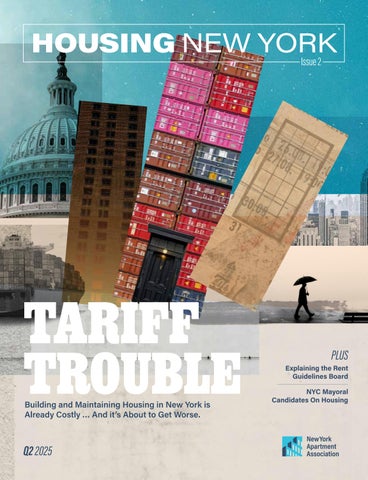

Explaining the Rent Guidelines Board

NYC Mayoral Candidates On Housing

Building and Maintaining Housing in New York is Already Costly … And it’s About to Get Worse.

Assured Paperwork has over 50 years of experience in digitizing documentation here in New York City. Assured Paperwork assists New York landlords with document scanning services, that moves their important paperwork to the cloud.

We offer Onsite and Offsite Scanning Services

Our experienced expeditors assist with helping to locate all important documentation on various NYC websites or government agencies. The benefits include saving office space, better customer service, less paper, enhanced security, ability to source records from anywhere, anytime.

Ask us for a Complimentary Real Estate Management Checklist

Ensure your properties paperwork are secured, safe, stored and available anytime, anywhere.

Avoid Rent Overcharge Complaints

Adjudicating a Rent Overcharge in Court or with the

By May 1, 2025, Local Law 157 mandates the installation of natural gas detectors in all NYC residences with gas appliances to monitor for leaks.

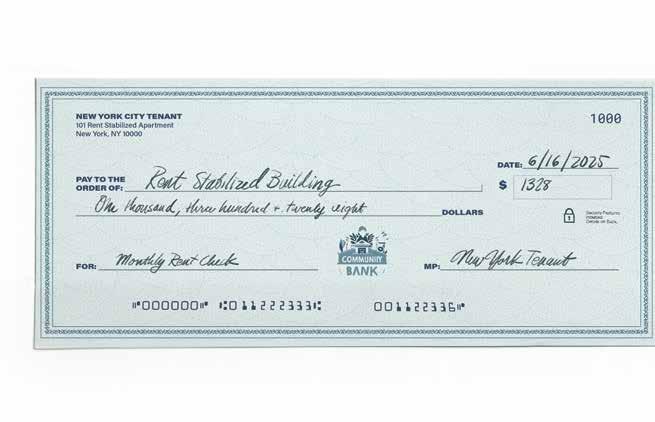

The average New York rent-stabilized apartment loses money, pre-mortgage, on operating expenses.

MEDIAN RENT: $1328

AVERAGE COSTS: $1379

Taxes: $350

Admin: $145

$113

Maintenance: $214 Labor: $125 Insurance: $166 Capital

METHODOLOGY : RGB data from 2023 is adjusted for inflation and reflects publicly available price data for fuel, insurance, water and sewer and property taxes.

The Rent Guidelines Board (RGB) releases detailed information on the expenses of operating an apartment in an older rent-stabilized building outside the Core of Manhattan. These buildings make up the majority of affordable housing in New York City. More than two-thirds of the buildings in this cohort are 100% stabilized and rely on RGB adjustments to cover operating costs.

This graphic highlights the most recent RGB data, which is from 2023, and shows where your rent check goes. NYAA has included additional data sources to more accurately reflect costs.

Housing is a top issue in the Democratic primary for New York City mayor. The winner of this contest will be the front-runner in the general election in November. Here is a brief rundown of where the candidates stand on this key issue:

The former governor has a plan to build 500,000 new homes, focusing on transit rich areas. He supports rent increases on stabilized units that keep up with rising costs. At a recent debate, he said the Rent Guidelines Board is an independent agency that needs to follow the law. Cuomo's housing plan and approach has gotten support from housing groups and in the media.

The assemblyman plans to build 200,000 government-controlled apartments using union labor for the low cost of $500,000, but does not explain how this is possible. He has pledged to freeze rents on stabilized units for four years. The New York Times noted Mamdani's approach would restrict housing supply, " and make it harder for new arrivals to afford housing."

Plans to expand upon the rezonings that have been passed in the City Council under her leadership. She has called for a rent freeze this year, but has not pledged to freeze rents every year. She said members of the Rent Guidelines Board will reflect the diversity of New Yorkers’ housing experiences. While Adrienne Adams track record as Speaker of the CIty Council has been mixed, her rhetoric on rent-stabilized housing and housing policy has some positive signs.

He introduced a plan to build and sustain one million homes by incentivizing private investment and upzoning large parts of the city. Has called for a rent freeze this year, but did not pledge to do so in the future.

His proposal would increase the supply of housing by 500,000 in ten years with mostly government-backed development, including repurposing four of the city’s golf courses. He has called for a rent freeze this year, but has not pledged to do so in the future.

She has proposed a Green New Deal for public housing, investment in expanded homeownership opportunities, and development of more supportive housing. She has called for a rent freeze, but has argued that property tax burden on rent-stabilized properties should be lowered to justify the freeze.

He hopes to unlock public land for housing development. He wants to aggressively seize deteriorating private property and use government funding to subsidize its redevelopment. He has called for a rent freeze this year, and in future years if the data backs it up.

He has called for an end to using credit scores for both renters seeking apartments and people seeking to purchase homes. His housing plan is centered around a Mitchell-Lama 2.0 and intends to build 600,000 new subsidized homes. If elected, he will call on the RGB to freeze rents.

He has advocated for abundant housing through incentives to private developers, streamlined permitting process, reforms to the Uniform Land Use Review Procedure (ULURP) and improving government capacity. He says the rent guidelines board should follow the data in making their decisions.

A ruling by the Appellate Division, First Department, in Matter of Stuyvesant Town-Peter Cooper Vil. Tenants Assn. v. NYS DHCR, 232 A.D.3d 484, has invalidated the waiver process implemented by the state Division of Housing and Community Renewal (DHCR) to approve costs for Major Capital Improvement (MCI) projects that exceed the agency’s reasonable cost schedule. The decision also held that the DHCR cannot approve a cost for any project or part thereof that is not listed on the reasonable costs schedule.

Since 2019, the DHCR has been required to publish a reasonable cost schedule for MCI work, which served as a guide for eligible project costs that could be claimed as an MCI. However, DHCR also allowed for owners to request a waiver from the cost schedule limits when MCI work exceeded those costs but were still reasonable under the circumstances. DHCR also recognized that not all types of work that could be MCI-eligible were listed in the cost schedule, and allowed owners to use the waiver process to claim that work - as long as it met the other requirements for an MCI.

But since this decision, the waiver process is no longer allowed for either purpose. The decision relied on the statutory language adopted in 2019, which states that the cost schedule is to “set a ceiling for what can be recovered” through an MCI rent increase. The court held that the statute is clear that the cost schedule is a ceiling, and therefore the DHCR’s decision to implement a waiver process to exceed the cost schedule in certain circumstances was beyond the authority granted in the new MCI statute.

Similarly, the waiver process can no longer be used to claim related expenses that are not specified in the cost schedule but which are necessary and related to the MCI. Although this has been a longstanding practice, the appellate court found that the new law prohibited DHCR from granting an MCI increase for any work, even related expenses that are necessary and customary as part of the larger project, if not listed on the cost schedule.

The small silver lining in the decision is that the court recognized DHCR’s authority to include the reasonable and necessary costs that are related to an MCI as part of the overall eligible cost for an MCI increase. But those related costs must be listed

in the cost schedule and cannot be determined on a case by case basis.

The DHCR decided not to appeal the decision to New York State’s highest court, the Court of Appeals. However, the agency is not expected to reopen orders that were previously granted using the waiver provisions. But it is still possible for tenants to request that those orders be revisited.

In a separate case also being pursued by the Stuyvesant Town-Peter Cooper Village Tenants Association, Stuyvesant Town-Peter Cooper Vil. Tenants Assn. v. New York State Div. of Hous. & Community Renewal, 2023 N.Y. Misc. LEXIS 85, the tenants are challenging the MCI eligibility of pointing work done on building facades. In particular, the tenants argue that pointing work is not depreciable under the federal Internal Revenue Code (IRC), and even if it were, the DHCR does not make its own determination on whether the claimed pointing work is depreciable as required by the MCI statute. The tenants pointed to DHCR’s existing regulations only requiring pointing and waterproofing “as

necessary” as conflicting with the statutory requirement that the work be depreciable. According to the tenants, if the pointing work was not extensive, but only on a small portion of the facade, the work should be considered a repair and therefore not depreciable.

The owners of Stuyvesant Town conducted Local Law 11 inspections at all buildings in the complex and performed pointing and other facade work where necessary. Although the DHCR granted the pointing work as an MCI, the tenants appealed under Article 78 and the Supreme Court reversed the DHCR’s order. In doing so the court held the “as necessary” standard was insufficient to meet the statutory requirement of determining depreciability of the work. The Supreme Court took issue with the fact that although the DHCR determined the pointing work was performed as necessary after a comprehensive inspection of all facades, some buildings only required a small portion of the facade to be worked on, and therefore the work was not substantial enough to be considered depreciable and was more akin to patchwork repairs.

The DHCR appealed the decision to the Appellate Division, First Department, and oral argument was heard in May. While it appeared from the judges’ questioning at oral argument that at least a few of them were skeptical of the lower court’s reasoning, a decision on the appeal has not been issued yet. But members who are contemplating facade pointing projects should be aware of the potential for changes in policy around the eligibility of the work as an MCI.

In 2024 the NYC Council passed the Fairness in Apartment Rental Expenses (FARE) Act which was designed to prevent real estate brokers from charging a fee to a tenant who rents an apartment when the broker is working with the owner through exclusive listings or some other relationship. Under the Act, brokers must represent tenants and be hired by the tenant in order to be able to collect a broker’s fee from the tenant in connection with finding an apartment to rent.

Shortly after the law was passed, a lawsuit was brought in federal court challenging the new law on several grounds, including free speech principles under the state and federal constitution, contracts clause principles, and state preemption. In a decision issued in June 2025, the Southern District of New York dismissed the plaintiffs motion for an injunction and all claims against the FARE Act, except for the contracts clause claim. See Real Est. Bd. of N.Y., Inc. v. City of New York, 2025 U.S. Dist. LEXIS 110088.

An appeal is possible, but as of this writing the FARE Act is in full effect. According to the SDNY decision, the contracts clause claim that remains is limited to agreements that were entered into before the FARE Act became law on December 13, 2024. Although there may be some relief for the limited category of brokers and owners with those pre-existing agreements, any listings or agreements made after the FARE Act’s effective date are subject to the new limitations on when a broker’s fee can be charged to a tenant.

BY KENNY BURGOS

“LADIES AND GENTLEMAN, THE BRONX IS BURNING.”

That encapsulated the decline of New York City in a single phrase. Yet just a few years earlier, there was clear evidence of the city’s decline in the financial situation of rent-regulated buildings.

Years of capped rents coupled with rising operating costs due to high inflation led to buildings with revenue that didn’t cover expenses.

Building owners were forced to choose between paying for fuel to heat their buildings or property taxes. Because owners picked fuel, the city’s budget suffered, contributing to the government’s plummet into bankruptcy.

Data released last week by the Rent Guidelines Board paint a picture eerily similar to what was happening in the Bronx before that day in 1977. The RGB report, which looked at 2023 data, showed that pre-1974 buildings in the Bronx are in severe distress.

More than 12% had operating costs that exceeded the building’s income, even before they paid the mortgage or did mandatory improvements like Local Law 97 compliance. When

you factor those things into the calculation, the majority of these older buildings are operating in the red. This is in line with various news reports about increased bankruptcy filings and buildings selling at ridiculous discounts of 70% or more. One building sold at a shocking 97% discount.

Overall, the number of older, rent-stabilized buildings failing to pay their mortgages shot up significantly in 2024.

In one case, a building owner is actually suing a bank because the bank refuses to take the building off the owner’s hands as part of the foreclosure process.

YOU READ THAT RIGHT: THE BANK DOESN’T WANT TO TAKE POSSESSION OF THE BUILDING BECAUSE IT KNOWS IT’S LOSING MONEY.

Buildings that are operating at a loss have no access to additional financing for emergency maintenance or mandatory improvements. Banks look at the potential for a building to repay a loan, and won’t extend a line of credit to a building that can’t clearly show that this is possible.

The unfortunate outcome for a building that has been defunded and is functionally bankrupt is an increase in violations. This comes from lack of money to make repairs, forced staff cuts and other disinvestment. And when a building doesn’t have the income to properly operate, the renters are the ones who suffer.

Government is making things worse, not better. Costly new mandates, like forcing building supers to pick through tenants’ trash to ensure proper composting or pay fines, add up and accelerate the decline in the quality of housing for hundreds of thousands of New Yorkers.

Our analysis shows that conditions in 2024 grew even worse for the majority of rent-stabilized buildings, which are located outside of the wealthiest parts of Manhattan.

Insurance premiums have shot up at an alarming rate; water and sewer costs are up more than 10%; fuel prices continue to rise — and even though most buildings have declining values, the city still raises their property taxes each year.

Three things must happen:

First, the Rent Guidelines Board needs to adjust rents above inflation, to make up for the past decade of below-inflation increases.

Second, the government needs to figure out a way to provide a tax break or other subsidy to the buildings that are in deep distress. According to the RGB data, 20% of pre-1974 buildings had no income or negative income in 2023 — yet still had to pay taxes.

Third, we need a more sustainable system going forward. This requires a hard look at the current regulations and adjustments to make sure buildings that are close to 100% stabilized can survive.

I’m a Bronx native, and I’m raising my family here. I don’t want to see my borough repeat the afflictions of the past. But when I see so many homes near bankruptcy, or already in the foreclosure process, it’s hard to be hopeful.

Kenny Burgos is the CEO of the New York Apartment Association and a former assemblyman from the Bronx.

The Jacobs family has been running F&F Supply for five generations. They provide supplies to thousands of multifamily build ings in New York City, selling everything from cleaning supplies to garbage cans to the DenovaDetect battery-powered natural gas detector that is now required to be placed in every apartment that has a gas stove.

“Uncertainty is the key word. We feel like we are on a yo-yo,” said Gary Jacobs, the owner of F&F. “With the tariffs, we are uncertain if we are buying from China or not buying from China. The current 90-day moratorium doesn’t help because we don’t know if shipping contain ers will get here before or after the moratorium is up.”

Fortunately, F&F hasn’t been forced to raise their prices too much, yet. They have a large warehouse and have stockpiled supplies for the past year. When they order goods to re-stock, they are forced to blend the in creased prices into the current supply, instead of simply jacking up costs.

(cont.) Like many generational business owners who have built relationships over decades of business, they are doing whatever they can to keep the prices low for customers. But sometimes it’s not possible. Goods that are on back order, like the natural gas detectors, come with a rider saying prices are subject to tariff fluctuations.

“All back order items have tariff provisions. And the building owners have been understanding of this. Many are also ordering ahead, because they know prices are just going to go up,” said Jacobs.

Items that could become particularly pricey are plumbing materials and hard rubber trash bins, which are generally produced in China with high quality and low-cost. Sourcing these items to domestic suppliers or even other countries that have less of a tariff burden would still lead to cost spikes for consumers.

Recent city mandates on trash containerization have made the need for heavy duty rubber trash bins more necessary. The cost of stocking, and

restocking trashbins that are approved by the Department of Sanitation will likely increase significantly unless the tariff policies shift.

Economists warn that tariffs, or even the threat of tariffs, will lead to higher rents for most people in New York City.

“By inflating building costs, these tariffs could deter builders from initiating new projects and compel developers to pause or scrap existing plans,” Realtor.com® economist Jiayi Xu wrote in their April New York City Rental Report.

The report suggests that new developments slated for Manhattan and the Bronx will be hardest hit by tariffs. It could derail projects that are in the pipeline and ultimately prevent New York City from reaching the modest housing targets.

The tariffs could also hurt the state’s ambitious climate goals. New York Focus reported that the New York City Housing Authority (NYCHA) has been relying on imported heat pumps from China as it moves to de-carbon-

ize its buildings. The innovative appliances plug into the wall like a normal air conditioner and don’t require outdoor components to heat and cool an apartment. The units have been applauded by residents and NYCHA was planning to scale up, but now they may not be able to move ahead with their original plan.

The uncertainty of future tariff policy is having a chilling effect on the larger economy, which in turn impacts housing policy in New York. Consum-

er confidence has dropped to pan demic-era levels. That has led many potential homebuyers from pulling the trigger, creating a chain reaction in the housing market. Homeowners including co-op and condo owners can’t find buyers for their homes if they are looking to sell. The poten

tial buyers are still renting, which increases demand and drives up rents. The result is a locked-in effect. People who want to move, either to downsize, or grow a family, or simply relocate to a new location, have limited options.

Unfortunately, things don’t look like they are going to get better. Federal Reserve Chair Jerome Powell has

Even if the tariff policy is solidified in the next few months, the damage is already done. The National Association of Home Builders estimates that average home prices are still going to go up by more than $9,000 due to the tariff policy changes currently in place. The exemptions for certain materials necessary for home building, like lumber from Canada, have helped

THE nATIOnAL ASSOCIATIOn OF HOME BUILDERS ESTIMATES THAT AvERAgE HOME PRICES ARE STILL gOIng TO gO UP By MORE THAn

$9,000 DUE TO THE TARIFF POLICy CHAngES CURREnTLy In PLACE.

warned that "we may be entering a period of more frequent, and potentially more persistent, supply shocks”, which means interest rates may remain high.

High interest rates have been a major deterrent to housing developers seeking to finance projects. They also have made it very difficult for older apartment buildings to refinance or secure capital for major repairs. This has led to deferred maintenance and building deterioration.

reduce some of the additional costs. But it has not been enough to stop the steady decline in housing permits across the country. Housing experts estimate that they are down by 12% from this same time last year.

NAHB Chairman Buddy Hughes told Newsweek that “uncertainty on the tariff front and rising construction costs are exacerbating housing affordability challenges.” Economists generally agree that housing prices will keep rising due to the added

costs from tariffs.

Still, there is some optimism. Apartment building starts increased significantly in April, compared to last year. This suggests that projects that were in the works are still moving forward despite the uncertainty of tariffs and high interest rates, at least for now. Starting the development of a multifamily building does not guarantee that it will be brought to completion in a timely manner. If costs rise due to tariffs, financing could become harder to secure, which would delay a building’s completion.

The “hope for the best, prepare for the worst” mentality seems to be how many people in New York City are approaching the tariff uncertainty as well. Building owners aren’t engaging in panic buying of supplies, yet. Developers aren’t axing projects, yet.

For Gary Jacobs and his family-run business, any certainty would be welcome.

“I have been bounced around so much it’s hard to keep track of what’s truth or fiction. It’s a mess.”

In nine out of the past ten years, the New York City Rent Guidelines Board has adopted rent adjustments that were below inflation. In total, the rent adjustments have been 14%, while inflation has gone up 23%. The RGB’s decisions have led to the devaluation of thousands of buildings, increased foreclosures, and bank failures. Currently, hundreds of thousands of rent-stabilized apartments cost more to operate

than the rents being collected, putting them at severe risk of deterioration and the long-term viability of this vital housing stock in jeopardy.

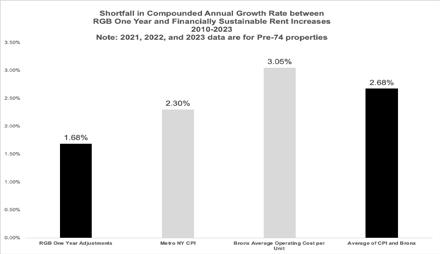

On April 10, 2025, Mark Willis, an NYU Furman Center Senior Policy Fellow presented research on the troubling decline in this housing stock. Their analysis showed that the RGB has fallen short in rent adjustments that keep up with costs by roughly 1% annually from 2010 to

2023. This has been particularly hard on the roughly 500,000 apartments that reside in highly stabilized buildings, where there are no deregulated apartments with market rents that are not limited by the RGB’s guideline. These buildings have no ability to increase revenue to cover operating costs other than the rent adjustment advanced by the RGB.

In short, roughly half of the rent-stabilized housing stock is being defunded.

Earlier this year the RGB announced a preliminary range for this year’s vote. That range is 1.75% to 4.75% on a one-year lease, and 3.75% to 7.75% on a two-year lease. Historically, the final vote has always fallen inside these ranges.

Before this Preliminary Vote, the RGB also released an analysis of the current rent-stabilized housing stock. In this report the RGB calculated a rent increase of 6.25% on a one-year lease was necessary to keep building operating budgets at current income to expense ratios - in other words to maintain the current levels of distress. This figure, called the commensurate adjustment, factors in the rising operating costs and current rents to determine what’s necessary to keep a 100% stabilized building healthy.

If the Rent Guidelines Board sticks to the preliminary range they approved earlier this year, then a majority of the rent-stabilized housing will once again be defunded.

Shortfall in Compound Annual Growth Rate between RGB One Year and Financially Sustainable Rent Increases 2010-2023.

Note: 2021, 2022, and 2023 are for pre-74 properties. Source: NYU Furman Center

The key data point that highlights the decline of rent-stabilized housing is net operating income (NOI). Each year, rent-stabilized buildings with more than 10 units, which make up roughly 75% of all rent-stabilized apartments, are required to open their books to the Department of Finance. The data submitted in the Real Property Income & Expense reports (RPIEs) is used by the RGB to calculate NOI. It is important to note that NOI does not account for debt service and capital reserves, so those additional expenses must be paid out of any NOI remaining.

The report released in 2025 uses RPIE’s filed in the Spring of 2024, which detail the entire year’s data from 2023. When the RGB casts its final vote on rent adjustments on June 30, they will be relying mostly on data that is 18 months old.

Even so, that data shows severe financial distress for the majority of rent-stabilized housing. The report publishes tables that breakdown the

income and expense data by borough and building age. The majority of rent-stabilized apartments, roughly 800,000, are in pre-1974 buildings that are located outside the core of Manhattan (which is defined as south of 96th street).

These buildings show steady decline of net operating income for as long as the RGB has been tracking this category of building. In 2023, the

Notes: Average operating cost per unit in Bronx Pre-47 housing with at least one rent stabilized unit. Does not include property taxes or water/sewer costs. Rightmost column implicitly assumes operating costs accounts for 50 percent of gross rental income.

Between 2022 and 2023 spending on maintenance and repairs declined by roughly 8%, despite costs of this work increasing. The deferred maintenance in older rent-stabilized buildings was the main reason that net operating income stayed constant instead of declining. But this

median net operating income was $361 per apartment, per month in these buildings. In 2022, it was $348. Adjusting for inflation, NOI from 2022-2023 is essentially flat.

When you look at NOI from 2018 to 2023 for the same category of buildings, a much more troubling downward trend develops. Adjusting for inflation, NOI was $479 in 2018, and has declined 24.6% since then.

cannot be a long-term solution, and is the same issue that led to significant deterioration of the housing stock in the 1970s and 80s/ If buildings can only maintain financial stability by reducing maintenance, the long-term sustainability of the bulk of NYC’s affordable housing stock is put at risk.

The majority of rent-stabilized apartments are in pre-war buildings

574 W 161st St.

June 2016 Sale Price: $9,194,669

September 2023 Sale Price: $2,287,325

Decrease Percentage: -75.12%

that require significant maintenance and capital investment. Historically, net operating income needed to stay around $500 per apartment, adjusting for inflation, in order to make sure there was adequate revenue leftoer to pay for mandatory upgrades that protected the long-term viability

of the housing stock.

As NOI declines, building quality declines. Renters will see this in slower repairs for non-emergency items like cracks to tiles. Over time, the building may not be able to afford a roof replacement if there are small leaks, instead opting for cheaper temporary repairs to address the problem. The more a building is defunded, the worse the conditions get. Eventually, the housing can become unsafe for renters.

Declining net operating income means the value of buildings is declining. Mortgages and debt service for buildings is calculated based on Net Operating Income. Non-profit housing providers tend to carry higher amounts of debt than for profit building owners, but they won’t exceed a debt service coverage ratio of 1.2, which means that you can only spend about 84 cents for every dollar of NOI on financing.

As the NOI declines, the allowable debt coverage by banks and lenders also declines. For example, a 40-unit building in 2018 may have had an average net operating income of $500 per unit. They would be able to get a loan from the bank with payments of $400 per unit at a responsible debt service coverage ratio of 1.25, allowing them to invest money back in the building for the future.

Over the course of five years, the net operating income declined by 25%, falling to $400 per unit. The mortgage on the building stays the same, bringing the debt service coverage ratio to 1. Apartment buildings have to refinance every 5 to 7 years. Since the NOI has declined, the bank will only

lend the building $333 per unit per month, if they are willing to lend at all. This means the owner of the building has to pay the bank significant money in order to secure a new loan.

In many cases, they cannot afford to make this payment, or do not want to invest more money into a failing building. This forces the bank to foreclose on the building, or enter into a pre-foreclosure in hopes of forcing a short sale. In either outcome, the renters lose. Buildings in foreclosure do not have access to additional funding in order to make emergency repairs, which puts the renters at risk.

One Bronx-based non-profit housing provider estimates that roughly 3,800 rent-stabilized buildings are currently in foreclosure or pre-foreclosure,

and therefore are unable to properly maintain their buildings.

The current state of distress is not the low point. All indications are that the financial health of rent-stabilized housing got even worse in 2024, as insurance premiums continued to skyrocket, fuel prices surged, and inflation remained sticky. We expect the Rent Guidelines Board reports in 2026 to detail this steady decline of net operating income for pre-1974 buildings in the outer boroughs.

The decline of rent stabilized property values does not just impact the owner and the lender. Recently a portfolio of rent-stabilized buildings in the Bronx, previously owned by the New York City Employees Retirement System and the Teachers Retirement System of the City of New York, sold for a loss of more than $160 million, adjusted for inflation. The 34 buildings with more than 2,000 apartments were systematically defunded over the

course of ten years due to operating costs rising faster than RGB adjustments. The owners of the buildings, to their credit, invested more than $31 million into the properties in the past decade to make sure they were well-maintained.

The story shows that the downfall of rent-stabilized buildings is not due to speculation, but a failure of the system. When the pension funds invested in the portfolio of buildings they were not expecting a windfall return and they were not backing a model of tenant turnover through eviction or harassment. They were simply hoping for a safe and modest return on their investment over time that they believed would be less volatile than the stock market.

capped the buildings with vacancy control on apartment turnover, which further devalued the buildings. Ultimately, retired teachers and city employees paid the price for these policy changes.

The story shows that the downfall of rent-stabilized buildings is not due to speculation, but a failure of the system.

Without substantive changes the picture is bleak. Mark Willis from the NYU Furman Center said distress will grow exponentially in highly rent-stabilized buildings, eventually bankrupting all of them. He added: “This is a large-scale problem: simply filling the gap with public subsidy could be very expensive over the long run.”

In the decade since that investment was made, the Rent Guidelines Board stopped adjusting rents to keep up with inflation and the passage of the 2019 rent laws handi-

By our calculations, the government would need to advance $432 million annually to sustain rent-stabilized properties in the Bronx alone, based on 2023 data. The price tag to save

Source: NYC Department of Finance, RPIE Filings

* Note that there are only 83 buildings of any year, and only 69 pre-1974 buildings, that contain at least one rent stabilized unit in Staten Island.

Sean Campion from the Citizens Budget Commission testified before the Rent Guidelines Board on May 22, highlighting their concern for the growing distress in older regulated buildings.

The testimony focused on the 100% stabilized buildings that were built before 1974. Their analysis found that many of these buildings are in “poor condition” and a growing number are in financial distress. They warned of a “death spiral” if action is not taken immediately to stop the physical and financial deterioration of this housing stock.

In their testimony, they warned that:

“Inaction will only further increase repair costs, push them onto the City and State, and threaten the quality of life of many of the 1.7 million New Yorkers who live in pre1974 stabilized units.”

They made two suggestions. First, they believe the Rent Guidelines Board must, at a minimum, keep pace with inflation. For the past ten years, the RGB has advanced rents below inflation.

Second, they call for the RGB to gather more information about the physical and financial well-being

of the stock. They called for this new report to look at building code violations, unpaid fees and taxes, and properties eligible for the city’s Third-Party-Transfer program.

In their testimony, they wrote:

“If the RGB worked with City agencies to produce an independent report drawing from these sources, the public could more easily understand both the physical condition of rent regulated housing and the change in conditions over time.”

Mark A. Willis from the NYU Furman Center testified before the Rent Guidelines Board on April 10, and expressed concern about the 100% stabilized apartment buildings, which house more than half of all rent-stabilized tenants in the city.

In his testimony, Willis expressed concern for the long-term preservation of this affordable housing stock. In his testimony he outlined that from 2010 to 2023 the RGB rent adjustments “fell short of what is needed to cover increased operating costs and inflation by roughly 1 percent per year in pre-1974 rent-stabilized buildings in the Bronx.”

He stressed that this defunding has put most of the regulated buildings in the Bronx in financial distress.

In his testimony he said:

“The analysis is particularly relevant to roughly 500,000 units that are in 100 percent rent stabilized buildings. Of those, approximately 200,000 are in unsubsidized buildings, built before 1974 and have below median rents relative to other properties, and another roughly 300,000 are in the city’s subsidized affordable housing stock.”

Furthermore, Willis was concerned with the decline in spending on maintenance in these properties over time. His analysis showed a 6.86% decline in 2023 for 100% stabilized buildings. This cutback is often a precursor to increased violations and physical deterioration of buildings.

They warned of a “death spiral” if action is not taken immediately to stop the physical and financial deterioration of this housing stock.

This muffler shop in the Bronx is being sold as a vacant lot and is worth more than a 10-unit apartment building next door that loses $3000 a month.

Afew months ago the New York Apartment Association took a trip to Jerome Avenue in the Bronx. Less than one mile from Yankee Stadium was a muffler shop that was for sale for $1.2 million.

Next door, on the same sized lot, stood a 10-unit rent-stabilized apartment building with two commercial spaces on the first floor. The building had full occupancy, including the two commercial storefront tenants, but tax challenge filings reveal that the building lost almost $40,000 in 2023, the last year the records were available for the building.

In total, the building collected $193,712 from rent. $36,000 of that

came from the retail space. The other ten units have an average rent of $1,314. The operating costs for the building were $190,448 before taxes. That included $85,010 in repairs and maintenance, and $53,600 in fuel to heat the building. The taxes on the building were $41,639.

Like many buildings in the Bronx, this building was financially healthy in 2020. The net operating income, or amount of revenue leftover after the building made all of the required expenditures, was a modest $21,459.

Years of rent adjustments below inflation have eliminated this modest margin, as operating costs continued to rise. The result is a building that is actually decreasing the value of

the land it sits on. With the current rent regulations and negative net operating income for the building, you couldn’t sell it for $1.2 million –the price for the muffler shop next door, which will be torn down to be redeveloped.

When the land is worth more without the building on it, the natural inclination for property owners is to move to demolish the building. Under current state laws, the cost of demolition is often too high. It requires the building owner to invest significant amounts of money on lawyers to file with the state to evict the current tenants. The owner then has to pay the tenants relocation costs.

In many cases, the owner of the

building can’t actually afford to pay for the demolition process. They also can’t afford to pay the property taxes on the building. NYAA estimates that several thousand buildings in the Bronx are in this current position. Recently, the city government brought back the Third-Party-Transfer Program. This will allow the city to seize buildings that are not paying taxes or being subject to emergency

for the current capacity of the city government or the approved sponsors who may be able to take over some of these buildings. For every building that is rescued by the city, there will likely be 15 to 20 more that simply fall into disrepair.

As these buildings fail they will need emergency repairs to be conducted by the city. Under that process, the bill for the repairs is sent to the

get doesn’t allocate enough money to pay for the scale of repairs that will be needed.

In our social media video we joke, “who would want to buy a building losing $3,000 a month.” The better question may be where New York City is going to find billions of dollars to bail out these buildings. With

repairs and transfer ownership to sponsors who pledge to invest money into the buildings.

But the scale of the crisis is too large

owner. But if the building cannot pay the property taxes, they also won’t be able to pay the city back for the repair bill. Additionally, the city bud-

BY BOB KNAKAL

Legislators in Albany celebrated in June of 2019 when the Housing Stability and Tenant Protection Act of 2019 was passed. Many of them now regret it, some even openly admitting it, as it has been the worst thing that has ever happened to our housing stock in the history of New York City. It is negatively impacting landlords financially and creating living conditions for tenants that are reminiscent of the urban decay of the 1970s.

It is estimated that HSTPA has vaporized hundreds of billions of dollars of asset value in the apartment building sector in New York City. When expenses rise faster than rents, there is simply no incentive to invest in the housing stock. This is bad for owners and bad for tenants.

HSTPA crushed two of the best programs legislators ever created the Major Capital Improvement Program (MCI) and the Individual Apartment Improvement Program (IAI). In 1978, the dilapidation rate in the New York City housing market had reached 14%, meaning 14% of the housing units were deemed uninhabitable because of their poor condition. The MCI and IAI programs were created which incentivized the private sector

to invest tens of billions of dollars into the housing stock and by 2018 the dilapidation rate had fallen to 0.04% and living conditions, and the quality of life, for all tenants (except those living in public housing) got considerably better.

HSTPA marginalized both of those programs to the point where owners would rather keep units vacant, that had previously been stabilized, where tenants vacated. At its peak, estimates were that as many to 60,000 to 80,000 units we're sitting unoccupied. That didn’t help owners and didn’t help any tenants.

making the loan on the property is also significantly impaired.

The financial health of property owners and lenders in this space is getting worse by the day. Look no further than the way the FDIC handled the sale of the Signature Bank loans.

HSTPA marginalized both of those programs to the point where owners would rather keep units vacant, that had previously been stabilized, where tenants vacated.

With an extended period where building expenses increase at a greater rate than rents were allowed to increase, cash flow in regulated apartment buildings has gone down significantly and, in many cases today, are negative. The diminution in value within this stock has been about 40% to 60% depending on percentage of regulated units and location, meaning that not only has the property owner’s equity been completely wiped out, but the bank

They didn't sell the loans. They sold a servicing contract on the loans. Their fear was that if the loans sold at their true value, it would put dozens of other banks out of business overnight. They couldn't let this happen so the transaction was structured in such a way as to the camouflage the real deterioration in value.

Making matters worse, the requirements of an owner and the liability associated with owning these buildings is so disadvantageous that even when a property owner would like to hand the keys back to the bank, because they can no longer make mortgage payments, the bank wants no part of taking title to the building.

The fact is that, generally for regulated apartment buildings, if you purchase a property, and even own it for just one day, you are liable for the misdeeds of all past owners. In a foreclosure process, the misdeeds of the previous owners are wiped out but the liability for rent overcharges moving forward would then flow to the lender or whomever the lender sells the property.

In a contentious foreclosure process, the property owner has tremendous leverage over the lender because they control the paperwork that dictates the legality of the rents. I have often said that since HSTPA passed, a seller of an apartment building is not selling the building as much as they are selling the boxes of paperwork in the management office. To the extent the owner does not turn those records over, the value of the properties are significantly lower. Some owners use this as leverage to get off, or reduce, personal guarantees and to minimize their exposure to the lender.

Either way, neither the owner nor the lender has any incentive to invest money into the building making living conditions far worse for the residents of the building. Bad for owners and bad for tenants.

The solution to our housing crisis is completely on the supply side. The solution would be to bring back the old 4/21 a tax abatement program to incentivize the private sector to build more housing.

During the pandemic, vacancy soared and free market rents in Manhattan dropped by 30%. No one disputes that. There is not a housing policy that's been implemented by any municipality around the country that has made rents go down by even 5%. If this isn’t indicative of the fact that we need new supply, I don't know what is. Even legislators who do not believe in economics can't look past the fact that we had this massive drop in rents during the pandemic. Create the correct incentives for new construction and we will get all the supply we need.

The 485X tax abatement program, which is supposed to incentivize new construction, is woefully inadequate and misguided. When you try to satisfy everyone with one piece of legislation, you end up satisfying no one.

Solutions to our housing crisis would include reinstating the MCI and IAI programs as they incentivized owners to fix up vacant units. This doesn't hurt any existing tenant. We should also have a system where tenants prove that they deserve rent stabilized protections. Would we hand out food stamps to folks randomly walking out of Grand Central Terminal? Of course not. Why hand out housing subsidies randomly? Advocates say means testing is too cumbersome, but the fact is that a tenant in an affordable component of a mixed building must prove they deserve to occupy one of those units. The same thing should be done for all stabilized tenants.

The political pendulum here has to swing back, or we could see that 14% dilapidation rate from the 1970s return. But that political pendulum is as heavy as I have ever seen it

This 3BR Apartment in northern Manhattan needs $120,000 in renovations. The average monthly operating cost is $1020. The new allowable rent after making required renovations is only $1046.

in 41 years doing this. It will take a herculean effort to get there. Maybe that effort will be created by so many tenant complaints about living in buildings that are in advanced states of disrepair and will only get worse under the current system.

All of this turmoil can only be directed in one place – our policy makers. To effect change, make sure you get out and vote so that we can help swing the pendulum. Not swinging it will have a devastating impact on everyone.

Bob Knakal is the Chairman & CEO of BKREA and has been a leader in real estate brokerage for decades.

April 1, 2025—ironically, April Fool’s Day—the New York City Department of Sanitation (DSNY) flipped the lid on a new era of waste management with the full rollout of its mandatory composting program. But for many property owners and managers, the policy has felt more like a bad joke than a green revolution.

Under the new rules, all food waste must now be separated from regular garbage. Tossing an apple core in the wrong bin? That’s now grounds for a fine. While this sounds simple enough on paper—or maybe banana peel—it’s causing a real stink in practice. Particularly for large multiunit buildings, the law has created a dumpster fire of logistical and financial headaches.

In single-family or two-family homes, the property owner likely holds the composting reins and can ensure compliance with the law. But in the sprawling towers of New York’s rental landscape, it's not so easy to keep tabs on what tenants toss. Simply plopping a green bin in the basement doesn't guarantee participation—especially when building owners are the

ones left holding the (garbage) bag.

Under the DSNY's new policy, if a tenant fails to comply, the building owner can be fined. These fines cannot be passed on to renters, even

oration—not compost confrontation. But unfortunately, the city didn’t let the compost cool. Fines started being issued from day one. DSNY began citing buildings where tenants failed

the bottom of the barrel. Now, these buildings face a new dilemma: spend precious resources hiring staff to comb through coffee grounds and eggshells, or pay steep fines for noncompliance.

Weeks after the policy's implementation—and after significant pushback —the city quietly dialed things down. DSNY announced it would no longer issue fines to buildings with fewer than 30 units. It was a small victory,

but for larger buildings, the waste wars rage on.

For those still under the microscope, the policy continues to be a load of rubbish. Without a mechanism to hold tenants accountable, building owners remain on the hook for someone else’s half-eaten burrito.

cause we can all get behind. But green policies need to be rooted in fairness, transparency, and shared responsibility. Otherwise, it’s just a pile of poorly composted problems.

At the end of the day, most property owners support sustainability goals. Turning waste into soil, not strife, is a

Until then, many owners feel stuck between a bin and a hard place— trying to save the planet while not letting their bottom line rot.

June 30 RGB Final Vote at El Museo del Barrio, 1230 5th Avenue in Manhattan

July 1 Annual Water and Sewer Charges Due: Last day for paying without incurring a penalty for buildings billed on a fixed annual rate

July 1 Property Taxes Due: For buildings assessed at more than $250,000 the semi-annual payment is due. For buildings assessed at less than $250,000, quarterly payment is due.

July 4 Sanitation Workers' holiday. No garbage pickup, no street cleaning.

July 31

Rent Registration Deadline: Last day to file Annual Apartment Registration (form RR-2A) and Annual Registration Summary (form RR-2S).

August 1 Benchmarking Notice of Data Inaccuracy: Failure to submit a report correcting any errors prior to the next quarterly deadline (Aug. 1, Nov. 1, and Feb. 1) will result in a violation for each period of non-compliance.

August 9 Local Law 31 Deadline: Owners must use an Environmental Protection Agency (EPA) certified inspector or risk assessor to conduct XRF testing for the presence of lead-based paint in a dweliing unit. The inspection must take place before this date.

August 15 Supplemental Storefront Registry: Vacant units on June 30 must be reported.

August 28 Annual Elevator Inspection Report: Last day to file by mail the Elevator (ELV3) annual inspection form.

August 31 HPD MDR Registration: Last day for owners of buildings with three units or more to file property registration with HPD. A $13 fee will be included in your property tax bill. Noncompliance can lead to civil penalties.

September 1 Last Day to File RPIE Rent Roll: Properties with an actual assessed value of $750,000 or more are required to file an addendum containing rent roll information

September 1 Labor Day: Sanitation workers holiday. No garbage pick-up. No street cleaning.

Learn More: For further deadlines subscribe to our calendar and subscribe to our substack

Rent-stabilized buildings in the Bronx are dying. Thousands of properties housing tens of thousands of renters are in severe fiscal distress, meaning they don’t collect enough rent to pay for basic things like maintenance, insurance and taxes.

On Thursday April 10, the New York City Rent Guidelines Board released data that tells us exactly what needs to happen if we are going to save these rent-stabilized apartments from further deterioration.

In it, they said a rent adjustment of 6.25% on a one-year lease is needed to stop the bleeding for thousands

of buildings, including the majority of rent-stabilized properties in the Bronx.

Let’s be clear. This is just math. Last week, the NYU Furman Center also testified about the severe distress that rent-stabilized buildings are facing. In their testimony they said at least 200,000 apartments are at risk.

We believe it is more than that. Hundreds of thousands more apartments are also at imminent risk of failure. They are in Pre-1974 buildings in the outer boroughs that are struggling to stay above water. If they fail, the consequences will be dire for New York and for the renters who live in these buildings.

If we view rent-stabilized housing as a dying patient, then the RGB is the emergency room doctor. Their job is to save these buildings from imminent failure by listening to the data and advancing a rent adjustment that prevents further damage. The long-term recovery of these buildings is up to elected officials. If they don’t address skyrocketing

Many buildings have failed to start mandatory upgrades or inspections simply because there is no money to do these things.

Already we are seeing an uptick in violations and renters are seeing delays in repairs. Many buildings have failed to start mandatory upgrades or inspections simply because there is no money to do these things. The reality is things are getting worse, not better.

costs that they control, then the buildings will die.

According to the PIOC released Thursday, property taxes on these buildings increased by 3.9% last year, which was above the projected increase of 3.6%. This was due to the New York City Department of Finance increasing the assessment on the

"Already we are seeing an uptick in violations and renters are seeing delays in repairs."

buildings, even though the real market value has declined dramatically.

Another cost the government controls, indirectly, is fuel costs. The state Public Service Commission sets the rates for natural gas transmission. When they increase those rates, the cost to heat a building increases. According to the PIOC, fuel went up 10.3%, when it was projected to decline by 6% by the RGB.

Utilities like water and sewer and non-heating gas and electricity also went up significantly. These prices are all set by various government boards. PIOC said those costs went up 8.2%, when they were projected to only go up 2.4% last year.

You are probably seeing a trend. The RGB makes projections that dramatically underestimate the actual costs of providing housing. Over the past five years, they typically underestimate costs by an average of $111 million for Pre-1974 buildings. Since 2019, the RGB has consistently defunded buildings. By our calculations it would require a 20% increase

to catch up with the disinvestment in pre-1974 buildings in just the Bronx. In total, building finances are an estimated $736 million below 2019 levels.

Since 2019, the RGB has consistently defunded buildings. By our calculations it would require a 20% increase to catch up with the disinvestment in pre-1974 buildings in just the Bronx

We aren’t asking for rents to rise that much. We’d much rather elected officials focus on lowering costs or providing more support to the thousands of buildings that are going bankrupt.

If the RGB and the government don’t act, renters are the ones that will suffer when buildings have no money to pay for emergency repairs or mandatory upgrades. Foreclosure will just make things worse as banks try to minimize losses on the properties by reducing spending on maintenance.

The government may be able to step in and help some buildings, but they only have the budget and staff to save a few dozen buildings a year – not 1,000.

The reality is that most of these buildings will decline into a state of disrepair or complete degra-

dation, unless something is done to reverse this trend.

As the NYU Furman Center said, this problem is growing, possibly exponentially. It could potentially lead to the complete collapse of rent-stabilized housing in New York City in as soon as a few years.

Rent-stabilized buildings are dying and this is triage. The only way we can stop the bleeding is by adjusting rents by the 6.25% on a one-year lease, which is what the data says is necessary. And then we will still need all stakeholders to step up and find a permanent solution to save these buildings.

Kenny

Burgos is the CEO of the New York Apartment Association and a former assemblyman from the Bronx.

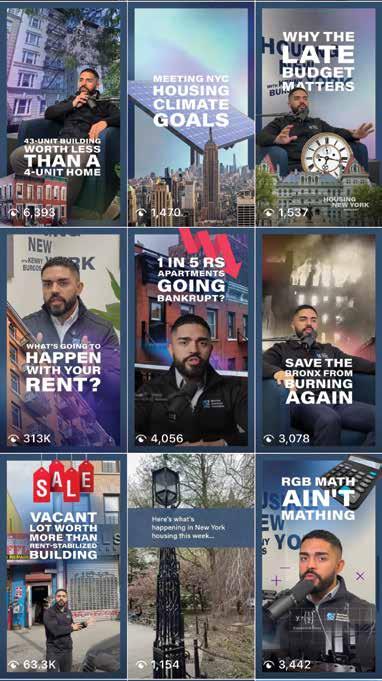

The New York Apartment Association: Leading the Dialogue on Housing Issues Across Social Media.

The New York Apartment Association (NYAA) is your premier source for all things housing, boasting millions of views and some of the highest engagement rates of any housing trade group in the country.

Our social media platforms are buzzing with conversations that matter—featuring exclusive insights from housing experts and public officials, dialogues with advocates, and stories from tenants across New York.

stay

Our social media channels are the go-to destination for anyone passionate about housing in New York. Whether you’re a property owner, tenant, or advocate, there’s a place for you in the conversation.

FOLLOW US! @HousingNY

Visit HousingNY.org to learn more and connect with us online!

The official publication of the New York Apartment Association

Chief Executive Officer

Kenny Burgos

Senior VP of External Affairs

Jay Martin

JMartin@housingny.org

Communications: Michael Johnson

MichaelJ@housingny.org

Advertising/Sales: Lisa Richmond

LRichmond@housingny.org

Andrew Pap

AndrewP@housingny.org

Housing New York Magazine is published semi-regularly

Publisher: New York Apartment Association, 123 William Street, 12th Floor, New York, NY.

USPS#: 013163

Telephone: (212) 214-9297

Periodicals postage paid in New York, NY

General Research Division, The New York Public Library. "Great American Shrike, 1. Male 2. Female 3. Young (Cratagus. Apiifolia.)" The New York Public Library Digital Collections

On-Time Rent, No Tenant Chasing

We

24/7 Repairs, No Late Night Calls

Maintenance

Stress -Free Compliance

We

Our