Traverse City Office 236 1/2 E. Front Street, #26 Traverse City, MI 49684 231-943-6988

Main Office 5931 Oakland Drive Portage, MI 49024 269-385-5888 or 888-777-0216

• We uphold a Fiduciary Standard and work with clients on a fee-only basis.

• We do not receive commissions, kick-backs, or soft dollars from product sales, eliminating inherent conflicts of interest.

• Our team of professionals holds designations and degrees such as CFP®, CFA, CPA, MBA, JD, and PhD.

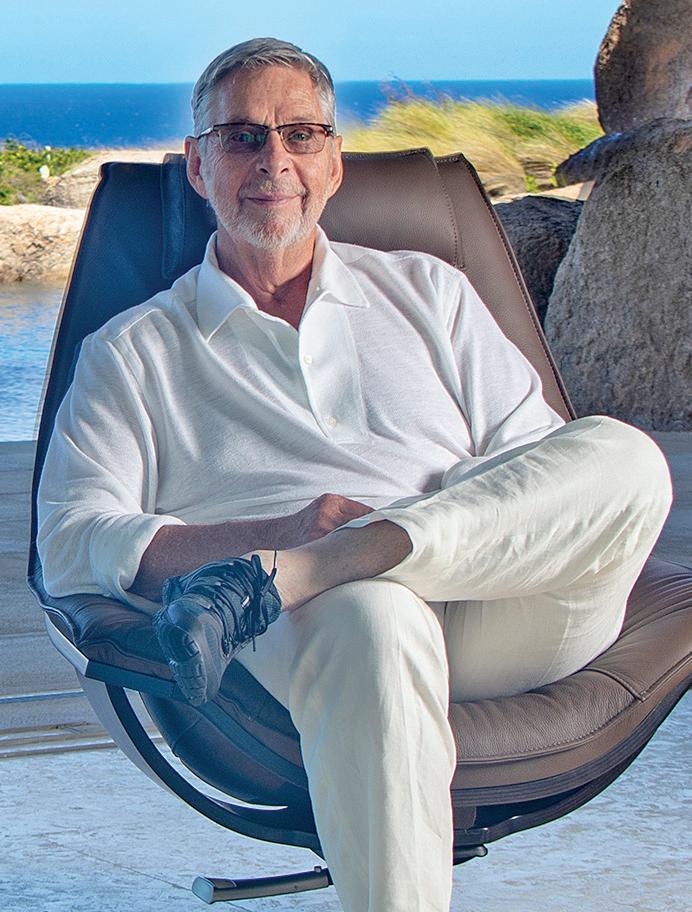

• Charles received his MBA from the Kellogg School of Management - Northwestern University, his MA in Economics from WMU, and Executive Education from Harvard Business School and Columbia University. Charles Zhang, CFP®, MBA, MSFS, ChFC

• Ranked #1 on Barron’s list of America’s TOP Independent Advisors for 2024. Charles has achieved the #1 ranking three times within the past four years.*

• Ranked #4 in the nation on Forbes’ list of TOP Wealth Advisors and is the highest-ranking Fee-Only Advisor on the list.*

Minimum investment: $1,000,000 in Michigan/$2,000,000 outside of Michigan. Assets under custody of LPL Financial and Charles Schwab.

The Michigan State Housing Development Authority recently awarded a $500,000 Employer-Assisted Housing Fund (EAH) matching grant to Munson Healthcare. The EAH Fund is backed by $10 million in state funding and offers direct support to employers that contribute matching funds through cash investments, land donation, a below-market interest loan, or a combination to help develop new housing options. With the matching grant, Munson will create a housing stipend for those who commit to a 24-month employment contract within the healthcare system. Munson estimates they will be able to hire between 40-60 additional employees using the program.

Delamar Traverse City recently celebrated the grand opening of Maison, the newest addition to the hotel’s culinary offerings. Maison is an all-day cafe with coffee, local baked goods, and other breakfast and lunch offerings. Maison then transitions to the hotel’s lobby bar in the evenings.

Eighteen employers in northwest Michigan have been awarded a total of $577,927 in cycle two of the 2025 Going PRO Talent Fund (GPTF), supporting training for 273 employees. Two-thirds of awarded employers included apprentices in their training plans — underscoring a strong regional focus on long-term talent development. “Grants like the Going PRO Talent Fund have a profound impact on the employers we serve,” said Rob Dickinson, regional director of business services at Northwest Michigan Works! in Traverse City. “These investments are giving local companies the tools to build sustainable workplace cultures, reduce turnover, and win more contracts.” Area companies that received awards include Cherryland Electric Cooperative, Lear, Promethient, Skilled Manufacturing, Dan Brady Painting, Thirlby Clinic, and Elk Rapids Engineering.

Northwest Michigan Works! and Northwestern Michigan College have expanded the region’s ability to train the next generation of skilled electric vehicle (EV) technicians by obtaining $120,000 in state workforce development funds. Funded through the State of Michigan’s Electric Vehicle Jobs Program, the initiative supports both employers and workers in the rapidly evolving mobility sector. Northwest Michigan Works! partnered with NMC to provide EV Jobs Program funding for the Automotive Technology Program, allowing the college to scale its hybrid and EV training capabilities for enrolled students. Approximately 50-75 working automotive technicians will now receive EV training annually and support a pipeline of EV-ready talent for northern Michigan employers.

JetBlue recently announced the start of its summer-seasonal service between Cherry Capital Airport and Boston Logan International Airport, operating Thursdays, Saturdays and Sundays through October 25. “This expansion not only enhances travel options but also strengthens the visitor economy – an essential driver of prosperity for our region,” said Trevor Tkach, president and CEO of Traverse City Tourism. “Supporting tourism and connectivity is vital to our continued growth, and this new addition marks another step forward for our community.” JetBlue joins American Airlines and Delta Airlines with seasonal direct flights to Boston Logan.

Grand Traverse Resort and Casinos recently celebrated the grand opening of its renovated Leelanau Sands Lodge in Peshawbestown. The redesigned lodge features 51 updated guest rooms, including elements that reflect the heritage of the Grand Traverse Band of Ottawa and Chippewa Indians. “This renovation is about more than aesthetics – it’s about creating a space that welcomes our guests with the spirit of the land, culture, and community,” said Jesse Ward, GM at Leelanau Sands Casino & Lodge, in an announcement about the renovated property.

The Cobblestone Farm, a wedding and event venue in Kingsley, is under new ownership. Tish Chase and Robert Valleau are the new co-owners of the 10acre property. “We’re thrilled to share the updates we’ve made to enhance the guest experience,” said Chase. The property features an 80-foot weatherproof structure, a Western-themed barn, a large dance floor, and its signature ‘Wedding Corral.’

TC Golf Performance Center has added a new, six-hole outdoor course called “The Rooster.” The course was designed for short game practice and gives golfers of any skill level an opportunity play in an environment reminiscent of a golf course. A grand opening for the new course will be held later this month. Learn more at tcgolfperformance.com.

consists of 15 townhome-style luxury condos at the intersection of Munson Avenue and Hamilton Street. Guests can rent by the unit, by the building, or reserve the entire property. Learn more at ogradydevelopment.com/hamilton-place.

JULY

Applications are still being accepted for the 2025/2026 Leadership Grand Traverse (LGT) cohort. LGT is a community-based program presented by Traverse Connect that prepares participants for decision-making leadership roles in areas such as policy, program implementation, and development. The program provides exposure to many of the major assets and leaders across our region, including natural resources, parks and recreation, community and economic development, health and human services, transportation, and agriculture. Learn more and apply at traverseconnect.com.

Traverse City has been recognized by culinary publication Food & Wine as one of the top small town in the United States for food and drink. The recognition is part of a larger feature from Food & Wine: the publication’s third annual “Global Tastemakers Awards.” Described as “a best-of list with a mission to celebrate culture, cuisine, and culinary experiences that are rooted in a true sense of place,” this year’s Global Tastemakers feature includes lists of the best American cities for pastry and coffee, the top 15 restaurants in the country, and more. Traverse City ranks number 11 on the 11-town list of the best small American cities for food and drink. Garnering specific name drops are business like Farm Club, The Cooks’ House, and Aerie , as well as Traverse City Tourism’s brand-new Traverse City Food & Wine festival, which is slated for August.

Discover a one-of-a-kind Northern Michigan estate

private frontage on two lakes, nestled on 16 acres with panoramic

views, a custom 3,165 sq-ft home, pool, gym, hot tub, and even a 6-site private campground for family & friends. Perfectly located between TC and Lake Michigan, this legacy retreat blends luxury, recreation, and serenity like no other.

Atlanta - ATL

Boston - BOS

Charlotte - CLT

Chicago - ORD

Dallas/Fort Worth - DFW

Denver - DEN

Detroit - DTW

Fort Lauderdale - FLL

Houston - IAH

Minneapolis - MSP

Newark - EWR

New Haven - HVN

New York - LaGuardia - LGA

Orlando/Sanford - SFB

Philadelphia - PHL

Phoenix/Mesa - AZA

Punta Gorda - PGD

Tampa/St. Pete - PIE

Washington DC - Dulles - IAD

Washington DC - Reagan - DCA

Cherry Capital Airport

Jody Barton, a single mom with a teenage daughter, says the stars aligned when she signed the lease for her apartment. Having a place of her own that she could afford, with her own bedroom, a well-equipped kitchen and comfortable living areas in a community near her employment and her daughter’s school was a dream come true. For Jody, like for so many of us, housing truly means everything.

Jody’s landlord, who made this dream a reality, is Homestretch Nonprofit Housing Corporation, a Community Housing Development Organization (CHDO) founded in 1996 in Traverse City. It was established in response to the regional shortage of affordable housing with a clear mission: to develop affordable housing that meets diverse needs, including those of working families, retirees and veterans.

Today, Homestretch continues to fulfill this mission. Executive Director Jon Stimson says it’s not just about bricks and mortar.

“...[I]t’s about dignity, opportunity and stability. It’s about people and building trust with our tenants, homeowners, and communities,” he said. “I’ve seen what it means for someone to finally have a place to call home. It’s not just a roof over their head. It’s stability for their kids; it’s the ability to save money; it’s a fresh start.”

The critical need for affordable housing in our 10-county lower northwest Michigan region is well-documented. According to the Housing Needs Assessment (HNA) commissioned by Housing North in 2023, the gap is 8,813 rental units projected through 2027. The largest gap, estimated to be 5,014 units, is for households earn-

EDITORIAL & BUSINESS OFFICE

P.O. Box 4020 Traverse City, MI 49685 231-947-8787

ON THE WEB

tcbusinessnews.com

PUBLISHER

Luke W. Haase lhaase@tcbusinessnews.com

CONTRIBUTING EDITOR

Gayle Neu

gneu@tcbusinessnews.com

HEAD WRITER

Craig Manning

STAFF WRITER

Art Bukowski

COMMENTARY BY CHRIS MACINNES

ing up to 50% of Area Median Household Income (AMHI), roughly $50,000 per year or less. Approximately 43% of these renters are considered “housing cost burdened” meaning they’re paying more than 30% of their income toward housing, with 23% being severely cost burdened, paying more than 50% of their income.

Developing quality, workforce affordable housing is challenging and complicated, but Homestretch has successfully overcome many of these hurdles. Yarrow Brown, executive director of Housing North, Northwest Michigan’s Rural Housing Partnership, says that “without nonprofit organizations like Homestretch, we would not have affordable housing in our region.”

Not only is the need great from a quality-of-life perspective, but it also impacts our region’s economic health. In the HNA, 74% of employers cited affordable housing as a major factor in their ability to attract and retain workers.

Josh Mills, Frankfort city manager and president of Housing North, describes affordable housing supply as “the critical infrastructure that drives future economic growth and quality.”

So, what are the key ingredients that enable Homestretch to “move the needle”?

There is no single factor; it’s a combination of elements, including design approach, construction and furnishings, a culture of partnerships and collaboration, public and private sources of capital, and the ability to develop at a scale that fits the needs and capacity of smaller, rural communities.

Homestretch applies innovative materi -

CREATIVE DIRECTOR Kyra Cross Poehlman

CONTRIBUTING WRITERS

Ross Boissoneau

Kierstin Gunsberg Rick Haglund

COPY EDITOR Becky Kalajian

WEB PRODUCTION: Byte Productions

MAILING/FULFILLMENT

Village Press

DISTRIBUTION Marc Morris

SERVING

Grand Traverse, Kalkaska, Leelanau and Benzie counties

als and construction processes that save money without jeopardizing quality. For example, they use panelized construction and mass timber, which are cost-effective, more durable and energy-efficient. In rural areas that may not have natural gas service, they use electric heat pumps as the energy source, which are both efficient and environmentally friendly. Interior and exterior designs are attractive, with high-quality fixtures and appliances. Their multi-family properties are not only affordable to build and operate, says Stimson, but are “where people feel happy and healthy –where they want to be. “

Another key to their success is garnering support from a broad range of partners to access funds and resources, including state and local governments, commercial lenders and community development financial institutions. Organizations like Housing North, Traverse Connect and the Grand Traverse Regional Community Foundation are also supportive. But for every project, Homestretch’s most important partner is the community. This means listening carefully to city, township or village leaders, respecting their voices, and developing plans that complement that community’s vision, master plan and zoning requirements.

A great example is the recently completed Lake & Main development in Frankfort, now home to 12 families with incomes that average between 60% to 80% of AMI ($43,562 to $72,603). It is in the heart of the city and close to jobs, schools, healthcare, shops, beaches and the Betsie Valley Trail. City Man-

AD SALES

Lisa Gillespie lisa@northernexpress.com

Kim Murray kmurray@tcbusinessnews.com

Kaitlyn Nance knance@northernexpress.com

Abby Walton Porter aporter@northernexpress.com

Michele Young myoung@tcbusinessnews.com

ager Mills, who worked closely with the Homestretch team on this project, describes them as “AWESOME partners” in a development that increases the affordable housing supply in Frankfort.

Location is another key ingredient. Warren Call, CEO of Traverse Connect, says that Homestretch’s ability to develop housing in rural communities, even where there may be a lack of infrastructure and planning resources, benefits the regional economy.

I am excited to speak firsthand about another Homestretch project in rural Benzie County: Crystal Commons, in Weldon Township, which is less than a half-mile from Crystal Mountain. For more than 25 years, we have looked for a partner to develop safe, high-quality, affordable workforce housing that is close to jobs, schools, childcare, recreation and public transportation. Our donation of land to Homestretch for the Crystal Commons project speaks to our belief that this project will help build a stronger, healthier community for all.

Though shovels are not yet in the ground, we are grateful that Homestretch is continuing to do what it does best: take the long view, applying a formula that not only improves the quality of life for individual families but also that of entire communities … because housing means everything.

Chris MacInnes is president of Crystal Mountain. In 1985, she and her husband Jim moved from California to join this business and together have led its evolution. She is also active in state, local and industry organizations.

The Traverse City Business News Published monthly by Eyes Only Media, LLC P.O. Box 4020 Traverse City, MI 49685 231-947-8787

Periodical postage qualification pending at Traverse City, MI.

POSTMASTER: Send address changes to The Traverse City Business News, PO Box 1810, Traverse City, MI 49685-1810.

The Traverse City Business News is not responsible for unsolicited contributions.

Content ©2025 Eyes Only Media, LLC. All rights reserved.

EYES ONLY MEDIA, LLC

By Art Bukowski

Adam Inman is co-owner of Francisco’s Market & Deli at the very busy intersection of Silver Lake and Zimmerman roads on the west side. The shop’s strategic location combined with its relentless dedication to good food has made it a go-to for killer take-out pizza (including their world-famous breakfast pizza), sandwiches and more. Inman is a hands-on owner who is rarely at his cramped desk space, but he gave us a peek anyway. If you have an idea for a From the Desk Of feature, please email abukowski@tcbusinessnews.com.

1. I do all the shopping for the store. I’m the Aunt Millie’s guy. I’m the milkman, the Lipari guy, the Carmela guy. If we run out of something, I’m on my way to pick it up. And with all the orders we have, if I don’t write it down in a notebook, I’m going to forget.

2. I love my weekly golf league. It’s a really good group of guys. With two little kids and the stress of work and parenthood, I don’t get out as much as I used to. So on Wednesday, no matter rain or shine, we’re going out golfing.

3. That’s my German Pilsner hat from Silver Spruce Brewing. They moved in next door last year and it’s been great. We do all the food for them over here. It’s been pretty harmonious.

4. That’s just the deposit from yesterday. I do all the back-end work – the payroll, the deposits, the banking stuff. I file all the invoices and receipts, all the QuickBooks stuff. Anything that has to do with either getting paid or paying somebody, that’s my job.

5. When we bought this place in 2016, we were known as the store with the big liquor wall, but food to go is now a huge thing for us. I sold food for 10 years before doing this and my business partner is a chef, and with our powers combined we’re really starting to shine with food. We’re doing the little

things that make a huge difference. People really love our pizza, sandwiches and soup.

6. You’ll almost never see me without a hat on. I was in sales for years before buying the shop, and I had to dress up. The best part of this job is I can wear a baseball cap and sweatshirt every day and still be a professional. It’s a nice change of pace.

7. Music is a big part of our culture in here. I’m in here every day at 6am cracking eggs, and we crank up the music. It’s kind of refreshing to come in and see the big guy singing under the hood. It’s not real groggy here in the mornings when you come in to ‘90s hip hop.

8. Here’s a few good bottles we’ll save for special customers. We have a great liquor selection, but if we could, it would be even better. It’s just been very difficult over the last handful of years to get product in the store. A lot of these big companies, you’ve got to play their game to get the good stuff. So we’ve just been trying over the last handful of years to kind of play ball.

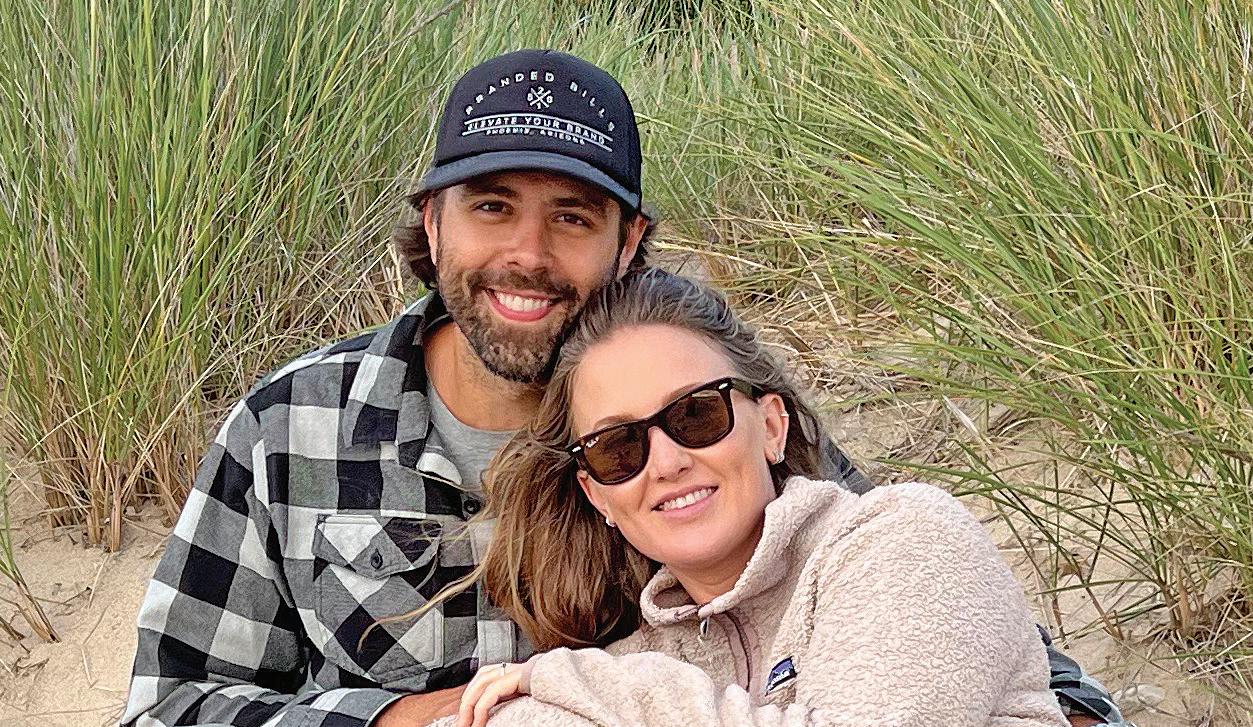

9. My co-owner and manager Michael Krenzke [on the right] is the whole reason this place is what it is. He has a deep passion for food and wine, and he’s the reason our food is so high quality. He’s also been a sommelier for over 10 years now.

By Art Bukowski

With more than $230 million in annual sales, nearly 600 employees and more than 6,000 customers in 45 countries, it’s clear that Petoskey Plastics is one of the most prominent companies in the Little Traverse Bay region.

And while those are indeed impressive figures, management is perhaps most proud of other stats. In 2024 alone, for instance, the company recycled nearly 40 million pounds of old plastic, diverting it from landfills and incorporating it into state-of-the-art new products that serve a wide variety of markets.

A recycling program that began years ago as a simple business opportunity for a young firm is now a key part of Petoskey Plastics’ operations and identity. As more and more consumers demand sustainable products, these practices are also increasingly vital to the company’s appeal and continued success.

At 50 years and counting, the company recently opened a plant in Texas and is poised for continued growth. The TCBN checked in with President Jason Keiswetter to find out what’s next for his family-owned and industry-leading firm.

What’s now a relative juggernaut began in a Petoskey pole barn in 1969. Duke Keiswetter, his son Paul and a couple of employees started using a single machine to make relatively simple plastic bags for a variety of applications.

Petoskey Plastics’ early days were promising but bumpy, and the company flirted with bankruptcy within its first five years. “We just needed time, in my mind,” Paul said in an interview collected for the company’s 50th anniversary. “I had confidence that we could survive, but how were we going to do it?”

A loan from the federal Small Business

“Anybody can put plastic in an extruder and regrind it and make a pellet, but then what are you doing with it?

Our ability to take millions of pounds a year of landfill-bound plastic and [give it] another life separates us in the market of plastics.”

- Jason Keiswetter, President, Petoskey Plastics

Duke had been in the restaurant business for a short time, but he wanted to find a new, stable opportunity for success. He came with a background in plastics, earlier running a company in Detroit that produced a variety of plastic and injection-molded components for the automotive industry.

Administration for new equipment and operations costs helped shore things up. A short time later, Paul reinvested earnings from a massive government bag contract into new equipment, allowing for further stability and growth. It wasn’t long before the company moved into a much larger facility along U.S. 31 near Bay Harbor.

In 1978, the company made its first venture into recycling plastics when Paul convinced Dow Chemical to sell him thousands of used plastic bags. Petoskey Plastics cleaned these bags, ground them up and turned them into new products, starting what would eventually evolve into a major segment of the company’s business model.

The 1980s saw another huge springboard as the company broke into the automotive market with Slip & Grip, a protective seat cover that could be counted on to stay in place during the vehicle manufacturing process. The company patented and began producing millions of these covers.

The 1990s were a time of significant expansion with Petoskey Plastics’ recycling programs. The company received a roughly $1 million grant from the state for additional equipment that transformed plastic waste into pellets for new applications. It became one of the first North American companies to successfully recycle low-density, post-consumer plastics on a large scale and use them in new products.

The turn of the century and first decade of the 2000s saw Petoskey Plastics acquire large facilities in Tennessee and Indiana to provide faster ship times and lower freight costs to customers throughout the country.

Company leaders also opened a new corporate headquarters in downtown Petoskey. In 2021, the company opened a manufacturing plant on the outskirts of Dallas in McKinney, Texas, an expansion intended to capitalize on proximity to raw material suppliers and shorten delivery times for West Coast customers.

Jason Keiswetter, Paul’s son, says that Paul has often remarked that people thought they were crazy for starting a manufacturing company way up in northern Michigan, far away from the supply chain and potential customers. Looking back, it makes the ride all that more fun.

“We’re going to make a bag company in northern Michigan, and no one could really imagine that we’re going to become this multi-state, multi-national customer base, but here we are,” Jason said.

Petoskey Plastics now sits with four major facilities and six divisions that provide hundreds of mostly blown-film plastics products to the automotive, medical, construction and institutional markets, among others. These products include a dizzying variety of bags, protective sheeting, medical gowns and much more.

About 70% of their products are sold to domestic customers (including more than 25 Fortune 500 companies), though the overseas business is not small potatoes.

“We’re thrilled to have our headquarters right here in Petoskey, Michigan, and our main plant – our original plant – is still in Petoskey. There’s a lot of pride in being here and supporting the many families that we have here.”

- Jason Keiswetter, President, Petoskey Plastics

Duke Keiswetter died in 2015 at age 94. Paul has transitioned to chairman and CEO, while Jason is now president. The past few years have been a rough ride, Jason says, with COVID, inflation, supply-side issues and more, but what hasn’t killed the company truly made it stronger.

“It’s really been a challenging four years, but we’re still here and we’re continuing to grow,” he said. “We survived all of it, and I’m pretty proud of that.”

The current economy and political climate also present plenty of uncertainty, but also opportunity. A drop in imports, for example, allows for growth in the retail sector.

“I’m seeing it on both sides. We had to pay a tariff on some equipment we brought in, but it’s also opening a lot of doors for us to quote new business because a lot of our products are heavy traffic in imports,” he said. “So I’m talking to companies I haven’t talked to before … and here we are at the table with a domestic supply option.”

Jason is glad to have the Texas plant up and running, particularly since planning for it began right before COVID shut the world down. Now, it’s onward and upward.

“Our investment into McKinney is very exciting. The infrastructure is behind us. We’ve done the heavy lifting, we’ve been through COVID and all of those

other things,” he said. “Now we’re going to be able to refine and execute on a different level than we have before.”

Still, despite this continued nationwide growth, the company’s heart remains where it was born and raised.

“We’re thrilled to have our headquarters right here in Petoskey, Michigan, and our main plant – our original plant – is still in Petoskey,” Jason said. “There’s a lot of pride in being here and supporting the many families that we have here.”

Jason has traveled the world and has found no better place to live and work than Petoskey, he says. Being a major player in the plastics industry is icing on the cake.

“We’ve got a good reputation in the market, and we’re respected in the market. Having that clout coming from northern Michigan, well, it really doesn’t get much better than that,” he said.

The company has strong worker retention, with many employees racking up multiple decades of service.

“Our associates really make the company, and … my hat’s off to them,” Jason said. “Most of them have known me since I was a kid, so that’s kind of fun, too. I’ve got a lot of parents running around the factory.”

Part of this is probably because the company continues to invest in its employees, a tradition dating back to when Paul partnered with North Central Michigan College about 20 years ago to create the first-ever college program in the country specifically designed to train skilled plastics workers – and then sent his employees.

“Immediately after they graduated, they got a four dollar an hour raise, but I wanted to get them educated the best I could [so they could] feel good about themselves and understand more about the industry,” Paul said in the 50th anniversary interview.

Investing in employees is more important than ever, Jason says, considering how hard it can be to keep them around.

“You really need to take training and make an investment into lifting their knowledge, because they have options, and they can move, and they can go and you’ve got to treat them right,” Jason said. “At the

end of the day, we have to give them the tools. A lot of people want to learn and better themselves.”

Paul’s initial foray into recycling Dow Chemical’s old bags more than 40 years ago was a “cost play,” Jason says – a clever move from a hungry young company. Who would have thought it would become a Petoskey Plastics signature?

“It’s evolved into high-speed recycling of landfill-bound plastic, and we’re remanufacturing it into everything from bags to seat covers to retail trash bags with drawstrings on them,” he said. “It’s been a journey from a situation where we just were looking for ways to compete, but now we’re competing and doing great things for the environment [at the same time].”

Plastic gets a bad rap, understandably so in many cases. But Jason points to studies that show a relatively low environmental impact with recycled plastics.

“We are a perfect example of it being real. We’re doing it every single day. We’ve been doing it for 20, 30 years,” he said. “And there’s people jumping on board, and we’re helping those people figure it out as well.”

While processing discarded plastic is the critical first step in the recycling process, Petoskey Plastics is also skilled at turning these recycled plastics into new products.

“Anybody can put plastic in an extruder and regrind it and make a pellet, but then what are you doing with it?” he said. “Our ability to take millions of pounds a year of landfill-bound plastic and [give it] another life separates us in the market of plastics.”

Company engineers are constantly developing new applications for recycled plastic, often combining it with virgin plastic for a strong, versatile product. The company recently invested more in its research and

development department to stay on top of the market.

“Most companies have one monolayer, and you can only put so much post-consumer in that product, but everything we do is multilayer. We have 65% post-consumer content [in a lot of products], and we’ve been toying around with 100% blends,” he said. “So we’re always pushing the limit and leading that front edge on the post-consumer content side.”

By Ross Boissoneau

The economic losses for the ice storm that ripped through northern Michigan early this spring are still being tallied.

A survey by the Northern Lakes Economic Alliance, which serves businesses in Antrim, Charlevoix, Cheboygan and Emmet counties, projects losses approaching $6.5 million. That does not include the cost of repairs, cleanup, or financial support to their employees. All told, the Michigan State Police estimate recovery efforts will cost upwards of $200 million, according to a report from the lobbying firm Michigan Legislative Consultants.

Gov. Gretchen Whitmer declared a state of emergency in 12 counties due to the ice storm that hit March 28 and lingered for three days. Virtually the entire area lost power due to the ice storm. Presque Isle Electric & Gas CEO Allan Berg said at the height of the outage, less than 1% of the customers in the affected area still had electricity.

Otsego County was one of the hardest hit areas.

“We were closed for 10 days and lost everything in the cooler,” said Denise Gilling, manager at the Pine Squirrel Bar & Grill in Gaylord.

She says the devastation was unlike anything she’d ever experienced. Yet just outside the area it was as if there hadn’t been a storm at all.

“It was strange and creepy,” she said. “My brother lives on Torch Lake. I drove there and it was like nothing happened.”

With everything down – no electricity, radio or cell service, impassable roads and no gasoline available for cars or generators for 60 miles – it took several days just to get the power flowing again.

“It was worse than the (Gaylord) tornado,” said Gilling, as it lasted so much longer.

Bob Wilson, who handles human resources and finance at Otsego Resort, concurred.

“It went through like the slowest-moving tornado,” he said.

He says most of the resort’s buildings and golf course were spared, but the woods surrounding it were devastated.

“It looks like a war zone,” Wilson said.

The costs for restaurants and grocery stores included not just loss of sales, but loss of product.

“We lost all of our perishable foods. We saved what we could but we have to prioritize food safety in all decision-mak-

ing, so we erred on the side of caution,” said Michael Walter, CEO of the natural foods store and co-op Grain Train in Petoskey and Boyne City. Fortunately the losses were covered by insurance.

At Crooked Tree Breadworks between Petoskey and Harbor Springs, Assistant Manager Isaac Winnell says one big concern was the company’s sourdough starter. It has been used for the company’s signature breads for more than 30 years.

With owner Greg Carpenter out of town, it was up to Winnell and staff to make sure it remained viable.

It came down to frequently feeding it.

“I would take water to a relative’s home with a gas stove, then put it in a thermal container,” Winnell said. “Nobody wants to see the starter die.”

While the starter survived, after the power came back on they discovered the bread oven wasn’t relighting properly. The bakery turned to more scones and pastries. Winnell said there was a significant uptick in sales of those items the first few days post-storm.

“We’d sell out every single day of everything we could make,” he said.

Nikki Devitt, president and CEO of the Petoskey Regional Chamber of Com-

merce, says virtually every industry took a financial hit.

“For retail and restaurants, the impact was immediate. For maple syrup, it’s a lasting impact,” she said.

A report from Michigan State University Extension Service puts losses for this year at an estimated $3.5 million in bulk syrup sales. In addition, many maple trees were destroyed, putting future production in jeopardy. As one example, Maple Moon Sugarbush and Winery of Petoskey faces losses of $280,000 in lost syrup over the next two years, with $250,000 needed to clean up and rebuild the infrastructure.

Dale Forrester’s Maple Dale Farm in Atlanta taps 10,000 trees and produces 5,000 gallons of syrup annually. He told Michigan Farm News the storm destroyed a third of his crop, with another third of his trees experiencing significant damage. One harvester quoted in the NLEA report said that the storm destroyed so many of its trees that it will not be able to make syrup for at least three to five years, with an annual loss of revenue of $140,000 minimum.

The destruction of millions of trees also dealt a huge blow to Michigan’s forest products industry. It contributed $26.5

billion to the state’s economy in 2022, according to a report from the Michigan Department of Natural Resources. Approximately one million acres of forest were affected by the ice storm, according to the Michigan Department of Natural Resources’ Forest Resources Division.

The utility companies likewise suffered a huge financial hit. According to Bridge Michigan, Alpena Power Company, one of the four energy providers serving the area, spent about $2.5 million restoring power after the storm. That is five times the company’s typical annual budget for storm restoration. In addition, the outages will cost the company about $300,000 to $350,000 in lost revenue.

Workers replaced over 2,500 poles, triple the average for an entire year. Berg says Presque Isle alone had to replace 3,600 miles of wire. Both Berg and Devitt said they heard over and over from the outside crews (more than 1,500 from across the country came to help) that wherever they were from and whatever else they had been through, they had never seen anything like the destruction from this storm.

While the storm is over, the damage is ongoing. Jon Demming, the head of Otsego’s County’s Emergency Services, said those trees which survived but were damaged are now more susceptible to disease, insects or other challenges. He brought in a forester to assess the damage and provide advice for how to deal with it.

The after-effects are not just financial. Devitt says the emotional reaction is lingering and is the least-talked-about after-effect of the storm.

“Whenever there’s a high wind day or thunderstorm you tense up. It’s a collective trauma,” she said. “We had a clinical therapist talk to a women’s luncheon.”

The sound of the snapping branches and falling trees was common, and Devitt said she still flinches when she hears a snapping sound. Gilling said things would be calm, then suddenly there would be sounds like gunshots.

“It was eerie and strange,” she said of the atmosphere.

Sarah Snider, owner of Poetess & Stranger gift shop in downtown Petoskey, says surviving the off-season is hard enough, and getting hit with a natural disaster at the end of March was financially painful.

“January through May is a gauntlet. In April, almost all service industry and retail businesses are limping to the finish line, and it’s the locals who have sustained us,” she said. “I can’t imagine what it has been like for the businesses that lost product, infrastructure, transportation.”

Now businesses and residents hope for financial assistance from the government while working to clear the debris. Teams from Michigan State Police, Emergency Management and Homeland Security Division (MSP/EMHSD), the Federal

Emergency Management Agency (FEMA), U.S. Small Business Administration (SBA), and local officials conducted damage assessments. The SBA’s presence means low-interest disaster loans may be available to qualifying homeowners, rent ers, businesses and nonprofits.

“The governor’s emergency declaration was one of the first pieces for (potential) FEMA funding,” said Devitt.

She praises the generosity of business es and neighbors helping one another, noting some were grilling food out in the middle of the street for residents. Snider runs a food pantry at her shop and was able to take food to the Odawa Casino’s warming center.

“On Sunday I spent time at North Coast Work charging our family’s phones and computers. They remained open many days for people to warm up, charge phones, etc.,” she said. “High Five Spirits was serving freshly made food to anyone stopping by.”

Such community-minded efforts con tinue. Walter says that a consumer co-op, Grain Train, is guided by seven principles. One of them is “concern for community.”

He says the management team decided one way to do that was to hold a sale to help the community restock pantries and refrigerators. “Community Days” offered customers $25 off for every $100 spent for all shoppers, owners and non-owners, May 2-4.

The next test comes as summer visitors

says she hopes they realize what the region has been through as the story fades from the headlines.

“I hope visitors have patience and understanding,” Devitt said. “I hope they go out to eat, buy locally. We need the support.”

By Rick Haglund

In the 30 years since its first resident arrived, Bay Harbor has morphed into a $1 billion resort featuring hundreds of multimillion-dollar homes, a yacht-filled harbor, a luxury hotel, a shopping and dining village, and a 525-seat performing arts center.

Its 27-hole golf course, designed by the late, prolific course architect Arthur Hills, has been called “the Pebble Beach of the Midwest.”

The 2,400-acre resort, bordered by five miles of stunning Lake Michigan shoreline, has an outsized impact on one of the most desirable regions of the state. It’s half the tax base of Petoskey, population 5,800, and employs about 1,000 full- and part-time workers.

What was once the site of an abandoned, decaying cement plant and limestone quarry has been transformed into an oasis for the well-heeled.

“To have that third resort creates another jewel in the crown [beyond Boyne Resorts] that makes this region so special,” said Jim Powell, executive director of the Petoskey Area Visitors Bureau. “Its presence is pretty awesome.”

Bay Harbor is located south of Petoskey in Resort Township. But an agreement 25 years ago between the city and township transferred Bay Harbor’s property to the city. Under the so-called state 425 agreement, Petoskey provides water, sewer and public safety services to the township while the city gets most of Bay Harbor’s tax revenue.

“I think the 425 serves both parties effectively,” said Petoskey City Manager Shane Horn. “Having access to utilities allows the township to grow. And we’re able to do a lot of things because of the tax base of the development.”

Among those things are improvements to Petoskey’s parks and other public spaces, Horn says. One proposed project would connect Bay Harbor to the Little Traverse Wheelway, a 26-mile, paved bike path that runs from Charlevoix to Harbor Springs.

“We’re always looking for ways to partner with them,” Horn said about the relationship between Bay Harbor and Petoskey. “We pay attention to their desires and needs.”

Bay Harbor even has a representative on the Petoskey City Council. Joseph Nachtrab, a retired certified public accountant who has lived with his wife full time at Bay Harbor for the past 25 years, was appointed in January to fill a vacancy on the council.

Bay Harbor at 30 years

cements reputation as one of the Midwest’s swankiest resorts

Nachtrab says he got involved in Petoskey politics when some of the resort’s residents voiced concerns about their property tax assessments. There are about 200 people living at the resort who are registered to vote in Petoskey. Nachtrab ended up serving on the city’s board of review and has worked as an

election inspector.

Winter-time sports attracted Nachtrab and his family to northwest Michigan decades ago.

“We were living in Toledo and used to come here for skiing; never in the summer,” he said. “My wife got a flyer in the mail announcing the Bay Harbor development and we just fell in love with it.”

bunch of rich people living behind the gates,” but says that’s unfair.

“I’ve gotten to know a lot of people in Bay Harbor,” he said. “So many of them have integrated into life in northern Michigan and care deeply for its people.”

He cites the Bay Harbor Foundation, which has given nearly $3 million in scholarships and grants to community organiza

The resorted was dogged for years by toxic pollution from the cement plant that operated on the property for more than a century before it was acquired by Detroit-area developer David V. Johnson and CMS Land, a division of CMS Energy, the parent company of Jackson-based Consumers Energy.

(Johnson later built Oil Nut Bay, a luxury resort at Virgin Gorda in the British Virgin Islands. He and his wife own what Dbusiness Magazine reported is a $40 million, 8,000 square-foot home on the property. Johnson was not made avail-

able for an interview for this story.)

Bay Harbor’s owners tangled with state and federal regulators – and each other – for more than a decade over the 2.5 million cubic feet of buried toxic cement kiln dust that was leaching into Lake Michigan. The environmental catastrophe received national media attention, including unflattering stories in the Washington Post and the Chicago Tribune.

CMS exited its partnership with Johnson in 2002 but agreed to foot the bill for a cleanup that cost the utility owner $315 million, according to CMS. A remedia-

tion agreement reached with the state in 2012 requires the resort to monitor its leachate collection system indefinitely, according to a summary of the problem by Resort Township.

The system “is exceeding expectations,” said Denny Brya, the resort’s general manager, adding that the lake is safe for swimming by resort visitors and homeowners. “It’s normal day-to-day operations.”

Bay Harbor was literally blasted into existence in 1994. Explosives took down the cement plant’s smokestacks and later a portion of the shoreline, allowing 2.5 billion gallons of Lake Michigan water to rush into the former limestone quarry, creating the yacht harbor.

“A project of this magnitude will put this region, indeed, on the nation’s map, if not the world’s map,” then-Gov. John Engler said as he helped detonate the charges that blew up the cement plant.

Early on, rumors spread that entertainment world celebrities, including Madonna, had purchased homes at the resort. Brya says the rumors weren’t true. Most of Bay Harbor’s property owners, mostly from the United States, made their bones in the business world.

“We call all our owners famous,” said Brya, who has worked at Bay Harbor for 30 years.

In addition to its early environmental headaches, the resort has navigated

through several difficult economic periods. The worst was the Great Recession, which culminated in the historic Chapter 11 bankruptcies of Chrysler Corp., now Stellantis, and General Motors Corp. in 2009.

Business also slowed during the COVID pandemic in 2020. But the pandemic also drew home buyers who could work remotely and decided they wanted to do it in a magnificent setting.

“We had people move here from California and they never went back,” Brya said. “We’ve always had challenges. Things are always changing but it seems like we adapt well to the changes to make things better.”

Today’s uncertain economic climate, fueled by a trade war and turmoil in the Middle East, so far hasn’t slowed Bay Harbor’s development momentum.

The resort recently sold a piece of property where a 120-room Hyatt Place hotel will be built. The hotel should attract a wider range of visitors with lower room prices than the swanky 105-room Inn at Bay Harbor, where rooms can run more than $1,500 a night.

And a new residential development, Village Heights at Bay Harbor, will offer 25 “high-end” condos in the resort’s marina district, Brya says.

“For the most part, we still see a strong market,” he said. “We’ve got more demand than supply right now.”

Bay Harbor milestones

• 1994: Cement plant smokestacks are imploded and Bay Harbor Lake is created in a former limestone quarry

• 1995: First resident moves into Bay Harbor

• 1996: Bay Harbor Yacht Club and Bay Harbor Golf Club open

• 1998: Inn at Bay Harbor opens

• 2000: Village Beach opens

• 2002: David V. Johnson acquires CMS Energy’s ownership interest and becomes sole owner

• 2004: Bay Harbor Foundation is formed

• 2016: Great Lakes Center for the Arts breaks ground

• 2017-2024: Several new residential projects and marina expansion take place

• 2025: Hyatt Place Hotel and the Village Heights at Bay Harbor condo project are announced

How northern Michigan’s community cinemas are surviving the streaming era – and why we need them to

By Kierstin Gunsberg

Hitting the cinema has been a lot less popular since the pandemic. That’s when the U.S. box office saw a drastic 80% drop while quarantine cemented the comfort (and affordability) of staying in to watch movies on the couch.

Now, even as audiences slowly return, northern Michigan’s community theaters are still figuring out how to compete in a homebody economy where streaming rules the scene.

To pull those homebodies away from the living room, The Bay Theatre in Suttons Bay is leaning into nostalgia.

“We very much want to preserve that friendly, kind of old-school vintage feel where you come in and there’s a nice, smiling face at the counter,” said Rick Andrews, board president of the nonprofit that operates The Bay, which is also Leelanau County’s only movie theater.

“You go in and it’s a smaller theater and the prices are always as affordable as we can make them.”

With just one screen and 187 seats, The

Bay has been a staple on St. Joseph Street since opening in 1946. But when its previous owners announced in late 2018 that they planned to close the venue with only a few weeks’ notice, Andrews and others in Leelanau feared losing more than just their local film-hub.

“The community said, ‘No, this is an important gathering place, an important

day still depends on volunteers. And not just the ones serving popcorn and checking tickets.

“There’s a lot that goes on behind the scenes too,” Andrews said. “We have a programming team that meets every week. These volunteers look at what movies we should get, what movies are possible and available.”

“We very much want to preserve that friendly, kind of old-school vintage feel where you come in and there’s a nice, smiling face at the counter.”

– Rick Andrews, Board President, The Bay

place for culture, pure entertainment, and education,’” recalled Andrews. “‘We can’t let it go … what do we do?’”

What they did was form a volunteer-backed nonprofit to take ownership of The Bay and keep its iconic double doors open.

Seven years later, The Bay now has a small paid staff, including a general manager, but the bulk of its day-to-

Altogether, he said, it takes more than 100 volunteers to pull off everything from year-round upkeep on the historic 70-yearold building to social media management.

Besides offering a nostalgic spot to catch a flick, Andrews points out something that The Bay offers that streaming never could – a boon to nearby businesses, as movie-goers kill time before and after their showtime by stopping into the

shops and restaurants surrounding it.

“To us, it’s a real anchor for the community,” he said. “And not just for Suttons Bay – for the broader county at least.”

Nonprofit by necessity

If survival in the streaming era is the name of the game, then staying financially solvent is the biggest objective for community theaters like The Bay. That’s what made the transition from a privately owned movie theater to a nonprofit so crucial to its longevity.

Because as it turns out, movie theaters operate on pretty thin margins.

“The actual business of selling concessions and movie tickets doesn’t fund [The Bay],” said Andrews. “We probably lose money on that. I’m sure we do lose money on the actual business of the theater.”

Andrews also notes that while The Bay expects to sell close to 15,000 tickets this year, a sign that sales are rebounding from their pandemic low, smaller venues have fewer opportunities to offset operating costs with ticket sales alone, especially since a portion of that revenue goes back to the studios who make the films that grace the marquee.

With just one screen, The Bay can only offer one or two screenings a day, limiting both ticket and concession sales compared to multiplexes like Traverse City’s AMC Cherry Blossom, which can run more than 50 screenings every day.

Non-profit status and the fundraising and sponsorships that come with it help to narrow the margin between maintaining a historic building and the high cost of running a movie theater.

“This past year we invested $120,000 into a new laser projection system,” said Andrews. “So we’ve got a state-of-the-art

projection system that was funded by little donations from the community.”

Meanwhile, the newest Tom Cruise action flick or Disney animation isn’t the only thing that attracts donations and ticket sales. The Bay’s board and volunteers have learned that the sense of community and access to the arts that spurred them to save the little cinema in the first place is indeed one of its biggest draws.

In the last few years, The Bay has added live events like concerts and comedy shows to its lineup, contributing to gains like last year’s 56% increase in net profits

over 2023. They also offer annual memberships ranging from $30 to $1,000 and exclusive benefits to go along with each tier.

One of their biggest campaigns has been the Made in Michigan film series that features special showings of movies filmed in the Mitten State along with cast and director panels.

“When we do those things, we definitely pull people from further away and pack the house,” Andrews said.

Offering a more personalized, niche experience to film aficionados and those

looking for something more engaging than two hours gazing up at the big screen is a tactic that other nonprofit community cinemas in northern Michigan have capitalized on. Traverse City’s State Theater, Elk Rapids Cinema, The Garden Theater in Frankfort and The Lyric Theatre in Harbor Springs – which all became nonprofits in the last two decades – have implemented similar strategies, offering a mix of meet and greets, memberships and budget-conscious family-focused screenings on top of major releases in order to hit each viewer demographic.

Hitting all of those demos is one of the greatest challenges of running a nonprofit community cinema, explains Scott Langton, executive director of The Lyric, which has three screens. Hollywood, he says, tends to release all its blockbusters at once and May through August, when those earlier-mentioned homebodies are more likely to peel away from the couch and seek out air-conditioned entertainment. The rest of the year, smaller or less in-demand films tend to get dumped, leading to long lulls in ticket sales.

Case in point is 2025’s two biggest titles so far – the family-friendly “A Minecraft Movie” and the action-horror “Sinners” – were both released within two weeks of each other. That creates a real dilemma for limited-screen venues like The Bay and The Lyric, which can only run up to a few movies simultaneously.

So when Wes Anderson’s latest postmodern flick “The Phoenician Scheme” was scheduled to hit theaters at the end of May, Langton had to decide if it could hold its own against a slate of guaranteed box office draws like Disney’s live-action “Lilo and Stitch” and the eighth “Mission Impossible” installment.

With just three screens, it couldn’t.

“I have to push [“The Phoenician Scheme”] into August,” he said, while the film plays on for weeks at larger multiplexes. “And so that’s the toughest thing.”

That’s one reason Langton wants more high-profile releases pushed into the shoulder seasons. He referred to off-season successes like “A Complete Unknown,” the Bob Dylan biopic released on Christmas Day 2024.

“That brought in 2,000 people,” Langton said, adding that the Timothée Chalamet feature helped carry The Lyric through the doldrums of January. “So

it would have been nice if I would have gotten three more [hit] movies in January, February, March and April that [also] brought in 2,000 people.”

As The Bay’s Andrews pointed out earlier, the economic effect of a community movie theater ripples beyond the box office. Those 2,000 “A Complete Unknown” moviegoers weren’t just supporting The Lyric, they were also dining at Harbor Springs restaurants and shopping downtown.

“We usually bring in about 40- to 50,000 people a year through the downtown area,” said Langton.

Like The Bay, The Lyric has also found that offering both first-run blockbusters and arthouse films not found at the typical multiplex is pivotal to building a loyal and diverse audience.

“People come from 45 minutes away because they want to see the programming that we have,” Langton said.

A part of the greater non-profit cinema community, Langton adds that’s a trend that other nearby cinemas in tourism-driven towns like Frankfort’s Garden Theater are capitalizing on. Recently upgraded with a multi-million-dollar solar panel system funded by donations, the venue is one of the few year-round entertainment options for the town’s 1,200 residents.

Reflecting on a recent visit to Babcock Ranch, a brand new 18,000-acre planned community near Punta Gorda, Florida, Langton says he was struck by a surprising omission.

Despite the focus on a commerce-forward design that includes multiple restaurants, ice cream shops and retail outlets, not one development included a movie theater.

“I thought, ‘Gosh … you just need a movie theater,’” he said. “Right smack down in your beautiful square here to transform everything about it.”

Our team is committed to building lasting relationships and supporting your health through preventive care and ongoing management. We want the very best for you and your family.

By Payton Heins, columnist

“Up North” – in our case the counties of Antrim, Charlevoix, Emmet and Cheboygan – is most often thought of for our incredible Great Lakes shorelines, inland waterways, ski resorts and miles of trails. We are a beloved destination for visitors which has made tourism such an important piece of our economic landscape. What is often lost in this image of “Up North” is the opportunity that exists in other sectors.

While tourism is a major economic driver, our region is also home to a strong and diverse base of manufacturers, construction firms and other industries. Our natural assets have also created unique opportunities in the outdoor recreation, marine-related, food processing and wood products industries. These industries provide family-sustaining career opportunities spanning diverse fields and skill levels.

Our region offers a compelling combination for talent and entrepreneurs: economic potential paired with an exceptional quality of life.

Like many rural regions across Michigan and the nation, we face challenges. Each year, the Northern Lakes Economic Alliance (NLEA) conducts direct outreach to our primary employers across the region, and in 2025 we added a new survey tool to better monitor the challenges and opportunities companies in our region encounter. The top two barriers to business growth voiced by business leaders in the region remain recruiting and retaining talent and workforce housing. Employers across the region are eager to hire but continue to struggle in finding both skilled and entry-level workers. Manufacturers also report concerns of a dwindling interest from young talent in manufacturing as a career path, further constraining their talent pool.

While state and national demographic trends are contributing to the challenge, there are positive signs for our region: U.S. Census data shows that the number of prime working-age individuals (25 to 54 years old) has been growing for three consecutive years. This reflects a newly emer-

Survey shows 42% of region’s businesses plan to expand within the next four years, most in the manufacturing

gent national trend of rural revival driven by the in-migration of young adults.

The traditional talent pipeline has not kept pace with demand, but employers continue adapting, offering competitive wages and incentives, going to great lengths to invest in training, and finding alternative talent pipelines. The region’s robust Career Technical Education programming and North Central Michigan College’s unique fast track programming further complement these employer-led efforts. Simultaneously, businesses are investing in technologies to increase automation and maximize efficiencies that lower their overall dependence on labor.

Regulatory and policy issues also remain top of mind for business leaders, ranking third as a key concern. Yet despite these hurdles, the region’s business community is growing. Many manufacturers are expanding, and the outlook is optimistic.

Last month, the NLEA released our Economic Pulse Report, providing a snapshot of the latest regional quarterly trends, including major business expansions and the top economic issues currently on the minds of local community and business leaders. The report highlights survey results showing 85% of the region’s businesses reporting stable or increasing sales. Even more encouraging, 42% of respondents plan to expand their physical

footprint in the region within the next four years, most of them in the manufacturing sector. These businesses range anywhere in size from five to 350 employees, averaging in the 50s for employee count.

Businesses in our region share many of the concerns felt elsewhere in Michigan and nationwide. While our challenges may not be unique, our opportunities are. By building a stronger talent pipeline, expanding housing options, and overcoming development hurdles, we are accelerating economic growth. More young talent and families are choosing rural communities like ours, drawn by the natural beauty, year-round recreation and quality of life. Though housing development has not kept pace, progress is being made with hundreds of new workforce housing units coming online this year.

The NLEA works to support a stronger and more resilient year-round economy by partnering with businesses and communities in our region. We assist businesses in securing tax abatements, incentives, and low-interest loans for physical expansion, equipment and other key growth initiatives. We also maintain an inventory of available industrial and commercial sites for businesses looking to expand or

relocate to the region, while serving as a bridge between the public and private sector to navigate regulatory hurdles. By fostering a supportive environment for business growth, we are laying the foundation for a more resilient and prosperous regional economy.

Northern Michigan is at a pivotal moment. With strategic investments for the future, our region is poised to outgrow our perception as a tourism economy – retaining and attracting more entrepreneurs and new talent wanting to pursue their diverse professional interests, while enjoying the many benefits of living where others choose to vacation.

Payton Heins is the president and CEO of Northern Lakes Economic Alliance, a regional economic development organization. She brings extensive experience in economic and community development from her previous leadership roles in the public and private sectors. She holds degrees from Michigan State University and the University of Michigan and is a certified economic developer with the International Economic Development Council. Visit www.TheNLEA.com to learn more about NLEA services and to download the Economic Pulse Report.

Wyant Technologies serves as local businesses’ IT department, including networking, security and, yes, AI.

TCBN: You sure fly under the radar! Most people might not recognize your brand, but we asked some business owners about trusted technology partners, and the Wyant name kept coming up!

Tom Wyant: That is great to hear. And yes, we tend to keep our heads down and solve IT problems for our clients!

TCBN: What is your “elevator speech,” or what you say about your business in fifteen seconds?

Wyant: We are the IT partner for northern Michigan businesses. We are their IT department, providing whiteglove service for networking, cybersecurity, phones, computer systems, and AI solutions.

TCBN: And is the arrangement typically on an on-call basis, or hourly, or what?

Wyant: We only work with clients on a fixed-fee basis. Clients can budget for their IT needs with confidence, knowing there are no hidden expenditures. With Wyant, you have a whole team to help with your issues. We like to consider ourselves an extension of your staff.

TCBN: What is on the minds of local companies these days in terms of technology?

Wyant: Quite a bit, as always. But the two most prominent things we hear are security and, more recently, AI.

TCBN: Give us an example of two or more of the local companies you are helping.

Wyant: We have worked with the likes of Forest Area Credit Union and Benzie Leelanau District Health Department for over a decade. World Magnetics and Hemming& Wealth Management are newer clients, and by that, I mean in the last three years. As of my last check, we’ve worked with a majority of our clients for at least 10 years.

TCBN: And I am guessing those organizations have encountered some technology issues you have solved.

Wyant: Oh yes. For Forest Area Federal Credit Union, security and compliance are top priorities due to the annual audits they undergo. We work closely with their IT director to ensure they are adequately covered. When we first started working with them, they had four branches, and they are now up to seven, with more growth still to come. World Magnetics came to us after their network had been breached multiple times. We came in and locked it down. We have controls in place, the data is locked down so people can only see what they need to, and they have secure remote access to their network resources.

TCBN: What about the health department? How did that go with COVID?

Wyant: We needed to get them set up to work remotely as quickly as possible, so we implemented an always-on VPN to enable them to work from anywhere they had internet access. Their data and equipment are secure, and they can access everything they need. We also help them with their HIPAA compliance.

TCBN: Are email hacks still common?

Wyant: Yes, we provide security awareness training to our clients, so they understand how to identify phishing emails and social engineering. End users are a key factor in network security, so we proactively educate them on how to recognize potential scams.

TCBN: And AI is now seeping into all kinds of local businesses, correct?

Wyant: Quickly. And here again, there are risks. Many people are unaware that their ChatGPT interactions, for instance, are potentially exposed to the public, so we assist companies in finding

TCBN: And you will also help small businesses with the other tech things they do not want to deal with, like phones, new computers, and equipment?

Wyant: Absolutely. Tedious, annoy-

ing, or complex, we handle all technological needs for our clients, and we have been doing this for over two decades. I would encourage anyone reading this just to reach out and ask if we can help with their challenges!

For more information, call 231-946-5969 or visit gowyant.com

By Art Bukowski

Every employee knows what they earn, right? The paycheck comes in and the dollar amount is right there. Simple stuff.

But what about all the rest? Contributions for healthcare and retirement savings. Special deals on the company’s products or services. Discounts on gym memberships, childcare or other amenities. Paid time off. Matching charitable contribution dollars. The list goes on.

While the number of perks or benefits varies widely depending on the employer, almost all full-time employees get something, and many at larger employers are getting substantially more than their direct pay alone.

Once everything is added up, that $60,000 employee might be getting $75,000 to $90,000 worth of total compensation. So why not tell them that?

Total compensation statements (TCS) itemize all aspects of an employee’s compensation, including benefits, incentives and other perks. A dollar amount is provided for each, giving a clear picture of the employee’s total compensation in terms of actual monetary value. Some statements, often called total rewards statements, also include non-financial benefits like compa-

ny culture and career growth.

These statements are not new, but they may be particularly useful in an increasingly competitive environment where many employers are having a very hard time finding and retaining employees.

First and foremost, human resources leaders say that while employees are prob-

to nearly 600 full-time workers.

“It allows them to see what the total investment is that we’re making in people, because it really is pretty significant,” McClyde-Blythe said. “The first year we rolled out the statement, I had quite a few people that asked me if that’s really how much the spend was.”

Many employers also provide these statements to prospective employees as part of the recruiting process. Interlochen has put

“If I have an employee who’s being poached by another company, I’m going to say, ‘Hey, you know what? Let’s take a look at this.’

And I’m going to pull out that total compensation statement. You’ve got to go apples to apples, and this is the tool for that.”

-

Rob Hanel, Board Member, Traverse Area Human Resource Association

ably aware of their benefits, it can be quite surprising to see the total price tag.

Interlochen Center for the Arts started using TCS not long after Tifini McClyde-Blythe arrived as associate vice president for Human Resources in 2020, and she said they were immediately eye-opening for employees. Like most other employers, Interlochen now provides them annually

considerable efforts into attracting talent, and part of that is a nice package of benefits that can be summarized on a TCS.

“I think [TCS] help us in being a destination employer because they give people more information to make more informed decisions,” McClyde-Blythe said. “It’s transparency about the value of what they’re getting, and I’ve talked to quite a few really

savvy people who, when they get job offers, create a table of the pros and cons and all of the things they’re gaining or losing if they decide to go somewhere else.”

At Interlochen, the gains end up being pretty persuasive.

“If somebody’s looking for the bottom line of how much their paycheck is going to be every week, a total compensation statement isn’t going to help them change their decision,” she said. “But if you value things like free meals, tuition discounts, going to concerts for free … it makes it harder for you to consider other employers.”

Rob Hanel is director of people and space (a fancy term for HR director) at TentCraft, a Traverse City company that employs about 90 people. He’s also on the board of the Traverse Area Human Resource Association, a group of local HR professionals.

Hanel has used TCS throughout his career, and he speaks highly of their role in helping to attract – and keep – great employees.

“Total compensation statements have been around a long time, and they have been very consistently used amongst

groups of employers who fully understand the value of retention,” he said.

It’s often too easy for an employee to be wooed by another company that offers a bump in base pay. Hanel is quick to remind that employee that they need to look at the whole package carefully before making a decision.

“If I have an employee who’s being poached by another company, I’m going to say, ‘Hey, you know what? Let’s take a look at this.’ And I’m going to pull out that total compensation statement,” he said. “You’ve got to go apples to apples, and this is the tool for that.”

TCS are also a great tool for providing transparency, building trust and boosting appreciation for the employer, Hanel says. And there’s nothing wrong with an employer trying to “get credit” for all of the perks it provides, he said.

“It’s like ‘Oh great, the company’s patting themselves on the back again trying to show me all the great things they do for me,’” Hanel said. “But that is in fact what we’re trying to show, and from my HR seat, if I can help an employee appreciate an employer, [that’s a win].”

Michele Shane is head of school at the Children’s House, a private, nonprofit Montessori school in Traverse City. The school has used TCS for several years, allowing employees to see things like tuition discounts (which are significant considering the school’s tuition costs) and other perks.

Shane feels these statements are important for many reasons, not the least of which is the relatively low pay offered to teachers in general.

“You can never pay a teacher enough, and it’s tough because we only have so many levers we can pull to make sure everyone is taken care of,” she said. “Sometimes people see their hourly wage or their annual salary and wish it were more, and we all do, but it’s also important for people to understand how much the organization invests in employees in ways

above and beyond the salary.”

Shane hopes that TCS helps employees feel better about their overall compensation.

“When folks can see that bottom line, I think emotionally it feels a lot better than just looking at your hourly wage or your annual salary,” she said. “And on the organization side … we want folks to know that this matters to us and taking care of our employees matters.”

Shane also believes that TCS are a good opportunity for employees to learn about the tough decisions administrators have to

make to make when faced with ever-increasing healthcare costs and other pressures.

“It’s a really delicate balance between people getting raises so that they can have money in their pockets, but also continuing to maintain high quality healthcare,” she said. “So, when people don’t understand why they’re not getting bigger raises every year, we can say, ‘Well, this is now what our outlay is for your family for healthcare.’ So I think it really benefits people to be able to see the bigger picture of the way the budget works.”

By Craig Manning

In February 2022, the Traverse City Business News ran one of its biggest and most ambitious cover stories ever: “The Relocators,” a spotlight on 28 professionals who had found their way to northern Michigan in the midst of the global pandemic. We’d heard a lot, in the first two years of COVID-19, about how office shutdowns and widespread pivots to remote work had unshackled millions of people from big cities for the first time in their adult lives, in turn sending them in search of more tranquil environs. Our thought was to test that theory, and to see how many movers and shakers we could actually find who had chosen to switch their zip code to Traverse City. As it turned out, there was no shortage of northern Michigan newcomers who fit the

Then: When we met Gallagher, he was the president and CEO of Faber-Castell USA, the Cleveland, Ohio headquartered arm of the global corporation known for making pens, pencils, and other art supplies. Gallagher had been leading American operations for the company since 2003, part of a 40-plus-year corporate career that also included jobs as director of sales and marketing job at LEGO and the general manager of USA operations role for Playmobil.

Why TC: Speaking to the TCBN in 2022, Gallagher explained that he and his wife had spent years eyeing the town of Lake George, New York as their eventual retirement destination. Then they discovered Traverse City, and plans changed.

“(Traverse City) just completely knocks out Lake George,” Gallagher said at the time. “Before moving here, it was a combination of outdoor feel, beauty and vibe, not too small, balance of life, people, seasons, and Midwest location (that attracted us). Later, I have learned that there is such an interesting opportunity to connect the area’s appreciation of creativity with talent and passion as a means of impacting the community and providing great futures for generations to come.”

Now: Gallagher stayed on at Faber-Castell – and continued splitting time between Traverse City and Cleveland – until April 2023, when he finally took his final bow with the company after a

nearly two-decade stint. After a six-month break, he formed an LLC called 4 the Win, under which he continues to take on speaking, lecturing, mentorship, and consulting engagements. It’s been a big pivot in his life, and not just because he’s now spending almost all of his time in northern Michigan.

“It’s been a huge change, and I think anybody in my position would say that,” Gallagher said. “Just the routine, and the cadence, and the busyness level. Now, I have something that for most of my life I didn’t have, which is a lot of discretionary time.”

When Gallagher and his wife pinpointed Traverse City as their retirement destination, his assumption was that most of that “discretionary time” would go toward enjoying the natural beauty and reveling in the leisurely charms of a life no longer beholden to the demands of corporate work. What Gallagher didn’t expect was getting as involved with the local business community as he has.

“You can get a sense of the natural beauty when you’re just visiting here, but what you can’t measure and can’t experience until you actually live here is the people,” Gallagher explained. “I think that’s been the single biggest blessing [of moving to Traverse City], is the community.” Specific examples, he said, include mentoring entrepreneurs and businesses through Traverse Connect, being a part of Northwestern Michigan College’s Office of Possibilities (OOPs), and serving on the board of the Economic Club of Traverse City.

“We’ve got so many interesting people up here who are so willing to share, and

bill – so many that we had to put a cap on how many of them we actually wrote about. “The Relocators” ended up profiling 28 professionals, spanning multiple generations and hitting every industry from tech to medicine to entertainment.

Three and a half years later, the world has changed once more, and now the discourse is about how companies are winding down their remote work programs and calling their employees back to the office. It got us wondering: Where are our relocators now? Did they stick around in northern Michigan and put down roots here for good? Or have they left Traverse City behind, thanks to the reversion to pre-pandemic norms? And for the ones who did stay here, are they still in the same roles they were in 2022, or have they moved on to entirely new chapters?

We caught up with six of our original 28 relocators to ask these questions and more.

they’re super smart and they’re really passionate, and that makes it a great place to semi-retire like I have,” Gallagher continued. “It gives me that chance to do a bit of consulting, a bit of mentoring, and just a lot of think tank stuff. For example, I’ve gotten together with a handful of people over at NMC, and we’re talking about what a professional development curriculum would look like for young professionals in Traverse City. I’ve gotten to be a part of a lot of discussions like that, and

it’s been really fruitful.”

“I can’t imagine any other choice [of retirement spot],” Gallagher concluded. “I have friends who are down at The Villages in Florida, or they’re out in Scottsdale, Arizona – different places like that – and I can’t imagine being them. I feel so fortunate to be here instead, because there’s a lot of fun stuff left to do. There’s a lot of people to help, and a lot of great experiences left to have, and I can’t tell you how much my wife and I are looking forward to it.”

Then: At the start of 2022, this husband-and-wife duo were northern Michigan newcomers – a couple of University of Michigan graduates who had, in July of 2021, traded a life in Ann Arbor for one in Traverse City. Juntila, a U of M med school alumna, had recently taken a job as an anesthesiologist for Traverse Anesthesia Associates (TAA). Prasad, who went to U of M for undergrad before earning his law degree at Notre Dame, was working remotely with both a St. Louis-based firm called AEGIS Law (as a mergers and acquisitions attorney) and a Novi-based company called V1 Sports (as chief operating officer). V1 Sports, which makes golf swing analysis apps, had recently landed Michael Jordan as an investor.