PAGE 44

AUGUST 6, 2021

Ocean City Today / Public Notices

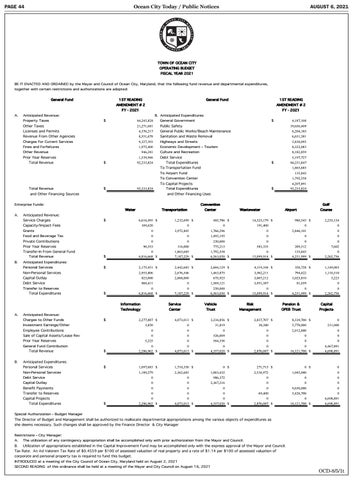

TOWN O F OCEAN N C IT TY O PERA ATING BUDG GET T FISC CAL YEA AR 202 21 BE IT ENACTED AND ORDAINED by the Mayor and Council of Ocean City, Maryland, that the following fund revenue and departmental expenditures, together with certain restrictions and authorizations are adopted: General Fund

1 ST READING

General Fund

1 ST READING

AMENDMENT # 2

AMENDMEN T # 2

F Y - 2 021 1 A.

F Y - 2 021 1

Anticipated Revenue: Property Taxes

B. Anticipated Expenditures: $

Other Taxes

44,245,828

General Government

21,271,081

Public Safety

$

4,187,108 39,656,409

Licenses and Permits

4,376,217

General Public Works/Beach Maintenance

6,204,185

Revenue From Other Agencies

8,551,678

Sanitation and Waste Removal

6,651,381

Charges For Current Services

9,327,393

Highways and Streets

5,830,095

Fines and Forfeitures

1,975,400

Economic Development - Tourism

8,322,083

Culture and Recreation

8,182,859

Other Revenue

946,281

Prior Year Reserves Total Revenue

1,539,946 $

92,233,824

Debt Service

5,197,727

Total Expenditures

$

84,231,847

To Transportation Fund

1,865,685

To Airport Fund

135,843

To Convention Center Total Revenue

$

92,233,824

and Other Financing Sources

To Capital Projects Total Expenditures

Co C onnve enntiio onn W Waate err

Trraannssp po orrtaatiio onn

$

6,616,495 $

Capacity/Impact Fees

Aiirrp po orrt

C Co ou urrsse e

1,232,699 $

485,786 $

14,325,179 $

980,543 $

2,255,134

0

0

191,400

0

0

Grants

0

3,972,845

1,766,296

0

2,846,101

0

Food and Beverage Tax

0

0

1,495,195

0

0

0

Private Contributions

0

0

250,000

0

0

0

90,553

116,000

773,215

583,335

289,512

7,602

$

0 6,816,668 $

1,865,685 7,187,229 $

1,792,558 6,563,050 $

0 15,099,914 $

135,843 4,251,999 $

0 2,262,736

$

2,175,451 $

2,442,683 $

2,604,129 $

4,119,104 $

350,728 $

1,149,003

2,955,806

2,676,546

1,463,875

3,962,211

794,422

1,110,510

Capital Outlay

825,000

2,068,000

675,925

3,067,212

3,025,810

3,223

Debt Service

860,411

0

1,569,121

3,951,387

81,039

0

Transfer-In From General Fund Total Revenue Anticipated Expenditures: Personal Services Non-Personal Services

Transfer to Reserves Total Expenditures

0 6,816,668 $

$

0 7,187,229 $

250,000 6,563,050 $

0 15,099,914 $

0 4,251,999 $

0 2,262,736

Information

Service

Ve ehicle

Ri sk

Pen sion &

Capi tal

Technology

Cen ter

Trustt

Managemen t

OPEB Trustt

Projje ects

Anticipated Revenue: Charges to Other Funds

$

Investment Earnings/Other

2,277,887 $

4,073,013 $

3,234,856 $

2,837,707 $

31,819

38,380

5,770,000

0

0

2,012,000

0

526,009

0

0

0

0

0

3,850

0

Employee Contributions

0

0

Sale of Capital Assets/Lease Rev

0

0

5,225

0

564,336

Prior Year Reserves General Fund Contribution Total Revenue B.

W Waasste ewaate err

109,620

Prior Year Reserves

A.

G Go ollff

C Ce ennte err

Anticipated Revenue: Service Charges

B.

4,207,891 92,233,824

$

and Other Financing Uses

Enterprise Funds: A.

1,792,558

0 4,357,020 $

0 2,876,087 $

8,339,700 $

0 231,000

0

$

0 2,286,962 $

0 4,073,013 $

0 16,121,700 $

4,467,891 4,698,891

$

1,097,683 $

1,710,330 $

1,189,279

2,362,683

1,003,432

2,534,972

1,045,000

0 $

0 0

Debt Service

0

0

986,372

0

0

0

Capital Outlay

0

0

2,367,216

0

0

0

Benefit Payments

0

0

0

0

9,650,000

0

Transfer to Reserves

0

0

0

69,400

5,426,700

0

Anticipated Expenditures: Personal Services Non-Personal Services

Capital Projects Total Expenditures

$

0 2,286,962 $

0 4,073,013 $

0 $

0 4,357,020 $

271,715 $

0 2,876,087 $

0 16,121,700 $

4,698,891 4,698,891

Special Authorization - Budget Manager The Director of Budget and Management shall be authorized to reallocate departmental appropriations among the various objects of expenditures as she deems necessary. Such changes shall be approved by the Finance Director & City Manager Restrictions - City Manager: A.

The utilization of any contingency appropriation shall be accomplished only with prior authorization from the Mayor and Council.

B.

Utilization of appropriations established in the Capital Improvement Fund may be accomplished only with the express approval of the Mayor and Council.

Tax Rate: An Ad Valorem Tax Rate of $0.4559 per $100 of assessed valuation of real property and a rate of $1.14 per $100 of assessed valuation of corporate and personal property tax is required to fund this budget. INTRODUCED at a meeting of the City Council of Ocean City, Maryland held on August 2, 2021 SECOND READING of this ordinance shall be held at a meeting of the Mayor and City Council on August 16, 2021

OCD-8/5/1t