GOOD DEEDS GUIDE

“Think

John D. Rockefeller Jr.

“Think

John D. Rockefeller Jr.

Welcome to the Good Deeds Guide, our first guide focused exclusively on Valley-based nonprofits!

Who are we? We’re EG Publishing, a local, familyowned publishing company. We’re all about community and are excited to share this new publication with you so that you can learn more about how we all can support amazing nonprofits doing vital work in the Valley.

Because of the work we do, we are inspired daily by the amazing people that call the Valley home. According to ASU Lodestar Center for Philanthropy and Nonprofit Innovation, there are over 19,000 nonprofits registered in the state of Arizona. The ones listed in this guide are just a handful of the amazing charities that are full of neighbors helping neighbors. We hope that you will flip through these pages and learn how you can best support local nonprofits and causes you’re passionate about.

In essence, this guide is the perfect example of what we as a company hold close to our hearts: helping Valley residents to stay informed on the good happening in their communities and how they can get involved.

Alongside this annual publication, our hyperlocal community papers include the North Phoenix News, North Tatum Times, Paradise Valley View, Scottsdale North News, The Scottsdale Standard, The Upper Westsider, and The Kyrene Times. Lastly, we publish a kids magazine called Epic Kids. Between all papers, we reach more than 150,000 homes across the Valley every month.

To do this, we focus on partnering with small, locally owned businesses and nonprofits looking to reach potential customers and clients in their own backyards. If you work with a nonprofit and would like to participate in the next Good Deeds Guide, send us an e-mail at natasha@egpublishing.com to connect. We are also happy to chat about our other publications, potential partnerships, and hear story ideas for future issues.

Thank you for reading our first Good Deeds Guide and for your support of Arizona’s vibrant nonprofits that do an amazing job serving this wonderful community we call home. In service, Natasha and Brian Beal EG Publishing

Hello and welcome to the first edition of the Good Deeds Guide! We hope you are inspired by the work being done in the community by these amazing local nonprofits and find a cause you’re passionate about where you can donate your time, talent or treasure.

In this guide we provide information on how you can best use your Arizona tax liability to help Valley-based nonprofits continue their vital work in our community. Added to that, we share information about Arizona Gives Day, upcoming fundraisers, stories from those that these important nonprofits impact, volunteer opportunities, and more. We hope this guide is helpful for you as not only Tax Day approaches, but year-round, as nonprofits need our support 24/365.

Why are nonprofits important? Our favorite answer comes from the National Council of Nonprofits: “They foster civic engagement and leadership, drive economic growth, and strengthen the fabric of our communities. Every single day. Every person in the United States benefits from the work of nonprofits in one way or another, whether they realize it or not.”

With this in mind, we hope you not only use this guide to sort out how you plan to approach the 2022 Tax Credits, but for future chances to volunteer and donate.

The causes these nonprofits support are wide and varied, but the overall message is the same: Every dollar helps. Every hour of service helps. The more we all chip in to help our neighbors, the more good deeds we do, the better our community is for it.

We hope you enjoy the first of what we hope are many editions of the Good Deeds Guide. We are inspired by the amazing work being done right in our own backyard and we are sure you will be too.

Michelle Talsma Everson Editor

While we recommend confirming specific details with your financial advisor, here are some basics on how tax credits work in the Grand Canyon State.

All information here is courtesy of the Arizona Department of Revenue (ADOR). Visit azdor.gov/tax-credits for more information.

Tax credit contributions, which need to be claimed by Tax Day, allow taxpayers to receive a dollar-for-dollar credit on their state income taxes.

Provide basic needs to qualifying low-income individuals and families, including the chronically ill and disabled. Tax credit limits are up to $800 per married couple and $400 per individual.

A QFCO can receive up to $500 from an individual and $1,000 from a married couple. A QFCO provides services that meet immediate basic needs of those in the foster care system.

An individual may claim a nonrefundable tax credit for making contributions or paying fees directly to a public school in this state for support of eligible activities, programs or purposes. The maximum credit allowed is $400 for married filing joint filers and $200 for single, heads of household and married filing separate filers.

Arizona provides tax credits for contributions made to Certified School Tuition Organizations that provide scholarships to students enrolled in Arizona private schools. The maximum credit that can be claimed is $623 for single, married filing separate and head of household taxpayers, and $1,245 for married filing joint taxpayers.

School may be out for summer, but Alice Cooper’s Solid Rock Teen Center is open year-round for all teens ages 12-20. Located in Phoenix (13625 N. 32nd St.) and Mesa (122 N. Country Club Dr.), the nonprofit teen centers offer youth a safe space to spend their time and the opportunity to discover their talents with free music, art, dance, photography, 3D printing and recording studio programs.

“Who knows if the next teen that walks in our door is the next Stevie Wonder, the next Lady Gaga or the next Eddie Van Halen? If they try dance or pick up a guitar, it may open a whole new world of opportunities for them,” says Alice Cooper, legendary Rock and Roll Hall of Fame musician and a long-term Phoenix resident.

The Rock Teen Center has also provided college scholarships for youth and opportunities to perform at Phoenix Suns and Arizona Cardinals games and live music events, opening for major musicians such as ZZ Top, P.O.D., Johnny Lang, Social Distortion and Collective Soul.

On April 2, teens will perform at Coopstock 2023 at Las Sendas Golf Club in Mesa with Alice Cooper, Tommy Thayer of KISS, John O’Hurley of Seinfeld, Robin Zander of Cheap Trick and Ed Roland of Collective Soul. The fundraiser concert raises money for the two teen centers and youth programs.

“We’ve had teens perform on stage with Monte Pittman [Madonna’s guitar player], sing backing vocals in the recording studio with Sister Sledge and perform on stage with Alice Cooper and Brian ‘Head’ Welch of KORN,” says Randy Spencer with Solid Rock Teen Centers. “We desire to elevate teens, give them mentorship, encouragement and guide them to better pathways for their future. We are inspired and amazed every day by their talent.”

A 501(c)3 non-profit organization.

Website: alicecoopersolidrock.com

Cooper’s 25th annual rock & roll fundraising bash and golf classic are back.

Photo courtesy of Coopstock

Paradise Valley resident and legendary rocker Alice Cooper is holding his annual rock & roll fundraiser on April 2, followed by his annual Rock & Roll Golf Classic on April 3.

Joining Cooper at Cooperstock 2023 is fan favorite Tommy Thayer of KISS, Ed Roland of Collective Soul, Robin Zander of Cheap Trick, Dave Jenkins of Pablo Cruise, Chuck Garric of the Alice Cooper Band, and SIXWIRE, as well as teen performers for

a groovy night under the stars with live/ silent auctions and more––all to benefit Alice Cooper’s Solid Rock Teen Centers in Mesa and Phoenix.

Held at the Las Sendas Golf Club, 7555 E. Eagle Crest Dr., Mesa, the event runs from 5 p.m. to 11 p.m. Ticket options include VIP (valet parking, table seat, dinner/drinks, etc.); Groovy Coopstock Chair (collectible Coopstock chair, premium seating); and Festival (lawn access, hamburgers, and hotdogs for sale––bring a lawn chair or blanket).

The following day is Cooper’s 25th Annual Rock & Roll Golf Classic, sponsored by Arrowhead BMW. Starting at 8 a.m., the event directly benefits Cooper’s Solid Rock Teen Centers and brings together some of the biggest names in entertainment, sports, and community leaders, at Las Sendas Golf Club.

A faith-based organization, Solid Rock’s primary mission is to make an everlasting difference in the lives of teens by helping them meet their spiritual, economical, physical, and social needs in the community by offering a safe, engaging environment during non-school hours. The organization runs two teen centers, one located in Phoenix at 13625 N. 32nd St., and one in Mesa at 122 N. Country Club Dr.

Maintaining “a teen’s worst enemy is too much time on their hands,” Solid Rock provides the music, arts, vocational programs, and fellowship that challenge teens to discover their passion through music, dance, video and sound production, self-expression, and creativity. For more information on both fundraisers, visit alicecoopersolidrock.com/event/ coopstock-alice-coopers-rock-roll-bash.

ICAN is a nationally recognized youth development program aiming to transform the educational, social, and emotional wellbeing of youth in underserved communities.

1. NO COST TO FAMILIES

ICAN promotes economic opportunities for families and parents, as those enrolled do not pay to be a part of the program.

2. EQUITY

We believe EVERY child and EVERY family deserves access to quality childcare, keeping parents working and kids safe.

3. PREVENTION

We teach youth the life skills they need now to lay the foundation for a brighter future. Every $1 invested in afterschool programs saves $3 by reducing crime, improving kids’ academic performance, and increasing kids’ earning potential (Afterschool Alliance).

4. ENRICHING

Not just academics and prevention, programs are enhanced with STEAM, Literacy, Sports, and more – based on current 21st Century Learning Skills that ready kids for the future.

5. MEALS

Full tummies make for happier kids! ICAN serves over 100,000 free meals each year, with over 87% of ICAN youth qualify for free and reduced lunch.

6. EXPANDING

ICAN has grown from one site to five sites in just two years, with the goal to continue to grow into new communities and reach more youth in underserved areas.

7. PARTNERS

Critical alliances with the Chandler Unified School District, Chandler Police, Mesa Public Schools District, and local social service agencies strengthen the support ICAN provides.

8. QUALITY

Nationally recognized by the National Summer Learning Association and statewide award winner, our program is more than just childcare - it’s intentional.

9. LEGACY

Founded by Henry Salinas over 30 years ago, ICAN remains true to its mission. ICAN is an independent, grassroots organization; all donations remain local.

10. SOCIAL EMOTIONAL LEARNING

Your support of ICAN ensures the program remains free to youth who need it most.

Even more critical after the pandemic, ICAN infuses the “5C’s of Positive Youth Development” into every lesson – confidence, character, competence, connection and contribution with the goal of teaching vulnerable youth about real-life skills, goal setting, and positive decision making. When filing taxes ICAN can be found listed as Improving Chandler Area Neighborhoods or use ICAN’s Tax Code 20031

Tax ID: 86-0761032

Founded in 1991, ICAN serves as a year-round, out-of-school time program aimed to transform the educational, social, and emotional wellbeing of youth in underserved areas. ICAN’s founder, Henry Salinas, was a Chandler native and humble man who saw gang violence impacting the youth in his community and chose to devote himself to making a change. Henry's initial investment of time and compassion to area teens has blossomed into a full-service youth center whose programs still impact youth, teens, and their families in the community that Henry held so dear.

ICAN is unique in that our nationally recognized programming is offered at no cost to families. This is because we believe that every family should have access to programs that promote wellbeing for youth and economic opportunity for parents. Pulled from the annual survey that is shared with families enrolled in ICAN’s program, 91% of parents agree that having access to ICAN’s program has had a positive impact on their finances.

ICAN is more than childcare as we aim to provide a space where kids can be themselves as they learn, grow and explore. Daily lessons are created based on the five C’s of Positive Youth Development (Confidence, Character, Connection, Contribution, and Competence), with a focus on activities surrounding science, technology, engineering, art, and math. With this intentional programming, 85% of families agree that they have seen a positive impact on their child's social emotional development.

Over the past three years, ICAN has expanded from one main site, to 5 sites across Chandler and Mesa where we now serve more than 700 youth. With over 493,000 kids living in Arizona communities where quality afterschool programs are not accessible, the need for ICAN's expansion is vast.

A 501(c)3 non-profit organization.

Website: icanaz.org

ICAN upholds a unique model of accessibility to strengthen our impact in the communities we serve. Our dedicated volunteers play a crucial role in our 30 years of meaningful connections in underserved neighborhoods. Some opportunities include assisting in an afterschool program, reading with children in a literacy program, hosting a club on Fridays, and supporting events.

We are looking for the right people (ages 16 and up) to join us in providing safe, enriching programs for ICAN youth and families. As an individual or a group, there are multiple ways for you to get involved and inspire a brighter future –find which one sounds right for you!

To learn more about our volunteering opportunities, email our Community Engagement Coordinator at sevde@icanaz.org. You can also visit icanaz.org/volunteer to learn more.

Tax ID: 20-5153613

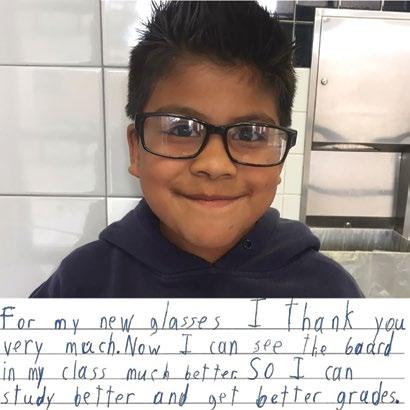

New Eyes’ mission is very simple – everyone deserves to see clearly! Since our founding in 1932, New Eyes has improved the vision and lives of hundreds of thousands of children and adults facing financial hardship across the U.S. by providing the simple yet critical tool of eyeglasses. Our timeless mission is as relevant today as it was 91 years ago.

Those who can’t see well live a life filled with fear, insecurity and vulnerability whether they are children, adults or seniors. Clear vision brings joy to the moment, security to everyday life and possibilities for the future. The transformative gift of glasses and the clarity they bring make a profound impact that lasts a lifetime.

The work we do is impactful, but it’s always best to hear directly from our clients:

“My glasses have been broken [cracked on the bridge of the frames] for half a year now, and I am legally blind without glasses. I have been holding them together with masking tape for six months. Through New Eyes, I have new glasses and frames – work and college will be free of frustration. Thank you!” Mary from Tempe, age 23

Here’s how you can help:

Donate: Just $23 provides a new pair of prescription glasses for an adult; two pair for each child.

Jewelry Donations: New Eyes accepts jewelry donations for our resale shop where all proceeds go to purchase new eyeglasses for those in need.

Buy Eyeglasses: Shop our gorgeous “Azimuth by New Eyes” branded eyewear. With every purchase, New Eyes provides new glasses to two people in need in the U.S. Looking good never felt so good!

Website: new-eyes.org

Founded in 1999, The Phoenix Animal Care & Coalition, PACC911, brings together over 140 animal rescue partners throughout Arizona, most in Maricopa County, by uniting them and offering opportunities to work together for the greater benefit of the animals. PACC911 aids our coalition partners by lifting their burden with some of the challenging behind-thescenes work, such as fundraising that comes with animal rescue so they can do what they do best: save and rehome displaced pets in need.

We provide four key resources to our animal rescue partners: large outdoor adoption events, ongoing fundraising events, educational outreach, and our ever-vital assistance through our critical care program to soften the high cost of veterinary care our four-footed friends require. These expenses can be prohibitive as most homeless pets require significant medical treatment before becoming adoptable. Our coalition partners depend on these funds to carry on with their rescue work. We’ve also brought under our umbrella of services the Chuck Waggin’ Pet Food Pantry, a food bank helping low-income families to keep their pets in the home by providing much needed pet food and support. We are always in need of pet food donations as well as monetary donations to help support this crucial program.

By supporting PACC911, you are supporting over 140 rescues in Arizona. In 2022, our programs saved the lives of over 1,200 animals and found homes for over 17,000 animals. Our website has a gallery of animals who have benefited from your help. While a picture says a thousand words, these transformations will leave you speechless. Remember, you can help us help them. You can also find a listing of all our rescue partners in the Pet Rescue Directory on our website as well. Please donate to make a difference in the lives of animals in Arizona.

Website: pacc911.org

Tax ID: 27-1173539

The Parkinson’s Foundation makes life better for people with Parkinson’s disease (PD) by improving care and advancing research toward a cure. In everything we do, we build on the energy, experience and passion of our global Parkinson’s community. We are the Parkinson’s Foundation. A community. An alliance. A movement. Where people living with Parkinson’s, families, caregivers, scientists, advocates, donors and volunteers join forces to improve lives and advance toward a cure.

For over half a century, we’ve made tangible progress on all fronts, from the largest clinical study of Parkinson’s, which has significantly improved care, to breakthrough treatments. Today, we continue to:

• Provide life-changing support to people living with Parkinson’s and their caregivers.

• Fund game-changing research on treatment and care.

• Convene the best minds from every corner of the global Parkinson’s community to find new approaches that enhance care and move us closer to a cure.

Everything we do is based on experience and informed by facts. The people we serve deserve nothing less than the highest level of support based on validated research and deep encouragement grounded in reality. Our donors and volunteers need to know that we are 100% accountable. This is why we focus on verifiable outcomes, not vague promises.

In partnership with the entire Parkinson’s community, we are making a real difference in people’s lives. And we have the research, the data — and the stories — to prove it. This is what happens when we all pull together as one global, determined and inspired movement. Better Lives. Together.

Website: parkinson.org

Saving One Life Animal Rescue and Sanctuary is a volunteer run organization that aims to protect and provide for at-risk companion animals through adoption programs, colony management, and community outreach initiatives. Over the past 14 years we have helped nearly 9,000 animals find loving homes and supported thousands more.

Established in 2009, Saving One Life is a volunteer-run, foster-based, never-kill animal rescue serving canines and felines in need throughout Arizona and Southern California. As a never-kill rescue, we provide all veterinary intervention needed for the animals in our care. We save cats and dogs of all types that are either abandoned or at-risk for euthanasia. We welcome animals from local shelters throughout Arizona and Southern California, owner surrenders, and through TNR (trap, neuter and rescue). Every one of our adoptable animals is placed in a loving foster home. All adoptable animals are thoroughly vetted before being placed for adoption. All feral cats are trapped, neutered, and returned to their home colony. We ensure each colony has a caregiver to provide food. Trapped cats that require additional services are given medical care at the time of spay or neuter.

Volunteers are the heart and soul of Saving One Life Animal Rescue and Sanctuary. We literally would not exist without the hard work and loving dedication of our Foster and Adoption Center Volunteers. We’re different from many other animal rescue organizations because we are completely foster based. This means that we spend the donations we receive directly helping the animals rather than paying rent on a shelter building. We have seven PetSmart adoption centers in Arizona. We are always in need of volunteers who can donate one to two hours every week or every month. Through donations and volunteers, we help companion animals find loving homes.

Website: savingonelife.org

Our Autism Adventure Education Program is a Training Program that combines the structure of disciplined learning with the exciting world of adventure travel, designed specifically for autistic young adults. We use the preparation for an epic adventure to Grand Canyon to teach real-life experiences in real-world settings. Each adventure itinerary is well-planned, safe, taught, and led by master-level education and safety-certified autism travel professionals.

Currently Enrolling Students

SPECIAL SUMMER CLASSES BEGIN IN JULY SPRING AND FALL CLASSES

See RaiseTheRoofForAutism.com For the Schedule

• 10-Week Virtual Spring & Fall Sessions

• 4-Week Virtual Summer Programs.

Virtual Classes also include several in-person meetups (Valley Only) to bring students, parents, and instructors together to build social connections and participate in physical activity similar to their 5-day Graduation Celebration Adventure to Grand Canyon.

Student Services & Inquires: info@RaiseTheRoofForAutism.com or SMS Text: 623.800.3649

For more info: RaiseTheRoofForAutism.com

100% OF YOUR CONTRIBUTION GOES TO STUDENT TUITION

We are building our program to include students regardless of their ability to pay the total enrollment costs. Please help us build our scholarship fund for partial and full scholarships for students who could not otherwise financially qualify for our program. Raise The Roof For Autism is Arizona State Empowerment Scholarship (ESA) Eligible.

Each year, juniors and senior students on the autism spectrum graduate from high school and look toward college, meaningful employment, and hopefully independent, productive lives. They are students who can learn, work, and achieve those life goals. But they need help to succeed. Our Autism Adventure Education Program is a virtual training program that combines the structure of disciplined learning with the exciting world of adventure travel, designed specifically for autistic young adults. We use the preparation for an epic adventure to Grand Canyon to teach real-life experiences in real-world settings. Each adventure is scripted, safe, taught, and led by master-level education and safety-certified autism travel professionals. Our training includes social skills development, self-management, executive functioning, and naturalistic interventions to help further independent living, college readiness, and employment skills. Our program's core confidence-building and life-affirming components are physical training, adventure preparation, and personal achievement. Artfully applied, we assist students in forming and expanding meaningful connections to the real world and the people around them in a way that is both unique and fun.

Currently Enrolling Students!

We offer 10-week virtual spring and fall sessions and four-week virtual summer programs. Our special summer classes begin in July. Virtual classes also include several in-person meetups (Valley only) to bring students, parents, and instructors together to build social connections and participate in physical activity similar to their five-day graduation celebration adventure to the Grand Canyon.

Become a Scholarship Sponsor: 100% of your contribution goes to student tuition. We are building our program to include students regardless of their ability to pay the total enrollment costs. Please help us build our scholarship fund for partial and full scholarships for students who could not otherwise financially qualify for our program. Raise The Roof For Autism is Arizona state Empowerment Scholarship (ESA) Eligible. Visit our website to find out how to donate. Website: RaiseTheRoofForAutism.com

Our Autism Adventure Education Program combines the structure of disciplined learning with the exciting world of active travel, designed specifically for autistic young adults. We replace animated electronic stimulation with challenging real-life experiences and the thrill of new and exciting destinations around the US and abroad. Expanding participants' horizons beyond a flat screen with guided, tangible, and memorable real life-experiences is core to our mission. Through planned challenges and physical activity, our teaching adventures create higher-order thinking and executive functioning skills. Artfully applied, we assist students and employees form and expand meaningful connections to the real world and the people around them in a way that is both unique and FUN! We meet students where they already are... ...on their mobile phones.

With purpose, we embrace it as a tool and connect it to the physical exercise required to complete each lesson.

A new feature of our program is gamification through geo-caching to provide long-term and meaningful engagement with students.

Arizona Gives Day has become one of the state’s most important fundraising events, having raised more than $36 million for Arizona nonprofits over the past decade, including more than $6 million in 2022. This year, Arizona Gives Day takes place on Tuesday, April 4, and approximately 1,000 Arizonabased nonprofits are expected to participate.

Arizona Gives Day unites nonprofits, big and small, new and established, to celebrate and increase philanthropy in Arizona through online giving at azgives. org. Arizona Gives Day helps raise awareness about the critical role Arizona nonprofits play in our communities and inspires people to give generously to create a thriving and stronger Arizona for all.

For those who can’t wait, donors can show their support for Arizona nonprofits as early as March 14.

Contributions to Arizona Gives Day are tax-deductible and, in some cases, can count toward the Arizona Qualified Charitable, Qualified Foster Care, or Public School Tax Credits.

For interested donors, AzGives.org offers an advanced search filter to find nonprofits by specific criteria, area of focus, and which donations may qualify as an Arizona tax credit. Donors also can create an account to set up recurring donations, allowing them to make changes to their giving throughout the year, track their donations, and create a fundraiser page for their favorite nonprofit.

The Arizona Gives program is run by the Alliance of Arizona Nonprofits and Arizona Grantmakers Forum. FirstBank has been the event’s presenting partner since its inception. The event was started in 2013 to connect people with causes

they believe in and build a lasting, stronger spirit of philanthropy.

“We are already seeing a tremendous amount of interest in this year’s Arizona Gives Day and we’re excited about the weeks to come leading up to April 4,” says Kristen Wilson, CEO of the Alliance of Arizona Nonprofits + Arizona Grantmakers Forum.

Arizona Gives Day 2022 raised more than $6 million for nonprofit organizations across the state during the 24-hour online fundraising event. More than 32,000 donations were made to 918 of the 1006 participating nonprofits to bring the grand total raised since the event began in 2013 to $36,406,062. During the 2022 event, 955 volunteers pledged a total of 36,269 hours to their favorite nonprofit organizations.

To learn more and donate, visit azgives.org.

While we recommend confirming specific details with your financial advisor, here are some basics on QCOs. All information here is courtesy of the Arizona Department of Revenue (ADOR). Visit azdor.gov/taxcredits for more information.

According to the ADOR:

• A QCO can receive up to $200 from an individual and $400 from a married couple.

• A QCO Is exempt from federal income taxes under Section 501(c)(3) or is a designated community action agency that receives community services block grant program monies pursuant to 42 United States Code Section 9901.

• A QCO provides services that meet immediate basic needs such as cash assistance; medical care; childcare; food; clothing; shelter; job placement; job training services; and any other reasonably necessary support to meet immediate basic needs.

• A QCO serves Arizona residents who receive temporary assistance for needy families (TANF) benefits, are low-income residents whose household income is less than 150 percent of the federal poverty level, or are chronically ill or physically disabled individuals.

• A QCO spends at least 50% of its budget on qualified services to qualified Arizona residents and affirms that it will continue spending at least 50% of its budget on qualified services to qualified Arizona residents.

Amanda Hope Rainbow Angels supports the here and now needs of families impacted by childhood cancer and other life-threatening illnesses through Comfort and Care counseling, Comfycozy’s for Chemo adaptive apparel, Financial Assistance, and Major Distractions events.

Tax Credit Donation: You can support Amanda Hope Rainbow Angels during this tax season with your Arizona Tax Credit. During this tax season, you can give up to $400 individually and $800 jointly by participating and receiving a dollar-for-dollar tax credit against your state tax liability. Your donation to Amanda Hope Rainbow Angels will support one of our many programs, like our Major Distractions, Comfort & Care, Financial Assistant, and Comfycozy Care Apparel and Gift! Learn more or give now at amandahope.org/tax-credit!

Cryptocurrency Donation: With the help of The Giving Block Amanda Hope Rainbow Angels now accepts over 80 different cryptocurrencies for donations! To learn more about how to donate cryptocurrency please visit amandahope.org/crypto.

WE HAVE MANY OTHER WAYS FOR YOU TO GIVE.

Night of Hope Gala: Amanda Hope Rainbow Angels is having their annual Night of Hope Gala on September, 30th, 2023. This annual event raises much needed financial resources to support the mission and services of Amanda Hope Rainbow Angels. AHRA offers Comfort and Care counseling, Comfycozy’s for Chemo apparel, Financial Assistance, and Major Distraction events for childhood cancer warriors and their families. To learn more about our event or how to become a sponsor, please visit amandahope.org/gala.

You can leave a legacy, become a monthly Halos for Hope supporter, get an Amanda Hope Project tee, or shop our Amazon wish list! Learn about all of the ways your can make a difference at AMANDAHOPE.ORG/GIVE.

Amanda Hope Rainbow Angels is a 501(c)(3) nonprofit organization that brings dignity and comfort into the harsh world of childhood cancer and other life-threatening diseases. We support the here-and-now needs of our warrior families through our Comfycozy’s for Chemo adaptive apparel, Comfort and Care counseling, financial assistance, and distractions like Meals of Hope, craft days, family events, teen nights, and more. Lorraine Tallman founded the organization after her young daughter Amanda Hope lost her almost four-year battle with leukemia then a brain tumor. Amanda dreamed that one day she would design a fun clothing line to provide comfort and dignity to kids who were also going through chemotherapy. Her dream lives on through Amanda Hope Rainbow Angels and our support services.

We bring Amanda’s sunshine to some of the most difficult days through our Major Distractions events and Meals of Hope lunches. We host Spa Days, Craft Days, Family Events, Teen Nights, and many more! Our warriors love to know that we always have something fun in store.

Our Comfort and Care team of licensed counselors, coaches, and mentors provide free counseling, play therapy, and supportive services to families impacted by childhood cancer or another life-threatening illness. Patients, siblings, parents, and caregivers can take advantage of bilingual individual, couples, and family therapy sessions. Added to this, we offer grief counseling, mindfulness practices, mother mentoring, and facilitated support groups for families to connect with others on the same journey.

Without your donations this is not possible. We accept over 80 different cryptocurrencies and are a qualifying charitable organization for the Arizona tax credit.

Website: amandahope.org

It’s simple: we help kids with cancer. Arizona Cancer Foundation for Children empowers families impacted by a pediatric cancer diagnosis by providing social, emotional and financial support.

“We are beyond grateful for all that you do,” says Susan, a mom of a cancer fighting warrior named Erin. “Your entire team truly cares so much, and we really feel supported. Your organization was exactly what we needed through this hard time. The emotional connection and knowing someone is there to have our back has been amazing.”

Our programs include:

• Financial Assistance • K9 Therapy • Individual and Family Counseling • Coping Skills Workshops • Sunshine Packs • Adopt-A-Family • Birthday Wishes • Respite Programs • End-Of-Life Support

Our volunteers play an integral part in helping further our mission. Volunteers act as ambassadors on our behalf and are the heartbeat of our organization. Each volunteer is screened and interviewed for the protection and safety of our warriors and their families.

To help raise funds and build community, we also host events. The Tom Londen Golf Classic is March 31-April 1 at Talking Stick Golf Club. More information on how to join in the fun is on our website. The foundation’s programs and services are 100% free and delivered with a reassuring smile and overwhelming support. This is only possible with the continued love of our dedicated community. Arizona Cancer Foundation for Children provides critical support to families who have a child battling cancer. Join us in the fight to save lives. Make your year-end tax credit donation today and save up to $800 on your Arizona taxes.

Website: azcancerfoundation.org

Burn survivors rely on medical professionals, emotional support staff, families, and friends. That’s why Arizona Burn Foundation offers compassionate services that bring all parties together through a comprehensive continuum of care.

Arizona Burn Foundation has been serving the Grand Canyon State and its residents for decades, providing education, emotional support, financial assistance, and leadership development programs to help those who’ve encountered the devastating effects of burn injuries.

From the time of a survivor’s injury through the rest of their life, Arizona Burn Foundation supports burn survivors and their families. We bring them through recovery until they no longer identify as a victim, but instead as a human being of intrinsic value and worth.

For more than 50 years, Arizona Burn Foundation has provided high-quality support programs for children, adult burn survivors, and their families. Two Maricopa County surgeons — Dr. MacDonald Wood and Dr. William Price — and attorney George “Fritz” Randolph established the Foundation in 1967. Ever since, we’ve collaborated with organizations, communities, medical professionals, burn centers, and hospitals across the state to ensure that anyone who suffers a burn injury receives the highest standard of care and assistance. What’s more, we help burn survivors reclaim their identity and that our work is instrumental to their holistic recovery. Burn and fire safety starts with prevention and education. Through our two signature programs Milo & Moxie: Smart Safety Rangers™ and Community Smoke Alarm events, we bring positive and proactive change that saves lives.

As a nonprofit, tax-exempt 501(c)(3) organization, we rely on your donations to help us achieve our mission: To improve the quality of life for burn survivors and their families in Arizona, while promoting burn prevention advocacy and education.

Website: azburn.org

Benevilla is a community supported human services agency serving Sun City, Sun City West, Youngtown, Peoria, Glendale, Surprise, El Mirage, and surrounding areas. “Bene” from the Latin meaning good and “Villa” from the Latin meaning home—together it means “good home.” Our name conveys the warmth and support this agency is proud to have offered for over four decades. Benevilla was formed as a not-for-profit organization in 1981 by a group of Sun City residents who were concerned that many of the community’s residents could not obtain important services to maintain their independence and quality of life. Benevilla has grown from a group of 30 volunteers helping with errands and home care services and a handful of employees to a network of Life Enrichment Day Programs, free support and educational services, comprehensive caremanagement programs, and social activities. This is all supported by more than 150 volunteers and more than 100 employees that seek to help keep people independent and in their own homes.

Your donation to Benevilla supports adult life enrichment day programs, Benefitness Adaptive Gym, Wirtzie’s Preschool and Daycare, Family Resource Center, C.A.R.E.S. Department with free resources and information, home services, support groups, educational workshops, caregiver resource events, community garden, resources for kinship caregivers, and more.

The mission of Benevilla is to enrich the lives of West Valley residents. By building a caring community of neighbors helping neighbors, Benevilla provides extensive support services for older adults, adults with disabilities, caregivers, children, and the families who care for them. Benevilla programs are supported through donations from individuals, congregations, service clubs, and corporations. These generous individuals and organizations ensure we can meet the needs of our community today and in the future. For every person enrolled in a Benevilla program, two people get their lives back: the individual and the caregiver.

Website: benevilla.org

Donate your and support student safety. Our name is our purpose: Bring Love On Others More 365 Days a Year

AZ QCO: 20914

Teen Dating Violence (TDV) is defined as, “A pattern of behavior that includes physical, emotional, verbal or sexual abuse used by one person in an intimate relationship to exert power and control over another.” Early relationships are positive and healthy for most teens, but for over 50% of Maricopa County high school students, they are abusive and violent (2013-2019 BLOOM365 Survey). Interpersonal violence is not just a problem that affects adults.

BLOOM365 is on a mission to prevent abuse before it starts by interrupting root causes, reducing risk factors and removing the barriers to help seeking for Gen Z youth who are experiencing, witnessing and/or using interpersonal violence.

• We educate young people on healthy vs. unhealthy relationships and build their skills to avoid controlling, abusive and violent behaviors now and later in life.

• We advocate for young people and individuals with disabilities who have been victimized by providing trauma informed emotional support, counseling and safety services to enhance healing and well-being.

• We activate high school and college students as Peer Advocates and young military service members as Peer Influencers who are trained to recognize the signs of abuse, respond appropriately, and reframe conversations and actions.

• We intervene early and provide trauma informed counseling, conflict resolution and coping skills to young people at risk for perpetrating violence.

• We train parents, school personnel, youth service providers and other trusted adults as allies ready to prevent, respond, and alleviate the impact of interpersonal violence trauma on youth.

Our efforts are focused on sustainable and scalable youth-driven education, advocacy, intervention and activism in schools and organizations across Arizona and the U.S. We envision a world of safe and healthy relationships for all.

Website: bloom365.org

Camp Patrick is a free week-long sleep away camp in Arizona for children and young adults living with Spina Bifida. It is a place where kids can strengthen their independence, try new things, and make lifelong friends with children that are similar. Camp Patrick provides a unique experience not just for the kids with Spina Bifida, but also for the families that are sending their kids off to camp. Camp Patrick creates a strong support system for these families and for all the campers that attend.

This all-volunteer ran camp is a free sleep away camp for children born with Spina Bifida. Camp Patrick is held in Northern Arizona for a week in June. Campers meet new friends with similar challenges, work on independence, and build confidence. The facility is all accessible so that every camper can participate in all activities without limitations. We have special medical staff that comes to camp to take care of their day-to-day medical needs.

In addition to donations to help campers have this experience free of charge, we also need dedicated volunteers. Camp is a week-long commitment for staff starting on Saturday, June 10 and ending on Friday, June 17. Check our website for descriptions on the different volunteer roles at Camp Patrick.

We are a 100% volunteer-run camp, so we need a lot of help! It is an amazing week and is super rewarding. If you would like to become a volunteer, be sure to fill out an application, found on our website.

Whether you donate, volunteer or both, thank you for helping Camp Patrick to make a difference in the lives of children with Spina Bifida and their families.

Website: camppatrick.com

AZ QCO: 21988

From birth to five, children form more than 1 million neural connections every second. Those critical changes taking place in their bodies and minds mean we must hold early learning experiences to high standards and give children the best chances at success.

That’s where Candelen comes in to help. We join with families, communities, and systems to illuminate the inherent potential of children to shine their brightest. Our early childhood experts offer essential educational programs, supportive services, and helpful tools for parents, caregivers, decision makers, and educators to collectively act in the best interest of children.

We focus on innovation, iteration, and collaboration to meet children and families where they are, with what they need to thrive. In the past year alone, we’ve served more than 40,000 children, 1,300 parents and caregivers, and 4,500 educators throughout both Arizona and Nevada.

When you make a donation to support Candelen, you’re investing in the future. For every $1 put toward early childhood, there is $16 return to the community through increased graduation rates, appropriate wages, and decreased dependence on financial assistance in the future. Your contribution brings prosperity back to the children and families in our communities and to you. Make a qualifying tax deductible donation today.

Website: candelen.org/donate

AZ QCO: 20665

Desert Voices is Arizona's only nonprofit school dedicated to helping children who are deaf and hard of hearing develop the oral language skills necessary to have a successful start to their education and life. By offering comprehensive listening and spoken language programs for children ages birth through six, we are helping children and their families gain the knowledge, skills, and confidence to help them mainstream to the school of their choice.

Our four programs focus on family education, building community, helping each child reach their individual language goals, and giving them the confidence in their skills and in themselves to have a bright future. The care put into each child's journey takes an immense amount of time and resources and is only made possible by generous donors like you.

You can truly make an impact on the deaf and hard of hearing children in our community with your tax dollars. When you give a tax credit donation through our partner, ECC SAY, Desert Voices will receive 100% of your contribution plus a 25% matching grant up to $5,000 collectively. Single filers can give up to $400 and joint filers can give up to $800 per tax year. Your simple gift goes a long way in ensuring a bright future for these children.

Desert Voices - helping deaf and hard of hearing children find their voices since 1997. Website: desert-voices.org

Imagine a community where every person ages with compassion, dignity, and hope. Duet: Partners In Health & Aging is turning this vision into reality though its mission to promote health and well-being through vitally needed free-of-charge services to grandparents raising grandchildren, family caregivers, and homebound adults.

Services for Grandparents Raising Grandchildren

Parenting isn’t easy – especially the second time around. In Arizona, more than 54,000 children are being raised by grandparents in an informal kinship home. Grandparents or relatives who find themselves in the unexpected position of parenting a second-time around face complex issues. The majority of grandfamilies who Duet serves do not receive any of the assistance awarded to foster families which makes the support Duet provides all the more vital. Duet provides grandparents with the tools and resources to thrive, keep the family together, and address the grandchildren’s needs.

Despite their age and not having raised children for decades, these grandparents are willing to make huge sacrifices to keep the children connected to family. Your support of Duet provides grandfamilies with personalized guidance in English and Spanish, virtual and in-person support groups, legal assistance, social outings, and respite funds. For the latter, Duet pays registration fees for the grandchildren to participate in out-of-school time sports, fitness, dance, and education remediation programs to help them thrive and provide much-needed respite for the grandparents. Duet’s services exist free of charge only because of the diversified support of our generous community and the hundreds of volunteers who help fulfill Duet’s mission. From giving homebound adults rides to the grocery store and medical appointments, to delivering help and hope to family caregivers and grandparents raising grandchildren, Duet is here to make sure no one faces life’s aging challenges alone. Volunteer. Donate. Ask for Help. Together, we are partners in health and aging.

Website: duetaz.org

The youth that Elevate Phoenix serves ache for someone to care about them. They experience daily chronic stressors, including unsafe neighborhoods and poverty; many come from single-parent households; and others have a parent who uses drugs or is incarcerated. Many struggle to learn in school due to being advanced before they were ready and the ripple effects of the pandemicrelated school shutdowns. Before being referred to Elevate Phoenix by their principals and counselors, many were on the brink of giving up and dropping out.

Founded in 2009, Elevate Phoenix’s mission is to deliver long-term, life-changing relationships with urban youth. Our innovative relationship-based approach with youth who feel beaten down by life is unique; no other agency in Arizona uses teacher-mentors who invest in the youths’ lives, teach accredited curriculum in the classroom, tutor them during lunch and after school, and remain available 24/7/365 to help with anything causing distress. Teacher-mentors are young adults, most from the same neighborhoods as the youth, and understand their challenges. As they begin interacting with our teacher-mentors and staff who embrace them and are committed to their success, they want to stay in school.

Elevate Phoenix conducts accredited literacy, life skills and workforce preparedness programs with 4,500 youth in Grades 2-12 at eight Title I schools in East, South and West Phoenix. Our socialemotional learning and trauma-informed strategies help these students learn. Each year, nearly 100% of the youth pass their courses and successfully advance to the next grade. More than 98% of our seniors graduate, compared to the state average of 78%; 100% graduate with a post-secondary plan in place (i.e., college, certification, the military, etc.) and more than 90% advance to college. Today, many youths who believed their college and career dreams were unattainable a few years ago are now employed in rewarding and well-paying careers. Your donation will be a positive investment in the lives of thousands of youths so they can break the cycle of poverty and have a successful future.

Website: elevatephoenix.org

Established in 2018, Foster Arizona Housing Project, a sister organization to Foster Arizona, was created to bridge the gap between kids in foster care and those aging out of the foster care system. With more than 800 youth transitioning out of Arizona’s foster care system annually, Arizona has a dire need for a safe place to reside and the Housing Project steps in.

The Housing Projects' mission is to educate, empower, and engage foster and at-risk youth and the community to offer hope through connections. Our vision is that every young adult transitioning out of foster care will be empowered, supported, and have the opportunity to enrich their lives through intentional community connections.

What started in March 2018 as a pilot of four young adults has expanded to serve approximately 50 young adults, ages 18-to-24, annually. The Housing Project is a six-unit, 26-bed transitional housing program that provides a safe place to reside, basic provisions, and supportive services for young adults.

The program is designed to meet our participants' basic necessities (housing and basic provisions). Once participants are in stable housing, our program is then able to focus on supportive services (life skills, leadership and empowerment opportunities, employment, education/trade, counseling support, and more). Participants in the program set financial, vocational, educational, personal, and housing goals that they work on while involved in the program. Participants engage weekly in mentoring to achieve the goals they have set for themselves.

Foster Arizona Housing Project creates a partnership between the program and the young adult participants in order to help increase self-sustainability and community connections by offering transitional housing, life skill classes, career exploration, education support, an individualized plan for self-sufficiency development, mentorship, and community normalization outings.

Your Arizona Charitable Tax Credit to Foster Arizona Housing Project helps make this program a reality. Website: fosterarizonahousingproject.org

Our work is driven by a passionate belief that the unconditional love of a pet can heal a child. With Arizona ranking 44th in the nation in child welfare, we know that our pet therapy visits to vulnerable children in places like Title I schools, crisis nurseries, homeless shelters, and group homes have a positive impact and enhance the social and emotional development of children. This year we expect to serve 2,300 children with 125 pet therapy teams at 75 partner agencies throughout Arizona.

Gabriel’s Angels serves vulnerable children in Arizona through the application of innovative pet therapy. The program’s goal is to increase the overall sense of well-being and happiness for children in a safe environment and to build critical core behaviors, such as empathy, respect, tolerance, and confidence.

Through the life-changing power of pet therapy, we enhance the social and emotional development of vulnerable children. “Gabriel’s Angels provides a non-threatening venue to learn self-control and sensitivity,” says one local school staff member.

In addition to donations, we rely heavily on dedicated volunteers. Do you have an amazing pet who is social and likes children? You and your pet can make an impact in your community by providing unconditional love to vulnerable children through the power of pet therapy. Volunteers receive personalized training, activities for pet therapy visits, and on-going support from Gabriel’s Angels staff.

You can support your love for animals with your Arizona Tax Credit. Gabriel’s Angels is one of the only animal-related charities that offers you a chance to donate and get it all back with the Arizona Tax Credit. With your gift, we can reach more vulnerable children who are hurting and in need of the unconditional love and support of a therapy dog.

Website: gabrielsangels.org

(HEADQUARTERS) 1640 E. McDowell Rd. Phoenix, AZ 85006 (602) 715-0999

252 N. Ironwood Dr. Apache Junction, AZ 85120 (480) 983-4673

77 General Crook Trail Camp Verde, AZ 86322 (928) 567-5433

850 N. California St. Coolidge, AZ 85128 (520) 723-8888

45978 W. McDavid Maricopa, AZ 85139 (520) 568-0532

• 7 locations across the Valley supporting over 1,600 women and teen girls per year

•Programs include free life skills education, mentoring, support groups, and community resource referrals. Clients can use earned program points for material resources

•Helping break cycles of poverty and abuse, helping mothers create a better future for children

• All donations are tax deductible and qualify for the Arizona Charitable Tax Credit (QCO 20256)

12101 NW Grand Ave. El Mirage, AZ 85335 (623) 875-4549

Hope Women's Center is a faith-based, trauma informed care center with six locations and a maternity home statewide. Hope's mission is to serve women and teen girls facing any difficult life situation. Whatever the adversity - addiction, domestic abuse, sexual abuse, unplanned pregnancy, feeling overwhelmed by parenting, unemployment, loss of confidence or support system, human trafficking, family conflict or change, children in the foster care system, homelessness, or healing past trauma - Hope's holistic approach helps engage, encourage, and equip women in all stages of life.

Free Confidential Services Include:

• 1:1 mentoring and support groups

• Parenting classes

• Life skills and faith-based education classes

• Grief support and celebrate recovery

• Rise above abuse and anger management classes

• Pregnancy testing and prenatal classes

• Childcare (0-5) for mothers attending Hope programs

• Crisis counseling

• Job skills classes and training

• Maternity home housing for pregnant and parenting moms

• Points earned for programs can be used for material assistance such as utilities, transportation, food, clothing, personal care items, household items, and baby or child products.

Website: hopewomenscenter.org

Website: impactone.pink AZ

Impact One is committed to improving the quality of life for female breast cancer patients. It is our belief that no woman should have to battle cancer alone. Our program is designed so that each woman not only receives one on one support through our Hope Box Essentials Project, but also receives helps with obtaining breast cancer screenings and prevention, referral resources, and education on breast health.

The Hope Box Essentials Project provides each woman with costly items that are in direct relation due to chemotherapy treatment, radiation treatment or any surgery that is related to breast cancer and often not covered by insurance. Each Hope Box is filled with items such as prosthesis, bras, wigs, and post-surgical garments. The Hope Box is shipped directly to their home, alleviating some of the financial and emotional stress during treatment and the recovery journey. Breast cancer patients can apply for a Hope Box on our website, and community members can donate them from our website as well.

Impact One Breast Cancer Foundation’s mission is to provide prompt support and resources to those impacted by breast cancer. At Impact One, our goal is to impact each individual woman, meeting her wherever she finds herself in her personal breast cancer recovery journey. We want to be a safe place for women to reach out to for support, compassion and services to ease some of the negativity cancer throws at them. It can be such a confusing time and we have the information and resources they need.

We are all affected by breast cancer in some way. We may know someone who is a fighter, be one ourselves, or simply know someone who could be at risk. Stand together with us and help us come alongside women who are on their breast cancer journey.

AZ QCO: 20941

The mission of Jewish Free Loan (JFL) is to provide interest-free loans to Arizona’s Jewish community. At JFL, we envision a financially secure Arizona Jewish community and work to bring this to fruition through our financial assistance services, basic needs resources and the dissemination of materials focusing on topics related to financial literacy.

Since our inception, thousands of individuals and families have been able to provide a loved one with a Jewish burial, avoid eviction, tend to medical/dental needs, adopt a child, continue their education, travel to Israel, start a business, experience Jewish summer camp, and navigate numerous other life experiences without the worry or burden of compounding interest.

A current borrower recently shared this: “We cannot thank JFL enough for what this loan has done for us. Thank you for going above and beyond to ensure we'd be in the best spot given the circumstances. There aren't too many people left in the world who care as you do.”

Jewish Free Loan is a Qualified Charitable Organization of the AZ Charitable Tax Credit (CTC). Through this program donors receive a dollar-for-dollar tax credit on their Arizona state income tax return at no additional cost. To receive this tax credit, simply donate to Jewish Free Loan any time before you file your taxes or before Tax Day (whichever comes first). Make sure to indicate you are taking advantage of the CTC Program. Please consult your tax advisor for more information. Your support is essential to help meet the financial needs of our community.

The programs supported by Charitable Tax Credit contributions include but are not limited to:

• Emergency and crisis situations • Rent and utility payments • Jewish burial

• Seniors/disability assistance • Medical and dental needs • Higher education and vocational training We continue to see increased need for financial assistance in all these categories. Your contribution will help make a difference in the lives of community members in need.

Website: jewishfreeloan.org

Mission of Mercy Arizona (MOM) restores dignity and heals through love by providing free primary healthcare, medication and patient education to working poor and uninsured Arizonans.

Over the past 25 years, Mission of Mercy Arizona has served more than 57,000 unique patients, providing 300,000 free medical visits and 500,000 free prescription medications. Serving in high-need areas throughout Maricopa County, MOM now operates six regular weekly and bi-weekly clinics. Our clinics are 95% volunteer staffed with licensed medical doctors, nurses, medical interpreters and other professionals, and serve up to 60 patients per day at more than 200 clinic days annually.

More than 90% of the patients who visit a MOM clinic have one or more chronic condition with the top three conditions being hypertension, diabetes and high cholesterol. Chronic conditions require routine medical care and patient education to prevent more serious health situations, including early death.

Every $100 donated pays for a patient medical visit, including labs and medication. MOM’s patients are never asked to pay anything or to prove their poverty in order to get the healthcare they need.

Your Arizona charitable tax credit donation of $400 (individual) or $800 (married filing jointly) will provide medical care in a compassionate setting for our neighbors who need it most.

Website: momaz.org

AZ QCO:

Started in 2011 by award winning chef Jennifer Caraway, The Joy Bus is a nonprofit organization delivering more than a meal to homebound cancer patients around the Valley. Our meals are made with fresh, organic, non-GMO produce and come in eco-friendly and chemical-free packaging. Tucked into each hand decorated paper bag is an informational sheet on the nutritional power of the ingredients used and how they will support the fight against cancer. Our service also includes critical home visits and wellness checks by our incredible team of volunteers, many of whom are cancer survivors themselves. Growing from our start as a one-woman operation serving two patients, we are so proud to now serve upwards of 140 patients, caregivers, and family members each week throughout the Phoenix area. We recently reached our milestone of 20,000 meals as an organization in 2022.

To continue this momentum, The Joy Bus has launched a $5.4 million More Than A Meal Capital Campaign, with a cabinet of strong community leaders chaired by Peter and Rebecca Ailes-Fine and Derrick and Amy Hall. It will be funded by foundations, businesses, and individuals who know and appreciate the challenges faced by homebound cancer patients and their caregivers. With this campaign, we will dramatically expand our kitchen, pantry, and dining capacity with a goal of providing over 2,500 meals per week by 2026.

For more information about The Joy Bus, the More Than A Meal Capital Campaign, volunteering, and other ways to support our organization, visit our website or find us on Facebook and Instagram.

"If you know us, you know what The Joy Bus means to us. Every hand that has touched the bags, the flowers, the incredible food, the hugs, the love... all of it has been as important as the medical science that we have been fortunate to receive."

Website: thejoybus.charity

In the communities we serve, youth experience poverty and three times the adversity of their peers. Beyond the instability and insecurity that makes it difficult to meet their most basic needs, these youth experience social, emotional, and cognitive obstacles that bar them from living the joyful, purposeful lives that every young person deserves. At New Pathways for Youth, we are changing that. We are building a future where every young person can live their life with joy and purpose, confident in their ability to decide their own path.

To make it happen, we provide 1:1 mentoring with a dedicated adult and a proven program for personal growth, including tailored goal setting and connection to vital resources, all within a supportive peer group. In doing so, we’re transforming the lives of youth by providing the support, stability, and skills they and their families need to flourish.

Each of our youth receives tailored action planning and support according to their needs and personal goals, as well as connections to critical resources for personal well-being, and daily necessities that support the youth’s entire family, ranging from housing assistance to food security to emergency relief. All of this is complemented by 1:1 support from an adult mentor within a group of peers to build stable, nurturing, life-changing relationships.

Our holistic, research-based program is proven to generate remarkable outcomes for the youth we serve - from improved mental health and personal wellness to academic success and greater high school graduation rates. We give youth the tools and resources to not only achieve safe, healthy lives, but find fulfilling career paths, seize new opportunities, and enhance their relationships with their families, peers, and all those around them.

With the support of the entire New Pathways community, youth are able to transform their lives and confidently find their own paths to fulfillment.

Website: npfy.org

As a faith-based organization, it is the mission of Midwest Food Bank (MFB) to share the love of Christ by alleviating hunger and malnutrition locally and throughout the world and providing disaster relief without discrimination.

Use your tax credit to feed our hungry neighbors through MFB’s four programs:

• Food for Nonprofits: MFB Arizona provides food to over 280 food pantries, soup kitchens, shelters, churches and other nonprofit organizations providing food to those in need in our communities.

• Disaster Relief: MFB Arizona provides relief to victims of natural disasters.

• Tender Mercies: These are savory rice and beans, fortified with vegetable protein and essential vitamins and minerals. They are packaged in-house and at volunteer packing events.

• Hope Packs: Midwest Food Bank’s student feeding program provides food-insecure children with supplemental weekend food.

The Arizona location of Midwest Food Bank opened in 2017. About 30 nonprofit agency partners received food at the first distribution.

Today, nearly 280 agency partners receive food from MFB Arizona. Food is distributed from our warehouse and a satellite distribution in Tucson.

Over 99¢ of every dollar donated goes to MFB programs and services. As the demand from agency partners increases, we continue to look for ways to provide food for all. Contact us today to see how you can be involved.

Website: midwestfoodbank.org/Arizona

Founded in 2016, Phoenix Cancer Support Network (PCSN) is a nonprofit organization lead by a group of physicians, healthcare administrators and other professionals whose passion for cancer care has come from a common bond. Through each unique journey we have learned that a cancer diagnosis is overwhelming, confronting the patient with an information overload that can be difficult to manage and navigate. Phoenix Cancer Support Network endeavors to empower clients throughout their cancer journey by providing support, guidance, and direction while promoting and protecting the unique needs, lifestyle and abilities of each patient and their caregivers.

Over the past five and a half years, PCSN (Phoenix Cancer Support Network) has proudly served over 500 cancer patients and their families in Arizona. Their mission is to fill in the gaps that exist in the cancer support community, by providing free support and advocacy to cancer patients and their families. A registered 501(c)(3) organization led by only volunteers, Phoenix Cancer Support Network relies 100% on donations and community partnerships to continue their important work.

PCSN strives to provide any service that a client may need to make their cancer journey easier. Some of these services include:

• Transportation to medical appointments • Meal support • Housecleaning • Lawn service

• Dog walking or sitting • Legal advice • Bill paying assistance • Virtual second opinions and guidance from oncology physicians • In-home caregiving • Childcare

PCSN was founded by Jenny Martin, MBA. Jenny lost her sister Annie to a rare pediatric cancer at the young age of 24. Since then, Jenny has dedicated her career to the oncology space in an administrative capacity and currently serves as VP of Business Development and Marketing for Arizona Center for Cancer Care. PCSN strives to alleviate as much of that burden as possible so cancer patients can focus on completing through their treatment.

Website: pcsnetwork.org

Imagine fear and uncertainty rushing over your body after receiving a devastating diagnosis from your child’s doctor. Now add the stress of learning that the critical medical care your child needs and deserves will take you miles away from your home and support system. Where will you stay? What will you eat? Can you afford to be away from home for that long? How will you keep your family together? It’s in these moments that Ronald McDonald House Charities of Central and Northern Arizona becomes a lifeline for families. Our mission is to provide a “home-away-from-home” for families who travel to the Valley for their child’s medical care. While doctors are taking care of patients, we take care of their families.

With three Houses in the Valley (two in Phoenix and one in Mesa), we can host up to 72 families each night. Families are welcomed with a private room where they can rest and rejuvenate after long days spent at the hospital. While they are in our care, we provide them nightly meals through our Dinnertime Heroes program, community spaces where they can build relationships with other families, and all the comforts of home, including laundry services, WiFi, and welcome bags filled with hygiene items and special gifts for all members of the family. These essentials help remove the burden of stress from families’ shoulders so they can focus on caring for their sick or injured children.

The care and compassion shown to families throughout our three Houses would not be possible without the generosity of the many hearts and hands who donate to Ronald McDonald House every year. As a completely community-funded organization, donations, no matter how large or small, are integral to the courage, hope, and togetherness the families we serve find within our spaces. Because of the generosity of so many, families are welcomed into our “home-away-from-home” free of charge.

Website: rmhccnaz.org

Since its inception, Ronald McDonald House includes more than 90% of the top children’s hospitals around the world for at least one RMHC core program. In 2021, they continued to expand programs to fulfill the unmet needs of families around the world. Systemwide,

10 new Ronald McDonald House programs opened and 1 House program increased its sleeping rooms.

Thanks to 74,000+ volunteers dedicating their time and talent from around the world, RMHC Chapters were able to direct more donation dollars to other

areas of programming that support families and children.

With the help of fantastic donors such as yourself and the amazing people giving their time, RMHC programs help alleviate families with sick children save more over $504 million in hotel and meal expenses.

JoAnn said, “We can do Wednesdays,” and before they served dessert, she added, “in fact, every agent in Maricopa County can ring the bells at Christmas time.” Later, she asked Joseph why he let her do that. He responded, “There was no stopping you,” and Real Estate Wednesdays was born. Since 2013, this extraordinary real estate program has raised more than a million dollars for the Salvation Army.

2013 over 1,000 Agents raised and saved $148,877 2014 over 1,400 Agents raised and saved $177,242 2015 over 2,000 Agents raised and saved $276,570 2016 over 2,200 Agents raised and saved $277,926 2017 over 2,400 Agents raised and saved $291,041 2018 over 2,600 Agents raised and saved $292,535

At St. Joseph the Worker, we know the value of every human life, no matter their challenges or circumstances, and we offer the blessing of second chances. We know that a paycheck is the only way to prevent or escape poverty and homelessness.

Jobs provide far more than money—they lead to stability, independence, and a sense of purpose. Jobs fill desperate hearts with joy, hope, and gratitude. Employment for all is essential to the health and well-being of individuals, their families, and the community.

St. Joseph the Worker’s mission is to give people a hand up – not a handout – by assisting underserved individuals in their efforts to become self-sufficient through quality employment. At no cost, our employment services provide the right kind of hand up to make economic self-sufficiency possible. We remove individual barriers to employment such as covering the cost of transportation to and from work, providing resumes, work clothing, coaching, and a transitional housing solution based around staying employed.

Our Workforce Villages program is a free transitional housing solution that moves homeless, but employed clients from the streets to their own apartments within 90 days—for a fraction of the cost of other housing models. We support these clients for one year with resources, budgeting and financial coaching, career advancement, and other hands-on support to help ensure sustained success.

St. Joseph the Worker serves clients from more than 50 zip codes across the Valley through five locations and 90+ nonprofit, government and private partners. In FY 2021-2022, we were able to serve 7,312 new clients. We are aiming to serve 10,000 clients during this fiscal year. We have helped transform the lives of more than 35,000 individuals since we began in 1988.

Your support ensures that people in need who are motivated to work, are able to get and keep a job, setting them on a path towards lifelong stability.

Website: sjwjobs.org

Phoenix-based Southwest Behavioral & Health Services (SB&H) is a 501(c)3 nonprofit organization that provides compassionate primary care, substance abuse, and mental health services that enhance lives and improve communities. Services include outpatient mental health treatment and psychiatric services, including medication monitoring; assistance for persons with addictions; intensive inpatient care; residential housing, in-home and supported housing services; prevention services, community outreach, and school-based counseling; services for individuals with autism spectrum disorder; and four opioid replacement clinics.

SB&H Values:

COMPASSION: We take an empathetic and caring approach to the well-being of one another through personal connections.

INTEGRITY: We do the right thing by being sincere, honest, and keeping our word under any circumstance.

QUALITY: We uphold a standard of excellence that focuses on achieving successful outcomes.

EMPOWERMENT: We champion self-determination, equity, and inclusivity in an environment where our team and community feel valued.

INNOVATION: We pioneer change by encouraging team involvement and dynamic thinking that implement progressive solutions.

TRUST: We nurture a culture where each individual can express themselves by building relationships based on respect, reliability, acceptance, and honest communication.

Southwest Behavioral & Health Services has locations throughout the greater Phoenix Metro area and in rural Maricopa, Gila, Mohave, Coconino, and Yavapai counties.

Website: sbhservices.org

Community support for STARS is seen through partnerships, collaborations, and donations that are welcomed and honored throughout the

Individuals with intellectual and developmental disabilities (IDD) are some of the most joyous people you can find anywhere. STARS has a proud legacy of care and commitment to individuals with IDD, creating quality opportunities for life-long empowerment and success.

AZ

Individuals with intellectual and developmental disabilities are some of the most joyous people you can find anywhere. STARS has a proud legacy of care and commitment to individuals with developmental disabilities. Their mission is to improve lives through day programs, on-site work centers, community-based employment training opportunities, and transition programs for young adults. Through their doors, you will find lots of laughing and collaboration as STARS provides a welcoming, safe, and inclusive environment for this underserved population of residents with programs and activities that focus on them and the things they love to do.

Since 1973, STARS has been providing programs and support for people with I/DD throughout Scottsdale and surrounding communities. Developmental disabilities include chronic conditions related to mental or physical impairments that arise before adulthood and cause difficulties in language, mobility, learning, self-care, and independent living. Participants of STARS stay busy with classes that encourage them to express themselves creatively and learn new life skills in art, music, movement, and through community field trips. STARS also works with participants to develop real-world job skills and helps places them in jobs with our community partners. Families entrust STARS with the well-being of their loved ones, and it is a role they take very seriously.

STARS is privileged to be able to celebrate not only its rich history – from its start in a trailer on what was then the Scottsdale Stadium to its two current locations in Scottsdale – but also its future, as it grows the number of individuals placed in independent work situations throughout the Valley, in both local and national businesses. STARS has always celebrated its anniversary with Fiesta – a celebration of its mission, its participants, its family, and their partners and friends. Please consider joining them on May 13 at the J.W. Marriott Camelback Inn.

Website: starsaz.org

AZ QCO: 22497

Soldier’s Best Friend provides U.S. military veterans living with combat-related Post Traumatic Stress Disorder (PTSD) or Traumatic Brain Injury (TBI) with service or therapeutic companion dogs, most of which are rescued from local shelters. The veteran and dog train together to build a trusting relationship that touches two lives at once and inspires countless others.

"My experience with Soldier’s Best Friend has been life changing,” says veteran Ric, who was matched with his new best friend, Wilfred. “Coping with civilian life has become more manageable. I often imagine how simple life is for my buddy Wilfred, it keeps it all in perspective. When things get to be too much, my buddy is there. From the restless nights to the difficult situations, I have something that has been an elusive possibility—I have hope again. I consider myself fortunate to have had this opportunity. Having this service animal has given me both an outlet for coping and restored much of my confidence. Thanks Soldier’s Best Friend and the generous donors who made this all possible.”