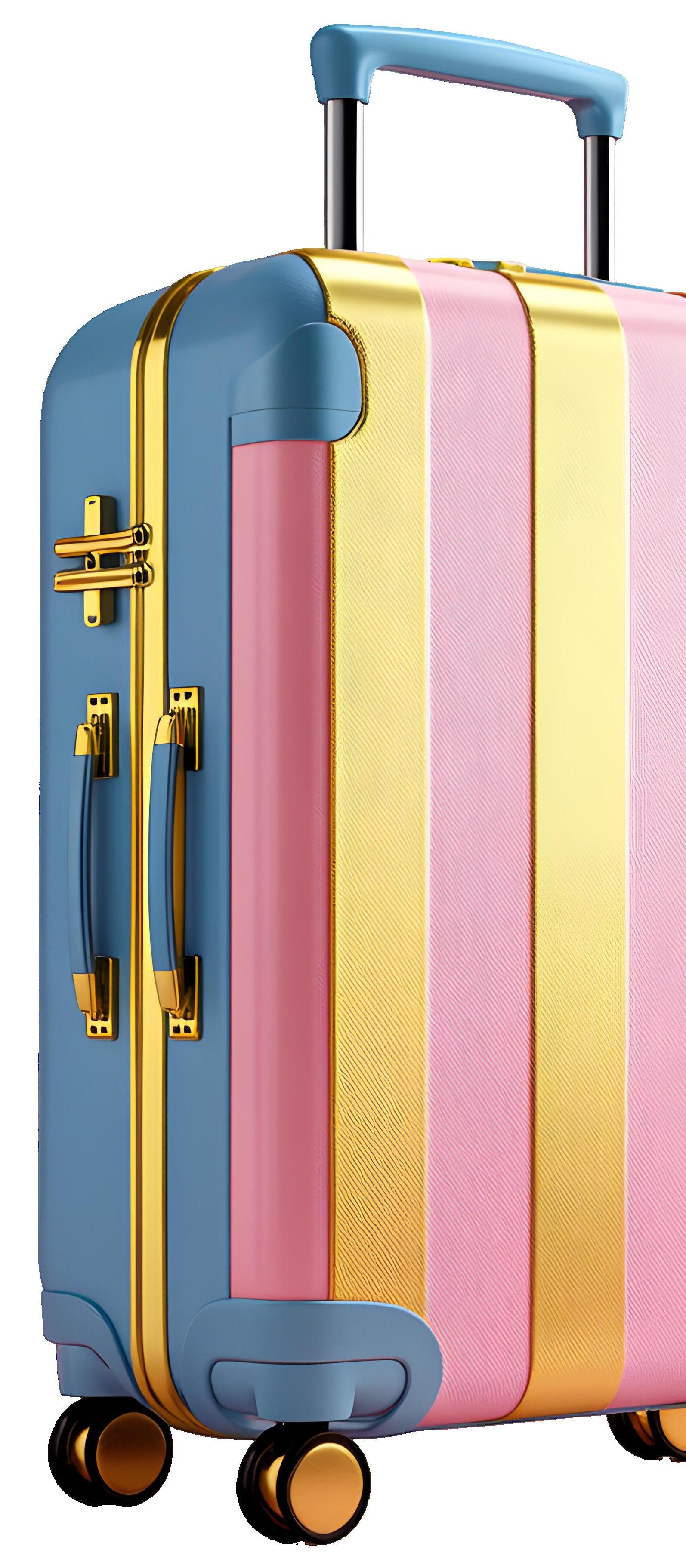

THE LAST MILE OF CONVERSION

How seamless payments drive revenue from high-intent travelers

Contents

Executive summary

Introduction

About the research

Convenience

• Ease of payment process

• Card decline rates

• Consumer reactions to card declines

Flexibility

• Preferred payment methods

• Top preferred payment methods by market

• Payment orchestration and currency preferences

• Split payments

Conclusion & next steps

About EDC & Nuvei

Executive Summary

The global airline industry is experiencing post-pandemic recovery, with passenger revenues projected to reach $693 billion in 2025. Yet payment friction remains a barrier to maximizing conversion rates and customer satisfaction.

Our survey of 1,011 travelers across five key markets reveals that while 92% rate payment ease as important, 17% still experience card declines when booking travel online. The payment landscape is shifting toward Alternative Payment Methods (APMs), with regional preferences varying depending on local customer expectations.

Brazilian consumers favor Pix (71%), Hong Kong travelers increasingly prefer AliPayHK (29%), and Spanish customers choose Bizum (23%), while PayPal is a key alternative payment method for online travel

in the US and UK markets. Travel providers must prioritize two strategic pillars: convenience through streamlined checkout processes and reduced decline rates, and flexibility via localized payment methods and split payment capabilities.

With 59% of travelers likely to abandon bookings when their preferred payment method is unavailable and 75% expressing preference for split payments, payment optimization directly impacts conversion rates and revenue protection.

For travel brands, every transaction counts. With fewer but higher-value purchases, even small payment issues can mean lost revenue. To maximize performance, travel businesses need clear insights into how their payments are working, a plan to improve them, and the right support to keep things running smoothly. When payments work seamlessly, they become a real competitive advantage, not just a back-end function.

Introduction

Building on strong performance in 2024 when industry profits surpassed pre-COVID 19 levels, the year 2025 marks another period of sustained recovery for global air travel. The industry is continuing its strong postpandemic rebound, reestablishing itself as a cornerstone of global commerce and mobility.

According to the International Air Transport Association (IATA), airline industry revenues are projected to reach a record $979 billion this year, up 1.3% from 20241. Passenger volumes are also rising, with global air travel expected to increase by 5.8% in 2025 and generate $693 billion of passenger revenue (excluding cargo and ancillary sales)2.

However, this growth presents new financial challenges for airlines and travel agencies, particularly within the payments ecosystem. As transaction volumes increase,

so do the associated payment processing costs. Airlines now spend an estimated $20.3 billion per year on payment-related expenses3, highlighting the need for cost optimization and innovation in this sector.

At the same time, the payment landscape is changing fast. Digital innovation and shifting consumer preferences are driving increased adoption of alternative payment methods (APMs) like mobile wallets, real time bank transfers and digital currencies. Market projections indicate that APMs will become the leading form of payment both online and in-store by 20284.

This shift is already evident in the travel sector where 77% of passengers in 2024 expressed interest in using digital wallets to pay for air travel5. In this environment, optimizing the

payment experience is imperative for airlines and travel providers seeking to meet customer

expectations and remain competitive in a digital-first economy.

GLOBAL AIRLINES REVENUE, USD BILLIONS

(source IATA Economics based on data from DDS)

About the research

Convenience

To understand the shifting traveler expectations and payment behaviours, we partnered with Edgar, Dunn & Company (EDC) to investigate key payment topics in the airline industry. We conducted a global consumer survey where we asked 1,011 respondents across 5 key markets (UK, US, Brazil, Hong Kong, Spain) about their payment experience when purchasing air travel online.

The study assessed airline digital payment strategies through two pillars directly tied to sales performance: convenience and flexibility.

Convenience gathers travelers’ feedback on the ease and efficiency of the payment process, as well as their responses to card decline. Flexibility evaluates a travel provider’s ability to accommodate passengers’ preferences for payment methods, currencies and split payment options. Both these pillars are critical to driving customer satisfaction, loyalty and retention. Our findings highlight that while 92% of passengers rate ease of payment as important, 17% still experience payment declines, underscoring ongoing challenges.

Travel brands often compete on pricing or loyalty perks, but our research shows the bigger battleground is now in payments. Every decline, missing method or point of unnecessary friction is an open invitation for a competitor to win that booking.

Airlines and OTAs that see payments as a commercial strategy as opposed to a technical process are the ones that keep high-intent travelers loyal to their platform.

Damien Cramer SVP of Global Travel

In this section, we aim to answer two critical questions for travel providers selling online:

How are airlines making it easier for their customers to complete a booking?

When a payment fails, do travelers attempt another payment method or do they abandon the booking altogether?

Ease of payment process

According to IATA’s 2024 Global Passenger Survey, speed and convenience are the top priorities for travelers today. To meet customer expectations, airlines must deliver a payment experience that is fast, seamless and intuitive. This means minimizing card declines, offering an easy-to-use interface, enabling personalization and ensuring a quick checkout process.

When asked about their most recent booking experience with an airline or online travel agency 92% of the respondents described the payment process as either “easy” (51%) or “extremely easy” (41%). Only 1% reported any difficulty.

However, regional differences are significant:

In the UK, 52% of travelers rated the experience as “extremely easy”. In contrast, just 33% said the same in Spain, where 11% described it as “neither easy nor difficult”. These differences underscore not only the importance of having localized payment strategies but also reflect the varying cultural expectations when it comes to assessing payment experience across several markets.

To address this, many airlines are expanding their range of Alternative Payment Methods (APMs) and tailoring them to both the preferences and cultural expectations of specific markets.

JAL has recently focused on developing mobile applications, and domestically, the introduction of Apple Pay allows customers to purchase airline tickets without having their physical cards on hand. We have also implemented EMV 3D Secure for all e-commerce transactions, and for loyalty members, we operate a system that does not require re-entering card information with each purchase. We believe that these initiatives contribute to enhancing a frictionless payment experience.

Masanori Miyajima VP of Commercial Platform, JAL

UK

HONG KONG

Card decline rates

Card declines remain a significant challenge in online travel payments. In our survey, 17% of travel consumers have reported experiencing a card decline when attempting to complete a booking on travel business websites.

Global passenger revenues are expected to reach $693 billion in 2025. Given that 17% of travel consumers in our survey experienced payment declines, the industry faces substantial exposure to payment friction, with potentially $117 billion in transactions at risk of disruption.

Interestingly, decline rates vary considerably between markets. In the UK, 13% of respondents encountered a card decline during an online travel booking, compared to 20% in Brazil.

A failed transaction does not just create friction in the customer journey; it also reduces conversion rates and erodes brand loyalty.

For travel merchants, optimizing payment acceptance is fundamental to protecting revenue and retaining consumer trust. Strategic risk management requires minimizing false declines, as rejecting legitimate transactions can be as costly as accepting fraudulent ones, particularly for high-value travel bookings.

HAS

YOUR DEBIT

OR CREDIT

CARD

BEEN

DECLINED at least once when you tried to make an online payment for travel?

Payment declines stem from far more than PSP performance as many factors across the payment flow sit outside a merchant’s direct control.

The merchants who succeed are those that orchestrate retries to capture legitimate sales while applying fraud controls with the highest accuracy.

When done well, this balance can lift acceptance by 5–10 percentage points. For many, that’s the equivalent of meeting half or all of their annual growth targets.

Peny Rizou Chief Fintech Officer, Etraveli Group

YOUR DEBIT OR CREDIT CARD BEEN DECLINED

UK USA

SPAIN

HONG KONG

Consumer reactions to card declines

When a card is declined during an online travel booking, most consumers attempt to continue the transaction, either with the same payment method at a different time or with another payment method. While this does not result in a lost sale, it creates friction in the payment experience, directly affecting customers' overall impression of the travel brand.

The financial impact becomes tangible when a significant portion of customers either switch to competitors or abandon their purchases entirely. According to our survey, 82% of respondents said they would retry with another payment method, while 13% would buy from another website and 5% would not complete the purchase at all. This means 18% of potential customers are lost when their card declines. This loss is particularly impactful in leisure travel, where purchases can often be driven by impulse buying.

A poor payment experience does not just mean lost revenue; it can directly fuel competitors’ growth.

When 13% of customers defect to competitors, this creates significant market share redistribution, potentially $15.2 billion worth of transactions shifting between airlines and their travel partners based on IATA's 2025 revenue forecast. Meanwhile, the 5% who abandon their purchase entirely represent direct revenue loss to the industry, potentially $5.9 billion in foregone revenue that leaves the travel sector altogether.

Among the 5 markets surveyed, respondents from Brazil are the most inclined to abandon their cart when facing a payment decline (19% not buying at all and 2% going to competition). This behavior is largely influenced by the widespread adoption of Pix, Brazil’s instant payment system.

Pix has raised consumer expectations by offering a frictionless experience with no card entry, no authentication steps, and instant confirmation. As a result, Brazilian consumers have little tolerance for delays or complex checkout processes.

Conversely, travel customers from Hong Kong show higher resilience, with 88% willing to retry their payment on the same site after a decline.

To reduce customer drop-off and protect revenue, travel businesses must actively monitor card decline rates to quickly identify problems and maintain a seamless customer experience.

A comprehensive payment diagnostic across all direct and indirect channels can help

uncover the root causes of high decline rates (e.g.: overly aggressive fraud rules, static 3DS, lack of acquiring connections, poor routing logic etc.).

In addition, offering alternative and flexible payment options are essential to boosting conversion and staying competitive.

If your DEBIT OR CREDIT CARD IS BEING DECLINED when you try to make an online payment for travel, what do you do?

82% I RETRY WITH ANOTHER PAYMENT METHOD

13% I BUY FROM ANOTHER WEBSITE 5% I DO NOT BUY AT ALL

DEBIT OR CREDIT CARD IS BEING DECLINED

HONG KONG UK USA SPAIN

Flexibility

Preferred payment methods

Flexibility refers to the ability of the travel provider to adapt its payment stack to its portfolio of markets.

We aim to answer three questions in this section:

How critical is offering preferred payment methods to reducing booking abandonment?

How do regional preferences affect travelers’ payment choices?

How important is split payment (e.g., card plus miles) for travel bookings?

According to IATA’s passenger survey, 82% of travelers seek hassle-free payment experiences, expecting their preferred payment options to be available during online booking6

Our 2025 consumer survey reinforces this, showing that almost 60% of travelers are likely to abandon a purchase if their preferred payment method is unavailable. This underscores the need for airlines and online travel agencies to track and offer a range of relevant payment options. Payment flexibility for travelers includes offering alternative payment options, payment plans, split payments, multiple currency acceptance and the ability to book on behalf of others.

Regional differences also emerged. 52% of US respondents indicated they were likely or very likely to abandon their purchases under these circumstances. Conversely, 65% of Spanish respondents indicated the same.

How likely are you to abandon your shopping if your preferred PAYMENT METHOD WAS NOT AVAILABLE ON THE CHECKOUT PAGE?

HOW LIKELY ARE YOU TO ABANDON YOUR SHOPPING IF YOUR PREFERRED PAYMENT METHOD WAS NOT AVAILABLE ON THE CHECKOUT PAGE?

USA

SPAIN

BRAZIL

UK

HONG KONG

Top preferred payment methods by market

Preferred payment methods vary significantly by market, influenced by cultural preferences, local payment infrastructure and mobile wallets. When asked to select their top two preferred payment methods for online purchases, the majority of respondents across all surveyed markets chose Visa, Mastercard, or Amex cards.

The second most preferred methods, however, differed notably. UK and US respondents favored PayPal (40% and 41%, respectively), while Brazilian consumers showed high reliance on Pix (71%). In Hong Kong, 29% of respondents selected AliPayHK as a top choice. Similarly, 23% of Spanish respondents selected Bizum, reflecting the success stories of domestic wallets leveraging real-time payment rails.

These responses confirm that the payment landscape has fundamentally shifted. In many markets, Alternative Payment Methods are close to overtaking cards as the dominant payment method.

For global merchants, particularly in the travel sector, this represents a major shift in how consumers expect to pay.

Adapting to this trend and catering to diverse local payment preferences is complex and costly. This is where payment orchestration platforms become essential.

Which of the following are your PREFERRED PAYMENT METHODS WHEN COMPLETING A PURCHASE ONLINE? (top 2 payment methods selected)

Payment Orchestration and currency preferences

An orchestration layer enables travel providers to seamlessly adapt to local payment methods and currencies. Multi-currency capabilities and DCC services allow travelers to view and pay in their preferred currency. As travelers increasingly expect access to their preferred payment methods and to see prices in their preferred currency, payment orchestration and DCC providers are becoming indispensable partners for online travel merchants.

According to our survey, 92% of respondents expressed a strong preference for viewing prices in their preferred currency, while only 1% of travelers considered this unimportant. This highlights the importance of offering a localized payment experience throughout the booking journey.

Beyond localization, payment orchestration platforms streamline the integration of APMs and the management of multiple payment providers, including acquirers, gateways and fraud prevention providers. In this context, payment orchestrators are strategic enablers for any airline or OTA seeking to maximize revenue and customer satisfaction.

Payment orchestration plays a crucial role in managing and optimizing the payment experience, particularly in the context of cross-border transactions. It enables real-time sourcing of FX rates, leverages geolocation to present travelers with localized currency options, and routes transactions to specific Merchant IDs to reduce costs for both merchants and travelers. Outpayce Xchange Payment Platform (XPP) empowers airlines to accept and process payments in the traveler’s local currency via MCP, using real-time exchange rates to ensure transparency and consistency from search through to checkout.

”

Nina Chambas FX Product Manager, Outpayce from Amadeus

How important is it for you to have the PRICES DISPLAYED IN YOUR PREFERRED CURRENCY WHEN BOOKING A FLIGHT on an airline website?

PRICES DISPLAYED IN YOUR PREFERRED CURRENCY WHEN BOOKING A FLIGHT

USA

SPAIN

UK

HONG KONG

BRAZIL

Split payments

Split payments allow travel customers to divide the cost of a booking across multiple payment methods (e.g. part of the amount is paid with a credit card and the remaining amount with frequent flyer miles or another method). This financial flexibility is increasingly expected by travelers, with 75% of survey respondents expressing a preference for split payments.

Our 2023 benchmark revealed two key findings on split payments: adoption remains limited, with only 73% of airlines and 22% of OTAs offering these capabilities, and most are basic loyalty-plus-card combinations. True group payments and multi-card capabilities remain rare. This highlights a gap between consumer expectations and industry offerings.

Beyond improving customer experience, this functionality offers significant value for airlines and OTAs. Split payment is a valuable tool for businesses to increase sales, expand the customer base, and reduce cart abandonment. They can also lower payment decline rates by distributing the transaction across methods, which helps avoid card limits or fraud flags.

For loyalty programs, split payments also provide a way for airlines to clear frequent flyer points or miles from their balance sheets while boosting member engagement by making rewards easier to use.

We currently support this functionality for specific use cases like combining miles with card payments, and we're constantly reviewing our capabilities to meet customer’s needs, including split card payments, as part of our ongoing initiatives roadmap. ”

Would you prefer PAYING PART OF THE TOTAL AMOUNT WITH YOUR CREDIT CARD AND THE REMAINING PART WITH FREQUENT FLYER MILES OR OTHER PAYMENT METHODS when buying travel on travel agent or airline website?

Barbara Quiroga-Lozano Delta Air Lines

PAYING PART OF THE TOTAL AMOUNT WITH YOUR CREDIT CARD AND THE REMAINING PART WITH FREQUENT FLYER MILES OR OTHER PAYMENT METHODS

UK USA

SPAIN

HONG KONG

Conclusion & next steps

The global air travel industry is experiencing strong post-COVID growth, with both revenues and passenger volumes on the rise. While the market has recovered, airlines and OTAs still need to streamline payment operations and reduce friction. At the same time, the rapid adoption of Alternative Payment Methods (APMs) is reshaping traveler expectations around convenience and flexibility during the checkout journey.

This global consumer survey across five key markets underscores travelers highly value ease and flexibility in payments. Yet, significant gaps remain: 17% still experience card declines, and nearly 60% would abandon a purchase if their preferred payment method isn’t available. These friction points result in lost revenue, reduced conversion and diminished loyalty.

Given the high-value and lowfrequency nature of online travel purchases, delivering a localized, convenient and flexible payment experience is of utmost importance. This report provides key insights that should help travel businesses improve their payment strategies and accelerate revenue growth.

To enhance payment processes, travel providers require a structured approach that includes:

• A comprehensive payment diagnostic which involves reviewing internal tools, workflows, contracts, and relationships with key partners such as payment gateways and acquirers

• A clear “ideal state”

• Dedicated internal resources

“We have invested heavily in building a robust payment engine with strong fallback mechanisms across our network.

This strategic focus has paid off—we've maintained seamless payment processing, ensuring our customers can always complete their transactions.

”

Barbara Quiroga-Lozano

Masanori Miyajima VP of Commercial Platform, JAL

When focusing on diversifying payment methods, we must always consider that the patterns of fraud will also increase accordingly. We are committed to further strengthening fraud prevention in collaboration with our partner travel agencies.

At the same time, we continuously monitor business model transformations, including the possibility that new technologies such as AI agents and FinTech may dominate this market, including payments.

We recognize the necessity of making appropriate investments to address these changes effectively.

Delta Air Lines

About EDC

Today, we serve clients in over 45 markets through our global office network in North America, Europe, Middle East and Australia.

For more information, visit www.edgardunn.com

Edgar, Dunn & Company (EDC) is a global consultancy specializing in payments and financial services. Since 1978, we have partnered with clients across the globe and developed an unrivalled depth in specialist expertise.

We offer a truly independent voice and our vision is to be the most trusted global payments consultancy

About Nuvei

Nuvei is accelerating the business of clients around the world. Nuvei’s modular, flexible and scalable technology allows leading companies to accept nextgen payments, offer all payout options and benefit from card issuing, banking, risk and fraud management services.

Connecting businesses to their customers in more than 200 markets, with local acquiring in 50 markets, 150 currencies and 720 alternative payment methods, Nuvei provides the technology and insights for customers and partners to succeed locally and globally with one integration.

For more information, visit www.nuvei.com