Partner Advisory Council

October 2025

Today’s Agenda

Time Session

9:00–9:10 AM Welcome

9:10–10:00 AM Emerging Disruptors: What Partners Need to Know (Glenbrook Partners)

10:00–10:50 AM Partner Playbook: Tech You Can Sell Today (Nuvei)

10:50–11:10 AM Break

11:10–12:00 PM

Beyond the Transaction: Best Practices and Next Steps for Embedded Payments (Nuvei + Glenbrook Partners)

12:00–1:00 PM Lunch & Networking

1:00–1:50 PM Navigating the Competitive Landscape: Lessons from Stripe (Glenbrook Partners)

1:50–2:40 PM Partner Success: Aligning for Impact (Nuvei)

2:40–3:00 PM Wrap-up

3:00–5:00 PM Happy Hour

Drew Edmond

Associate Partner, Glenbrook Partners, LLC

Emerging Disruptors:

What Partners Need to Know

About Glenbrook

Payments Strategy Consulting

- Clients are merchants, networks, PSPs, banks, fintechs, investors, etc.

Consulting Projects

- Payments Strategy

- Payments Research

- Payments Optimization

Payments Education

- Private Workshops for Execs, Product, Revenue and Account Management Teams

- Payments Boot CampTM Workshops

- Merchant Payments RoundtableTM

- Glenbrook Press

Macro Trends and Gen Z

2024 US Payments Systems Volumes

US 2024 Payments Systems

”Amount” as % of Total

Excludes Wires. Total count is 288 billion. Total amount is $127 trillion without Wires; $1,723 trillion with Wires. Debit includes general purpose, open-loop prepaid, and private label prepaid. Credit includes general purpose credit, private label credit, and oil cards. ACH and checks do not include on-us transfers. Fast includes RTP, FedNow, and Zelle. Cash

are consumer expenditures only.

Source: U.S. Federal Reserve; The Nilson Report; Nacha; The Clearing House; Early Warning Service; Glenbrook analysis, 2025

US Consumer Payments Trends

Big story over 15+ years is still the growth of debit

U.S.

Market Transaction “Count” 2008-2024

Source: The Nilson Report, Glenbrook Analysis, Mar 2025

Consumer Preference Trends

Consumers are starting to optimize their finances…

37% of US consumers select their payment method based on reward or financial gain – 63% don’t

38% of consumers have used BNPL; usage patterns reflect a shift from big-ticket to everyday spend

- 17% of US consumers have used BNPL for groceries

- 15% of US consumers have used BNPL for food delivery

40% of consumers said they were interested in an instrument that could toggle between debit, credit, and BNPL - 60% in the 25-44 age demographic

69% have used P2P for social spending and bill splitting

Source: Marqeta 2025 State of Payments Report, N=3,000 US & UK adults

Gen Z Payments Behavior

Could reflect the tip of the spear…

Credit cards – 81% of Gen-Z adults use regularly (up from 73% a year earlier); 47% pay off; 53% revolve; 28% pay less than half

BNPL – Gen-Z usage in Q1 2025 is 46% compared to 26% for the prior year

P2P Wallets – 93% of Gen Z consumers use Venmo, Zelle, or Cash App; 40% use them 5 or more times per month

Digital wallets – 81% of Gen-Z consumers use Apple Pay, Google Pay, or PayPal; 41% use these services 5 or more times per month

Wages – 62% of Gen-Z workers receive their pay in their bank accounts, 20% in their PayPal balances, 8% in their Venmo balances, and 34% expressed interest in “cryptocurrency”

Cash – For Gen-Z, cash usage is now just 7%

Card Network Update

Cap One to Discover Portfolio Migration

New Capital One debit cards will be issued on Discover Network

Existing debit cards will migrate to Discover Network

- Impacts any Capital One customers with 360 Checking Account

- Same DDA, Same PIN, New PAN, New CVN2, and New Expiry Date

- 8.4 million new cards will be reissued; targeting EOY 2025 completion

New Capital One credit cards will issue on Discover Network in Q4 2025

Some existing credit cards will migrate to Discover in 2026-2027

Mastercard will handle changes through Mastercard card updater (batch)

No solution to token transition right now, existing CapOne Mastercard tokens will likely need to be reissued

New Discover cards will continue to refresh through Discover card updater

Visa CEDP: Meet the New Level II/III

Visa’s new compliance program targeting Level II and Level III data integrity

Visa will now validate enhanced commercial card data –submission of junk data no longer allowed!

Merchants must enroll in the program and have their data verified by Visa before enrollment

Merchant fees of 5bps per transaction apply

Key program milestones throughout 2025 with legacy Level II and III programs being sunset by April 2026

Visa CEDP: Practical Advice

Merchants should first verify their eligibility by receiving a verification report from Visa via their acquirer

After data remediation efforts are completed, final verification and program enrollment activities can be performed

Ongoing compliance must be monitored – merchants will lose interchange benefits if they are not

Key Program Milestones

April 2025: Program go-live. Merchants should start receiving data integrity notifications.

October 17, 2025: New interchange rates take effect; merchants must be verified by this date to qualify for the Product 3 rates

April 17, 2026: Visa will phase out its legacy Level II interchange program for Commercial and Small Business cards, except for the Fleet fuel-only Level II program

Tokenization Update

Tokenization growth continues at a strong rate

“Tokenization is growing at tremendous speed.”

13.7 billion tokens issued since program launch in 2014

Now issuing 1 billion tokens per quarter

1 billion+ tokens now issued in Latin America

50% of online transactions are now tokenized

“Impact on fraud levels and approval rates is significant.”

35% of all transactions are now tokenized

In Europe, 50% of e-commerce transactions are tokenized

Now claiming 3% to 6% authorization rate uplift

Standing by their 2030 plan to eliminate manual entry of PANs

Tokenization: Foundational and Critical to Many Use Cases

Card networks view tokenization as critical ”plumbing” to drive new technologies and strategic efforts

• Visa Intelligent Commerce

• Mastercard Agent Pay Agentic Commerce

• Visa Tokenized Asset Platform (VTAP)

• Mastercard Multi-Token Network (MTN) Blockchain

• Click to Pay Online Checkout

• Google Pay and Apple Pay

• Mastercard Token Authentication Service (Passkeys) Authentication

The Birth of Agentic Commerce

Agentic Commerce

AI agents are getting ready to go shopping on your behalf in tomorrow’s AI-centric world.

Source: Akira AI

Agentic commerce aspires to leverage the power of AI to help people shop, compare, make recommendations, and pay for purchases with minimal involvement

Killer Use Cases: Consumer Convenience

- Stand in Line

- Track Price/Availability

- Repeat Purchases

Consortiums are developing to establish standards for buyers/agents and sellers

Agentic models are being tested

Image

Personal Assistant and Personal Shopper

AI tools will learn preferences and act as a curator and payment executor when certain conditions are met

Curation

• Active usage today

• Multi-criteria shopping (e.g., vacation)

• MCP not required, but can create better results

• Can enable HP and HNP payments

Human Present

• Ideal when parameters are more complex

• Enable “one-click” purchases across multiple vendors

• Voice commerce 2.0?

Human Not Present

• Best when parameters are precise

• Price hunting and deal execution; concert tickets, dinner reservations, price drops on specific items

Increased Risk

Potential Agentic Models

Purchases can be completed in-session with a user present or autonomously via the agent

Retailer -Owned

Affiliate

Facilitation

The retailer owns and manages the agent and processes end-to-end

The AI agent finds products for consumers then sends them to a merchant website to complete the purchase

The AI agent finds a relevant product for the consumer. The consumer never leaves the agent’s shopping service to complete the purchase.

Marketplace or Merchant of

Record Model

The AI search platform operates as the end-to-end marketplace, facilitating payments, chargebacks and (potentially) customer service issues/returns

Sources: Glenbrook Analysis, Forrester, Commerce Ventures

Google Agent Payments Protocol (AP2)

Diverse set of stakeholders contributed to an open protocol and industry standard to enable agentic payments across payment methods

The protocol helps to address some of the major challenges in Agentic Commerce using cryptographically signed Mandates

Key Challenges

- Authorization: Proof that the agent is authorized to make a purchase

- Authenticity: Match merchant’s expectations to user intent

- Accountability: Determine accountability in the case of fraud or mistakes

Intent Mandate

A digitally signed instruction from user describing what the agent is permitted to do

Cart Mandate

Formal approval to lock in prices and items for a transaction

Agentic Commerce

Glenbrook’s Take

Consumer usage of agentic payments is essentially zero right now, as the payments experience is extremely clunky

Expect a mix of payment methods to be used, as consumers will continue to desire choice of payment type, though some may emerge as more prevalent in certain use cases

The industry is coalescing into groups/consortia that are attempting to develop protocols, schemas, standards, layers, technology. Consider joining a group if you want to influence the design or evolution

The “retailer-owned” agentic model likely to be first to expand, as it is easier to control the payments experience and is essentially just an evolution of personalization/recommendation engines that exist today

For merchants, adjusting back-office operations now is premature, other than ensuring bot activity can be monitored to ensure risk vectors are controlled appropriately

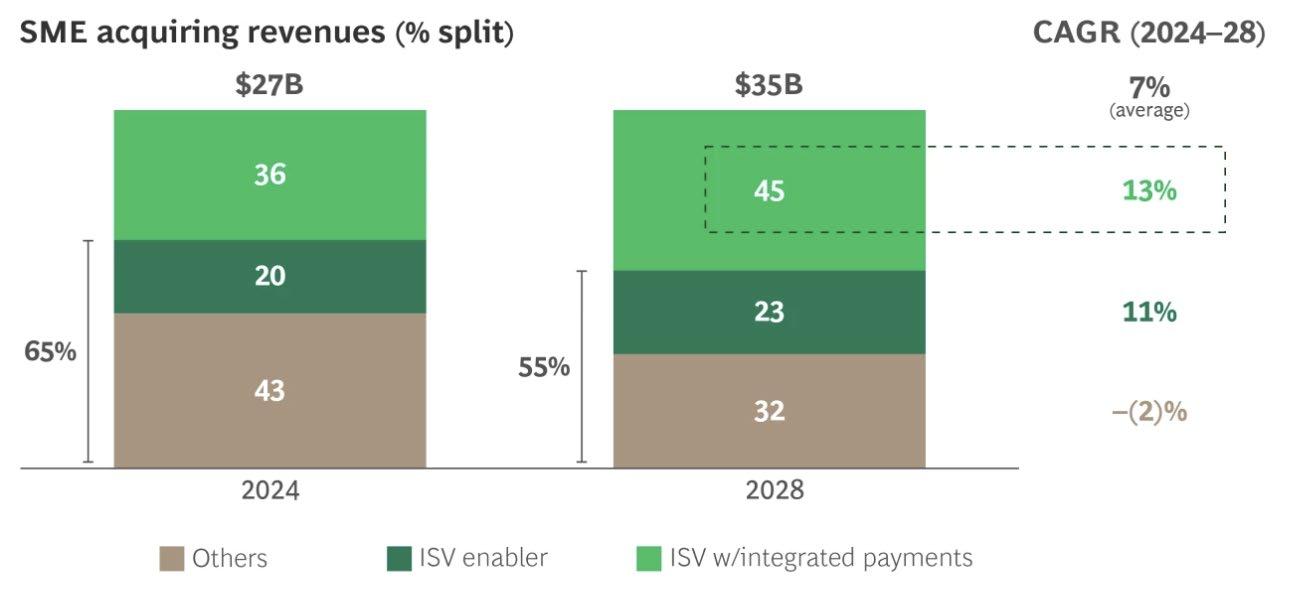

Opportunity for Growth in Embedded Finance

ISVs With Embedded Payments Will

Generate the Most Acquiring Revenue

This demonstrates SME acquiring matriculation from traditional acquiring to ISVs

ISV’s with integrated payments, as a whole, will generate the most revenue from SME merchant acquiring in 2028

>50% of ISVs in North America offer embedded payments within their SaaS platforms

SME adoption of vertical SaaS solutions grew from 50% to 59% from ‘22-’24

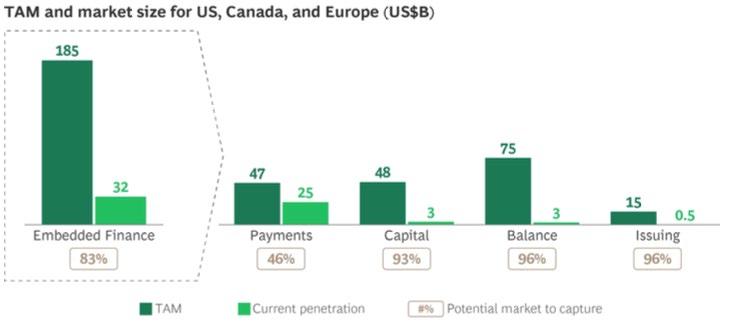

Payments is a Proven Embedded Product

Additional financial services have seen much more limited attach rate

Capital, Accounts, and Issuing have massive opportunities from growth for ISVs, but this will require taking share from Financial Institutions serving SMEs

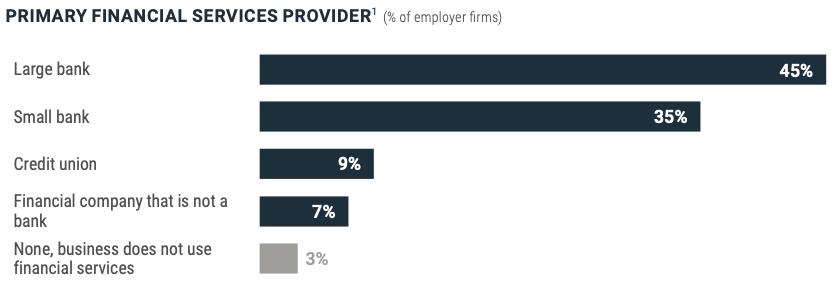

SMEs Still Use Banks for Financial Services

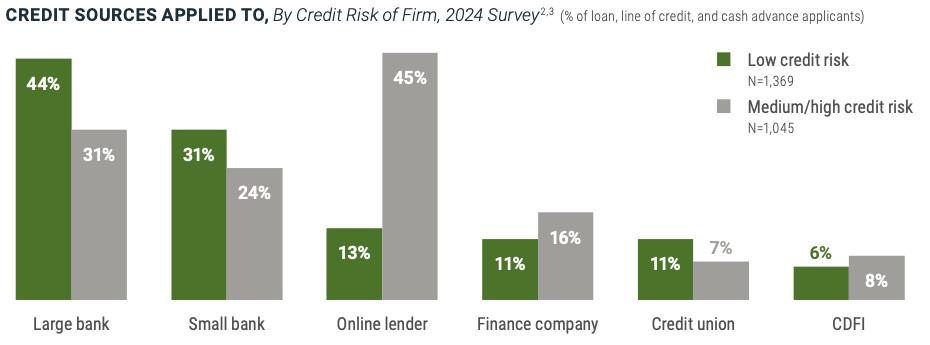

Firms look to different funding sources depending on credit risk

8 in 10 firms use a bank as their primary financial services provider

Source: 2025 Fed

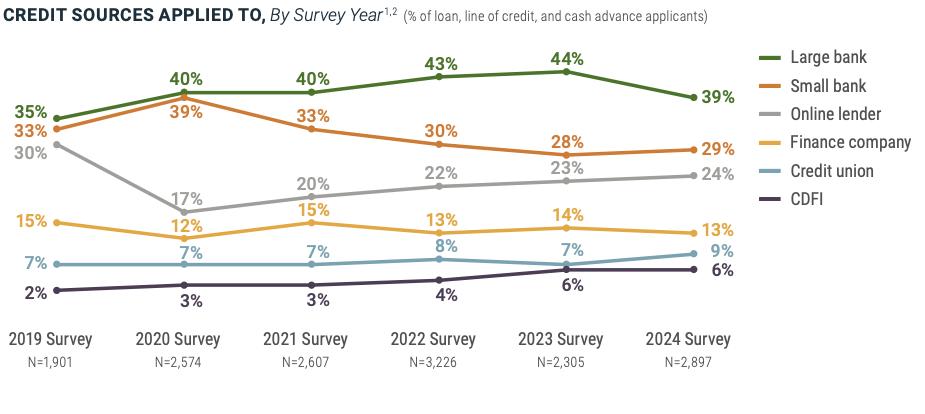

Loan Applications to Large Banks Dipped in 2024

37% of surveyed firms applied for loans, lines of credit, or merchant cash advances

Passkeys and VAMP

What Are Passkeys?

How Passkeys Work Passkey Benefits

Eliminates passwords

Simplifies user experience

Faster sign-in to wallets, websites and apps

Greater authentication success rate

Lower exposure to phishing attacks

Less vulnerability to data breaches

Creation: a pair of cryptographic keys; one public, one private is generated; the public key is stored with the service (like Visa or Mastercard), while the private key is bound, securely, to the user's device

Authentication: the service sends a challenge that the device signs using the private key, confirming the user's identity without transmitting sensitive information

Secure Access: accessing the private key on the device is protected by device-level security (biometrics, PIN, or pattern)

Network Passkeys

Glenbrook’s Take

In markets where SCA / 3DS is mandated, passkeys provide a lower-friction alternative and enhance other authentication methods

In markets where 3DS is optional, consumer preference for and familiarity with biometrics over passwords and OTPs may encourage greater deployment of digital authentication, especially if liability shift is available

Click-to-Pay provides an applicable use case, but passkeys are not a prerequisite…

… merchants can choose to leverage network passkeys elsewhere (albeit potentially limited to tokenized credential use cases)

The ability to streamline consumer onboarding (and the role that issuing banks can play) will have a material impact on the pace of adoption

It’s possible for merchant to have a passkey strategy without having a network passkey strategy!

Visa VAMP Update

VAMP Advisory period started on April 1, 2025

Enforcement period started on October 1, 2025 (Confirmed by Visa – no postponements)

Initial Merchant VAMP Ratio Fine Threshold: 2.2%

Merchant VAMP Ratio Fine Threshold reduces to 1.5% on April 1, 2026

Penalties of $8 per transaction, plus additional potential fines and fees for noncompliance

Acquirers have their own portfolio-level threshold, which is significantly lower than merchant thresholds

Merchants Voice VAMP Challenges

As the enforcement period commences, many merchants continue to express frustration with elements related to the program

Access to Data

• Merchants are reporting challenges in obtaining key TC-15 and TC-40 data files from acquirers

Data Unknowns and Disparities

• Unanswered VAMP “status inquiries”

• Acquirer reporting often does not match TC15 or TC-40 data

Acquirer Enforcement

• Unknowns about how acquirers will enforce the program, particularly given their portfolio-level thresholds

Cross-MID Visibility

• Will Visa’s acquirers correctly calculate ratios across multiple MIDs?

Stablecoins for Merchants

Digital Currency Evolution

Physical cash is trending digital

Cryptocurrency

Stablecoins

Value fluctuates in market

Value does not fluctuate

CBDCs

Supply and demand determines exchange rate to fiat currency

Optimized for investing

Stablecoins are pegged to and backed by assets or currency

Value does not fluctuate

CBDCs are fiat currency issued by the central bank

Optimized for payments

Optimized for payments

Privately owned

Community owned

Examples - Bitcoin, Ethereum, Solana, etc.

Examples – Tether, USD

Coin (USDC), etc.

Government owned

Examples – e-RMB, Sand

Dollar

What Are Stablecoins Being Used For

Primary use cases are for crypto trading, emerging market wealth protection, and cross-border money movement

Safe Haven Currency

Consumers and businesses in emerging markets can protect their wealth by converting their currency into stablecoins pegged to a stable currency like USD

Trading

Used as a settlement currency for traders moving funds from one cryptocurrency to another

Stablecoins enable nearinstant, 24/7 international transfers with lower fees than remittance services

Stablecoins

Glenbrook’s Take

Consumer-to-business payments may be the slowest use case to take hold, especially for buyers in developed countries

More likely to see enterprise businesses incorporate stablecoins for B2B supplier payments and payout/disbursements before pay-ins

Regulatory fragmentation, dollarization, and financial sovereignty concerns in other countries may slow growth

On-Demand Payments Education

http://www.glenbrook.com/education

Drew Edmond

Rebecca Mergner

VP, B2B Product

Comprehensive B2B Suite

Empowering partners to automate, monetize, and scale payments

Commerce Suite

Unified payments and finance platform for ERPs and ISVs

Seamless bidirectional ERP integration

Automates AR, AP, and financing in one environment

AR Automation

Accelerate receivables and reduce DSO

Enable self-service invoicing and payments

Simplify collections and reconciliation

AP Automation

Optimize vendor payments and cash flow

Eliminate pre-funding and manual invoice handling

Automate approvals, scheduling, and reconciliation

AR Financing

Convert invoices into working capital

Access on-demand liquidity and stabilize cash flow

Integrated within the Commerce Suite for simplicity

Nuvei Commerce Suite

Transforming how finance teams work — from payments to cash flow optimization

Simplify your Tech

Stack

Unified payments + finance platform

Works standalone or with any ERP

Reduces system complexity and data silos

Maximize cash conversion

Accelerate receivables & optimize payables

Unlock working capital with AR/AP automation

Enable AR financing to improve liquidity

Do more with less

Automate workflows end-to-end

Minimize manual effort and errors

Drive efficiency across finance ops

Enhance visibility & control

Real-time ERP sync for accurate GL postings

Built-in compliance and fee recovery tools

Gain transparency across all transactions

Nuvei Commerce Suite empowers ISVs and enterprise platforms to deliver smarter, more connected financial operations.

Nuvei AR Automation

Get paid faster, lower costs, and improve customer experience

Get paid sooner

Digitized invoicing and multiple payment options eliminate delays

Anonymous payment links and customer portal simplify payments

Automated reminders speed up collections

AR financing unlocks cash flow early

Control costs

Automation minimizes manual work and reduces invoice processing expenses

Optimize payment terms and discounts through ERP integration

Integrated surcharging enables compliant fee recovery and cost control

Enhance Customer Experience

Self-service dashboard centralizes invoices, payments, and receipts

Multiple payment options with scheduling and recurring capabilities

Securely stored payment methods streamline future transactions

Boosts efficiency

Automate reconciliation and eliminate manual data entry

Payments and adjustments post automatically to ERP

Operate within existing ERP workflows — no disruption or retraining

Nuvei AR Automation: Streamline receivables, reduce DSO, and improve liquidity through automation.

Nuvei AP Automation

Optimize vendor payments and cash flow

Let your money work for you

Turn faster payment cycles

Improve vendor experience

Boost efficiency

Direct ACH payments on processing day keep cash available longer

Extend payables strategically while maintaining vendor relationships

Sync invoices from ERP to streamline approvals and payments

Pre-validated vendor information ensures payment accuracy

Automate payments and scheduling directly within ERP

Early payment automation helps capture discounts and optimize cash flow

Vendors access invoices, payouts, and updates via selfservice portal

Real-time payment status tracking enhances communication

Automated reconciliation reduces disputes and errors

Automation reduces manual intervention across payments

Integrated workflows minimize delays and exceptions

Improved accuracy lowers processing costs and cycle time

Nuvei AP Automation: Simplify vendor payments, improve accuracy, and optimize working capital.

Nuvei AR Financing

Bridge Cash Flow Gaps With On-Demand Capital

Convert invoices into Working Capital

Access funds faster to improve liquidity

Turn receivables into immediate, predictable capital

Eliminate cash flow uncertainty

Flexible financing ensures reliable access to cash

Stabilize operations and reduce dependency on traditional credit cycles

Increase financial agility

Real-time forecasting and cash flow visibility

Improve decision-making with instant access to funding metrics

Streamline AR operations

Financing, payments, and reconciliation unified in one platform

Seamless ERP connectivity simplifies end-to-end cash management

Nuvei AR Financing: Unlock liquidity, stabilize cash flow, and simplify financial operations.

Nuvei Commerce Suite

Flexible Integration for Every ERP and Business Model

Adaptable by Design

• Works seamlessly with cloud, on-premises, and hybrid ERP environments

• Built to support diverse business models and partner ecosystems

• Provides consistent performance and reliability across deployment types

Integration Made Simple

• Pre-built APIs, SDKs, and plug-and-play connectors accelerate time-to-value

• ERPs and ISVs can embed payments directly within existing workflows

• Reduces integration effort and ongoing maintenance costs

Legacy ERP’s that do not have capability to go through PM are direct to gateway

Financing ISVs have option to go direct to gateway ERPs are direct to PM for gateway access or direct to gateway based on ERP

Middleway is gateway access

Nuvei enables ERPs and ISVs to integrate payments effortlessly — delivering adaptability, speed, and scale.

Seamless ERP Integration

Connect payments directly into leading ERP platforms for faster reconciliation and smoother financial workflows.

Nuvei Partner Value Proposition

Driving Growth for Partners Through Commerce Suite

For ISVs

• Embed payments and finance natively – provide end-to-end automation

• Increase merchant retention and engagement through AR/AP and cash flow solutions

• Monetize transactions and financing to unlock new revenue streams

• Seamless integration with pre-built connectors for faster go-to-market

• Expand offerings with end-to-end B2B payment automation (invoicing, collections, vendor payments)

• Reduce operational friction – automate workflows, lower DSO, and streamline cash flow management

• Increase merchant loyalty by recommending a scalable finance platform

• Gain a competitive edge with integrated financing and ERP automation

Nuvei enables partners to embed financial automation directly into their platforms and deliver modern finance solutions to merchants at scale.

VP, Integrated Partner Product Strategy and Customer Success Carin Obad

NUVEI BILL PAY

Why Nuvei Bill Pay

Nuvei Bill Pay is a billing and payment portal that helps you simplify operations, reduce friction, and deliver a seamless payment experience to consumers. When you are selling into field services, education, healthcare, or property management, Nuvei Bill Pay turns everyday billing into a competitive advantage.

Frictionless Payments – Bankcards, ACH bank transfers, Autopay, mobilefirst design

Multilingual & Scalable – English, Spanish, and easily extendable

Smart Account Tools – Manage account, bill viewing, and payment history

Text to Pay – Send bills via SMS, citizens pay in seconds

Automated Alerts & Notifications – Payment reminders, status updates, and past-due notices

Personalized Messaging – Tailored communications based on user preferences

Partial Payments – Flexible payment options for complex scenarios

eBilling– Paperless invoicing and payment workflows

IVR - Pay by Phone

Key Verticals

NUVEI BILL PAY

Flexible Payment Experiences

From online portals to walk-up windows to assisted phone payments, Nuvei Bill Pay gives users the freedom to pay their way.

Remotely

Online payments | e-bill presentment | Email invoicing

In-person

Walk-in payments | Self-serve stations | Lock-box services

Assisted Live phone payments | Interactive - IVR | Automatic bill-pay

NUVEI BILL PAY

Optimizing Your Implementation

Our client management team’s proven methodology provides a structured process flow that’s consistent, reliable, and focused on empowering your success.

3-tier Citizen Rollout Plan

Pre-Launch

• Bill Pay announcements Deployment

• Bill Pay best practices and Q&A factsheets

Post-Launch

• Bill Pay adoption solutions

Key Benefits

Communication channel options

Multilingual dashboard

24/7 Account access & bill pay

Reliable & secure portal

Billing delivery mngmt

Multi-property account view

Easy, One-time payments

Recurring payments

Billing & statement history

Beyond the Transaction: Best Practices and Next Steps for

Embedded Payments

President,

Hilly Productions

James Hilliard

Global Head of Partner Channel

Ben Weiner

Associate Partner, Glenbrook Partners, LLC

Drew Edmond

Drew Edmond

Associate Partner, Glenbrook Partners, LLC

Navigating the Competitive Landscape: Lessons From Stripe

Customer Segmentation and Fit

Enterprise: All-in-One vs. Point Solutions

Enterprises want control, not convenience

Perception gap: Large enterprises still associate it with startup and SaaS use cases

Pricing and flexibility: Enterprise merchants feel like they are paying for more than they use

Feature breadth vs depth: Stripe’s integrated stack is a strength for smaller merchants or platforms, but too bundled for enterprises that prefer point solutions or have equivalents

Orchestration is nascent: Enterprises may not want Stripe to retain visibility and control and the product is new

Structural Limits in Traditional Channels

Stripe’s model doesn’t map neatly to legacy ecosystems

A different white-label: Connect Custom lets platforms fully brand onboarding, payout, and reporting flow, but Stripe is still the PayFac of record. Platform does not own the merchant in the ISO sense

Residual model gap: Rev-share models exists (buy-rate basis), but lacks residual contracts

Hardware / POS depth: Stripe expanded third-party integrations but remains limited compared to multi-hardware acquirers

High-risk / specialty verticals: Stripe excludes many industries that ISO-centric providers serve

Control, Customization, and Risk

Stripe does not optimize for maximum flexibility

Risk control: Platforms cannot modify underwriting rules, funding delays, or chargeback criteria

3rd-party tooling: Stripe’s ecosystem is mostly closed; limited ability to plug in alternative fraud, lending, or KYC providers within the same flow

Surcharging: No native capabilities to support surcharging, though third-party partners exist to fill gap

Brand ownership: Stripe Connect Custom offers deeper control, but true underwriting autonomy remains centralized under Stripe’s PayFac license

Stripe’s Support Model for Platforms

Stripe’s Support Model

Self-service orientation through documentation and help portals

Support accessed via dashboard chat or email

No account management without paying for it

Reactive issue handling

Typical Platform Needs

Dedicated contact familiar with business operations

Proactive support, optimization, and quarterly reviews

Strategic and consultative engagement for onboarding and growth

Direct phone and email access

Considerations for Nuvei Partners

Stripe Constraints

Centralized control

Stripe owns KYC, risk, and compliance

Market Opportunities

Partner autonomy

Nuvei lets ISOs/ISVs manage merchants and underwriting

Flexible economics

Fixed pricing model

Limited margin and residual flexibility

Closed ecosystem

Limited third-party and tool integration

Custom buy-rates, rev share, and residual ownership

Open platform

Modular architecture and external integrations

API-first, enterprise-light

Minimal ERP or B2B depth

Narrow POS footprint

Few devices, Tap-to-Pay focus

Enterprise-grade orchestration

Routing, reconciliation, ERP readiness

Full omnichannel stack

Broad hardware and retail coverage

How Stripe Competes vs. Enables

Dimension Enables

Go-To-Market

Product Layer

Acts as the regulated PayFac and lets partners embed features in their own products

Provides APIs and compliance rails that partners build on top of

Economics

Control / Risk

Premium pricing, with revenue share available

Competes With

Strategic

Dynamic

Handles KYC, fraud, and funds flow

Sells directly to end merchant and verticals that partners target

Enabler of software-led payment distribution

Launches native products (Billing, Invoicing, Lending) that replicate what partners sell

No residuals, no ownership of MIDs

Centralizes control; can’t use alternate risk models or 3P providers

Competitor to legacy acquirers and fintech partners who want to own merchant relationships

Stripe Focused on Stablecoin Ecosystem

Cross-border capabilities through stablecoin infrastructure

Acquired Bridge to integrate stablecoin-based payment and treasury rails

Enables faster, lower-cost settlement across global markets

Expands Stripe’s reach beyond card networks into programmable money movement

Positions Stripe to compete in the emerging stablecointo-fiat transaction layer

Tempo: Stripe’s Blockchain for Payments

High throughput, low-cost global transactions

Payments First - Purpose built for stablecoin payments

Optimized for Scale

- High throughput

- Quick finality

Predictable, Low Fees - Compared to unpredictable “gas fees” that can spike

Pay Fees in Stablecoins

- No need for a separate token

Payments Lane

- Don’t get stuck behind other blockchain activity

Privacy - Supports use cases like payroll

Stripe Partner Directory

A curated marketplace showing companies that build on, integrated with, or provide services around Stripe’s platform; Not an ISO/reseller directory

• Professional services firms and SIs with a proven record of implementing Stripe

• Software platforms that embed Stripe (commerce, subscription, invoicing, marketplaces, vertical SaaS

• Prebuilt, ready-todeploy blueprints and integrations (connectors, templates, etc.)

Stripe Connect for Third Party Payments

Connect is Stripe’s infrastructure for platform payments, enabling ISVs and SaaS providers to onboard, accept, and pay out merchants in supported markets.

Offers Standard, Express, and Custom integration models with built-in KYC / AML / verification flows managed by Stripe for hosted or embedded onboarding.

Handles payment collection, routing, and fee-splitting across supported payment methods once account capabilities are enabled.

Powers scheduled, manual, and instant payouts (where available) while Stripe retains regulatory responsibility for compliance and fund settlement.

Stripe Connect Account Types

• Standard: The seller signs up directly with Stripe

• Express: Seller account under platform umbrella; Stripe-hosted onboarding UI

• Custom: Seller is a Stripe account, but fully white-labeled by the platform

Stripe Connect: Deep Dive

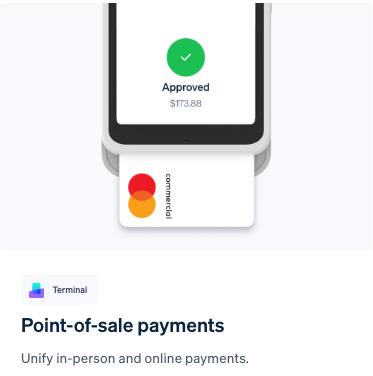

Stripe Terminal: POS Payments

Enables ISVs and SaaS platforms to embed in-person payment acceptance within their software.

Works with Tap to Pay and third-party POS integrations (FreedomPay, Cegid, Oracle Xstore) for omnichannel reach.

Provides single APIs and unified reporting across online and offline transactions.

Lets partners extend Stripe’s stack to retail without managing their own POS hardware or acquirer setup.

• Seamless shopping across channels

• No need for separate acquirers or recon systems by channel

• Offer in-store capabilities to merchants without building a full POS stack

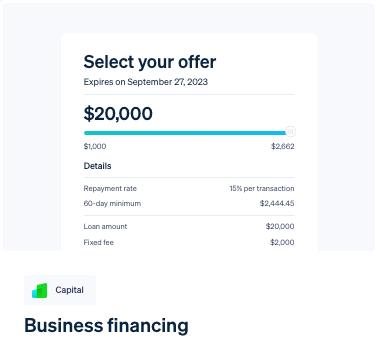

Stripe Capital: Business Financing

Allows platforms and ISVs to offer embedded working-capital loans to their merchants.

Stripe handles risk, underwriting, funding, and compliance while the platform surfaces loan offers.

Merchants get fast, automated funding and repayment via sales volume.

Helps partners increase retention and payment volume without becoming lenders.

• Earn referral fees without holding credit risk

• Deepens merchant relationships and increases stickiness

• Funding drives more transaction activity, compounding payments revenue

Issuing and Managing Cards

Lets SaaS and ERP platforms create branded virtual or physical cards for expenses, payouts, or rewards.

Partners control card design and authorization logic; Stripe manages banking, networks, and compliance.

Integrates with Financial Accounts and Connect for programmatic balance funding.

2025 updates allow partnerowned banking relationships, giving ISVs more flexibility.

• Launch card programs without issuer bank relationships

• Keep capital cycling within the platform

• Enable controlled disbursements or expense management

Stripe Financial Accounts

Provides embedded account infrastructure so platforms can let users hold, send, and receive funds.

Backed by Stripe’s partner banks, handling custody, KYC, and compliance.

Enables multi-currency balances and global payouts via Stripe APIs.

Empowers ISVs and SaaS platforms to embed “banking” functionality without becoming financial institutions.

• Turns platforms into financial operating systems for their users.

• Captures float, transfer, and payout economics once money stays inplatform

• Increases merchant dependency and lifetime value through embedded accounts

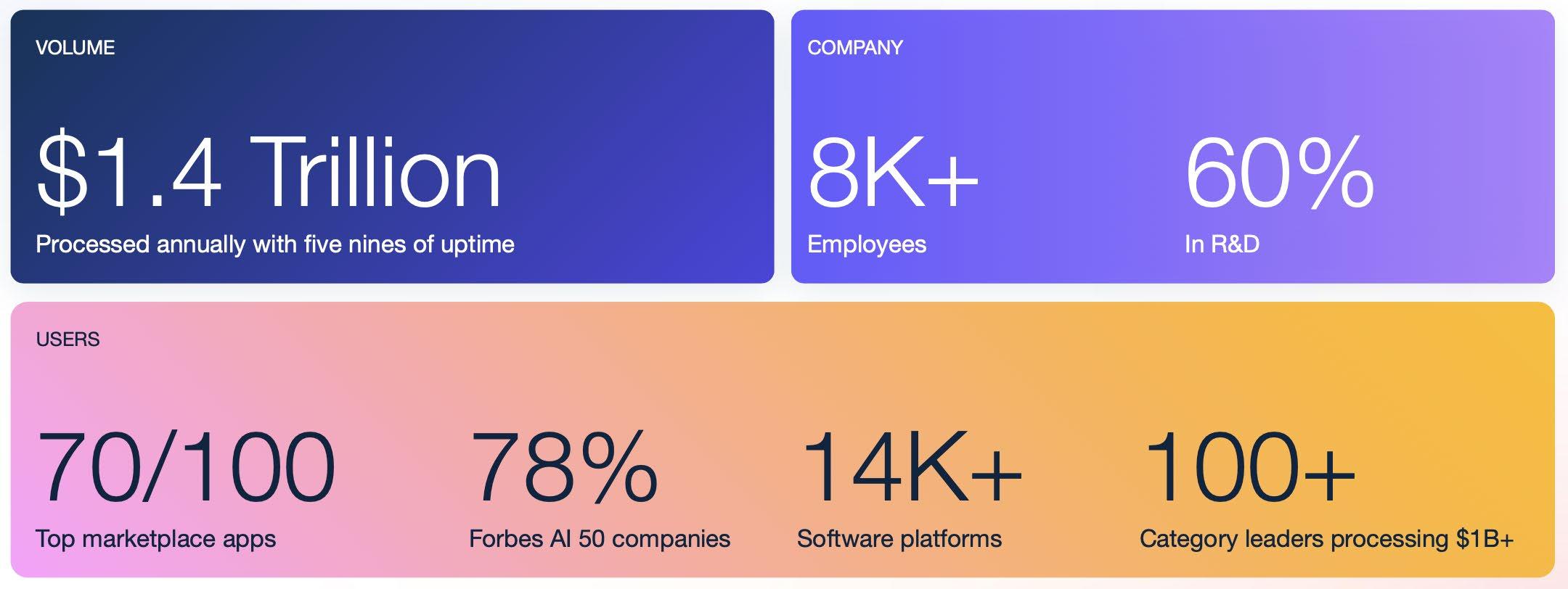

Stripe Snapshot: 2025

Strong volume growth led by Ecommerce and Platforms

Platforms and marketplaces have been a priority since 2012 Enterprise has been a priority for 2+ years

Stripe’s Value Propositions

Financial infrastructure for the internet

- A complete economic stack: banking, lending, payouts, stablecoins

Develop first and API-driven

- Easy integration, technical documentation “as a product”

Unified and Modular Platform

- One-stop-shop, but pick-and-choose modules

Global reach and compliance-as-a-service

- Go global easily

Embedded Finance and new revenue streams

- Enable partners to monetize

AI-powered optimization and intelligence

- Smarter conversion and fraud tools

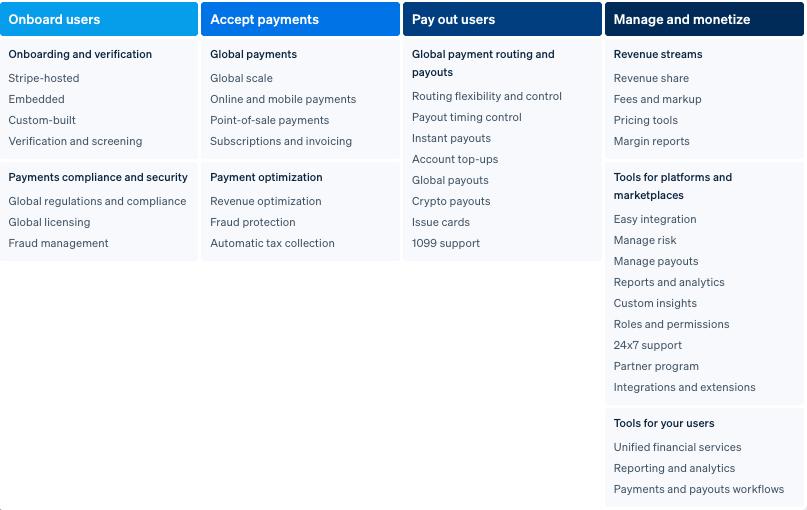

Stripe’s Unified, Modular Platform

• Online Payments

• Billing and Invoicing

• In-Person Payments

Onboarding

Issuing

Payouts

• Tax

• Payments Intelligence

• Reporting and Data

Monetization

Capital

Financial Accounts

Platform Management

Stablecoins

Partner Success: Aligning for Impact

Evan Zach

VP, Partner Success

Bridget Eurich

Head of Partner Success

Partner Success Evolution

Partner Success Teams

PARTNER SUCCESS

Manages daily operations and aims to improve overall satisfaction in support of our indirect channel partners in North America and beyond.

PARTNER SUPPORT

Manages support requests for a wide variety of issues including system access, equipment and account change requests.

PARTNER SUCCESS

OPERATIONS

Drives operational efficiency across the organization, leading initiatives to maximize operational effectiveness and improve efficiency.

Dawn Martinez Partner Success Operations

Durcell Lundy Director, Partner Support

Christine Poliquin Head of Partner Success

Bridget Eurich Head of Partner Success

Partner Success Support Model

We have redefined and segmented We have redefined the service model to align

Gold Gold

Silver

Bronze

Key Initiatives

Cross Training

• Success and support team members from Nuvei, Paya and Till

• System access

• Cross training team to support across previous entity lines –removing silos

Automation Projects

• Driving process efficiency, optimization, AI and automation whenever possible

− Daily reports Weekly reports Reduce inefficiency

• 100% of support requests now run through a centralized ticket management system

• All cases tagged by consistent categories to allow tracking by case type which allows us to provide guidance on expected turnaround

• Established support and relationship survey processes to capture transactional and overall partnership satisfaction

• Detailed reporting enabled for top partners

Priority Management

• Partnership Improvement Management

• Identifying, tracking and executing on ways to improve overall partnership

• Success Model cascaded to all Nuvei

• Continuously working to ensure proper prioritization of internal service and support for top partners

• Aligning geographical regions

KPI Development & Reporting