SMART GROWTH

STRATEGIES FOR SUSTAINABLE EXPANSION

Sustainable Growth Edition

STRATEGIES FOR SUSTAINABLE EXPANSION

Sustainable Growth Edition

One of the most complex challenges facing community banks today is determining the best path for growth. Traditionally, this meant physical expansion, opening new branches within our current footprint or entering new markets. However, the reality is that launching a new branch can require millions in upfront investment, with ongoing staffing and maintenance costs reaching hundreds of thousands annually. This raises a critical question: is there a more cost-effective way to expand our reach and achieve the same strategic outcomes as a traditional brick-andmortar branch, without the significant impact to our P&L?

As we continue to evolve as an industry there are several alternative ways to grow our customer base and balance sheet without taking on the expense of a new branch:

This is probably my least favorite growth strategy—but it’s a necessary one. Digital can get expensive, so having the right “expert” to help you create content and make sense of the results is absolutely key. Call me old school, but tracking clicks and pull-through for what often feels like minimal return doesn’t always seem worth it. That said, if you’re trying to grow your footprint across a wide geographic area, there’s no question that a solid digital strategy is essential.

Beyond just expanding your reach, offering all the digital bells and whistles, like mobile deposit, Zelle, and online banking, makes you more appealing to potential clients and helps you keep the ones you already have, especially younger generations who expect that kind of convenience.

This approach isn’t for everyone, but if you have the financial strength to support it, having a trusted advisor to guide you through available opportunities is essential.

These are a great way to “test the waters” without the high cost of a full-fledged branch, as POs are typically staffed with minimal FTEs and operate under short-term leases.

Super charged ATMs give you the flexibility of a branch for less than $100,000 per year. Because customers have the option of video “chatting” with a bank employee, you can have the same experience for the cost of a machine and the land it sits on. Leasing the space allows you even more flexibility to determine if where you placed the ITM is the

best location, minimizing costly expenses. If your data isn’t showing you the return you desire, you can simply choose to relocate the machine with minimal effort and cost.

At FC we decided to invest in a partnership with the Crew with the idea that the investment would significantly lower that of opening a new branch. We treat the sponsorship like a standalone branch, with new customer acquisition and expenses tracked manually as its own P&L. We have created a new product set to attract Crew fans and entertain prospects as well as customers alike to gain new business. Certainly not a traditional way to grow your footprint, but something outside the box to increase balances and brand awareness.

This strategy combines traditional marketing, like print, billboards, TV, radio, and direct mail, with digital and social media. Honestly, this is where we all need to be, because each generation consumes media differently. That wasn’t the case when I started in banking over 40 years ago, but it’s definitely the reality we face today.

I often share the example of my three children, all raised in the same household. One uses Facebook and Instagram, another prefers Reddit, and the third is all about YouTube and Snapchat. That’s how quickly technology, and how we engage with it, has evolved!

Anyone who knows me knows I utilize social media - A LOT – especially LinkedIn. Having a written social media plan with a cadence of posts and messages can really grow your brand awareness and, in turn, your customer base. This is a long-term strategy but one that can be very effective, especially in markets where there is a high density of competitors such as Columbus. Having a bank branded page as well as key employees engaged, will go a long way in sharing your message. Posting on a regular basis, writing thought leadership articles, sharing bank and customer posts as well as including personal content, can make you seem larger than you are, which places you top of mind when some one is looking for a new bank.

Place to Justify Spend

We spend a lot of time on our Marketing budget, analyzing sponsorships, networking groups and entertainment. We try hard to quantify the ROI on those dollars spent to tie it back to business. Having a strategy

for each “event” pre, during and post will help ensure you get the biggest bang for your buck. Do you receive email lists for those who attend? If not, how do you capture contact information? We often do a raffle item so that we have a means to reach out for further conversations. What is your social media plan for each event? Ensure that you have some sort of sponsorship graphic for any event you sponsor, as well as take pictures to post afterwards. Thought leadership articles around how the event supports your bank’s mission is also a nice touch to help elevate ROI. If you have a CRM, ensure all leads are documented with detailed follow-up plans to ensure you are not missing any opportunities.

We’re incredibly fortunate to have the OBL as a trusted resource as we evaluate our expansion strategies. Tapping into the experience and insights of our peers helps us, as leaders, make more informed decisions about next steps.

CEO Roundtables, both in-person and virtual, are a great way to exchange ideas and learn from each other’s successes and missteps, potentially saving us from costly trial and error. Signature events like the Economic Summit, CEO Symposium, Annual Convention, and Main Event bring in top-tier experts who offer valuable perspectives to help guide our planning.

The Government Relations team keeps us updated on the latest legislative and regulatory developments, ensuring we have the information we need to make smart, compliant decisions. And the various forums offered throughout the year give our C-suite teams the knowledge and tools to help shape our direction with confidence.

OBL’s network of preferred partners and vendors is another advantage. Not only can they offer guidance on growth strategies, often at a discounted rate, but when we use their services, a portion goes back to the OBL to support its mission of advocating for Ohio banks.

At the end of the day, the more informed you are, the better equipped you’ll be to make the right decision for your institution, no matter which path you choose.

Jenny Saunders President, FCBank, a division of CNB and Current OBL Chair

Resilience [ rəˈzilēəns ] is the ability to recover from challenges and grow through adversity. This skill develops over time through experiences and lessons learned.

The resilience of the banking industry is inspiring. Ohio banks exemplify resilience. Despite the current significant federal changes and economic uncertainty, bankers remain optimistic. Banks have faced numerous challenges, including economic downturns, regulatory shifts, pandemics and evolving consumer behaviors. The ability to adapt and thrive is a testament to your enduring spirit.

The banking industry, long a cornerstone of the American economy, offers compelling case studies that showcase this resilience. Ohio's banking industry dates to the early 19th century. The Ohio History Connection’s Ohio History Journal, a history of the industry, was written in 1912 by P. W. Huntington, then President of the Huntington National Bank in Columbus. It is a fascinating and insightful account full of challenges and examples of resilience.

Mr. Huntington wrote:

“The first institution in Ohio to issue notes for circulation as money was the Miami Exporting Company, of Cincinnati, which was incorporated April 15, 1803. The act of incorporation has no reference to a bank. There is no intimation anywhere in the charter that a bank was meant, nor that the company was granted authority to issue notes to be used as money; but it did issue them and they passed into circulation. These notes were not all finally redeemed. In the early history of the state, banking was practically free, and, as a natural consequence, it was fraught with disaster to stockholders and to the public alike. From 1803 down to the year 1845 the conditions under which the business of the state was conducted were most deplorable. Between March 10, 1808, and January 14, 1818, there were 20 banks incorporated in the state, with an aggregate authorized capital of $4,350,000; but it is, perhaps, impossible now to ascertain what proportion of this authorized capital was paid up. These banks were located in the southwestern, the central, the eastern and the northeastern sections of the state, and often in what were then isolated places, with only occasional communication with the outside world.”

He goes on to note that much of the paper money in circulation had been issued hundreds of miles away and its value was not known by those among whom it circulated. To me, this sounds a lot like crypto currency today. There are currently more than 21,000 different cryptocurrencies in circulation. Of the two I own as I write this, Bitcon is worth $108,491 and Ethereum is $2,507. I’m a slow typer and one Bitcoin is now worth $18,444. You get my point. Prior to the Federal Reserve coming into existence and the printing of national currency, counterfeit bank notes were rampant and recipients had no way of knowing. Today’s example might be a meme coin with no inherent utility or technological innovation.

The Bank of Cincinnati, chartered in 1814, is cited for paving the way for a network of financial institutions that would support economic growth in the region. As the state developed, so did its banking sector, which played a crucial role in financing the booming industries of steel, manufacturing and agriculture.

One significant event in Ohio's banking history was the Panic of 1837, a major economic crisis that led to widespread bank failures across the United States. Many banks in Ohio struggled to survive, but those that weathered the storm emerged stronger. The crisis prompted reforms in banking regulations, leading to the establishment of more robust frameworks governing financial institutions. This experience laid the groundwork for a more resilient banking sector that could adapt to future challenges.

Fast forward to the Great Depression in the 1930s, which posed another severe test for the banking industry. Ohio was not immune; the state saw numerous bank failures as a result of widespread economic hardship. However, the resilience of Ohio banks shone through during this period. Many institutions, such as the Cleveland Trust Company, adapted by offering innovative financial products and services, which helped restore public confidence in banking. The establishment of the Federal Deposit Insurance Corporation (FDIC) also played a crucial role in stabilizing the industry, providing a safety net for depositors and encouraging the growth of banks.

In more recent history, the banking industry in Ohio has faced new challenges, including the Home State failure of 1985 and the 2008 financial crisis. While these crises led to significant upheaval and stacks of new laws and regulations, Ohio banks exhibited resilience by adjusting accordingly and enhancing their capital reserves. Ohio banks and thrifts not only survived but emerged as competitive players in the national arena.

Today, technological advancements are reshaping banking. Ohio institutions have to adapt to stay relevant. Although investing in digital solutions is costly, it is essential for attracting younger customers. Unlike previous generations, these customers often seek digital banking options that align with their lifestyles. By embracing fintech innovations, Ohio banks demonstrate their ability to pivot in a rapidly evolving landscape.

The first half of the year has seen unprecedented changes in Washington, D.C., with significant implications for the banking sector. I’m pleased to report that OBL’s banker-driven advocacy has moved the needle. Through June, OBL will have been in our Nation’s Capitol six times. As reported in elsewhere in this edition of OBL’s Ohio Record, 125 Ohio banking leaders shared their insights with policymakers as a part of OBL’s annual DC Fly-In.

In more than one meeting with Sen. Bernie Moreno, he has told us to “think bigger.” He has his heart set on replacing Dodd-Frank with pro-banking laws. The importance of going through the legislative process versus via regulation is to make future change harder with the pendulum swings each time the White House gets a new occupant. The anticipated confirmations of Governor Miki Bowman as the Fed’s Vice Chair of Supervision and Jonathon Gould as Comptroller of the Currency will be influential partners with legislative leaders.

Recent legislative victories include the repeal of a misguided CFPB overdraft rule, which President Trump has signed, which blocks the CFPB from issuing a similar rulemaking in the future. The inclusion of key industry priorities in budget reconciliation efforts will be meaningful. However, the absence of a credit union tax exemption repeal remains a point of contention and OBL continues to push for Congress to put an end to it. As many of you have quite plainly asked, “If not now, when?” We agree! Given all of the change underway at the federal level, the rationale for credit unions to still enjoy their tax-advantaged status is unwarranted.

Additionally, the CFPB rescinded 67 guidance documents that created compliance challenges for banks. Those rescinded documents were on topics including fair

lending, overdraft fees, disclosure policies and consumer information requests. In many cases, these established interpretations that were inconsistent with or exceeded statutory text, creating new risks and compliance challenges for banks. Banks welcome guidance that helps them comply with the law, but too often, we have seen the Bureau, as well as FDIC, use guidance documents to circumvent Congress and the rulemaking process. This type of political behavior must come to an end.

We were also happy to see the OCC issued an interim final rule that restores its streamlined process for reviewing bank merger applications and rescinding several unpopular changes to the rules that were made under the previous administration. OCC’s actions followed a Senate vote on a resolution to overturn the 2024 final rule.

The crypto industry is advocating heavily to be legitimized so it can compete more directly with traditional banks. Stablecoin is a type of cryptocurrency pegged to the value of another asset, often the U.S. dollar. OBL has raised concerns most notably on disintermediation. By setting the stage for these assets to go mainstream, OBL is concerned that crypto providers will suck tons of deposits from traditional banks to fuel loans in our local communities. Consumer protection and the risk of fraud are also noted concerns. OBL does encourage Congress to enact framework for federal banking agencies to issue joint rules and guidance to promote clarity and consistency. Additionally, risk management expectations should be defined for banks’ engagement in digital assetrelated activities.

Lastly, it is also concerning that supposed free-market Republicans are pushing price controls. Limiting credit card convenience fees is disappointing public policy that will not benefit individual consumers or small businesses. Those outside of our industry have no idea how costly

fraud fighting efforts are regarding cards. Plus, credit card users won’t reap lower prices and, like we saw with the passage of the Durbin Amendment on debit cards, it will be a financial boondoggle for the big-box retailers. Another bill seeks to cap interest rates on cards. Supporters fail to realize that if this were to become law, many Americans will lose the ability to obtain a credit card. These misguided ideas reflect a race to the bottom.

For a bit of good news, OBL continues to advocate for legislation that would crack down on credit bureau sales of “trigger leads,” that often lead to prospective borrowers being overwhelmed by spam calls and texts from competing lenders.

The OCC recently announced plans to realign its supervisory structure. OBL has had a number of conversations with senior OCC leadership to seek clarity. We have repeatedly been advised that community banks will continue to be a specified focus. There is a push for increased exam tailoring. They have also expressed the unequivocable importance of community banks to the American economy. You are the lifeblood of the communities you serve. This is an area OBL will keep a close eye on and want to hear from our membership if your experience isn’t reflective of this messaging. We know you are resilient yet need to be treated fairly with exams reflecting the size, risk profile and business plan versus a one-size-fits-all.

The resilience of the banking industry, particularly in Ohio, is a testament to your ability to adapt and overcome challenges throughout history. Despite all of the change and uncertainty, Ohio's banks have proven their durability and foresight. I’m confident they will bend and flex as they find a way to continue profitably serving their community. As Ohio bankers continue to navigate the complexities of the modern financial landscape, the lessons learned from the past will undoubtedly inform their strategies moving forward, ensuring that they remain a vital part of the state's economy. And you have our continued commitment to support Ohio bankers in their ongoing journey toward resilience as OBL looks out further over the horizon.

Michael J. Adelman President & CEO, Ohio Bankers League

Michael Adelman President & CEO madelman@ohiobankersleague.com (614) 340-7616

Gauri Airi

Executive Director, Ohio Bankers Benefits Trust gairi@ohiobankersleague.com (614) 340-7598

Brenda Arnold Products & Services Manager, OBL BankServices barnold@ohiobankersleague.com (614) 340-7620

Don Boyd Vice President of State Government Relations and General Counsel dboyd@ohiobankersleague.com (614) 340-7608

Michelle Crume

Senior Vice President, OBL Executive Director, OBL BankServices mcrume@ohiobankersleague.com (614) 340-7622

Stephanie Elam Plan Coordinator & Customer Service Specialist selam@ohiobankersleague.com (614) 340-7591

Rita Hinkle Administrator, OBBT rhinkle@ohiobankersleague.com (614) 340-7609

Daniel Holstein, CPA Senior Accountant dholstein@ohiobankersleague.com (614) 340-7604

Paige Houlihan Products and Services Coordinator, OBLBankServices phoulihan@ohiobankersleague.com (614) 340-7613

Sarah Husk Education Manager shusk@ohiobankersleague.com (614) 340-7610

Audra Johnson Director of Communications ajohnson@ohiobankersleague.com (614) 340-7621

Susan Poling Jones Professional Development Director spoling@ohiobankersleague.com (614) 340-7611

Julie Kiplinger Education Manager jkiplinger@ohiobankersleague.com (614) 340-7612

Evan Kleymeyer

Senior Vice President of Government and External Relations ekleymeyer@ohiobankersleague.com (614) 340-7605

Anthony Lagunzad Manager, Government Relations & BankPAC alagunzad@ohiobankersleague.com 614.340.7614

Kimberley Mason Higher Education Partnership Manager kmason@ohiobankersleague.com (614) 340-7601

Stephen Mentzer Database Manager smentzer@ohiobankersleague.com (614) 340-7607

Jennifer Osburn, CPA CFO, Chief Administrative Officer josburn@ohiobankersleague.com (614) 340-7606

Megan Peiffer Education Specialist mpeiffer@ohiobankersleague.com (614) 340-7618

Christine Zeek Employee Benefits Manager, OBBT czeek@ohiobankersleague.com (614) 340-7617

The 2025 OBL CEO Symposium convened top banking executives for two days of strategic dialogue, leadership insights, and peer collaboration. Held at the Hilton Columbus at Easton, the event provided a platform for seasoned and newly appointed leaders to navigate the evolving financial landscape.

Keynote speaker James Evanow, a seasoned maritime captain turned leadership coach, opened the Symposium with his session on "Mastering Turbulent Times." Drawing parallels between navigating stormy seas and leading through uncertainty, Evanow emphasized the importance of adaptability, emotional intelligence, and clear communication in steering organizations through challenges.

The Symposium also featured dynamic Executive Roundtable sessions, fostering candid discussions among peers. Notably, this year's program introduced a dedicated roundtable for new Presidents and CEOs, providing a tailored forum for emerging leaders to share experiences and strategies unique to their roles.

Closing the event, Jim "The Rookie" Morris delivered an inspiring keynote, recounting his remarkable journey from high school science teacher to Major League Baseball pitcher. Morris's story of perseverance and late-in-life achievement resonated deeply, reminding attendees that it's never too late to pursue one's dreams and make impactful contributions.

The 2025 OBL CEO Symposium reinforced the importance of resilient leadership and peer support in the banking industry. Attendees departed with renewed motivation and actionable insights to lead their institutions confidently into the future.

JOIN US NEXT YEAR AT THE OBL CEO SYMPOSIUM

May 5 & 6, 2026 at the Hilton at Easton

Evanow gave a powerful presentation on the importance of overcoming adversity.

The OBL DC Fly-In was a tremendous success, bringing together more than 125 bankers from across Ohio, a record turnout for the event. The group had the opportunity to meet with both of Ohio’s U.S. Senators, Bernie Moreno and Jon Husted, along with several other members of the Ohio delegation. These important discussions helped highlight key banking issues and strengthen relationships between Ohio bankers and federal policymakers. The high level of engagement underscored the value of the Fly-In and its impact on advocacy efforts in Washington.

Joining the group at the D.C. Fly-in were the participants in the 2024-25 OBL Bank Leadership Institute. This key part of the program introduces young leaders to the importance of advocacy.

In addition to spending time on Capitol Hill, bankers met with federal regulators and had meaningful conversations around the future of their agencies and the peeling back of stringent regulations from previous administrations. Acting Comptroller Hood had this to say to the group, “This is the time for Community Banks to shine and thrive.”

Bankers left feeling optimistic about the future.

OBL President and CEO, Mike Adelman, and OBL Chair, Jenny Saunders, pose for a photo with Acting Comptroller Rodney Hood.

2 0 2 5

August 12-13

Hilton Nashville

Downtown Hotel

The Ohio Bankers League (OBL) maintains a professional government relations team with decades of combined experience in direct lobbying, legislative analysis, grassroots mobilization, and political strategy. Their work is vital to navigating the day-to-day developments in Ohio’s legislative and regulatory landscape. But their success—indeed, the success of the entire banking industry in the public arena—depends on one critical factor: active participation from bankers like you.

Our team serves as both translator and advocate— distilling complex legislative proposals into clear takeaways for bankers while articulating industry concerns in plain terms to lawmakers. This two-way communication only works when members are engaged, responsive, and involved in the advocacy process.

Legislators rely on constituent input to make informed policy decisions. Bankers have a unique opportunity to shape legislation by:

• Educating policymakers about the practical implications of proposed bills.

• Advocating for policies that promote financial stability, inclusion, and community development.

• Providing real-world examples of how legislative decisions impact Ohioans.

Without your voice, decisions may be guided by incomplete information or misperceptions. But when

legislators hear directly from bankers on the front lines, they gain a deeper understanding of how laws affect customers, communities, and economic growth.

One voice can be impactful, but many voices together are transformational. When bankers speak collectively, the message becomes more powerful and harder to ignore. Whether the issue is lending, regulatory burden, fraud prevention, or financial literacy, collaborative advocacy ensures the industry is seen—and heard—as unified and essential.

Effective advocacy is not just transactional—it’s relational. Long-term engagement with legislators positions bankers as trusted advisors on financial matters. When lawmakers are drafting legislation or preparing to vote, they are more likely to seek input from constituents they know and trust. These relationships take time to build, but they are invaluable in shaping policies that support a strong, competitive, and community-focused banking industry.

Engaging in advocacy is both a responsibility and a strategic necessity. As citizens, bankers have a duty to participate in democracy. As industry professionals, we must ensure that regulatory and legislative actions are grounded in the realities of banking. Active participation safeguards the industry’s future and strengthens its voice in public policy debates.

Every banker—regardless of role, experience, or comfort with politics—can make a meaningful difference. Here’s how:

• Stay Informed: Read OBL’s Banker Direct email every Wednesday for timely updates, and subscribe to the GRC email for deeper insights into key legislative developments.

• Share Your Perspective: If you see something in an OBL communication—or hear about a proposal affecting banking—let us know. Your input helps shape the industry’s position and enhances the credibility of our advocacy.

• Attend Events: OBL hosts flagship advocacy events such as the DC Fly-In and Day at the Capitol. These are turnkey opportunities to meet with elected officials and tell your story. OBL handles the logistics; you bring the local perspective. Throughout the year, we also coordinate banker attendance at political events to reinforce our presence and engagement.

The strength of OBL’s advocacy efforts lies not only in the expertise of its government relations team but also in the grassroots support and engagement of Ohio bankers. Your experience, voice, and relationships are indispensable tools in influencing public policy and protecting the future of banking in Ohio. You are the most important member of our advocacy team—because no one tells your story better than you.

If you’re ready to get involved or want to learn more, reach out to the OBL Government Relations team today. Let’s continue to lead together.

Don Boyd VP, State Government Relations & General Counsel, Ohio Bankers League dboyd@ohiobankersleague.com

Anthony Lagunzad OBL Manager, Government Relations & BankPac Ohio Bankers League alagunzad@ohiobankersleague.com

M B R A C E M O R E .

At COCC, our strength is in the partnerships we build. We work closely with community banks and credit unions to deliver innovative, flexible technology that supports growth and adapts to your unique needs

Together, we create lasting relationships, driving your institution’s success every step of the way.

The attendees engage as the 2025 OBL Security & Tech Conference kicks off.

spoling@ohiobankersleague.com with questions.

Led by Niki White, Chief Growth Officer, SRA Watchtower, a new OBL affiliate member, the OBL Risk Forum provides an exclusive platform for Chief Risk Officers and senior risk management professionals to engage in meaningful discussions on the most pressing issues affecting their institutions. The first session held in March featuring actionable insights, hand-on workshops and a chance to engage in peer-to-peer learning brought rave reviews.

Member Joe Ticich, EVP, Risk Management at Belmont Savings Bank, shared, “The first session of the OBL Risk Forum was a great experience for me. The speakers were very organized and knowledgeable and brought to light many helpful and useful insights regarding Enterprise Risk. I look forward to bringing back even more ideas regarding enterprise risk to my financial institution in future sessions.”

The next session on August 7 will focus on some of the most critical issues facing risk management professionals today, with an emphasis on artificial intelligence risks and policies, fraud detection and readiness, best practices, and effective risk reporting/communication with the board

The new OBL Risk Forum attendees pose for a photo at the OBL Education Center.

• AI Risk Management: Participants will gain clarity on the risks associated with AI technologies, including how to design robust AI policies and oversee AI vendors. This knowledge is critical for banks looking to adopt AI responsibly and ensure compliance with regulatory requirements.

• Fraud Preparedness: Attendees will learn about emerging fraud trends and best practices in fraud detection, enabling them to proactively manage fraud risk and reduce vulnerabilities.

• Effective Risk Reporting: The forum will help attendees improve their communication strategies for board reporting. Strengthening this aspect ensures that risk leaders are able to present complex data and risk metrics in ways that are clear, actionable, and impactful for senior leadership.

In addition to deep dives into these topics, the session allows participants to benchmark their current approaches and share strategies, especially around AI adoption and policy development. Plus, each session fosters collaboration

through interactive discussions and focused breakout groups, encouraging participants to share experiences and strategies with peers from similar institutions.

“We wanted to bring the Risk Forum back in a format that was both engaging and actionable,” said Tim Grooms, Vice President, Chief Operations and Risk Officer at First State Bank. “Having worked with both OBL and SRA Watchtower, I knew they could help us create a space where bank leaders could collaborate on the evolving challenges they face and proactive problem-solving from culture and credit risk to data strategy and AI.”

SRA Watchtower’s White noted, “Facilitating a session like this becomes incredibly productive when the group is so invested in the discussion. It’s clear that Ohio’s risk professionals are deeply committed to continuous improvement, and I’m excited to see how these discussions evolve in the upcoming August session. The collaboration and shared learning make this forum a truly unique and impactful experience for all involved.

about the New OBL Risk Forum!

Scan the QR Code.

We all sleep better at night knowing we’re safe. Exclusively providing IT solutions to community banks for 30 years.

provider for all your IT hardware, software, plans, testing, reporting, steering committees, BOD reports, exam preparation, risk assessments, training, help desk … everything Information Security Program related.

Brandon Krietemeyer Client Relation Specialist brandon@cbcohio.com 614-429-8823

If you’re not sure if you should call, just sleep on IT.

(From L to R) Kristen Brown, keynote speaker and author, Tammy Belcher, President & CEO, First Mututal Bank, FSB, Mary Snider, President & CEO, Fairfield Federal Savings & Loan Association of Lancaster, and Laura Tiller, SVP, Director of HR, Talent and Development, LCNB National Bank.

The 2025 OBL Women in Banking Conference, held March 27 & 28 at the Hilton Columbus at Easton, marked a milestone with record-breaking attendance, drawing over 260 professionals from across Ohio’s banking industry. This eleventh annual gathering provided a dynamic platform for women at all career stages to connect, learn, and lead.

A highlight of the event was keynote speaker Kristen Brown, renowned leadership expert and author, who captivated the audience with her session on the “7 Energies of Leadership.” Brown’s interactive presentation delved into how leaders can harness seven distinct energy types to enhance personal effectiveness and team performance. Her insights offered attendees practical strategies to elevate their leadership presence in today’s evolving financial landscape.

The conference featured a robust lineup of sessions addressing critical topics including empowering your career, imposter syndrome, and the art resilience. Back by popular demand was the Executive Panel Discussion featuring female banking executives from around the state of Ohio. Networking opportunities abounded, fostering collaboration and mentorship among attendees.

With its blend of inspiration, education, and empowerment, the 2025 OBL Women in Banking Conference solidified its reputation as a premier event for advancing women in the banking sector. Attendees left energized and equipped to drive positive change within their organizations and communities.

Brandie Thacker, President & CEO, EPCOR, and Jen Kirk, Principal Payments ProductManager, Arvest BankPower, make the audience laugh during their Wicked inspired presentation.

At the 2025 OBL Women in Banking Conference, two exceptional professionals were recognized for their outstanding contributions to Ohio’s banking industry. The Exceptional Woman in Banking Award was presented to Krista Dobronos, Consumer Banking Leader at Westfield Bank, FSB. As a seasoned leader whose career exemplifies excellence, mentorship, and community impact, Krista’s dedication to fostering growth and innovation within her institution has set a benchmark for leadership.

The Woman in Banking Rising Star Award celebrated Michelle Ward-Ciancio, VP | Commercial Relationship Manager at CFBank, N.A., as a dynamic young professional, acknowledged for her rapid career progression, innovative approaches, and commitment to community engagement. Her achievements signal a promising future for leadership in banking.

These honors underscore the conference's mission to empower and recognize women shaping the future of banking.

Join Us for the 2026 OBL Women in Banking Conference March 20 at the Hilton at Easton, with a networking reception the evening of March 19.

A sweeping transformation is underway in Washington’s financial regulatory environment—and for Ohio’s community banks, the timing couldn't be more welcome. With a renewed focus on pragmatic oversight under President Trump’s second administration and a reinvigorated Congressional Republican partner, a wave of legislative, executive, and judicial actions is reshaping the compliance landscape. The result: fewer bureaucratic roadblocks, clearer rules of the road, and real opportunities for growth and innovation.

The latest developments represent not just isolated reforms, but a coordinated strategy to support locally rooted banks. These changes reflect an understanding that regulation should protect consumers without choking off access to credit, stifling innovation, or hindering economic development—especially in rural and underserved areas. It has been hard to keep up with the constant new cycle and developments coming out of all three branches of the government but we have done our best to outline the most significant developments since the beginning of the new administration.

Among the most significant reforms have been the Consumer Financial Protection Bureau's rescission of dozens of guidance documents spanning fair lending, overdraft fees, and consumer disclosure obligations. These rollbacks signal a clear shift away from the expansive interpretation of authority that characterized the Bureau’s prior leadership.

Key rescinded guidance includes:

• A 2023 policy statement on “abusive” acts or practices

• A 2024 advisory opinion on medical debt and debt collection

• Circulars on unanticipated overdraft fees and improper opt-in practices

• A 2023 advisory on timely responses to consumer information requests

• A 2022 interpretive rule expanding state-level enforcement of federal law

• A 2024 circular on deceptive or unenforceable contract terms

• The CFPB also announced it “will not prioritize enforcement or supervision actions” with respect to its 2017 small-dollar lending rule, which was to take effect March 30

Additionally, the CFPB internally has rolled back several pending rules. CFPB announced it would not prioritize enforcement of the Section 1071 small-business lending data rule—a major win for banks and their small business customers. The rule, which required extensive demographic and financial reporting for small business loans, was paused by the Fifth Circuit Court of Appeals in February. The stay only applied to members of the plaintiff associations, but the CFPB has now acknowledged the inherent unfairness of enforcing the rule on some institutions but not others. It has since deprioritized enforcement across the board.

Another major reversal came in the medical debt reporting rule. Introduced during the final days of the Biden administration, the rule banned the inclusion of medical debt in credit reports and limited the use of medical information in underwriting. It was widely criticized as exceeding the CFPB’s authority. In a joint court filing last week, the CFPB agreed to void the rule, effectively conceding that the regulation went beyond its statutory limits.

Perhaps the most sweeping legal development is the CFPB’s retreat on its 2022 update to the UDAAP (Unfair, Deceptive, or Abusive Acts or Practices) manual, which introduced “disparate impact” as a measure of unfairness—a major expansion of authority not granted by Dodd-Frank. The banking industry won in district court, and the CFPB recently withdrew its appeal.

This reversal was further cemented by a new Executive Order from President Trump directing all federal agencies to stop relying on disparate impact in regulatory enforcement. The CFPB has since stated in court that it may formally withdraw the disparate impact provision from its UDAAP framework.

The House Financial Services Committee and US Senate Banking Committee have passed more legislation out of their committees in the first half of this year than the last two congresses combined. Lawmakers are advancing an ambitious reform agenda while working to repeal onerous regulation using the congressional review act. A suite of bills are currently pending that are aimed at modernizing and tailoring regulation for banks of all sizes.

• H.R. 976- 1071 Repeal to Protect Small Business Lending Act - Would completely repeal the small business loan data collection requirements established under Section 1071 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

• S.J.Res.18 - A Congressional Review Resolution that was signed into law by President Trump voids the CFPB 2024 overdraft rule.

• H.R. 1900 - Bank Failure Prevention Act of 2025 Streamlines merger and acquisition (M&A) approvals by capping the Fed’s review window at 90 days and eliminating reliance on third-party data in regulatory decisions.

• H.R. 3230 - Financial Institution Regulatory Tailoring Enhancement Act Raises regulatory thresholds from $10 billion to $50 billion, exempting more institutions from CFPB oversight, the Volcker Rule, and stricter mortgage underwriting rules.

• H.R. 3379 - HUMPS Act of 2025 Requires federal regulators to standardize supervisory practices, ensuring consistency and fairness in examinations.

• H.R. 3380 - TAILOR Act of 2025 Mandates riskbased supervision, allowing regulators to scale back requirements for institutions with low operational risk.

• H.J.Res. 92 - Overturn the recent OCC rule and restore stricter merger review standards. This legislation passed out of the House of Representatives, and it is pending action in the Senate.

• S.J. Res. 13 - Overturn the 2024 OCC final rule on bank mergers

Meanwhile, the FDIC’s March decision to withdraw several proposed rules reflects a renewed willingness to pause and reconsider initiatives that could have imposed undue burden. The board rescinded the pending brokered deposits rule, corporate governance and risk management guidelines, incentive compensation limits, and change in control notice requirements.

The OCC in March issued a statement declaring it had removed references to "reputation risk" from its supervisory guidelines and will no longer examine for it during bank assessments. This change clarifies that the OCC’s supervision focuses on robust risk management, not public opinion.

The banking regulatory agencies in March announced their rescission of the 2023 Community Reinvestment Act final rule considering pending litigation. They stated their plans to continue to work together to promote a consistent regulatory approach on the implementation of the CRA.

Perhaps most promising is the nomination of Federal Reserve Governor Michelle Bowman as Vice Chair for Supervision—a longtime community banker. Her elevation signals that the regulatory framework will increasingly be shaped by leaders who understand firsthand the challenges smaller institutions face.

While the CFPB and other agencies are not being dismantled, their scope is being redefined. Courts, Congress, and the executive branch are reasserting constitutional and statutory boundaries.

The changes taking shape in 2025 represent more than deregulatory gestures—they mark the beginning of a more balanced approach to financial oversight. For Ohio’s community banks, this translates into:

• Fewer compliance headaches

• Increased room for innovation and expansion

• Better support for rural and underserved markets

• Greater alignment between risk and regulation

The Ohio Bankers League continues to engage with lawmakers and regulators to ensure these reforms are implemented effectively. With a pro-growth agenda taking hold across all branches of government, Ohio’s community banks are well-positioned to thrive—building stronger relationships, funding local businesses, and supporting the financial goals of everyday Ohioans.

Evan Kleymeyer

Senior

Vice President

of Government and External Relations, Ohio Bankers League ekleymeyer@ohiobankersleague.com

Twenty-five Ohio bankers have joined the elite group of OBL Bank Leadership Institute alumni as they completed the four-part 2024-25 OBL Bank Leadership program this spring. To date, more than 500 bankers have graduated from this premier program designed to cultivate Ohio’s next generation of banking leaders. Through in-depth coursework, peer collaboration, and executive coaching, the participants gained essential skills in strategic thinking, communication, leadership, and community engagement. And they made connections with other classmates that will span their careers and lives.

Mike Adelman, President and CEO of the Ohio Bankers League, praised the 2024-25 graduating class for their commitment to leadership and innovation in community banking. “The Bank Leadership Institute is more than a professional development program, it’s an investment in the future of our industry,” Adelman said. “BLI graduates are equipped with the vision and capabilities to lead their banks and communities forward. We’re proud to have them as part of the OBL leadership community.”

Lacey Spangler Civista Bank

Scott LaBounty Federal Reserve Bank of Cleveland

Stacy Webb

First Citizens National Bank of Upper Sandusky

Matt Stein

First Federal Community Bank, N.A.

Najam Hassan First Federal Savings & Loan Association of Lakewood

James Hill

First Federal Savings & Loan Association of Lakewood

Billie Rae Henry First State Bank

Brittany Clark Hocking Valley Bank

Shaya Sealey

Hocking Valley Bank

Emily Cline Mechanics Bank

Sarah Husk Ohio Bankers League

Ben Getha Park National Bank

Ryan Smith Park National Bank

Jessica Bell Portage Community Bank

D. Ryan Page

Southern Hills Community Bank

Ayisha Ranford Spring Valley Bank

Kelly Smith

The Croghan Colonial Bank

Bruce Hengstler

The Farmers & Merchants State Bank

Jaime Velasquez

The Farmers & Merchants State Bank

Michelle Brandt

The First National Bank of Pandora

Angela Day

The North Side Bank and Trust Company

Bridget Garrett

The Ohio Valley Bank Company

Harmony Jones

The Ohio Valley Bank Company

Lori Rose

The Peoples Savings Bank of Urbana

Karen Koontz

The Union Bank Company

Graduate Kelly Smith, VP, Cleveland Market Manager, The Croghan Colonial Bank, addressed students and guests at the ceremony. “BLI enables us to take our values and create joy. We know now how to create plans to be better leaders for our teams and our organizations, which is where it all starts,” Smith said. “This program will certainly enhance my professional work every single day.”

Fellow classmate Najam Hassan, AVP, Credit Officer, First Federal Savings & Loan Association of Lakewood, shared, “The BLI class was engaged collectively in both personal and professional growth. I am confident that well after the program concludes, we will continue to grow and develop by leveraging the support and insights of our peers and classmates—recognizing that meaningful growth is rarely achieved alone.”

The program was led by Joe Micallef, bank strategist and coach, Grow Up Sales, and Debbie Peterson, career growth strategist, Getting to Clarity LLC. For details about the 2025-2026 OBL Bank Leadership Institute, contact Susan Poling Jones at spoling@ohiobankersleague.com.

Make contact faster and have more productive conversations with loan origination and property data for 90%+ of the United States CRE Market. We combine our CRE data with 44M+ business listings and UCC filings for 47 states so you can make contact with confidence.

GREATER COLUMBUS CONVENTION CENTER

Join industry leaders for the 2025 OBL Main Event, featuring topical general sessions and eight learning tracks, as well as the OBL BankServices Expo, the OBL Annual Business Meeting and countless networking opportunities. PLUS! The Track Day features the 2025 OBL Industry Awards for Bank of the Year, Banker of the Year and many more!

$695 - Full Event per Member*

NEW! Special Banker Offer Only!

$495 - Learning Track Day ONLY (Tuesday, December 2)**

*Includes all scheduled programming, receptions and events Dec. 1 - 3

**Includes the Learning Track day, breakfast and awards lunch on December 2

WATCH FOR COMPLETE DETAILS REGARDING LEARNING TRACKS AND SESSION DETAILS.

QUESTIONS?

For program questions, contact Susan Poling Jones at spoling@ohiobankersleague.com.

For registration assistance, contact Megan Peiffer at mpeiffer@ohiobankersleague.com.

MONDAY, DECEMBER 1

2:30 - 4:30 p.m.

2:30 - 4:30 p.m.

5:00 - 6:30 p.m. 6:30 p.m.

CEO Roundtables Lessons in Leadership Session Welcome Reception Dine-Arounds or Dinner on Your Own

TUESDAY, DECEMBER 2

8:00 a.m. - 2:00 p.m. 8:00 - 9:00 a.m. 9:00 - 10:15 a.m. 11:45 a.m. - 1:30 p.m. Morning & Afternoon 7:30 - 10:00 p.m.

OBL BankServices Expo Hot Breakfast Buffet

Opening General Session Lunch & OBL Industry Awards

Learning Tracks: Compliance & Risk Management, Executive, Finance, HR, Legal, Lending, Marketing and Operations & Retail

Come One, Come All! Cornhole, OBL BankPac Silent Auction & Desserts Reception

WEDNESDAY, DECEMBER 3

8:00 - 9:00 a.m.

9:00 - 9:30 a.m. 9:30 - 11:30 a.m.

OBL BankServices Expo, Breakfast & Prize Announcements

Rapid Fire Presentations

Closing General Session, OBL Annual Business Meeting & Closing Comments

With rising consumer expectations, growing competition, and ongoing economic uncertainty, banks can no longer rely on outdated, one-size-fits-all overdraft programs or legacy small-dollar loan offerings. Yet many institutions are still using ad hoc or legacy systems that lack transparency, adaptability, and actionable insight.

If your overdraft system assigns limits or manages old school loan risk without your team understanding the logic behind those decisions—it is time to ask the tough questions.

Regulatory agencies like the CFPB, FDIC, OCC, State Regulators, and others are sharpening their focus on fairness, transparency, and consistency in overdraft and liquidity practices. At the same time, customers expect financial institutions to deliver personalized and equitable service.

Ask yourself:

• Do we have a strategy to attract profitable consumers that seek new forms of liquidity?

• Can we explain, defend, and adjust our overdraft decisions in real time?

• Is our approach helping customers stay banked—not driving them away?

• Do we offer loan options underwritten by deposit behavior?

• Do we understand who is recovering from overdraft use—and who is not?

If your answer is “no,” you are not alone—but now’s the time to act.

Banks sit on enormous amounts of valuable data— deposit trends, transaction behaviors, fees, and recovery rates. But if your system does not adapt to risk, only provides canned reports, charges for peer benchmarking, or hides key logic behind “proprietary” algorithms, you are flying blind.

Worse, if you are applying the same limit to all accounts, you’re missing critical indicators of risk—and opportunity. A modern Consumer Liquidity small dollar loan and overdraft program should:

• React to individual account behavior daily.

• Adjust limits automatically based on real activity.

• Identify high-risk accounts before losses occur.

• Offset risk from either the loan or overdraft use.

This is not just about efficiency, it is about control, visibility, and long-term customer relationships.

Can you explain how a customer’s overdraft limit was set this month versus last month? Do you know when their deposit patterns changed and what you did in response? Is your front-line staff comfortable with explaining options for informed decision making?

If not, your institution may be exposed to compliance and operational risk.

A modern approach:

• Trains front line staff by experienced professionals.

• Audits every account relationship daily.

• Manages exception items automatically.

• Documents decisions clearly for examiners

More importantly, it aligns with proven best practices and gives you the confidence to stand behind your program— regardless of who is asking.

One of the most common struggles in overdraft programs is inconsistency in fee refund decisions. Without a structured approach, decisions often vary by branch, location, or staff discretion—raising red flags and exposing your bank to bias claims or unfair treatment accusations.

A data-driven, rules-based approach ensures refunds are handled fairly, consistently, and with clear documentation. That protects both your institution and your customers.

Every time a debit card transaction is declined, or ACH/ Check is returned, two things happen:

1. Your customer gets frustrated.

2. You lose income by discouraging consumption behaviors.

Often, a minimal limit or Reg. E opt-out are the root causes that could be addressed with automated communication, expanded purchasing power and staff empowerment.

A smart overdraft platform does more than record declines. It takes action:

• Send alerts or letters.

• Flags trends by branch or region to help staff with messaging.

• Triggers follow-ups contact or educational outreach.

Proactive tools turn service disruptions into relationshipstrengthening opportunities.

If your team needs IT support to run basic overdraft reports, your system is holding you back. Your executives, managers and frontline staff should be able to access the insights they need—on demand.

That includes:

• Fee consumption of deposits

• Reasons for declined transactions.

• Service level and liquidity exposure tracking.

• Charge-off trends by customer type, location, or relationship.

• Knowledge of what your peers are doing.

When compliance, operations, and marketing teams all have fast access to actionable data, your institution makes better, faster decisions—without relying on backend bottlenecks.

Your overdraft and consumer loan strategy should be an actively managed, strategically aligned part of your bank’s liquidity offerings—not a set-it-and-forget-it product. A modern solution helps you:

• Be competitive with new Fintech approaches.

• Align risk with opportunity.

• Provide transparent, fair services.

• Stay agile in a shifting economic and regulatory environment.

Ask yourself: Is your consumer liquidity approach helping build trust and resilience or keeping you anchored in the past?

If it is the latter, it is time to realign.

Tim Barrett Executive DDA Strategist, CSI

MEET YOUR OBJECTIVES THROUGH DATA DRIVEN PLANNING AND INNOVATIVE DESIGN.

Meeting growth and retention goals is increasingly difficult. A partner that can help you analyze your current and potential markets is essential. Starting with your strategic goals, we will develop a data-driven facility plan to determine network optimization, profitability, and expansion opportunities.

We’re not just about data, we also are experiential designers, branding, and technology experts that will deliver environments to delight your customers and staff while providing the functionality and flexibility to meet future demands.

Many community financial institutions experienced substantial balance sheet growth during the pandemic as a result of economic stimulus and the corresponding growth in deposits. While banks may be back to prepandemic growth rates, management should be diligent in monitoring triggers for additional regulatory requirements with budgets and strategic initiatives.

The Federal Deposit Insurance Corporation Improvement Act (FDICIA) threshold under Part 363 can have significant effects on operating and reporting requirements. The FDICIA regulatory requirements go into effect for those institutions with $500 million or more in total assets. Additional requirements become effective once a bank reaches $1 billion in total assets.

Requirements by Tier

FDICIA reporting requirements follow a tiered system based on the bank’s total assets as of the beginning of your fiscal year. These requirements include a combination of

• financial statements,

• audit reports, and

• management reports.

Audited, comparative financial statements and a corresponding independent public accountant’s report on the audited financial statements are required for all banks under Part 363. Further, management is required to provide a report regarding its responsibilities and certain conclusions with respect to internal controls and compliance with designated laws and regulations. Once your bank crosses the $1 billion asset threshold, an assessment of the effectiveness of internal controls over financial reporting is also required as part of the annual reporting package submitted to the Federal Deposit Insurance Corporation (FDIC).

The following elements are required based on the size of the bank:

FDICIA requires each bank to establish an independent Audit Committee of its Board of Directors that is comprised of outside directors. An outside director is defined as a director who is not, and within the preceding year has not been, an officer or employee of the bank or any of its affiliates.

For banks with total assets of $500 million but less than $1 billion, the majority of the Audit Committee’s members should be independent of management.

For banks with total assets of $500 million but less than $1 billion, the majority of the Audit Committee’s members should be independent of management.

For banks with total assets of $1 billion or more, all Audit Committee members should be outside directors that are independent of management.

When the bank has total assets over $3 billion as of the beginning of its fiscal year, the Audit Committee should further include members with banking or related financial management expertise, should have access to its own outside counsel, and should not include any large customers.

When a bank’s total assets as of the beginning of its fiscal year require compliance with the aforementioned requirements, no regulatory action will be taken if the bank (1) develops and approves written plan for compliance and (2) forms or restructures its Audit Committee to comply with Part 363 by the end of that fiscal year.

It’s important to start planning 18 to 24 months in advance to ensure your bank is ready to implement the requirements of FDICIA. We recommend you consider the following:

The independent public accountant must comply with the independence standards and interpretations of the American Institute of Certified Public Accountants (AICPA), the Securities and Exchange Commission (SEC) and the Public Company Accounting Oversight Board (PCAOB) for all banks, regardless of whether the bank is a public company.

SEC and PCAOB standards are generally more restrictive than AICPA standards with respect to permissible nonaudit services. As your bank nears the $500 million total

asset threshold, it is important to inventory the services performed by the independent public accountant and to determine whether those services remain permissible under the SEC and PCAOB independence standards.

As a result, your independent external auditor can’t perform certain nonattest services that include:

• Bookkeeping and financial statement preparation

• Designing and implementing financial information systems

• Appraisal or valuation services

• Actuarial services

• Internal audit services

• Tax return preparation for individuals who oversee financial reporting

As your bank approaches the applicable asset thresholds, you should consider the existing composition of the Board of Directors and its Audit Committee. Once your bank reaches $500 million in total assets, it is required to have an independent Audit Committee.

The Board of Directors of each institution should determine whether each existing or potential Audit Committee member meets the requirements of Part 363. To do so, the Board of Directors should maintain an approved set of written criteria for determining whether a director who is to serve on the Audit Committee is an outside director and is independent of management. At least annually, the Board of each institution should determine whether each existing or potential Audit Committee member is an outside director. The minutes of the Board of Directors should contain the results of and the basis for its determinations with respect to each existing and potential Audit Committee member.

The Audit Committee should perform all duties determined by the institution's Board of Directors and it should maintain minutes and other relevant records of its meetings and decisions. The duties of the Audit Committee should be appropriate to the size of the institution and the complexity of its operations, and, at a minimum, should include the appointment, compensation, and oversight of the independent public accountant, reviewing with management and the independent public accountant the basis for their respective reports issued under part 363. Additional responsibilities include:

• Reviewing with management and the independent public accountant the scope of services required by the audit, significant accounting policies, and audit conclusions regarding significant accounting estimates;

• Reviewing with management and the accountant their assessments of the effectiveness of internal control over financial reporting, and the resolution of identified material weaknesses and significant deficiencies in internal control over financial reporting, including the prevention or detection of management override or compromise of the internal control system;

• Reviewing with management the institution's compliance with the designated laws and regulations.

• Discussing with management and the independent public accountant any significant disagreements between management and the independent public accountant; and

• Overseeing the internal audit function.

The institution’s board and Audit Committee should exercise their own judgment in evaluating management’s FDICIA competence. Management needs to have the ability to make the assessments included in management’s report, including an understanding of the entity and its control environment and sufficient oversight over the operations of the institution. Additional members of management may be needed to supplement the knowledge and experience of existing members of management, particularly with respect to internal controls and risk assessment.

Assessment and/or implementation of an internal audit function

Depending on the current state of the internal audit function, it may be necessary to provide additional resources or supplement personnel, enhance procedures performed throughout the year, and revise lines of communication with the Audit Committee. The bank should have established processes in place for tasks such as risk assessment, evaluation of control design, testing of operating effectiveness, reporting of results and monitoring. Whether the internal audit work is to be performed internally or externally, management maintains the ultimate responsibility for implementing and monitoring a sound control environment.

For the internal audit function specifically, a one- to two-year plan to perform additional risk assessments, identify key controls for FDICIA purposes, create control

narratives, and either develop a testing plan or integrate existing testing with the FDICIA requirements is integral to FDICIA readiness.

Entity-wide training is paramount to support a sound internal control environment in preparation for the FDICIA requirements. It is beneficial to host training sessions for employees throughout the organization to educate them on the importance of their role as control operators in ensuring that controls are properly designed and operating effectively, and that adequate documentation of their procedures is in place.

Compliance with FDICIA requires considerable personnel time, analysis and documentation, and a willingness to take on additional costs.

Some common implementation challenges may include the following:

• Adoption – The framework and compliance procedures may be unfamiliar to your management team, which could result in confusing operational and regulatory controls with key internal controls over financial reporting (ICFR).

• Planning – Not allowing sufficient time to plan and commit necessary resources will result in ineffective implementation.

• Support – Difficulty obtaining support from senior management and the Board due to a lack of familiarity with an appropriate internal control framework and processes can prevent effective FDICIA implementation. An institutional culture that doesn’t emphasize ownership of key internal controls will result in an ineffective FDICIA internal control program on an ongoing basis.

• Expertise – Existing personnel may lack the necessary skills to consider, document, or test ICFR.

• Cooperation – Superficial communication with external auditors may result in ineffective, inefficient, or lastminute testing.

• Substance – Following a checklist approach rather than a thoughtful, risk-based approach will lead to a deficient FDICIA program.

Implementing FDICIA assessment procedures and executing testing and reporting is a complex and time-consuming process, which may be outside of management’s day-to-day expertise. Snodgrass has assisted many banks in navigating the complexities of FDICIA compliance. Our team can guide your institution through each step of the compliance process. To help you prepare for FDICIA compliance, we:

• Outline a plan for any remediation, as well as a plan for complying with FDICIA upon time of adoption

• Provide efficient communication between management and external independent auditors

• Maintain strong coordination and cooperation between auditors and third parties to ensure effective and efficient integration with the external audit process

Solve an unmet family banking need by serving the large and overlooked caregiver market

Variety of unique circumstances

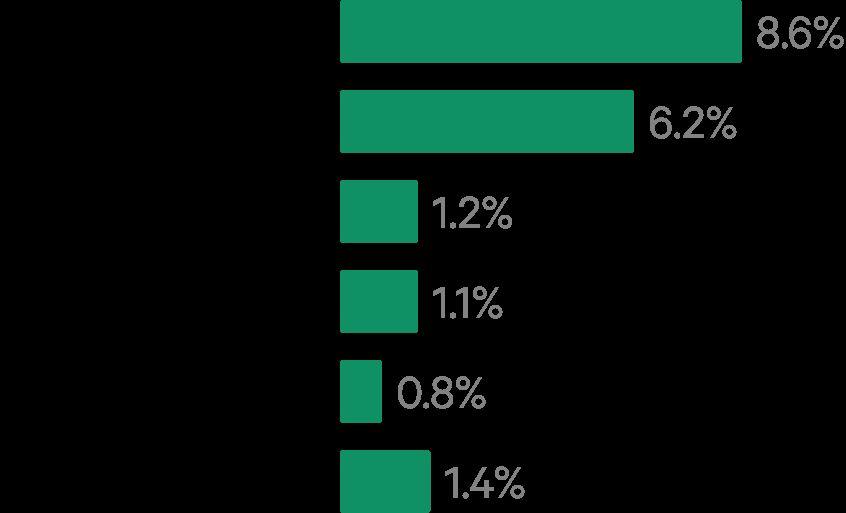

20% of Americans manage finances for someone else

For banks focused on long-term growth, financial caregivers represent a large and often overlooked opportunity. These head of household customers manage finances across generations, supporting an aging parent, a teen, or a loved one with a disability. At True Link, we’ve spent more than a decade building tools tailored to help caregivers and the families they support. This article shares what we’ve learned and how banks can turn a widespread challenge into a meaningful growth opportunity.

About one in five households manages money for someone else. This includes adult children supporting parents with dementia, parents helping teens build financial skills, and individuals assisting a loved one in recovery. Caregivers are more likely than other customers to utilize multiple high value financial products, such as mortgages (68%) and investment accounts (94%), and to have net worths over $250,000 (27%). This makes them strong candidates for cross-sell opportunities that drive both revenue and loyalty.

At the same time, banks are navigating a challenging landscape. They are consolidating branches, working to modernize legacy systems, and trying to stay ahead of rising fraud and growing customer expectations. Supporting caregivers offers a way to address these challenges head-on, while opening new paths for growth and deeper customer relationships.

Consider a customer like Melissa. She’s a full-time professional, a mother to a 16-year-old, and the daughter of a parent beginning to experience both memory loss and an increase in scam attempts from bad actors.

Both teens and older adults share a common struggle: a desire for independence. Teens are learning to assert it, while older adults are working to preserve it. For caregivers like Melissa, navigating those dynamics is emotionally complex and time-consuming.

When Melissa contacts her mom’s bank to share her concern for her mom’s financial safety and ask for a safe

way to help, she’s told, “We’re sorry, we can’t talk to you about your mom’s account.” The bank is following policy and does everything right, but still misses the opportunity to build loyalty in a critical moment because of a lack of purpose-built solutions.

Now imagine your institution could offer a different response: “I’m sorry to hear about the difficult situation you are in. Yes, we have tools that can help you and your mom.”

At True Link, we’ve built a holistic platform that helps banks serve the complex needs of caregivers while improving retention, helping to reduce fraud, and driving deposit growth. We support more than 500 professional partners, including 200 financial institutions, and have identified what consistently works:

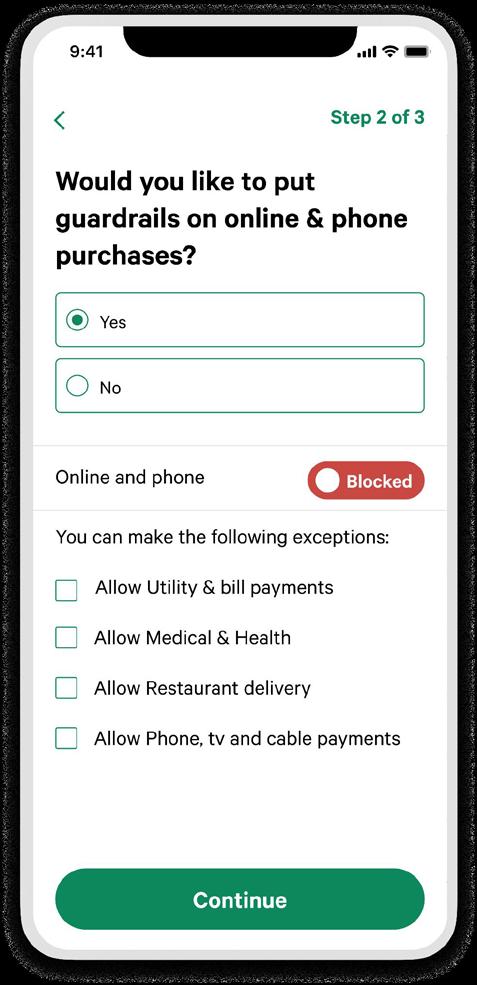

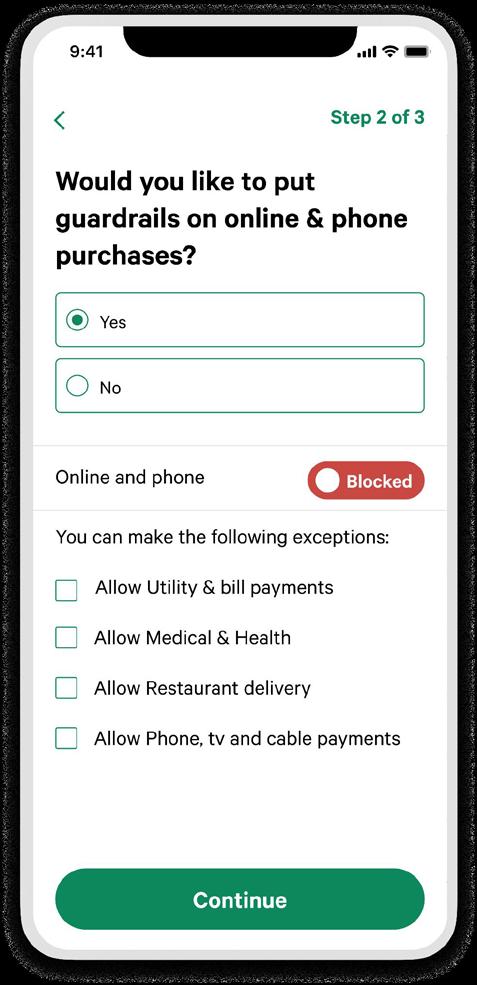

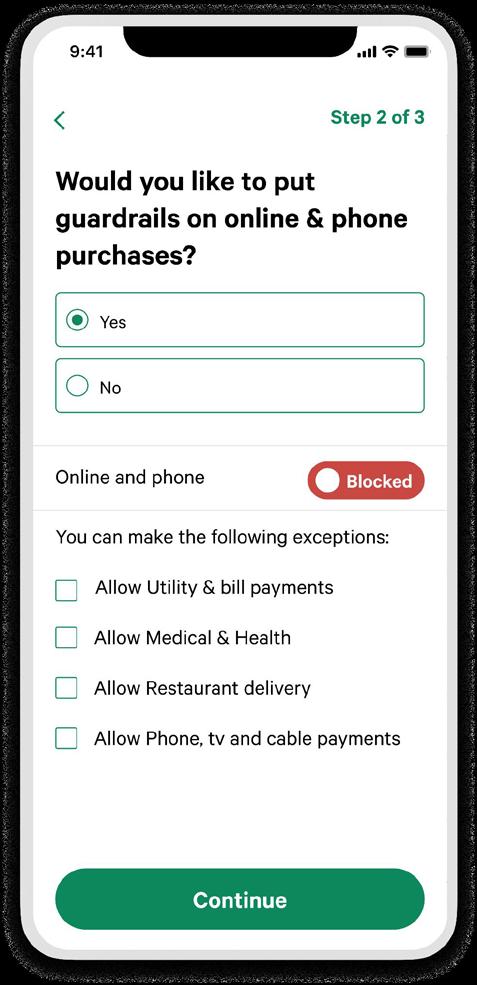

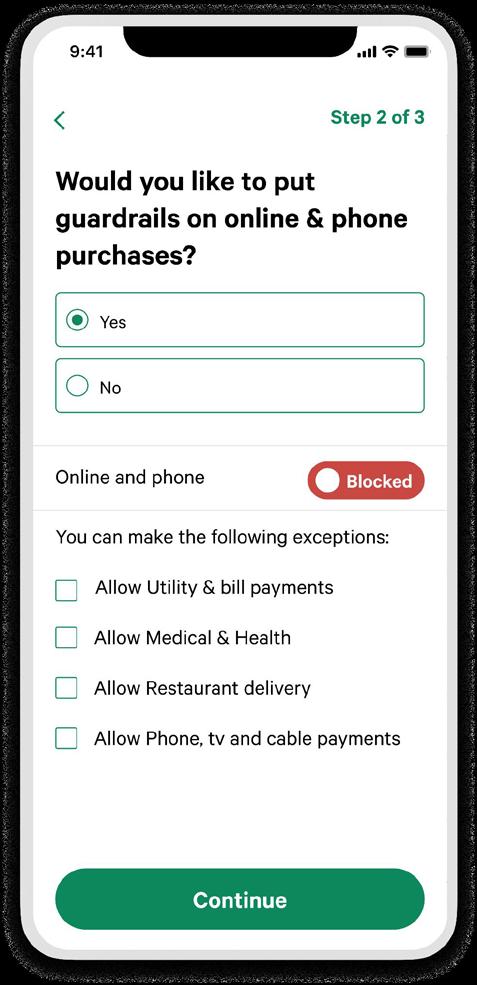

Spending controls alone aren’t enough. What drives adoption and results is aligning those controls with reallife behaviors and family scenarios. True Link’s platform offers customizable settings and smart suggestions informed by years of data and customer feedback.

For example, Melissa may want to block online and phone transactions for her mom, which are common channels for fraud, but still allow routine spending such as utility and bill payments, along with restaurant and grocery delivery, all of which happen online or over the phone. These proactive controls help prevent financial harm, reduce stress, and save customers more than $1,500 in unwanted purchases per year on average.

Every caregiving journey is different, and financial tools should reflect that. Our platform is designed to grow with your customers as their needs evolve over time. Whether they are supporting a teen opening their first account, managing finances for a child with a disability, or assisting an older adult experiencing cognitive decline, the level of support required will change.

Customers can start with light-touch features like custom alerts or spending visibility, then adjust as needed to add guardrails such as merchant category restrictions (e.g., block telemarketers, direct sales), merchant specific blocks (e.g., QVC), or set more specific limits (e.g., allow QVC purchases up to $100). Because the platform is fully configurable, families can adapt their settings over time without switching systems. This flexibility builds trust, supports longterm retention, and increases product engagement.

Serving caregivers effectively requires more than great tools. It requires understanding their needs and engaging with empathy and confidence. We offer training to frontline teams on navigating customer and family conversations, and provide the option to handle customer support end to end. Our approach is tailored for caregivers as well as individuals with cognitive disabilities, ensuring they are treated with dignity and respect.

Our marketing and communications toolkit helps institutions reach caregiver customers with messaging that resonates and drives engagement. Together, we can help your teams better serve customers while reducing internal lift for serving these complex needs that often don’t have an existing solution.

Join Us

Financial caregivers represent a large and untapped opportunity within your customer base. By offering tools and support that align with their evolving needs, your institution can build deeper relationships, driving deposits, primacy, and new sources of growth.

True Link is proud to be a member of the Ohio Bankers League. Contact me at partnerships@truelinkfinancial.com to learn more about how we can help support your customers.

Kara Brewer Chief Strategy Officer, True Link Financial

The landscape of compensation and pay transparency has changed significantly since 2020. Currently, 36 states have some form of pay transparency law in the United States. These laws vary from state to state and may include a variety of requirements, from posting a pay range for internal and external job postings to not asking salary history questions of applicants. Failure to follow these new pay transparency laws may result in monetary violations that range from $100 to $10,000 per violation. According to Forbes, these new laws, paired with labor costs, make up approximately 70% of expenses for most organizations, making it increasingly important for organizations to develop a compensation strategy. Organizations that invest in a thoughtful compensation strategy better position themselves to motivate and retain their employees, attract new hires through a stronger employer brand, and navigate the landscape of pay transparency and pay equity.

It is important to understand that a compensation strategy doesn’t only involve how to compensate employees in terms of pay and benefits but should start with the leadership team setting a foundational framework of where the organization is now and would like to be in the future. The leadership team should consider how the organization wants to position itself with the market and industry. Some questions to consider include: Is the organization in a growth phase? Does the organization need to attract and retain top talent? What positions will be added for anticipated growth? How do strategic goals align with the current and future budgets?

The leadership team needs to develop its retention philosophy and determine if more value will be placed on retaining current employees for organizational knowledge or attracting top-tier talent. Finally, the

compensation strategy should measure the equity of the positions internally and externally and align with the organization’s goals.

Leadership teams new to creating a compensation strategy shouldn’t overcomplicate it but start basic and build on it over time. Everyone in the organization needs to understand the strategy. While the organization shouldn’t share the full details of the compensation strategy, it is critical all managers and supervisors have a solid understanding of the compensation strategy, direction of the organization, goals that the organization is working towards and how the supervisor and their team will be able to contribute to the success.

Once the compensation foundation has been built and goals set, a job analysis should be completed. This process will study the foundation of a position, its essential functions and responsibilities including mental and physical skills, and determine its relative value and rank in the organization. Upon making those determinations, job levels and families need to be created. The supervisor is instrumental in creating the job analysis as they fully understand what is required of the position and its desired accomplishments. Human Resources will also be involved in facilitating, gathering, and evaluating the data. The job analysis will result in a hierarchy of jobs based on a level or point value determined by a variety of factors. Having a clear valuation of each position and aligning the pay accordingly helps to assure pay equity across the organization.

The job analysis will lead the organization in creating detailed job descriptions for every position that contains the responsibilities of the position and outlines which ones are essential or non-essential. This can also assist with the American Disability Act – reasonable accommodations and Worker’s Compensation claims. Job descriptions are commonly part of a performance review process and are used in a performance improvement plan (PIP). As an organization’s goals change, the responsibilities in a job description may need updating, and the compensation level for the position may need adjusting.

With a compensation strategy in place and the job analysis complete, there is now a road map to complete a pay analysis. Because there are many types of pay analysis completed, the organization will want to think back to the strategy and current goals to provide guidance. Communication of the pay analysis results, along with the organization’s follow-through and actions, will contribute to creating pay equity, and increasing employee loyalty and retention.

Working through these steps, there is now a strong foundation to build salary bands required for the new pay transparency laws. Analyzing the organization’s compensation against industry-specific salary benchmarking is a good place to start. The USource team can assist with access to the industry’s salary benchmarking. The position valuation combined with benchmarking to create a salary band for each position is an efficient process to ensure the organization’s compliance with the pay transparency laws.

Whether you are revisiting an existing compensation strategy or building one from scratch, understanding these principles and steps can empower your organization to develop a compensation strategy that supports both your employees and your goals.

The USource Team has a webinar titled “Achieving Pay Equity through Transparency, Analysis, and Actionable Insights.” USource members can access the recording in the USource library. If you are not a USource member, you can purchase it for $95.00 by contacting usource@ubb.com.

Kerry Gleason, SHRM-CP

Senior Human Resources Consultant, United Bankers' Bank

August 12-14 – Hyatt Regency Lexington, KY or Virtual RETURNS!

August 15 – Virtual Fraud Never Sleeps! Every bank in the industry is losing money and time from fraud! This annual program, offered in person and live stream via the Kentucky Bankers Association, will guide bankers through the latest insights and strategies to protect institutions from evolving threats to help to reduce those losses. The annual program covers 18 areas of fraud, including check fraud, elder fraud, cybercrimes and fraud prevention tools. Highlights include:

• Expert-Driven Curriculum - Learn from FBI, Secret Service agents, and top fraud specialists. Gain exclusive insights from those who’ve seen it all and know how to combat fraud effectively.

• State-of-the-Art Methodology - Our fraud specialists leverage cutting-edge techniques to address the evolving threats to financial security. Get prepared with proven strategies that work.

• Bitcoin & Cybercrime - Cryptocurrency and cybercrime continue to challenge the security of banks. Are you ready to tackle these modern threats head-on?

“This program is carefully designed for the financial industry, equipping you with the tools to save money and protect your institution from fraud,” said Sarah Husk, OBL Education Manager.

For registration assistance, contact Paula Cross at pcross@kybanks.com or 502-736-1276 at the KBA. OBL member pricing of $895 is available.

With the rapidly changing compliance landscape, you won’t want to miss this annual OBL program that brings together compliance officers from across the state to hear the latest in consumer compliance regulations from the CFPB, the OCC, the Federal Reserve Bank of Cleveland and the FDIC. Moderated by Scott Daugherty from Bankers Alliance, the 3-hour program features comments from each regulator, as well as best practices and the opportunity for attendees to submit questions in advance and during the program.

What do past attendees have to say about the program?

I find the most beneficial part of the program is when participants can ask questions. It's great to hear responses to "real-world" questions.

Hearing about what the regulators are finding is beneficial.

This is definitely my favorite program that the OBL hosts.

This program, priced at just $99 per attendee, will benefit compliance officers, consumer lenders and/or any employee involved in the regulatory examination process.

Check the website for complete details or contact Sarah Husk at shusk@ohibankersleague.com.

October 20 & 21 – OBL Education Center