The information and opinions in this presentation were prepared by New Zealand Rural Land Company (NZL). NZL makes no representation or warranty as to the accuracy or completeness of the information in this report. Opinions including estimates and projections in this report constitute the current judgment of NZL as at the date of this report and are subject to change without notice. Such opinions are not guarantees or predictions of future performance. This report is provided for information purposes only and does not constitute investment advice. Neither NZL, nor any of its Board members, officers, employees, advisers (including New Zealand Rural Land Management Limited) or any other representatives will be liable for any damage, loss or cost incurred by any recipient of this report or other person in connection with this report.

The Rural Land Investors

A perfect combination of advantages

• A rapidly growing global population, food demand and a decrease in available productive land means rural land is increasingly a more attractive investment. This scarce and critical asset has demonstrated consistent positive returns over time.

• New Zealand has some of the most productive agricultural land in the world. Water, soils, space and climate come together to deliver world-leading low cost production and carbon efficiency.

• NZL invests in land, not farm operations. There is no direct exposure to operational or commodity price risks.

• NZL currently owns 17,503 hectares (43,251 acres) of high quality productive rural land in New Zealand and leases it, long term, to high quality tenants.

• NZL is the only pure-play, NZX listed exposure to agricultural land in New Zealand. As such NZL provides investors with a liquid and inflation hedged investment.

• For overseas investors, NZL is one of the only ways they can gain exposure to New Zealand agricultural land.

• NZL shareholders receive twice-yearly dividends plus growth in land value. NZL since listing has established a track record of outperforming the broader rural land market.

The World’s Most Efficient and Lowest Cost Producer Advantaged Exporter, Well Positioned for Free Trade Sustainably Advantaged World Class Risk Mitigation

New Zealand’s temperate climate, fertile soils and pasture-based production systems provide a lower cost of production than most other countries worldwide.

New Zealand has a lower carbon footprint for its primary products than most if not all alternative producers.

The importance of agriculture to the New Zealand economy mitigates political risks to the industry. While social risks are mitigated by the industry’s active management of social perception and social licence.

New Zealand’s natural advantages and efficient production means that the country produces far more than it can consume domestically. This allows farmers to export the majority of their goods to high value international markets.

Temperate Climate

1st of 50 countries for Animal Welfare. 1st out of 113 countries for Food Safety. -40% lower cost of production than EU or USA.

95% of products are exported to over 130 countries.

90m people can source all their dairy from New Zealand.

$12.9b is the value of New Zealand’s Dairy Exports. 68% less carbon from cradle-to-farm gate than the global average.

New Zealand Rural Land Company is a landlord to New Zealand’s highly advantaged agricultural sector.

We own rural land and lease it to high quality tenants.

9

Tenants

• The global population is expected to reach 9.7 billion by 2050. A growing global population and surging demand for food alongside declining available productive land provide a strong long-term global tailwind for productive land ownership.

• Globally, productive rural land is a scarce/finite resource. New Zealand rural land is extremely well placed to capitalise on the global scarcity of high quality arable land.

between 1962 and 2018 the amount of arable (productive) land available per person to produce food is in significant decline.

• Soil in New Zealand is predominantly fertile volcanic loams – ideal for productive farming. This, coupled with New Zealand’s temperate climate, consistent rainfall and adequate sunshine make it a highly efficient, low cost producer of primary products.

• New Zealand’s pasture based farm systems also support many alternative uses (e.g. dairy, horticulture and forestry).

• New Zealand’s low input pasture based farming methods enable meat and dairy products to be produced with a significantly lower carbon footprint than other countries worldwide:

• Milk production in New Zealand has a 40% - 50% lower carbon footprint than producers in the EU and US.

• Sheep and beef meat production in New Zealand has a carbon footprint 63% and 77% lower than the global average, respectively.

Global Carbon Emissions per kg of Milk

• Joint sustainability commitments are written into NZL’s leases. These reinforce the shared vision between NZL and its tenants of what sustainability looks like and the commitment to proactively manage, mitigate and minimise greenhouse gas emissions, nutrient leaching and other potentially environmentally harmful practices, while ensuring the welfare and wellbeing of the people, communities and animals connected to the land.

• NZL’s directors and management have a track record of establishing and implementing sustainability initiatives across a number of New Zealand businesses.

Access to Transactions

• First mover

• Profile

• Volume

• Network

• Reputation

• Listed Company

Access to Capital

• NZX listed

• Relationship with Rabobank (and other rural lenders)

Access to Tenants

• Reputation and structural appeal

• DD process - thorough and proprietary

• Knowledgeable of who the best potential tenants are

• Network

ACCESS TO QUALITY TENANT PARTNERSHIPS

• Speed and certainty for vendors

• Ease of completion (no OIO)

• Social license to purchase farmland

Due Diligence and Lease Structure

• Advantaged and refined due diligence processes

• Proprietary and comprehensive leases and structures

• Proprietary risk vs. return analysis

• Highly repeatable process

• By only owning the land NZL has no direct exposure to the operational risks of farming:

No direct on-farm risks (via either sharemilker or operational partner)

No direct exposure to volatile commodity prices

Limited exposure to environmental risks

No exposure to animal health risks

No direct exposure to farmer co-ops

Listing provides greater liquidity than syndicates or direct investments

• By only owning rural land NZL has a number of advantages over traditional REITs:

Easy and low cost alternative use

Tenants with high credit quality and a history of operational excellence

Rural land assets have much less depreciating improvements

Uncorrelated with traditional assets

Low obsolescence risk

Food production is an essential service

Inflation hedged asset class

• Land offers investors a low risk profile with consistent returns (non-cyclical).

• NZL since listing has a demonstrated history of outperforming the farm price index1.

• For the last 28 years the value of rural land in New Zealand has grown consistently, with REINZ’s Rural Land Price Index increasing at a CAGR of +5.9% per annum (this is before operating or lease income).

• Currently NZL is receiving 5-9% cash leases on capital deployed for low risk assets. These are all triple net leases2 subject to uncapped inflation adjustments.

• The capital growth of rural land in New Zealand offers a significant tax advantage over other jurisdictions as capital gains are not taxed in New Zealand.

Long Term New Zealand Farm Price Index - Land Only CAGR +5.9% p.a.*

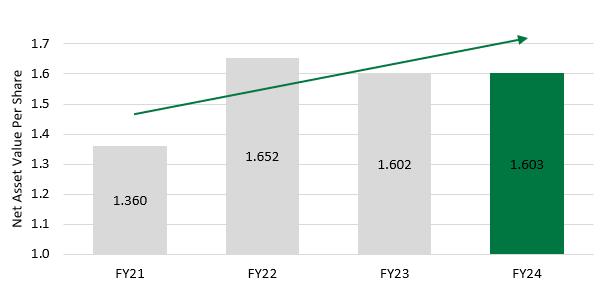

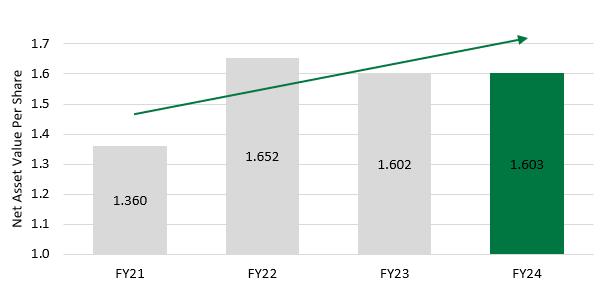

NZL’s NAV per share Has Increased +17.9% Since 2021

As at 31 December 2024 SECTION 2

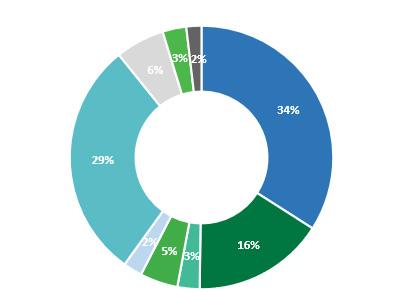

• NZL expects tenant diversification to increase as it continues to grow its asset base.

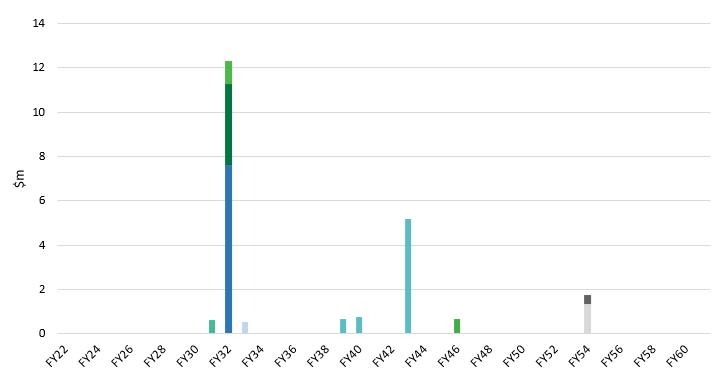

• NZL’s Weighted Average Lease Term (WALT) is currently 12.5 years (100% occupancy).

• NZL’s pastoral farm leases all have three, six and nine year CPI increases with tenant rights of renewal in years 10 or 11.

• NZL’s forestry leases all have annual CPI increases.

• NZL’s horticultural assets have annual rental increases of 2.5% or CPI whichever is greater.

• All leases are triple net leases, tenants are responsible for all repair and maintenance costs.

Tenant Concentration as % of Lease Value

Lease Expiry Profile by Value

As at 31 December 2024

CPI linked rental increases of +18.6% on 37.3% of NZL’s portfolio took effect in mid-2024. A further 26.5% of NZL’s portfolio was subject to a +4.0% increase on 15 April 2024.

Net asset value per share has grown from $1.25 at IPO1 to $1.603 (at 31 December 2024); total company returns have been +35.9% (NAV growth plus dividends)2. 1.

FY24 AFFO was $7.1m (4.94 cps)3 due to the impact of CPI increases and higher yielding recent acquisitions. This is in line with guidance on a like for like basis4. $1.603

NZL resumed its dividend during the year, paying an interim dividend of 1.46 cps. NZL will pay a final dividend of 2.54 cps bring total dividends for the year to 4.00 cps (net) equivalent to ~80% of NZL’s FY24 AFFO.

1.

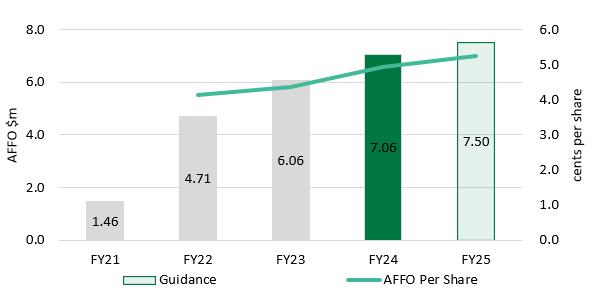

• NZL has increased AFFO on both an absolute and per share basis every year since listing1.

• In HY24 NZL updated its AFFO calculation to remove the impact of earnings from put/call arrangements as these are comprised of capitalised income rather than cash, which AFFO is a proxy for. AFFO for years prior to FY24 are adjusted to remove the impact of put/call earnings (~$1.2m p.a.) to facilitate a like-forlike comparison.

• On this basis, since FY22 NZL’s AFFO has increased +99.7%. Over the same period AFFO per share has increased +61.5% (per share growth has been achieved alongside a ~+27m increase in the number of shares on issue).

In December 2024 NZL restructured its borrowing arrangements, entering into a syndicated facility agreement with Rabobank and Bank of China. The new syndicated facility reduces NZL’s weighted average cost of debt and increases total available debt capital from $133.5m to $140m.

NZL has hedging arrangements in place for 65.0% of its total borrowings costing, on average, 6.2%. The remaining debt is floating and the cost of the floating debt component is 5.4%. Accordingly, NZL’s weighted average cost of debt is currently 5.9%.

Average Interest Cost

2.2 Years 2 Weighted Average Term to Expiry 5.9%2

NZL Debt Facility Expiry Profile

• NZL’s NAV per share has increased from $1.250 to $1.603 (+28.2%) since listing.

• This growth in NAV per share plus dividends over the same period means NZL has delivered total company returns of +35.9% since 21 December 2020.

• NZL delivered FY24 AFFO of $7.1m in AFFO (4.94 cps2)

• This represents AFFO growth of +16.6% (+13.6% cps)

• NZL forecasts FY25 AFFO of between $7.5m and $8.0m.

1. AFFO per share is based on the portion of the consolidated company’s total AFFO attributable to NZL.

• NZL reinstated its dividend in FY24 and paid an interim dividend of 1.46 cps for the six months to 30 June 2024.

• NZL will pay a final dividend of 2.54 cps for a full year dividend of 4.00 cps.

• Total dividends are equivalent to ~80% of NZL’s FY24 AFFO.

• NZL forecasts a full year dividend for FY25 of between 4.20 cps and 4.50cps representing ~80% of forecast AFFO.

As at 31 December 2024

Four AFFO and WALT accretive acquisitions settled during FY24. Further diversifying NZL by tenant, geography and sub-sector while also increasing rental adjustment frequency1.

• Twyford Orchards: Horticultural land supporting three apple orchards located in Hawke’s Bay, marking NZL’s entry into a new sub-sector (Horticulture).

• Forestry Estate 1: Forestry land located in close proximity to NZL’s existing estates and leased to New Zealand Forest Leasing (NZFL).

• Forestry Estate 2: Forestry land located in Taranaki, Whanganui and Rangitikei and leased to MM Forests Limited.

• Southern Orchards: The first tranche (47 hectares) of 126 hectares of horticultural land supporting an apple orchard in central Otago. Settlement of the property included consideration in the form of NZL shares. Settlement of the second tranche is scheduled for September 2025.

2.5%

CPI,

On 19 January 2024 NZL announced it had entered into an agreement to sell a 25% equity interest in its land portfolio to Roc Partners (Roc). This transaction settled on 9 February 2024.

Roc acquired the equity interest for approximately $44.2m in cash.

NZL used the proceeds to repay the $11.8m owing on a convertible note it drew down in April 2023 to partially fund its forestry acquisition. A further $26.2m of the proceeds were used to fund orchard and forestry land acquisitions.

The strategic benefits of this transaction were as follows:

• Capital recycling at a premium - the transaction is highly value accretive to shareholders given the value of the 25% sold versus the implied share price value of the rural land portfolio.

• Improved financial position - the proceeds of the transaction enabled NZL to repay its convertible note, and have the financial capacity to capitalise on opportunities that are NAV and AFFO accretive.

• Strategic partner – Roc Partners has extensive experience in rural property investment and conducted extensive due diligence as part of the transaction. NZL and Roc have already co-invested (through the LP) in two acquisitions successfully growing the portfolio.

• NZL has resolved to pay a final dividend of 2.54 cps bringing the total dividend for the year to 4.00 cps equivalent to ~80% of NZL’s FY24 AFFO1.

• NZL’s dividend policy targets a pay-out ratio of 60% - 90% of AFFO. The pay-out range grants the company greater flexibility to deploy NZL’s cash operating earnings in ways most beneficial to increasing shareholder value.

• NZL maintains its dividend reinvestment plan which offers shareholders the opportunity to reinvest the net proceeds of cash dividends payable on some or all of their NZL shares into additional fully paid shares.

• NZL maintains a selective on-market buyback programme.

• During the period NZL repurchased a total of 88,804 shares at an average price of $0.89 per share. A total of 710,131 shares have been repurchased under this programme since buyback was initiated in June 2023.

1. NZL’s AFFO after deducting Roc’s share of AFFO

NZL’s leases incorporate regular, uncapped, CPI reviews. Accordingly, inflation will result in rental growth. Furthermore, NZL is insulated from inflation-impacted (and all other operational) on-farm costs by owning only the land.

NZL has seen the positive impact of inflation in 2024, with many of its leases having successfully undergone CPI review. Further CPI linked lease reviews are due in FY25. These include:

• 31% of NZL’s pastoral leases will be subject to review in 2025. CPI accumulated since the leases began is expected to be ~+13.0%.

• 100% of NZL’s forestry assets will be subject to rent review in the first half of 2025. CPI accumulated since the last rent review for these properties is expected to be ~+2.1%.

NZL forecasts FY25 AFFO of between $7.5m and $8.0m (Note: this excludes earnings from properties with put/call arrangements in place). AFFO per share of 5.25 to 5.60 cents (Based on 142,953,801 shares on issue).

Dividend payout ratio in keeping with NZL’s new policy is 60-90% of AFFO.

New Zealand’s dairy sector is the backbone of the rural economy, and it’s financial health directly impacts land leasing models like NZL’s. Insights from DairyNZ’s economic tracker show what the average owner-operator experienced in the last six seasons from FY19 to FY24 (it also includes a forecast for the current season, FY25):

• Both breakeven milk price and the average payout received rose consistently, with farms maintaining above the line profitability. FY25 is forecast to be the most profitable in the last seven seasons.

• Profitable seasons allowed farmers to focus on improving financial stability, with debt-to-asset ratios steadily declining.

These trends strengthen NZL’s business model by enhancing tenant financial resilience and supporting stable lease payments. Additionally, improved farm profitability increases long-term land values, further improving return to shareholders.

In December 2024, Fonterra increased its forecast 2024/25 season Farmgate Milk Price by $0.50, to a midpoint of $10.00 per kilogram of milk solids (kgMS); with the forecast range moving to $9.50 - 10.50 per kgMS. This is an improvement on Fonterra’s final 2023/24 season Farmgate Milk Price of $7.83 kgMS. Fonterra believes the rebalancing domestic market in Greater China and the continued demand from countries in Southeast Asia is the driving force behind Farmgate Milk Price recovery. Milk supply in the United States and Europe is still being impacted by local factors while production in New Zealand has increased.

New Zealand’s carbon market is tightening, with emission unit availability set to drop from 45 million to 21 million between 2025 and 2029, driving carbon prices higher (announced 20 August 2024 - see chart below). Carbon prices increased to c.$60 per ton in response to these changes. The government has reversed some environmental policies, delaying agricultural emissions pricing and lifting the oil and gas exploration ban. The European Union’s Carbon Border Adjustment Mechanism will impact NZ exporters from 2026, requiring compliance with new carbon levies. These shifts reflect a balancing act between economic growth and climate commitments.

• Since 1996 the value of rural land in New Zealand has grown considerably, with REINZ’s Rural Land Price Index increasing at a CAGR of +5.9% per annum this is before operating or lease returns.

• NZL’s leases all incorporate CPI adjustments.

• NZL believes New Zealand’s rural land values will continue to grow over the long term. This will be driven by the increasing scarcity of productive land globally (particularly for land supporting the world’s most carbon and cost efficient production systems).

NZL Company Structure & Ownership

Director of Ara Ake Limited

Chancellor of Auckland University of Technology

Director of RC Custodian Limited

Director of LamCam Limited Founder and Managing Director of Calocurb Limited Director Lanaco Limited CEO - Designer Textiles International* Vice President International Farming - Fonterra* CEO & Director - Vitaco Health Limited* CEO - Healtheries of New Zealand Ltd*

Member of New Zealand Maori Tourism Audit and Risk Committee

Trustee of Ngati Tutemohuta Charitable Trust

Committee Member of Opepe Investment Committee Director of Piata Horizons Limited Member of Rongowhakaata Iwi Trust Audit Risk and Finance Committee Chief Financial Officer Tupu Angitu

ROB CAMPBELL Independent Chair

SARAH KENNEDY Independent Director

TIA GREENAWAY Independent Director

CHRISTOPHER SWASBROOK Non-Independent Director & Founder

SHELLEY RUHA

Director

Director - Heartland Bank

Director - Allied Farmers

Director - Icehouse

Director - 9 Spokes

Previously - BNZ Senior Management Team and leader of BNZ Partners

RICHARD MILSOM

Executive Director & Founder

Managing Director - Allied Farmers & New Zealand Rural Land

Management

Consultant – Bellevue Enterprises Limited – Bovine & Porcine

Genetic Improvement & Sustainable Pork Production Company

INFINZ Emerging Leader 2017

XAVIER LYNCH

General Manager - Corporate

Executive, Corporate Finance - Bancorp Merchant Bankers

Senior Analyst, Corporate Finance - Deloitte New Zealand

Analyst - Todd Property Group

Investment Analyst - Crown Irrigation Investments Limited

JOSH JENKINS

Investment Associate

Consultant - True Range - Kenya

Analyst - Airponix Limited - United Kingdom Livestock Specialist - HHC & Glenthorne Station - NZ

HAYDEN DILLON

Founder & Consultant

Managing Partner Findex (Waikato) & Head of Agribusiness New Zealand for Findex.

Independent Director - Williams Holdings Limited

Independent Director - Aquila Sustainable Farms Limited and associated Limited Partner Farms.

Chairman - Bioceta Limited

Consultants

NZL is highly advantaged because it is a New Zealand buyer of rural land.

Under the Overseas Investment Amendment Act 2021, NZL can have foreign domiciled shareholders of up to 49.9% of its share register (subject to certain share parcel restrictions). Private companies in NZ are limited to less than 25%.

As at 31 December 2024, NZL had foreign domiciled shareholders amounting to ~25.4% of its share register.

NZL’s Sustainability Programme

At the heart of our organisation is the commitment we follow in all our business dealings. It is enshrined in the contract between ourselves and our tenant partners. Its purpose is to be the engine of NZL’s organisational purpose: “to create and protect enduring land for life by applying five principles”.

Protecting and enhancing the environment has a positive impact on the sustainability of our assets and our planet. Our environmental initiatives are focused on protecting and enhancing soil health, water quality and biodiversity, alongside reducing greenhouse gas emissions on a per-unit-ofproduction basis. Accordingly, maintaining a Farm Environmental Plan (FEP) is an essential part of our lease requirements.

Economic success and prosperity is an essential part of sustainability: it ensures our long-term viability, enabling us to continue achieving our other sustainability aims. It’s vital to motivate partners and their teams, to create opportunity, foster growth, reduce inequality, improve health, and increase investment in research and development. This long-term economic success is in turn dependent on the long-term health of our core asset: the land. A long-term view, long-term leases and careful selection of quality tenants creates a virtuous circle of growth, investment in innovation, creation of jobs and increased opportunities for the community. Lease terms ensure farm finances are regularly reviewed.

People are one of the most important elements of any business. NZL partners with tenants who prioritise the economic welfare, career and personal growth of their people while providing safe, warm, and healthy work and living environments. We ensure this by careful selection of quality tenants committed to the wellbeing of their workforce. As part of our lease commitment tenants must comply with legislation covering Healthy Homes, Modern Slavery and other social obligations.

Along with land and people animals are an integral part of our ecosystem. Prioritising animal wellbeing has numerous positive outcomes, for the animals themselves as well as economic prosperity. NZL and its partners take pride in their animal welfare practice, which prioritises good nutrition, adequate shelter, and care for their physical and psychological wellbeing. This is written into our contractual commitment, including the Five Animal Freedoms*

We know that the success of any strategy starts with the tone at the top, and NZL values strong and diverse governance. Having the right mix of skills and commitment ensures NZL and our partners have the capability and vision needed to achieve our mission. This is demonstrated in our lease commitment to our partners, that we will deliver strong, effective governance via a diverse and inclusive governance structure.

*Proper and sufficient food, adequate shelter, the opportunity to display normal patterns of behaviour, physical handling which minimises the likelihood of unreasonable or unnecessary pain or distress, and protection from, and rapid diagnosis of, any significant injury or disease.

Best-practice irrigation efficiency

Ensure irrigation systems use water as efficiently as possible, ensuring plant demands are met while the risk of leaching and runoff is minimised.

Best-practice nutrient usage

Using nutrients efficiently minimises nutrient losses to water. Ensure nutrient losses remain in compliance with consented nitrogen loss limits.

Soil quality optimisation

Maintaining or improving the physical and biological structure of soils minimises the movement of sediment, phosphorous and other contaminants into waterways.

Ensuring animal effluent and solid animal waste is managed well, minimising nutrient leaching and runoff.

• All new irrigation systems will meet Irrigation New Zealand (INZ) design and installation COPs and standards;

• Irrigation systems will be maintained and operated to ensure optimal efficiency with their performance;

• Timing and depth of irrigation is appropriate for crop requirements and is supported by soil moisture monitoring, soil water budgets and climatic information;

• Staff are trained in the operation, maintenance and use of irrigation systems; and,

• All water meters accurately measure water use.

• Nitrogen, phosphorus and sediment losses from farming activities are minimised using all available loss mitigation measures;

• Proactively manage the amount, timing and application of fertiliser inputs to match the predicted plant requirements and minimise nutrient losses;

• Store and load fertiliser to minimise the risk of spillage, leaching and losses into water bodies; and ,

• Demonstrate plans to minimise nutrient and sediment losses from winter grazing of forage crops.

• Employ farming practices that do not exacerbate erosion;

• Implement farming practices which optimise water infiltration into the soil profile while minimising water runoff, sediment loss and erosion.

Biodiversity protection and enhancement

Wetlands, riparian areas and the margins of surface water bodies are managed to avoid damage to the bed and margins of the water body, and to avoid the direct input of nutrients, sediment and microbial pathogens. We also ensure in-stream biodiversity values are protected and enhanced.

Mahinga Kai

We strive to uphold Mahinga Kai values.

• All effluent systems meet industry codes of practice or an equivalent standard;

• Timing and rate of application of effluent and solid waste to land is managed in order to minimise the risk of contamination of groundwater or surface water bodies;

• Suitable storage is available to store animal effluent and wash-down water when soil conditions are unsuitable for application or appropriate practices are in place to manage insufficient storage while infrastructure is upgraded; and,

• Staff are trained in the operation, maintenance and use of effluent storage and application systems and keep accurate records.

• Stock are excluded from water bodies in accordance with regional council rules or any resource consents;

• Vegetated riparian margins of sufficient width are maintained to minimise nutrient, sediment and microbial pathogen losses to water bodies;

• Farm tracks, gateways, water troughs, self-feeding areas, stock camps, wallows and other farming activities that are potential sources of sediment, nutrient and microbial loss are located so as to minimise the risk to surface water quality;

• Mahinga Kai values are protected as a result of measures taken to protect and enhance water quality and stream health; and,

• All areas of indigenous biodiversity on the farm are identified, protected and enhanced, with priority given to springs, wetlands, and spring-fed streams.

• Mahinga Kai values are taken into account when implementing all other Farm Environmental Plan (FEP) objectives;

• All areas of indigenous vegetation are managed to avoid adverse effects on mahinga kai values of surface water bodies and in accordance with regional/district council vegetation clearance rules or any granted resource consent;

• Opportunities for additional plantings of indigenous vegetation that recognises mahinga kai values of surface water bodies are identified, and plantings are implemented and managed in accordance with regional council guidelines for riparian planting;

• Farming activities are undertaken in ways that minimise adverse effects on indigenous vegetation to recognise mahinga kai values of surface water bodies; and,

• Pest plants are managed in accordance with regional council rules.

Hot spot management (silage and offal pits, farm rubbish)

We ensure the number and location of pits are managed to minimise risks to health and water quality. Other hotspots are managed to minimise environmental damage and risks.

• All on-farm silage, offal pit and rubbish dump discharges are managed to avoid direct discharges of contaminants to groundwater or surface water;

• Rubbish, fuel and other hot spots are managed to minimise environmental damage.

Precise water use

Use water efficiently, ensuring that actual use of water is monitored and efficient.

• Actual water use is efficient for the end use.

Industry-leading greenhouse gas reduction

Manage, measure and mitigate farm greenhouse gas emissions, including methane, nitrous oxide and carbon dioxide.

• Calculate net farm greenhouse gas emissions using a recognised method;

• Identify relevant practices and prepare a plan with actions to reduce greenhouse gas emissions; and,

• Implement actions and practices to reduce GHG emissions and keep records of stock fertiliser and other farm data.

Ensure tenants are well capitalised

Meaning they can endure volatile operating environments and continue to succeed and thrive.

Number of tenants on 10 year + leases

We believe long-term leases encourage long-term thinkers and a commercial alignment of interests with regards to asset health and endurance.

Increase sector’s capital efficiency

Provide increased opportunity for employment growth by freeing up capital in the sector and increasing capital efficiency

How we measure success:

Outcome

Health and Safety excellence

Comply with the Health and Safety at Work Act 2015 to ensure all people connected to the land are free from the risk of harm and can return home safely at the end of each day.

Quality employment practices and environment

NZL manages and mitigates the risk of modern slavery.

Healthy homes

NZL’s worker accommodation to comply with all healthy homes standards.

/ Measured

• Tenants must advise NZL immediately of any accidents, incidents or near misses and take all necessary steps to prevent these from recurring;

• Tenants must identify and manage on farm hazards.

Safer working environments across the sector

More worker protection across the sector

Healthier and happier workers and worker families across the sector

How we measure success:

Prioritise best practice animal welfare

Develop and maintain industry-leading animal welfare practices, including commitment to the Five Animal Freedoms.

• Tenants must comply with the Animal Welfare Act 1999 and ensure animals have:

• Proper and sufficient food and water;

• Adequate shelter;

• The freedom to express normal behaviour;

• That appropriate physical handling is practiced; and,

• Animals are protected from injury and disease.

How we measure success:

Arie Dekker arie.dekker@jarden.co.nz

Vishhal Bhula vishal.bhula@jarden.co.nz

Richard Milsom

richard@nzrlm.co.nz

+64 21 274 2476

Level 1

85 Fort Street

Auckland Central

Auckland 1010

New Zealand

Xavier Lynch

xavier@nzrlm.co.nz

+64 27 282 8046

Level 1

85 Fort Street

Auckland Central

Auckland 1010

New Zealand