TheVibe STAFF BULLETIN

YOUR TOP STORY�

The Legend of Sports Day Pg. 31

YOUR TOP STORY�

The Legend of Sports Day Pg. 31

Pg. 3 Pathfinder Catalyst Academy’s Final Cohort Graduates

Pg. 6 The Power of Tiny Gains

Pg. 8 Pursuing Lost Talents: A Journey to Rediscovery

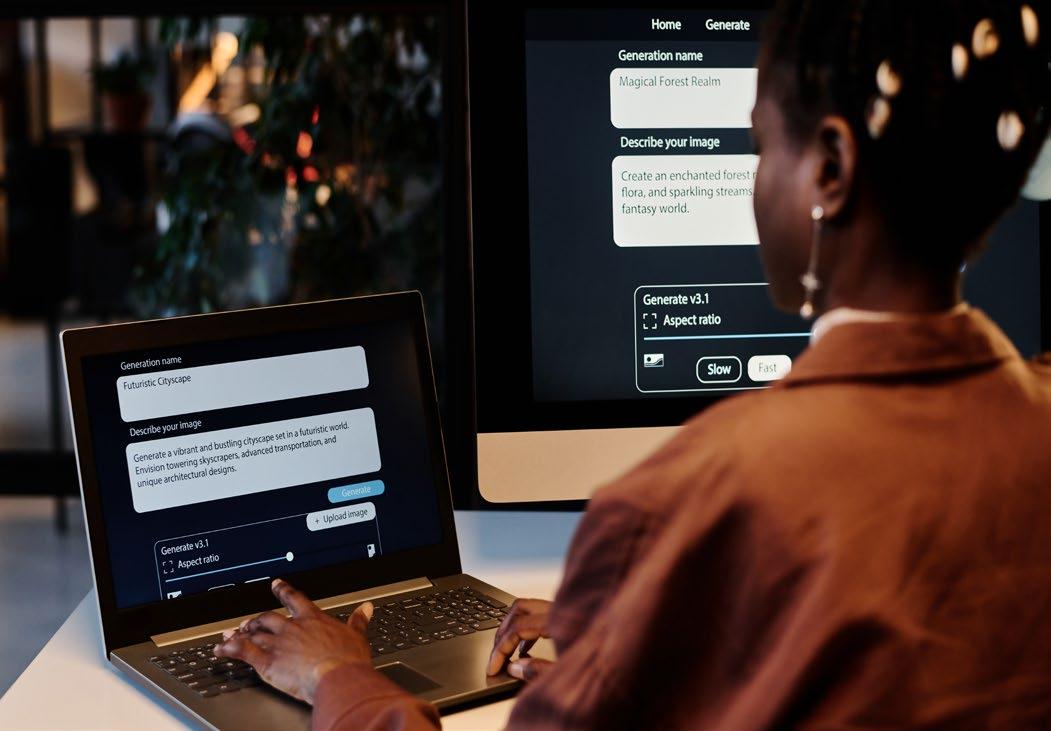

Pg. 10 Unlocking Productivity with AI

Pg. 13 Gradpa Joe vs The AI Pension Bot

Pg. 15 Remembering Hope Victory Shaba & Alice Kiconco

Pg. 18 Getting Out of Debt and Living Within Your Means...

Pg. 20 An Examination of the Stringency of the Insurance Regulatory Framework in Uganda

Pg. 26 Beyond the Office: How Adventure and Creativity Strengthen Teams

Pg. 29 Work-Life Integration: Are you Married to Work?

Pg. 31 The Legend of Sports Day: Recounting how things went down.

Pg. 37 Manchester United: From Glory Days to the Present - A Roller coaster of Emotions

Dear colleagues,

Welcome to Issue 9 of the Staff Bulletin!

As we step into another quarter, we take a moment to reflect on the remarkable strides we have made together. Our commitment to excellence, innovation, and shared purpose continues to define us as a Fund, and this issue brings you highlights of key milestones we have achieved over the past few months.

One of the standout initiatives this quarter has been Project Ignite Work, a bold and inclusive process aimed at validating our new Fund values. These values will serve as the guiding principles that shape our culture, decisionmaking, and interactions with stakeholders. Through collaborative engagement, we are ensuring that these values are not just statements on paper but deeply embedded in our ways of working. Thank you to all staff who have contributed their voices to this important exercise—it is through your input that we can build a stronger, values-driven Fund.

Another highlight worth celebrating is the successful graduation of the third and final cohort of the Pathfinder Catalyst Academy. This leadership program has, over the years, empowered over 100 women with essential leadership skills, confidence, and the networks needed to thrive in their careers. The most recent graduation, held at Kampala Serena Hotel, was graced by esteemed leaders, including our Managing Director, Mr. Patrick Ayota, and guest of honour, Josephine Okui

Ossiya, CEO of the Capital Markets Authority. Their resounding message was clear - growth, leadership, and excellence are within reach for all, and as a Fund, we remain committed to nurturing our people to their full potential.

As you read through this issue, take pride in the collective achievements that define our success. The journey continues, and with our shared commitment, we are confident that the best is yet to come!

Makubuya Abdul Kigozi SeniorManagerOrganizationalDevelopment

FionahKamukama-Cohort3President

AtNSSF, career growth and development are not just buzzwords - they are an intentional commitment. The Fund continues to create and support opportunities that empower employees to harness their full potential, equipping them with the skills, confidence, and networks they need to excel. One of the standout initiatives in this journey has been the Pathfinder Catalyst Academy, a transformative leadership program designed to elevate and empower women within the Fund.

On February 13, 2025, this commitment was once again brought to life as the third and final cohort of the Pathfinder Catalyst Academy graduated. Over 40 remarkable ladies successfully completed an intensive six-month leadership program, equipping them with critical skills to navigate and thrive in leadership spaces. The milestone event was held at the Kampala Serena Hotel, attended by distinguished guests, including the Managing Director, Mr. Patrick Ayota, various EXCO members, and an inspiring Guest of Honour, Josephine Okui Ossiya, CEO of the Capital Markets Authority.

In her keynote speech, Josephine Okui Ossiya delivered a powerful message, urging the graduates to step forward boldly, seize opportunities, and shine in their respective careers. She emphasized that leadership is about taking charge, being intentional, and making an impact, inspiring the ladies to go forth and chart their paths with confidence.

The Managing Director, Mr. Patrick Ayota, reaffirmed NSSF’s unwavering commitment to supporting women within the Fund, ensuring that they have the resources, mentorship, and opportunities necessary to reach the pinnacle of their careers. His words echoed the very essence of the Pathfinder Catalyst Academy - breaking barriers, fostering excellence, and paving the way for women to thrive in leadership roles.

The graduation ceremony was nothing short of spectacular. The elegant ambiance of Kampala Serena Hotel provided the perfect backdrop, while the soulful sounds of Akadope Band filled the air, adding a touch of vibrance to the celebrations. As the graduates received their

certificates, it was evident that this was not just the end of a training program - it was the beginning of new journeys, new aspirations, and new heights.

With the graduation of this final cohort, the Pathfinder Catalyst Academy has now successfully trained and empowered over 100 women at the Fund. This initiative is a testament to NSSF’s dedication to nurturing leadership talent and fostering an environment where every employee, regardless of gender, has access to opportunities for growth.

As we celebrate this milestone, one thing is certain—the future is bright for the Pathfinder graduates, and for NSSF as a whole. The leadership skills, networks, and confidence these women have gained will not only shape their careers but also contribute significantly to the Fund’s mission of driving impact and transformation. To all the graduates, the challenge is clear - go forth, lead with confidence, and inspire the next generation of trailblazers!

Olivia Newbold Senior Relationship Manager, Commercial

“Small daily improvements over time lead to stunning results.”

– Robin Sharma

We grew up hearing phrases from my dadlike “Romewasn’tbuiltinaday”and“A journey of a thousand miles begins with a singlestep.”But did i really understand them? I certainly didn’t—until 2018, when I decided I was done with Passableness.

That was the year I woke up and thought, this isn’t the life I want. So, I started making small, intentional changes in every area of my life— spiritual, mental, physical, social, and financial. Since then, I’ve never looked back.

When you envision a future with an amazing career, body and mental strength, great family or financial freedom, the truth is simple: it’s the tiny things you do every day that build that future.

John Maxwell, my all-time favourite author, talks about TheRuleof5—the idea that success comes from small, consistent daily actions. If I want to be a great speaker or leader in five years, what am I doing today to get there? Life, in my opinion, is built on five key capitals:

• Spiritual – What am I doing every day to grow closer to God?

• Social – Am I surrounding myself with people who uplift and inspire me?

• Intellectual – Am I reading, learning, and expanding my knowledge?

• Financial – Am I disciplined in saving, investing, and managing my money?

• Physical – Am I taking care of my body and mind?

Many people want things, but they don’t want to work for them. Spoiler alert: There’s no shortcut to success. If you don’t consistently save money, you won’t magically have a great retirement—unless you win the lottery or inherit millions (and let’s be real, how likely is that?).

Spiritual growth doesn’t happen overnight either. Years ago, I struggled with something as simple as forgiveness and letting go , but by reading, listening, and applying God’s word daily, I’ve grown tremendously. It’s all about small, daily steps in the right direction.

Let’s talk about fitness. In 2016, I weighed 84kg, a huge jump from my usual 54kg (even during pregnancy!). The weight crushed my self-esteem and affected my confidence. On top of that, my health was suffering. It took a shocking medical diagnosis to push me into action. I started exercising every single day, rain or shine, for just 20 minutes. Nine years later, I’m still on that journey.

James Clear, in Atomic Habits, says: “It’s so easy to overestimate the importance of one defining moment and underestimate the value of making small improvements daily.”

Sir Dave Brailsford, a former British cycling coach, introduced the “Aggregation of Marginal Gains”—a simple but powerful concept. He believed that if his team improved

by just 1% every day, those tiny gains would compound into massive success.

At the time, British cyclists had never won an Olympic gold in over 100 years. But Brailsford made small tweaks—he made nutrition upgrades, did Bike adjustments, introduced sleep optimisation and Taught cyclists proper handwashing to prevent illness!

The result?

• At the 2008 Olympics in Beijing, they won 60% of the gold medals available.

• In 2012, they shattered nine Olympic records and seven world records.

This is the compound effect—small, daily improvements snowball into extraordinary results over time.

Bad habits give immediate gratification but long-term regret. Think about a habit of scrolling on social media for two hours—it feels great in the moment, but that’s time lost that could’ve been spent learning, working out, or bonding with your family.

Good habits, on the other hand, are tough at first (waking up early, exercising, saving money), but they lead to long-term happiness and fulfilment.

Step by step, day by day, your choices shape your habits, and your habits shape your future.

Darren Hardy in his book - The Compound Effectgives us tips on this issue at hand.:

Small Choices Create Big Results-Every decision you make—good or bad—compounds over time.

• Consistency is Key-Success is not about

huge, one-time efforts but about sticking to small positive habits daily. persistence leads to exponential growth.

• The Power of Habits-Your habits determine your future; If you want to change your life, start by changing small daily habits.

• Tracking and Measuring Progress-What gets measured gets improved.Keep track of your actions (finances, health, relationships) to ensure you’re moving in the right direction.

• Momentum Matters-The “Big Mo” (momentum) works both ways—good habits create positive momentum, while bad habits create negative momentum.

• Eliminate Bad Influences-Surround yourself with people who inspire and uplift you.Cut out negative influences that slow down your progress.

• Take 100% Responsibility-Your success is entirely in your hands. Stop blaming circumstances, luck, or other people—own your choices and actions.

Final Thought: Start Small, Start Now

The life you desire won’t appear out of thin air— it’s built through tiny, consistent steps. By making small, smart choices consistently over time, you can create massive success in any area of your life. The compound effect is always at work—either for you or against you—so be intentional about the habits you cultivate!

Are you willing to take these tiny, consistent steps?

Achieng Amanda Owori Relationship Manager, Commercial

We all have that one thing we once loved doing. Something that brought us joy and fulfillment. It could be something as simple as painting, knitting, drawing or dancing. Somewhere along the way, many of us lose touch with these passions. Life happens, responsibilities change, and other priorities take over.

I, too, experienced this shift. Please allow me share my story. When I was younger, I had an insatiable love for discovery. While my friends were playing outside with the latest toys, I was the kid in the library. I was always devouring books and immersing myself in any interesting facts I could find. Books were a gift not only because they were a means of entertainment, but also because they were a doorway to an endless world of learning. I loved reading so much that at the age of 10, my fellow students voted me as the information prefect.

The role allowed me to combine my love for reading with my growing interest in communication. I would gather news from newspapers, school events, funny moments involving students, and then present during the morning assembly. I watched everyone listen intently, laugh at the funny moments, and even appreciate the serious updates. It gave me such a sense of pride and purpose, knowing that I could captivate and inform people. I realized then how powerful words could be. How they could inform, entertain, and even inspire.

However, as I transitioned into high school, the opportunities to write seemed to fade.

I had a few opportunities to write stories during literature classes, but generally, high school was a busy time. Like many teenagers, I succumbed to the social pressures and the general busyness of life. I pushed writing aside.

In university, the opportunities to write were not as prevalent. Nevertheless, God often provides us with many chances to do things. During my internship at Airtel Uganda, an opportunity to write came knocking. I was voted by my fellow interns to be the managing editor of the company’s internal magazine, Airtern. Suddenly, I was back in my element. I was guiding my peers, encouraging them to write articles, proofreading their work, and contributing to a magazine that we could all take pride in. It was a rewarding experience and the magazine turned out better than we all imagined.

However, after my internship ended, I found myself stepping away from writing once again. I felt that I did not have the platform or the drive to push myself the way I once did.

Last year, something shifted again. I joined the CIM and one of our tutors continuously encouraged us to write. At first, I hesitated. The uncertainty of putting myself out there again lingered. One day, I decided to take a leap of faith. I took to LinkedIn and wrote about my experience at the NSSF Pathfinder Catalyst Academy – Cohort 3. It felt amazing to hit that “post” button. The feedback I received from my tutor and classmates was uplifting. They were so supportive and it reminded me of why I had enjoyed writing so much in the past. Writing

was not just a way to express myself, but also a way to connect with others.

That post made me reflect deeply: Why did I stop writing? Was it because I no longer had opportunities, or had I simply stopped seeking them? How many of us have stopped doing things we loved, not because we did not care about them anymore, but because we did not think there was a way to continue?

and inspire someone who needs it.

If you are reading this and thinking that you too once had a passion that you have since abandoned, I encourage you to take a moment to reflect. Which talents or hobbies did you once pursue with excitement and joy? Maybe you stopped because you did not see an opportunity to continue, or maybe life simply took you in another direction.

As I reflect on this journey, I remember the one who fills me with gratitude. I am deeply thankful to God for the gifts that He has given me. The Bible says in James 1:17 (ESV), “Every good gift and every perfect gift is from above, coming down from the father of lights, with whom there is no variation or shadow due to change.”

Gifts and talents are not by chance. They are God-given. I believe that He has given each of us unique abilities to fulfill His purpose for our lives. When we use them to serve others and glorify Him, we begin to experience a full and purposeful life.

1 Peter 4:10 (ESV) tells us: “As each has received a gift, use it to serve one another, as good stewards of God’s varied grace”.

So here I am, submitting an article for the staff bulletin. This leap of faith aims to encourage

In fact, we might even find that by revisiting those talents, we discover new parts of ourselves that we never realized were there. It may not be easy at first, but it is worth it. Sometimes, the best version of ourselves hides behind the talents we have neglected.

Let us continue to explore, create, and grow in the areas that once made us happiest.

Most importantly, let us remember that it is never too late to rediscover the things we love.

Matilda Athieno

Executive Assistant to the Managing Director

Earlier this week, a colleague approached me with a new assignment, seeking guidance and reference to a similar document. Although I didn’t have a directly relevant document, I invited her to sit while I explored a solution. I quickly input the key terms she mentioned into an AI tool, and within moments, we had a draft ready. Her astonishment was palpable—a reaction I once shared when I first delved into the realm of AI.

The Catalyst: Engaging with our Strategy Team mates!

Collaborating closely with some of the Strategy teammates has immersed me in stimulating discussions. Artificial Intelligence (AI) has become a focal point in professional circles. Initially, I had a limited understanding of AI. To bridge this gap, I enrolled in the “AI for Everyday Life” course on Coursera. This program unveiled how AI, particularly generative AI like ChatGPT, can revolutionize tasks such as drafting emails, crafting letters, experimenting with

recipes, creating social media content, and unlocking creative writing potential.

Embarking on this AI-powered productivity journey has reshaped my approach to daily tasks. The objective? To revolutionize task management through AI-human collaboration. It’s time to transition from outdated methods and embrace AI to enhance our skills. Believe me, it’s no secret—those who value efficiency are already leveraging this technology!

Defining AI and Its Capabilities: Understanding AI’s potential to perform tasks

that typically require human intelligence, such as learning, reasoning, and problem-solving.

Prompt Engineering: Mastering the art of crafting effective prompts to interact seamlessly with AI tools.

Structured Prompt Engineering: Applying a systematic approach to real-world scenarios by considering context, audience, content type, and style. For instance, specifying a “keto meal plan with calorie counts and nutrient breakdowns” yields more precise AI-generated results than a general request for just a Meal plan.

Crafting Well-Structured Inputs: Learning to phrase inputs clearly to receive accurate and relevant AI responses.

(And yes, this is precisely what I did for my colleague in the earlier scenario!)

Understanding AI: Predictive vs. Generative

• Predictive AI – The Crystal Ball of Technology

Imagine having a tool that forecasts the future based on past events. That’s Predictive AI. If you’ve ever received personalized recommendations on YouTube or Netflix, you’ve experienced it firsthand. These platforms analyze your past viewing history to predict what you might enjoy next. Even your phone’s predictive text feature is a form of predictive AI—it learns your typing habits to help you communicate faster and more smoothly.

• Generative AI – The Infinite Creator

Now, picture an artist who never runs out of inspiration, constantly producing unique creations. That’s Generative AI. It generates content based on input, helping users write, brainstorm, and create. Think of it as your AIpowered assistant—whether it’s ChatGPT, Bard, or any other Large Language Model (LLM).

Initially, AI seemed intricate, but I soon realized it’s already woven into our daily lives, influencing various sectors and user experiences.

Microsoft 365 Copilot: The Fund utilizes Microsoft 365, which features an AI-powered assistant integrated across applications like Word, Excel, PowerPoint, Outlook, and Teams. Have you encountered Copilot? If not, you’re missing out on a tool that streamlines routine tasks, allowing you to focus on more strategic activities.

Discovering Gemini AI: Gemini AI is Google’s advanced multimodal AI assistant, designed to understand and generate content across various formats, including text, images, and code. Introduced in December 2023, Gemini has evolved to provide interactive assistance tailored to diverse tasks. I explored it for event planning assistance, drafting. There’s quick access to Gemini’s features from my home screen. It’s very exciting!

The question we should ask is are we taking responsibility for how we use AI output. It’s not the machine it’s the human who is responsible.

With the possibilities of AI collaboration also comes this responsibility, and I encourage you to embrace, both embrace the opportunity of AI human collaboration and embrace the responsibility as the human writer to engage with the world in a way that is ethical and how you use that output. In addition, we have the responsibility to double check the output to ensure accuracy.

AI is no longer a futuristic concept—it’s here, reshaping the way we work and think. Whether drafting reports, composing emails, or brainstorming ideas, AI can be a transformative ally. The key lies in learning to harness its capabilities effectively.

Let’s embrace this shift and work smarter, not harder. Are you ready to embark on your AIpowered productivity journey? Let’s go!

Alexandra Nankunda Kabwama Account Manager, Enterprise and Growth

The Day Mzee Kato Got Rejected by a Robot

Mzee Kato, a retired primary school teacher in Masaka, had worked for 35 years and contributed diligently to his pension. One morning, he walked to the local pension office, expecting to check on his NSSF benefits. To his shock, the officer behind the desk frowned at his screen and said:

“Mzee, your pension application has been deniedbythesystem.”

Kato was confused. “Denied? But I worked all mylife!Icontributedeverymonth!”

“The system says you have gaps in your contributions. The AI flagged your case as ineligible. You can appeal, but it may take monthstoreview.”

Mzee Kato felt helpless. A computer had decided his fate, and there was no explanation for why his benefits were denied. He was just another statistic in a system that didn’t see his struggles.

Uganda’s financial sector is rapidly adopting AI to improve efficiency. Systems like mobile money integration with pension funds, automated customer service bots, and AIdriven fraud detection are helping pension funds process claims faster.

Faster pension processing – No more long queues; applications are handled online.

Fraud detection – AI helps flag ghost beneficiaries and prevents fraud.

Automated financial advice – AI helps savers plan better for retirement.

But what happens when AI gets it wrong?

In Uganda, 80% of the workforce is in the informal sector—boda boda riders, market vendors, and domestic workers. Many make irregular contributions to pension funds like NSSF and other savings schemes. AI, however, tends to favour regular contributors and may unfairly flag informal workers as ineligible for pension benefits.

Many elderly Ugandans struggle with digital literacy. If AI-based pension systems require online verification, thousands of pensioners who don’t own smartphones or understand online processes could be locked out.

NSSF and other pension funds in Uganda still struggle with data accuracy. If an AI system is trained on incomplete or outdated records, it may reject pension applications unfairly. A name mismatch (e.g., “John K. Lwanga” vs. “John Kasule Lwanga”) could result in someone losing their rightful benefits.

If AI is programmed to assess pensioners based on income stability, those who worked informal jobs or had gaps in their contributions due to economic hardships might be unfairly penalized

How Can Uganda Ensure Ethical AI in Pensions?

a. Human Oversight in AI Decisions

AI should not have the final say on pension approvals—there must be a human review process for appeals.

Inclusivity for Informal Workers

Pension AI should account for the realities of Uganda’s workforce, ensuring that informal workers are not unfairly excluded.

b. Transparency in AI Decisions

If AI denies a pension claim, it must provide a clear explanation so pensioners can understand and challenge the decision.

c. Accessible Appeals Process

There should be a fast-track process for

pensioners like Mzee Kato to appeal wrongful AI decisions without waiting months.

d. Improving Data Accuracy

AI relies on good data. Uganda’s pension funds must clean up errors in their records to prevent unnecessary denials.

After weeks of frustration, Mzee Kato’s case was finally reviewed by a human pension officer - who quickly realized that AI had made a mistake. His pension was approved, but the delay had already caused him hardship.

Mzee Kato was lucky. But what about the thousands of other Ugandans who don’t know how to fight back when AI gets it wrong?

The future of pensions in Uganda is digital, but should it come at the cost of trust and fairness?

AI should assist, not replace, human judgment. If we’re not careful, the same technology meant to improve pensions could deny hardworking Ugandans the benefits they deserve.

Remigious Kaggwa Engagement Specialist, People and Culture

The year 2025 began on a sombre note for the NSSF family. On the morning of January 21st, a chilling silence swept through the corridors of the Fund as the heartbreaking news of Hope Victory Shaba’s passing spread like wildfire. It felt unreal – more like a bad dream we were all hoping to wake up from. Questions flew in every direction, messages flooded our community platforms, and in just moments, her absence was deeply felt. What started as a rumour was now real. A colleague, a sister, a friend, and a dedicated professional who had served the Fund with unwavering commitment had gone to rest. What began as a whisper soon became an undeniable truth. A colleague, a sister, a friend – a loyal member of the Fund family whose dedication and unwavering commitment had contributed to the very essence of the Fund, had been called to rest. The reality hit hard,

and the world seemed to pause as we grappled with the loss of someone who had touched our lives in ways words can scarcely capture.

Unbeknownst to us, the storm was far from over. On the morning of March 8th, I received a call from a close friend that sent another wave of shock through my being - Alice Kiconco was gone. At first, we clung to disbelief, hoping it was just another cruel rumour. But as the weight of the news settled in, the sharp ache in our hearts, cutting through to the very marrow, made it impossible to deny the painful truth - Alice, with her radiant soul, was no longer with us. The grief was overwhelming, a silent storm that left us shaken, struggling to accept the loss of someone so dear. Many were left speechless, unaware she had been battling for her life, believing instead that she was simply

on leave. The news sent shockwaves across the Fund, leaving us grappling with yet another painful loss.

These back-to-back tragedies struck us with a force that left us shaken to our core. Yet, amid the sorrow and the weight of our loss, something profound emerged from the darkness—the undeniable legacy of love, kindness, and selfless service that Hope and Alice left behind. Their footprints are etched deeply in the heart of the Fund, a testament to the impact they had not just through their work, but through the way they touched lives. Their legacy now weaves itself into the very fabric of NSSF, reminding us to embrace each moment, value every connection, and honor the incredible people who walk this journey with us.

Hope Victory Shaba became a valued member of the Fund family over two years ago when she joined as an Information Security Specialist in the Enterprise Risk Department. From the moment she stepped into this role, she exemplified exceptional professionalism, meticulous attention to detail, and unwavering dedication. Hope’s commitment to excellence was evident in every task she took on, whether it was sitting on procurement evaluation committees or contributing to key projects. She approached every challenge with a calm yet focused demeanour, earning the respect and admiration of those who worked alongside her.

Hope’s dedication to the well-being of her colleagues went far beyond her daily responsibilities. As a Wellness Champion for her department, she played a pivotal role in fostering a culture of health, fitness, and holistic well-being. Hope’s passion for wellness not only enhanced the lives of those around her but also left a lasting impact on the Fund’s broader vision for employee well-being. summarize in one paragraph

Though she was often quiet, Hope’s warmth and light-hearted sense of humour were infectious, creating an atmosphere where

people enjoyed collaborating with her. Her colleagues describe her as a true team player, combining sharp intellect with a humility that made her approachable and ready to lend a helping hand. She carried herself with integrity and a sense of duty, ensuring that her work in information security and risk management strengthened the Fund’s resilience in the face of an ever-changing digital world.

She perfectly embodied Philippians 4:13 – “I can do all things through Christ who strengthens me.” Indeed, Hope’s strength and grace inspired many, and she will be dearly missed.

For over 15 years, Alice Kiconco dedicated herself to the Fund, serving in various capacities with unwavering commitment and grace. Most recently, as a Records Officer in the People & Culture Department, Alice was more than just a colleague - she was a confidante, and a radiant presence whose wisdom and kindness spiced up our lives.

Alice was an icon for selflessness, faith,

and warmth, often carrying herself with an effortless grace and humility that made her a trusted part of us. Whether it was workrelated guidance, personal advice, or spiritual encouragement, she always had the right words to lift and inspire. Her deep-rooted faith and nurturing spirit left an indelible mark, creating an environment of collaboration, kindness, and laughter wherever she went.

And oh, Alice had a hilarious side! One day, she would be playfully challenging the young, unmarried men, asking why they were still single despite having the resources. The next, she would be narrating an over-the-top story about a mischievous character from her past, sending everyone into fits of laughter.

But perhaps the most fascinating thing about Alice was her obsession with the English Royal Family - a passion so intense that she could recite the King’s dinner menu, the latest family tensions, and even predict Meghan Markle’s next comeback move with unmatched accuracy. If you ever needed a royal update, Alice was your go-to source!

Her absence leaves a void that words cannot fill, but her legacy of joy, wisdom, and genuine

love for people will forever remain in the hearts of those who had the privilege of knowing her.

Alice’s dedication to her work and her colleagues reflected Romans 15:13 – “May the God of hope fill you with all joy and peace as you trust in Him, so that you may overflow with hope by the power of the Holy Spirit.” She lived a life of purpose, service, and devotion, leaving an indelible mark on the Fund and beyond.

In the wake of these profound losses, I join the entire NSSF family in expressing heartfelt gratitude to the Fund’s senior leadership for their unwavering support and compassion during the hospitalization of both Hope and Alice. The care, kindness, and generosity extended to their families during this difficult time are a true testament to the values we uphold as an organization - values that go beyond the workplace and speak to our shared humanity. Your support has not only provided solace to their loved ones but has also reinforced the deep bonds of unity and camaraderie that define us as colleagues.

Rest in peace, dear Hope and Alice. Your impact on us will never be forgotten.

Christine Nakayiza Olowo Strategy Services Supervisor, Strategy and Performance

Debt can be a heavy burden, causing stress, limiting financial opportunities, and preventing long-term stability. However, breaking free from debt and adopting a lifestyle that aligns with your income can lead to financial freedom and peace of mind. Understanding the importance of responsible money management and taking actionable steps toward debt-free living can transform your financial future.

Living with debt often means juggling multiple payments, high-interest rates, and financial insecurity. Common sources of debt include personal loans, mortgages, hire purchase arrangements, student loans. When debt accumulates beyond one’s ability to pay, it can

lead to financial distress, missed payments, and even damage to credit scores. Additionally, interest on debt can significantly increase the total amount owed, making it harder to escape the cycle.

While getting out of debt may seem daunting, it is possible with discipline, planning, and commitment. Here are some key steps to take:

1. Assess Your Debt – Start by listing all outstanding debts, including balances, interest rates, and monthly payments.

Understanding the full picture allows you to develop a strategy.

2. Create a Budget – Track your income and expenses to determine where your money is going. Identify areas where you can cut unnecessary spending and redirect funds toward debt repayment.

3. Prioritize Debt Repayment – Choose a repayment method that suits your financial situation. The snowball method focuses on paying off smaller debts first for quick wins, while the avalanche method targets highinterest debts to minimize total payments.

4. Negotiate Lower Interest Rates – Contact lenders to negotiate lower interest rates or explore refinancing options to reduce the burden of high-interest debt.

5. Increase Your Income – Consider taking on a side hustle, freelancing, or selling unused items to generate extra income dedicated to paying off debt faster.

6. Avoid New Debt – Resist the temptation to take on new loans

7. Use cash or debit cards for purchases to prevent further accumulation of debt.

8. Seek Professional Help – If debt becomes overwhelming, consider consulting a financial advisor or debt counselor for personalized guidance.

Once free from debt, adopting a lifestyle within your means ensures long-term financial stability. The benefits include:

Reduced Financial Stress – Without the pressure of debt repayments, you can enjoy a more relaxed and stress-free life.

Improved Savings and Investments – Money once spent on debt payments can now be directed toward savings, emergency funds, and investments for the future.

Greater Financial Security – Living within your means ensures you are prepared for unexpected expenses and financial challenges.

More Freedom and Opportunities – Being debt-free allows for more career choices, travel, and personal fulfillment without the burden of financial obligations.

Stronger Credit Score – A good credit score opens doors to better financial opportunities, such as lower interest rates on loans and easier approval for major purchases.

Becoming debt-free and living within your means is not just about cutting back—it’s about creating a sustainable financial future. By making conscious spending choices, saving diligently, and avoiding unnecessary debt, you can achieve financial independence and a better quality of life. Take control of your finances today, and enjoy the peace of mind that comes with financial stability.

Edith Twinamatsiko Legal Officer, Legal Department

Regulation refers to the process of directing the activities of the entities in a given market to perform per the norms defined by the regulatory authority. The regulator sets the prudential standards, guidelines, and rules of expected performance within the industry and penalties for non-compliance with the defined rules.

The theory of regulation is premised on a continuum of the regulator being strict, moderate, and liberal. Strictness involves applying the laws and regulations per the black letters of the law without any exception unless explicitly defined within the rules, moderate regulation involves the application of rules with due regard to the market dynamics of the sector and liberal regulation involves the

application of the rules in concurrent with the equity .

The regulatory framework for the insurance sector in Uganda is strict as it applies the law as it is rather than how it ought to be per the expectations of the different stakeholders . This forms the basis of this research paper to examine the rationale for the strict norm rather than the liberal nomenclature.

The regulatory framework of the insurance sector in Uganda is comprised of the laws , regulations , prudential guidelines, case laws , principles of insurance, and market norms of prudent insurance business accepted by insurers.

The regulations and guidelines are prescribed by the Insurance Regulatory Authority of Uganda. These are enacted under the principle of delegated legislation where a government agency is mandated under a statutory law to make rules for the effective and efficient functioning of the industry . Delegated legislation is an exception to the common law principle of delegatus non potest delegarethat is a body to whom authority has been delegated may not delegate that authority. In this aspect the authority delegated to the Parliament of Uganda to legislate is delegated to the Insurance Regulatory Authority to regulate the Insurance industry as provided in statute. The stringency of the insurance regulation is due to the following.

The consumer is defined as an individual or a person who has used, uses, is using, or contemplates using a product or service provided by a financial services provider .

The law ensures that the insurance policy holders of insurers or customers of other licensees are protected , the Insurance Regulatory Authority takes appropriate actions against persons carrying on unauthorized insurance businesses to protect the public from fraudulent business persons , the authority receives and resolves insurancerelated complaints from consumers , as well as promoting awareness, sensitization, and education of the public on the insurance business in Uganda.

Consumer protection in the insurance sector is strict and aims at promoting the principles of fairness, reliability, and transparency of the insurance products and services in the insurance market . The principle of fairness forbids deception and aggressive practices of intimidating customers, reliability entails informing customers of any changes in the financial services for instance postal addresses, telephones, and electronic mail and transparency ensures that the information issued to the consumers is authentic and correct whether written, electronic or oral.

The insurance regulation is strict to minimize or rather eliminate the collapse of insurance

companies which is prejudicial to consumers of insurance products . The insurance companies which closed business in Uganda include, AIG Uganda, Nova Insurance Company, Rio Insurance Company, and First Insurance Company.

The strict regulatory framework aims at promoting and upholding public confidence in the given sector, which is stable, sound, efficient, fair, and transparent among the stakeholders.

The Insurance Regulatory Authority licenses persons proposing to carry out insurance business , licenses bancassurance businesses , and has the mandate of revoking the license where the insurer conducts business without sound principles and practices to protect the stability of the insurance sector , as well as ensuring that insurance companies are solvent by conducting insurance business that meets the liabilities as and when due from the parties.

The insurance companies are obliged to keep adequate resources to support the insurance business taking into account the nature, scale, complexity, and risk profile of the

insurance . This is in addition to a restriction of not reducing the paid-up share capital of the insurance company at any given time without the consent of the Insurance Regulatory Authority .

a contractual situation where one party to a transaction possesses material knowledge than the other party so that the non-disclosure of such information at contracting leads to an information imbalance making the contract unenforceable at law under insurance due to the lack of utmost good faith in the transaction

The law requires licensed insurers to conduct insurance business which is based on sound insurance principles. The application of insurance principles reduces the problems of moral hazard, adverse selection, and information asymmetry which are inherent in the insurance business between the insurer and the insured . The deviation from insurance principles leads to losses and the collapse of the insurance company and adversely affects the sector in general.

The general principles of insurance include legality of the insurance contract, insurable interest, premium, subrogation, utmost good faith, risk, intermediaries, proximate cause, and loss materialization.

The Information asymmetry concept denotes

The concept of adverse selection means that a party contracts based on incomplete information which is detrimental or adverse to another party and it is both the duty of the insured and insurer to disclose material information at contracting and during the subsistence of the insurance contract and any lapse in material information disclosure makes the insurance contract unenforceable .

The doctrine of moral hazard refers to the incentive of increased risk-taking because another party in the contractual relationship bears the risk of loss. Thus, where the insured causes a loss in expectation of indemnity from the insurer claims compensation to be declined due to moral hazard which is ex-post to the insurance contract. The non-enforceability of the insurance contract where a party has caused the peril to materialize into a loss stems from the fact that insurance contracts are contracts of indemnity .

The regulatory regime for the insurance business is strict to minimize the agency problem that arises whenever there is a relationship between a principal and an agent in a transaction . The agency problem is featured in corporate bodies having a separation of management and control with shareholders appointing the board of directors to control the activist of management who are involved in the daily operations of the business .

The control of the agency problem in the insurance business aims at ensuring that agents in insurance companies carry out their duties as fiduciaries by exercising due care, professionalism, trust, and confidence forming the basis by which the insured confides in them while insuring their risks .

The law requires only corporate bodies to carry out insurance business in Uganda .

The directors of companies can act in their selfinterests of managerial utility maximization contrary to the strategic direction hence external auditors are used to audit the financial statements prepared by the management to control agency problems by stating the audit opinion .

The board of directors of an insurance company or insurance service provider is subject to the fit and proper test to establish their competencies and knowledge of conducting insurance business , including the senior manager so that the insurance business is performed efficiently and effectively to the expectation of the stakeholders .

The insurer is obliged to establish control functions to minimize operational risks stemming from people, processes, and procedures and these control functions of risk, compliance, actuarial, and audit are used to control the agency’s problem .

service providers.

The financial records and other records of the insurance business must be kept for ten years or else a fine of 1000 currency points for noncompliance with the record-keeping rule.

The preparation of financial statements on an annual basis is strict and must be prepared by every insurer, insurance broker, health membership organization, loss adjuster, risk adviser, loss assessor , and these financial statements must comply with the accounting standards adopted by the Institute of Certified Public Accountants of Uganda.

Thefinancialrecords andotherrecordsof theinsurancebusiness mustbekeptforten 1000yearsorelseafineof non-compliancecurrencypointsfor record-keepingwiththe rule.

The insurance and reinsurance brokers being a corporate body aim to minimize the agency problem , coupled with subjecting the insurance brokers to the fit and proper criteria by the Insurance Regulatory Authority as persons competent to perform insurance business .

Accountability means reporting one’s activities to another person by showing the extent to which the responsibilities entrusted with have been achieved in a given period using the defined resources .

The reporting obligation mandates insurance service providers to keep sufficient records which form the basis for the preparation of financial statements , as well as enablers in the conducting of external auditing by the appointed external auditors of the insurance

The insured, investors, and other stakeholders can establish the going concern status of the insurer by analyzing the financial statements prepared per the international accounting standards and accounting principles which improves confidence in the insurance industry . The external auditors are independent of the insurance service providers to promote the issuance of independent audit reports and management letters showing weaknesses in the internal controls which are rectified by management .

Risk is the probability of an event occurring that impacts the financial position either adversely or beneficially in terms of increasing cash flows in the profit and loss statements which are used for capitalization of the entity after discharging the operational expenses and taxes .

Insurance is a business of making profits by the insurer through risk-taking and this is possible whenever calculative risk-taking is undertaken . The prudent underwriting of policies involves the analysis of risks before insurance contracts are made leading to desirable business performance and sustainability.

The insurance businesses are regulated on a

risk-sensitive basis by the Insurance Regulatory Authority . This means that proactive steps are undertaken in the insurance supervision before risks materialize into losses using the risk management processes involving the identification, assessment, control, monitoring, review, and reporting of risks at defined intervals.

The risk sensitivity involves the inspection of insurance service providers at least once every three years under a statutory compliance risk management , and the risk profile of interest to the regulator includes strategic, operational, credit, liquidity, and market risk respectively.

The risk-sensitive approach entailed in the regulatory framework protects the public interest as the insurers can be inspected at any time whenever there is suspicion that the interests of policyholders, shareholders, and members of the public are prejudiced .

The risk management of insurance companies under the regulatory framework also aims at minimizing the materialization of contagion risk. This is a risk of an entity collapsing and having spillovers to the entire industry. This information disclosure is critical in the insurance business and insurers are obliged to disclose information to the regulatory authority to deter the insurance businesses from being used as conduits for criminal activities involving fraud, terrorism, money laundering, and other financial crimes .

7. Financial Inclusion, Intermediation, Outreach and Resilience.

The Insurance Regulatory Authority has one its cardinal objectives of promoting effective competition in the insurance sector in the interests of consumers, the growth and development of the insurance sector, and the development of an inclusive insurance sector. This connotes financial inclusion, outreach, and financial outreach embedded in the

Financial inclusion means individuals and businesses have access to useful and affordable financial services to meet their needs . The financial strategy for Uganda is to increase financial inclusion as a solution to poverty eradication by using digital financial services and financial literacy .

regulatory framework .

Financial resilience involves the ability to cope with financial shocks or recover from financial difficulties caused by the internal and market

forces affecting an entity. The Insurance Regulatory Authority takes action on individual licensees that are insolvent or likely to be insolvent so that they document and implement a recovery plan to deter liquidation .

The financial intermediation involves insurance service providers collecting funds from surplus parties as savers and investing such funds in risk-free instruments as well as lending to some of the policyholders in the form of insurance loans. The insurance license provides for this activity.

a. Allocative Inefficiency. The strict regulation results in allocative inefficiency which involves the production of goods and services below the optimal point of the production possibility frontier. This means that the regulation curtails the maximum production of resources .

The minimum paid share capital required before being licensed to conduct an insurance business can be used to provide insurance products and services to customers rather than being tied up in money terms invested in government securities . This limits financial outreach and financial breadth in terms of providing a variety of insurance products hence the need for a relaxed or liberal regulatory framework with little or no paid-up capital.

b. Bounded Rationality. This is the human decision-making process in which individuals satisfy rather than optimize the solution to a defined problem. The decision that is good enough is chosen rather than the best possible decision in the circumstances . This limitation on human nature to make the best decision

alternatives is caused by time constraints, incomplete information, and cognitive limitations. The insurer can provide insurance services to customers for convenience rather than in the best interest of customers as prescribed by the regulatory framework. Thus a liberal regulatory regime can solve these limitations by providing for satisfactory outcomes than the perfect ones.

The regulatory framework for the insurance sector is strict in Uganda, unlike sectors like trade and commerce, tourism, and transport which are liberal without capital requirements. The optimal solution is to set the regulatory requirements which are stakeholder-based based than regulatory so that different interest groups can benefit from the success of the sector.

Katto Japheth, Simeon Wanyama, Miriam Musaali (2014). Corporate Governance in Uganda: An Introduction to Concepts and Principles. Fountain Publishers, Kampala, Uganda.

Kirubi, C (2018). Why Strict Corporate Governance in the Regulated Sectors. Evans Publishers, Nairobi, Kenya.

Kwikiriza, Benson, A (2020). Developments in the Insurance Regulatory Framework in Uganda. Presentation to Uganda Law Society Members, Sponsored by the Insurance Regulatory Authority of Uganda.

Ssekana, M (2017). Public Law and Practice in Uganda. Events Publishers, Kampala, Uganda

David Amanyire CEO (Chief Enjoyment Officer) People and Culture

you think of team building, what comes to mind? A typical boardroom workshop? A few trust falls? For the People and Culture Department, team building meant something entirely different - an unforgettable blend of adventure, creativity, and pure fun.

The journey began with an adrenaline rush as the team tackled the high ropes challenge, an activity that tested both courage and trust. With harnesses secured and hearts racing, each person faced the daunting heights, some with hesitation, others with determination. Encouragement echoed from every corner, with teammates cheering each other on, proving that true support extends beyond the office walls.

A change of scenery brought a fresh wave of excitement as everyone set sail for Kalangala Island. The boat ride over the vast, shimmering waters felt like a passage into another world, where the pressures of deadlines and emails were momentarily forgotten. Upon arrival, the island’s breathtaking views and cool breeze

or feeling the smooth, coiled form of a snake created an unforgettable experience. Conversations shifted from work projects to wildlife conservation, leaving everyone with a newfound appreciation for nature.

As the sun dipped below the horizon, the

set the perfect stage for laughter, reflection, and conversations that strengthened bonds beyond work.

Creativity took center stage with a sip and paint session, where paintbrushes replaced keyboards and artistic expression flowed as freely as the wine. Colors blended on canvases, and so did personalities, as colleagues laughed at their masterpieces— some impressive, others more abstract, but all meaningful in their own way. The activity was more than just painting; it was a reminder that creativity and collaboration thrive in an environment where people feel free to express themselves.

A sense of adventure resurfaced during a visit to CTC Conservation Center, where the team came face-to-face with some of nature’s most majestic creatures. The thrill of touching a lion, zebra, snake, and the impala sparked a mix of awe and excitement. Standing just inches away from a lion’s powerful presence

energy shifted from exploration to celebration. A karaoke night brought out hidden talents (and some off-key surprises), with the room erupting in laughter and applause after each daring performance. The nights didn’t end there—the team took to the dance floor, where music, movement, and shared joy created

a perfect close to an already unforgettable experience.

Returning to the office, the team carried more than just memories; they brought a renewed sense of unity, energy, and collaboration. The retreat had proven that strong teams aren’t just built in boardrooms but in moments of shared adventure, creativity, and connection. Stepping

beyond the usual routine had strengthened not just professional relationships but the very spirit of the People and Culture team.

Because in the end, a great team isn’t just defined by how well they work together—but by how well they experience life together.

Ethel Nagaddya Ahura Wellbeing Manager, People and Culture

In today’s fast-paced work environment, it’s easy to find yourself devoting long hours to your job—whether it’s in pursuit of a promotion, managing an overwhelming workload, or simply trying to keep up. While occasional overtime may be necessary, consistently prioritizing work over personal well-being can have serious consequences.

Before overcommitting, consider the impact of poor work-life integration.

• Fatigue: Exhaustion can diminish your productivity and clarity, potentially harming your professional reputation and leading to costly mistakes. Fatigue also lowers immunity, making you more prone to illnesses. Overworking increases stress hormones, leading to mood swings, anxiety, and even depression.

• Strained Relationships: Missing out on important family events or time with loved ones can weaken relationships and leave you feeling disconnected.

• Unrealistic Expectations: Regularly working extra hours may lead to increased workload demands, adding even more stress and pressure. Finding balance between career and personal life is an ongoing challenge, but these approaches may help:

1. Keep close to family. Have family rituals that keep you in touch with one another,

such as prayers, monthly family meetings, gardening together whenever possible, or any other family projects that keep you working closely with your family.

2. Keep the communication channels open. Use social media, or any family chat groups to share videos and update each other on your daily activities. Keep connected to your loved ones.

3. Create memories. When you are at home, make it memorable and dedicate time to family (spouse and children) without distractions.

4. Request for flexibility at work. This will enable you to be present at important family events, and while there, make the best of it. These events can include - child’s birthday, baptism, funerals and births.)

5. Track Your Time. Identify daily tasks that are essential and fulfilling. Delegate or eliminate those that drain your energy without adding value.

6. Learn to Say No. Set boundaries by politely declining additional responsibilities that don’t align with your priorities.

7. Leave Work at Work. Create a clear separation between professional and personal time by disconnecting from work emails and calls after working hours.

8. Manage Your Time Wisely. Plan your errands efficiently, use a shared family calendar, and prioritize important tasks to reduce stress. Do what needs to be done and

9. Build a Support System. Collaborate with colleagues to share responsibilities when needed and seek help from family and friends for personal obligations.

10. Prioritize Self-Care and Nurture yourself. Maintain a balanced diet, stay active, and ensure adequate rest. Engage in activities that bring you joy and relaxation.

11. Passionate about something? Ensure that you pursue hobbies and activities that keep you relaxed.

12. Seek Professional Help When Needed. If integrating work and life feels overwhelming, consider speaking with a counselor or

mental health professional for guidance. Our Counsellors from Healing Talk Counselling Services are here to support you.

We need to understand that Work-life balance or rather Work-life integration is not a onetime achievement but an evolving process. As your career, family, and personal goals shift, periodically reassess your priorities and make necessary adjustments. A well-balanced life leads to greater well-being, stronger relationships, and sustained professional success.

Take a step back and evaluate - Are you working to live or living to work? AHealthyLifestyleforABetterLife!

The Legend of Sports Day: Recounting how things went down.

Remigious Kaggwa Engagement Specialist, People and Culture

They say sports reveal true characterand if that holds, the recently concluded NSSF Annual Sports Day was a grand spectacle of passion, determination, and sheer athletic prowess! Held at the Elite High School Sports Complex in Entebbe, this longawaited event lived up to the hype, offering a thrilling mix of competition, camaraderie, and unfiltered joy.

From weeks of playful banter across the Fund’s corridors to a day packed with roaring cheers, sweat-drenched battles, and well-deserved victories, one thing became clear - this event is more than just a competition; it’s a celebration of team spirit and unity. The story of Sports Day 2025 began with the careful crafting of four dynamic teams, each woven together with talent from across the Fund. The Titans –

fierce, relentless, and determined to conquer; The Legacy Legends - humble yet mighty, proving that wisdom and skill go hand in hand; The Spartans - vocal, high-energy, and always ready for battle, and The Mavericks – calm and collected, yet strategic and formidable.

With talent pooled from different departments, these teams went head-to-head across a diverse range of sports, including football, swimming, basketball, athletics, pool, and tug-of-war. Even the legendary Chwezi games made an appearance, with intense battles over tick-taka (or whatever it was called - we’re still figuring that out!).

If there was a sport that lasted the entire day, it had to be cheerleading. Teams didn’t just bring their A-game to the field—they brought an unstoppable energy to the sidelines, turning the event into a full-blown festival of dance, chants, and colourful theatrics. Special

mention goes to Team Red, whose cheer squad took things to another level - decked out in attire that could only be described as inspired by traditional healers! But that’s a story for another day (or maybe the next bulletin?).

Beyond the competition, Sports Day was a reminder of the power of teamwork, the thrill of the game, and the beauty of shared experiences. With a perfect blend of sportsmanship, laughter, and unbreakable bonds, it left everyone eagerly awaiting the next edition. Until then, let’s keep the spirit alive - because the countdown to the next showdown begins now!

The weeks leading up to Sports Day were nothing short of electric. If you took your eyes off the staff WhatsApp group for just a moment, you returned to find a flood of messages - bold predictions, outrageous accusations, and toptier ridicule. You innocently posted your team’s logo, only for some cheeky Titan to dismiss it as a “starved Johnny Bravo.” Before you could even react, another wild allegation was flying in - Team Legends had allegedly hired traditional healers to neutralize the soaring Titans. As that theory was being scrutinized, the Spartans were busy declaring that the Mavericks would

Let us try to go back to what made sports day a very unforgettable event for everyone that graced the day.

“lead from the bottom” (which, to be fair… they did). At this point, if you hadn’t built immunity to sports banter, you were in trouble.

The heat of the mind games carried straight

into game day. By 6:30 AM, a squad of Titans had already occupied the pitch, throwing intimidating stares at their opponents. Meanwhile, a certain group of defiant Spartans made it their mission to undermine every effort by other teams to rally their fans. The energy was unmatched!

Then came the moment of truth. Would all the verbal artillery fired in the previous weeks translate into actual wins? Well… let’s just say some “prophecies” came to pass. One unlucky team (we’ll keep their name classified for security reasons) conceded four goals so effortlessly, you’d think their goalkeeper had dipped his gloves in cooking oil. The echoes of Hon. Betty Nambooze’s iconic lamentation— “Naye Banange!”— could almost be heard across the field.

But beyond the vuvuzelas, taunts, and celebratory dances, the true spirit of Sports Day shone through - teamwork, camaraderie, and pure fun. Oh, and before I forget, I have a borne to pick up with a certain someone on the 14th Floor who turned my photo into a WhatsApp sticker. Tebinaggwa! (It’s not over yet!)

Had time allowed, I would have also narrated

how one bold Legacy Legend infiltrated the Titans’ camp, “stole” a team jersey, and confidently played as their goalkeeper. But that, my friends, is a story for another day.

It was nothing short of a modern-day fairytale as the four powerhouse teams—Titans, Legacy Legends, Spartans, and Mavericks—set out on their quest for sporting supremacy. A

talent showcase filled with raw passion, fierce competition, and electrifying energy, the 2025 NSSF Sports Day was a spectacle to behold.

The day kicked off with a grand parade, a stunning tradition that saw each team march onto the field in their signature colours. Though no prior rehearsals had taken place, the formations turned out to be an absolute delight to watch. The Titans stood bold in cool green with a touch of Fund blue, while the Spartans strutted in a striking blue ensemble— arguably the most stylish of the day. The Legacy Legends rocked a fierce red-to-blue gradient, and the Mavericks brought a touch of purity with their angelic white jerseys.

Then came the warm-up session, which turned out to be an unexpected battle of its own. Lubalula fever took over, leaving many players gasping for breath after expending half their energy reserves before the games had even begun! With adrenaline pumping and fans roaring, the games officially kicked off. Football, basketball, Kwepena, and more turned the sports complex into a battlefield, with each team putting on an awe-inspiring display of skill, determination, and sheer willpower. The fans, equally fired up, transformed the sidelines into a symphony of cheers, vuvuzelas, and passionate chants.

It didn’t take long for whispers to spread

across the grounds—speculation was already flying about which side was likely to walk away with the ultimate bragging rights. Early results suggested that, as widely predicted, the Titans had taken a commanding lead, their dominance felt across the field. They had already secured two back-to-back football victories against the Mavericks and the Legends, thanks to the dazzling footwork of midfield maestro Milton Owor and a squad stacked with talent, including Edwin Rwemigabo, Rachel Nsenge, and Oscar Twinomugisha.

But the Legacy Legends weren’t about to be outshined. Over on the basketball court, they turned the tide with a series of resounding victories, led by the unstoppable William Okabo and his well-balanced team. Their seamless coordination and tactical brilliance left fans in awe and opponents scrambling for answers. Meanwhile, the Mavericks boasted some of the Fund’s tallest athletes - Emmanuel Sserumaga among them - but even their towering presence struggled against the high-flying Legends. As for the Spartans, their winning formula remained a mystery for most of the day. It was only later revealed that they had secretly dominated rope skipping, proving that athleticism isn’t just about brute strength.

Elsewhere, on the pool table, true mastery unfolded. Cue-master Arthur Tugume led a formidable three-a-side team that demolished every challenger that dared to stand in their way. Before anyone knew it, the Titans had effortlessly pocketed the pool trophy, leaving

the Spartans—who had entered the contest with highly-rated players like Joseph Yiga and Henry Kasozi—stunned by the upset.

From dramatic showdowns to unexpected twists, the 2025 NSSF Sports Day was an unforgettable rollercoaster of emotions. As the dust settled and the final whistle blew, one thing remained clear—this was more than just a competition. It was a celebration of unity, teamwork, and the unbreakable spirit of the Fund’s sporting warriors. And for those who thought the sportsmanship ended there— think again! The banter and bragging rights have only just begun.

While the spotlight shone on fierce football battles, intense basketball showdowns, and electrifying pool table duels, there was an unexpected force quietly shaping the destiny of the 2025 NSSF Sports Day. A force so subtle yet so deadly, it moved like a silent assassin— collecting points unnoticed, striking when least expected. Enter the Legacy Legends.

Their master plan had been foreshadowed by one of their most vocal banter warriors, Tito, who had boldly declared, “We’ll do our thing quietly.” And true to his word, the Legends crept through the ranks, strategically accumulating points across various disciplines, until—BOOM!

- they were crowned the ultimate champions of the long-anticipated Fund sports showdown!

The announcement of the final results sent shockwaves across the venue. Even the Legends’ own fans were caught off guard! As the points were read out, Paul Kebba, a dedicated Spartan standing next to me, looked as if he had just survived a 7.7 magnitude earthquake. His legs trembled; his confidence wavered—was this real life?

For a brief moment, an eerie silence took over the crowd. One would have thought we were holding a moment of silence for a defeated Spartan squad. Senior leaders held their breath, cheerleaders froze mid-celebration, and event organizers wore knowing smiles. The tension was thick enough to slice with a butter knife. The Legacy Legends had snatched victory, finishing just a few points ahead of the Titans.

Now, as much as I’d love to remind you who took third and last place, I’ll spare you the details (you were there, you know the truth). But here’s what truly stood out that day: teamwork won!

Regardless of placement, every team was victorious—each walking away with a trophy in recognition of their efforts. It was a day that showcased grit, passion, and sportsmanship, proving that the NSSF family thrives when

That said, I am aware of an ongoing appeal filed against the champions. But as a law-abiding Ugandan, I will refrain from discussing matters that are now before the “DPP” (Department of Post-Game Protest). We await the final verdict, though I suspect it will take as long as certain cases in the courts of law.

As the dust settles on yet another exhilarating NSSF Annual Sports Day, one truth stands tall - teamwork won the day. Beyond the dazzling footwork, the high-flying dunks, the thunderous cheers, and even the occasional banter-fuelled confrontations, what truly defined this event was the collaboration, resilience, and unity displayed by every team.

Each squad, whether battling on the football pitch, dominating the basketball court, or strategizing at the pool table—embodied the very essence of what makes our Fund family thrive. The unshakable spirit of working together, lifting each other up, and

pushing towards a common goal was evident in every moment of the day. But, as with all competitions, there can only be one winner. And while the Legacy Legends walked away with the coveted trophy, the bigger picture tells a far greater story, one that reflects our larger mission as NSSF.

Just as we battled fiercely in different teams, yet ultimately worked towards a single, shared experience, our daily work at the Fund mirrors this same drive. We may represent different departments, pursue different strategic objectives, and navigate different challenges, but the goal remains the same.

• 95% staff engagement

• 50% coverage of working Ugandans

• 50 trillion in assets under management by 2035

The spirit that powered us on the sports field is the same energy that will drive us towards these milestones. If we can take home trophies, we can take home these wins too! So, let’s keep the fire burning, keep the teamwork alive, and most importantly—keep playing to win!

Diana Akurut Relationshp Manager, Commercial

United – the club that once made football fans quiver with fear and excitement, and now. Well, let’s just say they’ve swapped some of that swagger for a few nervous glances and “What just happened?” moments. But hey, it’s all part of the ride, right?

The Glory Days: Red Devils Roaring It feels like a distant memory now, but Manchester United were once the undisputed kings of English football, basking in the glory of Sir Alex Ferguson’s managerial genius.

Under Fergie’s leadership, United racked up a treasure trove of trophies, including Premier League titles, FA Cups, and UEFA Champions League trophies. In the 90s and 2000s, the club was feared across Europe. Sir Alex made winning look easy – well, as easy as scoring a last-minute goal in a Champions League final against Bayern Munich.

During this time, players like Ryan Giggs, Eric Cantona, Rooney and Cristiano Ronaldo became household names. Giggs could glide down the wing like he was born with roller skates, Cantona could score goals with a cheeky flair, Rooney was tough, with a mix of

technical skill, vision, and a strong work ethic. His goal-scoring ability was complemented by his leadership on the field. Ronaldo—well, he became a phenomenon!

United were like the football equivalent of the cool kid in school – everyone wanted to be them or at least have a piece of them.

The Fall: From Champions to “Uh, What Happened?”

Sir Alex Ferguson, a retired football manager and former player, who was best known for his legendary tenure at Manchester United, which spanned from 1986 to 2013, was widely regarded as the greatest manager of all time. Ferguson’s incredible success on the pitch saw him lift more trophies than any other manager in football history. When he retired in 2013, the footballing world collectively held its breath. Who could possibly replace the man who had transformed United into a global footballing empire? What followed was a journey of managerial changes, with each new appointment bringing its own vision, aspirations, and hurdles, as detailed below, David Moyes (1 July 2013 – 22 April 2014), the chosen successor, lasted a mere 10 months before being given the “thanks, but no thanks” treatment.

Louis van Gaal (16 July 2014 – 23 May 2016), whose tenure was marked by a defence-first approach that had fans wondering if they were watching football or a tactical chess match.

Next was José Mourinho (27 May 2016 – 18 December 2018), who, despite his charm (and the occasional rants), couldn’t bring back the glory days.

Then came, Ole Gunnar Solskjær (19 December 2018 – 21 November 2021), the club’s beloved “baby-faced assassin,” who was often seen on the sidelines with that look that said, “I’m about to win 3-0... or 4-0... or maybe 5-4.”

Then came Michael Carrick (Caretaker, 21 November 2021 – 2 December 2021) Carrick oversaw three games, leaving unbeaten and earning plaudits for his short-term impact.

Ralf Rangnick (Interim, 3 December 2021 – 22 May 2022) Rangnick’s interim spell was marked by underwhelming performances and a fractured dressing room. His high-pressing philosophy never fully clicked with the squad.

Then came Erik ten Hag (23 May 2022 –28 October 2024) who brought tactical sophistication and claimed two trophies during his two-and-a-half seasons. Despite initial promise, the team’s performances faltered, and his tenure ended prematurely.

Then came the beloved Ruud van Nistelrooy (28 October 2024 – 10 November 2024) The former United striker had a brief caretaker spell, managing just four games.

Now, it’s Ruben Amorim’s turn. He arrived at Manchester United with a stellar reputation from his time at Sporting Lisbon, tasked with the monumental challenge of restoring the club’s former glory. The odds were in his favor and now fast forward three and a half months and the club are 15th, 15 points from the top four and 12 points above the relegation zone.

While each manager contributed moments of hope, United’s performances never improved. The team oscillated between thrilling comebacks and catastrophic collapses. Currently, it is not unusual for fans to

experience a rollercoaster of excitement and anxiety within the same match.

Manchester United is in what can only be described as an “awkward teenage phase”— fluctuating between moments of brilliance and moments that make you want to throw your TV out the window (but don’t, because you’ll need it for the next game—or for the kids’ cartoons).

The team still shows glimpses of its former glory, especially in attack, where flashes of brilliance keep fans hopeful. But then there’s the defence. Oh, the defence. For every goal scored, there’s a blunder at the back that leaves fans clutching their heads in disbelief.

The current manager is trying to instil a sense of discipline. However, rebuilding a giant takes time - especially when Arsenal, Chelsea, Liverpool, and Manchester City are all determined to make the journey as difficult as possible.

So, where does that leave Manchester United? Somewhere between being a historic powerhouse and a team that could be flirting with relegation. The club’s current form suggests they could either finish 16th on the table or slip into the bottom three and face relegation – it’s that kind of season.

But here’s the thing: Manchester United has a rich history. Sure, they’re not winning titles every year, but as any football fan knows, football is cyclical. One minute you’re in the dumps, the next you’re lifting silverware.

To all those United fans out there especially my son Elisha, hang in there. After all, they say, it’s always darkest before the glory.

So, here’s to Manchester United – a club with a past full of triumphs, a present full of uncertainty, and a future that, hopefully, won’t involve too many more random defeats.