VOLUME 18.4 – 2023

PACKAGING EXTENDED PRODUCER RESPONSIBILITY • MONO-MATERIAL BARRIERS INFINITE MATERIALS • SUSTAINABLE PACKAGING SUMMIT • CIRCULARIUM AFRICA A CLOSE-UP LOOK AT DEVELOPMENTS AND ADVANCEMENTS

AI AND

Packaging Europe Ltd

© Packaging Europe Ltd 2023

of this publication may be reproduced in any form for any purpose, other than short sections for the

review,

publisher. ISSN 2516-0133 (Print) ISSN 02516-0141 (Online)

No part

purpose of

without prior consent of the

Part of the Rapid News Communications Group 9 Norwich Business Park, Whiting Road, Norwich, Norfolk, NR4 6DJ, UK Registered Office: Carlton House, Sandpiper Way, Chester Business Park, Chester, CH4 9QE. Company No: 10531302. Registered in England. VAT Registration No. GB 265 4148 96

+44 (0)1603 885000

editor@packagingeurope.com

production@packagingeurope.com Advertising: jr@packagingeurope.com Website: packagingeurope.com Twitter: twitter.com/PackagingEurope LinkedIn: uk.linkedin.com/company/packaging-europe YouTube: youtube.com/PackagingEurope THE CONTENT TEAM Tim Sykes Brand Director Victoria Hattersley Senior Writer Elisabeth Skoda Editor Libby Munford Journalist Fin Slater Digital Editor Emma Liggins Junior Journalist Frances Butler Junior Journalist THE PRODUCTION TEAM Rob Czerwinski Creative Lead Meg Garratt Digital Design & Production Assistant Syed Hassan Digital Analyst THE OPERATIONS TEAM Amber Dawson Operations Director Kayleigh Harvey Advertising Coordinator Guy Bill Events Marketing Executive THE SALES TEAM Jesse Roberts Sales Director Dominic Kurkowski Senior Portfolio Sales Manager Matt Byron Portfolio Sales Manager Clayton Green Business Development Manager 4 9 23 19 3 Editorial Elisabeth Skoda 4 AI in production and logistics Applications in the packaging industry 9 Extended producer responsibility Who will pay for change? 14 Mono-material barriers A look at the latest developments 19 Infinite materials The possibilities and pitfalls of materials that claim to be infinitely recyclable 23 Sustainable Packaging Summit What to expect at the 2023 event 26 Big interview Connecting the packaging sustainability dots – in Africa and beyond 30 AIPIA stories Active and intelligent packaging spotlight 32 Hive stats Statistics spotlight OUR TEAM CONTENTS

Telephone:

Editorial:

Studio:

Many of you will have enjoyed a well-deserved summer break (or still have a holiday to look forward to) as the latest Packaging Europe magazine lands on your desk.

While summer is a time of relaxation, the season unfortunately also serves as a stark reminder of the effects of climate change on our planet here in the Northern Hemisphere, with extremely high temperatures plaguing swathes of countries. It is more important than ever that decision makers in the packaging industry and beyond work together to find ways to drastically cut carbon emissions.

With our Sustainability Awards and Sustainable Packaging Summit, we hope to play a part in facilitating dialogue and innovation. The 2023 edition of the Summit as well as the AIPIA World Congress returns to Amsterdam on

14-15 November with a wider scope, multiple streams, more attendees and an exciting line-up of speakers. Read an interview with our brand director Tim Sykes to find out more about what to expect at this year’s summit. Tickets are now on sale at: https://www.packagingsummit.earth/amsterdam2023

Beyond that, we have a wide range of articles for you in this edition of the magazine. Everybody is talking about Artificial Intelligence and its scope, potential and dangers. Frances Butler looks at the topic from a packaging perspective and explores new applications of AI, particularly in the area of production and logistics.

Meanwhile, Libby Munford explores the topic of EPR (Extended Producer Responsibility). She asks the question of whether it is a progressive reform against a rising rate of mismanaged plastics, and takes a closer look at its role as part of the Global Plastics Treaty, which is currently being negotiated by 150 member states.

Staying with the topic of packaging waste, as we know, the Packaging and Packaging Waste Regulation states that all packaging must be designed for recycling by the beginning of 2030 and recycled at scale by 2035. Can ‘infinite material’ be an answer to the problem? Emma Liggins explores the possibilities and pitfalls of materials that claim to be endlessly recyclable.

Another piece of the puzzle when it comes to recycling is flexible mono-materials. These are easier to recycle, but creating barriers is more challenging than with multi-material laminates. Developments in this area have gathered speed in recent years. I speak to several industry experts to get an update on PE and PP mono-materials and their functionalities.

Last but not least, we have an interview with Clem Ugorji, who is the founder and lead advisor at Circularium Africa Advisory and a consultant to a number of organizations, including the World Bank and the World Economic Forum (WEF). I speak to him to find out about his work at Circularium Africa and get his take on the sustainability challenges Africa and the world faces and how to address them.

Enjoy your summer breaks, and hopefully see you at one of our virtual Linkedin Live discussion panels and of course at the Sustainable Packaging Summit and AIPIA World Congress in Amsterdam in November. n

CONTACT ME

3 Packaging Europe

Elisabeth

es@packagingeurope.com @PackEuropeEli

EDITORIAL

Skoda · Editor at large

Elisabeth Skoda

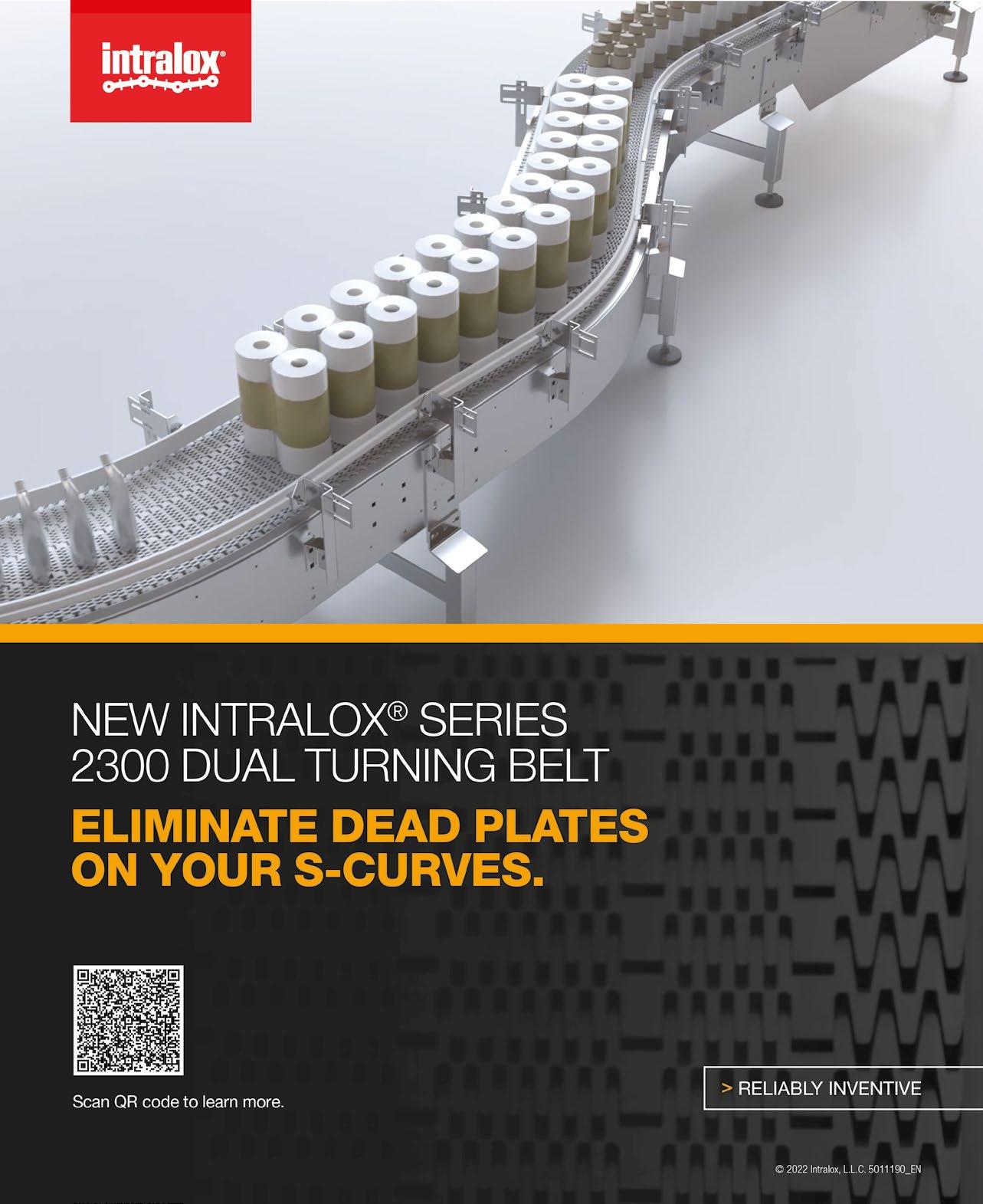

LOOKING TO THE FUTURE: AI IN PRODUCTION AND LOGISTICS

AI-assisted product sizing.

Focus on production and logistics

How is AI being used in packaging within the production and logistics sectors? Food processing and packaging solutions provider Tetra Pak published a whitepaper on Industry 4.0 (the trend of automation and data exchange in manufacturing technologies, including AI) suggesting ways for companies to increase productivity in the food and beverage industry.

One example given in the whitepaper is the connection and integration of equipment at customer plants, enabling machines to communicate with each other and synchronize themselves. Companies can keep track

Keeping track

In the adhesive materials industry, Avery Dennison recently announced updates to its atma.io connected product cloud, incorporating AI features such as ChatGPT. Businesses can use the cloud to track, store and manage events associated with individual products through the unique digital IDs assigned to them. We spoke to vice president of digital solutions Max Winograd to learn more.

Reportedly, atma.io provides firms with an overview of open issues for each supplier through ‘callout’ notifications. When a ‘callout’ needs actioning, logistics personnel find the affected supplier’s email, gather the information about the issue and compose and send the email. Winograd

4 Packaging Europe

ness means data is “readily available to tools that leverage AI or ML” and can be turned into actionable insights.

In contrast, he added that “the outputs are only as good as the inputs”, meaning the data being analysed and acted upon may not always be accurate “because the integrity of the data is not 100%”.

Avery Dennison also incorporates RFID (Radio-Frequency Identification) labels in the e-commerce and logistics areas. Winograd states:

“The combination of RFID and AI/ML within our applications enables pre-emptive and proactive alerts and actions based on inventory, supply chain, and product data, efficient e-commerce capabilities and increases the velocity of products from factory to consumer.”

A challenging environment

In 2019, an article by McKinsey described automation in logistics as “big opportunity, bigger uncertainty”. The authors outlined 5 reasons for companies’ hesitation to automate: “The unusual competitive dynamics of e-commerce, a lack of clarity about which technologies will

Packaging Europe 5

”

just need to read through it, customise it, and hit send.

between the length of contracts with shippers and the much-longer lifetimes of automation equipment and distribution centres.”

On the other hand, automation can assist with worker shortages, rising online sales and technological advances, the authors stated. They added that logistics companies are “intrigued by the potential of automation but wary of the risks” with McKinsey research estimating “investment in warehouse automation will grow the slowest in logistics, at about 3 to 5% per year to 2025.”

The authors said e-commerce companies’ buying power, companies such as Amazon having their own logistics capabilities and the “very spiky” demand for e-commerce are worth considering.

Humans and robots working together

However, one company implementing automation and AI in logistics is Active Ants, an e-fulfilment company with “automated end-to-end warehouse processes”. Both humans and robots cover logistics for online stores from receipt and storage to packaging and shipping to end customers. We spoke to Khalil Ashong, country director at Active Ants UK, to find out more.

Automation is an opportunity to engineer processes to be as efficient as possible and process “consistently large volumes of parcels through the warehouse without much reliance on human labour, which can be unreliable,” Ashong said. He added robots and automation will “do things the way you have designed them to do it, over and over again, until you change your instruction to them.”

6 Packaging Europe

7

There are challenges involved in having humans and robots working side-by-side. According to Ashong, it’s important to remember the company’s robots and automation is handled by humans. “The biggest challenge is getting our human colleagues to understand what the robots are there to do and making it clear to our human colleagues what they need to do in assisting the robots.”

On the developments AI could bring to the packaging industry, Ashong thinks AI can help with packaging efficiency and waste reduction. He expanded on this:

“If you know what you are packing and how much it weighs, you are not going to make a box that will have a lot of surplus air in it or a box that needs lots of void fill. The more information you have about your packing process the more efficient it becomes, because you are learning about past orders and using that information to shape your approach to future orders.”

Active Ants’ AutoStore warehouse storage solution reportedly takes up “six times less space than in a traditional warehouse”. Ashong said the system works on density, with items usually only stored in their master cartons when on pallets. The bins are stacked 16 high in columns and accessed from the top on an aluminium grid.

The company uses AI to monitor and track products through the supply chain. Ashong believes this information can help better understand clients. “If a client is shipping two or three of the same pair of shorts from three different locations, we have that information and we can help them to streamline and ship from just one location,” he said.

“Through our handling of a product we can tell how many times a client has shipped to a particular part of the country, what they ship to that location and feed it back to them, so they can improve their processes and products.”

When asked about the future developments and implementation of AI, Ashong concluded:

“Logistics is about doing the same things repeatedly in the most costeffective way. For repetitive and mundane tasks, robots and machines are always going to be available so we need to assign those tasks accordingly and elevate the humans from doing repetitive tasks to more skilled roles.”

It is difficult to predict how the working dynamic between humans and robots will develop in future as there are fears about AI replacing human jobs – however, as Ashong has illustrated, it is possible for both to be involved in warehouse operation side-by-side.

Overall, it seems that while there are concerns around the use of AI in logistics and production (such as the use of robots and also in e-commerce due to uncertainty around demand) there is potential for companies to implement AI to monitor and increase efficiency; apply changes to marketing strategies and packaging design from collected data; and use this data to predict future packaging needs and consumer behaviour. n

8 Packaging Europe

If a client is shipping two or three of the same pair of shorts from three different locations, we have that information and we can help them to streamline and ship from just one location.

”

Khalil Ashong, County Director, Active Ants UK

WHO WILL PAY FOR CHANGE?

A complex issue

Humans currently produce more than 350 million metric tons of plastic waste per year. Without changes to current policies, global plastic waste generation is projected to triple by 2060, to a staggering one billion metric tons. In contrast, if new measures and policies are introduced, such as increased taxes on plastics use and a vastly improved global recycling system, this figure could drop to less than 700 million metric tons. However, this remains an ambitious goal, as currently less than 10% of plastic waste is recycled per year. The vast majority of plastic waste generated is either landfilled or incinerated, emitting harmful pollutants. Another quarter ends up mismanaged or littered – according to a March 2023 report ‘Plastic waste worldwide – statistics & facts’, from Statista, a provider of market and consumer data.

Is Extended Producer Responsibility a progressive reform against a rising rate of mismanaged plastics?

Libby Munford investigates.

So how does EPR begin to tackle this issue? The concept was first formally introduced in Sweden by Thomas Lindhqvist in a 1990 report to the Swedish Ministry of the Environment. In subsequent reports prepared for the Ministry, the following definition emerged: EPR is an environmental protection strategy to reach an environmental objective of a decreased total environmental impact of a product, by making the manufacturer of the product responsible for the entire life-cycle of the product and especially for the take-back, recycling and final disposal.

Joachim Quoden, Managing Director, EXPRA, (The Extended Producer Responsibility Alliance), explains there was an urgent problem at the end of the 1980s - municipalities in Germany were running out of landfill space while at the same time the economy and therefore packaging consumption was increasing. There was a lot of trial and error in the implementation of

9 Packaging Europe

partly the national packaging value chain) continue to experiment but do not try to implement proven functioning parts for their EPR system.” Indeed, EPR schemes are very different one from the other and they don’t always have the same goal. Vito Buonsante, policy advisor at IPEN, elaborates: “In most cases they extend the financial and organizational responsibility for collecting materials and disposing of those materials. However, their effectiveness is tied to the type of product and to other requirements, such as collection and recycling targets and market access.”

The solution?

While today most but not all EU Member States have EPR systems in place, the Packaging and Packaging Waste Directive, a piece of EU legislation, obliges all Member States to set EPR schemes for packaging by 2024. The Waste Framework Directive has introduced general minimum requirements to improve harmonization, increase transparency, cost-efficiency, accountability and better enforcement of EPR obligations at national level. Under the new rules, eco-modulation of EPR fees has become mandatory with a view to boost recyclability.

On a wider scale, the Global Plastics Treaty is being negotiated by 150 member states and 1,500 people, including world leaders and industry executives, at the UN. The treaty aims to create a comprehensive, worldwide, and robust approach to plastic waste management. EPR is a key component of the treaty.

The most successful environmental treaty to date is the 1987 Montreal Protocol – signed by 197 countries – the first treaty in the history of the

stratospheric ozone by CFCs. The success of the Montreal Protocol was the result of an unprecedented level of cooperation by the international community, and collaboration between public and private sectors.

Will the Global Plastics Treaty create such monumental change?

Joachim Quoden, responds, “I really hope so.

“EPR is positive in that it is a concept and not a business plan. So, you can adapt it to the local needs. An EPR system in Germany will be different from an EPR system in an Asian country. But, the concept should be in the treaty best as a mandatory tool to make industry responsible. Responsibility is more than paying. It also means ensuring that the necessary steps are taken. With an industry controlled entity, we can ensure that there is sustain-

Packaging Europe

11

The E as extended typically doesn’t go beyond national borders. Once the product/material leaves the country, there is no more extended responsibility.

”

Vito Buonsante, IPEN

able funding, that the money is only used for the correct purpose and that cannot be used to solve a budget problem.”

Vito Buonsante, IPEN, says, “The Plastics Treaty, to be successful like the Montreal Protocol, needs to focus on upstream measures that drastically reduce plastic production and eliminate or minimize the toxic impacts of plastics on humans and the environment. To do so, financial resources will be necessary but a global EPR that is like existing ones will not be an effective solution.

“However, the fact that countries agreed to have a global treaty to solve the problem is very promising, the scale of the problem should be backed by ambition.”

He goes further, “There are several issues that are still unresolved and for which we would not consider EPR as a solution that firstly leads to reduction of plastics production, secondly would lead to better product design and thirdly would lead to polluters taking responsibility:

“The E as extended typically doesn’t go beyond national borders. Once the product/material leaves the country, there is no more extended responsibility.

“Unless taken into account, the EPR fees cover only the waste management part, not other potential harms that the products can cause, including costs for litter clean ups, legacy pollution or other social/health costs.”

David Newman, managing director, BBIA, the biobased and biodegradable industries association takes a different stance: “A Global Plastics Treaty is not what we need.”

“What we need above all is for countries to implement waste management systems, which still are largely unavailable in 70% of the world. Not just plastics, but all wastes are leaking into the environment including chemicals, poisoning earth, water, flora, fauna, humans, and of course, affecting air quality. For this to happen we require about $100bn a year, a comparatively small amount of money and equivalent to the tax avoidance of major corporations, mostly American, in Africa alone.

“I gave a speech on this to the UN in 2016. Despite the standing ovation, nothing changed.”

Spotlight on the UK

The UK is a perfect example as a microcosm of the complexity of the issues surrounding EPR. The Government’s EPR was developed to protect the environment by reforming the existing Packaging Waste Regulations to ensure producers such as brands and retailers take responsibility for their packaging once it becomes waste. Arriving hand-in-hand with deposit return scheme (DRS) legislation, both schemes have fallen victim to delays and stalling from policy and regulation.

Alice Rackley, CEO, Polytag, a company which aims to be pivotal in delivering Extended Producer Responsibility in the UK, comments:

12 Packaging Europe

Frankly, if governments waited upon industry to roll out EPR, we would all be where the UK is now. Waiting.

”

David Newman FCIWM, BBIA

“The government’s EPR response announced early this year was certainly a positive step in the right direction, but it missed an opportunity to create a cohesive, UK-wide approach. Instead, the fragmented approach taken will only risk businesses’ bottom lines at a time when they’re feeling the squeeze from inflation. An example of this is how Wales is including glass in the DRS, but England is not. Northern Ireland is still pending its decision. With no consistent, standard protocol to follow, how can we expect businesses to get on board?

“Meaningful, sustainable change can be difficult in the first place. It requires investment for the long term in changing supply chains and operating best practice. Therefore it’s a concern for businesses’ bottom line. At the moment, if a business is reporting quarterly earnings to the city, there is nothing driving them to divert hard-earned profits to invest in new processes and technologies that could have a hugely positive impact on the planet.

“Successful businesses don’t simply accept new policy decisions, because any form of turbulence is bad for profits. This is why the UK’s EPR scheme needs to be coherent and aligned, and must cater for, or at least take into consideration, the type and size of economy we have.

She concludes, “It’s a rather remarkable sight to see FTSE 250 bosses idly waiting on the sidelines for the government to tell them what to do, when businesses should be (and are completely capable of) leading by example and doing the right thing.”

She comments that businesses like Aldi, Ocado, and Co-op, amongst others, are working with Polytag to deliver real tangible results and change, while incentivizing consumers to recycle more.

Joachim Quoden has strong views on the current situation in the UK: “The UK system is not based on EPR – it is a government run taxation system which is using industry as a cash cow. The industry has not been involved in the system, there is no use of its expertise and intelligence. In my opinion, industry was ready and proposing to organize a real EPR system, full cost, and following best practices for example from Belgium, however, the government refused.”

David Newman FCIWM, Managing Director, BBIA, says:

“I am a great believer in not awaiting the perfect solution because it will never arrive. EPR was imperfect and remains so, but it HAS financed packaging and other waste collections, recycling and energy recovery that would probably otherwise not have happened.

“Moreover, EPR puts the burden of legal and not just financial responsibility on the polluter. This is a fundamental issue which is not merely financial – the application of the polluter pays principle establishes legal precedence.

“Frankly, if governments waited upon industry to roll out EPR we would all be where the UK is now. Waiting. The role of government is to determine a trajectory and put the legislation into place to meet those targets. No industry will ever vote to tax itself voluntarily, so we need government to impose objectives.” n

What we need above all is for countries to implement waste management systems, which still are largely unavailable in 70% of the world. Not just plastics, but all wastes are leaking into the environment including chemicals, poisoning earth, water, flora, fauna, humans, and of course, air quality.

”

David Newman FCIWM, BBIA

Alice Rackley, Polytag

David Newman, BBIA

Vito Buonsante, IPEN

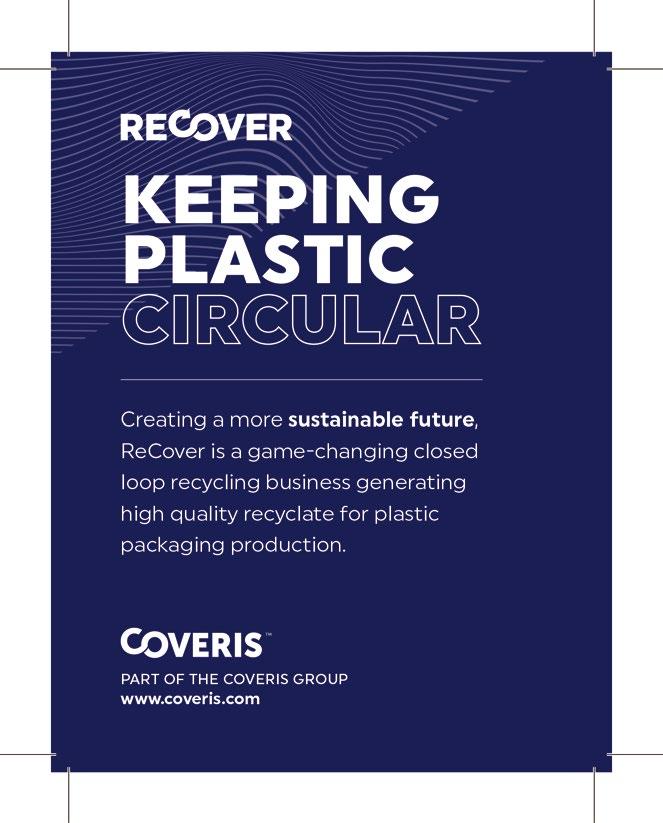

ADVANCES IN MONO-MATERIAL FLEXIBLE PACKAGING

Mono-material packaging uses predominantly one material type, such as polyethylene (PE), polypropylene (PP), polyester (PET) or paper and is designed to be more recyclable than conventional multi-material layered composite packaging, which requires separating various polymers and metal foils.

Mono-materials are seen as one of the possible answers to tackle the growing packaging waste crisis, and developments, on which we have been keeping an eye here at Packaging Europe, have really gathered speed in recent years.

Elisabeth Skoda speaks to several industry experts to get a snapshot of where we are at with innovations around PE and PP flexible packaging.

There is a clear upward trend in global flexible mono-material plastic packaging film. It is projected to be worth $55.7 billion in 2023, and will grow at a steady +4.1% compound annual growth rate (CAGR), globally, according to Smither’s latest market report, ‘The Future of MonoMaterial vs. Multi-Material Packaging to 2028’. The report also notes that across the same period, volume demand for multi-material packaging will increase at a slower 3.6% CAGR, driving consumption from 10.4 million tonnes (2023) to 12.4 million tonnes (2028).

What is possible with mono PP and PE?

There has been a lot of movement in the area of mono PP and mono PE flexible packaging in recent years. For example, A.HATZOPOULOS S.A. has its X-CYCLE PP, a recyclable mono-material film designed for recycling through the PP stream, and its X-CYCLE PE film, designed for recycling through the PE recycling stream. Furthermore, there’s the X-CYCLE POLY for the mixed polyolefins recycling stream.

Constantia Flexibles also offers mono-PE, known as EcoLam, and monoPP, referred to as EcoVer.

“The decision of which material to utilize often depends on the sealant material employed in existing non-recyclable applications,” explains Achim Grefenstein, Head of Group R&D of Constantia Flexibles.

“For applications requiring enhanced thermal resistance and stiffness, EcoVer emerges as the material of choice. On the other hand, EcoLam offers the advantage of being easily recyclable through existing recycling streams, making it a more sustainable option for producing new packaging films.”

Packaging Europe 14

Coveris’ mono-material solutions are also available as PE or PP singlesubstrate laminates – MonoFlex, or films – MonoFlex Lite.

“The latest addition to the family is MonoFlexBE, a fully recyclable polyethylene (PE) monolaminate for cheese and bakery products, providing a direct replacement for current non-recyclable packaging alternatives,” explains Eric Valette, Director Innovation BU at Coveris.

Focus on barriers

Recyclability is of key importance when it comes to developing sustainable flexible packaging, but of course packaging still has to fulfil the function of protecting the product, which is where barriers come in.

“The main challenge is finding the right layer that ensures the same level of barrier while still being compatible with the PE or PP recycling streams. In fact, PE and PP are good polymers to provide a moisture barrier but are too weak to provide protection from gas, grease or oil. Finding the right solution that provides all this in a sustainable way, is the biggest challenge, something we work on at Coveris’ Film Science Lab in the UK,” adds Mr Valette.

At the lab, Coveris also offers onsite analysis, testing and development for customers’ products. Products can also be adapted.

“We can monitor water vapour transmission rate (WVTR) and oxygen transmission rate (OTR) and our engineers adapt the properties to the product news.

15 Packaging Europe

“The main challenge is finding the right layer that ensures the same level of barrier while still being compatible with the PE or PP recycling streams.”

Eric Valette, Director Innovation BU at Coveris

16 Packaging Europe

whilst preserving the protective properties of the original materials.

“The X-CYCLE films incorporate adjustable barrier properties, according to the specific requirements of each final packaging application. The mono-material, all-PP and all-PE solutions we offer can provide very high protective properties against water vapour, oxygen, optionally blocking also light and mineral oils. Reaching maximum barrier levels that can even enable the replacement of aluminium foil, the X-CYCLE solutions are suitable for packaging sensitive products, such as coffee, dehydrated foods and snacks, pet foods and more,” explains Akis Naziris, Deputy General Manager of the company.

Machinability

We can see that mono-material films do a good job of maintaining barriers, but how do they work on standard packaging machines?

Achim Grefenstein points out that with the inclusion of specially designed heat-resistant and recyclable outer layers, these films can operate at the same speed as their counterparts. “However, it’s worth noting that certain older machines may require additional modifications to accommodate these innovative concepts.”

capabilities, we are able to tailor our solutions to individual customers’ needs and explore sustainable innovations.”

After comprehensive testing, A.HATZOPOULOS S.A’s mono-material solutions have been validated at several different pack lines at customers’ sites.

“Depending on the grade and the final application needs, the X-CYCLE structures can deliver easy-tearing properties or peelability at the sealant layer for consumer convenience, side-gusset sealing, high puncture resistance, adjustable pack stiffness, anti-static properties and total compatibility with various add-on pack components such as valves, stickers, zippers or spouts,” adds Mr Naziris.

Preparing for changing regulations

The overall European Commission goal is to transform 50% of plastic packaging to be reusable, recyclable, or compostable by 2025, according to the proposed Packaging Waste directive. Do our experts think that the industry is on track to achieve this?

Mr Naziris states that A.HATZOPOULOS S.A. welcomes the EU Commission’s proposal for a regulation that promotes the circular economy and,

17 Packaging Europe

“There is a need for greater legal clarity in order to navigate this landscape more effectively. Achieving recycled content goals could pose challenges if raw material suppliers are unable to provide an adequate supply of food grade recyclate.”

Achim Grefenstein, Head of Group R&D of Constantia Flexibles

as a member of EAFA/FPE and CEFLEX, closely monitors the EU Packaging and Packaging Waste Regulation and its requirements.

“The Design for Recycling (DfR) criteria to be established by the Commission are expected to significantly affect new packaging development at EU level also, bridging the gaps that exist among the different member states in the region.”

Nevertheless, he points out that there is high concern regarding the industry readiness to evolve fast, to meet the upcoming mandatory use of recycled materials at high rates. “Considering that to date there are limited quantities of recycled food contact materials available in the EU market, we expect relevant investment in the chemical recycling technologies and infrastructure to take place, to be able to develop and build up sufficient capacities of high-quality, food-safe recyclate.”

Mr Grefenstein agrees and says that the plastics industry, overall, has made significant preparations to meet recyclability requirements. “However, there is a need for greater legal clarity in order to navigate this landscape more effectively. Achieving recycled content goals could pose challenges if raw material suppliers are unable to provide an adequate supply of foodgrade recyclate.”

A lack of harmonization can also pose difficulties, with many countries introducing their own targets.

“This makes it challenging to ensure the solution fulfils individual regional recycling requirements. Despite the differences, the overarching

goal is to increase the use of recycled plastic content in manufacturing processes and create a circular loop, and this is what Coveris supports,” says Mr Valette.

With companies working hard to boost innovation further to make their mono-material products cater to a growing range of specific applications and include PCR content in their films, there is a lot of movement in the sector. Mono-material packaging has certainly proven itself as an important piece of the sustainability jigsaw. n

18 Packaging Europe

“Considering that to date there are limited quantities of recycled food contact materials available in the EU market, we expect relevant investment in the chemical recycling technologies and infrastructure to take place, to be able to develop and build up sufficient capacities of high-quality, food-safe recyclate.”

Akis Naziris, Deputy General Manager of A.HATZOPOULOS S.A

All packaging must be designed for recycling by the beginning of 2030 and recycled at scale by 2035, as per the Packaging and Packaging Waste Regulation. Manufacturers and brands alike are searching for compliant solutions; could so-called ‘infinite materials’ be the answer? Emma Liggins explores the possibilities and pitfalls of materials that claim to be endlessly recyclable.

ARE ‘INFINITE MATERIALS’ THE ANSWER TO ACHIEVING CIRCULARITY FOR PACKAGING?

Infinite materials do exactly what they say on the tin. In theory, they can be recycled an indefinite number of times, thus creating a closed loop and drastically decreasing the amount of virgin materials required for packaging production. Various substances fit under this umbrella, including…

Glass

The Glass Recycling Institute claims that glass is completely and infinitely recyclable. Neither the quality nor the purity of the glass is said to be impacted by repeated recycling. In fact, recycled glass is apparently an element of all glassmaking operations, and the amount used is directly proportional to a decrease in energy used in the furnace itself. Therefore, recycled glass is said to save energy and keep plant equipment in use for longer. It also cuts down on greenhouse gas emissions, lowers the consumption of raw materials, reduces costs, and optimises profitability in the long run.

On the other hand, this hinges on the material being free of contaminants. Cullet used in furnaces to produce glass must not contain stones, metals, gravel, or other impurities. Similarly, the amount of mixed-colour cullet that can be used to manufacture new containers is limited, meaning

separating discarded glass containers by colour is an important step in the recycling process.

Nor can glass used in food and beverage applications be recycled with other types of glass. Wine glasses, for example, feature chemical compositions that cause fracture points when recycled. If pure glass is mixed with crystal, Pyrex, and other similar substances during the recycling process, the resultant glass could be defective and even more breakable.

Another roadblock is the size of the intended recycling. If the pieces of recycled glass are too small to meet manufacturing specifications, the Institute explains, they cannot be used. Broken container glass is sometimes rejected by recycling companies, according to recycling calendar company Recycle Coach, because tiny pieces can contaminate other recyclables – an occurrence that many recycling facilities lack the technology to handle – and, whether small or large, the sharp edges of glass fragments pose a safety risk to handlers. Manufacturing specifications sometimes enforce similar rejections based on a minimum size requirement.

This begs the question of whether glass containers even need to be recycled if they are unbroken. Glass bottles are frequently utilised in refillable systems; Milk & More and Again have been running various delivery

19 Packaging Europe

and collection trials for beverages and dairy products this year, which have utilised refillable containers made of glass. If such packaging remains whole, undamaged, and uncontaminated, why can it not be continually reused? Should reusable glass be prioritized as a means of preventing unnecessary energy consumption and emissions in furnaces?

Ultimately, though, glass is a fragile material that will eventually shatter. In this case, perhaps the recycling industry should turn its attention to developing new technologies and systems. If the appropriate infrastructure to handle recycled glass was available at every recycling plant, far less of this delicate material would go to waste.

Aluminium

On the plus side, aluminium is another material that claims to offer infinite recyclability – a positive when its 77.4% recycling rate in Europe came second only to paper and pulp in 2019, if data from the Statista Research Department is accurate. It certainly holds significance in the packaging industry, with 51,000 of the reported 24 million tonnes of aluminium produced in the UK every year being used to manufacture food and drink packaging.

To create one kilogram of new aluminium, four kilograms of raw bauxite ore must be electrolysed – a costly and inefficient process thought by Dynacast to require between 190 and 230 megajoules of energy. The smelting process itself emits sulphur dioxide and nitrogen dioxide, which contribute to smog and acid rain.

Alternatively, the Aluminum Association asserts that recycling aluminium requires 95% less energy (and cost, according to Dynacast) than it takes to acquire the primary metal. Around 75% of all the aluminium ever produced in the United States is still thought to be in circulation and is predicted to

result in economic savings of over $800 million if every aluminium can used in the country in a year is recycled.

Various industry players state that recycling aluminium saves over 90 million tonnes of CO2. For every percentage increase in the recycling rate for the aluminium beverage can market, the carbon intensity of production is thought to reduce by 1.02 kg of CO2 equivalent per 1,000 cans, which would be a significant contribution to industrial decarbonisation efforts.

Simultaneously, existing recycling processes are said to save more than 100,000 GWh of electrical energy – equivalent to the annual power consumption of the Netherlands. Still, despite the reported 90% decrease in energy between new and recycled aluminium production, it is worth noting that the melting point of aluminium remains at around 660 degrees Celsius. The environmental impact of this process remains the same, regardless of whether the aluminium is virgin or recycled.

For all its benefits, there is disagreement as to whether aluminium’s recycling process is truly infinite. Many claim that aluminium retains its properties through indefinite recycling treatments, especially those in the aluminium industry itself, although others argue that it will eventually lose quality.

There is also the reality of aluminium recycling to consider; for example, the website for Lehigh County in Pennsylvania reports that 2 out of 3 aluminium cans used in America are currently recycled and that the average can contains 50% recycled aluminium. This suggests that virgin aluminium is still being mined and there is room for improvement in certain locations’ recycling rates.

Plastics

As it currently stands, plastics have limited recyclability. Existing recycling processes break down their polymers to remould the material, but this causes degradation. Even when reinforced with virgin plastic, the weakening of the material is inevitable.

Academics have been attempting to overcome this problem in recent years. In 2018, a team of researchers led by Eugene Chen, professor of chemistry at Colorado State University, used only a trace amount of catalyst at room temperature – no intensive lab procedures or toxic chemicals required, the team claimed – to convert a polymer back to a small-molecule state. The method is hoped to preserve the plastic’s quality through indefinite recycling processes.

At the time, the chemists emphasised that experiments had only been conducted at an academic laboratory scale. Funding would contribute towards further research and optimisation of the process, but as of 2023, no further breakthroughs have been announced.

20 Packaging Europe

Another team at Berkeley Lab developed their own ‘infinitely recyclable’ plastic three years later. This one, named poly(diketoenamine) or PDK, aimed to tackle the high energy consumption, excessive emissions, and low yield of chemical recycling, said chemist and fabrication scientist and project contributor Brett Helms. In theory, the resin generates high yields from a low-energy recycling process – and, looking forward, the team aspired to achieve carbon neutrality for PDK by developing the resin from microbe-fermented plant material.

A study released by the team simulated a facility that chemically recycled mixed PDK waste into new resins with an annual output of 20,000 metric tons. Factoring in the relevant costs, emissions, technology, and chemical inputs, it believed that PDK could replace traditional plastics and become cheaper to use with time.

Last year, a team led by Dr. Junpeng Wang at the University of Akron developed a polymer said to facilitate both recycling and circular reuse while meeting the same standards as existing plastics – this time through depolymerization. A monomer was specially designed to dissolve in an organic solvent and undergo what is known as a ring-opening metathesis polymerization reaction.

To put it simply, this involves taking cyclic alkenes – hydrocarbons featuring a ring of carbon atoms and at least one double bond that does not form a ring structure – and splitting open a double bond to attach it to other cyclic alkenes, forming a long polymer chain.

At room temperature, monomers derived from a cyclic alkene known as cyclooctene polymerized with a yield of 67%. This increased to 90% at 50°C. Apparently, the resultant polymer only depolymerizes if a catalyst is present, ensuring its strength in other applications while resisting mechanical stress, corrosion, and heat, with a thermal decomposition temperature as high as 370°C.

Even existing and conventional plastics are hoped to undergo infinite recycling processes in time. Chemical recycling, while capable of destroying contaminants in recycled plastics and lowering demand for feedstocks derived from crude oil, is still feared to be carbon-intensive, with the wider impacts on human health under continuous discussion. Researchers are therefore turning to alternative processes.

An enzyme variant developed at the University of Texas at Austin has mutated and developed the natural enzyme PETase into what is now known as FAST-PETase. It claims to break down pollutive plastic in a matter of days and consume less energy than conventional methods of plastic disposal, including pyrolysis and methanolysis.

A similar breakthrough in the recovery and reuse of plastics at a molecular level comes from Australian start-up Samsara and its ‘plastic-eating’ enzymes. Initially focusing on PET and polyester, the company has now partnered with athletic apparel company lululemon to create the ‘world’s first’ recycled nylon 66 and polyester from clothing waste. This technology, too, hopes to facilitate infinite recycling.

21

Packaging Europe

Despite the variation in progress, all these innovations are undoubtedly at the early stages of development. Until further trials have been conducted to apply them to packaging, they remain as optimistic ideas for the future rather than market-ready solutions.

Where do we go from here?

In the case of any material, access to a closed-loop recycling system is essential for its infinite recyclability. Unfortunately, these are not universally available. Innovations in materials, packaging design, recycling systems, and other such solutions continue to develop as the packaging industry works towards complete circularity, but until that is achieved, infinite recyclability will not be a universal term.

Within this issue, the recyclability of a material often relies on its purity, which can, in turn, be impacted by its disposal. Increasingly, packaging designs are ensuring that their respective parts are easily separable, or that the entire pack is made of a mono-material, to smoothen the recycling process for consumers. Still, confusion or lack of education surrounding the correct disposal of different materials will inevitably affect their end-of-life treatment.

Container glass, for example, can fall victim to downcycling. The Glass Recy cling Institute tells us that waste recovered where bottle-to-bottle recycling mar kets are far away is often implemented into concrete pavements, filtration, tile, and other ‘secondary’ uses. While this diverts it from landfill, it takes resources out of the material loop and breaks the circularity of the substance.

Examining the potential of infinite materials is useful insofar as knowing the limits of circularity, but they are not a silver bullet. The packaging industry should not let the potential of an indefinitely recyclable material distract it from ensuring that recycling itself is normalized, streamlined, and effective – only then can a material become truly infinite.

Packaging Europe 22

AT THE CUTTING EDGE OF SUSTAINABILITY

The finalists of Packaging Europe’s 2023 Sustainability Awards have been announced, ready for the big reveal at a special dinner at the Sustainable Packaging Summit in Amsterdam. As the Packaging Europe team is busy preparing for the event on November 14th and 15th, we caught up with brand director Tim Sykes to find out what makes the Sustainability Awards one of the most coveted accolades in the industry, and what attendees can expect at the Sustainable Packaging Summit.

There are many awards out there – what differentiates Packaging Europe’s Sustainability Awards?

The Sustainability Awards are driven by a mission to spotlight the most important innovation around the world. I’d say the most important dif-

tional corporates to tiny start-ups) with no entry fees creating a barrier to submission, that it has constantly evolved along with our understanding of what our sustainability goals demand of innovation, and perhaps most importantly, that we have assembled a large, international jury (now 50+ members) with an awe-inspiring diversity of expertise. We are humbled by the dedication of our judges – very senior figures from the worlds of sustainability, packaging, R&D, etc. – and how generous they are with their time and expertise. The fact that 95% opt to continue on the jury each year feels like an endorsement of the Sustainability Awards mission and the impact we’re trying to have.

Could you talk a bit more about the judging process?

With over 50 judges representing every continent, inevitably, the judging process has to take place digitally. Judges work through assignments in their own time, but get to share comments and questions with each other. An important criterion for judging any category is that the holistic impact of any innovation must be considered: we don’t want to celebrate products that solve one problem while creating another one. The highly rated submis-

23 Packaging Europe

SCAN ME!

TO JOIN US AT THE SUSTAINABLE PACKAGING SUMMIT

sions score well not just in terms of the innovativeness of a project, but also the impact. We ask for LCAs and other forms of data from our entries, and the judges are rigorous in assessing whether claims can be substantiated.

What’s different about this year’s Sustainability Awards in comparison to previous years?

The competition evolves a little bit every year in response to the feedback from our judges and wider audience. Recently we expanded the number of categories for pre-commercialized technologies as we recognized there was more and more exciting activity taking place on the innovation horizon. This year hasn’t seen any dramatic changes to the format, but (speaking as an observer, since I don’t have any involvement in the judging) I’d say the quality and variety of the best innovations this year is greater than ever before. There are some outstanding submissions that might have won the trophy in previous years, but weren’t even shortlisted this time. And in the selection of finalists there’s a great mixture of novel materials, formats and initiatives driving sustainability at scale, which is testament to both the talent and the commitment of people across our industry.

How do the awards tie in with the Sustainable Packaging Summit?

It’s fair to say that the Sustainable Packaging Summit has grown in parallel with the Sustainability Awards: it always made sense when presenting the most important examples of innovation to put this into context by discussing the wider trends they belong to and challenges they respond to. As the competition has ballooned over the years, so we have progressed from hosting a panel discussion before an awards ceremony to organizing a large and ambitious multi-stream event that gathers together the most important thinkers and players in the field.

Again, there are lots of packaging conferences out there – what makes the Sustainable Packaging

Packaging Europe 24

which firstly means assembling people who are in a position to influence the direction of industry and secondly means curating a program that emphasizes not what we’ve achieved to date, but what we need to do next: where are the barriers and disconnects and how can we accelerate progress? Therefore, we work hard to bring key stakeholders from across the packaging/FMCG value chain into the room, along with NGOs, recyclers, investors and regulators, and to bring them together to discuss the pain points and the opportunities for strategic alignment. It’s inspiring to witness the openness and honesty, and the sense of common purpose that is manifested on this stage.

Could you give us a sneak preview of the programme and speakers?

We have an exciting line-up, from big names representing global brand owners (e.g. P&G’s chief sustainability officer Virginie Helias) to introducing disruptive start-ups to the audience. The two key pillars we’ll focus on are strategic challenges and innovation. This will comprise high level panels assessing our overall sustainability objectives and progress, the global and regional regulatory landscape, how we need to incorporate climate into our strategies, EPR and investment in circular economy, and a strategic look at R&D. There will also be more granular explorations of important challenges, such as how to scale up reuse and refill, what’s going on in the world of renewable materials, and the role of chemical recycling. We’ll be hearing from all of the key European materials platforms and projects, including CEFLEX, 4evergreen, HolyGrail2.0 and Permanent Materials. And there will be opportunities for start-ups working in areas such as novel feedstocks, reuse and driving circularity to pitch their solutions.

What else is going on at the event?

Part of our ‘Davos’ ambition for the event is creating a must-attend space for everyone with a passion for sustainability and innovation to learn and contribute, and where we are not necessarily in control of everything that takes place. So we’re glad to add more and more dimensions to the gathering. I already mentioned the Sustainability Awards, which in addition to showcasing innovation acts as an informal dinner setting for networking among all the attendees. We’re also co-located with the AIPIA World Congress, which is the world’s essential annual conference for smart, active and intelligent packaging technology. This has great synergy with the Summit, as it represents the absolute cutting edge of innovation, with huge potential in sustainability applications: from supply chain efficiencies to supporting accurate sorting at end of life to promoting transparency of provenance to cutting food waste. We’re also open to hosting member meetings for associations and platforms with a mission aligned to that of the Sustainable Packaging Summit. For instance, HolyGrail2.0 will be holding a stakeholder meeting in the same venue this year. Together, we believe these different events have a lot of synergies, enabling attendees to accomplish far more than usual from a single trip, and generating a critical mass of professionals who can make a difference to our industry.

In summary, why should people attend the Sustainable Packaging Summit?

Our mission is to mobilize a community to bring about a sustainable future for packaging in a changing world. If that chimes with your role and your ambitions, we’d love for you to be part of it. n

Packaging Europe 25

SUSTAINABILITY DOTS – IN AFRICA AND BEYOND

The world faces a plastic waste problem. Joined-up thinking is needed to address this considerable challenge. Clem Ugorji is the founder and lead advisor at Circularium Africa Advisory, a network of partners which works to join up policies, programmes and partnerships to enable sustainable growth and development, and a consultant to a number of organizations, including the World Bank and the World Economic Forum (WEF). He discusses problems and solutions to the challenges the world and the industry are facing with

ES: You previously worked at Coca-Cola and now consult for the World Economic Forum’s Global Plastic Action Partnership (GPAP). What insights have these roles given you on the global plastic waste problem?

CU: My experience at Coca-Cola and, more recently, in consulting has broadened my insights on the plastic waste challenge from the perspectives of the industry and the development sectors. First, plastics are so ingrained in our global economy and lifestyles that the idea of their elimination (even single-use plastics) seems at best a very long-term prospect. So, along with

Elisabeth Skoda.

the search for a globally viable replacement material or materials, we must also ramp up efforts at discouraging the avoidable use of plastics across sectors and scaling both mechanical and chemical recycling capacities across the world. These are really urgent needs, as the growth in plastic consumption and waste generation has continued to overwhelm the pace of recovery and recycling globally. For instance, global plastic consumption is estimated to have doubled in the 20-year period between 2000 and 2019, rising from 234,000,000 tonnes per annum to about 460,000,000 tonnes per annum while the recycling rate has remained very low at under 15%.

Packaging Europe 26

CONNECTING THE PACKAGING

Secondly, we have to significantly improve cost-efficiency in both recycling and downcycling solutions to achieve price-competitiveness for recyclates. The current price advantage of virgin materials in most cases is a huge barrier to circular economy transition, especially in the developing world and, among other factors, is frustrating the adoption of rPET in the Africa region.

Thirdly, regulations and effective enforcement are crucial tools. We’ve seen an example of how the effective use of regulations has placed the EU on a relatively stronger pathway to plastic circularity. Lastly, we can’t overemphasize the importance of multi-stakeholder action. We need shared understanding, commitment and collaboration by actors across sectors to be able to effectively deal with the multidimensional challenges of plastic pollution.

landscape in Ghana, from production and consumption, to waste generation and the resulting challenges around plastic waste pollution. The study outlined domestic policy options for improving plastic management outcomes and creating economic opportunities as well as how regional and international trade policies can be leveraged to support these objectives and the overall goal of fostering a plastic circularity to boost investments, job creation and industrialization.

The study showed that, like most other countries, Ghana has a high plastic consumption growth rate which averaged 6.25% between 2015 and 2019 and that packaging (mostly single-use applications) accounts for about 70% of the country’s plastic consumption, thus putting significant strain on the municipal solid waste management system which manages to recycle just about 10% of the plastic waste. We found that, mindful of this challenging scenario, the Ghanaian government has made credible commitments to foster a circular economy for plastics but it needed to implement specific regulatory measures to create a viable domestic demand for recycled plastics, targeting potential high offtake industries like packaging, construction, textiles and automotive. We also found that Ghana is a key supply point for finished and semifinished plastic products to some of its smaller neighbours and can evolve this role into a sub-regional plastic hub through the effective use of various trade instruments to access appropriate technology and foreign direct investments to boost local plastic manufacturing and recycling capacities as well as safely facilitate transborder flow of input and output plastic goods.

ES: What inspired you to set up Circularium Africa? Could you tell me a bit more about what it does?

CU: At Circularium Africa Advisory we work to bridge the divide between governments and the private sector and to advance policies, programmes and partnerships for a circular Africa. I was in the corporate sector for over 25 years, mostly managing sustainability and public policy issues from a corporate lens, and this entailed collaborating extensively with governments and stakeholders in the development sector. Of course, working at Coca-Cola, the plastic pollution crisis was a big part of my focus. In that period, I often experienced firsthand the disconnect and largely avoidable tension between governments and the private sector, particularly large businesses, on policies and regulations. I also saw the crucial need for shared understanding, trust and collaboration between these two major actors in any economy, and I became increasingly drawn to the idea of contributing to this goal from a neutral platform.

All this motivated me to take an early retirement in 2021 from my career at Coca-Cola and set up Circularium, a globally-oriented and Africafocused public policy and circular economy consulting firm.

ES: The World Economic Forum and Global Plastic Action Partnership contracted Circularium to deliver a case study on trade, circular economy and plastic action in Ghana. Could you talk us through some of the key findings?

CU: The Ghana study was carried out in 2021 in partnership with a Geneva-based trade law firm, Tulip Consulting. We assessed the plastic

ES: What are some of the biggest sustainability challenges, in particular around plastic packaging, that African countries face?

CU: There are several challenges, frankly, but I’ll focus on just two that I consider to be pivotal. We can point to the macro issue of poverty that is driving exponential growth of miniature-size packaging in plastic sachets for food, beverage, cosmetics and household hygiene products as well

27 Packaging Europe

Global plastic consumption is estimated to have doubled in the 20-year period between 2000 and 2019, rising from 234,000,000 tonnes per annum to about 460,000,000 tonnes per annum while the recycling rate has remained very low at under 15%.

Clem Ugorji

the “sachet economy”, provides affordable price points for the majority of consumers in lower socio-economic groups, it is unfortunately one of the biggest drivers of rapid growth of single-use packaging derived from hardto-recycle or non-recyclable plastics.

A second factor is the lack of markets for recycled plastics, especially for food-contact rPET due to regulatory constraints such as explicit or implicit disapproval of food-contact rPET and the absence of a general or specific mandate in any African country for recycled content in plastic packaging. Africa can learn from the EU on this issue. There is also the much talked about challenge of plastic waste collection which is prevalent across the region. In my view, this is only a symptom of the more fundamental problem of a lack of local demand or market for recycled plastics. Developing domestic demand or markets for recycled plastics through appropriate regulations will help to unlock some of the barriers that constrain growth in collection and recycling rates.

ES: You’ve mentioned public policy and regulatory issues. What are some of the common issues Circularium Africa deals with and how have they been solved?

CU: Besides advancing public policies and regulations for a circular economy, Circularium Africa is also focused on building multistakeholder alignments and collaborations which are a crucial enabler, and this is the focus of the work we do with the Global Plastic Action Partnership. One of the markets where we’ve supported significant work in this area is Ghana, where a fully functional National Plastic Action Partnership (NPAP) has

civil society and the international development community to agree on a set of realistic policies and other measures for turning the plastic pollution crisis into opportunities, and to collectively drive the implementation of these measures which are articulated in the Ghana NPAP’s National Action Roadmap (2020-2040) and its supporting Financing Roadmap that were launched in 2021 and 2022 respectively. We launched the Nigeria NPAP in May this year and are actively engaging a number of governments in the region who have shown interest to have the platform in their countries.

In other areas, through my consultancy work for the World Bank’s PROBLUE project, we contributed to a study on Reducing Marine Plastic Pollution and Creating Plastic Recycling Market in Lagos State, Nigeria and are also involved in the bank’s project to support the development of national EPR implementation guidelines for Nigeria’s plastic sector.

At the regional level, Circularium Africa is providing strategic support in laying the groundwork for the initiative to develop common regional recycling standards for food-contact rPET for Africa which is imperative for boosting a circular economy for plastics in the region that is anchored on sustainable regional plastic recycling value chains. This initiative is being championed by the African Circular Economy Alliance (ACEA), a government-led coalition of African nations and global partners, in collaboration with the African Regional Standards Organization (ARSO) and supported by the United Nations Environment Programme (UNEP) and the GPAP.

ES: On a more general level, how can governments and the private sector work together to build a worldwide circular economy?

28 Packaging Europe

CU: Essentially, the interests of the private sector and of governments are not conflicting – both need an enabling environment for sustainable growth and development for business, economy and society. Therefore, their long-term goals are interlinked and can be mutually reinforcing. Given this fact, it is vital to foster shared understanding, trust and collaboration between governments and the private sector, as the two principal drivers of activities in any economy, if we are to make progress on the transition to a circular economy. While governments take the lead in formulating national aspirations and ground rules in consultation with other stakeholders, the private sector takes the lead in the delivery of those aspirations through investments, innovation, products and services.

Interestingly, until recently, it seemed that governments and the private sector were diametrically opposed by their parallel interests of profit and social good respectively. However, I think that in the current global reality where businesses and governments have found themselves having to align on and commit to some common priorities and outcomes around environmental and social agenda, a convergence of interests as well as more effective collaboration between the sectors will increasingly happen as a matter of course. We see a higher degree of this already in the EU and other developed markets while it is still an emerging trend in Africa and the rest of the developing world.

ES: What are Circularium’s goals for the future – and what is your personal outlook on addressing the circularity challenges the world faces?

CU: For Circularium Africa, we want to make significant contributions to the evolving reality of a circular and integrated African economy, and we are pleased to have been able to establish relevance in this area in just two years of existence. We want to grow our relevance and impact, not

just in the area of plastic circularity but also in regional integration through advancing common policies and regulations that enable regional value chains and boost trade. This is why we are excited to support the project for the common recycling standards for food-contact rPET.

Personally, I think that there are a couple of things that are vital for addressing the circularity challenges the world faces. The primary issue is ensuring that success is not defined narrowly in national or regional terms but in global terms, given the degree of interconnectedness of the global economy and the climate change risk. I believe this is an underlying reason for the proposed UN Global Plastics Treaty. Given this reality and since we can only be as strong as our weakest link, the developing regions, including Africa, need to be effectively supported to overcome the multifaceted barriers that limit their pace of transition and potential success. Among these is the cost of transition, which is hardly discussed, weak institutional capacities for policy formulation and enforcement, low infrastructure base for material recovery and transformation as well as poor market development for circular economy products. Luckily, there is a high level of commitment to a circular economy by most governments as well as an array of fledgling waste transformation solutions, albeit at small and micro scales, in regions like Africa to build upon.

As we all know, policy is king. In the absence of policy and effective enforcement, market players (including global businesses operating in regions like Africa) are left to do what is convenient. And it is obvious that a convenient approach cannot get us to where we need to be on this global journey to a circular economy.

This article is a shortened transcript of a recent edition of the Packaging Europe podcast. For the full version and more podcasts please visit https://packagingeurope.com/sections/podcasts

29 Packaging Europe

n

ACTIVE AND INTELLIGENT PACKAGING SPOTLIGHT

In collaboration with our partners AIPIA, we bring you the latest from the world of intelligent packaging.

The wine industry is poised for a significant transformation as the European Union’s regulatory changes are scheduled to take effect on December 8, 2023. Embracing these changes, Cellr, a connected packaging software company based in Australia, has developed what it describes as a cutting-edge solution that ensures compliance and empowers the wine and spirits industries to thrive globally.

The EU regulations require wines sold in the European market to declare detailed information on ingredients, allergens, nutrition, recycling, and responsible consumption, with translation required into 24 languages. While these regulations may present significant challenges for the wine and spirits industry, they also represent a step towards enhancing consumer transparency and facilitating informed decision-making. Cellr’s

adaptable software solution simplifies compliance and empowers wine brands to embrace these changes positively, it claims.

Cellr’s eLabel solution will allow wine brands to create products digitally, enter in the information required, and deliver it via a QR code or URL. Products are built in a format of Product > Model (Vintage) > Variant (Size) and can inherit information to remove the need to duplicate information, making it a more efficient solution. It offers compliant language translation, ingredient lists, nutritional panel, recyclability and responsible use information, amongst other features. Additional information can be delivered outside of the legislative requirements, providing another opportunity to strengthen the connection with consumers in multiple markets.

“Cellr’s commitment to compliance extends beyond the EU regulation changes,” added Daniel

Hill, head of marketing & client success at Cellr.

“Our software solution offers any consumer brand the flexibility to adapt to diverse market requirements while providing brand protection and engaging experiences for consumers worldwide.”

The Cellr software features, including interactive content, competitions, loyalty programs, and personalization, enable wine brands to foster deeper connections with consumers, it believes.

Digimarc Corporation, a longstanding AIPIA member, recently announced a major new contract to protect the authenticity of precious metals and building materials and guard the integrity of a national deposit return system (DRS) for recycling food and beverage containers.

The 5-year contract with an international solutions provider is worth more than $32 million, with the potential to grow significantly based on other optional programs in 2024 and beyond. Under the deal, the Digimarc Illuminate platform will protect the authenticity of gold, silver, platinum, and other precious metals as well as key building materials used in commercial construction.

From the packaging sector perspective, the contract also marks the company’s entry into a new market by guarding the integrity of a DRS scheme, combining Digimarc’s expertise in both anti-counterfeiting and recycling to support the increased circularity of these containers.

“This exciting opportunity reflects the reputation for security, scalability, and trustworthiness we have earned through our work with the

world’s central banks, combined with the proven power of our technology to fight counterfeits and improve recycling in the commercial world,” said Riley McCormack, CEO at Digimarc.

“Moreover, these programs embody who we are and our commitment to changing the world by promoting a prosperous, safer, and more sustainable planet. This contract expands Digimarc’s reach in the security printing world, opening a large and exciting new market segment for our Illuminate platform,” he added.

As well as providing anti-counterfeit technology for central banks for many years, in the commercial realm, Digimarc has provided product authenticity solutions for the pharmaceutical, tobacco, and other industries for many years, it says.

DIGIMARC SIGN $30M CONTRACT TO AUTHENTICATE HIGH-VALUE ITEMS AND DRS PROGRAM

DIGIMARC SIGN $30M CONTRACT TO AUTHENTICATE HIGH-VALUE ITEMS AND DRS PROGRAM

Packaging Europe 30

CONNECTED SOFTWARE SOLUTION HELPS WINE IMPORTERS MEET NEW EU REGULATIONS

ALDI TO TRACE PACKAGING RECYCLING RATES THROUGH UV TAGS IN COLLABORATION WITH POLYTAG

invisible UV tags on its packaging with the

gather real-time recycling data on an item level. This UV reading technology was developed by Polytag in collaboration with researchers at the Advanced Manufacturing Research Centre.

By providing Aldi with access to information surrounding the life cycle of its packaging, it is hoped that the retailer will be able to more accurately gauge its progress towards its sustainability targets, such as a 50% reduction in its carbon footprint by 2025.

“Leading retailers in the UK are awake to the fact that the only way we will truly tackle the waste problem in this country is by using data,” said Alice Rackley, Polytag’s CEO. “Gaining access to real-time packaging lifecycle information will be a game-changer, enabling retailers to develop a

greater understanding of their products’ journey and make meaningful progress towards their sustainability pledges.”

Luke Emery, plastics and packaging director at Aldi UK, added: “We are constantly working to be a more sustainable retailer, so we are excited to see how Polytag’s technology will enable us to access and analyse more data around our packaging lifecycles, and use these learnings to accelerate our progress towards our sustainability goals.”

Polytag has also collaborated with Co-op to implement UV tags and unique-every-time QR codes into its own-label, two-litre PET spring water bottles in a bid to increase visibility during the recycling process and contribute towards the establishment of a Digital Deposit Return Scheme.

CONDITION SENSOR CAN BE PRINTED DIRECTLY ON TO FOOD PACKAGING

Senoptica Technologies, a deep-tech packaging sensor technology company based in Ireland, has created a new sensor to monitor the condition of packaged, perishable food products using a food-safe ink that can be printed directly onto the inside of the packaging, it says. The patented sensor measures the oxygen level inside modified atmosphere food packs in real-time.

The company is a spin-out from Trinity College, Dublin and is on a mission to help halve food waste by 2030 on fresh packaged foods.

The technology at its core is a novel packaging sensor that can measure the atmosphere surrounding the food in fresh food packs. The sensor can indicate the condition of the food in real time and help to avoid good food being thrown away, according to the company.

As the sensor is formed from a food-safe ink, it can printed directly onto the food packaging. The illumination of the active materials in the food-safe ink enables the sensor to measure the oxygen inside the food packaging in real-time, avoiding the disposal of still-edible products. The ink can

also be printed onto labels for manual application and allow oxygen measurement in real-time.

The technology is designed to work on the packaging that over half of the world’s fresh food is packed in, it claims. Research indicates food waste associated with this type of packaging is costing global retailers over €27bn per year in lost sales and contributing massively to their scope three emissions.

Started in 2018, Senoptica expects to have regulatory approval by the end of this year and aims to launch the technology in Q2 2024.

MOLSON COORS’ BEER BRAND MADRÍ EXCEPCIONAL LAUNCHES ‘CONECTADA’ PLATFORM WITH ON-PACK QR CODE

Major beer brand Molson Coors has launched the next stage of its multimillion-pound summer marketing campaign for its Mediterranean style-lager, Madrí Excepcional. The ‘El alma de Madrid’ or ‘The Soul of Madrid’ campaign features on-pack QR codes giving consumers access to its first-ever ‘Conectada’ platform.

The launch forms part of Madrí Excepcional’s summer campaign and builds on its recent strong performance, having established itself in the top five world lagers for the ‘off trade’ in the UK, the company says.

Consumers can access the ‘Conectada’ platform by scanning QR codes on every bottle

can and multipack of Madrí Excepcional, which was rolled out at the end of June. The QR codes will also be visible across public events, social media and out-of-home (OOH) advertising over the summer, according to the company.

Revealing little-known brand facts, users will learn about the collaboration between Molson Coors and the La Sagra Brewery near Madrid, and how Madrí Excepcional captures “The Soul of Madrid”. Consumers can also access personalized city maps directing them to special events, exclusive music gigs and their nearest Madrí Excepcional stockist.

The campaign is the latest part of the beer brand’s five-month-long ‘El alma de Madrid’ campaign which aims to bring the vibrancy, warmth

and progressive spirit of modern Madrid to the UK and follows its return to TV screens in April. It is supported by video-on-demand, experiential, social activations, influencer partnerships, and a brandnew OOH advertisement, including billboards and pop-up displays.

Point-of-sale (POS) materials will also create theatre in-store, including eye-catching aisle fins, shelf frames and free-standing display units to engage shoppers.

31 Packaging Europe

STATISTICS SPOTLIGHT

Launching soon! Hive is a brand-new set of tools created by Packaging Europe that aims to help packaging professionals know more about the industry they work in, offering briefings, reports, digital live events and a cutting-edge data tool.

Here is another snapshot from the extensive collection of statistics on offer at Hive.

This time, we are taking a closer look at the top 25 recyclers around the world. Which countries are leaders in the field of recycling, and which ones

need to improve? This graphic will give you an insight into recycling rates across the world.

The EU’s Packaging and Packaging Waste Directive lays down measures to prevent the production of packaging waste, and to promote reuse of packaging and recycling and other forms of recovering packaging waste. In this context, it’s interesting to note that the top four recyclers are not situated in the EU. n

RECYCLING RATES BY COUNTRY

Top 25 recyclers

32 Packaging Europe

Liechtenstein Singapore Korea, Rep. Iceland Germany Slovenia San Marino Australia Samoa United States Belgium Hong Kong SAR, China Ireland Sweden Switzerland Luxembourg Finland Philippines South Africa Denmark United Kingdom Poland Congo, Rep. Norway Hungary 64.6 61 58 55.81 47.83 46.44 45.05 42.1 36 34.6 34.30 34 33 32.37 32 28.37 28.12 28 28 27.27 27.25 26.39 26.2 26.16 25.94 Waste Treatment Recycling Percent 0 10 20 30 40 50 60

Average = 37.15212

Source: World Bank

14-15 NOVEMBER, AMSTERDAM

TICKETS AVAILABLE NOW FOR THE AIPIA WORLD

CONGRESS 2023 SCAN ME!

14-15 NOVEMBER, AMSTERDAM

TICKETS AVAILABLE NOW FOR THE SUSTAINABLE PACKAGING SUMMIT 2023 SCAN ME!

DIGIMARC SIGN $30M CONTRACT TO AUTHENTICATE HIGH-VALUE ITEMS AND DRS PROGRAM

DIGIMARC SIGN $30M CONTRACT TO AUTHENTICATE HIGH-VALUE ITEMS AND DRS PROGRAM