✓ Budget Advocacy

✓ Building Development

✓ Coalition Building

✓ Communications

Allied is a high stakes, bipartisan public strategy and lobbying firm. We know what it takes to win in difficult situations with proven results for New York’s most successful companies and not-for-profits. Allied is led by Former President of the NYS Senate, Jeff Klein. For the past 3 years Jeff Klein has delivered unparalleled results for his clients both in our state capitol and at city hall.

Jeff

Klein, Esq. President

jklein@alliedgovernmentaffairs.com

Michelle Dolgow

Vice President

mdolgow@alliedgovernmentaffairs.com

Contact us: (914) 979-1522 | alliedgovernmentaffairs.com

Albany (City) adopted in June 2024

In June, the state legislature passed “good cause” eviction. The legislation limits rent increases to 10 percent or 5 percent plus the consumer price index (CPI), whichever is lower. Any rent increases above this limit could be challenged in court and need to be proven reasonable. Good cause eviction is mandatory in New York City, but other municipalities in the state can opt in to the program. Since it was passed, multiple places have done so.

Good cause eviction is also being considered in the following places:

• Syracuse

• Binghamton

Kingston (City) adopted in July 2024

Ithaca (City) adopted July 2024

Poughkeepsie (City) adopted July 2024

Beacon (City) adopted August 2024

Newburgh (City) adopted September 2024

Nyack (Village) adopted September 2024

Hudson (City) adopted October 2024

New Paltz (Village) adopted October 2024

Catskill (Village) adopted November 2024

Fishkill (Town) adopted November 2024

Rochester (City) adopted December 2024

The Office of Rent Administration is required to produce an annual report on rent-stabilized housing. The report details all of the registered rent-stabilized apartments, their rents, and also details the work of the Division of Housing and Community Renewal from the actions of the Tenant Protection Unit to the approval of Major Capital Improvements. Here are some key findings from the report.

921,536

The number of apartments that were registered on time in 2024. The total number of rentstabilized apartments is likely still closer to 970,000.

296

The number of Major Capital Improvement applications approved in 2024. This number is 75% below 2018, showing a dramatic decline in building investment since the passage of the 2019 Housing Stability and Tenant Protection Act.

290,162

The number of units with preferential rents, meaning the rent the tenant pays is less than the legal amount the property owner could charge under rentstabilization.

366,138

The number of apartments with rents at or below $1,450. This is roughly the cost the government spends to operate similar buildings without having to pay property taxes and mortgages.

307

The number of overcharge cases granted in 2024. This is equivalent to 0.03% of all rentstabilized apartments. Less than one-third of valid overcharge complaints were ultimately granted as overcharges.

2024 brought about some big changes to the New York City and state housing landscape. Here are a few of the most notable events of the past year.

In February 2024, the LeFrak group filed a lawsuit against Queens Housing Court, highlighting the court’s “nightmarish” delays and inability to hit court mandated deadlines. Court officials admit the backlog has led to months-long delays.

In March 2024, the New York Court of Appeals reinstated a lawsuit by Tax Equity Now New York (TENNY) challenging New York City’s inequitable property tax system. Most elected officials admit the current tax laws disproportionately impact low-income people of color, but they have failed to act on this for more than 40 years.

485-x

In April 2024, New York State introduced the 485-x tax incentive program, known as “Affordable Neighborhoods for New Yorkers,” to replace the expired 421-a program. Key provisions include permanent affordability for designated units, increased construction wage requirements, and more.

In April 2024, New York State passed the Good Cause Eviction Law, setting caps on rent increases for apartments not currently in rent stabilization, and ending holdover evictions unless a "good cause" is presented by the property owner.

In April 2024, New York State amended regulations on Individual Apartment Improvements (IAIs) for rentstabilized units, effective October 17, 2024. The revisions increased the expenditure cap from $15,000 to $30,000 over a

In September 2024, the Rent Stabilization Association (RSA) and the Community Housing Improvement Program (CHIP) merged to form the New York Apartment Association (NYAA).

In June 2024, the Rent Guidelines Board (RGB) approved rent increases of 2.75% for one-year leases and 5.25% for two-year leases on rent stabilized apartments. The rent adjustment was below inflation for the 11th straight year.

In November 2024, the U.S. Supreme Court denied certiorari in G-Max Management, Inc. v New York and Building Realty Institute v. New York, leaving New York’s Rent Stabilization Law and Housing Stability and Tenant Protection Act intact.

In December 2024, New York City’s Fairness in Apartment Rental Expenses (FARE) Act became law, shifting the responsibility for broker fees from tenants to owners. The Real Estate Board of New York (REBNY) filed a lawsuit challenging the FARE Act.

In December 2024, the New York City Council approved the “City of Yes for Housing Opportunity” initiative, a plan that aims to create approximately 80,000 new homes over the next 15 years by implementing comprehensive zoning reforms.

The New York Apartment Association: Leading the Dialogue on Housing Issues Across Social Media.

The New York Apartment Association (NYAA) is your premier source for all things housing, boasting millions of views and some of the highest engagement rates of any housing trade group in the country.

Our social media platforms are buzzing with conversations that matter—featuring exclusive insights from housing experts and public officials, dialogues with advocates, and stories from tenants across New York.

just stay updated—get involved!

Our social media channels are the go-to destination for anyone passionate about housing in New York. Whether you’re a property owner, tenant, or advocate, there’s a place for you in the conversation.

FOLLOW US! @HousingNY

Tune in weekly for our Housing New York podcast hosted by NYAA CEO Kenny Burgos. Each week we discuss the biggest housing news in New York, and explain why it matters.

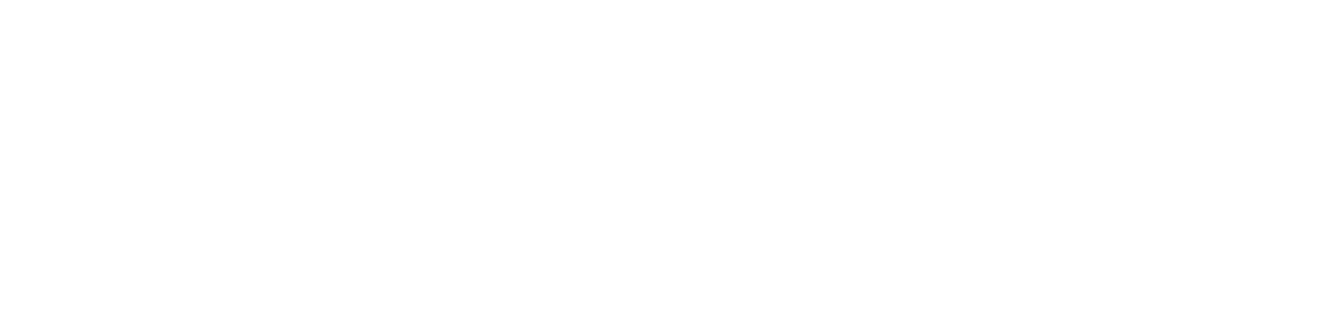

Kenny Burgos likes to build things.

At his home in the Bronx, he built his deck, the fence around his yard, and his newborn son’s nursery.

As a state lawmaker, he built bridges within his community and enacted policy to help his constituents.

And now, the dynamic 30-year-old CEO of the newly formed New York Apartment Association (NYAA) wants to build better housing in New York City.

“I like creating things and seeing them to completion,” Burgos said. “What we do in the next 12 to 18 months can have massive impacts on the next three to four decades in this state.”

He knows he cannot do this alone. Nor will the path forward be an easy one.

But he feels equal to the task.

“I like to see a project from its infancy, and then take a few steps back and realize what we’ve made it into, what we’ve accomplished” he said. “Here at NYAA … [we have] unlimited potential for what we can accomplish.”

Burgos grew up in the Bronx. The only son of divorced parents, he split his time with his mother and his younger half-sister in an apartment on the west side, and his father, older stepsister and younger half-sister in their single-family home on the east side.

His dual household shaped a lot of his vision of the world, he said. “[It] may sound like just a small

path, he initially followed in his father’s footsteps, opening a small business shortly after graduating Cum Laude from University of Albany, SUNY.

While operating his business, he got an internship with the New York City Council, and found himself enjoying politics, despite growing up with apolitical parents.

“If you want to influence the place you live in beyond being a small business owner, not just to create better small business policy but to shape your entire community, it’s politics,” — Kenny Burgos, NYAA CEO

difference, but being in a different zip code, being in a different kind of housing, I recognize what those experiences are,” he said. “How their world was shaped, what their experience was, the schools that they went to, the food options available to them.”

His father was an entrepreneur and small business owner. His mother worked for Verizon for 32 years before she retired earlier this year. When it came to choosing his own

“If you want to influence the place you live in beyond being a small business owner, not just to create better small business policy but to shape your entire community, it’s politics,” he said.

He ran for office in 2020 and was elected to the state assembly. He has always looked at the world through a policy lens, especially when traveling, and this path seemed like a way he could build something lasting.

As a state lawmaker, he was struck with the thought that anything imagined could be wrought into existence with patience, persistence and perseverance.

“It may take a month. It may take 10 years. But you can make that happen in a democracy like America,” he said. “I always love going to a new place and analyzing the people who live there and [seeing] how their local government decided to shape their neighborhood. It expands your mind into the opportunities that we can have here. When you put it into that perspective, you truly can imagine anything is possible.”

He enjoyed representing his community in the Bronx, learning about the issues people were dealing with and working toward solutions. And he found one of the most pressing conversations at any time was housing.

He said he was constantly surprised by how little policymakers know about the real estate industry and housing, considering how critical it is to the entire landscape of New York and a person’s life.

“Not everyone is a developer, not everyone is a broker,” he added. “Specifically for rent-stabilized

(Kenny Burgos, cont.)

housing providers, it is a very unique experience and very different from everyone else operating in the real estate world.”

He said the problem he encounters is that it’s not even a disagreement on politics, but a lack of education, and a historical perception of conflict.

When the opportunity arose to head the newly formed NYAA, which was formed from a merger between the Community Housing Improvement Program and the Rent Stabilization Association, he decided to take the chance to become an expert.

“The good news is, there is so much to learn.”

“The good news is, there is so much to learn.”

“There’s been this line drawn in the sand between renters and property owners that makes it incredibly difficult to have a fruitful conversation towards better housing policy that can be beneficial for both sides,” he added. “So to me, that’s where we begin.”

Burgos is part of a growing cohort of a younger generation stepping up to make a difference in the world.

“When I was first elected, I was the second youngest elected in the entire state at the time,” he mused.

“Most of the responses I got … was that it was a welcome change. They

were hopeful that having a younger leader would inspire other younger people to be more involved in government, in civics, and in their city.”

Although NYAA is still in its infancy, he already sees this happening with the large multigenerational membership of the organization, especially the younger generation stepping into the businesses started by their parents or grandparents.

“They recognize what a pivotal moment it is for them to lead their family’s business,” he said. “They recognize how important the work they do is, where they’re helping to shape the landscape and the experience of living in this city.”

The immediacy and necessity of this really hit home when Burgos and his wife welcomed their first child, a son, into the world earlier this year.

“Everything I do now is with him in mind,” he said. “That goes for the work I do here.

“I never plan to leave New York. I love this place. I’ve been here my entire life, and I would assume that means my son will be coming of age in New York, will at some point, have to find housing in New York and create and chart a life for himself. I can do everything I can for him, but I have to make sure that the environment is set as best as possible.”

And thus the work begins.

“We influence the world on so many layers,” Burgos said. “To lead an organization of this size and magnitude is both an honor and an exciting challenge. There’s so much to be done and there’s so much to look forward to in the future if we get this right.”

New York Housing Court

A convicted drug dealer is sitting in the Rikers Island correctional facility over Thanksgiving weekend, waiting for his sentence to end. When he gets out, he might be able to go back to an apartment in Queens, despite not being the legal tenant, who he befriended before they died of an overdose.

He is a squatter. After the tenant’s death, the property owner called the police. They confronted the squatter, and he told the police that he had been living there for 30 days. The police told the building owner there was nothing they could do. So the property owner went to court. This was in March.

The case was called several times but the squatter never appeared. Despite this, the judge refused to give the owner permission to take the apartment back. Meanwhile, other tenants in the building began to complain about alleged drug deals and strangers in and out of the building.

In June, police raided the apartment, confiscated tens of thousands of dollars of drugs, and arrested the

squatter. The property owner and tenants were relieved because they thought the ordeal was over. Unfortunately, that wasn’t the case.

The judge continued to adjourn the case and refused to let the owner take back the apartment. Once in September. Once in November.

The reason? The judge wanted to wait until the drug dealer’s sentence was up so they could appear in court in person.

There are safeguards to ensure cases cannot drag on while no rent is paid, but they are only after a certain number of adjournments, and with such long adjournments given without attribution, those protections cannot be used. This also delays the start of any meaningful appearances or a trial, resulting in most cases being unresolved for more than a year from the filing date.

This is just one example of the lengthy delays and frustrations that take place in housing courts all across the city.

While this is an extreme example, the culture for judges in housing court has become one of delay and extend. Judges almost always automatically give a “no attribution” adjournment of at least 2 to 3 months at the first appearance.

Even if a case ultimately results in a decision for the owner, the delays continue. The law requires that a warrant be issued between 8 and 10 days, but they are often set three to four months later. During that time, the tenant could get a one-shot deal from the city to pay the arrears and remain in the apartment, with the cycle repeating shortly after.

These are the official timelines that court staff have recently provided to landlord & tenant (L&T) attorneys at meetings in Queens and Manhattan. Their reports are in line with what L&T attorneys see every day. Whether an attorney is representing a property owner in a nonpayment

proceeding or a tenant working to get repairs, it’s likely going to be more than nine months before it is resolved.

The unacceptable delays have led one property owner to file a lawsuit, Argentine Leasing v. OCA, which directly challenges the courts to speed things up. In the filing, they allege that the courts are failing to abide by Article 7 of the Real Property Actions and Proceedings Law, which mandates a clear procedure and timeline “in order to adjudicate housing disputes efficiently and judiciously.”

In the petition, they explain that the courts have been dysfunctional for a long time:

“While practitioners before the Housing Court may wax nostalgic about a long-gone era in which summary proceedings trended towards and not away from efficiency,

they have been collectively mired in interminable and inexplicable delays in seeking the vindication of their clients’ rights to their respective property for so long that it has surreally become “normal.” Landlords have been forced to merely accept the game as rigged and trudge along the nightmarish procedure of Housing Court in the hopes that one day, far in the future, they will be able to retake and make their property economically viable once more.”

The crux of the argument is that housing court case timelines are set very clearly by statute, and housing court judges are violating those statutes by allowing cases to significantly exceed those timelines. In the petition, the plaintiffs don’t ask for money, but for the courts to operate in a timely manner. They conclude their petition as such:

“The failings of Respondents to honor and fulfill their duties as arbiters of

justice and administrators of statutory directives are not isolated but systemic and ongoing. And the harm caused thereby to Petitioners, and all similarly situated landlords is acute, repeated, and imminent.”

There are long-standing social and policy-oriented reasons for creating “summary” proceedings for landlord-tenant disputes. But long delays in court have a negative impact on the overall health of the housing market, which ultimately hurts renters. The lost building revenue leads to deferred maintenance, and the inability to remove a problem tenant can diminish tenants’ quality of life. The difficulty of operating housing in NYC also deters housing providers from starting businesses or remaining in business.

Recently, the National Bureau of Economic Research published a working paper, Nonpayment and Eviction in

the Rental Housing Market, which looks at the factors that lead to filing a housing court case. The report states:

Our data show that nonpayment is common, is often tolerated by landlords, and is often followed by recovery, suggesting that landlords face a trade-off between initiating a costly eviction or waiting to learn whether a tenant can continue paying. This suggests that housing court is usually the last resort for housing providers, and evictions cannot be relied upon as a business model and are usually for chronically nonpaying tenants.

The paper also looks at the impact of tenant protections like rent controls,

eviction protections, higher filing fees/ legal costs, and short-term rental assistance, suggesting that they don’t prevent evictions nearly as effectively as a long-term rent subsidy model. Basically, most housing providers do not want to go to court. They would rather the tenant be able to pay the rent. But when the government mandates a process that requires renters to go to court to get rental assistance, it increases the likelihood the tenant will get evicted.

Instead of forcing tenants into housing court to receive assistance, other municipalities and states, including Philadelphia, Pittsburgh, New Jersey

and Massachusetts, have used eviction diversion programs to help renters resolve nonpayment issues without ever stepping foot in court.

This approach has been effective and the concept is simple. Before filing a nonpayment case, a housing provider and tenant can elect to enter into a rent arrears assistance program, in which back rent would be paid and eligible tenants would be provided with a rental payment subsidy moving forward.

The New York Apartment Association has been in discussions with elected officials for more than a year, advising them on what would be required in the program to make it work for housing providers. We are optimistic that the City Council will introduce a pilot program in 2025.

Manhattan Civil Court Building

The Office of Court Administration recently hired more staff for housing courts and their public comments to the news media have indicated an admission that the delays are unacceptable. Still, it seems like the backlog and lack of staff will be lingering problems.

Property owners upset with the delays can file a writ of mandamus, which might expedite the specific case it is tied to, providing owners more timely justice. In order to make a significant impact on the court backlogs, there will need to be multiple cases filed.

If you have questions about the expediting of cases, please contact NYAA at info@housingny.org

For 54 years, New York City has been under a state of emergency. The housing “emergency” is the official term used to describe the housing crisis, and it is the legal justification for renewing the rent-regulation scheme every few years that keeps more than a million apartments under some form of rent-control. In reality, its manufactured scarcity, and while mayor after mayor comes up with a newly-named housing plan to build more, maintaining the scarcity is a critical part of keeping the status quo.

Maintaining scarcity means keeping existing housing at crisis levels, despite the rhetoric for change. We see this everywhere. Older rent-regulated buildings outside the core of Manhattan are seeing unprecedented distress with NOI declining more than 5 percent in 2021 and then almost 2 percent in 2022. The vacancy rate hovers at 1.4 percent, and fewer multifamily buildings are being built. Vacant units remain empty because renovation costs are significantly higher than rents, and costs have skyrocketed in the outer boroughs, especially insurance, which increased 9.3 percent from

2021 to 2022, and has continued to rise rapidly since then. Housing court has an unmanageable backlog and rent arrears remain high despite emergency pandemic funding.

Rent-stabilized housing is at a breaking point. And New Yorkers deserve better.

If you ask most elected officials about the current state of rent-stabilized housing you’d probably not hear panic or concern. It still seems

at New York

rents to stay in line with inflation and nowhere near enough to cover growing expenses like property taxes, which have gone up 5 percent since the start of the pandemic, despite the values of buildings declining.

Things got worse after the 2019 rent laws dramatically limited investment into apartments on turnover, removing a revenue stream many older buildings relied on to offset the defunding from the RGB. So now the majority of the rent-stabilized housing stock, primarily older buildings outside the core of Manhattan, have seen their net operating income shrink and many owners are struggling to pay their mortgages and

Rent-stabilized buildings are facing a sudden and dramatic decrease in value in New York.Since 2018 nearly two-thirds are listed for less than or close to their last sales price and many have sold at over a 50% loss.

increases in operating costs. In 2022, the net operating income or amount leftover to pay the mortgage, declined by nearly 20% in older stabi-

Low-income New Yorkers are the most likely to suffer. Rent-regulated housing makes up nearly half the rental market in New York City, and while anyone can luck their way into a rent-regulated apartment, it is low-income tenants that are left with

As values continue to decrease, rent-regulated housing will continue to languish and deteriorate. We’ve seen this in the tens of thousands of apartments sitting vacant waiting

In 2022, the net operating income or amount leftover to pay the mortgage, declined by nearly 20% in older stabilized buildings.

Community Bancorp, which acquired a significant amount of Signature’s rent-regulated real estate loan book.

When a building loses value, it also loses access to loans for capital improvements, vacant unit turnover or basic maintenance. So if a building is not collecting rents that sufficiently cover operating costs, it has no other options to fall back on and falls into disrepair.

We have seen this most clearly in the Bronx, where buildings are rapidly deteriorating while also facing high property taxes, exorbitant insurance rates and rent adjustments that are far less than inflation, much less

for repairs but lacking the funding. And the city, state, and federal government are unlikely to have the means or motivation to step up, as evidenced in public housing’s fiscal woes. Even nonprofits have failed in running these buildings, because no matter who owns the building, the reality is that there is no value and no funding in these buildings. Fewer buildings means less housing for New Yorkers. Which keeps rent-stabilization in place, but means people still can’t find affordable quality homes. Without regulatory reform, or massive government subsidies, this cycle will continue.

Utility costs keep rising, which does one of two things: Drives up rents, or in rent-regulated apartment buildings, defunds buildings. Here is a recap of some of the biggest cost drivers that have made housing less affordable.

Rep. Ritchie Torres released a report in August showing Con Edison charged twice as much for natural gas transfer fees as National Grid. Although the two energy giants provide national gas to different parts of the city and are not in direct competition, their clientele is similar and they are delivering the same product. This disparity in price is unprecedented.

In 2024, National Grid charged an average delivery charge of $0.60

per Therm, the standard unit of energy measurement, compared to a $1.45 per Therm delivery charge from ConEd during the same time. This difference in delivery charge is estimated to have cost an additional $17,213 for a rent-stabilized building of 30 units, based on the average per apartment usage of 675 Therms. Owners are not able to choose their energy provider. National Grid services Staten Island, Brooklyn and parts of Queens. Con Edison territory includes Manhattan, Bronx and parts of Queens. The ConEd delivery

charge accounts for 16.9% of net operating income at the average pre-1974 rent-stabilized building in the Bronx.

Rep. Torres called on the state’s Public Service Commission, which allows the prices to be set, to investigate the disparity, even as both ener-

has seen their monthly water bill rise by $93 annually. The city is charging its own Water Board more than $1.4 billion in rent over four years to lease its water and sewer systems from the city, which means water rates could continue to jump significantly.

The New York City Independent Bud-

In 2024, National Grid increased its rates by 19.4 percent in Queens, Brooklyn and Staten Island. Con Ed is hiking rates 12 percent for electricity and 19 percent for natural gas over three years.

gy giants had major price increases approved. Reasons for the increases included infrastructure upgrades, federal and state safety mandates, and increased property taxes.

In 2024, National Grid increased its rates by 19.4 percent in Queens, Brooklyn and Staten Island. Con Ed is hiking rates 12 percent for electricity and 19 percent for natural gas over three years.

And that’s just the gas bill.

This past summer, the NYC Water Board approved a rate hike of 8.5 percent, the largest in 15 years and double last year’s hike. This is to cover a huge “rental payment” the city is charging the Water Board to use its infrastructure. This is only the third time since 2017 the Water Board has been charged a rental fee for infrastructure.

The city tried to claim this fee ended a subsidy for “wealthy homeowners” but in reality, is having devastating effects on affordable rental housing and rent-stabilized buildings. Water rates typically cover the operating costs of the system, but with the rental fee tacked on, some of the hike goes directly back to the city instead of going to the water board.

Since July 1, the average customer

get Office (IBO) analyzed the New York City Water and Sewer system and provided insight into the rate setting process, the rental payment to the City, and assessed water bills by charge, type, borough, property type, and council district. They found residents were paying rent to the city for using the water and sewer infrastructure, even after Water Board bonds issued for capital projects had been satisfied in 2005.

While technically legal, this “financial fiction” is used by the city to pad the city’s General Fund, which can then be used for expenses unrelated to any water or sewer infrastructure issues or needs. The result is higher rate increases on water and sewer bills that go to pay for other city services.

The IBO study also found that multi-family residential buildings generate the highest total bills by property type, ranging from $663 million to $926 million per year.

The buildings most affected by these increases are rent-regulated buildings, which are unable to raise rents to match cost increases and which have had rent adjustments well under inflation, much less costs, for years.

Instead of finding ways to lower the costs or subsidize these buildings, the city council is considering a bill that would bring back a third-party transfer program that would essentially allow the city to transfer ownership of distressed buildings with tax liens, including unpaid water and sewer bills, and high violation counts to nonprofits.

There is $1 billion in overdue water bills owed to the city, though ironically, the biggest delinquent is New York State, which owes a cumulative $76.5 million in arrears between the Metropolitan Transportation Authority, Riverbank State Park on Manhattan’s West Side, and the Port Authority of New York and New Jersey.

This bill has a dangerously low definition of unpaid tax liens with only one year liability, which increases the number of buildings at risk of being seized. The available repayment terms are unrealistic for these struggling properties, and with a TOPA provision, it seems like the city is more interested in transferring these buildings to non-profit or tenant ownership, even though that would do nothing to increase the building’s income for taxes, utilities, or to fix violations without additional government subsidies.

While there needs to be a mechanism to get owners to pay, that solution cannot include taking distressed property from owners after the city caused the distress in the first place. Overall, this is a clear example of the runaway costs buildings face, with noticeable examples of ways lawmakers could reduce costs, but instead increase them, hurting renters and housing providers alike.

The future of residential leasing brokers in New York City is unclear. That’s the best way to describe the situation following the passage of the Fairness in Apartment Rental Expenses (FARE) Act. The new law requires the person hiring the broker to pay the broker fee, but it is more complicated than that. If an available apartment is posted online, anywhere, then the broker fee must be paid by the owner, under the law.

Following its passage in late November, Mayor Eric Adams did not take any action on the bill and it lapsed into law on December 15, 2024. Two days later, a lawsuit backed by the Real Estate Board of New York was filed to block the implementation of the law. They claim the new law is

illegal on three fronts: First that it limits free speech, secondly that it violates the U.S. Constitution’s Contracts Clause, and finally they argue that the City Council doesn’t have the power to alter the broker–tenant relationship because housing policy must be dictated by the state.

“This legislation will not only raise rents and make it harder for tenants to find housing but it also infringes upon constitutional guarantees of free speech and contract rights, as well as New York state law,” said Carl Hum, general counsel at REBNY.

officials in New York City want to end the current broker practice. It is naive to think lawmakers will just give up if they are stopped in the courts. This is why the future of brokers is uncertain in New York City. That causes a problem for property owners as well. For years they have grown accustomed to reducing operating costs by not having to pay for the services of brokers. The brokers mostly served as middle men, establishing relationships with owners in

The writing is on the wall: elected officials in New York City want to end the current broker practice.

The legal process will likely play out over the next few months, with the state’s highest court (The Court of Appeals) ultimately deciding if the law is constitutional. This could delay the implementation of the law, or ultimately strike it down. But the writing is on the wall: elected

order to get supply of apartments to lease to renters. As part of this process, brokers increasingly used websites like StreetEasy or Apartments. com to advertise available units.

If the FARE Act goes into effect, it is likely that owners will change

how they lease apartments. In many cases, it won’t make sense for the building owner to absorb this cost. They will find an alternative. Some have suggested that this could be a black market of listings for highly desirable apartments that are either strictly rent regulated or subject to Good Cause Eviction, which caps rent increases at 5% plus Consumer Price Index (CPI).

Supporters of the FARE Act have repeatedly dismissed the idea that things will change. They believe the law will force owners to pay brokers, and they cite other cities as their justification for this belief. What they fail to see is that New York City is not like any other housing market in the world. The volume of rentals is dramatically higher than any other major city in the country and demand remains high. This imbalance creates an environment where property owners generally do not need to

market their apartments in order to attract renters.

In normal cities, when there is a supply and demand imbalance in place, the market responds and builds more housing. This reduces rents and creates competition, which forces property owners to hire brokers to market their apartments.

In New York City, the lack of supply is entrenched by several key factors.

First, an archaic zoning code that prevents the creation of more rental housing. The recent passage of the City of Yes for Housing Opportunity is a small step towards solving this problem, but the current zoning code virtually guarantees a supply and demand imbalance for the next two decades.

The second factor is rent stabilization. New York City’s Rent Stabilization Law is designed to perpetuate

NYC property taxes rise almost every year. Yet those who know the property’s true value can pay less.

housing scarcity, by tying tenant protections to a low vacancy rate of apartments. If the city built adequate housing, rent stabilization would end. Due to the structure of this law, which has been in place since 1974, elected officials have intentionally blocked the building of adequate affordable housing for decades.

Third, the cost of operating and building housing in New York remains significantly higher than everywhere else in the country. This is not just due to high land values. The costs are higher for labor, insurance, and property taxes. Some of the largest cost burdens come from voluminous administrative fees or delays that are unique to developing and operating housing in the city. So long as there is a lack of supply, tenants will continue to bear the burden of high rents, even if the leasing process changes.

We advise and represent property owners of commercial and retail properties, apartment buildings, condominiums and cooperatives.

January 1 (grace period until Jan. 15):

For properties assessed at more than $250,000, the last semi annual payment for fiscal year 20242025 is due. For properties assessed at $250,000 or less, the third quarterly payment is due.

January 1-16: Lead Paint Notice must be delivered to every tenant between this time in buildings built prior to 1960.

January 1-16: Window Guard Notice must be delivered to every tenant between this time.

January 1-16: Stove Knob Cover Notice must be delivered to every tenant between this time.

January 15: Notice of assessed value, the tentative assessment roll is open for public inspection on the City’s website www.nyc.gov/finance. Dept. of Finance mails notices of annual property tax assessment in January, but is not obligated to notify you of an increased assessment. NYAA recommends that all owners review the records for their buildings.

January 16: 2024 Personal Estimated Income Tax due, last payment for Federal, State and City income taxes.

January 31: Federal Tax Forms Due, the deadline to provide all employees with W-2 Wages and Tax Statement for the calendar year 2024. Form 1099-Misc-Statement for Recipients of Miscellaneous Income-2024 must be furnished where applicable.

February 1: 2024-2025 MBR Cycle. Owners must serve each rent controlled tenant with form RN-26s.1 and file the Master Building Rent Scheduled within 60 days of Jan.1 or the issue date of the order, whichever is later, to collect the rent increases for the first year of the 2024-2025 cycle.

February 1: Benchmarking Notice of Data Inaccuracy Failure to submit a report correcting any errors prior to the next quarterly deadline (May 1, August 1, November 1, and February 1 last deadline) will result in a violation and penalty for each period of non-compliance.

February 15: TENANT’S RESPONSE TO LEAD PAINT NOTICE DUE If tenant fails to respond, you must inspect the apartment at “reasonable times” to determine if a child under 6 years of age (5 years or younger) lives there. If there is no response by March 1, write to the Department of Health and Mental Hygiene (DOHMH) documenting your efforts to contact the tenant and to gain access to their apartment.

February 15: TENANT’S RESPONSE TO WINDOW GUARD NOTICES DUE If tenant fails to respond, you must inspect the apartment at “reasonable times” to determine if a child under 11 years of age (10 years or younger) lives there. If, there is no response by March 1, write to Department of Health and Mental Hygiene (DOHMH) documenting your efforts to contact the tenant and to gain access to their apartment.

February 15: SUPPLEMENTAL STOREFRONT REGISTRY STATEMENT due to report vacancies as of Dec. 31.

February 21: LOCAL LAW 11 OF 1998 (FAÇADE INSPECTIONS) Compliance deadline for owners of buildings over six stories to inspect the exterior walls and to file a facade inspection report. Cycle 10 begins Feb. 21, 2025 and runs through Feb. 20, 2029. Sub cycle 10A – Building blocks ending in 4, 5, 6 and 9 must file between Feb. 21, 2025 through Feb. 21, 2027.

March 1: DEADLINE TO NOTIFY DOHMH Write to Window Falls Prevention Program if tenants fail to respond to window guard notice, and you are unable to determine if a child under eleven lives in the apartment, detailing attempts to acquire the information and to gain access to inspect the apartment.

March 1: DEADLINE TO NOTIFY DOHMH Write to Lead Poisoning Prevention Program if tenants fail to respond to lead paint notice, and you are unable to determine if a child under six lives in the apartment, detailing your attempts to acquire the information and to gain access to inspect the apartment.

March 1: NYC REAL PROPERTY TAX ASSESSMENT PROTEST CLASS 2 & CLASS 4 PROPERTIES Today is the last day to apply to the Property Division of the Dept. of Finance (DOF) for a reduction of the 2025-2026 assessment for Class 2 & Class 4 properties.

March 1: TAXABLE STATUS DATE Assessed value for the following City fiscal year is based on ownership, condition and value as of this date.

March 15: NYC ASSESSMENT APPLICATION DEADLINE For filing Tax Commission applications for correction of 2025-2026 tentative assessed valuation for Class 1 properties.

March 15: FILE CORPORATE INCOME TAX RETURNS Last day to file for calendar year ending December 31, 2024, unless you file for an extension. All other corporations must file within two and a half months after the closing of their fiscal year unless you file for an extension.

Learn More: For further deadlines - subscribe to our calendar and subscribe to our substack

Aaron Sirulnick, the Chairman of the New York Apartment Association

As we head into 2025, I am optimistic about the future of housing in New York. The reason is because we have launched the New York Apartment Association, the product of years of work organizing industry interests towards a unified goal of implementing better housing policy that will allow us to run our buildings and provide a better product for our customers— the renters.

In order to reach this goal, a fresh perspective was necessary. That’s why I am thrilled that Kenny Burgos accepted the role and responsibility of being NYAA’s first CEO.

Since he took over in August, he has taken several steps to put us on a pathway to a successful future,

working closely with NYAA members. His unique experience as a former Assemblyman has allowed us to improve our advocacy and messaging, highlighting many problems that both our members and renters would like to see fixed.

These efforts have put our organization in place to lobby both the city and state government, opening pathways of communication that we believe will allow NYAA to be a partner on positive reforms.

In its first few months, NYAA has also taken steps to provide better guidance and services to our members. We are modernizing our operations to help keep property owners and managers aware of changing

regulations through multiple forms of communication. We will be providing a host of seminars and webinars in 2025 to make sure you have the latest information on key topics like lead-paint testing and compliance with source-of-income discrimination laws.

This is all possible due to the hardworking staff at NYAA. I want to thank them for their effort this year and I know they will continue to work hard in 2025.

The official publication of the New York Apartment Association

Chief Executive Officer

Kenny Burgos

Senior VP of Business Development

Frank Ricci

Senior VP of External Affairs

Jay Martin

JMartin@housingny.org

Communications:

Michael Johnson MichaelJ@housingny.org

Rochel Leah Goldblatt RGoldblatt@housingny.org

Briana Spariosu BSpariosu@housingny.org

Advertising/Sales:

Lisa Richmond LRichmond@housingny.org

Andrew Pap AndrewP@housingny.org

NYAA Counsel: Olga Someras OSomeras@housingny.org

Joseph Condon JosephC@housingny.org

Housing New York Magazine is published semi-regularly

Publisher: New York Apartment Association, 123 William Street, 12th Floor, New York, NY.

USPS#: 013163

Telephone: (212) 214-9297

Periodicals postage paid in New York, NY

Madison Square, Snow, 1904