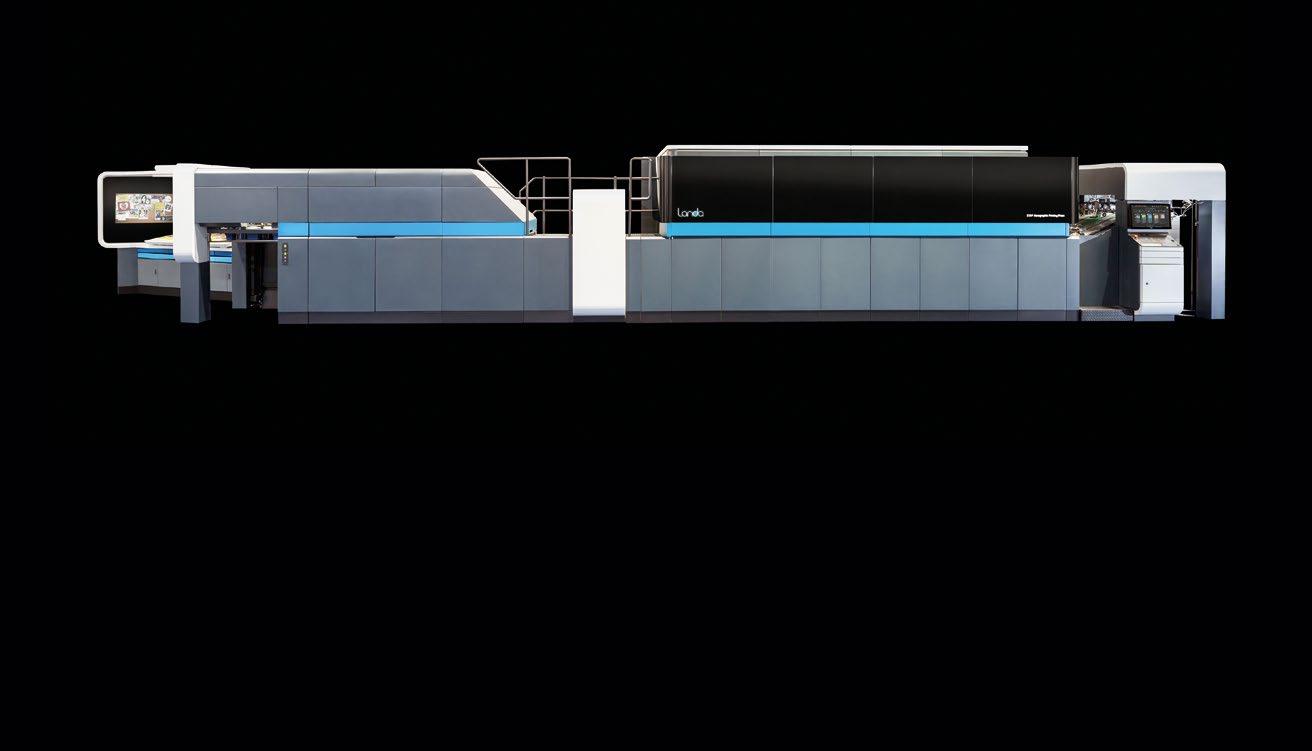

Speaking of the pages of this magazine, you may notice something special about the print quality of this month’s edition. This is because we’ve collaborated with Landa to print the magazine on a Landa S10P Nanographic Printing® Press – you can read more about this project in the centrefold.

CONTACT ME

Elisabeth Skoda · Editor at large es@packagingeurope.com

Also in this edition – understanding consumer purchasing behaviour is one of the key factors for brands when it comes to deciding what to sell and how. But how can we ‘sell’ sustainable behaviour? Victoria Hattersley asks how a greater understanding of consumer behaviours and motivations can help build a more sustainable supply chain in our big feature.

Staying on the subject of consumer behaviour, we take a deep dive into a joint study by McKinsey and NielsenIQ that explores the relationship between ESGrelated claims made on product packaging and consumer spending habits with the goal to find out how companies can balance sustainability-minded progress with commercial success.

interpack 2023 is done and dusted, but the next big event in Düsseldorf is just around the corner. A year ahead of drupa 2024, where we’ll be supporting the special touchpoint packaging project, I talk to the organizers to explore industry megatrends impacting print and printed packaging.

Frances Butler zooms in on the reuse and refill market and finds out what advancements and new developments there are in the toiletries and cosmetics packaging sector. Emma Liggins takes an in-depth look at whether traceability could serve as a solution to address both sustainability and security challenges in the future. Meanwhile, Fin Slater discusses innovations in the area of weighing and inspection and shines a spotlight on some of the developments that were shown at interpack 2023.

Also in this issue, I interview UNESDA Soft Drinks Europe’s Director General Nicholas Hodac, and we discuss the state of the drinks and drinks packaging market as well as progress towards the association’s circular packaging vision for 2030.

We also have a comment piece from Alina Marm, who on top of her role at packaging ink and coating specialist Siegwerk, is a PhD researcher at the University College London. She sheds light on people who are often overlooked in the packaging recycling process and explains why we must pay attention to human rights when scaling up the use of recycled content, and how unintended consequences can be avoided.

All that remains for me to say is that by the time you receive this magazine, the finalists for our Sustainability Awards 2023 will have been announced –head over to packagingeurope.com to find out who they are if you haven’t done so yet. Winners will be announced at a special dinner and networking party at the Sustainable Packaging Summit. We hope to see you there, and in the meantime, we welcome you to our upcoming virtual panels and hope that you enjoy this latest edition of the magazine.

Elisabeth Skoda

3 Packaging Europe EDITORIAL

@PackEuropeEli

n

‘SPEAK THE SAME LANGUAGE’: PROMOTING SUSTAINABLE CONSUMER HABITS

WEknow that understanding consumer purchasing behaviours is key for brands when it comes to deciding what to sell and how. But it’s not all about the bottom line anymore. Far more important is how the wider packaging value chain can ‘sell’ more sustainable behaviours.

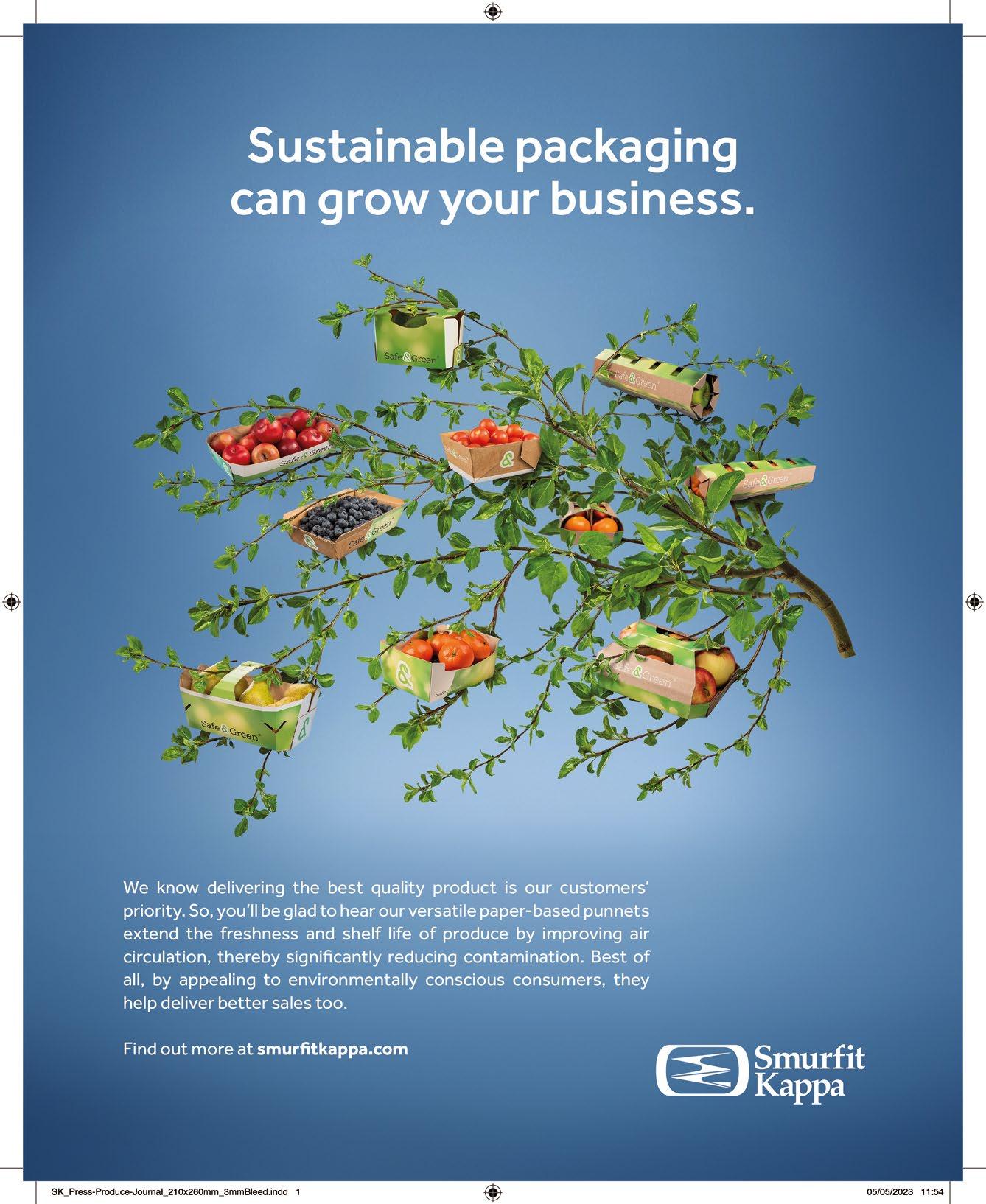

So what kinds of environmental issues do consumers, in the broader sense, prioritize today, and how do they view ‘sustainability’ when it comes to packaging? Unless we have been living off-grid, we’re all aware, for example, of the recent negative perceptions of plastics and resulting move towards paper-based solutions. However, according to Richard Cope, trends consultant at Mintel and author of the company’s 2023 Global Outlook on Sustainability report, the average consumer may now be starting to understand there are more facets to the issue.

“When we survey consumers about their priorities, a major concern is that the package protects the product itself inside rather than what it is

made of. After that, closely behind, they say it’s important packaging is low impact and that it can be recyclable, but that’s really a secondary concern. In recent years, I think a lot of our clients and brands had been getting frustrated that consumers didn’t realize things were wrapped in plastic for a good reason. I think that is starting to change.”

That is not, of course, to say that plastic waste is no longer an important issue: quite rightly, there is widespread recognition that we need to both reduce the amount of unnecessary plastics we use and transform our recycling infrastructures – but it’s positive to also see a gradual shift towards understanding that reducing carbon and ensuring resource efficiency, as opposed to plastic, may be equal if not bigger concerns.

However, one problem with asking consumers how they feel about sustainability is that what we say and what we do can be very different things: the ‘value-action gap’. The above-mentioned Mintel Global Sustainability Report found that, when surveying consumers, the gap between them agreeing with

4 Packaging Europe

How can a greater understanding of consumer behaviours and motivations help build a more sustainable supply chain? Victoria Hattersley reports.

statements such as ‘I try not to be harmful to the environment’ and actually performing very simple and costless (to them) tasks such as recycling packaging is a very significant 23 percentage points.

Rebuilding consumer trust

So how can brands and retailers use what they know about consumers to promote more sustainable behaviours? For starters, says Alexander Reitz, Team Lead at PreZero Sustainable Packaging, there are major issues with labelling that need to be addressed. At the moment, many on-pack labels are far too unclear and this can lead to apathy when it comes to recycling.

“Labelling has to be improved and standardized. When it comes to the separate issue of recyclability guidelines it’s too complex because each country has a different set of rules of what is recyclable and what is not, which can be confusing for brand owners. But recyclable packaging is a prerequisite for a functioning circular economy. To quickly and reliably determine the recyclability of packaging and to help manage the complexity of different standards and guideline, PreZero will launch at the beginning of June a specially developed software tool. Companies and organizations can use it and more easily create sustainable packaging solutions.”

The need for clarity when it comes to packaging also draws us into the rather knotty question of transparency on the part of brand owners, as this is perhaps where consumer trust has been eroding the most. According to Mintel, over a third (38%) of consumers don’t trust companies to be honest about their environmental impact.

Part of the problem, says Richard Cope, is that “brands are often guilty of communicating to consumers in metrics they can’t comprehend and that is where a lot of the cynicism comes from. Speak the same language and be honest about where you are.” One option, he says, could be the use of clear ‘eco-scores’ similar to those which already provide nutritional information for food – whether directly on-pack or using QR codes.

“Brands like Levi’s do a good job of saying how much water they use, for example, and explaining their targets and how far they have come to reaching them. That approach is OK. It’s fine to admit that you’re still on a journey but what you can’t do is sit around and wait to be attacked for doing nothing.”

It’s also fair to say that people are becoming wary about the notion of carbon offsetting. As a concept, it’s a nebulous one to say the least. “It’s outsourcing rather than taking action to change what you’re doing and throwing money at the problem,” as Richard says.

So there’s an element of ‘borrowing from Peter to pay Paul’ when it comes to practices such as offsetting?

“Yes, absolutely. We’re still in an era where brands are trying to say they’re environmentally friendly and that’s dead as a concept. There’s no such thing as an ‘environmentally friendly’ brand because everything we do has an impact. Instead of making outrageous claims (e.g. Lufthanza claiming they’re environmentally friendly when they’re an airline!) brands could be communicating that they are choosing a certain material because it reduces a certain percentage of emissions overall.”

6 Packaging Europe

Whose responsibility is recycling?

Another area of confusion for consumers around packaging is around the responsibility for package recycling or disposal – whose is it? When it comes to questions such as renewable energy transitions, the answer is simple: the government must take responsibility. With packaging, it’s often brand owners who are perceived as holding the responsibility even if this is not necessarily the case. It’s true that some companies, like Amazon, are now putting money into developing their own recycling infrastructure, but they are still the outliers.

“Obviously there’s a disconnect somewhere,” says Richard Cope. “I get annoyed we can’t recycle Tetra Pak where I live, but is that their responsibility? The government? I think regardless, as a company you start to lose credibility with consumers if you’re putting something on the market that is technically recyclable but not actually recycled in practice.”

In other words, the brand owner’s role in the circular economy can’t stop at the point where their product enters the market. But it would be naïve to rely on a company’s sense of moral fair play in this regard; what is really needed is some kind of legal framework for them to adhere to.

Richard suggests that one way of encouraging consumers to take a more active role in the recycling process themselves would be to harness the (sometimes ugly but undeniable) power of national pride. Never underestimate the power of patriotism.

“There can be a lot of pride around products that are ‘made in Britain’, for example. But what about ‘recycled in Britain’ being a badge of honour rather than it being shipped off somewhere else or put into landfill? What if all countries were to adopt this approach?”

Scaling up reuse

We know that there are also increasing calls for companies to step up reusable/refillable packaging models. Yet so far these have been largely unsuccessful. Why is this, and how can a greater understanding of consumer behaviours and priorities help to develop more successful reuse models in future?

“It’s partly a hangover from the pandemic and the (mistaken) idea that single-use is still more hygienic,” says Richard. “More broadly, I guess it’s just not very convenient still. You’ve got to go on a journey to take the

Packaging Europe

Alexander Reitz

Team Lead at PreZero Sustainable Packaging

7

Richard Cope Trends consultant at Mintel

level of convenience. I believe reuse might take off more widely if it is integrated into e-commerce grocery deliveries. We have seen this to some extent with the Loop system, but that is a more ‘premium’ model.”

Furthermore, Alexander Reitz says we should reject the notion that reuse is always more sustainable as it really depends on context. For example, cleaning containers after each use adds to the pack’s overall water footprint and additional emissions for transportation have to be taken into account, so it is only more environmentally beneficial if the alternatives have even greater environmental impact. As ever, it comes down to examining each individual case. It’s no wonder the ‘right’ system can take so long to implement.

Where are we with smart packaging?

We drifted earlier into the area of smart packaging when we discussed the possibility of providing consumers with clearer information on packs using QR codes. But while there are big possibilities for smart packaging technologies these have not, as yet, hit their stride when it comes to reducing environmental impact. Ultimately, many technologies such as AR may still be perceived by many consumers as ‘gimmicky’.

“I honestly think it’s fundamentally not a convenient thing,” says Richard Cope. “If you can just print simple eco-scores on the pack that would give the consumer the information they need, why complicate things?”

That’s not to say there aren’t areas in which smart technologies couldn’t make a huge difference to efficiency and circularity – we just may have to accept these aren’t all necessarily consumer facing.

“I don’t think consumers have time to scan codes, but smart technologies could certainly be helpful further down the value chain in areas such as sorting plants, for example.” The HolyGrail project, which uses digital watermarking technologies to sort packaging waste, is an obvious candidate here.

Alexander Reitz does however point out one possible use for VR in particular. “If you could get consumers to take VR tours of sorting plants to

tion and maybe even change behaviour.”

It’s about the overall impact

In future, it’s clear consumer messaging needs to be far more transparent and focused on educating about the overall carbon impact of a product. Both Alexander and Richard believe there is still too much emphasis on what is happening to the packaging at the end of the product’s life – understandable, perhaps, as the package is a tangible thing we have a level of agency over when disposing of. But they also feel consumers should be educated about the energy and resources that are consumed further up the supply chain, right up to the point of production.

Alexander expressed concern that there may already even a certain amount of ‘apathy’ on the part of consumers when it comes to the topic of sustainability itself. After all, attention spans can be short.

“Sustainability must be the main focus for the foreseeable future, above all else. I wish we weren’t always looking for the ‘next big thing’ rather than focusing on what we need to do now.”

Rather than seeing them as an ‘other’, separate group, perhaps brands need to recognize that there are strong similarities and overlaps between their own motivations and those of consumers. To borrow a quote from the Mintel report:

“People like to be perceived as healthy, considered and informed in their choices, as well as community orientated, but the reality gaps here are often equally as wide. The simple, actionable conclusion is that people are extremely image- and reputation-conscious, and like to portray themselves as ‘good’ and be perceived as ‘good’. In that regard, they are no different from many brands and their motivations for being sustainable. Making people feel – and look – good has to be a marketing goal.”

Quite simply, brands need to consider how, rather than making themselves and consumers look good, they can be ‘good’ through the positive actions they take. n

9 Packaging Europe

CAN TRACEABILITY BOOST BOTH SECURITY AND SUSTAINABILITY?

As traceability becomes a more prominent talking point at both an industrial and legislative level, Emma Liggins explores whether this approach could serve as a solution addressing both sustainability and security challenges in packaging in the future.

Traceability is an essential facet at all stages of the packaging value chain. At the Rockwell Automation Fair in 2022, vice president and chief IP counsel John Miller and director of revenue and brand protection Ryan Smaglik noted that global supply chain disruptions are limiting stock availability; that increasing pressure on procurement professionals is incentivizing them to consider unauthorized sources; and that deceptive business practices seem to have increased opportunities for counterfeiters and unauthorized resellers.

Thus emerge the dangers of the so-called ‘grey market’, wherein misleading claims of 24- to 48-hour delivery or plentiful stock, or outright false claims that the seller is authorized or buys from authorized sources, can lead to the sale of automated products without the appropriate warranties and licensing for software or firmware – as well as potentially exposing customers’ systems to security and safety risks or breaching mandatory certifications, directives, marking requirements, or regulations.

Beyond the automation space, packaging itself can fall victim. Incorrect or modified packaging can impact a brand’s reputation and harm its market performance. If, for instance, the packaging displays incorrect instructions for the use of the product, it can damage perceptions of a brand’s authenticity.

Nor is it only industry players at risk – inaccuracies of this kind could cause inconvenience at best, and danger at worst, for consumers. An insights survey sponsored by Digimarc and conducted by Censuswide saw 39% of respondents report that they had unknowingly purchased a fake product at some point. 67% were concerned about the authenticity of the products they buy for their homes and families, while 64% worried about the efficacy and health and safety risks, including potential toxicity, of a counterfeit product.

NFC, RFID and beyond

Anti-counterfeiting solutions are already on the rise, but they are not without their flaws. Barcodes were first patented in the USA over 70 years ago and, while they can effectively trace a product’s movement throughout the supply chain, they cannot guarantee the legitimacy of the product itself, especially when it is possible to fake them. Such can even be the case for more recent alternatives, like QR codes and holographic adhesive labels.

Authena AG tells us that faking products not only impacts companies through lost revenue but also leaves room for forced and exploitative labour in direct contradiction with global ESG goals. The company offers one solution – near-field communication (NFC) technology. With the tap of a smartphone, consumers can access authenticity and ownership certificates via cryptographic non-fungible tokens (NFTs) associated with a physical twin through Authena’s M3TA blockchain technology. In turn, companies can track products at all stages of the supply chain.

In general, though, NFC is an imperfect solution. It is a low-speed and expensive method that some users may find confusing, and with the hacking of phone data on the rise, it does not guarantee complete security.

Radio frequency identification (RFID) tags serve as an alternate option that claims to tackle some of these issues. Alastair Hanlon, CCO at PragmatIC Semiconductor, told Packaging Europe that these tags are difficult to copy and hard to damage beyond the point of readability, unlike barcodes. Large batches of RFID-tagged items can be read at the same time, and these tags can be positioned beneath a label without impacting their readability.

10 Packaging Europe

Not everyone agrees with these perks. Sagitta HPC’s COO Emily Mitchell told Business.com that only a smartphone is needed to clone RFID tags and, in her example, pay for one product at the cheaper price of another. Nor do RFID tags stop tracking at the point of purchase, she explained – so long as the tag is attached to a pack, the recorded data can theoretically be linked to specific purchases on a credit or debit card, or even a loyalty discount card, and track a consumer’s movements throughout a shopping complex.

Focus on e-commerce

Perhaps this particular issue is less of a concern for e-commerce applications, although its longer supply chain arguably creates more opportunities for theft, tampering, and loss. Currently, Amazon’s solution is its Transparency product serialization service, which utilizes unique and secure codes to ensure that individual units can be identified. By restricting its listings to products featuring a valid Transparency QR code, the company aims to prevent counterfeits from reaching customers.

Even when an item has been delivered, its code can be scanned via the Amazon Shopping and Transparency apps to confirm its authenticity and access content provided by the sellers in a bid to improve customer engagement. Participating sellers can also use the resultant data to optimize their supply chains by gaining insights at batch or lot level, thus identifying issues and their root cause to implement solutions with minimal disruption. Jorge Hernández Jimenez, general manager at electrical equipment supplier OcioDual, reports on Amazon’s website that the solution has increased his company’s revenue by 30% and eliminated any infringement attempts on the company’s products.

Traceability becomes a useful asset in such extreme cases as counterfeiting, but also for less drastic issues – product recalls, issues in the distribution process, or even positive circumstances such as gathering sales data and targeting marketing campaigns to specific consumers. Another important motivation behind improving traceability, though, is an ongoing push for sustainability.

Gathering data

Last September, McKinsey published a report suggesting that fewer than 30% of organizations had clear metrics surrounding recyclability, sustainability, or recycled content to hand. Without this information, consumers must take a brand’s word for its sustainability metrics – and, given that accusations of greenwashing have not slowed in the past few years, it can be difficult to know whom to trust. Enforcing traceability could be one solution to ensuring that the sustainability credentials of individual packaging designs are accurate.

On a continental scale, upcoming revisions to the Packaging and Packaging Waste Directive are holding market surveillance authorities responsible for identifying any economic operators that make non-compliant packaging available on the market, meaning that economic operators, in turn, must retain information regarding their transactions “for a certain period of time”. Moreover, Regulation (EU) 2022/2065 of the European Parliament and of the Council takes a stance on distance contracts set to offer packaging to consumers in countries located within the European Union, especially amongst companies operating online. It aims to prevent the avoidance of extended producer responsibility by expecting providers of online platforms to obtain information about producers’ compliance with EPR requirements, with the Regulation also laying out rules surrounding the traceability of traders selling packaging via the internet.

Wider still is the expectation that Member States provide an annual report of their recycling rate data to the Commission. Information such as recycling rates of packaging waste per material and type, the amounts of separately collected packaging waste for each packaging material, the amounts of packaging waste placed on the market per material and packaging type, and the installed capacities of sorting and recycling are to be delivered electronically, alongside two reports – one being a quality check report, the other describing the measures put in place to enable quality control systems and, indeed, the traceability of packaging waste. All the information provided will be used to establish a methodology for the assessment of at-scale recyclability.

Packaging Europe 12

An insights survey sponsored by Digimarc and conducted by Censuswide saw 39% of respondents report that they had unknowingly purchased a fake product at some point.

Keeping track of packaging materials

Recycling stations are not always owned by the brands producing packaging. When the end of a pack’s life cycle is out of its creator’s hands, traceability is necessary to enable recycling plants to keep track of its progress – where it has been, how many times the material has been recycled, et cetera. Consumers can also utilize this information if a watermark or QR code is available to them; in theory, this could put an end to bogus sustainability claims and ensure that packaging providers take meaningful steps towards a circular economy to protect their company’s integrity.

So, too, is serialization proving useful in HolyGrail 2.0, the digital watermarking initiative. In this solution, imperceptible codes or watermarks as small as a postage stamp are printed across the packaging for consumer goods, including labels, sleeves, thermoformed trays, and PET and HDPE bottles. Not only does it hope to facilitate transparency and combat counterfeiting, but this solution expects to improve sorting and recovery, providing consumers with accurate disposal information and enabling discarded packaging to be placed into the correct stream at recycling facilities.

It is not only recycling efforts that benefit from traceability, though. Part of the Packaging and Packaging Waste Directive’s required conditions to define packaging as reusable will include the provision of any relevant information surrounding its traceability. Combining smart technology with reusable solutions can help its enforcers optimize the process by tracking the movements of each pack, charting material flow, and identifying shortcomings in the process.

Closing the loop with technology

Announced last year, PragmatIC Semiconductor’s Technology-enabled Reusable Assets for a Circular Economy (TRACE) platform sought to facilitate this process. Using NFC technology, it aimed to prescribe unique digital identities (UIDs) to each pack, collecting data to evaluate the solution’s environmental

and economic benefits. Within a system like this, reusables can circulate with full visibility and transparency until they are no longer in a suitable condition for further use, at which point they can be located and withdrawn.

Similar systems are currently being piloted with QR technology. Under the umbrella of Starbucks and Hubbub’s Bring It Back Fund, reuse technology company Again is helping Uber Eats trial reusable packaging with a complementary doorstep collection service in central London, while Keep Scotland Beautiful has recruited local businesses around the NC500 route in the Scottish Highlands to trial reusable beverage containers – and these are far from the only projects of their kind. Most remain in the same early stages, however, and their true feasibility is yet to be seen.

The same can be said about a vast majority of digital traceability solutions – they remain in their infancy, currently more theoretical than practical in some areas. The packaging industry is still figuring out how to balance sustainable ideas with thorough security measures while keeping it realistic from an efficiency point of view. Nevertheless, it is heading in the right direction to ensure that its sustainably minded systems are as smooth, effective, and precise as they can be.

13 Packaging Europe

n

Enforcing traceability could be one solution to ensuring that the sustainability credentials of individual packaging designs are accurate.

REUSE AND REFILL: FOCUS ON COSMETICS

In November last year, the European Commission announced its planned revisions to the Packaging and Packaging Waste directive including reuse and refill targets, aiming towards a target to reduce 15% of packaging waste by 2040 per capita per member state, proposing that “companies will have to offer a certain percentage of their products to consumers in reusable or refillable packaging” and there will be “some standardization of packaging formats and clear labelling of reusable packaging.”

The same month, WWF published a position paper setting out a framework for scaling sustainable reuse systems for plastic packaging, focusing on reducing plastic waste but with a secondary goal of reuse systems which complement strategies such as phasing out singleuse plastics where possible.

The NGO claimed “scaling up European reuse systems by 20% by 2027 would save 1.3 million tonnes of emissions, almost 2.5 billion cubic metres of water, and 10 million tonnes of materials every year”, but cited high entry costs for current reuse solutions as a restriction.

Frances Butler, junior journalist, takes a look at how the cosmetics and personal care sector has reacted and pushed forward developments.

First Steps

Last year, US based cosmetics brand Izzy spoke to us about its refillable mascara solution. The primary packaging for Izzy’s Zero Waste Mascara BLK is a stainless steel tube designed to be cleaned and refilled “over 10,000 times”, contained in a reusable shipper. The consumer can then use the shipper to return the empty mascara tube to the company, where it is cleaned, refilled and sent back to the consumer.

There are also refill options available via either a one-time purchase or subscription. Founder Shannon Goldberg claims the mascara has “a 78% smaller carbon footprint after 25 refills”, with all manufacturing taking place within a 400-mile radius and the water from the cleansing process being reused.

15 Packaging Europe

In January this year, Quadpack announced its refillable compact with wooden casing and a twist system to separate the base and lid. The base contains a magnet designed to hold a refillable godet in place and enable separation for recycling, with a recess designed to allow users to extract the godet and replace it with a filled version.

Major deodorant companies have recently begun using reusable and refillable packaging, with Dove launching its first refillable solution in February. The stainless steel case is designed to be refilled until the end of its life, cutting down on the disposal of single-use packaging.

The Body Shop has introduced a refill scheme for its shampoo, conditioner, shower gel and handwash products, stating: “We’ve rolled out refill stations across 720 of our stores globally and we are launching a further 130 in 2023.”

Making reuse work

Another cosmetics company offering refill products is Kao, which states it has 380 refill products, modified according to bottle sizes and viscosity of contents, and has made packaging a key element of its global ESG strategy, aiming to achieve net zero waste for plastic packaging by 2040, and negative waste for plastic packaging by 2050.

One of its refill products is the Raku-raku Eco Pack Refill, used for refilling high viscosity products such as body soap, reportedly reducing CO2 emissions generated throughout the manufacturing, use, and disposal stages “by about 80% compared to rigid containers.”

Asked about the challenges when developing reusable and refillable packaging in the cosmetics industry, Martin Uellner, vice president of research and development at Kao’s Europe Research Laboratories, points out that in Japan, refills have already become an industry standard and that Kao, as well competitors, are selling 80% of their personal care and household products as a refill.

“There have been several challenges, especially creating a truly sustainable refill solution, as currently, refills are often harder to recycle. Refills are still expensive to produce so investment is not yet attractive to many companies, which makes pricing challenging. Consumers want to act sustainably without compromising on quality, user experience or price,” he points out.

Given these challenges, how can reusable packaging reduce the carbon footprint and use of materials?

Martin Uellner explains that this is hard to calculate as a refill needs to be compared to the individual primary pack it substitutes.

17 Packaging Europe

”

Using refills needs to become a habit but should also be enjoyable. The packaging needs to look attractive, come at an attractive price point, and create a positive user experience.

“Looking at the refill pouches we develop at Kao, on average you save around 70% of plastic versus a standard primary pack.”

Speaking of the carbon footprint, according to OECD, plastics have a significant carbon footprint and contribute 3.4% of global greenhouse gas emissions throughout their lifecycle – so every piece of packaging that is not produced significantly supports efforts to fight global warming.

“When looking at materials, it is important to consider the impact of production, transportation and lifecycle. Plastic has a benefit as it is often much lighter and has a lower energy consumption than many of the alternatives,” he adds.

“Therefore, it is a case-by-case decision if plastic, aluminium, glass, or other materials should be used. This depends on the product, the transportation distance, the level of recycling infrastructure in various countries and many other factors.”

Appealing to consumers

Consumers can be hard to please, and Martin Uellner high lights the importance of creating packaging that consumers love to use.

“Refills are not easy to handle. You want packaging that can be completely emptied and does not spill. Our research and development team in Japan has consistently improved the refill packs and has created a unique nozzle, enabling an easy-tohandle, clean and efficient refill process for the consumer. Kao is holding a patent for this technology.”

He explains that one specific challenge was to change the typical pouch shape into a very compact form to reduce head space and have a stable base.

“This has been achieved by changing the pouch from a classic triangle shape to a cylindric shape with a flat top sheet and a special flat spout construction.”

The company has plans to scale up and introduce more refill solutions into its portfolio, especially in the salon and the luxury sector.

“Refills offer a big benefit to salon owners as they produce less waste and are easy to store. For our British boutique brand Molton Brown we have just launched our Infinite Refill bottle, an aluminium bottle that can be refilled with a range of our bath and body products.”

Martin Uellner believes that from an ESG point of view, refills have a clear advantage and are an important building block to reducing plastic packaging, but reiterates that companies need to win consumers’ hearts.

“Using refills needs to become a habit but should also be enjoyable. The packaging needs to look attractive, come at an attractive price point, and create a positive user experience. This has been the success model in Japan and I am convinced we can be successful with refill packaging in other markets as well. But it needs all players in the cosmetics industry to join forces. The industry and consumers need to drive the change together.”

Looking towards the future, he points out that to address the aim of zero waste, we need to investigate various options: “Compacting products so they need less packaging, waterless solutions like soap bars that can be packed in paper instead of plastic – or turning a refill pack into the primary pack.”

Breaking the status-quo

Making progressive changes to current systems, such as creating a “universal, professionally-refillable” reusable packaging platform is the brainchild of Re, a reusable packaging platform created by Jo and Stuart Chidley, the founders of sustainable beauty brand Beauty Kitchen. Re leases packaging to brands, provides standardized reusable packaging made from stainless steel, aluminium and glass, and is aiming to coordinate retailer engagement and implementation of a nationwide network for return points, washing and reuse.

Jo Chidley highlights that the systemic changes required to shift from a take-make-waste system that has been “perfectly designed to make profit and waste over the last 70 years” can only be achieved with collaboration.

“The barriers that need to be overcome include moving together to standardized smart reusable packaging-as-a-service and shared investment in a reuse platform that is consumer centric, including convenient return locations, consumer rewards, reverse logistics and washing facilities. From our work to date the innovation required is not technically challenging. In our experience businesses are willing to collaborate on systemic change and the momentum is building.”

18 Packaging Europe

”If reusable packaging is developed to only be reusable for one product, brand or organisation it is massively less likely to be reused. If each standardised packaging type could be reused on 100 different products, […] reuse could be guaranteed.

Reusable and refillable packaging has many sustainability benefits, as she points out.

“Ultimately reuse keeps our planet’s limited resources flowing in continuous cycles and at scale, which generates the consumer behaviour change and return rate.”

She concedes that packaging designed for durability and reuse will often have higher carbon emissions for its first use, but highlights the fact that sustainability should be measured over its lifetime, using future input values and considering every other element of the LCA including waste and impacts on biodiversity.

“With the right standardization and system design, with local returns, washing and reuse, reusable and refillable packaging should deliver lower emissions and waste.”

Jo Chidley describes breaking the status-quo of a well-designed and profitable single-use system as the biggest challenge to overcome.

“Whilst many individuals and some businesses believe that reuse is the correct long-term answer, short-term financial pressures make collaboration and shared investment without legislation challenging. Systemic change is hard, it requires real innovation, collaboration and long-term commitment.”

Standardization is key

Re provides standardized reusable packaging and leases packaging to brands. This can make a difference, as she points out.

“If reusable packaging is developed to only be reusable for one product, brand or organization it is massively less likely to be reused. If each standardized packaging type could be reused on 100 different products filled in many different factories in many different locations reuse could be guaranteed. The

packaging-as-a-service means the item can be leased for a very similar cost to a standard bottle. The lease fee includes the reverse logistics and washing cost, removing the complexity and cost from the user.”

Re is working with a range of brands, retailers and global packaging suppliers to build a universal, professionally-refillable, reusable packaging platform, starting in the UK to build a globally scalable model, and Jo Chidley concludes with a call to action:

“We are working with WRAP and the UK Plastic Packaging Pact on a series of workshops to engage as many collaborators as possible ahead of a shared investment in implementing the system. You can expect to see it in action in some major retailers with major brands soon and we are calling

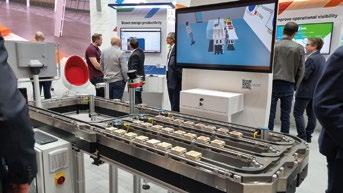

It’s fair to say that 2023 – with its geopolitical issues, inflationary pressures, and lingering COVIDrelated complications – wasn’t always smooth sailing for the packaging industry. One area that was particularly hard at work in terms of keeping up with consumer expectations (which, inevitably, remained largely unchanged) was weighing and inspection.

In this article we’ll look back at some of the innovations in this field that we covered on our website in 2022, whilst also looking at some of the innovations that were demonstrated at interpack 2023.

LOOKING TO THE FUTURE (AND THE PAST) OF WEIGHING AND INSPECTION

What did we see in 2022?

SICK unveiled two new solutions in this category in 2022 – its Smart Box Detection system and Roller Sensor Bar. The former is a part of the deTec4 Safety Light Curtain, and aims to ensure operator safety and a continual and efficient output on packaging lines. It uses intelligent pattern recognition to detect cuboid objects and differentiate them from human operators, which is said to prevent unnecessary interruptions and stoppages at the in- and outfeeds of packaging machinery.

Meanwhile, the roller sensor bar has been designed for quick and easy installation, high sensing performance, and preventing conveyor jams that can cause unplanned downtime in packaging, parcel sorting, and logistics

hubs. Its job is to detect the leading edges of varied, flat or irregularly shaped packages on conveyors.

It also appears as if the benefits of deep learning are starting to be felt in the detection sector – with Cognex introducing a vision system that automates error detection in minutes, without PC or programming skills.

Using an array of tools, deep learning can locate and count complex objects or features, detect anomalies, and classify said objects or even entire scenes. It can also recognize and verify alphanumeric characters using a pre-trained font library.

On a similar theme, Pellenc ST’s latest instalment of its Xpert technology combines a dual-energy transmission X-ray with machine learning, a form

20 Packaging Europe

of artificial intelligence said to learn and remember data to improve the efficiency of metal and e-scrap waste sorting processes.

Meanwhile, on slightly more familiar ground, Ishida unveiled an X-ray inspection system that combines sensor and image processing technology to detect small and low-density foreign bodies inside a pack.

The IX-PD, combined with Ishida’s existing Genetic Algorithm (GA) and Dual Energy technologies, is designed to produce a clear, high-resolution image when detecting low-density items and foreign bodies, including stainless steel wires and bones in fish fillets. It is claimed that the X-ray process is still effective for products that overlap or stand upright within a pack.

Wipotek’s All-in-One Inspection Unit represents a number of different solutions in one machine, combining X-ray for foreign objects detection and precision checkweighing in a single vision system that can also verify label placement, barcode legitimacy, film detection, and validation of expiration.

What was on show at interpack 2023?

One of the centrepieces of Ishida’s offering was CCW-AS, the company’s 11th generation of multihead weighers. Ishida also demonstrated the IX-PD – an X-ray inspection system that incorporates new sensor and image processing technology in a bid to achieve the highest level of detection sensitivity.

Scanware also made an appearance – with a particular focus on an AIenabled inspection solution named ‘Quality Intelligence’. QI follows a modular

21 Packaging Europe

Using an array of tools, deep learning can locate and count complex objects or features, detect anomalies, and classify said objects or even entire scenes. It can also recognize and verify alphanumeric characters using a pre-trained font library.

build, meaning administrative and inspection tasks are handled in separate areas. The data base at the centre evaluates teach-in images, creates inspection parameters and eliminates potential for human error caused when manually inserting parameters.

The highlight on the Minebea Intec exhibition stand was the new metal detector Mitus with MiWave technology. This solution reportedly enables extremely precise detection of foreign objects, even with large product effects.

MiWave is used to modulate the transmission signal for several frequencies, then separate and evaluate them individually using an intelligent algorithm. As a result of this division into several signals, the products can be symbolically inspected from several perspectives. This increased information content apparently means that high search sensitivities can be achieved despite large product effects. In addition, Minebea reports that the technology is less susceptible to fluctuations such as temperature changes or thawing processes.

NSY, Marchesini’s brand-new no-contact monobloc machine for the high-speed automatic inspection of syringes, also made an appearance at interpack 2023.

The monobloc consists of a unit which performs robotized picking of the syringes from tubs/nests and feeds them into the inspection phase in a

single row with no contact between syringes or with metal parts. The heart of this solution is inspection itself, which can reportedly achieve speeds of up to 36,000 syringes/hour.

This part of the machine can contain up to ten inspection stations to inspect every zone of the syringe: flange, stopper, particle detection, filling level, needle shield, defects in the glass walls and integrity inspection using HVLD (High Voltage Leak Detection) technology.

Meanwhile, PFM demonstrated the multi-head weigher MBP 12 C4 in the fragile products industry. The solution has been designed to minimize impact and therefore eliminate the risk of product breakage during weighing phases.

The strength of the 12 C4 multi-head weigher’s design concept is to reduce the product’s falling height as much as possible and thus the impact against rigid surfaces.

It is characterized by 12 weighing buckets fed directly from the vibrating channels, excluding the pre-dosing buckets. Furthermore, the central vibrating plate, used for distributing the product on the radial channels, has a flat horizontal shape: a feature that improves the product’s distribution on the channels and minimizes the product’s falling height coming from the loading system, which is only 80 mm. n

22 Packaging Europe

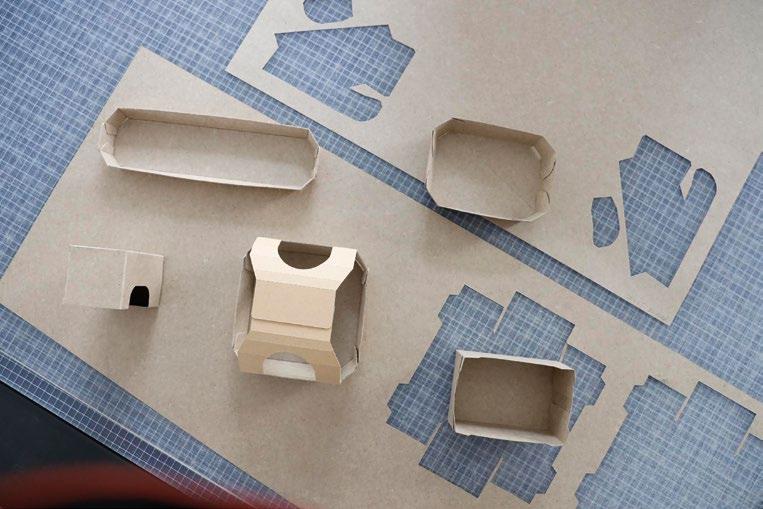

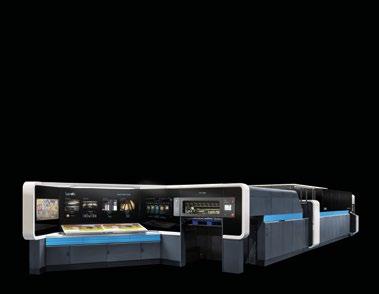

HOW THIS ISSUE WAS

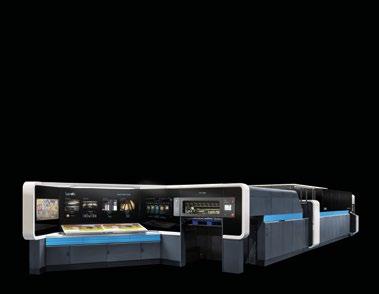

The job of producing each issue of a magazine requires a real balancing act: deadlines to be met, sponsors to close, graphics to approve, and of course – printing it to life. And everything always needs to be faster, cheaper, and of the highest quality. The printing process we chose for this issue is with the Landa S10P Nanographic Printing® Press, which answers all the above.

First, there is the question of speed. A print run of this size would normally require us to print on traditional offset presses: 16 pages per sheet, which then need to be collated to be bound properly. This without mentioning the normal offset make-ready process, which is both time-consuming and wasteful. We were pleased to learn that Nanographic Printing® avoids these common challenges. Pages are printed pre-collated, no make-ready needed, and the issue can be bound in two steps, greatly increasing efficiency.

Next, we look at costs. There are a lot of things that go into the cost of printing a magazine like this, but one of the prominent factors that spring to mind is that Nanographic printing doesn’t use plates while still being able to produce a run of the length required. Aluminum is, after all, not getting cheaper (and is one of the most environmentally hazardous metals to produce). The inks are water-based, too, which contributes to a lower carbon footprint.

Consistency naturally also plays into costs. Colours should be the same whether you’ve got an issue from the start, middle or end of a batch, and any deviation costs time and money to fix. No plate changes and a single set-up for the entire run means we were able to rise to the consistency challenge beautifully.

And lastly, there is the topic of quality. Quality can mean different things for different uses. Some packaging requires strict brand requirements that dictate how logos and colours should come out. Certain verticals, which you will read

about shortly, have strict regulations that require a press of a uniquely high calibre. For a magazine like this, it’s the vibrancy of the colours and the sharpness of text and image that matters to the readers. The Landa presses clear the bar on all accounts. The ultra-small drops create far less colour bleeding, and the wide colour gamut produced as many different rich colours as we needed.

All three of these aspects – speed, costs, quality - could be summed up in one word: sustainability. Not only in the environmental sense, though the reduction in waste certainly helps in that aspect, but in the sense of being able to reduce our footprint not just for this issue, but for the next one as well, and the one after that. And all the while not compromising on the standards of quality that keep us in business.

Being able to maintain a consistent standard, without increasing costs or resorting to corner-cutting practices that often end up hurting the environment, is a tremendous advantage we were happy to be able to showcase in this issue.

23 Packaging Europe

We have gathered some of Landa’s customers to tell us their impressions of using their Landa Presses and how they added value for their own customers and their brands:

BLUETREE GROUP

Bluetree Group, which printed this issue of Packaging Europe on its Landa S10P Nanographic Printing® Press at its South Yorkshire site, is the UK’s largest online commercial printer. It operates several brands, among which are: Instantprint.co.uk, which offers direct to consumer print catering mostly to SMBs; Route 1 Print, the UK’s largest online

trade printer; and Kingsbury Press, a preeminent luxury books printer. All three brands take advantage of the group’s Landa Press.

“Our focus is on high-quality production and ensuring we make innovative use of technology wherever possible to increase efficiencies for customers,” says Phil Tasker, head of the Route 1 Print brand. “The opportunity for us with Landa lies in achieving excellent quality and high resolution on the print with simultaneous cost savings. It ties directly into our commitment to empowering and simplifying the lives of our print buyers.”

Tasker names Landa’s sheet size, flexibility and ability to handle variable data as additional advantages. “What Landa allows us to do is bridge the gap between digital and offset printers as we’re finding that medium runs are becoming more and more popular as budgets get stretched with customers.”

Tasker mentions that the Landa has already opened up new avenues for Bluetree Group into sectors that require advanced levels of scope and expertise. “It’s looking particularly exciting when it comes to producing large scale floorplans for high end American property developments which can demand up to 100 versions in an A1 format. Landa is allowing us to actively problem solve on projects like this that have an extra element of complexity.”

24 Packaging Europe

“It’s looking particularly exciting when it comes to producing large scale floorplans for high end American property developments which can demand up to 100 versions in an A1 format. Landa is allowing us to actively problem solve on projects like this that have an extra element of complexity.”

MAYR-MELNHOF (MM) PACKAGING PHARMA & HEALTHCARE

Mayr-Melnhof Packaging is a leading international producer of folding cartons and is organized in four different business units. Among others, the MM Packaging Pharma & Healthcare business unit is fully dedicated to the manufacturing of secondary packaging for this industry, providing folding boxes, leaflets, labels and booklets from 28 sites across the world.

Its Landa S10 Nanographic Printing® Press is located at its Bradford site, which produces cartons and leaflets for the pharmaceutical industry.

“For us it’s important to have the Landa Press for its larger sheet size and flexibility,” says Marga Romo, Head of Marketing at Pharma&HC business unit. “We see how runs are getting shorter as a trend in the pharma industry. That’s why we looked towards a digital solution and specifically the Landa.”

The pharma industry has strict quality and colour requirements, which the Landa was extensively tested for. “Our customers don’t specify which technology they want their product printed on,” says Romo. “We make that decision depending on factors such as batch size with absolute consist-

BLUEPRINT AG

INits 27 years of existence, BluePrint has grown into one of the biggest printers in Munich. The Landa S10P Nanographic Printing® Press is its latest press, starting production one year ago.

BluePrint does much of its business with both the automobile industry and the pharmaceuticals industry. Many of the jobs, especially for the Swiss market, requires having multiple versions of the same product in

ency in quality regardless of the technology used. Some therapies, such as oncology, have small batches. We can produce these in the Landa and the customer knows their quality is guaranteed.”

Romo also highlights the decrease in waste associated with the Landa. “During the cardboard shortage in COVID era, digital printing enabled us to generate a greater number of jobs while using less material, ensuring we could meet our customers’ needs during a challenging period.”

different languages. “We may receive a request for a pharma customer that wants the same run with 80% in German, 10% French, and 10% Italian,” says Gerhard Meier, CEO of BluePrint AG. “We must have consistency across all languages. That’s where we rely on Landa’s flexibility. We can send the entire batch as one job, without needing to switch plates from one language to another, and the costs are much lower than they would be if we were to print the whole thing on a digital press. Coupled with runs getting shorter, we found that we can print most of our jobs through the Landa at a good price point.”

Blueprint AG considers itself unique for its adoption of new technologies. It is currently the only printer in Germany that prints in seven colours. “One of our clients is a bookazine called ‘Rize’ which we wanted to ensure printed in the highest quality with no compromise. Printing on the Landa in seven colours resulted in such intensive colours and sharpness, we’ve had some of the readers of the bookazine come to us as customers wanting to get the same level of quality for themselves.”

25 Packaging Europe

“We must have consistency across all languages. That’s where we rely on Landa’s flexibility. We can send the entire batch as one job, without needing to switch plates from one language to another, and the costs are much lower than they would be if we were to print the whole thing on a digital press.”

“For us it’s important to have the Landa Press for its larger sheet size and flexibility.”

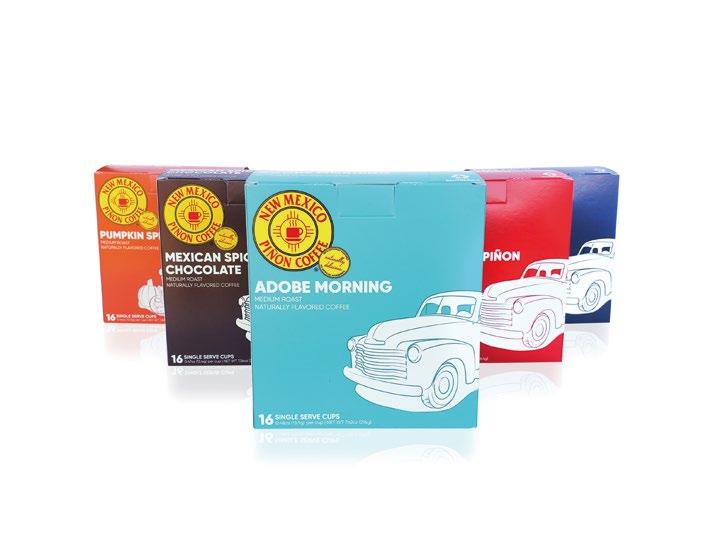

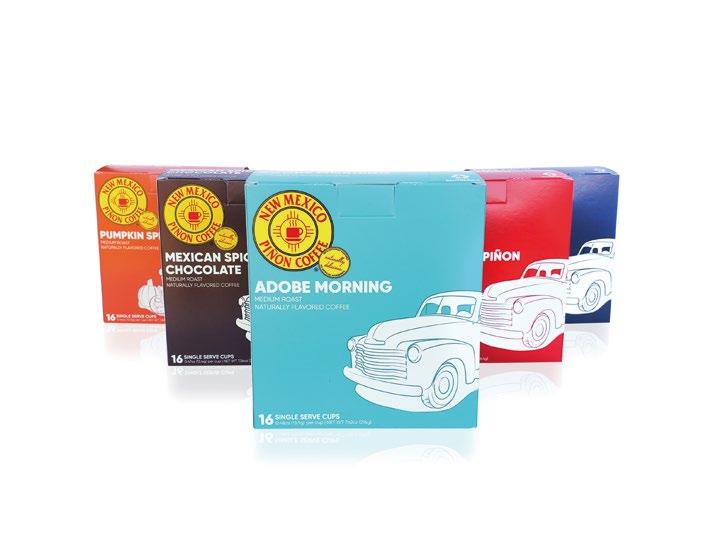

SOUTHERN CHAMPION TRAY (SCT)

Founded in 1927 in Tennessee, Southern Champion Tray specializes in paperboard packaging, supplying packaging for products from food service to retail, nutraceuticals, beauty, pet, and more. Their Landa S10 Nanographic Printing® Press is located at their Mansfield site.

“Our business model is based on rapid response,” says Brad Haralson, General Manager at Southern Champion Tray. “We offer a quick turn to market application, running at about two to three weeks from start to finish. The Landa was a great fit for us because it allowed us to get a little bit more specialty in our applications while also giving our customers the prospect of doing smaller volume runs with more customization without sacrificing speed.”

A particular case that exemplifies the value that Landa brings to SCT’s customers comes from a brand that produces energy bars. “Each differ-

GROUPE PRENANT

Groupe Prenant is a French family-owned printing company with three factories surrounding Paris. Its Landa S10P Nanographic Printing® Press has been with the company for four years.

“Groupe Prenant is able to have a response on quite any subject with different teams with different plans,” says Philippe Vanheste, Deputy General Director at Groupe Prenant. “From a million copies of a simple document to a high value document with small quantities and personalized application. The latter is especially suitable for the Landa, which can handle variable data in ways that classical print simply cannot.”

A stand-out case for the Landa came in the form of a puzzle job, which involved printing both the puzzle and its packaging. “The most expensive stage for a puzzle is cutting the forms, but after that, it’s printing with classical offset. Offset print is not expensive with a large quantity, but for a puzzle company it’s very important to have as many versions at the same time, with the unit cost as low as possible. Changing from offset to Landa we were able to make that marketing strategy work. It essentially opened a new market for Groupe Prenant.”

The Landa color gamut also played a part in that case. “Originally, the customer asked for four colour plus an additional spot color. We were able to show them that printing in seven colours we have the ability to reach the same quality as an offset printer with the added pantone® tone or better.” n

ent flavour of bars means a plate change on an offset press,” states Tara Duckett, Sales Manager at SCT Mansfield. “With the Landa, we were able to avoid the eight hours of make-ready that would be necessary for this type of job. Another customer, a seafood company, has 14 different versions in their product line. It’s so much easier to print a job like this on the Landa, without the common worries associated with gang or combo running.

“What’s more, the Landa’s colour gamut allowed us to produce the type of vibrant colours that help the customer’s product stand out. Us being able to print three or even more spot colours without increasing the price was tremendous for them.”

“With the Landa, we were able to avoid the eight hours of make-ready that would be necessary for this type of job. Another customer, a seafood company, has 14 different versions in their product line. It’s so much easier to print a job like this on the Landa.”

Packaging Europe 26

“Changing from offset to Landa we were able to make that marketing strategy work. It essentially opened a new market for Groupe Prenant.”

FOCUS ON PACKAGING PRINT: LOOKING AHEAD TO TOUCHPOINT PACKAGING AT DRUPA 2024

The world of packaging is dynamic and fast-paced, and packaging printing is no exception. A year ahead of drupa 2024, Elisabeth Skoda takes a closer look at the touchpoint packaging event series and explores industry megatrends.

Packaging Europe is excited to support touchpoint packaging as a content and media partner. In its third iteration, the event series, taking place from May 28th to June 7th, will offer drupa visitors a dynamic platform which will zoom in on a range of topics around packaging printing and will focus on environmental, technological, economic, social and legal aspects. The event will pinpoint challenges, present innovative solutions and showcase added value, impulses and growth potential for packaging solutions in a constantly changing world.

Visitors, in particular brand owners, will be able to attend presentations that feature best practice examples and innovative packaging design, and that give an overview of the latest developments in design and production and gain useful insights. There will be no charge for the event.

Packaging experts from across the value chain, from material sourcing to production and workflow to converting and retail will take part as partners or active participants. Participants include major drupa exhibitors such as esko, Koenig & Bauer, Heidelberg, HP, Zecher, hubergroup, KURZ, manroland Goss and Saueressig.

drupa continues its successful partnership with the European brand and packaging design agency edpa, which will be responsible for the concept and the running of the event. Marketing intelligence agency Mintel will support the event with specialist knowledge.

Furthermore, all members of the packaging printing value chain are invited to become exhibiting partners, whether it’s brands, material suppliers, convert ers or embellishment experts. Find out more at www.drupa.com.

Ahead of the event, we asked key stakeholders about what visitors can expect from the touchpoint packaging event and what key industry trends they have observed.

What can visitors expect to see at touchpoint packaging?

epda Vice-President Uwe Melichar: We want to discuss topics ‘Beyond machines and materials’. It’s important to involve all stakeholders of the value chain and to take a holistic look at things, including the design perspective, we believe. We will focus on use case scenarios and inspire with future-oriented product and packaging solutions.

What are the key trends that will be addressed at the event?

Claudia Josephs, epda General Manager: Our objective is to show visitors how new technologies in print and packaging can meet the needs of the end-consumer and inspire brand owners when developing new products and packaging. For that purpose, we have defined five key topical areas reflecting the main overall trends. These topics will be leading exhibition contents as well as the all-day conference programme: Neo-ecology, glocalization, taxes and regulations, connectivity and the consumer’s mind and behaviour.

What

major trends

and developments

observed in the packaging industry since the last drupa?

have you

Dr Andreas Pleßke, Vorstandssprecher Koenig & Bauer: Today, packaging has considerably more functionality. It’s not only about protection, transport, shelf life or the marketing message at the point of sale. The next phase has started, and traceability, authenticity and augmented reality solutions that offer added value to customers are in high demand. Packaging is becoming interactive. On top of that, brand owners and their customers demand sustainable packaging.

Christian Menegon, Business Development Manager Industrial Products at HP: A very visible newcomer amongst the trends is sustainability. This word is too generic to define measurable and comparable targets and is therefore hard to quantify. For instance, an ink manufacturer will use fewer

27 Packaging Europe

motors; a brand owner will reduce its inventory and therefore produce less waste; at home, I have replaced all halogen lamps at home with LEDs, etc… All of these actions are important but which one counts more than the others? While comparison is not necessarily possible and maybe even not needed, it is good that industry players are innovating to save the planet; this leads to the implementation of changes, process innovations, workflow improvements, etc. It is fair to say that cooperation between actors of the value chain will bring even better results. In the past any improvement was geared more towards better specs, performance and cost reduction; nowadays the new eco-system brings different targets. Efficiency, waste reduction and circularity can be seen as the ‘headlines’ for whatever internal development plan a given company acts on, with many diverse sub-levels.

Jan De Roeck, Esko Director of Marketing, Industry Relations & Strategy: Given that 2020 saw the need for drupa to go virtual due to the global pandemic, the last physical event was in 2016 – seven years ago, which really is an eternity in terms of technological evolution. With that in mind, the main trends I have observed since are the ongoing acceleration of digital transformation and the ever-growing impact of environmental sustainability. Taking a bit of a higher vantage point to look at these two megatrends, I really believe the end-user of packaging, i.e. the consumer, is impacting both of these megatrends. The macro-economic and societal megatrends that are happening around us – which include supply chain issues, inflation, a pandemic, online shopping, consumer trends, the war in Ukraine, political polarization, and many more – have a profound impact on how and what consumers buy. As a consequence, brands and retailers accelerate the speed at which they respond to these changing consumer needs.

of consumers. The packaging and label supply chain needs to follow. Pressure on lead times is the most frequently heard business challenge, with quality now being the expected absolute minimum, table stakes if you will, and cost pressure never having left the scene. Given that, there is only one way forward for packaging and label converters: to seek operational excellence and continuous elimination of waste and cost out of the production process. And the environmental sustainability debate fundamentally also starts with the consumer. A profound desire to safeguard our planet for generations to come is an underlying societal trend with a profound impact on packaging. Reduction, recycling and re-use of packaging may well be a substrate-centric discussion in the first place, but every step in the process from concept to shelf can contribute to waste reduction. This way sustainability and operational efficiency are tightly connected. n

Find out more about the event at https://www.drupa.com/

28 Packaging Europe

UNPACKING INTERPACK A LOOK BACK AT THE 2023 EVENT

In May, interpack, the fixture in the packaging landscape returned as an in-person event to Düsseldorf in Germany for the first time since 2017. With visitors from 155 countries and a total of 2,807 exhibitors, the trade show had a massive scale, covering 18 trade fair halls. We look back on a busy and successful event.

interpack 2023 was organized into seven main areas according to enduse: food, beverages, confectionery and baked goods, pharmaceutical products, cosmetics, non-food and industrial goods. Each of these hosted exhibitors from every part of the value chain, from packaging material and packaging producers to processing machinery, smart packaging technologies, labelling and finishing, and everything else that goes into bringing a pack from concept to the end of its life.

The Packaging Europe team was in the middle of it all with our own stand which we used as a base and to promote our Sustainable Packaging Summit in Amsterdam in November – it was great to connect with so many of you, the response was overwhelming. In addition, we visited stands, attended press conferences and reported on the latest developments and

innovations launched at the event – of which there were many! We also successfully launched our ‘60 seconds with…’ video interview series, which proved very popular. Last but not least, our brand director Tim Sykes hosted three of Taghleef’s Ti Talks Live sessions – high-level discussions with industry experts from the full value chain, as well as Kloeckner Pentaplast’s panel discussion on what is preventing the industry from accelerating a circular future for plastic packaging.

Given current market developments and the challenges and opportunities faced by the industry, interpack offered a valuable space to exchange ideas. Rapid transformation is happening, and the need to automate, the will to act sustainably and changed consumption habits are all expressions of transformation.

29 Packaging Europe

Attracting plenty of attention were specials such as the interpack Startup Zone, the joint stand Co-Packing, several award ceremonies spotlight ing exciting packaging innovations, the ‘SAVE FOOD Highlight-Route’ with new approaches to fighting global food loss and waste and last but not least, the ‘Women in Packaging’. We at Packaging Europe greatly enjoyed the event – it was inspiring to hear experiences of successful women in the packaging industry and to network.

Spotlight on packaging innovation

interpack’s strategic orientation towards the four Hot Topics: Circular Economy, Resource Management, Digital Technologies and Product Safety found concrete expression in numerous innovations – far too many for the scope of this article, but let’s shine a spotlight on just a few.

In anticipation of the EU’s upcoming Sustainable Products Initiative, a drive-based energy monitoring software from Baumüller is designed to help companies calculate and provide evidence of their energy usage at various points in the supply chain. Meanwhile, Syntegon is aiming for a 30% reduction in energy consumption with the ‘modern electronics concept’ of its LFS filling solution for sauce, dips, and other liquid or viscous deli foods.

Material optimization is another progress point. While the LFS filler is compatible with both paper and polypropylene, ROTZINGER Group’s WRF Flex slab former widens a slab and compresses it to the finished width –reducing the density at the edge of edible bars to shrink or even eliminate packaging trims in a waste reduction effort.

Heidelberger Druckmaschinen AG unveiled an innovation for the segment of high-volume folding carton printing, which it describes as a strong growth

30 Packaging Europe

reduces the total cost of ownership in industrial packaging production.

Blue Ocean Closures, Stora Enso, and AISA launched what is claimed to be the first paperboard tube with a fibre-based closure, reportedly consisting of over 85% fibres. All the components of the new tube are designed for recycling. The fibre-based screw cap – developed by Blue Ocean Closures

to increase resource efficiency, thus utilizing fewer materials than conventional multi-layered and complex materials.

Gauging the state of the industry

Düsseldorf’s interpack has always provided a triennial snapshot of the

functionality, from flexible barrier papers to moulded fibres, with a view to realizing opportunities to offer the renewable/recyclable substrates in applications dominated by fossil-based plastics. I recommend watching the products being brought to market by key players such as Stora Enso and Metsä, as well as disruptive newcomers such as Delfort.”

He notes that meanwhile, in plastics there was less breakthrough innovation on show, for the reason that much of the breakthrough innovation around monomaterials and design for a circular economy has already taken place.

“At least three times in Düsseldorf I heard the same point being made about circular plastics: ‘We know what we need to do: now it’s all about realizing it.’ For plastic packaging, the challenge is no longer primarily technological, but one of aligning stakeholders around harmonized strategy and investment. As such, some of the most inspiring conversations I had at interpack involved start-ups (such as Resycure and Recyda) who are bringing smart information-based approaches to removing friction from the circular economy.”

32 Packaging Europe

n

WHAT DOES THE DIGITAL TRANSFORMATION MEAN TO PACKAGING MANUFACTURING?

Technologies such as cloud-based manufacturing, AI, and the Internet of Things (IoT) can all combine to deliver solutions, optimize production, empower the workforce, and drive sustainability. By transforming operations in manufacturing to more streamlined processes, digital solutions are shifting the dynamic of the packaging value chain.

Roger Gaemperle, head of industry strategy and marketing EMEA consumer segment, Rockwell Automation, highlighted that the packaging industry’s digital transformation impacts not only the technology involved, but also the people and domain expertise.

“You need a range of skills to successfully implement and utilize digital technologies, which requires a high level of expertise. So, I think in the end, it impacts all of them,” Roger described. “While digital solutions enable new capabilities and optimization of processes and production, they also require changes in processes and a change management approach usually, depending on the scale of digital transformation.”

Increased productivity and efficiency

In many organizations, data is often stored in separate silos, such as separate databases or software systems. This can create inefficiencies and make it difficult for different teams to collaborate and share critical information. However, by investing in cloud-based systems and integrated software platforms, these data silos can be broken down, allowing for better sharing of insights, more informed decision-making, and improved performance.

“Producers need to find new ways to decrease costs and boost productivity,” Roger stated on the topic of innovation in a growing digital landscape.

One of the ways this can be achieved through digital operations is with the utilization of augmented reality tools. These tools allow for remote commissioning, where maintenance and repair work can be conducted and discussed from anywhere in the world. Experts can easily access and share data remotely, resulting in significant cost savings. Additionally, augmented reality tools can be used for guiding workers through different maintenance or troubleshooting steps. This not only increases the quality of their work, but also safety. At the same time, less skilled workers can be utilized to perform the required work steps supported by connected remote experts.

“Travel restrictions during the COVID-19 pandemic made on site machine maintenance and also factory acceptance tests challenging. Digital tools that connect local machines and workers with remote experts helped solve some

of these challenges and their large benefits remain even in a post-pandemic time,” Roger emphazised.

Rockwell Automation’s cloud-based wireless software platform enables Premier Tech Chronos, an Italian processing and packaging machine builder, to share vital diagnostic information with customers to enable predictive and preventative maintenance activities, accessible via mobile technology. The capabilities can range from flagging issues to fulfilling orders and scheduling maintenance. As a result, machine health and maintenance can be better tracked and improves overall performance.

Another way to increase productivity is with robotics technology, which enables greater productivity and efficiency through packaging operations, leading to improved productivity within the workforce, as well as addressing the potential shortage of skilled workers.

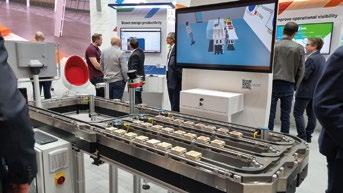

Additionally, Rockwell Automation’s iTRAK system overcomes the limitations associated with conventional manufacturing methods. It allows for independent control of the machine’s magnetically propelled movers and facilitates automatic changeovers, thereby reducing the need for system restarts. This technology creates opportunities for automated processes, which can relieve the workforce and improve speed and accuracy that aligns with today’s packaging production needs.

33 Packaging Europe

As with many other industries, packaging manufacturers are seeking to digitize their operations. Although not an entirely new concept, it is yet to be adopted across all operations in packaging manufacturing as organizations look to prioritize opportunities that enable immediate return on investments and promote long-term growth.

Improved product quality

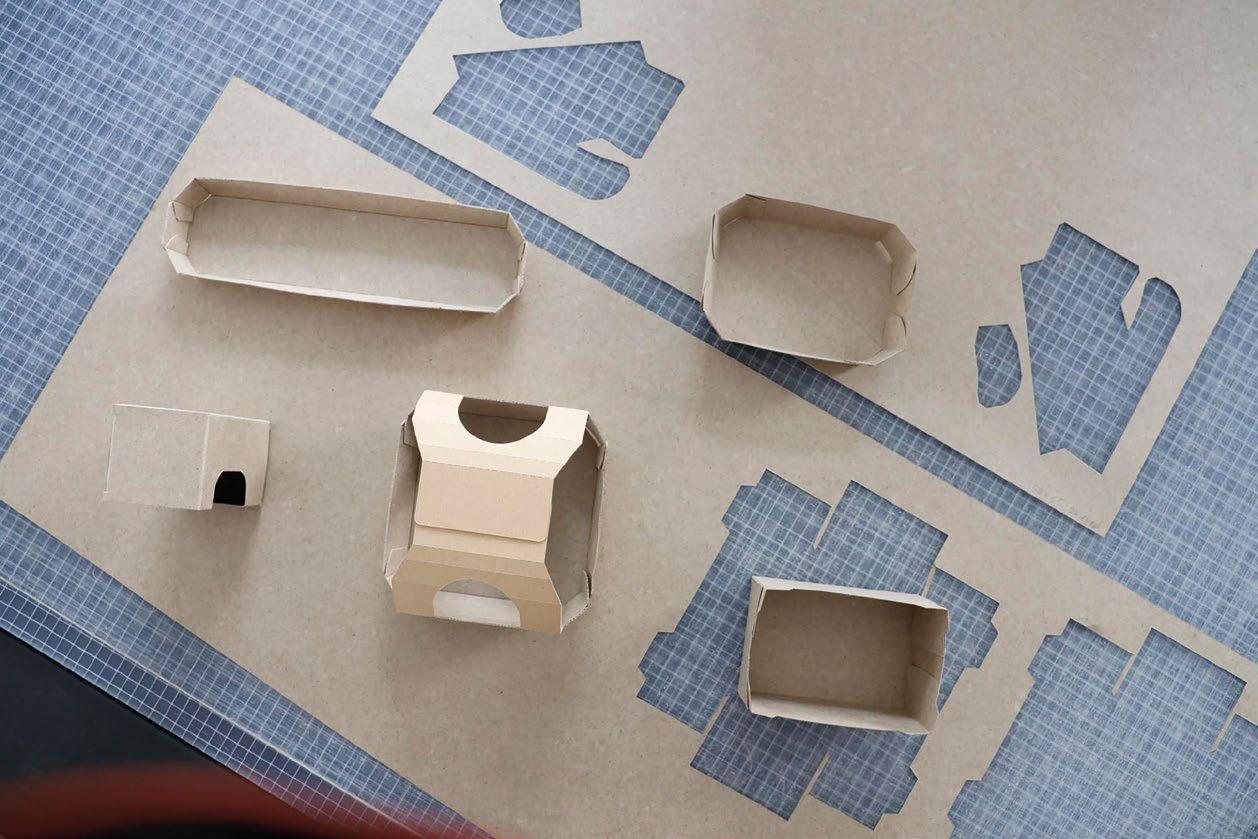

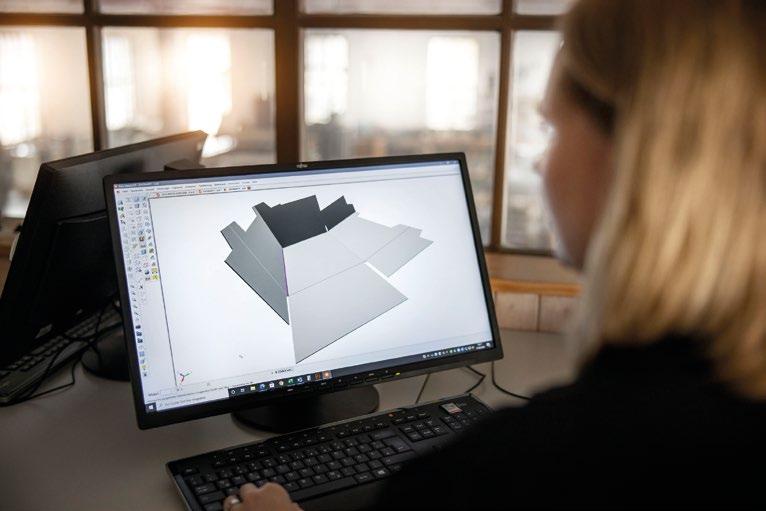

Digital solutions can provide prototyping capabilities, saving time and money that would otherwise be wasted on producing an entire machine or production line only to discover flaws that require starting over again.

Traditionally, machine builders built and assembled physical prototypes to test the machines and to identify potential issues, now with virtual prototypes manufacturers can test their functionality and evaluate their suitability before committing to large-scale production. This process also enables manufacturers to quickly identify potential design issues early on, ensuring that the final product meets the required quality standards, avoiding costly production mistakes down the line.

“You can design the machine or even the whole production line virtually and you don’t have to build a prototype, which would cost money and time,” Roger explained.