Run your IT operations at Ooredoo Tier III ready Industry grade Data Center Facility

Chief Executive Officer

Akhmeem Abdul Razzaq

Chief Content Officer

Mohamed Khoorsheed

Chief Digital Officer

Ibrahim Areef

Chief Operating Officer

Ahmed Nasir

Chief Creative Officer

Zaya Ahmed

Chief Design Officer

Hamdhoon W.

Chief Commercial Officer

Raaya Abdulla

Chief Editor Nashama M.

Managing Editor

Ibrahim Maiz

Content Manager Ali Rishfan

Managing Editor Ali Yoosuf

Marketing Manager

Aminath Suha Mohamed

Assistant Editor

Maanee Mohamed

Assistant Editor

Mariyam Yusra

Multimedia Journalist

Ahmed Shaif

Multimedia Journalist

Fathimath Lamya Abdulla

Office Assistant Mohammad Ratan

Published by

Copyright c 2025 Orca Media Group. All rights reserved throughout the world. Reproduction in any manner is prohibited. Opinions expressed in the articles are of the authors and do not necessarily reflect those of the editor or publishers. While the editors do their utmost to verify information published they do not accept responsibility for its absolute accuracy. Materials in this publication may not be reproduced, whether in part or in whole, without the consent of Orca Media Group.

marketing@orcamedia.group

Website orcamedia.group

Address Orca Media Group Pvt. Ltd 4th Floor, Ma. Oliveena Chandhanee Magu, Male’ Republic of Maldives

Welcome to the August 2025 edition of Corporate Maldives Magazine. This quarter’s Corporate Maldives Spotlight marks 20 years of Ooredoo in the Maldives. From laying the first subsea cables to rolling out 5G coverage across the nation, the company has played a key role in shaping the country’s digital landscape. We spoke with Chief Commercial Officer Hussain Niyaz about his own journey, from field technician to C-level, and what’s next for a telecom operator that now sees itself as a digital partner for national development.

Elsewhere in this issue, we take stock of a country at a crossroads. The CEO Summit 2025 was not just another event, it surfaced tough questions about debt, data, development, and whether our systems are built for the future. Our coverage captures the raw takeaways, sectoral gaps, policy mismatches, and also the ideas that might just move the country forward.

We also look outward. From financing for development to climate diplomacy, the Maldives continues to make its voice heard internationally, using its unique vulnerabilities to push for reform and resilience within the global system.

From the quiet rise of AI in finance and healthcare to ongoing challenges around youth employment, governance, and digital trust, the stories in this issue reflect a Maldives trying to adapt, not just to global shifts, but to its own internal contradictions. It’s a time of ambition, but also reckoning.

Thanks for reading.

08

CORPORATE MALDIVES SPOTLIGHT: OOREDOO MALDIVES

58

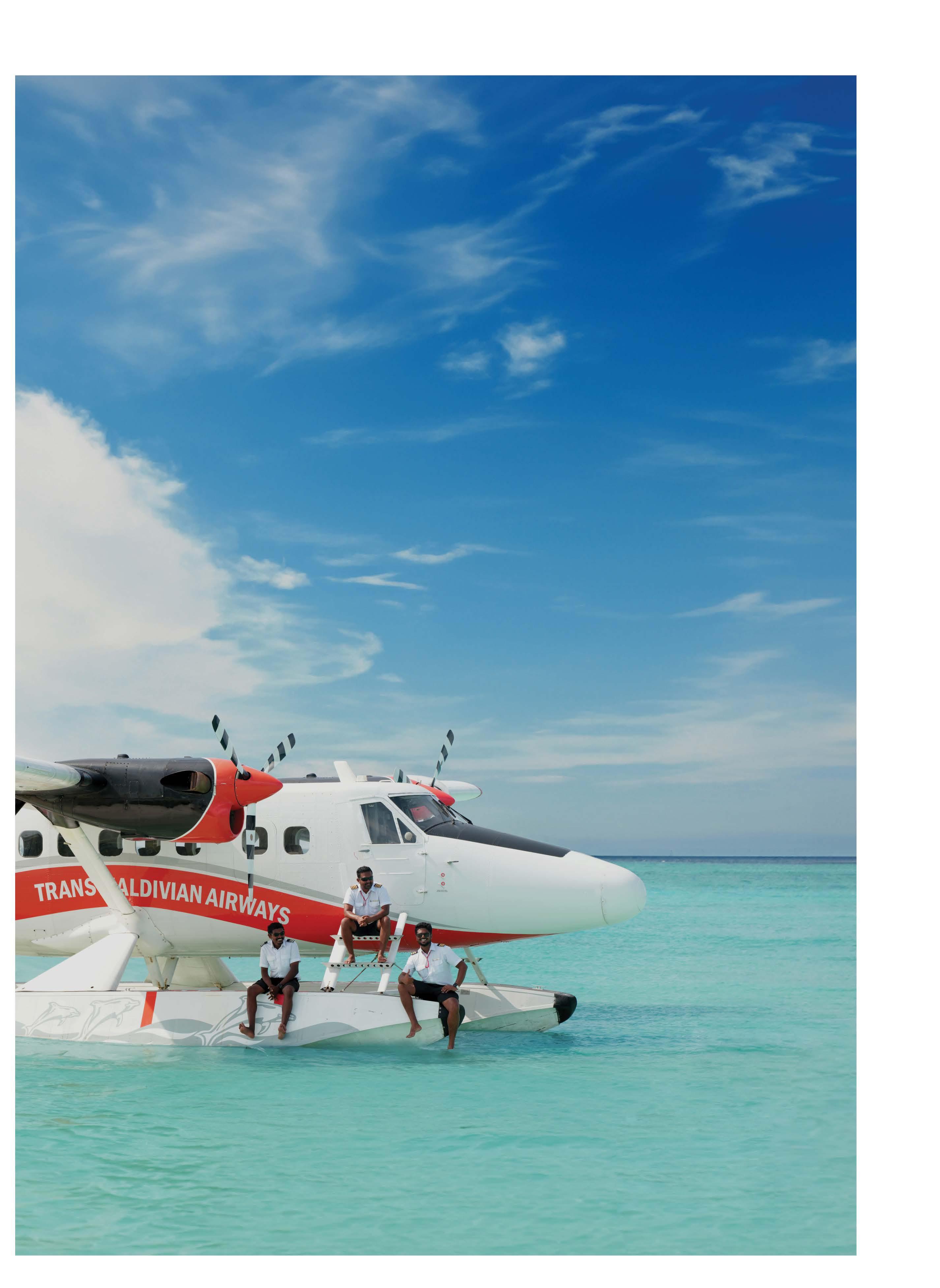

TOURISM & AVIATION

36

CORPORATE MALDIVES CEO SUMMIT

46

GOVERNMENT & ECONOMY

BANKING & FINANCE

62

CLIMATE

66

HUMAN RESOURCES

TECHNOLOGY & INNOVATION

FOREIGN POLICY

82 96

TRADE & SHIPPING

90

TRANSPORT & CONSTRUCTION

CORPORATE MALDIVES SPOTLIGHT

At the heart of Ooredoo Maldives’ two-decade transformation is Hussain Niyaz, a former military technician who helped build the company’s network from the ground up, often quite literally. Now serving as the company’s first local Chief Commercial Officer, Niyaz represents both the history and the future of telecoms in the country. It is a journey that spans cables laid across the ocean floor, towers raised on remote islands, and an infrastructure ready for an AI-driven era.

Since joining Ooredoo (then Wataniya) during the 2G era, Niyaz has been part of every major network milestone, from expanding fixed broadband to all inhabited islands to preparing the country’s digital backbone for 5G and beyond. But beneath the technological achievements lies something more personal, a belief in digital inclusion, shaped by memories of crisis and a desire to ensure that no island, no household, and no person gets left behind.

We sat down with Niyaz to reflect on Ooredoo’s 20-year journey, his own path from fieldwork to the boardroom, and how the company is preparing for the next leap in connectivity and innovation.

It’s been 20 years since Ooredoo entered the Maldives. What is one moment from the early days that still defines what this company stands for?

You made the leap from national service to telecoms, from defence electronics to digital infrastructure. What convinced you that this was the right frontier to build next?

There are many moments I could point to, but one that really stands out is when we finally received the licence for fixed broadband. That came a full decade after we got our initial mobile licence in 2005. Getting the green light in 2015 was not easy. We had to push through countless obstacles and lobby across three different administrations. But it paid off. We laid submarine cables across the country, and for the first time, households on islands were truly connected. That shift was about more than just technology. It meant people on remote islands had access to the same opportunities as those in the capital. We didn’t stop there.

Another milestone was the move to our new headquarters. It took years of planning, negotiations, and perseverance, from land acquisition to building through the challenges of COVID-19. When we started, Central Park didn’t even exist. People used to say Wataniya wouldn’t survive, but here we are, two decades later, leading the market. What defines us is this unwavering commitment. We never gave up.

I’ve been drawn to electronics since I was a child. My father used to repair TVs and radios, and I would sit beside him, learning the ins and outs. That early exposure stayed with me. I entered the national service through the electronics division, where I worked on everything from CCTV to telephones and walkie-talkies.

When I heard Wataniya was entering the Maldives, I was immediately curious. The field of radio frequencies fascinated me. At that point, I was already handling communication devices in the military, and joining a telecom company felt like a natural extension of that path. So I took the leap and joined as an RF technician during the 2G era.

Back then, the internet wasn’t what it is today. It was still dial-up, mostly used to check the news or basic communication. There was no Facebook or WhatsApp. I loved the field. In my Grade 10 yearbook, I wrote that I wanted to work in electronics, and somehow, life found a way to take me there.

Eventually, my colleague Shabeen and I realised we had reached a ceiling in terms of technological growth in the military. We knew we needed to look beyond if we wanted to continue learning and building. That’s when we approached Wataniya. The rest, as they say, is history.

You helped build the network from the ground up, sometimes quite literally. What did that kind of fieldwork teach you that boardrooms never could?

Ooredoo has introduced every major network milestone, from 3G to 5G. What was the breakthrough moment when you realised the Maldives was ready to go fully digital?

My journey started in the field, not in a meeting room. I was a technician first. I installed towers, ran cables, mounted antennas — all the hands-on work that makes a network function. That’s where I learned the foundation of this business, and I’m grateful for it.

Years later, when the company was looking to bring someone with technical experience into a commercial role, I was approached. They needed someone who understood the technology, who could communicate in Dhivehi, and who could represent the company well. I had never seen myself in a commercial role before, but I took the opportunity seriously.

Coming from a technical background gives me a different lens in the boardroom. I’m not just discussing strategy. I understand what it takes to execute that strategy in the real world. I know how the technology works, where the challenges are, and how to overcome them. That perspective is something not everyone brings to the table, and it’s a strength I carry with me to this day.

The turning point was when we brought 4G connectivity to every inhabited island in the Maldives. From the very beginning, even when we were operating on 2G, we believed that the future of communication in the Maldives would revolve around the internet. Today, we talk about AI as the next frontier. But back then, our sights were set on getting people connected and online.

Today, every island in the Maldives has 4G, and around 80 percent already have access to 5G. We’ve built two major data centres, one in Malé and one in Kulhudhuffushi, both connected via submarine cables directly to Singapore and France. These centres are ready for the future. We’ve even partnered with NVIDIA and prepared our infrastructure for AI workloads.

When you think about it, people don’t even remember buffering anymore. That’s because we’ve designed a network to meet today’s demands and tomorrow’s possibilities. The pandemic didn’t knock us offline. That’s a sign of strength. We built with resilience and readiness in mind. Today, we are ready for tomorrow.

Digital inclusion has been a recurring theme in your leadership. Was there a moment that made this personal for you?

Yes, absolutely. I was serving in the military during the 2004 tsunami. Communication across the country broke down completely. People had no way of knowing whether their loved ones were safe. In some islands, communication was down for up to four days. I remember seeing the fear and frustration in people’s eyes.

I was working in the communication coordination unit at the time. Colonel Nazim instructed us to bring every boat’s radio onto a single common frequency. That way, we could at least restore basic communication across the islands. It was a difficult moment, but it showed me how essential communication is, especially in a country like ours, where people live scattered across the sea.

That experience stuck with me. When Ooredoo started building its network, we kept those lessons close. For an island nation, digital inclusion isn’t a luxury. It’s a necessity. And we have always tried to build a network that never leaves anyone behind, not in a crisis, and not in everyday life. We designed and built our network with resilience in mind.

AI is transforming telecoms, from predictive service to customer engagement. How do you see it shaping the next chapter for operators like Ooredoo?

AI has already become part of our everyday operations. People may not realise it, but it’s already here. From customer service bots to network management, we use AI in ways that improve efficiency and reliability.

Take something simple, like a call handover between two towers. That used to be manual. Today, AI handles it seamlessly. That’s why calls don’t drop when people are on the move. We call it a selfoptimising network (SON). It’s intelligent, it learns, and it adjusts in real time.

Internally, we’re using tools like Microsoft’s Co-Pilot to enhance our work. AI isn’t something we’re waiting for. It’s something we’re using. And as the pace of change accelerates, we have to keep evolving. It took years to move from 2G to 3G, and then to 4G. But 5G came quickly. Now, the industry is already exploring 6G. We intend to stay ahead of that curve.

You are the first local C-level executive at Ooredoo Maldives. What does that milestone mean to you today, and what kind of precedent do you hope it sets for future leaders?

It means a great deal to me. To be the first Maldivian in a C-level role at a global telecom company like Ooredoo is something I never imagined when I started out as a technician. It’s a huge responsibility. Commercial is a demanding portfolio; it covers everything from customer experience and sales to brand and distribution. There’s a lot to manage.

In sectors like tourism, we’ve seen Maldivians rise to leadership positions even in international companies. In tech, that hasn’t happened as much. But I believe it will. We are already investing in our people. We’ve sent colleagues to leading institutions like Harvard. The talent is here. What’s needed is the opportunity and the belief.

I hope my story shows that it’s possible. That someone who starts on the ground can rise to the top. And more importantly, I hope it encourages others to keep pushing forward.

Describe Ooredoo’s 20-year journey in three words. No explanations, just the words.

Before smartphones became essential. Before mobile internet made island life more connected. Before the Maldives could livestream a football match or run an entire business from a phone, there was Wataniya.

In 2005, the Maldives stood at the threshold of a digital shift. But for most people, communication was still basic, slow, and limited. Internet access was unheard of in most parts of the country. There was an absence of choice when it came to your network provider. The idea of mobile money, video streaming, or public Wi-Fi wasn’t even on the horizon.

It was into this world that Wataniya Telecom Maldives entered, not simply to compete, but to build. From the very beginning, Wataniya introduced technologies that hadn’t existed in the country before.

In 2006, just a year after launching, the company established the Maldives’ first international subsea cable, a physical link that would go on to power the country’s digital future. That same year, it launched the first mobile virtual private network (MVPN), signalling a commitment to both consumers and enterprises

These weren’t just service upgrades; they were structural changes. In 2007, SMS-based information services were introduced. By 2008, 3G had arrived, followed closely by wireless broadband in 2009. For many Maldivians, this was the first time they had access to fast mobile data, a shift that quietly changed how people lived, worked, and communicated.

Ooredoo’s early innovations came in rapid succession: prepaid broadband, mobile video broadcasting, new tower technologies. The company wasn’t waiting for global trends to trickle down to the Maldives; it was delivering them.

Then in 2013, the shift became even more pronounced. Wataniya rebranded as Ooredoo Maldives and, in partnership with Huawei, introduced the Maldives’ first LTE network, bringing a new era of broadband access across both fixed and mobile platforms. With the rebrand came a broader transformation in identity: Ooredoo wasn’t just a telecom provider anymore; it was becoming a national digital partner.

By 2014, Ooredoo launched 4G LTE Advanced, the first of its kind in the country. It began rolling out public Wi-Fi zones and tailored solutions for the resort sector, extending its impact beyond the everyday user to the country’s critical industries.

In the span of a decade, Ooredoo had moved the Maldives from limited choice to leading edge. But these first ten years were only the beginning. The next decade would see it take on new roles in digital finance, e-commerce, education, and even health, as it helped the Maldives not only connect, but transform.

By the time Ooredoo crossed its tenth year in the Maldives, mobile phones had become a fixture in everyday life. But the company wasn’t content with simply offering faster speeds or broader coverage. Its second decade would be about something deeper: inclusion, access, and reimagining what a telecom company could be.

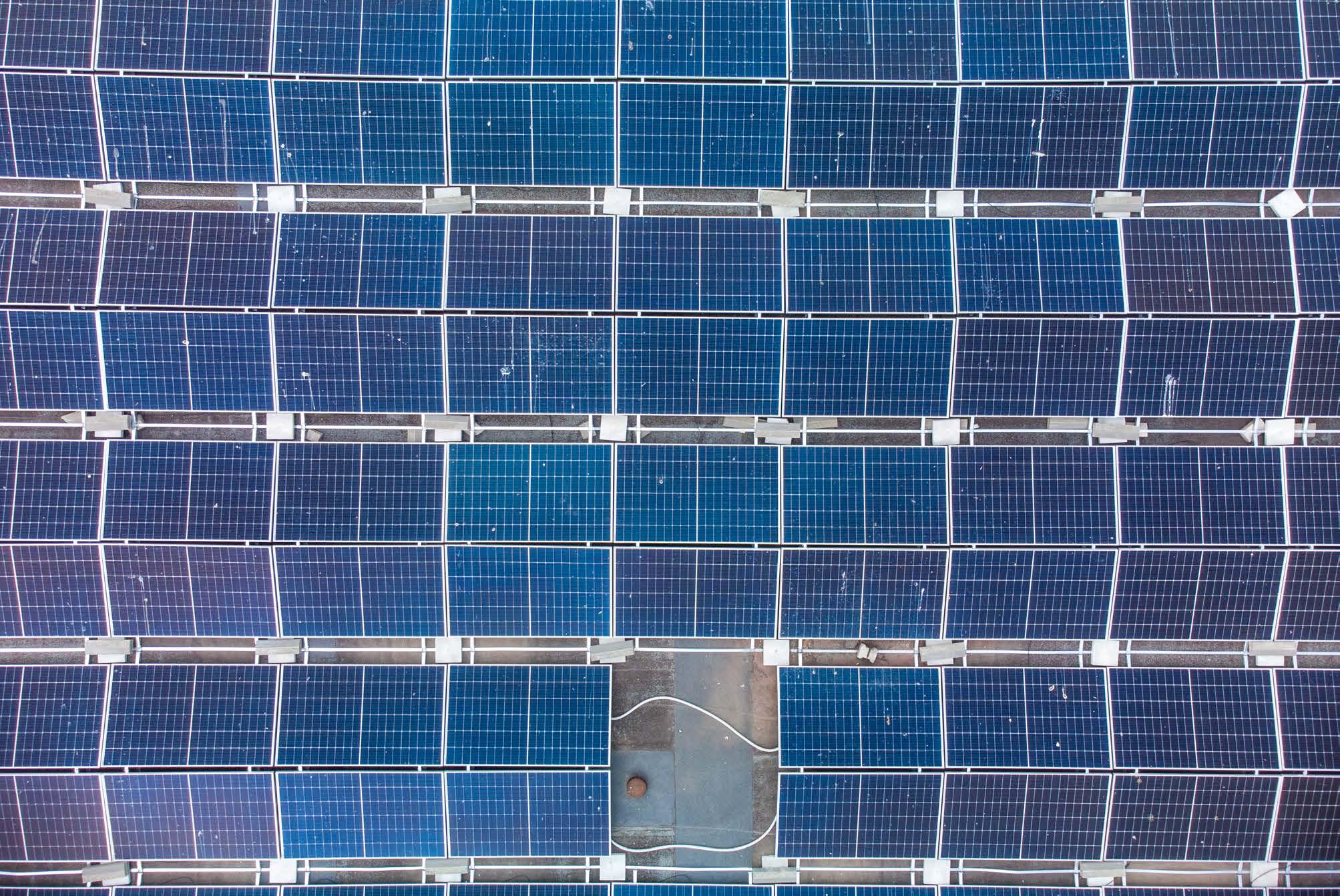

In 2015, Ooredoo introduced green technology to its network with Huawei’s Easy Macro, designed to reduce environmental impact while enhancing user experience. That same year, it partnered with Facebook to bring Free Basics to the Maldives, offering free access to essential online services. It also kicked off the Nationwide Submarine Cable Project, laying the physical foundations for highspeed access across the islands.

But 2016 was a turning point. The company launched m-Faisaa, the Maldives’ first mobile money platform, and SuperNet, its fixed broadband service. Mobile number portability arrived, and the Ooredoo Smart Campus initiative began. These weren’t just new offerings; they were tools that brought more people into the digital economy. That year, Ooredoo converted into a public limited company, a marker of both financial growth and public trust.

From 2017 to 2020, Ooredoo expanded its reach, but also its relevance. It launched a nationwide 4G+ network and rolled out customer-centric innovations like Magey Plan, Ooredoo Next, and Ooredoo Faseyha. It broke ground on a flagship building and began trading on the Maldives Stock Exchange. Partnerships with UNDP and HDC around Smart Cities signalled its growing role in the national development conversation. At the same time, community events like the Colour Run and Mas Race became cultural staples, reminders that digital transformation could also be joyful and inclusive.

As the pandemic swept across the world in 2020, Ooredoo quickly adapted. It donated over MVR 2.5 million in aid, provided intubation boxes for hospitals, and enabled remote education by offering free internet for students and teachers. Moolee, its e-commerce platform, became a lifeline for contactless delivery, and it introduced the country’s first sign-language customer service hotline. FlexiWork plans, bill flexibility, and platforms like QuickPay helped businesses and households adapt to a new, uncertain normal.

The years that followed saw a wave of new investments in infrastructure and experience. Ooredoo launched the Maldives’ first Tier 3-ready data centre, introduced data rollover, expanded SuperNet broadband, and brought voice-over-Wi-Fi and LTE roaming to local users. Ooredoo enhanced its AI customer care assistant, launched Ooredoo Nation virtual gaming tournaments powered by 5G, and expanded its domestic submarine cable network.

Then came the company’s 19th anniversary, and with it, a new kind of celebration. Ooredoo launched the Digital Island initiative in N. Landhoo, partnered with TikTok and with its global ambassador Paris Saint-Germain hosted coaching camps, virtual tournaments, and freediving safety events. The Guinness World Record for the world’s largest underwater panel discussion became a symbolic milestone, not just a technological feat but a statement of possibility.

In 2024 and 2025, Ooredoo deepened its investment in people. It donated MVR 16 million worth of air ambulance equipment to the government and partnered with Harvard University to deliver leadership development programmes for its staff. Events like the Fun Run expanded to more islands. With 5G coverage now reaching 80 percent of the population, the infrastructure is firmly in place for what comes next.

Two decades in, Ooredoo is no longer simply a telecom operator. It is a digital partner, a platform, a community catalyst. From connectivity to commerce, from health to education, it has helped the Maldives move not only faster but forward.

There was a time when digital inclusion in the Maldives was measured in megabytes and mobile coverage. But as the nation’s technological footprint expanded, a new question emerged: were communities ready to truly live digitally?

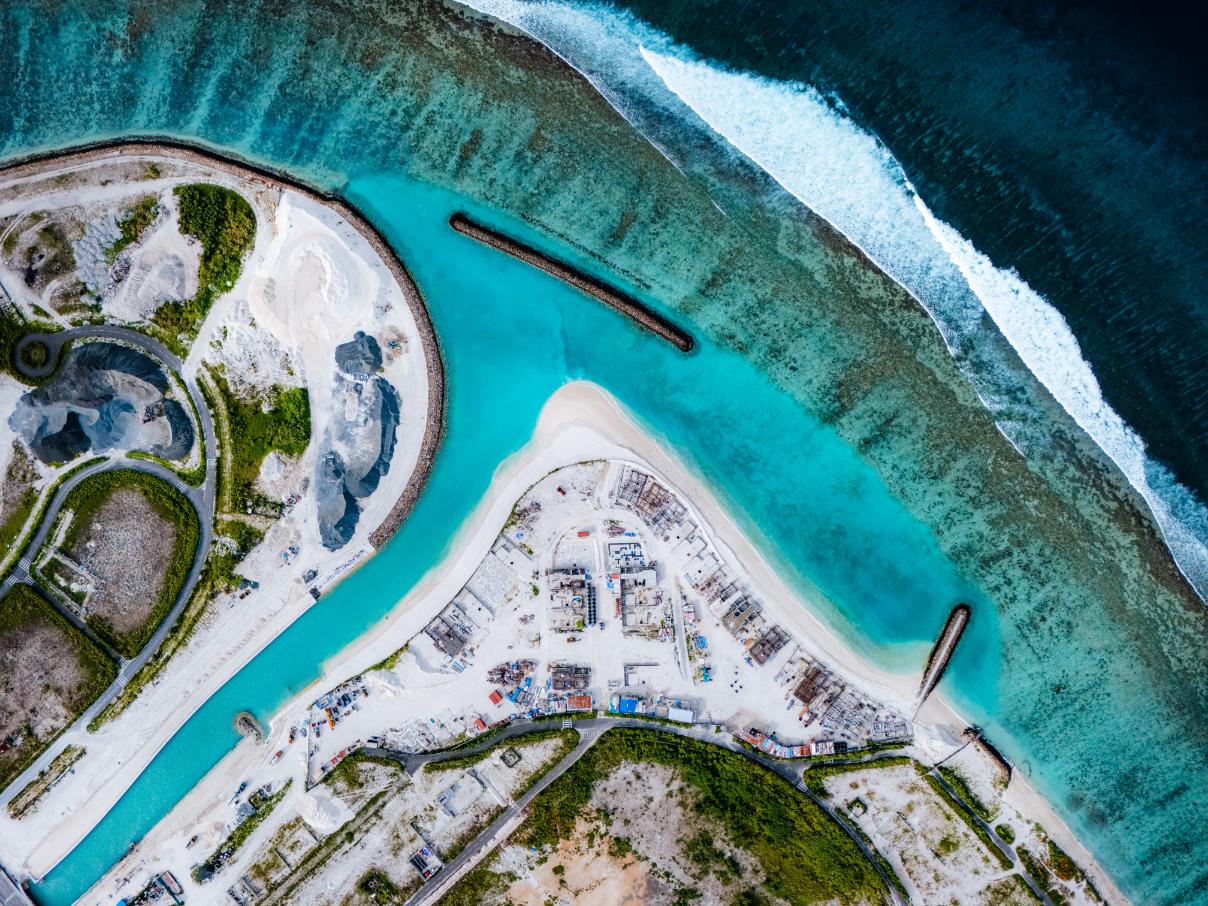

That question found its answer in a small island in Noonu Atoll, N. Landhoo, where residents, council, and service providers have come together to create something unprecedented: the Maldives’ first Digital Island.

Launched under Ooredoo Maldives’ wider commitment to building a Digital Maldives powered by AI, the transformation of Landhoo goes far beyond infrastructure. It marks a shift in thinking. This is about readiness not only to use digital tools, but to understand them, trust them, and build a way of life around them.

The Ooredoo Digital Island initiative was developed in close partnership with the Landhoo Council. This relationship proved key to its success. Together, they focused not only on bringing technology to the island but also on helping the community embrace it. That meant more than providing connectivity. It meant creating real-world use cases, building trust, and integrating digital services into daily life.

At the centre of this shift is m-Faisaa, Ooredoo’s digital wallet. Today, 40 percent of the island council’s income is collected through m-Faisaa. Soon, 100 percent of the waste collection fees on the island will also be paid digitally. Across Landhoo, 65 percent of retail transactions, including those in shops, cafés, and guesthouses, are now processed through m-Faisaa.

These are not isolated statistics. They reflect a community-wide pivot to digital living. They show that digital readiness is no longer just a policy goal or a corporate vision. It is happening in the lived experience of islanders.

What sets Landhoo apart is not just the availability of tools like the Ooredoo Super App, Moolee e-commerce, or Fiber broadband SuperNet, but the way these services have been understood and adopted. Residents now experience everyday convenience through cashless payments, digital shopping, and simplified council services. These changes make the case for a more efficient, transparent, and inclusive future.

President of the Landhoo Council, Abdul Azeez Mohamed, emphasised the council’s commitment to leveraging technology to enhance public services and improve the quality of life for residents. His remarks reflect the local leadership’s proactive approach to integrating innovation into governance and service delivery.

Ooredoo Maldives CEO, Khalid Al Hamadi, highlighted the island’s digital maturity, noting that a significant majority of Ooredoo’s transactions in Landhoo are now conducted digitally. He pointed to this as evidence of the community’s strong openness to adopting digital solutions in everyday life.

This shift also aligns with broader goals. The Digital Island initiative supports the UN Sustainable Development Goals by advancing women’s economic empowerment, encouraging small business growth, and driving inclusive economic participation through digital financial inclusion.

Landhoo is the first, but it will not be the last. The lessons from this pilot are already shaping how Ooredoo approaches the potential of other communities across the country. The success in Landhoo proves that when technology is introduced with care, community engagement, and real purpose, adoption becomes organic.

This is not a story about a company launching a new service. It is about a community reshaping its rhythm of life, its habits, and its relationship with the future. It is about what happens when digital transformation is not something that happens to people, but with them.

In the heart of Noonu Atoll, the digital Maldives is no longer a vision. It is already underway.

In the early days of mobile networks in the Maldives, corporate responsibility often meant sponsoring an event or donating equipment when called upon. But as the country digitised and dependence on technology deepened, so too did the expectations on those powering the change. What happens when your business is no longer just a service, but an essential part of how people learn, work, bank, and stay healthy?

Ooredoo Maldives has answered that question not through a singular grand gesture, but through a gradual evolution in how it sees its role in public life. Its corporate social responsibility initiatives over the years form a picture not of a company stepping in during moments of crisis, but of one staying present, listening, and adapting to the needs of the people it connects.

Take the case of internet safety. In 2020, as the country turned to online tools for everything from education to commerce, digital threats also grew. Ooredoo responded by launching an internet safety programme in collaboration with the Maldives Police Service and key ministries. It wasn’t a flashy campaign. It was a steady rollout of webinars, videos, and community sessions focused on cyber hygiene, digital literacy, and practical safety tools, designed for everyone from students to the elderly. At a time when access to the internet was no longer a luxury, making it safer became part of the company’s mandate.

That same year, as the COVID-19 pandemic upended daily life, Ooredoo’s sense of responsibility expanded again. While ensuring continuity for its staff and customers, the company also moved quickly to support national response efforts. It partnered with the Ministry of Education to support online schooling, provided connectivity to frontline workers, and ensured patients in quarantine could stay in touch with loved ones. There were donations, including MVR 2.5 million to the government and medical supplies and SIM cards, but behind each was a focus on maintaining connection, both digital and human.

During the same period, Ooredoo helped move the Miyaheli social innovation camp online. The platform, a long-time partnership with UNDP, invites young Maldivians to design creative solutions to community problems. Held virtually during lockdown, it gave rise to ideas like a silent distress alert system, an online doctor consultation platform, and a local educational YouTube channel for children stuck at home. These projects were not hypothetical. With seed funding and mentorship, they moved from concept to prototype, proving that youth-led ideas can carry real weight in public response.

Ooredoo’s focus on healthcare has grown steadily alongside its digital programmes. From 2022 onwards, the company continues to donate health kits to all health centres in the country, ensuring that basic diagnostic tools are available even in remote islands. The initiative aligned with the company’s support for the UN Sustainable Development Goals and its ongoing investment in wellness through events like the Ooredoo Fun Run.

Ooredoo’s commitment to healthcare has spanned years and evolved with national needs. In 2018, the company donated three fully equipped sea ambulances to the Ministry of Health, enhancing emergency medical access across the atolls. That commitment deepened in 2024 with the donation of MVR 16 million worth of specialised equipment to support the newly launched national Air Ambulance service, which has already transported hundreds of patients in critical condition. Together, these contributions reflect a long-term investment in strengthening the country’s emergency response systems and offer a clear example of how corporate responsibility can deliver meaningful, life-saving impact.

What ties all of this together is not a CSR slogan, but a shift in identity. Ooredoo has moved from being a service provider to becoming an actor in community wellbeing. Its work has touched education, health, innovation, and crisis response, areas far outside a traditional telecom brief. Yet each of these efforts stems from the same logic: if your business connects people, then you are also responsible for the spaces they connect within.

As the Maldives builds a more digital future, the private sector will increasingly shape public outcomes. In this new landscape, what matters is not just investment, but presence. Ooredoo’s story shows that social impact does not come from one-time projects, but from staying in the room long after the headlines fade.

On a quiet island morning, as fishermen set out and schools begin to stir, someone uses m-Faisaa to settle a utility bill before heading to work. A few hours later, a student logs in to a remote class, her internet connection quietly strengthened by machine-learning tools that detect and fix performance drops before she even notices them. By evening, a shopkeeper in a small café speaks to a digital assistant in Dhivehi, asking about data top-ups while customers tap their phones to pay for coffee. None of this makes a headline. But this is the future Ooredoo is quietly building.

For years, connectivity in the Maldives was about towers, reach, and speed. But now, it is becoming about fluidity, about how seamlessly life flows when digital services feel intuitive, reliable, and truly local. The next phase of Ooredoo’s journey is not defined by a single piece of technology, but by the invisible way many tools will begin to work together.

The company is turning to artificial intelligence not to impress, but to improve. Predictive systems are being deployed to monitor and optimise the network in real time, making slow connections and latency feel like a thing of the past. This matters in a country where distance defines everything and where every second saved online can mean hours of real-world convenience.

Ooredoo’s vision of service goes beyond the signal. It now includes a digital assistant that understands both English and Dhivehi, available day or night, trained not just to answer questions but to anticipate needs. These chatbots are not replacements for people, but extensions of care, designed to resolve common queries and free up human agents for what matters most.

At home, the company’s Smart(er) Home initiative is quietly changing how spaces work. Lights that respond to movement, devices that conserve energy, and security systems that integrate directly into mobile apps are all part of the portfolio. Ooredoo is expanding these offerings not as a tech experiment, but as a reflection of how the Maldivian home itself is evolving.

Much of this transformation is anchored in the Ooredoo SuperApp. Over time, more services will be integrated into the app, from broadband upgrades to device delivery, allowing the company to reduce its physical footprint while improving nationwide reach. This is not a retreat from service, but a redistribution of it, where your phone becomes the front desk, the cashier, and the service window.

Then there is money. Or rather, the growing absence of it in cash form. Through m-Faisaa, Ooredoo is aiming to build a payment culture that works from the street corner vendor to the city council. But adoption takes more than tech. It takes trust. The company recognises this and plans to lead with outreach, particularly among the elderly, to ensure the digital economy feels familiar, not foreign.

Behind all this lies a larger ambition to bring the Maldives not just up to speed with global trends, but to do so in a way that fits Maldivian life. Whether it’s supporting online education, backing health infrastructure, or pushing for greener, leaner networks, Ooredoo’s future strategy is as much about responsibility as it is about progress.

This is not the kind of transformation you’ll see in dramatic product launches or glossy advertisements. It’s the kind that settles in slowly, in quiet tap-to-pay moments, in smart connections that don’t break, in the comfort of knowing that service is always a few swipes away. The road ahead is not loud. But it is ambitious. And if Ooredoo has anything to say about it, it will be built thoughtfully, island by island, person by person, and with the future folded gently into the present. A truly Digital Maldives.

Tourist ArrivalsMonthly

Tourist Arrivals -

Share of Bed Capacity by Type

Tourist arrivals to the Maldives have continued to gain momentum through mid-2025, with 1,282,319 visitors recorded as of 29 July. This reflects a 9.4% increase compared to the same period last year, according to the Ministry of Tourism.

The month of June brought in 141,772 visitors, up 15% from the previous year, while 174,189 tourists arrived between 1 and 29 July, marking an 11.4% year-on-year increase. These figures build on robust growth earlier in the year, including January’s 11.7% rise and April’s 17.8% surge, effectively offsetting a modest 1.5% dip in February.

With an average daily arrival rate of 6,106, the Maldives remains on course to exceed its record-breaking 2024 total of over two million visitors. The government is targeting an annual increase of 15%, buoyed by infrastructure upgrades including the upcoming new terminal at Velana International Airport.

China continues to lead as the top source market in 2025, contributing 186,546 visitors (14.5%). Russia (11.8%) and the United Kingdom (9.4%) remain key contributors, followed by Italy (7.2%) and Germany (7.1%). Other major markets include India, the United States, France, Spain, and Switzerland.

Resorts remain the primary choice of accommodation, hosting 73.1% of all visitors. Guesthouses account for 22.1%, while hotels and safari vessels make up 2.7% and 2.1% respectively. This reflects the country’s diversified tourism offerings. As of 29 July, 1,244 tourist establishments are in operation nationwide, offering a bed capacity of 65,943, with over two-thirds situated in resort islands.

Despite global uncertainties, the sustained growth of the tourism sector reinforces the Maldives’ standing as a worldclass destination. The steady rise in visitor numbers, backed by both consistent market performance and strategic long-term investments, highlights the industry’s resilience and enduring significance to the national economy.

Total Assets

Foreign Currency Finacial Assets

Local Currency Finacial Assets

Total Liabilities

Foreign Currency Financial Liabilities

Local Currency Financial Liabilities

The Maldives Monetary Authority experienced a slight contraction in total assets in June 2025 following earlier gains, with foreign currency reserves easing slightly. However, equity continued to improve, and liability adjustments suggest a rebalancing of commitments. The figures point to cautious but stable financial stewardship amid changing monetary dynamics.

Inflation is the percentage change in the general price level in the economy during a given period.

Inflation in the Maldives exhibited considerable fluctuations towards the end of 2024 and into the first half of 2025. It stood at 1.1% in October, before sharply increasing to 4.1% in November and reaching 4.8% in December. The upward trend peaked at 5.6% in April 2025, following 5.3% in both January and March, and a slight dip to 5.1% in February. However, May saw a notable easing to 4.6%, suggesting potential signs of stabilisation. The persistent elevation in inflation earlier in the year was largely driven by rising costs in food and utilities, reflecting the economy’s ongoing sensitivity to global price shocks.

Value in Millions - USD

Maldives’ trade figures in early 2025 continued to show a pattern of volatility. Imports, which peaked at USD 375.79 million in December, dropped to USD 334.4 million in January and further to USD 284.58 million in February. After a slight rise to USD 285.21 million in March and USD 304.51 million in April, imports declined again to USD 283.91 million in May.

On the export front, January marked the highest value in the sixmonth period at USD 55.73 million, followed by a gradual decline to USD 43.88 million in February, USD 42.46 million in March, USD 42.59 million in April, and a sharp drop to USD 25.75 million in May. The persistent gap between imports and exports highlights the Maldives’ structural trade imbalance and its heavy reliance on imported goods.

Government revenue in the Maldives continued to grow in the first half of 2025, supported by consistent inflows from the tourism sector, although fluctuations became more apparent from April onward.

According to the Maldives Inland Revenue Authority (MIRA), total revenue collection stood at MVR 3.34 billion in January, dipped to MVR 2.54 billion in February, and climbed to MVR 3.43 billion in March. In the second quarter, collections dropped to MVR 2.63 billion in April, fell further to MVR 2.17 billion in May, and rebounded slightly to MVR 2.63 billion in June.

Goods and Services Tax (GST) from the tourism sector remained the largest contributor, exceeding MVR 1 billion in each of the first three months. Tourism GST reached MVR 1.06 billion in January, MVR 920 million in February, and MVR 1.45 billion in March. However, receipts dropped to MVR 1.16 billion in April, fell further to MVR 963 million in May, and continued down to MVR 593 million in June, reflecting seasonal tourism slowdowns.

Corporate Income Tax also demonstrated considerable volatility. After peaking at MVR 842 million in January, collections declined to MVR 272 million in February, MVR 45.7 million in March, and just MVR 25.8 million in April. The figure bottomed out at MVR 22.6 million in May, before a significant rebound to MVR 333 million in June, aligning with mid-year filing patterns.

Bank Profit Tax followed a similarly irregular path, contributing MVR 153 million in January, plunging to MVR 6.8 million in February, disappearing from the March to May records, and returning at MVR 134 million in June.

Non-resident withholding tax remained an important revenue stream, recording MVR 139 million in January, MVR 80 million in February, MVR 111 million in March, MVR 113 million in April, then falling to MVR 82 million in May, and rising again to MVR 111 million in June.

Revenue from expatriate quota fees declined from MVR 36.2 million in January to MVR 30.5 million in February and MVR 21.8 million in March, before stabilising at MVR 28 million in April and MVR 27.1 million in May, then easing again to MVR 23.7 million in June.

Green Tax collections increased from MVR 108 million in January to MVR 270 million in March, then tapered off to MVR 227 million in April, MVR 205 million in May, and MVR 163 million in June.

Lease period extension fees saw a spike in February (MVR 307 million) but disappeared from the records for the following months. Despite strong numbers in the first quarter, the second quarter figures point to the Maldives’ continued fiscal dependence on tourism and a limited revenue base. The monthly swings in tax receipts highlight the vulnerability of government income to seasonal and sector-specific trends, underlining the need for broader revenue diversification.

Key Drivers Behind the Monthly Increase:

Other positive contributors included:

The overall Consumer Price Index (CPI) for the Maldives rose by 0.48% in May 2025, reversing the decline of 0.50% recorded in April. This month-on-month increase indicates a return of upward pressure on prices, although at a slower annual pace than before. Year-on-year inflation stood at +4.55%, down slightly from +5.62% in April, suggesting easing—though still elevated—price pressures in key sectors.

The most significant contributor to the CPI rise was the Housing, Water, Electricity, Gas, and Other Fuels category, which increased by 1.91%, largely driven by a 12.99% surge in electricity prices. This was the most notable price hike recorded across all groups.

Personal Care and Miscellaneous Services (+0.27%), led by higher grooming and hairdressing costs.

Furnishings and Household Equipment (+0.17%), mainly due to increases in the price of air conditioners.

Food and Non-Alcoholic Beverages (+0.05%), with prices of tuna (+3.03%), dry coconut (+9.51%), lime (+8.38%), and githeyo mirus (+11.39%) rising. However, this was partially offset by significant declines in garlic (-12.54%), carrots (-15.56%), and oranges (-16.38%).

Price Declines Were Notable in:

Transport (+0.05%), driven by a modest 0.28% increase in motorcycle prices.

Restaurants and Accommodation Services (+0.01%) and Tobacco and Aracanuts (+0.03%) also recorded slight upticks.

Information and Communication (-0.12%), mainly due to a 0.34% fall in mobile phone service costs.

In Malé, the CPI rose by 0.36%, driven by a 17.01% rise in electricity prices, while food prices fell due to sharp declines in items such as oranges, garlic, and tuna.

In the Atolls, the CPI increased more sharply, by 0.66%, with a 4.19% rise in the housing and utilities category, especially electricity. However, this was partially offset by a 5.16% drop in water prices.

Food prices were more stable, and the largest decline came from the Information and Communication group.

Annual Government Debt Figures (2015–2025)

SOURCES: Data is compiled from official Maldivian government sources – primarily the MINISTRY OF FINANCE (Debt Management Department reports and Fiscal Strategy documents) and the MALDIVES MONETARY AUTHORITY (MMA) statistical database

On a humid June afternoon at JEN Maldives Malé by Shangri-La, something unprecedented unfolded within the elegant walls of the hotel ballroom. It wasn’t just another corporate event, nor a typical gathering of business elites. The inaugural CEO Summit 2025 brought together leaders spanning business, government, development finance, and civil society. The purpose was not merely to network, but to engage in structured, forward-facing dialogue about the country’s most urgent and structural economic questions.

Held as the centrepiece of Corporate Maldives Bizweek, the summit revolved around a single theme: building a resilient economy. Rather than limiting the word ‘resilience’ to post-crisis recovery, the summit challenged its participants to think bigger. It asked them to define resilience as the country’s capacity to withstand, adapt to, and thrive amid external shocks, internal limitations, and accelerating global transitions.

In contrast to the often one-directional format of panels and keynote speeches, the CEO Summit was designed to create multidirectional, participatory discourse. The event featured a candid, multi-sector panel discussion in the morning, followed by ten simultaneous roundtable sessions in the afternoon. Each table focused on one crucial pillar of economic transformation.

It was a day defined by frank reflection, dynamic exchanges, and practical ideas grounded in lived experience. The diversity of the room, ministers, fintech pioneers, lawyers, CEOs, SME founders, diplomats, and civil society figures, reflected the magnitude of the task at hand.

This feature chronicles what happened at the CEO Summit 2025. It captures the essence of what was said, by whom, on what themes, and why it matters as the Maldives stands at a crucial inflection point in its economic history.

Moderated by Iyaz Waheed, the President of Universal Foundation, the morning panel opened with a question that hung heavy in the air: What does economic resilience mean for the Maldives, practically, systemically, and politically?

The panel brought together a high-level group of decision-makers and industry leaders. It featured the Dr Abdulla Muththalib. Minister of Construction, Housing and Infrastructure, the Chief Business Officer of Bank of Maldives Moosa Nimal, the Chief Executive Officer of Dhiraagu Ismail Rasheed and Chief Executive Officer of Ooredoo Maldives Khalid Al-Hamadi, and the Chief Commercial Officer of First National Mariyam Visam. What followed was not a ceremonial discussion. It was a direct and, at times, uncomfortable exploration of where the cracks in the economic system lie and how they might be repaired.

The Telecommunications Bedrock

The Minister of Construction opened with a frank assessment of the country’s vulnerability to imported energy. He stressed the urgency of transitioning to renewables, not simply to meet sustainability targets but to safeguard economic stability. “We have no choice,” he said, referencing the 100 MW floating solar project planned for the Malé region and the development of Ras Malé as a city powered entirely by clean energy. Ras Malé, he added, is being developed as a fully self-sustaining island, a prototype the government hopes to replicate. But his most pointed remarks were about value retention. “Billions are generated from our tourism sector,” he noted, “but very little of that capital stays within the country.” He made a passionate call to rethink foreign investment frameworks to ensure that capital generated on Maldivian soil continues to circulate within its borders.

Ismail Rasheed, CEO of Dhiraagu, highlighted how digital infrastructure has become the invisible scaffolding of the modern Maldivian economy. He noted that Dhiraagu has connected every inhabited island with broadband and mobile services, and that telecommunications was the first utility to achieve 100 percent coverage. But Ismail was clear-eyed about the work that remains. “We need stronger data governance, better interoperability, and secure frameworks for digital identity,” he said. “Connectivity alone isn’t enough.”

Digital Banking and AI’s Next Frontier

Tech Companies as Future Builders

Representing Bank of Maldives, Moosa Nimal described how over 95 percent of the bank’s customer base now transacts digitally. He spoke about the future of banking as one of integration with artificial intelligence, anonymised data, and personalised financial services shaping customer experiences. But he warned that widespread digital adoption is not the same as digital literacy. “We have the tools,” he said. “What we lack is awareness, particularly among SMEs.”

He also raised the issue of data silos, explaining how anonymised aggregate data could be used to provide businesses with insights into customer demographics, behaviour, and economic trends if the data-sharing policies existed.

Khalid Al-Hamadi, CEO of Ooredoo Maldives, reminded the room that the future isn’t something to brace for. It is something to build. He outlined how Ooredoo, as part of its global group, is already working with AI leaders like NVIDIA, and how infrastructure developed here can be plugged into wider ecosystems. “We are not just a telecom company anymore,” he said. “And we must not treat ourselves as such.”

Capital Markets and the Missing Middle

Visam Ali, CCO of First National, spotlighted the gaps in Maldivian capital mobilisation. While international investors show appetite for sectors like tourism and logistics, outdated legal frameworks and public unfamiliarity with capital markets limit what is possible. “We are actively working to list Maldivian firms on regional exchanges,” she said, “but we need an enabling ecosystem that includes legislative reform and education.”

Together, these voices painted a portrait of an economy with enormous potential but one held back by fragmented systems, outdated regulatory tools, and a lack of cohesive long-term planning. As the moderator noted in closing, “Resilience begins when we stop managing crises and start designing systems that prevent them.”

At the CEO Summit 2025, held on 18 June at JEN Maldives Malé by Shangri-La, the roundtable discussions served as the most grounded and diverse segment of the day. While the panel featured high-level insights from national leaders and corporate executives, it was in the roundtables that deeply practical, sometimes uncomfortable realities came into view. Each table focused on a theme vital to economic resilience. The representatives who shared back to the full summit did not speak as policymakers or theorists, but as professionals reflecting the real-world complexities of their fields.

What follows is a full account of those summaries, exactly as shared by each table’s chosen speaker.

Table 1: Governance and Policy Reform for Resilience

The speaker from this table began by highlighting how outdated regulations continue to impede innovation and investment. There was concern that some of the recently introduced regulations, especially those related to digital assets and fintech, were drafted and enforced without adequate consultation with stakeholders. The group believed that regulations should be enabling, not restrictive, and that any new frameworks should be tested before implementation. The takeaway was clear: laws must evolve with the market, and public input must be central to how they are designed.

Table 2: Education and Workforce Development

This summary opened with a reflection on the disconnect between the education system and employment realities. The table noted that the current school curriculum lacks vocational and experiential training. One illustrative example shared in the summary was of a medical doctor working in a call centre, highlighting how even highly educated individuals are not ending up in relevant roles.

The table discussed the absence of STEM education from early schooling and proposed that this be included moving forward. A reference was made to how STEM is embedded from early stages in countries like China. The representative noted that the Chinese Ambassador at the table expressed interest in supporting such initiatives. The summary also stressed the importance of retraining even C-level executives in emerging areas like AI and digital systems, given how much the workforce has changed. The group’s final takeaway was that Maldivians are fast learners, and with the right access, they can adapt across age groups.

Table 3: Creative Industries and Cultural Economy

This group approached the topic from varied professional backgrounds. According to their table summary, the biggest challenge facing the creative economy is the lack of corporate skillsets required to turn individual talent into viable business. While creativity was seen as abundant, the group pointed to a major gap in monetisation infrastructure and business support.

They also discussed the need for a national platform that could connect creators and consumers, including tourists, and allow creative work to be discovered, appreciated, and sold. A key issue was the lack of visibility of Maldivian culture within the tourism experience. The speaker remarked that even locals are often unaware of the depth of the country’s own cultural assets. In addition to platforms and promotion, the table called for stronger intellectual property laws and improved access to funding.

Table 4: Energy

The summary from this table focused heavily on the Maldives’ persistent planning-execution gap. According to the speaker, the group felt that renewable energy policies are delayed by repeated cycles of replanning and shifting political priorities.

Two major challenges were highlighted: space constraints, particularly in the tourism sector, and the large capital investments required for renewable projects. The table pointed out that while financing is available from institutions like the World Bank and the Green Climate Fund, there’s a lack of readiness to apply and execute on time. They discussed the importance of public-private partnerships and mechanisms that allow private entities to benefit from investing in national renewable infrastructure. Ocean-based energy, particularly thermal technologies, was also noted as an underutilised opportunity.

The summary from this table described the topic as one of the most complex of the day. The group agreed that the biggest challenge is the absence of a long-term national development plan. Projects like airports and harbours tend to change direction with every political cycle, disrupting continuity and investor confidence.

An unexpected insight shared was how permanent address registration has become a structural barrier. Many Maldivians are legally tied to islands they have never lived in, making relocation and service access unnecessarily complicated. Housing was cited as the most urgent national development issue.

The table called for a legally supported 20-year urban development strategy. They also recommended that service centres be distributed across the atolls, noting that companies like Dhiraagu are already operating from islands and other SOEs could follow suit. The speaker said the table strongly supported enabling all citizens to legally settle in the island of their choice, rather than remaining tied to their birth island.

This table began their summary by redefining the meaning of food security. They asked: what does it mean to be food secure in the Maldives today? While a generation ago that might have meant rice, sugar, and tuna, consumer preferences have shifted. The group noted that imported produce like mozzarella and exotic vegetables are now part of everyday demand, and food security must respond to this new context.

Physical constraints were acknowledged — limited land, fragmented geography, poor soil — but the summary also stressed that much of the sector’s weakness comes from a lack of integrated planning. During COVID-19, the country realised how exposed it was, yet land allocation for agriculture remains insufficient.

The group discussed how agriculture must be integrated into other sectors like tourism and transport. They also pointed out that Maldives produces high-quality local food, such as watermelons and papayas, that remain undervalued due to lack of branding. While vertical farming and hydroponics exist, they are underused and often presented as novelty rather than strategy. The table suggested establishing these systems in major urban centres and supporting them through education and investment.

Table 7: Healthcare

This table’s summary focused on systemic service gaps. The lack of economies of scale in smaller islands was a key problem, particularly in delivering specialised healthcare. According to the speaker, the shortage of qualified doctors, nurses, and health professionals persists in both the capital and the atolls.

Pharmaceutical regulations were described as overly complex, and the Aasandha health scheme was noted as a source of concern, particularly regarding its accessibility and efficiency. The table proposed expanding public-private partnerships to build specialty hospitals, diagnostics services, and telemedicine platforms. Shared infrastructure models between the state and private investors were suggested as a way to address costs while retaining public oversight.

Workforce development, retention, and decentralisation were emphasised as priorities for the years ahead.

Table 8: Finance and Investment Access

With bankers making up most of the group, the summary focused on why financial institutions hesitate to lend. One of the biggest issues is inconsistency in financial reporting. Businesses often submit one version of financials to the bank and another to the tax authority. This makes it difficult for banks to assess risk or verify data.

Another challenge discussed was that many borrowers seek funds for sectors in which they lack prior experience. Without industry knowledge, banks are reluctant to approve financing. The table also touched on real estate, noting that it can take five to seven years to transfer a title deed for an apartment, making it an impractical form of collateral.

The speaker shared a recommendation to create a joint investment guarantee scheme and proposed that banks should consider accepting financial instruments or equity as collateral in place of immovable assets.

This summary challenged the long-standing idea that the Maldives is only about sun and sand. According to the speaker, their group offered real-world examples of diversification already happening — from international sporting events hosted by local councils to wellness and yoga retreats.

The biggest problem facing local tourism, they said, is cost. Unlike resorts, which can centralise services, guesthouses must duplicate them, driving up expenses. Electricity and operational costs in local islands were reported to be significantly higher than in resorts, making local tourism less competitive despite offering the same product.

The table called for regulatory harmonisation, particularly for small-scale guesthouse operations, and suggested tax relief for remote resorts lacking reliable transport. They also recommended a full audit of the country’s tourism brand strategy, arguing that the Maldives can no longer afford to sell itself with a single image.

The final table described trust as the cornerstone issue in the country’s tech landscape. According to the summary, the Maldives lacks a digital trust framework. There are no proper data governance laws, weak digital identity systems, and limited interoperability between government and private sector platforms. One example shared was that personal data like ID cards and addresses are easily accessible online, highlighting the absence of strong cybersecurity. The table believed that the health sector is the most promising application for digital technology, especially in telehealth and remote diagnostics.

However, without foundational reforms, none of these opportunities can be realised. The group urged fast-tracking of cyber regulations, but stressed the importance of tailoring them to the local context to avoid overburdening small businesses. Finally, they recommended national awareness campaigns to raise digital literacy at the community level.

The roundtable summaries at the CEO Summit 2025 revealed a country rich in insight and local expertise. These were not abstract policy discussions. They were lived realities — of barriers encountered, opportunities missed, and practical solutions that, if supported, could shape a more adaptive and resilient Maldives. Each table gave voice to sectoral challenges often buried in silence. Taken together, they offer a blueprint grounded not in theory but in experience. As follow-ups and reporting continue, the lessons drawn from these conversations will be essential to shaping policy, investment, and public discourse in the years ahead.

The Maldives has officially entered the global investment migration market. In partnership with Henley & Partners, the country is launching its first-ever residence by investment programme, offering foreign high-net-worth individuals the right to long-term residence in exchange for real estate investment. The move is being framed as a strategic effort to diversify the economy and tap into global capital beyond tourism revenues.

But while the appeal of attracting deep-pocketed investors is clear, especially for a small island nation facing mounting economic pressures and climate vulnerabilities, the path ahead is far from simple. If not carefully designed and managed, this new initiative could bring unintended consequences, as seen in other countries that embraced similar schemes.

According to the press release from the Ministry of Economic Development and Trade, the programme will focus on real estate acquisition, offering “state-of-the-art properties with the utmost privacy and exclusivity.” It promises investors a stable, secure, and tropical lifestyle, a familiar pitch for countries marketing themselves as safe havens in an increasingly unstable world.

The Maldives’ offering will sit alongside programmes from countries like Portugal, Greece, and the UAE, which have also tried to monetise residency rights through investment. These schemes typically require property purchases, with thresholds ranging from €250,000 to over €1 million, often paired with minimum stay requirements.

Portugal’s golden visa programme, launched in 2012, was initially lauded for bringing in billions in foreign direct investment. But over time, the negative side-effects became harder to ignore: property prices surged, locals were priced out of urban centres, and speculative development thrived while much-needed affordable housing dwindled. By 2023, the Portuguese government began phasing out parts of the programme.

Cyprus, too, shut down its passport-for-sale scheme after a corruption scandal and mounting pressure from the EU. Even in Dubai, where investor visas are part of a broader development model, the strategy only works because of extensive infrastructure, business ease, and a well-oiled residency and legal framework.

The lesson is clear: offering residency is not just about the visa. It’s about what lies beneath, governance, infrastructure, legal predictability, quality of life, and the credibility of institutions.

For this programme to be more than a short-term cash grab, the Maldives must urgently address key gaps:

• Infrastructure and Accessibility: A luxury villa in the Maldives is only as attractive as the ability to get there easily and affordably, with reliable electricity, water, internet, and healthcare. Investors expecting a second home will demand more than just sand and sea.

• Legal and Tax Certainty: Clear rules on property ownership, dispute resolution, inheritance rights, and taxation are critical. High-net-worth individuals tend to avoid jurisdictions where rules shift frequently or where legal enforcement is unclear.

• Healthcare and Education: Long-term residence means people might bring families. International-standard healthcare and access to quality education, even if private, become essential offerings. Environmental Planning: Real estate-driven growth often collides with environmental conservation, particularly in ecologically sensitive island chains like the Maldives. Poor planning could backfire both reputationally and ecologically.

• Public Buy-In: The government must also consider how this scheme is perceived by locals. Will it widen inequality? Will it create enclaves of foreign wealth amid local hardship? Transparency and public communication will matter.

Done right, this investor visa programme could be a tool for attracting quality investment, creating jobs, and upgrading national infrastructure. Done poorly, it could inflate property prices, strain local resources, and create a two-tier society that benefits the few at the expense of the many.

The Maldives is offering a version of paradise, not just to tourists now, but to permanent residents. Whether it becomes a meaningful path to prosperity or a short-sighted sale of sovereignty depends entirely on the details still to come.

This is not just about attracting capital. It is about building a country where people, local or foreign, actually want to live, invest, and contribute for the long haul.

In any democracy, the size and structure of government reflect deeper national priorities. Budgets, roles, and appointments are more than administrative details. They are statements of intent. In the Maldives, a recent public disclosure has brought that reality into sharper focus.

According to the President’s Office, 922 individuals currently serve in political roles appointed under Article 115(f) of the Constitution. This includes 20 ministers, 14 individuals with ministerial rank, 93 state ministers, and 216 deputy ministers. The remainder, nearly 600 positions, comprise political directors, assistant directors, and other senior political staff. While these figures are subject to change, the data provides the first official accounting of political appointments well into President Dr Mohamed Muizzu’s term.

The headline number alone is significant. But more telling is how it scales within the national context. With a population of around 515,000, the Maldives now has one political appointee for every 558 citizens. This ratio is remarkably close to the country’s doctor-to-population ratio, which stands at roughly one doctor per 500 people. In essence, a Maldivian is now almost as likely to encounter a political appointee as a licensed medical professional. This comparison is more than symbolic. It forces a re-examination of how government resources are allocated in a small island democracy where public service delivery, fiscal discipline, and administrative efficiency are ongoing concerns.

When viewed globally, the scale of political staffing in the Maldives stands out. The United States, with over 330 million people, operates with around 4,000 political appointees, approximately one for every 83,000 people. In the United Kingdom, fewer than 150 ministerial and junior ministerial posts are shared among 67 million citizens, resulting in a ratio of about one per 450,000.

To be sure, small states face unique governance challenges. A limited pool of civil servants and the need to staff remote atolls can justify a higher number of appointees relative to population. But the Maldivian tally, especially with more than 300 directors and assistant directors, suggests a much broader and deeper reliance on political appointments than is typically observed elsewhere.

That depth also prompts questions about institutional priorities. Are these positions aligned with strategic goals, or are they fulfilling political obligations? How are their functions evaluated, and what benchmarks exist to ensure performance and accountability?

The timing of the disclosure further complicates the picture. This is the first time such data has been publicly shared during the current administration. In any robust democratic system, information on political staffing is a basic feature of transparency and governance. It should not be an afterthought, nor should it take more than a year and a half into an administration’s tenure to provide a baseline figure. The absence of regular updates undermines public confidence and limits the ability to engage meaningfully with how government is structured and resourced.

Transparency in appointments should not be seen as a concession but as a duty. Clearer reporting, ideally on a quarterly basis, alongside a published ceiling on political roles and better delineation between political and civil service positions would help align governance practice with democratic expectation.

In the end, the doctor comparison endures not because of its novelty, but because of what it reveals. A nation that invests as heavily in political roles as it does in essential services must reckon with the long-term sustainability of that model. Governance is, after all, not only about how many people serve in office, but how wisely those people are appointed, supported, and held to account.

A new World Bank report warns that opaque debt practices are endangering the financial stability of many developing countries and calls for “radical transparency” to prevent future crises. The report, titled Radical [Debt] Transparency, highlights that while public debt reporting has improved since 2021, significant gaps remain, especially in off-budget financing, collateralised loans, and domestic debt disclosures.

The Maldives is among the countries identified as facing high debt distress. In a footnote, the report cites an instance where India granted a one-year extension on two treasury notes worth USD 50 million purchased in 2023 by the Reserve Bank of India. However, critical terms such as the interest rates were not disclosed, raising concerns about transparency in bilateral arrangements.

Globally, the report reveals that nearly 60 percent of low-income countries are at high risk of debt distress. While 75 percent of countries now publish annual debt data, only one in four discloses loan-level information. The problem is especially acute in the case of contingent liabilities, state-owned enterprise debt, and unconventional instruments like central bank swaps and private placements.

For the Maldives, this is not just a matter of improving internal governance. As the country increasingly relies on external borrowing to finance development, the lack of comprehensive reporting could weaken investor confidence and obscure the true fiscal position. The report’s mention of delayed payments to contractors, hospitals, and fisheries-related businesses in the Maldives further highlights the local relevance of these global concerns.

The World Bank outlines urgent recommendations. Borrowers are advised to publicly disclose transaction-level debt data, expand oversight over unconventional loans, and consent to creditors publishing lending terms. Creditors, in turn, are urged to reconcile loan data, disclose restructuring terms, and include transparency clauses in agreements. Meanwhile, institutions like the World Bank and IMF are encouraged to develop systems for automated data reconciliation and support third-party audits.

Technological solutions like a Loan Clearing Module are already being piloted in Indonesia. These could be replicated in the Maldives, ensuring that both creditors and debt managers maintain real-time, harmonised records.

Ultimately, the report argues, transparency is more than just a technical fix. It is foundational to building trust, ensuring accountability, and avoiding the costly consequences of hidden debt. For small island developing states like the Maldives, which are especially vulnerable to economic shocks, ignoring these warnings could come at a steep price.

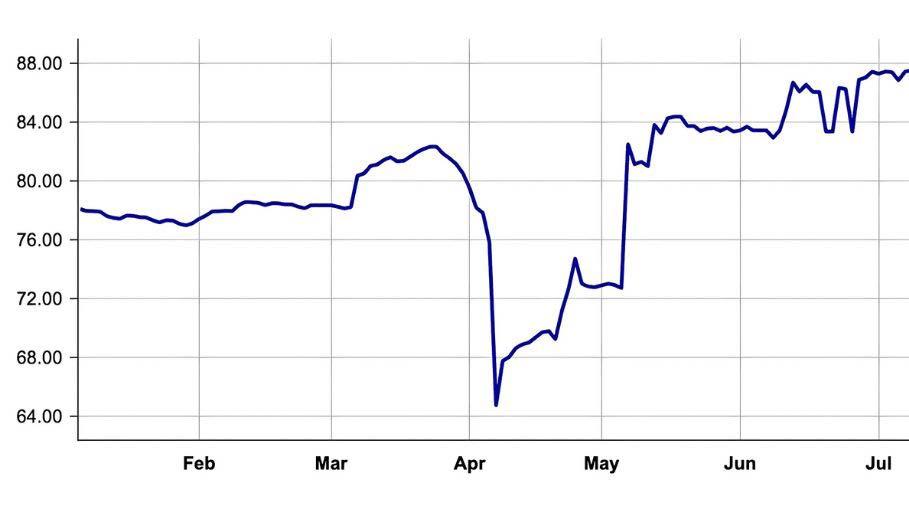

The price of the Maldives’ sovereign Sukuk has risen sharply, from approximately USD 64.7 in early April 2025 to USD 87.5 on 8 July, highlighting growing investor confidence that appears to outpace the country’s still-stressed credit standing.

What’s Behind the Rally?

According to the Ministry of Finance and Planning, recent fiscal discipline has bolstered sentiment. In March, the government settled a large private creditor repayment. This was followed by the timely payment of a Sukuk coupon in April. Simultaneously, discussions with bilateral partners have advanced negotiations around an upcoming refinancing package. These moves are credited with reassuring markets of the Maldives’ commitment to honouring its debts.

There is also evidence of favourable external factors. Gross foreign exchange reserves almost doubled from USD 371 million in September 2024 to USD 856 million in April, partly due to a USD 400 million currency swap with India’s central bank and strong tourism inflows.

Despite these improvements, Moody’s and Fitch have retained low sovereign ratings. Moody’s has maintained its rating at Caa2 with a negative outlook since confirming it in December 2024. Fitch affirmed its CC rating in June 2025, warning of very high levels of credit risk and emphasising that default remains a distinct possibility.

These ratings reflect substantial external vulnerabilities, including heavy upcoming debt repayment obligations (USD 688 million due in the second half of 2025 and USD 1.1 billion in 2026), shallow net foreign reserves, and elevated debt-to-GDP ratios projected at around 125 percent for 2026.

A disconnect is emerging between market pricing and long-term rating assessments.

First, short-term liquidity gains from the RBI swap and tourist revenues have provided immediate reassurance to investors facing imminent repayments.

Second, tangible policy actions, including the March repayment and April coupon payment, have strengthened the Maldives’ reputation for fiscal responsibility.

Third, renewed refinancing momentum through ongoing negotiations with bilateral creditors signals that long-term financial planning might be stabilising. In effect, investors appear to be treating the Sukuk more like a bet on policy follow-through and liquidity relief than on structural economic strength.

The elevated Sukuk price demonstrates a market-implied recognition that policy interventions are yielding results. Yet the fundamental risks remain entrenched, including low net reserves, significant refinancing needs, and a bloated debt burden. Critics and rating agencies continue to warn that default remains probable unless fiscal reforms advance and buffer reserves rise.

For the Maldives, the challenge lies in converting this temporary market confidence into sustainable fiscal stability. Upcoming refinancing outcomes, reserve improvements, and meaningful reform measures will determine whether the Sukuk price surge represents a genuine turnaround or merely a short-term reprieve.

At a time of growing uncertainty in global trade, supply chains and investment flows, the World Economic Forum’s inaugural Resilience Leaders’ Roundtable, held on 7 July 2025, offered a clear message: resilient growth in emerging markets will depend on deeper collaboration between businesses, governments and multilateral institutions.

The virtual gathering, which will be followed by in-person sessions in Davos and Riyadh in 2026, brought together key players from international organisations and the private sector to chart a course for economic resilience and innovation in high-potential regions. The discussions centred on four key themes: strengthening local supply chains, incentivising private investment, unlocking capital and accelerating coordinated action.

Relevance for the Maldives

For a country like Maldives, a small island economy navigating climate vulnerability, limited fiscal space and a narrow economic base, the strategies discussed are timely and highly relevant. The country has long relied on tourism and imports, leaving it exposed to global shocks, as we’ve seen and experienced so many times. As the government works to expand sectors such as logistics, fisheries, construction and renewable energy, the need for resilient infrastructure, investment-friendly regulation and longterm planning has never been more urgent.

A key takeaway from the roundtable was the importance of embedding resilience at the local level. Private companies that align with community needs and take the lead in adapting supply chains to local contexts are better positioned to handle disruptions. In the Maldives, where local councils and island communities are central to service delivery, this model holds particular promise. Developing regional logistics hubs or decentralised cold storage networks for fisheries, for example, could help the country address both resilience and development goals.

The roundtable also highlighted the need for governments to create enabling conditions for private sector growth. Regulatory reform, transparent processes and investor protections were highlighted as vital. With ongoing efforts in the Maldives reform state-owned enterprises and attract more foreign direct investment, the country can take cues from the success stories discussed at the event such as Saudi Arabia’s investment reforms.

Attracting FDI to strategic sectors like renewable energy and digital infrastructure could not only enhance resilience but also generate long-term value in line with the country’s development goals.

Access to capital remains a challenge for many small and emerging economies. The roundtable pointed to the role of multilateral development banks in providing early-stage project preparation, supporting enabling legislation and acting as anchor investors. For the Maldives, partnering with these institutions and exploring blended finance options can help unlock investment in critical areas such as transport, housing and renewable energy, particularly in outer atolls where private capital is often scarce.

The discussion also stressed the importance of legal clarity, local capital market development and data transparency. For the Maldives, establishing consistent investment policies and improving access to economic data can help build investor confidence and reduce perceived risk.

As part of the Forum’s Resilience Consortium, the roundtable concluded with a call to action to convert high-level dialogue into tangible initiatives. For the Maldives, participating in such platforms offers an opportunity to shape and benefit from collective solutions that speak to the realities of small island states.

With rising debt levels, climate pressures and global uncertainty, the country’s long-term resilience will depend not only on how it adapts internally but also on how effectively it engages with global frameworks and partnerships.

Maldivian Tourist arrivals are up. By the first week of July, over 1.15 million visitors had already landed in the Maldives, marking a 9.3 percent increase over the same period last year. June alone saw more than 141,000 arrivals, a 15 percent rise. On paper, it’s a good year so far.

But beneath the numbers, something more troubling is unfolding. Tourists are staying for shorter periods. Resort occupancy is softening. Guesthouses are rapidly gaining market share, now accounting for more than 22 percent of all stays, while the resort model, long the foundation of Maldivian tourism, is slowly being edged out.

For a country that built its global image on exclusivity, tranquillity and one-island-one-resort charm, the shift raises hard questions. Because the Maldives never set out to be a mass-market destination. It succeeded by being rare, by offering something few places could.

The World Economic Forum’s latest report, Travel and Tourism at a Turning Point, could not be more timely. It warns that the coming decade will bring massive growth, with 30 billion global tourist trips and USD 16 trillion in GDP contribution by 2034. But that growth, it cautions, will bring tension between visitors and residents, development and nature, culture and commercialism.

Nowhere are these tensions more relevant than in a nation of small islands and fragile ecosystems. The Maldives is not built for volume. Its carrying capacity is not a matter of spreadsheets and economic models. It is physical, ecological, and cultural

The WEF lays out ten guiding principles. Among them, one stands out: embrace growth segments strategically. Don’t chase every tourist. Focus on those who align with your identity. For the Maldives, that means ecotourism, wellness, and longer, slower, more immersive travel. These are segments growing globally, and they match the country’s DNA.

Another key principle is to commit to regenerative practices. Not just reducing harm, but actively restoring ecosystems. For a country whose natural beauty is its most valuable asset, this is not just good policy, it’s survival.

But the current trajectory risks drifting from these ideals. More guesthouses, more budget airlines, more weekend trips. The Maldives is getting busier, but not necessarily better. Growth is becoming an end in itself, rather than a tool to preserve and enrich what makes this place matter.

Tourism has long been the country’s economic lifeline. But if it comes at the cost of its identity, then it threatens to unravel the very success story it built. Because not all growth is good growth. The world is full of destinations. But the Maldives became iconic by being irreplaceable. That irreplaceability is now at risk, not because the numbers are falling, but because the model is.

The future of Maldivian tourism doesn’t lie in expansion. It lies in distinction. That means turning away from the logic of crowd economies and instead investing in experiences that are authentic, grounded, and deeply connected to place.

Being the Maldives was always more than enough. The real danger is forgetting why.