TRADITION MEETS TECH

MODERN BANKING WITH A HUMAN TOUCH

A MESSAGE FROM YOUR OBL CHAIR

I still remember when I first started at FCBank. We were kicking off a rebrand and had brought in a marketing firm to help with the process. During one of our early meetings, the marketing executive leading the effort said something that completely caught me off guard: “Customers don’t want a relationship with their bank.”

I just about fell out of my chair. I looked at him and said, “I couldn’t disagree with you more. Customers absolutely want a relationship with their bank, they just don’t think it’s possible.”

That moment stuck with me. And it’s why the theme of this issue of The Ohio Record magazine really hits home for me.

The big question is: How do banks modernize the customer experience without losing that personal, human connection? How do we use technology to better serve small businesses, improve mobile banking, and strengthen our communities, all while keeping our customers at the center of it all?

For me, it always comes back to people, at every level of the relationship. I often tell bankers, “Don’t start by asking, ‘Where do you bank?’ That question makes it all about us. The conversation should start with the customer. Their story. Their needs. Their goals.

And this approach doesn’t just apply to frontline staff. It’s everyone from loan processors and fraud teams to customer service reps and BSA officers. Every interaction, powered by tech or not, can either build trust or break it. It can strengthen the relationship...or weaken it.

So here are a few things I think are worth thinking about as you evaluate your own bank’s ability to balance tech and touch:

How does technology show up in your first interaction with a client?

Is your business development officer using an iPad to showcase products? Taking notes electronically and entering them straight into the CRM? Can you open accounts at the client’s business or take applications online?

If the meeting is in a branch, does your universal associate use a laptop to open the account and move seamlessly from the teller line to their desk? Are disclosures sent electronically or printed out in stacks? Is the debit card issued on the spot or mailed 7–10 days later? Did you help set up mobile deposit and online banking?

Every one of these details plays into how your tech supports, or slows down, the customer experience. The goal is to make things easy, fast, and functional… so your customers can get moving right away.

What happens after the account is opened?

Do you have a clear onboarding process? Are you reaching out at two weeks? three months? six months? On their anniversary? Who owns those follow-ups? Is it tracked in your CRM?

Some of these touchpoints can be automated; a welcome message from your president, for example, but they should still feel personal. The key is consistent communication early and often, so the customer feels valued and knows they’re more than just another account number.

Help your team understand that tech isn’t about job loss, it’s about better service.

Let’s be honest, technology has a reputation for replacing people. But in banking, we’re seeing the opposite. The industry is thriving, and more people are working in it than ever.

When used the right way, tech can free employees from repetitive tasks and open doors to more meaningful, higher-paying roles. It’s not about doing less, it’s about doing more of what matters.

Meet customers where they are.

This is a tricky one, especially when you consider how wide the generational gap can be. I always think about my own three kids, they’re 17 years apart. The oldest is 35, the middle is 28, and the youngest is 18.

All raised in the same house, but they each use technology so differently.

• My oldest is on Facebook and WebMD.

• My middle one is a Reddit guy, always factchecking me!

• And my youngest? YouTube and Snapchat all the way.

But interestingly, they all use Instagram and text to stay in touch with each other (and with dear old Mom and Dad!).

The same goes for banking. My mom is 84 and still writes checks. My kids? They wouldn’t even know where to get one. They’re all about mobile apps, cards, Zelle, and Venmo.

So, we’ve got to build systems that serve all generations and be careful not to assume that younger clients always want the latest tech, or that older ones don’t. You’d be surprised how often those assumptions are wrong.

Tech doesn’t replace human service…especially when there’s a problem.

Let’s face it: if someone’s walking into a branch these days, it’s probably because something went wrong. So how well-trained is your team when it comes to solving problems and then turning that into a deeper conversation?

You might not get a second chance to talk to that customer in person, make it count.

Have you explored Interactive Teller Machines (ITMs)?

They’re a great way to increase efficiency while still giving customers the option to interact with a real person. Sure, adoption can take time, but they’re gaining traction fast across the industry.

What’s your website like?

Can customers open accounts or apply for loans directly from your site? Is the navigation easy? Is there a clear call to action, and is your phone number front and center?

And if someone calls, especially after hours, what’s the process? Do they get a callback? How quickly?

At the end of the day, technology is only as strong as the people who know how to use it and explain it. Customers want things to work, and when they don’t they want to talk to someone who can fix it.

At FC, we call it “Banking Humanly.” Think of it as technology with a human touch. Even the most digital experiences still have humans behind them: shaping them, supporting them, and stepping in when needed.

If you haven’t already, try mapping out the customer journey across your digital tools and channels. You’ll be amazed at what you discover and how many small changes can make a big difference.

How much should you invest in technology? That’s up to you. But the truth is, modernizing banking means faster loan decisions, quicker closings, and better service. It’s not cheap, whether you build it in-house or bring in a partner, but it has to be functional and user-friendly.

Just remember this: customers do want a relationship. They want convenience, security, and connection and they want it on their terms. The way you integrate technology to support that experience will help define your strategic roadmap for years to come.

Jenny Saunders President, FCBank, a division of CNB, and Current OBL Chair

OVER THE HORIZON

Thinking about Main Street conjures images of a bustling commercial artery or primary thoroughfare. A central, prominent street is nearly universal in every American town, village and city. Regardless of whether it is literally named “Main St.” or is Front St., Broadway, High St. or Columbus Ave., the importance of a main street that serves as a hub for community building and economic development is significant.

Whenever engaging a policymaker who is at odds with the banks and rooting against us, my consistent comeback is that everyone should be cheering for their local banks to thrive. This is basic economics: banks are a reflection of their local community. If the town’s economy is doing well, so is the bank. If there is a struggle with a significant manufacturer scaling back or shuttering, the bank will directly feel it. Show me a vibrant growing bank and you will see a prosperous community with an economic engine providing loans, good-paying jobs and local investment. The local banks are visible at the junior fair, have their name on the school scoreboard and are trusted partners providing crucial local thought leadership to move the community forward. That bank is a valuable source of strength during uncertain times.

On the Road

I’ve been on many “Main Streets” this year. Through August, I have visited 76 banks -- my annual goal is 70. The road warriors reading this understand the commitment necessary to log such a high number of visits across the state. Those are my favorite days on

the job, so being out and about is easy. The real work is following up, for which I give the OBL team full credit. I take considerable pride in sharing with bankers that they have a team of 20 professionals in Columbus getting up every morning focusing on adding value to Ohio’s banks.

That is the OBL’s “why.” Our sole reason for existence is to ensure the best possible environment for banks to thrive. Countless bankers have told me on my travels that OBL is key to their bank’s continued existence. I’m touched every time I hear this. It inspires me to work even harder to offer meaningful solutions so that they can succeed in serving their communities and remain that beacon on main street. It is to a bank’s benefit to leverage professional development programming being sourced and created by our team. Utilizing OBL BankServices through its Endorsed Business Partners and Affiliate Member relationships can stretch an OBL Member Bank’s resources and aid their bottom line. Last, but not least, OBL’s four registered lobbyists on staff are focused on advocating in the public policy arena for sensible laws and regulations. All three aspects of the OBL mission combine to give banks options regarding their futures.

Takin’ It to the Streets

Thanks to all the bankers who participated in OBL’s August recess District Meetings. We had engaging conversations with Congressmen Mike Carey (R-Columbus), Warren Davidson (R-Troy) and Greg Landsman (D-Cincinnati). We were enlightened with details in the voluminous One Big Beautiful Bill. There

OBL President participating in a meeting with FHFA Director Pulte and Senator Bernie Moreno (R-OH).

is plenty in that act to help businesses on Main St., which is certainly good for banks. Bankers took these opportunities to advocate on brokered deposit reform, regulatory relief and 1071 small business data collection as well as proposed caps on credit card interest rates and interchange.

OBL was also invited to participate in a meeting with Sen. Bernie Moreno (R-OH) and U.S. Federal Housing Finance Agency Director Bill Pulte. Thanks to the numerous interactions OBL has had with Ohio’s member of the U.S. Senate Banking Committee, we know Sen. Moreno is committed to being helpful to our industry. As a political outsider and successful business person, he has a visceral sense of urgency and is not bound to “the way things have always been done.” It quickly became clear in the meeting that Director Pulte emphatically operates in a similar manner. From what I heard, the Ohio banking industry has a friend at the helm of FHFA. I raised the concern many smaller community banks have expressed with OBL the past couple of years regarding the proposed creation of a floor on the number of loans a lender must sell to Fannie Mae to participate in their program. Director Pulte grasped the source of our frustration and asked for a solution to which we followed up with a draft order within days. We will keep you posted on that policy.

We also took the opportunity to thank Sen. Moreno for his support in the enacting of the trigger leads bill, recently signed by President Trump. We raised that issue in our first meeting with him before he was even sworn

into office. As an auto dealer, he knew the issue intimately and wanted to be clamp down on this practice.

Word on the Street

Navigating the regulatory landscape is a hot topic in my bank visits this year. Change, even when helpful, can result in pain – new policies, processes, training, consultants, etc. As an industry, we realize that there is likely a finite window of opportunity for positive regulatory changes. This is why we’re making the best use of our time, visiting Washington, D.C. six times this year. The importance of being visible in Washington, D.C. cannot be overstated. In combination with being visible with our elected officials back home, it is impactful to also see them on the Hill. Plus, a group’s success directly correlates with the relationships they develop with staff. Given the breadth of issues that a Member of Congress or U.S. Senator is expected to legislate on, informed staff are very influential. One highlight of the most recent trip was meeting Sen. Husted’s new staffer covering banking issues. It was an easy conversation thanks to his close collaboration with the Indiana Bankers Association from prior jobs in his career. OBL also recently had a meeting with senior leadership at the OCC to share concerns about exams over the past year. Our goal is to ensure the banker’s exam experiences align with the supportive industry messaging we are hearing at the highest levels of the agency.

Fraud, unfortunately, remains too high on the hot topics list. In all of its forms, fraud is rampant. It will be helpful for the federal government to stop issuing paper checks from the U.S. Treasury. OBL continues to advocate with the prudential regulatory agencies and Trump policy team that more needs to be done to marshal a more holistic federal response.

Succession planning with bank leadership, boards and shareholders continues to be a focus for many banks. OBL is grateful to those banks that look to us to address their professional development needs as well as recommendations for strategic planning and shareholder issues. A special thanks to the banks that participated in this year’s Summer Banking Institute. The goal of the

Bankers pose for a photo with Congressman Warren Davidson (R-Troy).

Bankers participated in a roundtable discussion with Congressman Mike Carey (R-Columbus).

ASSOCIATION STAFF

Michael Adelman President & CEO madelman@ohiobankersleague.com (614) 340-7616

Gauri Airi

4215 Worth Avenue, Suite 300 Columbus, OH 43219

Fax (614) 340-7596

The Ohio Record is published quarterly by OBL BankServices.

POSTMASTER: Send address changes to Ohio Record at the address listed above.

Statements and opinions expressed in Ohio Record are not necessarily those of the OBL.

Executive Director, Ohio Bankers Benefits Trust gairi@ohiobankersleague.com (614) 340-7598

Brenda Arnold Products & Services Manager, OBL BankServices barnold@ohiobankersleague.com (614) 340-7620

Don Boyd Vice President of State Government Relations and General Counsel dboyd@ohiobankersleague.com (614) 340-7608

Michelle Crume

Senior Vice President, OBL Executive Director, OBL BankServices mcrume@ohiobankersleague.com (614) 340-7622

Stephanie Elam Plan Coordinator & Customer Service Specialist selam@ohiobankersleague.com (614) 340-7591

Rita Hinkle Administrator, OBBT rhinkle@ohiobankersleague.com (614) 340-7609

Daniel Holstein, CPA Senior Accountant dholstein@ohiobankersleague.com (614) 340-7604

Paige Houlihan Products and Services Coordinator, OBLBankServices phoulihan@ohiobankersleague.com (614) 340-7613

Sarah Husk Education Manager shusk@ohiobankersleague.com (614) 340-7610

Audra Johnson Director of Communications ajohnson@ohiobankersleague.com (614) 340-7621

Susan Poling Jones Professional Development Director spoling@ohiobankersleague.com (614) 340-7611

Julie Kiplinger Education Manager jkiplinger@ohiobankersleague.com (614) 340-7612

Evan Kleymeyer

Senior Vice President of Government and External Relations ekleymeyer@ohiobankersleague.com (614) 340-7605

Anthony Lagunzad Manager, Government Relations & BankPAC alagunzad@ohiobankersleague.com 614.340.7614

Stephen Mentzer Database Manager smentzer@ohiobankersleague.com (614) 340-7607

Jennifer Osburn, CPA CFO, Chief Administrative Officer josburn@ohiobankersleague.com (614) 340-7606

Megan Peiffer Education Specialist mpeiffer@ohiobankersleague.com (614) 340-7618

Christine Zeek Employee Benefits Manager, OBBT czeek@ohiobankersleague.com (614) 340-7617

FORUMS SET IN 2026

The world is full of Top 10’s. Top 10 songs, artists, books, movies, and more. At the OBL, the TOP 10 in 2026 includes new and returning OBL Forums. Did you know that more than 310 bankers from more than 80 Ohio banks currently participate in 2025 OBL Forums? Is your institution among them? In 2026, the OBL will offer a record number of 10 forums, including a NEW Payments Strategy Forum, along with the returning Risk Forum, which was reinstated this year. Additional forums include:

CFO

Begins February 25

Commercial Lending Begins March 11

Education & Trainers Dates TBD

Human Resources Begins March 3

IT – Begins with the Security & Tech Conference April 15 – 17

Marketing Begins March 18

Mortgage Lending Begins March 17

Senior Retail Begins March 24

Risk Forum Begins April 28

NEW!

Payments Strategy Forum Begins March 10.

These 10 OBL Forums will continue to keep bankers on the cutting edge of their industry while also building relationships with others across the state. “Bank customers value relationship banking – and so do Ohio’s bankers. These in-person programs provide a high return on investment as members connect with and learn from each other throughout the year,” said Michelle Crume, Executive Director OBL BankServices & OBL SVP Professional Development.

How do they work?

These peer groups are based around the individual banking functions listed above. Members meet throughout the year where, under expert facilitation, they tackle challenges and opportunities, as well as engage in open discussion and best practices sharing.

How are agendas set?

Forum members are invited to submit hot topic ideas in advance of each session, as well as to weigh in on suggested topics, to help build the agendas. The sessions truly are built BY bankers FOR bankers.

NEW! PAYMENTS

STRATEGY FORUM: MAXIMIZING REVENUE, MINIMIZING RISK, ENHANCING EXPERIENCE.

NEACH Payments will facilitate the OBL’s newest forum in 2026. Facilitator Caitlyn MullinsSmith, AAP, APRP, NCP, VP & Director, will work with members to set an agenda that will include heavy discussion on payment rails, including credit/debit card management, wire, instant, ACH, digital currency, and check, as well as fraud. The dates for this Forum are: Tuesday, March 10; Tuesday, August 18; and Tuesday, October 6.

Scan for more information on OBL Forums

ANNUAL CONVENTION A SUCCESS WITH NEW NCBA/OBL PARTNERSHIP

The 2025 NCBA/OBL Annual Convention marks the first of three years that these two associations will partner for this valuable program – and according to attendees and vendors alike – the program was a grand success! More than 380 industry leaders and guests were “Together at the Homestead” in June to learn, connect and network with each other, as well as share their stories with more than 40 knowledgeable partners in the Exhibit Hall, sponsored by OBL BankServices and NCBA.

Economist Elliot Eisenberg, PhD from GraphsandLaughs LLC kicked the general sessions off with a timely program on “Taxes, Tariffs & Treasuries: What’s in Store for Banks”. Dr. Julie Bell of Chartwell Partners also provided an enlightening session on Unlocking Greatness: How to Build Champions, Teams & Legacies; while association CEOs Mike Adelman and Peter Gwaltney spoke about Regulatory Relief and What that Means, as they broke down all that happened in the first six month of the Trump Administration and when banks could expect changes to filter down to their institution.

An Executive & Directors Workshop and seven breakout sessions rounded out the program presentations; while Executive Roundtables provided the ideal opportunity for bankers across state lines to connect and forge relationships that will be deepened throughout the future.

NCBA President & CEO, Peter Gwaltney and OBL President & CEO, Michael Adelman, led a fireside discussion about the current regulatory and political landscape under the Trump Administration.

FHLB's Bryan Parkhurst networks with attendees during their time in the expo.

What Was Most Beneficial to Attendees?

“This was my first convention, so while networking was big - the content and programing was also very impactful to me.”

“The Annual Convention gives me a chance to catch up and network with my peers.”

“The agenda included broad spectrum topics that are meaningful to our industry. I also appreciated the Executive Roundtables by bank size and the opportunity to learn from my peers across Ohio – and North Carolina!”

“The NCBA is a great group of friendly, knowledgeable bankers. A very nice fit for the OBL to partner with and I am looking forward to seeing them all again next year.”

“As a first-time attendee, I appreciated the opportunity to establish new contacts and meet additional bankers whose institutions have a similar asset size.”

SAVE THE DATES!

June 29 – July 2, 2026

The Cloister Sea Island, GA

Watch for program details as they become available on this Convention landing page.

Attendees enjoyed the golf outing that took place at the start of the event.

Julie Bell, PhD, Chartwell Partners, led an enthusiastic session on leadership.

Attendees give the presenter a round of applause!

Dr. Eliott Eisenberg gave an energetic economic update.

OHIO’S NEW STATE BUDGET WINS, FIXES, AND WHAT’S NEXT FOR BANKS

The passage of Ohio’s two-year operating budget, House Bill 96, capped off a busy first half of the 136th General Assembly. At more than 3,000 pages, the budget is the largest single piece of legislation Ohio lawmakers pass in any two-year cycle—and, as always, it carries significant implications for the banking industry. Thanks to strong advocacy by the Ohio Bankers League (OBL) and member institutions, the budget includes important victories for banks and their customers while also setting the stage for upcoming policy debates.

A Key Victory: Fixing the Homebuyer Plus Program

One of the headline successes in this year’s budget is a critical fix to the Ohio Homebuyer Plus Program. Established in 2023, Homebuyer Plus was designed to

help Ohioans save for a first home by allowing banks to offer enhanced interest rates through a linked-deposit program, while providing account holders with a state income tax deduction of up to $5,000 per year. Family members can also contribute, making it a flexible savings tool that benefits both customers and banks by strengthening deposit relationships.

But as OBL members discovered during the most recent tax season, the program had an unintended flaw: withdrawals for non-qualified expenses triggered an unfair double taxation penalty. Even if funds had already been taxed before being deposited—or if no tax deduction had ever been claimed—account holders were forced to add the entire withdrawal back as income on their tax return. This discouraged participation and put banks in a difficult position with frustrated customers.

OBL immediately went to work, engaging the Treasurer of State, legislative leaders, and the DeWine Administration to secure a fix. The budget amendment does three things:

• Eliminates double taxation by limiting the penalty to only the amount previously deducted (plus contributions from other individuals).

• Adds flexibility by allowing funds to be transferred between institutions if the account holder stays the same.

• Provides a 90-day grace period for mistakenly withdrawn funds to be redeposited without penalty.

Importantly, these changes apply retroactively to tax year 2024, and customers have one year to file amended returns to claim refunds. This win reflects the power of OBL members’ collective voice, particularly those who raised the issue during OBL’s Day at the Capitol and in ongoing conversations with policymakers.

Beyond the Budget: Key Legislative Trends

While the budget consumed most of the legislature’s time in the first half of 2025, lawmakers also advanced several non-budget bills with banking implications. OBL’s first quarter wrap-up highlights the following areas of interest:

• Property & Real Estate: Bills are moving that adjust foreclosure, probate, and real estate wholesaling rules, with OBL successfully securing language to protect lienholder rights.

• Cryptocurrency & Digital Assets: Ohio continues to explore bold moves in crypto policy. Proposals include creating a Strategic Cryptocurrency Reserve (HB 18), requiring state acceptance of Bitcoin payments (SB 57), and clarifying that crypto transactions cannot face special local taxes (HB 116). While OBL is monitoring these closely, their scope raises questions about volatility, custody, and regulatory oversight.

• Workforce & Economic Development: Legislation creating an employer-provided childcare tax credit (HB 167) could benefit banks looking for recruitment and retention tools. Similarly, a regulatory sandbox bill (HB 176/SB 90) aims to promote fintech innovation.

• Consumer Protection: From medical debt limits (HB 257) to mobile app age verification rules (HB 226), consumer-oriented legislation remains a priority, with potential ripple effects for banks in lending, collections, and digital services.

As the Ohio General Assembly returns from summer recess, here are the top legislative issues OBL is tracking that could directly impact Ohio banks:

1. PROPERTY TAX REFORM

Ongoing debates on property tax relief and potential ballot initiatives could reshape escrow practices, mortgage affordability, and servicing obligations.

2. CRYPTOCURRENCY & DIGITAL ASSETS

Multiple bills (HB 18, HB 116, SB 57) propose everything from state cryptocurrency reserves to Bitcoin tax payments. OBL is monitoring implications for custody, compliance, and volatility.

3. FORECLOSURE & PROBATE CHANGES

HB 55 and SB 135 propose updates to lien priority rules, appraisals, and foreclosure procedures. OBL is working to protect lienholder rights and streamline real estate processes.

4. CONSUMER PROTECTION MEASURES

Proposals on medical debt (HB 257), mobile app protections (HB 226), and eviction laws (SB 83) could reshape compliance obligations and customer engagement. Additional efforts to prevent elder exploitation could be on the horizon as well.

5. WORKFORCE & INNOVATION INCENTIVES

Legislation on childcare tax credits (HB 167) and fintech regulatory sandboxes (HB 176/SB 90) may provide new tools for bank recruitment and product development.

On the Senate side, issues range from non-compete bans (SB 11), which OBL opposes, to property tax adjustments, foreclosure reforms, and new escrow requirements tied to property tax freezes for seniors (SB 81). Each of these bills could affect lending practices, compliance, or bank operations, and OBL remains deeply engaged in shaping outcomes.

The Veto Question

Governor DeWine used his line-item veto power a record 67 times on this budget, striking provisions across a wide range of policy areas. One veto override has already occurred, and additional efforts may follow—particularly around property tax reform, which could also be the subject of a ballot initiative next year. For banks, property tax changes are a high-stakes issue, affecting escrow accounts, mortgage affordability, and servicing practices.

Why This Matters for Banks

Taken together, the budget and related legislation underscore the value of an engaged banking industry. Fixes like the Homebuyer Plus amendment not only protect customers from unfair penalties but also reinforce the trust between banks and their communities. At the same time, proposals on crypto, foreclosure, property taxes, and consumer protection highlight the need for ongoing advocacy to ensure well-intended policy does not create unintended burdens for financial institutions.

OBL’s Government Relations Team has been actively engaged on all of these issues, advocating for favorable amendments, blocking harmful provisions, and keeping lawmakers informed of the real-world impact on banks and customers alike. These efforts are only possible because of the active participation of OBL members— whether by raising issues, sharing feedback, or engaging directly with legislators.

Looking Ahead

With the budget behind us, the legislature is now on recess until the fall. When lawmakers return, attention will shift to non-budget priorities, and OBL will continue to represent the interests of Ohio banks every step of the way. Issues like crypto, property tax reform, foreclosure procedures, and consumer protection will remain front and center, alongside ongoing efforts to foster workforce development and economic growth.

For OBL members, the takeaway is clear: our advocacy works, but it only works when the industry speaks with a united voice. The Homebuyer Plus fix is proof of that. As we move into the next phase of the General Assembly, we encourage every member bank to stay engaged, keep raising issues, and continue partnering with OBL to ensure that Ohio’s banking industry remains strong, competitive, and trusted.

Don Boyd VP, State Government Relations & General Counsel, Ohio Bankers League dboyd@ohiobankersleague.com

AI can fuel big wins, or it can quietly derail your entire workflow. The difference? A strategy built on clarity, not chaos and trends.

Before you launch your next AI tool, get the guide built for real-world success.

R O W S T R O N G E R . T O G E T H E R .

At COCC, we believe partnership isn't just support, it's shared momentum We work side by side with community banks to provide flexible, forward-thinking core and fintech solutions that reflect your goals, your community, your mission It’s innovation with intention backed by people who know your name and understand your mission R E A C H F U R T H E R .

We all sleep better at night knowing we’re safe. Exclusively providing IT solutions to community banks for 30 years.

provider for all your IT hardware, software, plans, testing, reporting, steering committees, BOD reports, exam preparation, risk assessments, training, help desk … everything Information Security Program related.

Brandon Krietemeyer Client Relation Specialist brandon@cbcohio.com 614-429-8823

If you’re not sure if you should call, just sleep on IT.

Betsy Allen-Manning engages the audience during her morning workshop.

2025 OBL NEXT GEN CONFERENCE PREPARING TOMORROW'S WORKPLACE LEADERS

The Ohio Bankers League’s Next Gen Conference gathered emerging leaders from across the state for a dynamic experience focused on growth, connection, and innovation in banking. Held over multiple days, the conference offered a robust agenda filled with inspiring keynotes, handson workshops, and peer networking opportunities tailored for the next generation of banking professionals.

The event opened with an energizing keynote from Betsy Allen-Manning, a leadership expert known for her work on high-performance culture and behavioral science. Her session equipped attendees with practical tools to increase their influence, improve productivity, and lead with confidence in today’s rapidly changing environment.

Throughout the conference, attendees explored topics such as digital disruption, workforce transformation, emotional intelligence, and strategic innovation. Interactive sessions encouraged collaboration and real-world application, while networking events allowed professionals to build lasting connections across institutions. Attendees also participated in an Executive panel discussion with three dynamic and engaging bank leaders: Lindsay Cloud, President, Southern Hills Community Bank; Fred DeBiasi, CEO, Valley Central Bank; and Brendon Matthews, President & CEO, The First National Bank of Pandora.

The closing keynote featured Logan Mallory, whose session “Lessons in Leadership from Ted Lasso” delivered a powerful and entertaining message on the value of optimism, authenticity, and servant leadership. Using the popular TV character as inspiration, Mallory encouraged attendees to lead with heart, humility, and humor.

The executive panel participants (L to R): Fred DeBiasi, Brendon Matthews, Lindsay Cloud

SAVE THE DATES!

June 4 & 5, 2026

Greater Columbus Convention Center

OBL PRESENTS SHALANA SHREFFLER WITH NEXT GENERATION LEADERSHIP AWARD

Shalana Shreffler, Vice President and Human Resources Director at First State Bank, was honored with the OBL’s Next Generation Leadership Award at the 2025 Next Gen Conference. This prestigious honor recognizes emerging leaders in Ohio’s banking industry who demonstrate exceptional leadership, dedication to community, and a strong commitment to advancing the future of banking.

Shreffler stood out among a highly competitive field of nominees for her visionary leadership and her innovative work in transforming human resources practices to support talent development and employee engagement across all levels of the bank. Since joining First State Bank, she has spearheaded initiatives that have significantly improved employee retention, enhanced training programs, and fostered a culture of continuous learning.

Beyond her professional achievements, Shreffler is deeply involved in her community, serving on several local nonprofit boards and mentoring young professionals in the financial sector. She currently serves as the Chair of the OBL’s Next Gen Advisory Board. Her commitment to both her organization and her community exemplifies the values the Next Generation Leadership Award seeks to honor.

Shalana Shreffer poses for a photo with her bank’s CEO and her mentor, Mike Pell.

The team from LCNB National Bank spent some time team building, working together to form this pyramid!

The OBL Government Relations Team, Don Boyd, Evan Kleymeyer and Anthony Lagunzad, spent time taking Q&A about lobbying and the legislative process.

Logan Mallory makes the audience laugh and feel energized during his closing keynote.

Stay One Move Ahead of

A MAJOR VICTORY FOR CONSUMER PRIVACY

TRIGGER LEADS

LEGISLATION

REACHES THE FINISH LINE

Ohio bankers have long understood the frustration their customers feel after applying for a mortgage, only to be bombarded with phone calls, emails, and text messages from unfamiliar lenders. For many borrowers, it creates the false impression that their trusted bank sold their personal information, undermining the very trust at the core of the banking relationship. That frustration will soon come to an end.

Congress has passed the Homebuyers Privacy Protection Act (H.R. 2808)—a bipartisan measure that represents a significant win for consumer privacy and for the banks that serve them. The House approved the measure earlier this summer, and in early August, the Senate followed suit by passing the House version and sending it on to the President for signature. Signed into law on September 8, the new protections will take effect in six months.

At the heart of the legislation is a simple but powerful change: it will sharply restrict the use of so called “trigger leads.” For years, credit reporting agencies have been able to sell the fact that a consumer applied

for a mortgage to outside lenders, who would then flood the consumer with solicitations. Under the new law, that practice will be limited to only a narrow set of circumstances. A consumer’s information may only be shared if the borrower has expressly authorized it, or if the party receiving the lead already has a meaningful relationship with the borrower—such as being the bank that originated or services the loan, or a financial institution where the consumer already holds an account.

This new standard strikes at the core of what has made trigger leads so problematic: the ability of unrelated third parties to swoop in at the most vulnerable stage of the homebuying process. By cutting off that avenue, the law ensures that Ohioans will no longer be harassed with unwanted offers the moment they begin working with a trusted lender. It also clears up the damaging misconception that their banks were responsible for selling customers’ information in the first place.

The legislation goes a step further by directing the Government Accountability Office to conduct a study

within the first year of enactment on the use of text based trigger leads. That research will help policymakers and regulators better understand how technology is shaping consumer experiences—and where further safeguards may be needed.

For Ohio banks, this development represents more than just a policy win. It’s a reaffirmation of the principle that the banking relationship is built on trust and respect. By protecting borrowers from deceptive and invasive practices, Congress has reinforced the role of banks as consumer advocates and reliable partners in one of life’s biggest financial decisions.

As the effective date approaches, banks will want to communicate to customers that this victory belongs to them too. Homebuyers can now move through the mortgage process with greater confidence, knowing that their information will stay where it belongs—secure, private, and under their control.

This victory did not happen overnight. The Ohio Bankers League has spent years pressing lawmakers in Washington to rein in abusive trigger leads, consistently elevating the voices of our member banks who see firsthand the frustration these practices cause their customers. From countless meetings on Capitol Hill

to coordinated letters and testimony, Ohio bankers have been instrumental in pushing this issue forward and ensuring that policymakers understood both the consumer harm and the damage to the banker–customer relationship. The passage of this bill is a testament to that sustained effort, and OBL extends its deepest thanks to the bankers across Ohio who lent their time, expertise, and credibility to help bring this legislation across the finish line.

Evan Kleymeyer Senior Vice President of Government and External Relations, Ohio Bankers League ekleymeyer@ohiobankersleague.com

THE KEYS TO SUSTAINABLE GROWTH

HYPERPERSONALIZATION, RELEVANCE AND ROI

The banking industry has always been highly competitive and is more so now with the proliferation of consumer options that include non-bank financial services companies, fintech innovators, and niche lenders. On average, consumers own 5.3 accounts across all types of financial institutions. Increased marketing noise is also adding to the challenge of standing out from this crowd. The amount that U.S. banks spent on marketing across U.S. grew 8% to $22.5 billion in 2024, and money spent on advertising is projected to increase 20% in the banking and lending sector in 2025, led by larger bank spending. The competitive impact on community banks is even more dramatic.

That said, many community banks dealing with tighter margins and an unpredictable economy face the pressure of holding marketing budgets flat or decreasing overall spending. How does a community bank stay competitive while navigating these challenges? The key is marketing efficiency and ROI.

There are several trends accelerating in the banking and financial services industries that hold great promise for driving marketing efficiency and productivity, including automation, artificial intelligence (AI), advanced data analytics, and—probably most tactically important— hyperpersonalization.

First, let's start by defining hyperpersonalization: Hyperpersonalization is a marketing strategy that goes beyond traditional “using their name” personalization by using real-time data, AI, and machine learning to tailor content, product recommendations, and other information that's highly specific to the individual. It's about creating unique, personally relevant experiences that resonate with each customer based on their individual preferences, behaviors and life circumstances.

Traditional personalization approaches have been limited to including a customer's (or prospect's) name in an email or relying on surface-level segmentation such as age, income or assets in targeting a marketing message. Two people who look demographically the same on paper may be motivated by very different priorities. Thus, messaging that is effective for one customer may fall flat for the other, and overall results of a campaign are dampened, efficiency is lowered, and ROI is diminished.

Hyperpersonalization may seem counterintuitive in terms of generating efficiency, requiring the evolution from a singular one-size-fits-all approach to marketing and customer engagement to more versions of a message and variable channel mix. However, AI and automation can facilitate hyperpersonalization without draining the capacity of a marketing team and reduces mass marketing to very targeted delivery (think 500 targeted versus 5,000 mass marketed).

Hyperpersonalization may make intuitive sense, but does it make real-world business sense? The evidence is fairly clear:

• Banks using sophisticated personalization techniques have seen product sales increase by up to 30% while improving customer satisfaction.

• Financial institutions excelling at personalization generate 40% more revenue from those activities compared to competitors.

• According to McKinsey & Company, personalized digital communications make consumers 76% more likely to consider purchasing from a brand.

• Personalization helps build stronger relationships, making customers feel valued and increasing retention and lifetime value. In fact, highly satisfied banking customers have 37% higher average balances, are 87% more likely to purchase additional products, and provide 5.8 times more referrals

Moreover, consumers have come to expect a high level of personalization from businesses across industries, especially through digital communications. Today's customers, particularly younger generations, expect convenient, fast, and digital-first interactions, and digitally native fintech companies are pushing banks to accelerate digital transformation efforts. Hyperpersonalization will inevitably move from a trend to table stakes in banking, sooner rather than later.

Banks have a treasure trove of data on their customers, including demographic, socioeconomic, and behavioral data (e.g., accounts opened, responses to offers and marketing tactics, etc.), and predictive analytics, when deployed, have proven useful for anticipating customer needs. However, these data do not provide insight into why people behave as they do or their intrinsic motivations. This is the missing component to the greatest level of efficiency.

Harnessing these insights can be powerful for hyperpersonalized marketing and customer engagement, but such data are not typically captured in a bank's customer record. This is where psychographics come in.

Psychographics: Insights Into Action

Psychographics pertain to people's attitudes, values, personalities and lifestyles, and are core to their motivations, priorities and communication preferences. These drive the reason behind customer decisions and behaviors. Leading companies across industries, such as Procter & Gamble, Porsche, and Geico, have used psychographics to develop marketing that resonates on a deep, personal level, achieving remarkable results and enhanced ROIs with very efficient marketing spends. The key is moving the data into actionable knowledge that can be tactically deployed by a community bank.

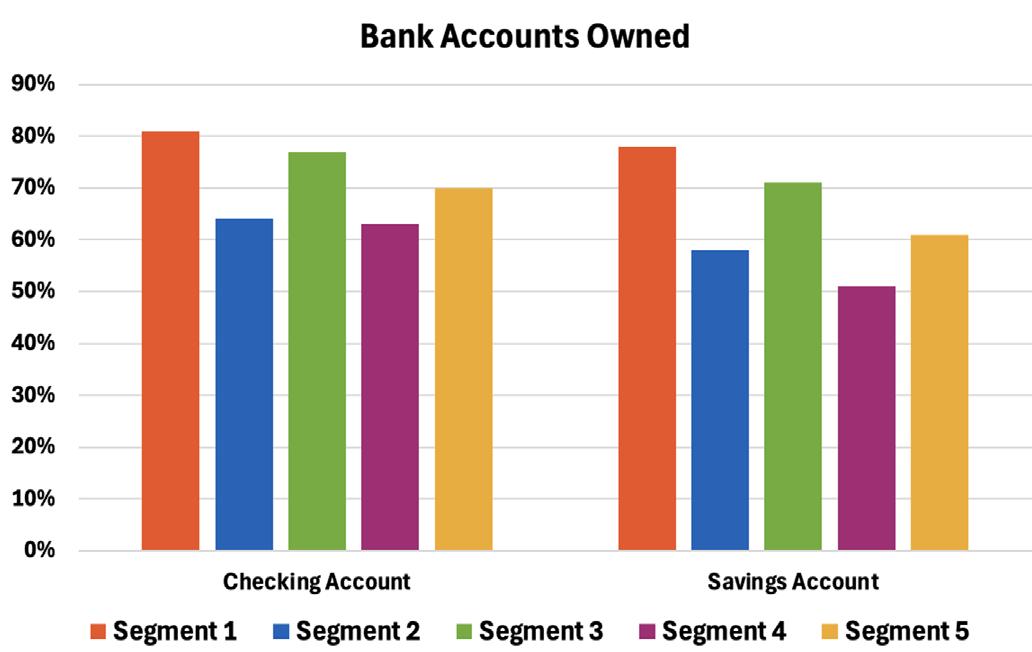

As an example, Psympl® has developed a powerful psychographic model for the banking and financial services industries—Motivation Intelligence—which provides the insights for message development and delivery that are hyperpersonalized for each individual customer. Psympl identified five distinct segments of people based on their unique approaches to finances and investing, derived from statistically valid national consumer research:

SEGMENT 1 (17%)

I'm financially comfortable and I invest, but I'm hands-off with my investments. I want experts to guide my investments using a safe and predictable approach.

SEGMENT 2 (22%)

I'm financially secure and actively following the stock market and discussing finances. I favor a more aggressive approach, seeking the highest returns, and am interested in alternative investments like cryptocurrency.

SEGMENT 3 (20%)

I'm financially secure and confident in my financial standing and retirement. I'm comfortable making my own financial decisions and prefer a balanced approach to risk, seeking both potential gains and security.

SEGMENT 4 (25%)

I'm living paycheck to paycheck and worried about my retirement. I avoid investing and often carry credit card debt because of my financial situation. I would appreciate assistance with my finances.

SEGMENT 5 (16%)

I'm reasonably financially secure. I don't invest or trust the stock market, but I have checking and savings accounts and I'm still on track for retirement. My finances aren't complex, so I prefer to just manage them myself.

Note that people in segments 1, 2, and 3 have, on average, the same level of income and assets, which is significantly more than assets owned by people in segments 4 and 5:

Looking at the five financial psychographic segments' banking behaviors, specifically, the majority of people in each segment owns both a checking account and a savings account; however, assets in segments 2 and 4 are significantly underdeveloped relative to the other segments, and people in these two segments have very different financial personalities. Working with community banks, MarketMatch turns this segment knowledge into actionable tactics that leverage insights, generate increased engagement, and produce a high ROI.

When looking at the types of institutions that actively manage the financial assets of people in each segment, people in segments 2 and 3 are significantly more likely than people in other segments to work with a national bank (assets over $100 billion; e.g., Bank of America, Chase Bank, Wells Fargo, Citigroup, etc.) and a regional bank (assets between $10 billion and $100 billion; e.g., Fifth Third Bank, PNC Bank, etc.). People in segment 5 are the most likely to work with a local/community bank (assets under $10 billion). People in segments 4 and 5 are the most likely to choose a credit union over the other institutions.

These data help community banks understand the mindset of people in each segment but also highlight opportunities for targeting and conversion. Segments that demonstrate a propensity for certain institutions represent lower hanging fruit for marketing efforts and greater marketing efficiency and ROI.

These data can also be used to target niche and underserved geographic markets with relevant products and services. While people in segments 1, 2, and 3 are prime prospects for wealth management, those in segments 4 and 5 may benefit from services designed to manage their money better or realize healthier returns.

For example, people in segment 4 are significantly more likely to carry some form of ongoing debt and feel overwhelmed by it. People in this segment would greatly

benefit from easy-to-use budgeting tools and financial literacy programs focused on practical skills such as budgeting, debt management, and understanding credit. Encouraging automated savings plans that deduct small amounts from each paycheck can help them break free from the paycheck-to-paycheck cycle.

People in segment 5 are institutionally suspicious by nature and prefer to manage their money themselves. This is especially true given that even seemingly simple financial matters can have hidden complexities that impact long-term well-being. A community bank could offer complementary financial check-ups to identify potential areas for improvement, such as tax optimization or estate planning, which they may have overlooked. This demonstrates the value of professional guidance.

Such insights are useful to know, but unless one can direct psychographic segment-specific messaging to the appropriate customers, it may not deliver on its promise of hyperpersonalization. This is where tactical expertise is critical to overall effectiveness. How does one identify an individual customer's psychographic profile?

Identifying Psychographic Segments

Through MarketMatch, Psympl offers a short survey that it calls the Motivation Decoder, which is 90% predictive of an individual's segment. (Note: >70% predictive is considered strong for psychographic models.) While this is the most accurate way to identify a customer's segment, it may not be practical over an entire customer population in a short period of time.

Recognizing this challenge, Psympl is working with a leading national data compiler (a company that determines consumers' credit scores) to statistically project the five psychographic segments over the entire U.S. population of adults ages 18+. This will enable community banks to: 1) immediately append its Marketing Customer Information File (MCIF), assigning each customer their psychographic segment; and 2) heatmap specific markets, identifying the

segment composition and filtered by other demographic and socioeconomic variables (e.g., age, income, assets, debt), for geo-targeted prospect marketing down to the household level. This is the game changer that brings the personal level knowledge into view and creates the ability for actionable tactical delivery.

Operationalizing Psychographics for Hyperpersonalization

Each financial psychographic segment requires a different engagement approach to maximize response rates. If one were to rely solely on financial variables to target marketing efforts, the messaging may appeal to one segment but be much less effective with the other segments.

First, while it may seem like a heavy lift to create content that uniquely appeals to each of the five psychographic segments, the effort is greatly reduced with the appropriate resources. First, a strategy may only require a focus on one or two psychographic segments, depending on the product or service being marketed, based on that segment's likelihood to want said offering. This is where expert strategic planning comes in, such as the consultation offered by MarketMatch, which has partnered with Psympl for its psychographic capabilities.

MarketMatch can help define or refine a bank's target audiences (WHO), the value proposition for products and services (WHAT), and the channel mix that will most strongly resonate with the targets (HOW), enhanced with psychographic insights (WHY) that will activate desired customer behaviors. The WHY is the secret sauce that is the key tool for delivering the personally relevant experience.

Second, with a company like MarketMatch guiding the community bank, the Psymplifier uses Psychographic AI to automatically generate segment-specific marketing content (e.g., emails, push messages, digital or print advertising, social media, etc.) or rewrite existing content for each of the five psychographic segments. Moreover, the Psymplifier integrates with existing CRM and other customer engagement platforms to import said content for marketing communications. What might have taken a team of marketers

and copywriters significant time to execute until recently is now a low-effort approach to hyperpersonalization through MarketMatch's expert tactical delivery.

Summary

Hyperpersonalization is a trend that delivers against rapidly evolving customer expectations, customer acquisition and loyalty. Further, it creates marketing efficiency, increased ROI and greater engagement.

Though hyperpersonalization can be applied across channels of customer engagement (e.g., face-to-face interactions), it can be accomplished at scale through digital communications and marketing. Psychographics provide the insights to resonate with each customer's intrinsic motivations, increasing the likelihood of desired behavior activation, such as choosing a bank, buying a product or service, consolidating accounts, or staying loyal to a bank for greater lifetime value. This is a proven approach across industries and can be lucrative for innovative community banks looking to stand out in a highly competitive marketplace and without a multi-million-dollar budget. However, it starts with sound strategy and expert operationalization, which is the hallmark of MarketMatch, helping community banks achieve marketing with a proven, guaranteed ROI. Scaling hyperpersonalization efficiently is made possible with Psychographic AI content creation and automation driven by MarketMatch and powered by Psympl.

Again, hyperpersonalization done right is not a nice-tohave; it's a must-have to compete in today's banking marketplace. McKinsey & Company summed it up nicely in its April 24, 2025, article “Riding the storm: How consumer finance companies can survive and thrive”:

“But the future of consumer finance isn’t just digital; it’s also Darwinian. Companies that evolve, embracing AI and hyper-personalization, will thrive in this new ecosystem. As for the rest, the extinction event for outdated lending models has already begun.”

Bruce A. Clapp President, MarketMatch

Brent Walker Cofounder, Psympl

OHIO SUPREME COURT REAFFIRMS STABILITY IN COMMERCIAL LENDING

OBL’S ADVOCACY

HELPS SECURE KEY VICTORY

The Ohio Supreme Court has issued a landmark decision in Huntington Natl. Bank v. Schneider ( 2025Ohio-2920), reversing a First District Court of Appeals ruling that threatened to upend decades of settled commercial lending practice. The Court held that lenders do not have an affirmative duty to disclose facts that may materially increase a guarantor’s or surety’s risk, unless a special relationship of trust or confidence exists between the parties.

This decision restores stability to Ohio’s lending environment, ensuring that contracts made at arm’s length will be enforced as written. The Court emphasized that Ohio law has long recognized the freedom of parties to structure agreements without imposing new, extracontractual disclosure obligations. By rejecting the “doctrine of increased risk” from the Restatement of Security, the Court protected the enforceability of guaranty agreements—an essential tool in commercial finance.

Case Background

The case stemmed from Huntington National Bank’s $77 million financing arrangement with entities connected to a health care enterprise. Raymond Schneider, a co-owner, signed a personal guaranty. After the borrowers defaulted, Schneider argued the bank failed to disclose financial risks tied to his business partner’s misconduct. The trial court ruled for the bank, but the First District reversed, adopting a new duty of disclosure for lenders.

The Supreme Court, in a majority opinion by Chief Justice Sharon Kennedy, rejected that approach, reinstating summary judgment for Huntington. Justice

Jennifer Brunner concurred in part and dissented in part, suggesting disclosure duties might apply for unsophisticated investors, but the majority drew a firm line: absent fraud or a fiduciary relationship, banks owe no special disclosure duties in guaranty or surety agreements.

OBL’s Role and Amicus Brief

The Ohio Bankers League, alongside the American Bankers Association, the Ohio Credit Union League, and America’s Credit Unions, filed an amicus brief urging reversal. The brief warned that the First District’s ruling would retroactively transform standard guaranty agreements into suretyships, injecting uncertainty into thousands of existing contracts and curtailing credit availability across Ohio.

OBL emphasized that personal guaranties are vital for commercial lending—particularly for small businesses, startups, and development in underserved communities. Without enforceable guaranties, lenders face heightened risk, which would increase borrowing costs, restrict access to credit, and ultimately hinder economic growth.

Impact on Ohio Banking Industry

The Supreme Court’s decision is a significant victory for Ohio’s banking industry and the broader state economy. It reaffirms that:

• Standard guaranty agreements remain enforceable as written.

• Lenders and borrowers can continue to rely on established commercial lending practices.

• Ohio remains a business-friendly state with predictable contract enforcement.

By avoiding the creation of new disclosure duties, the Court preserved the availability of credit while preventing additional compliance burdens on financial institutions.

OBL LEGAL DEFENSE FUND PROTECTING THE INDUSTRY IN THE COURTS

The Huntington v. Schneider case underscores exactly why the OBL created the Legal Defense Fund—to ensure that when judicial threats arise, the Ohio banking industry has the resources needed to respond effectively. Filing amicus briefs and pursuing litigation to defend core banking practices can cost tens of thousands of dollars, yet these legal battles are critical to safeguarding our industry’s future. The OBL Legal Defense Fund serves as both a sword and a shield, protecting banks against unfair rulings and reinforcing the rule of law in Ohio’s courts. We encourage all member banks to contribute to the Fund and help sustain this vital resource. For additional details on how to support the Fund, please contact OBL General Counsel Don Boyd at dboyd@ ohiobankersleague.com

Conclusion

The OBL is proud to have played a central role in protecting the integrity of commercial lending in Ohio. Our successful advocacy in this case demonstrates the importance of the banking industry speaking with one voice to ensure sound legal and economic policy. This ruling is not only a victory for banks but also for Ohio businesses and communities that rely on access to capital for growth and development.

Ohio

Bankers League

Legal Defense Fund

About the Fund

In today’s challenging regulatory and legal landscape, Ohio’s banking industry must be prepared to fight back against government overreach and judicial threats. That’s why the Ohio Bankers League (OBL) Legal Defense Fund was created—to protect our industry, defend our rights, and ensure fair treatment in the courts.

With legislative gridlock making it harder to enact meaningful change, litigation has become an essential tool in safeguarding banking in Ohio. The OBL Legal Defense Fund serves as both a sword and shield, allowing us to take proactive legal action and respond swiftly when the industry is under attack.

The Legal Defense Fund challenges regulatory overreach at both state and federal levels, supports litigation that defends Ohio banks against unfair rulings, files amicus briefs to influence key court decisions that impact the industry and ensures laws are properly interpreted and upheld to benefit financial institutions.

Why Your Support Matters

Legal battles are costly. Filing an amicus curiae brief can cost tens of thousands of dollars, while leading a lawsuit can run into six figures.

Courts increasingly influence banking policy. Recent cases, like Huntington v. Schneider, threaten fundamental banking practices, such as the use of personal guarantees in commercial lending. Immediate resources are essential. The Legal Defense Fund ensures we have the financial backing to act quickly when legal threats arise.

Join the Fight – Make a Contribution Today!

This fund is 100% dedicated to protecting Ohio’s banking industry. Contributions can be made by individuals or corporations, and every dollar goes directly towards protecting our industry. For more information or to make a contribution, contact OBL General Counsel Don Boyd today at dboyd@ohiobankersleague.com.

A Sword and Shield for the Industry

YOUR BRANCHES ARE MORE THAN JUST BUILDINGS – they need to engage customers, activate your brand, and adapt to evolving banking needs. Explore five essential branch design considerations, the pros and cons of three different branch models, and the value of branded environments in our free SmartGuide: A Guide to Retail Branch Design. SCAN THE CODE or visit designcollaborative.com/branchdesignsmartguide

TURNING MISSED MOMENTS INTO MEANINGFUL CONNECTIONS

HOW AI DRIVES DEPOSIT GROWTH BY AMPLIFYING THE HUMAN TOUCH IN COMMUNITY BANKING

Community banks have long had a competitive edge: deep, trusted relationships with their customers. But in today’s environment—where digital expectations meet lean staffing and fragmented systems—even these relationship-driven institutions face new challenges.

Large banks are investing billions in artificial intelligence and data analytics to replicate what community institutions do naturally: build meaningful, personal relationships. According to Citibank, 93% of financial institutions expect AI to improve profits within five years, potentially unlocking $170 billion in industry-wide gains by 2028.

Yet the real issue facing community banks isn’t just technology—it’s the quiet acceptance of the limits of human capacity, and the normalization of inefficiency.

The Core Challenge: Banking Has Normalized Missed Opportunities

Most community financial institutions have accepted that frontline staff can only do so much. Customerfacing personnel like branch managers and relationship bankers often juggle hundreds—or thousands—of client relationships. With each customer having multiple accounts and generating thousands of transactions, it’s operationally impossible to consistently deliver proactive, personalized service without additional support.

The outcome? A culture of reactivity.

• A customer quietly transfers funds to a competitor— and no one follows up.

• A customer switches jobs, prompting financial changes that go unnoticed due to a lack of timely alerts.

• A well-connected team member at a large local employer with referral potential is never identified as an influencer.

These moments aren’t missed due to lack of care or intention. They’re missed because banks have had to accept the limits of their current staffing models and tools. Hiring enough employees to cover every opportunity would be cost-prohibitive. So, institutions settle for staffing formulas that prioritize coverage over connection.

But what if they didn’t have to choose?

The Opportunity: Use Data and AI to Scale Personal Service Without Scaling Headcount

Modern AI-driven solutions now allow community financial institutions to expand their capacity for personal engagement—without expanding headcount. By consistently analyzing transactional, behavioral, and CRM data, AI can surface timely signals and suggest the right message at the right moment to drive deposit growth and deepen relationships.

Instead of relying solely on customer-initiated interactions, institutions can proactively reach out when the data indicates a key moment—such as a large transfer, a job change, or a shift in spending behavior.

These tools work quietly in the background, scanning for patterns, and prioritizing and delivering bite-sized, actionable insights directly to frontline employees. Rather

than requiring teams to comb through dashboards or reports, AI delivers intelligence directly where it's needed—empowering bankers to engage proactively and purposefully.

No dashboards. No digging. Just timely, actionable insights tailored to each role.

Now, banks can identify critical relationship moments before they’re lost—retaining deposits, strengthening loyalty, and generating new business without adding staff.

Examples in Action

• Retention: A high-value client moves a large sum to a competitor. AI detects the transaction and prompts immediate outreach.

• Engagement: A shift in direct deposits signals a life transition. Staff receive an alert to check in and support the customer.

• Acquisition: A potential advocate is identified based on network or employer data, prompting the launch of a referral playbook.

Critical First Step

The most important component of all AI systems is the quality and structure of the data itself, and the data model they reference to generate answers and perform humanlike tasks. Without a solid data foundation, AI efforts often struggle with fragmented, inconsistent, or incomplete data, limiting their effectiveness and scalability. Therefore, the first step is to create a reliable knowledge base to serve as the source of truth. Operating in an environment that requires impeccable accuracy and traceability, community-based financial institutions must prioritize the underlying data model to set themselves up for success.

From Analysis to Action

Traditional business intelligence platforms often lead to dashboard fatigue—where insights sit unused and underleveraged. New AI tools flip the model, emphasizing decision-making over data review. By focusing only on the signals that matter most, and delivering them in a personalized, accessible way, financial institutions free up staff time to focus on relationships, not reporting.

Even a few hours saved per employee each week can compound into hundreds of hours redirected to strategic engagement across the organization.

But realizing the full value of AI-driven insights requires more than just technology—it takes expert guidance to turn insights into sustained action. Leading service providers extend beyond software delivery to offer

strategic partnerships—pairing advanced technology with hands-on guidance and deep industry expertise. Dedicated teams of data engineers and analytics professionals support implementation and long-term success, ensuring institutions can act on AI insights confidently and effectively.

A Modern Strategy That Supports the Human Mission

Community banks shouldn’t have to choose between digital transformation and human connection. With AI, they can have both. Intelligent systems can augment—not replace—the relationship model, making it possible to deliver the same high-touch service at greater scale.

In a world increasingly driven by automation, relationships still win. And with the right AI strategy, they can win at scale.

About the Author

Tracy Graham is Co-Founder and CEO of Aunalytics. Tracy’s focus is developing and driving product growth at Aunalytics and oversees company operations and finances. Tracy specializes in investing in, and building, technology and technology-enabled companies. He leverages his long history of successfully acquiring and operating businesses to provide strategic and operational support to a growing portfolio of small and middlemarket companies. He is currently focused on leveraging analytics and artificial intelligence to help companies evolve via digital transformation.

Prior to Aunalytics, Tracy co-founded GramTel, Inc. (a managed data center provider) in partnership with The Jordan Company (a private equity firm headquartered in New York). As President of GramTel, he was responsible for the company’s strategic direction as well as aligning all internal and external resources to gain market share in the small and mid-sized business market. He led the company to become the largest provider of managed data center services in the state of Indiana and the largest privately held provider in the Midwest. In 2007, he completed the successful sale of GramTel to Cincinnati Bell, Inc (a publicly traded telecommunications company).

Tracy Graham Co-Founder and CEO Aunalytics

Power your business intelligence models with market insights from the premier source for banking-specific financial data.

What Will It Take to a Smarter Bank?

Cornerstone knows. Here's our take on the key characteristics that banks need to embrace now to ensure they future proof their organizations:

Hyper Efficient

Groundbreaking efficiency will be the hallmark of the Smarter Bank, driven by a combination of digital selfservice, process automation and artificial intelligence.

Differentiated

To compete with non-traditional banks, the Smarter Bank will need to shrug off plain vanilla “sameness” and forge distinct competitive positions and segmented brands.

Fast

Forget annual planning cycles. Banks that intend to survive in a technology-first era understand they are in a constant “release” environment and must continually balance structure with “getting stuff out the door fast.”

Smarter Banks will take inspiration from trailblazer organizations that know how to drive value by leveraging data to make better, faster, and more informed decisions.

Opportunistic

Whether it’s M&A, talent carve-outs, new market entries, or new lines of business, Smarter Banks will be the ones that know when to move and look for opportunities—particularly when the industry is inward-focused and risk-averse.

DIGITAL TRANSFORMATION IN BANKING THE ROLE OF CYBERSECURITY IN MODERN BANKING

Digital transformation in banking is reshaping how financial institutions operate and engage with customers. However, as digital capabilities expand, so does the attack surface. From mobile banking to AI-powered automation, the modernization of the financial sector requires a cybersecurity strategy that keeps pace — and one that’s integrated at every stage of transformation.

The future of banking is not just about better technology. It’s about building secure, resilient systems that inspire customer trust. Cybersecurity in banking isn’t a separate initiative but rather a foundational thread that must run through every phase of the digital transformation journey.

What Is Digital Transformation in Banking?

At its core, digital transformation in banking involves reimagining banking operations, customer engagement, and internal workflows using digital technologies. It’s more than digitizing services — it requires embracing a technology-first culture that fosters innovation, drives efficiency, and builds resilience across the organization.

Customers today expect more than just new technology. They want experiences that are fast, intuitive, and secure. Whether accessing accounts via mobile apps or interacting with automated services, users expect digital transformation to improve both convenience and protection. Meeting these expectations is essential to earning trust and staying competitive. And the shift is accelerating: Global investment in digital banking technologies is expected to reach nearly $14 billion by 2026, representing an annual compound growth rate of more than 11%, according to MarketsandMarkets.

Digital transformation impacts every aspect of banking, from behind-the-scenes operations to customer-facing services. Examples include:

• Upgrading legacy core systems to scalable, cloudbased infrastructure

• Using AI to enhance fraud detection, underwriting, and customer support

• Streamlining customer onboarding and authentication through digital identity tools

• Expanding access to financial services via mobile apps and remote platforms

• Modernizing risk management, compliance tracking, and regulatory reporting

To succeed, banks must shift their strategy, upgrade their architecture, and embed cybersecurity into every layer of that evolution — not just as a final step but from the ground up.

Cybersecurity in Banking: The Backbone of Digital Trust

Cybersecurity must evolve alongside digital transformation. In banking, that means shifting from a reactive function to a proactive, embedded discipline. With cyberattacks growing in sophistication and scale, relying on legacy defenses is no longer an option.

To build digital trust and secure every layer of operations, modern cybersecurity strategies should include:

• Proactive security practices, such as regular risk assessments, incident response planning, business continuity strategies, and technical safeguards

• Continuous monitoring and identity controls, especially as banks adopt cloud infrastructure, mobile platforms, and open banking APIs

• Robust third-party risk management, including secure APIs, vendor due diligence, and regular assessments as digital ecosystems expand

• Strong regulatory alignment, with processes in place to protect consumer data and demonstrate compliance to both regulators and customers

• Modernized governance programs, with information security programs that are streamlined, current, and followed by all employees

Together, these practices help ensure cybersecurity isn’t just a support function but rather part of the institution’s DNA, embedded into every aspect of transformation.

Challenges of Digital Transformation in Banking

The challenges of digital transformation in banking are complex and often interconnected, spanning technical limitations, cultural resistance, regulatory pressures, and security concerns. While the benefits of modernization are clear, the path forward is rarely straightforward.

Common challenges include:

• Outdated infrastructure that resists integration with modern systems

• Fragmented data environments that hinder visibility, agility, and informed decision-making

• Internal resistance to change, especially in established institutions with entrenched processes

• Limited in-house cybersecurity expertise, making it harder to manage growing threats and evolving technologies

• Changing regulatory requirements, which demand constant attention to compliance in a digital context

• Lack of leadership buy-in and a security-focused culture, which can derail even well-planned transformation efforts

To overcome these barriers, institutions must prioritize education and employee training, partner with experienced vendors, and set realistic road maps that build in security from the start.

Securing Transformation with AI, Cloud, Blockchain, and Big Data

Modern digital transformation relies on a powerful mix of technologies — including artificial intelligence (AI), cloud computing, blockchain, and big data — to improve operations, customer engagement, and risk management.

AI enables real-time fraud detection, automated decision-making, and behavior forecasting, while also strengthening cybersecurity through intelligent threat monitoring and faster incident response. Cloud platforms provide scalability, resilience, and secure storage when configured correctly. Blockchain enhances transaction transparency and tamper resistance. Big data analytics helps banks turn massive datasets into actionable insights for both customer experience and risk mitigation.

To unlock the full potential of these tools, banks must align innovation with governance. That means embedding security throughout every layer of the infrastructure — from encryption and identity controls to vendor oversight and continuous audits — ensuring that transformation doesn’t outpace protection.

Enhancing Customer Experience with Security in Mind

The customer journey in banking is increasingly digital, but that doesn’t mean it should be less secure. Security must be built into the user experience, not added as an afterthought. When users log in to mobile apps, they

expect multifactor authentication to be seamless. On online payment platforms, they trust that encryption protects their transactions. And as they sign up for new services, they assume their personal data is handled responsibly.

This shift toward mobile is clear in user preferences. Mobile banking apps are now the go-to choice for nearly half of U.S. consumers, while just under a quarter still prefer desktop-based online banking, according to the American Bankers Association.

Balancing convenience and protection is key to customer satisfaction. Institutions that achieve this balance strengthen their technical defenses, brand loyalty, and reputation.

The Future of Digital Transformation in Banking

Digital transformation in banking is no longer optional — it’s foundational. But transformation without security is risky and incomplete. Financial institutions must adopt a forward-thinking approach that places cybersecurity in banking at the center of every digital initiative.

This means investing in the right technologies, building secure infrastructure, training employees, and embracing a culture of risk awareness. It also requires strong executive oversight and governance to keep transformation efforts on track and aligned with business goals. Leveraging governance, risk, and compliance (GRC) tools like TRAC risk management software can help institutions streamline risk assessments, improve awareness across departments, and ensure compliance.

Measuring outcomes — like reduced risk exposure, faster incident response, and improved customer experience — is essential to understanding what’s working and where to improve.

Banks that embed cybersecurity at every stage of transformation, innovate with intent, and lead with governance will shape the future of digital banking.

This blog was originally published on sbscyber.com.

SBS helps business leaders identify and understand cybersecurity risks to make more informed and proactive business decisions. For more information, contact Kirsten M. Elkins at 567-298-3425 or kirsten.elkins@sbscyber.com. Learn more at sbscyber.com.

Chad Knutson CEO SBS CyberSecurity

BUILDING CONFIDENCE

MEET YOUR OBJECTIVES THROUGH DATA DRIVEN PLANNING AND INNOVATIVE DESIGN.

Meeting growth and retention goals is increasingly difficult. A partner that can help you analyze your current and potential markets is essential. Starting with your strategic goals, we will develop a data-driven facility plan to determine network optimization, profitability, and expansion opportunities.

We’re not just about data, we also are experiential designers, branding, and technology experts that will deliver environments to delight your customers and staff while providing the functionality and flexibility to meet future demands.

THE MAIN EVENT

DECEMBER 1-3, 2025

DECEMBER 1-3, 2025

GREATER COLUMBUS CONVENTION CENTER

GREATER COLUMBUS CONVENTION CENTER

THE OHIO BANKING INDUSTRY’S PREMIER PROFESSIONAL DEVELOPMENT & NETWORKING EVENT

Join industry leaders at this third annual event featuring eight learning tracks and networking opportunities, as well as the OBL Annual Business Meeting and OBL BankServices Expo. Plus!

The OBL will present the 2025 OBL Industry Awards in categories such as Bank of the Year, Banker of the Year, Next Generation Leadership Award, Exceptional Woman in Banking Award and others – including the first presentation of the OBL Five Pillar Awards!

REGISTER YOURSELF AND YOUR TEAM TODAY ! REGISTER YOURSELF AND YOUR TEAM TODAY!