“Old Mill continues to make waves in the financial planning industry, maintaining our position as one of the leading firms in the UK.”

Paula Hodge, Partner, Head of Wealth Management

“Old Mill continues to make waves in the financial planning industry, maintaining our position as one of the leading firms in the UK.”

Paula Hodge, Partner, Head of Wealth Management

With 2025 now well underway, we’re delighted to bring you the first edition of Wealth Management Insight for the year.

We continue to evolve at Old Mill, ensuring our clients receive the highest level of service and expertise, so we’re incredibly proud to have been recognised once again as one of the UK’s leading financial planning firms, earning places in both the FT Adviser Top 100 Firms and New Model Adviser Top 100 Firms for 2024.

In this edition, we explore a range of topics that may be particularly relevant as you review your plans for the year ahead. A key theme throughout is the importance of financial foresight—whether that’s ensuring your investments remain aligned with your goals, protecting your wealth for future generations, or preparing for potential changes in taxation and legislation. With that in mind, we take a closer look at the 2024 investment landscape, reviewing portfolio performance over the past year and considering what might be in store for 2025.

For those looking ahead to later life, we also examine the increasing pressures in the care sector and what this means for financial planning. The cost of care—both in terms of funding and availability—is an issue that will affect many of us, and we outline some of the steps you can take now, to secure greater control over your future options.

We also revisit the topic of inheritance, exploring both the emotional and financial aspects of receiving wealth from

loved ones. Many people find managing an inheritance unexpectedly complex—whether it’s understanding how to put it to good use or feeling uncertain about spending money they didn’t personally earn. Our article on inheriting money provides practical guidance on how to make the most of this opportunity whilst keeping emotions and longterm goals in balance.

Last year’s Autumn Budget brought a number of key updates, particularly around pensions and tax. One of the most significant changes on the horizon is the inclusion of pension funds within estates for Inheritance Tax (IHT). This is likely to have a major impact on estate planning, and while we await further details from HMRC, we outline the potential implications and steps you may wish to consider in the meantime.

We also discuss the importance of life insurance— particularly in today’s evolving family structures where financial dependency often spans multiple generations. Ensuring your loved ones are protected should the unexpected happen remains a crucial element of a wellrounded financial plan.

As always, our Wealth Management Insight isn’t just about long-term strategy—it’s also about real, practical steps you can consider now to ensure your finances remain on track. Whether that’s making the most of tax-efficient allowances before the tax year-end, reviewing your investment portfolio, or ensuring your estate planning is up to date, small adjustments today can lead to significant benefits in the future.

We hope this edition provides you with valuable insights and ideas. If there’s anything you’d like to discuss further, or if you have topics you’d like us to cover in future editions, we’d love to hear from you. Please do speak to your financial planner.

We look forward to working with you throughout 2025 and beyond.

Paula Hodge Partner, Head of Wealth Management

Paula Hodge Partner, Head of Wealth Management 07825 620042 paula.hodge@om.uk

Ange Crowley Business Development Manager 07989 423527 angela.crowley@om.uk

Tim Blowers

Chartered Financial Planner 01749 335111 tim.blowers@om.uk

Simon Cole Partner, Chartered Financial Planner 07825 620041 simon.cole@om.uk

Stuart Coombe Director, Chartered Financial Planner 07815 561333 stuart.coombe@om.uk

Chris Tweedie

Chartered Financial Planner 07545 642086 chris.tweedie@om.uk

Natalie Galvin Senior Trust Manager 01935 709397 natalie.galvin@om.uk

Gavin Jones

Chartered Financial Planner 07825 620037 gavin.jones@om.uk

Lewis Dyer

Associate Financial Plannner 07872 599142 lewis.dyer@om.uk

Jon Orchard Partner, Chartered Financial Planner 07854 417301 jonathan.orchard@om.uk

Tom Parry

Chartered Financial Plannner 07866 187645 tom.parry@om.uk

When there are changes in taxation and the treatment of different financial products such as those announced in the Autumn Budget 2024, it’s always advisable to review your current circumstances. As an existing client, your financial planner will work with you as part of the ongoing service we provide to determine the impact of any changes on your financial plan. You may also be speaking to family and friends who would welcome the opportunity to discuss their own circumstances, and we would be pleased to help. To make the process of speaking to Old Mill easier, we offer a free and without obligation ‘Wealth Management Health Check’.

Our health check will consider a person’s current financial position and against this, review both financial and nonfinancial goals with the aim of advising on how the chances of financial success can be improved.

Some of the areas we might explore as part of the health check includes:

• How much money does their lifestyle cost?

• What people enjoy doing and want to do more of

• When they can retire (if they haven’t already)

• Whether current savings and investments are suitable and in line with the risk they need to take to achieve their goals

• Whether existing pension plans enable them to enjoy the lifestyle they desire

• Are they protected against unexpected financial challenges? (e.g. critical illness)

• How to effectively pass on wealth to the next generation

• Are they paying too much tax? If so, how can we reduce this?

• Are they making the most of their tax allowances?

This service is typically of benefit to those with investable assets (investments and/or pensions) in excess of £250,000.

Ange Crowley Business Development Manager

angela.crowley@om.uk

The topic of inheritance can be dominant in discussions with our clients. Whether working to achieve the best financial outcome for beneficiaries, through to mitigating concerns of Inheritance Tax or, just being available for questions and queries on what can be a difficult subject matter. One area you, or your children, may find surprising, are the emotions involved. For some, inheriting money can feel like a windfall that wasn’t earnt, leading to feelings of discomfort or undeserving. This article, whether to be read by yourselves or your beneficiaries, is intended to help alleviate those feelings.

It’s important to remember that this didn’t happen by accident. Your loved ones intended on passing their wealth down to you and they likely worked very hard to do so. Just imagine how they would want their legacy to be used, it’s unlikely that someone’s dying wish is for their legacy to be saved in the best interest rate bearing account possible and to be left untouched thereafter.

By striking a balance between enjoying some of what you have been left, and managing the rest wisely, perhaps someday you will provide your loved ones with a similar legacy, and you will have set a positive example of what to do with it that they can follow.

Rather than stressing over what to do or feeling uncomfortable, consider this an opportunity. An opportunity to honour your loved one’s wishes and to do something meaningful like ticking off items on your bucket list, investing in yours or your family’s future, or perhaps donating to causes that are important to you or that were important to them.

We work closely with a number of charitable organisations and for those clients that have surplus funds and would like to give something back, we help them get involved with organisations like the Somerset Community Foundation, who do incredible work with individuals, businesses, trusts and the public sector to build stronger communities and to help those who need it most. For many, it starts with a donation and ends with membership and involvement in social events and philanthropic ventures.

We often speak to clients who have inherited large sums of money, but for whatever reason, be it fear, uncertainty, stress, or general malaise and ‘kicking the can down the road’ they have simply done nothing with it and left it in cash until an unspecified later date.

Aside from the more immediate risks of holding large sums of money in a default bank account and often exceeding the Financial Services Compensation Scheme limit of £85,000 per account which covers your money if a bank goes bust the real hidden cost is inflation.

The gradual and unrelenting rise in the price of goods and services means that holding money in low-interest cash accounts leads to a rapid decrease in purchasing power over time. In October 2022 UK inflation hit a 41 year high of 11.1%, driven largely by soaring food and energy costs, partly caused by the economic impact of Covid lockdowns and supply chain disruptions from the ongoing conflict in Ukraine. Households saw energy prices rise by an average of £770 per year and these increases, although very much a

spike from the normal longer term inflation rate of 2% show how money can lose its real value extremely quickly.

A £100,000 inheritance held for 10 years in a low-interest savings account would be worth approximately £81,859 in today’s terms, had inflation averaged only 2% over that period. This money invested and achieving 2% above inflation return would be worth significantly more around £122,000 which would provide more security and freedom when called upon.

One of the best tools to help you manage your inheritance is cashflow planning. This financial tool allows you to understand how long your inheritance funds could last, whether you can afford to gift some of it or donate to charity, or how much you can afford to spend yourselves on the things you’ve always wanted to do. Cashflow planning provides peace of mind by giving you a clear picture of what your financial future could look like, and we’ve had many clients who were able to retire early or achieve their goals years before they ever expected to because of it.

By understanding your current and future income, your normal expenditure habits, and the expected growth of any assets you own, we can look forward and predict where you may end up. We factor in inflation, relevant tax rates, risk profiles of different assets and one-off events to give you the most accurate forecast possible. This can be a one-off exercise, but more often we review regularly and can improve your situation each year by making the most of tax allowances, ensuring your money is diversified and invested in line with your needs and reacting to unexpected

life events and changes to ensure you remain on track and don’t stray away from your objectives. Cashflow planning is your roadmap to success, removing uncertainty and giving you back control of your finances.

Lastly, the most important thing for us as financial planners is to do everything we can to ensure our clients make the most of life. Peace of mind that you’re going to be ok, and the knowledge that you have options and freedoms are paramount, but part of this is knowing you are protecting your wealth for family and loved ones as well. This can involve the use of trusts, protection, wills and lasting powers of attorney, or simply putting a plan in place to ensure the money lasts and is sheltered from any unnecessary taxes or risks.

So, ditch the guilt and embrace the opportunity. By managing your inheritance responsibly, you can hopefully do all the things you’ve wanted to do, whilst providing both stability and opportunities for your loved ones in the future.

Lewis Dyer

Associate Financial Planner 07545 642088

lewis.dyer@om.uk

The ability to pay for care will determine how much control someone has over their future should care be needed. This article examines some of those pressures and highlights some issues to consider as part of your financial plan.

The UK’s population is aging; the International Longevity Centre (ILC) predict that the number of people over age 65 in the UK will increase by 53%, from 11.2 million in November 2022 to 17.2 million in 2040.

The Government’s ‘Operational guidance to implement a lifetime cap on care costs’ (published in September 2021 and updated in January 2023) states that:

Care and support needs are unpredictable. Many of us will need some form of care and support over the course of our lives. Around three out of four adults over the age of 65 will face care costs in their lifetime. However, the amount we will be expected to spend will depend on the level of our needs. Some of us will be fortunate and spend a minimal amount, but one in seven people will face care costs of more than £100,000, excluding hotel and accommodation costs (see figure 1). Roughly one in ten individuals will face care costs above £120,000 over their lifetime.

Figure 1: Expected future lifetime costs of care for people aged 65 in financial year (FY) 2010 to 2011, by percentile (2010 to 2011) in FY 2021 to 2022 prices, DHSC analysis based on Care Policy and Evaluation Centre (CPEC) modelling.

For readers, the most alarming point in the Government statement above is that hotel and accommodation costs (including food and personal requirements) are additional to the £100,000 care costs that people will face. These hotel costs can be significantly greater than the care costs. Carehome.co.uk in their article ‘Care Home Fees and Costs: How Much Do You Pay?’ (14 January 2025) reports that average weekly residential care costs are £1,410 per week across the UK. This type of care does not include any nursing component, it’s mostly hotel and accommodation costs. In the South West of England, the fees can be considerably higher.

The care home industry is under huge financial pressure and the position could well worsen. Under 50% of care residents are self-funders, meaning the majority are supported by the Local Authority to meet their care needs, which brings ongoing profitability challenges for care homes.

Furthermore, care homes face quality standards assessments: according to The Lancet (Lancet Healthy Longev 2024;5e297-302) the Care Quality Commission (CQC) forced involuntary closures of 816 care homes (representing 19,918 registered beds) from January 2011 to September 2023.

Independent corporate finance company, CIearwater International, reported that the UK care industry faces employee retention and recruitment challenges, including wage inflation, loss of staff due to Brexit and the pandemic, and the impact of vaccination status on staffing, are shown to be ongoing problems across the sector, with workforce solutions key to delivering services.

With rising costs, the only option to remain profitable is for care homes to raise their fees. If care homes cut costs too much then they risk poor care delivery outcomes and possible censuring and even closure by the CQC. Both of these points are not good news for the consumer who already consider care fees to be extortionate, and the provision of care home beds insufficient to meet demand.

The proposed measures for a cap on the cost of care of £86,000 in a person’s lifetime, and an increase in the means test threshold from £23,250 up to £100,000, were abolished

by Rachel Reeves on 29 July 2024. Local Authorities had previously petitioned central government to abandon the proposals on the grounds that they would cause Local Authorities to go bankrupt, many of whom were already deep into the red on their care funding budgets. The incoming Labour government saw this and the black hole as insurmountable and abolished the measures.

With costs difficult to control, the next step that care homes can take is to only accommodate clients who are selffunders and can pay the full rate of fees for the duration of their stay. More and more care homes are doing this and building it into contracts.

So, in order to have the maximum choice and control over future care provisions, it’s crucial that people have enough resources to pay for care indefinitely, however expensive it becomes, for the rest of their lives.

• Plan ahead to check how much future care might cost you. Your financial planner can run cash flow forecasts to estimate in advance how well provided for you are.

• If planning on making gifts, undertake a future care adequacy check first. Only gift away what you are certain you will never need yourself in the future.

• If care is likely to be needed, take advice on how best to pay for it. Most people’s income is well short of the care fees they may face. Our Society of Later Life Advisers (SOLLA) experts can advise you on how to reduce the care fees shortfall (see below; Steps to take if you need care now) and optimise the use of your finances.

• Don’t leave care planning and funding issues too late so it becomes a crisis management issue. Clearly, you can’t be sure if a sudden illness (e.g. a stroke) will occur, but after the age of 60, the likelihood of such an event increases almost exponentially.

Take advice to ensure optimal use of financial resources and improve the chances of positive financial outcomes.

There are numerous steps that a qualified (Society of Later Life Adviser) care funding planner will go through to optimise the use of financial resources, which are:

1. Ensure a Continuing Health Care (CHC) assessment is undertaken if there is a likely primary care need.

2. Ensure a Funded Nursing Care (FNC) assessment is undertaken (if there is no eligibility for CHC) to check for eligibility for this benefit.

3. Ensure Attendance Allowance (AA) is claimed at the appropriate level – higher level where possible.

4. Where capital exists consider using an Immediate Needs Annuity (INA) to increase guaranteed income for life, the aim would be to plug the gap entirely if CHC is not available.

5. Analyse and understand the financial resources to clarify the short-term and long-term adequacy positions.

6. If an INA is not viable how best to use a combination of steps 2, 3, and 5 to ensure finances last as long as possible and hopefully for the entire period of tenure in care.

It’s a financial product called an annuity that provides additional guaranteed income for someone in care. The main features of an INA are as follows:

• Capital is used to buy an annuity – it’s an exchange of a cash lump sum for an ongoing income. It is effectively buying extra pension income.

• The income is tax-free where it’s paid to a Care Quality Commission (CQC) registered care provider.

• The income is paid until the person receiving it (the annuitant) dies. The contract comes to an end at this point. The capital has gone.

• The income can be level or escalating.

• Escalating income can be arranged in line with the retail price index (RPI) or at a fixed increase of up to 10% per annum.

• Short-term death benefits are automatically included in case of death in the first few months of the contract.

• Long-term death benefits are optional and can be built in so that capital may be returned on a decreasing basis when the annuitant dies. This protection costs more (it’s an insurance added to the annuity). The protection can be set at levels up to 75% of the amount used to buy the INA (the initial premium amount). Typical levels of protection that are considered are: 75%, 50% and 25%. Death benefit cover decreases with each annuity payment made, so eventually, if the annuitant lives long enough, the life cover runs out.

• Deferred annuities can be arranged where the benefits do not start for a set period of time, for example, one or two years. You fund the care for the deferred period and the annuity pays the shortfall (or most of it) after the shortfall ends. Deferred annuities are much cheaper to buy.

• The guaranteed income provides peace of mind to the annuitant/their family or representatives.

• The income level, after claiming the appropriate benefits is calculated to meet the care shortfall so the individual has long-term financial security.

• The Court of Protection (in Deputyship cases) approve the use of INAs (where used suitably) because the product brings certainty to the planning arrangement and can be used to guarantee financial security for life.

• The Court of Protection (in Deputyship cases) approve the use of INAs (where used suitably) because the product brings certainty to the planning arrangement and can be used to guarantee financial security for life.

If an INA is not viable, for example, a) if the capital available is insufficient to buy an annuity, or b) the annuity is too expensive meaning that the INA is not good value for money, then prudent management of cash and investments can improve the likelihood of funds lasting longer, although this may not guarantee that funds will not become entirely depleted.

Considerations about future care and active planning can help avert a future crisis. The care industry continues to face challenges going forward and most of these relate to cost-based issues which will be passed onto clients. The key to your future security, if you need care, is to not run out of money, i.e. stay as a self-funder and not need Local Authority support.

Chris Tweedie Chartered Financial Planner, Accredited Member of SOLLA (Socitey of Later Life Advisers) 07545 642086

chris.tweedie@om.uk

We created the Old Mill Charity Fund so that we could build on many years of charity support across our offices and bring it together through our own charitable fund. It means that we can help respond to key local needs in the communities our staff and clients care about – supported by the expertise of our local Community Foundations who manage our fund. The Old Mill Charity Fund brings the team together to support good causes and unsung heroes on our doorstep, it encourages our team to share their time and expertise with local charities.

Community Foundations are local charities that provide vital funding for small, local charities, supported by donors like Old Mill. They’re experts in local needs and have unparalleled knowledge of their local communities and charities. They provide high-quality philanthropy advice and manage The Old Mill Fund on our behalf, carrying out due diligence, awarding grants, and collecting feedback so we know we’re making the most impact possible and can share updates like these on the difference we’ve made.

Building brighter futures - helping young people to build skills, confidence and resilience and succeed at school and beyond.

Reducing rural loneliness –supporting activities that reduce loneliness and help to improve physical and mental health.

Strengthening communities – supporting projects that bring people together and build strong, supportive communities that help the most disadvantaged.

These are just some of the numerous beneficiaries:

Loveable was set up to counter the social isolation and loneliness in the lives of learning disabled and autistic people in Somerset. They offer relationship support as well as a programme of social meetups, yoga sessions, a theatre group and a ‘DJ Club’.

They are currently running a popular DJ club project which they have been running for three months but need financial support now to ensure it can carry on. DJ Club is a monthly setting in which attendees can learn to mix, learn about making music, hang out with their mates, build confidence and self-esteem and learn something new which has not

been offered to this community before. They have also linked up with the ‘Rhythm of the Night’ in Bristol, a club night run by and for people with learning disabilities. They go up there monthly to meet new friends, dance and enjoy the nightlife and are hoping that once their members have some DJ skills, they will be able to DJ at one of the Bristol nights. This grant will enable them to ensure the ongoing success of this project; to buy their own equipment for DJ lessons, DJ tutor hire, venue hire and minibus costs to get the individuals to the Bristol club night.

Chippenham Uniform Exchange is a dedicated, unified system of recycling school uniform in Chippenham, and the surrounding villages- an independent ‘one-stop shop’ to obtain preloved uniform for any child, any time, regardless of the school attended, and without shame or embarrassment. Uniform is provided for a voluntary donation to anyone that needs it.

Families Out Loud offer subsidised one-to-one professional counselling and support services to adults & teens aged 13-17 who are affected by the addiction, drug or alcohol, of a family member or friend.

Doorway is based in Chippenham and provides a drop-in for vulnerable adults experiencing homelessness or housing issues, providing food, washing & laundry facilities, activities, support and advice.

Founded in 2022 to establish a Community Hub in the former Methodist Church in Buckfastleigh (a relatively isolated rural town on the edge of Dartmoor). It aims to create a space where local people can come together for education, art, food and wellness activities, and to

build a resilient community. Current activities include running a community cafe and community fridge, organising different arts activities including community weaving and mural projects. Any grant will go towards the costs of delivering these activities.

A small organisation running mental health and wellbeing support services, working with children, young people and their families. They work in communities and schools in East Devon and have an experienced team of Wellbeing Workers. Specifically, they are seeking funding to continue their peer support groups and school mentoring for young people aged 11 to 25 with mental health issues.

Jon Orchard Partner, Chartered Financial Planner 07854 417301 jonathan.orchard@om.uk

• You can scan the QR code below. Remember to choose Gift Aid if you’re a UK taxpayer and your donation will be boosted by 25% at no extra cost to you.

• Remember to choose Gift Aid if you’re a UK taxpayer and your donation will be boosted by 25% at no extra cost to you.

Understanding and resolving the financial implications of divorce or separation at what is an emotionally challenging time can be difficult. Alongside the marital home, for many their pensions can often represent the largest assets in terms of value.

It’s not just investment-based pensions but final salary pensions already being paid and annuities that need to be considered. There are three ways that pensions can be split as part of a divorce settlement - offsetting, earmarking or sharing.

When divorcing or dissolving a civil partnership, pension offsetting is one option. This can be good for people wanting a clean break.

Someone who has built up a pension might agree that they keep it, in exchange for giving the other person some cash and equity in the house to balance it out. It’s a really simple way to agree on things but can result in unfairness. If one person gets a house, this isn’t taxed in the same way as a pension. At present, a pension might only be accessible after the age of 55, and even then, there might be penalties for taking it ‘early’.

Offsetting orders are not affected by remarriage or death and could also be a good option for people with pension assets overseas, as these cannot be shared via a UK court order.

However, offsetting also runs the risk of leaving one person with little or no retirement pot. The process can also be difficult because the value of assets like pensions and property change over time. Getting a fair result for both parties from offsetting could be a challenge.

Since 1996, earmarking has been another option. A pension earmarking, or attachment order, can, once pension payments begin, redirect all or part of a private or work pension to an ex-spouse or civil partner.

An earmarking order could, for example, require someone to pay half of their pension income to the former spouse. This can be a good option to ensure someone receives continued financial support after a divorce.

However, there are several drawbacks to earmarking. The main drawback is the lack of control the recipient has. If the former partner were to die, this might reduce what they get or stop the income completely. Also, unless there is a clear agreement over when the pension starts if their ex-partner delays taking the pension, there could be a significant impact.

There are also drawbacks in terms of taxation. If the person getting the pension is a higher rate taxpayer, the pension will be taxed at this rate even if it’s subsequently paid on to an ex-partner, who could be a basic rate or even a nontaxpayer.

Earmarking does not offer a clean break and financial ties could continue for many years.

Since being introduced in 2000, pension sharing has become a more common course of action for dealing with pensions during a divorce. A court issues a pension sharing order which states how much of the pension the ex-spouse is entitled to receive. Couples agree to a split of pensions on a percentage basis.

For example, if one party has no pension and the other has built up a significant amount, the latter could agree to share 50 per cent with the other party. The person receiving the pension share will in most cases then ‘transfer out’ to their own pension, but in rare cases, they are able to join the scheme as a ‘shadow’ member.

Valuations for pensions can be complicated, particularly if pensions are different types or the divorcing couple are very different in age. It’s a more complex option, with a report calculating options for sharing sometimes required, and therefore more cost involved, but can deliver greater fairness if done correctly.

The benefit of sharing is that it achieves a clean break by splitting the pension at the time of divorce, with each party receiving their share independently. Remarriage or death will not affect the court order.

If a pension is subject to a pension sharing order, the pension scheme or pension provider has up to four months to implement or carry out the order from the time when they receive all the necessary information. However, they should do it within a reasonable time frame.

Tim Blowers

Chartered Financial Planner 01749 335111

tim.blowers@om.uk

Tim Blowers specialises in financial planning on divorce, is a Chartered Financial Planner and Associate of Resolution, a body of family justice professionals. Please get in touch if you would like to know more.

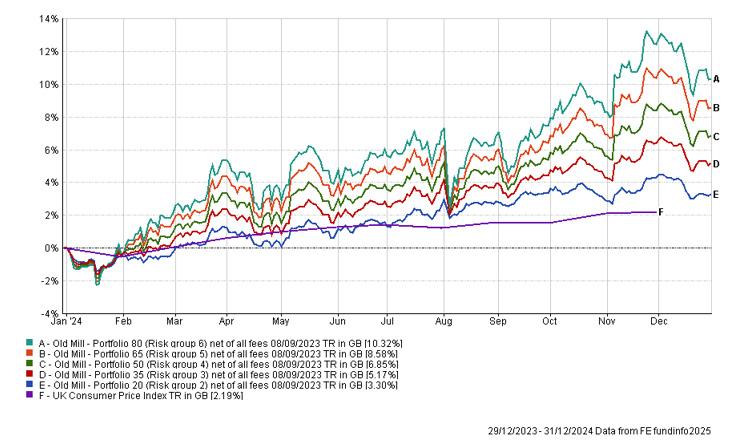

Performance over the last year (up to Tuesday 31 December 2024)

Over the past year, despite the pullback in December, we’re pleased to report that all portfolios posted positive returns. For those prepared to take on more investment risk, the rewards have been a double-digit increase in the last 12 months, and for those more cautious there has also been a good return, ahead of inflation. This return was driven by the growth part of the portfolio, with the prospect of falling interest rates and the pro-business policies of Donald Trump driving growth in the second half of the year. The final quarter was positive for most portfolios but the US Federal Reserve signalling that US interest rates may fall more slowly than previously forecast, saw global stock markets fall and fixed interest yields rise in December.

Longer term performance over the last 10 years (up to Tuesday 31 December 2024)

The ten-year returns illustrate the value of investing over the longer term. It also highlights that in pursuing higher returns, there will be periods of volatility that call for patience and trust in the investment process. Nowhere did we see this more than in the early days of the Covid pandemic in spring 2020 as the chart above aptly illustrates.

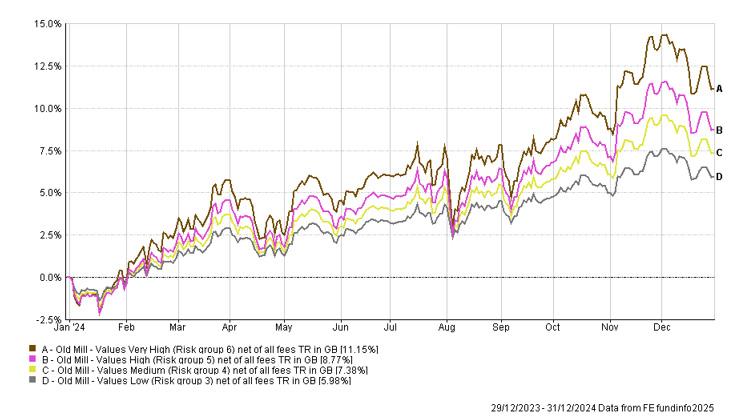

Performance over the last year (up to Tuesday 31 December 2024)

Performance over the last year for values portfolios has been slightly higher when compared to the standard portfolios as the environmental, social and governance (ESG) screened global equity fund has shown strong performance.

The values portfolios have only been available to our investors for the last five years, but the graph below shows the longer time frame of ten years showing the potential upside over longer periods.

Longer term performance of the values portfolios shows robust growth. The last ten years have seen strong performance from growth assets, especially US equities, even taking into account the Covid pandemic five years ago and the return of inflation after the invasion of Ukraine by Russia at the beginning of 2022.

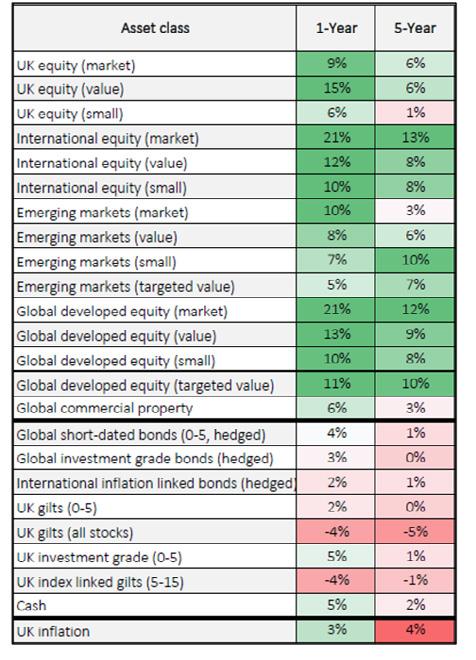

The table to the left shows the performance of a number of asset classes in 2024 and the annualised return over the last five years as at close of play on Tuesday 31 December.

Stuart Coombe Director, Chartered Financial Planner

07815 561333

stuart.coombe@om.uk

Vicky King and Lavinia Watson are integral to the fabric of Old Mill, bringing a combined 50 years of dedicated service that form the foundation of who we are today.

Vicky has been a part of Old Mill’s Wealth Management Team since 1990, with the exception of a three-year break while supporting her husband’s overseas military service. Her deep connection to Old Mill extends beyond her own career — both of her daughters also work here.

Lavinia, too, has made a significant impact, contributing over 20 years of commitment and expertise. Together, they embody the spirit and values that define Old Mill.

V: At Old Mill, we’re the link between the company and the platform that we use to invest client money. We set up applications, submit applications, control funds and deal with anything to do with the investment. We manage cash across the accounts to ensure enough is held to cover fixed withdrawals and income that clients take from their portfolios. Where cash is low, we advise the planner teams and they then provide a rebalance calculator so that we may place the necessary trades to raise additional cash.

L: We hold regular meetings with the platforms that we use for investing. We put forward better ways of working and give feedback to ensure that the client is getting the best possible experience and ensure that everything is done in the most efficient way, as there are only two of us!

V: We must weigh up the client’s risk versus the money they make.

L: We invest money in line with risk and achieve what the client hopes to achieve.

V: I work out of the Yeovil office and cover Yeovil and Exeter, whilst Lavinia covers Wells and Chippenham. We’re constantly in communication, reviewing each other’s work whilst we joke and laugh, we’re a great team.

V: We won team of the year within Old Mill Wealth Management three years in a row from 2017 – 2019.

L: Up until 11am, we’re physically trading money – placing trades to sell or purchasing funds to get new models. After 11am, we deal with new applications, deal with data analysis, check all our work, raise commitments for fees and put new direct debits in place.

V: In September, we must rebalance every single portfolio on the platform. Portfolios need to be realigned to the client’s chosen risk and typically this occurs around September - there are a number of choices for investment portfolios and it’s our responsibility to bring the overall investment strategy for each account back in line with the investment choice otherwise investments would become

out of balance and drift towards a higher or lower risk than the client has agreed. Annual rebalancing around September covers the accounts unaffected by tax e.g. ISAs and SIPPs. Whilst there is automation, we manually check that everything is right. For accounts where tax liabilities arise these are reviewed generally once per year but usually at the time of the client review as these need more in-depth research and careful management of taxable gains or agreement from the client to accept gains if they are very high. Should the model portfolio need to be changed e.g. the client’s requirements/ outlook may have changed, then this would involve remodelling accounts moving funds which aren’t needed anymore to move them into the current set of funds required for each account.

L: The rebalancing only covers the non-taxable accounts. The rest of our holding covers the taxable accounts. Our overall holding is 755 million pounds, with our investment platform M&G over 5205 accounts, and we also use the Parmenion platform.

L: It’s a challenge, but in a good way!

V: It’s the madness of the day. There is so much money and it’s the thrill of it all. You’re dealing with millions of pounds, and the pressure and stress of it, is what keeps me going.

L: The people make Old Mill. Most of the time we have to liaise with the teams, we have to get things right, it’s a balance. I feel like I’m quite lucky with who I have to work with. I couldn’t do it without Vic.

V: It’s always changing, if there’s something you don’t like, you can bet your life it will change – we’re constantly evolving. Nothing stays still, it’s the challenge of what’s coming in next.

V: Both of my daughters work at Old Mill too and I love that the whole family works for this company.

V: I like going to London to watch musical shows. I also have a house down in Dawlish Warren so it’s either the slow pace of Dawlish or busy of London. I’m also involved in the local Scout Group.

L: I like music but of a different kind. I go to a lot of heavy metal and punk gigs. I’m treasurer of an allotment society in Wells. I also do lots of crafty hobbies, but I tend to make miniatures to go into doll’s houses. I love tapestry and needlework, and I also collect antiques and collectablesanything which I find interesting.

What should I do about my pension?

The announcement that from April 2027, pension funds will be included in estates for Inheritance Tax (IHT) purposes has resulted in many seeking advice on what they should now do with their pension funds.

Since the introduction of Pension Freedoms in 2014, there has been much more freedom on how people choose to use their pension funds. It has been attractive to save into a pension with the benefit of tax relief and also to take advantage of the rules that allowed for any unused funds to be passed down to beneficiaries free of IHT. This has led many people to leave pension funds untouched given they are free of IHT and instead spend other (taxable) assets first.

Alongside the Budget documents, a government consultation was launched explaining how the changes proposed would ensure that tax reliefs on pensions are being used for their intended primary purpose – to encourage saving for retirement and later life.

The consultation period has now ended and we await a response from HMRC. We cannot be certain how the final rules will look and until then, the current rules will continue to apply. It’s difficult to give specific advice at this early stage but below we have given more detail in simple terms of what we believe will be the tax treatment of your pension fund on death post-April 2027. We will be able to give specific advice for your individual circumstances once the final details are known.

Details of the proposed introduction of IHT on pensions

IHT will be payable on the value of your pension fund immediately before death. The IHT charge will need to be calculated by the pension scheme administrators and held back before funds are distributed or designated to beneficiaries. The scheme administrators will pay any IHT due directly to HMRC.

Back in November, you will have received our ‘Old Mill Autumn Budget Summary 2024’ with the headlines of all the key announcements in the Budget.

Here,

we cover some of the key topics we have been discussing with clients and been asked about in light of the changes announced.

The process will require the personal representatives and the pension scheme administrator/trustee having to work together to establish the IHT charge and the proportion of the charge the pension scheme must pay.

As an example, consider an estate of £2 million which includes a pension fund of £1 million for an individual with no spouse and no children. They have an IHT nil rate band of £325,000 which will be shared equally between the free estate and the pension fund. The personal representatives contact the pension scheme administrators and agree that the IHT nil rate band will be split equally between the free estate and the pension fund.

The pension administrators ignore the half share of the nil rate band (£162,500) and apply 40% IHT to the remainder. £1 million - £162,500 = £837,500 x 40% = £335,000 IHT for the pension scheme to pay to HMRC.

This leaves £665,000 in the pension fund to be distributed according to the deceased’s wishes.

Spousal Exemption

Spousal exemption will work in the normal way so if your spouse or civil partner is nominated for the entire pension benefit on your death, there should be no IHT charge on the first death at least.

In the example above, if there was a surviving spouse or civil partner there would be no charge to IHT.

Existing pension tax charges

Although pension funds currently are not subject to IHT, they can be subject to other pension charges when beneficiaries draw funds from the pension. We believe these charges will continue to apply post-April 2027 in addition to any IHT charge. Effectively this represents double taxation.

At the present time, we understand IHT will be calculated and charged before any existing tax charges are applied. Broadly this means there will be a difference depending on whether you die before or after age 75 and who your death benefit goes to. Put simply, unless your pension is nominated to your spouse, the funds available to be distributed could be reduced by up to 40%.

1. If you die before your 75th birthday

Existing tax charges will continue to apply so there could be additional tax due for those below 75 who elect to take a lump sum death benefit above the Lump Sum and Death Benefits Allowance (LSDBA). The standard LSDBA is £1,073,100 but higher figures may be possible if pension protection is in place. There should be no additional tax charges where benefits are taken in the form of a beneficiary’s drawdown plan.

The table below isn’t exhaustive but covers the tax charge for most scenarios.

2. After your 75th birthday

For deaths occurring after age 75, where benefits are transferred to a beneficiary drawdown plan, any funds subsequently withdrawn will be subject to Income Tax in the hands of the beneficiary at their own marginal rate of Income Tax. Where a lump sum payment is made there is a marginal rate tax charge on the recipient – so up to 45%, which including the IHT can mean a total tax charge of up to 67%.

Key questions and considerations

There has been much talk in the media about the unfairness of ‘double’ taxation of IHT and possible pension charges on top for those with large funds above the LSDBA who die before 75 and for those who die after 75.

Until final details are known, we’re not able to provide specific advice. While the current rules remain in place until April 2027, you may not want to disturb your current arrangements for dealing with your pension fund on death. For those who are likely to draw on their funds significantly to support their retirement income requirements, these changes are likely to have less impact. For those who do not require their pension funds to generate their income, these changes are potentially very significant and how this can be managed will require very careful consideration once the rules have been published. In all cases, the implications of this change will need to be factored into your planning.

When should I start to draw my pension?

If you are over the age of 55 (rising to 57 from April 2028) you can start drawing on your pension fund, with a tax-free lump sum of usually 25% of the fund value (within limits) and any income received is simply taxed at your marginal rate of Income Tax.

For anyone who is a non-taxpayer or pays tax at the basic rate and, especially those over the age of 75, it may now be beneficial to start drawing income ahead of the changes in April 2027 provided it remains taxable still at the basic rate. This income could potentially be free of IHT if gifted whereas leaving the funds to accumulate in the pension could mean they will become taxable if the estate is liable to IHT.

If you have reached the age of 75 and not yet drawn your tax-free cash sum, or do not have a spouse you can pass on to tax free, then it’s likely to be sensible to take this before the changes in 2027. Whilst the lump sum may be liable to IHT at 40% in your estate, it will avoid additionally incurring pension charges as well which would see an overall

effective tax rate of 67%. Your financial planner will be able to advise on the merits of doing this in your circumstances. Does it make sense for me to gift more to reduce the value of my estate?

While there were some big changes to IHT, the normal rules of gifting were left unchanged and for some can provide an effective way of reducing or eliminating a possible IHT liability. Gifting options available include:

1. Potentially exempt transfers (PETs): are gifts to individuals to remove money from your estate. PETs allow you to gift an unlimited amount during your lifetime direct to anyone you wish. If you live for seven years after the gift, it will be outside of your estate for IHT purposes.

2. Chargeable lifetime transfers: occur when you are gifting money indirectly to people, via a trust. This may give you greater control over the money but there are lifetime IHT charges that may be due for larger transfers, or if you have already made certain gifts. There is a limit on how much can be gifted to a Trust without incurring an immediate tax charge of £325,000 per person. You will need to live for seven years for the gift to become fully outside your estate.

3. Normal expenditure out of income exemption: allows you to gift income that is surplus to your requirements and which is potentially outside of your estate immediately. Used properly, this can be an extremely effective way of saving IHT. Such regular gifts can be made directly to an individual, or it may be more desirable to make regular contributions indirectly to a beneficiary’s pension, for instance, or even a Trust.

There are certain rules that will need to be followed to ensure a successful claim for gifts to be treated as being regarded as normal expenditure out of income during your lifetime. HMRC states that a gift:

Formed part of the transferor’s normal expenditure:

HMRC will look for evidence that there is a regular pattern to the gift, perhaps by setting up a direct debit.

Was made from income:

The gift cannot made from capital, or capital assets like jewellery.

Left the transferor with enough income for them to maintain their normal standard of living:

Your personal representatives will have to provide calculations to HMRC of income and expenditure for each tax year considered to determine the surplus income amount. The income amount may not be the figure used for an Income Tax calculation, i.e. income from an Individual Savings Account (ISA) can be included.

Do I need to review my pension beneficiary nominations?

It’s likely all pensions and death benefit nominations will need to be reviewed over time but especially for those who have earmarked their pensions for estate planning purposes.

For those with a spouse or civil partner, it’s likely to become the default that they are nominated to avoid an IHT charge on the first to die. This will avoid unnecessarily using nil rate bands that may otherwise be used by the survivor on the second death.

Certain situations are going to be more difficult to manage, particularly where pensions have been used to plan for complex families – perhaps where a second spouse is gifted assets, but pension funds are earmarked for children from a first marriage or farming families where one child has been gifted the farm and the pension nominated for other nonfarming children by way of compensation.

Do the changes impact my death in service schemes?

There has been speculation in the press about the taxation of life assurance schemes designed to pay out a multiple of an employee’s salary if they die before retirement. These are often set up within a pension wrapper and currently the benefit payable is not subject to IHT. There is a possibility that such schemes may be included in these changes.

The technical consultation on the changes did state, ‘All life policy products purchased with pension funds or alongside them as part of a pension package offered by an employer are not in scope of the changes in this consultation document.’ We hope this means that these schemes will not be taxed but clarification will be needed.

Summary

There has long been an argument for a set of consistent rules for pension schemes to give people confidence to plan for the future. While some of the proposed changes are understandable from a tax point of view, the cliff edge implementation in 2027 will have serious consequences for some who had planned within the existing rules.

The inclusion of pension funds within estates for IHT purposes is potentially very complex and as a consequence, it also seems that the job of personal representatives will get more onerous with the need to deal with pension companies and arrange for them to settle tax liabilities. We have an estate administration service to make this job a little easier for your loved ones on your death, and we cover the services provided later in this publication.

Once we have the final legislation, we will be setting out any additional steps that people may wish to consider when minimising the impact of the changes on their financial planning. It’s important to speak to your financial planner before taking any action.

Frozen allowances

It was announced that the Inheritance Tax nil rate band will remain frozen at £325,000 until 5 April 2030. The residence nil rate band will also remain at £175,000 as well as the threshold of £2 million at which it starts to be lost.

Frozen allowances mean a greater proportion of estates will be subject to IHT over time as asset values increase. If the nil rate band had increased by inflation since 2011 when it was last increased, it would currently be over £480,000. An effective stealth tax for some of £62,000. Understanding the extent to which your estate would be liable to IHT and considering options to reduce this liability continue to be a priority for those looking to preserve their wealth for future generations.

Agricultural Property Relief (APR) and Business Property Relief (BPR)

For those with businesses or business interests, assets that qualify for 100% business property relief (BPR) or agricultural property relief (APR) have an unlimited amount of benefit under the current rules. The original intention of these reliefs was to avoid the breakup of a family business on the death of an owner if their beneficiaries had to sell assets to pay the IHT due. It’s a valuable relief and the IHT savings on large estates can be very significant.

In the Budget, it was announced from 6 April 2026, there will be a new £1 million allowance introduced. This will be a combined benefit between agricultural and business property with any excess above this limit qualifying for relief at the lower level of 50%, a tax rate of 20%.

For example, if an individual owns £1 million of assets that currently qualify for 100% APR and £1 million of assets that qualify for 100% BPR, on death after 5 April 2026 those assets will be combined so £1 million would get 100% relief from tax and the remaining £1 million would only get 50% relief. The result is an increase in IHT from zero to £200,000.

This reduction in the allowance could have significant and wide-ranging implications on some estates and will require some careful planning to try and mitigate the impact. This can include a review of wills to ensure they are as tax efficient as possible. The new allowance is still

at an early stage with a technical consultation due to be published in early 2025 to provide additional details and draft legislation. Once we have this, we will be in a better position to consider what planning will be possible.

Anti-forestalling

As the changes will only affect deaths occurring after 5 April 2026, there is still time to plan and make transfers of assets. This is a complicated area and we would urge you to take professional advice before taking any action. Anti-forestalling was included alongside the Budget so if you transfer agricultural or business property on or after Budget day and die on or after 6 April 2026 and within seven years of transfer, the new £1 million allowance will still apply.

It’s also important to consider the Capital Gains Tax (CGT) consequences of transfers. The transfer of assets is typically a disposal for CGT purposes so transferring will cause any gain on the assets to become chargeable and consequently there could be a significant CGT liability to consider.

Widely predicted before the Budget was a change to the 100% business property relief available for quoted shares designated as ‘not listed’ on recognised stock exchanges. This will apply in particular to shares on the Alternative Investment Market (AIM).

On transfers or death after 5 April 2026, relief will be given at the 50% rate with no £1 million allowance as for other BPR, APR qualifying assets. Anyone who holds AIM shares should review their individual situation as this will mean a 20% tax charge on death from 2026.

Conclusion

The new APR/BPR limit of £1 million has been widely criticised as being too low.

While there is still 50% relief above the £1 million limit, it could still have a destabilising impact on businesses above this level. We will certainly see business groups lobbying the Government to raise the limit before legislation is finalised. In the meantime, please speak to your financial planner if you are concerned about the impact of these changes on you.

Capital Gains Tax (CGT) has seen several changes in the last few years. The annual allowance being the amount of gains that can be made each year without incurring any tax, has been falling. The allowance was £12,300 in 2022 before falling to £6,000 in 2023 and since 6 April it’s lower again at £3,000.

Main rate

From 30 October 2024, disposals incurring CGT at the basic rate will incur 18% tax (up from 10%), and for higher rates it will be at 24% (up from 20%).

This brings the CGT rates back in line with residential property CGT rates for the first time since 2016.

Maximising tax wrappers

Reducing tax liabilities is a key financial planning objective. Many of you will have your investments wrapped in pensions and Individual Savings Accounts (ISAs) where unlimited gains can be made without giving rise to a tax charge.

Where investments are held outside of pensions and ISAs, it’s increasingly difficult to avoid incurring CGT. As a result, and depending on your circumstances and size of investment, we may consider other tax wrappers and in particular onshore and offshore bonds.

These have the ability to defer some or all taxes over time, with a potential tax payment only falling due when you make withdrawals above a certain level or once the bond is encashed. The tax considerations of such bond wrappers also have to be balanced with their increased complexity and cost.

Your financial planner will be able to determine whether the use of a bond wrapper may have a role to play in your financial planning.

Business Asset Disposal Relief (BADR) and Investors’ Relief

BADR (formerly called Entrepreneurs’ relief) and Investors’ relief (that applies to business angels or unconnected investors into businesses) are special rates of CGT for those who sell qualifying businesses.

Rates of CGT for BADR and Investors’ relief will remain for qualifying gains at 10% on disposals until 5 April 2025. On 6 April 2025 tax rate will increase to 14% and then on 6 April 2026 it will increase to 18%.

The lifetime limit for Investors’ relief will reduce from £10 million to £1 million for disposals on or after 30 October 2024. The lifetime limit for BADR has been £1 million since 2020.

Our tax specialists will be able to answer any questions you may have about these rates of CGT or the practicalities of selling your business.

Once the final legislation on the Budget proposals is published, we think that many of you will need to review your financial position to understand the impact of these changes on your own circumstances.

The financial planning process is ongoing and plans inevitably evolve over time in response not only to tax

changes but also to circumstances as well. Successive governments have made constant tax adjustments to suit their political and economic agendas, and we all have to deal with the financial implications of this.

While the recent changes may not have an impact on your retirement income, for example, your estate planning may need revisiting. While pensions have been a major part of passing wealth down to beneficiaries in the last ten years, these rule changes will necessitate different strategies. In the past, life cover has been a much bigger part of estate planning, and we may see a return to this.

Your financial planner will discuss your individual circumstances with you when you next meet. However, if you have any immediate concerns please reach out to them.

Gavin Jones Chartered Financial Planner 07825 620037

gavin.jones@om.uk

Life insurance is often associated with the young. Common use of life insurance products is to protect your mortgage or to provide for children or other financial dependents against the risk of you dying unexpectedly. In today’s modern families, dependency is more complex and can often stretch across multiple households and generations.

As part of our service, your financial planner can ‘stress test’ your finances to ensure your lifestyle is affordable in a range of different scenarios that may occur in the future.

For those that are approaching retirement or are already financially independent, in today’s world, you may still have debt, against your main residence or second properties. Although children may have left home, we know that after Covid and with the ongoing cost-of-living crisis, many parents and grandparents are having to financially support other generations more frequently.

We have covered gifting in a tax efficient manner in the past, but this article looks at ensuring your family is protected if you should die unexpectedly.

Everyone’s circumstances are different, but we have listed below some of the scenarios we identify from our clients’ financial plans where insuring against your life might be included and the solutions available.

In the past, it was common for one spouse/partner to be the main breadwinner, and often pension provision was not equal.

On death, it’s common for a pension to continue to be paid to a surviving dependant although this may often be at a lower level.

Our financial planners can help to identify if the projected level of income on death will continue to be sufficient for the survivor’s lifestyle. If there is a shortfall, this is where life cover comes in as it can provide cover to bridge any shortfall, so providing essential protection to dependents.

One element of your finances that can be overlooked or not deemed relevant can be your expenditure.

There is a common misconception that ‘budgeting’ or understanding how much one spends a week, month or year is only applicable to lower income individuals or families where money is tight. For those in a ‘healthier’ financial position, the longer term repercussions of not quantifying lifestyle costs are still worth considering, dealing more with what you want to happen, rather than needing cover.

In later life, your thoughts may turn to what you want to do for your family. Potentially this includes leaving your loved ones a legacy. Your will governs how your assets are distributed on death (NB there are separate rules for pensions) although if your estate contains an Inheritance Tax (IHT) liability this must be settled before the estate can be finalised. Where the tax man takes a share, this means your loved ones receive less. A tax bill can also cause problems, including inequality and ill feeling, where specific assets are left (tax free) to named individuals while other beneficiaries receive their inheritance reduced by the tax liability. A life insurance policy can be written on a whole of life basis, where it provides a guaranteed lump sum in exchange for a fixed premium. Such a life policy can pay any IHT due, leaving your loved ones to receive the full value of your estate. This also ensures your specific bequests are honoured, and no beneficiary is left to bare an unfair share of the tax burden.

As the number of extended families increases, the beneficiaries you wish to benefit after your death may be varied and be in different family groups.

Splitting your assets to cater for each group may be complicated for you now, as well as for your executors after you are gone. You may like to provide that all of your

assets go to one family group while providing support to other members of an extended family by setting up a life insurance policy specifically for this purpose.

Having thought through what you might need life insurance for we can then consider:

1. The level of cover

There are two key elements in assessing the level of cover that is appropriate. The first is any liabilities which we can identify from your financial plan and also, what your desired lifestyle expenses are. We have talked before about understanding your expenditure and you can include payments to your wider family if appropriate, even if they may be ad hoc or infrequent. Common payments include paying school or university fees, lump sums for house deposits or even helping with third party pension payments to provide for eventual retirement.

2. Affordability

One of the issues is affordability. What ‘affordable’ means will vary from family to family and is dependent not only on income levels but on priorities. People have different views on what they are willing to pay for.

Remember that if your life cover is to provide a lump sum to those who survive you, to pay an IHT bill or the like, you don’t have to pay for that yourself, although you may like to. If it’s affordable to your family, they may welcome the suggestion of a policy to cover the tax to pay when you die.

3. Cost of cover

With the cost of life cover increasing typically with age or as health decreases you should try and get cover in place as soon as practically possible if you want it. For many policies taking it out early can cap the cost and if your health worsens the price doesn’t go up.

“Your financial planner can ‘stress test’ your finances to ensure your lifestyle is affordable”

Through our Old Mill Trust Corporation, we’re able to offer our Estate Administration Service, even if we aren’t named as professional executors in your will.

The wealth of experience among our Estate Administration team and our client advisers means that we’re ideally placed to acknowledge, understand and navigate our way through family dynamics at every stage of the process.

Working alongside your adviser, our Trust and Estates team will undertake much of the work required to effectively administer your estate on behalf of the executors. The collective expertise of our team and our detailed understanding of your finances means we’re in a strong position to carry out the administration of your estate swiftly and smoothly. Because we charge an hourly rate rather than a percentage of the value of your estate, we believe this will save the estate a considerable sum.

On a practical level we will support everyone through the process by:

• Providing step-by-step guidance to the executors on the practical aspects of what needs to be done, both immediately and during the weeks and months ahead including dealing with all tax reporting requirements.

• Meeting regularly with the executors to ensure they’re kept fully informed of all progress.

• Keeping everyone in the loop and ensuring all beneficiaries have a voice.

We’re also aware that in some cases beneficiaries aren’t properly equipped to receive unexpected legacies, possibly due to age or circumstance. We can ensure the necessary financial planning guidance and advice is available throughout the process, to fully prepare and support individuals and the wider family, enabling them to make informed decisions regarding any legacy.

We’ll arrange an initial meeting to discuss the estate and gather the information and documents needed for the administration process to get underway.

During the meeting we’ll discuss:

Confirming that arrangements have been made for the personal aspects of the estate, including funeral arrangements and personal effects.

Asset planning

Ensuring everyone understands details of the assets held by the estate and the plans for these assets (i.e. liquidation, appointment etc.).

Tax planning advice

Identifying whether any individual beneficiaries or the overall estate needs tax planning advice, particularly on Inheritance Tax or Capital Gains Tax.

Tax and accounts

Identifying the tax compliance requirements of the estate.

Responsibilities

Confirming the respective responsibilities of the executors and the Estate Administration team so everyone is clear who is doing what.

Fees

An indication of our fees to administer the estate, which will be based on an hourly charge rather than a percentage of the value of the estate, which we believe is the fairest way to charge for this service.

Next steps

Identifying the short-term actions that need to be completed, the overall timeline to administer the estate, and agreeing on a schedule of regular meetings.

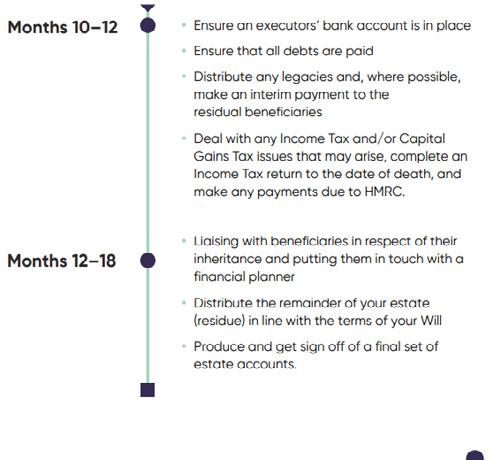

This is a question we’re often asked. While administering an estate can sometimes be a lengthy undertaking, we aim to complete the administration of most estates within 12 months, although where multiple properties or complex tax issues are involved, it may take longer. We know that this aspect is very important to all concerned. Therefore, we will advise you of our predicted timescale for the conclusion and distribution of the estate during our meetings so that the beneficiaries can plan for their future. The timeline below provides an indication of what you might expect to happen as we go through this process.

Speak to your financial planner if you want to explore this further.

Natalie Galvin Senior Trust Manager

01935 709397

natalie.galvin@om.uk

Our Investment Committee is responsible for the ongoing oversight of our investment solutions and spends much of its time managing the investment risks associated with our portfolios rather than managing the portfolios based solely on what has performed well in the past. Well understood, and tightly managed risks should be compensated accordingly.

Our risk-focused approach to investing ensures that the risks inherent in a portfolio are understood allowing investors to form a reasonable expectation about the investment journey they may experience and the potential performance of their investments.

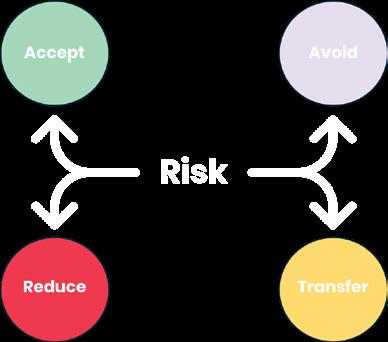

There are four choices when it comes to managing risk: accept, avoid, reduce, and transfer. We explore these in turn below.

Accepting risk means to accept the uncertainty that one understands to be present in an opportunity. Decades of academic research and data insights have helped to build a solid foundation of evidence from which investors can develop an understanding of what it means to accept certain risks. Some risks our Investment Committee chooses to accept are listed below – this list is by no means exhaustive:

Stock market risk: owning a diversified basket of stocks enables investors to benefit from the rewards capital markets can bring. It’s well understood that stock markets provide an efficient mechanism through which savers can partake in the growth of companies from around the world by owning a small slice of each. This does not come without uncertainty (risk has two sides –upside and downside) and can lead to significant and protracted declines. It’s therefore crucial for investors to understand how much stock market risk – or any risk for that matter – they can bear.

Emerging market risk: it’s reasonable for investors to own a portion of their stock holdings in companies that are listed, and perhaps operate, in developing economies –coined ‘emerging markets’. Such economies can be highly productive and generate a significant proportion of global output. Risks within these economies, such as state control, corruption, or poor accounting standards, to name a few, imply that there exist greater risks of stock ownership in these economies relative to more developed economies. As such, accepting a considered amount of emerging market stock risk gives investors the opportunity to benefit from the upside that these markets have to offer.

Another choice when it comes to managing risk is the decision to avoid a risk. Avoiding unwanted risks can be as rewarding as accepting desirable ones. Those drawn by the bright lights of good performance may find themselves guilty of accepting unwanted risks, which can reveal themselves at another often inopportune time. An example of a risk we avoid is liquidity risk.

Liquidity risk: having access to your capital as and when it’s required – without having to sell at fire sale prices is important. For this reason, we only include liquid markets and asset classes in your portfolio, such as publicly traded stocks and bonds.

Some risks we want to accept might come part and parcel with unwanted risks unless they are mitigated appropriately.

Stock-specific risk: by accepting ‘stock market risk’, investors have the opportunity to share in the growth of wealth that capital markets allow. However, by holding a small selection of stocks in companies, outcomes will be dominated by stock-specific risk. An investor owning just a few different stocks might be heavily impacted by a case of corporate fraud, for example. These things can, and unfortunately

do, happen. Thankfully, the evidence provides investors with an effective tool to reduce stock-specific risk called diversification. By owning stocks and bonds from different sectors and countries from around the world whilst avoiding overconcentration in individual companies. This risk can be greatly reduced.

Perhaps the more abstract but equally important choice an investor faces with risk is the decision to pass the risk onto another party that is willing to accept it, usually at a cost.

Overseas bond currency risk: Bonds can make up a significant proportion of portfolio investments but owning bonds that are denominated in different currencies from governments and companies around the world is an effective way to improve portfolio diversification. Given bonds are owned in the portfolio as an insurance policy against equity market trauma, these bonds are typically of higher quality and shorter term. Without transferring or ‘hedging’ currency risk, the outcomes of overseas shortdated high-quality bonds are instead dominated by currency movements. Therefore, bonds in your portfolio are hedged back to the local currency which helps avoid the unwanted impact of currency volatility on bond prices.

Source: Albion Strategic Consulting

Simon Cole Partner, Chartered Financial Planner 07825 620041 simon.cole@om.uk

Contact

Exeter

Leeward House

Fitzroy Road

Exeter Business Park

EX1 3LJ

+44 (0)1392 214635

Chippenham

Unit 2

Greenways Business Park

Bellinger Close

SN15 1BN

+44 (0)1225 701210

Wells

Bishopbrook House

Cathedral Avenue

BA5 1FD

+44 (0)1749 343366

Yeovil

Maltravers House

Petters Way

BA20 1SH

+44 (0)1935 426181

Ilminster

Meads Barn

Ashwell Business Park

TA19 9DX

+44 (01460 259852