‘There are multiple ways you can maintain your chosen lifestyle during retirement through prudent planning and investment.’

‘There are multiple ways you can maintain your chosen lifestyle during retirement through prudent planning and investment.’

Welcome to the Summer 2024 edition of Wealth Management Insight.

This edition provides us with the opportunity to highlight and explore some of the topics we have been discussing with clients over recent months. I sincerely hope you find the articles informative and that they provide some interesting ideas for your own wealth management.

Firstly though, I am delighted to introduce our newest members of the Wealth Management team, Hugh Johnson and Tim Blowers. Hugh brings a fresh, digital approach to financial planning, which complements our more traditional service, and is perfect for clients who prefer to deal with their financial affairs electronically. Tim, with over 12 years of wealth management experience, is a welcome addition to our team of Wells based Financial Planners, bringing with him an abundance of knowledge and expertise in the private client sector.

You will see on page 8 that Tim is keen to share his expert tips on ‘Keeping wealth in the Family’ in which he explores the importance of open discussions about family finances.

With the removal of the Lifetime Allowance (LTA) and the introduction of two new allowances at the beginning of this tax year, Stuart Coombe provides an update on the changes to pension legislation and taxation. Understanding these changes is crucial for optimising your retirement benefits and minimising tax liabilities.

Natalie Galvin, our Senior Trust Manager, explains how we may be able to help you and your family with the administering of an Estate and points out where specialist knowledge may be required to avoid unnecessary delays and complications.

With the election scheduled for Thursday 4 July and accepting there may be changes ahead, Tom Parry reflects back on the Spring Budget and what this means for you. He also touches upon the new British Savings Bond which is now on sale. Gavin Jones provides his views on ‘Managing Capital Gains Tax (CGT) on your investments’ offering insight into recent changes and practical tips to reduce your current tax burden.

We have a guest slot in this edition from Izzy Bristol, one of our accountancy Associate Directors who shares with us her thoughts on how best to create a tax efficient remuneration structure and the value of reviewing any existing remuneration arrangements in place.

Simon Cole, the Chair of our Investment Committee takes a look at the investment story for 2024 and reflects on how elections and prevailing governments have historically affected stock market performance.

Finally, please do read the progress we have made with The Old Mill Fund which was set up to provide financial support to local charitable projects within the communities we live and work in. We also make a special mention of a charitable challenge being taken on by Matt Clark, our Wealth Management Operations Director who will be cycling over 1,100 miles to raise funds for a charity dear to his heart. We wish Matt all the very best and I know his friends and colleagues will be cheering him on during his 13-day cycle trip.

As I have stated previously, our Wealth Management team are here to assist you on every step of your wealth management journey. If any of your family or friends are keen to discuss their own finances, then please do put them in touch as we’d be delighted to have an initial video call with them. Simply ask them to contact us by email at enquiries@om.uk, and one of the team will get in touch to set up an initial meeting at our cost.

Paula Hodge Partner, Head of Wealth Management

Paula Hodge

Partner, Head of Wealth Management 07825 620042 paula.hodge@om.uk

Ange Crowley

Business Development Manager 07989 423527 angela.crowley@om.uk

Tim Blowers

Chartered Financial Planner 07825 620026 tim.blowers@om.uk

Hugh Johnson

Financial Planner 01749 343366 hugh.johnson@om.uk

Stuart Coombe

Chartered Financial Planner 07815 561333 stuart.coombe@om.uk

Natalie Galvin

Senior Trust Manager 01935 709397 natalie.galvin@om.uk

Gavin Jones

Chartered Financial Planner 07825 620037 gavin.jones@om.uk

Tom Parry

Chartered Financial Plannner 07866 187645 tom.parry@om.uk

Isobelle Bristol

Associate Director, Adviser 07825 620025 isobelle.bristol@om.uk

Simon Cole

Partner, Chartered Financial Planner 07825 620041 simon.cole@om.uk

Jon Orchard

Partner, Chartered Financial Planner 07854 417301 jonathan.orchard@om.uk

Since our last Insight, we have been fortunate to recruit two new Financial Planners to our team.

Hugh Johnson.

Hugh joined Old Mill in October 2023 as a Financial Planner having started his career in the City in 2008. Hugh’s focus is on providing digital-first advice to clients who prefer to interact with us primarily online.

Tim Blowers.

A Chartered Financial Planner who joined the team in October 2023 and is primarily based out of our Wells office. He brings with him more than 12 years of experience working in Financial Services.

Hugh: Up until I joined Old Mill, I had spent most of my career working for national or international companies –my roles meant I got to travel a lot and whilst this was exciting, I wanted to work somewhere with a stronger sense of local community.

I became aware of Old Mill through PR I saw and was attracted by the ambition, innovative approach and expertise across different areas combined with a local office-based set up.

Tim: Old Mill’s excellent reputation in the market and exciting growth plans combined with the firm’s shared belief in the value of integration and collaboration – meant I knew it was the right fit for me both personally and professionally. Old Mill truly live the client-first approach with a view to all processes improving understanding and results in combination with a clear financial plan.

Hugh: Since joining, I’ve found the community aspect of working at Old Mill has proven itself.

Staff and clients alike are really friendly and welcoming. It’s great to be part of a team with such a diverse skill set, which gives me confidence that we can provide expert advice to our clients regardless of complexity or niche requirements.

Tim: It’s a really supportive environment to work in and everyone

pulls together to challenge ourselves on what we could be doing better as part of a desire to do our best for our clients. The opportunity for me to proactively provide input with ideas for the business is fantastic – I’m currently looking at how we can support those separating or divorcing and the unique range of expertise that is available at Old Mill.

Hugh: I’m a big lover of the outdoors, whether it’s surfing in Devon and Cornwall, cycling in the Mendips, or simply looking after the garden. As a quieter hobby I enjoy painting, which I try to squeeze in when our two young daughters allow.

As I’ve always loved the entrepreneurial spirit, I also use some of my free time to provide mentoring and support to innovative, early-stage start-ups in the advice industry.

Tim: I’m kept busy with my 3 wonderful children ably assisted by my wife, Helena, who also works in Wells (for the NHS). We’re very lucky that she is from Iceland with lots of family still there which allows for regular trips over to visit. I enjoy playing football, more for fun now mainly with a great group of fellow Dads so sometimes the competitive element still comes out. When I can also mix in watching stand-up comedy (Wells Comedy Festival), cooking and ideally some golf (although my wife will forever be much better than me). I also look forward to running next year’s Bath half-marathon.

I’m very keen to help within the local community and volunteer as lead trustee for a dementia charity (Keynsham and Saltford Dementia Action Alliance). Being a small charity means I cover lots of different roles including supporting an event at the local music festival which was opened by former Bake Off winner Giuseppe Dell’Anno.

Ange Crowley

Business Development Manager 07989 423527 angela.crowley@om.uk

‘Old Mill truly live the client first approach with a view to all processes improving understanding and results in combination with a clear financial plan.’

Hugh. Old Mill

A recent report from M&G Wealth ‘Family Wealth Unlocked’ found that there’s been an increase in the number of people not wanting to discuss family finances since the start of the cost-of-living crisis and are hiding money worries from their loved ones:

• 37% of those surveyed have reduced savings and investments contributions because of the cost-of-living crisis, with an additional 27% also looking to do so before May 2024.

• The number of adults who confirmed they talk openly across the generations about money had reduced by 20% to 64% compared to last year’s report.

At the same time, the amount of Inheritance Tax (IHT) received by the government has been going up. Receipts for the 12 months to October 2023 were over £7.5 billion, a 15.4% increase on the previous 12 months to October 2022. The Office for Budget Responsibility (OBR)’s latest Economic and fiscal outlook forecasts this trend to continue with IHT receipts for future tax years increasing to £9.8 billion by 2028/29.

IHT planning by making full use of available IHT exemptions and reliefs, can not only help to reduce the tax burden but it could also provide the family with much needed financial support at a time it is needed.

1. Start planning early

Planning what happens to your money and possessions when you die can ensure the following:

• your money goes to the people you want to leave it to

• you can reduce or even eliminate IHT to leave more to those you love

• your wishes are carried out without unnecessary expense or delay.

This might sound simple, but managing the transfer of your wealth after you’re gone is a complicated area with many financial and legal considerations. The best way to avoid unwanted consequences is to start making plans early.

Gifting capital during your lifetime can be very effective in helping to reduce the IHT liability but it is important to ensure any such gifts are affordable. Working with Old Mill, we are able to identify wealth that is surplus to your own requirements which you may like to pass to the next generation earlier, enabling you to see your family benefit from the money during your llifetime. With the M&G report identifying that 36% of those surveyed had reduced or stopped their savings, and 23% reduced or stopped their pension contributions, a helping hand now to your family may be very welcome aside from the tax savings.

2. Make a Will and review it regularly

If you don’t have a Will, then your estate will be shared according to the rules of intestacy which may be very different from your wishes.

If you are married or in a civil partnership without any children, then the estate will pass to the survivor. If you have children; up to £270,000 will go to the spouse / civil partner and half the remainder, but the other half will be shared between any children.

If you are not married or in a civil partnership and have no children then the estate will pass to your family; to your parents, if they survive you or else wider family – siblings etc. If you have children, your estate will be shared between them.

With the annual census in 2021 finding that almost 1 in 4 couples living together are cohabiting rather than married or in a civil partnership, this could lead to unanticipated consequences on death. Whilst such couples might describe

themselves or be described by others as being in a ‘common law marriage’, this is not a legal term and as such does not give them the same rights on death as those who are married or in civil partnerships. In particular, there is a specific exemption for assets passed on death between spouses or civil partners meaning that no IHT is due. This will not apply to those cohabiting so there could be some very unwelcome IHT implications.

Property is often owned under a joint tenancy which means that on death the property passes to the survivor. But the share of the property that belonged to the deceased will also be in their estate and liable for IHT if it’s above the £325,000 nil rate band. This can lead to problems with finding the tax if the Will leaves everything to the cohabitee. Or if the Will leaves everything to their family, or they don’t have a Will it can mean a big tax bill with no means to pay it.

The consequences can be devastating for those you leave behind. If you’ve already made a Will, review it regularly to ensure it’s kept up to date. A change in family circumstances, changes in IHT rules and wider legislation can all affect your Will.

While beyond the scope of this article if you have foreign assets, like a holiday home abroad you will need a separate Will in that country.

3. Set up a Power of Attorney

Sometimes people wrongly believe because they have a will they don’t need a Power of Attorney (POA). The POA lets you appoint someone you trust to make decisions on your behalf if you’re not able to do so yourself, for instance if you become incapacitated. There are two types of POA: Financial which allows your attorney to deal with financial matters on your behalf, and Health, to make medical decisions for you. It might help to think of a will as something that helps your loved ones after you die, whereas a POA is designed to help you while you’re still living. Once registered with the Office of Public Guardianship a financial POA can be written for your attorney to help you while you can still make decisions yourself. A health POA can only be used once you are unable to make decisions for yourself.

4. Make sure you know who stands to inherit your pension

It can often be overlooked that your Will does not have any jurisdiction over who may inherit your pension benefits. This is normally determined by a ‘nomination of beneficiary’ form that should have been completed when the pension was set up. The people you list on that form will normally inherit your pension when you die and can do so without having to wait for Probate to be granted. Pension funds are often significant assets and over the years, it can be easy to forget who you’ve nominated to receive your fund. It’s therefore important to regularly review nominations to ensure they continue to benefit the right people as all too quickly they can become out of date if your circumstances change. If you’re not sure who inherits your pension, your financial planner can help.

5. Speak to your loved ones about your succession planning

This is often the step that’s forgotten about. It’s really important to keep your Will, POAs and pension nominations up to date and even more important your loved ones know how to get hold of them when they’re needed. By letting your loved ones know in advance you’ve done this important planning, it can make it a lot easier on them at what could be a very difficult time.

Whilst the family will have the support of your professional advisers, it can be very useful to outline to them what you hope to achieve with your estate on your death and your reasons. It is not necessary to mention the exact sums involved if you don’t wish to. This will help your family understand your specific plans and could reduce any potential disagreement. They may also have some relevant input into the management of your estate and it may be worth taking on board their expectations and opinions with regard to your assets and possessions. Often it will not be the money but small items of sentimental value that have the potential to be overlooked and go to the ‘wrong’ person.

Old Mill works with many families on a multigenerational basis. The last few years have seen an increasing number of clients helping younger generations as first Covid and then the cost-of-living crisis has impacted their finances.

The M&G report highlights that the number of people who have received a financial gift had increased in the last year, especially for those who had received a gift from Grandparents, which increased from 48% to 64% of those surveyed. Reasons for the gifts included:

Help with the cost of living. Gifting ‘to help with bills’ 21%; gifting to pay off debts’ 15%; and ‘money to help with rent and mortgage’ 16%.

Enabling property ownership. Gifts for ‘a house deposit’ 22%, support ‘an outright property purchase’ 14% and even more significantly, gifting of an entire property increased significantly from 10% to 16%.

Education and personal development. Gifting to support the cost of university rose as students wrestled with fees and the increasing cost of utility bills and student accommodation.

While on the surface, gifting sounds straightforward, it carries risks if carried out without expert financial advice as there are often important tax considerations to ensure gifts are structured effectively from a tax point of view.

The M&G report highlights the importance of intergenerational conversations, behaviours and actions. More generations are now sharing advisers to plan and manage wealth transfer and we are increasingly seeing children and grandchildren becoming clients in their own right.

Joined up intergenerational financial planning can be very powerful in supporting the management of family wealth and succession and is a topic that is always worth exploring during our annual planning meetings.

Tim Blowers

Chartered Financial Planner 07825 620026

tim.blowers@om.uk

Following the removal of the Lifetime Allowance (LTA) at the start of the new tax year, we share the salient details of the new Lump Sum Allowance (LSA) and the Lump Sum and Death Benefits Allowance (LSDBA) and how these impact the tax you may pay on your pension(s).

The LTA was a cap on the overall level of pension benefits you could build up, above which there was a specific tax charge of up to 55%.

However, the new rules now in place mean that tax-free lump sum payments from pensions, either when you start to draw upon them, or on death will be capped at the level of the old LTA. This is a classic example of the government giving away with the one hand and taking back with the other. As they say, the devil is often in the detail.

rules which came into effect on Saturday 6 April 2024

• The standard allowance is £268,275; effectively the same as the amount of tax-free cash you could take from your pension as a lump sum under the old rules

• If you have LTA protection you will have a LSA based on your protected LTA (e.g. if you have Fixed Protection 2016, you will have a LSA of £312,500 (25% of £1.25million).

The allowance will be reduced based on any lump sums that you take or have taken from pensions. The table below gives an example for the standard allowance

Starting value of pension

Benefits already taken

Current value of pension

Remaining LSA

£1,073,100

£673,100

£400,000

£268,275 - £168,275 (£673,100 x 25%) = £100,000

In the example above, it will be possible to take a tax-free lump sum from your pension of 25% or £100,000 within the new allowance. If your pension fund was larger, any excess would be taxed at your marginal rate of Income Tax.

The standard allowance is £1,073,100. Those with LTA protections under the old rule will have a LSDBA based on their protected LTA (e.g. if you have Fixed Protection 2016, you will have a LSDBA of £1.25million).

The LSDBA will be reduced by any lump sum pension benefits that you take or have taken. This will include the lump sums previously taken into account for the LSA but is wider ranging – for instance, serious ill health or death benefits taken from other plans.

As an example, if you die with a remaining pension fund of £900,000, having previously taken a Pension Commencement Lump Sum (PCLS) of £250,000.

The total lump sum benefits are £900,000 + £250,000 =£1,150,000

This is in excess of the LSDBA so up to £1,073,100 can be taken tax free and the remainder will be taxed at your marginal rate.

One of the challenges of the new rules is considering pension benefits you may have taken in the past.

This will be done by a standard calculation based on the ‘Lifetime Allowance previously used amount’. This is the amount that would have been the previously used amount for the purposes of working out how much of someone’s Lifetime Allowance they had available under the old LTA rules assuming it was taken on 5 April 2024.

The LSA is reduced by 25% of the previously used amount and the LSDBA by 100% of that amount. That means if 100% of the Lifetime Allowance was used, the remaining LSA and LSDBA is nil.

If you took less than 25% tax-free cash in the past, you can apply for a ‘transitional certificate’ so instead of applying a straight 25% of the benefits taken, the certificate will show

the exact amount of tax-free lump sums you’ve received. This must be done before you take additional benefits from your pension after 5 April 2024. It is not possible to apply after this.

These changes to allowances are in addition to the existing complexity around the options available for your pension fund on death. It is essential you review your existing plan to ensure the full range of options are available for your beneficiaries. Lump sum on death Beneficiary Drawdown

Death before 75 Tax Free* Tax Free

Death after 75 Taxed at marginal rate* Taxed at marginal rate

* Potentially taxable in beneficiaries’ estate

Practically, while most newer pension contracts will allow the full range of options, many older schemes will only allow lump sum payments on death. For those aged over 75, this will mean the beneficiary of the lump sum will face an immediate tax charge at their marginal rate. In a beneficiary drawdown the tax charge is only incurred when income is drawn out.

For many people with smaller pension funds, the changes will not really have any impact. For those with larger pension funds and where they have previously taken benefits that need to be taken into account, we would recommend advice is taken. If we can be of help for your pensions, or your family or friends, do get in touch with your Old Mill financial planner.

StuartCoombe Chartered Financial

Planner07815 561333 stuart.coombe@om.uk

Administering a loved one’s estate can sometimes feel like a daunting task. At an already emotional time, it can be difficult to know where to start.

There can be a temptation to try and deal with everything as quickly as possible, however this could lead to crucial aspects being missed. Given that your responsibilities as an executor can extend beyond the administration period, it‘s vital that the estate is administered correctly to avoid potential issues later on.

At Old Mill. we have a dedicated Estate Administration Team to assist with any aspect of the estate and our team are on hand to guide you through the process from start to finish. We can assist in the initial stages with obtaining valuations from the various banks and investment providers, as well as preparing the Inheritance Tax (IHT) return and calculating the IHT due, right through to opening an executors’ bank account, preparing estate accounts and tax returns and encashing the assets of the estate.

1. Valuing the estate

It’s important to identify all assets of the estate and as our financial planners have an in-depth understanding of their client’s investments, this provides a good starting point and ensures the process can start quickly and efficiently.

2. Understanding the Will

Understanding the terms of the Will is fundamental to calculating IHT and distributing the estate correctly and

whilst the intentions of the deceased may be known within the family, the Will itself can sometimes be difficult to understand. It is not uncommon for the Will to leave assets on Trust either for the surviving spouse or to minors and how these assets will be distributed under those circumstances will differ to an outright gift. There is also now a requirement to register Trusts with Revenue & Customs, regardless of tax status, and our team are able to advise on this aspect as well.

3. Assets left to charity

Charities also commonly feature in wills, either being left a specific legacy or a share in the residue. This could impact the overall IHT position if certain conditions are met, and the rate of IHT could potentially be reduced to 36%, which if missed may lead to unnecessary IHT being paid. This can also change the way the estate is administered. Where charities are left a share in residue, they will want to be kept up to date on the progress of the estate, they will also request copies of estate accounts and proof that disposals of assets have been at the best possible price. This can be a time-consuming process for the executor, however, our team are available to liaise directly with the charities on your behalf.

4. Locating beneficiaries

In some cases, the Will may have been drafted many years ago and legacies left to family members or friends that have since moved, lost contact or possibly passed away themselves. As executor, you will be responsible for locating these individuals, which may seem like an impossible task. Our team have access to experts in this area who will be able to offer assistance in locating beneficiaries quickly.

The estate may be subject to IHT, Capital Gains Tax and Income Tax at various stages throughout the administration process and our team of estate specialists will be able to calculate the tax due and ensure that this is paid on time and via the correct route. For instance, Income and Capital Gains Tax can either be dealt with informally at the end of the administration period or via an annual tax return depending on certain conditions.

Executors are personally liable for any errors or omissions in the estate, however, there are ways in which this liability exposure can be reduced, such as taking out a s27 notice, which advertises for any unknown creditors and provides protection for the executor should a creditor come forward after the notice period has expired and the estate has been distributed. Our team can place these notices on behalf of executors.

Depending on how the estate is being distributed, it may be beneficial to prepare estate accounts which will be especially important if the estate is being left to charities or a wide range of beneficiaries in different proportions. Accounts provide a clear picture of the estate, from the values at date of death right through to the final distribution amounts and will detail all taxes and costs that the executor has paid from estate funds. Estate accounts allow the executors to obtain the beneficiaries’ agreement to the distribution amounts before distribution takes place, providing further protection for the executors.

Our estate team use their specialist knowledge of estate administration to make sure that the financial aspects are effectively dealt with, providing peace of mind and a safety support net for your family. We charge for this service at an hourly rate rather than charging as a percentage of the state, because we believe this is fairer. Please get in touch with your usual Old Mill contact or one of our dedicated estate team if you would like any assistance with an estate.

Natalie Galvin Senior Trust Manager 01935709397

natalie.galvin@om.uk

You will have already received our Old Mill Spring Budget Summary 2024 with the headlines of all the announcements in the budget back in March.

With the headline announcements effectively reduced to nothing more than a cut to National Insurance contributions, there was little of note for many of our clients. While billed as a tax cutting budget, with Income Tax allowances remaining frozen and a decrease in Dividend and Capital Gains Tax allowances, taxes may well increase for those who have finished working. According to the Institute of Fiscal Studies, the overall level of taxation in the UK is at its highest level in 70 years.

We have looked at how the announcements may impact on you and have provided further detail of steps you can take below.

In terms of general planning, investing couples should aim to use their dividend and personal savings allowances in full.

You should also try to arrange your investment holdings in such a way to ensure you fully use both personal allowances, personal savings allowances, dividend allowances and starting/basic rate tax bands.

Consideration can also be given to making Gift Aid payments to help save tax while helping good causes.

The 0% dividend allowance means that, regardless of your tax rate, you can receive £500 dividend income from Saturday 6 April 2024 with no tax liability.

This has reduced significantly since the original £5,000 allowance was introduced in 2016, before falling to £2,000 in 2018 and £1,000 last April.

Another allowance falling is the CGT annual allowance. This was £12,300 in 2022 before falling to £6,000 last April and it will be £3,000 in the current tax year.

As a result of the reduction, we think it will be more common to pay CGT in the future. While paying any tax can be galling, this may be one of the more palatable taxes given it‘s only payable on a capital gain and the rates are half that of income taxes: 10% for basic rate taxpayers and 20% for higher rate taxpayers.

We look in more detail at the impact of the changes to CGT on your investments in the ‘Managing Capital Gains Tax (CGT) on your investments’ on page 20.

Investing within a pension and an Individual Savings Account (ISA) remains attractive as income, dividends and capital gains will not be subject to further taxation.

Ensuring you use your ISA allowance consistently becomes even more important now, especially where your dividend allowance is fully utilised. If we assume you hold £100,000 in ISAs in our medium risk portfolio compared to holding the investments directly and the interest and dividends earned remain the same, this could provide tax savings of over £2,400 in the next five years for a basic rate taxpayer and over £5,600 for a higher rate taxpayer.

As announced by the Chancellor in the Spring Budget, National Savings & Investments (NS&I) has announced the interest rates for its three-year British Savings Bonds:

Type of Bond Rate

Guaranteed Growth Bond 4.15% gross/AER

Guaranteed Income Bond 4.07% gross/4.15% AER

The bonds are below the best three-year fixed rate interest rates in the market according to Moneyfacts which is currently 4.75%. Investing with NS&I does, however, have the certainty that 100% of your money is safe - they have the backing of HM Treasury.

The government also plans to launch a new UK ISA with a subscription limit of £5,000 which will be in addition to the current standard ISA subscription limit of £20,000. The new ISA will be a new tax-free product that will allow people to invest in UK focused assets.

A consultation document was released alongside the budget to determine which assets will be appropriate for the investment and this consultation will close in June. Once details have been released, we will provide an update in our monthly Insight email.

1. For business owners and those still working Income Tax

As well as the points above consideration ought to be given to maximising pension contributions which remain very tax efficient.

From the beginning of the 24/25 tax year there has been changes to the High Income Child Benefit Charge. Child benefit is now £25.60 a week for the eldest or only child, and £16.95 a week for each additional child. If you receive this and the highest earner in the family has income between £60,000 and £80,000 there is a tax charge. For someone with two children who earns £80,000, there would be a tax charge of £2,212, effectively reclaiming the child benefit paid. The charge is based on ‘adjusted net income’ so pension planning and/or making Gift Aid payments can reduce your income for this purpose and therefore the tax due. Making a

£20,000 pension contribution (costing £16,000) would mean Self Assessment tax savings of £4,000 Income Tax and no child benefit charge of £2,212. This means the effective cost of the contribution after the tax saved would be £9,788 or 51% tax relief.

Pension contributions and Gift Aid can also reduce income below £125,150 which is the point where the personal allowance is lost completely. If income falls to £100,000 the personal allowance is fully reclaimed which is worth over £5,000 in saved tax. The tax relief in fully reinstating the personal allowance by making a pension contribution is 60%.

The further reduction in the main rate of National Insurance for employees and self-employed individuals will be a welcome change with both employees and self-employed individuals better off.

According to the Chancellor, the average earner now has the lowest effective personal tax rate since 1975, although it was pointed out by the opposition that overall taxes in the country are the highest they have been for 70 years.

Employees should continue to consider salary sacrifice for pension contributions. Using salary sacrifice means that both the employee and the employer pay less NICs, so further tax savings can be achieved. Take an employee with a salary of £30,000. 5% pension contributions mean that £1,200 would be taken from their after-tax salary (which will be £1,500 in their pension after tax relief is added). If they instead sacrifice £1,500 of their salary each year in favour of an employer pension contribution, their salary for tax and NIC purposes will be lower as the table below illustrates:

For those who already have salary sacrifice in place, it may become slightly less attractive as the tax savings will be less and a review of the agreement may be needed to ensure the same level of pension saving is maintained (or increased!).

Abolishing Class 2 NICs and reducing the rate of Class 4 NICs will also be a welcome change given it will save money for so many while still being able to get access to contributory benefits including the State Pension.

Dividend vs salary

For business owners, please see the ‘Remuneration considerations for entrepreneurs’ article on page 22 for details of things to consider when deciding whether to take salary and/or dividends from your business.

Furnished Holiday Lets (FHL)

Historically, the commercial letting of furnished holiday accommodation has been treated as a trade so has benefited from a number of tax advantages:

• CGT reliefs for traders (Business Asset Rollover Relief, relief for gifts of business assets and relief for loans to traders)

• Plant and machinery capital allowances for items such as furniture, equipment and fixtures

• Profits count as earnings for pension purposes.

The abolition of the FHL tax regime from Saturday 6 April 2025 will mean that furnished holiday lets will lose this beneficial treatment.

Business Asset Disposal Relief (formerly Entrepreneurs Relief) means that any gain made on disposal of an FHL business would be taxed at just 10%, but from 6 April 2025 they will be subject to the same rates of CGT on disposal as any other residential property of 18% or the recently reduced 24% rate.

Landlords of FHL properties will need to take tax advice on how best to structure their property investments following abolition of the current favourable regime.

While there have been no changes to trust tax rates announced, the reduction of the CGT rate on disposals of property from 28% to 24% from Saturday 6 April 2024 will also be relevant to trustees holding property, although this will be offset by the reduction in the CGT annual allowance, falling from a maximum of £3,000 to £1,500 or lower if the settlor has created more than one trust.

While not announced in the Budget, there is a reminder below of the new rules which came into effect from Saturday 6 April 2024 for trusts, namely:

• Exemption from tax for trusts and estates with income up to £500. Where a settlor has created other trusts, the amount is the higher of £100 or £500 divided by the total number of existing trusts (subject to some exceptions)

• Removal of the default basic rate and dividend ordinary rate of tax that applies to the first £1,000 slice of discretionary trust income (i.e. the ’standard rate band’).

Tom Parry

Chartered Financial Planner 07866 187645 tom.parry@om.uk

The amount of gains that can be made each year without paying any tax, called the annual allowance, has fallen over the last few years. The allowance was £12,300 in 2022 before falling to £6,000 in 2023 and since Saturday 6 April it is lower again at £3,000.

As part of our service, we try and reduce tax wherever possible. Many of you will have investments wrapped in pensions and Individual Savings Accounts (ISAs) where unlimited gains can be made without CGT becoming due.

If you have investments outside of pensions and ISAs, we can consider the best options for you individually.

As a result of the reduction in the annual allowance, we think it will be more common to pay CGT in the future.

Paying tax at only 10% is an attractive rate and it is certainly not guaranteed to stay at this rate in the future, no matter which government is in power.

The Old Mill Investment Committee manages portfolios on an unconstrained basis. This means we do not take CGT into consideration when making changes; however, we do not believe in regularly changing portfolios to chase the latest trends and we therefore make every effort to minimise portfolio changes.

We believe it is better to take profits than to sacrifice control of asset allocation and fund choice so CGT may therefore be incurred during the management of your portfolio. Our research indicates that a taxable portfolio with values of less than £200,000 (or joint account with values of less than £400,000) should not incur any material CGT if it’s rebalanced back to the original allocation each year.

As with looking at transferring income producing assets between spouses to benefit from lower rates of Income Tax, the same can be true for CGT. If an asset is transferred between spouses prior to a sale, you could make use of a further annual exempt amount, and perhaps lower rates of CGT depending upon their level of income.

As part of the annual management of your portfolio outside of pensions or ISAs, there may be unintended consequences if we try and avoid paying CGT on gains.

As you know we rebalance portfolios back to your original risk profile each year. If we do not do this, the resulting differences in investment performance could easily outweigh any tax saving.

While the annual CGT allowance is reducing, it can still be used to offset gains each year. This is a use it or lose it relief, so if not used, it’s lost and cannot be carried forward to the following year. Using your allowance each year in part or in full to rebalance your investment portfolio will ensure it remains in line with your individual attitude to investment risk.

Depending on your circumstances and size of investment, we may consider other tax wrappers, in particular onshore and offshore bonds.

These are tax wrappers with the ability to defer some or all taxes over time, with a potential tax payment when you make withdrawals or once the bond is encashed. The tax benefits of these bond wrappers however need to be balanced against the additional costs that can be incurred in holding these investments.

Trusts have a lower CGT allowance and this tax year - it will be a maximum of £1,500, half the personal rate, or lower if the settlor has created more than one trust.

Trustees are subject to additional rates of Income Tax –45%, but gains are taxed at 20%.

While trusts are not able to hold pensions or ISAs, it can be advantageous for certain trusts to invest into onshore or offshore bonds and these will be considered when giving advice.

Should profits be created that lead to a gain for CGT purposes, we will provide you with the necessary information to meet your HMRC reporting requirements. If you would rather someone report to HMRC on your behalf, then our Tax Team can offer that service at a competitive rate for our existing clients.

Gavin JonesAssociate Director 07825 620037 gavin.jones@om.uk

Business owners should ensure they are drawing income in the most optimal way. A remuneration structure review, in conjunction with their accountant, can be essential to achieve this.

This is especially so given the reductions we have seen to employee NICs in both the 2023 Autumn Statement and the 2024 Spring Budget and the increase in Corporation Tax for many businesses.

Creating a remuneration structure with the correct blend of salary, dividends and tax efficient pension contributions can make a significant tax difference to the after tax and NI outcome for shareholding directors.

With the relatively recent changes to Dividend Tax rates, Corporation Tax and the reduction in the Dividend Tax allowance together with the new changes to employee NICs, this review will be very important.

Detailed below is a summary of each option and potential advantages and drawbacks of each route:

‘A fixed regular payment, typically paid on a monthly basis but often expressed as an annual sum, made by an employer to an employee.’

• Qualifying year for state pension if above thresholds - if a salary is over the lower earnings limit (£533 per month) a qualifying year is gained towards state pension, this is not the case for dividends

• Earnings for mortgages/lending - when a company is in its infancy, lenders sometimes prefer you to take a salary rather than dividends as generally this is more often regarded as consistent stable income, even though this may not be the case

• Pay Income Tax at 20%/40%/45% - depending on levels taken

• Pay employees and employers NIC - National Insurance is payable on salary at 8% (from April 2024) for employees and 13.8% for employers whereas no National Insurance is payable on dividends

• Deductible from Corporation Tax - salary and employer’s National Insurance are an allowable deduction on Corporation Tax which can save tax of up to 25% of these costs.

‘A sum of money paid regularly (typically annually) by a company to its shareholders out of its profits (or reserves).’

• Paid from reserves, therefore if no profits cannot take dividends - dividends are therefore not available for all companies, especially start-ups

• Not deductible from Corporation Tax - these are shown as equity in the balance sheet of a company and are not deductible expenses for Corporation Tax

• Lower Income Tax rates - first £500 (from April 2024) of dividends are tax free, then taxed at 8.75% and then 33.75% and finally 39.35% depending on levels of income

• Not paid in line with work done for business - dividends can be paid to shareholders who do not work in the business as these are a reward for the shares owned. This therefore gives you the ability to plan as a family rather than an individual.

Pension contributions continue to be tax efficient. As an employer, your company can opt to make direct pension contributions for employees, including directors. For shareholder directors who take a salary from their business then salary sacrifice, as detailed in the National Insurance Contribution (NIC) section of the ‘Spring Budget 2024’ article on page 18, would also be an option to consider.

Isobelle Bristol Associate Director 07825 620025 isobelle.bristol@om.uk

‘Working out the best balance of salary, dividends and pension contributions will be specific to each entrepreneur. Old Mill can help you work out the best options for you and your company.’

Alongside the fantastic work that The Old Mill Fund enables the community foundations in Somerset, Devon and Wiltshire to undertake, there are also individual members of our team who take it upon themselves to complete some challenging endeavours to raise funds for causes that are close to their own hearts. In this article, we provide an update on some of the projects The Old Mill Fund has supported over recent months and details of an individual’s fundraising challenge.

As a reminder, the Fund has three key priorities, chosen to focus our charitable giving on areas of greatest need across the three counties:

• Building brighter futures: helping young people to build skills, confidence and resilience and increase social mobility

• Reducing rural loneliness: supporting activities that support people in isolated communities and help to improve mental health

• Strengthening communities: investing in bringing people together and building vibrant, inclusive and supportive communities.

Yeovil Freewheelers, Somerset

The Yeovil Freewheelers get on their bikes and save lives. As the oldest continuously operating blood bike charity in the country, they offer a free emergency motorcycle service for NHS hospitals in South Somerset completing around 3,000 urgent medical deliveries each year.

The Old Mill Fund grant of £3,500 has made sure these volunteer riders can continue their vital work around our county.

Coldharbour Mill Trust, Uffculme, Devon

Coldharbour Mill Trust maintain an historic mill and aim to engage, educate and inspire the next generation.

Funding from The Old Mill Fund helped fund the charity’s Rural Skills Programme, helping 42 adults with longterm challenges such as mental health issues, long-term unemployment, a history of offending or learning difficulties.

The programme enabled participants to gain certificated qualifications in First Aid, Manual Handling, Brush Cutting, Tree Identification and Management and Dry Stone Walling. This helped them to build new confidence, social networks and move towards employment.

Dorothy House provides palliative and end of life care to adults with a progressive, treatable but not curable lifelimiting illness or with severe frailty, and their families.

Funding from The Old Mill Fund was used to help fund the charity’s Children and Young People’s Service, which offers emotional and psychological support children and young people may need when their parent has been diagnosed with a palliative illness, or following a parent’s death through illness. Last year, the service supported 148 children and young people.

If you are engaged with local community groups or charities in need of funding, you can apply to your local Community Foundation directly for one of their many grants. If your needs are in line with one or more of the three key areas The Old Mill Fund focuses on (see above) then please apply through the Somerset Community Foundation. Rounds for applications are open quarterly.

Somerset Community Foundation (SCF): 01749 344949 or visit somersetcf.org.uk

Wiltshire Community Foundation: 01380 729284 or visit wiltshirecf.org.uk

Devon Community Foundation: 01884 235887 or visit devoncf.com

Travelling

In this edition we feature Matt Clark, Operations Director for Wealth Management as he takes on a bike ride of over 1,100 miles.

Back in the summer of 2009, Matt was, by chance, diagnosed with Osteosarcoma - a rare childhood bone cancer that is extremely aggressive, with brutal and particularly invasive treatment, which ultimately resulted in Matt now having a prosthetic in his leg. You can read Matt’s full story by going to: www.willberrywonderpony.org/blogs/news/matts-story.

In 2015 Matt found out about Hannah’s Willberry Wonder Pony Charity (HWWPC), a charity that was started by Hannah Francis, following her own diagnosis of Osteosarcoma in 2015, which sadly resulted in her passing away in August 2016, aged just 18 years old.

The charity funds scientific research into Osteosarcoma to ensure no young person has to go through the same pain and trauma of treatment that she and her family faced. Her charity has already funded seven projects to try and find alternate and kinder ways to treat this horrendous condition and has also granted almost 100 equestrian-related experiences to seriously ill people and their families.

The ride – The Travelling Willberry’s

No, not the band, but instead the charity’s mascot. The aim is to take Willberry on tour. Over 13 days, Matt and his support team will transport Willberry around the length and breadth of the UK, raising funds and awareness as they go. Willberry will be stopping at some of the main equestrian eventing sites in the UK; starting at Badminton, moving on to Blair Castle, back down to Burghley, across to Blenheim and then finally finishing at The Hannah Francis One Day Event, held at Southfield House, home of Hannah’s pony club, and run in aid of her charity. The distance of this journey? Over 1,100 miles...

Given Matt’s disability, the ride is extremely challenging, in that most of the work will be undertaken through his one good leg, with the other largely redundant and just going along for the free ride, and the marketing angle!

If you’d like to support Matt’s fundraising efforts you can do so on his just giving page https://www.justgiving.com/ page/matthew-clark-travellingwillberrys/ or by scanning this QR code:

Jonathan Orchard Partner, Chartered Financial Planner

Jonathan Orchard Partner, Chartered Financial Planner

07854 417301

jonathan.orchard@om.uk

Portfolios, how did they do in 2023 and what factors will influence returns in 2024?

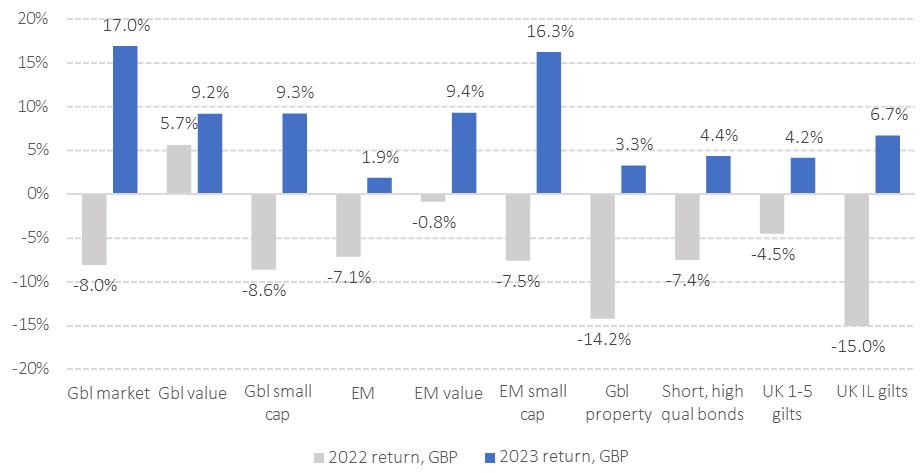

High inflation in 2022 led to a rapid rise in interest rates around the world, contributing, in part, to the fall in global bond and equity prices.

2023 delivered a much more positive story and all core assets delivered positive returns, however, it still remained quite a volatile year.

The US market contributed the lion’s share of returns – and, in particular, the ‘Magnificent Seven’ as the press have dubbed the big tech firms – regained the losses they suffered in 2022. In fact, they contributed around three quarters of the return of the US market over the year. As a consequence, global developed market returns were very strong, given that the US weight in global markets is around 63%.

On the defensive side of portfolios, high quality, short-dated bonds have recouped over half of the falls suffered in 2022largely on account of the higher bond yields delivering returns similar to cash.

In the graph below we compare asset returns for last year compared to the year before.

Global investment returns – 2022 and 2023 compared

Data: Morningstar - Gbl = Global, EM = Emerging Markets & IL = index-linked

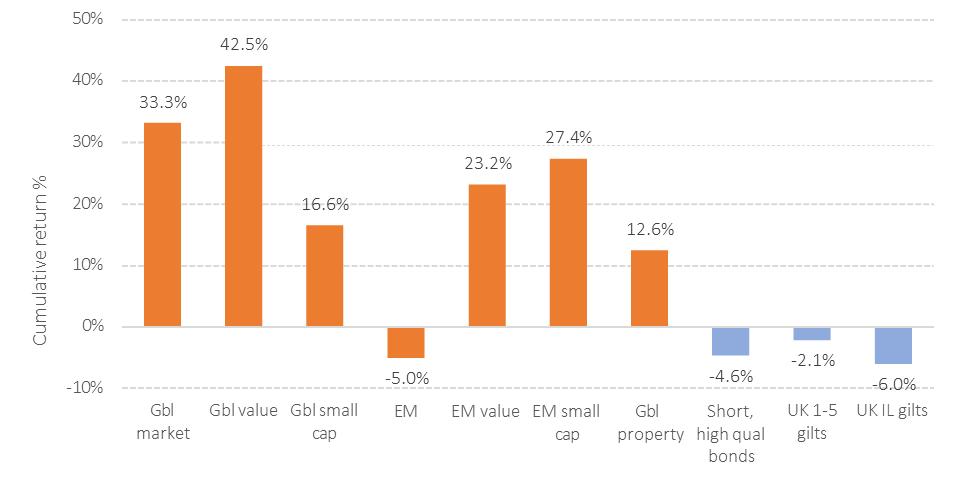

We talk about remaining invested and the long-term benefits from investing but we know it can be hard to do this. The graph below shows three-year cumulative returns to illustrate the benefit of remaining invested through tough years such as 2022.

Bond returns over this period have been poor for a number of reasons; low starting yields of around 0% due to the Covid crisis followed by subsequent yield rises (and thus bond price falls), but these were more than compensated for by strong growth asset returns.

Cumulative global investment returns – three years to the end of 2023

Data: Morningstar - GBl = Global, EM = Emerging Markets & IL = index-linked. The orange bars represent growth assets and

the blue bars represent defensive assets.

You only need to look at the news to see uncertainty abounds. It’s important to remember that forward-looking views are already reflected in today’s prices. What comes next, no one truly knows. The key is to remain highly diversified, resolute in the face of any market setbacks and focused on long-term goals.

In light of this, with elections due this year, we look at how this may impact your investments.

Portfolios, how did they do in 2023 and what factors will influence returns in 2024?

Elections and your investments

At the time of writing we are in the midst of the general election campaigns ahead of the country voting on Thursday 4 July.

While we await the eventual outcome, the question of how and whether elections and the prevailing Government should influence long-term investment decisions in one that we consider below.

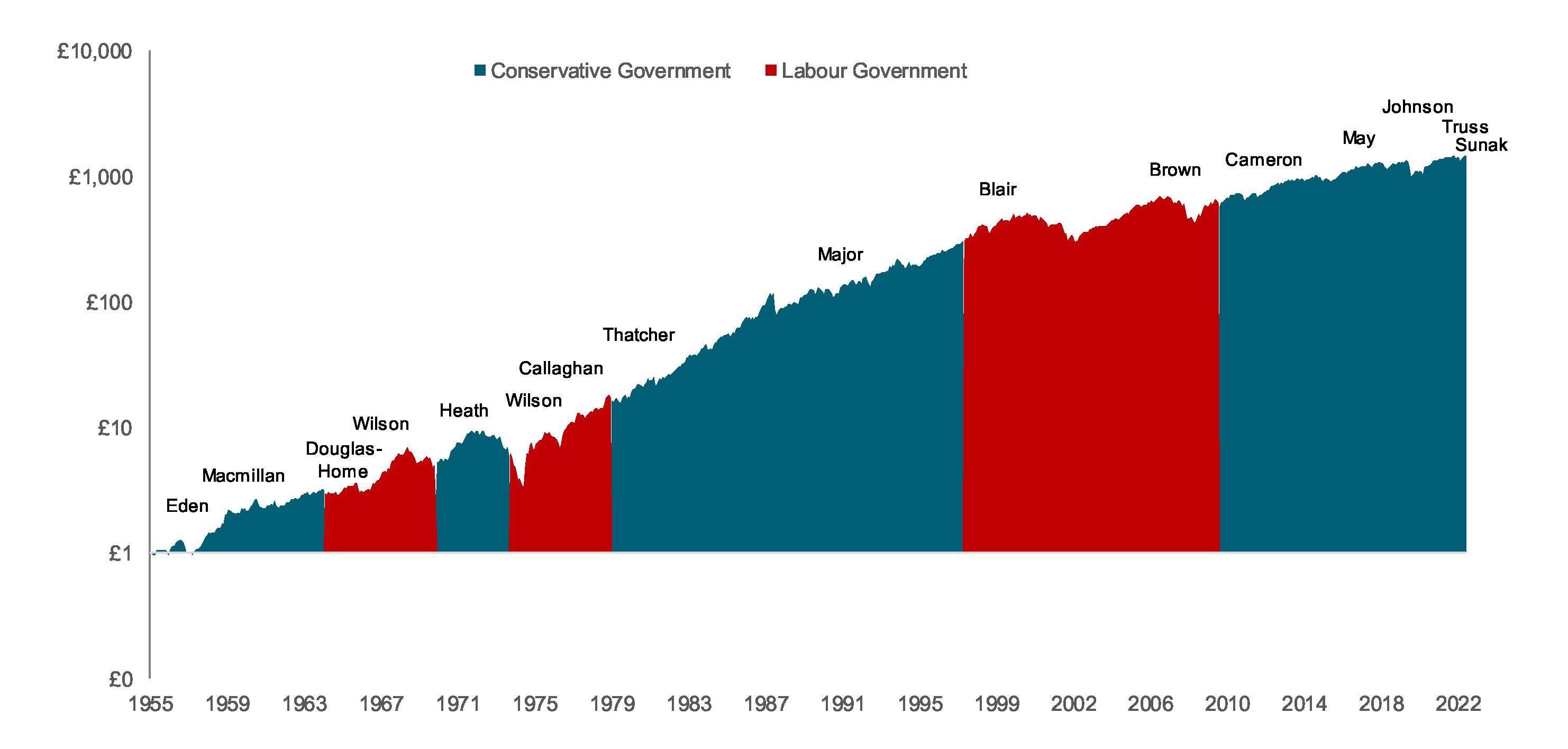

Predictions about the impact of the election outcome on the stock market tends to focus on which party will be ’better for the market’ over the long run. The graph below shows the growth of £1 invested in the UK market over almost 70 years and 16 prime ministers (from Anthony Eden to Rishi Sunak).

This does not suggest an obvious pattern of long-term stock market performance based upon which party has the majority in the House of Commons. What it shows is that over the long run, the market has provided substantial returns regardless of who lives at Number 10.

Growth of a pound invested in the Dimensional UK Market Index

January 1956 to December 2022

Source: Dimensional

We would caution investors against making changes to a long-term plan in a bid to profit or avoid losses from changes in the political winds.

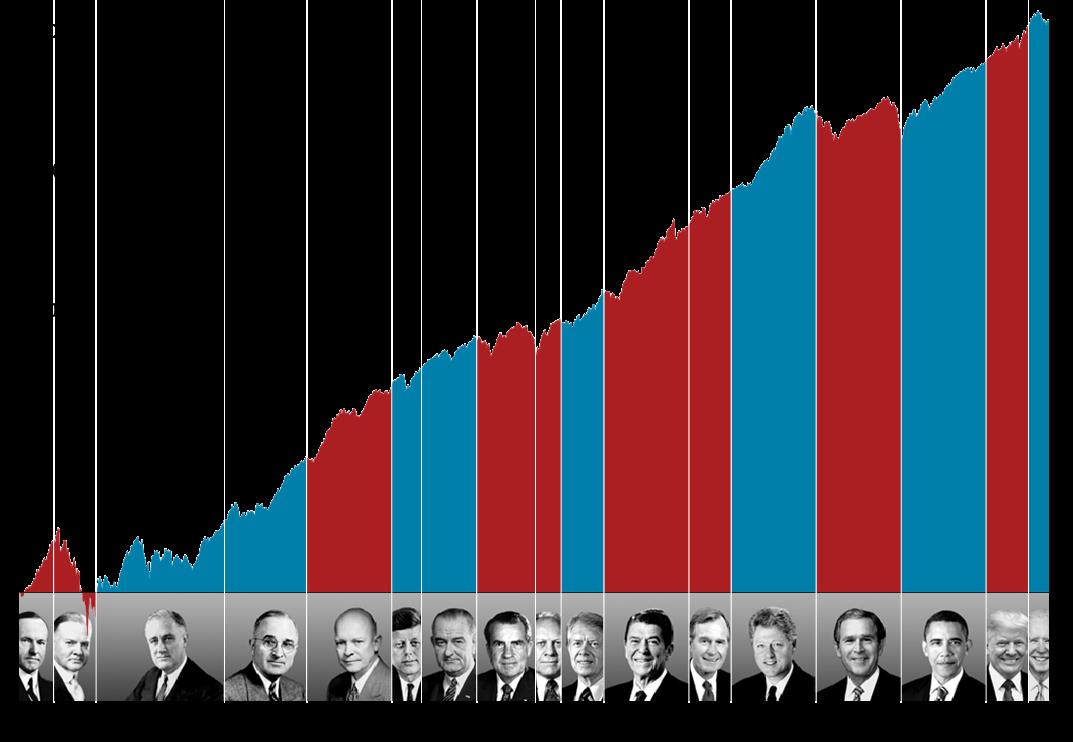

A similar picture is shown for the US. The US presidential election will be held on Tuesday 5 November 2024 and looks likely to be a rerun of the 2020 contest between Joe Biden and Donald Trump.

Growth of a dollar invested in the S&P 500 Index

1926 - 2022

Source: Dimensional – the red bars represent Republican presidents and the blue bars Democratic presidents.

It’s natural for investors to look for a connection between who wins the White House and which way stocks will go. Shareholders however are investing in companies, not a political party and companies focus on serving their customers and helping their businesses grow, regardless of who is in the White House.

Stocks have rewarded disciplined investors over the long term, through Conservative and Labour Prime Ministers as well as Democratic and Republican presidencies. Making investment decisions based on the outcome of elections, or how investors think they might unfold, is unlikely to result in reliable excess returns. On the contrary, it may lead to costly mistakes. Accordingly, there is a strong case for investors to rely on a consistent approach to asset allocation—making a long-term plan and sticking to it.

Simon Cole Partner, Chartered Financial Planner07825 620041

simon.cole@om.uk

Contact

Exeter

Leeward House

Fitzroy Road

Exeter Business Park

EX1 3LJ

+44 (0)1392 214635

Chippenham Unit 2

Greenways Business Park

Bellinger Close

SN15 1BN

+44 (0)1225 701210

Wells

Bishopbrook House

Cathedral Avenue

BA5 1FD

+44 (0)1749 343366

Yeovil

Maltravers House

Petters Way

BA20 1SH

+44 (0)1935 426181