TRAVERSE CITY BUSINESS NEWS MARCH 2024 1 PRSRT STD U.S. POSTAGE PAID TRAVERSE CITY, MI PERMIT NO. 7 $3 MARCH 2024 • VOLUME 28 • NUMBER 8 Engine AT WORK Member FDIC Our new office, now under construction on Garfield Avenue.

Great things are coming,TC!

•

•

• Our team of professionals holds designations and degrees such as CFP®, CFA, CPA, MBA, and PhD.

• Charles received his MBA from the Kellogg School of Management - Northwestern University, his MA in Economics from WMU, and Executive Education from Harvard Business School and Columbia University.

Zhang, CFP®, MBA, MSFS, ChFC

• Ranked #1 on Barron’s list of America’s TOP Independent Advisors and is the highest ranked NAPFA-Registered Fee-Only Advisor on the list.*

• Ranked #4 in the nation on Forbes’ list of TOP Wealth Advisors and is the ONLY Independent Advisor in the top 10.**

*As

2 MARCH 2024 TRAVERSE CITY BUSINESS NEWS Charles Zhang - Michigan’s #1 Financial Advisor by both Barron’s* and Forbes** A Fee-Only Wealth Management Group

reported in Barron’s March 11, 2023 and September 17, 2021. Based on assets under management, revenue produced for the firm, regulatory record, quality of practices, and other factors. For fee-only status see NAPFA.org. **As reported in Forbes April 4, 2023. The Forbes rankings, developed by SHOOK Research, are based on an algorithm of qualitative criteria, mostly gained through telephone and in-person due diligence interviews, and quantitative data. Those advisors that are considered have a minimum of seven years experience, and the algorithm weighs factors like revenue trends, assets under management, compliance records, industry experience and those that encompass best practices in their practices and approach to working with clients. See zhangfinancial.com/disclosure for full ranking criteria. Fee-Only Unbiased Investment Advice

work with clients

We uphold a Fiduciary Standard and

on a fee-only basis.

from product

Credibility & Professionalism

We do not receive commissions, kick-backs, or soft dollars

sales, eliminating inherent conflicts of interest.

Charles

www.zhangfinancial.com

Founder and President

investment: $1,000,000 in Michigan/$2,000,000 outside of Michigan. Assets under custody of LPL Financial, TD Ameritrade, and Charles Schwab. Serving the Entire Traverse City Area Traverse City Office 236 1/2 E. Front Street, #26 Traverse City, MI 49684 231-943-6988 Main Office 5931 Oakland Drive Portage, MI 49024 269-385-5888 or 888-777-0216

Our Zhang Financial Team

Minimum

WINDOW BUSINESS ACQUIRED

Old Mission Windows, founded in Traverse City in 1985, was recently acquired by US LBM, a distributor of specialty building materials in the United States. “We’re thrilled to join the US LBM family of companies,” said Marc Cesario, who has led Old Mission Windows for more than 20 years. Old Mission Windows marks the 21st Michigan location for US LBM and will operate as part of the company’s Standard Supply and Zeeland Lumber division, which includes Northern Building Supply in Traverse City and Suttons Bay.

VENTURE NORTH APPOINTS NEW CHAIR, MEMBERS

Venture North Funding and Development in Traverse City recently announced several additions to its board. New officers include Laura Reznich, chair – CFO, Plascon; Carla Gribbs, immediate past chair – formerly of DTE Energy; and Bill Byrne, treasurer – vice president of financial planning and acquisitions, Hagerty. New members include Andy Cole, senior vice president, northwest Michigan region, Cunningham-Limp; Chris Hackbarth, regional manager, DTE Energy; and Louise Wenzel, chair, The Antrim Foundation.

MANUFACTURING CO. CREATES WELDING APPRENTICESHIP

A first-of-its-kind apprenticeship program in northern Michigan will help a Traverse City manufacturing company train its employees. JanTec Incorporated, a manufacturer of conveyance systems and products, is launching a U.S. Department of Labor registered apprenticeship for welders in partnership with Northwest Michigan Works! JanTec is providing apprentices with approximately 36 months of on-the-job learning along with over 400 hours of related educational instruction provided through Northwestern Michigan College.

TRAVERSE CONNECT FILLS GOVERNMENT RELATIONS POST

Haley Bennett has joined Traverse Connect as its new director of government relations. Bennett will also serve in the same role for the Northern Michigan Chamber Alliance. “Haley brings extensive experience in advocacy and policy to her new role with Traverse Connect, having started her career as an intern in the Michigan Legislature,” said Traverse Connect President and CEO Warren Call. “Haley will be a strong advocate for rural businesses and communities as Traverse Connect and the Northern Michigan Chamber Alliance build upon years of success.” Bennett has lived in Traverse City since 2019.

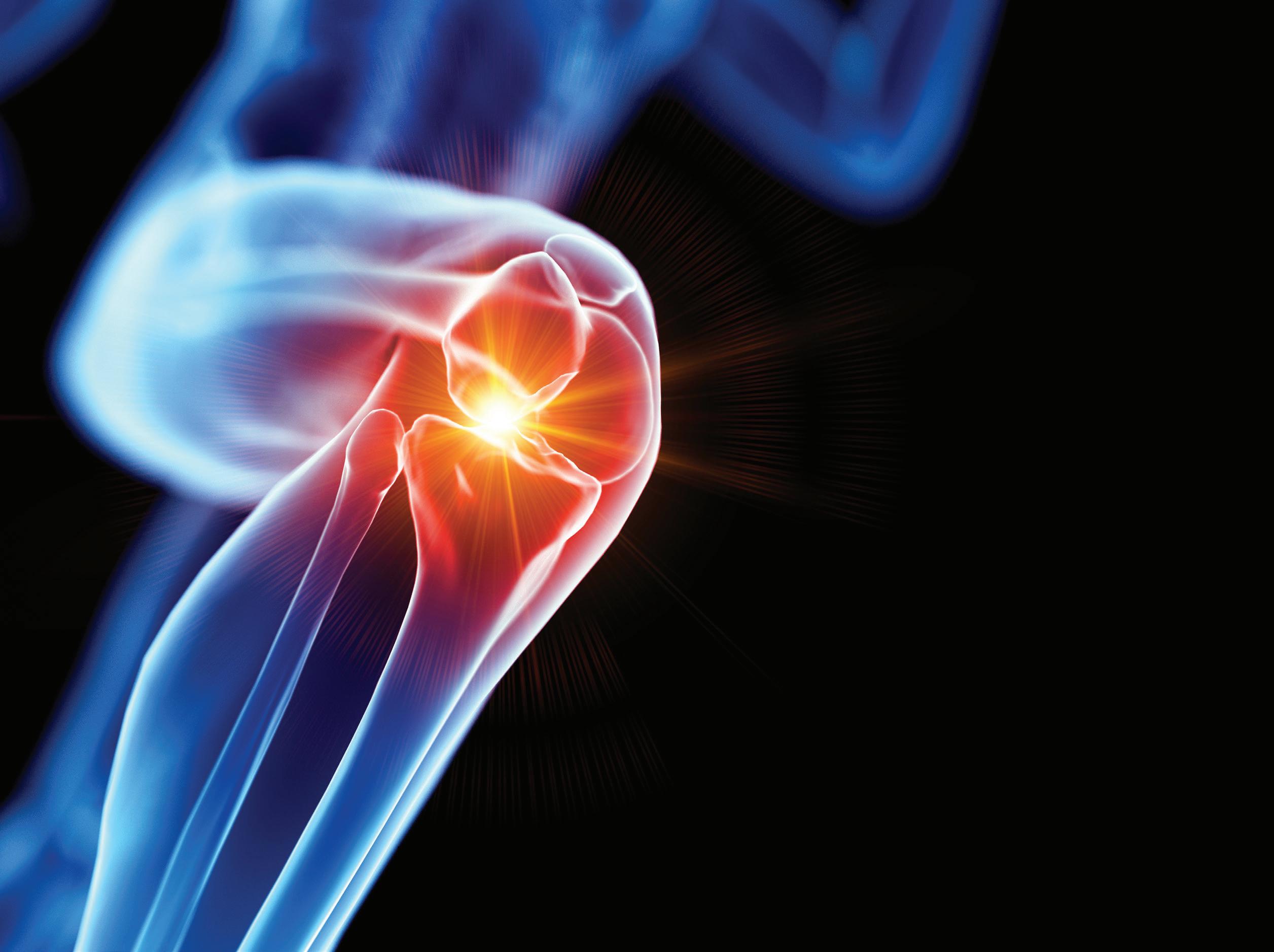

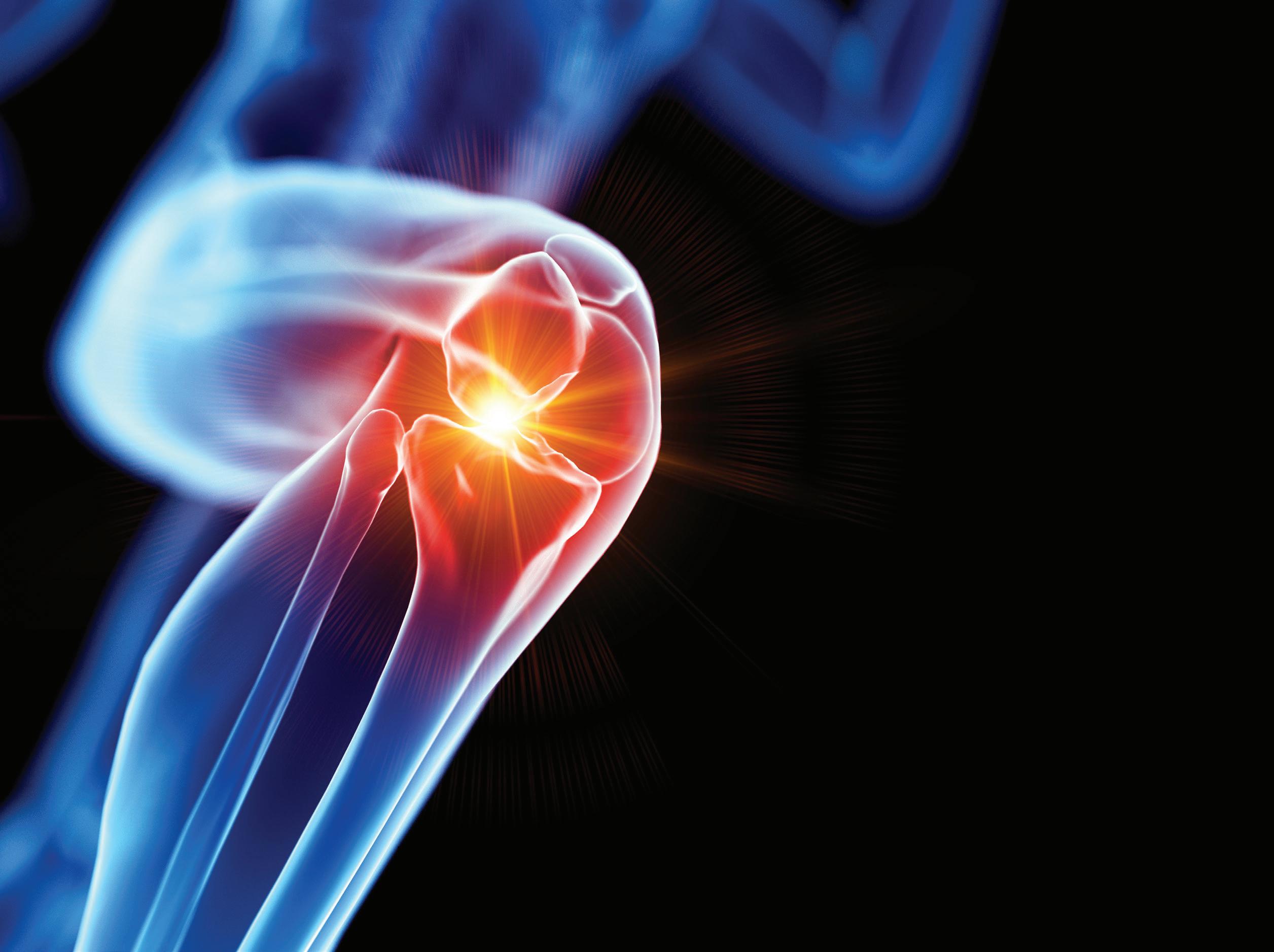

TC COMPANY TO TRIAL COVID TREATMENT

HealthBio AI, a Traverse City company led by Dr. Bruce Patterson, has received acceptance from the United States Food and Drug Administration to proceed with a randomized clinical trial for the treatment of long COVID. The company is proposing the use of two existing medications: maraviroc, an FDA-approved prescription medicine for the treatment of HIV infection, and atorvastatin, FDA-approved for the treatment of high cholesterol levels, as therapeutic treatment. Working in combination, the drugs address the blood vessel inflammation responsible for many of the symptoms, including fatigue, chronic headaches, migraines, post-exertional malaise, brain fog, ringing in the ears, hot-cold sensitivity, and more.

TVC TO HOUSTON: DIRECT

Cherry Capital Airport (TVC) recently added its 19th direct flight – to Houston’s George Bush Intercontinental Airport. United Airlines is offering seasonal Saturday service beginning June 29 and running through August 17. Houston is United’s fifth non-stop destination –which also includes Chicago, Denver, Newark, and Washington D.C./Dulles. The new service was made possible by a U.S. Department of Transportation Small Community Air Service Development Program Grant ($750,000) with community partnerships between the airport, Traverse City Tourism, and Traverse Connect.

TRAVERSE CITY BUSINESS NEWS MARCH 2024 3

BRIEFLY Much More than Pumping plumbing done Drain Line & Sewer Cleaning Line Repair& Replacement Sump Pump Services Camera Line Inspections right 231-228-7499 williamspumping.com plumbing services State Farm Bloomington, IL 2001290 Right coverage. Right price. Right here in town. Here’s the deal. The right insurance should help you feel confident and comfortable. I’m the right good neighbor for that. Call me today. Like a good neighbor, State Farm is there.® Todd Hart Insurance Agency Inc Todd Hart CPCU ChFC CLU, Agent agent@toddhart.net www.toddhart.net Bus: 231-946-8790 Fax: 231-946-0822

CLASSIC FINE CLOTHING WOMENS MENS KIDS BABY Downtown Suttons Bay 18 76 EST. bahles.net LOCATED IN BEAUTIFUL hoursMON–SAT 10AM-530PM SUNDAY CLOSED Style WITH Live EVERYDAY IN AVAILABLE 4.1.24 0 S Equal Housing Lender | Member FDIC | (888) 295-4373 | westshorebank com $ 1 , 0 0 0 S C H O L A R S H I P S Awarding A p p l y b e f o r e A p r i l 1 2 , 2 0 2 4 a t 1 1 : 0 0 P . M . E S T Data Charges may apply

DUNEGRASS OPENS FLAGSHIP STORE

Cannabis retailer Dunegrass Co. has opened its flagship store in downtown Traverse City at 440 E. Front St. next to The Little Fleet. Dunegrass, a family-owned chain of dispensaries, has seven other locations around the region. “It’s amazing after years of opening stores throughout Northern Michigan we finally get to come home,” said Eric Piedmonte, COO of Dunegrass.

NMC APPOINTS MARSH TO BOARD

Bill Marsh Jr. is the newest member of the Northwestern Michigan College board of trustees. Marsh was one of six applicants for the board seat vacated by Rachel Johnson in January. He will serve on the board until the next regular community college election on Nov. 5. At that point, voters will choose a candidate to serve out the remainder of Johnson’s term, which runs through the end of 2026. Marsh, a longtime co-owner of the Bill Marsh Auto Group, announced in January that he and his brothers were selling their three dealerships to Serra Automotive. Marsh previously was a member of the NMC Foundation board, joining in 2010 and serving in turn as annual fund co-chair, executive committee officer, and ultimately as board chair from 2016 to 2018. In 2020, as the college worked through a new strategic plan, Marsh served as part of the steering community. That same year, he received the NMC Fellow award.

KOMBUCHA CO. FIGHTS HUMAN TRAFFICKING

Cultured Kombucha Co. in Traverse City recently announced it is committing one percent of its profits to fight against human trafficking. More than 5,000 human trafficking survivors, including women, children and men, have been identified across Michigan since 2007, according to the Human Trafficking Hotline.

BRIEFLY

WINERIES WIN AT COMPETITION

Several local wineries were award winners at the recent 2024 American Fine Wine Competition, known for recognizing excellence in winemaking. Wineries receiving recognition include Black Star Farms, Bel Lago, Brengman Brothers, Bel Lago, Blustone Vineyards, and Brys Estate Vineyard & Winery. A complete list of the winners and their wines is available at americanfinewinecompetition.org.

CONSIGNMENT SHOP SELLS, REBRANDS

After 18 years, Pat and Phil Thies have sold Jaffe’s Resale and Consignment in Lake Leelanau back to its founder, Jaffe Wade. Wade originally opened the shop in 2003 and sold it two years later. The Lake Leelanau store will be rebranded as Evergreen Consignment April 1, mirroring the consignment shop Wade opened in Traverse City in 2015, located at 541 E. Eighth Street.

RED GINGER SOLD

Red Ginger, the Asian restaurant and a downtown Traverse City staple, has been sold. Dan and Pam Marsh have agreed to sell to key employees Jordan Apsey and Oana Neacsu, according to the Ticker. Apsey is a chef and the Marshes’ son; he has worked at the restaurant since it opened in 2007. Neacsu is a manager and has been with Red Ginger since 2017. The transaction includes the sale of the business assets, though the building will continue to be owned by Dan and Pam Marsh. The Marshes will continue in a consultative role with the restaurant for two years.

TRAVERSE CITY BUSINESS NEWS MARCH 2024 5 GOLF . SWIM . GATHER . DINE { Lifetime friendships made here. } Contact our Membership Director Susan McElduff for information. susanl@tcgcc.com 231.947.0985 TCGCC.COM Stuffiness not included! Enjoy everything the CLUB has to offer in a beautiful, private escape. Golf and Social Memberships Looking for a great way to connect with other families and professionals? We offer individual and family memberships. Ask about our amenities and additional benefits. Reconnect with old friends. And meet some new ones too!

6 MARCH 2024 TRAVERSE CITY BUSINESS NEWS THREEWEST.COM (231) 929-2955 THREEWEST.COM (231) 929-2955 TEAM EFFORT We are Northern Michigan’s #1 Commercial Real Estate Brokerage

On January 28, more than 120 million viewers were captivated by the NFC Championship showdown between the Lions and the San Francisco 49ers. Though the Lions did not clinch a victory that day, the State of Michigan quietly earned a win with record viewership of a debut commercial for the state’s new “Make It in Michigan” talent retention and attraction campaign. The commercial showcased the high quality of life and exciting career opportunities available in Michigan.

Michigan’s new promotional program is designed to address our crucial need to retain and attract more talented workers, especially younger workers, within the state. To do this, we need to highlight the many positive attributes that Michigan can offer. While cost of living and housing expenses are predictable considerations, one factor stands out: quality healthcare. Whether you’re a Gen Z job seeker or a seasoned baby boomer, access to reliable medical services is paramount.

Thankfully, Munson Healthcare, a vital contributor to Michigan’s healthcare landscape, has also unveiled its new Regional Care Transformation initiative. This plan details important organizational improvements, the plethora of career possibilities within Munson’s network of hospitals and clinics, and the exceptional level of care provided by its dedicated healthcare professionals. Munson’s career opportunities and quality healthcare programs are important differentiators in our battle for talent attraction and retention.

Munson Healthcare’s extensive reach in northern Michigan encompasses eight hospitals spread across 11,177 square miles – an area equivalent to Vermont and Delaware combined. With 7,500 employees, 1,000 physicians, 63 specialties, 694 licensed acute care beds, and 212 licensed long-term care beds, Munson Healthcare stands as a cornerstone of healthcare in the region and for the state overall.

Munson’s Regional Care Transformation plan is a comprehensive three-year strategy designed to improve outcomes across its vast 29-county service area. Medical advancements and investments in innovative technology will enable Munson to shift the focus from inpatient to outpatient services, resulting in shorter wait times and improved access. Telemedicine and technology will bridge the gap between rural communities and hospitals in our more urban centers, allowing patients to connect with healthcare professionals remotely. The plan also involves recruiting specialists and experienced healthcare professionals to eliminate the need for residents to travel south for specialized treatment.

Recognizing that different communities have unique needs, Munson is realigning inpatient services regionally creating new avenues for care, where patients encounter fewer administrative hurdles, experience smoother transitions, and have more care options close to home. This strategic approach ensures that staffing resources match patient requirements. No more unnecessary long journeys – care will be

LETTERS TO THE EDITOR

where patients need it.

Looking beyond the present, Munson is preparing for a future where our communities receive seamless healthcare through advances in rural health technology and innovation, thereby advancing healthcare accessibility in remote areas. There are exciting developments in virtual urgent care and remote patient monitoring, while drone technology could revolutionize medication delivery, bridging the gap

Looking

between remote areas and hospitals.

Munson’s transformation isn’t just about patients – it’s also about the career opportunities and support for the dedicated professionals who provide care. Our locally led healthcare system plays a key role in elevating the region’s overall

economic vitality by fostering economic growth, driving innovation and supporting the region’s talent attraction and development efforts. As Munson develops into a fully integrated and united health system, deploying advanced technology, opportunity and stability will benefit both patients and staff.

The combination of talent development and economic impact is on full display in the important collaboration between Northwestern Michigan College and Munson Healthcare. This long-term strategic partnership spans various facets, including NMC’s nursing programs, which includes the recent Bachelor of Science in Nursing plan and occupational specialty programs. Together, Munson and NMC foster educational opportunities and create pathways for our area’s healthcare professionals.

Michigan’s healthcare landscape is evolving. As Munson Healthcare continues to evolve, northern Michigan stands to gain from this modern approach to ensure better outcomes. By providing quality healthcare, advanced facilities and attractive careers, Munson contributes to the overall development and strength of northern Michigan. Let’s celebrate this transformation – one that puts patients and their well-being at the heart of it all, along with the dedicated professionals who make Michigan a healthier, happier place to live.

WEB

MAILING/FULFILLMENT

HEAD

Lisa

Abby

Kaitlyn

Todd

Michele

TRAVERSE CITY BUSINESS NEWS MARCH 2024 7 Have something to say? Send your letters to: news@tcbusinessnews.com We reserve the right to edit for space and clarity.

//

Warren Call is the president and CEO at Traverse Connect.

WHERE PATIENTS NEED IT’

Michigan stands to gain from Munson’s

theTCBN The Traverse City Business News Published monthly by Eyes Only Media, LLC P.O. Box 4020 Traverse City, MI 49685 231-947-8787 Periodical postage qualification pending at Traverse City, MI. POSTMASTER: Send address changes to The Traverse City Business News, PO Box 1810, Traverse City, MI 49685-1810. The Traverse City Business News is not responsible for unsolicited contributions. Content ©2024 Eyes Only Media, LLC. All rights reserved. EYES ONLY MEDIA, LLC EDITORIAL & BUSINESS OFFICE P.O. Box 4020 Traverse City, MI 49685 231-947-8787 ON THE WEB tcbusinessnews.com PUBLISHER Luke W. Haase lhaase@tcbusinessnews.com CONTRIBUTING EDITOR Gayle Neu gneu@tcbusinessnews.com

‘CARE

Northern

Regional Care Transformation Plan

WRITER Craig Manning

Becky Kalajian CREATIVE DIRECTOR

Poehlman

WRITERS

Boissoneau

Bukowski

Gunsberg

Haglund

COPY EDITOR

Kyra

CONTRIBUTING

Ross

Art

Kierstin

Rick

PRODUCTION: Byte Productions

Village Press

Morris

Grand Traverse, Kalkaska, Leelanau and Benzie counties

SALES

Bloemer cbloemer@tcbusinessnews.com

DISTRIBUTION Gerald

SERVING:

AD

Caroline

Gillespie lisa@northernexpress.com

Walton Porter aporter@northernexpress.com

Nance knance@northernexpress.com

Norris tnorris@tcbusinessnews.com

Young myoung@tcbusinessnews.com COMMENTARY BY WARREN CALL

beyond the present, Munson is preparing for a future where our communities receive seamless healthcare through advances in rural health technology and innovation, thereby advancing healthcare accessibility in remote areas.

FROM THE DESK OF...

Jerry Achenbach, Superintendent of the Great Lakes Maritime Academy

By Art Bukowski

After serving more than two decades in the United States Coast Guard, Jerry Achenbach, Superintendent of the Great Lakes Maritime Academy at Northwestern Michigan College since 2010. The New York native is now quite at home in the Great Lakes state, and he was gracious enough to show us around his desk and office at the academy. If you have a suggestion for a future “From the Desk Of” feature, please let us know at info@tcbusinessnews.com.

1. I keep the push-up stands in here. I shoot for 10 in the morning and 10 in the afternoon. It’s the best I can do these days.

2. I definitely live off of Diet Coke. It’s my biggest vice. I don’t smoke or drink anymore, but I can’t get off the Diet Coke.

3. A lot of mementos under the glass, including photos of my father in World War II and grandfather in World War I. Keeps me connected with my roots.

4. I have little figurines of the Buc-ee’s Beaver and the Blue Meanie. I went to Texas Tech, and anyone who’s been through Texas knows all about Buc-ee’s. The Blue Meanie is from Yellow Submarine, probably my favorite movie.

5. This baseball is from the time we made a port call with the training ship in Milwaukee and went to a Brewers game with the cadets. It’s a great memory.

6. I have this Soviet belt buckle from the time I did a Coast Guard mission in Bulgaria not long after the Berlin Wall fell. It’s a nice souvenir from that trip.

7. The one subscription I still get as a hard copy and I read every week is The Economist. It’s a habit I developed in grad school in the ‘90s, and there’s always at least one article in there that’s fascinating to me, every single week.

8. A few years ago the Seamen’s Church Institute gave one of these bells to all the maritime academies. I put it here inside my office because I knew if I put it outside my office, cadets would just ring it nonstop. I wanted to make sure it was someplace worthy, but I also didn’t want it driving me crazy.

8 MARCH 2024 TRAVERSE CITY BUSINESS NEWS

4 2 5 7 6 3 8 1

Jerry at his desk looking out over the water. “Every time the president comes over I get nervous, because my office is nicer than his. I’m very fortunate to have this space and I honestly don’t appreciate it as much as I should. It’s a very nice office – one of the best in Traverse City.”

TRAVERSE CITY BUSINESS NEWS MARCH 2024 9 Acme Alpena Cadillac Charlevoix Cheboygan Gaylord Petoskey Traverse City IN STORE EVERY TIME YOU DONATE! % OFF 10 goodwillnmi.org/donate-items ENJOY THAT DECLUTTERED FEELING Donate For Good 8 Drop-off Locations WWW.THESHAWNSCHMIDTGROUP.COM M-88 STORAGE BARNS 7450 GLENDALE TRAIL, BELLAIRE, MI 49615 522 E Front St, Traverse City, MI 49686 Looking for pole barn storage space? M-88 Storage Barns, located just south of Bellaire and west of Shanty Creek Resort, has immediate availability with pricing starting at $54,900. Up to 5000 sq-ft., insulated/ heated or uninsulated/unheated options available. 231.645.5922 Mike.Petrucci@CBGreatLakes.com Mike Petrucci REALTOR® 866-929-9044 ComfortKeepersTC.com Custom Solutions for Independence Care at home the way you want it, when you want it. When your family needs a helping hand, lean on us.

FOR LOVE AND MONEY

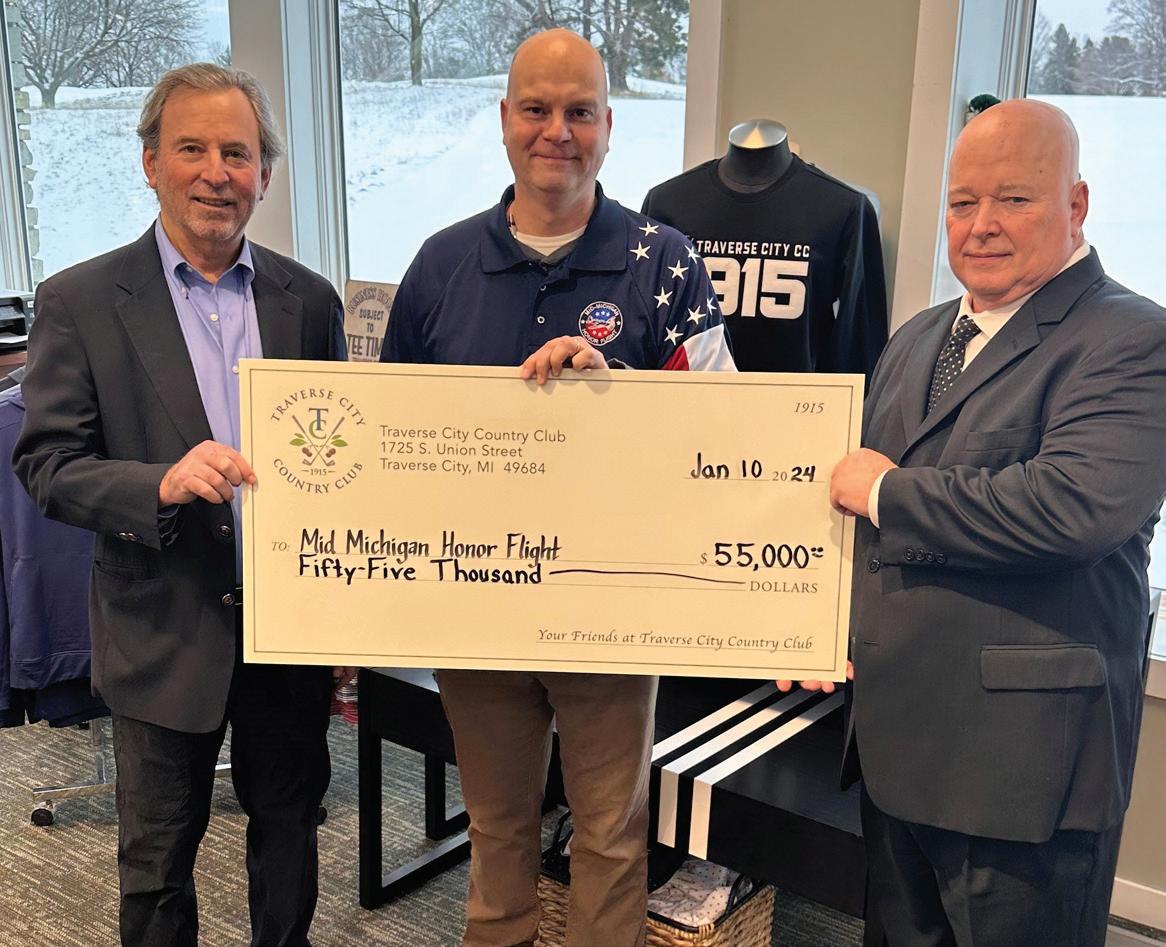

Nearly two dozen banks, credit unions support Grand Traverse area community organizations

By Rick Haglund

Banks and credit unions play an important role in the financial lives of their customers and members, but also in the fabric of the community. There are 20 of them serving Benzie, Grand Traverse, Kalkaska and Leelanau counties.

The following is a listing of those institutions with information about the various community organizations and events they contribute to and sponsor. A few banks and credit unions did not respond to requests for information. In those cases, TCBN listed the institutions using information from their websites and other publicly available information.

Honor Bank

Huntington Bank

Local leader: Nick Florian, market

leader

Year founded: 1866

Headquarters: Columbus, Ohio

Assets: $189 billion

Notable nonprofit and/or commercial customers: Florian says Huntington works with high-profile customers of “all sizes” throughout northern Michigan, including municipalities, nonprofits, housing developers, small businesses and corporations (names not disclosed.)

Community support impact: Strategic Community Plan allocated $40 billion to small business lending, and loans and investments that foster equity in affordable housing and other areas.

Florian on community support efforts: “Huntington is committed to making people’s lives better, helping businesses thrive and strengthen the communities we serve.”

Fifth Third Bank

Local leader: Autumn Gillow, northern Michigan market executive

Year founded: 1858

Headquarters: Cincinnati, Ohio

Assets: $213 billion

Notable nonprofit and/or commercial customers: Big Brothers Big Sisters, Habitat for Humanity, The Festival Foundation, Munson Foundation, Traverse Connect and Venture North.

Gillow on community support efforts and impact: “Fifth Third invests around $100,000 annually with northern Michigan community partners. We support a number of organizations, both in financial support and board support.”

Local leader: Norman Plumstead, president and chief executive officer

Year founded: 1917

Headquarters: Honor

Assets: $387.2 million

Notable nonprofit and/or commercial

customers: Burritt’s Fresh Market, National Cherry Festival, Old Town Playhouse, Keen Technical Solutions, Ford Insurance, Anavon Technology Group, Crystal River Outfitters, Leelanau Construction, Bay View Insurance Agency, Jonathan Zoutendam, DDS.

Community support impact: Plumstead says that for many years, Honor Bank has partnered with the Northwest Michigan Food Coalition on a community-wide “Honor Thy Neighbor” program. In the past three years alone, the initiative has raised more than $40,000 to support the program, which stocks pantries across northern Michigan with fresh, locally grown, healthy food.

Plumstead on community support efforts: “Besides helping with the food insecurity challenge, Honor Bank contributes tens of thousands of dollars and man-hours to community service with financial education, home buyer education, cybersecurity, entrepreneurial start-up endeavors and many other community projects to benefit hundreds of organizations every year.”

Independent Bank

Local leader: David Boeve, senior vice president

Year founded: 1864

Headquarters: Grand Rapids

Assets: $5.3 billion

Notable nonprofit and/or commercial customers: Names not disclosed.

Community support impact: Employees have volunteered at the Peace Ranch, Women’s Resource Center and Northwest Michigan Ballet Theatre. The leading bank in Michigan for affordable housing grants from the Federal Home Loan Bank of Indianapolis. $1.8 million awarded last year to assist projects, including Ruth Park apartments in Traverse City, Vineyard View apartments in Suttons Bay and rehabilitation of Riverview Terrace in Traverse City. Provided $50,000 in scholarships and donations to nonprofits last year.

Boeve on community support efforts: “We support community needs our employees are passionate about, including affordable housing, food insecurity, mental health, youth sports programs and social welfare organizations.”

10 MARCH 2024 TRAVERSE CITY BUSINESS NEWS THE WEALTH REPORT/BANKING & FINANCE

First Community Bank

Local leader: Anthony Palumbo, community bank president-Traverse City market

Year founded: 1905

Headquarters: Harbor Springs

Assets: $420.4 million

Notable nonprofit and/or commercial customers: Northern Michigan Supportive Housing

Palumbo on community support efforts: “We like to serve the low-income housing sector as we believe there is a great need in our community.”

First National Bank of America

Local leader: Todd Gignilliat, vice presi-

dent

Year founded: 1955

Headquarters: East Lansing

Assets: $5.3 billion

State Savings Bank

Local leader: Dan Druskovich, regional president for Traverse City and Suttons Bay Year founded: 1896 Headquarters: Frankfort

Assets: $375.2 million

Notable nonprofit and/or commercial customers: A number of notable nonprofits and businesses; names not disclosed.

Community support impact: “We listen to what our employees are passionate about. Instead of supporting one or a few entities at a major level, we do our best to support many causes, but always local.”

Druskovich on community support efforts: “We support our people when they choose to volunteer for local organizations. For example, Ian Hollands, who I work with in our Traverse City office, has served as president of the National Cherry Festival Board and continues to be closely involved with the festival. A lot of our people volunteer locally; we encourage them to do that. It’s an important part of who we are.”

West Shore Bank

Local leader: Sid Van Slyke, vice president and market leader

Year founded: 1898

Headquarters: Ludington

Assets: $742.4 million

Notable nonprofit and/or commercial customers: Dozens of local nonprofits; names not disclosed.

Community support impact: Donated $239,000 in 2023 to nonprofits in the bank’s six-county service area. Bank team members put in 2,300 volunteer hours serving communities in those counties. West Shore also offers a “community engagement room” in its Traverse City office for use by community organizations at no charge. The room hosted 107 events last year.

Van Slyke on community support efforts: “We take our role as a community bank very seriously. It’s more than just being available for banking needs; it’s doing our part to improve the community we live and work in. We’re fortunate to have 28 team members here that all understand and live that belief.”

TRAVERSE CITY BUSINESS NEWS MARCH 2024 11

it comes to serving clients, Melissa is a straight shooter. She works closely with them to make sure their transactions are a complete success. If you’re buying or selling a home or property, ask for Access. We’re the local title experts.

When

Melissa Schaub | Manager

Suttons Bay, Traverse City • accesstitleagency.com Access Title Agency_Michelle Erica Melissa Nicole_Ad_10.25 x 4.291_v1.indd 2 10/31/23 1:17 PM THE WEALTH REPORT/BANKING & FINANCE

Gifted golfer. Has a strong drive to help people.

PNC Bank

Mercantile Bank

Local leader: Scot Zimmerman, community bank president

Year founded: 1997

Headquarters: Grand Rapids

Assets: $5.2 billion

Notable nonprofit and/or commercial customers: The bank serves a number of organically grown and transplanted locally domiciled businesses and a handful of impactful community organizations; names not disclosed.

Community support impact: Sponsorships and donations to the following organizations – Traverse Connect, Women’s Resource Center, Father Fred, Cherryland Humane Society, Veterans in Crisis, Grand Traverse Industries, Leelanau Chamber of Commerce, Suttons Bay Chamber of Commerce, Munson Healthcare Foundations, Northern Michigan College, Traverse Area Community Sailing.

Zimmerman on community support efforts: “Mercantile Bank’s community support is directed to local organizations that have a close relationship with those served, with the support meant to have an immediate impact on those in need, with a special focus on hunger, safety, shelter and healthcare. We also support undertakings that make our community strong and improve the quality of life for all.”

TBA Credit Union

Local leader: Karen Browne, president and CEO

Year founded: 1955

Headquarters: Traverse City

Assets: $343.7 million

Notable nonprofit and/or commercial customers: Veterans in Crisis

Community support impact: Donates to Traverse City Area Public Schools, LEAP Scholarship, Thirlby Field Banner & Scoreboard, Dry Erase Markers for elementary students. Offers a Student-Run Credit Union in nine schools, Reality Fairs in both Traverse City Central and Traverse City West High Schools.

Browne on community support efforts: “At TBA Credit Union we understand the call to service and believe we have a responsibility to make our community a better place, and it starts with our philosophy of ‘people helping people.’ Since 1955, our focus has not only been on outstanding member services but helping our community. Our entire team supports our charitable outreach through contributions and donations to over 30 local nonprofits and volunteering over 2,353 hours in 2023. In addition, we offer scholarship programs, grants, free educational seminars, our Student-Run Credit Union, high school reality fairs, community shred events, and blood drives.”

Local leader: Sean Welsh, PNC regional president for West Michigan

Year founded: 1852

Headquarters: Pittsburgh, Pennsylvania

Assets: $557 billion

Notable nonprofit and/or commercial customers: Names not disclosed.

Community support impact: Contributes to and sponsors Up North Pride, Grand Traverse Pavilions, Early Head Start Home Visiting Programs, Northwest Michigan Habitat for Humanity, Northern Initiatives

Welsh on community support efforts: “PNC’s community efforts in northern Michigan focus on early childhood education, economic development, including arts and culture, and health and human services. Through sponsorships and grants, we support community events and organizations that benefit citizens throughout the region and help northern Michigan thrive.”

4Front Credit Union

Local leader: Andrew Kempf, CEO

Year founded: 1954

Headquarters: Traverse City

Assets: $1.1 billion

Notable nonprofit and/or commercial customers: Norte, Big Brothers Big Sisters of Northwestern Michigan, TART Trails, Make-a-Wish Michigan, Lakeshore Habitat for Humanity

Community support impact: Donated $202,984.89 to local community organizations in 2023. Volunteered over 2,000 hours that benefited more than 100 organizations. The 4Front Foundation awarded $45,000 in grants and scholarships to high school graduating seniors last year.

Kempf on community support efforts: “Investing in our community is the greatest investment we can make, and it’s the credit union difference. Because when our community thrives, we all thrive. It’s not just about building a stronger financial future, it’s about building a stronger community, one member at a time.”

Making switching banks less painful for 107 108 years.

12 MARCH 2024 TRAVERSE CITY BUSINESS NEWS

THE WEALTH REPORT/BANKING & FINANCE

Forest Area Credit Union

Local leader: Alex Lutke, CEO

Year founded: 1983

Headquarters: Fife Lake

Assets: $238.3 million

Notable nonprofit and/or commercial customers: Not disclosed.

Community support impact: $15,000 to graduating high school seniors. A “humanity fund” that provides financial assistance to Forest Area Credit Union members dealing with catastrophic life events. Sponsors youth financial literacy programs. Donated more than $100,400 to community organizations last year.

Lutke on community support efforts: “Our commitment to our communities is ingrained in the culture of our credit union and goes way beyond financial services; it’s about nurturing relationships, fostering growth, and empowering individuals to thrive. Together, we’re not just building a stronger credit union; we’re building stronger, more resilient communities for generations to come.”

Team One Credit Union

Local leader: Martin Hall, branch manager

Year founded: 1935

Headquarters: Saginaw

Assets: $738.4 million

Notable nonprofit and/or commercial customers: Names not disclosed.

Community support impact: Donations to various food banks, Father Fred Foundation, Leelanau Christian Neighbors. Michael’s Place, Northwest Michigan Habitat for Humanity, Crooked Tree Center for the Arts, National Cherry Festival. Focus on supporting children, students, veterans, homeless and food banks.

Hall on community support efforts: “The largest community impact program would have to be our level of corporate sponsorship of the Cherry Fest. We know, of course, how much this annual festival brings in to the community and how much is given back through the form of proceeds and sponsorships. Team One genuinely cares about being in Traverse City and making a positive impact on all of the communities we serve. Our staff cares about not only our members but our neighbors and are here to make our community happier, healthier and more prosperous.”

MSUFCU Credit Union

Local leader: Marie Charbonneau, assistant vice president of branches

Year founded: 1937

Headquarters: East Lansing

Assets: $7.7 billion

Notable nonprofit and/or commercial customers: McMillen’s Custom Framing, Strathmore Group, Edge 72, Socks Construction, 20 Fathoms

Community support impact: Philanthropic partnerships with Michael’s Place, Traverse City Opera House Women’s Resource Center, Habitat for Humanity. Has contributed more than $68,000 to local organizations and events since January 2023.

Charbonneau on community support efforts: “Our employees care deeply about the Traverse City Community and doing their part to create vibrant and thriving neighborhoods. In addition to corporate giving, employees donate from their personal wealth and volunteer their time with local charities. Our teams are proud to give back, anything from framing walls with Habitat for Humanity to cleaning up flower beds with the Women’s Resource Center.”

Lake Michigan Credit Union

Local leader: Carolyn Brooks, branch manager

Year founded: 1933

Headquarters: Grand Rapids

Assets: $12.9 billion

Traverse Catholic Federal Credit Union

Local leader: Patty McManus, president and CEO

Year founded: 1950

Headquarters: Traverse City

Assets: $89 million

JPMorgan Chase Bank

Local leader: Julie Hunko

Year founded: 1799

Headquarters: New York City

Assets: $3.4 trillion

Northwest Consumers Federal Credit Union

Local leader: Tina Steed

Year founded: 1952

Headquarters: Traverse City

Assets: $28.6 million

TRAVERSE CITY BUSINESS NEWS MARCH 2024 13 Switch today to a really really local bank. myhonorbank.com/switch THE WEALTH REPORT/BANKING & FINANCE

14 MARCH 2024 TRAVERSE CITY BUSINESS NEWS LUXURY VINYL PLANK WITH CUSTOM STAIR TREADS OVER 40 STYLES IN STOCK AND ON SALE NOW AT AMERICA’S CARPET BARN! ASK US ABOUT OUR CUSTOM ONE-PIECE VINYL STAIR TREADS Check out our Google reviews to see for yourself! 883 US Highway 31 S Traverse City 231-943-PIGS (7447) www.americascarpetbarn.com “Happy Anniversary America’s Carpet Barn!” 25th AnniversaryCHERRY ON TOP

By Claudia Rodriguez, columnist

By Claudia Rodriguez, columnist

The SECURE Act, which stands for Setting Every Community Up for Retirement Enhancement, was enacted in 2019 with the aim of improving retirement security for millions of Americans. As we step into 2024, it is important to understand the impact of this legislation on employers. The following are some of the key provisions of the SECURE Act and how they have impacted the responsibilities and options available to employers.

Expansion of Eligibility and Participation

One of the significant changes brought about by the SECURE Act is the expansion of eligibility and participation in employer-sponsored retirement plans. Previously, part-time employees were often left out of such plans. However, the act now requires employers to allow long-term, part-time employees who work at least 500 hours per year for three consecutive years to participate in retirement plans. This presents a challenge for employers to manage increased participation while ensuring the financial feasibility of the plans.

Adding Emergency Savings Plan Provisions

In an attempt to address Americans’ overall lack of savings, SECURE 2.0 offers two key provisions. First, effective 2024, plan participants are permitted to take up to $1,000 as an in-service withdrawal in a year for certain emergencies without paying an early withdrawal penalty. Participants can only do this every three years, unless certain requirements are met. The second provision allows plans to establish employee emergency savings accounts with a cap of $2,500. The intention is to provide non-highly compensated employees easy savings access with at least four fee-free withdrawals per year. The contributions must be made on an after-tax Roth basis.

More Complicated Catch-Up Contributions

Due to its complexity, this provision

The SECURE Act 2024: A new deal for employers and employees

was extended until Jan. 1, 2026, but important to note now. Catch-up contributions for those who are 50 and older and earned $145,000 or more in the prior year must be made as Roth contributions – whether their regular contributions are pretax or not. This adds administrative complexity for employers around compliance as well as an effort to determine which employees meet the earnings threshold. If your plan does not already offer a Roth option, you will need to consider establishing one to allow catch-up contributions to be made.

Automatic Enrollment and Escalation

To address the issue of employees not saving enough for retirement, the SECURE Act promotes automatic enrollment and escalation features in retirement plans. Employers are encouraged to adopt these features to increase employee participation and contribution rates. By automatically enrolling employees into retirement plans and gradually increasing their contribution rates over time, employers can help employees build a more robust retirement nest egg.

Lifetime Income Provisions

Recognizing the need for retirement income security, the SECURE Act includes provisions to encourage employers to offer lifetime income options

within retirement plans. Employers now have a fiduciary safe harbor, which protects them from liability when selecting a lifetime income provider. This encourages employers to include annuity options in their plans, providing participants with a reliable stream of income during retirement.

Safe Harbor 401(k) Plans

The SECURE Act introduced changes to Safe Harbor 401(k) plans, providing employers greater flexibility. The act allows employers to amend their plans to include safe harbor provisions at any time before the end of the following plan year, eliminating the need for costly mid-year changes. This flexibility empowers employers to make adjustments based on their business needs without compromising compliance.

The SECURE Act, as of 2024, has significantly impacted employers. From expanding eligibility to increasing flexibility in making changes, the act has brought about changes requiring careful consideration and strategic decision-making from employers. Employers can navigate the evolving retirement landscape and understand and adapt to these changes by working with a strong team.

Claudia Rodriguez is a financial advisor with Horizon Financial specializing in retirement plans for employers and financial planning for individuals and families.

As an employer, what can you do to ensure you are compliant?

• Meet with the financial advisor on the plan annually. They should be your quarterback in managing the plan.

• Make sure you are working with a strong third-party administrator.

• Work with a reputable record keeper.

• There must be clear communication between all parties.

• If you don’t know, ask.

• You have an opportunity to make an important difference in your employees’ lives and help provide them with a secure and prosperous future. Make sure you have a team doing the same for you.

TRAVERSE CITY BUSINESS NEWS MARCH 2024 15 THE WEALTH REPORT/BANKING & FINANCE

A NUMBERS GAME

Female financial advisors on their growing field and how times have changed

By Art Bukowski

A bit more than half of the nation’s population is female, and women comprise slightly less than half of the nation’s workforce. That’s tens of millions of women out there every day earning a paycheck.

And while the share of working women has remained relatively steady in recent years after increasing dramatically in the second half of the 20th Century, gender representation remains far from equal across career paths.

Studies show that typical white-collar careers tend to have more diversification than other trades, with big gains over the last 25 years in the fields of law, veterinary science, commercial and industrial design, sales management and more. But certain careers continue to be very much dominated by men, particularly in the financial sector.

Depending on the source, only 15-30% of financial advisors are women, with a trend toward a smaller percentage in smaller markets. This figure is particularly striking considering that women have comprised a much higher percentage of the workforce for decades, with many of them having their own money to manage and an increasingly strong desire to have their voices heard in the financial planning process.

The TCBN sat down with some local female financial advisors (and one trust relationship officer) to get their take on what they bring to their profession and why they’d like to see more women in the office.

Wolves on Wall Street?

It’s not hard to understand how it got this way. Many careers tied to banking and finance have an undercurrent of machismo that made the entire field less appealing to most women, local advisors say.

“I think when people think about our industry, they think about stockbrokers, the wolf of Wall Street type of thing, with aggressive pushing to buy or sell this stock or product,” said Barbara Shellman, a Traverse City-based financial advisor with Stifel Investment Services. “It’s just not an industry that, generally speaking, a lot of women would find appealing.”

Because financial advisor roles traditionally involve a lot of selling, the corresponding high-pressure sales environment also has done no favors for gender diversification.

“When I came into the business, it was very cutthroat. I had no salary, no income, unless I sold something. You would make 30 calls a day; cold call people,” said Holly Gallagher, a 33-year veteran who now runs an all-women team at Horizon Financial in Traverse City.

“The industry has evolved, but a lot of big firms are still looking for someone who is a rainmaker or salesperson to produce or get assets.”

But things have changed. Yes, sales are still a part of the job and always will be. But an increased focus on a genuine connection with clients creates a situation where women might find the job much more appealing, Shellman says.

“Yes there’s a sales component, but I

Shellman

“More women are in the workforce in general. They’re making their own money and feeling a much larger sense of ownership compared to years ago. And I think for the same reason that women like going to a female doctor, women are just more comfortable working with women.”

– Barbara Shellman, Stifel Group

tell women not to be afraid of that, because the most important thing is relationships,” Shellman said. “We’re not here aggressively pushing a product and moving on to the next client. It’s not transactional. It’s all about building those lasting relationships.” Gallagher also says her firm is a good example of making room for highly skilled women who might not be sales

driven, but still can provide excellent value for the business and for clients through analysis and other tasks.

Trust is key

And while the field likely is more appealing to women in recent years, perhaps the more notable fact is that women pos-

16 MARCH 2024 TRAVERSE CITY BUSINESS NEWS

THE WEALTH REPORT/BANKING & FINANCE

sess innate traits that can help them not only survive, but thrive in this increasingly relationship-driven business.

Certain studies have shown women to have better listening skills, for instance, and they are often perceived to be better at – or at least place a stronger premium

“I think we’re more aware of interpersonal things like the importance of listening and even nonverbal communication,” she said. “You’re picking up on people’s personalities, the things that aren’t being said, the body language.”

Regina Jaeger, senior trust relationship

the field just makes sense from a business perspective.

“More women are in the workforce in general,” Shellman said. “They’re making their own money and feeling a much larger sense of ownership compared to years ago.

And I think for the same reason that women

think they understand that more women in the industry helps the industry overall. It’s not an old boys network anymore –they have all realized that we’re here and we’re here to stay.”

More women are entering the field than ever before, with some predicting

TRAVERSE CITY BUSINESS NEWS MARCH 2024 17 THE WEALTH REPORT/BANKING & FINANCE

Rodriguez and Gallagher

VISION Revitalize a Brownfield site, consolidate multiple branches into one world-class Front Street facility Mike and the Burdco team had such a clear understanding of our vision. They listened to our goals, communicated clearly and worked through the construction challenges

His experience, along with his relationships with subcontractors and township officials made the entire process so smooth. CONSTRUCTIVE TRAVERSE CITY • GAYLORD • PETOSKEY BURDCO.COM • 231.941.9074 ” SOLUTIONS “

Jaeger

we faced.

Karen Browne TBA Credit Union Mike Brown Owner, Burdco – Karen Browne, President TBA Credit Union DESIGN/BUILD MEDICAL OFFICES COMMERCIAL ASSISTED LIVING INDUSTRIAL

TBACU

By Rick Garner, columnist

By Rick Garner, columnist

. Several years back, the Tax Cuts and Jobs Act nearly doubled the standard deduction while restricting the state tax deduction. A significant number of taxpayers shifted from itemizing deductions to claiming the standard deduction. As a result, you may not be receiving the incremental tax benefits from your charitable contributions as in the past. If you like the idea of helping others, a handful of strategies exist to help you give more while paying less in taxes.

The most direct approach: gifting appreciated stock or mutual funds directly to a charitable organization. These appreciated investments have untaxed gains and by gifting them, you avoid having to pay capital gains tax on the investment’s growth. This type of gifting directly translates into the goal of gifting while also receiving a tax deduction.

However, an investor may still desire a stream of income while being charitably inclined. It is possible to generate income from those appreciated securities before they are donated by establishing a charitable reminder trust (CRT). The first step is to create the trust. Assets are then put into the CRT and the charity or charities that will ultimately benefit are chosen. Beneficiaries of this irrevocable trust are required to receive between five to 50% of the income annually for not more than 20 years – after which time the assets are distributed to the predetermined charity or charities.

If generating income is not your goal, perhaps a donor advised fund (DAF) is better suited. A DAF is an irrevocable transfer of assets, often highly appreciated securities, with the specific intent of funding charitable gifts. Rather than declaring charitable beneficiaries, the DAF architecture provides simple, flexible and efficient ways to manage charitable giving. One of the biggest benefits is the ability to gift a lump sum to the DAF to offset a particularly high tax bill. The lump sum donation can then be spread across multiple gifts (grants) for many years – as long as the assets last. As donor, you direct the grant recipient, grant amount and the

Give More, Pay Less: Tax-intelligent charitable giving strategies

timing of when the charity received the funds. This strategy can also be used to create a family gifting legacy.

Already in your retirement years? A qualified charitable donation (QCD) allows the transfer of up to $100,000 in tax-deferred retirement savings to the qualified charity of your choice, tax-free. Instead of liquidating pre-tax IRA assets, paying taxes and then donating the proceeds, you simply donate the money directly and avoid the taxable event. QCDs are both exempt from income tax and not reportable as adjusted gross income on a tax return. As a result, they can be used to offset required minimum distributions. A retired investor can start using QCDs to their advantage at the age of 70 1/2.

Lastly, charitable contributions can be bunched – using a combination of any of the previously mentioned techniques –into a larger lump sum once every couple of years. The intent here is to exceed the

standard deduction once every few years with a large charitable contribution,

A qualified charitable donation allows the transfer of up to $100,000 in tax-deferred retirement savings to the qualified charity of your choice, tax-free.

allowing you to itemize your deductions and receive an incremental tax benefit. In off years, you simply take the stan -

dard deduction.

Working with a Certified Financial Planner™ can help you maximize your charitable impact while optimizing your tax situation. Your tax-savvy financial professional will help you determine which strategy or strategies will most efficiently meet your charitable and personal financial goals.

Rick Garner, CFP® is the director of wealth management and a CERTIFIED FINANCIAL PLANNER™ at DGN Wealthcare, LLC. Contact him at RGarner@ DGNCPA.com. Securities offered through Avantax Investment Services, member FINRA, SIPC. Investment advisory services offered through Avantax Advisory Services. Avantax affiliated financial professionals may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state.

18 MARCH 2024 TRAVERSE CITY BUSINESS NEWS THE WEALTH REPORT/BANKING & FINANCE

231.922.6800 | Free Case Assessment | Now accepting new clients Proudly serving Northern Michigan since 1998

TITANIC TRANSFER

How trillions in generational wealth shifts could affect charitable giving

By Craig Manning

The New York Times called it the greatest wealth transfer in history.

According to Cerulli Associates, a Boston-based consulting firm, some $84 trillion is set to change hands over the course of the next two decades, most of it driven by baby boomers inching into their twilight years. Per the Cerulli Associates report, most of that money will be handed off to heirs. But a whopping $12 trillion is expected to go to charity – a massive, unprecedented windfall that could reshape the futures of countless nonprofits, foundations and endowments.

As this titanic transfer of wealth draws nearer, it begs an important question: How have the trends in charitable giving been shifting from generation to genera-

tion? As they divest themselves of wealth, will boomers follow in the footsteps of their parents and grandparents, or will their preferences for end-of-life philanthropy diverge significantly from those of the greatest generation or the silent generation? And looking past the baby boomer windfall, how might younger generations redefine charitable giving – especially given the fact that those generations are, for the most part, statistically less well-off than their parents?

To get the answers, the TCBN connected with Alison Metiva, chief operating officer of the Grand Traverse Regional Community Foundation (GTRCF). As a key hub for giving in northern Michigan, with more than 150 endowments across the five-county region, GTRCF and its team know a thing or two about the world of philanthropy. The organization has also

been around for more than three decades, which means it has rubbed shoulders with various generational cohorts – and watched giving trends change as those generations have ebbed and flowed.

“The base for GTRCF was really built by the greatest generation and the silent generation,” Metiva said. “Most of those folks have passed away now, but the assets that we’re stewarding now were largely built by that generation. And their approach was usually to give to an endowment really focused on specific causes or organizations. Their giving was very directive, in that way: They identified specific things that they wanted to make sure were supported over time.”

In the past 10 years, Metiva says there’s been a noticeable move to expand away from that specific, directed giving toward

something else – something she attributes to generational shifts.

“It’s not as much, ‘I want to support very specific causes’ anymore,” Metiva explained. “Like, environmental education in Benzie County, for example; we have a fund that someone specifically endowed for that purpose. Instead, the lens has been broadening. Now, people say, ‘I still want to make sure specific causes are supported, but also I know that as an individual donor, I don’t know what all the needs are in my community.’ And maybe more importantly, it’s ‘I don’t know how those needs are going to change over time after I’m no longer here.’ Organizations like GTRCF can help with that, because we’re scanning for the greatest needs all the time, and we’re adapting as needs change.”

20 MARCH 2024 TRAVERSE CITY BUSINESS NEWS

THE WEALTH REPORT/BANKING & FINANCE

Charitable giving is evolving in other ways, too – and not just as it relates to end-of-life gifts. Metiva says one of the biggest changes among younger generations has been a diversification of the ways in which people contribute to charitable causes and efforts.

Traditionally, Metiva notes, philanthropy has been defined by the three T’s: time, talent, and treasure. Those three words have long encompassed the three main ways that people give back to their communities.

Starting with Generation X and continuing on with younger cohorts, Metiva says she is starting to hear about two additional T’s – ties and testimony – being added to that list.

“Ties has to do with your network and your connections, and testimony has to do with advocacy or using your voice to support a cause,” Metiva said.

One reason for that particular shift could be that younger generations simply have less time and less treasure (read: cash) to give to charity than their parents did. Studies suggest millennials will be the first generation to earn less than their parents did. Combine that bombshell with other factors – inflation, rising cost of living, and a mounting childcare crisis, to name a few – and Metiva says it’s hardly a surprise that younger people have had to adapt to find ways of still supporting the causes they believe in.

In other words, even if younger generations have less net worth – and less disposable income – than their forebears, they are still finding ways to give back.

Thanks to the internet and social media, for instance, younger generations have platforms and bully pulpits their parents lacked, and are using those stages to spread the word about their favorite causes – hence the addition of testimony as one of philanthropy’s core T’s.

As for ties, Metiva says that because younger generations are still working,

they still have that valuable professional network that their parents maybe don’t have anymore, and they are bringing those connections to bear on their philanthropy.

Similarly, Metiva notes that Gen Xers and millennials have proven themselves particularly adept at leveraging payroll deductions and company match programs to maximize their giving – another example of professional ties manifesting impactfully within the charitable giving space.

While philanthropy has changed in some ways, Metiva says there’s evidence to

their lives where they have more discretionary dollars to give.

“There was a study last year by Giving USA, and it said the millennial generation had the largest increase of giving among all the generations for the year,” Metiva said. “So, that’s a big indication of growth of giving there.”

Metiva says those indicators of expanding support from younger generations are heartening, as they offer assurances that the bottom won’t simply fall out of the philanthropy world when the uber-wealthy baby boomer generation is no longer

“They’re often giving small amounts on a regular basis, versus writing a check at the end of the year to make some tax threshold, like an older generation might have done.”

– Alison Metiva, Chief Operating Officer, Grand Traverse Regional Community Foundation

suggest that younger generations are getting closer to the traditional three T’s as they get older. For example, she points to research that shows Gen Xers are starting to have more time for philanthropy, and are “really finding their footing in terms of giving their time.”

“I looked at our board of directors (at GTRCF), and 45% of our board is aged 45 to 70. So that’s Gen X and a little bit into boomer, but it definitely signals that this generation is at an age where maybe other dynamics are freeing up their time to serve on boards or get more involved,” she said.

Research also suggests that Gen Xers and millennials are rapidly increasing their financial support of charities, Metiva says, suggesting that those generational cohorts are perhaps getting to the point in

around. Still, Metiva says she is adamant that organizations which rely on generosity make a point of understanding the giving psychology of younger demographics. While those generational cohorts might be giving more as they age, that doesn’t mean they’re giving in the same ways – or for the same reasons – that their parents or grandparents did.

Two particularly notable shifts? One, younger donors really want to give in ways that align with their values. Two, younger people are more likely than older generations to give directly to causes.

Metiva credits this growing level of giving discernment to all the other factors that the millennial generation is balancing and figuring out – including inflation, cost of living, and the question of what sort of financial resources they

actually have to give.

As a result, Metiva says, millennial donors are doing their homework to make sure they are only supporting causes they believe in on a moral level, for instance. They also want to know where their money is going, that it actually is making a difference, and that they can trust the people they are giving it to.

For these reasons and more, Metiva says peer-to-peer fundraising is especially popular among millennials, simply because it allows the option of giving directly to the people who need help, rather than giving to an organization and then hoping that money trickles down to the people in need.

Even when millennials do give to nonprofits, their giving patterns differ from previous generations.

“They’re often giving small amounts on a regular basis, versus writing a check at the end of the year to make some tax threshold, like an older generation might have done,” Metiva said.

Going forward, Metiva says she expects that finding ways to win the favor of millennials and their picky philanthropic preferences will be crucial for organizations of all shapes and sizes. While the great wealth transfer of the coming decades will bring a windfall in giving – GTCRF itself already has 45 documented future gifts via estates – the day will eventually come when younger demographics need to be the lifeblood of philanthropy.

Preparing for that day might mean changing to support new styles or preferences of giving, but Metiva stresses that it will also involve staying true to the one thing that always stays the same about giving, no matter the generation.

“At the end of the day, folks just want to know that their giving is making a difference and that they are having an impact within the communities that they love,” Metiva said.

TRAVERSE CITY BUSINESS NEWS MARCH 2024 21

THE WEALTH REPORT/BANKING & FINANCE

4

5

6

7

“We strive to bring hope and enrich the lives of those who come to Father Fred seeking help, treating each person with dignity and respect.”

- The Father Fred Foundation

22 MARCH 2024 TRAVERSE CITY BUSINESS NEWS 2779 Aero Park Drive Traverse City, MI 49686 marketing@vpdcs.com 800.773.7798 THANK YOU to The Father Fred Foundation for helping individuals and families with their essential immediate needs and instilling hope for a bright future. Autumn 2023 Newsletter Father Fred News In this Issue:

Summer Food Programs: Meeting the Need

Starting School on the Right Foot

The Garden That Keeps Giving

Feature: What a Difference a Day Makes

By Eric Braud, columnist

By Eric Braud, columnist

Most of what we do every day comes from habits driven by thoughts and emotions. Even the most successful investors sometimes experience feelings of stress or excitement when they deal with money. Take a moment to think about what you do each morning. Do you pop out of bed right away or take your time easing into the day? Do you take a shower before or after breakfast? You may not even notice these things unless someone points them out to you. They are learned responses that guide you through life, and they can greatly influence your decisions.

Researchers have discovered that the same idea applies to money. How you see, feel, and think about money shapes how you deal with it, talk about it, and work toward your financial goals. Regardless of your level of wealth, we all have what’s called a “money script” and, undoubtedly, the financial decisions we make from that script are influenced by our emotions. Let’s dive deeper into the origins of our money habits and explore ways to keep emotions out of the script.

The Money Script

With all financial decisions, but especially with bigger-ticket items like homes, vehicles, or vacations, it’s wise to remain rational and carefully consider potential consequences before pulling the trigger. Do you sometimes find it challenging to remain disciplined or patient when making large (and usually exciting) purchases? You’re not alone. These feelings are often tied to the emotional and psychological baggage we carry around relating to our money – otherwise known as our money scripts. And, as with most of the baggage we’ve lugged into our adult lives, these scripts usually start forming at a very young age.

Even though we may not be aware of it, we spend our childhood picking up on how our parents and other significant role models relate to and handle money, and over time, our brains are subconsciously trained to respond in similar ways. As a successful investor, perhaps your parents were confident in their ability to make wise investments, and that habit passed

THE MONEY SCRIPT:

Don’t let your emotions control your wealth

down to you. Contrarily, someone else who experienced their parents scrounging to get by and often quarreling over expenses likely has some pretty strong feelings of guilt when making certain purchases.

The seeds of money scripts are planted in childhood, watered by observation, and eventually grow to influence your emotional beliefs about finances as an adult. For this reason, it is vital to be intentional and diligent in talking to your kids about money and modeling healthy financial behaviors. It is just as important to take the time to examine yourself and understand your money scripts and how they influence your financial behavior.

The Negative Side of Money Scripts

To be fair, not all money scripts are bad. Some behaviors we learn plant seeds for beneficial emotions about finances. However, other behaviors, such as money avoidance, focus on financial status, or the idolization and even worship of money, can be flat-out detrimental. Unhealthy emotions and belief patterns can lead to all kinds of financial problems, such as financial infidelity, compulsive buying, pathological gambling, and financial dependence. Certain money scripts have been tied to lower levels of net worth, lower income, and higher amounts of revolving credit.

Those may sound extreme, but have you ever let panic during a market downturn take your focus off of your long-term investing plan? Have you ever been unable to make a decision because you were paralyzed with worry and anxiety about the future? Have you ever wreaked havoc on your budget for the

momentary high of acquiring something you really wanted? All of these behaviors stem from your personal money script.

Money Scripts Can Be Changed

It seems that no matter how big our accounts may get, we still think that if we just had more, our stress and worry would disappear. But our anxiety around finances is more about how we approach money, not necessarily because we don’t have enough. This is good news! Even if our income doesn’t continue to increase exponentially, we can learn to control our attitudes and perceptions. Our money scripts may be ingrained from childhood, but they are not permanent. With a focused and concerted effort, they can be changed.

The first step you must take in rewriting your money scripts is to identify them. To do this, you must become aware of your emotional responses to common financial situations. Start taking notice of your emotional responses to these common experiences among high-net-worth individuals:

• Assessing your risk

• Inflation

• Safeguarding your wealth

• Unexpected global events

• Making big financial decisions

• Volatile markets

• Healthy markets

• Changing tax codes

How do these things make you feel? Anything that elicits strong emotions warrants further reflection. Keep in mind that negative emotions are not the only ones that can harm your financial life. Some positive emotions, like optimism and self-confidence, can

bring about negative results if unwarranted and left unchecked.

How to Manage Emotional Money Decisions

The key to changing your money scripts and developing healthier money habits is learning to control your emotions. You can also build some new, healthy habits that shield you financially and incorporate them into your life. Habits and disciplines such as scheduling regular meetings with your advisor and enlisting the help of someone reliable to keep you accountable are great places to start. Eventually, you will learn how you respond to emotional triggers and you can then take steps, like mandating a “cooling off” period for yourself, before making any decisions.

Finally, you need to be willing to forgive yourself when you make mistakes. Leave the past in the past and move forward with the new knowledge you have gained. Choosing to forgive yourself for past mistakes frees you up to be more effective with your new tools. As you begin to collect victories, both big and small, you will likely find it even easier to extend forgiveness.

Eric Braund, CFP®, CRPC® is the founder and CFO at Black Walnut Wealth Management, a financial advisory firm providing counsel and fiduciary financial services to individuals, families, and private foundations throughout the Traverse City and northern Michigan region. Contact him at (231)421-7711 or visit BlackWalnutWM.com. He is an Investment Advisor Representative with Dynamic Wealth Advisors dba Black Walnut Wealth Management. All investment advisory services are offered through Dynamic Wealth Advisors.

TRAVERSE CITY BUSINESS NEWS MARCH 2024 23 THE WEALTH REPORT/BANKING & FINANCE

‘DESPERATE PEOPLE DOING DESPERATE THINGS’

Steps employers can take to deter employee theft

By Art Bukowski

By Art Bukowski

Nearly every business has at least some systems in place to guard against theft, internal or otherwise. And many of these safeguards seem like relatively common sense, all things considered.

But employee theft – ranging from minor, spontaneous cash grabs to systemic and calculated embezzlement of many thousands of dollars – has long been a very popular crime in the Grand Traverse region. In short, those common-sense controls evidently aren’t common enough to prevent case after case of this bothersome and damaging transgression.

“It’s not rare at all,” said Kyle Attwood, chief assistant Grand Traverse County prosecutor. “It feels like almost weekly that we have a check (fraud) case in a business context. Living in northern Michigan, we might have this notion that we’re insulated from this kind of stuff, but that’s not the case.”

And while a forged check or sticky fingers at the till can certainly be problematic, it’s the long-term, methodical thefts that can spell doom for businesses. There have been multiple cases in the region within the past five years alone in which an employee managed to steal $100,000 or more before eventually being caught. What’s worse, such embezzlement is often (though not always) carried out by some-

one who has a very high amount of trust.

“We’ve seen it several times where there’s a small family business with a long-standing employee who is basically like a member of the owner’s family, and they steal from them to the extent that their business is jeopardized,” Attwood said.

An ounce of prevention

First off, many smaller transgressions can be prevented by something Attwood acknowledges many businesses are uncomfortable with: security cameras.

“If you have cameras where there’s a point of sale or where people have access to cash or check writing, having eyes on that area is a good deterrent up front,” Attwood said. “And then if we have to unwind something after a crime has actually been committed, it helps narrow down suspects and lead the investigation.”

And while someone’s past behavior is no surefire indication of their future performance, Capt. Chris Clark of the Grand Traverse Sheriff’s Office Investigative Division says it’s always a great idea to head over to Google and check out potential new hires. It’s surprising what a few mouse clicks can tell you, he said.

“Sometimes it’s the simple things like doing some sort of background check on a person before hiring,” he said. “Plenty

“You should be transparent about your systems. If employees know that you have those systems in place then they may be less enticed to do something that they normally wouldn’t do.”

– Capt. Chris Clark, Grand Traverse Sheriff’s Office Investigative Division

of these resources are available to you, even if you’re just checking them on social media.”

Attwood says this is an especially good practice before hiring contractors, who often will simply pack up shop and move to new territory after causing trouble elsewhere.

“You’ll see people that hire contractors, and then after they are victimized they’ll go online and find 15 judgments against them,” he said. “Had they done that work up front they would have saved themselves the aggravation of losing the money.”

Many large embezzlement cases follow a relatively familiar pattern. A trusted

employee with no criminal history begins to take money while under duress for one or more of a variety of reasons. Maybe it’s high medical bills or an overdue mortgage. Perhaps there are substance abuse or gambling problems. In any case, they take a little, and, after not getting caught, take more and more.

And while there’s certainly no excuse for embezzlement (which at $1,000 is a felony crime in Michigan), officials suggest a strong and open relationship with employees can help head off problems before they happen. Regularly checking in on employees’ well-being, while probably

24 MARCH 2024 TRAVERSE CITY BUSINESS NEWS THE WEALTH REPORT/BANKING & FINANCE

the right thing to do regardless, can also give insight into the stresses that turn otherwise normal people into potential criminals.

“You should get in the habit of engaging with your employees to see how they’re doing in life, and a lot of times you can see those triggers that may cause them to embezzle,” Clark said. “Those personal matters can play a big role.”

Because those that steal usually enjoy trusting relationships, the situation often goes on for months or years before being uncovered. Having trust in people is good, but trusting while verifying is even better. No amount of trust should ever lead to a situation in which checks and balances are disregarded, Attwood says.

“Don’t assume that just because you’re close to somebody and that you’ve treated them well that they’re not capable of theft,” Attwood said. “When the chips are down and people are desperate, you’ll see desperate people do desperate things.”

Systems can help

A plan to “trust but verify” is much easier with basic systems in place to deter and detect financial malfeasance.

The most effective safeguards may seem the most obvious, but they’re missing in enough cases to make investigators scratch their heads. No one person should have

total control over the books, for example. Several sets of eyes within a company can and should examine financial records on a regular basis, Attwood says.

“You have to have more than one person keeping an eye on things to verify that everyone is on the up and up,” Attwood said. “Periodic check-ins and verifying that the books are what they appear to be can be invaluable in preventing years’ worth of theft.”

As another example, multiple people should be signing or viewing checks. Authorities suggest dividing responsibilities, with different people writing, signing and reconciling checks. Different people can also be responsible for receiving and depositing payments or handling other matters. The more people involved, the harder it is to effectively conceal wrongdoing.

Unfortunately, many systems are often circumvented for the sake of expediency or convenience, says Attwood.

“A lot of times you’ll have businesses where the system will be set up where everybody has their own unique login, so if somebody does something in a system that’s nefarious, you can identify who that was,” Attwood said. “But a lot of times to make things easier, people will share logins. Once you start sharing logins, the whole safety system is useless.”

Regularly talking about these safeguards can also be a very strong deter-

“Don’t assume that just because you’re close to somebody and that you’ve treated them well that they’re not capable of theft. When the chips are down and people are desperate, you’ll see desperate people do desperate things.”

–

Kyle Attwood, Chief Assistant Grand Traverse County Prosecutor

rent, Clark says. “You should be transparent about your systems,” Clark said. “If employees know

that you have those systems in place then they may be less enticed to do something that they normally wouldn’t do.”

TRAVERSE CITY BUSINESS NEWS MARCH 2024 25 THE WEALTH REPORT/BANKING & FINANCE

What are your wealth aspirations? We’ll help you get there. Traverse City • Petoskey 231-946-1722 dgnwealthcare.com Securities offered through Avantax Investment ServicesSM, Member FINRA, SIPC, Investment advisory services offered through Avantax Advisory ServicesSM TAX-ADVANTAGED FINANCIAL PLANNING WEALTH MANAGEMENT RETIREMENT PLANNING COMPREHENSIVE, HOLISTIC APPROACH