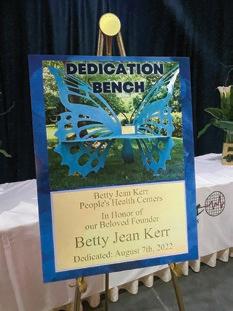

August 4, 2022, marked the 50th year Betty Jean Kerr People’s Health Centers has stood as an unwavering provider of gold standard primary health care for our community. On that day, 50 years ago, Ms. Kerr and her partners decided to turn their dreams of health equity provided with dignity and respect into reality with the opening of the People’s Clinic, later renamed Betty Jean Kerr People’s Health Centers.

Betty

Betty

Establishing credit can be done in a variety of ways by paying bills on time and monitoring your credit score, but I will touch on that basis later. You may already be taking actions that affect your credit score without knowing it. Those actions may include but are not limited to paying your utility bills on time or keeping a low credit card balance, which can positively influence your credit. Similarly, missing payments or racking up high balances can hurt your credit. When you are ready to start building credit with a credit card, make sure you apply for the right type of card. If you are trying to build credit as a college student, consider one of the top credit cards for students. If you have a car, fuel expenses are already a part of your spending—and gas credit cards help you use those purchases as a foundation for building credit.

MONITOR YOUR CREDIT REPORT Keep a watchful eye on your credit report so you can monitor your financial habits and dispute any errors you find. It is also a clever idea to keep track of your credit score—there are many ways you can check your credit score for free.

KEEP AN EYE ON UTILIZATION To boost your credit score as quickly as possible, try to keep your balances below 30 percent of your available credit. If you have a credit card with a $1,000 credit limit, for example, that means keeping any revolving balance below $300—and it is even better if you can pay your balance off in full every month.

DON’T APPLY FOR TOO MANY NEW CREDIT ACCOUNTS AT ONCE Applying for multiple credit accounts at once is not always a good idea. Not only will the back-to-back credit inquiries lower your credit score, but lenders might also turn you down simply because you have applied for too many credit cards within a brief period.

According to Creditkarma.com you could even build your credit score with a retail store credit card. Retail credit cards often come with high interest rates, but they are available to people with less-than-perfect credit. That makes store cards a good starting point for people who want to improve their credit history. While you are establishing credit, it is important to know how to build a positive credit history. Having a good credit score opens the door to lower interest rates and better opportunities for loans and credit in the future. Here are some good credit habits that can help you build credit more quickly:

PAY BILLS ON TIME Since your payment history makes up 35 percent of your credit score, it is important to pay your bills on time. If you accidentally miss a payment, contact your credit card issuer, and make up the payment 30 days before it is past due.

AVOID UNNECESSARY CREDIT INQUIRIES If you are considering a new credit card, try not to waste credit inquiries on applications that are not likely to be accepted. Instead, look for credit options designed for people with your credit history and background.

KEEP OLD CREDIT ACCOUNTS OPEN Try to use each of your credit cards at least once per year to prevent lenders from closing your accounts due to inactivity. If you have an old credit card that charges an annual fee, consider downgrading your card to one with no annual fee—that way, you can keep the line of credit open and continue to build your credit history.

Continue to practice responsible credit habits, and you can look forward to higher credit limits, lower interest rates, better credit card rewards and all the other financial benefits that come with building good credit.

Darnell WrightEating healthy on a budget can be hard for anyone, but it is especially hard for college students who are new to cooking and preparing meals for themselves. Eating healthy during college does not have to be hard or expensive and will get easier with experience.

Prepping your own meals is an effortless way to cut costs and eat healthier in college. According to fitplan.com, the average lunch is about $20 dollars a day, times that by five, that’s $100 week. Times that by four, wow, that’s about $400 dollars a month for lunch alone.

A trip to the grocery store can cost $60 to $100, and you will have food for breakfast, lunch, and dinner. You might be surprised by how much healthy food you can keep in your dorm and even how much meal prep you can do if you have mini-fridge and/or microwave. For example, prebagged salads are convenient, but you pay more for that convenience.

To save on cash, grab a head of lettuce ($1–$2), along with carrots (less than $2 for a whole bunch), a cucumber ($1), and maybe a few more veggies of your choice (spend up to $5).

Chop everything up at home and store in an airtight container in your fridge for an easy-to-grab base for lunch and dinner salads. Most retailers and grocery stores in college towns offer discounts for students, so long as they show a student ID. Use this to save on healthy groceries whenever you can. Not only is it the easiest way to save, but the discount is also generally high, around 20% off in many cases.

Saving money on healthy food in college is doable. Whether you use an app, do your research, or rely on the bulk bins each week, you can get what you need without going over budget.

Darnell WrightAs a student, you’re always juggling responsibilities. Your time is limited and what you focus on expands. That’s why it’s important to better manage your energy and priorities.

If you want to learn something, you need to space out your study time. Spacing it out then helps store the information into your long-term memory.

You have the planner that’s helping you stay organized. Every Sunday night, I’d set aside time to plan out my week, and get back on track with organizational habits. Then I’d block the days and times when I’d plan to work on assignments and for what classes.

You want to find a space with no distractions, a place you like, somewhere that’s comfortable (but not too comfortable), with natural lighting.

I recommend getting clarification on anything that you don’t understand as soon as you can. You wouldn’t want to go into an exam or assignment and be confused because of how someone else studies.

Your school has many resources you can use to get the answers you need.

Financial literacy can be a confusing concept to understand, there are so many topics to discuss such as avoiding scammers, investing money, saving, debt, loans, insurance, etc. And the worst thing that can happen is that you learn about it through a negative real world experience. Falling into debt because you do not know where your money is going or getting tricked by a scammer is the last way you would want to learn about improving personal finance and financial safety. If you want to know what to expect and how to handle financial situations in the real world before they happen, you should test out game simulators that will help improve your knowledge. These games go over any topic you can think of pertaining to financing and scammers.

Left to Right: Spent; Shady Sam; Lights, Camera, Budget!

Shady Sam Shady Sam is a game designed to demonstrate how loan terms can hurt you if you do not pay attention. This game is presented by NGPF who is revolutionizing the way financial literacy is taught to improve the financial lives of the next generation.

Shady Sam comes with worksheets: Categorizing Credit, Understanding Amortization, FICO Credit Scores, and Impact of Credit Scores on Loans.

Lights, Camera, Budget!

“Lights, Camera, Budget!”

Was made to help educate middle school and high school students on financial literacy topics and budgeting skills. Students play as a movie producer who has been given 100 million dollars to produce a movie. The student’s objective is to prove that they have good personal finance skills to stay on their budget.

Money Magic is a game that is centered on budgeting, the players goal is to help “Enzo” manage his budget and reach his savings goal to make it to Vegas. This game is also presented by NGPF. NGPF has 9 other financial literacy games that take less than 20 minutes to complete.

Spent is an interactive budgeting games that shows you the stress of living paycheck to paycheck. This game challenges you to make through the month given the circumstances thrown at you. This game is presented by NGPF.

This course goes over multiple financial topics such as opening a bank account, employment & taxes, learning their budgeting personality, making every day purchases such as cars and houses, understanding credit cards & credit scores, different higher education options, risk management strategies and precautionary measures, and the roles of different insurance. This course has 7 lessons to complete.

Banzai! Provides interactive financial literacy courses that teach skills such as budgeting, saving, understanding debt, and using the internet safely, etc. This is a free site that educates children, teens, and adults.

Shayla McClendon Banzai!Money is an important part of global culture and is one of the main motivators behind why we go to work. No one wants to work for free after providing their services to a corporation, people want to be paid for their labor, especially in the economy we are living in. According to Study in US, if you are living in America you would have to budget $1000-$1500 a month for housing and utilities. The annual spending average on food in 2020 according to Bureau of Labor Statistics was $4,942. Due to the war between Russia and Ukraine, the CPI (Consumer Price Index) inflation rate has risen to 8.6 percent in May 2022, the highest in 40 years, as stated by the Federal Reserve Bank of St. Louis. Meeting financial goals is a struggle for most people because they do not know basic financial literacy skills. Milkeninstitute.org states that Adults with low financial literacy spend an average of 12 hours per week dealing with personal financial issues versus those with high financial literacy spend 3 hours per week. If financial literacy were a common part of school curriculum, there would be over 57 percent of Adults in America who have financial skills and knowledge.

PISA (Program for Internationalist Student Assessment) reveals that many high school students in the US are illiterate in financial knowledge and skills. On a 1,000-point scale, the average score for US students was 506, a low scale that has been resistant to progress. If financial literacy was taught from the age children can enter school and graduate from high school, by the time that they are young adults they

will be adept in money management skills and knowledge. They would also be confident in knowing that they can make strong financial decisions as it would become second nature.

Financial literacy can encourage students to start saving early and build their savings accounts, and by the time students enter early adulthood, they would have accumulated $1,000 dollars or more in savings. Students may also become interested in exploring stocks and investing their money to generate a source of income of their own. With success students should also be knowledgeable on the importance of insurance, credit, consumer protection, investor protection, how to pay taxes and other topics that focus on finances.

With students having financial skills and knowledge hopefully they can live the rest of their lives without financial stress and grow their wealth. They may also pass on their knowledge and skills to others who are just starting their financial journeys or to people who are working on fixing their financial situations.

According to ngpf.org, currently 8 states have guaranteed standalone personal finance courses for all high school students in 2022. And 15 states have made it mandatory to take a personal finance course before graduating.

What are stocks? A stock indicates that the holder has some ownership in the company. People buy stocks to get a small piece of the company’s profit. For example, if you were to invest fifty dollars into your favorite company, your fifty dollars could turn into one-hundred dollars and so on.

What are the pros and cons of stocks? The amount of return you receive in stock depends on how well the company you chose is doing, remember if the company you invested in is profiting you will too. Companies can also suffer financially, and the money you have been investing can be taken away. According to Investopedia, companies fail due to not investigating the market, business plan problems, too little financing, bad location, remaining rigid, and expanding too fast.

To safely invest, know what company you want to support and how many. If you are a beginner or a teenager, according to The Balance, pick one or two stocks and learn how to follow and evaluate individual stocks, consider picking companies you are familiar with. Companies to investigate for beginners would be Nike, Amazon, Disney,

and Microsoft. Determine whether your top picks are good investments and would it be risky to invest money into these companies? Cash App, Plynk, and Robinhood are great downloadable sources for doing research while you invest.

There are three risk levels when investing into stocks, minimal risk, medium risk, and elevated risk. A minimal risk investment means that your investment will not be at stake, but there will also be less to gain and losing profit would not be devastating. A medium risk investment means that your investment is potentially at stake, but there will be more to gain and lose. An elevated risk investment means that there is a fifty-fifty chance of devastating loss, but the profit you can earn will be exceptionally large. To avoid losing your profit, it is a clever idea to invest your money in multiple companies instead of one. If you place all your money into one company, there is a chance that the company will plummet, and it will take your profit with it. So be careful and aware of your decisions, and if you need help making them seek professional assistance.

Shayla McClendonIt seems every other week we hear about another mass shooting that has left many dead and a lot more injured. At some point it becomes a norm, but these recurring incidents should not be normal at all. These mass shootings are causing people to live in fear. People are afraid to do their day-to-day tasks because of this. Parents are afraid to send their children to school and students are afraid to go to school. According to Washington.com in a survey conducted after the El Paso and Dayton Ohio shootings back in 2019, 62% of parents fear their children will be victims of a mass shooting.

Students should be able to go to school and only worry about learning. They should not have to worry about potentially becoming victims of gun violence. Although you should always be vigilant, you cannot live your whole life in fear. It is completely okay to be afraid but do not let it consume you. Here are a few ways you can cope with your anxiety surrounding school and mass shootings.

Talking to someone else about how you are feeling can help make you feel more at ease. You can get a sense of comfort and even spark an interesting conversation.

The best protection in the world is your knowledge. If you know the warning signs you could prevent a peer from hurting others or even themselves.

Staying informed is great but constantly reading or watching disturbing content can begin to affect you negatively. It could make your anxiety worse or even cause you to spiral into depression. Make sure you take time away from all the chaos and do things you enjoy.

Times are tough. We have experienced at least 309 mass shootings so far this year according to npr.org. Still our people in power are failing to take action to change our gun laws. The Robb Elementary shooting being the deadliest school shooting in America since Sandy Hook many are concerned about the upcoming school year. How many more children and innocent people must lose their lives before we can put a stop to this?

Cindi Frazier

With all the crazy things going on in the world it can be easy to fall into a rabbit hole of negative thoughts and feelings. It is important that you make sure you are taking care of yourself not only physically but mentally. So here are a few self-care tips to help better your mental health!

Teenagers aged 13-18 need at least 8-10 hours of sleep each night. The more rested you are, the more energy you will have to be productive throughout the day.

This could include playing a sport or even doing something artistic like painting. Either way it will be a terrific way to exercise your mind and body. You may even gain some new friends and expand your social network.

Plan hangouts with your friends and family. This can create stronger bonds and give you a reason to get busy and stay emotionally/physically fit.

Having a show, you can look forward to binge watching can help you wind down and de-stress after a long day.

Although TikTok and Instagram can be fun it can also be very mentally draining. Take some time away from your phone and read a book or spend some time on a new hobby.

Buy yourself that new shirt you have been wanting. Get your nails done. Take yourself out on a lunch date. You deserve it!

Your mental state is just as important as your physical state. Therefore, it is especially important that you make sure you are taking care of yourself. You will thank yourself overall!

Cindi FrazierOnce or multiple times you heard your peers talk about abusive relationships, but what does it look like? How can you tell the difference between a healthy relationship versus an unhealthy one? How can you avoid it? A new relationship can appear sweet in the beginning, but it can drastically change for the worse. To avoid this kind of relationship you must be aware of the dangerous signs and behaviors.

Your partner may be fussy about what you want to do or how you present yourself, this behavior may seem like an innocent gesture but really a ploy to lessen your will to have autonomy. This behavior can appear verbally, they may say things like “You are not going anywhere, you already went out this week.” Or “Find something else to wear, I don’t like it.” How your partner sounds when speaking to you is important. Physical signs can include he or she is hiding your car keys, bus pass, cancelling your Uber ride, holding you up with meaningless conversations or arguments.

What does it feel like? If they constantly have a reprimanding or a stern voice when speaking to you that is a sign that they are trying to place authority over, you. This constant behavior can mentally drain you to the point that you may allow them to have their way.

You may perceive your partner as someone who is overprotective and genuinely concerned for your wellbeing

but if you are constantly feeling alone or isolated from the outside world that is not the case. Your partner is purposely suffocating and isolating you to keep a firm grasp on your life. When you and your partner go out to an event where other people are attending, they may demand that you always stay by their side and may get hysterical if you decide to leave them for a brief period. When you are having a conversation with others, their attention may be heavily focused on you and the people you talk to, or they will participate in the conversation, and when questions are directed towards you, they will immediately answer for you.

A suffocating partner may constantly loom over you, giving you no time or space to yourself, they want to take up all your time, and leave no room for you to spend time outside of the relationship. While using computer or handheld device, they may feel the need to monitor your activity to make sure you are not doing anything to “destroy” the relationship. Controlling partners may say things like “You don’t love me,” “You are tired of me,” “You need to spend time with me,” “I bet you are about to go cheat on me.”

If these signs are attached to your current relationship, please seek help, abuse in any form is never okay!

Shayla McClendonWith every new school year that approaches, it can be very overwhelming. You will have new teachers and some new classmates that you have to get to know. Your course load may even be heftier, this mean you’ll need help juggling things. So here’s a few tips to help you become successful!

Making sure you have all the correct supplies shows responsibility and it can also prevent you from being behind in a class.

Connecting with your classmates can help tremendously, with their help, you can stay on schedule and get caught up if you miss a few days of class or even if you don’t understand a concept.

At times school can be draining, remember sometimes you have to step away, take a deep breath, and come back. Set some goals to keep yourself motivated and help prevent yourself from slacking off or procrastinating.

Buy a planner or write due dates down in a notebook. If you are aware of when assignments are due you can plan which assignments you need to complete first.

Don’t Cram If you know you have a test coming up, start studying the week before. Go over different concepts each day so you have plenty of time to fully retain the information, also make sure you have a comfortable space where you can focus and study.

If you’re having an issue with anything, let your teacher know. Don’t be afraid to ask for help. Teachers are there to help and communicating with them can prevent any confusion from occurring.

Have Fun School should not always be about work. Go to basketball games, participate in school events, and join a club. You spend more time at school than you do at home therefore you should try to enjoy it as best you can.

School can be tough. It can be a lot to handle and many lose focus and don’t quite know how to manage it all, but as long as you remember to stay organized and on top of your assignments you’ll do great!

Cindi Frazier

Cindi Frazier