Packaging Europe Ltd

vh@packagingeurope.com

@PackEuropeVicky

It’s that time of year again when we throw open our virtual doors and beckon through innovations from the length and breadth of the value chain. Yes, the Sustainability Awards 2023 are now open for submissions. Described recently as ‘the Nobel Prize for sustainable packaging innovation’, the competition is free to enter and provides an annual snapshot of the most important new technologies, solutions and initiatives throughout the value chain. As ever, this year’s awards will be independently judged by a diverse, international jury. Submissions will close on 17th March so start getting your entries in here: packagingeurope.com/sustainability-awards

While we start the new year with the same sustainability priorities – even as these increase in urgency with the deepening climate crisis – the awards submissions we receive always act as a timely and welcome reminder that there are still many positives to build on. That there is great work being done in many areas. On that vein, there is of course another major event happening this year that will no doubt offer some more of that positivity: interpack 2023. Read our first look ahead to the show in this issue, in which we take a look at some of the key themes it will be covering and explain how Packaging Europe will be participating.

Also in this issue, Emma Liggins has been examining the subject of renewable materials for food packaging, and the various issues this raises around food-contact regulations. I take a look at the prospects for the growing waterless products segment – including shampoo bars and concentrates – getting some insights from both the brand and the design perspective. Elsewhere, Elisabeth Skoda talks to representatives from Heidelberg and Bobst about the role packaging converters play in increasing sustainability and efficiency along the value chain.

We have some big interviews in this issue. The first comes courtesy of Frances Butler, who speaks to Avery Dennison and Covectra about the importance of packaging technology in all its forms for consumer protection. Meanwhile, Elisabeth Skoda talks to Certified B Corporation Mr Green Africa and its investors Dow about how the company is working to enable more efficient diversion of plastic waste and help to close the loop across Africa.

We also have a comment piece from Andrew Capper of design agency Echo, who pinpoints some of the key items that should be on FMCG brands’ sustainability agendas for 2023 and beyond. Finally, there are of course our regular active and intelligent packaging spotlight and our On Second Thoughts… column – the latter of which is this time contributed by James Harmer of Cambridge Design Partnership.

All that remains to be said is we hope you all had a positive start to the year. We look forward to seeing many of you at interpack (and don’t forget to get those Sustainability Awards entries in!). n

Victoria HattersleyDescribed recently as ‘the Nobel Prize for sustainable packaging innovation’, the competition is free to enter and provides an annual snapshot of the most important new technologies, solutions and initiatives throughout the value chain.

As the world’s most important packaging industry event, interpack – taking place at Messe Dusseldorf from 4-10 May – is the place to be this year for anyone with a vested interest in the sector. Here we highlight some of the key themes we’re looking forward to learning more about this year, as well as how Packaging Europe itself will be participating.

interpack is where the global packaging community comes together to learn about and share its most important innovations. The sheer magnitude of such an event can allow visitors to appreciate – if they haven’t before – just how reliant each member of the value chain is on the others.

It’s also an opportunity to discover the ‘next big things’ on the horizon and how they can help the industry to meet its priorities for sustainability. As the world’s most important packaging industry event, interpack tends to synchronize industry calendars and innovation cycles. Many OEMs have timed major product launches for May 2023, keeping Packaging Europe’s journalists very busy in seeking out the most important advances across packaging materials and machinery. This work starts well before the expo itself, featuring a dedicated feed on the website, newsletters and live foretastes of the interpack innovation landscape on LinkedIn.

To help visitors navigate such a huge-scale event covering 18 trade fair halls, interpack 2023 has been organized into seven main areas according to end-use: food, beverages, confectionery and baked goods, pharmaceutical products, cosmetics, non-food and industrial goods. Each of these will host exhibitors from every part of the value chain, from packaging material and packaging producers to processing machinery, smart packaging technologies, labelling & finishing, and everything else that goes into bringing a pack from concept to the end of its life.

Aside from the show itself, don’t forget that there will be plenty of other events happening in the vicinity. An example is NVC’s PUMA project,

which will be conducting a conference on the eve of the show. (For those interested, details can be found here: https://www.en.nvc.nl/events/de1e-puma-wereldconferentie/)

This year, interpack’s organizers have identified four big themes to take note of: Circular Economy, Resource Management, Digital Technologies and Product Safety. It’s important to note that while each of these things is important in its own right, there are inevitably overlaps between them. (Many digital technologies, for example, can be used to improve product safety or help further the circularity agenda.)

Below, we take a closer look at these key themes. To give visitors some idea of the kinds of innovations they might expect to see, we also give some snapshots of projects we have taken particular interest in over the past year or so.

We all know by now that circularity is the watchword for packaging. In order to meet its waste reduction targets, the industry needs to be putting as many resources back into the value chain at the end of a pack’s lifetime as possible. This involves design for recycling, focused on areas such as renewables, monomaterial solutions, biomaterials as well as an increased emphasis on making reusables a more viable part of the sustainability equation. Expect to see examples of these and much more at interpack.

Given the particular scale of the plastic waste problem, a great deal of the drive towards circularity is also focused on improving the recyclability – and recycling infrastructure – of plastics, whether these are traditional, fossil-based materials, or biobased. We’ve seen plenty of innovation in the area of healthcare packaging, where recyclability can be an issue when it comes to products such as blister packs. For example, Amcor Healthcare’s recent AmSky blister system is a recycle-ready blister package with thermoformed bottom web and lidding. Both elements are made from HDPE, which allows for whole-package recyclability.

When it comes to plastics recyclability, not only the package itself but other components such as dispensing systems – the majority of which cannot currently be recycled in existing streams – are being modified to meet the demands of a circular economy. A dispensing solution specifically for the needs of the booming e-commerce sector is Aptar’s Future monomaterial pump – a finalist in our 2022 Sustainability Awards. This solution is fully recyclable when paired with a PE or PET bottle.

There is also, of course, an ongoing campaign from CELFEX and its members – among others – to build a circular economy for flexibles, so expect to see much evidence of this at interpack 2023. Over the past year in this space we have seen Constantia Flexibles launch what it claims is a recycle-ready, mono-material polypropylene (PP) laminate with high chemical resistance for pharmaceutical applications; and NOVA Chemicals introduced a mono-material oxygen barrier packaging material which was shortlisted in the ‘Recyclable Packaging’ category of our 2022 Sustainability Awards.

Bioplastics are also likely to take a prominent place in this year’s exhibition; European Bioplastics is exhibiting and many of its members will also be in attendance. Given that the EU still prioritises reuse and recyclability over compostability, we can perhaps expect to learn more about how the bioplastics industry intends to convince EU legislators that it can have a stronger role to play in the circular economy moving forward.

On to renewables: more advanced barrier papers that are recyclable in existing streams have been a major theme of recent years. We have seen many examples from the likes of Mondi with their FunctionalBarrier Paper, to Rotor Print’s high barrier ready-to-recycle paper. But to ensure such papers can be scaled up, it is also necessary to have compatible machinery solutions – many brand owners may be reluctant to make the shift to paper because of the potential for costly machinery replacements. Mitsubishi HiTec Paper and SN Maschinenbau have collaborated on a solution that allows the former’s recyclable, water-coated barrier papers to be processed on the latter’s pouch packaging machines without the need for retrofitting. Look out for more collaborations between machinery and material producers.

The world has limited resources. When you combine a lack of materials –particularly good-quality recyclates and sustainable feedstocks – with supplychain bottlenecks it creates problems for the entire industry. And supply chain issues have only been exacerbated by the ongoing consumer preference for online purchasing, itself accelerated by the Covid-19 pandemic.

The more efficient management of resources will include a focus, among other things, on the switch to renewable energies rather than fossil-based. Plastics based on renewable feedstocks will also come to feature more highly in the coming years, as will (as we have already seen above) increasing the applications for paper in order to reduce our reliance on plastics.

Last year, for example, TotalEnergies launched RE:clic, a new range of low-carbon recycled polymers aiming to reduce the carbon footprint of end-use applications by improving their energy efficiency. Meanwhile,

Hoffmann Neopac’s BlueMint Steel product, another of the finalists in our Sustainability Awards, is claimed to provide CO2 savings up to 70% in the

A growing emphasis on reusables will also help the industry to make the best

We’ve heard about the Internet of Things, but let’s not forget that the Inter net of Packaging is also on the horizon. Digital technologies – whether RFID, NFC tech, digital twinning, augmented reality or something else entirely –are going to increase in future as the market adapts to new realities.

marking system to enable automated sorting of packaging and radically improve recycling rates. We recently saw P&G transitioning its laundry brand, Lenor, to shrink-sleeved transparent rPET bottles with digital watermarking, as part of this initiative, in order to enable automatic sorting and enhance recyclability.

Artificial Intelligence (AI) will almost certainly feature at interpack. CO2 AI by Boston Consulting Group is an end-to-end, ready-to-deploy, AI-powered digital solution that it says corporations from all industries can use to quantify emissions accurately – and find solutions to reduce them at scale.

Digital twinning is yet another big topic. Merck KGaA and Gerresheimer have jointly developed a digital twin solution to increase traceability and trust in crucial steps along the pharmaceutical supply chain.

To learn more about the many, many new smart packaging technologies in development across the industry or recently released to the market, why not take a look at the ‘AIPIA’ section of the Packaging Europe website: https://packagingeurope.com/topics/smart-packaging

It might perhaps be more accurate to describe this as the ‘product protection’ spotlight. There is a clear balancing act here, of course: on the one hand, the package must be robust enough to keep perishable products, particularly food and pharmaceuticals, intact until they reach the consumer; on the other hand, it must ideally be recyclable or reusable, and be designed to ensure the least environmental impact.

But aside from protecting the product and reducing waste, packaging can add value in additional areas. Intelligent packaging solutions (and here, of course, we see a crossover with the ‘Digital Technology’ theme) can be key here. Techs such as RFID can help with monitoring expiry dates as well as with tamper-proofing, while QR codes can help the consumer feel more empowered by providing them with additional information about the product and its provenance.

bridge the gap between the need for a sustainable solution while also protecting the product. One such is the edible ‘peel’ from Apeel Sciences, which can be applied to the outside of fruits and vegetables to create an optimal microclimate to slow the rate of water loss and oxidation.

Twelve members of the Packaging Europe team will be present at interpack, including five of our reporters and content specialists. However, the Project:interpack begins well before the packaging world descends on Dusseldorf in May. Our mission before, during and after interpack will be a combination of listening, learning and connecting the dots of the bigger picture for our audience across the value chain.

The many of you also traveling to Dusseldorf are likely to come across Packaging Europe staff across the various halls of the Messe. We’ll be moderating public panel discussions on various booths and stages throughout the week to discuss the bigger challenges on the packaging agenda. Our crews will also be shooting videos, conducting interviews and live posting from the fairgrounds. Packaging Europe will also have a stand (North Entrance level 1, booth 16). We’ll use this as a platform to promote and discuss the environmental agenda ahead of the Sustainable Packaging Summit and Sustainability Awards (taking place 13-15 November in Amsterdam). Everyone is welcome to drop by – rest those tired feet and let us know what matters most from your vantage point in the packaging ecosystem.

Finally, once we all go home we’ll digest our collective experience of interpack and attempt to map out the shape of the forest from the thousands of trees we have examined in Dusseldorf. Over the years, each edition of interpack has signalled the industry’s step-changes in technology and the marketplace’s shifts in emphasis. What will be the meta-stories of interpack 2023? Our Content team will let you know in our extended review.

Food packaging manufacturers have been dipping their toes into the prospect of using renewable materials, and while it is a sustainable solution in theory, it hasn’t all been smooth sailing. Emma Liggins looks back on the conversations surrounding food-contact renewables, takes stock of current innovations, and forecasts where and how the sector will develop.

Areport published by McKinsey in February 2022 – titled ‘Sustainability in packaging: Global regulatory development across 30 countries’ –assessed the unfolding progression in sustainable packaging regulations, emphasizing that packaging companies must keep up and stay compliant. In a closing statement, it argued that investment at a product and technology level should be considered, as it would “be important to identify partnering opportunities for circular recycling, including renewable materials”.

Packaging manufacturers have undoubtedly been making valiant efforts to lean into a renewable future. To name one example, Siegwerk has been a major player in developing the field of renewable inks. It was crowned the overall winner of the 2022 Sustainability Awards for its UniNATURE range, said to replace fossil carbon with up to 50% of its biorenewable alternative – nine times the amount found in standard water-based inks – and combine natural and conventional resins so that no existing processes need to be adjusted.

Prior to its nomination, the company also unveiled SICURA Litho Pack ECO, its UV offset ink series for paper and board applications thought to

contain over 40% renewable and vegetable-based components. Its share of bio-renewable content is said to be four times higher than standard UV inks – and, given that there is not yet a universal consensus as to how to calculate bio-renewable content in printing inks or even a standard definition of bio-renewable raw material, the company established its own.

“When calculating the bio-renewable content of our inks we focus on the actual share of raw materials with bio-renewable origin that are present in the respective ink formulation, taking all constituents into consideration,” explained Alina Marm, head of Global Sustainability and Circular Economy at Siegwerk. “Thereby, our calculation refers to the sum of all components present in a raw material, also taking into account substances and solvents – except water – that are excluded in the methods commonly used so far, such as ASTM D6866, EN 16640 and NAPIM.”

Despite this progress, SICURA Litho Pack ECO is specifically excluded from food-contact applications. Even beyond the world of inks, this seems to be a particular sticking point for renewable materials. Some are not

deemed safe to package edible products, while others that might otherwise be suitable fail to live up to the environmental benefits promised to consumers – and these issues have been stalling progress towards sustainability for the last few years.

In her 2020 Report to the Food Standards Agency, Marina Renton raised concerns about the legislative ambiguity surrounding food-contact biomaterials. She believed that progress in the field was proving too rapid for the EU regulatory framework to keep up, and that the use of such materials is therefore risky. One shortcoming she pointed out was the low availability of industrial composting facilities – a concern echoed more recently by Laura Collacott, freelance editor at the Ellen MacArthur Foundation. In an article for Packaging Europe, she indicated that fewer than 100 facilities currently exist in the US, and that the ideal process of in-vessel composting is energy-intensive, requiring several weeks’ worth of heat and oxygen inputs.

On that note, Collacott also stated that, while current data is sparse and LCAs are not thought to track environmental impacts in the long term, the few that have been carried out regarding compostable materials suggest that they can even have a higher environmental impact than their non-compostable alternatives. This references an analysis undertaken by the Oregon DEQ in 2018 that reviewed eighteen years’ worth of scientific literature and concluded that the production and use of compostables could cause more harm due to an inability to recover nutrients or value from the material, inconsistencies in operations from facility to facility, the “potential for higher burdens” when producing feedstocks for compostable packaging, and more.

In addition, a House of Commons report from 2019 apparently doubted that recycling infrastructure and consumer awareness of disposal methods had yet reached an appropriate level for compostable packaging to be effectively scaled up in the UK, leading to another concern of Renton’s – the adequacy of information provided to consumers on product labels. Although EU regulation forbids the intentional misleading of customers regarding sustainability, it was her view that, at the time of writing, there were not enough restrictions on the claims brands could make to the biobased content and biodegradability of their packaging.

Even now, University College London’s Big Compost Experiment, launched in the same year, receives photographs through its website in which participants have placed industrially recyclable or biodegradable packaging into their compost. 85% of respondents to the accompanying survey have expressed their

desire to buy compostable packaging while admitting that they might struggle to identify it on the shelves – and, of the 456 twelve-month composting experiments recorded in November 2022, 148 reported that pieces of discoloured packaging larger than 2mm remained visible within composting timeframes. Clearly, then, there is still progress to be made, in Britain and beyond.

More generally, Renton cautioned that the longevity and safety of biobased food contact materials needed to be tested further. Risks posed by such packaging were said to include additive migration, particularly where heavy and bioaccumulative metals such as lead are concerned (although it is unusual for such substances to contaminate at high levels). Similarly, the safety of composite materials, reactions to allergenic compounds, and potential lowering of shelf life in the case of food-contact products are all possibilities that she argued must be tested further.

To this day, it is much easier said than done. As explained to us by Nikko Markkinen, food contact material testing expert at Measurlabs, the classification of biomaterials can be complicated. He uses regenerated cellulose films as a prominent example – generally, they fall under Commission Directive 2007/42/EC, which lays out the positive list of substances it is compatible with, alongside the permissible amount of said substance it can package and its migration restrictions. Adding plastic coatings introduces the further requirement of adhering to Regulation (EU) No 10/2011 for plastic packaging. On the other hand, there is not yet harmonised EU legislation surrounding paper and

paperboard packaging, which contain high amounts of cellulose. Even with the same renewable substance at their core, different forms of packaging are held to different standards.

Nor is it a walk in the park to produce a food-safe material. Further contaminants can come from the raw materials themselves, external sources such as smoke, or the processing of the biomaterial. Combined with the near impossibility of producing bio-based packaging from mono-materials and the necessity of testing for non-intentionally added substances (NIAS) picked up during processing and manufacturing, the importance of thoroughly testing biobased materials – especially with how rapidly they are growing on the market – is evident.

This does not mean that renewables are not or can never be tested effectively. When we spoke to Corina Milz, head and CSR of sustainability at Lidl Switzerland, about the company’s collaboration with Empa to develop an edible cellulose layer for fruit and vegetables, she claimed that tests had proven the layer’s capability to prolong a banana’s shelf life for over a week.

Sustainability Awards 2022 finalists Coveris Flexibles and Brigl & Bergmeister reported that their food-approved PaperBarrier Seal was in the testing phase during their interview with Packaging Europe. When dealing with any biomaterial, but especially those applied directly to food, its effectiveness and safety are clearly considered before its market launch.

Alexander Rauer – head of Business Development at Flextech and product manager Flexible Packaging Paper at Koehler Paper – also joined us on a Sustainability Perspectives podcast and identified the industrial trend of high barriers and water barriers, in which the packaging protects the product within from oxygen and water vapours. These can help renew able materials that would otherwise be incompatible with edible products achieve food-contact status.

It is worth noting that their outcome is not inherently sustainable. Taking paper as an example, its biodegradability and recyclability are often impacted by petroleum-based polymers present in traditional barri ers – usually polyethylene, polypropylene, or EVOH. New innovations are starting to change this, however. Recent examples include Huhtamaki’s smart paper packaging technology, ICON, combining SFI-certified paper board with a water-based barrier coating; and BioInnovation’s granting of additional funding to PulPac, Nordic Barrier Coating, and OrganoClick to continue the development of 100% biobased, plastic-and-PFAS-free barriers for food packaging applications. As far back as 2020, Oatly and Stanpac were producing a paperboard ice cream cup with a polyethylene coating derived from sugarcane – both features said to make the design fully renewable.

In a more general sense of testing, Renton states that more LCAs must be undertaken to establish the direct and indirect effects of biomaterials’ production, use, and disposal. This has since begun to take place – one example being an LCA of bio-based packaging solutions for extended shelf-life milk, conducted by Giulia Cappiello, Clizia Aversa, Annalisa Genovesi, and Massimiliano Barletta in 2021 for the academic publica tion Environmental Science and Pollution Research. Further insight will undoubtedly accumulate over time.

Granted, the industrial implementation of bio-based renewables still has further to go. European Bioplastics has suggested that less than 1% of 367 million tonnes of plastic produced annually are considered to be bioplastics, while the Confederation of European Paper Industries previously reported that only 3% of the total industry value was attributable to new bio-based products, although this figure is only set to increase.

At the same time, general interest in bio-based materials is beginning to grow. Dr Pratima Bajpai predicted in her 2019 book Biobased Polymers: Properties and Applications in Packaging that the demand may reach 9.45 million tons this year. It should not be forgotten that there is still a way to go before renewable solutions such as these can be fully implemented –effective sorting systems, facilities with the space to process biomaterials at end-of-life, and, of course, the assurance that their manufacture will not compete with food production are all essential to establish first.

Yet the Packaging and Packaging Waste Directive is placing renewed emphasis on the transition from fossil- to bio-based materials, which will likely drive industrial interest. Especially now that proposed revisions to the existing legislation are considering the enforcement of packaging types that must be bio-based to increase disposal via biowaste, manufacturers will have to work hard to follow McKinsey’s advice and comply.

From Grupo Agroindustrial Numar S.A.’s compostable packaging for butter and margarine to Nestlé’s redesigned Quality Street wrappers, many companies are already transitioning to recyclable paper in place of fossil-based

Victoria Hattersley spoke to Artur Litarowicz of P&G Beauty for the brand perspective, and Nick Dormon of Echo for the design perspective.

Carbon footprints are – quite rightly – talked about a lot. Water footprints less so. But we live in an increasingly water-scarce world; according to WHO over 2 billion people globally live in water-stressed countries and climate change can only exacerbate this. In this context, the growth of anhydrous – or waterless – cosmetic and household products such as solid shampoos and soaps, and concentrated detergents with refillable packaging, is an important topic. Up to recently these had been seen largely as ‘niche’ products pioneered by the likes of solid product pioneers Lush, but we’re glad to report that this is no longer the case. According to Future Market Insights, waterless cosmetic sales are expected to grow at a 13.3% CAGR between 2021 and 2031.

And let’s not forget that reducing water and carbon footprints are not mutually exclusive goals. A concentrated product containing little or no water is far lighter and will use use less CO2 to transport compared to a liquid-based product, which can contain anything up to 80% water. That’s a given. But as we shall see they can also reduce plastic waste. All compelling reasons for companies to continue down this path.

“Solids and other water-free formulae have a clear role to play in reducing our environmental footprint,” says Artur Litarowicz, Senior Vice President of P&G Beauty’s European Hair Care business.“Shipping water as an ingredient in finished products around the region comes with a greenhouse gas emission cost. Solids help us to reduce direct GHG emissions from transportation – solid being 80% more efficient in transportation vs. liquid.”

As with anything that requires a shift in consumer habits, it can take time to build up market momentum. In fact, we could say that the biggest challenge with creating wider market uptake for these products is not so much the packaging considerations or cost, but purely one of buyer perception. Consumers may be increasingly eco-conscious, but they still value convenience; bottled liquids are less messy to store and are often seen as easier to use as they don’t require the user to reconstitute them at home, as is the case with concentrates. This is not to mention the perceived ‘sensorial’ value from liquid products.

What can be done to change this? Firstly, bringing people round to the idea of solids and concentrates involves not just the products themselves but improving the systems around them – packaging, dispensing solutions, etc. This requires some joined-up thinking from different segments of the market. Central to this, says Nick Dormon, founding partner and strategy director for Echo, a global brand design agency, will be developing and adapting existing household technologies.

“We need to embrace technology in the home to enhance the experience by utilizing delivery ‘systems’. Solid detergent cartridges could be installed in washing machines that last for months. The shower can have automatic shampoo dispensing possibly with selectable fragrances and formulations. Both examples

How much can we expect to see uptake of waterless products, such as shampoo bars and liquid concentrates, increase in the coming years – and what do brands need to consider when making the switch?

would take the manual labour out of the equation and re-set consumer perceptions. This could have been happening for decades, but hasn’t because they [consumer goods and household technologies] are very different industries, and the value never outweighed the effort. Imagine a scenario where Amazon see the potential to lease you a washing machine that they obtain through an OEM manufacturer and provide you your concentrated consumables through a subscription service.”

However, it’s not all about ambitious household technology: improving consumer experience of waterless products can be as simple as a better-designed dispenser. Silgan Dispensing, for example, has announced the launch of its new dosing solution, MeaSURE, a closure with a built-in chamber that delivers controlled dosing for applications such as laundry, cleaning, automotive, and personal care.

Silgan says that the closure is ideal for concentrated formulas, which use less packaging and can save on both raw materials and shipping. The solution is reportedly suitable for laundry, lawn and garden, automotive, cleaning, and personal care applications.

Then there are solutions such as the just-add-water formula from British start-up Plus Body Wash, which comes in 100% dissolvable packaging that goes down the plughole while you shower. Such solutions are certainly interesting –although it does remain to be seen whether they are scalable.

Of course, waterless solutions require not only careful packaging design but also a different approach on the part of CPG companies. We reported earlier this year on how Procter & Gamble brands Head & Shoulders, Pantene, Herbal Essences, and Aussie are now offering shampoo and conditioner bars in a volume equivalent to two 250ml liquid bottles, packaged in recyclable FSCcertified paper boxes. We spoke to P&G’s Artur Litarowicz to find out how they went about incorporating shampoo bars into their production profile in order to increase consumer acceptance of these products.

“First of all, I believe it is important that we recognize it is difficult for consumers to implement new habits,” he says. “Because of this, it’s vital to create performing and valuable products that people will want to buy again and again.”

We all know that consumers also value choice and variety. P&G feels the most successful approach for a multinational is to offer several solutions across a range of popular brands. “We believe the right way to go to drive adoption is

to do it across multiple brands and multiple benefits,” he explains. “For example, Head & Shoulders has pioneered our first active anti-dandruff formula solid shampoo bar, bringing this formula to millions who suffer from dandruff. And Aussie is becoming our first household brand to have launched a solid conditioner bar. We hope that with this scaled effort using high-performing quality products, we will drive higher adoption.”

It’s important to point out here that P&G is not the only CPG brand that is taking hold of this trend. Other multinationals, as well as smaller, independent pioneers are also jumping on board. French personal care giant L’Oreal, for example, has introduced shampoo bars under its Garnier brand. Meanwhile Unilever’s Dove brand launched a 4x concentrated body wash using patented technology that thickens when mixed with water.

Aside from reducing water and carbon footprints, solids and concentrates also create possibilities for the development of refillable packaging solutions, which in turn can help to address the separate problem of plastic waste. Examples include refillable deodorant packaging for Unilever’s Dove, Axe and Rexona brands, which comes in a stainless steel case designed to ‘last a lifetime’. According to the company, the refill will help to reduce virgin plastic waste by around 30 tonnes in its first year, as the case is made from stainless steel and the refill packaging from 98% recycled plastic.

Arguably, waterless solutions can also increase the prospects for a transition from plastic to paper packaging in personal care and household applications. In the past cosmetics packaging, particularly high-end, has tended to focus on a ‘premium’ look with metallic effects and other elements that could make the package more problematic to recycle. But products such as shampoo bars are much more suited to paper. For exam-

“We need to embrace technology in the home to enhance the [waterless] experience by utilizing delivery ‘systems’.”

ple, Alberto Balsam, launched a shampoo bar that’s 100% plastic-free and comes in packaging made from 100% recyclable, FSC-certified cardboard.

P&G is another example of a prominent consumer goods company that is increasingly using paper for shampoo brands – and what’s more, it claims, encouragingly, that this has been partly driven by consumers themselves.

“Global research conducted by P&G Beauty reveals that 75% of consumers would like to buy more beauty products with packaging made from recycled material,” says Artur Litarowicz, “and a significant proportion of consumers (65%) already try to buy plastic free packaging. The launch of solid bars at scale will further contribute to the reduction of virgin petroleum based plastic usage thanks to their boxes that are paper based with FSC certified paper.”

We’ve now seen what is already possible when it comes to waterless consumer packaged goods, but are there any other future applications we should be anticipating?

According to Nick Dormon, “Alcohol concentrates and gels are a very interesting area if the safety aspects can be overcome – again device mixing and delivery (aka Soda Steam) it a probable solution. A recent distillery client said to us, ‘will we really be shipping liquids around the world in heavy glass bottles in 20 years’ time?’”

He also highlights some interesting developments in mineral water and soft drinks. In recent years Danone, for example, has invested in a German company, Mitte, which has developed a countertop purifier to enable households to turn tap water into mineral water. The minerals are added using special cartridges that, it says, can last for 250 litres before needing replacing. Such solutions, if they become more widespread, could clearly dramatically cut use of plastic bottles.

Stories such as these, incidentally, are always good in themselves. When multinationals – traditionally less agile and slower to embrace newer business models – invest in young, forward-thinking brands that are not at the mercy of long-established supply chains it benefits the entire industry and can lead to a more widespread adoption of previously ‘unscalable’ ideas.

But before we get carried away with the possibilities, we must also be pragmatic: Artur Litarowicz believes that it would be unrealistic for the industry to put all its resources into promoting waterless products. The drive for circu-

larity must continue in more ‘traditional’ product lines as well. After all, there will never be 100% market uptake of waterless products unless brands stop producing liquid products entirely – something they are highly unlikely to do.

“We believe shampoo bars’ performance and value will allow for consumers conscious of sustainability to implement new routines into their bathroom beauty habits and we hope to see this adopted at scale. However, we want all consumers to be able to improve their sustainability footprint irrespective of which form of our brands they prefer. This is why we are reducing our packaging impact also on our regular forms: most of our shampoo & conditioner bottles are recyclable and 51% of our shampoo bottles are made from 100% recycled plastic in Europe, and more than 95% of our line up contains recycled plastic.”

All of this, finally, leads us to the most important question: Is there a realistic prospect of waterless household and personal care products matching or even overtaking liquid forms in the next few years? Nick Dormon sounds a cautiously optimistic note.

“Absolutely. One of the simplest and most dramatic, technical ways to reduce carbon footprint is to take pointless water out of shipping weight and volume in the supply chain. The critical hurdle will be down to consumer perception of value and convenience, but this change will accelerate exponentially as more and more brands come online and the supermarket shelf transforms and it becomes the norm.” n

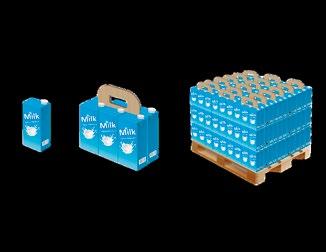

Are your multipacks ready for the circular economy? Multipack bundling

hbfuller.com/multipack-bundling

Aluminum

If your goal is to reduce plastic, then our adhesives offer new design possibilities for circular multipacks. Work with our experts to develop your sustainable packaging design enabled by H B Fuller adhesive innovations.

Connect with our experts today for a sustainable future in multipack bundling

Are your beverage multipacks at their best? AdhesiveExperts.EU@hbfuller.com

Consumer protection in packaging can range from the physical packaging to the technology used in labelling, affecting consumers of industries including pharmaceuticals, food and beverages. Last year, Markem-Imaje highlighted the challenges of counterfeiting, particularly around the holiday period.

The article pointed out the dangers of fake items to consumers and brand reputations, stating there is an “urgent need” for digital solutions that “thwart counterfeiters and help maintain consumer trust by allowing for immediate product authentication”, adding brands need to be protected across both online and in person outlets.

The article mentioned the company’s e-Fingerprint product authentication for packaged consumer products, apparently providing each product with a digital identifier which can be scanned via a smartphone app for verification; and for luxury products e-Fingerprint embeds a near-field communication (NFC) tag into each product.

In its Consumer Protection Study 2022, the UK government’s department for business, energy and industrial strategy found that between April 2020 and April 2021, “69% of consumers in the UK experienced consumer detriment”, which for the study is defined as “at least one problem with a product (either a service or an item)” the consumer bought or used in that 12-month period, which “caused them stress, cost them money, or took up their time”.

It’s worth noting the data was gath ered during the Covid-19 outbreak, with consumers feeling that 43% of their incidents of detriment “had been affected in some way by the pandemic”, and 56% of the experiences of detriment ended with a positive resolution.

There are several companies aiming to help brands protect customers through technology. One of these is labelling firm Avery Dennison, which uses technology including security labels with tamper evident and anticounterfeiting solutions and RFID inlays for pharmacies, hospitals and clinics to itemize and sort stock.

We asked Hassan Rmaile, Avery Dennison’s senior vice-president and general manager for Europe, the Middle East and North Africa, how to identify counterfeit products and the ways technology and labelling can help protect consumers.

FB: Counterfeit packaging and products can be a concern, particularly in industries such as pharmaceuticals, food, and beverages. How would you identify counterfeit packaging or products?

HM: Counterfeit products in the pharmaceutical industry pose a major threat to patients because there is no way for consumers to spot the difference between real and fake products. In many cases, the packaging is genuine, but the product is counterfeit, putting patients at serious risk. [UCONN says that] according to the World Health Organization about 11% of medications sold in developing countries are counterfeit.

The Falsified Medicines Directive sets regulations against counterfeits. This directive requires all packaging of medicinal products to contain a tamper evidence device and a 2D barcode printed on each label. Security labels reduce the risk of packaging falsification and include destructible labels, box damage films, and void labels.

RFID (Radio Frequency Identification) can potentially solve. The Drug Supply Chain Security Act (DSCSA), a directive in the US, will mandate an increase in the amount of traceability required in the US through product identifiers. However, this directive does not dictate that this is achieved through a barcode, which means companies can look to enable RFID.

FB: What difference can the information and materials used in labelling make in informing consumers’ choices and safety?

HM: To ensure products are sold in the legitimate market, brands must protect them in multiple ways. Digital ID technology such as RFID inlays can dramatically enhance patient safety, brand protection, inventory management, operational efficiency and regulatory compliance.

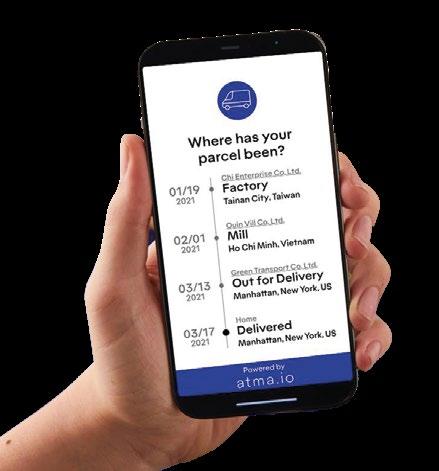

This has a positive impact on consumer engagement in the following ways: delivering information such as warnings, contents, expiration dates, and instructions on proper usage and disposal; connecting consumers to extensive information [such as] a product’s origins, contents, uses and environmental impact; and enabling real-time tracking of products so consumers know where their package is and delivery issues can be resolved more efficiently, building consumer trust.

consumer safety, and be used in areas such as consumer goods? For pharmaceuticals, how would intelligent packaging impact patient care and stock checks?

HM: RFID inlays provide unique microchips (also known as integrated circuits) to products. Tagging pharmaceuticals or consumer goods with RFID technology enables products with a unique digital ID and a ‘digital twin’ that can be tracked and traced online via inventory management applications or other software, providing improved visibility into supply chains and inventories by enabling users to track any item, anywhere,

Regarding patient care, NFC (Near Field Communication) tags can be used to engage consumers directly and provide critical information about their products. For example, if a product is authentic and safe to use. It can also provide complete, secure, and easily accessible proof of a product’s provenance and a

In addition, specially designed RFID inlays can be used for tamper-proofing. The microchip detects any damage to the label, which is then recorded and documented as being tampered with. Intelligent labels can also remind patients to take

Hassan Rmaile · Avery Dennison Senior Vice President and General Manager for Europe

Regarding stock checks, RFID can enable monitoring of expiration dates for medication and supplies, as well as automated alerts about items nearing the end of their shelf lives.

FB: You developed your atma.io cloud technology to connect products through digital IDs, track and store information. How might companies utilize this to protect consumers?

HM: Atma.io connected product cloud assigns unique digital IDs to everyday items, providing end-to-end transparency by tracking, storing and managing all the events associated with each individual product — from source to consumer and beyond to enable circularity. This technology allows companies to protect their consumers and patients by, for example, making recalls faster and more precise, allowing users to locate and remove affected products immediately. It also enhances consumer engagement and loyalty by providing detailed, clear usage and disposal instructions.

FB: What technology would you like to see implemented in packaging to help protect consumers in the future?

HM: There are many possibilities for adding new functionalities to labels and packaging, e.g. time-temperature sensors, freshness sensors, and packaging that inhibits bacterial growth. Labels and packaging that connect to augmented reality experiences (e.g. demonstrating exactly how to use a product) provide a richer consumer experience that helps to increase brand loyalty.

Another company whose solutions could be used to help protect consumers is Covectra, which provides serialization-based solutions for track and trace as well as aiming to combat drug abuse and counterfeiting. We spoke to Steve Wood, strategic executive at Covectra, about features of effective counterfeits, serialization and the use of intelligent packaging in the pharmaceutical industry.

FB: Counterfeit packaging and products can be a concern, particularly in industries such as pharmaceuticals, food and beverages. What measures could be taken to effectively combat counterfeiting?

SW: Effective anti-counterfeit features should have the following qualities: The appearance of the feature should be subtle, and not distract from the appearance of the product or package; if possible, each primary package should be uniquely identifiable by the operator with a minimum of effort; if other equipment is needed to perform the authentication, it should be a device that is owned by almost all owners, such as a smartphone; and serialization of each primary package should be strongly considered.

If a package is not used on the product, the feature should be easily visible on the physical product.

FB: Are there any specific signs that consumers should look out for?

SW: Some of the more obvious signs in counterfeit packaging include broken seals, missing logos, expiry dates, or important information such as contact information and package inserts. Convenience is the most important feature from a consumer’s standpoint, and by no means should the consumer feel that he is paying a premium for the counterfeit feature.

FB: You launched the AuthentiTrack serialization database back in 2009 – has this helped with consumer protection over the years, and what are the main developments you’ve noticed?

SW: Yes, considerably. However, serialized codes could be used by counterfeiters on fake products. Therefore, serialized codes can be used by the supply chain, but these should be supplemented by anti-counterfeit features.

FB: More recently, you introduced your ControlTrack solution to monitor medication compliance. How might this help with consumer safety?

SW: One of the features of ControlTrack is that each unit dose is monitored and tracked, enabling it to provide additional safety and security features to ensure that each unit dose is tracked and traced.

The unit dose monitoring is made possible by the packaging of each drug unit dose in a blister pack – the unit doses are individually printed to enable tracking by the patient.

FB: For pharmaceuticals, how would intelligent packaging impact patient care and stock checks?

SW: Given the level of sophistication of drugs available today, and the importance of providing the maximum of security for those drugs, intelligent packaging is very desirable. Serialization provides the ability for industry players to track products throughout the supply chain. Additionally, it allows for a supplier to have a granular view of its inventory, precisely to specific salable units. On the other hand, the StellaGuard brand protection feature provides an important layer of protection to ensure product authenticity, along with a clear view of territories where products are transiting, thus enabling brand owners to have control over product diversion and territory ownerships.

FB: Your StellaGuard label technology is designed to provide brand protection. What are the main challenges in this area, and how could companies use this technology to protect consumers?

SW: Having a security feature that is intuitive, non-disruptive and costefficient to implement. The brand protection feature should allow the consumer to easily authenticate a product without diverting its attention from the brand itself.

Steve Wood · Covectra Strategic Executive

Steve Wood · Covectra Strategic Executive

Packaging converters play an important role in the value chain and handle a wide range of materials and substrates. But how does the sector innovate to deal with a challenging economic climate and increasing sustainability demands, and what are the latest trends and developments? out more, speaking to HEIDELBERG and BOBST.

2022brought with it a host of new developments and challenges, not least supply chain disruptions and material cost inflation, as Christian Steinmassl, Head of Segment Packaging at HEIDELBERG, points out. In addition, staff shortages, especially for skilled staff, are also here to stay.

“We expect this to lead to a growing interest in automated solutions and autonomous machinery,” he says.

The impending EU Green Deal is likely to drive substitution of plastic by fibre-based packaging materials.

“This trend is already visible, with more and more large producers of branded consumer goods switching to carton board for sustainability reasons.”

Sara Alexander, Marketing & Communication Manager Flexible Packaging at BOBST, also thinks that a move to fibre-based materials is a hot topic in the industry, and predicts that although plastic alternative solutions will be a primary focus for many, paper alternatives are growing, further pushed by brand owner interest and the consumer perception of paper as a sustainable option.

“We launched oneBARRIER FibreCycle at K 2022, a full paper, mono-material, recycle-ready solution created together with partners Michelman and UPM, in response to increasing demand in the industry for more paper-based packaging options. At K 2022, together with Finnish-based converter Huhtamaki, BOBST also revealed the first ever hero samples of converted packaging using the FibreCycle solution,” she says.

Sara Alexander · BOBST Marketing & Communications Manager Flexible Packaging

The industry is working towards improving packaging functionality and sustainability at the same time, which comes with its own set of challenges, as Ms Alexander explains.

“Finding alternatives to plastic is difficult, particularly for food packaging, where high barrier protection against oxygen and water is an absolute must. Any alternative needs to have similar properties in terms of preservation and protection, versatility and price – all while being visually pleasing to the consumer. And part of the challenge can be found in the variability of flexible plastic packaging – stand-up pouches, sachets, films, bags, liners, wraps and so on – which generally consist of several layers of different types of plastics.”

She highlights that BOBST set out to address this challenge with the oneBARRIER family of sustainable flexible packaging solutions both using monomaterial polymers and paper-based alternatives, which was shown at K 2022.

“oneBARRIER PrimeCycle, for example, is a polymer-based mono-material, which is recycle-ready up to 98% while retaining excellent barrier qualities. PrimeCycle is an EVOH-free, top-coat-free solution for full PE barrier and is an alternative to metallized polyester film.”

Another important aspect of sustainability in the converting industry is avoiding waste and boosting energy efficiency. Mr Steinmassl gives the example of a Speedmaster machine.

“A comparison of the Speedmaster CD 102-6+L from the year 1990 with the current Speedmaster XL 106-6+L shows that energy consumption per 1000 sheets has been cut from 13.8 kWh to 8 kWh, a reduction of 40%.”

He adds that the biggest lever that can help a print shop minimize its ecological footprint is systematically reducing the paper waste associated with makeready processes.

“We offer a range of tools for that, such as our inline colour and register measurement and control system, Prinect Inpress Control. Furthermore,

from end to end when developing more sustainable solutions. Smart software can make a difference here – HEIDELBERG utilizes artificial intelligence to optimize the runtime efficiency and maintenance costs of our printing presses. Our Saphira Eco Line of environmentally friendly print consumables is another example of the responsible approach we take when reflecting on material characteristics.”

To meet the demand for higher outputs, HEIDELBERG recently launched the Speedmaster XL 106 21k press, described as the fastest sheetfed machine in the packaging industry, with the potential to produce more than 100 million sheets per year.

“The new flagship die cutter, Mastermatrix, with an advanced drive concept, was successfully launched in 2022. In terms of digital technologies, HEIDELBERG is working on a ‘Green Pass app’ for print jobs. This will allow our customers to determine the complete CO2 equivalent for each individual order, for example. Our customers in the packaging segment will be legally required to report such information in the future,” says Mr Steinmassl.

Ms Alexander also highlights the importance of developing innovations that enable better sustainability performance across the portfolio, for example

The industry will continue to consolidate and prepare for more digitalized and sustainable packaging solutions by 2025. And in an environment that is more competitive than ever before, today’s new technology can give a significant competitive advantage.

510 are a more sustainable technology compared to traditional flexo, due to their lower waste, higher uptimes and consistent production of highquality labels at high speeds.”

Advances in efficiency are made possible by a constant digital information flow, Industry 4.0 infrastructure and data-driven services.

To this end, BOBST Connect is helping customers to get fact-based business insights, and leverage Industry 4.0 cloud-based infrastructures, explains Ms Alexander.

“BOBST Connect is an all-in-one digital platform – it brings data and digital services together in one fully connected platform, with BOBST machine insights and expertise built-in. It gives our customers an overview and orchestration of the production process and helps them to benefit from accurate Overall Equipment Efficiency, from specific equipment monitoring

and feedback valuable information in real-time with our Performance Advisor Technology (PAT), says Mr Steinmassl.

It appears that there is a lot of innovation happening in the converting industry, but what can we expect in the coming year?

Ms Alexander thinks that transformation in the flexible packaging industry will be driven by the potential of new recycle-ready substrates.

“We believe that in 2023, this transformation will occur in the context of a calmer environment compared to 2022, with a more normal global supply chain and cost equilibrium.

The industry will continue to consolidate and prepare for more digitalized and sustainable packaging solutions by 2025. And in an environment that is more competitive than ever before, today’s new technology can give a significant competitive advantage – whether that’s great efficiency and productivity, or with services, the ability to keep on track and delivering for customers no matter what the situation.”

Mr Steinmassl sees scarcity of skilled workers, climate change, energy prices and the circular economy as major driv-

“Automation is key to compensating for the shortage of skilled workers. Simplicity and transparency are further key success factors when it comes to efficient process design. Emission control to mitigate climate change and the demand for energy-efficient solutions and a circular economy will become the main drivers for n

Christian Steinmassl · HEIDELBERG Head of Segment Packaging

HEIDELBERG is working on a ‘Green Pass app’ for print jobs. This will allow our customers to determine the complete CO2 equivalent for each individual order, for example. Our customers in the packaging segment will be legally required to report such information in the future.

Certified B Corporation Mr Green Africa sets out to have a sustainable, long-term social, environmental and economic impact through the collection, conversion and sale of post-consumer waste. Dow recently invested in the company to enable further diversion of plastic waste and to help close the loop. Elisabeth Skoda speaks to Dow’s Adwoa Coleman and Mr Green Africa’s Keiran Smith to learn more.

ES: To start off with, Keiran, could you give me a quick overview about Mr Green Africa? Why was it set up, and what’s its mission statement?

KS: When I arrived in Kenya, I saw a huge opportunity around plastics lying around. Once you start digging a little bit deeper, you realise that there are already many informal communities engaged in the collection of valuable waste and trying to make a livelihood out of it – and once you go even further, you realise that the supply chains in that space are very similar to smallholder farmer supply chains in agribusiness. In most cases, smallholder farmers get the short end of the stick. The same thing applied to low-income communities with waste pickers in the waste supply chain. That’s really how Mr Green started: can we apply these fair-trade principles that you see in agribusiness in our waste supply chain in Kenya? It’s based on the principle of inclusive, fair value chain transparency with pricing and working conditions for the people who collect plastic waste, but also with a strong focus on local validation. We believed from day one that we don’t want to extract the resource and create the high validation outside of the country of origin; we want to create the validation within.

ES: What attracted Dow to work together with Mr Green Africa?

AC: The solid waste management landscape is very complex, and for a company that sits at the beginning of the plastic value chain, as a raw material supplier, we looked at this issue of the end of life of plastics and thought, how can we create impact aligned to our core expertise area but also ensuring that we have an impact on the specific issue of plastic waste? For Dow, one of our key goals in initiating projects around the region is to ensure that plastics that would have otherwise ended up in the environment and landfill after their use are diverted and brought back into circular economy systems. We started with little pilots across the region, working with local partners to see how we can collect and recover the materials, and the question after bringing the material in, of course, is what are we going to do with it?

This is where our expertise came in around mechanical recycling, also working with brands to incorporate those materials into their packaging, and then working with them to consider alternative packaging that is recyclable or more sustainable where applicable. Additionally, we know that

not all packaging streams are mechanically recyclable, and so within that stream, we also looked at what other alternative end uses exist in-region and how we can help to develop or support them.

At the time, when we were speaking to Mr Green, they had just closed the loop for a particular material with a brand owner, and it was very exciting to see a fully circular system operating in-region. We said to them, how can we do this? Specifically for flexible materials.

ES: How does this tie in with Dow’s wider sustainability strategy?

AC: I made a reference earlier to some core aspects of our strategy –there’s the two parts. Stop the waste, so everything we do to ensure that the materials no longer end up in the environment; and close the loop, which is everything we do to enable a circular economy for those materials. Within stop the waste, the investment in Mr Green will enable the diversion of a significant amount of plastic waste from environments and landfill – roughly 90,000 metric tonnes within the next four years.

Additionally, within the close the loop space, a fraction of that material will be converted through mechanical recycling into resins, which will then hopefully find their way back into packaging applications.

ES: Keiran, you hinted at it already, but what’s the general situation regarding plastic recycling in Kenya and neighbouring countries?

KS: It’s not even just in Kenya or Eastern Africa or even on the African continent; the situation is very similar when you look at the entirety of the Global South. What we see in these structures is somewhat of a concept of waste collection, but then it’s very decentralized. The waste that has been collected ends up either in landfill or on the streets.

Also, in Kenya, what you do have is smaller SMEs, manufacturing companies that are in plastic that try to extract some of the value out of these supply chains into their own products directly, which is great, as it’s already a closed loop local economy. It’s just that the value distribution is not very fair and not very transparent.

That’s what is already in place, and when we look at formal waste collection, it’s very privatized, especially in Kenya, or subcontracted by the government. Even those infrastructural setups are completely overwhelmed, so it makes a lot of sense to try to ease those waste collection infrastructures as much as possible.

ES: How does Mr Green Africa’s work complement the structures that are already in place?

KS: What many governments or sub-counties are pushing for now is working with NGOs or other collaborating partners to try and set up what we call MRFs (materials recovery facilities), where all waste streams can always come in, be separated out, then go into their respective recycling industries and applications. What Mr Green can offer is the expertise on creating the highest possible value out of the plastic streams and helping to train their groups or workers in the MRFs on how to best separate and sort the plastic streams.

ES: How does the technological side of all this work?

KS: When we talk about the differentiation of Mr Green Africa, we have two key pillars. One is technology-driven, and the other one is being fair, inclusive, and local. What makes us unique is that we have two aspects of tech. One is software tech, a digital ecosystem solution that we’re creating,

and what we’re doing to enable full traceability and activity and fairness and transparency, and at scale what we want to do with aggregating, transporting, and processing plastic, software tech is a key driver to do that. Also, we can use the data to make better decisions and replicate the model across other regions.

There is also the hardware tech side of the business, which is where we leverage off-the-shelf recycling technologies that you see in Europe that allow us to create that high validation within the country.

ES: Do you recycle all types of plastics from flexible to rigid?

KS: Let’s put it this way – we have an angle for rigid plastics that is very well-included and we created closed-loop applications products. But within the plastics space, we all know there are many fractions of plastics. What Mr Green Africa has started doing is creating a hierarchy of the most recyclable and least recyclable plastics, and we are currently in the middle of a journey where we are trying to valorize as many plastic types and fractions as possible.

In terms of flexibles, we have started with monolayer flexible plastic items. Where we have been able to, we have mechanically recycled and found a market fit for them. But then, obviously, there is still a ton of work that needs to go into the multilayer flexible packaging and more difficult, more contaminated flexible packaging.

This also speaks to this great collaboration we have with Dow because it starts from design, but it also really goes back into application. What qualities can you turn these plastics that you collect into, and what is the most suitable application that you can go into?

ES: Could you tell me a bit more about the different recyclates you’re producing in Kenya?

KS: In the rigid spectrum, we have HDPE, PP materials, blow moulding and injection moulding applications, and so those are the key recyclates that we go back into. The great thing that Mr Green Africa has started doing is separating by type and then by colour code, which enables us to go into

much more diversified product applications. Our output product is basically a recycled pellet that goes back into the local conversion industries to be used in various different home care and personal care applications – but not food grade yet. That’s the next thing we want to take on.

ES: What are the next steps for the project? How are you planning on scaling things up?

KS: As part of this investment round, we have three focus areas. One is trying to ramp up capacity and capability for the eastern African region; going five times as big as we are today in terms of processing capability so that we can truly replicate the model from a collection perspective as proven. With that comes a lot more emphasis on better supply chains and becoming a champion in all the aspects that we want to: from a business perspective, a running process perspective, et cetera.

The second part is that we’ve already started expanding our model to tackle uncollected plastic. I mentioned that between five and at maximum thirty percent of recyclable plastic is being collected by the informal market, so it poses a big question – what happens with the other 70% or more? Together with Dow in the past 24 months, we’ve started doing a lot of consumer testing on how we can include the consumer into these value chains and incentivize them.

Creating a whole new supplier category for our business and the prototyping that we’ve been doing has been very promising. The second focus area is really going deeper into that, putting more resources behind that, scaling that, and seeing how far we can get it.

The final focus area is trying to replicate some of these aspects that we’ve learned and proven in Kenya into other regions on the continent –South Africa, Western Africa – and really see how can we close these gaps that we see in these markets. The problem that we see in Kenya is not necessarily the same in South Africa, but we are very certain that some of these business cases we have built can fit into a South African market or a Western African market, and that’s really what we’re trying to do. Three years from now, we hope to show that the model can be further replicated beyond the boundaries of Africa.

It’s the start of 2023. After a year of floods, droughts and wildfires, surely we are at a tipping point for sustainability? Will we see exciting, far reaching, and lasting innovation as premium brands look to evolve their footprint on the Earth?

For the most part, FMCG brands have been doing a lot of work to get their sustainability ships in order. Whether it’s because their bottles are the mainstay of our weekly shop or the images of plastic waste in our oceans has made it front of mind; even though there is still a long way to go, these brands are largely spearheading the sustainable movement. But what about the premium sectors of beauty and alcohol that have so far largely resisted change? Are they coming under the same consumer pressures?

Consumers have been programmed to expect certain codes and use them as a judge of craft and quality. What would that gift of a premium whisky or fragrance be without the weighty glass bottle, multi-finish label, ritualistic closure, and superfluous secondary box?

For many, these indulgent products are a ‘want’ – not ‘need’. They’re a reflection of status and highly personal. Practically, their longevity on our shelves means they are not perceived as throw-away. Do we give them an easier ride as we are more emotionally invested? Or, as these brands are often an outward display of consumer values, do they need to make a more radical shift as attitudes change?

Unlike many FMCG categories that operate on fine margins, these brands have kudos, wealth and a highly loyal and invested consumer following. So why is it that they’re not spearheading sweeping changes in behaviour?

Behaviours ingrained with premium brands (because we actively want to engage with them) will filter down to the everyday and be much easier to embed. This happens with product innovation, so why not sustainable behaviours? Serums were developed by prestige skincare brands and were affordable to few, but

in a short period of time they have become common place, sparking a revolution in skin care regimens that will soon overtake creams as the core care product on the bathroom shelf.

There are many playing around the edges, with sustainable lighthouse projects that have little impact on a brand’s total sustainability metrics. Armani, Lancôme, SKKN, and Fenty are among those that have launched refill systems, but they beg several questions.

Firstly, what does a durable/refill system offer if the refill doesn’t need the durable element to function? There’s a net increase in material use and it doesn’t help solve end-of-life recyclability. Why produce a durable element at all?

SKKN, Kim Kardashian’s skincare brand, has come under scrutiny for greenwashing. The ‘refills’ are sold as full products in pulp packaging, with pump dispensers which are then refilled into an additional outer packaging. A counterpoint to those is Izzy, a US-based cosmetics brand that now offers products in a refillable stainless-steel tube that can be returned, cleaned, and reused. The medical-grade, stainless-steel tubes are designed to be cleaned and refilled over 10,000 times, so users literally never have to throw them away.

When designing the packs to allow for future portfolio expansions the caps have all been designed to fit onto the full cosmetic tube range to allow for future launches. The tubes themselves will change in diameter and length. This ground-up, future-focused innovation is key.

If refills are the future, why did Armani only create a refill system for one particular perfume line, ‘My Way’, rather than its entire fragrance portfolio? Is that the only consumer base likely to adopt it?

Innovations like these should be brand agnostic, come from the business core and consider tomorrow’s needs, as well as today’s.

Andrew Capper · Echo Creative Director and Co-Founder

This attitude reflects a divergence in premium and prestige brands. Longevity, ethical and altruistic ethos are reimagining premium packaging experiences from the ground up and those that continue to play by the classic rule of ‘more is more’. There’s no reason why even the most complex or seemingly challenging products in these categories can’t be reimagined.

By 2025 there will be 320 million disposable masks produced every year that will end up in landfill. Experiment has created a durable facemask, ‘Avant Guard’, from silicone that can be paired with a favourite serum or moisturiser to create a custom experience. The benefit is that it offers a more comfortable, custom fit than disposable alternatives.

Conversely, Veuve Clicquot continues to stick to its traditional packaging. In the same time frame, it aims to reduce each glass bottle’s weight by 7%. Surely with its design-led brand image, we should expect a more radical and ambitious solution that challenges the norm? If we’re going to get serious about sustainability, do we really believe the future of champagne is shipping liquid thousands of miles from a single location in France in heavy glass?

From leather alternatives like ‘Corskin’ (made from cork production waste and PLA), to plastics made from discarded scallop shells, we will see brands exploring alternatives to plastic, glass and metals. A word of caution, though – it’s important that these are developed in conjunction with more durable circular systems, or they can create as many end-of-life issues as standard materials.

More radical thinking is going to be needed to go beyond light-weighting. There’s a point where packaging made from ever reducing amounts of material will fail. Fail to be fit for purpose. Fail to protect the product in transit. Fail to convey brand equity. Sustainability 2.0 is going to require more ambition and investment.

Rather than starting from a single-use outlook, brands will reinvent how they manifest and leverage new materials, forming rituals and functional improvements that can be unlocked by moving to durable and refill offerings. Designed well, a refill/durable combination can be re-used as little as three times to already be more sustainable than the one-way equivalent.

As brands must consider more circularity, it means not just designing a pack, but taking responsibility for complex infrastructure and many more touchpoints. It also offers the opportunity to have more of a two-way brandconsumer relationship that can be leveraged to build loyalty and advocates. There are many electric toothbrushes with changeable heads, but few offer a genuinely circular journey. Suri not only has plant-based heads that can be returned for recycling, but the whole brush can be disassembled for repair or end-of-life reclamation.

Consumers are increasingly more informed, and their understanding of sustainability is gradually becoming more nuanced. Brands celebrating their sustainability efforts need to be damn sure they’ve invested the time to achieve solutions that are genuinely better – otherwise, consumers will call you out.

What’s clear is that rather than sustainability trends permeating premium brands, it should start there. These brands set the yardstick by which all other brands are measured. If their design language and interactions evolve and consumers become more attuned to diversifying codes and embedding new behaviours where we are prepared to invest time, it will be so much easier for all brands.

Drive change, stop being a passenger to change.

In collaboration with our partners AIPIA, we bring you the latest from the world of intelligent packaging.

IQStructures, a research and production organization focused on nanotechnology engineering, part of the IQS Group, has introduced holograms for packaging-related security applications that can be authenticated automatically, using normal light and a mobile phone app.

When checking the security features, it can happen that a supervisor is not completely sure of the authenticity and yet, for various reasons, is not able to verify it against the database entry. This is what the machine-readable holograms solve, says the company. By illuminating the hologram, it becomes readable with a phone and the downloaded app confirms authenticity there.

“Machine-readable holograms combine two very powerful principles. Our holograms contain unique

visual effects that virtually cannot be replicated because they are based on special nanostructures. The second principle is automated control, immune to human failure,” says IQ Structures CEO Petr Franc. “This new technology has a range of applications, from personal documents to paper certificates and brand protection.”

The machine-readable holograms are put into ID documents as part of IQ proID’s product. This product is based on micro-segmentation technology to ensure seamless integration into the card. Any attempt to manipulate the holographic layer ends up disintegrating the hologram into thousands of miniature parts. Other advantages of IQ proID are the possibility of full area protection, so no one can change any data on the document, plus the possibil-

ity of creating integrated security features combining different technologies (security printing, UV and OVI printing, tactile surface embossing and holographic). Many customers prefer this technology because of the distinctive visual effects, it claims.

Machine-readable holograms can be also used in the area of brand protection. With brand protection, for example, the company may have some sort of track and trace system, but doesn’t want to give access to all customers.

The customer doesn’t even know the details of the hologram, so they are only able to make a general check that there is a hologram present on the packaging. With machine-readable hologram technology, he or she could download an app and check that it is a genuine security feature.

Spain’s top juice brand, Don Simon, has unveiled what it describes as its first-ever 100% environmentally friendly and smart packaging. In partnership with its packaging supplier Elopak and creative technology studio Appetite Creative, an AIPIA member, Don Simon has incorporated a fun and interactive connected experience to help educate consumers about the benefits of the new Pure-Pak® eSense packaging. The smart packaging utilizes a web app-based connected experience accessed via QR codes to inform consumers about the benefits of the new aluminium-free carton.