96

China Economic growth will reach 8.1% this year as the economy rebounds, but will slow to 5.1% in 2022 and 2023. The swift recovery, driven by strong exports on the back of re-opening of overseas economies and robust investment, has stalled in the second half of the year. A large real estate company’s default is shaking financial markets and confidence in the sector, thereby weakening real estate investment, an important engine of growth. Prospects for manufacturing investment have also worsened due to temporary power cuts in a large number of provinces. Consumption growth is stable, but adverse confidence effects coupled with inadequate social protection still hold it back. Consumer price inflation is low as there is only limited pass-through from surging prices in upstream industries. Monetary policy will remain prudent, ensuring sufficient liquidity, but refraining from significant easing. Fiscal policy will consolidate further to meet fiscal rule targets. The rebound of economic activities and the phasing out of COVID-19-related tax exemption and reduction measures has resulted in buoyant revenues. Reining in anti-competitive practices may cause disruptions in service provision in the short term, but will lead to greater efficiency over time. Confidence would be enhanced by more systematic implementation of anti-trust regulations. The authorities should adhere to their commitment not to bail out failing private enterprises to sharpen risk pricing. On-going electricity shortages and power cuts should be used to accelerate the transition toward renewables as well as the adoption of cleaner technologies. The number of cases is relatively low, but there is no rush to open borders Strict measures remain in place to keep the spread of the virus under control and sporadic outbreaks are suppressed by stringent, localised lockdowns, mass testing and mass isolation measures. Inoculation targets have been met and as of end-October nearly 80% of the population is vaccinated. A new large-scale isolation centre is being built in Guangdong Province for overseas arrivals. However, with the preponderance of virus variants that are more contagious and more difficult to trace, and the disruption of supply chains due to restrictions, the zero tolerance policy is increasingly questioned. Given the rapid spread of new variants and the high share of asymptomatic carriers (partly owing to vaccination), border controls are unlikely to be an effective way to remain COVID-free in the longer run.

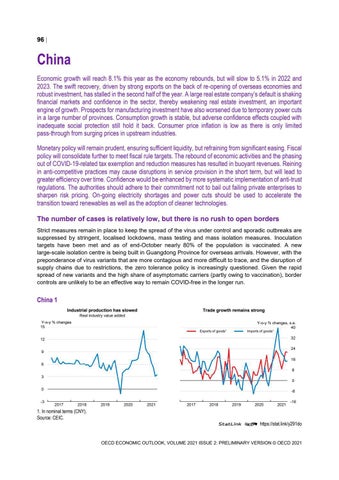

China 1 Industrial production has slowed

Trade growth remains strong

Real industry value added Y-o-y % changes 15

Y-o-y % changes, s.a. 40

Exports of goods¹

Imports of goods¹

32

12

24

9

16 6 8 3

0

0 -3

-8 2017

2018

2019

2020

2021

0

0

2017

2018

2019

2020

2021

-16

1. In nominal terms (CNY). Source: CEIC. StatLink 2 https://stat.link/y291do

OECD ECONOMIC OUTLOOK, VOLUME 2021 ISSUE 2: PRELIMINARY VERSION © OECD 2021