143

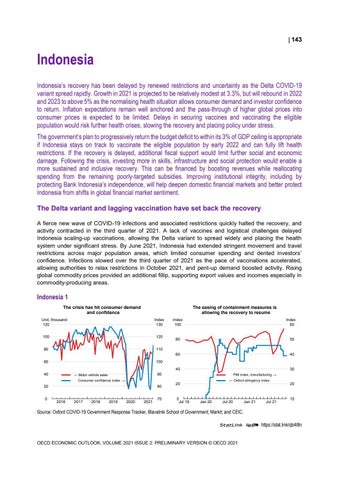

Indonesia Indonesia’s recovery has been delayed by renewed restrictions and uncertainty as the Delta COVID-19 variant spread rapidly. Growth in 2021 is projected to be relatively modest at 3.3%, but will rebound in 2022 and 2023 to above 5% as the normalising health situation allows consumer demand and investor confidence to return. Inflation expectations remain well anchored and the pass-through of higher global prices into consumer prices is expected to be limited. Delays in securing vaccines and vaccinating the eligible population would risk further health crises, slowing the recovery and placing policy under stress. The government’s plan to progressively return the budget deficit to within its 3% of GDP ceiling is appropriate if Indonesia stays on track to vaccinate the eligible population by early 2022 and can fully lift health restrictions. If the recovery is delayed, additional fiscal support would limit further social and economic damage. Following the crisis, investing more in skills, infrastructure and social protection would enable a more sustained and inclusive recovery. This can be financed by boosting revenues while reallocating spending from the remaining poorly-targeted subsidies. Improving institutional integrity, including by protecting Bank Indonesia’s independence, will help deepen domestic financial markets and better protect Indonesia from shifts in global financial market sentiment. The Delta variant and lagging vaccination have set back the recovery A fierce new wave of COVID-19 infections and associated restrictions quickly halted the recovery, and activity contracted in the third quarter of 2021. A lack of vaccines and logistical challenges delayed Indonesia scaling-up vaccinations, allowing the Delta variant to spread widely and placing the health system under significant stress. By June 2021, Indonesia had extended stringent movement and travel restrictions across major population areas, which limited consumer spending and dented investors’ confidence. Infections slowed over the third quarter of 2021 as the pace of vaccinations accelerated, allowing authorities to relax restrictions in October 2021, and pent-up demand boosted activity. Rising global commodity prices provided an additional fillip, supporting export values and incomes especially in commodity-producing areas.

Indonesia 1 The crisis has hit consumer demand and confidence

The easing of containment measures is allowing the recovery to resume

Unit, thousand 120

Index 130

100

120

80

110

60

100

Index 100

Index 60

80

50

60

40

40 40

Consumer confidence index →

20 0

80

2016

2017

2018

30

90

← Motor vehicle sales

2019

2020

2021

70

PMI index, manufacturing → ← Oxford stringency index

20

0 Jul 19

Jan 20

Jul 20

Jan 21

Jul 21

20

10

Source: Oxford COVID-19 Government Response Tracker, Blavatnik School of Government; Markit; and CEIC. StatLink 2 https://stat.link/qb4l8n OECD ECONOMIC OUTLOOK, VOLUME 2021 ISSUE 2: PRELIMINARY VERSION © OECD 2021