FOR THE PERIOD ENDED 31 DECEMBER 2023

FOR THE PERIOD ENDED 31 DECEMBER 2023

During the reporting period New Zealand Rural Land Company (NZL) held 14,847 hectares (36,688 acres) of high-quality agricultural land. On 9 February 2024 the land was sold into a Limited Partnership which is 75% owned by NZL and 25% owned by Roc Partners. We are growing our portfolio of productive land and partnering with skilled primary producers. It’s important we make smart decisions about how we use our land because investment performance is inherently tied to its enduring integrity

While New Zealand’s primary sectors have earned a global reputation as trusted suppliers of low emission, quality products, we are also aware of the potential impacts of climate change. Our temperatures are warming, and weather patterns are shifting – trends consistent with those recorded around the globe. We acknowledge that the climate does not discriminate, resilience and preparedness are more important than ever in a world challenged by climate variability.

Along with physical risks, we are exposed to potential transition risks as the global economy shifts to decarbonize. These risks include potential changing of consumer preferences, regulations and trade and market access. While these transition risks may present challenges, we also see opportunities to leverage in the transition to a net zero, nature positive future.

This is our first climate-related disclosure and is an important step in understanding how climate change may impact our business through time and determining the right strategy to increase the resilience of our portfolio. This climate statement has been prepared in compliance with the Aotearoa New Zealand Climate Standards (NZCS1, NZCS2 & NZCS3), published by the External Reporting Board.

We acknowledge the importance of identifying, managing, and disclosing material climate-related risks and opportunities in a consistent and comparable way. To this end, we have developed three possible future scenarios which utilise Aotearoa Circle’s Agricultural Sector Climate Scenario work. Rather than predictions of the future, these climate scenarios provide a window into different plausible futures, enabling us to stress test our strategy under plausible socio-economic, technological, environmental, and political futures. Insights from the scenario analysis process are crucial to building resilience and preparing for the risks and opportunities we may encounter in the future.

We look forward to increasing the depth of our disclosures in subsequent reporting periods and support the shift toward a greater level of publicly available climate-related information. We understand the need for an efficient allocation of capital to help smooth the transition to a more sustainable, low emissions economy. To effectively tackle the climate crisis and support preparedness we offer an investment approach that contributes to a future that is better for the environment and communities.

Management of climate-related risks is a burgeoning field, characterised by evolving data and methodologies. This document includes forward-looking statements, encompassing climate-related scenarios, targets, assumptions, projections, and judgments, which may not materialise as anticipated and are based on our understanding as at the time of writing. Whilst NZL has endeavoured to establish a reasonable foundation for these statements including through utilising the work of the Aotearoa Circle, NZL will continue to enhance its response to climate-related risks and opportunities over time.

This document does not constitute financial, legal, tax, or other advice or guidance regarding capital growth or earnings.

NZL wishes to thank The Lever Room for their assistance in preparing this report and assisting NZL identifying and exploring potential impacts of climate change on our business.

Approved for release by the board on 29 April 2024

Rob Campbell Chair Tia Greenaway Director

The NZL Board of Directors are ultimately responsible for protecting and enhancing the value of our company assets. This responsibility includes oversight of risks and opportunities presented by climate-related issues. The Board approves and is responsible for, our overall climate strategy, initiatives, frameworks, targets, metrics and policies.

The Board meets regularly, at least eight times each year, and is updated on the management and strategic risks of climaterelated issues on a periodic basis during meetings. The Board works together with operational partner New Zealand Rural Land Management (NZRLM) joining each board meeting to ensure appropriate risk oversight.

The NZL Board reviews its performance, composition, and structure on an annual basis Collectively the board and NZRLM together hold accountability for the inclusion and delivery of actions relating to climate change into risk management, business planning, business processes and capital allocation within the overall budgets and financial delegations set by the Board.

NZRLM works together in partnership with NZL to drive activities on leased sites within our portfolio. The partnership is collectively responsible for the regular assessment and monitoring of all risks, including climate related risks and opportunities The main assessment mechanism for on-farm activities is facilitated through the Enduring Land for Life framework.

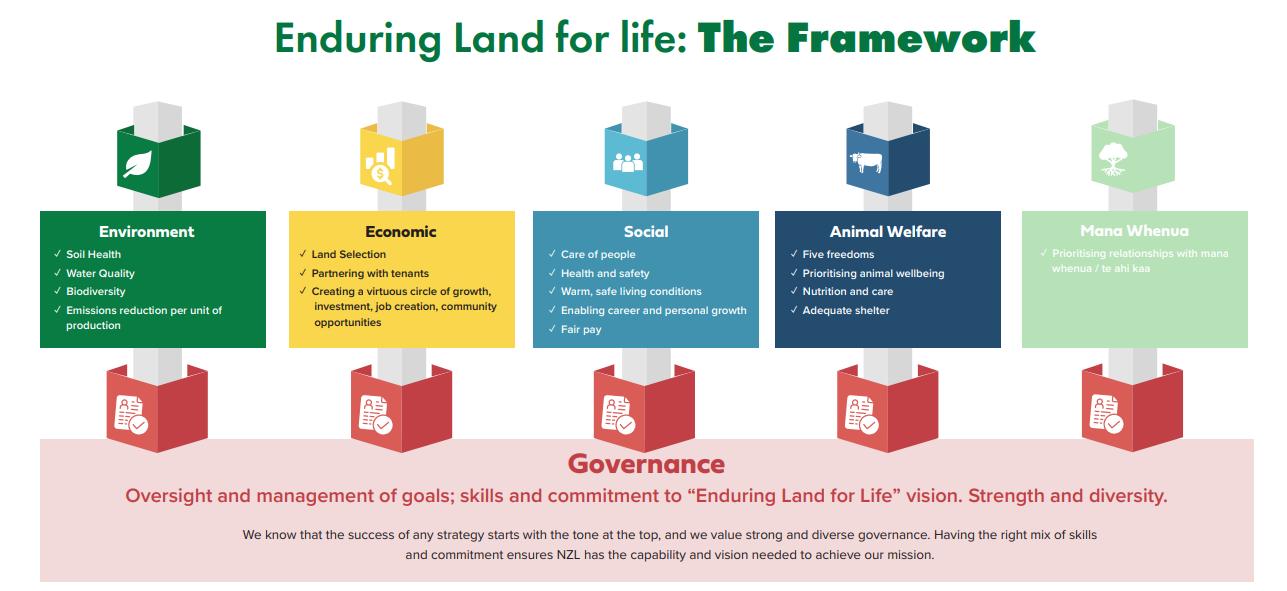

The Enduring Land for Life (ELFL) Framework allows the governance body to receive advice and consider climate-related impacts when developing and overseeing implementation of the organisation’s strategy. The Board is updated every two months on the Framework, including carbon management. The framework sets exacting standards in our approach to land management, animal welfare, human resources, and governance, ensuring the land we own and our farming partners of today will be safeguarded to support the producers of tomorrow. Best practice expectations are binding, as they are written into the contractual relationship with partners to ensure we become a positive, market-leading force for exceptional land stewardship and sustainability.

While the Enduring Land for Life Framework is an industry-leading means for communicating measurement and management of emissions within our properties (with emissions reduction per unit of production used as a key reporting metric), we are committed to furthering this work through a more explicit focus on climate-risk and opportunity and how NZL governance can best be kept informed on an ongoing basis

NZL Board

Rob Campbell – Independent Chair

Sarah Kennedy – Independent Director

Tia Greenaway – Independent Director

Christopher Swasbrook – Non-independent Director

NZRLM

Shelley Ruha – Director

Richard Milsom – Executive Director and Founder

Xavier Lynch – General Manager

Elisha Friedlander – Investment Director

Josh Jenkins – Investment Associate

We engage specialists on an as needed basis and will engage climate-impact specialists to provide on-going advice on climaterelated readiness to the Board on a regular basis. Specialist advisory in the climate space will support the Board to keep abreast of latest science and monitor progress against and oversee achievement of metrics and targets for managing climaterelated risks and opportunities. This function will also support us to consider climate-related risks and opportunities when developing and overseeing implementation of our strategy, specifically how these considerations can more fully inform our acquisition strategy

Sustainability is a skill considered essential for the effective governance of climate-related risks and opportunities. Our Board continues to expand its knowledge and further climate training sessions are planned for the next reporting period. We look forward to reporting progress in our next disclosure in March 2025.

Our strategy is to own quality rural land in New Zealand, growing a diverse portfolio while delivering attractive risk-adjusted returns as a ground lessor. Our choice to be a leader in the sustainable ownership of land is based on the fundamental belief that investment performance is inherently tied to the enduring integrity of our land. This means that as the global and domestic economies transition towards a low-emission, climate resilient future state NZL will continue to position itself as a leader and genuine steward of land and of the planet.

Our commitment to this sustainable leadership stance is demonstrated by the fact that central to our business model is the ownership of land on a longer-term basis than the typical operator. Our properties are 100% tenanted on long-term leases, with an average lease term of 12.5 years. We leverage our position as the ground lessor via contractual commitments to caring for the land, climate, and communities. NZL therefore has both the incentive and the ability to ensure lessees are using land with respect and are prepared for the impacts of climate change

NZL is actively mapping its current portfolio for marginal land which can be enhanced with planting and a programme to increase biodiversity. The mitigation of erosion is a key outcome of this planting with potential for carbon sequestration and sediment control. Two properties containing marginal areas have launched planting programmes in 2024.

We explore in further detail below the current and future impacts of climate-related risks and opportunities of most relevance to our business, and why we believe NZL, and our lessees are well positioned to capture opportunities and meet the challenges ahead. In 2024 we assessed NZL’s climate-related risks and opportunities over the short (2026), medium (2030) and longer (2050) term This work has validated the importance of considering climate-related risks and opportunities in our strategic and operational business planning.

NZL generates shareholder value through a combination of asset value appreciation and cash flow from long-term leases. While NZL is not directly responsible for operational on-farm costs and risks, we acknowledge that the health, safety and prosperity of our lessees is crucial to the success of our business model. We have a vested interest in ensuring our lessees are situated on land that minimises exposure risk in a changing climate. Our due diligence in this space supports financial stability for NZL and lessees, both now and into the future.

Our land acquisition strategy already considers some of the potential physical impacts of climate change (e.g., drought, sea level rise and extreme weather events) and some transition risks such as domestic regulatory changes that could affect the lessee business environment. Our business model allows us the privilege of being agile, as we are not tied to a particular landuse type or industry.

While our initial focus has been on acquiring pastoral properties, we are expanding our focus to other primary sectors, particularly as investment opportunities arise in horticulture, green energy, forestry as well as sheep and beef. Years 2023 and 2024 marked NZL’s entry into two new sub-sectors: two forestry estate acquisitions in the Manawatū-Whanganui region and a horticulture acquisition supporting three apple orchards located in the Hawke’s Bay region of the North Island.

This diversification improved the resilience of NZL’s portfolio, in conjunction with driving greater returns through value appreciation and an increased overall rental income. As NZL grows, it will continue to diversify its portfolio and lessees while delivering attractive risk-adjusted returns.

Keeping abreast of the climate risk and opportunity landscape will continue to inform our acquisition strategy and decisionmaking process. As part of the internal capital funding and decision-making processes there is opportunity to further develop assessment of climate-related risks and opportunities as the approach to scenario analysis evolves

New Zealand’s economy relies heavily on productive land: the agricultural, horticultural and forestry sectors contribute significantly to export earnings (more than half of New Zealand’s total export income) and a sizeable proportion of Aotearoa New Zealand’s total land is used for primary production While the effects of climate change on the economy have the potential to intensify over the coming decades, a number of impacts are already being observed.

Agriculture in New Zealand has entered a period of potential disruption due to impacts from change drivers including trade agreements, evolving consumer preferences and expectations, pandemic and disease, and emerging technologies.

We are aware that climate impacts being experienced by our lessees and their sectoral counterparts have the potential for flow-through both in our current operating environment, and into the future. Current climate-related impacts of most relevance to NZL were identified in diagnostic interviews with Board members and tested at a Climate Risk workshop. The results of these conversations are summarized in Table 1 Anticipated future impacts of climate change are explored more fully in section 3.6 (below).

Current

Physical Impacts Risks Extreme Weather Events

Aotearoa New Zealand is experiencing an increase in extreme weather events such as Cyclone Gabrielle that devastated parts of the North Island of New Zealand in February 2023. Our lessees are at risk of experiencing the effects of such events, including flooding, power outages, road damage, and logistical breakdown.

Extreme weather events can cause long-term disruption to rural communities, and to vital networks and support services. Some communities may need to relocate, either temporarily or permanently.

Many Māori live in rural areas and have strong connections to land, environment and taonga that are at threat from the impacts of climate change.

Opportunity Land Value

As climate impacts trade and production globally, rural land in Aotearoa New Zealand becomes more valuable on a global scale relative to regions that are more greatly affected by the impact of climate change

Current Transition Impacts Risk & Opportunity Regulatory Environment Impacting Productivity

The combination of forestry, biodiversity, freshwater and climate policy is already having an impact on how land is used by the agricultural sector.

Emissions pricing, and incentives for private sector financing could change the profitability of certain farm systems and practices. They could also affect the price of food, with significant implications for food security.

Aotearoa New Zealand's primary sectors have earned a global reputation as a trusted supplier of quality products and ingredients. If we are unable to maintain the integrity of our natural environment under a changing climate, this reputation could be tarnished, impacting consumer preferences.

Reputational risk also applies to NZL as an entity, given the reliance on sustainability credentials in our brand proposition. Continuing to protect the integrity of our land through partnerships with our lessees and acquisition of climate resilient parcels will ensure our reputation remains our competitive advantage.

To assist our forecasting of climate related risks and opportunities over the short, medium and long-term, as well as to test our business strategy and model, we undertook a climate scenario analysis exercise. This process involved the NZL Board and representatives from NZRLM and was facilitated by external specialists. Being our first scenario analysis exercise it was treated as a stand-alone process. The workshop held comprised:

• Summary of climate change context using globally agreed data

• Summary of sector level drivers of change and impact pathways

• Risk Prioritisation exercise - to identify the highest ranked priority risks and opportunities

• Climate Scenario Analysis exercise – to take the highest ranked priority risks and opportunities and test them under three future climate scenarios.

In accordance with the requirements of NZ CS1, three future climate scenarios were analysed, each of which represent an alternative potential future:

• Orderly / Tū-ā-pae a 1.5 degrees Celsius climate-related scenario (Mandatory Scenario)

• Disorderly / Tū-ā-hopo a 2 degrees Celsius climate related scenario (NZL Selected Scenario)

• Hothouse World/ Tū-ā-tapape a 3 degrees Celsius or greater climate related scenario (Mandatory Scenario)

To ensure consistency in approach we made use of the related scenario definitions created for the New Zealand agriculture sector by the Aotearoa Circle. The sector scenario work brought together sectors across New Zealand to support climate reporting entities and encourage greater comparability of reporting. Te Kāwai Ārahi Pūrongo Mōwaho - External Reporting Board (XRB) recognises the value of sector scenarios and encourages sector collaboration.

The boundary of the assessment accounted for both direct operations along with those within our value chain, upstream and downstream such as suppliers, partners, and customers. Time horizons relevant for the analysis were discussed by participants in light of our business processes and strategy setting practices as outlined in the table below.

Short-term 1 – 5 years

2024 - 2029

Medium-term 6 – 10 years

Operational planning timeframes relevant for Board’s budget + business planning cycle.

2030 - 2034 In line with NZL long-term strategic planning.

More certainty of climatic impact and policy settings over these time frames.

Long-term 10+ years 2034 + Longer term strategy planning. Lifespan relevant timeframe for significant assets such as property + tenancy agreements, in line with strategic outlook of Board and tenants, including 2050 Net Zero ambitions

Table 3: Climate Scenarios

Scenario definition/source

Circle (agriculture sector specific)

Scenario description This scenario describes a 2050 world that has succeeded in implementing the Paris Agreement (net zero by 2050)

Circle (agriculture sector specific)

Divergent NetZero scenario reaches net zero emissions around 2050 but with higher transition costs due to delayed, divergent policies being introduced across sectors leading to rapid phase out of oil use

Circle (agriculture sector specific)

This scenario describes a 2050 world where failure to curb emissions means that humanity and nature are facing the consequences of significant climate disruption

NZ resource and agricultural management Regenerative practices and mixed farming systems have built resilience to the physical and transition impacts of climate change across the sector.

Although some farm operations have been lost, thriving rural communities have emerged. Skilled workers are driven to the sector by its strong international reputation.

Around 2030, a sequence of compound weather events swept across the country, causing significant damage to people and property. The most vulnerable parts of the country suffered the greatest losses and food production was impacted heavily.

The Central Government responded by dramatically scaling up action to adapt to climate change and reduce emissions, joining the global effort to meet the goals of the Paris Agreement.

The associated transition was disruptive and took a toll on the agriculture sector which saw dramatically increased operating and capital costs. As farmers and growers adapt to changing seasons and variability, stranded assets have

Physical climate change has affected growing regions around the country. Costs are high for farmers and growers who struggle to get insurance but are still exposed to weather extremes that damage crops, reduce yields and impact transport routes.

Without a cohesive land use policy, food production falls until innovation enabled indoor farming systems begin to thrive and additional types of proteins emerge into the market.

A balance has been struck between productive agricultural and forestry land, biodiversity protection, emissions reductions, and food security. Climate and land use data has improved and become easily accessible for the sector so that farmers and growers can understand their climate risks, build resilience, and best understand their contribution to achieving net zero. As a result, native forestry has dramatically increased, biodiversity and water quality outcomes have improved, and the sector is prosperous.

become an issue through poorly planned land use change.

Consumer demand is still strong for staples and desire for homegrown products gives confidence to the horticulture and broad acre cropping subsystems. But the incentivisation of exotic forestry by the government through the emissions trading scheme has seen many sheep and beef farms converted to exotic forestry.

Some farmers and growers have been able to diversify by adopting mixed or innovative farming systems. These farmers and growers have been the most successful in the face of climate change.

But investing in innovative systems such as indoor or vertical farming comes at a high cost and many farm operations could not transition quickly enough to remain viable.

There is little regard given to protecting biodiversity or soil health. Local meat products remain reasonably popular and competition from a more diversified protein sector is strong.

Exports are high, but instead of being a priority for food production as in the 2020s, supplying the domestic market takes precedence which yields lower incomes for farmers and growers.

Community tension over lack of water control and who should have priority access, led to the introduction of the Water Allocation Act in 2032, which aimed to shift water from wet to dry regions. However, the Act did not appropriately recognise the needs of ecosystems and although it has helped prolong intensive agriculture in some areas, it has led to devastating impacts on biodiversity

NZL used scenario narratives to explore potential climate-related impacts over the short, medium, and long-term time horizons. The analysis took into consideration our long-term acquisition strategy, current operating context, and our ability to respond. During a scenario analysis workshop, climate related risks and opportunities were prioritized from an initial long list.

The analysis of climate-related risks found varying degrees of impact on the business across the three scenarios and time horizons. We set out NZLs material climate-related risks and opportunities, their anticipated impacts and management response that we reasonably expect in Table 4.

Our analysis indicates that global demand for sustainably productive land in climate resilient areas will continue to grow over the long-term.

A key piece of our transition planning which is reflected throughout our summary findings is to maintain diversity by geographical location and land utilisation type in the parcels of land we acquire. This will allow us to remain agile in our response to a climate changed world, regardless of scenario type we find ourselves in the coming decades.

Assessing land for resilience in a climate changed world is set to become an increasingly key consideration for NZL in business case considerations. We intend to continue to increase our sophistication and capability around climate scenario analysis to help inform these ongoing strategic processes and internal capital deployment over time.

Risk Description

Transition

Inability for sector to develop a whole system approach to build resilience for effective adaptation

Inability of sector to keep up with the rate of global technological change

Long

Increased operational costs due to decreased fuel availabilities and more expensive energy and agriculture inputs

Strategic Mitigations

Loss of identity and degradation of mauri for rural communities and agricultural sector operators

Long

Uncertainty around whether future technology will enable the transition of food production systems from an extractive model to a sustainable one that works for the New Zealand agriculture sector.

Participation in sector wide adaptation pathway planning initiatives

Policy becomes misaligned with the needs of the sector and how it operates

Medium

Social licence to operate within rural communities could be impacted if land management practices and relationships with rural communities not maintained.

Proactively assess and refine strategy and risk responses

Monitor developments, seek regular specialist advice to ensure consideration of technological changes are incorporated in forecasts + acquisition strategy

Continue capital allocation to ELFL programme, broadening scope of programme to include climate risk and opportunity

Establish proactive engagement strategy

Tightening environmental regulations may cause significant direct and indirect cost increases over short and medium terms. Environmental regulations are already starting to increase in many of the markets in which lessees operate.

Global regulatory landscape will increasingly incorporate climate objectives which will influence how we will access markets in the future.

Continue to monitor domestic and global regulatory landscape, emerging risks and opportunities

Actively engage with policy makers in key markets to stay at the forefront of regulatory changes

Physical and Transition Land use changes by geographical location

Medium Long Implementation and expansion of regulatory requirements relating to emissions pricing and trading could affect value of carbon forestry assets.

Unanticipated or premature write-downs, devaluations, or conversion to liabilities due to these changes in regulatory and/or physical environment could leave lessees with increased liabilities, challenging their ability to meet commercial obligations.

Strengthen engagement with lessees to support on-farm preparedness pertaining to regulatory environment

Strategic allocation of geographically diverse farm locations with multiple utilization potential

Seek regular, specialist advice on both ETS and voluntary carbon markets, incorporate into acquisition decisionmaking-process

Strengthen engagement with lessees to support on-farm preparedness pertaining to physical environment

Investigate adding asset class for Biodiversity / Wetlands

Physical Inability for existing practices to maintain productivity output

Medium Long The agriculture sector is already experiencing worsening climate extremes and disruption. These will be exacerbated and will have a greater negative impact across the whole agriculture sector value chain as the frequency of extreme weather events increases

Maintain a balance of sustainable food production and carbon sequestration asset classes within our portfolio

Monitor developments in valuing of ecosystems services

Strategic allocation of geographically diverse farm locations with multiple utilisation potential

Seek regular, specialist advice on trends in physical impacts to agriculture sector,

Increased volatility in production and reduced ability to get product to market

Inability for agriculture industry operator to access financial products

More frequent and severe extreme weather events impact lessee ability to conduct operations, increased damage to capital assets. Unanticipated or premature write-downs, devaluations or conversion to liabilities resulting from these impacts could leave lessees with increased liabilities, challenging their ability to meet commercial obligations.

incorporate into acquisition decisionmaking process

Investigate adding asset class for Biodiversity / Wetlands

Maintain a balance of sustainable food production and carbon sequestration asset classes within our portfolio

Strengthen engagement with lessees to support on-farm preparedness pertaining to physical risk environment

Investigate opportunities within ELFL Framework to strengthen climateresilient practices beyond reducing emissions

Support lessee preparedness through incorporation of business continuity planning for extreme weather events into Enduring Land for Life Programme

Long

Reduced productivity and disruptions to logistical supply chains

Seek advice and monitor trends

Long Reduced availability of financial and insurance products for lessees due to the inability to meet institutions’ increasing climate related requirements such as targets, performance, and standards.

Engage with financial institutions to monitor future trends + risks

Increased water stress and lack of water security

This may result in increased operating costs, financial exposure and/or land-use change.

Equitable access to water will increasingly become a key driver in maintaining/decreasing productivity. Lack of water security could render certain land use types inviable.

Water has cultural significance beyond commercial and recreational use; water imbues mauri and mana, if not managed well by lessee operations, this could impact social licence to operate in our rural communities.

Continue to report and share sustainability performance of ELFL Framework on behalf of lessees to support their reporting

Monitor domestic and global regulatory landscape (including private sector operators such as irrigation market)

Direct monitoring of climate relevant water variables in key land holding locations, incorporate into acquisition strategy

The NZL Board has an established an Audit and Risk Committee comprising of 3 board members, Sarah Kennedy (Chair), Rob Campbell and Tia Greenaway The decisions of this Committee are reported back to the Board to allow the other members of the Board to question Committee members.

The objective and purpose of the Audit and Risk Committee is to assist the Board in fulfilling its responsibilities in all matters related to risk management and the financial accounting and reporting of NZL. This includes assisting the Board in fulfilling its oversight responsibility to shareholders, potential shareholders, and the investment community.

The Committee undertakes a formal review of its objectives and activities at least once every two years Other committees may be established on a case-by-case basis where the Board considers it appropriate to do so. The Board retains ultimate responsibility for the functions of its committees and determines their responsibilities.

As a result of the Climate Scenario Analysis process, we consider climate risk is best included as an activity area of the Risk and Audit Committee We will also consider the most effective means for prioritising climate-related risks relative to other types of risks in the decision-making process and most appropriate frequency of assessment.

We are also seeking specialist external advice on how best to integrate climate risks activities into our programme of work. Establishing specific “climate impact” reporting metric(s) and developing tools and methods to identify and assess the scope, size, and impact of our climate-related risks is included in this programme or work. Refer to the Strategy section for the outputs of our scenario-based approach that explored plausible future scenarios and potential impacts on NZLs performance over short, medium and long-time horizons. No parts of our value chain were excluded from the analysis.

The formal integration of climate-related risk within our Risk Management Framework is a programme of work we intend to complete. We look forward to reporting progress against this activity area in subsequent reporting years.

Ultimately - NZLs key mechanism for managing climate related risk, and seizing climate related opportunities lies in our agile acquisition strategy. Processes for identifying, assessing and managing climate related risks, and its integration into NZLs overall risk management processes will be codified in our acquisition strategy.

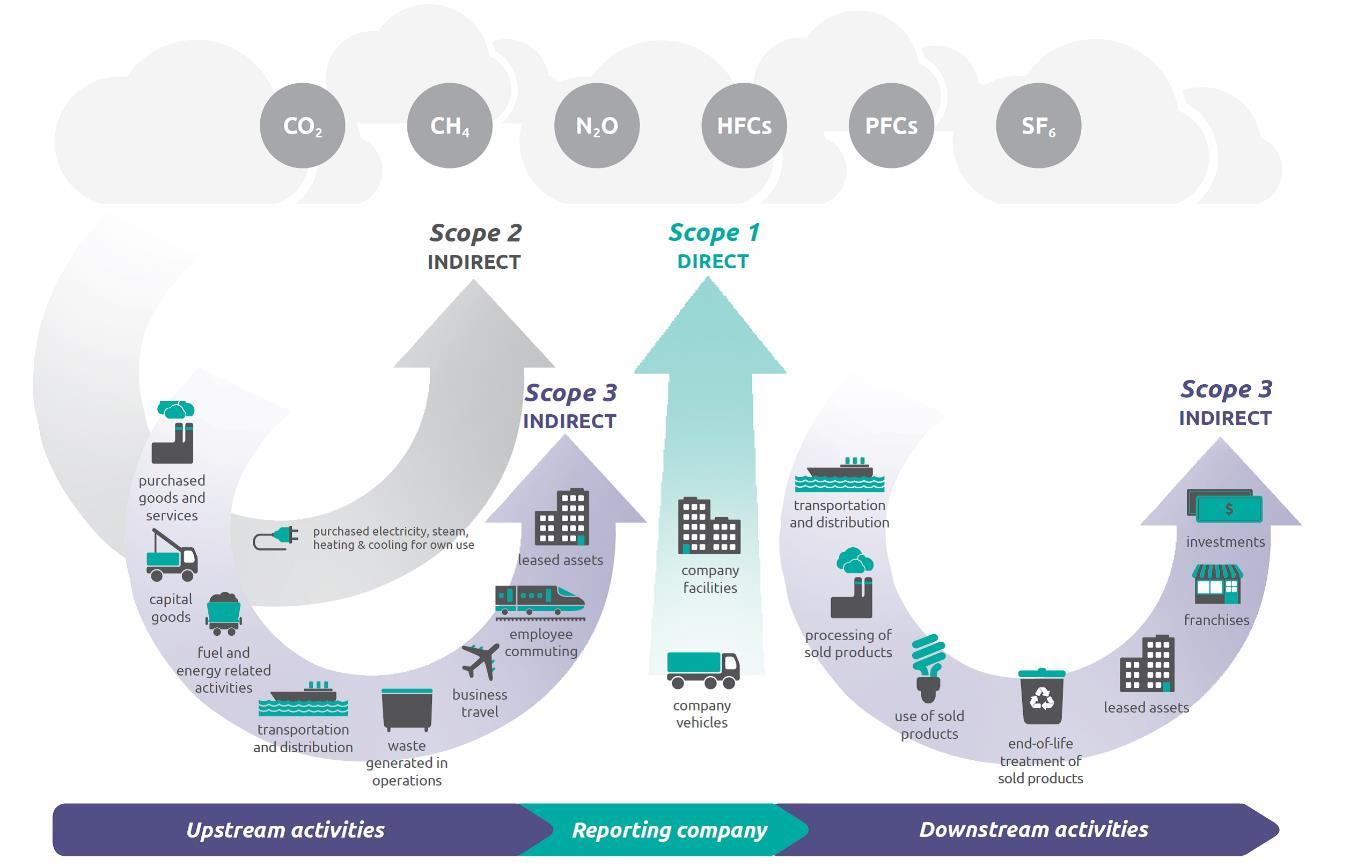

A Greenhouse Gas (GHG) Inventory is the measurement of emissions generated by an organisation, this covers 6 main gas types, Carbon Dioxide (CO2), Methane (CH4), Nitrous Oxide (N2O), hydrochlorofluorocarbons (HFCs), perfluorocarbons (PFCs) & sulphur hexafluoride (SF6) that are usually reported as a carbon dioxide equivalent or CO2e.

GHG Emissions are reported across 3 scopes based on the type of activity and where in the organisations value chain it took place (see Figure 1).’

Scope 1 emissions: are direct greenhouse (GHG) emissions that occur from sources that are controlled or owned by an organisation (e.g emissions associated with fuel combustion in boilers, furnaces, vehicles).

Scope 2 emissions: are indirect GHG emissions associated with the purchase of electricity, steam, heat, or cooling.

Scope 3 includes all other indirect emissions that occur in the upstream and downstream activities of an organisation (e.g travel, purchased goods and services, freight etc)

A combination of data sources are used to calculate an inventory, activity data such as power consumption from electricity invoices, industry average values from $ spent and modelled assumptions. These are often sourced from the organisations financial system, with further information provided by the organisation, suppliers and other stakeholders where required.

In 2023, we embarked on our inaugural greenhouse gas (GHG) measurement for NZL, marking a crucial milestone in our sustainability journey.

This foundational year serves as a pivotal point, establishing a baseline that will guide the development of future targets and inform our transition planning towards a more environmentally responsible operation. Our GHG inventory encompasses mandatory Scope 1 and 2 emissions, alongside selected Scope 3 activities, reflecting our commitment to comprehensive and transparent reporting. For further insights into the specific inclusions within our inventory, detailed information is provided below.

Note to Inventory; The emission profile of NZL does not include any Scope 1 or 2 emissions due to the entity holding no office space of its own and no vehicles All land held as assets is leased out and therefore activities occurring on that land is outside of the operational control of NZL This will be measured and included in future reporting but has been omitted in year 1 as per NZ CS2 – Provision 4.

Note to Scope 3; It is understood GHG Category 13: Downstream Leased Assets is a significant part of our overall impact; it has been excluded for this period but will be included in our next submission as required.

The NZL board and management team will use the 2023 baseline GHG measurement to develop and implement targets for year 2 reporting as permitted by NZ CS2 – Provision 3

5.3.1.

The measurement of greenhouse gas (GHG) emissions disclosed in this report have been conducted in strict adherence to the internationally recognised standard ISO14064-1:2018. This robust framework ensures the accuracy, reliability, and consistency of our GHG emission data. An operational control has been used for consolidation purposes; this approach aligns most closely with the structure of NZL

The following emission factors have been selected as recommended by the New Zealand Ministry for the Environment, they represent the geographical locations in which NZL operate and are regularly updated. A review of emission factor selection will be performed during each reporting period to ensure best practice is maintained.

1) New Zealand Ministry for the Environment’s Measuring emissions: A guide for organisations: 2023 summary of emission factors.1 Uses the 100-year GWPs in the IPCC Fifth Assessment Report (AR5)

2) Market Economics Limited | Auckland Council Environmental Services: Consumption Modelling, March 20232

1 https://environment.govt.nz/publications/measuring-emissions-a-guide-for-organisations-2023-detailed-guide/ 2 https://www.knowledgeauckland.org.nz/publications/consumption-emissions-modelling

Land is essential for life. It’s the source of most of our food, it underpins half of New Zealand’s export earnings, and it supports families, iwi, jobs, companies and communities. NZL through the Enduring Land for Life programme are building a portfolio of highly productive land and partnering with skilled primary producers. NZL are setting exacting standards in our approach to land management, animal welfare, human resources, and governance, ensuring the land we own and our farming partners of today will be safeguarded to support the producers of tomorrow.

Farms are complex natural systems where the performance of one component, such as sheep or dairy cattle, is influenced by others, including soil fertility, quality feed or the training, competence, and morale of farm staff.

Enduring land management is achieved through goals and actions in four connected areas: environmental, economic, social and animal welfare. A fifth area, governance, ensures oversight and management of these goals in each on-farm area, and the monitoring and measurement of performance. These goals and the specifics related to their achievement are included in our partnership agreements with lessees.

Further information on the programme can be found at NZRLC.co.nz/sustainability.

NZL ultimately have a single asset class – land. While we are building resilience into our portfolio through geographic and land utilization diversity, we do not consider any part of our value chain to be insulated entirely from either transition or physical risks that will present under any given future scenario. Having undergone the scenario analysis process however, it is clear to our Board that we are well placed to grasp opportunities in a future where the climate is likely to put further pressure on global stacks of productive land.

The primary opportunity for NZL across our entire asset base is to continue to invest in land that is least exposed to physical and transition risks, particularly:

• Regions where the agriculture subsystems are not ‘extremely exposed’ to physical climate related risks such as extreme weather events and rising sea levels

• Areas that are least likely to experience logistic disruptions

• Land that supports multiple utilization types (to meet shifting environmental conditions, consumer preferences, regulatory constraints, lessee access to financial products and global trade restrictions)

• Areas that are water secure

• Land use types best able to support our rural communities (with specific consideration for mana whenua prosperity and wellbeing)

NZL acknowledges the importance of having an internal price of carbon that is backed up by a robust methodology and regularly reviewed. In order to meet these requirements, we have contracted an independent expert to assist, they provided 3 price path scenarios covering a high, mid and low-price path The scenarios use current NZU prices, substantiated assumptions, and international market signals to provide a forecast based on the best available information.

• High Price Path: 2023 - $71, 2030 - $266, 2050 - $419

• Mid-Price Path: 2023 - $71, 2030 - $187, 2050 - $294

• Low Price Path: 2023 - $71, 2030 - $108, 2050 - $168

We currently use the middle scenario for internal risk management, this decision will be reviewed as required.

Further details on the methodology used by our provider are available on request.

NZLs work relating to climate scenario analysis has just begun with detailed climate risk interrogation processes and climate disclosure preparation activities being reported for the first time in this period (FY24). The challenges of our unique operating environment as a landholder facing the full scope of the agricultural value chain, coupled with limited direct control over onfarm operations present a unique lens for tailoring and quantifying analyses and outcomes to our specific operations. We acknowledge there is further work to do in relation to the outcomes and insights of this scenario analysis process, and two key areas where we can exert positive impact for the land and for our investors. These are:

• Further refining our acquisition strategy to ensure climate resilience is a fundamental consideration underpinning the decision-making process.

• Codifying climate resilience into our contractual agreements with our tenants to ensure they are limiting NZLs contribution and exposure to climate change, while to grasp opportunities as the global economy decarbonises

In terms of future work in this area, NZL has identified the following the key initiatives:

1. Assign measures to track risk and opportunity realisation (planned prior to the end of FY25).

2. Disclose the financial implications of current climate related impacts along with deployed mitigation and adaptation costs.

3. Integrate climate scenario analysis processes (frequencies, time horizons etc.) within overall risk management processes and business strategy reviews.

4. Continue to refine processes by which climate related risks and opportunities serve as input to capital deployment and funding decisions.

5. Determine the percentage of activities vulnerable to transition and physical risks and opportunities, along with the amount of capital deployed toward those.

6. Continue to assess and assign financial implications of risks and opportunities along with the time horizons over which they may be realised (planned prior to the end of FY25).

7. Review remuneration policies of the Board to assess for opportunities for linking to climate risk and opportunity.

We look forward to reporting progress towards these initiatives in our next reporting cycle in March 2025.