HOUSING

EXCLUSIVE POLL: 61% OF NEW YORKERS SAY CURRENT HOUSING POLICY IS MAKING THINGS WORSE, NOT BETTER

EXCLUSIVE POLL: 61% OF NEW YORKERS SAY CURRENT HOUSING POLICY IS MAKING THINGS WORSE, NOT BETTER

Assured Paperwork has over 50 years of experience in digitizing documentation here in New York City. Assured Paperwork assists New York landlords with document scanning services, that moves their important paperwork to the cloud.

We offer Onsite and Offsite Scanning Services

Our experienced expeditors assist with helping to locate all important documentation on various NYC websites or government agencies.

The benefits include saving office space, better customer service, less paper, enhanced security, ability to source records from anywhere, anytime.

Ask us for a Complimentary Real Estate Management Checklist

Ensure your properties paperwork are secured, safe, stored and available anytime, anywhere.

Important Filings

Leases

Avoid Rent Overcharge Complaints

Adjudicating a Rent Overcharge in Court or with the DHCR

Seamless sale of your property because all of your building paperwork is available in a concise and orderly fashion

New York City’s Property Tax System has been described as unfair, unjust, and even was labeled racist by the NAACP.

A lawsuit brought by the Tax Equity Now New York coalition argued that “Apartment building owners pay a very high tax burden making it dificult to build and keep afordable housing units.”

New York City taxes rental apartments higher than any other city in the country. We surpassed Detroit, Michigan in 2014* and the taxes on apartment buildings have just kept growing for the past decade.

* http://www.lincolninst.edu/ publications/other/50-state-propertytax-comparison-study

Former New York City Mayor Bill de Blasio’s 3-family home in Park Slope pays $8,703.63. That’s roughly $5.22 per square foot.

An 8-unit rent-stabilized apartment building around the corner pays $28,548, which is about $13.03 per square foot.

Across Prospect Park, there is a 68-unit rentstabilized building that pays $207,172 in taxes or $20.78 per square foot: Roughly 4 times as much as the former mayor’s home.

On the same block in Astoria, two diferent buildings tell a story that defines New York’s broken property tax system.

Every month, tenants in a rentstabilized building scrape together close to $2,000 for rent. What they don’t realize is that nearly a quarter of that, about $500, isn’t going toward repairs, maintenance, or even the owners bottom line. It’s going straight to property taxes. In just one year, that single building paid $312,000 to the city.

Just a few doors down, the picture couldn’t be more diferent. A

two-family home on the same block pays about $300 a month, less than $4,000 a year in property taxes for the entire house. The owners enjoy a steadily appreciating asset that has doubled in value over the past decade, while paying pennies on the dollar compared to their renter neighbors.

The math is jarring. Tenants in the rent-stabilized building, including Assemblyman Zohran Mamdani,

who lives there, are efectively shelling out $6,000 a year in taxes through their rent, while nearby homeowners skate by with a fraction of that bill.

This is the product of a property tax system that for decades has shielded homeowners and shifted costs onto renters. The very buildings that provide afordable housing, particularly rent-stabilized ones, have been saddled with disproportionate tax burdens. As a result, renters, who don’t even hold the deed, are subsidizing a system designed against them.

The consequences ripple far beyond this one block in Astoria. Across New York City, the backbone of afordable housing is being pushed to the financial brink. Taxes climb higher each year, while these buildings

struggle to cover rising costs and keep apartments livable. Meanwhile, homeowners continue to enjoy artificially low bills, further widening the gap.

Fixing the system means confronting decades of policy that has entrenched inequality, easing the tax load on stabilized apartments, and gradually shifting the burden so everyone pays their fair share. And most urgently, it means immediate relief for buildings that are 100% or nearly 100% stabilized, the housing stock New York cannot aford to lose.

If nothing changes, the story writes itself. Renters will keep shouldering an unfair tax burden, homeowners will continue to reap the benefits, and the city’s afordable housing will collapse.

AND MOST URGENTLY, IT MEANS IMMEDIATE RELIEF FOR BUILDINGS THAT ARE 100% OR NEARLY 100% STABILIZED, THE HOUSING STOCK

New York Housing Court

Upholds DHCR’s “as necessary” Standard for Pointing and Waterproofing MCIs

As reported in the last issue of the Housing NY Magazine, a case coming out of Stuyvesant Town/Peter Cooper Village challenged the way in which the Division of Housing and Community Renewal (DHCR) determines whether pointing and waterproofing work done in conjunction with Local Law 11 façade inspection requirements was eligible for a major capital improvement (MCI) rent increase. The tenants’ association argued that the DHCR was required to determine if pointing and waterproofing work could be depreciable under the Internal Revenue Code (IRC), as required by the statute, and that only projects with a substantial amount of façade work could meet that definition. According to the tenant’s argument, any work that was limited and not encompassing the entire façade should be characterized as ordinary repairs and maintenance. As a result, the “as necessary” standard employed by DHCR was inappropriate to make a proper determination about depreciability of the work as required under the statute.

While the DHCR found that the work was comprehensive, according to the contractors’ statements that all facades were inspected, and work was performed as necessary (according to diagrams submitted by the contractor), the tenant’s filed an Article 78 petition in which a NY County Supreme Court agreed with the tenant association’s arguments and held that the DHCR did not properly determine whether the claimed work was depreciable under the IRC. If left to stand, this would have altered the way in which DHCR approved pointing and waterproofing MCIs, and creating a very dificult to meet standard. However, upon appeal to the Appellate Division First Department, the lower court was reversed and DHCR’s long-standing practices and regulations around pointing and waterproofing MCIs were upheld. The tenants association’s request for permission to appeal was denied, so this case remains the final say on the matter.

(Matter of Stuyvesant Town-Peter Cooper Vil. Tenants Assn. v NY State Div. of Hous. & Community Renewal, 239 AD3d 528, 529 [1st Dept 2025]).

While this decision is a victory for good housing policy, there are still significant questions looming for MCIs related to façade work, as

much of the related and necessary costs that accompany façade MCIs far exceed the caps for work allowed under the MCI Reasonable Cost Schedule. No longer is DHCR permitted to exceed the cost schedule caps, or approve the cost for work that is not listed in the cost schedule, and those limitations could render the MCI program useless for these projects. However, DHCR updates the cost schedule annually and has an opportunity to ensure it aligns with actual costs for 2026.

In another win at the Appellate Division on MCIs, the court sent a case back to DHCR for failure to establish a rational basis in denying work that restored amenities to the outdoor areas of an apartment complex after completing a concrete resurfacing project. The resurfacing project was performed at a large apartment complex, which required removing all existing outdoor amenities – such as basketball courts, playgrounds, landscaping, and outdoor recreational areas – in order to properly perform the resurfacing. In the MCI order, the DHCR denied the costs of restoring

the outdoor amenities based on their determination that the restored amenities were beyond the scope of what previously existed. In other words, the restored amenities were above and beyond what used to be there, and DHCR used this rationale to find that they were not MCI eligible under an internal policy that tenants should not be made to pay an added MCI increase for ancillary work that went beyond the scope of what was necessary to restore the pre-existing features which had been removed.

The DHCR made this determination based on its own analysis of before and after photographs, despite afidavits from the owner’s engineer explaining that the restored amenities were comparable and were only enhanced when required to comply with building codes. Despite already being on remand from an Article 78 petition several years ago relating to the same issue, the DHCR again denied the costs for plumbing, electrical, playground construction, and other work related to restoring the outdoor facilities at the complex.

The owner filed a second Article 78 petition, which was denied by the Supreme Court, and the owner appealed to the Appellate Division, which remanded the case (again) to the DHCR for consideration of the additional costs for restoring the outdoor amenities as part of the overall resurfacing MCI, as both other necessary work performed in connection with, and directly related to, the approved MCI, and whether any diference was required for code compliance. (Matter of Promenade Nelson Apts. LLC v NY State Div. of Hous. & Community Renewal, 239 AD3d 490, 491 [1st Dept 2025]).

An owner filed a sub rehab application in 2021 that was denied by the agency. The owner never filed a petition for administrative review. In 2024, the owner filed another sub rehab application, claiming that the prior order was issued without review of all the evidence in the record, and was denied due to procedural defaults rather than on the merits of the application. The DHCR has refused to process the second application, claiming that there is no new evidence being presented and the prior order denying the sub rehab application has preclusive efect under principles of collateral estoppel and res judicata. The DHCR’s position was upheld on Article 78 review, but the owner has filed a Notice of Appeal to the Appellate Division. (Matter of 379 S 5 LLC v NY State Div. of Hous. & Community Renewal, 86 Misc 3d 1253[A], 2025 NY Slip Op 51270[U], *4 [Sup Ct, Kings County 2025]).

In a new twist on the use of class actions to bring overcharge claims, an appellate court granted class certification to tenants of 22 buildings managed by A&E Real Estate Management on the issue of whether there was “a methodical attempt to illegally inflate rents” across the various buildings. The apartments are al-

leged to have experienced excessive increases from IAIs and improperly used preferential rents to improperly deregulate the units and otherwise inflate rents. Earlier this year, a New York County Supreme Court decision denied the plaintif ’s motion for class certification on the basis that the “common issue” for which class certification was being sought would still require proof as to damages and liability on a claim-by-claim basis for each member of the class, and therefore class certification would not streamline or expedite the case compared to other methods of adjudication. However, on appeal, the Appellate Division reversed the lower court decision and granted class certification on the broadly defined issue. While class certifications have been granted before, this is the first case in which the issue for class certification is defined so broadly it encompasses several diferent theories. The Appellate Court relied on the Court of Appeals decision in Maddicks v. Big City for the notion that a lack of commonality did not defeat a motion for class certification. However, Maddicks was not a decision on class certification, but on a motion to dismiss, and the diferent posture of that case required a diferent analysis that should not have been used by the court in this case. The Court of Appeals has never reviewed the issue of class certification for rent overcharge claims that arise from a variety of diferent theories and approaches just because they are related to the same owner or management company, and the owner is seeking leave to appeal this decision to the Court of Appeals. (Staford v A&E Real Estate Holdings, LLC, 240 AD3d 421, 423 [1st Dept 2025]).

The first step towards solving a problem is admitting there is a problem. For the past several years there have been countless politicians who have said New York is in a housing crisis. There have been some solutions proposed, a few things have passed, and occasionally elected oficials have patted themselves on the back for these developments. But despite everything that has been done over the past decade, voters have continued to sour on housing policy.

In August, the New York Apartment Association commissioned a poll on housing policy in New York City. Speaking to 1,000 voters, we found that there was near universal agreement on one thing: housing is broken.

We specifically asked the voters if they believed the current housing policies and rent regulations are helping to improve housing or are they making things worse. The results were overwhelmingly negative, with 61% of respondents saying the government is making things worse and only 11% saying policy is improving the situation.

Do you believe New York City’s current housing policies and rent regulations are helping to improve thehousing situation or making things worse?

The disapproval with housing policy was bipartisan with 62% of Democrats saying policy is making things worse, along with 66% of Republicans and 55% of independents. Younger voters, between 18 and 39, were the most upset with housing policy with 66% saying they were making things worse. A majority of older voters, over 65, also said politicians were making things worse at 54%.

What was potentially the most eye-opening response came from rent-stabilized tenants who were surveyed. Among this group, 65% said that housing policy and rent regulations were making things worse and only 12% said politicians were improving the situation.

One of the reasons the vast majority of voters think things are getting worse is what they are seeing. We asked if the number of afordable apartments had increased or decreased in recent years and 48% said it decreased, with only 19% saying the number had increased.

In the past few years, do you believe the number of afordable apartments available for rent in New York has increased, stayed about the same, or decreased?

In the past ten years, the New York City Department of Housing Preservation and Development reports that they have created about 67,000 afordable homes. They also say they have preserved about 135,000 afordable homes. Preservation projects generally focus around the government providing subsidies to nonprofits to take control of failing apartment buildings. While rescuing these buildings is a vital part of the city’s eforts to preserve afordable housing, it is expensive and pulls resources away from creating new supply.

From 2010 to 2023, the overall supply of housing in New York City grew by an estimated 307,000 or about 7.4%. This may sound like an achievement, but the national average for housing growth in that time was 10.3%, which was still not enough to keep up with population growth in the country.

The result of failing to build enough new housing and spending so much of the city’s resources on rescuing failing buildings has been that supply has not kept up with demand. That leads to more competition for available apartments, higher rents and bidding wars, and more frustration for renters.

Renters in stabilized apartments with below market rents often feel trapped. They may want to move to another neighborhood in the city that is closer to their job, or their family, but they cannot find an apartment with a similar rent in their desired location. Rent control policies have long been criticized for the chilling impact they have on the dynamic movement inside a city. Economic studies show that over time the policy

creates a divide in the rents paid by tenants who remain in place and the vacant units available for rent. In 2024 in New York City, the average apartment rent was estimated to be around $1650, while the average asking rent for a vacant unit was $3,400 or more than twice the average rent paid. Reforming rent-stabilization to allow for more mobility for tenants may be a way for elected oficials to improve the public opinion of current housing policy. Our poll found that reform is desperately desired.

We asked voters if they think housing needs “a lot of reform” or “some reform” or “little reform” or “no reform”. The majority of respondents told us that a lot of reform was needed, 54%, with 25% saying some reform was necessary.

Do you believe New York City’s housing policies need reform? (IF YES) Would you say they need a lot of reform, some reform, or only a little?

"We asked voters if they would support a rent freeze for 40% of renters if it meant rents will increase faster for 60% of tenants. Support for the rent freeze proposal dropped to 32% support and 50% opposed. Among just renters, support for the plan was 40% support and 40% opposed. "

Interestingly, rent-stabilized tenants were some of those asking the most for reform with 70% saying housing policy needed “a lot of reform”. An additional 16% said policy needed “some reform”. Only 5% of rentstabilized tenants said no reform was needed.

The desire for changes from the majority of rent-stabilized tenants, just six years after the state legislature made significant changes to the laws, call into question the efectiveness of the reforms. Clearly rent-stabilized tenants overwhelmingly still feel that the rent laws are failing them.

Our polling also looked at the proposal to freeze rents for roughly one-million stabilized apartments in New York City. Instead of mentioning the number of apartments, we asked voters if they supported a rent freeze for 40% of renters, which is equal

to the one million stabilized apartments. Among all voters 58% supported this rent freeze. Among stabilized tenants, 65% supported the rent freeze.

We also asked renters if they believe freezing rents for 40% of renters would lead to higher rents for the other 60% of renters. Twothirds of respondents said this was likely to happen. Economic studies have repeatedly shown that rent control schemes which impact a portion of rentals lead to a large gap in rents. In New York City, median regulated rents are around $1500, while asking rents for market rate units average well over $3,000. Recently, NYAA visited a building in the East Village that had a $502 rent control unit across the hall from a market unit with a $5,000 rent. Down the hall was a stabilized apartment with a rent of $906.

We then asked voters if they would support a rent freeze for 40% of renters if it meant rents will increase faster for 60% of tenants. Support for the rent freeze proposal dropped to 32% support and 50% opposed. Among just renters, support for the plan was 40% support and 40% opposed.

Do you strongly support, somewhat support, somewhat oppose, or strongly oppose a rent freeze for 40% of the city’s apartments for the next four years. Support for the proposal was 56% to 34% opposed, with 34% strongly supporting the measure and 24% strongly opposing the plan.

We asked voters if they thought higher rents on market rate apartments were likely if rents were frozen for stabilized units. 67% of respondents said it was likely with 34% saying it was very likely. Only 23% said it was unlikely.

We then asked the question slightly diferently, gauging support for the rent freeze for 40% of apartments that would be paid for by higher rents on the other 60% of apartments in the city. Support for this proposal plummeted. Only 32% supported the rent freeze with 50% opposing the idea. Strong opposition grew to 35% with strong support only reaching 15%.

Looking just at renters who were surveyed, support for the plan was 40% and opposition was 40%.

The desire for changes from the majority of rentstabilized tenants, just six years after the state legislature made significant changes to the laws, call into question the efectiveness of the reforms.

The debate over a rent freeze has accelerated after it became a focus of the New York City mayoral campaign. Over the past decade, the New York City Rent Guidelines Board has adjusted rents below inflation. Under the de Blasio administration, the rent adjustments averaged 0.65% below inflation annually.

Under the Adams administration the rent adjustments averaged 1.3% below inflation annually. During that time, property taxes have increased at roughly 30% faster than inflation and insurance

costs have risen at roughly 85% faster than inflation.

In 100% stabilized buildings, a below inflation rent adjustment forces the building to reduce spending on maintenance and repairs, especially when property taxes and insurance premiums increase rapidly. This is the reason that roughly 5,000 rent-stabilized buildings housing more than 200,000 apartments are functionally bankrupt, meaning that the rental income fails to cover basic costs.

In their 2023 data, the most recent available, the Rent Guidelines

Board outlined that net operating income had mostly stayed flat for older rent-stabilized buildings that do not receive any government subsidy. A closer look at the data found that the reason net operating income did not shrink was due to a significant pullback in spending on maintenance, which is a key indicator that physical distress is likely to increase rapidly in the next few years.

Housing experts at NYU Furman Center, the Citizens Housing Planning Council, and the Citizens Budget Commission have warned that the trend of defunding older rent-stabilized housing has put this key housing stock at dire risk. Their analysis is that if immediate change is not made to preserve this housing, it likely will be lost forever.

When Mayoral Candidate Zohran Mamdani said that struggling rent-stabilized housing providers should just use the hardship program, it sounded simple enough. But scratch the surface just a little bit, and you’ll find a system that’s set up to fail.

Last year only three hardship applications were filed statewide. At the same time, housing experts across the board were sounding the alarm about widespread financial distress in stabilized housing. How can both be true? Because the program isn't actually ofering relief, it’s a dead end. In fact, since 2022 not a single application has been approved.

Owners who’ve tried, describe the process as a bureaucratic obstacle course. Applications get tossed for tiny technicalities, a missing signature here, a form filed in duplicate instead of triplicate there. One small Manhattan owner shared how he

before anyone even looked at his file. And when they did?

Another rejection.

This isn't the exception, it’s the norm which is why hardly anyone bothers to apply.

There’s another catch. You can’t apply for hardship and challenge your property taxes at the same time. And for most owners, property taxes are the bigger issue and the biggest expense. More than 15,000 stabilized buildings challenged their taxes last year, while just three filed hardship applications. The choice seems obvious, even if it leaves no safety net.

Eligibility: 3-year Net Operating Income is below 3-year NOI from 1968 to 1970

Feasibility: Very dificult to provide accurate data from more than 50 years ago

If Successful: Rent increases allowed to bring NOI to ‘68-’70 standard

Rents: Cannot increase more than 6% any year

Eligibility:

• HCR verifies building is maintaining services

If New York is serious about savordable housing, the fix is straightforward: Reform the hardship program so it actually delivers relief, or reduce the crushing property tax burden on stabilized buildings. Bet-

state’s hardship program isn't a

• HCR verifies there are no tax challenges currently underway

• Operating expenses are not less than 95 percent of the gross rental income

Feasibility: If all paperwork is correct and building is maintained, the process should take a few years to process

If Successful: Building rents adjusted to meet the 95% standard

Rents: Cannot increase more than 6% any year

Insurance companies settle, collect the deductible from the owner, and then increase premiums, which in turn leads to higher rents.

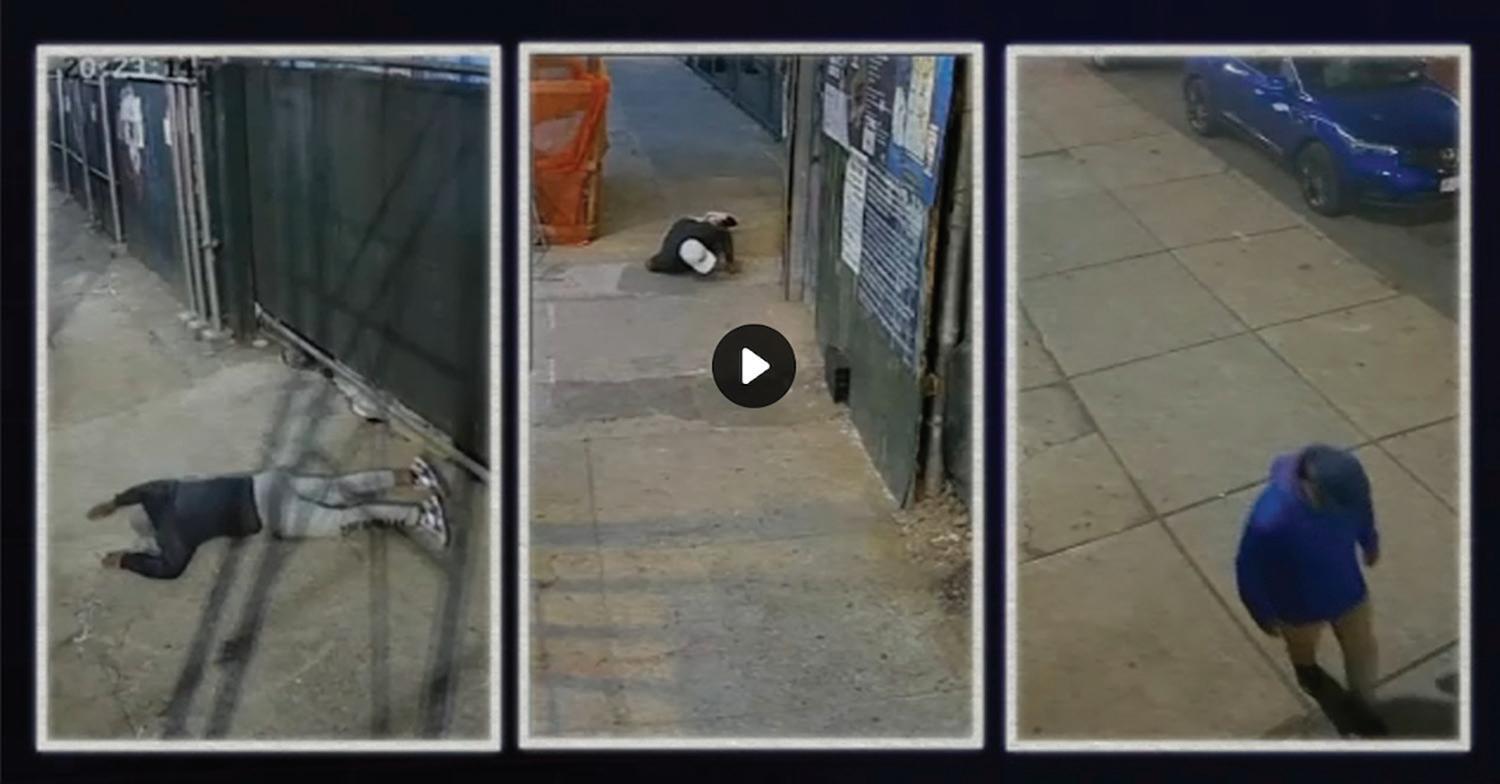

New York City leads the nation in slip-and-fall scams, and building owners, even with video proof of fraud, are paying the price. By law, building owners are responsible for the sidewalks outside their buildings. Whether it’s a crack, a chip, or any other defect, owners are expected to maintain it so no one gets hurt. But when someone claims to have fallen, whether true or false, the owner’s insurance company has absolute power to resolve the claim. They can investigate and take the case to trial, which is what you’d expect them to do when fraud is clearly visible based on video evidence. Unfortunately, that is not what typically happens.

Building owners say scammers have even gone so far as to damage perfectly good sidewalks, only to return hours later and stage a fall. In one such case caught on camera, the fraud was obvious, yet even when a judge dismissed it, the owner was left paying a deductible in the tens of thousands, simply because the insurance company had to investigate.

In New York, just the filing of a slip-and-fall claim sets of a chain of costs that always ends with the building owner. It doesn’t matter if the claim is real or fake, settled or dismissed. The damage is already done. Owners pay the deductible. Owners pay higher premiums. Owners pay regardless.

Cases in New York are so frequent and costly that many insurers who try to operate here fold almost immediately. That leaves only a handful of companies in the market, and with no real competition, they can charge what they like.

In many cases, the victims seeking payment in these cases have had multiple slip and fall accidents in less than one year, which should trigger investigations by insurance companies and also local law enforcement. Certain

law firms have a long history of representing clients in these cases, which should also trigger fraud investigations.

In August 2024, WABC did a special report on this growing fraud activity. They found that two men who intentionally destroyed the sidewalk before a slip and fall “accident” worked for a law firm that represented the person filing the claim.

These fraud schemes also cost New York City. In 2023, the city spent more than $53 million paying out slip and fall claims, according to the city comptroller’s ofice. As of October, 2025, there have been no reports of fraud investigations launched by New York City.

As premiums keep rising, owners are left with little choice but to take on less coverage to keep costs manageable. That means significantly higher deductibles than even five years ago, a cost that the Rent Guidelines Board data doesn’t capture. The numbers don’t show the full story: building owners today are paying more for less protection.

If the government wants to make New York City more afordable, one step would be an efort to prosecute clear fraud.

For as long as there have been rent control policies there have been side efects or distortions that have come from them. Supporters of these policies point to evidence that renters move less and establish stronger ties to the community. Opponents of the proposal argue that many of these same tenants feel trapped because the market is constricted and they can’t find similar housing in a diferent neighborhood that may be closer to their job or their family. Others have suggested that the inability to move freely around a city hurts the dynamic nature of cities and makes them stale.

One new line of research has been the impact of the policy on unemployment. A recent study by economists Hanchen Jiang, Luis Quintero, and Xi Yang1 found some shocking results: A 6% increase in unemployment for rent-stabilized tenants:

“We show rent stabilization increases tenants’ unemployment by six percentage points, more than double the average unemployment rate during the study period. Moreover, the efect is concentrated in traditionally privileged groups.”

The group of economists conclude that most of the unemployment was concentrated in white and highly educated

tenants and tenants living in neighborhoods with high rent discounts, suggesting that these individuals were choosing not to work because they did not need employment to pay their rent.

The comprehensive study looked at unemployment records for a 15-year period from 2002 to 2017. The authors created an empirical model and determined that the lower rental payments that most stabilized tenants have allowed them to make several decisions that resulted in unemployment. For example, a worker “may decide to forgo taking a job ofer and search for longer,” they write:

“This finding is an unintended consequence of rent stabilization, a policy that is not seemingly connected to the labor market but afects tenant job-search behavior and unemployment outcomes.”

They add that the size of the rent discount had an impact on this behavior:

“The proposed theory predicts the efect of rent stabilization on unemployment will be larger for tenants with higher rent discounts, higher expected income, and higher risk aversion. We empirically confirm these predictions with subgroup analyses: the efect is concentrated among white and

highly educated tenants and tenants living in neighborhoods with high rent discounts.”

In short, this research suggests that many stabilized tenants have wealth from savings or other avenues that allow them to continue to pay their rent, even if they are not working. The fact that rent-stabilized tenants benefit from lower than market rents and therefore have more flexibility in deciding what job to take is likely viewed as a positive outcome of rent regulations. Giving people more financial freedom to choose their path is generally viewed as a positive outcome for workers.

The authors summed up the clear impact rent-stabilization has on employment as an unintended consequence. They write:

“On one end, the policy could be discouraging job-search eforts. In this case, the policy would be ineficient. On the other end, the longer implied unemployment duration allows longer and better searches. In this case, the ineficiency statement is weakened, but the implications for inequality and equity of the policy are heightened.”

This is an important conclusion, since the median income of rentstabilized tenants is often cited as

1 Jiang, Quinter, Yang: https://conference.iza.org/conference_files/TAM_2022/jiang_h32461.pdf

a main argument for the program’s need to keep rents low. It is fair to say the data on income heavily influences government policy. New York City Mayoral candidate Zohran Mamdani has publicly quoted this data on multiple occasions as a defense for his signature campaign proposal: a four-year rent freeze for stabilized tenants.

This study suggests that many renters have additional wealth that is not calculated when the government surveys renters for their annual income. These facts have never been a part of policy debates around rent regulation. The argument has always been that renters cannot aford to pay the rents, based on the income data of regulated households. That data has been the justification for the Rent Guidelines Board to advance rent adjustments that are below inflation and operating costs for more than a decade. The information from this significant

study suggests that lower renter income for stabilized tenants is actually more of a choice and not a product of inability to find work. One of the strongest findings from the study was analysis of the large percentage of rent-stabilzied tenants who didn’t know they were living in stabilized apartments. Among this group, even though they were receiving financial benefits from rent stabilization, they were more likely to work and find work than stabilized renters who were aware that they were protected by the state’s Rent Stabilization Law. In the paper, the authors write:

New York’s rent regulations have always led to market manipulations and distortions. Understanding these consequences or tradeofs is vital for policy makers, but unfortunately data collection and analysis is scarce. There have been a limited amount of research eforts into the impacts of rentstabilization policies in New York City, leaving lawmakers in the dark about the impact of the policies they are passing.

If rent-stabilization is leading to a significant increase in unemployment, something nobody anticipated or caught, it begs the

“We show rent stabilization increases tenants’ unemployment by six percentage points, more than double the average unemployment rate during the study period. Moreover, the efect is concentrated in traditionally privileged groups.”

“Because tenants unaware of their rent benefits by definition are not sorting based on their unobserved gain from treatment, they can serve as a control group to show housing choice in the absence of the rentstabilization distortion.”

question: What other ways is this policy impacting society? Elected oficials should fully understanding the implications of rent regulations so they can craft a policy that best serves New York.

New York City has roughly 2.3 million apartments1 Roughly one-million of these units are rent-regulated, with an estimated 996,000 stabilized. The rest of the units are market rentals (1,139,000), public housing (178,700) or other rentals (52,810), which are typically afordable units financed by the government in some way that are not categorized as rent stabilized. There has been a proposal by Zohran Mamdani, the Democratic nominee for mayor of New York City, to freeze the rents for the estimated 996,000 stabilized apartments for the next four years. These freezes would be implemented by his appointees to the Rent Guidelines Board (RGB) and would take efect starting on October 1, 2026 and last until September 30, 2030. The average rent for stabilized apartments was $1,599 in 2023 and is estimated to be around $1,680 by October 1, 2026. The median rent in 20232 was $1,384 and is estimated to be around $1,455 at the start of the proposed rent freeze.

Average operating costs for rent stabilized apartments were $1,160 in 2023. They are currently estimated to be $1,292 based on the RGB’s Price Index of Operating Costs.3

The amount of revenue leftover after RGB calculated operating costs is referred to as Net Operating Income. This is not profit. The RGB describes NOI as: “the amount of money an owner has for financing their buildings; making capital improvements; paying income taxes and taking profits.”

In most cases, roughly 80% of net operating income goes to building financing. This is true for privately owned buildings as well as non-profit housing and social housing. Under the rent freeze projection outlined above, the majority of rent-stabilized buildings would no longer be able to pay their debt service, leading to a massive foreclosure crisis and significant physical deterioration of this vital housing stock.

The Rent Stabilization Law has a provision to apply for hardship, which allows buildings to raise the rents by up to 6% a year above the adjustment put forth by the RGB. Under our projection, roughly half of rentstabilized buildings would be eligible for alternative hardship by 20305 .

1 2023 Housing and Vacancy Survey: https://www.nyc.gov/assets/hpd/downloads/pdfs/about/2023-nychvs-selected-initial-findings.pdf

2 2025 Income and Expense Study: https://rentguidelinesboard.cityofnewyork.us/wp-content/uploads/2025/03/2025-IE-Study.pdf

3 2025 Price Index of Operating Costs: https://rentguidelinesboard.cityofnewyork.us/wp-content/uploads/2025/04/2025-PIOC.pdf

4 2024 Income and Expense Study: https://rentguidelinesboard.cityofnewyork.us/wp-content/uploads/2024/03/2024-IE-Study.pdf

5 DHCR Alternative Hardship Fact Sheet #39: https://hcr.ny.gov/system/files/documents/2020/11/fact-sheet-39-06-2019.pdf

Stabilized Units: 100%

2024 Average rents: $1,106

2024 Average costs: $890/apartment

2024 Average taxes: $162/apartment

Estimated Debt Service: $70/apartment

Mandatory Capital Costs: $100-$200 / apt.

Analysis:

Like many buildings in the Bronx, this privately-owned and 100% stabilized building has seen operating costs and property taxes rise over the past five years, eliminating all of its net operating income. In 2024, the building had $29,160 in operating income for the entire year. This was not enough to cover the estimated $37,800 in debt service payments. There was no money to pay for mandatory capital costs.

In the past five years, the building has been systemically defunded by rising expenses and capped rent increases. In 2019, average rents in the building were $987. Average costs and taxes were $865. That resulted in a net operating income of $65,880, which, adjusting for inflation, would be $80,911 in 2024 dollars or 177% more than the current operating income.

At this point, all of the building’s rental income is being invested directly back into the building operations. The declining operating income means the building has no access to additional capital and is unable to make mandatory upgrades. The result has been increasing violations and physical decline.

The proposed rent freeze would go into efect on October 1, 2026. Average rents for this building would be an estimated $1,139 for the next four years.

Historically, operating costs rise by 5% annually, and property taxes for this building have increased by an average of 6.4% annually. If this continues for the next four years, we can model the operating income.

Rents

Starting in year one of a rent freeze this building will begin to lose money. Even if the taxes were frozen on the building, it would also lose money. Historically, tax assessments rarely ever decline on buildings, but the unprecedented move of freezing rents might force the NYC Department of Finance to reduce building assessments.

Facing the inevitability of financial loss it is very likely that the building will have to find ways to reduce costs where possible. Typically the first expense to be cut back is spending on repairs and maintenance. Buildings may also reduce labor costs, resulting in slower response times to renters’ concerns. Eventually, as the building falls deeper into financial distress, they will likely be forced to miss mortgage payments or stop paying property taxes.

The building could file for comparative or alternative hardship1 with the state Department of Housing and Community Renewal. Typically these applications take two or three years before a successful verdict, at which point the rents may be adjusted upward by no more than 6% a year. In the case of this building, they would likely be eligible for hardship relief starting in 2028, allowing them to raise rents to $1,207. This would reduce the building’s estimated operating deficit from $150 per apartment to $82 per apartment.

It is important to note that in order to be eligible for hardship the property owner would have to spend tens of thousands of dollars on lawyer fees to handle the application process. The owner also has to go through the expensive and time consuming process of removing violations on the building that have already been fixed. Due to backlogs at HPD, appropriate paperwork and follow up inspections to remove violations that have been cured can take years.

Historically, building owners do not file for hardship because of the costs associated and the bureaucratic uncertainty. Also they have to forgo their rights to challenge their property tax assessments. Starting a tax challenge immediately pauses any hardship application, restarting the clock on relief.

1 DHCR: https://rules.cityofnewyork.us/wp-content/uploads/2025/06/fact-sheet-39-06-2019.pdf

Stabilized Units: 61%

2024 Average rents: $1,598

2024 Avg. Market rents: $2,083

2024 Average costs: $790/apartment

2024 Average taxes: $452/apartment

Conservative Debt Service: $433/apartment

Mandatory Capital Costs: $100-$200/ apartment

Analysis:

This 1927 building has 35 stabilized apartments and 22 market rate apartments, roughly a 61% to 39% split. The market rate rents in the building are 30.4% higher than the stabilized rents.

Over the past five years the Rent Guidelines Board has adjusted stabilized rents by 12.75%, which has been 6.15% below inflation. This has forced the building to more aggressively raise rents on market rate units (34.3%) in order to cover growing operating costs and mandatory capital improvements.

This is common practice in buildings that have a mix of stabilized units and market rate units. In years when the RGB has adjusted rents below inflation, the other units in the building have seen higher rent increases. In years when the RGB has increased rents near or above inflation, the rents in market rate units typically have increased about the same as stabilized units.

Applying the same methodology as Case Study #1, we calculated expected rent increases in 2025, 5% annual increases in expenses, and 6.4% annual increases in property tax assessments. In this scenario, we apply an 8% increase on market rate rents due to the passage of Good Cause Eviction, which limits rent increases to 5% plus the Consumer Price Index.

In 2021, the diference in rents between stabilized units and market rate units in this building was 29.2%, with stabilized rents at $1,425 and market rents at $1842. Under this simulation, the diference will grow to 69.1% as the 22 market units are relied on to cover all of the building’s cost increases. At the same time, operating income for the building will decline, which in turn will lower the value of the building and put it at risk of making its mortgage payments and likely leading to deference of mandatory capital expenditures.

The building owner will likely raise market rents as much as possible, capped at an estimated 8% annually, instead of the 4% to 5% that they were raised for the previous four years. This would be necessary to ofset the expected increases in operating costs and taxes, allowing the building to maintain operating income to pay of debt service.

It is possible that market forces would limit the ability to increase rents aggressively, forcing the building owner to either absorb the operating income decline or adjust operations in an attempt to maintain a healthy net operating income and keep up with mortgage payments. Due to high interest rates there is a good chance that the mortgage payments on this building would actually need to increase, or the building owner would need to find new capital in order to secure a loan.

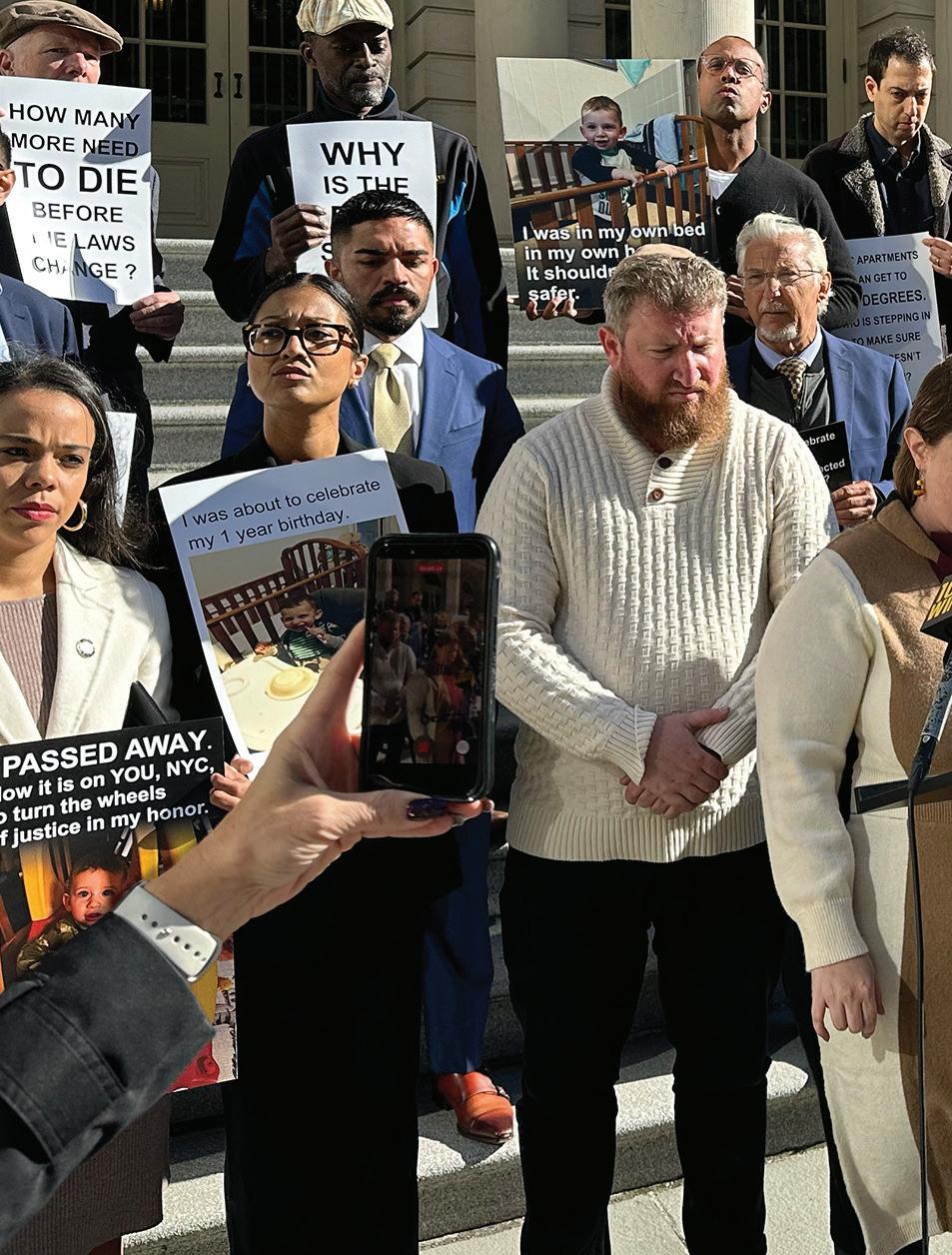

n a windy morning at City Hall, members of the City Council stood with representatives from the New York Apartment Association and the Real Estate Board of New York, as well as victims of faulty radiators and their families, to support the passage of Intro 925A.

Known as Ben Z’s law, the legislation was introduced in 2024 by Councilwoman Farah Louis following the tragic death of Binyomin Zachariah Kuravsky, who died when a radiator malfunctioned and the temperature in his room rose to more than 200 degrees. Under the legislation, radiator inspections will be required every two years in apartments and common areas where children under 6 years old live or spend a large amount of time. Co-ops, condors and other owner-occupied homes are exempt from the inspections.

Many multifamily building owners already do regular inspections and maintenance of radiators, but there is no requirement on the laws that this be done. NYAA recognized that this was a necessary regulation to ensure that apartments are safely maintained, but we had reservations about the practicality of complying with the law in the original version.

Working with Councilwoman Louis, her staf, and the leadership in the city council, NYAA was able to secure changes to the bill language to make inspections easier and more eficient, enhancing overall safety. Specifically, the bill will allow building superintendents to do visual inspections as part of their annual safety checks.

The City Council passed the bill with 49 votes.

In late September, the New York City Council passed Intro 429, an omnibus bill that updates and changes the regulations around gas piping. The legislation includes new rules about inspecting gas piping and the ability to engage in emergency repair work more quickly without the need to get permits from the Department of Buildings.

Unfortunately, the bill also changes the legal definition of ordinary plumbing work, which bans building supers and other technicians from installing stoves, washers, dryers, and dishwashers in multifamily apartment buildings and singlefamily homes. Under this change in the law, only a master licensed plumber or an apprentice working under a master licensed plumber

can replace a faulty stove or remove a stove from the T-valve connection to conduct repairs.

Under current regulations, property owners hire master plumbers to do any extensive gas piping or other work leading into the apartment and extending to the valve that connects appliances. Installing an appliance to the valve has traditionally been done by technicians or building supers, who generally have hundreds of hours of experience with these types of hookups. If you purchase a new stove or dishwasher from Home Depot, Lowe’s, or PC Richards & Sons, they typically ofer an installation service at a modest cost.

NYAA opposed this provision of the bill, which we estimate will increase

the cost of stove replacements by hundreds of dollars and lead to months in delays when a stove breaks in an apartment building. Supporters of this bill, which is mostly organized plumbers, argue that there are safety issues associated with allowing non-plumbers to do this hookup. There is no recorded incidence of a faulty stove hookup leading to a natural gas explosion. Those explosions typically come from illegal gas piping inside the building.

The legislation has garnered national attention, with advocates for abundance and smarter regulations slamming the City Council for advancing this costly mandate to benefit organized plumbers. As one op-ed in the NY Daily News points out, there is no other city or state with a similar requirement for installation of appliances.

Prominent news outlets including the NY Daily News, the NY Post, Reason Magazine, and others have published op-eds and written scathing critiques of this bill.

The mayor has yet to sign or veto the legislation.

Investments by New York City’s own pension funds have provided the clearest evidence yet that the 2019 rent laws have absolutely gutted the value of rent-stabilized housing. What began as a post-Sandy “can’t-lose” investment to preserve afordable apartments and grow retirement funds for city workers has imploded. Funds that once topped half a billion dollars have lost well over half of their value. BisNow’s reporting traces how the invest-

Bisnow traces the pension losses back to a post-Sandy push to preserve afordable housing. In 2013, NYC put $300M with Related and $200M with Hudson expecting 9–12% returns. Early flips made money, but after the 2019 Housing Stability and Tenant Protection Act cut of key revenue streams, values crashed. Bisnow’s deed analysis of more than 80 “NYSandy” LLCs shows properties like 442 Lorimer Street in Williamsburg, bought for $25.5M in 2016, sold for $12M in 2024, being unloaded at steep discounts. Related’s fund has lost $127M on sales and its net asset value has plunged to $26M.

Quotes from BisNow:

“The losses should have raised big, red alarm bells” —Eric Sanders (attorney whose work includes representing pensioners of the New York City Employees’ Retirement System)

“It should be a wake-up call to everyone that the pension fund made money before 2019 and lost money afterwards”—Kenny Burgos (NYAA CEO)

Original reporting on the Bisnow story was conducted by Sasha Jones and published on September 11, 2025, on the Bisnow website.

ments were structured and how the HSTPA cut of revenue streams owners relied on. The Real Deal lays out the hard numbers on vacancies, code violations and fire-sale prices. Together they paint a stark picture: the city is no longer just a bystander. NYCERS and the Teacher’s Retirement Fund are collateral damage and the data make a powerful case for fixing the 2019 rent laws before even more value is destroyed.

The Real Deal shows how severe the drop has been since 2019. Two city-managed pension funds invested in rent-stabilized housing have lost 69% of their value, from $531M to $165M.

A 34-building Bronx portfolio sold for $192.5M, 24% less than its 2014 purchase price, despite $30M in renovations. Of 2,020 units, 13% were vacant and the buildings had 3,000+ code violations. TRD found 43 Related buildings bought with pension money were later sold at losses between 2023 and 2025, with a median cut of 24% and some near 60%. Inflation and taxes added pressure, but the 2019 rent laws made it impossible to raise rents enough to cover costs.

“New York City’s own pension fund proves the damage of the 2019 rent laws” —Kenny Burgos

“Maintenance death spiral” —Citizens Budget Commision

The Real Deal story was reported by Quinn Waller, with research by Matthew Elo, and published on September 25, 2025, on The Real Deal website.

New York is home to more than one million registered rent-stabilized apartments, with the majority in New York City. We broke down the numbers to see which state senator and assembly person has the most apartments and the highest and lowest rent-stabilized rents.

Which districts have the highest amount of rent stabilized apartments?

Most Apartments – Assembly

Yudelka Tapia 35,848

Manny de los Santos 35,214

George Alvarez 34,924

Most Apartments – Senate

Robert Jackson 78,998

Gustavo Rivera 72,610

Luis Sepulveda 64,928

Which districts have the highest median rents?

Highest Median Rents – Assembly

Jo Ann Simon

Tony Simone

Emily Gallagher

Highest Median Rents – Senate

Kristen Gonzalez

$3,190

$2,788

$2,750

Districts in Northern Manhattan and the Bronx have the highest concentration of rent stabilized apartments in New York City.

Which districts have the lowest median rents?

Lowest Median Rents – Assembly

Aron Wieder

$1,397

Nikki Lucas $1,409

Karine Reyes $1,414

Lowest Median Rents – Senate

$2,636

Liz Krueger $2,234

Brad Hoylman-Sigal $2,160

Robert Jackson

Borough Breakdown: Manhattan: Registered apartments: 261,106

Brooklyn: Registered apartments: 293,420

Bronx: Registered apartments: 253,224

Queens: Registered apartments: 180,494

Staten Island: Registered apartments: 8,979

Jessica González-Rojas

J. Gary Pretlow

Yeger

Larinda C. Hooks

Simcha Eichenstein

Marcela Mitaynes

Steven Raga

Carl E. Heastie

Phefer Amato

Nily D. Rozic

E. Cook

David I. Weprin

Erik M. Dilan

Michaelle C. Solages

R. Sepúlveda

Cleare

M. Serrano

Zellnor Myrie

Brad Hoylman-Sigal

Simcha Felder

Stephen T. Chan

Nathalia Fernandez

Jamaal T. Bailey

Comrie

John C. Liu

Jessica Scarcella-Spanton

Roxanne J. Persaud

Joseph P. Addabbo jr

Toby Ann Stavisky

James Sanders Jr.

Shelley B. Mayer

Siela A. Bynoe

Andrew J. Lanza

Jack M. Martins

Patricia Canzoneri-Fitzpatrick

Pete Harckham

Tune in weekly for our Housing New York podcast hosted by NYAA CEO Kenny Burgos. Each week we discuss the biggest housing news in New York, and explain why it matters.

ZION also markets itself as more than a one-stop property manager. In addition to day-to-day oversight, it ofers brokerage, renovation coordination, and association management, positioning the firm as a one-stop shop for owners who prefer a single point of accountability. Pricing is structured to be transparent and tailored, with an emphasis on avoiding the hidden fees that have long been a sore spot in the industry. This extends to a flat-rate model for core property management services, as low as ordable, customized options based on each property’s unique needs to maxi-

The Resident Guarantee further underscores this by waiving leasing fees for early tenant turnover, while maintenance and satisfaction guarantees ensure no surprise

The approach seems aimed squarely at a market segment often underserved, midsize owners who may have multiple units or small portfolios but lack the infrastructure of large real estate firms. For them, outsourcing management is less about chasing yield than about preserving sanity, and ensuring compliance in an environment where

Of course, guarantees and service promises only go so far in a sector where reputation is built slowly and eroded quickly. But ZION’s growth suggests its formula is finding traction. With more than five decades of experience behind it, the firm is betting that trust, formalized through guarantees and reinforced by service, will remain a difer-

For landlords navigating today’s complex rental market, that might be exactly what they’re looking for, not a reinvention of property management, but a partner willing

Learn More: For further deadlines subscribe to our substack

11/1

11/1

11/1

11/4

11/11

11/27

COOLING TOWER ANNUAL CERTIFICATION Last day to File Annual Certification with DOB and DOHMH.

BENCHMARKING Notice of Data Inaccuracy Failure to submit a corrected report prior to the next quarterly deadline (August 1, November 1, and February 1) will result in a violation for each period of non-compliance.

WASHING SIDEWALKS, DRIVEWAYS, STREETS ARE PROHIBITED Between November 1 - March 31 and also during other months between 11am to 7pm.

ELECTION DAY Sanitation Workers' holiday. No garbage pick-up, no street cleaning. City ofices closed.

VETERAN'S DAY Sanitation Workers' holiday. No garbage pick-up, no street cleaning. City and State ofices closed.

THANKSGIVING DAY Sanitation Workers' holiday. No garbage pick-up, no street cleaning. City, State and NYAA ofices closed. NYAA ofices will be closed November 27 and November 28.

12/1

12/1

BEDBUGS Property owners are required to file bedbug report by December 31, for the previous year (December to November). Failure to file timely may result in the issuance of a violation.

LOCAL LAW 1 (LEAD PAINT) Annually investigate units where children under six reside as well as common areas in the property to find peeling paint. Maintain records about annual inspections and any work performed. Correct any outstanding lead-based paint violations (issued under previous lead-based paint laws) using safe work practices set forth in Local Law 1, and maintain records about work performed.

12/25 CHRISTMAS DAY Sanitation Workers' holiday. No garbage pick-up, no street cleaning. City, State, and NYAA ofices will be closed.

12/31 BEDBUGS Last day to file bedbug report for the previous year (December to November). Failure to file timely may result in the issuance of a violation.

12/31

Elevator Inspection - Submit through DOB within 60 days of inspection.

12/31 LOCAL LAW 87 Deadline to file Energy Eficiency Report for covered buildings with tax block number ending in 5. Filing fee $375.

12/31 BOILER INSPECTION Owners must have their boiler inspected by a licensed plumber and reports must be filed by December 31.

12/31 LOCAL LAW 152 Deadline for Buildings in Community Districts 2, 5, 7, 13, and 18 in all boroughs must have gas piping systems in all buildings, except for buildings classification in occupancy group R-3 inspècted by a Licensed Master Plumber (LMP) or a qualified individual working under the direct and continuing supervision of an LMP.

12/31 LOCAL LAW 126 Parking garage inspection deadline for Manhattan Community Districts 8, 9. 10, 11 and 12 and all Brooklyn Community Districts.

There is no free lunch. Someone always pays for it. That’s true of housing as well. Freezing rent for all rent-stabilized tenants, who make up 40% of renters, will have two main consequences. First, 60% of renters won’t see a freeze but will likely see higher rents. Second, the 40% getting a rent freeze will be at risk of worse living conditions.

Let’s tackle the first group. Most renters in New York City do not have rent-stabilized leases. Roughly 500,000 apartments are in buildings that have rent-stabilized units, and the higher rents that these tenants pay subsidize the lower rents of their neighbors.

One East Village building illustrates this. On the same floor, there’s a rent-controlled unit at $502 (only about 20,000 of these

remain), a rent-stabilized unit at $906, and a free-market unit at $5,000, subject to good cause eviction protections. If stabilized and rent control units are frozen for four years, the owner is likely to raise the $5,000 rent by 8% or $400 at renewal.

These 500,000 free-market units in rent-stabilized buildings also distort the Rent Guidelines Board’s annual data. This year, the RGB said landlords’ net operating income (NOI) rose 12%, which was driven almost entirely by growing rents in these free-market units, primarily due to the city’s housing shortage.

About a quarter of rent-stabilized buildings are filled with primarily free-market units. In the other 75%, which are mostly older buildings, the median NOI,

adjusted for inflation, was flat in 2023. The only reason it didn’t decline was a 10.3% drop in repairs and maintenance spending.

Most rent-stabilized housing is in 100% regulated buildings or close to it. When rents are frozen in these buildings, there’s no way to increase revenue to cover costs like rising property taxes. The majority of renters benefiting from freezes live in such buildings and will likely endure years in properties that are bankrupt or are heading that way.

Don’t take our word on this. Independent housing experts from the NYU Furman Center, the Citizens Budget Commission and the leaders of the mission-driven lender Community Preservation Corporation have already sounded the alarm that roughly 200,000

rent-stabilized apartments are in buildings that are functionally bankrupt.

And a recent report from Columbia Business School found that freezing rents for four years would guarantee that the average building in the Bronx would fail, even if rent increases resumed in 2030.

A bankrupt building has no access to new capital. Rents must cover all costs, forcing owners to choose between paying the mortgage, property taxes, insurance or maintenance. If a private owner stops paying mortgage, insurance, or taxes, foreclosure looms. This is why repairs and maintenance are the first to be cut.

Some argue foreclosures aren’t a concern. They say to sell the building, let tenants buy it or transfer it to a nonprofit. In reality, nobody buys a building losing money. Most tenants would pay more per month if they purchased the property. Few entities can take over failing buildings, and even then, it works only if the government subsidizes the takeover with property tax relief, grants or low-interest loans. The belief that such transfers ensure financial stability is false. Cutting taxes and ofering lowinterest loans can help distressed buildings, but nonprofits and

community-based housing providers will not survive rent freezes without more support.

CPC, one of the largest missiondriven afordable housing lenders, has stated that rent freezes will lead to more foreclosures and distress for rent-stabilized housing. In testimony to the RGB, they explained that even below-inflation rent adjustments cause distress: a 3% increase on a $1,145 rent (the Bronx median) is $34.35 –less than the increase of monthly expenses.

One proposed ofset to freezes is property tax relief. This would help privately owned rent-stabilized buildings, but it would not prevent foreclosures in most nonprofits, which already pay little or no tax. Hundreds of millions in new government funding would be necessary to ofset freezes just in apartments run by nonprofits.

Property tax relief is still necessary, though. Pre-1974 rent-stabilized buildings are overtaxed, paying five to six times as much as 1- and 2-family homes on the same land in the same neighborhood. These decades-old tax breaks for wealthy homeowners have shifted the burden onto afordable properties, while forcing the city and state to ofer massive tax breaks to new construction in order to incentivize development.

For example, a 40-unit building in Crown Heights with average rents of $1,600 pays nearly $250,000 in property taxes. A brand-new building next door, with 30 “afordable” units averaging $3,300, pays nothing.

But property tax relief has been stalled in Albany for decades and is unlikely this year. No other proposals have emerged to reduce housing costs for either privately owned rent-stabilized buildings or nonprofits, so it would be foolish to think they are magically going to happen in the next year.

This is why a rent freeze will harm afordable housing citywide. Renters should be prepared for the consequences.

Kenny Burgos is the CEO of the New York Apartment Association and a former member of the state Assembly.

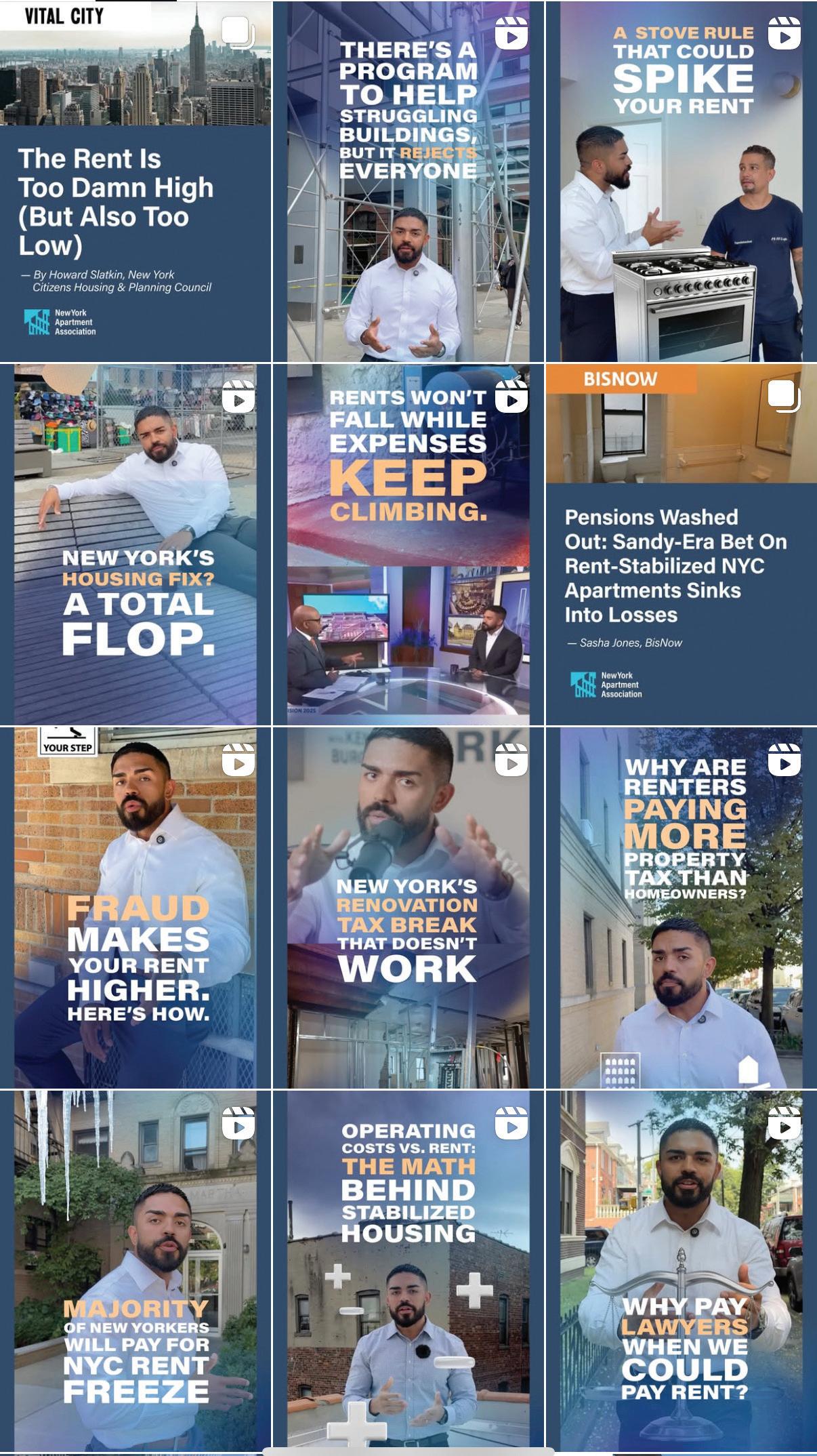

The New York Apartment Association: Leading the Dialogue on Housing Issues Across Social Media.

The New York Apartment Association (NYAA) is your premier source for all things housing, boasting millions of views and some of the highest engagement rates of any housing trade group in the country.

Our social media platforms are buzzing with conversations that matter—featuring exclusive insights from housing experts and public oficials, dialogues with advocates, and stories from tenants across New York.

Our social media channels are the go-to destination for anyone passionate about housing in New York. Whether you’re a property owner, tenant, or advocate, there’s a place for you in the conversation.

FOLLOW US! @HousingNY

Communications: Michael Johnson

MichaelJ@housingny.org

The oficial publication of the New York Apartment Association

Chief Executive Oficer Kenny Burgos

Senior VP of External Afairs

Jay Martin

JMartin@housingny.org

Kade Buci

Kbuci@housingny.org

Advertising/Sales: Lisa Richmond

LRichmond@housingny.org

Andrew Pap

AndrewP@housingny.org

Housing New York Magazine is published semi-regularly

Publisher: New York Apartment Association, 123 William Street, 12th Floor, New York, NY.

USPS#: 013163

Telephone: (212) 214-9297

Periodicals postage paid in New York, NY

Spencer Collection, The New York Public Library. "Le chevalier Des Touches, [Binding components]" The New York Public Library Digital Collections. 1886.